CBIZ & Marcum: Stronger Together. July 31, 2024 Exhibit 99.2

CBIZ, INC. | NYSE: CBZ Important Information CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS This communication includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included herein that address business performance, financial condition, activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. Investors are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward-looking statements. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company, including but not limited to: the ability of the parties to consummate the transaction in a timely manner or at all; satisfaction of the conditions precedent to consummation of the transaction, including the ability to secure regulatory approvals in a timely manner or at all, and the approval by Marcum’s partners and the approval by the Company's stockholders; the possibility of litigation related to the transaction and the effects thereof; the possibility that anticipated benefits and/or synergies of the transaction will not be achieved in a timely manner or at all; the possibility that the costs of the transaction and/or liabilities assumed will be more significant than anticipated; the possibility that integration will prove more costly and/or time consuming than anticipated; the possibility that the transaction could disrupt ongoing plans and operations of the parties or their respective relationships with clients, other business partners and employees; the possibility that the financing will not be obtained as anticipated and the effects of the increased leverage of the Company following the transaction; and other risks described in the Company’s SEC filings. All forward-looking statements are based on management’s estimates, projections and assumptions as of the date hereof. Except as required by law, the Company does not undertake any obligation to update any forward-looking statements to reflect events or circumstances that subsequently occur or of which it subsequently becomes aware. ADDITIONAL INFORMATION ABOUT THE TRANSACTION AND WHERE TO FIND IT In connection with the transaction, the Company will file a proxy statement with the SEC. The definitive proxy statement will be mailed to the Company’s stockholders and will contain important information about the transaction and related matters. THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT CAREFULLY WHEN IT BECOMES AVAILABLE BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE TRANSACTION BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION. The definitive proxy statement and other relevant materials (when they become available) and any other documents filed by the Company with the SEC may be obtained free of charge at the SEC’s website, at www.sec.gov. In addition, stockholders will be able to obtain free copies of the definitive proxy statement from the Company on the Investor Relations page of the Company’s website, www.cbiz.com, or by writing to us at Attention: Investor Relations Department, 5959 Rockside Woods Blvd. N., Suite 600, Independence, Ohio 44131. PARTICIPANTS IN THE SOLICITATION The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the transaction. Information with respect to the Company’s directors and executive officers is set forth in the Company’s Proxy Statement on Schedule 14A for its 2024 Annual Meeting of Stockholders, which was filed with the SEC on March 25, 2024, and its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 23, 2024. These documents are available free of charge at the SEC’s web site at www.sec.gov, or from the Company on the Investor Relations page of the Company’s website, www.cbiz.com, or by writing to us at Attention: Investor Relations Department, 5959 Rockside Woods Blvd. N., Suite 600, Independence, Ohio 44131. Additional information regarding the interests of participants in the solicitation of proxies in connection with the transactions will be included in the proxy statement that the Company intends to file with the SEC. NON-GAAP FINANCIAL INFORMATION This communication contains references to certain non-GAAP financial measures. These non-GAAP financial measures may not provide information that is comparable to similarly-titled measures provided by other companies. These non-GAAP financial measures are not measurements of financial performance of the Company or Marcum under GAAP and should not be considered as alternatives to amounts presented in accordance with GAAP. The Company views these non-GAAP financial measures as supplemental to, but not as substitutes for, comparable GAAP measures. Refer to Non-GAAP Financial Information in the Appendix for additional information.

CBIZ, INC. | NYSE: CBZ Today’s Speakers Jerry Grisko President & CEO Chris Spurio President, Financial Services Ware Grove Senior VP & CFO

CBIZ, INC. | NYSE: CBZ Agenda 1 Strategic Rationale & Transaction Overview 2 Go-To-Market 3 Integration 4 Financial Summary Q&A 6 Closing Remarks

