INDEX TO FINANCIAL STATEMENTS

Consolidated Financial Statements of Telemar Participações S.A. and Subsidiaries: |

|

Reports of Independent Registered Public Accounting Firms | F-2 |

Consolidated Balance Sheet as at December 31, 2013 and 2012 | F-4 |

Consolidated Income Statement for the Years Ended December 31, 2013, 2012 and 2011 | F-5 |

Consolidated Statement of Comprehensive Income for the Years Ended December 31, 2013, 2012 and 2011 | F-6 |

Consolidated Statement of Changes in Equity for the Years Ended December 31, 2013 and 2012 | F-7 |

Consolidated Statement of Cash Flows for the Years Ended December 31, 2013, 2012 and 2011 | F-8 |

Notes to the Consolidated Financial Statements | F-11 |

Report of Independent Registered Public Accounting Firm on consolidated financial statements

To

The Board of Directors and Shareholders of

Telemar Participações S.A.

Rio de Janeiro - RJ

We have audited the accompanying consolidated balance sheets of Telemar Participações S.A. and subsidiaries (the “Company”), as of December 31, 2013 and 2012 and the related consolidated statements of income, comprehensive income, changes in shareholders’ equity and cash flows for each of the years in the two-year period ended December 31, 2013. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Telemar Participações S.A. and subsidiaries as of December 31, 2013 and 2012, and the results of their operations and their cash flows for each of the years in the two-year period ended December 31, 2013, in conformity with International Financial Reporting Standards (IFRS), as issued by the International Accounting Standards Board (IASB).

/s/ KPMG Auditores Independentes |

|

|

|

KPMG Auditores Independentes |

|

|

|

|

|

Rio de Janeiro, Brazil |

|

February 18, 2014 |

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Telemar Participações S.A.

Rio de Janeiro - RJ

We have audited the accompanying consolidated statements of income, comprehensive income, changes in equity and cash flows of Telemar Participações S.A. and subsidiaries (the “Company”) for the year ended December 31, 2011. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such consolidated financial statements present fairly, in all material respects, the results of operations and cash flows of Telemar Participações S.A. and subsidiaries for the year ended December 31, 2011, in conformity with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board — IASB.

As discussed in Note 2.b to the consolidated financial statements, the Company has changed its method of accounting for jointly controlled entities in the year ended December 31, 2013 due to the adoption of International Financial Reporting Standard 11 — Joint Arrangements (IFRS 11). As allowed by the transition guidance, the consolidated statements of income, comprehensive income, changes in equity and cash flows for the year ended December 31, 2011 have not been retrospectively adjusted.

/s/ Deloitte Touche Tohmatsu |

|

DELOITTE TOUCHE TOHMATSU AUDITORES INDEPENDENTES |

|

Rio de Janeiro, Brazil |

February 18, 2014 |

Telemar Participações S.A. and Subsidiaries

Consolidated Balance Sheets as at December 31, 2013 and 2012

(In thousands of Brazilian reais - R$, unless otherwise stated)

|

| Note |

| 2013 |

| 2012 |

|

Current assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

| 9 |

| 2,484,908 |

| 4,491,668 |

|

Short-term investments |

| 9 |

| 492,510 |

| 2,713,029 |

|

Derivative instruments |

| 19 |

| 452,234 |

| 640,229 |

|

Trade receivable, net |

| 10 |

| 7,096,679 |

| 7,017,533 |

|

Inventories, net |

|

|

| 432,633 |

| 385,165 |

|

Current recoverable taxes |

| 11 |

| 918,796 |

| 1,741,535 |

|

Other taxes |

| 12 |

| 1,474,408 |

| 1,557,177 |

|

Judicial deposits |

| 13 |

| 1,316,478 |

| 2,068,691 |

|

Other receivables |

| 1 |

| 1,775,691 |

| — |

|

Pension plan assets |

| 25 |

| 9,596 |

| 9,311 |

|

Other assets |

|

|

| 1,305,875 |

| 900,025 |

|

Total current assets |

|

|

| 17,759,808 |

| 21,524,363 |

|

Non-current assets |

|

|

|

|

|

|

|

Long-term investments |

| 9 |

| 99,129 |

| 63,692 |

|

Derivative financial instruments |

| 19 |

| 1,620,945 |

| 348,870 |

|

Deferred taxes |

| 11 |

| 4,475,747 |

| 4,259,234 |

|

Other taxes |

| 12 |

| 890,835 |

| 738,019 |

|

Available-for-sale financial asset |

| 3 |

| 914,216 |

| 905,829 |

|

Judicial deposits |

| 13 |

| 11,050,936 |

| 9,722,525 |

|

Pension plan assets |

| 25 |

| 60,197 |

| 73,708 |

|

Held-for-sale assets |

|

|

| 260,370 |

| 112,852 |

|

Other assets |

|

|

| 376,786 |

| 270,701 |

|

Investments |

| 14 |

| 173,686 |

| 179,640 |

|

Property, plant and equipment, net |

| 15 |

| 25,925,802 |

| 24,812,159 |

|

Intangible assets, net |

| 16 |

| 14,796,892 |

| 15,975,157 |

|

Total non-current assets |

|

|

| 60,645,541 |

| 57,462,386 |

|

Total assets |

|

|

| 78,405,349 |

| 78,986,749 |

|

Current liabilities |

|

|

|

|

|

|

|

Payroll, related taxes and benefits |

|

|

| 651,649 |

| 773,761 |

|

Trade payables |

| 17 |

| 4,733,498 |

| 4,658,244 |

|

Loans and financing |

| 18 |

| 5,150,494 |

| 3,740,904 |

|

Derivatives instruments |

| 19 |

| 409,851 |

| 309,555 |

|

Current income taxes payable |

| 11 |

| 432,463 |

| 1,065,772 |

|

Taxes other than income tax |

| 12 |

| 2,112,863 |

| 2,248,081 |

|

Dividends and interest on capital |

|

|

| 230,721 |

| 576,253 |

|

Licenses and concessions payable |

| 20 |

| 457,173 |

| 1,058,881 |

|

Tax financing program |

| 21 |

| 100,302 |

| 99,732 |

|

Provision for pension plan |

| 25 |

| 184,295 |

| 103,666 |

|

Provisions |

| 22 |

| 1,223,526 |

| 1,569,356 |

|

Other payables |

| 23 |

| 847,810 |

| 1,438,329 |

|

Total current liabilities |

|

|

| 16,534,645 |

| 17,642,534 |

|

Non-Current liabilities |

|

|

|

|

|

|

|

Loans and financing |

| 18 |

| 33,962,228 |

| 33,139,662 |

|

Derivatives instruments |

| 19 |

| 156,800 |

| 204,742 |

|

Deferred taxes |

|

|

|

|

| 233,849 |

|

Taxes other than income tax |

| 12 |

| 1,747,012 |

| 2,238,571 |

|

Licenses and concessions payable |

| 20 |

| 1,027,234 |

| 1,099,116 |

|

Tax financing program |

| 21 |

| 1,020,002 |

| 985,367 |

|

Provision for pension plan |

| 22 |

| 459,267 |

| 767,121 |

|

Provisions |

| 25 |

| 4,409,418 |

| 4,866,177 |

|

Other payables |

| 23 |

| 2,533,452 |

| 570,005 |

|

Total non-current liabilities |

|

|

| 45,315,413 |

| 44,104,610 |

|

Equity attributable to controlling shareholders |

| 24 |

|

|

|

|

|

Share capital |

|

|

| 1,921,142 |

| 1,921,141 |

|

Capital reserves |

|

|

| 708,383 |

| 638,569 |

|

Income reserves |

|

|

|

|

| 137,291 |

|

Premium on capital transactions and changes in equity interest percentages |

|

|

| (155,727 | ) | (289,396 | ) |

Other comprehensive income |

|

|

| (16,161 | ) | (11,886 | ) |

Valuation adjustment to equity |

|

|

| (366,295 | ) | (366,305 | ) |

Redeemable preferred shares |

|

|

| (743,774 | ) | (909,055 | ) |

Accumulated losses |

|

|

| (268,460 | ) |

|

|

|

|

|

| 1,079,108 |

| 1,120,359 |

|

Equity attributable to noncontrolling shareholders |

|

|

| 15,476,183 |

| 16,119,246 |

|

Total equity |

|

|

| 16,555,291 |

| 17,239,605 |

|

Total equity and liabilities |

|

|

| 78,405,349 |

| 78,986,749 |

|

The accompanying notes are an integral part of these consolidated financial statements.

