SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(A) of the Securities Exchange Act of 1934

Filed by the Registrant ☑Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to ss.240.14a-11(c) or ss.240.14a-12 |

GSE SYSTEMS, INC.

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

_________________________________________________________________________________

| | (2) | Aggregate number of securities to which transaction applies: |

_________________________________________________________________________________

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

_________________________________________________________________________________

| | (4) | Proposed maximum aggregate value of transaction: |

_________________________________________________________________________________

_________________________________________________________________________________

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

_________________________________________________________________________________

| | (2) | Form, Schedule or Registration Statement No.: |

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

GSE SYSTEMS, INC.

1332 Londontown Blvd., Suite 200

Sykesville, MD 21784

(410) 970-7800

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of GSE Systems, Inc. on Monday, August 31, 2020. The Annual Meeting will begin at 9:00 a.m. local time and is currently scheduled to take place at 6724 Alexander Bell Drive, Hub Spot Conference Center, Suite 105, Columbia, Maryland 21046.

The business to be presented for action at the Annual Meeting is described in the Proxy Statement. We urge you to read the Proxy Statement carefully. In addition to the formal items of business, I will be available at the meeting to answer your questions.

We look forward to seeing you at the meeting.

Very truly yours,

Jack Fuller

Chairman of the Board

GSE SYSTEMS, INC.

1332 Londontown Blvd., Suite 200

Sykesville, MD 21784

NOTICE OF THE ANNUAL MEETING OF STOCKHOLDERS

Monday, August 31, 2020

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders (the “Annual Meeting”) of GSE Systems, Inc. (the “Company”) will be held on Monday, August 31, 2020, at 9:00 a.m. local time, at 6724 Alexander Bell Drive, Hub Spot Conference Center, Suite 105, Columbia, Maryland 21046, and thereafter as it may from time to time be adjourned, for the purposes stated below:

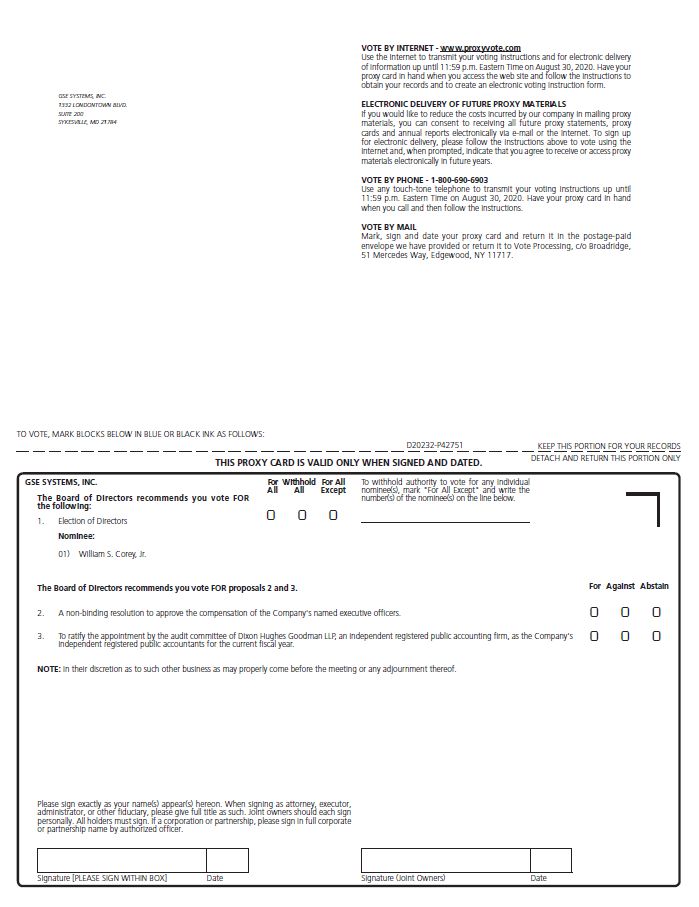

| 1. | To elect one Class I director to serve until the 2023 Annual Meeting and until his or her successor is elected and qualified; |

| 2. | To approve a non-binding resolution regarding the compensation of the Company’s named executive officers; |

| 3. | To ratify the appointment by the Audit Committee of the Board of Directors of Dixon Hughes Goodman LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020; and |

| 4. | To transact such other business as may properly come before the Annual Meeting or at any adjournments or postponements thereof. |

The Company currently intends to hold the Annual Meeting in person at the address provided above. The Company is actively monitoring developments in connection with the coronavirus (COVID-19) outbreak, however, and is sensitive to the public health and travel concerns that stockholders may have and the protocols or guidance that federal, state, and local governments and agencies such as the Centers for Disease Control and Prevention and World Health Organization may recommend or impose. In the event it is not possible, prudent, or advisable to hold the Annual Meeting in person, the Company will announce alternative arrangements for the meeting as promptly as possible, which may include holding the Annual Meeting solely by means of remote communication or holding the Annual Meeting at another date and/or time. If the Annual Meeting will be held solely by means of remote communication, the Company will announce that fact as promptly as practicable, and details on how to participate will be posted on the website at which the Company’s proxy materials are available at www.proxyvote.com, and such announcement will be filed with the U.S. Securities and Exchange Commission as additional proxy material and also posted on the Company’s website after release. Please monitor the Company’s website and the website at which the Company’s proxy materials are available at www.proxyvote.com for updated information.

The Board of Directors has fixed the close of business on July 2, 2020, as the record date for the Annual Meeting. Owners of the Company’s common stock at the close of business on that day are entitled to receive this notice of and to vote at the Annual Meeting or at any adjournments or postponements thereof. Information regarding each of the matters to be voted on at the Annual Meeting is contained in the attached Proxy Statement and this Notice of Annual Meeting of Stockholders. We urge you to read the Proxy Statement carefully.

If you plan to attend the Annual Meeting, please mark the appropriate box on the proxy card to help us plan for the Annual Meeting.

By Order of the Board of Directors

Daniel W. Pugh

General Counsel and Secretary

Sykesville, Maryland

July 24, 2020

GSE SYSTEMS, INC.

1332 Londontown Blvd., Suite 200

Sykesville, MD 21784

(410) 970-7800

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

To be Held on Monday, August 31, 2020

GENERAL ANNUAL MEETING INFORMATION

This proxy statement contains information related to the annual meeting (the “Annual Meeting”) of stockholders of GSE Systems, Inc. (the “Company” or “GSE Systems”) to be held on Monday, August 31, 2019 at 9:00 a.m. local time at 6724 Alexander Bell Drive, Hub Spot Conference Center, Suite 105, Columbia, Maryland 21046. Proxies are hereby being solicited by the board of directors (“Board of Directors”). This proxy statement and the proxy card will be mailed to stockholders on or about July 24, 2020, which will be the date on which these materials will be filed with the Securities and Exchange Commission (“SEC”).

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on August 31, 2020. The proxy statement and annual report are available at:

https://www.gses.com/about/investors/corporate-governance/

On or around July 24, 2020, we began sending this proxy statement, the attached notice of annual meeting of stockholders, and the enclosed proxy card to all stockholders entitled to vote at the Annual Meeting. Although not part of this proxy statement, our 2019 Annual Report on Form 10-K, which includes our financial statements for the fiscal year ended December 31, 2019, accompanies this proxy statement.

You can also find a copy of this proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2019, at: https://www.gses.com/about/investors/corporate-governance/.

Annual Meeting Business

What proposals will be addressed at the Annual Meeting?

Stockholders will be asked to vote on the following proposals at the Annual Meeting:

| 1. | Election of one Class I director to serve until the 2023 annual meeting of stockholders and until his or her successor is elected and qualified; |

| 2. | A non-binding resolution to approve the compensation of the Company’s named executive officers; |

| 3. | A resolution ratifying the appointment by the Audit Committee of the Board of Directors of Dixon Hughes Goodman LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020; and |

| 4. | Any other matters properly brought before the meeting or any postponement or adjournment thereof. |

Our Board unanimously recommends that the stockholders vote FOR the nominee for Class I director in Proposal 1, William S. Corey, Jr., and FOR proposals 2 and 3.