Strategic Rationale & Transaction Overview

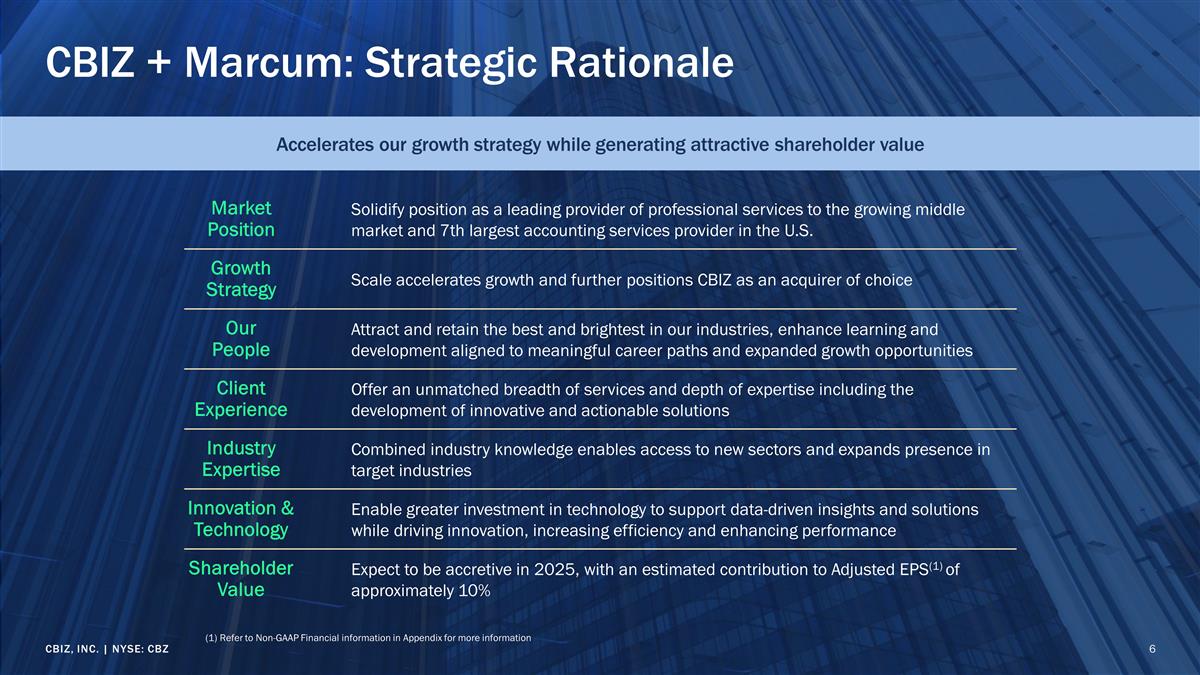

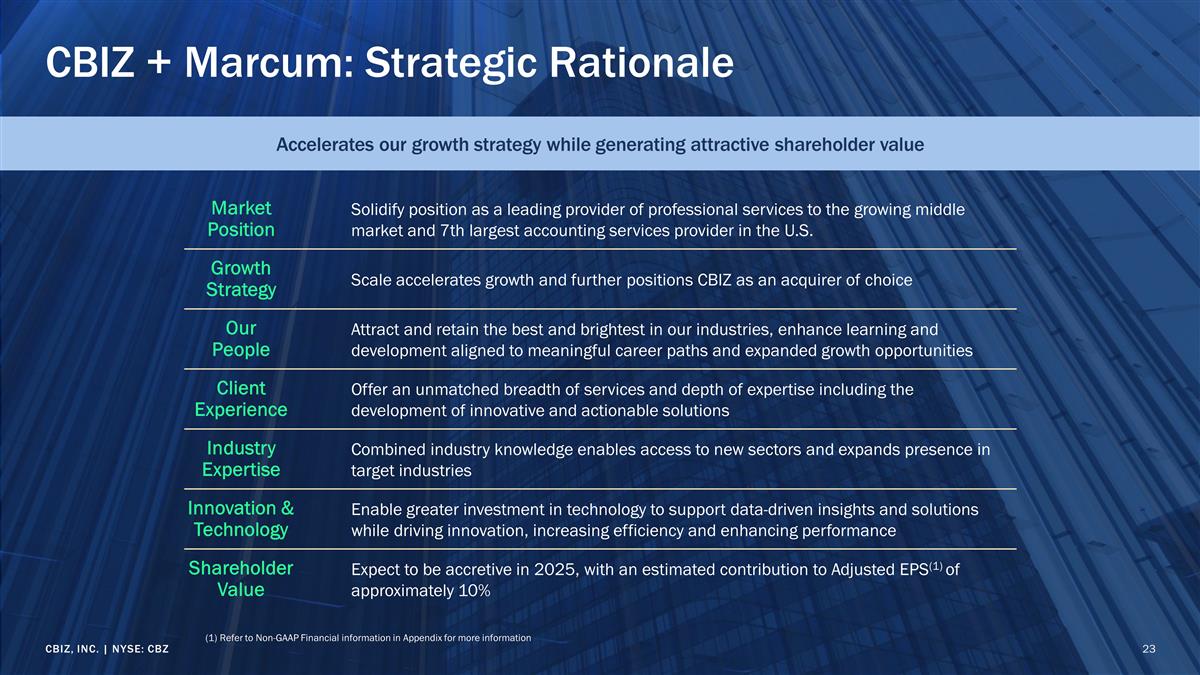

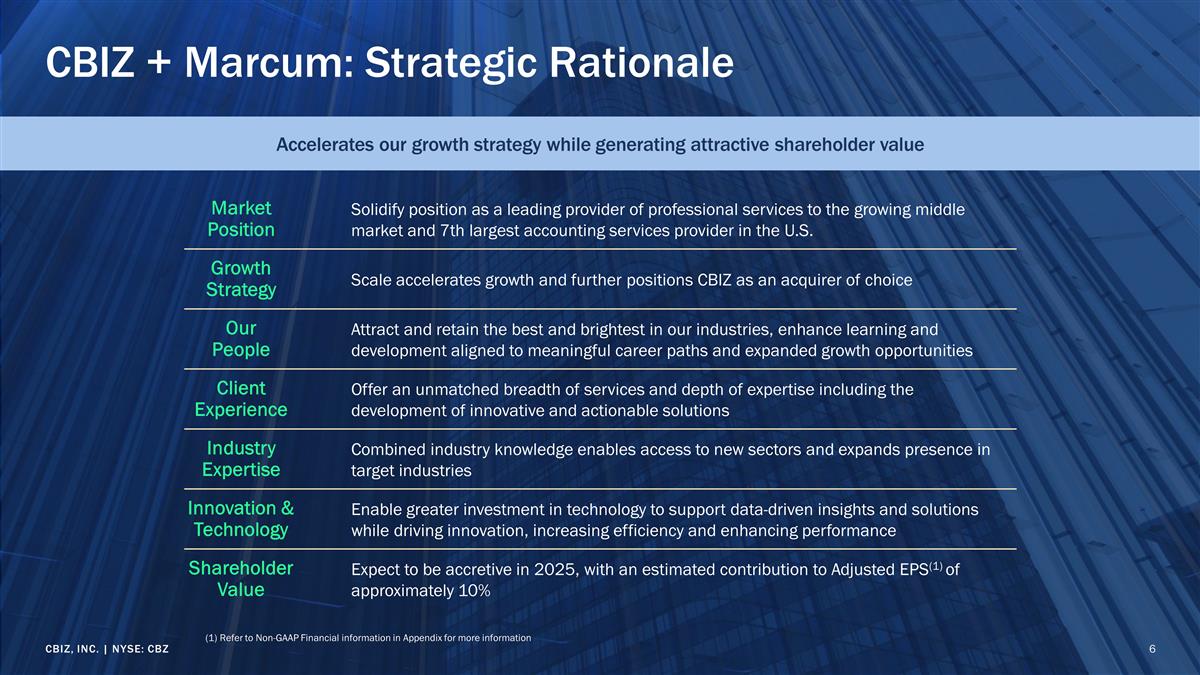

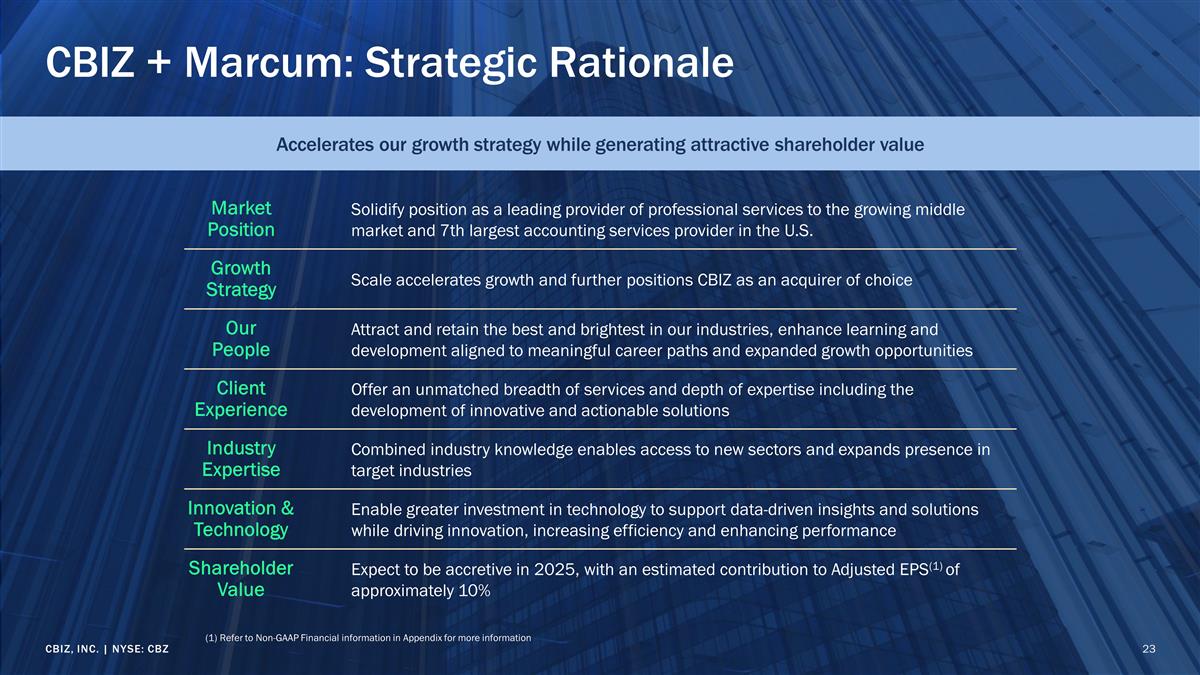

CBIZ, INC. | NYSE: CBZ CBIZ + Marcum: Strategic Rationale Accelerates our growth strategy while generating attractive shareholder value (1) Refer to Non-GAAP Financial information in Appendix for more information Market Position Solidify position as a leading provider of professional services to the growing middle market and 7th largest accounting services provider in the U.S. Growth Strategy Scale accelerates growth and further positions CBIZ as an acquirer of choice Our People Attract and retain the best and brightest in our industries, enhance learning and development aligned to meaningful career paths and expanded growth opportunities Client Experience Offer an unmatched breadth of services and depth of expertise including the development of innovative and actionable solutions Industry Expertise Combined industry knowledge enables access to new sectors and expands presence in target industries Innovation & Technology Enable greater investment in technology to support data-driven insights and solutions while driving innovation, increasing efficiency and enhancing performance Shareholder Value Expect to be accretive in 2025, with an estimated contribution to Adjusted EPS(1) of approximately 10%

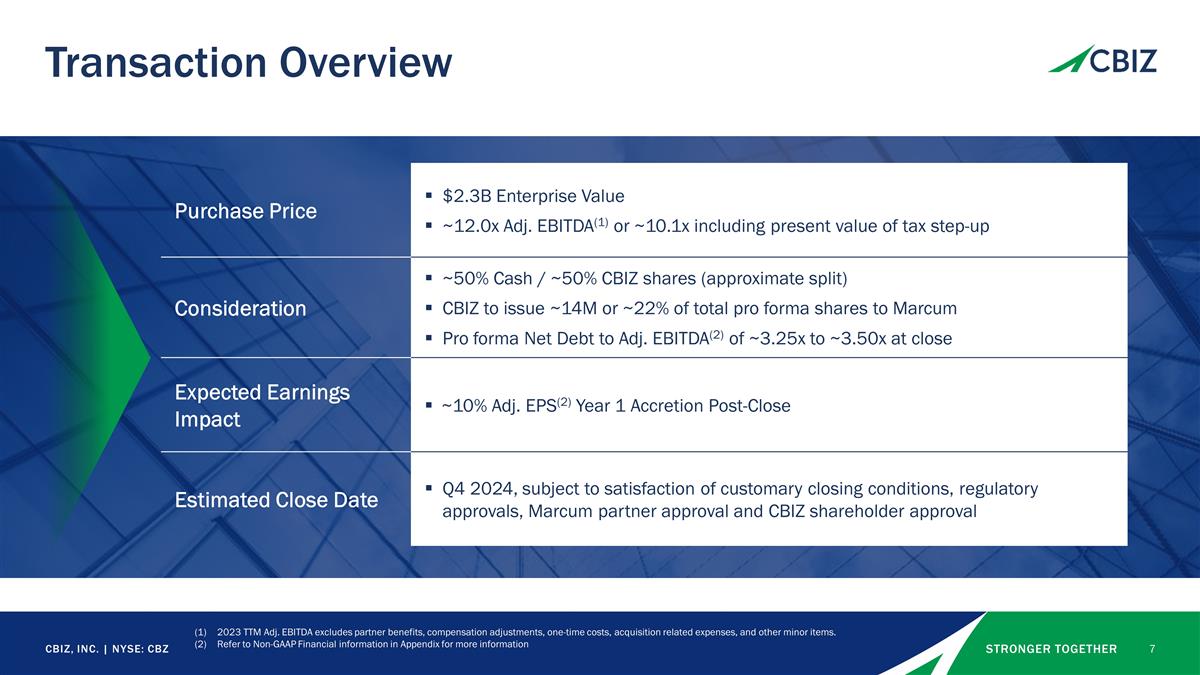

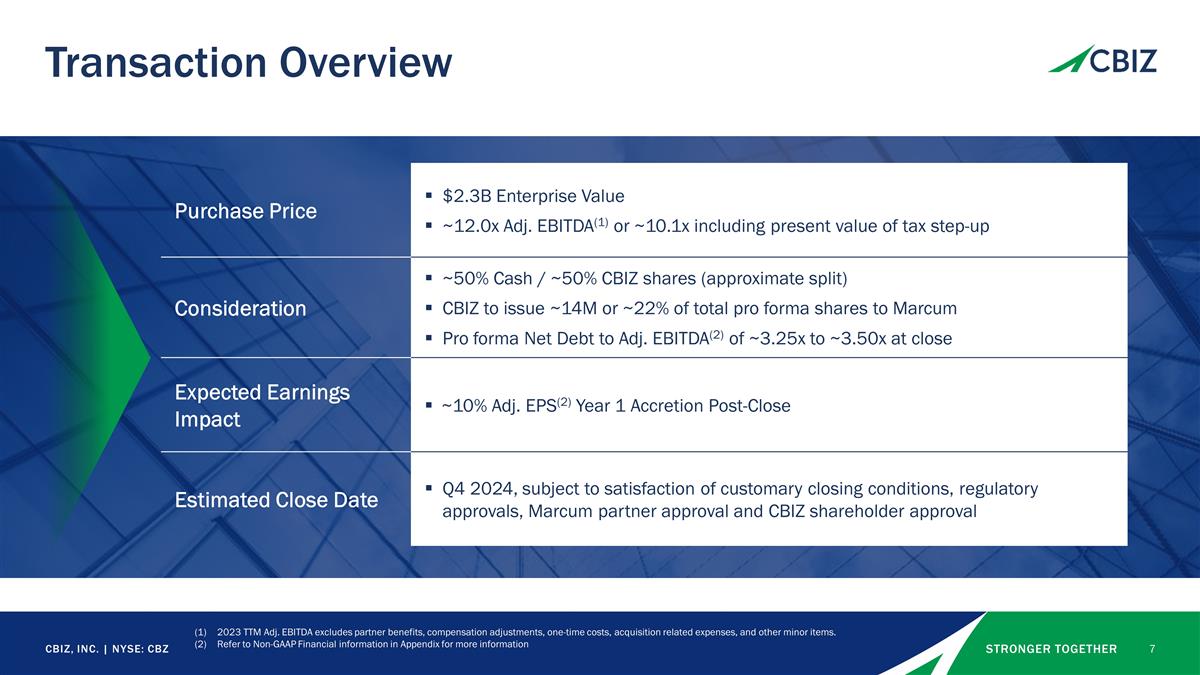

CBIZ, INC. | NYSE: CBZ Transaction Overview 2023 TTM Adj. EBITDA excludes partner benefits, compensation adjustments, one-time costs, acquisition related expenses, and other minor items. Refer to Non-GAAP Financial information in Appendix for more information Purchase Price $2.3B Enterprise Value ~12.0x Adj. EBITDA(1) or ~10.1x including present value of tax step-up Consideration ~50% Cash / ~50% CBIZ shares (approximate split) CBIZ to issue ~14M or ~22% of total pro forma shares to Marcum Pro forma Net Debt to Adj. EBITDA(2) of ~3.25x to ~3.50x at close Expected Earnings Impact ~10% Adj. EPS(2) Year 1 Accretion Post-Close Estimated Close Date Q4 2024, subject to satisfaction of customary closing conditions, regulatory approvals, Marcum partner approval and CBIZ shareholder approval

