- CIVB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Civista Bancshares (CIVB) 8-KRegulation FD Disclosure

Filed: 17 Nov 16, 12:00am

Investor Presentation Third Quarter 2016 James O. Miller - Chairman, President & Chief Executive Officer Dennis G. Shaffer - Executive Vice President & President of Civista Bank Richard J. Dutton - Senior Vice President, Chief Operating Officer Exhibit 99.1

Forward-Looking Statements Comments made in this presentation include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to numerous assumptions, risks and uncertainties. Although management believes that the expectations reflected in the forward-looking statements are reasonable, actual results or future events could differ, possibly materially, from those anticipated in these forward-looking statements. For factors that could cause actual results to differ from our forward-looking statements, please refer to “Risk Factors” in the Company’s Form 10-K filed with the SEC on March 15, 2016. The forward-looking statements speak only as of the date of this presentation, and Civista Bancshares, Inc. assumes no duty to update any forward-looking statements to reflect events or circumstances after the date of this presentation, except to the extent required by law.

Contact Information Civista Bancshares, Inc.’s common shares are traded on the NASDAQ Capital Market under the symbol “CIVB.” The Company’s depository shares, each representing 1/40th ownership interest in a Series B Preferred Share, are traded on the NASDAQ Capital Market under the symbol “CIVBP.” Additional information can be found at: www.civb.com James O. Miller Chairman, President & Chief Executive Officer jomiller@civb.com Telephone: 888.645.4121

Corporate Overview 10th Largest Publicly Traded Commercial Bank in Ohio Community Banking Focused Operations in 12 Ohio Counties 27 Branches & 1 Loan Production Office Operations in 4 of the top 5 Ohio MSAs Acquisitive Franchise Poised for Future Growth Corporate Overview Full-Service Banking Organization with Diversified Revenue Streams Commercial Banking Retail Banking Wealth Management Mortgage Banking Key Facts Corporate Rebranding NASDAQ: CIVB ¹ Market data as of November 7, 2016.

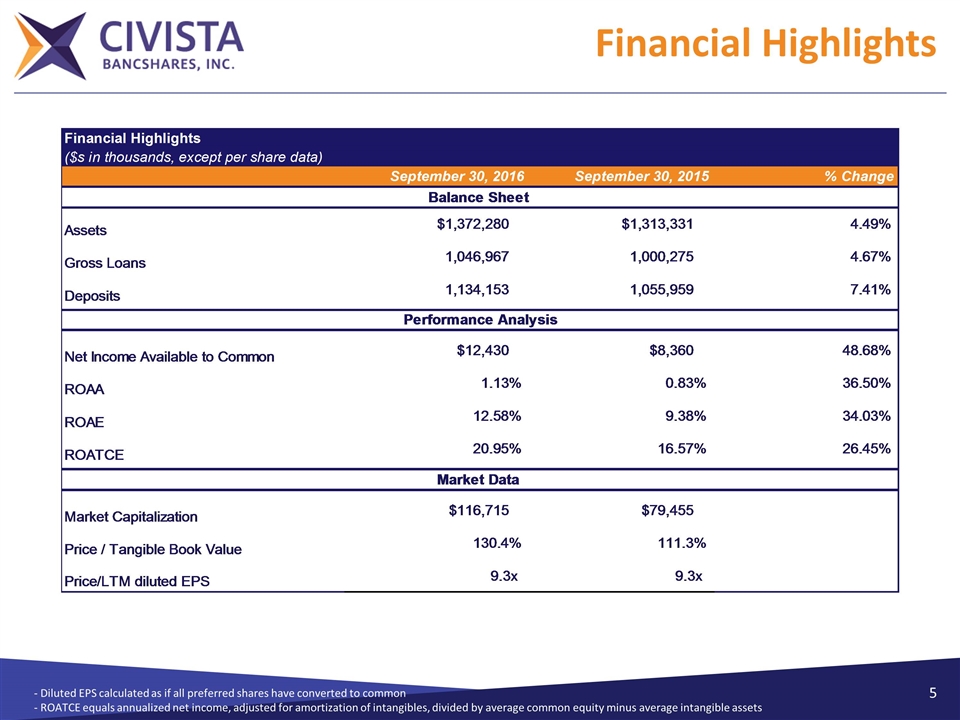

Financial Highlights - Diluted EPS calculated as if all preferred shares have converted to common - ROATCE equals annualized net income, adjusted for amortization of intangibles, divided by average common equity minus average intangible assets

