- CIVB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Civista Bancshares (CIVB) 8-KRegulation FD Disclosure

Filed: 11 Sep 13, 12:00am

Exhibit 99

Serving our communities for over 125 years

Moving You Ahead

Cautionary Statement Regarding Forward-Looking Information

Comments made in this presentation include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to numerous assumptions, risks and uncertainties. Although management believes that the expectations reflected in the forward-looking statements are reasonable, actual results or future events could differ, possibly materially, from those anticipated in these forward-looking statements.

The forward-looking statements speak only as of the date of this presentation, and First Citizens Banc Corp assumes no duty to update any forward-looking statements to reflect events or circumstances after the date of this presentation, except to the extent required by law.

First Citizens Banc Corp

$1.1 Billion Bank Holding Company headquartered in Sandusky, Ohio Ticker Symbol FCZA on Nasdaq Organized in 1987 through The Citizens Banking Company Operates as The Citizens Banking Company North-central Ohio and as Champaign Bank in the Akron, Columbus and Urbana markets.

First Citizens Banc Corp

First Citizens has completed 6 acquisitions from 1990 to 2007: The Castalia Banking Company The Farmers State Bank of New Washington The Citizens National Bank of Norwalk The First National Bank of Shelby Miami Valley Bank – Russell’s Point Champaign Bank of Urbana

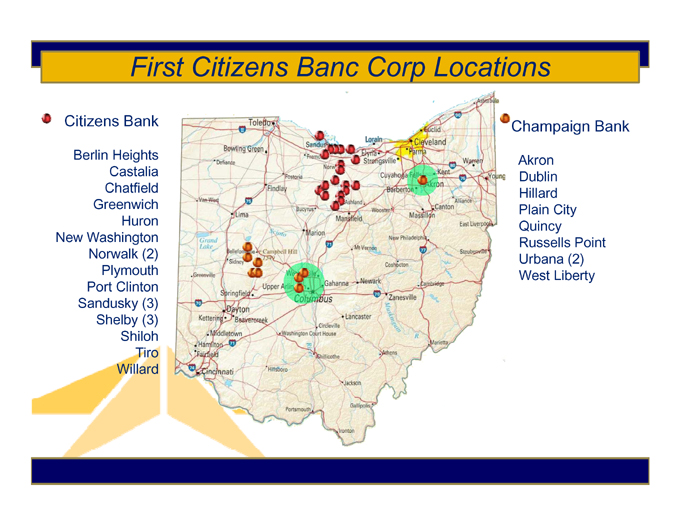

First Citizens Banc Corp Locations

Citizens Bank

Berlin Heights Castalia Chatfield Greenwich Huron New Washington Norwalk (2) Plymouth Port Clinton Sandusky (3) Shelby (3) Shiloh Tiro Willard