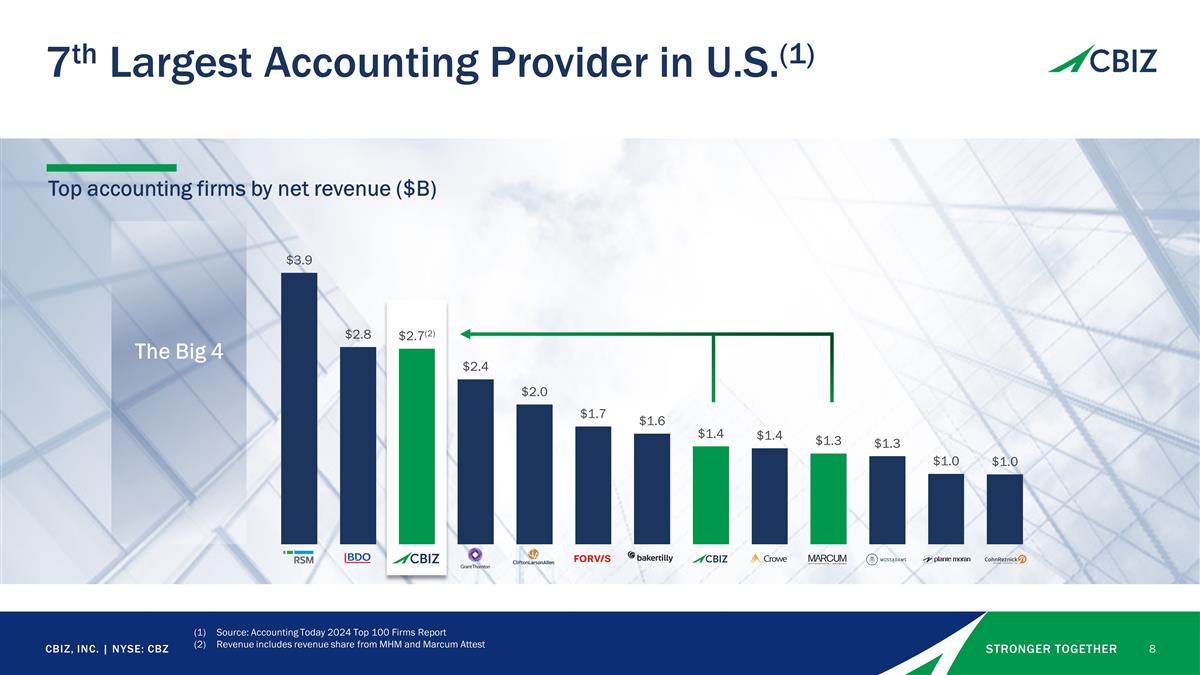

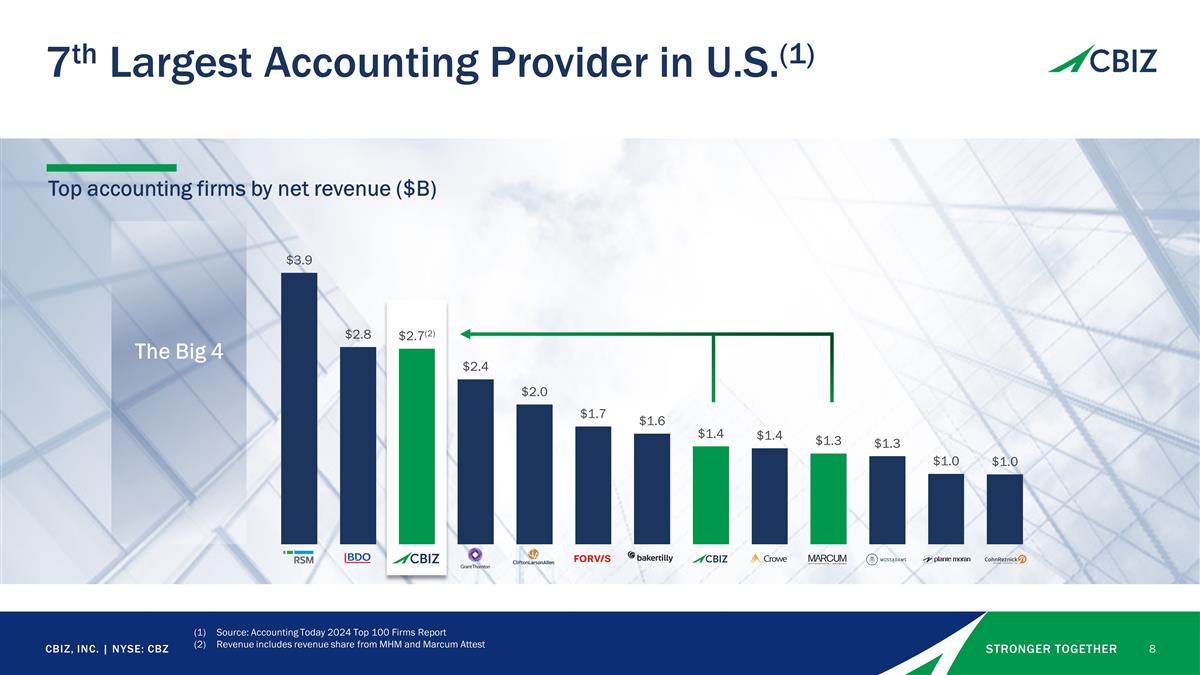

Top accounting firms by net revenue ($B) CBIZ, INC. | NYSE: CBZ 7th Largest Accounting Provider in U.S.(1) Source: Accounting Today 2024 Top 100 Firms Report Revenue includes revenue share from MHM and Marcum Attest (2) The Big 4

Stronger Together: Go-To-Market

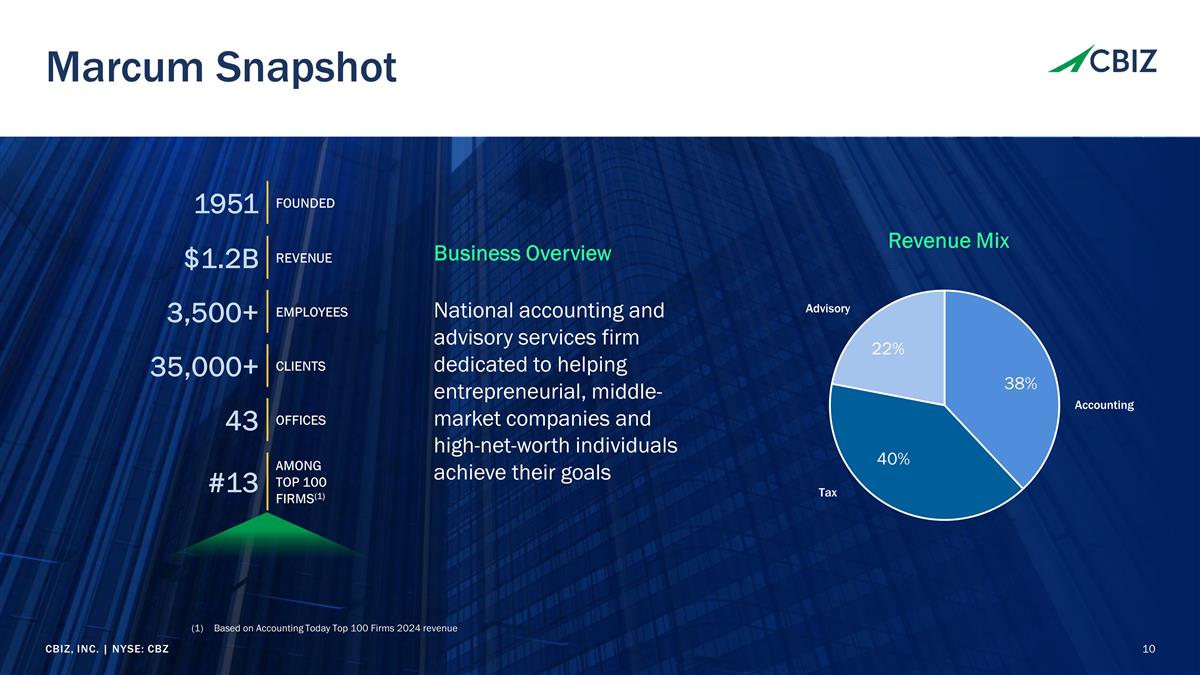

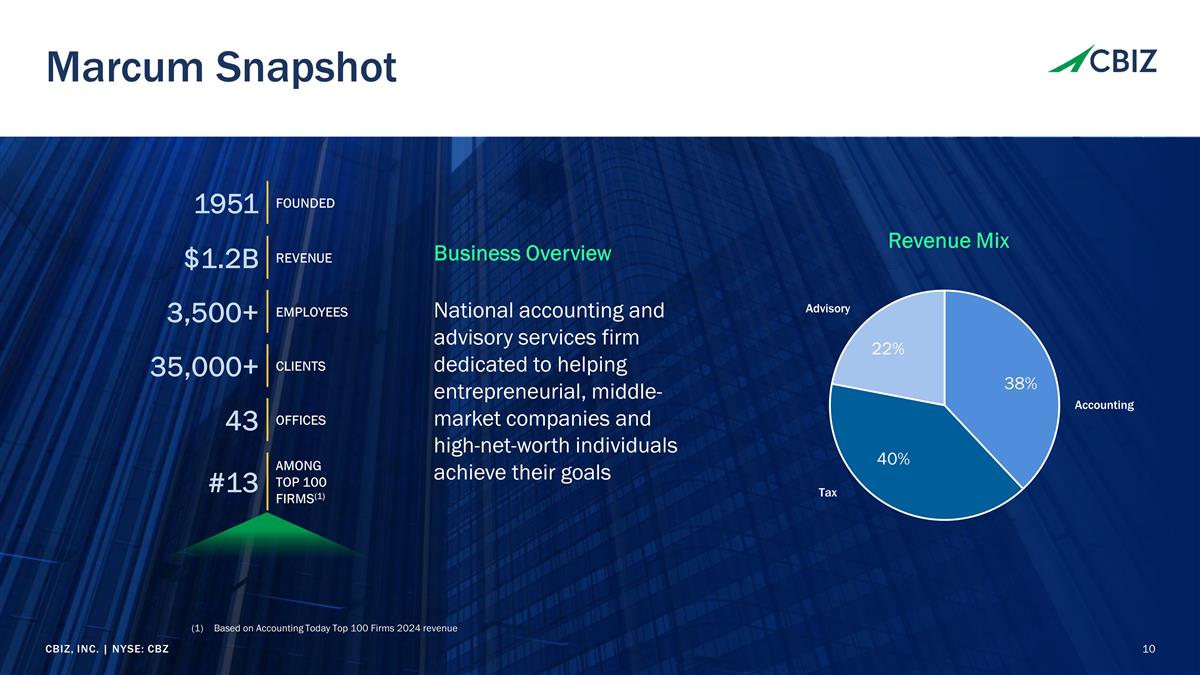

CBIZ, INC. | NYSE: CBZ CBIZ, INC. | NYSE: CBZ Marcum Snapshot 1951 Founded $1.2B REVENUE 3,500+ Employees 35,000+ Clients 43 offices #13 Among Top 100 firms(1) Business Overview National accounting and advisory services firm dedicated to helping entrepreneurial, middle-market companies and high-net-worth individuals achieve their goals Accounting Tax Advisory Revenue Mix Based on Accounting Today Top 100 Firms 2024 revenue