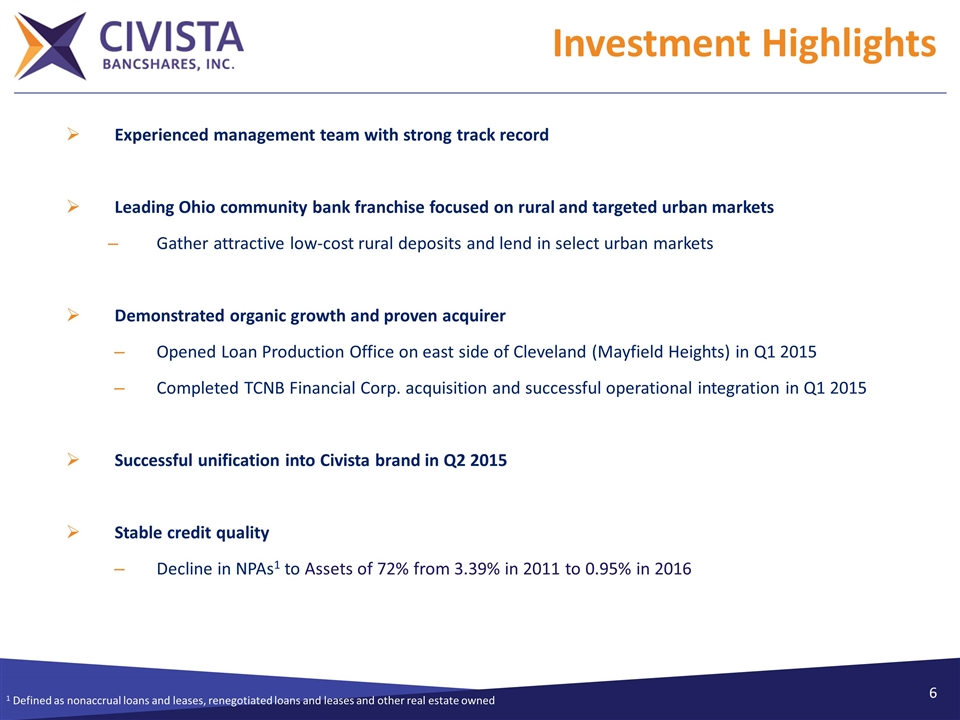

Investment Highlights Experienced management team with strong track record Leading Ohio community bank franchise focused on rural and targeted urban markets Gather attractive low-cost rural deposits and lend in select urban markets Demonstrated organic growth and proven acquirer Opened Loan Production Office on east side of Cleveland (Mayfield Heights) in Q1 2015 Completed TCNB Financial Corp. acquisition and successful operational integration in Q1 2015 Successful unification into Civista brand in Q2 2015 Stable credit quality Decline in NPAs1 to Assets of 72% from 3.39% in 2011 to 0.95% in 2016 1 Defined as nonaccrual loans and leases, renegotiated loans and leases and other real estate owned