Champaign Bank

Akron Dublin Hillard Plain City Quincy Russells Point Urbana (2) West Liberty

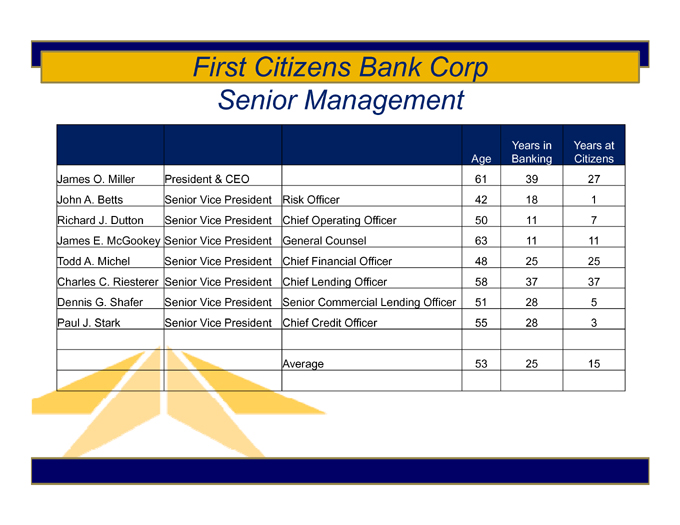

First Citizens Bank Corp Senior Management

Years in Years at Age Banking Citizens James O. Miller President & CEO 61 39 27 John A. Betts Senior Vice President Risk Officer 42 18 1 Richard J. Dutton Senior Vice President Chief Operating Officer 50 11 7 James E. McGookey Senior Vice President General Counsel 63 11 11 Todd A. Michel Senior Vice President Chief Financial Officer 48 25 25 Charles C. Riesterer Senior Vice President Chief Lending Officer 58 37 37 Dennis G. Shafer Senior Vice President Senior Commercial Lending Officer 51 28 5 Paul J. Stark Senior Vice President Chief Credit Officer 55 28 3 Average 53 25 15

First Citizens Banc Corp

Where are we today?

Total Assets

$1,200,000,000 $1,100,000,000 $1,000,000,000 $900,000,000 $800,000,000 $700,000,000 $600,000,000 $500,000,000

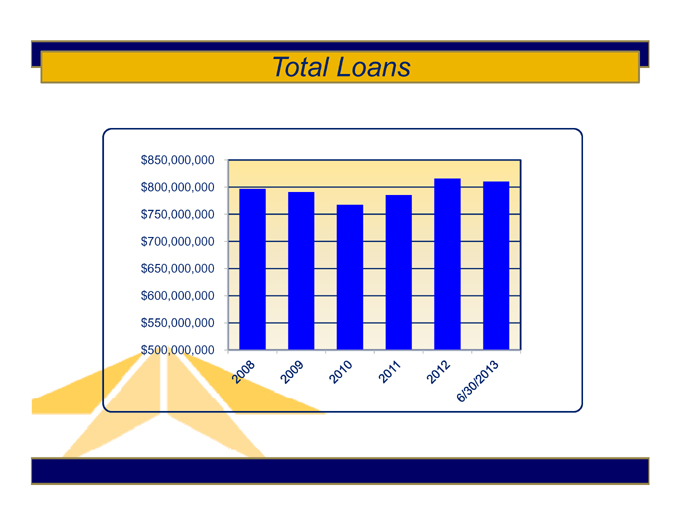

Total Loans $850,000,000 $800,000,000 $750,000,000 $700,000,000 $650,000,000 $600,000,000 $550,000,000 $500,000,000