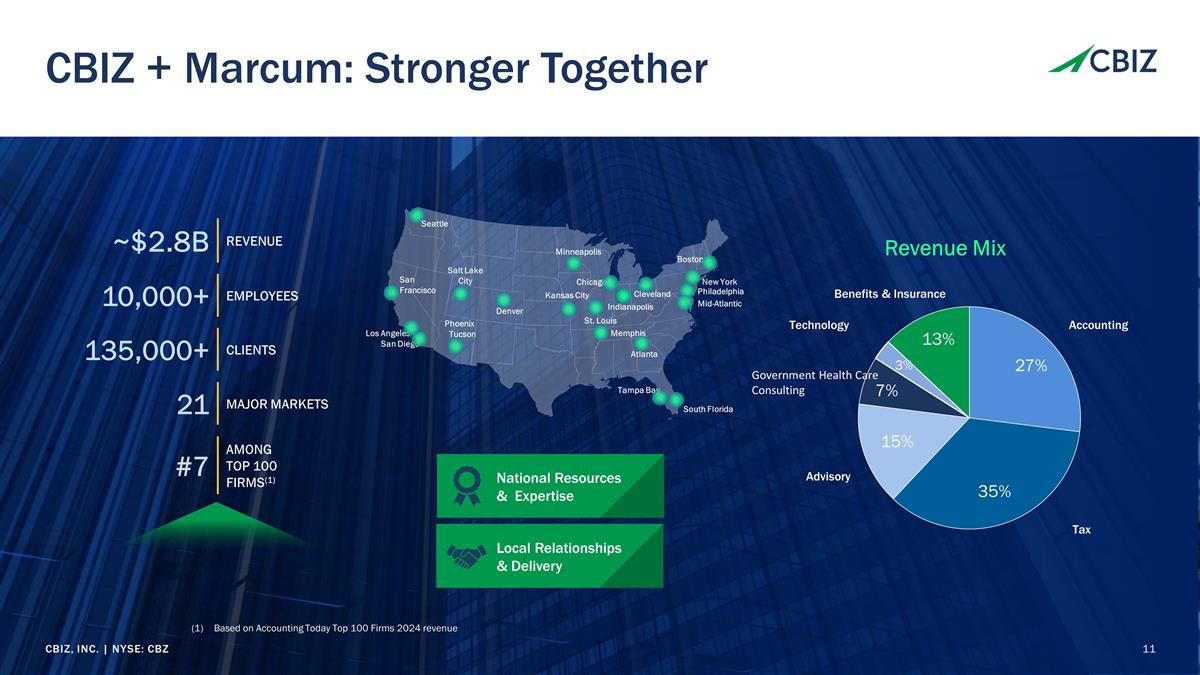

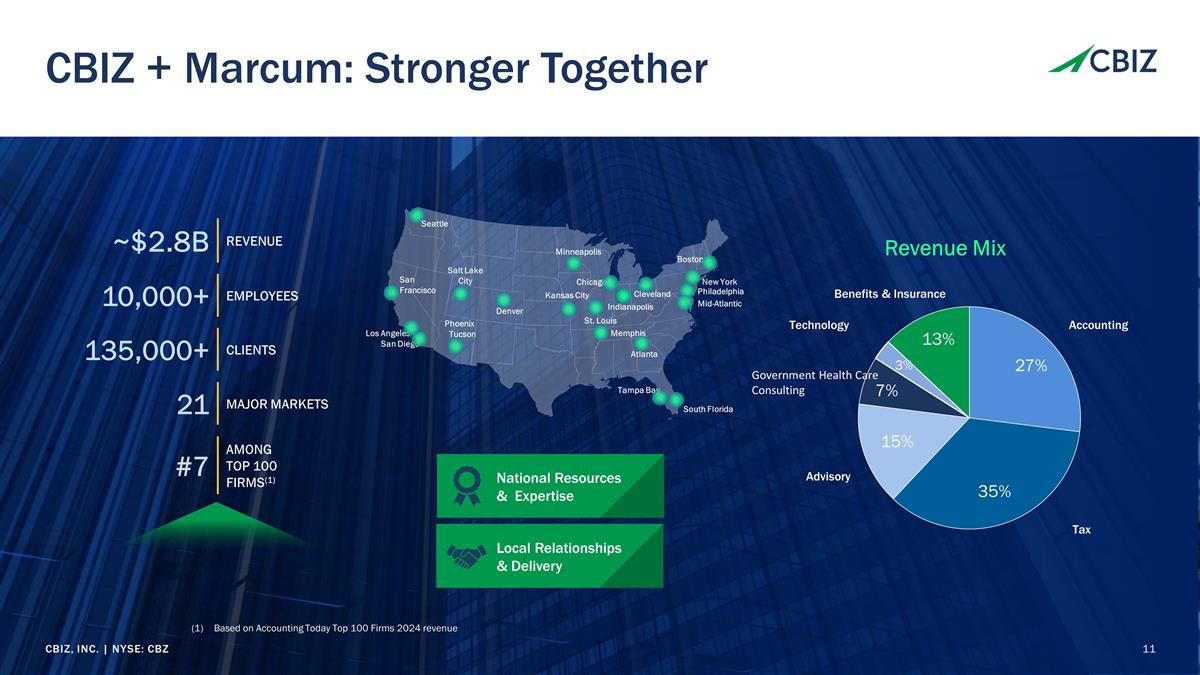

CBIZ, INC. | NYSE: CBZ CBIZ + Marcum: Stronger Together Based on Accounting Today Top 100 Firms 2024 revenue Seattle Salt Lake City San Francisco Denver Phoenix Tucson Los Angeles San Diego Minneapolis Chicago Kansas City St. Louis Memphis Atlanta Tampa Bay South Florida Mid-Atlantic Philadelphia New York Cleveland Indianapolis Boston National Resources & Expertise Local Relationships & Delivery ~$2.8B REVENUE 10,000+ Employees 135,000+ Clients 21 Major markets #7 Among Top 100 Firms(1) Revenue Mix

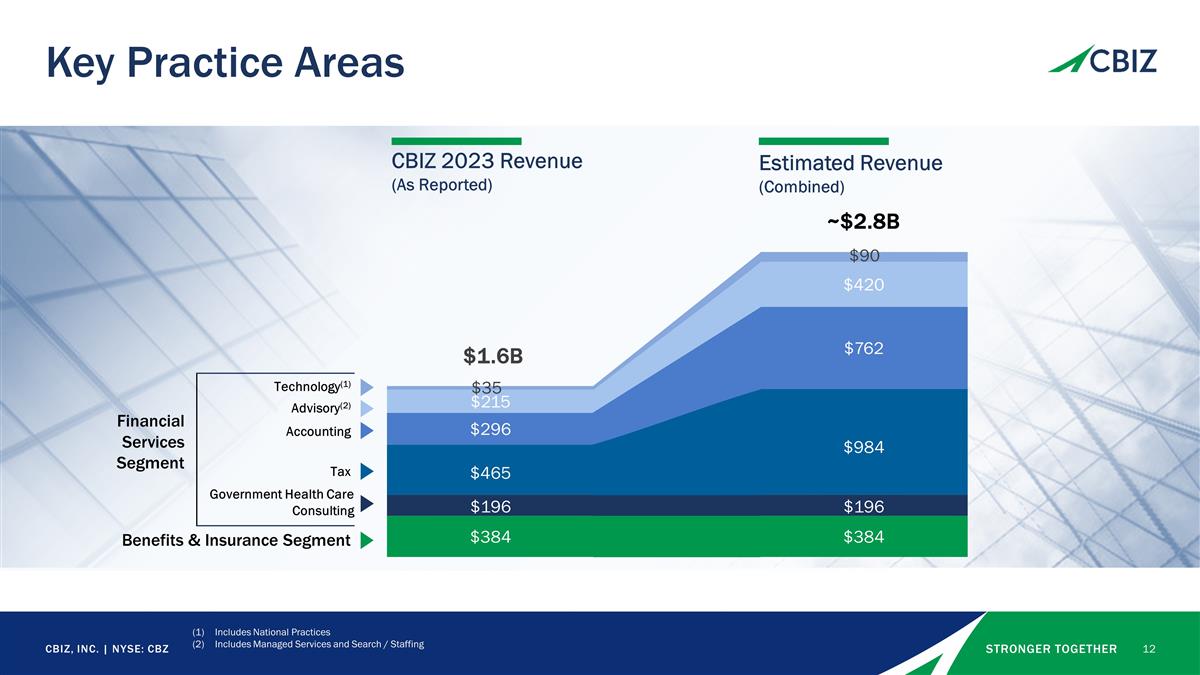

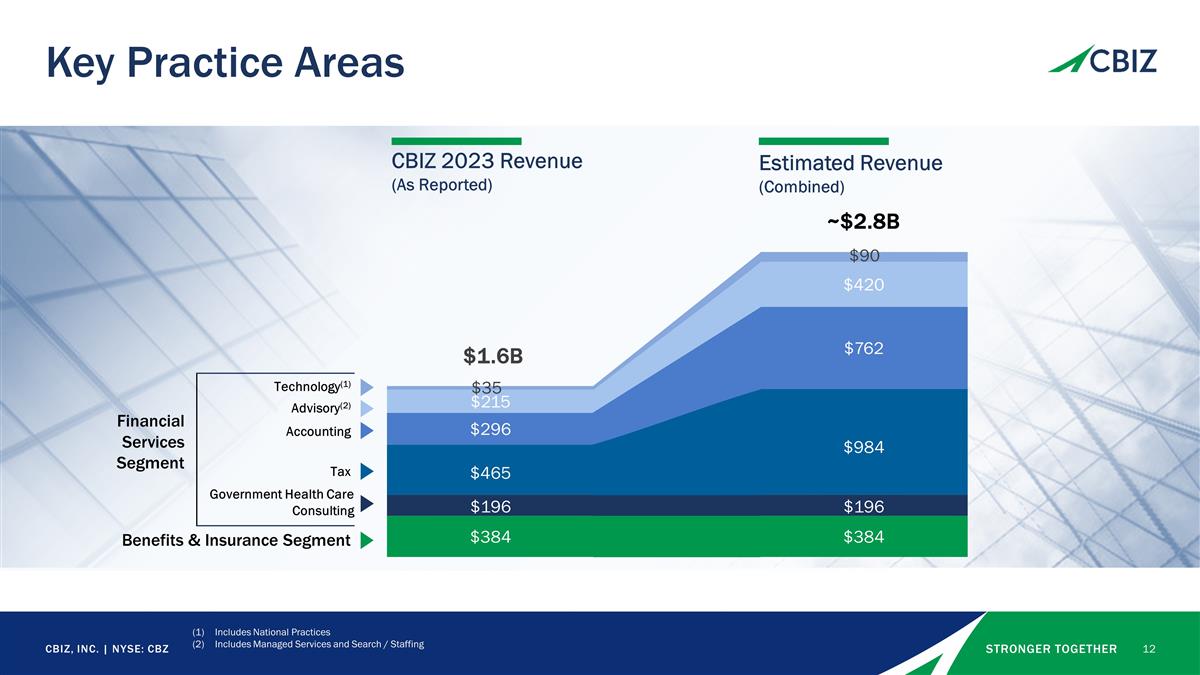

Key Practice Areas ~$2.8B Includes National Practices Includes Managed Services and Search / Staffing CBIZ, INC. | NYSE: CBZ CBIZ 2023 Revenue (As Reported) Estimated Revenue (Combined) Financial Services Segment Technology(1) Advisory(2) Accounting Tax Benefits & Insurance Segment Government Health Care Consulting

