Exhibit 1

OI S.A.

Corporate Taxpayers’ Registry

(CNPJ/MF) No. 76.535.764/0001-43

Board of Trade (NIRE) No. 33.30029520-8 Publicly-Held Company | Telemar Participações S.A.

Corporate Taxpayers’ Registry

(CNPJ/MF) No. 02.107.946/0001-87

Board of Trade (NIRE) No.3.33.0016601-7 Publicly-Held Company |

MATERIAL FACT

Oi S.A.(“Oi” or the “Company”, Bovespa: OIBR3, OIBR4; NYSE: OIBR and OIBR.C) and Telemar Participações S.A.(“CorpCo”), in accordance with article 157, paragraph 4 of Law No. 6,404/76 (the “Brazilian Corporations Law”) and CVM Instruction No. 358/02, notifies their shareholders and the market in general of the previously informed transaction of the combination, in one entity, of the activities and business operations of Oi in Brazil and Portugal Telecom, SGPS, S.A. (“Portugal Telecom”) in Portugal and Africa, consolidating the industrial alliance between Oi and Portugal Telecom, initiated in 2010 and developed since that time, and combining the shareholder bases of Oi, Portugal Telecom and CorpCo (the “Transaction”).

On February 19, 2014, several definitive agreements have been entered into (“Definitive Documents”) that describe the necessary phases for completing the Transaction. Such documents provide that Telemar Participações S.A. will be the entity that, after all phases of the Transaction have been approved, will consolidate the shareholder bases of the companies involved in the Transaction.

The following assumptions guide the Transaction:

| (i) | the formation of a single large multinational company based in Brazil; |

| (ii) | the continuity of operations under the trademarks of Oi and Portugal Telecom in their respective regions of operation, subject to unified control and management by CorpCo; |

| (iii) | the consolidation of the Industrial Alliance, enabling the maximization of synergies, reduction of operational risks, optimization of efficient investments and ensuring best practices; |

| (iv) | the strengthening of the capital structure of the integrated companies, facilitating their access to capital and financial resources; |

| (v) | the consolidation of the shareholder bases of CorpCo, Oi and Portugal Telecom solely in common shares traded on the Novo Mercado segment of the BM&FBOVESPA, the NYSE Euronext Lisbon and the NYSE; |

1

| (vi) | the diffusion of CorpCo‘s shareholder base, which, after the implementation of the Transactions, will have no shareholder or group of shareholders holding a majority of the capital; |

| (vii) | the adoption of best corporate governance practices of the “Novo Mercado” segment of the BM&FBOVESPA; and |

| (viii) | the promotion of greater liquidity of the shares traded in these markets. |

Creation of a telecommunications multinational leader

The combination of Oi and Portugal Telecom will create a multinational telecom operator with operations covering a total population of 260 million people and more than 100 million clients. The combination of the groups will aim to achieve significant economies of scale, maximize operational synergies and add value for their shareholders, customers and employees.

Commitment to highest corporate governance standards

The Transaction will be executed in order to consolidate the industrial alliance established in 2010 between Oi and Portugal Telecom. As part of the Transaction, CorpCo will apply to be listed on the “Novo Mercado” segment of the BM&FBOVESPA and will implement of the highest corporate governance practices with one type and class of shares, with equal voting and dividend rights for all shareholders.

Unified management team led by Zeinal Bava

Zeinal Bava, CEO of Portugal Telecom from 2008 to 2013 and the current CEO of Oi as well as CEO of PT Portugal, will head CorpCo and its subsidiaries as its CEO.

Agility in taking advantages of growth opportunities in Brazil

The Transaction will allow CorpCo to leverage Oi’s unique footprint in Brazil and Portugal Telecom’s experience in the Portuguese market, thus allowing it to crystalize the growth opportunities in convergence and mobility in Brazil.