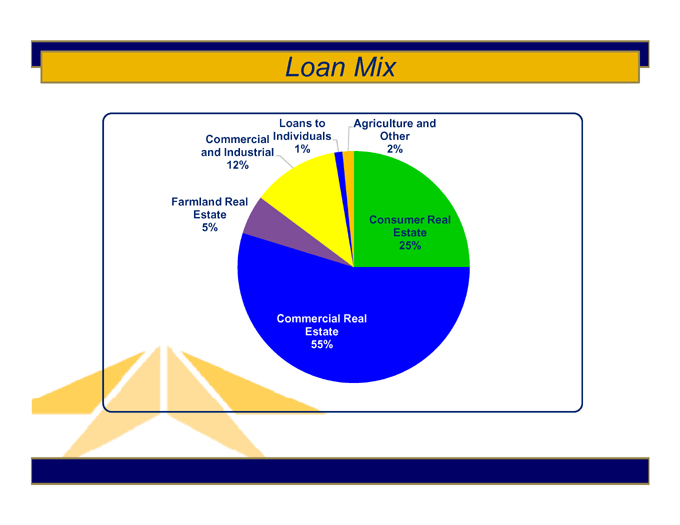

Loan Mix

Loans to Agriculture and Commercial Individuals Other and Industrial 1% 2% 12%

Farmland Real Estate

Consumer Real 5% Estate 25%

Commercial Real Estate 55%

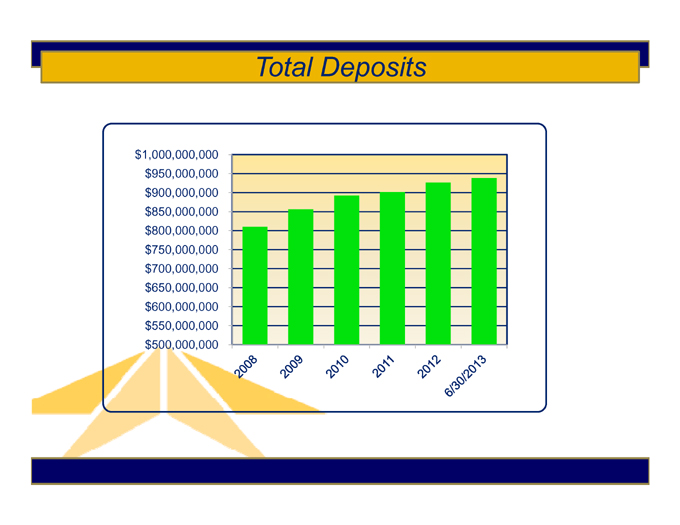

Total Deposits

$1,000,000,000 $950,000,000 $900,000,000 $850,000,000 $800,000,000 $750,000,000 $700,000,000 $650,000,000 $600,000,000 $550,000,000 $500,000,000