Telemar Participações S.A. and Subsidiaries

Consolidated Income Statements

for the Years Ended December 31, 2013, 2012 and 2011

(In thousands of Brazilian reais - R$, unless otherwise stated)

|

| Note |

| 2013 |

| 2012 |

| 2011 |

|

|

|

|

|

|

|

|

|

|

|

Net operating revenue |

| 4 |

| 28,422,147 |

| 28,131,672 |

| 27,906,989 |

|

|

|

|

|

|

|

|

|

|

|

Cost of sales and services |

| 5 |

| (16,584,540 | ) | (15,888,268 | ) | (16,260,109 | ) |

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

| 11,837,607 |

| 12,243,404 |

| 11,646,880 |

|

|

|

|

|

|

|

|

|

|

|

Operating income (expenses) |

|

|

|

|

|

|

|

|

|

Equity in earnings of joint ventures |

| 14 |

| (17,750 | ) | (15,548 | ) |

|

|

Selling expenses |

| 5 |

| (5,553,891 | ) | (5,417,716 | ) | (5,095,236 | ) |

General and administrative expenses |

| 5 |

| (3,675,994 | ) | (3,375,348 | ) | (3,107,221 | ) |

Other operating income |

| 6 |

| 3,128,044 |

| 2,189,711 |

| 1,875,591 |

|

Other operating expenses |

| 6 |

| (1,918,244 | ) | (2,558,013 | ) | (2,441,842 | ) |

|

|

|

|

|

|

|

|

|

|

Operating income before financial income (expenses) and taxes |

|

|

| 3,799,772 |

| 3,066,490 |

| 2,878,172 |

|

|

|

|

|

|

|

|

|

|

|

Financial income |

| 7 |

| 1,395,796 |

| 2,365,418 |

| 2,250,985 |

|

Financial expenses |

| 7 |

| (4,983,388 | ) | (5,254,100 | ) | (6,054,689 | ) |

|

|

|

|

|

|

|

|

|

|

Financial income (expenses) |

| 7 |

| (3,587,592 | ) | (2,888,682 | ) | (3,803,704 | ) |

|

|

|

|

|

|

|

|

|

|

Income (loss) before taxes |

|

|

| 212,180 |

| 177,808 |

| (925,532 | ) |

|

|

|

|

|

|

|

|

|

|

Income tax and social contribution |

|

|

|

|

|

|

|

|

|

Current |

| 8 |

| (419,676 | ) | (1,051,915 | ) | (660,184 | ) |

Deferred |

| 8 |

| 382,535 |

| 986,496 |

| 770,852 |

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) for the year |

|

|

| 175,039 |

| 112,389 |

| (814,864 | ) |

Net loss attributed to controlling shareholders |

|

|

| (270,655 | ) | (297,452 | ) | (469,237 | ) |

Net income (loss) attributed to noncontrolling shareholders |

|

|

| 445,694 |

| 409,841 |

| (345,627 | ) |

|

|

|

|

|

|

|

|

|

|

Basic and diluted earnings per share |

| 24(h) |

|

|

|

|

|

|

|

Common shares — basic (R$) |

|

|

| (0.08975 | ) | (0.10171 | ) | (0.16311 | ) |

Common shares — diluted (R$) |

|

|

| (0.08975 | ) | (0.10171 | ) | (0.16311 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

Telemar Participações S.A. and Subsidiaries

Consolidated Comprehensive Income

for the Years Ended December 31, 2013, 2012 and 2011

(In thousands of Brazilian reais - R$, unless otherwise stated)

|

| 2013 |

| 2012 |

| 2011 |

|

|

|

|

|

|

|

|

|

Net income (loss) for the year |

| 175,039 |

| 112,389 |

| (814,864 | ) |

Items that may be reclassified subsequently to profit or loss: |

|

|

|

|

|

|

|

Hedge accounting gain (losses) |

| (139,334 | ) | 139,532 |

| 652 |

|

Items that will not be reclassified subsequently to profit or loss: |

|

|

|

|

|

|

|

Actuarial gains (losses) |

| 114,896 |

| (168,293 | ) |

|

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss) for the year |

| 150,601 |

| 83,628 |

| (814,212 | ) |

|

|

|

|

|

|

|

|

Comprehensive income (loss) attributable to controlling shareholders |

| (274,930 | ) | (304,147 | ) | (469,399 | ) |

Comprehensive income (loss) attributable to non-controlling shareholders |

| 425,531 |

| 387,775 |

| (344,813 | ) |

Statement of comprehensive income items are carried net of taxes.

The accompanying notes are an integral part of these consolidated financial statements.

Telemar Participações S.A. and Subsidiaries

Consolidated Statements of Changes in Equity for the Years Ended December 31, 2013 and 2012

In thousands of Brazilian reais - R$, unless otherwise stated)

|

|

|

| Capital reserve |

|

|

| Retained |

| Premium, losses and |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

|

|

| Share |

|

|

| Profit reserves |

| earnings |

| transactions and changes |

| Other |

| Valuation adjustments to equity |

|

|

| Total interest |

|

|

|

|

| ||||||

|

| Share capital |

| subscription |

| Subsidiaries’ |

| Legal |

| Redemption |

| Investments |

| (accumulated |

| in equity interest |

| comprehensive |

| Subsidiaries’ |

| Subsidiaries’ |

| Redeemable |

| of Company |

| Non-controlling |

| Total equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2011 |

| 1,798,529 |

|

|

| 26,759 |

| 2,195 |

| 267,082 |

| 580,911 |

|

|

| (164,342 | ) |

|

|

|

|

|

| (1,239,616 | ) | 1,271,518 |

| 17,166,956 |

| 18,438,474 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital increase |

| 122,612 |

| 638,569 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 761,181 |

|

|

| 761,181 |

|

Capital increase in subsidiaries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4,593,372 |

| 4,593,372 |

|

Redemption and cancellation of preferred shares |

|

|

|

|

|

|

|

|

| (165,281 | ) |

|

|

|

|

|

|

|

|

|

|

|

| 165,281 |

|

|

|

|

|

|

|

Dividends and interest on capital declared by subsidiaries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (246,175 | ) | (246,175 | ) |

Bonus shares to be redeemed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (761,763 | ) | (761,763 | ) |

