SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

ENCORE MEDICAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Notes:

encore medical corporation

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 13, 2003

To our Stockholders:

The 2003 annual meeting of stockholders of Encore Medical Corporation (the “Company”) will be held at The University Club, One West 54th Street, New York, New York, on Tuesday, May 13, 2003, beginning at 10:00 a.m. local time. At the meeting, stockholders will act on the following matters:

| | (1) | | Election of one director by the holders of Common Stock, for a term of three years and the election of two directors by the holders of Series A Preferred Stock, each for a term of one year; and |

| | (2) | | Any other matters that properly come before the meeting. |

Stockholders of record at the close of business on April 1, 2003 are entitled to vote at the meeting or any postponement or adjournment.

By order of the Board of Directors, |

|

|

Harry L. Zimmerman Corporate Secretary |

April 2, 2003

Austin, Texas

encore medical corporation

9800 Metric Blvd.

Austin, Texas 78758

PROXY STATEMENT

This proxy statement contains information related to the annual meeting of stockholders of Encore Medical Corporation (the “Company”, “Encore” or “we”) to be held at The University Club, One West 54th Street, New York, New York, on Tuesday, May 13, 2003, beginning at 10:00 a.m. local time, and at any postponements or adjournments thereof.

ABOUT THE MEETING

What is the purpose of the annual meeting?

At the Company’s annual meeting, stockholders will act upon the matters outlined in the accompanying notice of meeting, including the election of one director (the “Common Director”) by the holders of common stock of the Company, par value $.001 per share (the “Common Stock”), and the election of two directors (the “Series A Preferred Directors”) by the holders of Series A Preferred Stock of the Company, par value $.001 per share (the “Series A Preferred Stock”). In addition, the Company’s management will report on the performance of the Company during 2002 and respond to questions from stockholders.

Who is entitled to vote?

Only holders of record of Common Stock and Series A Preferred Stock at the close of business on the record date, April 1, 2003, are entitled to receive notice of the annual meeting and to vote the shares of Common Stock or Series A Preferred Stock that they held on that date at the meeting, or any postponement or adjournment of the meeting. Each outstanding share of Common Stock entitles its holder to cast one vote on each matter to be voted upon other than the election of the Series A Preferred Directors. Each outstanding share of Series A Preferred Stock entitles its holder to cast 100 votes on each matter to be voted upon, other than the election of the Common Director. Except as noted above, the holders of Common Stock and Series A Preferred Stock will vote on all matters as a single class.

Who can attend the meeting?

All holders of Common Stock and Series A Preferred Stock as of the record date, or their duly appointed proxies, may attend the meeting.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of shares of capital stock outstanding on the record date with a majority of the voting power for a matter will constitute a quorum, permitting the meeting to conduct its business. As of the record date, 11,174,971 shares of Common Stock were outstanding and 131,603 shares of Series A Preferred Stock were outstanding. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting.

How do I vote?

If you complete and properly sign the accompanying proxy card and return it to the Company, it will be voted as you direct. If you attend the meeting, you may deliver your completed proxy card in person.

Can I vote by telephone or electronically?

No.

Can I change my vote after I return my proxy card?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised by filing with the Secretary of the Company either a notice of revocation or a duly executed proxy bearing a later date. The powers of the proxy holders will be suspended if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

How do I vote my 401(k) shares?

If you participate in the Encore Medical Corporation 401(k) Plan, you may vote shares of Common Stock equivalent to the value of the interest credited to your account by instructing Wells Fargo Bank, N.A., the trustee of the plan, pursuant to the instruction card being mailed with this proxy statement to plan participants. The trustee will vote your shares in accordance with your duly executed instructions received by May 8, 2003. If you do not send instructions, the share equivalents credited to your account will be voted by the trustee in the same proportion that it votes share equivalents for which it did receive timely instructions.

You may also revoke previously given voting instructions by May 8, 2003, by filing with the trustee either a written notice of revocation or a properly completed and signed voting instruction card bearing a later date.

What are the Board’s recommendations?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors of the Company (the “Board”). The Board’s recommendation is set forth together with the description of each item in this proxy statement. In summary, the Board recommends a vote:

| | • | | For election of the nominated slate of directors (see page 5); |

What vote is required to approve each item?

| | • | | Election of Directors. The affirmative vote of a plurality of the votes cast at the meeting that are entitled to elect each director is required for the election of both the Common Director and the Series A Preferred Directors. A properly executed proxy marked “WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. |

| | • | | Other Items. For each other item, the affirmative vote of the holders of shares of capital stock with a majority of the voting power represented in person or by proxy and entitled to vote on the item will be required for approval. A properly executed proxy marked “ABSTAIN” with respect to any such matter will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote. |

If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. Thus, if you do not give your broker or nominee specific instructions, your shares may not be voted on those matters and will not be counted in determining the number of shares necessary for approval. Shares represented by such “broker non-votes” will, however, be counted in determining whether there is a quorum.

