Investor Presentation Third Quarter 2019 Dennis G. Shaffer - President & Chief Executive Officer Richard J. Dutton - Senior Vice President, Chief Operating Officer NASDAQ: CIVB Exhibit 99.1

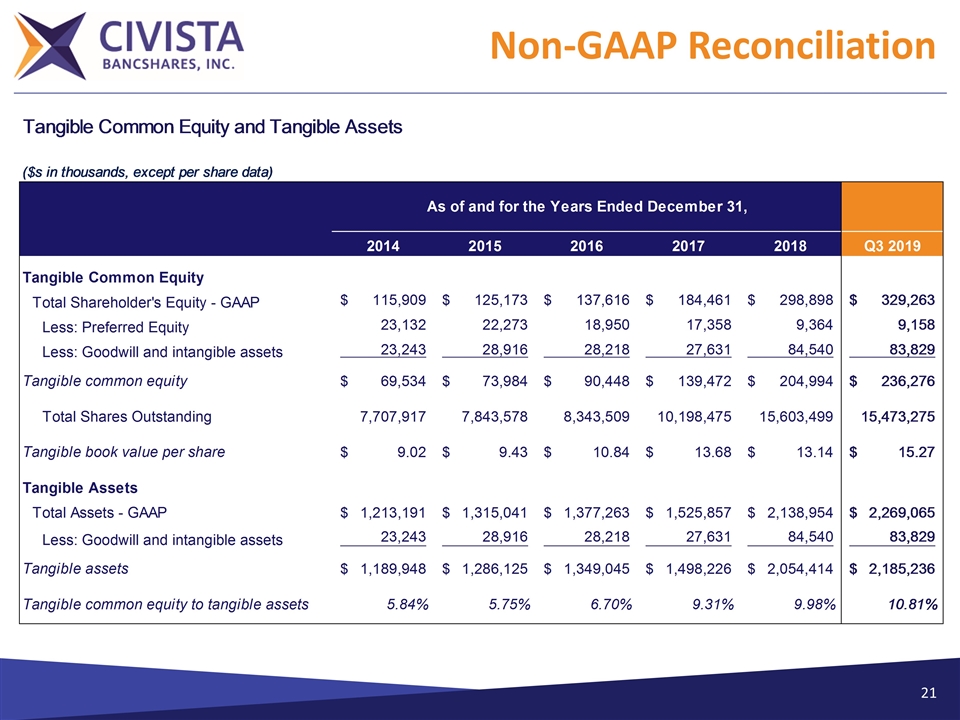

Forward-Looking Statements. This presentation may contain forward-looking statements within the meaning of such term in federal securities law. Forward-looking statements express management’s current expectations, forecasts of future events or long-term goals, and may be based upon beliefs, expectations and assumptions of the Company’s management are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “intend,” “estimate,” “may,” “will,” “would,” “could,” “should” or other similar expressions. All statements in this material speak only as of the date they are made, and we undertake no obligation to update any statement. A number of factor, many of which are beyond the ability of the Company to control or predict, could cause the actual results to differ materially from those in its forward-looking statements. Additional information regarding such risks can be found in public documents on file with the SEC, including those risks identified in “Item 1A. Risk Factors” of Part I of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Use of Non-GAAP Financial Measures. This presentation contains certain financial information determined by methods other than in accordance with accounting principals generally accepted in the United States (“GAAP”). These non-GAAP financial measures include “Tangible Book Value per Share” and “Tangible Common Equity to Tangible Assets”. The Company believes that these non-GAAP financial measures provide both management and investors a more complete understanding of the Company’s profitability. These non-GAAP financial measures are supplemental and are not a substitute for any analysis based on GAAP Measures. Not all companies use the same calculation of these measures; therefore this presentation may not be comparable to other similarly titled measures as presented by other companies. Reconciliations of these non-GAAP measures are provided in the Appendix section of this presentation.

Contact Information Civista Bancshares, Inc.’s common shares are traded on the NASDAQ Capital Market under the symbol “CIVB.” The Company’s depositary shares, each representing 1/40th ownership interest in a Series B Preferred Share, are traded on the NASDAQ Capital Market under the symbol “CIVBP.” Additional information can be found at: www.civb.com Dennis G Shaffer President & Chief Executive Officer dgshaffer@civb.com Telephone: 888.645.4121

Corporate Overview Bank originally founded in 1884 10th Largest Publicly Traded Commercial Bank Headquartered in Ohio Community Banking Focused Operations in 12 Ohio, 2 Indiana and 1 Kentucky Counties 35 Branches & 2 Loan Production Offices Operations in the 5 largest Ohio MSAs Franchise Poised for Acquisitions and Organic Growth Closed and converted the UCB transaction 9/14/18. Recognized integration and acquisition expenses of $12.7 million during 2018 Full-Service Banking Organization with Diversified Revenue Streams Commercial Banking Retail Banking Wealth Management Mortgage Banking Tax Refund Processing Corporate Overview ¹ From AB Magazine. © 2019 SourceMedia, Inc. All rights reserved. Used under license. 1

Experienced Management Team Dennis G. Shaffer SVP & Chief Operating Officer 33 years of banking experience Joined in 2007 Richard J. Dutton SVP & Chief Lending Officer 31 years of banking experience Joined in 2016 Charles A. Parcher SVP & General Counsel 16 years of banking experience Joined in 2018 Lance A. Morrison SVP & Controller 31 years of banking experience Joined in 1988 Todd A. Michel SVP & Chief Risk Officer 23 years of banking experience Joined in 2013 John A. Betts SVP & Chief Credit Officer 34 years of banking experience Joined in 2010 Paul J. Stark Donna M. Jaskolski SVP & Customer Experience Officer 17 years of banking experience Joined in 2017 CEO & President President, Civista Bank 34 years of banking experience Joined in 2009

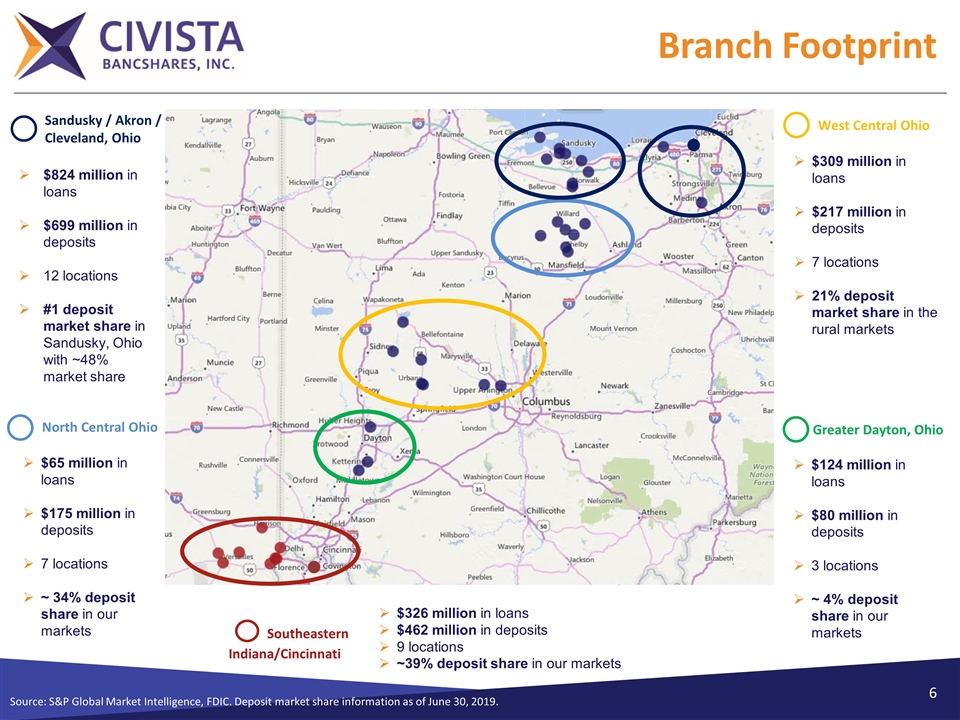

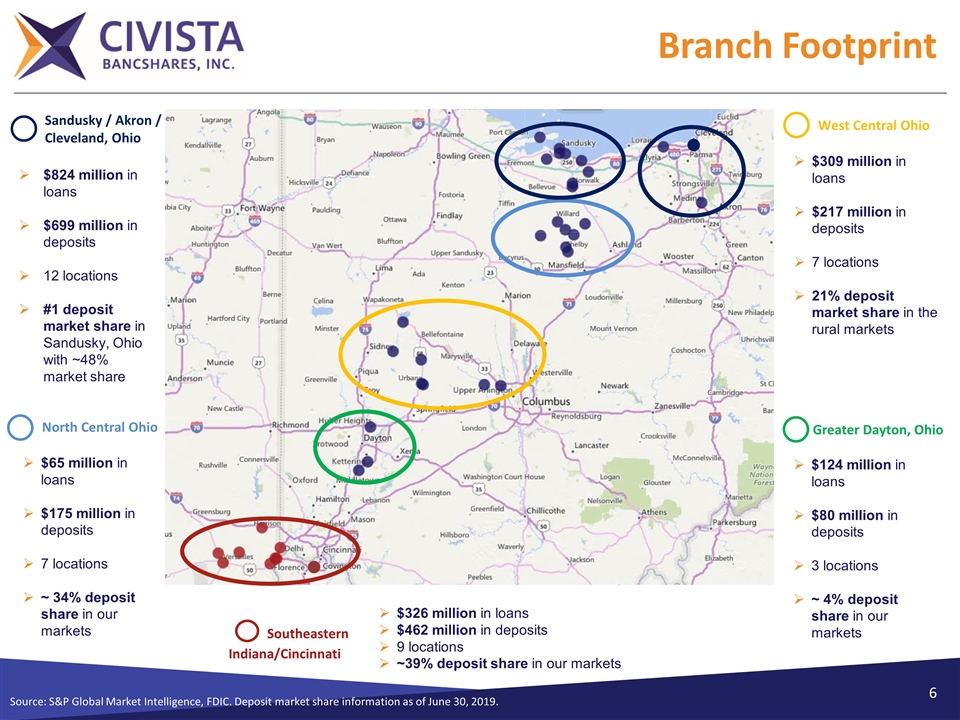

$326 million in loans $462 million in deposits 9 locations ~39% deposit share in our markets Branch Footprint Source: S&P Global Market Intelligence, FDIC. Deposit market share information as of June 30, 2019. Sandusky / Akron / Cleveland, Ohio $824 million in loans $699 million in deposits 12 locations #1 deposit market share in Sandusky, Ohio with ~48% market share North Central Ohio $65 million in loans $175 million in deposits 7 locations ~ 34% deposit share in our markets $309 million in loans $217 million in deposits 7 locations 21% deposit market share in the rural markets West Central Ohio Greater Dayton, Ohio $124 million in loans $80 million in deposits 3 locations ~ 4% deposit share in our markets Southeastern Indiana/Cincinnati