Stock option plan |

|

|

|

|

| 1,375 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1,375 |

| 5,733 |

| 7,108 |

|

Hedge accounting gain (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (162 | ) |

|

|

|

|

|

| (162 | ) | 814 |

| 652 |

|

Change in equity interest percentage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (341,910 | ) |

|

|

|

|

|

|

|

| (341,910 | ) | 341,910 |

|

|

|

Other effects directly to equity of subsidiaries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (5 | ) |

|

|

|

|

|

|

|

| (5 | ) | (2,559 | ) | (2,564 | ) |

Loss for the year |

|

|

|

|

|

|

|

|

|

|

|

|

| (469,237 | ) |

|

|

|

|

|

|

|

|

|

| (469,237 | ) | (345,627 | ) | (814,864 | ) |

Allocation of income |

|

|

|

|

|

|

|

|

|

|

| (469,237 | ) | 469,237 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transfer to Reserve bailout fund |

|

|

|

|

|

|

|

|

| 17,473 |

| (17,473 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2011 |

| 1,921,141 |

| 638,569 |

| 28,134 |

| 2,195 |

| 119,274 |

| 94,201 |

|

|

| (506,257 | ) | (162 | ) |

|

|

|

| (1,074,335 | ) | 1,222,760 |

| 20,752,661 |

| 21,975,421 |

|

Adoption of IAS 19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (5,029 | ) |

|

|

|

|

|

| (5,029 | ) | (33,955 | ) | (38,984 | ) |

Balance at January 1, 2012 |

| 1,921,141 |

| 638,569 |

| 28,134 |

| 2,195 |

| 119,274 |

| 94,201 |

|

|

| (506,257 | ) | (5,191 | ) |

|

|

|

| (1,074,335 | ) | 1,217,731 |

| 20,718,706 |

| 21,936,437 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transfer to redemption fund reserve |

|

|

|

|

|

|

|

|

| 94,201 |

| (94,201 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redemption and cancellation of preferred shares |

|

|

|

|

|

|

|

|

| (165,280 | ) |

|

|

|

|

|

|

|

|

|

|

|

| 165,280 |

|

|

|

|

|

|

|

Dividends and interest on capital declared by subsidiaries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (2,225,261 | ) | (2,225,261 | ) |

Subsidiaries share issue cost - Oi |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (10,029 | ) |

|

|

|

| (10,029 | ) | (46,580 | ) | (56,609 | ) |

Withdrawal rights related to the corporate reorganization — Oi |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (356,276 | ) |

|

| (356,276 | ) | (1,652,049 | ) | (2,008,325 | ) |

Redeemable bonus shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock option plan |

|

|

|

|

| 154 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 154 |

| 629 |

| 783 |

|

Termination of the stock option plan |

|

|

|

|

| (28,288 | ) |

|

|

|

|

|

| 28,288 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hedge accounting gains (losses) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 24,997 |

|

|

|

|

|

|

| 24,997 |

| 114,535 |

| 139,532 |

|

Changes in interests in investments |

|

|

|

|

|

|

|

|

|

|

|

|

| 356,065 |

| 216,825 |

|

|

|

|

|

|

|

|

| 572,890 |

| (623,872 | ) | (50,982 | ) |

Other direct impacts on subsidiaries’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 36 |

|

|

|

|

|

|

|

|

| 36 |

|

|

| 36 |

|

Loss for the year |

|

|

|

|

|

|

|

|

|

|

|

|

| (297,452 | ) |

|

|

|

|

|

|

|

|

|

| (297,452 | ) | 409,841 |

| 112,389 |

|

Subsidiaries’ actuarial gains (losses) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (31,692 | ) |

|

|

|

|

|

| (31,692 | ) | (136,601 | ) | (168,293 | ) |

Acquisition on non-controlling interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (35,032 | ) | (35,032 | ) |

Redemption of bonus shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (405,071 | ) | (405,071 | ) |

Profit or loss allocation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transfer to redemption fund reserve |

|

|

|

|

|

|

|

|

| 86,901 |

|

|

| (86,901 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2012 |

| 1,921,141 |

| 638,569 |

|

|

| 2,195 |

| 135,096 |

|

|

|

|

| (289,396 | ) | (11,886 | ) | (10,029 | ) | (356,276 | ) | (909,055 | ) | 1,120,359 |

| 16,119,246 |

| 17,239,605 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital increase |

| 1 |

| 99,999 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 100,000 |

| (73,525 | ) | 26,475 |

|

Dividends and interest on capital declared by subsidiaries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (727,838 | ) | (727,838 | ) |

Redemption of bonus shares by subsidiary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (133,675 | ) | (133,675 | ) |

Hedge accounting gains (losses) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (25,511 | ) |

|

|

|

|

|

| (25,511 | ) | (113,823 | ) | (139,334 | ) |

Subsidiaries’ actuarial gains (losses) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 21,236 |

|

|

|

|

|

|

| 21,236 |

| 93,660 |

| 114,896 |

|

Redemption of redeemable preferred shares |

|

|

| (30,185 | ) |

|

|

|

| (135,096 | ) |

|

|

|

|

|

|

|

|

|

|

|

| 165,281 |

|

|

|

|

|

|

|

Gain on capital transaction with controlling shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 133,206 |

|

|

|

|

|

|

|

|

| 133,206 |

| (133,206 | ) |

|

|

Subsidiaries’ share issue costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 10 |

|

|

|

|

| 10 |

| 51 |

| 61 |

|

Other changes in subsidiaries’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 463 |

|

|

|

|

|

|

|

|

| 463 |

| (400 | ) | 63 |

|

Loss for the year |

|

|

|

|

|

|

|

|

|

|

|

|

| (270,655 | ) |

|

|

|

|

|

|

|

|

|

| (270,655 | ) | 445,694 |

| 175,039 |

|

Partial absorption of loss for the year |

|

|

|

|

|

|

| (2,195 | ) |

|

|

|

| 2,195 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2013 |

| 1,921,142 |

| 708,383 |

|

|

|

|

|

|

|

|

| (268,460 | ) | (155,727 | ) | (16,161 | ) | (10,019 | ) | (356,276 | ) | (743,774 | ) | 1,079,108 |

| 15,476,183 |

| 16,555,291 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1,921,142 |

|

|

| 708,383 |

|

|

|

|

|

|

| (268,460 | ) | (155,727 | ) | (16,161 | ) |

|

| (366,295 | ) | (743,774 | ) | 1,079,108 |

| 15,476,183 |

| 16,555,291 |

|

The accompanying notes are an integral part of these consolidated financial statements.