2

STOCK OWNERSHIP

Who are the largest owners of the Company’s stock?

The Company knows of only seven (7) persons (or entities) that are, as of March 14, 2003, the beneficial owners of more than five percent of the Common Stock or Series A Preferred Stock. They are:

Name and Address of Beneficial Owner

| | Number of Shares

| | Percent of Class

| |

SHARES OF COMMON STOCK

| | | | | |

|

Galen Partners III, L.P.(1) 610 Fifth Avenue New York, NY 10020 | | 11,176,691 | | 51.5 | % |

|

Galen Partners International III, L.P.(2) 610 Fifth Avenue New York, NY 10020 | | 1,011,633 | | 8.3 | % |

|

Ivy Orthopedics Partners, LLC(3) Four Brighton Road, Suite 250 Clifton, New Jersey 07012 | | 1,042,049 | | 8.6 | % |

|

Nicholas Cindrich(4) 9800 Metric Blvd. Austin, Texas 78758 | | 1,195,872 | | 10.6 | % |

|

CF Holdings, Ltd.(5) 6831 Prospect Ave. Pittsburgh, PA 15202 | | 1,123,164 | | 10.1 | % |

|

Kenneth W. Davidson(6) 9800 Metric Blvd. Austin, Texas 78758 | | 814,100 | | 7.2 | % |

|

CapitalSource Holdings LLC (7) 4445 Willard Avenue, 12th Floor Chevy Chase, MD 20815 | | 2,198,614 | | 16.4 | % |

|

SHARES OF SERIES A PREFERRED STOCK

| | | | | |

|

Galen Partners III, L.P.(8) 610 Fifth Avenue New York, NY 10020 | | 105,201 | | 79.9 | % |

|

Galen Partners International III, L.P.(8) 610 Fifth Avenue New York, NY 10020 | | 9,522 | | 7.2 | % |

|

Ivy Orthopedics Partners, LLC Four Brighton Road, Suite 250 Clifton, New Jersey 07012 | | 9,804 | | 7.4 | % |

| (1) | | Includes 10,520,100 shares of Common Stock issuable upon the conversion of the 105,201 shares of Series A Preferred Stock it beneficially owns. Does not include (i) the 43,500 shares of Common Stock issuable upon the conversion of the 435 shares of Series A Preferred Stock or (ii) the 1,189 shares of Common Stock, beneficially owned by Galen Employee Fund III, L.P., the beneficial ownership of which is disclaimed by this person. |

| (2) | | Includes 952,200 shares of Common Stock issuable upon the conversion of the 9,522 shares of Series A Preferred Stock it beneficially owns. Does not include (i) the 43,500 shares of Common Stock issuable upon the conversion of the 435 shares of Series A Preferred Stock or (ii) the 1,189 shares of Common Stock, beneficially owned by Galen Employee Fund III, L.P., the beneficial ownership of which is disclaimed by this person. |

| (3) | | Includes 980,400 shares of Common Stock issuable upon the conversion of the 9,804 shares of Series A Preferred Stock it beneficially owns. |

3

| (4) | | Includes 1,011,177 shares of Common Stock owned by CF Holdings, Ltd., of which Mr. Cindrich is a significant stockholder of the corporate general partner and a limited partner. Mr. Cindrich disclaims beneficial ownership of Common Stock held by CF Holdings, Ltd., except to the extent of his pecuniary interest therein. Also includes 136,987 shares that Mr. Cindrich has the right to acquire within 60 days of March 14, 2003. |

| (5) | | Includes Common Stock owned beneficially by Mr. Cindrich. |

| (6) | | Includes 196,100 shares of Common Stock issuable upon the conversion of the 1,961 shares of Series A Preferred Stock he beneficially owns. |

| (7) | | Includes 2,198,614 shares of Common Stock issuable on the conversion of the Warrant granted to CapitalSource Holdings, LLC. |

| (8) | | Does not include 435 shares of Series A Preferred Stock beneficially owned by Galen Employee Fund III, L.P. |

How much stock do the Company’s directors and officers own?

The following table shows the Common Stock ownership of (i) the Company’s directors, (ii) the executive officers of the Company named in the Summary Compensation Table below, and (iii) the directors and executive officers of the Company as a group, in each case as of March 14, 2003.

