PORTUGAL TELECOM, SGPS, S.A.

NIF/NIPC n° 503 215 058

Av. Fontes Pereira de Melo, 40, 1069-300 Lisboa

Portugal

March 10, 2014

Dear holders of American depositary shares and U.S. holders of ordinary shares of Portugal Telecom SGPS, S.A.:

On October 2, 2013, Portugal Telecom announced the proposed business combination of, inter alia, Portugal Telecom, Oi S.A. and the following holding companies of Oi: AG Telecom Participações S.A., Bratel Brasil S.A., PASA Participações S.A., LF Tel S.A., EDSP 75 Participações S.A. and Telemar Participações S.A., or “TmarPart,” to be combined into a single multinational telecommunications company based in Brazil, or the “Business Combination.” The Business Combination is expected to be accomplished through a series of transactions that are expected to result in (1) Oi’s owning the assets comprising Portugal Telecom’s operations, other than Portugal Telecom’s interests in Oi, Contax Participações S.A., a provider of contact services in Brazil, and Portugal Telecom’s subsidiary Bratel B.V., (2) Oi’s entering into a Brazilian merger of shares with TmarPart and becoming a wholly owned subsidiary of TmarPart and (3) Portugal Telecom’s merging with and into TmarPart, in each case subject to conditions. As a result of the Business Combination, the shareholders of Oi and Portugal Telecom are expected to become shareholders of TmarPart.

In connection with the Business Combination, Portugal Telecom has issued a notice for an extraordinary general shareholders’ meeting to be held to approve Portugal Telecom Group’s participation in a share capital increase of Oi by contributing all of its operating assets and related liabilities, with the exception of the shares of Oi S.A., Contax Participações, S.A. and Portugal Telecom’s subsidiary Bratel B.V., or the “PT Asset Transfer.”

The information statement that accompanies this letter has been prepared for holders of ADSs of Portugal Telecom and U.S. holders of ordinary shares of Portugal Telecom in connection with the shareholder vote on the PT Asset Transfer. This information statement relates only to this shareholder vote and is not intended to provide all the information that you may wish to review in connection with the Business Combination. We urge you to read the information statement carefully. This is not a proxy solicitation, and you are requested not to send Portugal Telecom a proxy.

We are at your disposal to provide any clarification or additional information in connection with this letter or the information statement. Please do not hesitate to contact our Investor Relations Department at Av. Fontes Pereira de Melo, 40 – 9 º, 1069-300 Lisboa, Portugal, Attn: Nuno Vieira, Tel. +351 21 500 1701, Fax +351 21 500 0800.

| Sincerely, |

|

|

|

|

|

|

| Henrique Granadeiro |

| Chief Executive Officer |

INFORMATION STATEMENT

PORTUGAL TELECOM, SGPS, S.A.

We are not asking you for a proxy, and you are requested not to send us a proxy.

This information statement is being furnished in connection with the shareholders’ meeting to be held to approve the participation of Portugal Telecom, SGPS, S.A., or “Portugal Telecom,” in a share capital increase, or the “Capital Increase,” of Oi S.A., or “Oi,” by contributing all of its operating assets and related liabilities, with the exception of the shares of Oi, Contax Participações, S.A., or “Contax Holding,” and Portugal Telecom’s subsidiary Bratel B.V., or the “PT Asset Transfer.”

The PT Asset Transfer is being submitted for shareholder approval in the context of the proposed business combination of, inter alia, Portugal Telecom, Oi and the following holding companies of Oi: AG Telecom Participações S.A., Bratel Brasil S.A., PASA Participações S.A., LF Tel S.A., EDSP 75 Participações S.A. and Telemar Participações S.A., or “TmarPart” (collectively referred herein as the “Oi Holding Companies”), to be combined into a single large multinational telecommunications company based in Brazil, or the “Business Combination.”

The PT Asset Transfer and the Business Combination are subject to several conditions and approvals as described in this information statement.

Portugal Telecom’s ordinary shares are listed on the NYSE Euronext Lisbon under the symbol “PTS.” The Portugal Telecom ADSs are listed on the NYSE Euronext New York Stock Exchange under the symbol “PT”.

In reviewing this information statement, you should carefully consider the matters described under “Risk Factors” beginning on page 16 for a discussion of certain factors that should be considered by shareholders and ADS holders of Portugal Telecom.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this information statement or any other document referred to herein. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities. We are furnishing this information statement to holders of ADSs and U.S. holders of ordinary shares of Portugal Telecom solely to provide information about the proposed PT Asset Transfer and the Capital Increase. This is not a proxy solicitation.

The date of this information statement is March 10, 2014.

TABLE OF CONTENTS

| Page |

|

|

Important Notice | ii |

Available Information | ii |

Incorporation by Reference | iii |

Presentation of Financial and Other Information | v |

Summary | 1 |

Risk Factors | 17 |

Cautionary Statement Concerning Forward-Looking Statements | 50 |

The Shareholder Meeting and the Business Combination | 52 |

Additional Information for Shareholders | 72 |

Independent Accountants | 74 |

Annex A: Proposal of the Board of Directors | A-1 |

In this information statement, unless otherwise indicated, all references in this document to “Portugal Telecom,” “our company,” “we,” “our,” “ours,” “us” or similar terms refer to Portugal Telecom SGPS, S.A.

Unless otherwise indicated, all references to “ADSs” or “Portugal Telecom ADSs” refer to the American depositary shares representing ordinary shares of Portugal Telecom.

Unless otherwise indicated, all references herein to “ordinary shares” refer to Portugal Telecom’s authorized and outstanding common shares, which are designated ordinary shares (ações ordinárias) with a nominal value of €0.03 per share.

All references herein to “Euros,” “EUR” or “€” are to the Euro. All references to “U.S. dollars,” “dollars” or “US$” are to U.S. dollars. All references to “Real,” “Reais” or “R$” are to the Brazilian Real, the official currency of Brazil.

IMPORTANT NOTICE

This information statement is not an offering document and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. We are delivering this information statement to you to provide information about the Portugal Telecom extraordinary general shareholders’ meeting that will consider the PT Asset Transfer.

This information statement contains information with respect to (1) the proposed Capital Increase of Oi, (2) the proposed merger of shares (incorporação de ações) between TmarPart and Oi and (3) the proposed merger (incorporação) of Portugal Telecom with and into TmarPart.

In connection with the proposed merger of shares between TmarPart and Oi and the proposed merger of Portugal Telecom with and into TmarPart, TmarPart plans to file with the Securities and Exchange Commission, or the “SEC,” (1) a registration statement on Form F-4, containing a prospectus that will be mailed to shareholders of Portugal Telecom and Oi (other than non-U.S. persons as defined in the applicable rules of the SEC) and (2) other documents regarding the proposed Business Combination.

We urge investors and security holders to carefully read the relevant prospectuses and other relevant materials when they become available as they will contain important information about the proposed Business Combination.

Investors and security holders will be able to obtain the documents filed with the SEC regarding the proposed mergers, when available, free of charge on the SEC’s website at www.sec.gov or from Portugal Telecom, Oi or TmarPart.

AVAILABLE INFORMATION

We are subject to the information reporting requirements of the Securities Exchange Act of 1934, or the “Exchange Act,” pursuant to which we file reports and other information with the SEC. These materials may be inspected without charge at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Copies of all or any part of these materials may be obtained from the Public Reference Room upon payment of fees prescribed by the SEC. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet website at http://www.sec.gov, from which you can electronically access these materials.