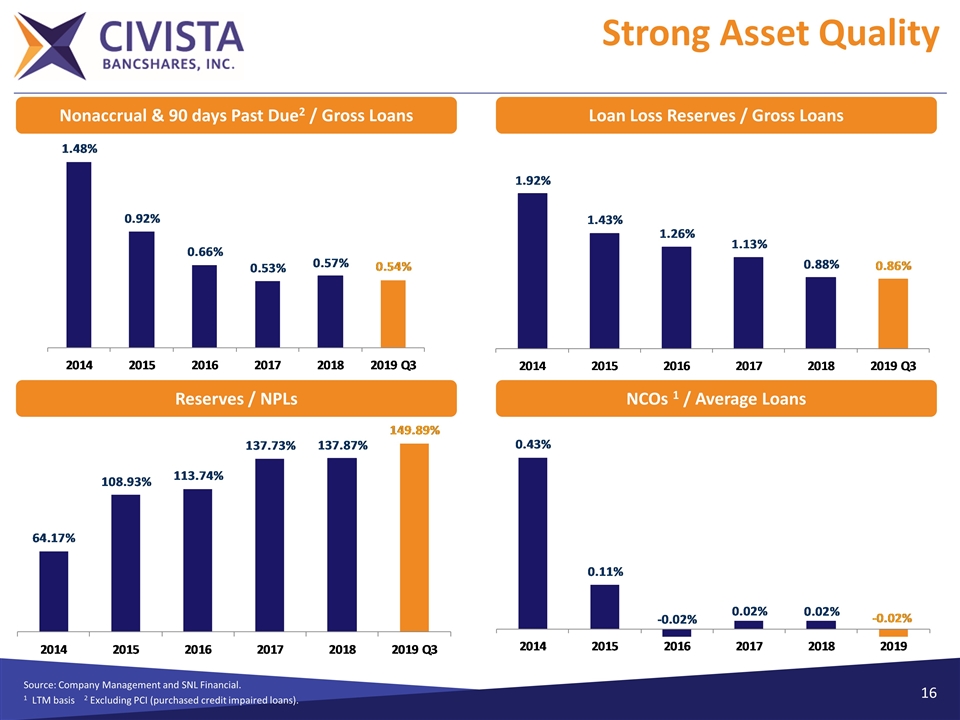

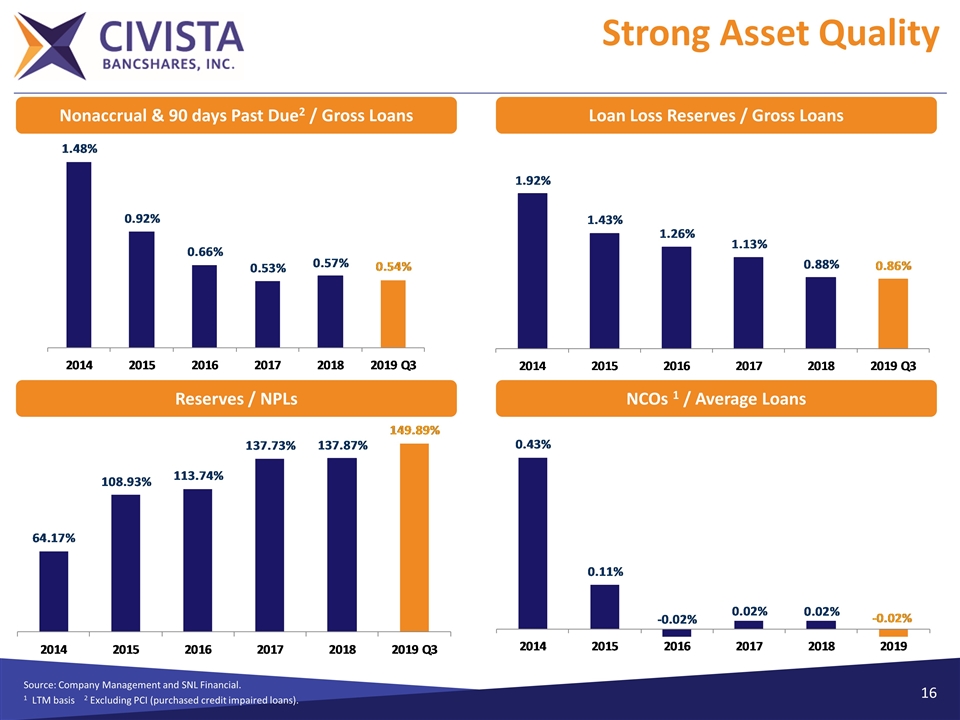

Investment Highlights Experienced management team with a deep bench Community bank franchise in growth markets with an established operating model Gather attractive low-cost rural deposits (47 bps total cost of deposits) Generate loans in select growing urban markets (operations in the 5 largest MSAs in Ohio) Use of LPOs to extend our reach One Loan Production Offices in Cleveland MSA (Westlake) One Loan Production Office in Cincinnati MSA (Fort Mitchell, KY) Disciplined underwriting verified with strong credit quality metrics Nonaccrual and 90 days Past Due (excluding PCI1) to Gross Loans of 0.54% as of 9/30/2019 Noninterest income enhanced by unique tax refund processing platform Continued strong returns in 2019 ROAA2: 1.53% ROAE2: 10.90% FTE NIM 4.35% Member Russell 2000 index Source: Company Management and SNL Financial. 1PCI – purchased credit impaired loans. 2 LTM