Telemar Participações S.A. and Subsidiaries

Consolidated Statements of Cash Flows

for the Years Ended December 31, 2013, 2012 and 2011

(In thousands of Brazilian reais - R$, unless otherwise stated)

|

| 2013 |

| 2012 |

| 2011 |

|

Cash flows from operating activities |

|

|

|

|

|

|

|

Income (loss) before taxes |

| 212,180 |

| 177,808 |

| (925,532 | ) |

|

|

|

|

|

|

|

|

Items not affecting cash |

|

|

|

|

|

|

|

Charges, interest income, and inflation adjustment (i) |

| 4,539,012 |

| 3,751,515 |

| 3,576,630 |

|

Depreciation and amortization |

| 5,745,742 |

| 5,306,076 |

| 5,708,902 |

|

Provision for doubtful accounts |

| 849,779 |

| 596,405 |

| 920,872 |

|

Provisions |

| 381,949 |

| 440,377 |

| 931,807 |

|

Reversal of inflation adjustment of judicial deposit (ii) |

|

|

|

|

| 198,853 |

|

Depreciation of financial assets available for sale |

|

|

|

|

| 667,926 |

|

Provision for pension plan |

| 10,325 |

| 382,875 |

| 7,823 |

|

Share of profits of subsidiaries |

| 17,750 |

| 15,548 |

|

|

|

Loss on disposal of permanent assets |

| 399,488 |

| 387,388 |

| 85,486 |

|

Income from asset sales |

| (214,127 | ) | (389,128 | ) |

|

|

Provision for concession fee |

| 93,563 |

| 137,068 |

| 119,200 |

|

Employee and management profit sharing |

| (115,671 | ) | 418,927 |

| 57,939 |

|

Derivative transactions |

| (1,158,520 | ) | (244,359 | ) | (209,929 | ) |

Inflation adjustment on provisions (ii) |

| 246,936 |

| 287,251 |

| 1,053 |

|

Inflation adjustment on tax refinancing program (iii) |

| 81,262 |

| 94,489 |

| 177,847 |

|

Expired dividends |

| (35,744 | ) | (74,732 | ) | (189,023 | ) |

Fixed dividends on and inflation adjustment to redeemable preferred shares |

| 121,537 |

| 135,946 |

| 159,833 |

|

Other |

| 1,851,061 |

| 1,306,211 |

| 780,162 |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

Trade receivables |

| 556,009 |

| (1,873,323 | ) | (1,121,326 | ) |

Inventories |

| (53,696 | ) | (251,540 | ) | (67,760 | ) |

Taxes |

| (599,140 | ) | 514,382 |

| 10,085 |

|

Held-for-trading short and long term investments |

| (6,230,243 | ) | (9,672,761 | ) | (7,756,357 | ) |

Redemptions of held-for-trading short and long term investments |

| 8,490,368 |

| 9,440,445 |

| 7,724,577 |

|

Trade payables |

| (249,040 | ) | (994,381 | ) | 1,016,117 |

|

Payroll, related taxes and benefits |

| (931 | ) | 8,720 |

| (280,571 | ) |

Provisions |

| (934,039 | ) | (803,877 | ) | (788,793 | ) |

Provision for pension plan |

| (124,246 | ) | (100,526 | ) | (96,148 | ) |

Other assets and liabilities |

| (3,536,408 | ) | (633,049 | ) | (885,570 | ) |

Financial charges paid |

| (2,649,276 | ) | (2,905,938 | ) | (2,772,857 | ) |

Income tax and social contribution paid - Company |

| (315,399 | ) | (1,111,419 | ) | (562,565 | ) |

Income tax and social contribution paid - third parties |

| (325,931 | ) | (326,368 | ) | (315,673 | ) |

Dividends received |

| 65,006 |

| 83,087 |

| 170,092 |

|

|

|

|

|

|

|

|

|

Cash flows from operating activities |

| 7,119,556 |

| 4,103,117 |

| 6,343,100 |

|

The accompanying notes are an integral part of these consolidated financial statements.

Telemar Participações S.A. and Subsidiaries

Consolidated Statements of Cash Flows

for the Years Ended December 31, 2013, 2012 and 2011

(In thousands of Brazilian reais - R$, unless otherwise stated)

(continued)

|

| 2013 |

| 2012 |

| 2011 |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

|

Purchase of property, plant and equipment and intangible assets |

| (5,976,488 | ) | (6,023,070 | ) | (5,109,990 | ) |

Due from related parties and debentures - receipts |

|

|

| 133,023 |

|

|

|

Proceeds from sale of property, plant and equipment |

| 4,127 |

| 720,175 |

| 170,536 |

|

Increase in permanent investments |

| (11,796 | ) | (67,470 | ) | (12,591 | ) |

Judicial deposits |

| (1,693,945 | ) | (2,522,819 | ) | (2,488,620 | ) |

Redemption of Judicial deposits |

| 958,679 |

| 776,241 |

| 620,252 |

|

Available-for-sale financial asset |

|

|

| (250,186 | ) | (1,366,910 | ) |

Acquisition on non-controlling interests |

|

|

| (35,032 | ) |

|

|

Cash flow arising on the loss of control of subsidiaries |

| (50,732 | ) |

|

|

|

|

Net cash received from sale of equity interests |

|

|

|

|

| 46,983 |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

| (6,770,155 | ) | (7,269,138 | ) | (8,140,340 | ) |

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

Loans and financing, net of debt issuance cost |

| 3,534,612 |

| 10,875,517 |

| 11,184,323 |

|

Repayment of principal of loans, financing and derivatives |

| (3,908,140 | ) | (8,657,038 | ) | (11,747,050 | ) |

Licenses and concessions |

| (710,968 | ) | (327,679 | ) | (351,131 | ) |

Payment on redemption of preferred shares |

| (165,281 | ) | (165,280 | ) | (165,280 | ) |

Capital increase |

| 26,474 |

|

|

| 4,715,984 |

|

Share issue premium |

|

|

|

|

| 638,569 |

|

Tax refinancing program |

| (174,455 | ) | (176,485 | ) | (162,674 | ) |

Payment of dividends and interest on capital |

| (1,033,584 | ) | (1,961,241 | ) | (598,151 | ) |

Share reimbursement |

|

|

| (2,008,325 | ) |

|

|

Bonus shares |

| 24,738 |

| (1,068,598 | ) |

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities |

| (2,406,604 | ) | (3,489,129 | ) | 3,514,590 |

|

|

|

|

|

|

|

|

|

Foreign exchange differences on cash equivalents |

| 50,443 |

| (4,471 | ) | 160,217 |

|

|

|

|

|

|

|

|

|

Cash flows for the year |

| (2,006,760 | ) | (6,659,621 | ) | 1,877,567 |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of year |

| 2,484,908 |

| 4,491,668 |

| 11,151,289 |

|

Cash and cash equivalents at beginning of year |

| 4,491,668 |

| 11,151,289 |

| 9,273,722 |

|

|

|

|

|

|

|

|

|

Increase in cash and cash equivalents |

| (2,006,760 | ) | (6,659,621 | ) | 1,877,567 |

|

(i) Includes: (1) inflation adjustment on provision for pension plans that are adjusted by estimated inflation rate based on actuarial assumptions (see note 25) and (2) inflation adjustment on licenses and concessions payable that are adjusted by Telecommunications

Service Index (IST) plus 1% p.m. and General Price Index - Domestic Availability (IGP-DI) plus 1% p.m.;

(ii) Adjusted for inflation in accordance with the specific indexes defined by the respective courts or legislation in force;

(iii) Adjusted for inflation by Special System for Settlement and Custody Rate — Selic variation 7,25% p.y.

The accompanying notes are an integral part of these consolidated financial statements.

Telemar Participações S.A. and Subsidiaries

Consolidated Statements of Cash Flows

for the Years Ended December 31, 2013, 2012 and 2011

(In thousands of Brazilian reais - R$, unless otherwise stated)

Additional disclosures relating to the statement of cash flows

Non-cash transactions

|

| 2013 |

| 2012 |

| 2011 |

|

Acquisition of property, plant and equipment and intangible assets (incurring liabilities) |

| 637,884 |

| 1,146,565 |

| (150,807 | ) |

Offset of judicial deposits against provisions |

| 495,259 |

| 378,693 |

| 409,985 |

|

The accompanying notes are an integral part of these consolidated financial statements.