Commitment to financial discipline and value creation

CorpCo will place a strong focus on excellence in integration and operational practices. A clear plan for action has been identified to integrate areas of potential efficiency. This includes identified teams in place to capture synergies and address existing operational challenges.

2

After the last stage of the Transaction, it may generate operational and financial synergies estimated to have a net present value of approximately R$5.5 billion.

CorpCo is committed to its financial discipline to improve the flexibility of its balance sheet in order to reduce financial risk and to allow future investments in growth areas.

Stages of the Transaction

The approved Transaction will consist of the following stages:

| 1. | Transfer of shares held by AG and LF |

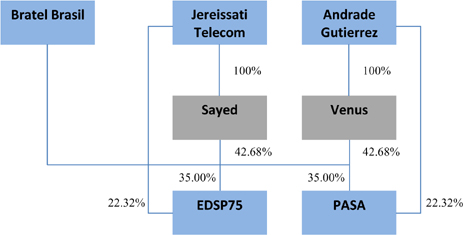

Initially, there will be transfers by Andrade Gutierrez S.A. (“AG”) of shares of PASA Participações S.A. (“PASA”) that it holds to Venus RJ Participações S.A. (“Venus”), and by Jereissati Telecom S.A. (“Jereissati Telecom”) of shares of EDSP75 Participações S.A. (“EDSP75”) that it holds to Sayed RJ Participações S.A. (“Sayed”). As a result, AG, Bratel Brasil S.A., a subsidiary of Portugal Telecom (“Bratel Brasil”) and Venus will be PASA’s shareholders and Jereissati Telecom, Bratel Brasil and Sayed will be EDSP75’s shareholders. The corporate structure chart below sets for the configuration of these companies after these share transfers occur.

| 2. | Issuance of Convertible Debentures |

Venus, PASA, AG Telecom Participações S.A. (“AG Telecom”), Jereissati Telecom, EDSP75, LF Tel S.A. (“LF”) and CorpCo will each issue debentures convertible into common and/or preferred shares, as the case may be, in order to provide the cash proceeds necessary to equalize the indebtedness between these companies and/or their subsidiaries. Venus and Sayed will each issue debentures convertible into shares that will be subscribed to and paid for by PTB2 S.A. (“PTB2”), a subsidiary of Portugal

3

Telecom, in the amount of R$938.5 million each. Following this, PASA and EDSP75 will each issue debentures convertible into shares that will be subscribed to and paid for by Bratel Brasil, Venus and Sayed in the amount of R$2,394 million. Immediately thereafter, LF and AG Telecom will each issue debentures convertible into shares that will be subscribed to and paid for by EDSP75 and PASA in the amount of R$2,394 million. Finally, CorpCo will issue debentures convertible into shares that will be subscribed to and paid for by LF and AG Telecom in the amount of R$3,428 million.

| 3. | Oi’s Capital Increase |

On February 19, 2014, the Company’s Board of Directors has approved the request to register with the Brazilian securities regulator (Comissão de Valores Mobiliários, the “CVM”) an initial public offering of the Company’s common and preferred shares, including shares in the form of American Depositary Shares, represented by American Depositary Receipts, to be simultaneously carried out in Brasil and abroad (“Public Offering” and “Oi’s Capital Increase”, respectively). The protocol for this registration with the CVM was also completed on February 19, 2014.

Oi’s Capital Increase will be within its authorized capital limit, in conformity with the proposed bylaw amendment to be decided on at the Company’s extraordinary general shareholders’ meeting scheduled to occur on March 27, 2014. Oi’s Capital Increase will not confer the right of first refusal to its current shareholders; however, Oi’s current shareholders will have priority with respect to the priority offering.