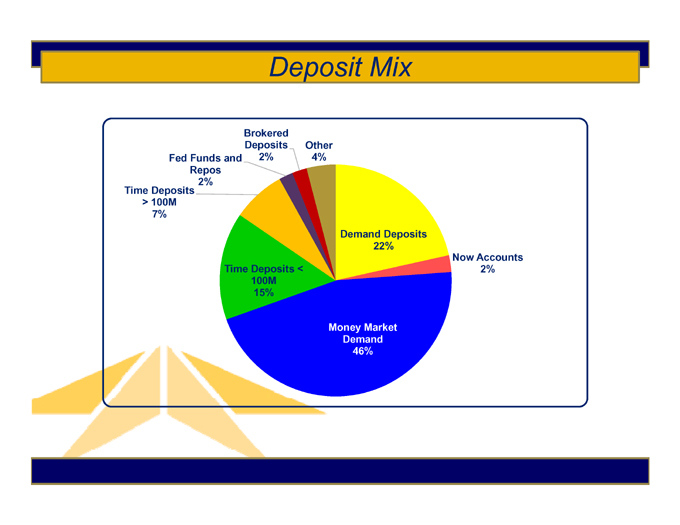

Deposit Mix

Brokered Deposits Other Fed Funds and 2% 4% Repos 2% Time Deposits

> 100M 7%

Demand Deposits 22%

Now Accounts Time Deposits < 2% 100M

15%

Money Market Demand 46%

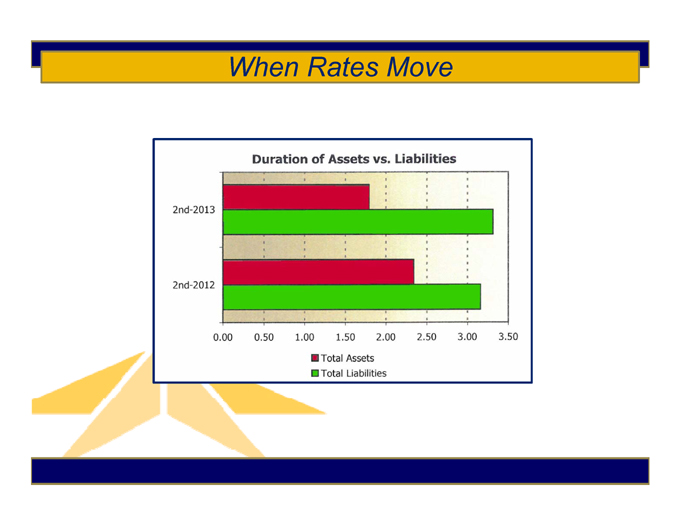

When Rates Move

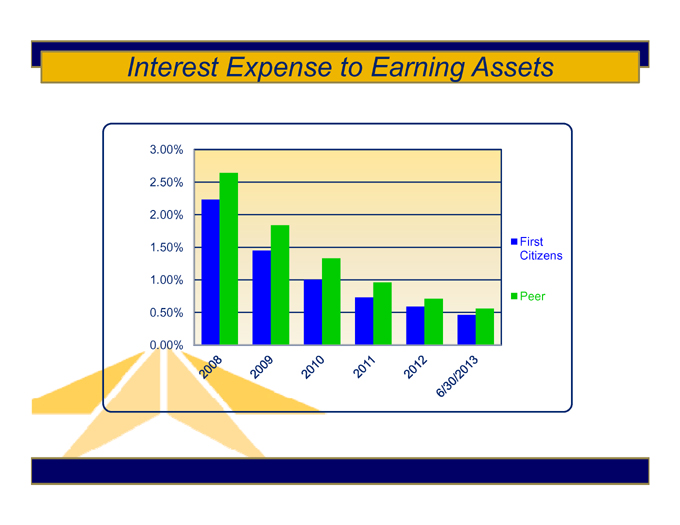

Interest Expense to Earning Assets

3.00%

2.50%

2.00%

First

1.50%

Citizens

1.00%

Peer

0.50%

0.00%

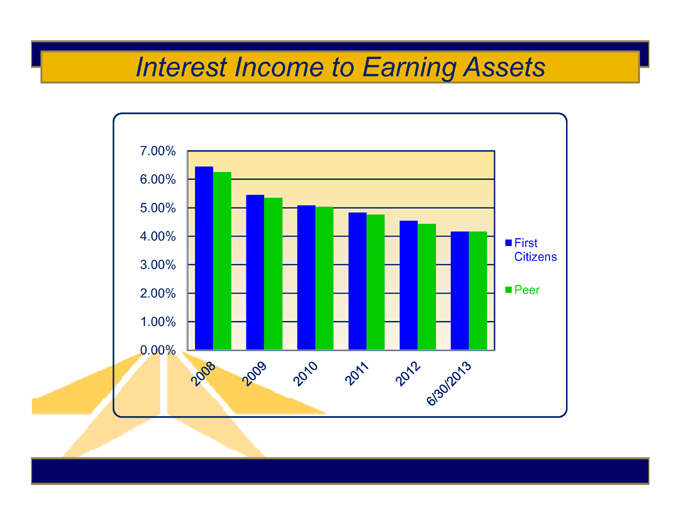

Interest Income to Earning Assets

7.00%

6.00%

5.00%

4.00%

First Citizens

3.00%

2.00% Peer

1.00%

0.00%

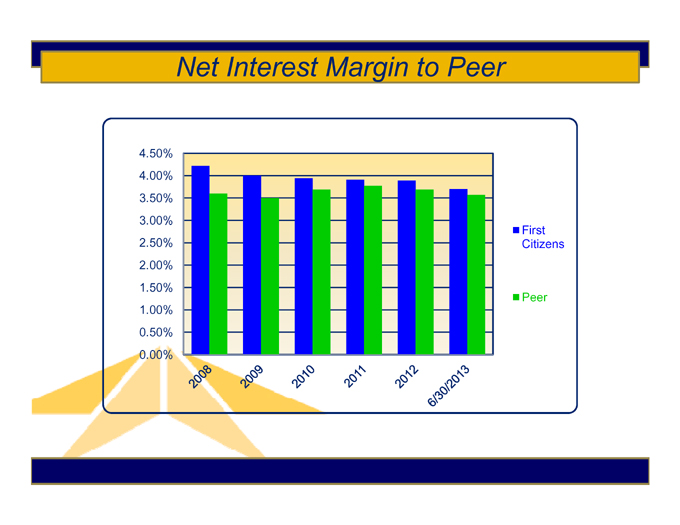

Net Interest Margin to Peer