Telemar Participações S.A. and Subsidiaries

Notes to the Financial Statements

for the Years Ended December 31, 2013 and 2012

(Amounts in thousands of Brazilian reais, unless otherwise stated)

1. GENERAL INFORMATION

Telemar Participações S.A. (“Telemar” or “Company”) is a publicly held company engaged in holding direct or indirect equity interests in Oi S.A. (“Oi”), formerly Brasil Telecom S.A. or “BrT”, and can also provide management and administrative services to companies under its control, and hold interests in other companies in Brazil and abroad. As at December 31, 2013 the Company holds 16.34% of Oi’s outstanding shares and 48.51% of its voting capital. The Company is headquartered in Brasil, in the city of Rio de Janeiro, Botafogo district, at Praia de Botafogo, 300 — 11º andar — Parte. The Company is a holding company, jointly controlled by LF Tel S.A., AG Telecom Participações S.A., and Fundação Atlântico de Seguridade Social, and as at December 31, 2013 each company held 19.36%, 19.36%, and 11.51% of the Company’s voting capital, respectively. BNDES Participações S.A. — BNDESPAR, holder of 13.05%, Caixa de Previdência dos Funcionários do Banco do Brasil — PREVI (9.69%), Fundação dos Economiários Federais — FUNCEF (7.48%), Fundação Petrobrás de Seguridade Social — PETROS (7.48%), and Bratel Brasil S.A., (12.07%) are also signatories of the Shareholders’ Agreement of the Company. The Company is registered with the Brazilian Securities and Exchange Commission (CVM) as a public company.

In addition to the interest in Oi, Telemar holds equity interests in Valverde Participações S.A. (“Valverde”) and Bakarne Investments Ltd. (“Bakarne”).

Oi S.A. (“Oi”), formerly Brasil Telecom S.A. or “BrT”, is a Switched Fixed-line Telephony Services (“STFC”) concessionaire, operating since July 1998 in Region II of the General Concession Plan (“PGO”), which covers the Brazilian states of Acre, Rondônia, Mato Grosso, Mato Grosso do Sul, Tocantins, Goiás, Paraná, Santa Catarina and Rio Grande do Sul, and the Federal District, in the provision of STFC as a local and intraregional long-distance carrier. Since January 2004, Oi also provides domestic and international long-distance services in all Regions and local services outside Region II started to be provided in January 2005. These services are provided under concessions granted by Agência Nacional de Telecomunicações - ANATEL (National Telecommunications Agency), the regulator of the Brazilian telecommunications industry.

Valverde is a corporation, wholly-owned subsidiary of the Company, which was acquired on March 1, 2011, mainly engaged in holding interests in other companies, which as at December 31, 2013 holds 2.49% of Oi’s outstanding shares and 7.94% of its voting capital.

Bakarne is a wholly-owned subsidiary of the Company headquartered in Tortola, British Virgin Islands, incorporated in 2003 and engaged in the provision of financial transaction management and advisory services to the Company. The executive committee approved at the meeting held on February 11, 2014 the liquidation of Bakarne (Note 30 — Subsequent Events)

The Company’s financial statements were analyzed and approved by the Board of Directors, and authorized for issuance at the meeting held on February 18, 2014.

The equity interests held in Company direct and indirect subsidiaries, less treasury shares, are as follows:

Telemar Participações S.A. and Subsidiaries

Notes to the Financial Statements

for the Years Ended December 31, 2013 and 2012

(Amounts in thousands of Brazilian reais, unless otherwise stated)

|

|

|

|

|

| Direct |

| Indirect |

| Direct |

| Indirect |

|

Company |

| Business |

|

|

| 2013 |

| 2013 |

| 2012 |

| 2012 |

|

Oi S.A. |

| Fixed—line telephony — Region II |

| Brazil |

| 16.34 | % | 18.83 | % | 15.23 | % | 17.72 | % |

Valverde Participações S.A. |

| Holding company |

| Brazil |

| 100 | % |

|

| 100 | % |

|

|

Bakarne Investments Ltd. (1) |

| Holding company |

| British Virgin Islands |

| 100 | % |

|

| 100 | % |

|

|

Oi Móvel |

| Mobile telephony — Region II |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

Brasil Telecom Comunicação Multimídia Ltda. (“BrT Multimídia”) |

| Data traffic |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

BrT Card Serviços Financeiros Ltda. (“BrT Card”) |

| Financial services |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

BrT Serviços de Internet S.A. (“BrTI”) |

| Holding company |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

Internet Group do Brasil S.A. (“iG Brasil”) |

| Internet |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

Brasil Telecom Cabos Submarinos Ltda. (“BrT CS”) (i) |

| Data traffic |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

Brasil Telecom Subsea Cable Systems (Bermuda) Ltd. (i) |

| Data traffic |

| Bermuda |

|

|

| 18.83 | % |

|

| 17.72 | % |

Brasil Telecom of America Inc. (i) |

| Data traffic |

| United States of America |

|

|

| 18.83 | % |

|

| 17.72 | % |

Brasil Telecom de Venezuela, S.A. (“BrT Venezuela”) |

| Data traffic |

| Venezuela |

|

|

| 18.83 | % |

|

| 17.72 | % |

Brasil Telecom de Colombia, Empresa Unipersonal (i) |

| Data traffic |

| Colombia |

|

|

| 18.83 | % |

|

| 17.72 | % |

Oi Paraguay Comunicaciones SRL |

| Data traffic |

| Paraguay |

|

|

| 18.83 | % |

|

| 17.72 | % |

Rio Alto Participações S.A. (“Rio Alto”) |

| Receivables portfolio management and interests in other entities |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

Copart 5 Participações S.A. (“Copart 5”) |

| Property investments |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

Telemar Norte Leste S.A. |

| Fixed—line telephony — Region I |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

TNL PCS S.A. (ii) |

| Mobile Telephony — Regions I and III |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

Paggo Empreendimentos S.A. |

| Payment and credit systems |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

Paggo Acquirer Gestão de Meios de Pagamentos Ltda. |

| Payment and credit systems |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

Paggo Administradora de Crédito Ltda. (“Paggo Administradora”) |

| Payment and credit systems |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

Oi Serviços Financeiros S.A. (“Oi Serviços Financeiros”) |

| Property investments |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

Copart 4 Participações S.A. (“Copart 4”) |

| Property investments |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

Telemar Internet Ltda. (“Oi Internet”) |

| Internet |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

Dommo Empreendimentos Imobiliários S.A. |

| Purchase and sale of real estate |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