What vote is required to approve each proposal?

Conduct of business at the Annual Meeting requires the presence of a quorum of stockholders. A quorum is achieved if stockholders holding at least a majority of our outstanding common stock as of the close of business on July 2, 2020 (the “Record Date”) are present at the Annual Meeting, in person or by proxy. Abstentions and broker non-votes will not be counted as present for purposes of determining whether a quorum is present for the conduct of business.

Proposal 1: Election of Director. To be elected to the Board of Directors, a nominee for director must receive the affirmative vote of a majority of the sum of (a) the total votes cast for and (b) the total votes affirmatively withheld as to such nominee. There is one Class I director to be elected at the Annual Meeting and one individual has been properly nominated. Abstentions and broker non-votes have no impact on the outcome of the election of directors as long as a quorum is present. The nominee for Class I director is William S. Corey, Jr.

Proposal 2: A Non-binding Resolution to Approve the Company’s Named Executive Officer Compensation. The approval of Proposal 2 requires the affirmative vote of a majority of the votes cast on this proposal. Abstentions and broker non-votes are not votes cast and, therefore, will not affect the outcome of the voting for this proposal as long as a quorum is present. This proposal is non-binding on the Board of Directors. Although non-binding, the Board of Directors and the Compensation Committee will carefully review and consider the voting results.

Proposal 3: Ratification of Appointment of Independent Registered Public Accounting Firm. The approval of Proposal 3 requires the affirmative vote of a majority of the votes cast on this proposal. Abstentions will have no effect on the results of this vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street names on this proposal. If a broker does not exercise this authority, such broker non-votes will not affect the outcome of the voting for this proposal.

The Company will continue its long-standing practice of holding the votes of all stockholders in confidence from directors, officers and employees except: (a) as necessary to meet applicable legal requirements and to assert and defend claims for or against the Company; (b) in case of a contested proxy solicitation; or (c) if a stockholder makes a written comment on the proxy card or otherwise communicates his/her vote to management.

Voting and Proxies

Who may vote at the Annual Meeting?

All stockholders of record of the Company’s common stock, par value $0.01 per share (“Common Stock”), on the Record Date will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, the Company had 20,425,016 shares of Common Stock outstanding and entitled to vote.

How many votes do I have?

You are entitled to cast one vote for each share of Common Stock owned by you on the Record Date on all matters properly brought before the Annual Meeting.

How do I vote?

If you are a holder of record (that is, if your shares are registered in your name with Continental Stock Transfer & Trust Company, our transfer agent (the “Transfer Agent”)), there are four ways to vote:

Telephone Voting: You may vote by telephone by calling the toll-free telephone number indicated on the proxy card. Please follow the voice prompts that allow you to vote your shares and confirm that your instructions have been properly recorded.

Internet Voting: You may vote electronically over the Internet by following the instructions on the proxy card. Please follow the website prompts that allow you to vote your shares and confirm that your instructions have been properly recorded.

Return Your Proxy Card By Mail: You may vote by completing, signing and returning the proxy card in the postage-paid envelope provided with this proxy statement. The proxy holders will vote your shares according to your directions. If you sign and return your proxy card without specifying choices, your shares will be voted by the persons named in the proxy in accordance with the recommendations of the Board of Directors as set forth in this proxy statement.

Vote at the Meeting: You may cast your vote in person at the Annual Meeting. Written ballots will be passed out to anyone who wants to vote in person at the meeting.

Telephone and Internet voting for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. local time on August 30, 2020. Telephone and Internet voting is convenient, provides postage and mailing cost savings and is recorded immediately, minimizing the risk that postal delays may cause votes to arrive late and, therefore, not be counted.

Even if you plan to attend the Annual Meeting, you are encouraged to vote your shares by proxy. You may still vote your shares in person at the Annual Meeting even if you have previously voted by proxy. If you are present at the Annual Meeting and desire to vote in person, your vote by proxy will not be counted.

How do I vote if I hold my shares in “street name?”

If you hold shares in “street name,” you should follow the voting directions provided by your broker or nominee. You may complete and mail a voting instruction card to your broker or nominee or, in most cases, submit voting instructions by telephone or the Internet to your broker or nominee. If you provide specific voting instructions by mail, telephone or the Internet, your broker or nominee will vote your shares as you have directed.

Will my shares be voted if I do not provide my proxy?

If you are the stockholder of record and you do not vote or provide a proxy, your shares will not be voted.

If your shares are held in street name, your broker can only cast a vote on your behalf on “routine” matters under applicable New York Stock Exchange rules governing brokers. Your broker may not vote your shares on non-routine matters unless they have received voting instructions from you. The election of Directors and the non-binding resolution to approve the Company’s executive compensation are not considered to be “routine” matters, and therefore your broker may not vote your shares with respect to these proposals without receiving your voting instructions.

Can I change my mind after I vote?

Yes. If you are a stockholder of record, you may change your vote or revoke your proxy at any time before it is voted at the Annual Meeting by:

| • | submitting a new proxy by telephone or via the Internet after the date of the earlier voted proxy and prior to the deadline for submitting a vote by telephone or Internet; |

| • | signing another proxy card with a later date and returning it to us prior to the Annual Meeting; or |

| • | attending the Annual Meeting and voting in person after giving notice to the Secretary of the Annual Meeting. |

If you hold your shares in street name, you may submit new voting instructions by contacting your broker, bank or other nominee. You may also vote in person at the Annual Meeting if you obtain a legal proxy from your broker, bank or other nominee.

Other Meeting Information

Could the Annual Meeting be postponed?

If a quorum is not present or represented at the Annual Meeting, the chair of the meeting or the stockholders entitled to vote at the meeting have the power to postpone the meeting. The presence, in person or by proxy, of at least a majority of the shares of Common Stock outstanding as of the Record Date will constitute a quorum and is required to transact business at the Annual Meeting. Logistical difficulties and uncertainties associated with the current COVID-19 pandemic could interfere with gathering sufficient proxies or in-person attendance to satisfy the quorum requirements, and if this occurs, a postponement of the Annual Meeting would result.

Who bears the cost of soliciting proxies?

The Company will bear the cost of preparing, assembling and mailing the full set of proxy materials and of reimbursing brokers, nominees, fiduciaries and other custodians for out-of-pocket and clerical expenses of transmitting the proxy materials to the beneficial owners of our shares. In addition to use of the mail, proxies may be solicited by directors, officers and other employees of the Company, without additional compensation, in person or by telephone. The Company does not plan to employ a professional solicitation firm with respect to items to be presented at the Annual Meeting.

Where are the Company’s principal executive offices or headquarters?

The principal executive offices or headquarters of the Company are located at 1332 Londontown Boulevard, Suite 200, Sykesville, Maryland 21784, and our telephone number is (410) 970-7800. The Company has additional executive offices located at 6940 Columbia Gateway Drive, Suite 470, Columbia, Maryland 21046. The same telephone number applies to this location. The Annual Meeting will be held at an off-site location near the Company’s offices in Columbia, Maryland: 6724 Alexander Bell Drive, Hub Spot Conference Center, Suite 105, Columbia, Maryland 21046, unless it is not possible, prudent, or advisable to hold the Annual Meeting in person, in which case the Company will announce alternative arrangements for the meeting as promptly as possible.

How can I obtain additional information about the Company?

The Company will, upon written request of any stockholder, furnish without charge a copy of its Annual Report on Form 10-K for the fiscal year ended December 31, 2019 (the “2019 Form 10-K”), as filed with the SEC, including financial statements and financial statement schedules required to be filed with the SEC pursuant to Rule 13a-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), but without exhibits. A list describing the exhibits not contained in the 2019 Form 10-K will be furnished with the 2019 Form 10-K. Please address all written requests to GSE Systems, Inc., 1332 Londontown Blvd., Suite 200, Sykesville, Maryland 21784, Attention: Corporate Secretary. Exhibits to the 2019 Form 10-K will be provided upon written request and payment of an appropriate processing fee which is limited to the Company’s reasonable expenses incurred in furnishing the requested exhibits. In addition, the 2019 Form 10-K can be found on the Company’s website, www.gses.com, under Investors/Financial Information, and you may also view proxy materials or request paper copies online at www.proxyvote.com using the information and instructions provided on the proxy card.