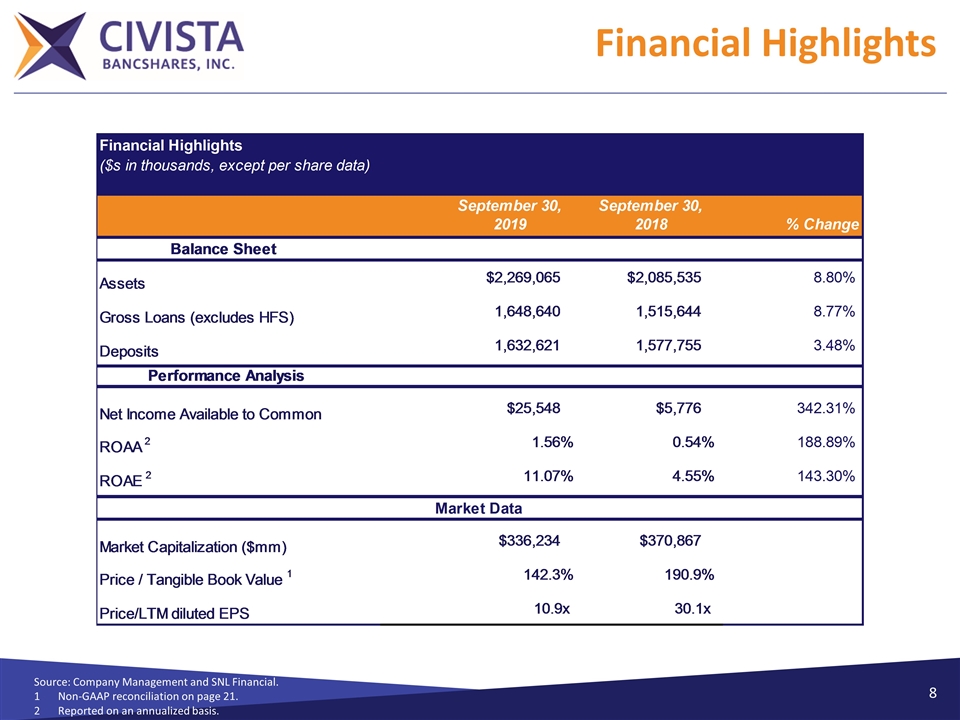

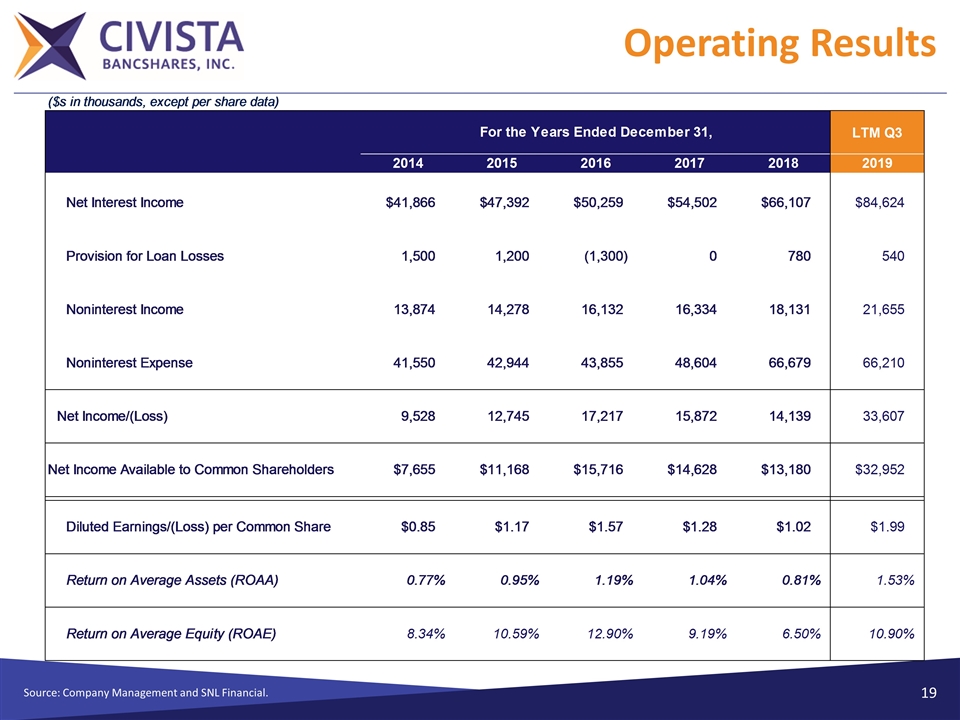

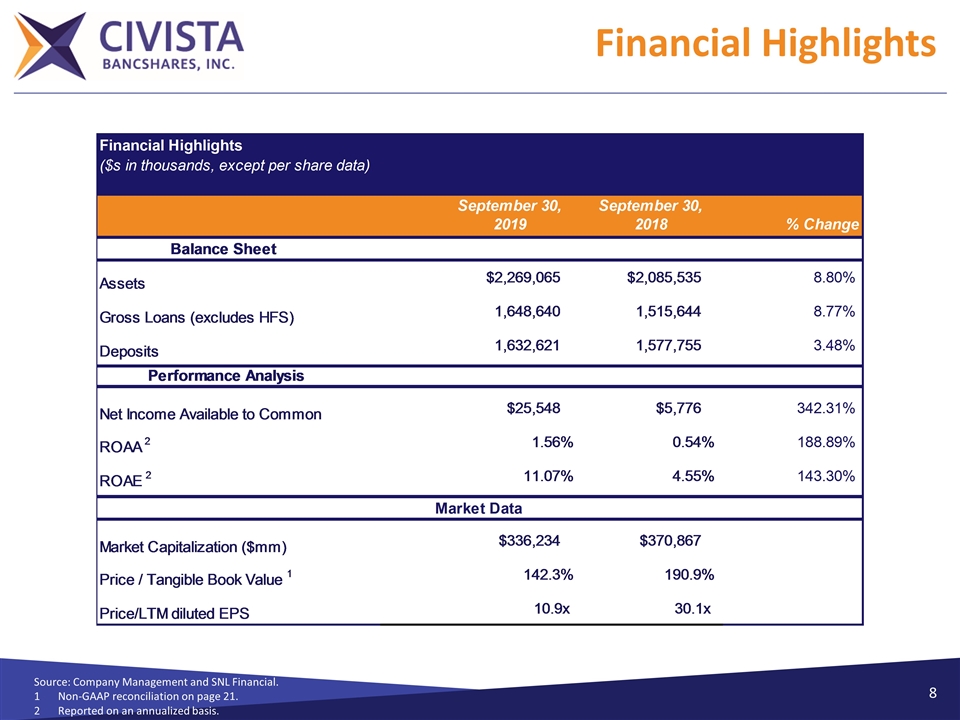

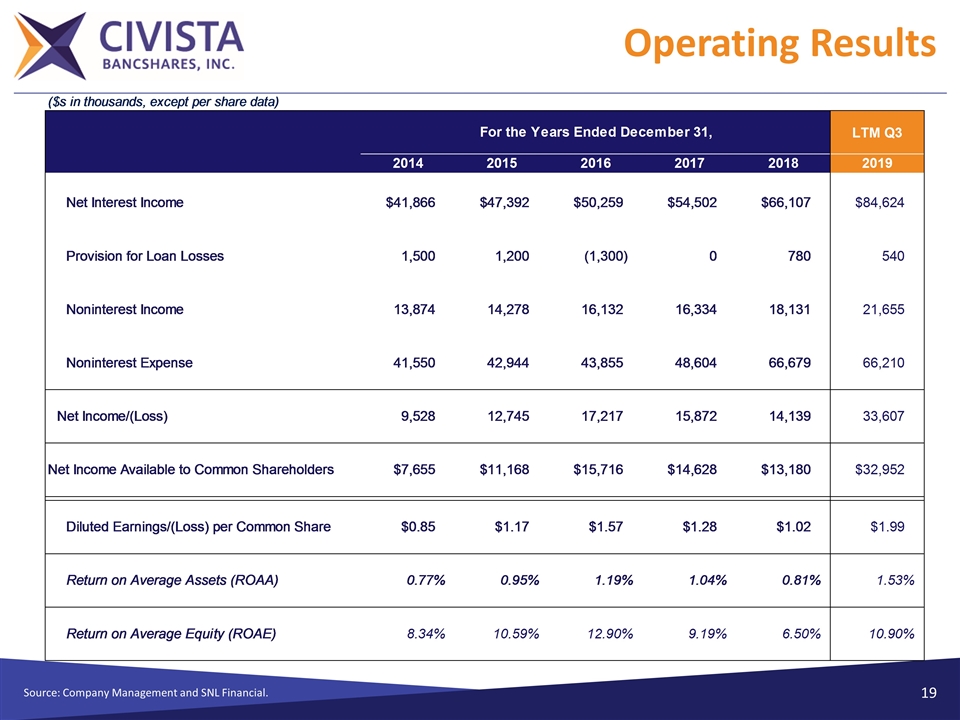

Financial Highlights Source: Company Management and SNL Financial. Non-GAAP reconciliation on page 21. Reported on an annualized basis.

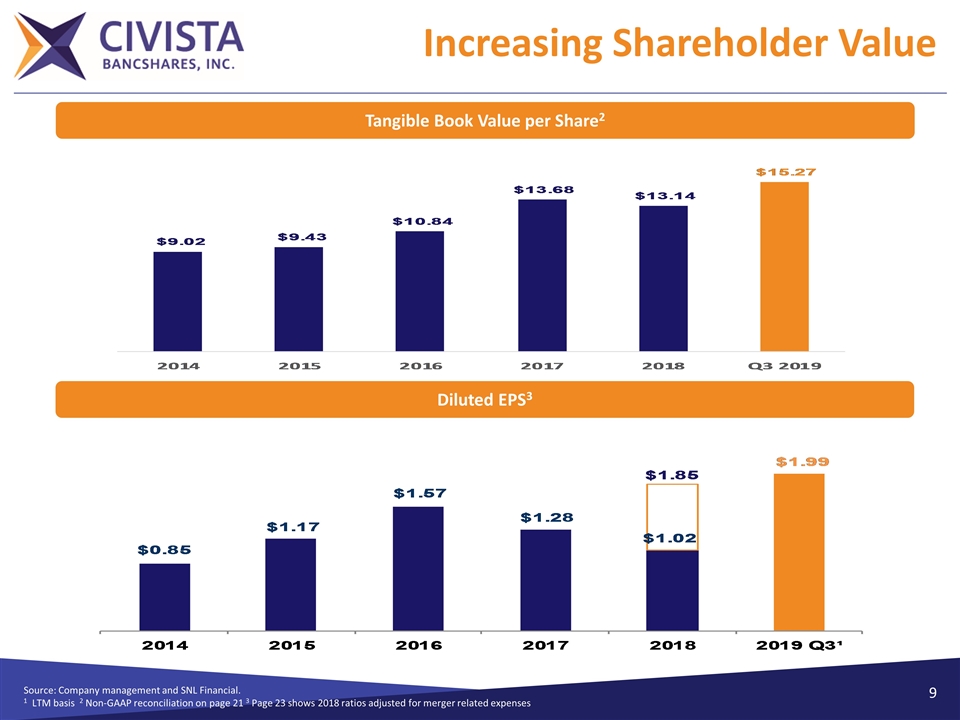

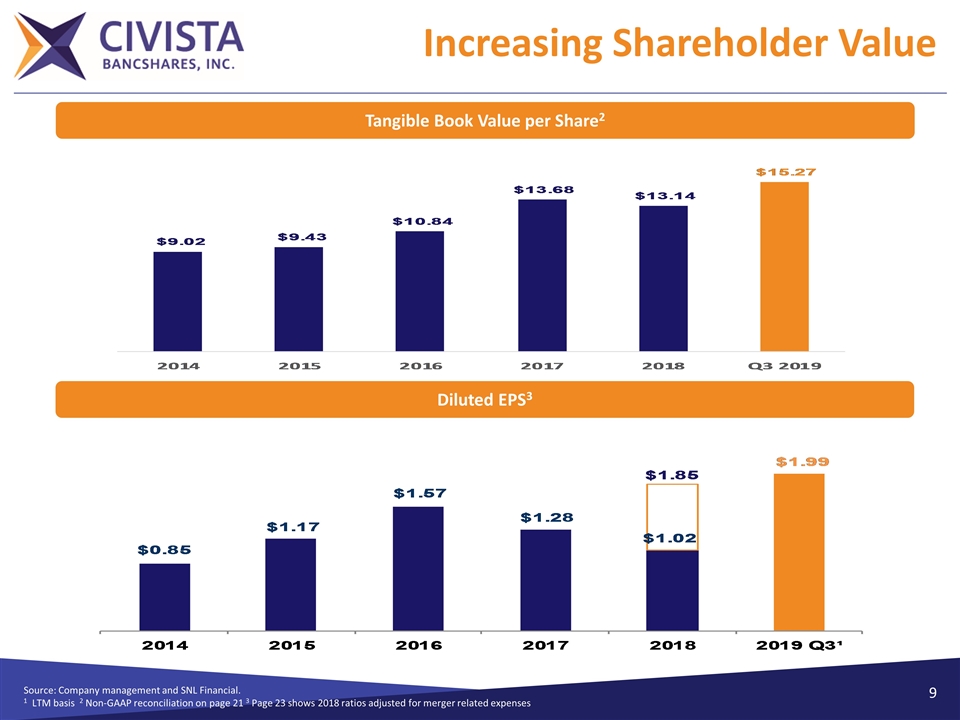

Increasing Shareholder Value Source: Company management and SNL Financial. 1 LTM basis 2 Non-GAAP reconciliation on page 21 3 Page 23 shows 2018 ratios adjusted for merger related expenses Tangible Book Value per Share2 Diluted EPS3