4.50%

4.00%

3.50%

3.00%

First

2.50% Citizens

2.00%

1.50%

Peer

1.00%

0.50%

0.00%

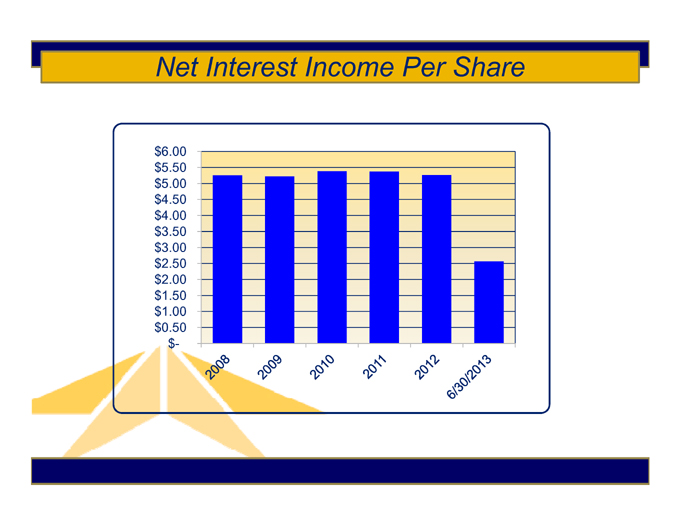

Net Interest Income Per Share

$6.00

$5.50

$5.00

$4.50

$4.00

$3.50

$3.00

$2.50

$2.00

$1.50

$1.00

$0.50 $-

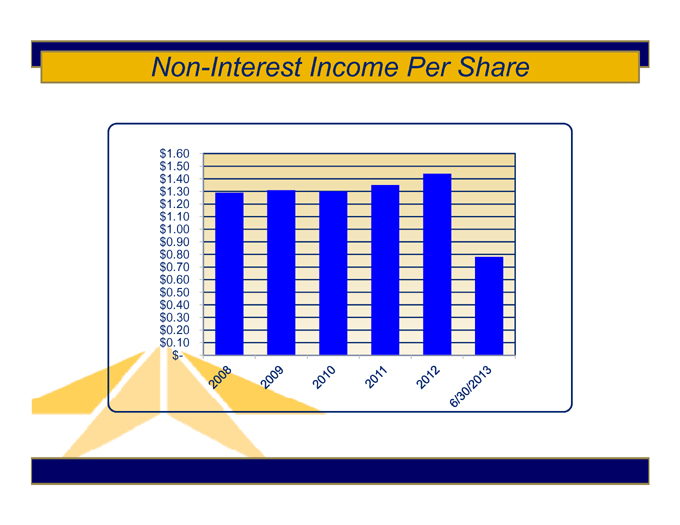

Non-Interest Income Per Share

$1.60

$1.50

$1.40

$1.30

$1.20

$1.10

$1.00

$0.90

$0.80

$0.70

$0.60

$0.50

$0.40

$0.30

$0.20

$0.10 $-

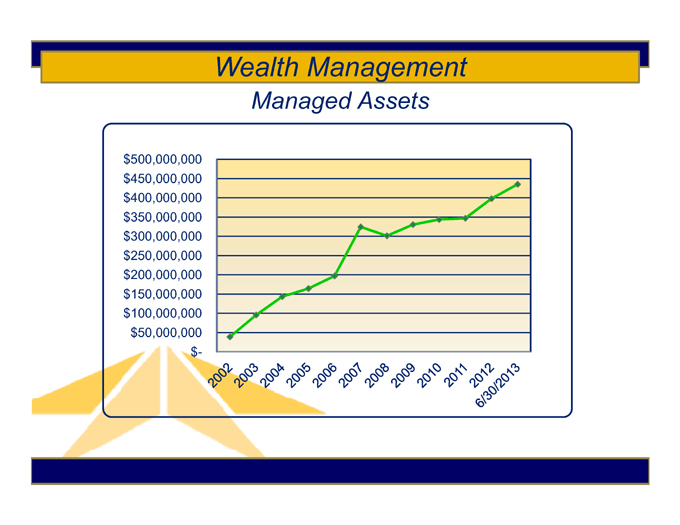

Wealth Management

Managed Assets

$500,000,000 $450,000,000 $400,000,000 $350,000,000 $300,000,000 $250,000,000 $200,000,000 $150,000,000 $100,000,000 $50,000,000 $-