Portugal Telecom has undertaken to subscribe to a portion of Oi’s Capital Increase to be paid in with assets, in order to contribute to Oi, with respect to the priority offer, shares in the companies that hold the entirety of (i) Portugal Telecom’s operational assets, except direct and indirect interests held in Oi, Contax Participações S.A. and Bratel, BV and (ii) Portugal Telecom’s liabilities as of the date of contribution considered in the valuation report (the “PT Assets”). Portugal Telecom’s undertaking to subscribe to a portion of Oi’s Capital Increase is subject to conditions precedent, including approval by Portugal Telecom’s general shareholders’ meeting and subscription in cash for no less than R$7,000,000,000 (seven billionreais) in Oi’s Capital Increase.

The PT Assets were independently valued by Banco Santander (Brasil) S.A. and the respective valuation report (“Valuation Report”), which will also be submitted to the Company’s shareholders for approval at the Company’s extraordinary general shareholders’ meeting scheduled to occur on March 27, 2014, will be available on the Company’s investor relations website and the IPE system of the CVM (both referenced at the end of this Material Fact) on February 21, 2014, the date on which the call notice to the referred to general shareholders’ meeting will be published. According Santander’s valuation report, the PT Assets were valued at an amount between €1,636.3 million and €1,808.5 million; such amounts will be converted into Brazilianreaison

4

February 21, 2014. At this extraordinary general shareholders’ meeting and in accordance with the Brazilian Corporations Law, Portugal Telecom and its subsidiary Bratel Brasil will not cast votes on matters concerning the valuation report of the PT Assets. The valuation of the PT Assets, for purposes of the payment for shares issued by Oi in Oi’s Capital Increase, has been established as €1,750.0 million, which is within the range indicated by the Valuation Report and meets the amount of €1,900 million required by the Memorandum of Understanding entered into on October 1, 2013, taking into account the dividend to be paid by Portugal Telecom before the conclusion of this Transaction and other costs related to it as set forth in the Memorandum of Understanding. These amounts were already taken into consideration in the Valuation Report.

An investment vehicle managed by Banco BTG Pactual S.A. (“FIA” and “BTG Pactual”) has undertaken to subscribe to common and/or preferred shares issued by Oi in an amount equivalent to the difference between R$2.0 billion and value corresponding to the subscription orders that are placed in the offering by CorpCo’s shareholders, excluding Bratel Brasil. FIA’s undertaking to subscribe to Oi’s shares is subject to conditions precedent, including the necessary corporate approvals from the Company and Portugal Telecom.

The total value of the Oi Capital Increase is estimated to be approximately R$14.1 billion.

The Public Offering will be carried out by a firm commitment (“Firm Commitment”) to be granted by the Underwriters to the Company and exercisable on the date of conclusion of the bookbuilding process at a subscription price per common share and/or preferred share to be proposed by the Underwriters to the Company on such date, taking into consideration market conditions and price per share posted during the bookbuilding and also as mutually agreed by the Underwriters and the Company in accordance with market standards normally accepted by CVM and the SEC in this type of transaction. No Firm Commitment will be granted with respect to (i) the portion of the Public Offering to be paid in with PT Assets by Portugal Telecom and (ii) the portion of the Public Offering equivalent to the investment intention in the approximate amount of R$2 billion to be made by Corpco’s current shareholders and by an investment vehicle managed by BTG Pactual.

| 4. | Settlement of the Convertible Debentures and Separation of the CTX/Contax Assets |

After settlement of the Oi Capital Increase, the convertible debentures issued by Venus, PASA, AG, Sayed, ESP75 and LF (the “Holdings Debenture”) and the convertible debentures issued by CorpCo (the “CorpCo Debentures”) will be paid for by Portugal Telecom and by the Holdings. Then AG, LF, PASA and EDSP75 will engage in split-off transactions in order to separate the interests they directly and indirectly hold in

5

CTX Participações S.A. (“CTX”) and Contax Participações S.A. (“Contax”) from interests directly and indirectly held in CorpCo and Oi. After completing these split-offs, Bratel Brasil, on the one hand, and AG and Jereissati Telecom, on the other, will exchange shares they hold in PASA Contact Center Participações S.A. and Detmold RJ Participações S.A. (which will receive, respectively, the split-off assets of PASA and EDSP75) for shares issued by PASA and EDSP75, respectively.