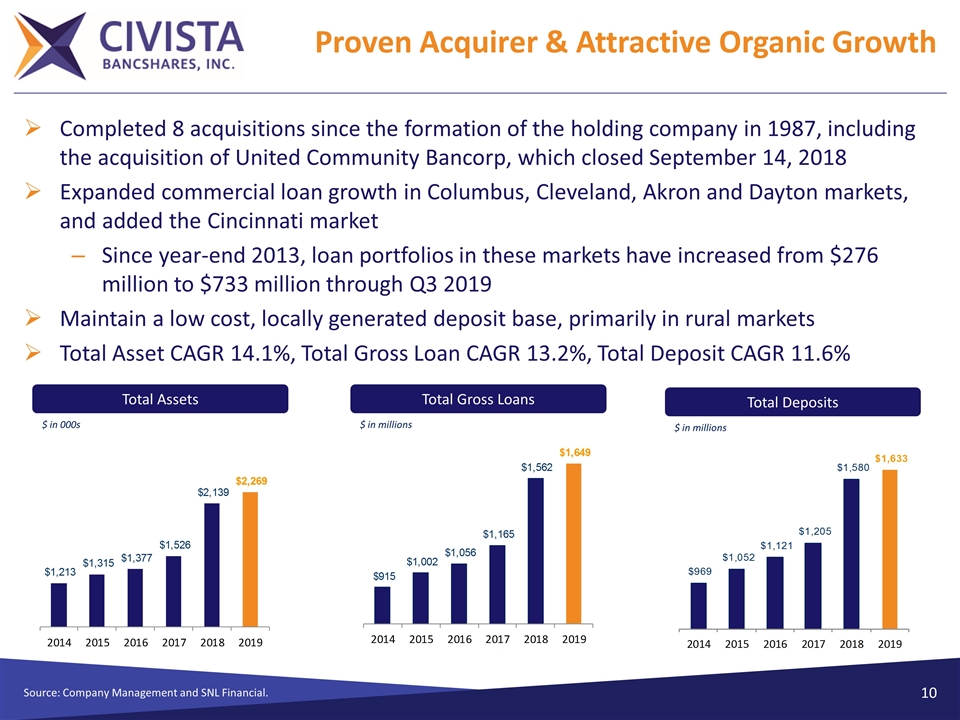

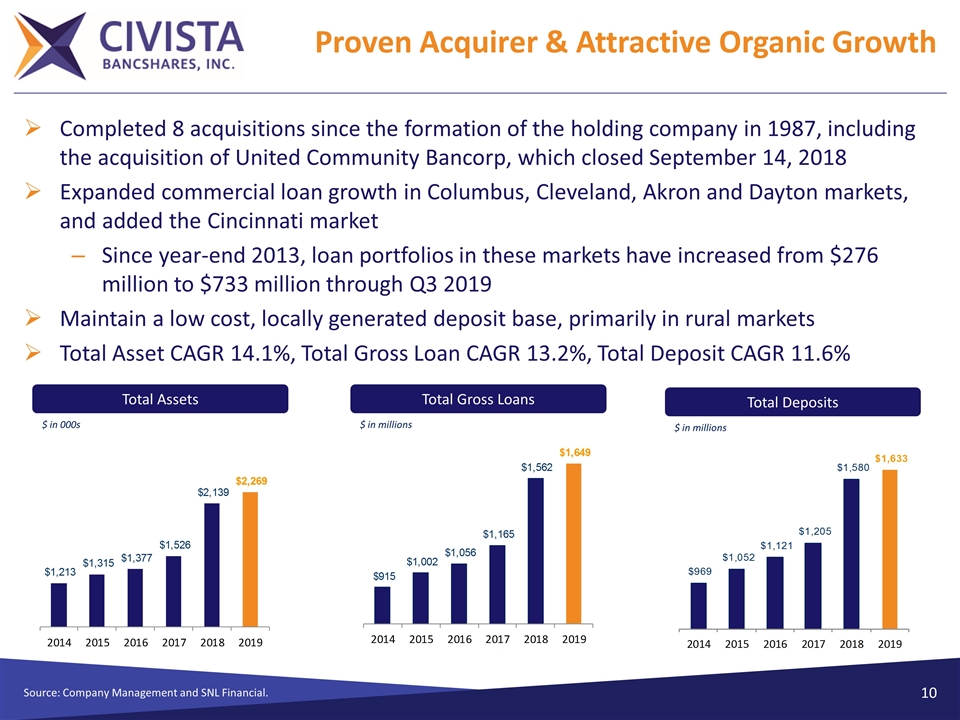

Proven Acquirer & Attractive Organic Growth Source: Company Management and SNL Financial. Completed 8 acquisitions since the formation of the holding company in 1987, including the acquisition of United Community Bancorp, which closed September 14, 2018 Expanded commercial loan growth in Columbus, Cleveland, Akron and Dayton markets, and added the Cincinnati market Since year-end 2013, loan portfolios in these markets have increased from $276 million to $733 million through Q3 2019 Maintain a low cost, locally generated deposit base, primarily in rural markets Total Asset CAGR 14.1%, Total Gross Loan CAGR 13.2%, Total Deposit CAGR 11.6% Total Assets $ in 000s Total Gross Loans $ in millions Total Deposits $ in millions

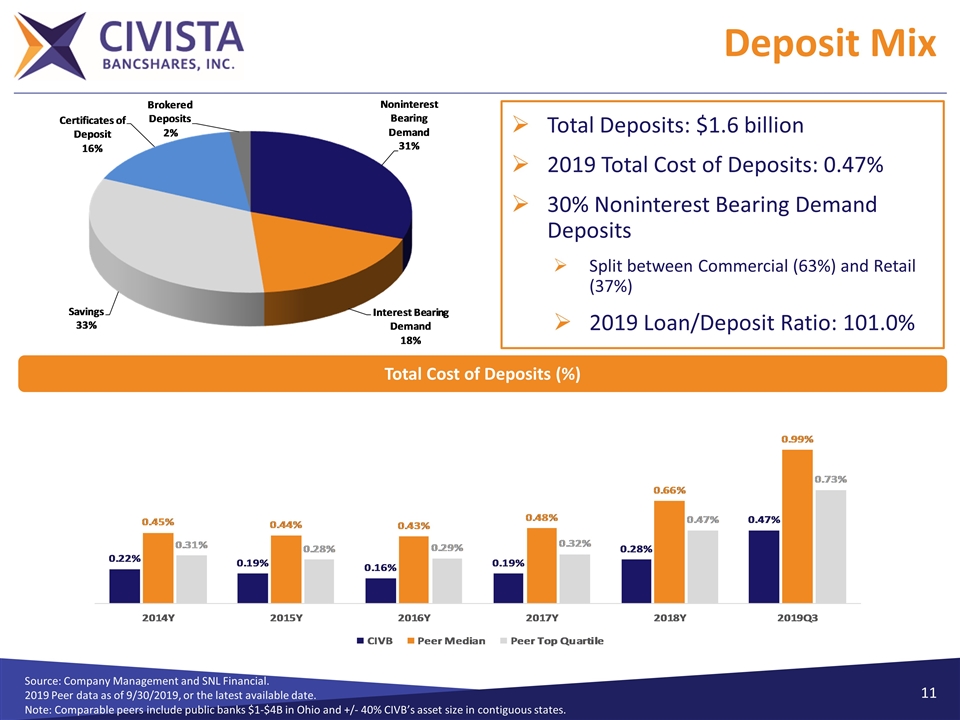

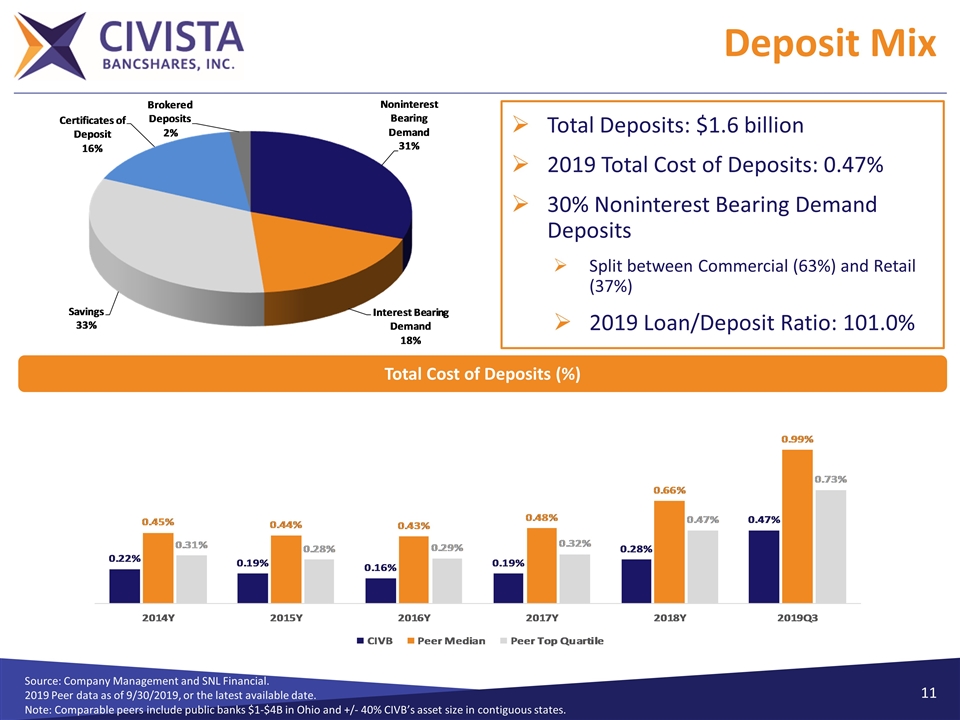

Source: Company Management and SNL Financial. 2019 Peer data as of 9/30/2019, or the latest available date. Note: Comparable peers include public banks $1-$4B in Ohio and +/- 40% CIVB’s asset size in contiguous states. Deposit Mix Total Deposits: $1.6 billion 2019 Total Cost of Deposits: 0.47% 30% Noninterest Bearing Demand Deposits Split between Commercial (63%) and Retail (37%) 2019 Loan/Deposit Ratio: 101.0% Total Cost of Deposits (%)