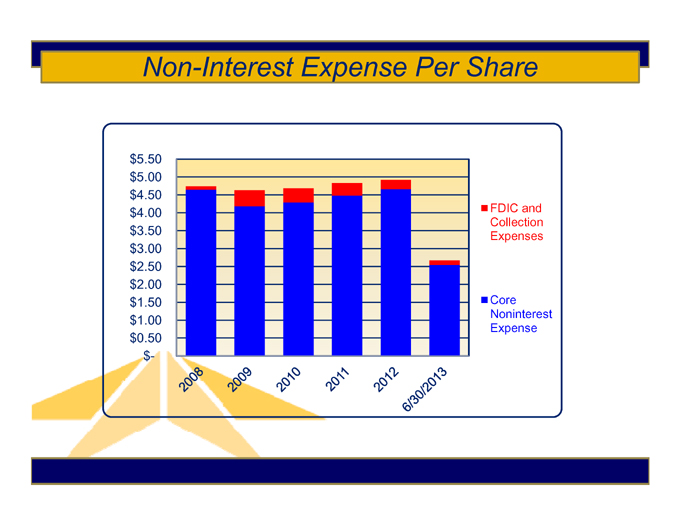

Non-Interest Expense Per Share

$5.50

$5.00

$4.50

$4.00 FDIC and Collection

$3.50 Expenses

$3.00

$2.50

$2.00

$1.50 Core Noninterest

$1.00

Expense

$0.50 $-

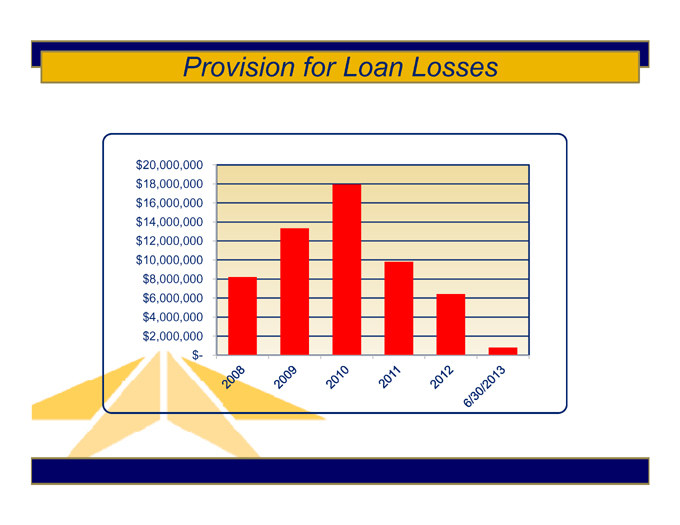

Provision for Loan Losses

$20,000,000 $18,000,000 $16,000,000 $14,000,000 $12,000,000 $10,000,000 $8,000,000 $6,000,000 $4,000,000 $2,000,000 $-

Net Earnings Per Share

2012 2011 2010 2009 2008*

$ 0.57 $ 0.36 $(0.32) $ 0.09 $ 0.56

* |

| The per-share number for 2008 excludes a noncash write-down of goodwill of $(5.62) |