INCORPORATION BY REFERENCE

We “incorporate by reference” information into this information statement, which means that we disclose important information to you by referring you to those documents. The following information incorporated by reference in this information statement is considered to be part of this information statement:

· Portugal Telecom’s Annual Report on Form 20-F for the year ended December 31, 2012, filed with the SEC on April 30, 2013, or the “2012 Portugal Telecom Annual Report”;

· Oi’s Amendment No. 1 to its Annual Report on Form 20-F/A for the year ended December 31, 2012, filed with the SEC on November 29, 2013, or the “2012 Oi Annual Report”;

· any future annual reports on Form 20-F filed by Portugal Telecom with the SEC after the date of this information statement and prior to the date of the Portugal Telecom extraordinary general shareholders’ meeting;

· any future annual reports on Form 20-F filed by Oi with the SEC after the date of this information statement and prior to the date of the Portugal Telecom extraordinary general shareholders’ meeting;

· the following sections of the Disclosure Annex contained in Portugal Telecom’s Report on Form 6-K furnished to the SEC on February 7, 2014, or the “February 7 6-K”:

· Part 1 (“Description of Oi”);

· Part 4 (“Description of the Business Combination—Management of TmarPart Upon the Completion of the Business Combination,” but not any other subsection of such Part 4);

· Part 5 (“Additional Information About Portugal Telecom”); and

· Part 6 (“Financial Statements—Unaudited Interim Consolidated Financial Statements of Portugal Telecom, SGPS S.A.,” but not any other financial statements included in such Part 6);

· the following portions of Portugal Telecom’s Report on Form 6-K furnished to the SEC on February 21, 2014, or the “February 21 6-K”: the audited consolidated financial statements of Portugal Telecom as of December 31, 2013 and 2012 and January 1, 2012 and for the years ended December 31, 2013 and 2012, and the report of Portugal Telecom’s independent auditors thereon, each of which is included in the Consolidated Annual Report furnished in such February 21 6-K (but not any other portion of the February 21 6-K);

· Portugal Telecom’s Report on Form 6-K furnished to the SEC on February 26, 2014, or the “February 26 6-K,” which includes copies of:

· the Proposal of the Board of Directors in connection with the Portugal Telecom extraordinary general shareholders’ meeting; and

· the PT Assets Valuation Report (as defined in “The Shareholder Meeting and the Business Combination—Steps of the Business Combination— Transfer of Assets and Liabilities to PT Portugal in Preparation for the Capital Increase”;

· Oi’s Report on Form 6-K furnished to the SEC on December 16, 2013, or the “Oi December 16 6-K,” which includes unaudited consolidated financial statements of Oi as of and for the three- and nine-month periods ended September 30, 2013 and 2012;

· Amendment No. 2 to the Statement on Schedule 13D filed with the SEC by Portugal Telecom and certain of its subsidiaries on February 27, 2014, or the “February 27 Schedule 13D”; and

· any future reports on Form 6-K that Portugal Telecom may furnish to the SEC after the date of this information statement and prior to the date of the Portugal Telecom extraordinary general

shareholders’ meeting that are identified in such reports as being incorporated by reference into this information statement.

We encourage you to review the reports that Portugal Telecom files with the SEC through the date of the Portugal Telecom extraordinary general shareholders’ meeting. We may provide updates to this information statement through those reports to the extent provided above. However, we do not expect to mail copies of those reports to you unless you request them as provided below. See “Available Information.”

Information that is incorporated by reference into this information statement after the date of this information statement will automatically modify and supersede the information included or incorporated by reference into this information statement to the extent that the subsequently filed information modifies or supersedes the existing information.

You may request a copy of any and all of the information that has been incorporated by reference into this information statement and that has not been delivered with this information statement, at no cost, by writing or telephoning us at Av. Fontes Pereira de Melo, 40 – 9 º, 1069-300 Lisboa, Portugal, Attn: Nuno Vieira, Tel. +351 21 500 1701, Fax +351 21 500 0800.

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Where You Can Find the Financial Statements

The table below sets forth where you can find the financial statements of Portugal Telecom and Oi referred to in this information statement.

Financial Statements |

| Location |

|

|

|

Audited consolidated financial statements of Portugal Telecom as of and for the years ended December 31, 2012, 2011 and 2010 (IFRS). |

| 2012 Portugal Telecom Annual Report, “Item 18. Financial Statements.” |

|

|

|

Unaudited interim consolidated financial statements of Portugal Telecom as of and for the nine months ended September 30, 2013 and 2012 (IFRS) (Recast). |

| Part 6 of the February 7 6-K, “Financial Statements—Unaudited Interim Consolidated Financial Statements of Portugal Telecom, SGPS S.A.” |

|

|

|

Audited consolidated financial statements of Portugal Telecom as of December 31, 2013 and 2012 and January 1, 2012 and for the years ended December 31, 2013 and 2012 (IFRS) (Recast). |

| February 21 6-K. |

|

|

|

Audited consolidated financial statements of Oi as of and for the years ended December 31, 2012, 2011 and 2010 (Brazilian GAAP). |

| 2012 Oi Annual Report, “Item 18. Financial Statements.” |

|

|

|

Unaudited consolidated financial statements of Oi as of and for the three- and nine-month periods ended September 30, 2013 and 2012 (Brazilian GAAP). |

| Oi December 16 6-K. |

Portugal Telecom Financial Statements

Portugal Telecom maintains its books and records in Euro, the single EU currency adopted by certain participating member countries of the European Union, including Portugal, as of January 1, 1999.

Our audited consolidated financial statements have been prepared in accordance with International Financial Reporting Standards, or “IFRS,” as issued by the International Accounting Standards Board, or the “IASB.” IFRS comprise the accounting standards issued by the IASB and interpretations issued by the International Financial Reporting Interpretations Committee, or “IFRIC.”

On March 28, 2011, we acquired a direct and indirect economic interest of 25.3% in Telemar Norte Leste S.A., or “Telemar,” through a 25.6% economic interest in TmarPart, a fixed line telecommunications operator in Brazil that was controlled by Tele Norte Leste Participações S.A., the parent company of the Oi Group at that time, and that controlled, directly or indirectly, the majority of the voting shares of the companies included in the Oi Group, primarily its mobile telecommunications operators, another fixed line telecommunications operator and several other support and holding companies. Our economic interest in the Oi Group decreased to 23.2% (from the initial 25.3% economic interest held in Telemar) as a result of a corporate reorganization of the Oi Group in 2012, or the “2012 Oi corporate reorganization,” described in “Item 4—Information on the Company—Our Businesses— Brazilian Operations (Oi)—Strategic Partnership with Oi—Reorganization of the Oi Group.”

Concurrently with our investment in Oi, we acquired a 16.2% economic interest in CTX Participações S.A., or “CTX,” the controlling shareholder of Contax Holding and Contax S.A., or “Contax,” a provider of contact center, business process outsourcing, or “BPO,” and IT services in Brazil and other countries in Latin America. Even before our investment in Contax, we provided call center and Information Technology/Information Systems, or “IT/IS” services, in Brazil through our subsidiary Dedic, S.A., or “Dedic,” and its subsidiary GPTI—Tecnologias de Informação, S.A., or “GPTI.” On June 30, 2011, we merged Dedic and GPTI into Contax, and our economic interest in Contax increased to 19.5%. On April 2, 2013, our economic interest in Contax increased to 21.1%

through the transaction described in “Item 4—Information on the Company—Our Businesses—Other International Operations—Other Brazilian Operations” of the 2012 Portugal Telecom Annual Report, which is incorporated herein by reference.

In our consolidated financial statements reported in the 2012 Portugal Telecom Annual Report, we proportionally consolidated 25.6% of TmarPart for the period beginning April 1, 2011, following IFRS as issued by the IASB. In addition, in our consolidated financial statements reported in the 2012 Portugal Telecom Annual Report, we proportionally consolidated Contax since April 1, 2011 (Contax’s results included the results of Dedic and GPTI beginning July 1, 2011).

However, as from January 1, 2013, we voluntarily adopted IFRS 11, Joint Arrangements, before we were required to do so in the EU. We reviewed and assessed the classification of our investments in joint arrangements in accordance with the requirements of IFRS 11 and concluded that the investments in TmarPart and CTX should be classified as joint ventures under IFRS 11 and accounted for using the equity method.

As a result of the adoption of the IFRS 11 and of the amendments to IAS 19, Employee Benefits, or “IAS 19,” we restated the previously reported consolidated statements of financial position as of December 31, 2012 and 2011 and the consolidated income statements for the periods then ended. In addition, we retrospectively adjusted the summary consolidated financial data for the years ended in December 31, 2009, December 31, 2010, December 31, 2011 and December 31, 2012 that is reflected in “Summary—Summary Historical Financial Data—Summary Historical Financial Data of Portugal Telecom” in this information statement to reflect the adoption of the IFRS 11 and the amendments to IAS 19.

Oi Financial Statements

Oi maintains its books and records in Reais.

Oi prepares its consolidated financial statements in accordance with accounting practices adopted in Brazil, or “Brazilian GAAP,” which differs in certain important respects from accounting principles generally accepted in the United States, or “U.S. GAAP.” For a discussion of certain differences between Brazilian GAAP and U.S. GAAP as they relate to Oi’s financial statements, see Note 32 to Oi’s audited consolidated financial statements included in the 2012 Oi Annual Report, which is incorporated herein by reference. See “Presentation of Financial Information” in the 2012 Oi Annual Report.