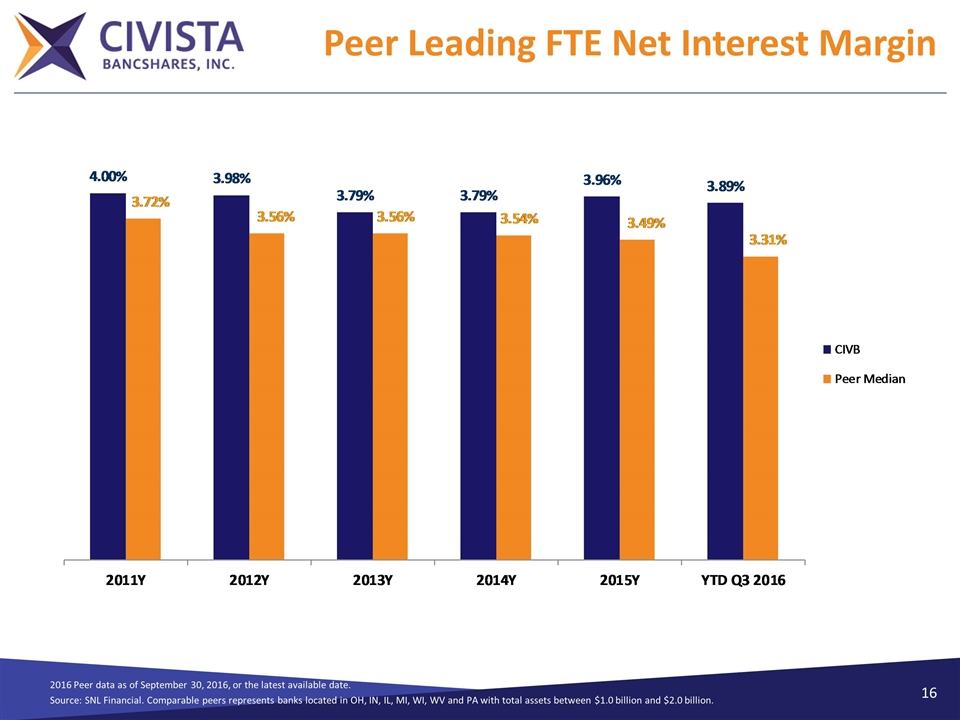

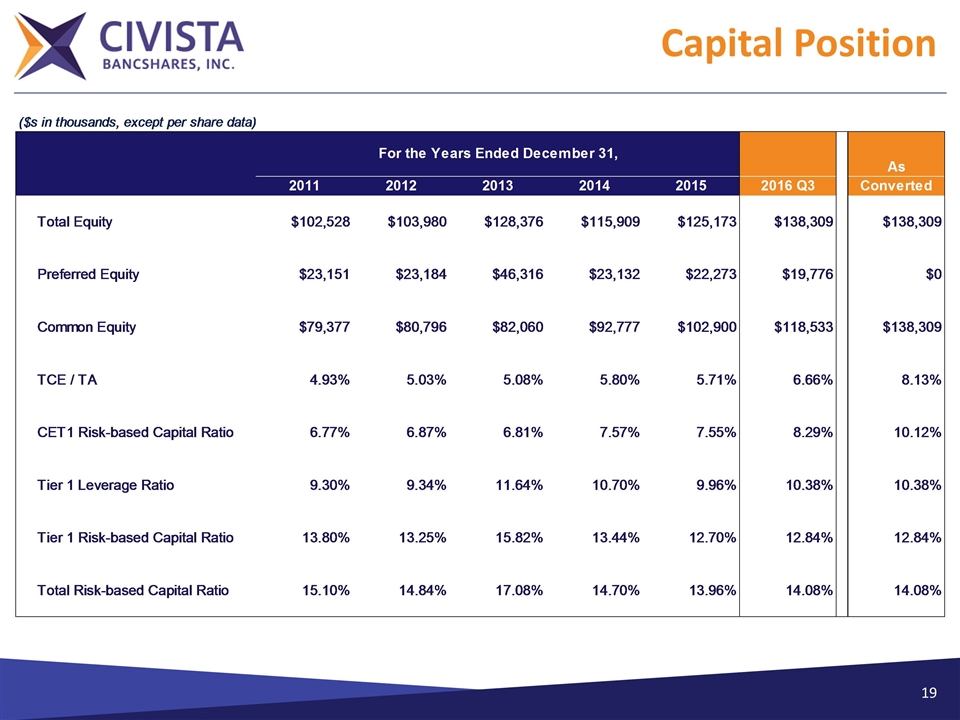

Investment Highlights Demonstrated earnings growth YTD FTE Net Interest Margin 3.89% - We have maintained this level over the last twelve months in this low-rate, flatter yield curve environment. Strong noninterest income growth enhanced by unique tax refund processing platform Y-o-Y net income available to common shareholders growth of ~49% ROATCE of 20.95% for 2016 Improving operating leverage 51% growth in gain on sale of loans, YTD Q3 2016 over YTD Q3 2015 Continued focus on costs – YTD noninterest expense only up 3.0% over YTD 2015 Achieved cost synergy targets in TCNB acquisition within first year while maintaining revenue and loan growth goals Capital $50 million shelf registration statement went effective with SEC in August 2015 Shareholders recently approved proposals to eliminate preemptive rights and cumulative voting Ability to grow capital organically (TCE increased from 4.93% in 2011 to 6.66% Q3 2016) - ROATCE equals annualized net income, adjusted for amortization of intangibles, divided by average common equity minus average intangible assets

Experienced Management Team Chairman, President & CEO 42 years of banking experience Joined in 1986 James O. Miller SVP & Chief Operating Officer 30 years of banking experience Joined in 2007 Richard J. Dutton SVP & Chief Lending Officer 28 years of banking experience Joined in 2016 Charles A. Parcher SVP & General Counsel 14 years of banking experience Joined in 2002 James E. McGookey SVP & Controller 28 years of banking experience Joined in 1988 Todd A. Michel SVP & Chief Risk Officer 20 years of banking experience Joined in 2013 John A. Betts SVP & Chief Credit Officer 31 years of banking experience Joined in 2010 Paul J. Stark Dennis G. Shaffer EVP President, Civista Bank 31 years of banking experience Joined in 2009

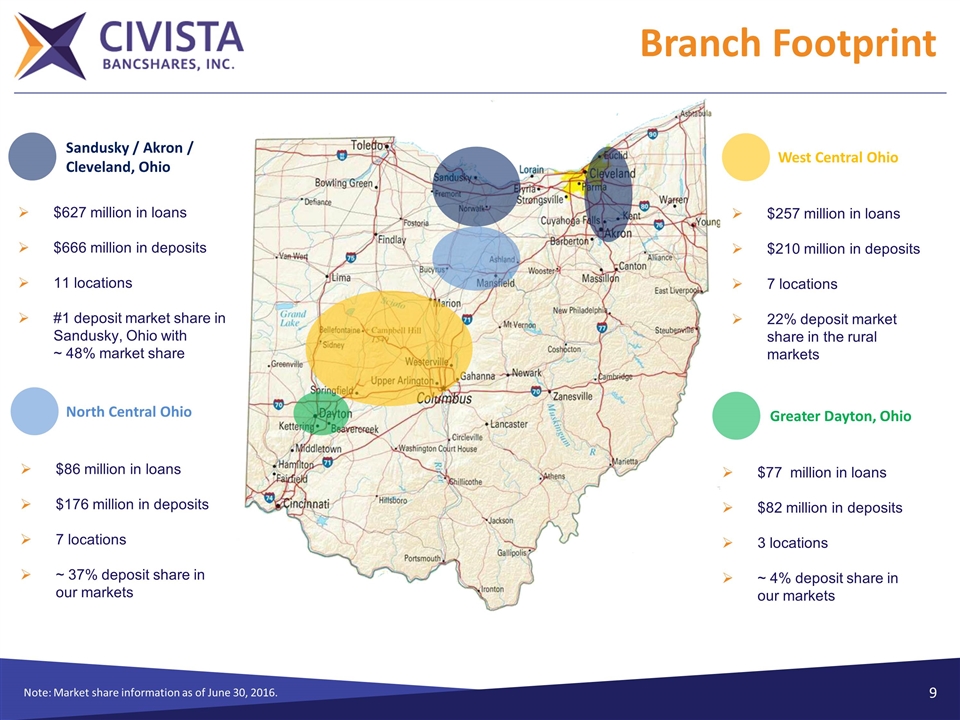

Branch Footprint Note: Market share information as of June 30, 2016. Sandusky / Akron / Cleveland, Ohio $627 million in loans $666 million in deposits 11 locations #1 deposit market share in Sandusky, Ohio with ~ 48% market share North Central Ohio $86 million in loans $176 million in deposits 7 locations ~ 37% deposit share in our markets $257 million in loans $210 million in deposits 7 locations 22% deposit market share in the rural markets West Central Ohio Greater Dayton, Ohio $77 million in loans $82 million in deposits 3 locations ~ 4% deposit share in our markets