Strong Historic Growth ü ü Comprehensive & Essential Services ü ü Recurring Revenue ü ü High Client Retention ü ü Strong & Consistent Cash Flows ü ü High Client Retention ü ü Loyal & Diverse Middle-Market Client Base ü ü Variable Expenses ü ü Deep Industry & Subject Matter Expertise ü ü Unwavering Commitment to Client Service ü ü CBIZ, INC. | NYSE: CBZ Key Shared Attributes

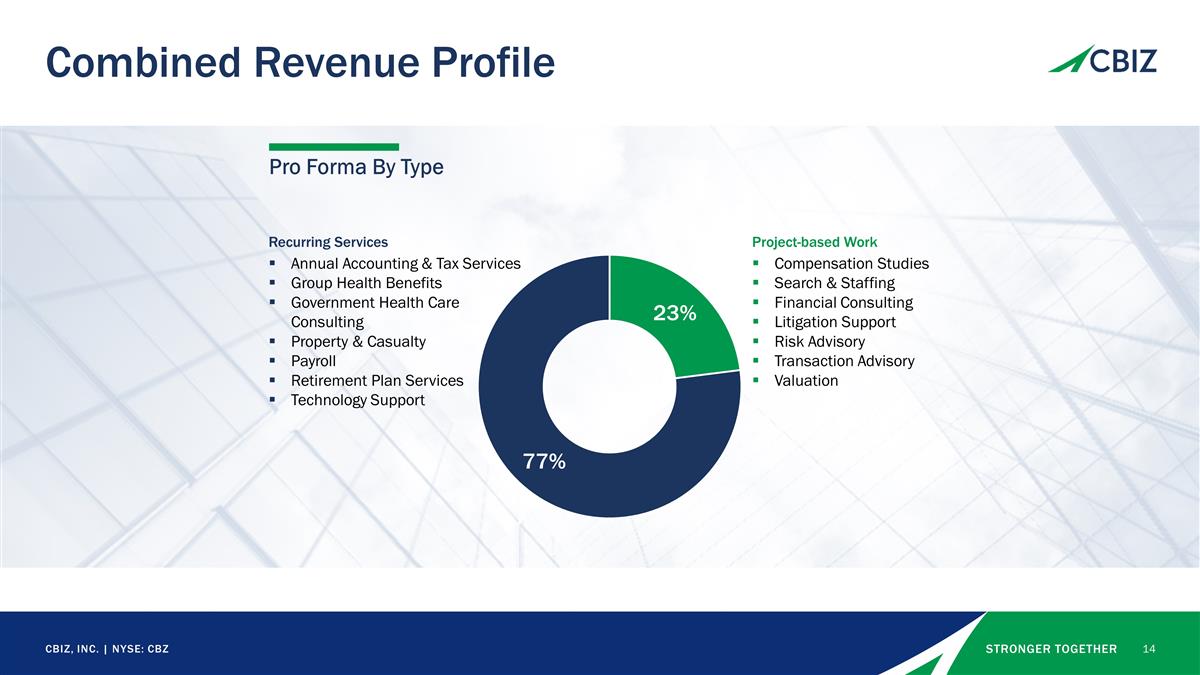

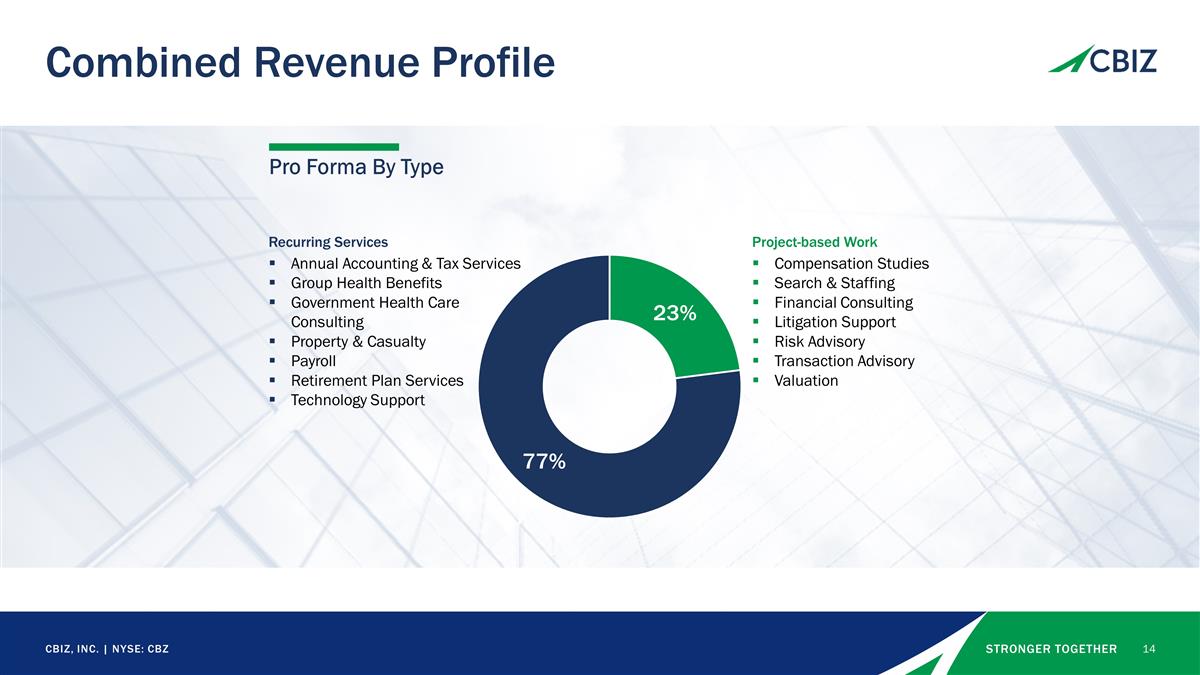

CBIZ, INC. | NYSE: CBZ Combined Revenue Profile Pro Forma By Type Compensation Studies Search & Staffing Financial Consulting Litigation Support Risk Advisory Transaction Advisory Valuation Project-based Work Annual Accounting & Tax Services Group Health Benefits Government Health Care Consulting Property & Casualty Payroll Retirement Plan Services Technology Support Recurring Services

Integration

CBIZ, INC. | NYSE: CBZ Track Record of Successful M&A 120+ Combined Acquisitions Since 2008 Focus on Employee Growth and Retention Integration Roadmap M&A has been an integral part of both the CBIZ and Marcum historical growth strategies Broad institutional knowledge and experience in integrations and change management Detailed integration plan Focus on implementing best of both Compatible, growth-focused cultures Retention and performance incentives Equity consideration creates shareholder alignment

CBIZ, INC. | NYSE: CBZ Integration Roadmap At Closing 2026 & Beyond People-focused onboarding Brand elevation and joint marketing Client engagement Alignment of financial processes and reporting First 18 Months Alignment of operational processes and move to common platforms and systems Client service and solution standardization Consolidation of resources Anticipated $25M+ cost synergies Process and practice innovation

Financial Summary

CBIZ, INC. | NYSE: CBZ Builds on Our Attractive Financial Attributes (1) Refer to Non-GAAP Financial information in Appendix for more information Historical Metric Transaction Benefits / Impact Revenue 7.4% 2023 Same-Unit Growth Scale accelerates growth Adj. EBITDA(1) 17.7% 2023 Growth Adds $25M+ of anticipated annual cost synergies, expected to be fully actioned ~36 months post-close Additional operating leverage from increased scale Adj. EPS(1) 13.1% 2023 Growth Estimated Adj. EPS(1) accretion of ~10% in Year 1 Accretion expected to increase as we realize synergies and de-lever post-close Leverage 2.0x (Current Net Debt / TTM Adj. EBITDA(1)) Targeting pro forma leverage of ~3.25x to ~3.50x Adjusted EBITDA(1) at close, with rapid de-leveraging post close Enhanced long-term cash flow enables greater ability to deploy capital on strategic M&A, share repurchases and technology