Do any of the officers or directors have a material interest in the matters to be acted upon?

To the best of our knowledge, no directors, officers, or any of their associates have a material interest, direct or indirect, in any matters to be acted upon at the Annual Meeting, other than with respect to the non-binding executive compensation proposal.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS, AND MANAGEMENT

Voting Securities and Principal Holders Thereof

The following table sets forth certain information known to the Company regarding the beneficial ownership of the Common Stock as of the Record Date by (1) all beneficial owners of 5% or more of the Common Stock; (2) each director and nominee for election as director; (3) each executive officer named in the Summary Compensation Table appearing elsewhere in this Proxy Statement (the “Named Executive Officers”); and (4) all executive officers, directors and nominees of the Company as a group. The number of shares beneficially owned by each person is determined under the rules of the Securities and Exchange Commission (the “SEC”) and the information is not necessarily indicative of beneficial ownership for any other purpose. SEC rules deem a person to be the beneficial owner of any securities which that person has the right to acquire within 60 days of the Record Date. The Common Stock is the only class of voting securities of the Company. Except as otherwise indicated in the footnotes to the tables below, the Company believes that the beneficial owners of the Common Stock have sole investment and voting power with respect to such shares, subject to community property laws where applicable. Unless otherwise indicated, the address for each of the stockholders listed below is c/o GSE Systems, Inc., 1332 Londontown Blvd., Suite 200, Sykesville, Maryland 21784.

| Name of Beneficial Owner | GSE Common Stock Amount and Nature of Beneficial Ownership (A)(1) | | Percent of Class (B)(1) |

| Beneficial Owners: | | | |

| | | | |

NGP Energy Technology Partners II, L.P. 1700 K St. NW, Suite 750 Washington, DC 20006 | 2,616,525 | (2) | 12.8% |

| | | | |

| | | | |

Polar Asset Management Partners Inc. 401 Bay Street, Suite 1900 P.O. Box 19 Toronto, Ontario, M5H 2Y4, Canada | 2,000,000 | (3) | 9.8% |

| | | | |

| | | | |

PVAM Perlus Microcap Fund L.P. c/o Conyers Trust Company (Cayman) Limited Cricket Square, Hutchins Drive, P.O. Box 2681 Grand Cayman, KY1-1111, Cayman Islands PVAM Holdings Ltd. and Pacific View Asset Management (UK) LLP 8th Floor, 20 Farringdon Street London, EC4A 4AB, United Kingdom | 1,658,819 | (4) | 8.1% |

| | | | |

| | | | |

Needham Asset Management, LLC, Needham Investment Management L.L.C., Needham Aggressive Growth Fund, and George A. Needham 250 Park Avenue, 10th Floor New York, NY 10177-1099 | 1,100,683 | (5) | 5.4% |

| | | | |

| | | | |

| Board and Management | | | |

J. Barnie Beasley | 33,227 | (6) | * |

William S. Corey, Jr. | -- | (7) | * |

John D. Fuller | 40,579 | (8) | * |

Kathryn O’Connor Gardner | 23,590 | (9) | * |

James H. Stanker | 48,118 | (10) | * |

Suresh Sundaram | 51,961 | (11) | * |

Kyle J. Loudermilk | 470,803 | (12) | 2.3% |

Emmett A. Pepe | 132,751 | (13) | * |

Christopher D. Sorrells | 418,451 | (14) | 2.0% |

Paul T. Abbott | 110,003 | (15) | * |

| | | | |

Directors and Executive Officers as a group (10 persons) | 1,386,422 | (16) | 6.8% |

| | | | |

| (A) | This table is based on information supplied by officers, directors and principal stockholders of the Company and on any Schedules 13D or 13G filed with the SEC. |

| (B) | Applicable percentages are based on 20,425,016 shares outstanding on July 2, 2020, adjusted where applicable for each owner as required by rules promulgated by the SEC. |

| (1) | Includes all time-restricted stock units vesting within 60 days of the Record Date. |

| (2) | Based on a Schedule 13G filed with the SEC on February 13, 2020, by NGP Energy Technology Partners II, L.P., on its own behalf and on behalf of NGP ETP II, L.L.C., Energy Technology Partners, L.L.C., and Philip J. Deutch. Each of the Reporting Persons other than NGP Energy Technology Partners II, L.P., disclaim beneficial ownership over the securities reported except to the extent of the Reporting Persons’ pecuniary interest therein. |

| (3) | Based on a Schedule 13G filed with the SEC on February 11, 2020, by Polar Asset Management Partners Inc. Polar Asset Management Partners Inc. serves as investment advisor to Polar Multi-Strategy Master Fund, Polar Micro-Cap Fund, Polar Micro-Cap Fund II L.P., and certain managed accounts, with respect to the shares of Common Stock, and shares with such entities collectively the right to receive or the power to direct the receipt of dividends therefrom or the proceeds of sale thereof. |

| (4) | Based on a Schedule 13G/A filed with the SEC on February 14, 2020, on behalf of PVAM Perlus Microcap Fund L.P., PVAM Holdings Ltd., and Pacific View Asset Management (UK) LLP, as reporting persons with respect to the shares of Common Stock. |

| (5) | Based on a Schedule 13G filed with the SEC on February 14, 2020, by Needham Asset Management, LLC, Needham Investment Management L.L.C., Needham Aggressive Growth Fund, and George A. Needham. Each of Needham Asset Management, LLC, Needham Investment Management L.L.C., and George A. Needham share voting and dispositive power with respect to 1,100,683 shares of Common Stock, while Needham Aggressive Growth Fund shares voting and dispositive power with respect to 1,052,625 shares of Common Stock. |

| (6) | Includes 33,227 shares of Common Stock owned directly by Mr. Beasley. |

| (7) | Candidate for election as a director. |

| (8) | Includes 40,579 shares of Common Stock owned directly by Mr. Fuller. |

| (9) | Includes 23,590 shares of Common Stock owned directly by Ms. Gardner. |

| (10) | Includes 48,118 shares of Common Stock owned directly by Mr. Stanker. |

| (11) | Includes 51,961 shares of Common Stock owned directly by Dr. Sundaram. |

| (12) | Includes 470,803 shares of Common Stock owned directly by Mr. Loudermilk. |

| (13) | Includes 131,013 shares of Common Stock owned directly by Mr. Pepe. |

| (14) | Includes 418,451 shares of Common Stock owned directly by Mr. Sorrells as of his departure from the Company on September 30, 2019. The Company is not apprised of any changes in Mr. Sorrells's ownership after that date. |

| (15) | Includes 110,003 shares of Common Stock owned directly by Mr. Abbott. |

| (16) | Includes 1,386,422 shares of Common Stock owned directly by the directors and executive officers. |

INFORMATION ABOUT DIRECTORS AND EXECUTIVE OFFICERS

Independent Directors

| Name | | Age | Title(s) |

| John D. (“Jack”) Fuller | (1) | 69 | Director, Chairman of the Board of Directors |

| James H. Stanker | (1) | 62 | Director, Chair of the Audit Committee |

| Suresh Sundaram | (1) | 55 | Director, Chair of the Compensation Committee |

| J. Barnie Beasley | (1) | 68 | Director, Chair of the Nominating & Governance Committee |

Kathryn O’Connor Gardner | (1) | 45 | Director |

William S. Corey, Jr. | (2) | 60 | Nominee |

(1) Member of Audit Committee, Compensation Committee, and Nominating & Governance Committee

(2) Nominee for election to the Board of Directors as an Independent Director

Directors who are also Executive Officers

| Name | | Age | Titles |

| Kyle J. Loudermilk | | 52 | Chief Executive Officer, President, Director |

Executive Officers

| Name | | Age | Title(s) |

| Paul T. Abbott | | 54 | President, Nuclear Industry Training & Consulting Division |

| Emmett A. Pepe | | 55 | Chief Financial Officer, Treasurer |

| Daniel W. Pugh | | 54 | Chief Legal and Risk Officer, Secretary |

| | | | |

Background of Directors and Executive Officers and Qualifications of Directors

Biographical information with respect to the directors and executive officers of GSE Systems is set forth below. There are no familial relationships between any directors or executive officers.