TmarPart Financial Information

TmarPart maintains its books and records in Reais. TmarPart prepares its consolidated financial statements in accordance with IFRS as issued by the IASB.

Certain Defined Terms Used in this Information Statement

Unless otherwise indicated or the context otherwise requires:

· all references to “TmarPart” are to Telemar Participações S.A.;

· all references to “Telemar” are to Telemar Norte Leste S.A.;

· all references to “TNL” are to Tele Norte Leste Participações S.A.;

· all references to “Portugal Telecom,” “our company,” “we,” “our,” “ours,” “us” or similar terms are to Portugal Telecom, SGPS S.A. and its consolidated subsidiaries;

· all references to “Oi” are to Oi S.A., including its consolidated subsidiaries as the context requires;

· all references to “Oi Group” are, collectively, to Telemar Participações S.A., its subsidiary Oi and Oi’s subsidiaries.

· all references to “PT Portugal” are to PT Portugal SGPS, S.A. including its consolidated subsidiaries and investments following the reorganization of Portugal Telecom in preparation for the Oi capital increase (as described in this information statement);

· all references to “Bratel Brasil” are to Bratel Brasil S.A., an indirect wholly-owned subsidiary of Portugal Telecom and a member of a group of shareholders that controls our company;

· all references to “AG Telecom” are to AG Telecom Participações S.A., which is a member of a group of shareholders that controls our company;

· all references to “LF Tel” are to LF Tel S.A., which is a member of a group of shareholders that controls our company;

· all references to “PASA” are to PASA Participações S.A., which is the sole shareholder of AG Telecom;

· all references to “EDSP” are to EDSP 75 Participações S.A., which is the sole shareholder of LF Tel;

· all references to “AGSA” or to “Andrade Gutierrez” are to Andrade Gutierrez S.A., which together with Bratel Brasil are the only shareholders of PASA;

· all references to the “AGSA Holding Companies” are to PASA and Venus, collectively;

· all references to “Jereissati Telecom” are to Jereissati Telecom S.A., which together with Bratel Brasil are the only shareholders of ESDP;

· all references to the “Jereissati Telecom Holding Companies” are to EDSP and Sayed, collectively;

· all references to “Venus” are to Venus RJ Participações, S.A., a subsidiary of AGSA to which AGSA will contribute its shares of PASA as described in this information statement;

· all references to “Sayed” are to Sayed RJ Participações, S.A., a subsidiary of Jereissati Telecom to which Jereissati Telecom will contribute its shares of PASA as described in this information statement;

· all references to “BNDESPar” are to BNDES Participações S.A., a current shareholder of our company, which is the private equity arm of the Brazilian national development bank (Banco Nacional de Desenvolvimento Econômio e Social), or BNDES;

· all references to “FASS” are to Fundação Atlântico de Seguridade Social, a current shareholder of our company;

· all references to “PREVI” are to Caixa de Previdência dos Funcionários do Banco do Brasil—PREVI, a current shareholder of our company;

· all references to “PETROS” are to Fundação Petrobras de Seguridade Social—PETROS, a current shareholder of our company;

· all references to “FUNCEF” are to Fundação dos Economiários Federais—FUNCEF, a current shareholder of our company;

· all references to “CTX” are to CTX Participações S.A., a company controlled by AG Telecom, LF Tel, FASS and Portugal Telecom;

· all references to “Contax Holding” are to Contax Participações S.A., a company controlled by CTX;

· all references to “Contax” are to Contax S.A., a company controlled by Contax Holding;

· all references to “MEO” are to MEO – Serviços de Comunicações e Multimédia, S.A.;

· all references to “Brazil” are to the Federative Republic of Brazil;

· all references to the “Brazilian government” are to the federal government of the Federative Republic of Brazil;

· all references to the “Brazilian Corporation Law” are to Brazilian Law No. 6,404/76, as amended;

· all references to the “CVM” are to the Brazilian Securities Commission (Comissão de Valores Mobiliários);

· all references to “ANATEL” are to the Brazilian National Telecommunications Agency (Agência Nacional de Telecomunicações), the Brazilian federal telecommunications regulator;

· all references to “CADE” are to the Brazilian antitrust regulator (Conselho Administrativo de Defesa Econômica);

· all references to “Portugal” are to the Portuguese Republic, including the Madeira Islands and the Azores Islands;

· all references to the “Portuguese government” are to the federal government of Portugal the Portuguese Republic, including the Madeira Islands and the Azores Islands;

· all references to the “Portuguese Companies Code” are to Portuguese Decree Law 262/86, as amended;

· all references to the “CMVM” are to the Portuguese Securities Commission (Comissão do Mercado de Valores Mobiliários);

· all references to “ANACOM” are to the Portuguese National Communications Authority (Autoridade Nacional das Comunicações), the current designation of the current designation of the Portuguese telecommunications regulator, previously known as Portuguese Institute of Communications (Instituto das Comunicações de Portugal), or ICP;

· all references to the “Portuguese Competition Authority” are to the Portuguese antitrust regulator (Autoridade da Concorrência);

· all references to the “PT Merger Agreement” are to the Protocol of Merger and Instrument of Justification (Protocolo de Fusão/Protocolo e Justificação de Incorporação) expected to be entered between TmarPart and Portugal Telecom;

· all references to the “Oi Merger Agreement” are to the Protocol of Merger of Shares and Instrument of Justification (Protocolo e Justificação de Incorporação de Ações) expected to be entered between TmarPart and Oi; and

· all references to the “EU” are to the European Union.

Rounding

We have made rounding adjustments to reach some of the figures included in this information statement. As a result, numerical figures shown as totals in some tables may not be arithmetic aggregations of the figures that precede them.

Exchange Rates

On February 28, 2014, the exchange rate for Euros into U.S. dollars was €1.00 to US$1.3806, based on the noon buying rate in the City of New York for cable transfers in Euro. The noon buying rate was €1.00 to US$1.3779 as of December 31, 2013, €1.00 to US$1.3186 as of December 31, 2012 and €1.00 to US$1.2973 as of December 30, 2011. The Euro/U.S. dollar exchange rate may fluctuate widely, and the noon buying rate as of February 28, 2014 may not be indicative of future exchange rates.

On March 6, 2014, the exchange rate for Reais into U.S. dollars was R$2.309 to US$1.00, based on the selling rate as reported by the Central Bank of Brazil (Banco Central do Brasil), or the “Brazilian Central Bank.” The selling rate was R$2.343 to US$1.00 as of December 31, 2013, R$2.044 to US$1.00 as of December 31, 2012 and R$1.876 to US$1.00 as of December 31, 2011, in each case as reported by the Brazilian Central Bank. The Real/U.S. dollar exchange rate may fluctuate widely, and the selling rate as of March 6, 2014 may not be indicative of future exchange rates.

Solely for the convenience of the reader, we have translated some amounts included in “Summary—Summary Historical Financial Data” from (i) Reais into U.S. dollars using the selling rate as reported by the Brazilian Central Bank as of December 31, 2013 of R$2.343 to US$1.00 and (ii) Euro into U.S. dollars using the noon buying rate in the City of New York for cable transfers in Euro as of December 31, 2013 of €1.00 to US$1.3779. These translations should not be considered representations that any such amounts have been, could have been or could be converted into U.S. dollars at that or at any other exchange rate.

SUMMARY

This summary highlights information contained elsewhere in this information statement and may not contain all of the information that may be important to you. For a complete understanding of the business of Portugal Telecom and the Business Combination, you should read this summary together with the more detailed information and the financial statements included or incorporated by reference in this information statement. You should read this entire information statement and the documents incorporated by reference carefully, including the “Risk Factors” and “Cautionary Statement Concerning Forward-Looking Statements” sections.

The Companies

Overview of Portugal Telecom

Portugal Telecom provides telecommunications services in Portugal, in Brazil through its strategic partnerships with TmarPart, Oi and Contax, and in certain countries in sub-Saharan Africa and Asia.

In anticipation of the proposed Business Combination, Portugal Telecom will contribute all of its operating assets, except interests held directly or indirectly in Oi, Contax Holding and Bratel B.V., to PT Portugal, and PT Portugal will assume all of Portugal Telecom’s liabilities at the time of the transfer. In addition, Portugal Telecom has exchanged of all of its direct and indirect interest in CTX and Contax Holding for additional direct and indirect stakes in PASA and EDSP. We refer to the shares of PT Portugal (and consequently of the assets and liabilities to be transferred to PT Portugal) as the “PT Assets.” For more information about these transactions, see “The Shareholder Meeting and the Business Combination—Transactions Undertaken in Anticipation of the Business Combination.”