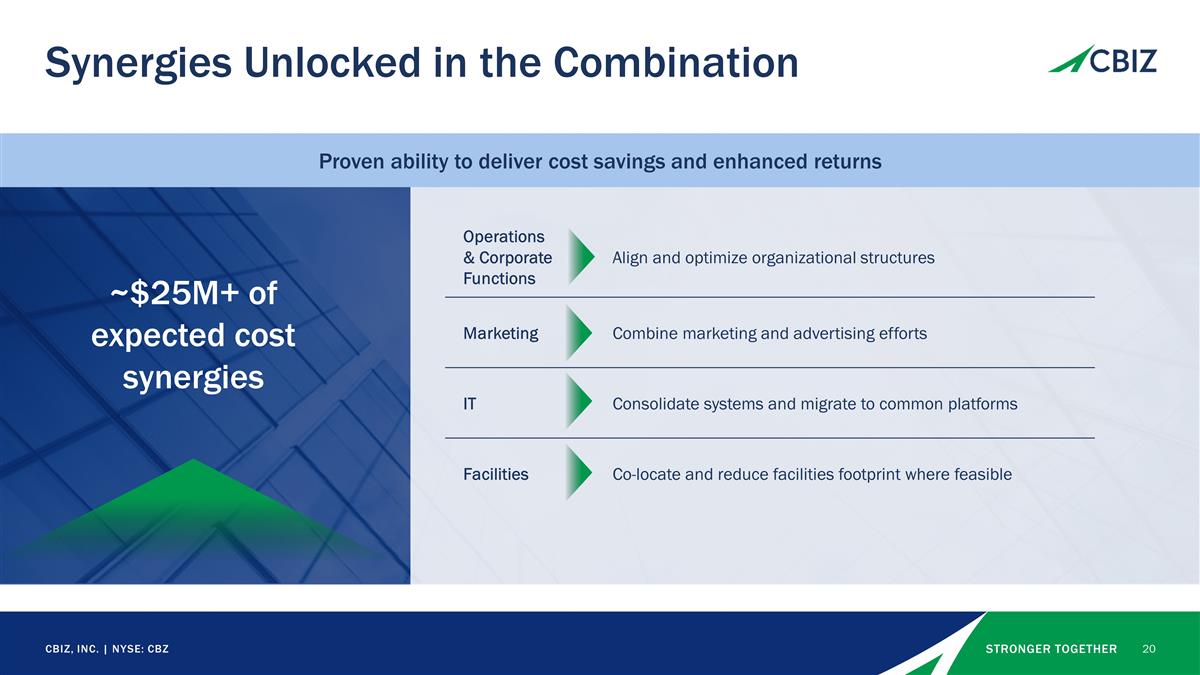

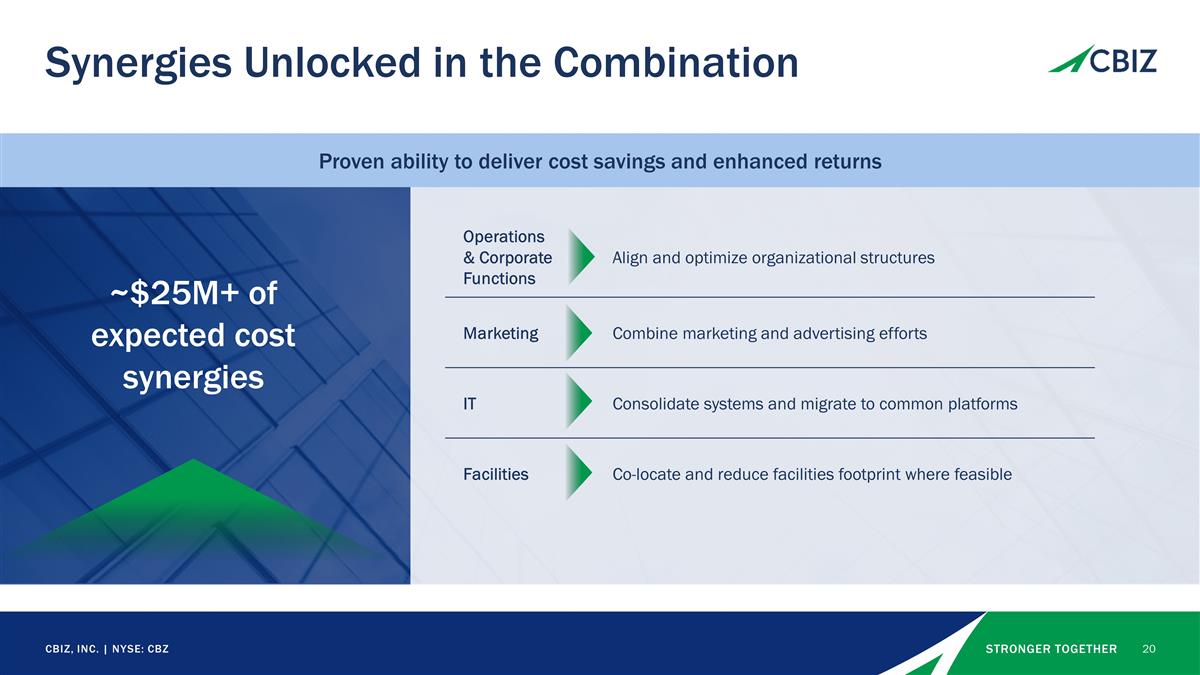

CBIZ, INC. | NYSE: CBZ Synergies Unlocked in the Combination Operations & Corporate Functions Align and optimize organizational structures Marketing Combine marketing and advertising efforts IT Consolidate systems and migrate to common platforms Facilities Co-locate and reduce facilities footprint where feasible ~$25M+ of expected cost synergies Proven ability to deliver cost savings and enhanced returns

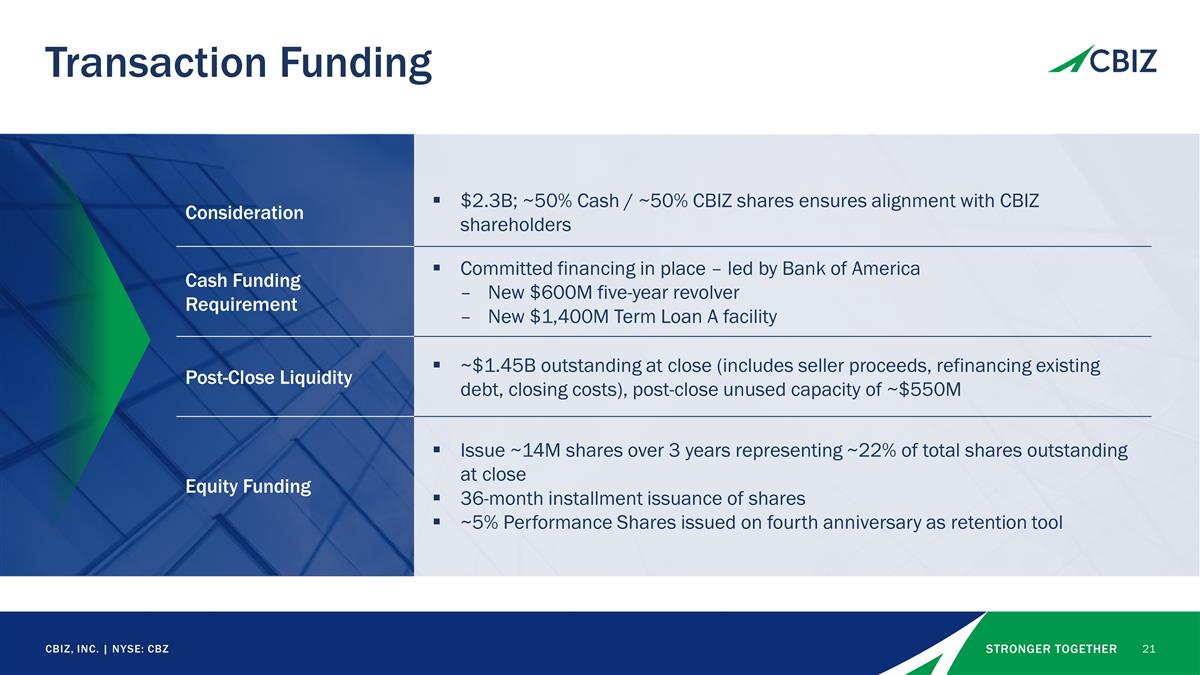

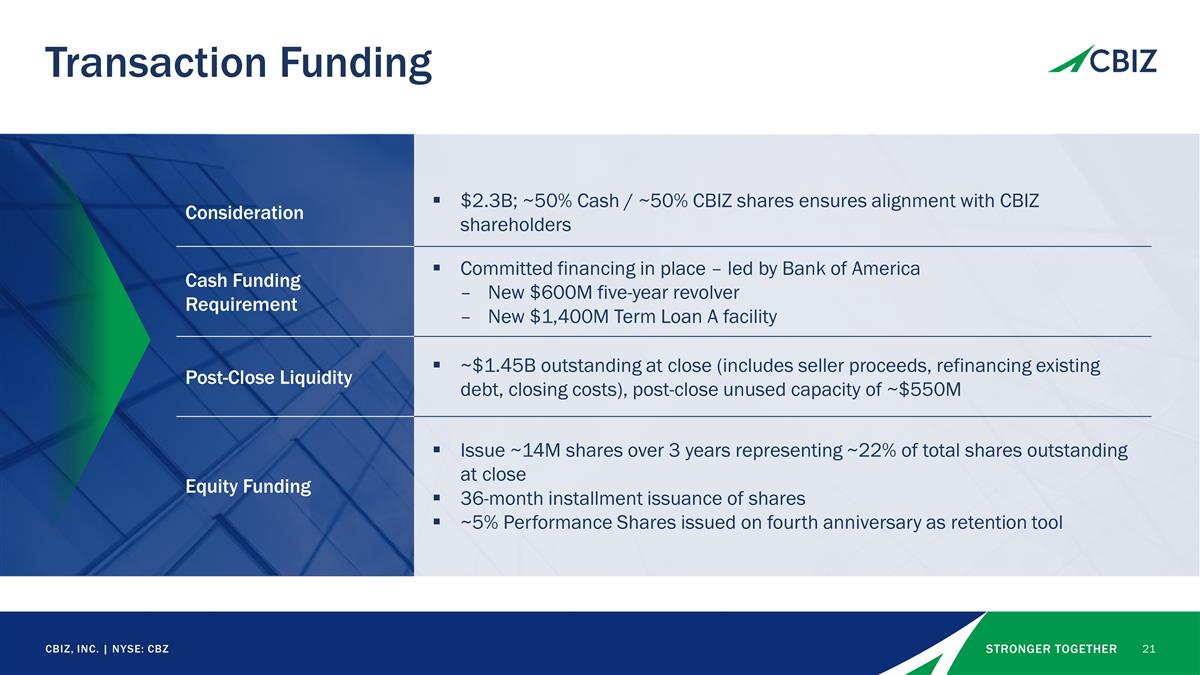

CBIZ, INC. | NYSE: CBZ Transaction Funding Consideration $2.3B; ~50% Cash / ~50% CBIZ shares ensures alignment with CBIZ shareholders Cash Funding Requirement Committed financing in place – led by Bank of America New $600M five-year revolver New $1,400M Term Loan A facility Post-Close Liquidity ~$1.45B outstanding at close (includes seller proceeds, refinancing existing debt, closing costs), post-close unused capacity of ~$550M Equity Funding Issue ~14M shares over 3 years representing ~22% of total shares outstanding at close 36-month installment issuance of shares ~5% Performance Shares issued on fourth anniversary as retention tool