Independent Directors

J. Barnie Beasley – Mr. Beasley has served as an independent director of GSE Systems since June 2018. He currently serves on the Boards of Directors of American Electric Power (NYSE:AEP), one of the largest electric utilities in the United States, delivering electricity to nearly 5.4 million customers in 11 states, and of KCI Technologies, Inc., a privately held engineering services company. His AEP director responsibilities include a five-year membership on the Audit Committee and membership on the Policy Committee, Human Resources and Compensation Committee, and the Nuclear Oversight Committee, of which he is Chairman. On the KCI Technologies board Mr. Beasley serves as Chairman of the Compensation Committee and as a member of the Audit Committee and the Nominating and Governance Committee. He also served from 2014 to 2019 as an independent consultant to Energy Solutions, an international nuclear services company. In this consulting role he served as Chairman of the Nuclear Safety Review Board for the nuclear power stations being decommissioned by Energy Solutions.

Mr. Beasley retired in 2008 as Chairman, President, and Chief Executive Officer of Southern Nuclear Operating Company, the subsidiary of the Southern Company that operates and maintains Southern Company’s nuclear power plants. Mr. Beasley’s career with Southern Nuclear Operating Company began in 1997, where he served as Vice President and later as Executive Vice President and Chief Nuclear Officer before becoming Chairman, President, and CEO. Prior to Southern Nuclear, Mr. Beasley spent 27 years in various roles with Georgia Power Company including Plant General Manager of the Vogtle Nuclear Generating Station.

Mr. Beasley served for five years on the Board of Directors of Energy Solutions (NYSE:ES), a public international nuclear services company with operations throughout the United States, Canada, the United Kingdom, and other countries. As a director on the Energy Solutions board, he served on the Audit Committee and the Compensation Committee, and was involved in the company’s successful sale in 2013 to a private equity group. He also served for three years as an independent nuclear safety and operations expert advising the Tennessee Valley Authority (TVA) Board of Directors. Mr. Beasley’s prior board service also includes the National Nuclear Accrediting Board, the Board of Directors and Executive Committee of the Nuclear Energy Institute (NEI), the Board of Directors of the Foundation for Nuclear Studies, and the Board of Directors of the Southeastern Electric Exchange.

Mr. Beasley graduated from the University of Georgia with a B.S. degree in Engineering. He has held a Senior Reactor Operator’s license from the U.S. Nuclear Regulatory Commission, and he currently holds a Professional Engineering License in the State of Georgia. He served for ten years as a member of the College of Engineering Advisory Board at the University of Georgia for which he also served as its inaugural Chairman. He is a member of both the Georgia Society and the National Society of Professional Engineers.

Mr. Beasley’s extensive experience working in the nuclear power industry enables him to make valuable contributions of business and strategic insight to GSE’s executive leadership team and the Company’s Board of Directors. Mr. Beasley’s broad career experience in corporate, governance, and financial roles enables him to provide leadership expertise as a member of the Board, in the area of corporate governance as Chair of the Company’s Nominating and Governance Committee, as a financial expert on the Company’s Audit Committee, and as a member of the Compensation Committee of the Board.

William S. Corey, Jr. – Mr. Corey is a candidate for election to the GSE Systems Board of Directors, to which he would bring more than 37 years of experience in public accounting including extensive experience in auditing SEC registrants, financial reporting, complex accounting, and internal controls evaluation. Mr. Corey currently serves on the Board of Directors and the Audit Committee of Stewart Information Services Corporation (NYSE: STC), a global real estate services company, as well as the LP Advisory Committee for Squadra Ventures, a venture capital and private equity firm located in Baltimore, Maryland. He also currently serves on the Board of Directors of the Port Discovery Children’s Museum in Baltimore and as a member of the Board of Advisors of the James Madison University College of Business. From 2002 until June 2020, Mr. Corey was an Audit, Senior Relationship and National Pursuit Team Partner for PricewaterhouseCoopers LLP (“PwC”), where he led the audit practice and served as office managing partner for PwC’s Baltimore office for more than 11 years. Prior to his work with PwC, Mr. Corey served as an audit partner at Arthur Andersen LLP from 1995 to 2002, and in other roles in its Audit Practice from 1982 to 1995. Mr. Corey graduated with honors from James Madison University with a B.B.A. in accounting and finance and a minor in economics in 1982.

Mr. Corey’s extensive career has included auditing public and large private companies and advising boards of directors and audit committees on financial reporting, internal controls, internal and external investigations, disaster recovery, regulatory reviews, and cyber-attacks. He is qualified as a “Financial Expert” for all public company audit committee and audit committee chair requirements. Having traveled extensively for clients around the world, he possesses a global perspective, and has a proven ability to work collaboratively with management and board members. Mr. Corey’s financial insight and his expertise in risk and audit matters will bring added depth and strength to the Board.

John D. (“Jack”) Fuller – Mr. Fuller has served as an independent director of GSE Systems since June 2017 and as Chairman of the Board of Directors since June 2018, and, as disclosed on GSE’s Current Report on Form 8-K, filed with the SEC on May 15, 2020, he has notified the Company that he does not intend to stand for re-election when his term ends at the Annual Meeting on August 31, 2020. Mr. Fuller retired as Chairman of the Board of GE Hitachi Nuclear Energy (“GEH”), a global alliance that is headquartered in Wilmington, North Carolina, in July 2011. Mr. Fuller has two decades of experience in the nuclear industry serving in senior leadership positions covering new power plant development, nuclear services, fuels, enrichment and related nuclear technologies. He previously served as President and CEO of the GEH alliance, CEO of Global Nuclear Fuels and as the CFO for nuclear business of General Electric Company. Mr. Fuller’s previous assignments with GE were in multiple business disciplines of the Aircraft Engine business, the Aerospace business, and the Information Technology and Energy segments. He initially joined GE in 1972. Mr. Fuller also spent a few years as Corporate Controller of Mead Corporation. In his 40-year career, Mr. Fuller held senior leadership assignments in general management, business development, strategic planning, finance, product development and plant operations.

Mr. Fuller also currently serves as Chairman of the Board of Plantation Village, a non-profit senior living community organization located in Wilmington, North Carolina. Until recently he served as an independent member of the Board of Directors of PaR Systems, LLC, a privately held automation and robotics applications company based in Minneapolis, Minnesota, and on the boards of both the Nuclear Energy Institute in Washington, DC, and the World Nuclear Association in London, England. Prior to his retirement, he was actively engaged in supporting nuclear industry initiatives on a global basis. Mr. Fuller’s for-profit and not for profit board roles over the past 16 years have included committee assignments in the areas of finance, audit, quality, compensation development, strategic planning, executive development, and board leadership including service as Chairman of several of these boards. He is a native of northern Ohio, and earned a Bachelor degree in Aeronautics/Math from Miami University, Oxford, Ohio.

Mr. Fuller’s broad and deep experience in the nuclear industry enable him to contribute meaningful insight into the Company’s business and experience-based strategic guidance to the executive team and his fellow directors. He currently serves as a member of the Audit, Compensation, and Nominating and Governance Committees of the Board.