As a result of the split-offs and share exchanges described above, Bratel Brasil, as well as AG, LF, PASA and EDSP75 will only hold direct and indirect interests in CorpCo and Oi.

| 5. | Conversion of Debenture Holdings |

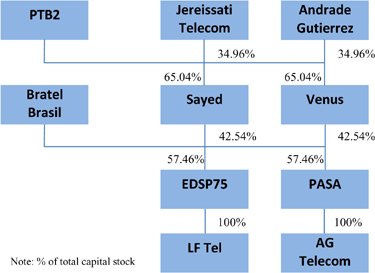

Soon after the slit-off and share exchanges, the Holdings Debentures will be converted into common and preferred shares in Venus, PASA, AG, Sayed, EDSP75 and LF. The corporate structure chart below presents the configuration of such companies after the conversion of the Holdings Debentures:

6

| 6. | Conversion of the CorpCo Debentures and the Corporate Reorganization of the Intermediary Companies that Control CorpCo and Oi |

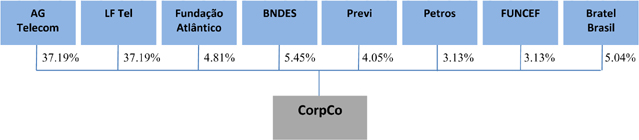

On the date of the shareholders’ meetings that will decide on the Intermediary Company Reorganization (as defined below) and the merger of shares of Oi and CorpCo (which are expected to occur approximately 60 days after the settlement of the Oi Capital Increase), the CorpCo Debentures will be converted into common shares issued by CorpCo, subject to the approval of such Intermediary Company Reorganization and the merger of shares of Oi and CorpCo, which will result in the following distribution of capital among its shareholders.

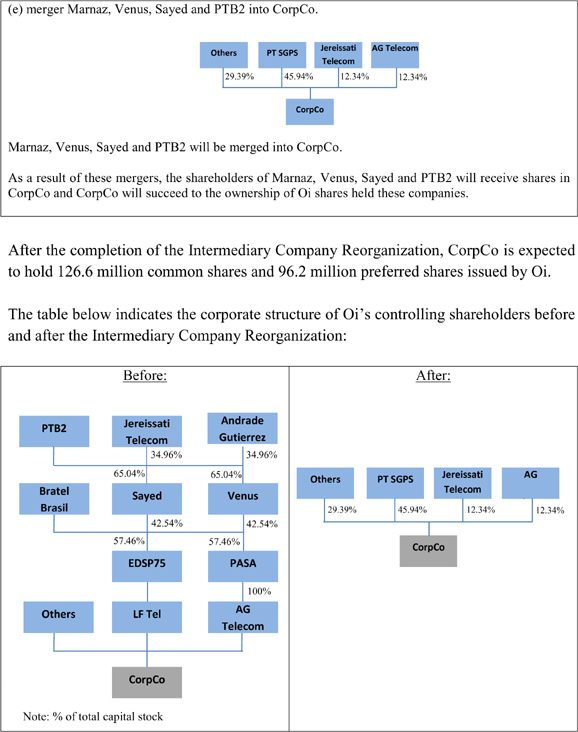

Immediately after the converting the Convertible Debentures, CorpCo’s and Oi’s controlling shareholders will carry out corporate reorganizations in order to simplify their organizational structure (the “Intermediary Company Reorganization”). The transactions that will be carried out within the scope of the Intermediary Company Reorganization will be done without diluting the interests of the other shareholders that hold interests in the companies involved, given that the established exchange ratiossolely take into account the direct and indirect interests between them and in Oi’s share capital, observing the premise that these companies will not have, with the possible exception of goodwill recorded in relation to their investments, relevant assets or liabilities (or they will have sufficient cash and cash equivalents to fully repay such liabilities). Any goodwill, or other assets, recorded by the companies whose structure will be simplified may be transferred to Oi or to CorpCo, as the case may be, for the benefit of their shareholders, and these amounts will not be considered when establishing exchange ratios.