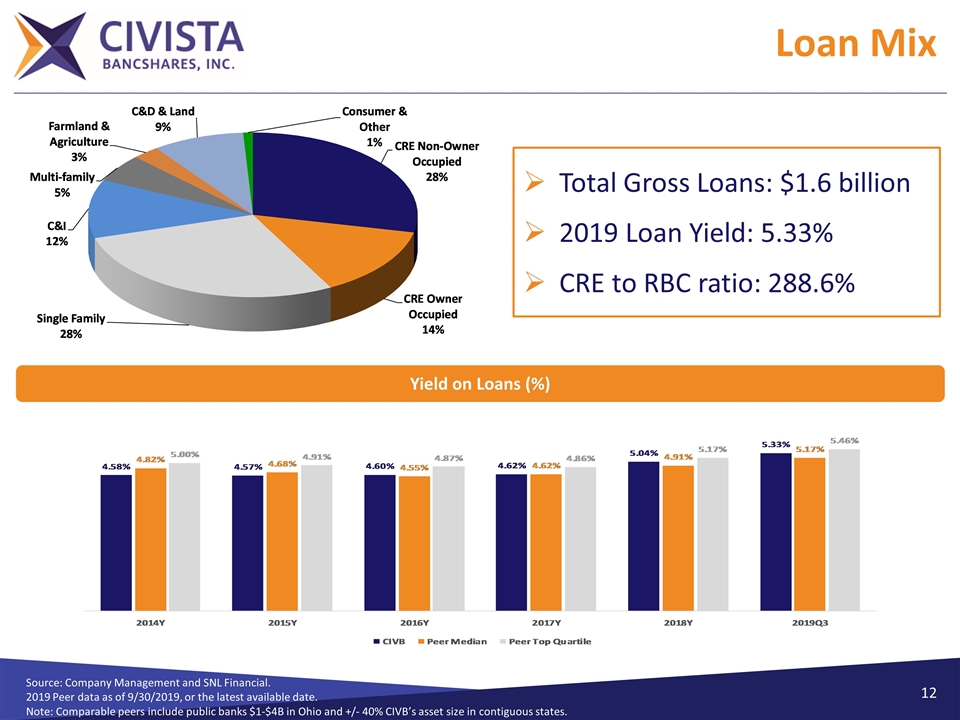

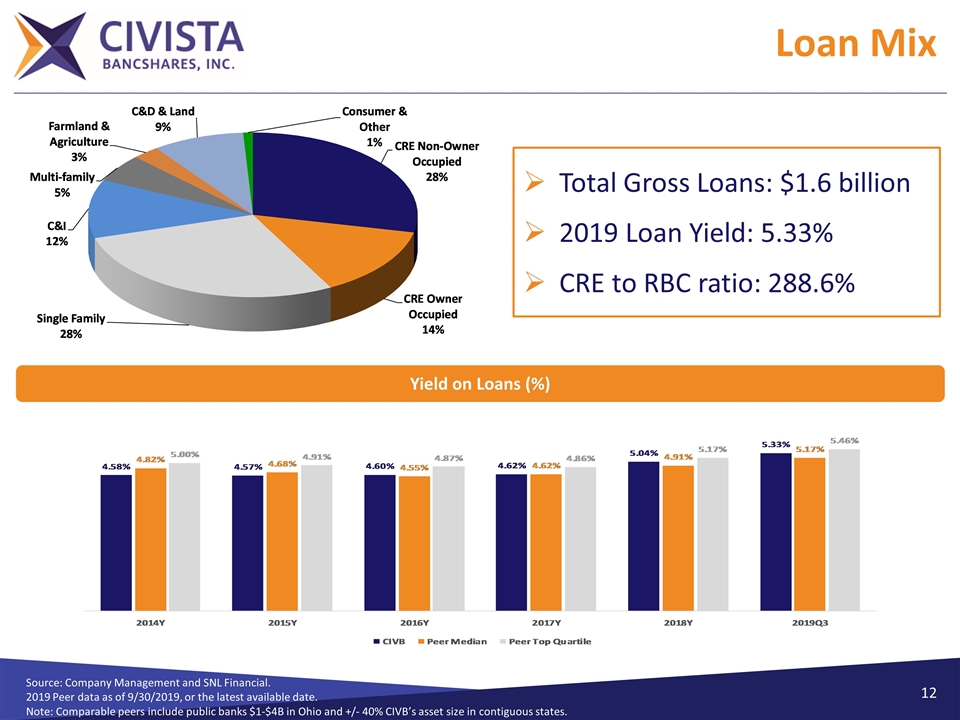

Source: Company Management and SNL Financial. 2019 Peer data as of 9/30/2019, or the latest available date. Note: Comparable peers include public banks $1-$4B in Ohio and +/- 40% CIVB’s asset size in contiguous states. Loan Mix Total Gross Loans: $1.6 billion 2019 Loan Yield: 5.33% CRE to RBC ratio: 288.6% Yield on Loans (%)

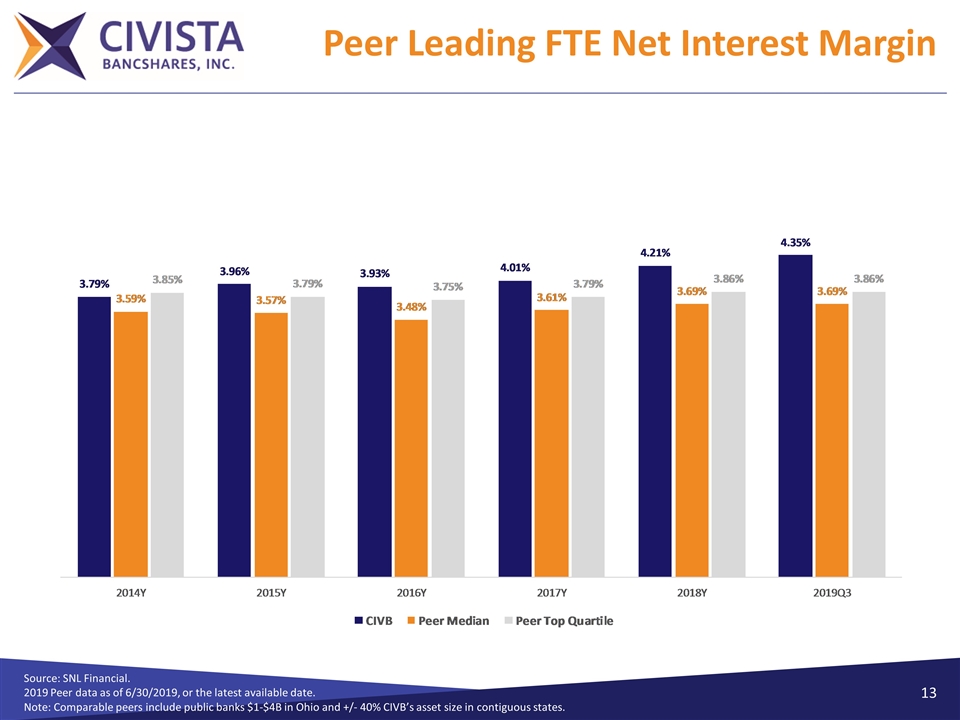

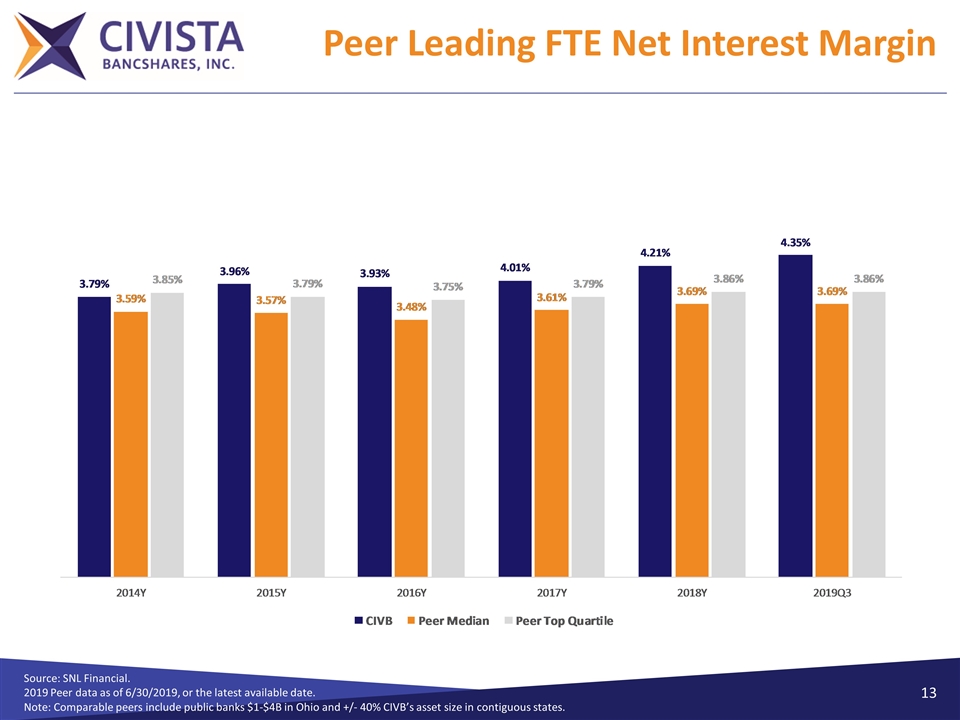

Peer Leading FTE Net Interest Margin Source: SNL Financial. 2019 Peer data as of 6/30/2019, or the latest available date. Note: Comparable peers include public banks $1-$4B in Ohio and +/- 40% CIVB’s asset size in contiguous states.