Attractive Target Markets Sandusky / Akron / Cleveland North Central Ohio West Central Ohio Greater Dayton Ohio

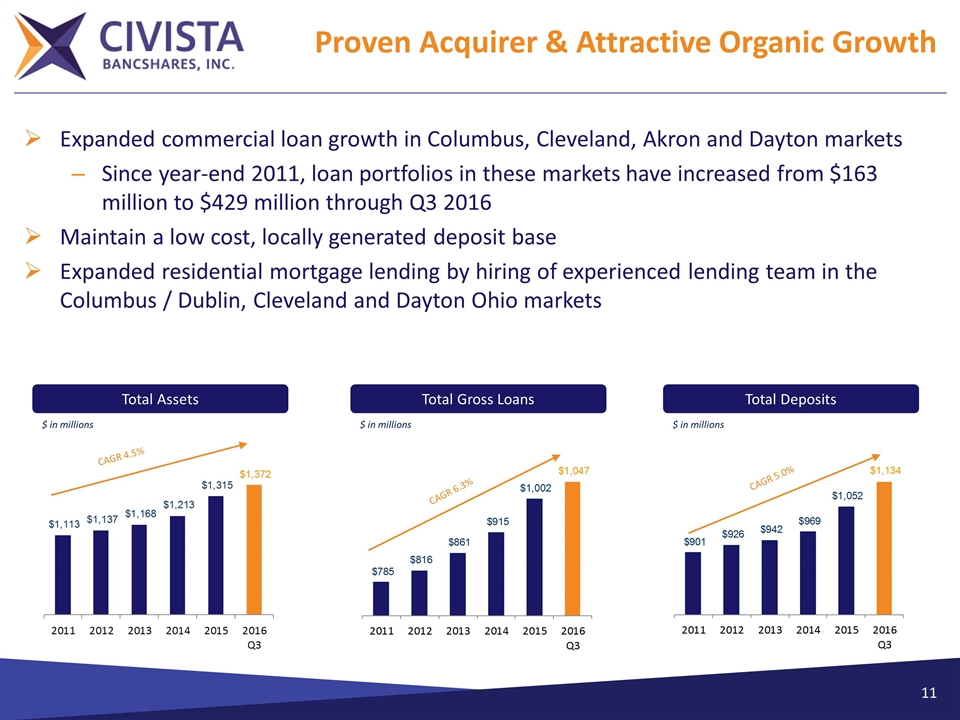

Proven Acquirer & Attractive Organic Growth Expanded commercial loan growth in Columbus, Cleveland, Akron and Dayton markets Since year-end 2011, loan portfolios in these markets have increased from $163 million to $429 million through Q3 2016 Maintain a low cost, locally generated deposit base Expanded residential mortgage lending by hiring of experienced lending team in the Columbus / Dublin, Cleveland and Dayton Ohio markets Total Assets $ in millions Total Gross Loans $ in millions Total Deposits $ in millions CAGR 4.5% CAGR 6.3% CAGR 5.0%