Name

| | Aggregate Number of Shares Beneficially Owned(1)

| | Acquirable within 60 days(2)

| | Percent of Shares Outstanding

| |

Nicholas Cindrich | | 1,058,885 | | 136,987 | | 10.6 | % |

Craig L. Smith, Ph.D. | | 276,031 | | 0 | | 2.5 | % |

Harry L. Zimmerman | | 256,750 | | 0 | | 2.3 | % |

August Faske | | 271,442 | | 0 | | 2.4 | % |

Kenneth W. Davidson | | 618,000 | | 196,100 | | 7.2 | % |

Jack Cahill | | 120,500 | | 0 | | * | |

Paul Chapman | | 0 | | 12,500 | | * | |

John H. Abeles, M.D. | | 296,931 | | 153,000 | | 5.6 | % |

Jay M. Haft | | 141,250 | | 55,000 | | 3.7 | % |

Joel S. Kanter | | 150,000 | | 155,000 | | 2.4 | % |

Richard O. Martin, Ph.D. | | 8,883 | | 75,000 | | * | |

Bruce F. Wesson | | 751,713 | | 11,530,800 | | 54.4 | % |

Zubeen Shroff | | 718,713 | | 11,530,800 | | 54.4 | % |

All Directors and executive officers as a group (13 persons) | | 3,998,907 | | 16,272,294 | | 69.4 | % |

| * | | Represents less than 1% of the Company’s outstanding Common Stock. |

| (1) | | The number of shares shown includes shares that are individually or jointly owned, as well as shares over which the individual has either sole or shared investment or voting authority. Certain of the Company’s directors and executive officers disclaim beneficial ownership of some of the shares included in the table, as follows: |

| | A. | | Mr. Cindrich is a significant owner of the corporate general partner and is a limited partner of CF Holdings, Ltd. and disclaims beneficial ownership of the 1,017,177 shares of Common Stock held by CF Holdings, Ltd. except to the extent of his pecuniary interest therein. |

| | B. | | Dr. Abeles’ stock (both Common Stock and Series A Preferred Stock) is held by Northlea Partners, Ltd., a limited partnership of which Dr. Abeles is the general partner and the Abeles Family Trust is the sole limited partner. Dr. Abeles has sole voting and investment power with respect to such shares. |

| | C. | | Mr. Kanter’s shares include 50,000 shares owned by Windy City, Inc., and 100,000 shares of Common Stock and 100,000 shares of Common Stock issuable upon the conversion of the 1,000 shares of Series A Preferred Stock beneficially owned by the Kanter Family Foundation, a charitable not-for-profit corporation. Mr. Kanter is the President and a member of the Board of Directors for both Windy City, Inc. and the Kanter Family Foundation and has sole voting and investment control over said securities. Mr. Kanter disclaims any and all beneficial ownership of securities owned by either corporation. |

| | D. | | Mr. Shroff’s and Mr. Wesson’s shares include shares of Common Stock and Series A Preferred Stock owned by the Galen Entities, of which they are partners of entities that control the general partner of the Galen Entities. They do not have sole voting or investment power with respect to such shares, nor do they have full beneficial ownership of such shares. They disclaim beneficial ownership of these shares except to the extent of each of their pecuniary interest therein. |

| (2) | | Reflects the number of shares that could be purchased by exercise of options or by conversion of Series A Preferred Stock on March 14, 2003 or within 60 days thereafter under the Company’s stock option plans or pursuant to the terms of the outstanding shares of Series A Preferred Stock. |

4

Based upon a review of filings with the Securities and Exchange Commission and written representations that no other reports were required, the Company believes that all of the Company’s directors and executive officers complied during 2002 with the reporting requirements of Section 16(a) of the Securities Exchange Act of 1934 except for (i) a filing of a Form 4 by Paul Chapman which was not timely filed due to an administrative oversight.

ITEM 1—ELECTION OF DIRECTORS

DIRECTORS STANDING FOR ELECTION

The Board is currently divided into three classes, each having three-year terms that expire in successive years. The term of office of the directors in Class III expire at the 2003 Annual Meeting. Mr. Cindrich, who has served as a Class III director of the Company since 1997 has chosen, for personal reasons, not to be re-nominated when his term expires at the 2003 Annual Meeting. The Board has chosen not to nominate anyone in his place and to reduce the size of the Board to seven (7). The Board proposes that the nominee described below, who is currently serving as a Class III director, be re-elected to Class III for a new term of three years and until his successor is duly elected and qualified.

The Class III nominee has consented to serve a three-year term. If he should become unavailable to serve as a director, the Board may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board.

Since the time of the last annual meeting of the Company, no directors have resigned from the Board.