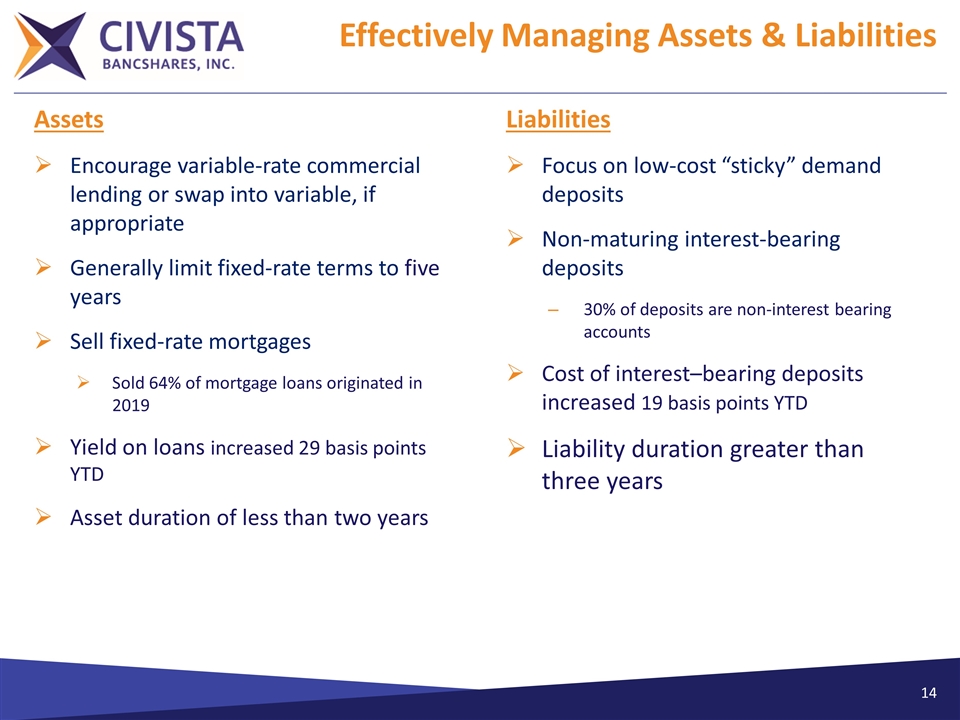

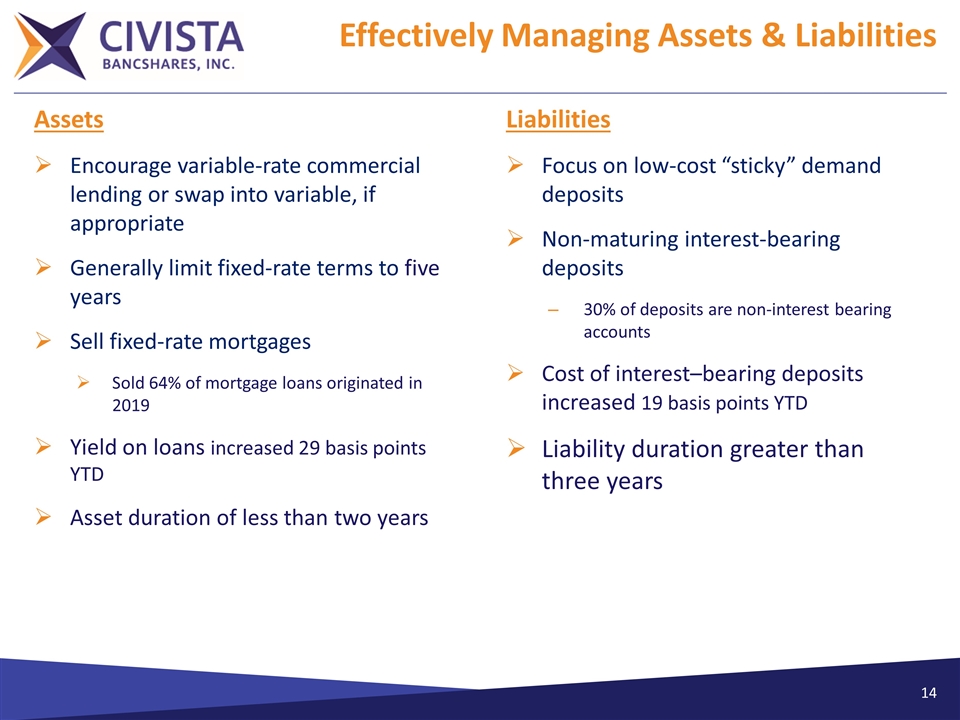

Effectively Managing Assets & Liabilities Assets Encourage variable-rate commercial lending or swap into variable, if appropriate Generally limit fixed-rate terms to five years Sell fixed-rate mortgages Sold 64% of mortgage loans originated in 2019 Yield on loans increased 29 basis points YTD Asset duration of less than two years Liabilities Focus on low-cost “sticky” demand deposits Non-maturing interest-bearing deposits 30% of deposits are non-interest bearing accounts Cost of interest–bearing deposits increased 19 basis points YTD Liability duration greater than three years

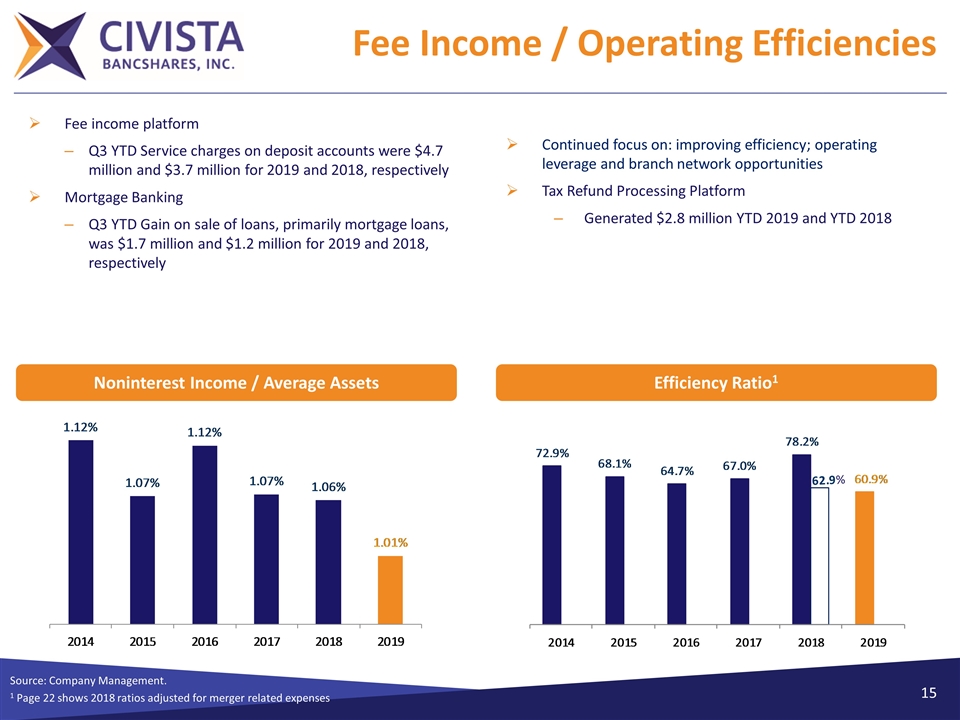

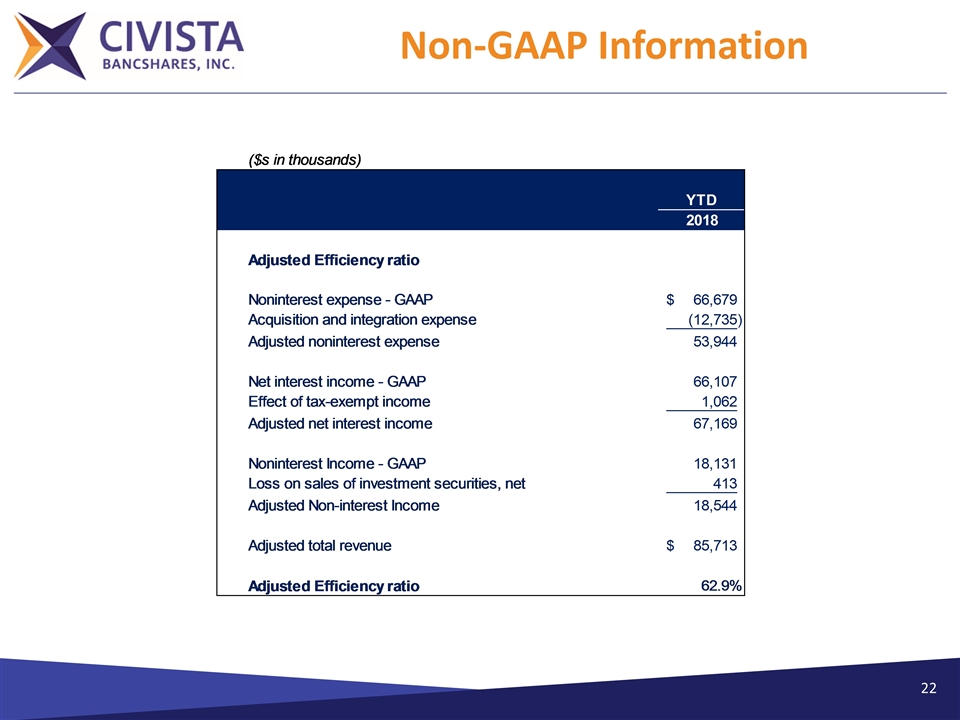

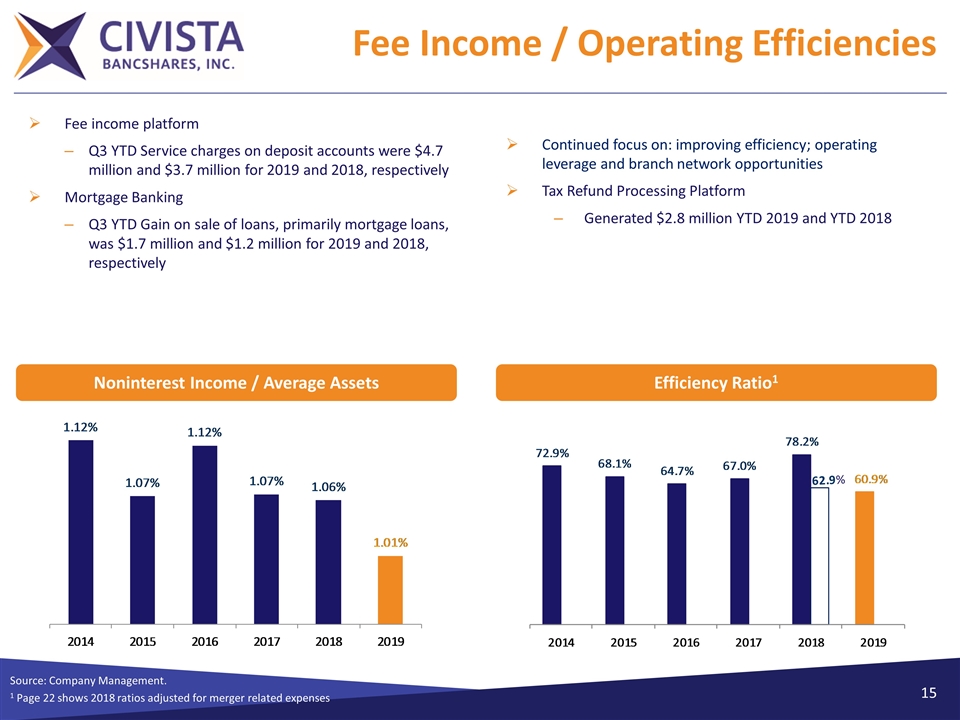

Fee Income / Operating Efficiencies Source: Company Management. 1 Page 22 shows 2018 ratios adjusted for merger related expenses Efficiency Ratio1 Noninterest Income / Average Assets Fee income platform Q3 YTD Service charges on deposit accounts were $4.7 million and $3.7 million for 2019 and 2018, respectively Mortgage Banking Q3 YTD Gain on sale of loans, primarily mortgage loans, was $1.7 million and $1.2 million for 2019 and 2018, respectively Continued focus on: improving efficiency; operating leverage and branch network opportunities Tax Refund Processing Platform Generated $2.8 million YTD 2019 and YTD 2018