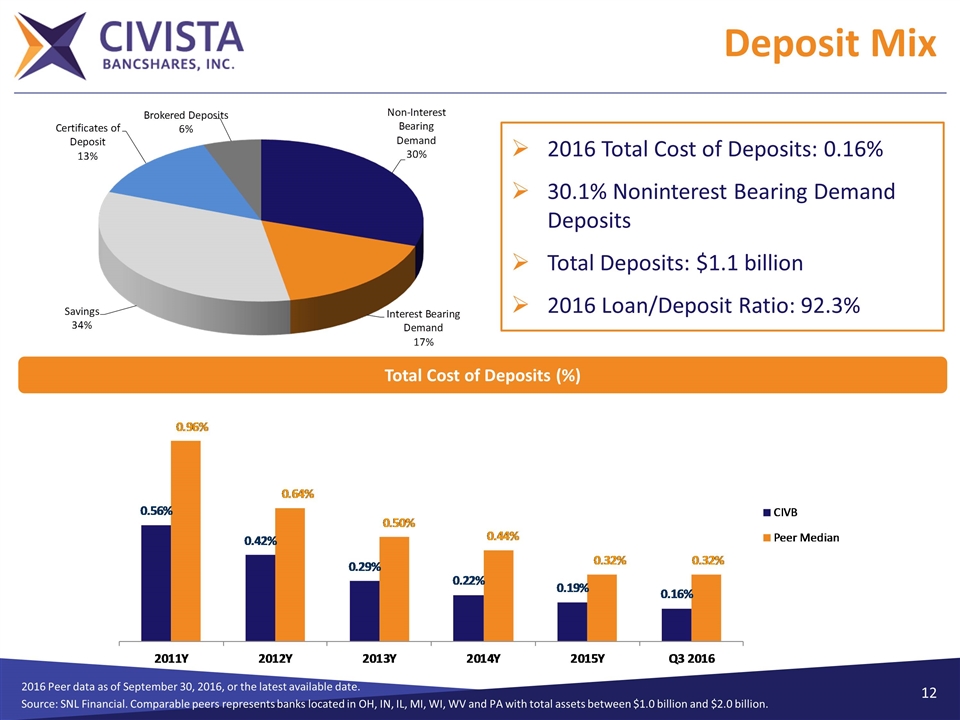

2016 Peer data as of September 30, 2016, or the latest available date. Source: SNL Financial. Comparable peers represents banks located in OH, IN, IL, MI, WI, WV and PA with total assets between $1.0 billion and $2.0 billion. Deposit Mix 2016 Total Cost of Deposits: 0.16% 30.1% Noninterest Bearing Demand Deposits Total Deposits: $1.1 billion 2016 Loan/Deposit Ratio: 92.3% Total Cost of Deposits (%)

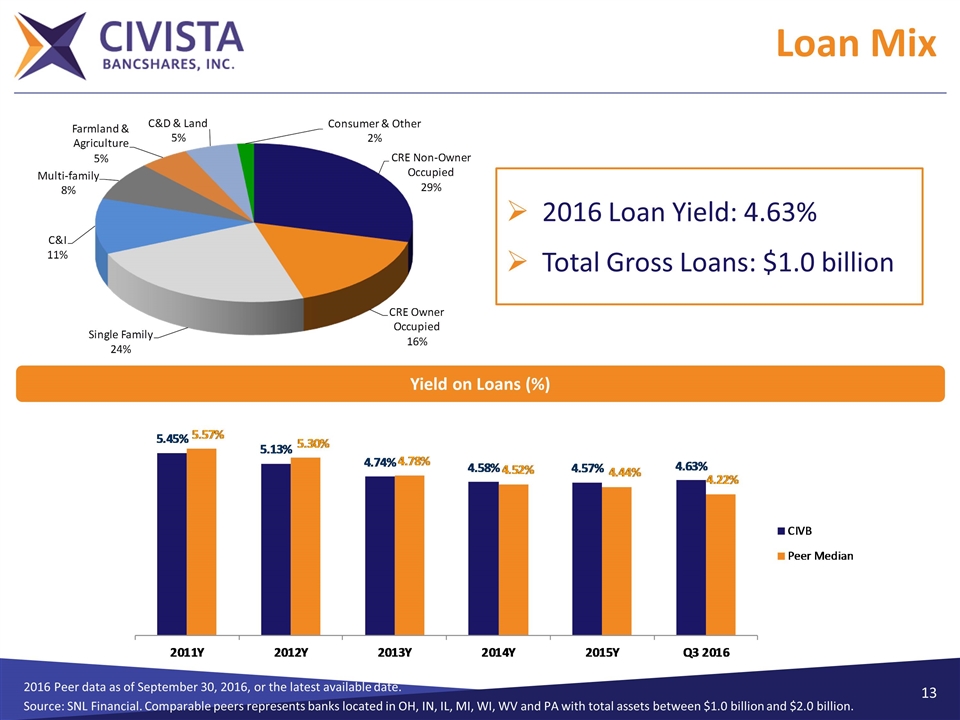

2016 Peer data as of September 30, 2016, or the latest available date. Source: SNL Financial. Comparable peers represents banks located in OH, IN, IL, MI, WI, WV and PA with total assets between $1.0 billion and $2.0 billion. Loan Mix 2016 Loan Yield: 4.63% Total Gross Loans: $1.0 billion Yield on Loans (%)