In the proposed Capital Increase, Portugal Telecom will subscribe for Oi common and preferred shares and will settle the purchase of these shares through the contribution to Oi of all of the outstanding shares of PT Portugal. As a result, Portugal Telecom will own, directly and through its subsidiary Bratel Brasil, Oi common and preferred shares. Finally, Portugal Telecom owns, directly and indirectly, 383,359,675 of TmarPart’s common shares, representing 12.1% of TmarPart’s issued and outstanding share capital and voting share capital.

As a consequence of the transfer of assets to Oi, Portugal Telecom’s non-current assets will consist solely of the TmarPart common shares, Oi common shares and Oi preferred shares that it will own directly and indirectly, and its current assets will consist of accounts receivable and cash or bank deposits in an amount sufficient to settle all of its liabilities, including cash and cash equivalents expected to be held by Bratel B.V. that may be used to subscribe for the debentures described under “—The Shareholder Meeting and the Business Combination—Steps of the Business Combination—Recapitalization of TmarPart.”

The principal executive office of Portugal Telecom is located at Avenida Fontes Pereira de Melo, 40, 1069-300 Lisbon, Portugal, and its telephone number at this address is +351-21-500-1701.

Overview of Oi and TmarPart

Oi is one of the largest integrated telecommunications service providers in Brazil, based on information available from ANATEL regarding the total number of Oi’s fixed lines in service and mobile subscribers as of December 31, 2013, and one of the principal telecommunications services providers offering “quadruple play” services in Brazil.

Prior to the Capital Increase, TmarPart owns, directly and through its wholly-owned subsidiary Valverde Participações S.A., 290,549,788 Oi common shares, representing 17.7% of the outstanding share capital of Oi and 56.4% of the voting share capital of Oi. TmarPart’s only material asset is its interest in Oi.

Oi offers a range of integrated telecommunications services that includes fixed line and mobile telecommunications services, data transmission services (including broadband access services), ISP services and other services for residential customers, small, medium and large companies, and governmental agencies. Oi is the largest telecommunications provider in both Region I (which consists of 16 Brazilian states located in the northeastern and part of the northern and southeastern regions) and Region II (which consists of the Federal District and nine Brazilian states located in the western, central and southern regions) in Brazil, based on information available from ANATEL and other publicly available information regarding customers and revenues as of and for

the year ended December 31, 2012. Oi has also been offering mobile telecommunications services in Region III (comprising the state of São Paulo) since October 2008.

According to the Brazilian Institute for Geography and Statistics (Instituto Brasileiro de Geografia e Estatística), or “IBGE”:

· Region I had a population of approximately 105.3 million as of 2011, representing 54.7% of the total Brazilian population, and represented approximately 40.3% of Brazil’s total gross domestic product, or “GDP,” for 2011 (the most recent period for which such information is currently available).

· Region II had a population of approximately 45.5 million as of 2011, representing 23.7% of the total Brazilian population, and represented approximately 27.1% of Brazil’s total GDP for 2011.

· Region III had a population of approximately 41.6 million as of 2011, representing 21.6% of the total Brazilian population, and represented approximately 32.6% of Brazil’s total GDP for 2011.

Fixed line Telecommunications and Data Transmission Services

Oi’s traditional fixed line telecommunications business in Regions I and II includes local and long-distance services, network usage services (interconnection) and public telephones, in accordance with the concessions and authorizations granted to us by ANATEL. Oi is one of the largest fixed line telecommunications companies in Brazil in terms of total number of lines in service as of November 30, 2013 (the most recent date for which such information is currently available). Oi is the principal fixed line telecommunications service provider in Region I and Region II, based on Oi’s 11.6 million and 6.7 million fixed lines in service in Region I and Region II, respectively, as of December 31, 2013, with market shares of 67.8% and 62.4%, respectively, of the total fixed lines in service in these regions as of April 30, 2013, based on the most recent information available from ANATEL.

Oi offers a variety of high-speed data transmission services in Regions I and II, including services offered by its subsidiaries BrT Serviços de Internet S.A., or “BrTi,” and Brasil Telecom Comunicação Multimídia Ltda. Oi’s broadband services, primarily utilizing Asymmetric Digital Subscriber Line, or “ADSL,” technology, are marketed under the brand name “Oi Velox.” As of December 31, 2013, Oi had 5.3 million ADSL subscribers in Regions I and II, representing 41.5% of its fixed lines in service at that date. Additionally, Oi provides voice and data services to corporate clients throughout Brazil.

For the year ended December 31, 2013, Oi’s fixed line and data transmission services segment generated R$20,401 million in net operating revenue and recorded operating income before financial income (expenses) and taxes of R$3,775 million.

Mobile Telecommunications Services

Oi offers mobile telecommunications services throughout Brazil. Based on Oi’s 50.2 million mobile subscribers as of December 31, 2013, we believe that Oi is one of the principal mobile telecommunications service providers in Brazil. Based on information available from ANATEL, as of December 31, 2013, Oi’s market share was 22.9% in Region I, 15.0% in Region II and 13.1% in Region III, of the total number of mobile subscribers in these regions.

For the year ended December 31, 2013, Oi’s mobile services segment generated R$12,187 million in net operating revenue and recorded operating income before financial income (expenses) and taxes of R$1,376 million.

Other Services

Oi offers subscription television services under its “Oi TV” brand. Oi delivers subscription television services throughout Regions I and II using direct-to-home, or “DTH,” satellite technology. In Belo Horizonte, Poços de Caldas, Uberlândia and Barbacena in the State of Minas Gerais, Oi uses a hybrid network of fiber optic and bidirectional coaxial cable. In December 2012 and January 2013, Oi introduced delivery of Oi TV through its fixed line network in Rio de Janeiro and Belo Horizonte, respectively.

Oi also operates a call center business for the sole purpose of providing services to Oi and its subsidiaries.

The Business Combination

This information statement has been prepared solely in connection with the Portugal Telecom extraordinary general shareholders’ meeting that will consider the PT Asset Transfer. However, we provide information regarding the Business Combination because the PT Asset Transfer is a step in that transaction.

On October 2, 2013, we announced the proposed Business Combination of Portugal Telecom, Oi and the Oi Holding Companies, to be combined into a single multinational telecommunications company based in Brazil.

Reasons for the Business Combination

We believe that the Business Combination will:

· permit the formation of a single large multinational telecommunications company based in Brazil with more than 100 million customers in seven countries with a total population of approximately 260 million people;

· maintain the continuity of operations under the trademarks of Oi and Portugal Telecom in their respective regions of operation, subject to unified control and management by TmarPart;

· further consolidate the operations of Oi and Portugal Telecom, with the goal of achieving significant economies of scale, maximizing operational synergies, reducing operational risks, optimizing efficient investments and adopting best operational practices;

· strengthen the capital structure of TmarPart, facilitating its access to capital and financial resources:

· consolidate the shareholder bases of TmarPart, Oi and Portugal Telecom as holders of a single class of common shares or ADSs traded on the Novo Mercado segment of the BM&FBOVESPA, the New York Stock Exchange, or the “NYSE,” and NYSE Euronext Lisbon;

· diffuse TmarPart’s shareholder base, as a result of which no shareholder or group of shareholders will hold a majority interest in TmarPart’s capital;

· result in the adoption by TmarPart of the corporate governance practices of the Novo Mercado segment of the BM&FBOVESPA; and

· promote greater liquidity of the TmarPart common shares than currently is available to holders of Oi and Portugal Telecom shareholders.

Background of Business Combination

In July 2010, AG Telecom and LF Tel, two of TmarPart’s controlling shareholders, entered into a letter of intent with Portugal Telecom, Tele Norte Leste Participações S.A., or “TNL,” and Telemar as intervening parties, to establish the principal terms that served as a framework for a strategic partnership between Portugal Telecom and Oi. The objective of the strategic partnership was to develop a global telecommunications platform that would allow for cooperation in diverse areas, aiming, among other things, to share best practices, achieve economies of scale, implement research and development initiatives, develop technologies, expand the parties’ international presence, particularly in Latin America and Africa, diversify services, maximize synergies and reduce costs, always seeking to offer better services and care to customers of both groups and to create value for their shareholders. As a consequence, in January 2011, Portugal Telecom and its subsidiary, Bratel Brasil, entered into agreements with TNL (a predecessor company of Oi), Telemar (currently a subsidiary of Oi), AG Telecom, Luxemburgo, LF Tel, BNDESPar, FASS, PREVI, PETROS and FUNCEF to implement the strategic partnership.

