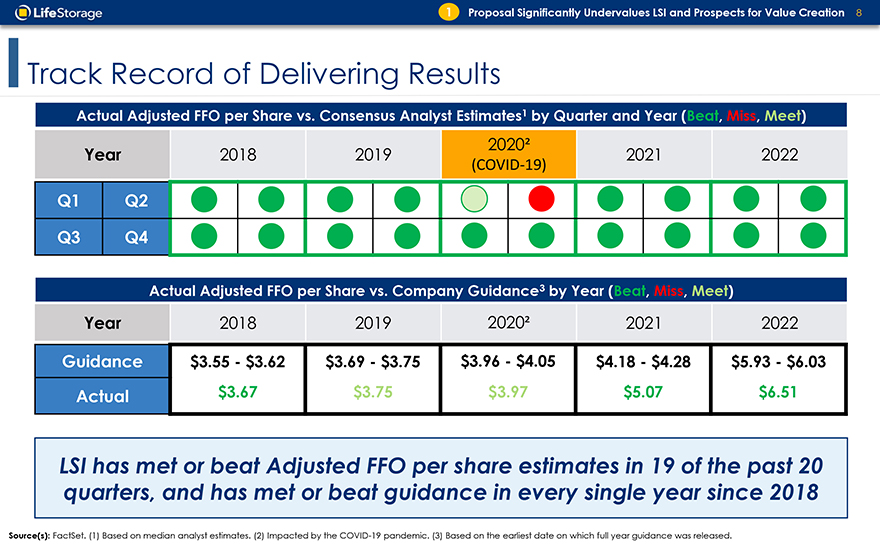

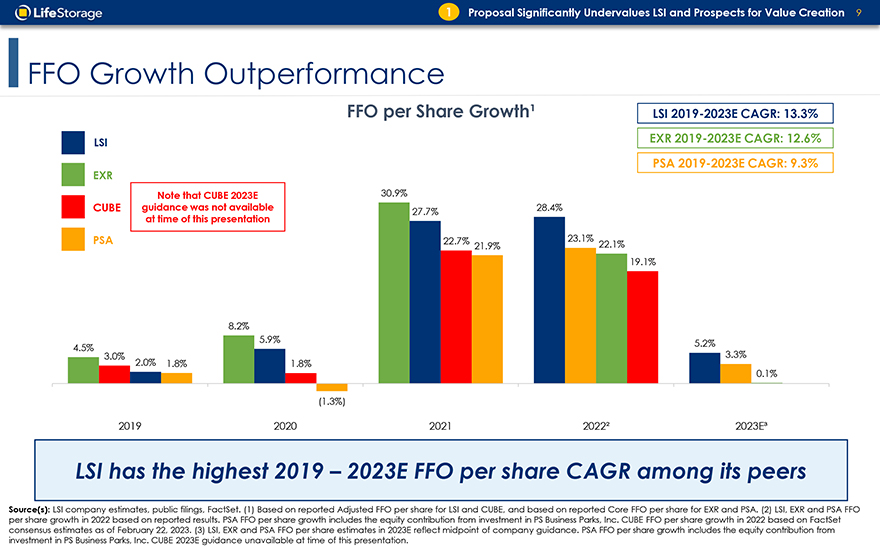

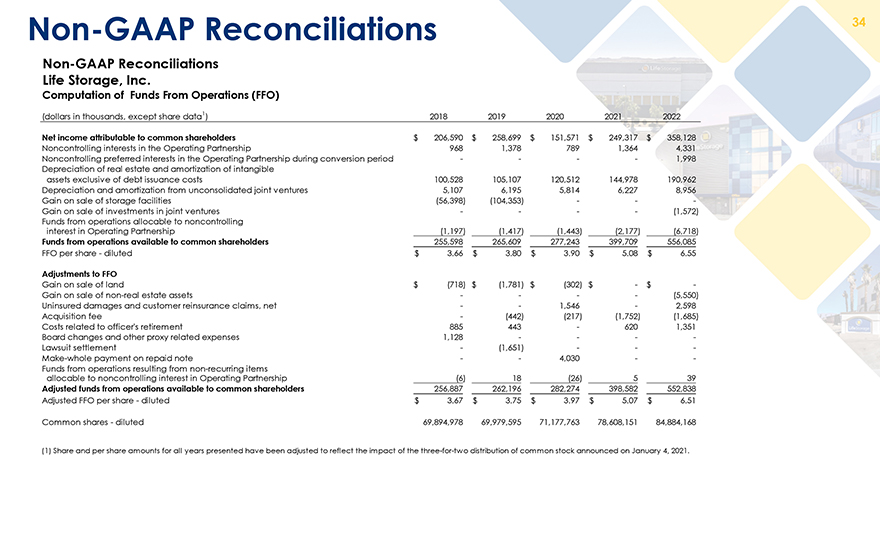

Non-GAAP Reconciliations Non-GAAP Reconciliations Life Storage, Inc. Computation of Funds From Operations (FFO) (dollars in thousands, except share data1) 2018 2019 2020 2021 2022 Net income attributable to common shareholders $ 206,590 $ 258,699 $ 151,571 $ 249,317 $ 358,128 Noncontrolling interests in the Operating Partnership 968 1,378 789 1,364 4,331 Noncontrolling preferred interests in the Operating Partnership during conversion period 1,998 Depreciation of real estate and amortization of intangible assets exclusive of debt issuance costs 100,528 105,107 120,512 144,978 190,962 Depreciation and amortization from unconsolidated joint ventures 5,107 6,195 5,814 6,227 8,956 Gain on sale of storage facilities (56,398) (104,353) — — -Gain on sale of investments in joint ventures (1,572) Funds from operations allocable to noncontrolling interest in Operating Partnership (1,197) (1,417) (1,443) (2,177) (6,718) Funds from operations available to common shareholders 255,598 265,609 277,243 399,709 556,085 FFO per share—diluted $ 3.66 $ 3.80 $ 3.90 $ 5.08 $ 6.55 Adjustments to FFO Gain on sale of land $ (718) $ (1,781) $ (302) $ —$ -Gain on sale of non-real estate assets (5,550) Uninsured damages and customer reinsurance claims, net — — 1,546 — 2,598 Acquisition fee — (442) (217) (1,752) (1,685) Costs related to officer’s retirement 885 443 — 620 1,351 Board changes and other proxy related expenses 1,128 -Lawsuit settlement — (1,651) — — -Make-whole payment on repaid note — — 4,030 — -Funds from operations resulting from non-recurring items allocable to noncontrolling interest in Operating Partnership (6) 18 (26) 5 39 Adjusted funds from operations available to common shareholders 256,887 262,196 282,274 398,582 552,838 Adjusted FFO per share—diluted $ 3.67 $ 3.75 $ 3.97 $ 5.07 $ 6.51 Common shares—diluted 69,894,978 69,979,595 71,177,763 78,608,151 84,884,168 (1) Share and per share amounts for all years presented have been adjusted to reflect the impact of the three-for-two distribution of common stock announced on January 4, 2021.