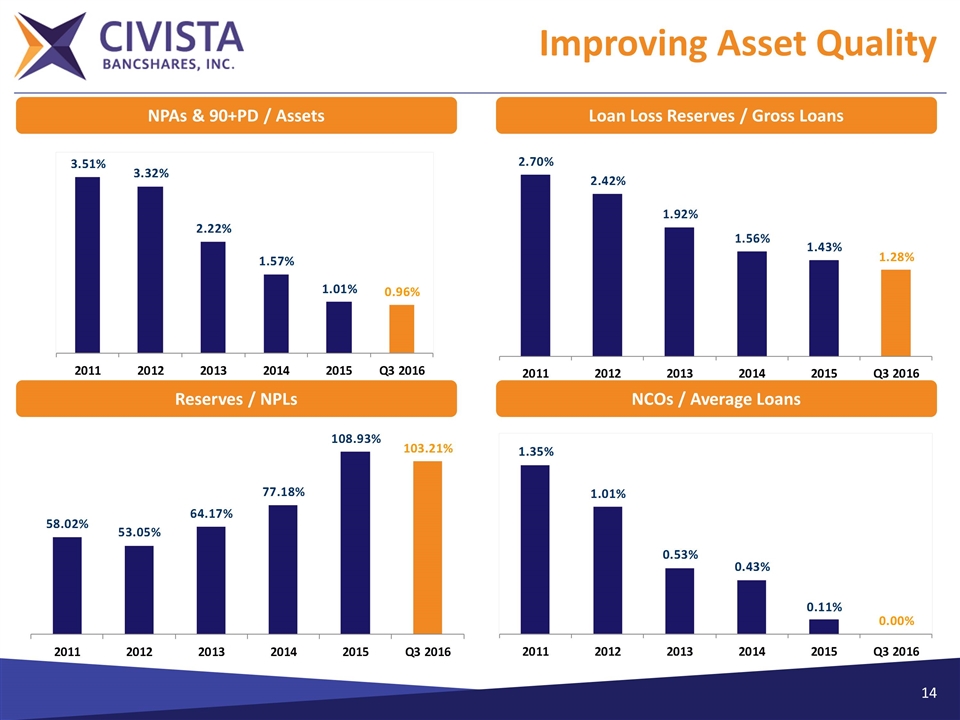

Improving Asset Quality Reserves / NPLs NCOs / Average Loans Loan Loss Reserves / Gross Loans NPAs & 90+PD / Assets Loan Loss Reserves / Gross Loans NPAs & 90+PD / Assets

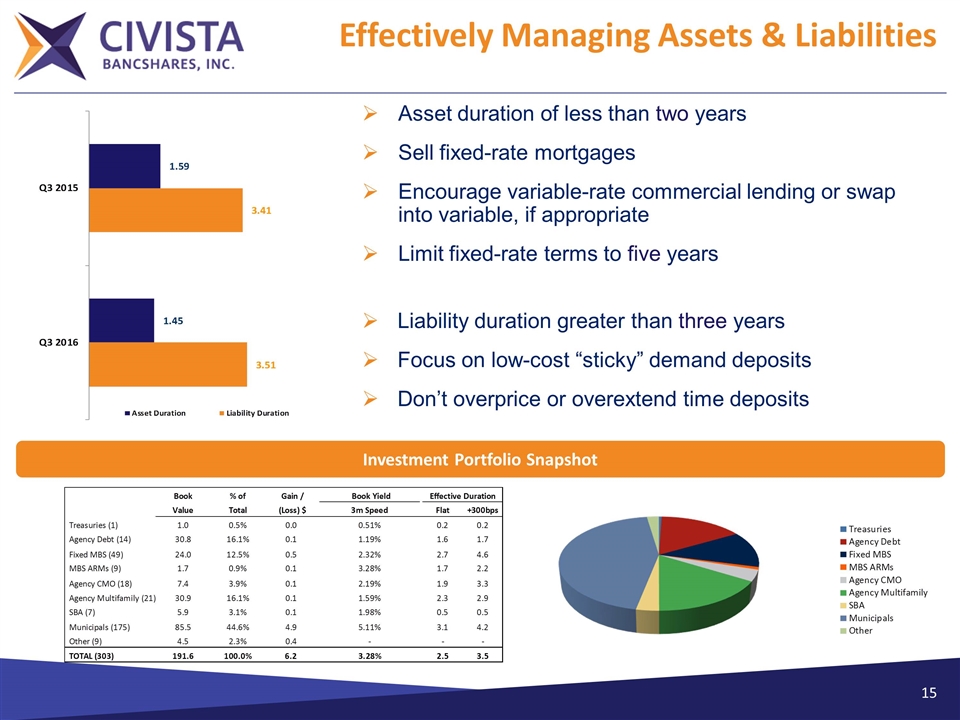

Effectively Managing Assets & Liabilities Asset duration of less than two years Sell fixed-rate mortgages Encourage variable-rate commercial lending or swap into variable, if appropriate Limit fixed-rate terms to five years Liability duration greater than three years Focus on low-cost “sticky” demand deposits Don’t overprice or overextend time deposits Investment Portfolio Snapshot

Peer Leading FTE Net Interest Margin 2016 Peer data as of September 30, 2016, or the latest available date. Source: SNL Financial. Comparable peers represents banks located in OH, IN, IL, MI, WI, WV and PA with total assets between $1.0 billion and $2.0 billion.