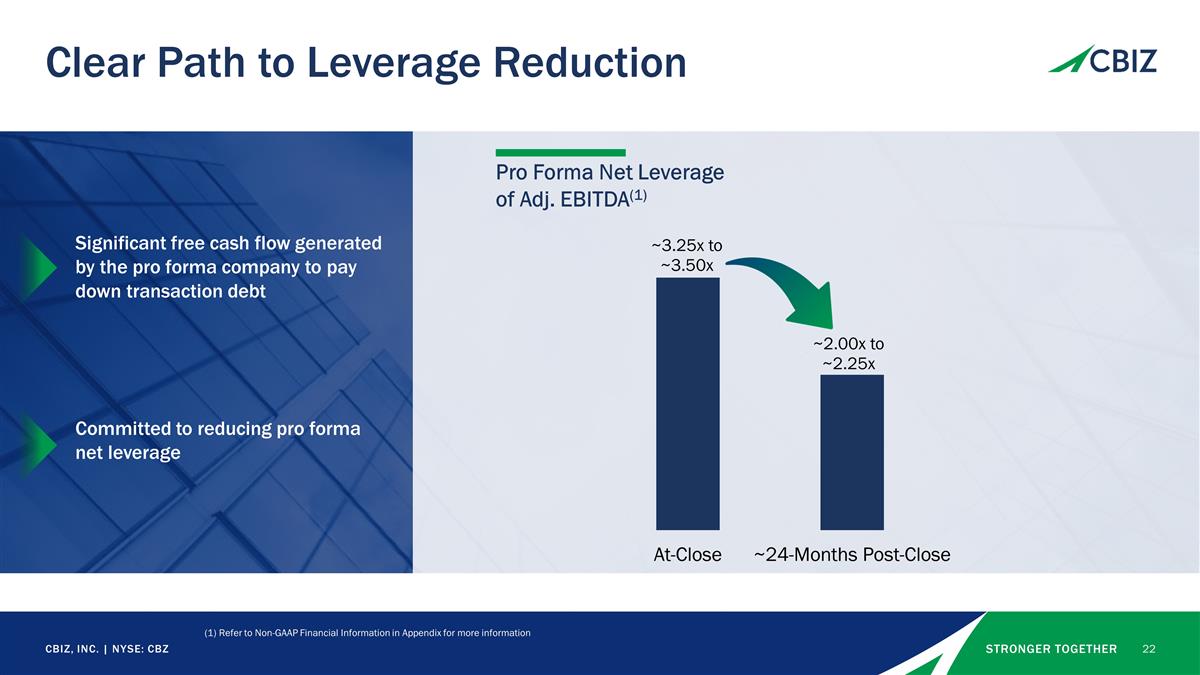

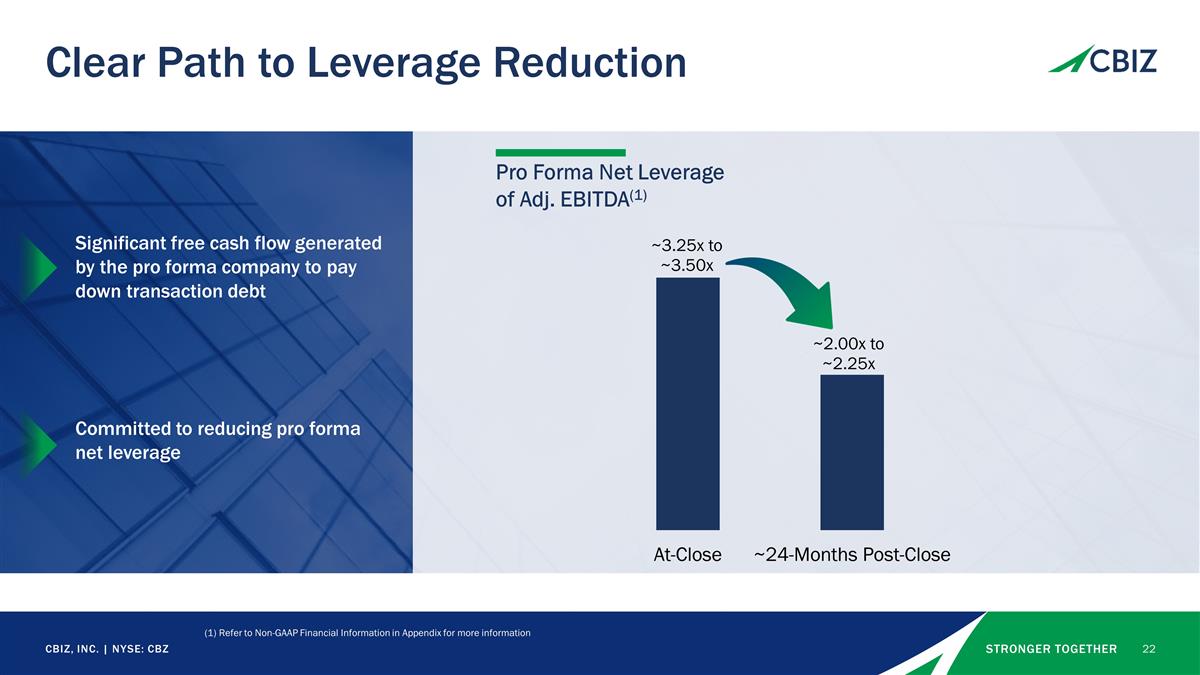

CBIZ, INC. | NYSE: CBZ Clear Path to Leverage Reduction Pro Forma Net Leverage of Adj. EBITDA(1) Significant free cash flow generated by the pro forma company to pay down transaction debt Committed to reducing pro forma net leverage (1) Refer to Non-GAAP Financial Information in Appendix for more information

CBIZ, INC. | NYSE: CBZ CBIZ + Marcum: Strategic Rationale Accelerates our growth strategy while generating attractive shareholder value (1) Refer to Non-GAAP Financial information in Appendix for more information Market Position Solidify position as a leading provider of professional services to the growing middle market and 7th largest accounting services provider in the U.S. Growth Strategy Scale accelerates growth and further positions CBIZ as an acquirer of choice Our People Attract and retain the best and brightest in our industries, enhance learning and development aligned to meaningful career paths and expanded growth opportunities Client Experience Offer an unmatched breadth of services and depth of expertise including the development of innovative and actionable solutions Industry Expertise Combined industry knowledge enables access to new sectors and expands presence in target industries Innovation & Technology Enable greater investment in technology to support data-driven insights and solutions while driving innovation, increasing efficiency and enhancing performance Shareholder Value Expect to be accretive in 2025, with an estimated contribution to Adjusted EPS(1) of approximately 10%