In March and April 2011, Telemar purchased 62,755,860 shares of Portugal Telecom, representing 7.0% of its outstanding shares, for an aggregate purchase price of R$1,207 million. In April and May 2012, Telemar acquired 25,093,639 additional shares of Portugal Telecom and now holds 89,651,205 Portugal Telecom ordinary shares, representing 10.0% of its outstanding shares.

On October 2, 2013, Oi and Portugal Telecom announced the execution of a Memorandum of Understanding in which they had agreed to the principles governing a series of transactions to implement the Business Combination.

On February 19, 2014, the parties to the Business Combination executed a number of definitive agreements to implement the Business Combination.

Steps of the Business Combination

The Business Combination is expected to be accomplished through a series of transactions that are expected to result in Oi’s owning the assets comprising Portugal Telecom’s operations, other than Portugal Telecom’s interests in Oi, Contax Participações and Bratel B.V., Oi’s entering into a Brazilian merger of shares with TmarPart and becoming a wholly owned subsidiary of TmarPart, and Portugal Telecom’s merging with and into TmarPart, in each case subject to conditions. As a result of the Business Combination, the shareholders of Oi and Portugal Telecom are expected to become shareholders of TmarPart. The three primary transactions are:

· the Capital Increase of Oi in which Oi is expected to issue (1) common and preferred shares for cash to investors, with a priority right of subscription for existing holders in Brazil of common shares and preferred shares of Oi, and (2) common and preferred shares to us in exchange for the transfer by us to Oi of all of the shares of PT Portugal SGPS, S.A., or “PT Portugal,” which is expected to own (a) all of our operating assets, except interests held directly or indirectly in Oi, Contax Participações and our subsidiary Bratel B.V. (which is expected to hold cash and cash equivalents that may be used to subscribe for the debentures described below under “—Recapitalization of TmarPart”), and (b) all of our liabilities at the time of the transfer;

· a merger of shares (incorporação de ações) under Brazilian law, a Brazilian transaction in which, subject to the approvals of the holders of voting shares of Oi and TmarPart, all of the Oi shares not owned by TmarPart will be exchanged for TmarPart common shares and Oi will become a wholly-owned subsidiary of TmarPart; and

· a merger (incorporação) under Portuguese and Brazilian law, of us with and into TmarPart, with TmarPart as the surviving company. Pursuant to the proposed merger, each of our issued and then outstanding ordinary shares will be cancelled, and the holder thereof will automatically receive TmarPart common shares. As a result of the merger, we will cease to exist.

Following the consummation of the Business Combination, Oi is expected to own the assets comprising our operations in Portugal, Africa and Asia, directly or indirectly through PT Portugal.

TmarPart’s common shares are expected to be listed on the Novo Mercado segment of BM&FBOVESPA and the NYSE Euronext Lisbon, and TmarPart’s ADSs are expected to be listed on the NYSE Euronext New York Stock Exchange.

Conditions to the Business Combination

The steps of the Business Combination described above are subject to certain conditions described below.

The Capital Increase

As described above, we are expected to subscribe for common shares and preferred shares of Oi in the Capital Increase in exchange for the transfer by Portugal Telecom to Oi of all of the shares of PT Portugal, which will hold the assets and liabilities described above under “—Steps of the Business Combination.”

Our subscription to the Capital Increase of Oi is subject to a number of conditions, including, without limitation, the following:

· the approval of the valuation report with respect to the PT Assets described in “The Shareholder Meeting and the Business Combination—Valuation Report” by the common shareholders of Oi;

· the minimum total amount to be subscribed in cash by investors must be at least equivalent to R$7.0 billion;

· certain current shareholders of TmarPart, and BTG Pactual S.A., directly or through an investment vehicle managed and administered through Banco BTG Pactual S.A., must participate in the offering by placing a subscription order for approximately R$2.0 billion;

· the authorization, or a decision of non-opposition by, ANATEL;

· the approval of the Portuguese Competition Authority; and

· the receipt of prior approvals of creditors and third parties, as well as the consent and waiver of our creditors for the execution of the Business Combination.

Oi’s obligation to issue shares to us in the Capital Increase is also subject to certain of the conditions set forth above and certain other conditions. In addition, the sale by Oi of common and preferred shares for cash to investors in the Capital Increase is expected to be subject to customary conditions applicable to an offering of shares in a capital markets transaction.

Certain of the conditions to the consummation of our subscription to the Capital Increase are waivable by us or Oi, as the case may be, in our and their sole discretion.

We will not be obligated to complete the Business Combination if the percentage of our participation in TmarPart is less than 36.6% of the total capital stock of TmarPart on a fully diluted basis after giving effect to the Business Combination, and TmarPart will not be obligated to consummate the Business Combination if the percentage of our participation in TmarPart exceeds 39.6% of the total capital stock of TmarPart on a fully diluted basis after giving effect to the Business Combination.

The Merger of Shares

The boards of directors of each of TmarPart and Oi will have to approve a merger of shares in which, subject to the approvals of the holders of voting shares of TmarPart and Oi, all of the outstanding Oi shares not owned by TmarPart will be exchanged for TmarPart common shares and Oi will become a wholly-owned subsidiary of TmarPart.

The merger of shares must be approved at separate extraordinary general meetings of the shareholders of Oi and TmarPart. There are no conditions to the completion of the merger of shares other than:

· the approval of the merger of shares by (a) the affirmative vote of holders representing a majority of the number of issued and outstanding TmarPart common shares present or represented at a duly convened extraordinary general shareholders’ meeting, and (b) the affirmative vote of holders representing a majority of the total number of issued Oi common shares;

· the approval of the merger of shares by ANATEL; and

· that the relevant registration statement has been declared effective by the SEC.

The Merger

The merger will be subject to the approval of our board of directors and TmarPart’s board of directors in which, subject to the approvals of our shareholders and TmarPart’s shareholders, we will merge with and into TmarPart, with TmarPart as the surviving company. As a result of the merger, we will cease to exist.

The merger must be approved at separate extraordinary general meetings of our shareholders and TmarPart’s shareholders. There are no conditions to the completion of the merger other than:

· the approval of the merger by (1) the affirmative vote of holders representing a majority of the number of issued and outstanding TmarPart common shares present or represented at a duly convened extraordinary general shareholders’ meeting, and (2) the affirmative vote of holders representing two-

thirds of the total number of outstanding Portugal Telecom ordinary shares and “A” shares present or represented at a duly convened extraordinary general shareholders’ meeting with a quorum of one-third on first call;

· the approval of the merger of shares by the shareholders of TmarPart and Oi entitled to vote with respect to the merger of shares;

· the approval of the merger of shares and the merger by ANATEL;

· the approval of the merger by the Portuguese Competition Authority; and

· that the relevant registration statement has been declared effective by the SEC.

We will not be obligated to complete the Business Combination if the percentage of our participation in TmarPart is less than 36.6% of the total capital stock of TmarPart on a fully diluted basis after giving effect to the merger shares.

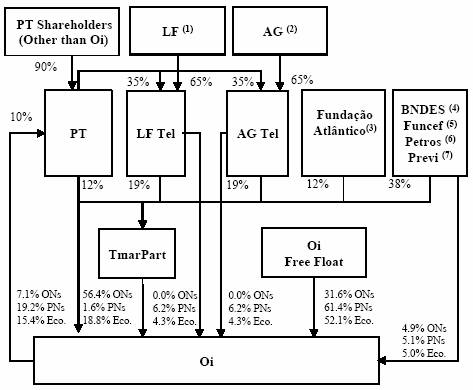

Structural Diagrams

The diagram below sets forth the simplified ownership structure of TmarPart and Oi before giving effect to the Business Combination:

(1) Jereissati Telecom S.A.

(2) Andrade Gutierrez S.A.

(3) Fundação Atlântico de Seguridade Social

(4) BNDES Participações S.A.