Kathryn O'Connor Gardner – Ms. Gardner most recently was a Senior Vice President and Corporate Credit Research Analyst within AllianceBernstein’s high-yield research group, focusing on the energy sector. In this role, she oversaw all energy-related investments for traditional high yield portfolios with roughly $35 billion in assets under management. She was also an Investment Committee Member for the Energy Opportunity Funds at AllianceBernstein. Prior to joining AllianceBernstein in 2016, Ms. Gardner was a Managing Director on the sell-side at Deutsche Bank where she covered industries including energy, automotive and aerospace & defense. Ms. Gardner’s Wall Street experience spans more than 20 years, and she also has experience serving as an advisor for startups on strategy, financial analysis and capital market transactions.

Ms. Gardner is a Founding Board Member of the Haas Center for Gender, Equity & Leadership, which seeks to build the economic case for supporting workplace diversity, and is a member of the Haas Dean's Advisory Board, which brings together the school's next generation of leaders. Finally, she sits on the board of the CSNK2A1 Foundation, which is focused on finding a cure for an ultra-rare genetic disorder called Okur-Chung Neurodevelopmental Syndrome. Ms. Gardner holds a BS in economics and a BA in business administration (Walter A. Haas School of Business) from the University of California, Berkeley. Her valuable experience in the finance industry enables her to provide broad financial and investor expertise as a member of the Board and the Audit, Compensation, and Nominating and Governance Committees, and to serve as a financial expert on the Audit Committee.

James H. Stanker – Mr. Stanker has served as a director of the Company since August 2016, and, as disclosed on GSE’s Current Report on Form 8-K, filed with the SEC on May 22, 2020, he has notified the Company that he does not intend to stand for re-election when his term ends at the Annual Meeting on August 31, 2020. Mr. Stanker has more than 30 years of strategic audit expertise and financial leadership with multinational corporations in the technology, manufacturing, and commercial product industries. Since September 1, 2018, he has served as the chief financial officer of Processa Pharmaceuticals, Inc., and is currently a visiting professor in the George B. Delaplaine School of Business at Hood College. On August 1, 2016, Mr. Stanker concluded a sixteen-year career at Grant Thornton LLP, where he served in various leadership capacities, including audit partner, professional practice director for the Atlantic Coast market, and global head of audit quality for the Firm’s international organization. Prior to Grant Thornton, Mr. Stanker served terms as the Chief Financial Officer of a Nasdaq-listed technology company and as the Chief Financial Officer of a privately-held life science startup. He started his career as an auditor with Touche Ross in the early 1980’s. Mr. Stanker earned a Master of Business Administration from California State University, East Bay, and a B.S. degree in Aeronautics from San Jose State University. He is a Certified Public Accountant.

Mr. Stanker’s career accomplishments in financial services and audit enables him to provide broad financial expertise and technology leadership as a member of the Board and the Audit, Compensation, and Nominating and Governance Committees of the Board, and to play a critical role as a financial expert on, and as Chair of, the Company’s Audit Committee.

Suresh Sundaram, Ph.D. – Dr. Sundaram has served as a director of the Company since September 2016. Dr. Sundaram has more than 27 years of experience in product development, sales, and marketing, focused on high-tech. He is currently the General Manager of Trimble Real Estate and Workplace Solutions, a division of Trimble, Inc. Prior to Trimble, Dr. Sundaram was Chief Product and Marketing Officer at CiBO Technologies, a Cambridge, MA based startup bringing simulation and data science technology to the agriculture industry. Prior to CiBO, he was the Senior Vice President – Products and Marketing at Exa Corporation, and before that, held a variety of leadership roles during a twenty-year career at Aspen Technology, a publicly-traded process software company, where his last role was Senior Vice President of Products and Market Strategy. Dr. Sundaram earned his Master of Science and Ph.D. degrees in Chemical Engineering from the Massachusetts Institute of Technology (MIT) and a Bachelor of Science degree in Chemical Engineering from the Indian Institute of Technology (IIT), Bombay.

Dr. Sundaram brings a wide range of applicable experience and knowledge to his role as a member of the Board, particularly with respect to providing strategic guidance on product development and marketing, business turnaround, scaling companies, mergers and acquisitions, and as a member of the Audit, Compensation, and Nominating and Governance Committees of the Board. He also contributes his expertise in executive and board compensation and leadership as Chair of the Company’s Compensation Committee.

Directors who are also Executive Officers

Kyle J. Loudermilk – Mr. Loudermilk joined the Company in August 2015 as the CEO and President and also serves as a member of the Board of Directors. He is a technology executive whose 25-year career has focused on growing technology companies through organic growth, geographic expansion and acquisitions, creating significant stockholder value along the way.

Mr. Loudermilk was the VP of Operations – Technology from 2013 to 2015 and VP of Corporate Development from 2005 to 2009 at MicroStrategy, a company focused on business intelligence, big data, and mobile identity solutions. From 2009 to 2012 he was the VP of Product Management at Datatel, now known as Ellucian, a firm focused on higher education solutions, growing the company significantly through new product introduction during his tenure. Mr. Loudermilk held management roles including VP of the Design and Simulation Business Unit and VP of R&D/Operations at Aspen Technology. He began his career as a Process Engineer for Mobil Oil Corporation. He earned his B.S. and M.S. from Columbia University in chemical engineering, and is an alumnus of Harvard Business School having completed The General Manager Program.

Mr. Loudermilk’s extensive experience in leading and providing strategic guidance to technology driven organizations enables him to contribute valuable perspective and first-hand knowledge as a Board member.

Executive Officers

Paul T. Abbott – Mr. Abbott is the President of the Company’s Nuclear Industry Training & Consulting Division. He was a principal of Hyperspring LLC, helping grow that business since 2007, and assumed the role of divisional President in November 2017. Prior to joining Hyperspring, he was a senior reactor operator at two different U.S. nuclear facilities and served in the U.S. Navy. He earned his B.S. in Nuclear Engineering Technology from Excelsior College.

Emmett A. Pepe – Mr. Pepe has served as the Company’s Chief Financial Officer and Treasurer since July 2016. From 2012 to 2016, Mr. Pepe had served as Senior Vice President – Finance and worldwide Controller of MicroStrategy, Inc., a publicly-traded enterprise-analytics, mobile, and security software company, overseeing that company’s financial activities including accounting, financial reporting, tax, and treasury. From 2007 to 2012, Mr. Pepe served as Vice President – Accounting and Corporate Controller at BroadSoft, Inc., a software and services company that enables telecommunications service providers to deliver hosted, cloud-based unified communications to their enterprise customers. While at BroadSoft, Mr. Pepe was responsible for overall global accounting, SEC reporting, tax, treasury, human resources, and facilities, and was part of the executive management team that took BroadSoft public in 2010. Mr. Pepe also has held a number of senior financial leadership positions with various other companies including Software AG, webMethods, Inc., British Telecom Inc., Concert Communications Company, and MCI Communications Corporation. Mr. Pepe has a B.S. degree in Accounting from Penn State University and is a Certified Public Accountant.

Daniel W. Pugh – Mr. Pugh joined the Company in February 2016 and serves as its Chief Legal and Risk Officer and Corporate Secretary. He is a business attorney with more than 25 years of experience working with technology-enabled software and service companies. Mr. Pugh’s core areas of expertise include operations, transactions, risk management, technology development and commercialization, intellectual property protection, and corporate practices improvement. From October 2010 through January 2016, Mr. Pugh served as General Counsel of ANCILE Solutions, Inc., a leading workforce performance improvement enterprise software company, where he was responsible for all legal and corporate matters and operational risk management. Prior to that he served as General Counsel of Synthetic Genomics, Inc., a biotechnology and biofuels research and development company, and as Counsel to other public and private businesses. His degrees include a S.B. from the Massachusetts Institute of Technology, a J.D. from the University of Maryland Carey School of Law, where he served as Executive Editor of the Maryland Law Review, and a M.B.A. from the University of Maryland Smith School of Business. Mr. Pugh also is a Certified Financial Risk Manager (FRM).