Q&A

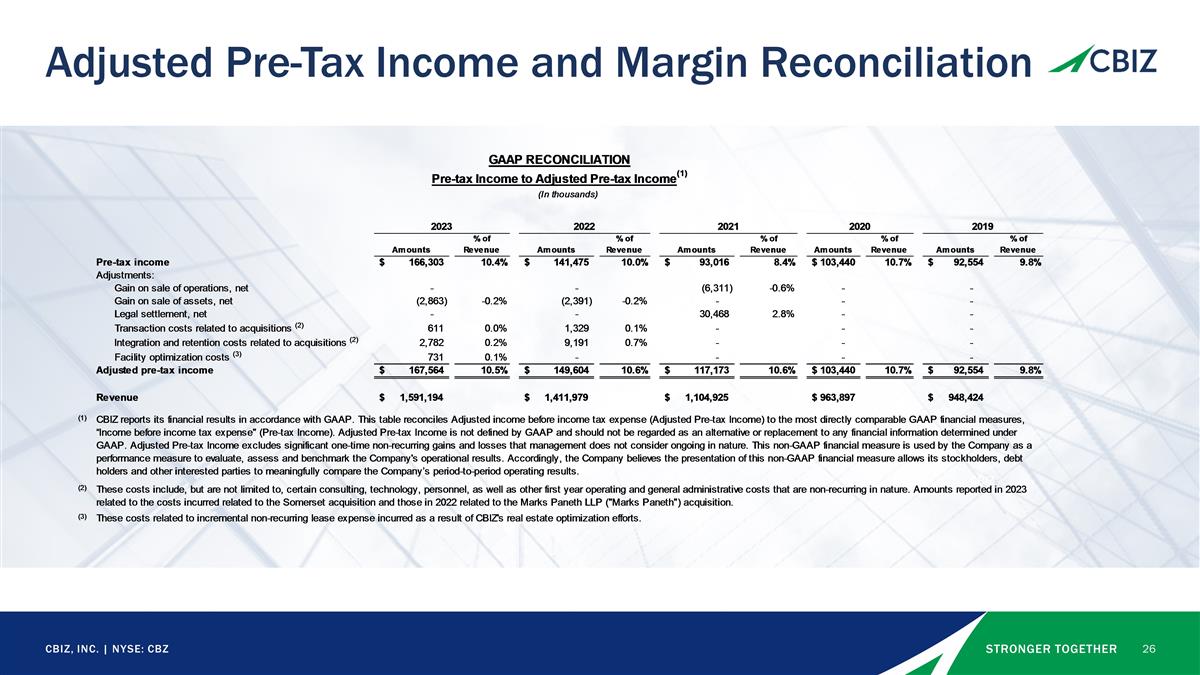

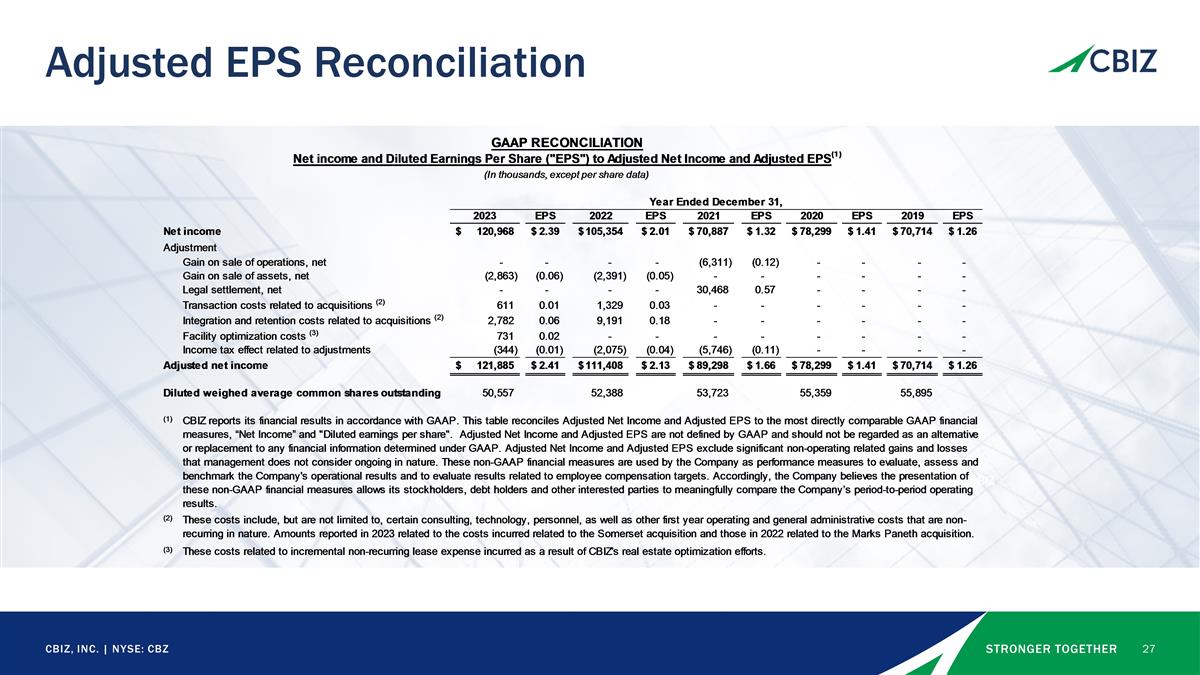

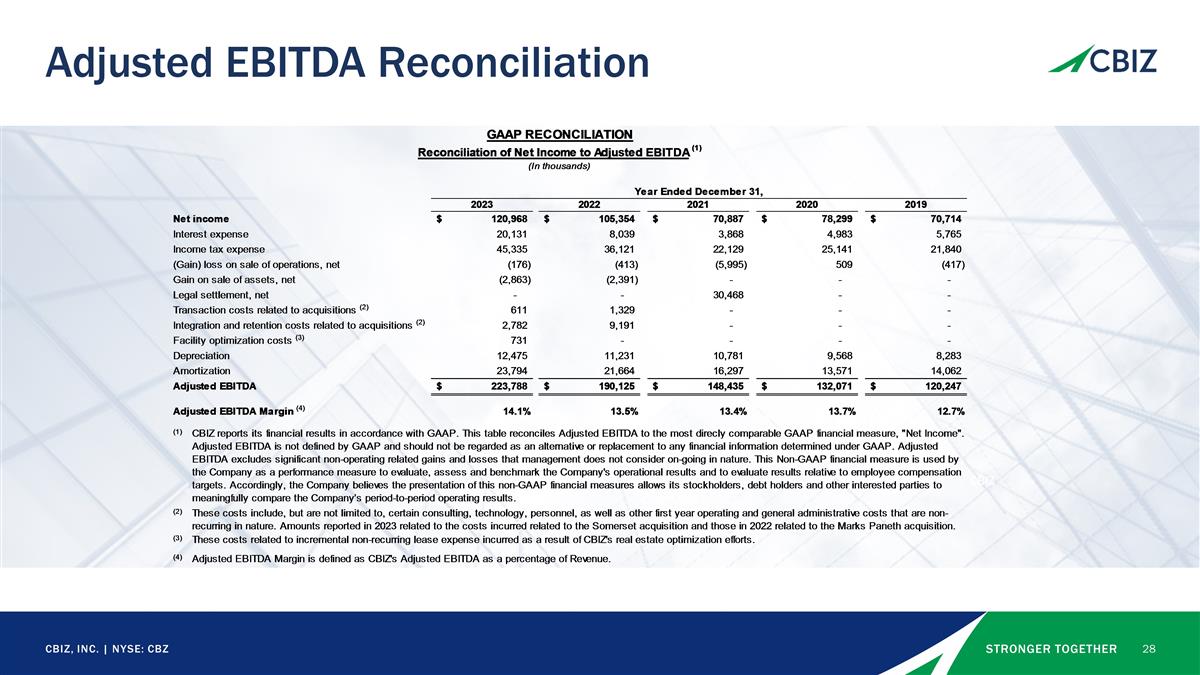

Non-GAAP Financial Information The following tables reconcile certain non-GAAP measures referenced in this presentation. In addition to historical information for the Company, this presentation references the Company's estimates for certain forward-looking information on non-GAAP basis after giving effect to the transaction. The Company's estimates for these measures are based on generally similar types of adjustments included in historical measures.

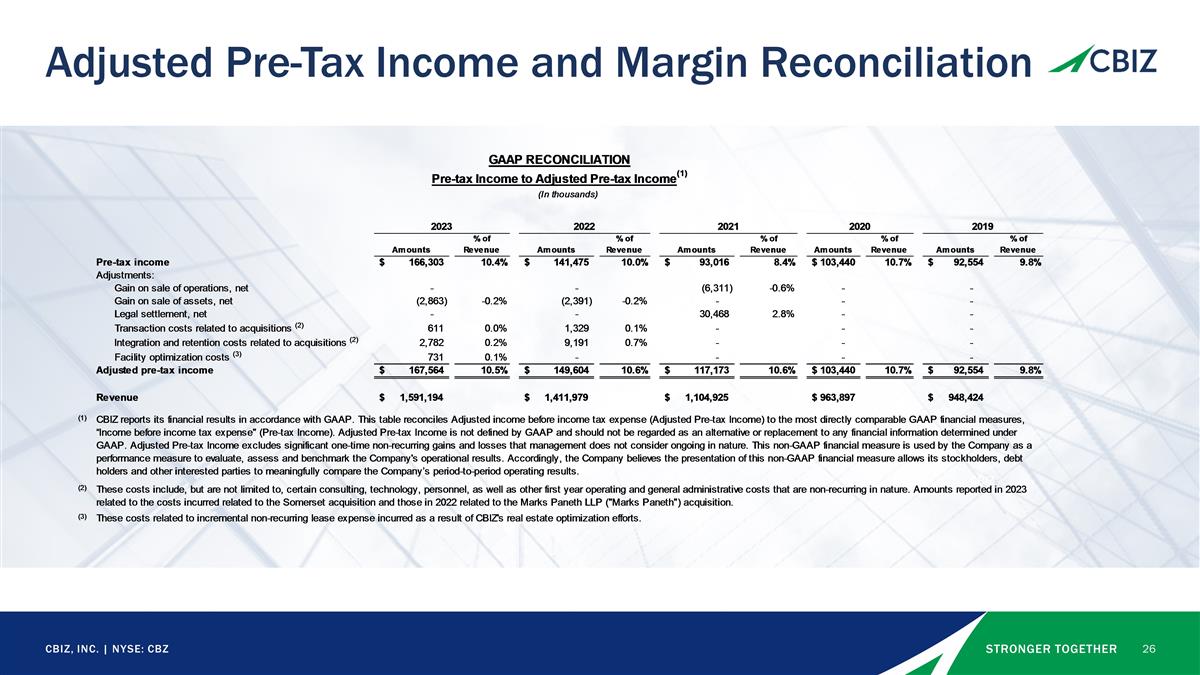

CBIZ, INC. | NYSE: CBZ Adjusted Pre-Tax Income and Margin Reconciliation CBIZ

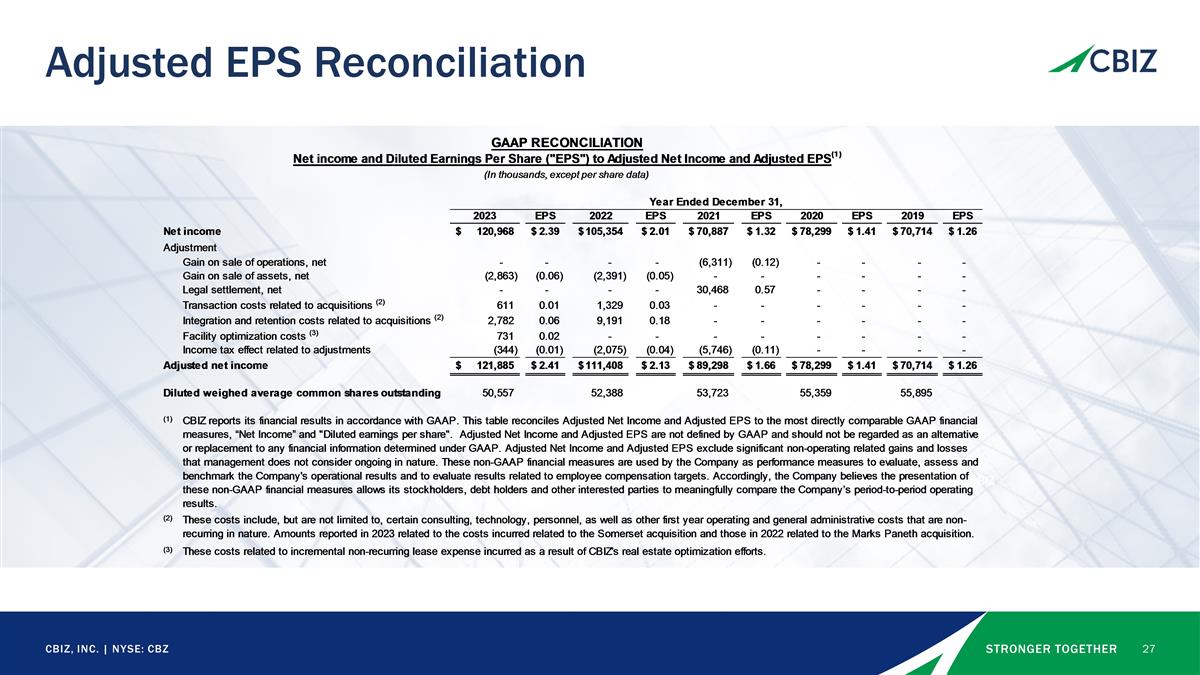

CBIZ, INC. | NYSE: CBZ Adjusted EPS Reconciliation CBIZ

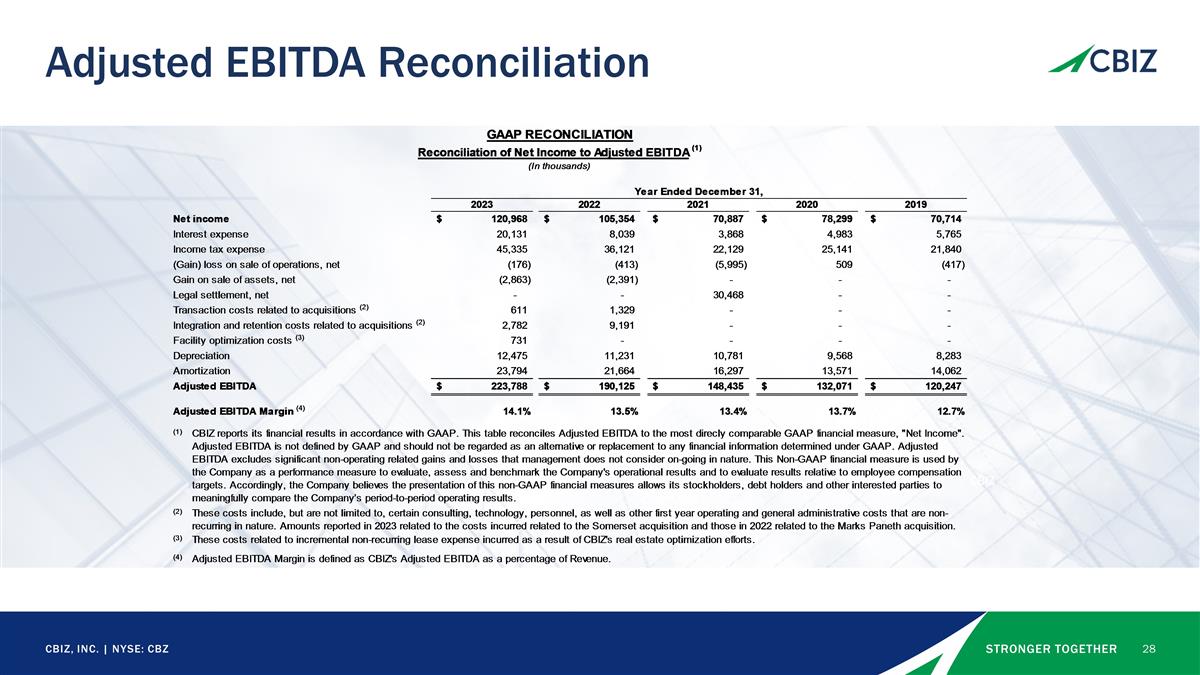

CBIZ, INC. | NYSE: CBZ Adjusted EBITDA Reconciliation CBIZ

Your Team Connect with us at CBIZ.com