(5) FUNCEF – Fundação dos Economiários Federais

(6) PETROS – Fundação Petrobrás de Seguridade Social

(7) PREVI – Caixa de Previdência dos Funcionários do Banco do Brasil

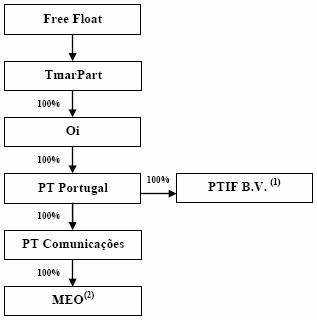

Following the Business Combination, the composition of TmarPart’s ownership structure is expected to be as follows:

(1) Portugal Telecom International Finance B.V.

(2) MEO – Serviços de Comunicações e Multimédia, S.A

Who Can Help Answer My Questions?

If you have questions about the Business Combination, you may contact:

Portugal Telecom, SGPS S.A.

Av. Fontes Pereira de Melo, 40

1069-300 Lisboa, Portugal

Attention: Nuno Vieira

Investor Relations Office

Telephone: +351-21-500-1701

Facsimile: +351-21-500-0800

Email: nuno.t.vieira@telecom.pt

You may also contact the information agent:

MacKenzie Partners, Inc.

105 Madison Avenue

New York, New York 10016

Call Collect: +1-212-929-5500

Call Toll-Free 1+800-322-2885

If you are a holder of Portugal Telecom ADSs, you may also contact:

Deutsche Bank Trust Company Americas

60 Wall Street

New York, New York 10005

Telephone: +1- 212-250-9100

This information statement has been prepared for holders of Portugal Telecom ADSs and U.S. holders of Portugal Telecom ordinary shares, and it explains the terms and conditions of the Business Combination and provides information about Portugal Telecom. This is not a proxy solicitation. This information statement is being furnished by Portugal Telecom solely to provide information to holders of Portugal Telecom ADSs and U.S. holders of Portugal Telecom shares who will vote will vote on the transfer of assets to Oi, as part of the Business Combination. It is not, and is not to be construed as, an inducement or encouragement to buy or sell any securities of Portugal Telecom. The information contained in this information statement is believed by Portugal Telecom to be accurate with respect to Portugal Telecom as of the date set forth on the cover. Changes may occur after that date, and Portugal Telecom does not undertake any obligation to update this information.

Portugal Telecom has not authorized anyone to give you any information or to make any representation about the Business Combination or the parties thereto that differs from or adds to the information contained in this information statement or in the documents Portugal Telecom has publicly filed with the SEC. Therefore, if anyone should give you any different or additional information, you should not rely on it.

Summary Historical Financial Data

The following summary historical financial data has been derived from consolidated financial statements of Portugal Telecom and Oi.

Summary Historical Financial Data of Portugal Telecom

The following summary financial data have been derived from Portugal Telecom’s consolidated financial statements. The summary consolidated statement of financial position data as of December 31, 2013, 2012, 2011 and 2010 and the summary consolidated income statement data for the years ended December 31, 2013, 2012, 2011 and 2010 have been derived from audited consolidated financial statements of Portugal Telecom, which were prepared in accordance with IFRS and are incorporated by reference in this information statement. The summary consolidated statement of financial position data as of December 31, 2009 and the summary consolidated income statement data for the years ended December 31, 2009 have been derived from consolidated financial statements of Portugal Telecom, prepared in accordance with IFRS, that are not included in this information statement or incorporated herein by reference.

As a result of Portugal Telecom’s sale on September 27, 2010 of its interest in Vivo Participações S.A., or “Vivo,” to Telefónica, Portugal Telecom’s interest in the net income of Vivo is presented under the line item “Discontinued Operations” for all periods through the completion of the sale, and the summary consolidated statement of financial position as of December 31, 2010 no longer includes the assets and liabilities related to Vivo.

You should read this summary financial data in conjunction with (1) “Presentation of Financial and Other Information,” (2) the audited consolidated financial statements of Portugal Telecom and the related notes thereto and (3) the unaudited interim consolidated financial statements of Portugal Telecom and the related notes thereto, which are incorporated by reference in this information statement.

You should be aware that the summary historical financial data in this “Summary Historical Financial Data of Portugal Telecom” section is based on the audited consolidated financial statements of Portugal Telecom as of and for the years ended December 31, 2011, 2012, and 2013. These financial statements reflect the adoption of IFRS 11, Joint Arrangements, and the revised version of IAS 19, Employee Benefits, as described in “Presentation of Financial and Other Information.”

Income Statement Data

|

| For the Year Ended December 31, |

| ||||||||||||||||

|

| 2013(1) |

| 2013 |

| 2012 |

| 2011 |

| 2010 |

| 2009 |

| ||||||

|

| (in |

| (in millions of Euros, except per share and ADS data) |

| ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Continuing Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Revenue |

| US$ | 4,011 |

| € | 2,911 |

| € | 3,079 |

| € | 3,380 |

| € | 3,742 |

| € | 3,733 |

|

Costs, expenses and net losses and income |

| (3,536 | ) | (2,566 | ) | (2,587 | ) | (2,873 | ) | (3,344 | ) | (3,049 | ) | ||||||

Income before financial results and taxes |

| 475 |

| 345 |

| 492 |

| 507 |

| 398 |

| 684 |

| ||||||

Financial (losses) and gains, net |

| 145 |

| 105 |

| (56 | ) | (1 | ) | (82 | ) | 201 |

| ||||||

Income before taxes |

| 620 |

| 450 |

| 436 |

| 507 |

| 316 |

| 885 |

| ||||||

Income taxes |

| 85 |

| (62 | ) | (126 | ) | (99 | ) | (74 | ) | (184 | ) | ||||||

Net income from continuing operations |

| 535 |

| 388 |

| 310 |

| 408 |

| 243 |

| 701 |

| ||||||

Discontinued Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net income from discontinued operations |

| — |

| — |

| — |

| — |

| 5,565 |

| 83 |

| ||||||

Net income |

| 535 |

| € | 388 |

| € | 310 |

| € | 408 |

| € | 5,808 |

| € | 784 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net income attributable to non-controlling interests |

| 79 |

| 57 |

| 84 |

| 74 |

| 148 |

| 104 |

| ||||||

Net income attributable to equity holders of the parent |

| 456 |

| 331 |

| 226 |

| 334 |

| 5,660 |

| 679 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Income before financial results and taxes per ordinary share, A share and ADS |

| 0.54 |

| 0.39 |

| 0.55 |

| 0.57 |

| 0.44 |

| 0.76 |

| ||||||

Earnings per ordinary share, A share and ADS: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Basic(2) |

| 0.54 |

| 0.39 |

| 0.26 |

| 0.39 |

| 6.46 |

| 0.78 |

| ||||||

Diluted(3) |

| 0.54 |

| 0.39 |

| 0.26 |

| 0.39 |

| 6.05 |

| 0.75 |

| ||||||

Earnings per ordinary share, A share and ADS from continuing operations, net of non-controlling interests: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Basic(2) |

| 0.54 |

| 0.39 |

| 0.26 |

| 0.39 |

| 0.18 |

| 0.73 |

| ||||||

Diluted(3) |

| 0.54 |

| 0.39 |

| 0.26 |

| 0.39 |

| 0.18 |

| 0.71 |

| ||||||

(1) Translated for convenience only using noon buying rate in the City of New York for cable transfers in Euro as of December 31, 2013 for Euros into U.S. dollars of €1.00=US$1.3779.

(2) Based on 896,512,500 ordinary and A shares for all periods presented.

(3) The weighted average number of shares for purposes of calculating basic earnings per share is computed based on the average ordinary and A shares issued and the average number of treasury shares.