CORPORATE GOVERNANCE

The Board of Directors

The Board oversees the business affairs of the Company, while Management carries out the daily processes, controls and execution of the Company’s long-term strategy. Among the Board’s most significant responsibilities are the oversight of the Company’s long-term strategy, the selection and support of the CEO of the Company, and the annual election of the Company’s executive officers. The Board has the responsibility for establishing broad corporate policies and for the overall performance of the Company. The Board recognizes the importance of ensuring that the Company’s overall business strategy is designed to create long-term value for Company stockholders. As a result, the Board maintains an active oversight role in formulating, planning and implementing the Company’s long-term strategy and has sought to align compensation incentives with that vision. Members of the Board are kept informed of the Company’s business and progress in relation to this long-term strategy by regular communications with the CEO, various reports and documents sent to them, and by way of operating and financial reports made at Board and Committee meetings. The Board regularly considers the progress of and challenges to the Company’s strategy and related risks throughout the year. At each regularly-scheduled Board meeting, the Chairman leads an executive session with the non-employee members of the Board to discuss executive officer performance, the Company’s long-term plans, and strategic and other significant business developments since the last meeting.

In terms of the structure of the Board, the Company’s Certificate of Incorporation provides that the Board is divided into three classes, as nearly equal in number as possible, that serve staggered three-year terms. The stockholders elect at least one class of directors annually. Stockholders will elect one Class I director at the 2020 Annual Meeting, and Mr. William S. Corey, Jr., has been properly nominated for election to a three-year term at the Annual Meeting. The incumbent Class I directors, John D. (“Jack”) Fuller and James H. Stanker, have notified the Company that they do not intend to stand for re-election when their term ends at the Annual Meeting on August 31, 2020. Class II directors (Suresh Sundaram and J. Barnie Beasley) serve until the 2021 annual meeting and their successors are duly elected and qualified, and Class III directors (Kathryn O’Connor Gardner and Kyle J. Loudermilk) serve until the 2022 annual meeting and their successors are duly elected and qualified. The Board believes that the Company continues to be best served by a staggered or classified board as it promotes continuity as the Company pursues its business strategy. Nevertheless, the Board is aware of the concerns related to a staggered Board and, in recent years, has promoted Board refreshment and revitalization.

Independence

The Board has adopted specific director independence criteria, consistent with the NASDAQ listing standards, to assist it in making determinations regarding the independence of its members. The Board considers the independence of its members at least annually. No directors will be deemed to be independent unless the Board affirmatively determines that the director in question has no material relationship with the Company, directly or as an officer, stockholder, member or partner of an organization that has a material relationship with the Company. The Board has determined that no director other than Mr. Loudermilk has a direct or indirect material relationship with the Company, nor does any other director have a direct or indirect material interest in any transaction involving the Company. Every current director other than Mr. Loudermilk satisfies the Company’s independence criteria, and Mr. William S. Corey, Jr., nominee for election as a Class I director at the Annual Meeting, also meets the NASDAQ independence standards. The Board has further determined that all of the members of the Audit Committee (Messrs. Stanker, Sundaram, Fuller, and Beasley, and Ms. Gardner) meet the applicable heightened standards for audit committee independence.

Board Leadership Structure

Mr. Fuller currently serves as Chairman of the Board of Directors. Mr. Loudermilk currently serves as Chief Executive Officer and President of the Company. The Company believes it is the Chairman’s responsibility to lead the Board of Directors and the Chief Executive Officer’s responsibility to lead the day-to-day operations of the Company. As directors continue to have more oversight responsibility than ever before, the Company believes it is beneficial to have a Chairman whose focus and responsibility is to lead the Board, which allows the Chief Executive Officer to focus on running the Company. This separation of responsibilities ensures that there is no duplication of effort between the Chairman and the Chief Executive Officer. The Company believes this separation of leadership provides strong leadership for its Board, while also positioning its Chief Executive Officer as the leader of the Company in the eyes of customers, employees, and stockholders.

Board’s Role in Oversight

While the Board oversees risk management, Company management is charged with managing risk. The Board and the Audit Committee monitor and evaluate the effectiveness of the Company’s internal controls at least annually. Management communicates with the Board, committees, and individual directors on the significant risks identified and how they are being managed. Directors are free to, and indeed often do, communicate directly with senior management. The Board implements its risk oversight function both as a whole and through Committees. The Audit Committee oversees risks related to the Company’s financial statements, the financial reporting process, and accounting matters. The Audit Committee oversees the audit function and the Company’s ethics programs. The Audit Committee members meet separately with representatives of the Company’s independent registered public accounting firm. The Compensation Committee evaluates the risks and rewards associated with the Company’s compensation philosophy and programs. The Nominating and Governance Committee selects and recommends to the full Board nominees for election as directors. The Nominating and Governance Committee also bears responsibility for overseeing corporate governance matters.

Board of Director Attendance

The Board held thirteen meetings during the fiscal year ended December 31, 2019. During the 2019 fiscal year, no director attended less than seventy-five percent (75%) of the aggregate of (1) the total number of meetings of the Board (held during the period for which he or she was a director) and (2) the total number of meetings held by all committee(s) of the Board on which he or she served (during the periods that he or she served on those committees). The Company encourages, but does not require, all of its directors to attend the Annual Meeting of Stockholders, and all directors attended the Annual Meeting in 2019.

Committees of the Board of Directors

The Board has three standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee. As a Nasdaq Capital Market listed company, we are subject to the NASDAQ listing standards. The Company is required under the NASDAQ listing standards to have a majority of independent directors and all of the members of the Audit Committee are required to comply with additional, heightened independence standards applicable to a director’s service on such committee.

Audit Committee – The Audit Committee consists of Ms. Gardner and Messrs. Fuller, Sundaram, Beasley, and Stanker (Chair), each of whom meets the general as well as the heightened independence standards set by applicable SEC rules and the NASDAQ listing standards. In addition, the Board has determined that Mr. Stanker, Ms. Gardner, and Mr. Beasley are “audit committee financial experts” as defined by applicable SEC and NASDAQ rules. The Audit Committee operates under a written charter adopted by the Board. Management is responsible for the Company’s internal controls and preparing the Company’s consolidated financial statements. The Company’s independent registered public accounting firm is responsible for performing an independent audit of the consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board and issuing a report thereon and the Committee is responsible for overseeing the conduct of these activities. The Audit Committee appoints and engages the independent registered public accounting firm, reviews with the independent registered public accounting firm the plans and results of the audit engagement, approves professional services provided by the independent registered public accounting firm, reviews the independence of the independent registered public accounting firm and reviews the adequacy of the Company’s internal accounting controls. The Audit Committee met nine times during fiscal year 2019. See “Audit Committee Report” below. The Audit Committee Charter is available on our website at www.gses.com.

Compensation Committee – The Compensation Committee consists of Dr. Sundaram (Chair), Mr. Stanker, Mr. Fuller, Mr. Beasley, and Ms. Gardner. Dr. Sundaram, Mr. Stanker, Mr. Fuller, Mr. Beasley, and Ms. Gardner are all “independent” directors as that term is defined by applicable NASDAQ listing standards. The Compensation Committee is responsible for recommending to the full Board the compensation for the Company’s executive officers, including the granting of awards under the Company’s 1995 Long-Term Incentive Plan, as amended (the “Long-Term Incentive Plan”). The Compensation Committee met five times during fiscal year 2019, and members of the Compensation Committee provided further advice and recommendations to the Board as a whole on Compensation Committee matters at Board meetings. The Compensation Committee operates pursuant to a written Charter which is available on our website at www.gses.com.

Nominating and Governance Committee – The Nominating and Governance Committee consists of Mr. Fuller, Mr. Stanker, Dr. Sundaram, Ms. Gardner, and Mr. Beasley (Chair). All five members are “independent” directors as that term is defined by applicable NASDAQ listing standards. The Nominating and Governance Committee selects and recommends to the full Board nominees for election as directors and oversees the Company’s corporate governance generally. The Nominating and Governance Committee met five times during fiscal year 2019, and members of the Nominating and Governance Committee provided further advice and recommendations to the Board as a whole on Committee matters at Board meetings. The Nominating and Governance Committee operates pursuant to a written Charter which is available on our website at www.gses.com.