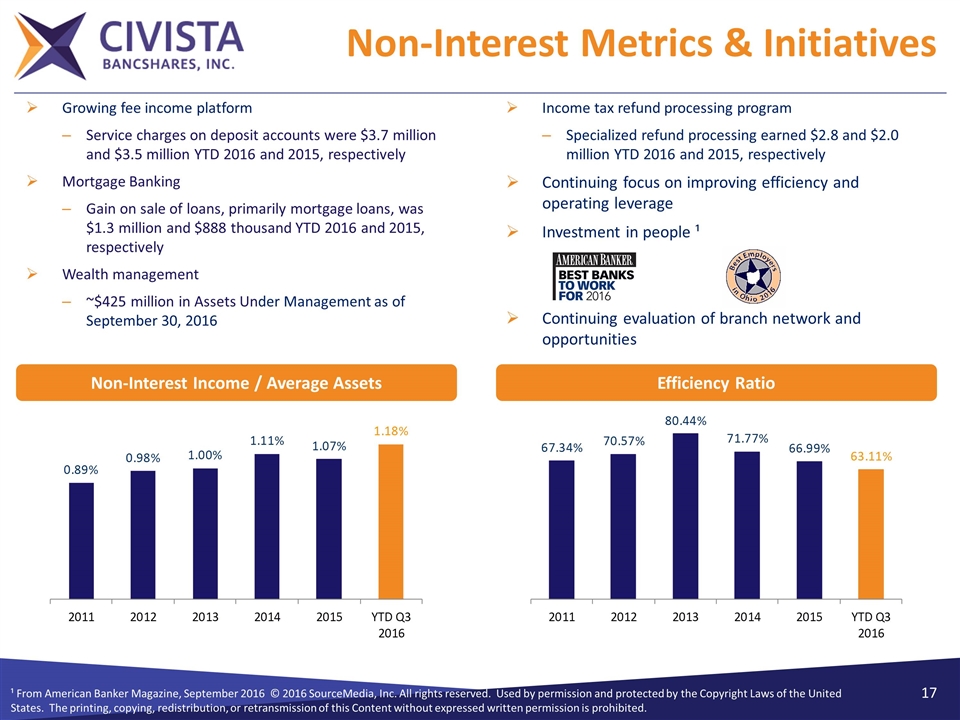

Non-Interest Metrics & Initiatives ¹ From American Banker Magazine, September 2016 © 2016 SourceMedia, Inc. All rights reserved. Used by permission and protected by the Copyright Laws of the United States. The printing, copying, redistribution, or retransmission of this Content without expressed written permission is prohibited. Efficiency Ratio Non-Interest Income / Average Assets Growing fee income platform Service charges on deposit accounts were $3.7 million and $3.5 million YTD 2016 and 2015, respectively Mortgage Banking Gain on sale of loans, primarily mortgage loans, was $1.3 million and $888 thousand YTD 2016 and 2015, respectively Wealth management ~$425 million in Assets Under Management as of September 30, 2016 Income tax refund processing program Specialized refund processing earned $2.8 and $2.0 million YTD 2016 and 2015, respectively Continuing focus on improving efficiency and operating leverage Investment in people ¹ Continuing evaluation of branch network and opportunities

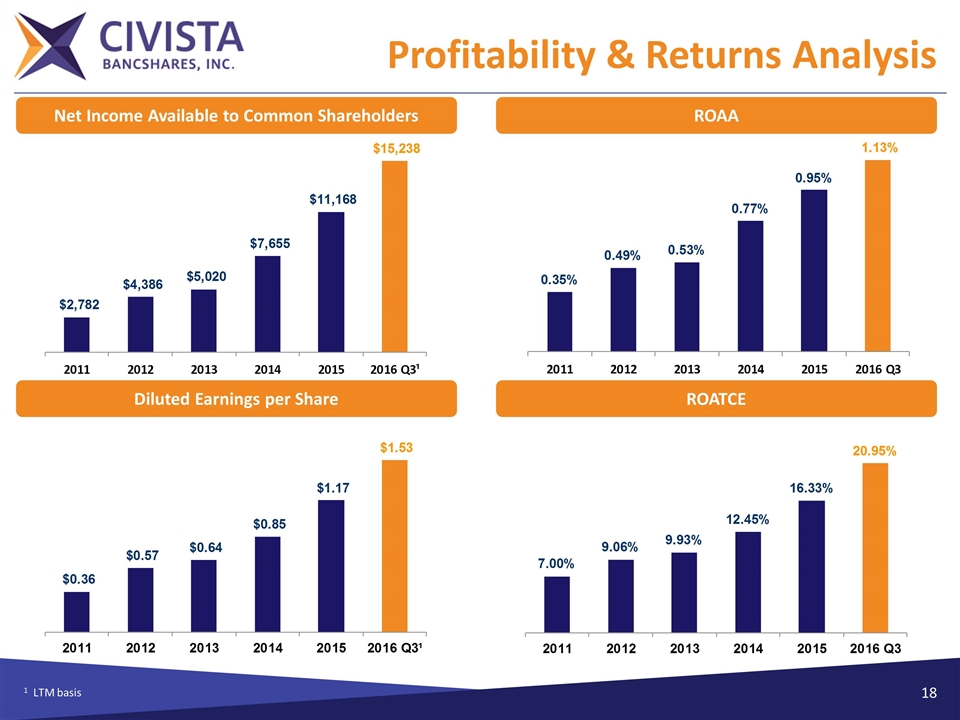

Profitability & Returns Analysis 1 LTM basis Diluted Earnings per Share ROATCE ROAA Net Income Available to Common Shareholders