SEREDE — Serviços de Rede S.A. |

| Network services |

| Brazil |

|

|

| 18.83 | % |

|

| 17.71 | % |

Pointer Networks S.A. (“Pointer”) |

| Wi-Fi internet |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

VEX Wifi Tec España S.L |

| Wi-Fi internet |

| Spain |

|

|

| 18.83 | % |

|

| 17.72 | % |

VEX Venezuela C.A |

| Wi-Fi internet |

| Venezuela |

|

|

| 18.83 | % |

|

| 17.72 | % |

VEX Wifi S.A. |

| Wi-Fi internet |

| Uruguay |

|

|

| 18.83 | % |

|

| 17.72 | % |

VEX Ukraine LLC |

| Wi-Fi internet |

| Ukraine |

|

|

| 16.95 | % |

|

| 15.94 | % |

VEX USA Inc |

| Wi-Fi internet |

| United States of America |

|

|

| 18.83 | % |

|

| 17.72 | % |

VEX Bolivia |

| Wi-Fi internet |

| Bolivia |

|

|

| 18.83 | % |

|

| 17.72 | % |

Pointer Networks S.A. — SUC Argentina |

| Wi-Fi internet |

| Argentina |

|

|

| 18.83 | % |

|

| 17.72 | % |

VEX Wifi Canada Ltd. |

| Wi-Fi internet |

| Canada |

|

|

| 18.83 | % |

|

| 17.72 | % |

VEX Chile Networks Serv Tec Ltda |

| Wi-Fi internet |

| Chile |

|

|

| 18.83 | % |

|

| 17.72 | % |

VEX Colombia Ltda |

| Wi-Fi internet |

| Colombia |

|

|

| 18.83 | % |

|

| 17.71 | % |

VEX Paraguay S.A. |

| Wi-Fi internet |

| Paraguay |

|

|

| 18.83 | % |

|

| 17.72 | % |

Pointer Peru S.A.C |

| Wi-Fi internet |

| Peru |

|

|

| 18.83 | % |

|

| 17.72 | % |

VEX Portugal S.A. |

| Wi-Fi internet |

| Portugal |

|

|

| 18.56 | % |

|

| 17.46 | % |

VEX Panamá S.A. |

| Wi-Fi internet |

| Panamá |

|

|

| 18.83 | % |

|

| 17.72 | % |

Oi Brasil Holdings Cooperatief UA (“Oi Holanda”) |

| Payment and credit systems |

| The Netherlands |

|

|

| 18.83 | % |

|

| 17.72 | % |

Circuito das Águas Telecom S.A. |

| Property investments |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

Caryopoceae Participações S.A. |

| Property investments |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

Bryophyta SP Participações S.A. |

| Property investments |

| Brazil |

|

|

| 18.83 | % |

|

| 17.72 | % |

(i) Companies sold in December 2013, as described in Note 1.

(ii) Company merged in February 2014, as described in Note 30.

The interest in joint ventures are measured using the equity method and are as follows:

|

|

|

|

|

| Direct |

| Indirect |

| Direct |

| Indirect |

|

Company |

| Business |

| Home country |

| 2013 |

| 2013 |

| 2012 |

| 2012 |

|

Companhia AIX de Participações (“AIX”) |

| Data traffic |

| Brazil |

|

|

| 9.42 | % |

|

| 8.86 | % |

Paggo Soluções e Meios de Pagamento S.A. (“Paggo Soluções”) |

| Financial company |

| Brazil |

|

|

| 9.42 | % |

|

| 8.86 | % |

Telemar Participações S.A. and Subsidiaries

Notes to the Financial Statements

for the Years Ended December 31, 2013 and 2012

(Amounts in thousands of Brazilian reais, unless otherwise stated)

Revision of Oi’s Bylaws

Oi’s Extraordinary Shareholders’ Meeting held on November 7, 2012 approved the amendment to its Bylaws to adapt them to the new rules of BM&F/BOVESPA’s Level 1 of Corporate Governance Listing Regulations to allow Oi to enter said corporate governance level.

Corporate Reorganizations in 2012

Corporate Reorganization of the Oi Group undertaken in February 2012

The shareholders of the Oi companies (Tele Norte Leste Participações S.A. (“TNL”), TMAR, Coari Participações S.A. (“Coari”) and Oi) approved at the shareholders’ meetings held on February 27 2012 the corporate reorganization that consisted of the partial split-off of TMAR with the merger of the split-off portion by Coari followed by the merger of TMAR shares by Coari and the mergers of Coari and TNL with and into Oi, the company that now concentrates all the shareholdings in Oi companies and is the only Oi company listed in a stock exchange, and whose corporate name was changed to Oi S.A. at the time of the same shareholders’ meetings.

As a result, 395,585,453 new common shares and 798,480,405 new preferred shares of Oi S.A. (former Brasil Telecom S.A.) were issued, and its subscribed, fully paid-in capital increased to R$6,816,468, represented by 599,008,629 common shares and 1,198,077,775 preferred shares, all registered and without par value.

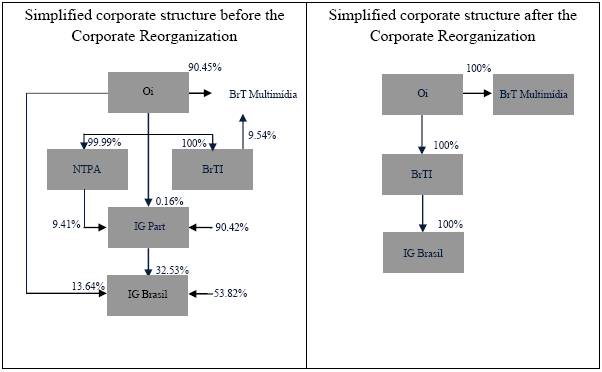

The simplified organization chart below shows the corporate structure before and after the corporate reorganization:

Telemar Participações S.A. and Subsidiaries

Notes to the Financial Statements

for the Years Ended December 31, 2013 and 2012

(Amounts in thousands of Brazilian reais, unless otherwise stated)

The purpose of the corporate reorganization was to definitely simplify the corporate structure and the corporate governance of the Oi companies, resulting in the creation of value for the shareholders by, but not limited to:

· simplify the corporate structure, which previously included three publicly-held companies with seven different classes of publicly traded shares, by consolidating our shareholder bases in one public company with two classes of shares that will be traded in Brazil and abroad;

· reduce operational, administrative and financial costs following the consolidation of the general management of the Oi companies, the simplification of their capital structure, and the improvement of their ability to attract investments and access the capital markets;

· align the interests of the shareholders of TNL, TMAR and Oi;

· enhance the liquidity of the shares issued by Oi; and

· eliminate the costs of separate listings of the shares of TNL, TMAR and Oi, as well as costs arising from separately complying with the public disclosure requirements applicable to TNL, TMAR and Oi.

Oi’s Extraordinary Shareholders’ Meeting (ESM) held on February 27, 2012 also approved the Oi redeemable bonus preferred shares proposal attributed exclusively to BrT shareholders prior to the merger, totaling R$1.5 billion. The base date of the bonuses payable to shareholders whose shares are traded on the BM&FBOVESPA and shareholders whose shares are traded on the NYSE was March 29, 2012 (deadline to exercise withdrawal rights). Accordingly, beginning March 30, 2012, these shares were traded ex-bonus on the stock exchange. On April 9, 2012, the redemption amount of the redeemable shares was paid proportionally to the each shareholder’s interest in share capital social and on the same date the reimbursement amount was paid to any withdrawing TNL and TMAR shareholders, which totaled R$2 billion. The amount of the redeemed shares above was deducted from the calculation of the approved share exchange ratios.

The table below shows the exchange ratios resulting from the mergers of TNL and Coari with and into Oi:

Original share/Replacement share |

| Exchange ratio |

|

TNLP3 / BRTO3 |

| 2.3122 |

|

TNLP4 / BRTO4 |

| 2.1428 |

|

TNLP4 / BRTO3 |

| 1.8581 |

|

TMAR3 / BRTO3 |

| 5.1149 |

|

TMAR5 and TMAR6 / BRTO4 |

| 4.4537 |

|

TMAR5 and TMAR6 / BRTO3 |

| 3.8620 |

|

The common and preferred shares of Oi S.A. started to be traded, under their new tick code OIBR3 and OIBR4, respectively, on April 9, 2012.