Enhancements to Corporate Governance

Led by the Nominating and Governance Committee, the Board of Directors is committed to best practices in corporate governance. The Board believes that good governance enhances stockholder value and goes beyond simply complying with the basic requirements of state law and NASDAQ and SEC rules and regulations. Good governance means taking thoughtful approach to promote integrity, accountability, transparency, and the highest ethical standards. The Board and its Nominating and Governance Committee are committed to having an engaged and independent Board that upholds the strictest ethical standards. During 2019, the Board continued its efforts to analyze existing practices, evaluate best practices, and make improvements through adoption of revised policies and practices to ensure effective governance. The Board anticipates that these efforts will continue to include the following:

Development of a Board Skills Matrix – When evaluating each director nominee and the potential needs and composition of the Board as a whole, the Nominating and Governance Committee looks for individuals with the potential to make significant contributions that will enhance the Board’s ability to continue to serve the long-term interests of the Company and its stockholders. The Board also self-assesses its own strengths and weaknesses to identify skills that individuals may add to the Board. To that end, the Nominating and Governance Committee has undertaken an effort to identify critical attributes, experiences, qualifications, and skills required of members of the Board to deliver long-term value to the stockholders of the Company. From that list, the Board develops a matrix to ensure each of the identified critical attributes, experiences, qualifications, and skills are adequately represented among the Company’s directors. The Nominating and Governance Committee and the Board will regularly review this skills matrix to confirm that it appropriately supports the Company’s long-term strategy.

Board Tenure and Diversity – As a key component of ensuring that the Board reflects an appropriate mix of attributes, experiences, qualifications, and skills, the Nominating and Governance Committee regularly reviews director diversity, tenure, and succession. In recent years, the Board has experienced significant refreshment as a result of this process, adding new directors each of the past three years. The Committee believes that in future years the Company will benefit from the deep Company knowledge and continuity of longer-tenured directors complemented by the fresh perspectives of newer directors. In future years, relying in part on its developing skills matrix, the Company intends to pursue diversity in all forms to enhance the long-term value of the Company for its stockholders.

Self-Evaluation – Beginning in 2019, the Nominating and Governance Committee led an enhanced annual performance evaluation of the Board. Board members completed questionnaires that collected information about the overall effectiveness of the Board and each Board committee together with specific commentary on strengths and weaknesses of these groups. The evaluations were compiled and analyzed both quantitatively and qualitatively, and then discussed in detail within each Board committee and among the full Board. Next, each director was asked to complete a questionnaire assessing the effectiveness of the individual Board members; following compilation and analysis, the Board chairman discussed these results individually with each director as a tool for self-analysis and improvement. The positive outcomes of the 2019 self-evaluation process confirm the Board’s view that self-evaluation of Board and committee performance is an integral part of its commitment to continuous improvement. The Nominating and Governance Committee currently is conducting a similar self-evaluation process for the current Board service year.

Whistleblower Policies and Ombudsman – The Board’s enhanced internal reporting and whistleblower mechanisms continued to operate during 2019 and continues to operate during 2020, providing alternative outlets for complaints within the Company. The Board has taken these steps to ensure that employee concerns and complaints reach the Board, and the Board receives reports from the Company Ethics and Compliance Officer on a quarterly basis.

Communications with the Board of Directors

The Board desires to foster open communications with its stockholders regarding issues of a legitimate business purpose affecting the Company. Under the Board’s supervision, the Company makes a concerted effort to engage with stockholders to ensure that the Board considers their views and address their interests. In addition to meeting with stockholders to discuss performance, strategy, and operations, the Company also engages with its stockholders to solicit their views on matters of corporate governance and other topics. In addition to communicating with stockholders during our proxy season, Mr. Loudermilk, Mr. Pepe, and Mr. Fuller engage with many of our major stockholders to promote a constructive dialogue.

To this end, the Board has adopted policies and procedures to facilitate written communications by stockholders to the Board. Persons wishing to write to our Board, a specific director, a committee of the Board, the Chairman of the Board of Directors, or the non-management directors as a group, should send correspondence to the Corporate Secretary at 1332 Londontown Blvd., Suite 200, Sykesville, Maryland 21784.

The Corporate Secretary will forward to the directors all communications that, in his judgment, are appropriate for consideration by the directors. Examples of communications that would not be appropriate for consideration by the directors include commercial solicitations and matters not relevant to the stockholders, to the functioning of the Board, or to the affairs of the Company. Any correspondence received that is addressed generically to the Board will be forwarded to the Chairman of the Board, with a copy to the Chair of the Audit Committee.

Stockholder Proposals

To be considered for inclusion in the Company’s proxy materials for next year’s annual meeting in accordance with Rule 14a-8 under the Exchange Act, a stockholder proposal must be submitted in writing by May 3, 2021, to the Company’s principal executives offices c/o Corporate Secretary at 1332 Londontown Blvd., Suite 200, Sykesville, Maryland 21784, and must otherwise comply with the requirements of Rule 14a-8 of the Exchange Act.

In addition, the Company’s Third Amended and Restated Bylaws (the “Bylaws”) establish an advance notice procedure for stockholders who wish to present certain matters before an annual meeting of stockholders without including those matters in the Company’s proxy statement. Such proposals, including the information required by the Bylaws, must be received at the Company’s principal executive offices c/o Corporate Secretary, 1332 Londontown Blvd., Suite 200, Sykesville, Maryland 21784, no earlier than May 3, 2021, and no later than June 2, 2021. If the date of the 2021 annual meeting of stockholders is moved more than 30 days before or 60 days after the anniversary of the 2020 Annual Meeting, stockholders must give notice on or before the close of business on the 10th day following the day on which the Company’s notice of the date of the meeting was mailed or other public disclosure of the annual meeting date is first made. A stockholder’s notice to the Company must set forth, as to each matter the stockholder proposes to bring before an annual meeting, the information required by the Bylaws, which have been publicly filed with the SEC.

If a stockholder fails to give notice of a stockholder proposal as required by the Bylaws or other applicable requirements (including those attendant to the Exchange Act), then the proposal will not be included in the proxy statement for our 2021 annual meeting of stockholders and the proposal will not be presented to the stockholders for a vote at the 2021 annual meeting of stockholders.

Copies of the Company’s Bylaws are available to stockholders without charge upon request to the Corporate Secretary at the Company’s address set forth above.

Stockholder Nominations of Directors

The Nominating and Governance Committee will consider nominees for director who are submitted by stockholders. All nominations must be made in accordance with the Bylaws. Written notice of all stockholder director nominees proposed for election at the 2021 Annual Meeting must be received at the Company’s principal executive offices c/o Corporate Secretary, 1332 Londontown Blvd., Suite 200, Sykesville, Maryland 21784, no earlier than May 3, 2021, and no later than June 2, 2021. If the date of the 2021 annual meeting of stockholders is moved more than 30 days before or 60 days after the anniversary of the 2020 Annual Meeting, stockholders must give notice of all stockholder director nominees on or before the close of business on the 10th day following the day on which the Company’s notice of the date of the meeting was mailed or other public disclosure of the annual meeting date is first made. A stockholder’s nomination of a director must set forth the information required by the Bylaws, which have been publicly filed with the SEC, including:

| • | the name and address of the nominating stockholder as they appear on the Company’s books and of the beneficial owner, if any, on whose behalf the nomination is being made, |

| • | the class and number of shares of the Company that are owned by the nominating stockholder (beneficially and of record) and owned by the beneficial owner, if any, on whose behalf the nomination is being made, as of the date of the nominating stockholder’s notice, and a representation that the nominating stockholder will notify the Company in writing of the class and number of such shares owned of record and beneficially as of the record date for the meeting promptly following the later of the record date or the date notice of the record date is first publicly disclosed, |