Capital Position

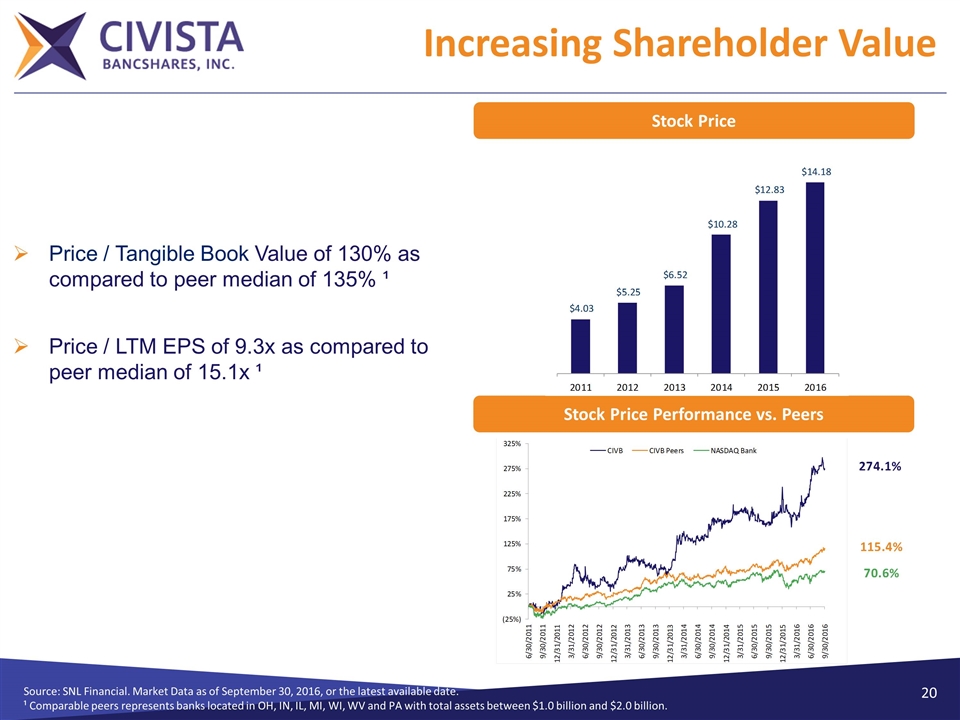

Increasing Shareholder Value Source: SNL Financial. Market Data as of September 30, 2016, or the latest available date. ¹ Comparable peers represents banks located in OH, IN, IL, MI, WI, WV and PA with total assets between $1.0 billion and $2.0 billion. Stock Price Price / Tangible Book Value of 130% as compared to peer median of 135% ¹ Price / LTM EPS of 9.3x as compared to peer median of 15.1x ¹ Stock Price Performance vs. Peers

Commitment to Shareholders Long-term Shareholder Value through Growth and Profitability

Strategic Focus & Growth Strategy Organic growth Capitalize on commercial and consumer lending opportunities Grow core deposit base in rural and targeted urban markets Identify and evaluate loan production opportunities in select metro markets Acquisition opportunities Rural Urban Asset quality Efficiency and operating leverage Capital

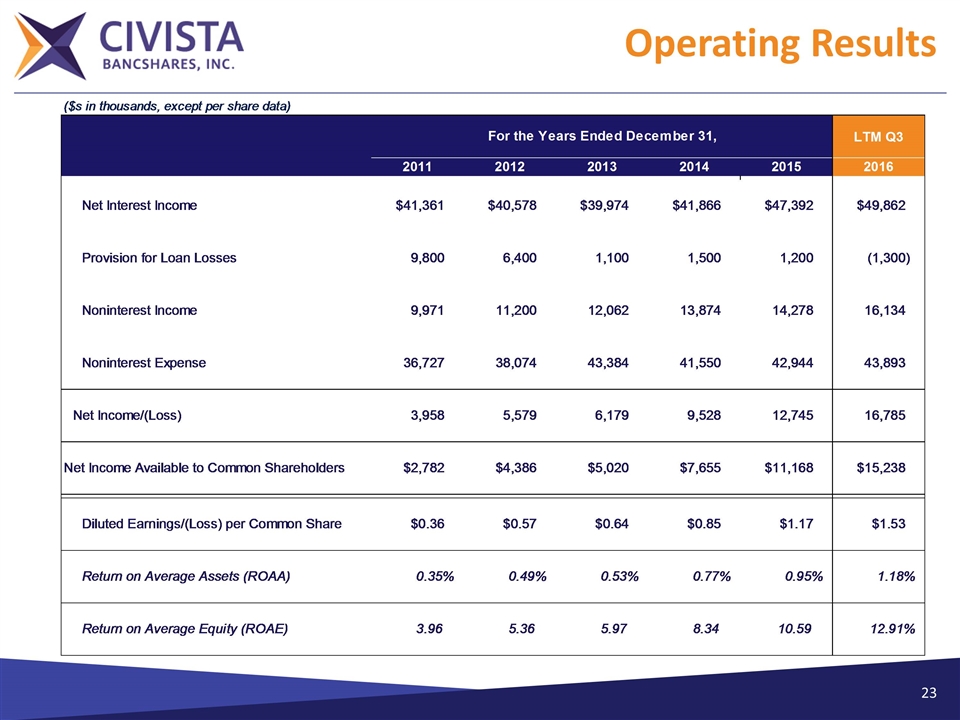

Operating Results

The Civista Story Strong and Seasoned Management Team Leading Ohio Community Banking Franchise Proven and Disciplined Acquirer Attractively Valued Versus Peers Platform to Support Future Growth

Compelling Investment Opportunity Trading at a discount to peers on a Price/Tangible Book Value basis and a substantial discount on a Price/LTM EPS basis. Superior asset quality Proven acquirer Peer leading NIM Low cost deposits – 16 BPs lower than peers High quality loan portfolio – 41 BPs higher than peers Experienced Ohio based management team with an of average 28 years in banking Strategically positioned in high quality Ohio lending markets as well as low cost deposit markets Seasoned lending teams in all markets incentivized to underwrite high-quality loans Superior profitability improvement from 2011 to Q3 2016 Net Income CAGR: 43.8% ROAA CAGR: 28.0% EPS CAGR: 35.6% ROATCE CAGR: 26.0% Peer data as of September 30, 2016, or the latest available date.

Thank You