7

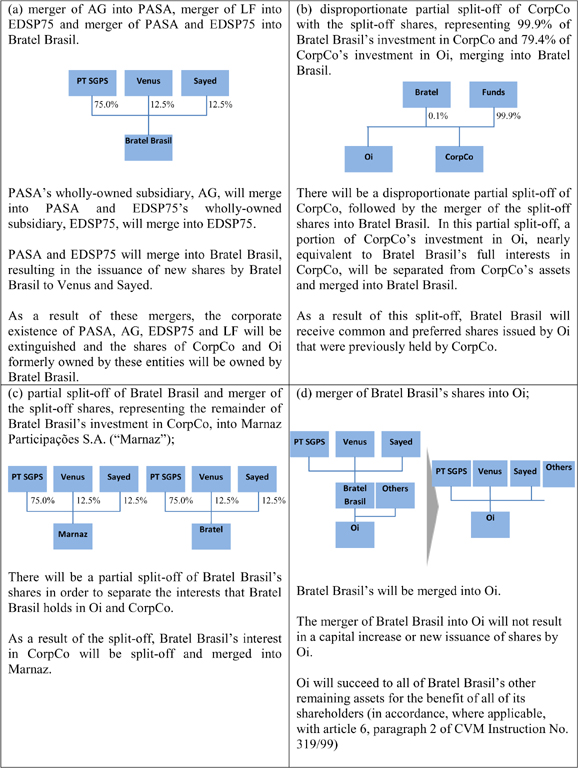

The Intermediary Company Reorganization is expected to include the following transactions, which will be approved on the same date and will occur in the order in which they are described below:

8

9

| 7. | Merger of Oi’s Shares into Corp Co |

On the same day that the transactions comprising the Intermediary Company Reorganization are approved, general meetings of the shareholders of Oi and CorpCo will be held to deliberate on the merger of Oi’s shares into CorpCo, in order for Oi to become a wholly-owned subsidiary of CorpCo (the “Merger of Oi’s Shares”).

As a result of the Merger of Oi’s Shares, each common share issued by Oi will be replaced by one new common share issued by CorpCo and each preferred shares issued by Oi will be replaced by 0.9211new common share issued by CorpCo.

The exchange ratios were established based on the market quotations of Oi’s shares during the 30-day period prior to the announcement of the material fact disclosing the Transaction, assuming that CorpCo will not have relevant assets or liabilities (or it will have sufficient cash and cash equivalents to fully repay its liabilities), and the capital of CorpCo will reflect the number of shares issued by Oi and held directly or indirectly by CorpCo immediately before the Merger of Oi’s Shares.

In accordance with article 137, item II of the Brazilian Corporations Law, Oi’s shareholders will not have withdrawal rights with respect to the Merger of Oi’s Shares.

With respect to the decision to approve the Merger of Oi’s Shares, CorpCo’s dissenting shareholders will have the right to withdraw from the company, subject to the provisions of article 137 of the Brazilian Corporations Law, in exchange for the book value per share. However, it is not expected that such shareholders will exercise their right of withdrawal.

| 8. | Merger of Portugal Telecom into CorpCo |

The same shareholders’ meeting that will deliberate on the Merger of Oi’s Shares into CorpCo, will deliberate on the merger of Portugal Telecom into CorpCo, with CorpCo as the surviving entity (the “Portugal Telecom Merger”).

At the time of the Portugal Telecom Merger, aside from shares issued by CorpCo, Portugal Telecom will not have any relevant assets or liabilities (or it will have sufficient cash and cash equivalents to fully repay its liabilities). In the Portugal Telecom Merger, Portugal Telecom shareholders will receive an aggregate number of common shares issued by CorpCo equal to the number of common shares issued by CorpCo and held by Portugal Telecom immediately prior to the Portugal Telecom Merger.