Telemar Participações S.A. and Subsidiaries

Notes to the Financial Statements

for the Years Ended December 31, 2013 and 2012

(Amounts in thousands of Brazilian reais, unless otherwise stated)

In addition to the relevant corporate approvals, the corporate reorganization was approved by the ANATEL on October 27, 2011. Additionally, the shares to be issued by Oi S.A. in this context were registered with the SEC, and we obtained the consent of Oi companies’ creditors to implement the corporate reorganization, where applicable.

The impacts of all stages of the corporate reorganization were prospectively accounted for based on the book net assets of each company. The resulting increase in Oi’s equity and its consolidated financial statements amounts to R$4,146,035. In this calculation, the equity of the Company, together with its subsidiary Valverde, increased by R$572,180.

The appreciation determined in the property, plant and equipment items and intangible assets, net of amortization as at February 27, 2012, is R$9,427,978. The Company recognized the appreciation proportionately to its equity interest in Oi, amounting to R$1,435,638.

Also as a result of the corporate reorganization, the company recorded share of the profits of TNL and TMAR for January and February, and its share of the profits of Oi for March, 2012. For consolidation and comparison purposes, the Company disclosed the consolidated information in profit or loss line items by adding the balances of TNL and TMAR line items for January and February and the balances of Oi line item for March, 2012.

Corporate Reorganization of the iG Group undertaken in October 2012

On October 24, 2012, Oi’s Board of Directors approved the corporate reorganization of the iG Group’s subsidiaries by undertaking the following steps: (i) BrT Internet (“BrTI”) capital increase, by the Company, amounting to R$51,828, paid in by transferring our stake in NTPA (99.99%), iG Participações (“iG Part”) (0.16%), and iG Brasil (13.64%); (ii) BrTI capital reduction, amounting to R$48,807, by transferring the investment held in BrT Multimídia to the Company, and (iii) mergers of iG Part with and into iG Brasil and NTPA with and into BrTI, at their carrying amounts, and as a result iG Brasil became a wholly-owned subsidiary of BrTI.

Telemar Participações S.A. and Subsidiaries

Notes to the Financial Statements

for the Years Ended December 31, 2013 and 2012

(Amounts in thousands of Brazilian reais, unless otherwise stated)

Other mergers undertaken in 2012

During October, November and December 2012, several mergers were undertaken involving Oi Group holdings and dormant companies to streamline the corporate structure. The equity of the merged companies was valued at their carrying amounts.

i. Merger of Vant with and into BrT Multimídia on October 30, 2012;

ii. merger of TNL.Net, TNL Trading, TNL Exchange, and JINT with and into BrTI on November 1, 2012;

iii. merger of Tomboa, Tete, and Carpi with and into TMAR on November 30, 2012;

iv. merger of Blackpool with and into Oi Internet on December 1, 2012; and

v. merger of TNCP (wholly-owned subsidiary) with and into TMAR on December 31, 2012.

2013 Corporate Reorganization

On January 31, 2013, as a sequence to the Corporate Reorganization, the Board of Directors authorized Oi to increase the capital of its wholly-owned subsidiary TMAR through the transfer of investments, other assets, and intercompany debentures.

The purpose of this reorganization is to streamline the corporate structure, reduce intragroup debt, and obtain operating synergy gains.

Telemar Participações S.A. and Subsidiaries

Notes to the Financial Statements

for the Years Ended December 31, 2013 and 2012

(Amounts in thousands of Brazilian reais, unless otherwise stated)

GlobeNet

As disclosed in the material fact notice published on July 15, 2013, Oi entered into an agreement with BTG Pactual YS Empreendimentos e Participações S.A. under which it agrees to transfer all its stake in subsidiary BrT CS, subject to certain, contractually provided for adjustments. BrT CS, wholly-owned subsidiary of the “GlobeNet” group, controls part of the Oi Group’s fixed telephony/data through the provision of integrated data services with fiber optics connection points in the United States, Bermuda, Venezuela, and Brazil. It is part of the scope of the underwater optical fiber cable system transfer transaction and the supply of capacity by GlobeNet to Oi and its subsidiaries.

This transaction was subject to the compliance of certain conditions precedent laid down in the agreement, including the necessary approval of the regulators and competition protection agencies in the different jurisdictions where GlobeNet operates, pursuant to the relevant legal terms and conditions.

As disclosed in the material fact notice published on December 23, 2013, Oi announced the completion of the transaction, where Oi transfers its entire equity interests in GlobeNet to BTG Pactual YS Empreendimentos e Participações S.A. The financial settlement of the transaction, amounting to R$1,779 million, was made in January 2014.

The gain on the sale of GlobeNet, amounting to R$1,497 million was recognized in other operating income, less related transaction costs.

2. SIGNIFICANT ACCOUNTING POLICIES

The accounting policies detailed below have been consistently applied in all fiscal years presented in these Consolidated financial statements, and have been consistently applied both by the Company and its subsidiaries.

(a) Reporting basis

The financial statements have been prepared based on the historic cost, except for certain financial instruments measured at their fair values, as described in the accounting policies in (b) below.

The preparation of financial statements requires the use of certain critical accounting estimates and the exercise of judgment by the Company’s management in the application of the Group’s accounting policies. Those areas that involve a higher degree of judgment or complexity or areas where assumptions and estimates are significant are disclosed in note (c) below.

Consolidated Financial Statements

The Company’s consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (IFRSs) issued by the International Accounting Standards Board (IASB).

Telemar Participações S.A. and Subsidiaries

Notes to the Financial Statements

for the Years Ended December 31, 2013 and 2012

(Amounts in thousands of Brazilian reais, unless otherwise stated)

(b) Adoption of new accounting policies

In presenting in the comparative financial statements for the year ended December 31, 2012 we made adjustments to retrospectively present the effects of adopting IAS 19 and IFRS 11, effective beginning January 1, 2013. In accordance with paragraph 40 of IAS 1, the Company is not presenting a third balance sheet, as at the beginning of the prior period because the retrospective application of these standards would not have a material impact on the balance sheet as at January 1, 2012.

The adjustments made to the presentation of the financial statements for the year ended December 31, 2012 as shown in the tables below:

|

| Balances |

| Actuarial |

| Joint |

| Adjusted balance |

|

Current assets |

| 21,531,180 |

|

|

| (6,817 | ) | 21,524,363 |

|

Cash and cash equivalents |

| 4,496,549 |

|

|

| (4,881 | ) | 4,491,668 |

|

Cash investments |

| 2,713,029 |

|

|

|

|

| 2,713,029 |

|

Derivative Instruments |

| 640,229 |

|

|

|

|

| 640,229 |

|

Accounts receivable |

| 7,018,497 |

|

|

| (964 | ) | 7,017,533 |

|

Inventories |

| 385,165 |

|

|

|

|

| 385,165 |

|

Current recoverable taxes |

| 1,741,589 |

|

|

| (54 | ) | 1,741,535 |

|

Other Taxes |

| 1,557,177 |

|

|

|

|

| 1,557,177 |

|

Judicial Deposits |

| 2,068,691 |

|

|

|

|

| 2,068,691 |

|

Dividends and interest on capital |

|

|

|

|

|

|

|

|

|

Pension plan assets |

| 9,311 |

|

|

|

|

| 9,311 |

|

Other assets |

| 900,943 |

|

|

| (918 | ) | 900,025 |

|

Non-current assets |

| 57,382,409 |

| 79,372 |

| 605 |

| 57,462,386 |

|

Cash investments |

| 63,692 |

|

|

|

|

| 63,692 |

|

Derivative Instruments |

| 348,870 |

|

|

|

|

| 348,870 |

|

Deferred taxes recoverable |

| 4,154,165 |

| 106,779 |

| (1,710 | ) | 4,259,234 |

|

Other Taxes |

| 738,019 |

|

|

|

|

| 738,019 |

|

Available-for-sale financial asset |

| 905,829 |

|

|

|

|

| 905,829 |

|

Judicial deposits |

| 9,722,731 |

|

|

| (206 | ) | 9,722,525 |

|

Pension plan assets |

| 101,115 |

| (27,407 | ) |

|

| 73,708 |

|

Held-for-sale assets |

| 112,852 |

|

|

|

|

| 112,852 |

|

Other assets |

| 318,499 |

|

|

| (47,798 | ) | 270,701 |

|

Investments |

| 80,758 |

|

|

| 98,882 |

| 179,640 |

|

Property, Plant and Equipment |

| 24,819,122 |

|

|

| (6,963 | ) | 24,812,159 |

|

Intangible Assets |

| 16,016,757 |

|

|

| (41,600 | ) | 15,975,157 |

|

Total assets |

| 78,913,589 |

| 79,372 |

| (6,212 | ) | 78,986,749 |

|

Telemar Participações S.A. and Subsidiaries

Notes to the Financial Statements

for the Years Ended December 31, 2013 and 2012

(Amounts in thousands of Brazilian reais, unless otherwise stated)

Current liabilities |

| 17,645,851 |

| — |

| (3,317 | ) | 17,642,534 |

|

Payroll, related taxes and benefits |

| 774,792 |

|

|

| (1,031 | ) | 773,761 |

|

Trade Payables |

| 4,659,158 |

|

|

| (914 | ) | 4,658,244 |

|

Borrowings and Financing |

| 3,740,904 |

|

|

|

|

| 3,740,904 |

|

Derivative Instruments |

| 309,555 |

|

|

|

|

| 309,555 |

|

Current taxes payable |

| 1,065,772 |

|

|

|

|

| 1,065,772 |

|

Other Taxes |

| 2,248,314 |

|

|

| (233 | ) | 2,248,081 |

|

Dividends and interest on capital |

| 576,253 |

|

|

|

|

| 576,253 |

|

Licenses and Concessions Payable |

| 1,058,881 |

|

|

|

|

| 1,058,881 |

|

Tax Refinancing Program |

| 99,732 |

|

|

|

|

| 99,732 |

|

Provisions |

| 1,569,356 |

|

|

|

|

| 1,569,356 |

|

Provisions for pension funds |

| 103,666 |

|

|

|

|

| 103,666 |

|

Other Payables |

| 1,439,468 |

|

|

| (1,139 | ) | 1,438,329 |

|

Non-current liabilities |

| 43,820,856 |

| 286,649 |

| (2,895 | ) | 44,104,610 |

|

Borrowings and Financing |

| 33,139,662 |

|

|

|

|

| 33,139,662 |

|

Derivative Instruments |

| 204,742 |

|

|

|

|

| 204,742 |

|

Deferred taxes |

| 233,849 |

|

|

|

|

| 233,849 |

|

Other Taxes |

| 2,238,571 |

|

|

|

|

| 2,238,571 |

|

Licenses and Concessions Payable |

| 1,099,116 |

|

|

|

|

| 1,099,116 |

|

Tax Refinancing Program |

| 985,367 |

|

|

|

|

| 985,367 |

|

Provisions |

| 4,867,169 |

|

|

| (992 | ) | 4,866,177 |

|

Provisions for pension funds |

| 480,472 |

| 286,649 |

|

|

| 767,121 |

|

Other Payables |

| 571,908 |

|

|

| (1,903 | ) | 570,005 |

|

Equity |

| 1,157,080 |

| (36,721 | ) |

|

| 1,120,359 |

|

Equity attributable to owners of the Company |

| 1,157,080 |

| (36,721 | ) |

|

| 1,120,359 |

|

Issued capital |

| 1,921,141 |

|

|

|

|

| 1,921,141 |

|

Capital reserves |

| 638,569 |

|

|

|

|

| 638,569 |

|

Income reserves |

| 137,291 |

|

|

|

|

| 137,291 |

|

Premium on capital transactions and changes in equity interest percentages |

| (289,396 | ) |

|

|

|

| (289,396 | ) |

Other comprehensive income |

| 24,835 |

| (36,721 | ) |

|

| (11,886 | ) |

Valuation adjustment to equity |

| (366,305 | ) |

|

|

|

| (366,305 | ) |

Redeemable preferred shares |

| (909,055 | ) |

|

|

|

| (909,055 | ) |

Non-controlling interests |

| 16,289,802 |

| (170,556 | ) |

|

| 16,119,246 |

|

Total liabilities and equity |

| 78,913,589 |

| 79,372 |

| (6,212 | ) | 78,986,749 |

|

Reconciliation of equity at December 31, 2012:

Equity originally presented |

| 1,157,080 |

|

Non-controlling interests originally presented |

| 16,289,802 |

|

Equity |

| 17,446,882 |

|

Adjustments: |

|

|

|

Actuarial gains and (losses) in subsidiaries (i) |

| (207,277 | ) |

|

| 17,239,605 |

|

Attributable to: |

|

|

|

Controlling shareholder |

| 1,120,359 |

|

Non-controlling interests |

| 16,119,246 |

|

Adjusted equity |

| 17,239,605 |

|

Reconciliation of net income for the period ended December 31, 2012:

|

| Balances originally |

| Joint |

| Adjusted balance |

|

|

|

|

|

|

|

|

|

Revenue from sales and/or services |

| 28,141,599 |

| (9,927 | ) | 28,131,672 |

|

Cost of sales and services |

| (15,891,222 | ) | 2,954 |

| (15,888,268 | ) |

Gross profit |

| 12,250,377 |

| (6,973 | ) | 12,243,404 |

|

Operating income/expenses |

| (9,182,934 | ) | 6,020 |

| (9,176,914 | ) |

Selling expenses |

| (5,425,600 | ) | 7,884 |

| (5,417,716 | ) |

General and administrative expenses |

| (3,381,624 | ) | 6,276 |

| (3,375,348 | ) |

Other operating income |

| 2,189,734 |

| (15,571 | ) | 2,174,163 |

|

Other operating expenses |

| (2,565,444 | ) | 7,431 |

| (2,558,013 | ) |

Income before financial income/expenses and taxes |

| 3,067,443 |

| (953 | ) | 3,066,490 |

|

Financial Income (Expenses) |

| (2,888,405 | ) | (277 | ) | (2,888,682 | ) |

Financial income |

| 2,365,725 |

| (307 | ) | 2,365,418 |

|

Financial expenses |

| (5,254,130 | ) | 30 |

| (5,254,100 | ) |

Income/loss before taxes on income |

| 179,038 |

| (1,230 | ) | 177,808 |

|

Income tax and social contribution |

| (66,649 | ) | 1,230 |

| (65,419 | ) |

Current |

| (1,053,475 | ) | 1,560 |

| (1,051,915 | ) |

Deferred |

| 986,826 |

| (330 | ) | 986,496 |

|

Profit from continuing operations |

| 112,389 |

|

|

| 112,389 |

|

Consolidated profit for the year |

|

|

|

|

|

|

|

Attributable to Company owners |

| (297,452 | ) |

|

| (297,452 | ) |

Attributable to non-controlling interests |

| 409,841 |

|

|

| 409,841 |

|