Source: Company Management and SNL Financial. 1 LTM basis 2 Excluding PCI (purchased credit impaired loans). Strong Asset Quality Reserves / NPLs NCOs 1 / Average Loans Loan Loss Reserves / Gross Loans NPAs & 90+PD / Assets Loan Loss Reserves / Gross Loans Nonaccrual & 90 days Past Due2 / Gross Loans

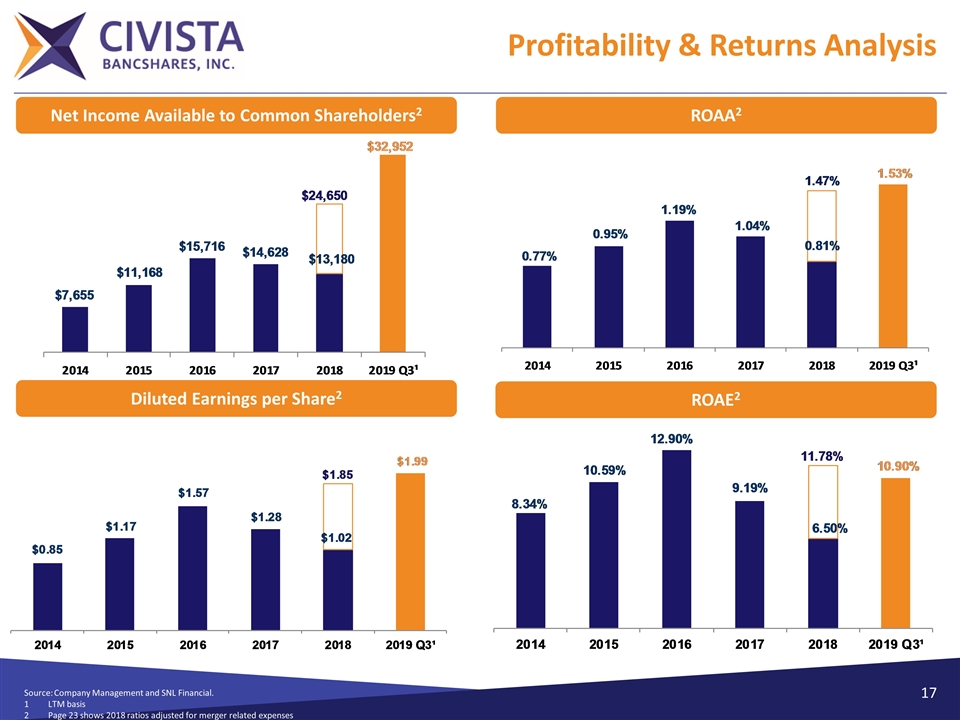

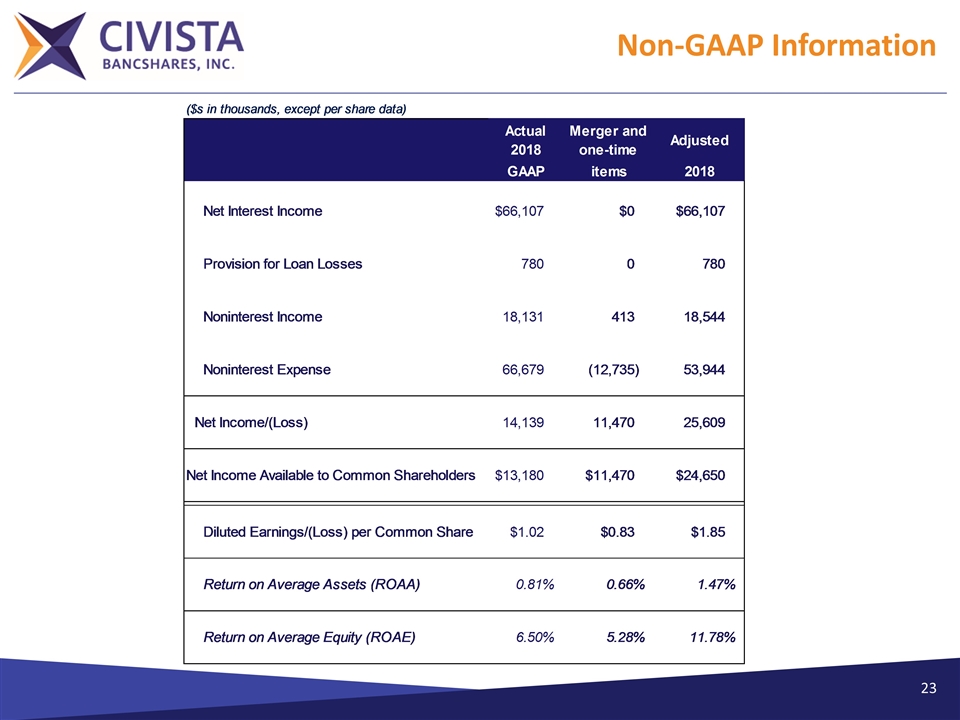

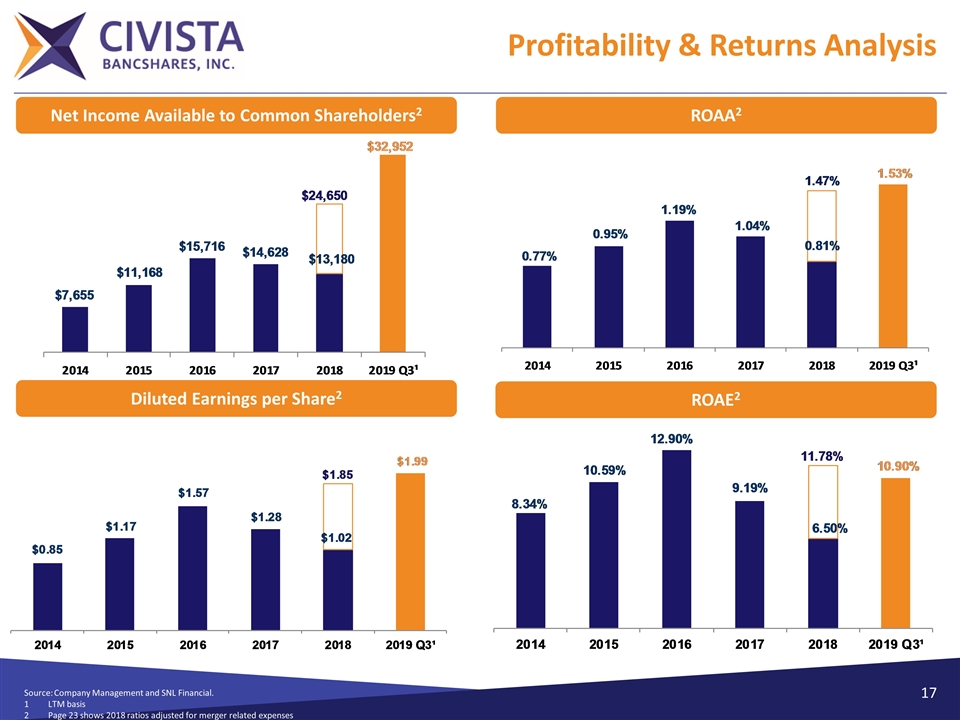

Profitability & Returns Analysis Source:Company Management and SNL Financial. LTM basis Page 23 shows 2018 ratios adjusted for merger related expenses Diluted Earnings per Share2 ROAE2 ROAA2 Net Income Available to Common Shareholders2