10

CorpCo’s inclusion in the Novo Mercado and Management

In connection with the implementation of the actions required to carry out the Transaction, measures for the inclusion of CorpCo in theNovo Mercado listing segment of BM&FBovespa (the “Novo Mercado”) will be taken, subject to the approval of the Merger of Oi’s Shares.

Among these measures, a general meeting of CorpCo’s shareholders will be held to decide on the reform of its Bylaws, in order to:

| (i) | approve the selection of the company’s new corporate name; |

| (ii) | conform to the rules of the Novo Mercado Listing Regulations, as well as to approve the listing of CorpCo’s shares on the Novo Mercado; and |

| (iii) | approve the split of shares that will adjust the number of CorpCo’s shares in a manner that immediately before the Merger of Oi’s Shares the ratio between Oi’s outstanding common shares and CorpCo’s outstanding common shares will be 1:1. |

At the same meeting of CorpCo’s shareholders that decides on inclusion of CorpCo in theNovo Mercado, new members of its Board of Directors, Executive Board and the Fiscal Council will be elected, which will also be conditioned on approval of the Merger of Oi’s Shares. The elected members of CorpCo’s Board of Directors will have a 3-year term of office from the date of their election or until the general shareholders’ meeting deciding on the approval of CorpCo’s financial statements the year ended December 31, 2016, whichever occurs first.

Other Information about the Transaction

The conclusion of the stages of the Transaction described above is subject to the implementation of some conditions, including its approval by the competent corporate bodies of each entity involved in the Transaction, the obtainment of legal and regulatory authorizations, consent from creditors and third parties as well as the final and valid consummation of Oi’s Capital Increase.

The public offering of shares connected with Oi’s Capital Increase is subject to due registration with the CVM. Considering that the shares of Oi and Portugal Telecom are registered with the U.S. Securities and Exchange Commission (the “SEC”), the issuance of shares in connection with Oi’s Capital Increase and the issuance of CorpCo’s shares to the shareholders of Oi in connection with the Merger of Oi’s Shares and to the shareholders of Portugal Telecom in connection with Portugal Telecom Merger will be subject to registration with the SEC under the U.S. Securities Act of 1933, and may be subject to registration in other jurisdictions. This press release does not constitute an offer to sell or solicitation of an offer to buy any securities or a solicitation of any vote

11

or approval in any jurisdiction in which the disclosure of an offering document or such offer, solicitation or sale would be unlawful prior to registration or outside of the framework of securities law in such jurisdiction.

The information required by CVM Instruction No. 319/99, as applicable, will be disclosed in the form of a Material Fact when the call notices to the general shareholders’ meetings of Oi and CorpCo that will decide on the mergers comprising the Transaction.

Also on February 19, 2014, amendments to the Shareholders’ Agreements of AG, LF and CorpCo, executed or amended on January 25, 2011 were signed, establishing the commitment of the shareholders of CorpCo

to exercise their voting rights in CorpCo, and also for their representatives on the Boards of Directors of Oi and CorpCo to exercise their rights to vote, in order to approve the Transaction. In addition, Portugal Telecom, FIA, Bratel Brazil, CorpCo, AG and Jereissati entered into a Provisional Voting Commitment agreement, undertaking as shareholders of Oi to take all the required actions for the effective completion of the mergers of Bratel Brazil, Sayed, Venus and PTB2 into Oi and the merger of Oi’s shares into CorpCo.

In addition, as part of the business combination of Oi and Portugal Telecom and conditioned on the PT Assets being contributed to Oi’s capital, Oi has agreed to provide guarantees for certain indebtedness of Portugal Telecom and its subsidiaries that will be assumed by Oi at the time that it acquires the PT Assets.