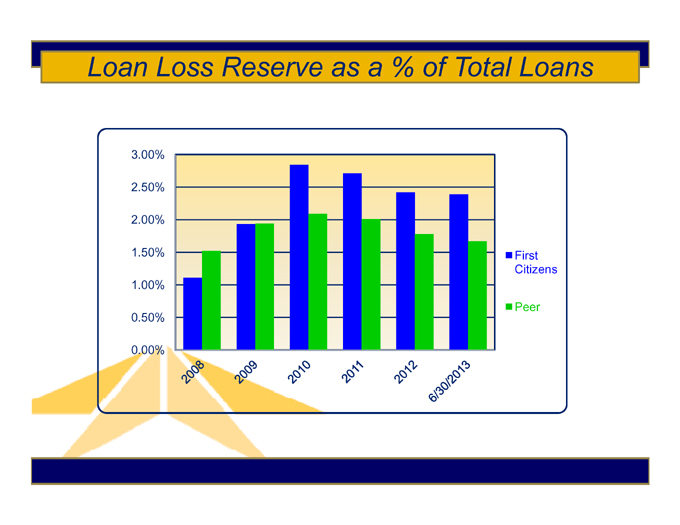

Loan Loss Reserve as a % of Total

3.00%

2.50%

2.00%

1.50% First Citizens

1.00%

0.50% Peer

0.00%

Other Real Estate Owned

$12,000,000

$10,000,000

$8,000,000

First $6,000,000 Citizens

$4,000,000

Peer

$2,000,000

$-

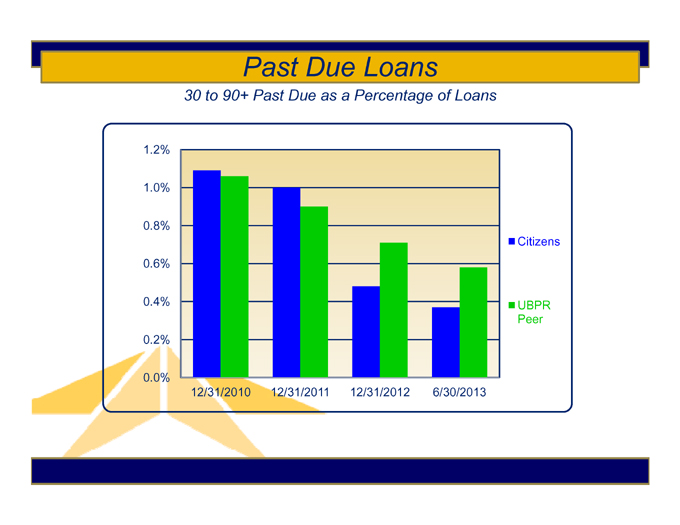

Past Due Loans

30 to 90+ Past Due as a Percentage of Loans

1.2%

1.0%

0.8%

Citizens

0.6%

0.4% UBPR

Peer

0.2%

0.0%

12/31/2010 12/31/2011 12/31/2012 6/30/2013

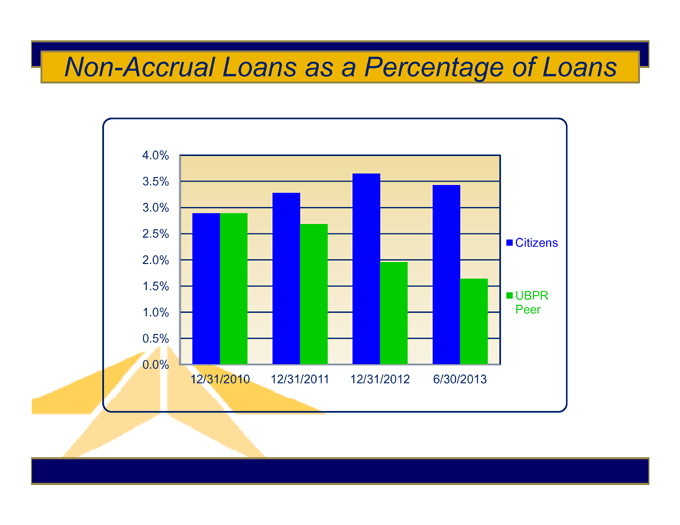

Non-Accrual Loans as a Percentage of Loans

4.0%

3.5%

3.0%

2.5%

Citizens

2.0%

1.5%

UBPR

1.0% Peer

0.5%

0.0%

12/31/2010 12/31/2011 12/31/2012 6/30/2013

Where do we go from here?

As a Corporation

• |

| Address the TARP Preferred Stock |

• |

| Look for growth opportunities |

• |

| Long-term goal—$2,000,000,000 in assets to leverage infrastructure As a Bank |

• |

| Continue the work for increased customer share – loans, deposits, wealth management |

• |

| Prudently diversify loan portfolio |

• |

| Provide products for electronic world |

Growth Opportunities

Smaller Rural Banks

• |

| Low cost of funds |

• |

| Low loan-to-deposit ratios |

• |

| Solid customer base Urban Locations |

• |

| Platform to expand lending in more vibrant markets Strategic |

• |

| Acquisition to leverage infrastructure at a more rapid pace |

Bank Strategies

Integrated Calling Efforts

• |

| Commercial Lending |

• |

| Cash Management |

• |

| Wealth Management Diversify Portfolio |

• |

| More exposure into C&I (prudently) |

• |

| Increases emphasis on consumer lending Electronic World |

• |

| Mobile Products |

• |

| Internet Access Products |

• |

| Younger customer base |

Conclusion

The team is in place The infrastructure is in place The formula works

We know how to integrate acquisitions Focus on evolving into the future

First Citizens banc Corp

Serving our communities for over 125 years