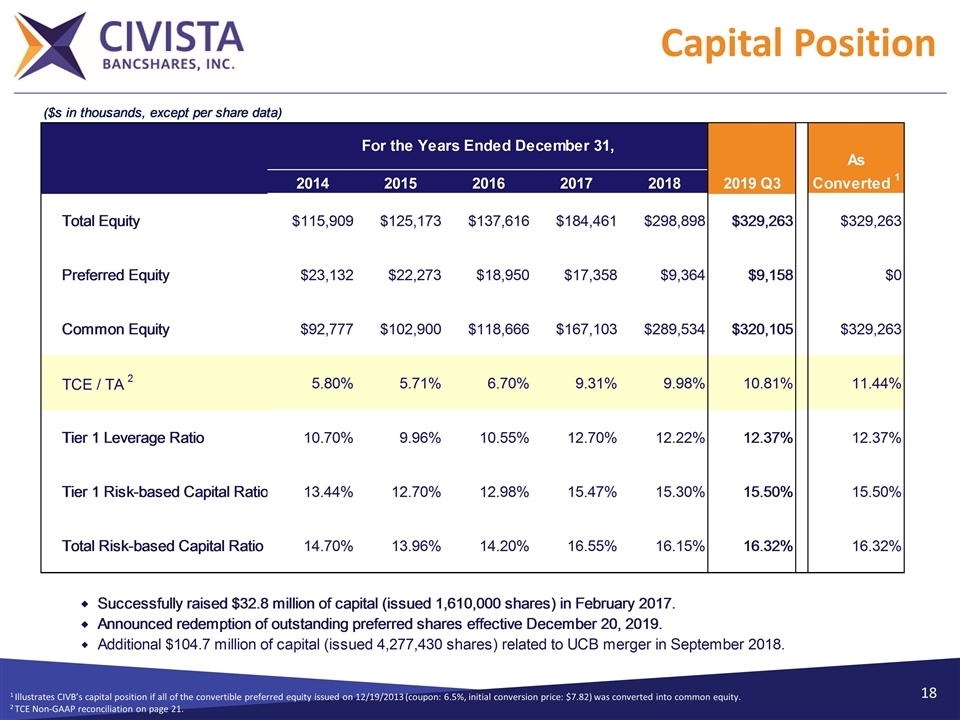

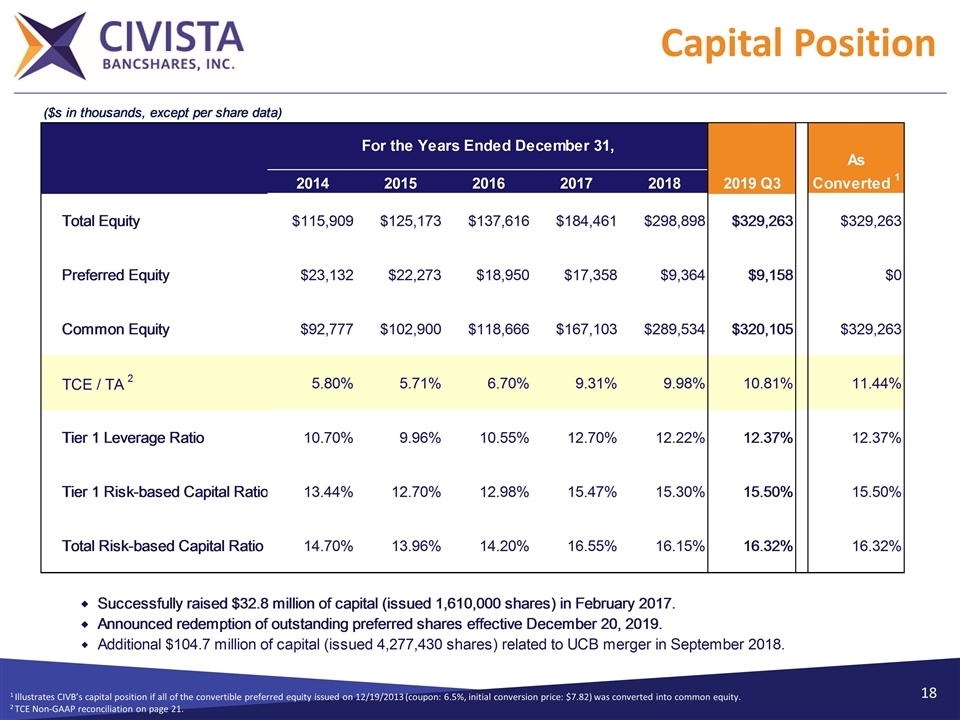

1 Illustrates CIVB’s capital position if all of the convertible preferred equity issued on 12/19/2013 (coupon: 6.5%, initial conversion price: $7.82) was converted into common equity. 2 TCE Non-GAAP reconciliation on page 21. Capital Position

Source: Company Management and SNL Financial. Operating Results

Compelling Investment Opportunity Strong asset quality Proven acquirer Completed 8 acquisitions since the formation of the holding company in 1987, including the acquisition of United Community Bancorp, which closed on September 14, 2018 Peer leading NIM Low cost deposits – 52 bps lower than peer at September 30, 2019 High yield loan portfolio – 16 bps higher than peer at September 30, 2019 Experienced management team with an average of 27 years in banking Strategically positioned in attractive Ohio lending markets funded by low cost deposits One Loan Production Offices in Cleveland MSA (Westlake) One Loan Production Office in Cincinnati MSA (Fort Mitchell, KY) Continued profitability improvement from 2014 to Q3 2019 Net Income CAGR: 36.3% TBV / Share CAGR: 11.7% LTM EPS CAGR: 19.6% 2019 Peer data as of 9/30/2019, or the latest available date. Note: Comparable peers include public banks $1-$4B in Ohio and +/- 40% CIVB’s asset size in contiguous states.

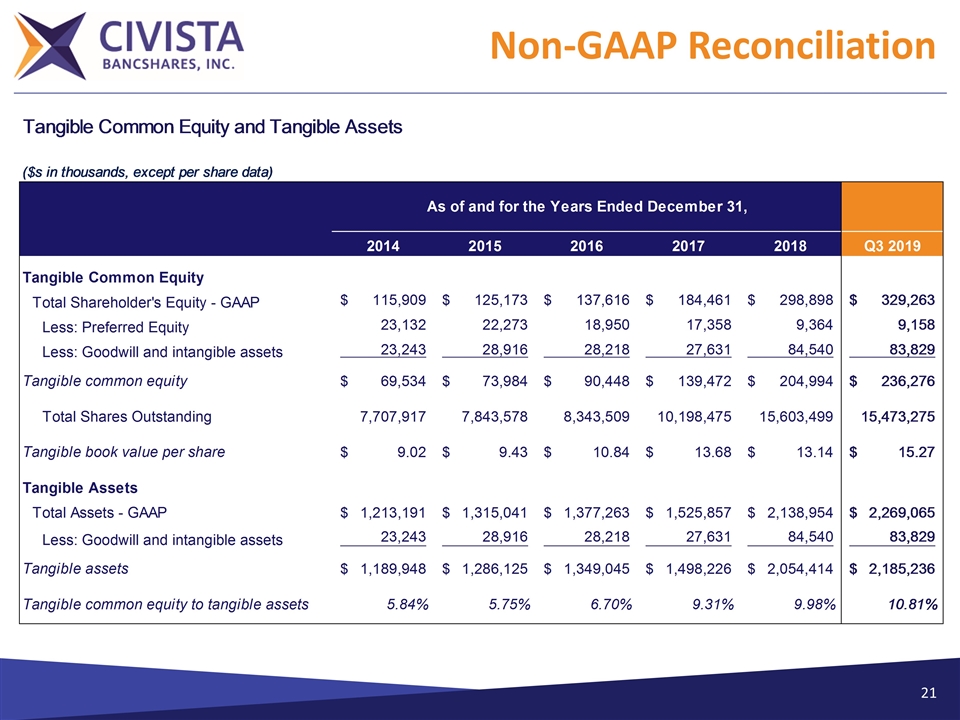

Non-GAAP Reconciliation

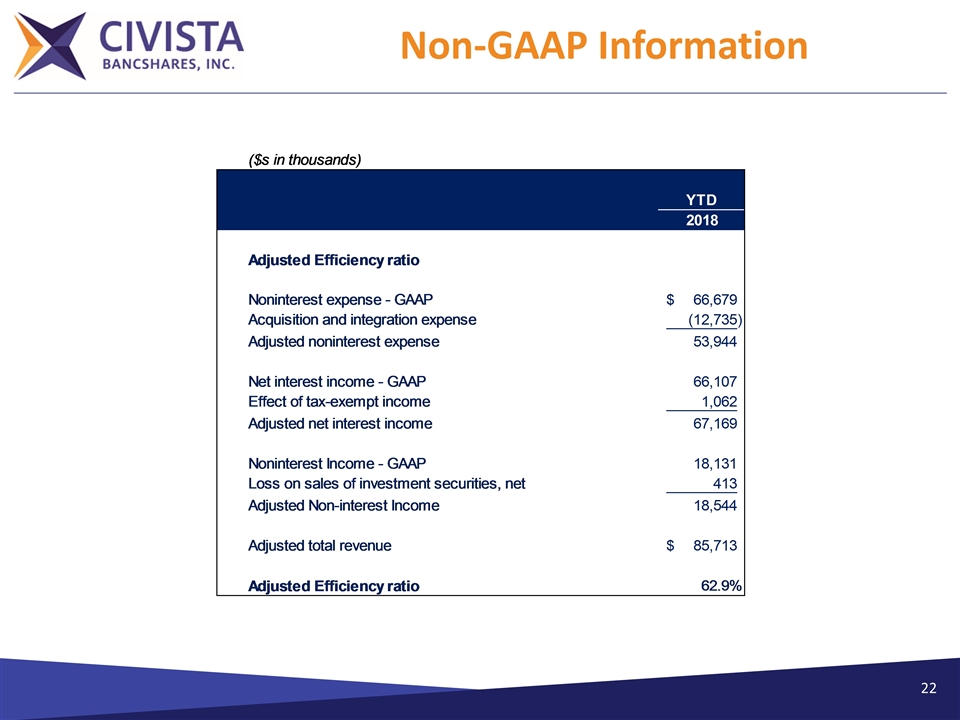

Non-GAAP Information 22

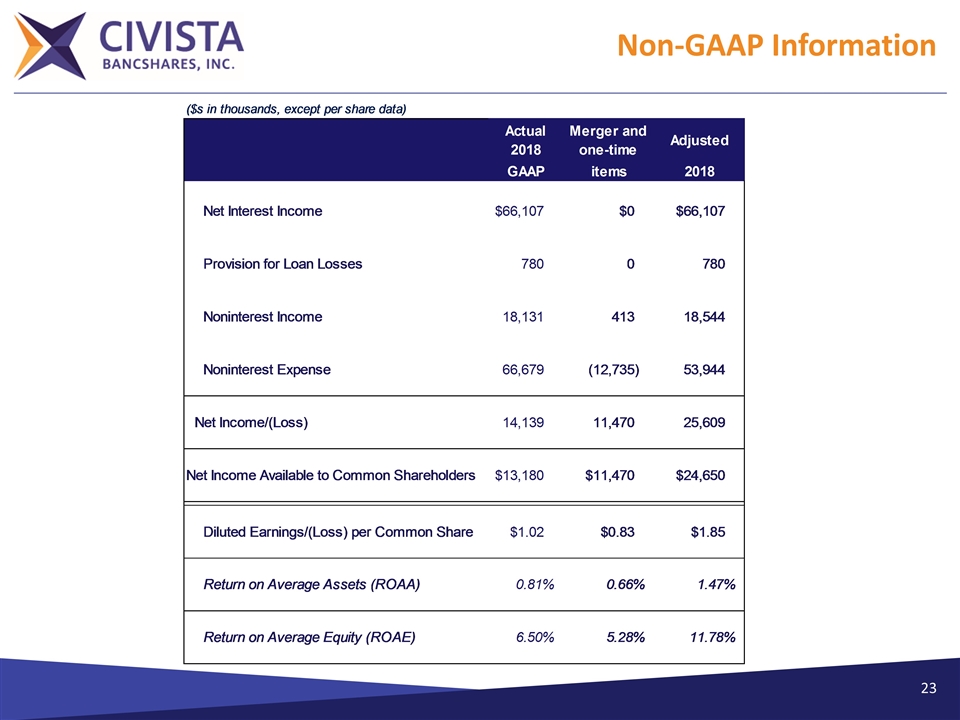

23 Non-GAAP Information

Thank You