The table below sets forth a timetable for the estimated dates on which certain stages of Oi’s Capital Increase will be implemented. Oi and CorpCo cannot guarantee that the events listed below will occur on their respective estimated dates:

Event | Estimated | |

| First filing with the CVM | Feb. 19, 2014 | |

| General Meeting of Portugal Telecom’s Shareholders to approve Portugal Telecom’s participation in Oi’s Capital Increase by contributing the PT Assets | March 27, 2014 | |

| General Meeting of Oi’s shareholders to approve the valuation report of the PT Assets and increase the authorized capital stock of Oi | March 27, 2014 | |

| Pricing of Oi’ Capital Increase | April 16, 2014 | |

| Closing of Oi’ Capital Increase | April 23, 2014 | |

* * * * *

12

Oi and CorpCo will keep their shareholders and the market in general informed of any subsequent material events related to the Transaction.

Rio de Janeiro, February 20, 2014.

OI S.A.

Bayard De Paoli Gontijo

Investor Relations Officer

Telemar Participações S.A.

Pedro Jereissati

Investor Relations Officer

Additional Information and Where to Find It:

This communication is not an offering document and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval in any jurisdiction in which distribution of an offering document or such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of that jurisdiction.

This communication may contain information related to (1) the proposed capital increase and related public offering of common shares and preferred shares by Oi, (2) the proposed merger of shares (incorporação de ações) between TmarPart and Oi, and (3) the proposed merger (incorporação) of Portugal Telecom with and into TmarPart.

Oi may file a registration statement (including a prospectus) with the U.S. Securities and Exchange Commission (the “SEC”) for the offering of its common shares and preferred shares to be issued in connection with its proposed capital increase. Before you invest, you should read the prospectus in that registration statement and other documents Oi has filed with the SEC for more complete information about Oi and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, Oi will arrange to send you the prospectus after filing if you request it by calling toll-free 1-855-672-2332.

In connection with the proposed merger of shares between TmarPart and Oi and the proposed merger of Portugal Telecom with and into TmarPart, TmarPart or one of its affiliates plans to file with the SEC (1) one or more registration statements on Form F-4, containing a prospectus or prospectuses which will be mailed to shareholders of Oi

13

and/or Portugal Telecom, as applicable (other than non-U.S. persons as defined in applicable rules of the SEC), and (2) other documents regarding this proposed merger.

We urge investors and security holders to carefully read the relevant prospectuses and other relevant materials when they become available as they will contain important information about the proposed capital increase, proposed merger of shares and proposed merger.

Investors and security holders will be able to obtain the documents filed with the SEC regarding the proposed mergers, when available, free of charge on the Commission’s website at www.sec.gov or from TmarPart or Oi.

Special Note Regarding Forward-Looking Statements:

This communication contains certain forward-looking statements. Statements that are not historical facts, including statements about our beliefs and expectations, business strategies, future synergies and cost savings, future costs and future liquidity are forward-looking statements. The words “will,” “may,” “should,” “could,” “anticipates,” “intends,” “believes,” “estimates,” “expects,” “plans,” “targets,” “goal” and similar expressions, as they relate to TmarPart, Oi or Portugal Telecom, are intended to identify forward-looking statements and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, tendencies or expected results will actually occur. Such statements reflect the current views of management of Oi and are subject to a number of risks and uncertainties. These statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, corporate approvals, operational factors and other factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations. All forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements set forth in this paragraph. Undue reliance should not be placed on such statements. Forward-looking statements speak only as of the date they are made. Except as required under the U.S. federal securities laws and the rules and regulations of the SEC or of regulatory authorities in other applicable jurisdictions, we do not have any intention or obligation to update or to publicly announce the results of any revisions to any of the forward-looking statements to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. You are advised, however, to consult any further disclosures TmarPart, Oi or Portugal Telecom make on related subjects in reports and communications TmarPart, Oi or Portugal Telecom file with the SEC.

14