Statement of Financial Position Data

|

| As of December 31, |

| ||||||||||||||||

|

| 2013(1) |

| 2013 |

| 2012 |

| 2011 |

| 2010 |

| 2009 |

| ||||||

|

| (in |

| (in millions of Euros) |

| ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Cash and cash equivalents |

| US$ | 2,286 |

| € | 1,659 |

| € | 1,989 |

| € | 3,642 |

| € | 4,765 |

| € | 1,159 |

|

Cash investments |

| 1,259 |

| 914 |

| 626 |

| 463 |

| 342 |

| 22 |

| ||||||

Trade accounts receivable, net |

| 1,051 |

| 763 |

| 797 |

| 889 |

| 1,054 |

| 913 |

| ||||||

Total current assets |

| 5,474 |

| 3,973 |

| 4,102 |

| 5,503 |

| 8,855 |

| 2,505 |

| ||||||

Investments in joint ventures |

| 3,318 |

| 2,408 |

| 2,980 |

| 3,510 |

| — |

| 2,898 |

| ||||||

Investments in group companies |

| 704 |

| 511 |

| 407 |

| 533 |

| 362 |

| 597 |

| ||||||

Tangible assets |

| 4,737 |

| 3,438 |

| 3,579 |

| 3,656 |

| 3,875 |

| 3,538 |

| ||||||

Intangible assets |

| 989 |

| 718 |

| 758 |

| 801 |

| 695 |

| 1,101 |

| ||||||

Total assets |

| 16,562 |

| 12,020 |

| 12,829 |

| 15,064 |

| 15,165 |

| 11,605 |

| ||||||

Short-term debt (including current portion of medium- and long-term debt) |

| 2,056 |

| 1,492 |

| 1,396 |

| 2,691 |

| 952 |

| 331 |

| ||||||

Total current liabilities |

| 4,168 |

| 3,025 |

| 2,995 |

| 4,765 |

| 2,684 |

| 2,147 |

| ||||||

Medium- and long-term debt |

| 8,101 |

| 5,879 |

| 5,979 |

| 5,708 |

| 6,254 |

| 5,720 |

| ||||||

Share capital |

| 37 |

| 27 |

| 27 |

| 27 |

| 27 |

| 27 |

| ||||||

|

| As of December 31, |

| ||||||||||

|

| 2013(1) |

| 2013 |

| 2012 |

| 2011 |

| 2010 |

| 2009 |

|

|

| (in |

| (in millions of Euros) |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total equity |

| 2,573 |

| 1,867 |

| 2,537 |

| 3,063 |

| 4,623 |

| 1,498 |

|

Equity excluding non-controlling interests |

| 2,261 |

| 1,641 |

| 2,305 |

| 2,841 |

| 4,406 |

| 1,336 |

|

Non-controlling interests |

| 310 |

| 225 |

| 233 |

| 222 |

| 217 |

| 162 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of ordinary shares |

| — |

| 897 |

| 897 |

| 897 |

| 897 |

| 897 |

|

(1) Translated for convenience only using noon buying rate in the City of New York for cable transfers in Euro as of December 31, 2013 for Euros into U.S. dollars of €1.00=US$1.3779.

Summary Historical Financial Data of Oi

The following summary financial data have been derived from Oi’s consolidated financial statements. The summary financial data as of and for the year ended December 31, 2013 have been derived from audited consolidated financial statements of Oi that were prepared in accordance with Brazilian GAAP and are not included in this information statement or incorporated herein by reference. The summary financial data as of December 31, 2012 and 2011 and for the years ended December 31, 2012, 2011 and 2010 have been derived from audited consolidated financial statements of Oi that were prepared in accordance with Brazilian GAAP and are incorporated herein by reference to the 2012 Oi Annual Report. The summary financial data as of December 31, 2010 and 2009 and for the year ended December 31, 2009 have been derived from audited consolidated financial statements of Oi that are not included in this information statement or incorporated herein by reference.

Oi’s consolidated financial statements are prepared in accordance with Brazilian GAAP, which differs in certain important respects from U.S. GAAP. For a discussion of certain differences relating to Oi’s financial statements, see Note 31 to Oi’s audited consolidated financial statements, which are incorporated herein by reference to the 2012 Oi Annual Report. Under U.S. GAAP, Oi’s financial information has been retrospectively adjusted to reflect the effect of the 2012 Oi corporate reorganization for all periods during which Oi, TNL, Telemar and Coari Participações S.A., or “Coari,” were under common control, which for these purposes was January 1, 2009.

You should read this summary financial data in conjunction with (1) “Presentation of Financial and Other Information,” (2) the audited consolidated financial statements of Oi and the related notes thereto and (3) the unaudited interim consolidated financial statements of Oi and the related notes thereto, which are incorporated by reference in this information statement.

Income Statement Data

|

| For the Year Ended December 31, |

| ||||||||||||||||

|

| 2013(1) |

| 2013 |

| 2012 |

| 2011 |

| 2010 |

| 2009(2) |

| ||||||

|

| (in millions |

| (in millions of Reais, except per share and ADS data) |

| ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Brazilian GAAP: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net operating revenue |

| US$ | 12,131 |

| R$ | 28,422 |

| R$ | 25,161 |

| R$ | 9,245 |

| R$ | 10,263 |

| R$ | 10,919 |

|

Cost of sales and services |

| (6,513 | ) | (15,259 | ) | (12,670 | ) | (4,587 | ) | (4,732 | ) | (5,764 | ) | ||||||

Gross profit |

| 5,618 |

| 13,163 |

| 12,491 |

| 4,659 |

| 5,531 |

| 5,155 |

| ||||||

Operating income (expenses) |

| (3,362 | ) | (7,876 | ) | (7,731 | ) | (3,091 | ) | (3,072 | ) | (6,232 | ) | ||||||

Operating income (loss) before financial income (expenses) and taxes |

| 2,256 |

| 5,287 |

| 4,760 |

| 1,567 |

| 2,459 |

| (1,077 | ) | ||||||

Financial income |

| 587 |

| 1,375 |

| 2,275 |

| 1,406 |

| 979 |

| 630 |

| ||||||

Financial expenses |

| (1,985 | ) | (4,650 | ) | (4,491 | ) | (1,478 | ) | (1,060 | ) | (912 | ) | ||||||

Financial income (expenses) net |

| (1,398 | ) | (3,275 | ) | (2,216 | ) | (72 | ) | (80 | ) | (281 | ) | ||||||

Income (loss) before taxes |

| 859 |

| 2,012 |

| 2,544 |

| 1,495 |

| 2,379 |

| (1,358 | ) | ||||||

Income tax and social contribution |

| (222 | ) | (519 | ) | (760 | ) | (490 | ) | (408 | ) | 339 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the Year Ended December 31, |

| ||||||||||||||||

|

| 2013(1) |

| 2013 |

| 2012 |

| 2011 |

| 2010 |

| 2009(2) |

| ||||||

|

| (in millions |

| (in millions of Reais, except per share and ADS data) |

| ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net income (loss) |

| US$ | 637 |

| R$ | 1,493 |

| R$ | 1,785 |

| R$ | 1,006 |

| R$ | 1,971 |

| R$ | (1,019 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net income (loss) attributable to controlling shareholders |

| US$ | 637 |

| R$ | 1,493 |

| R$ | 1,785 |

| R$ | 1,006 |

| R$ | 1,971 |

| R$ | (1,021 | ) |

Net income (loss) attributable to non-controlling shareholders |

| — |

| — |

| — |

| — |

| — |

| 2 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net income (loss) allocated to each class of shares: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Common shares |

| 200 |

| 469 |

| 560 |

| 316 |

| 619 |

| (1,021 | ) | ||||||

Preferred shares |

| 437 |

| 1,024 |

| 1,225 |

| 690 |

| 1,352 |

| — |

| ||||||

Net income (loss) per share(2): |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Common shares — basic |

| 0.39 |

| 0.91 |

| 1.09 |

| 0.61 |

| 1.20 |

| (0.62 | ) | ||||||

Common shares — diluted |

| 0.39 |

| 0.91 |

| 1.09 |

| 0.61 |

| 1.20 |

| (0.62 | ) | ||||||

Preferred shares and ADSs — basic |

| 0.39 |

| 0.91 |

| 1.09 |

| 0.61 |

| 1.20 |

| — |

| ||||||

Preferred shares and ADSs — diluted |

| 0.39 |

| 0.91 |

| 1.09 |

| 0.61 |

| 1.20 |

| — |

| ||||||

Weighted average shares outstanding (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Common shares — basic |

| — |

| 514,758 |

| 514,758 |

| 514,758 |

| 514,758 |

| 514,758 |

| ||||||

Common shares — diluted |

| — |

| 514,758 |

| 514,758 |

| 514,758 |

| 514,758 |

| 514,758 |

| ||||||

Preferred shares — basic |

| — |

| 1,125,273 |

| 1,125,273 |

| 1,125,273 |

| 1,125,273 |

| 1,125,273 |

| ||||||

Preferred shares — diluted |

| — |

| 1,125,273 |

| 1,125,273 |

| 1,125,273 |

| 1,125,273 |

| 1,125,273 |

| ||||||

(1) Translated for convenience only using the the selling rate as reported by the Brazilian Central Bank on December 31, 2013 for Reais into U.S. dollars of R$2.343=US$1.00.