| • | a description of any agreement, arrangement or understanding with respect to such nomination between or among the nominating stockholder and any of its affiliates or associates, and any others (including their names) acting in concert with any of the foregoing, and a representation that the nominating stockholder will notify the Company in writing of any such agreement, arrangement or understanding in effect as of the record date for the meeting promptly following the later of the record date or the date notice of the record date is first publicly disclosed, |

| • | a description of any agreement, arrangement or understanding (including any derivative or short positions, profit interests, options, hedging transactions, and borrowed or loaned shares) that has been entered into as of the date of the nominating stockholder’s notice by, or on behalf of, the nominating stockholder or any of its affiliates or associates, the effect or intent of which is to mitigate loss to, manage risk or benefit of share price changes for, or increase or decrease the voting power of the nominating stockholder or any of its affiliates or associates with respect to shares of stock of the Company, and a representation that the nominating stockholder will notify the Company in writing of any such agreement, arrangement or understanding in effect as of the record date for the meeting promptly following the later of the record date or the date notice of the record date is first publicly disclosed, |

| • | a representation that the nominating stockholder is a holder of record of shares of the Company entitled to vote at the meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice, and |

| • | a representation whether the nominating stockholder intends to deliver a proxy statement and/or form of proxy to holders of at least the percentage of the Company’s outstanding capital stock required to approve the nomination and/or otherwise to solicit proxies from stockholders in support of the nomination. |

The Company may require any proposed nominee to furnish such other information as it may reasonably require to determine the eligibility of such proposed nominee to serve as an independent director of the Company or that could be material to a reasonable stockholder’s understanding of the independence, or lack thereof, of such nominee. The foregoing is qualified in its entirety by reference to Section 2.7 of the Bylaws, which have been publicly filed with the SEC.

The Nominating and Governance Committee will apply the same criteria when considering stockholder nominees as it does to Company nominated candidates.

Each director nominee will be evaluated considering the relevance to the Company of the director nominee’s skills and experience, which must be complimentary to the skills and experience of the other members of the Board and those critical attributes, experiences, qualifications, and skills identified on the Company’s skills matrix. Although the Nominating and Governance Committee does not have a formal policy regarding diversity, in considering director candidates, the Nominating and Governance Committee considers such factors as it deems appropriate to assist in developing a board and committees that are diverse in nature and comprised of members who have various types of experience (industry, professional, public service). Each director nominee is evaluated in the context of the Board’s qualifications, as a whole, with the objective of establishing a Board that can best perpetuate the Company’s success and represent stockholder interests through the exercise of sound business judgment.

Certain Relationships and Related Party Transactions

It is the Company’s policy that any transactions with related parties are to be reviewed and approved by the Company’s Audit Committee, with the exception of officer compensation which is approved by the Compensation Committee.

Code of Business Conduct and Ethics

The Company has adopted a Code of Ethics for the directors, Principal Executive Officers, and Senior Financial Officers of the Company and its subsidiaries, and a Conduct of Business Policy for directors, officers, and employees of the Company and its subsidiaries. It is the Company’s intention to disclose any amendments to or waivers of such Code of Ethics or Conduct of Business Policy on the Company’s website at www.gses.com. The Company’s Code of Ethics and Conduct of Business Policy is available on the Company’s website at www.gses.com.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires any person who was one of our executive officers, directors or who owned more than ten percent (10%) of any publicly traded class of our equity securities at any time during the fiscal year (the “Reporting Persons”), to file reports of ownership and changes in ownership of equity securities of the Company with the SEC. These Reporting Persons are required by SEC regulations to furnish the Company with copies of all Section 16(a) filings.

Based solely upon a review of Forms 3 and Forms 4 and amendments thereto furnished to the Company during the most recent fiscal year, and Forms 5 and amendments thereto with respect to its most recent fiscal year, or written representations from certain Reporting Persons that such filings were not required, the Company believes that all forms except for one were filed in a timely manner in 2019; one Form 4 was filed late by one day in March 2019 for Christopher Sorrells. During 2020 to date, two Form 4s were filed late by two days in July, one for Emmett Pepe and one for Ravi Khanna.

AUDIT COMMITTEE REPORT

The Audit Committee has:

| • | reviewed and discussed the Company’s audited consolidated financial statements as of and for the year ended December 31, 2019, with management and with BDO USA, LLP, the Company’s independent registered public accounting firm for 2019, who represented to the Audit Committee that the Company’s consolidated financial statements for the year ended December 31, 2019, were prepared in accordance with U.S. Generally Accepted Accounting Principles; |

| • | discussed with BDO USA, LLP, the matters required under applicable professional auditing standards and regulations by the Public Company Accounting Oversight Board (“PCAOB”) Statement on Auditing Standards No. 1301, Communications with Audit Committees; |

| • | received the written disclosures and the letter from BDO USA, LLP, required by the applicable requirements of the PCAOB regarding BDO USA, LLP’s communications with the Audit Committee concerning independence, including Ethics and Independence Rule 3526, Communication with Audit Committees Concerning Independence, and has discussed with BDO USA, LLP its independence from the Company and its management; |

| • | discussed with BDO USA, LLP, the overall scope and plans of their audit, and met with BDO USA, LLP, with and without management present, to discuss the results of their examinations and the overall quality of the Company’s financial reporting; and |

| • | recommended, based on the reviews and discussions referred to above, to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019, for filing with the SEC. |

By the members of the Audit Committee:

James H. Stanker, Chair

John D. Fuller

Suresh Sundaram

J. Barnie Beasley

Kathryn O’Connor Gardner

AUDIT COMMITTEE PRE-APPROVAL OF AUDIT AND NON-AUDIT SERVICES

The Audit Committee pre-approves all audit and permissible non-audit services provided to the Company by its independent registered public accounting firm. These services may include audit services, audit-related services, tax services, and other services. The Audit Committee has adopted policies and procedures for the pre-approval of services provided by the independent registered public accounting firm. Management must provide a detailed description of each proposed service and the projected fees and costs (or a range of such fees and costs) for the service. The policies and procedures require management to provide quarterly updates to the Audit Committee regarding services rendered to date and services yet to be performed.

As permitted under the Sarbanes-Oxley Act of 2002, the Audit Committee may delegate pre-approval authority to its Chair for audit and permitted non-audit services. Any service pre-approved by the Audit Committee or its Chair must be reported to the Audit Committee at the next scheduled quarterly meeting. In addition, the pre-approval procedures require that all proposed engagements of the Company’s independent registered public accounting firm for services of any kind be directed to the Company’s Chief Financial Officer before they are submitted for approval prior to the commencement of any service.

The following table presents fees for professional audit services and other related services rendered by BDO USA, LLP, to the Company for the years ended December 31, 2019 and 2018. The Audit Committee approved 100% of the services described in the following table.

| | 2019 | | 2018 | |

| | | | | |

| Audit fees (1) | $ | 914,349 | | $ | 547,620 | |

| | | | | | | |

| Audit-related fees (2) | | 49,091 | | | 68,180 | |

| | | | | | | |

| Tax fees | | - | | | - | |

| | | | | | | |

| All other fees | | - | | | - | |

| | | | | | | |

| Total Fees | $ | 963,440 | | $ | 615,800 | |

| (1) | Audit fees consisted of fees for the audit of the Company’s consolidated financial statements, including quarterly review services in accordance with SAS No. 100 and statutory audit services for subsidiaries of the Company. |

| (2) | Audit related fees consisted of fees for the audit of the financial statements of the Company’s 401(k) Savings Plan, in the amount of $22,471, and fees for the audit of the financial statements of the Company’s recently acquired subsidiary, in the amount of $26,620. |

There were no other fees paid to BDO USA, LLP, except as outlined in the above table.

AUDIT COMMITTEE APPOINTMENT OF NEW INDEPENDENT AUDIT FIRM

The Audit Committee notified BDO USA, LLP (“BDO”) that the Company was dismissing BDO as its independent registered public accounting firm and engaging Dixon Hughes Goodman LLP (“DHG”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020, effective on and as of July 23, 2020. The decision to dismiss BDO and to engage DHG was approved by the Audit Committee.