(2) As required by Pronouncement 41, Earnings Per Share, of the of the Brazilian Accounting Standards Committee (Comitê de Pronunciamentos Contábeis), or “CPC,” Oi has adjusted retrospectively the calculation of basic and diluted earnings per share taking into consideration the shareholder structure resulting from the 2012 Oi corporate reorganization. In addition, under the Brazilian Corporation Law, preferred shareholders are not obligated to absorb losses, and such losses are exclusively attributed to common shareholders.

|

| For the Year Ended December 31, |

| ||||||||||||||||

|

| 2013(1) |

| 2013 |

| 2012 |

| 2011 |

| 2010 |

| 2009 |

| ||||||

|

| (in millions |

| (in millions of Reais, except per share and ADS data) |

| ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

U.S. GAAP: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net operating revenue |

| US$ | 12,131 |

| R$ | 28,422 |

| R$ | 28,141 |

| R$ | 27,907 |

| R$ | 29,479 |

| R$ | 29,861 |

|

Cost of sales and services |

| (7,028 | ) | (16,467 | ) | (15,825 | ) | (16,180 | ) | (16,576 | ) | (18,371 | ) | ||||||

Gross profit |

| 5,102 |

| 11,955 |

| 12,316 |

| 11,727 |

| 12,903 |

| 11,490 |

| ||||||

Operating income (expenses), net |

| 3,402 |

| (7,972 | ) | (8,579 | ) | (9,016 | ) | (8,611 | ) | (3,691 | ) | ||||||

Operating income (loss) before financial income (expenses) and taxes |

| 1,700 |

| 3,983 |

| 3,737 |

| 2,712 |

| 4,292 |

| 7,799 |

| ||||||

Financial income (expenses), net |

| 1,409 |

| (3,302 | ) | (2,617 | ) | (3,471 | ) | (2,440 | ) | (2,385 | ) | ||||||

Income (loss) before taxes |

| 290 |

| 681 |

| 1,120 |

| (759 | ) | 1,852 |

| 5,414 |

| ||||||

Income tax and social contribution |

| (32 | ) | (77 | ) | (254 | ) | 202 |

| 20 |

| (548 | ) | ||||||

Net income (loss) |

| 257 |

| 604 |

| 866 |

| (557 | ) | 1,872 |

| 4,866 |

| ||||||

Net income (loss) attributable to controlling shareholders |

| 257 |

| 604 |

| 859 |

| (296 | ) | 1,492 |

| 3,933 |

| ||||||

Net income (loss) attributable to non-controlling shareholders |

| — |

| — |

| 7 |

| (261 | ) | 381 |

| 933 |

| ||||||

Other comprehensive income (loss) |

| 15 |

| 34 |

| (319 | ) | (133 | ) | (62 | ) | 252 |

| ||||||

Total comprehensive income (loss) |

| US$ | 272 |

| R$ | 638 |

| R$ | 547 |

| R$ | (690 | ) | R$ | 1,810 |

| R$ | 5,118 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net income (loss) allocated to each class of shares(2): |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Common shares — basic |

| US$ | 80 |

| R$ | 190 |

| R$ | 289 |

| R$ | (296 | ) | R$ | 613 |

| R$ | 1,617 |

|

Common shares — diluted |

| 80 |

| 190 |

| 289 |

| (296 | ) | 620 |

| 1,637 |

| ||||||

Preferred shares and ADSs — basic |

| 176 |

| 414 |

| 570 |

| — |

| 878 |

| 2,316 |

| ||||||

Preferred shares and ADSs — diluted |

| 176 |

| 414 |

| 570 |

| — |

| 872 |

| 2,296 |

| ||||||

Net income (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Common shares — basic |

| 0.15 |

| 0.37 |

| 0.57 |

| (0.65 | ) | 1.79 |

| 4.72 |

| ||||||

Common shares — diluted |

| 0.15 |

| 0.37 |

| 0.57 |

| (0.65 | ) | 1.76 |

| 4.63 |

| ||||||

Preferred shares and ADSs — basic |

| 0.15 |

| 0.37 |

| 0.57 |

| — |

| 1.79 |

| 4.72 |

| ||||||

Preferred shares and ADSs — diluted |

| 0.15 |

| 0.37 |

| 0.57 |

| — |

| 1.76 |

| 4.63 |

| ||||||

Weighted average shares outstanding (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Common shares — basic |

| — |

| 514,758 |

| 504,990 |

| 456,149 |

| 342,917 |

| 342,837 |

| ||||||

Common shares — diluted |

| — |

| 514,758 |

| 504,990 |

| 465,598 |

| 352,283 |

| 353,341 |

| ||||||

Preferred shares and ADSs — basic |

| — |

| 1,125,270 |

| 994,880 |

| 536,927 |

| 491,199 |

| 490,860 |

| ||||||

Preferred shares and ADSs — diluted |

| — |

| 1,125,270 |

| 994,880 |

| 540,924 |

| 495,194 |

| 495,601 |

| ||||||

(1) Translated for convenience only using the the selling rate as reported by the Brazilian Central Bank on December 31, 2013 for Reais into U.S. dollars of R$2.343=US$1.00.

(2) In accordance with ASC 260, Earnings Per Share, basic and diluted earnings per share have been calculated, for U.S. GAAP purposes, using the “two class method.” See Note 32 to the audited consolidated financial statements of Oi, which are incorporated herein by reference to the 2012 Oi Annual Report.

Balance Sheet Data

|

| As of December 31, |

| ||||||||||||||||

|

| 2013(1) |

| 2013 |

| 2012 |

| 2011 |

| 2010 |

| 2009 |

| ||||||

|

| (in millions |

| (in millions of Reais) |

| ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Brazilian GAAP: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Cash and cash equivalents |

| US$ | 1,035 |

| R$ | 2,425 |

| R$ | 4,408 |

| R$ | 6,005 |

| R$ | 3,217 |

| R$ | 1,717 |

|

Short-term investments |

| 210 |

| 493 |

| 2,426 |

| 1,084 |

| 832 |

| 382 |

| ||||||

Trade receivable, net |

| 3,029 |

| 7,097 |

| 7,018 |

| 2,010 |

| 2,070 |

| 1,992 |

| ||||||

Total current assets |

| 7,549 |

| 17,687 |

| 21,138 |

| 12,246 |

| 8,487 |

| 6,127 |

| ||||||

Property, plant and equipment, net |

| 10,579 |

| 24,786 |

| 23,103 |

| 5,794 |

| 5,317 |

| 5,267 |

| ||||||

Intangible assets, net |

| 1,673 |

| 3,919 |

| 4,196 |

| 1,085 |

| 1,318 |

| 1,572 |

| ||||||

Total assets |

| 29,917 |

| 70,096 |

| 69,150 |

| 31,664 |

| 26,886 |

| 24,564 |

| ||||||

Short-term loans and financing (including current portion of long-term debt) |

| 1,775 |

| 4,159 |

| 3,114 |

| 1,144 |

| 1,044 |

| 870 |

| ||||||

Total current liabilities |

| 6,633 |

| 15,540 |

| 17,093 |

| 8,619 |

| 6,691 |

| 5,424 |

| ||||||

Long-term loans and financing |

| 13,527 |

| 31,695 |

| 30,232 |

| 6,962 |

| 3,321 |

| 3,573 |

| ||||||

Share capital |

| 3,189 |

| 7,471 |

| 7,309 |

| 3,731 |

| 3,731 |

| 3,731 |

| ||||||

Total equity |

| 4,918 |

| 11,524 |

| 11,109 |

| 10,589 |

| 11,337 |

| 9,906 |

| ||||||

Equity attributable to controlling shareholders |

| 4,918 |

| 11,524 |

| 11,109 |

| 10,589 |

| 11,337 |

| 9,905 |

| ||||||

Equity attributable to non-controlling shareholders |

| — |

| — |

| — |

| — |

| — |

| 1 |

| ||||||

(1) Translated for convenience only using the the selling rate as reported by the Brazilian Central Bank on December 31, 2013 for Reais into U.S. dollars of R$2.343=US$1.00.

|

| As of December 31, |

| ||||||||||||||||

|

| 2013(1) |

| 2013 |

| 2012 |

| 2011 |

| 2010 |

| 2009 |

| ||||||

|

| (in millions |

| (in millions of Reais) |

| ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

U.S. GAAP: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Cash and cash equivalents |

| US | 1,035 |

| R$ | 2,425 |

| R$ | 4,413 |

| R$ | 11,025 |

| R$ | 9,052 |

| R$ | 6,206 |

|

Short-term investments |

| 210 |

| 493 |

| 2,426 |