Class III Director. The Director standing for election by the holders of Common Stock is:

Joel S. Kanter

Mr. Kanter was a director of Healthcare Acquisition Corporation (“HCAC”) prior to the merger between Healthcare Acquisition Inc., a wholly owned subsidiary of HCAC and Encore Orthopedics, Inc. (“Encore Orthopedics”) (the “Merger”), and has served as a Director of the Company since the Merger. Since June 1986, Mr. Kanter has served as President of Windy City, Inc., a privately held company specializing in public and private equity investments. From 1993 through 1999, Mr. Kanter was also President and a Director of Walnut Financial Services, Inc., a venture capital and financial service firm listed on the Nasdaq National Market. Mr. Kanter currently serves as a director of several publicly traded companies including I-Flow Corporation, Magna Labs, Inc., and Logic Devices, Inc. Mr. Kanter earned a B.A. degree from Tulane University. Mr. Kanter is 46 years old.

Directors Elected by the Holders of Series A Preferred Stock. The term of office for the following Series A Preferred Directors will end at the 2003 Annual Meeting and the Board proposes that the nominees below, both of whom are currently serving as Series A Preferred Directors, be re-elected for a new term of one year and until their successors are duly elected and qualified.

Zubeen Shroff

Mr. Shroff has served as a director of the Company since June 2001. He is a director nominated by the holders of the Series A Preferred Stock. Mr. Shroff is a general partner of Galen Associates (“Galen”), a healthcare-focused private equity investment fund. Mr. Shroff joined Galen in January 1997 from The Wilkerson Group, a provider of management consulting services to the health care products and services industry, where he was a principal/consultant from 1992 to 1996. Mr. Shroff currently serves on the boards of Halsey Drug Co., Inc., Cognia, Inc., Cortek, Inc., and AmericasDoctor, Inc. Mr. Shroff is 38 years old.

Bruce F. Wesson

Mr. Wesson has served as a director of the Company since June of 2001. He is a director nominated by the holders of the Series A Preferred Stock. Mr. Wesson is a general partner of Galen. Prior to his association with Galen, Mr. Wesson served as a Managing Director in the Corporate Finance Division of Smith Barney. He currently serves as a director for Crompton Corporation, Halsey Drug Co., Inc., and several privately held companies. Mr. Wesson is 60 years old.

5

DIRECTORS CONTINUING IN OFFICE

Class I Directors. The term of office for the following Class I Directors shall end at the 2004 Annual Meeting:

John H. Abeles, M.D.

Dr. Abeles was President, Treasurer and a director of HCAC prior to the Merger and has served as a Director of the Company since the Merger. From 1971 to 1975, Dr. Abeles was an executive with several major pharmaceutical companies in the United Kingdom and the United States, including Sterling Drugs (UK), Pfizer Labs and USV Pharmaceuticals (a division of Revlon Healthcare). From 1975 to 1980, he was an analyst in Kidder Peabody’s healthcare research department. Since 1980, Dr. Abeles has been President of MedVest Inc., which has provided consulting services to, and has been active in the founding and financing of, emerging companies, principally in the healthcare industry. He is General Partner of Northlea Partners, Ltd, a private investment concern. Dr. Abeles is currently a member of the Board of Directors of Oryx Technology Corporation, DUSA Pharmaceuticals, Inc., Molecular Diagnostics Inc and I-Flow Corporation. He is a Director of the Higuchi BioScience Institute at the University of Kansas, an Advisor to the School of Chemistry at University of California, Berkeley and a Visiting Professor of Clinical Pharmacology at the International University of the Health Sciences (IUHS). Dr. Abeles earned the B.Sc. (Hons) and M.B., Ch.B. degrees from the University of Birmingham (England). Dr. Abeles is 58 years old.

Richard O. Martin, Ph.D.

Dr. Martin was a director of Encore Orthopedics from February 1996 until March 1997 and became a director of the Company in March 1997. Dr. Martin retired in October 2001 as President of Medtronic Physio-Control, a position he held since the merger of Physio-Control International Corporation (“Physio-Control”) and Medtronic in September 1998. Prior to the merger, Dr. Martin served as Chairman and Chief Executive Officer of Physio-Control, positions that he held since 1991. Prior to joining Physio-Control, Dr. Martin held a variety of positions culminating as President and Chief Operating Officer of Intermedics, Inc. of Angelton, Texas. He has also served as President and Chief Operating Officer of Positron Corporation of Houston, Texas. Dr. Martin is the past National Chairman of the AeA, the nation’s largest trade association representing the high-tech industry. He is also past Chairman of the American Heart Association’s Northwest Affiliate. He holds a B.S. in Electrical Engineering from Christian Brothers College (1962), a M.S. in Electrical Engineering from Notre Dame University (1964) and a Ph.D. in Electrical/Biomedical Engineering from Duke University (1970). Dr. Martin also serves on the Board of Directors of Scout Medical Technologies, Cardio Dynamics, Inc., Cardiac Dimensions, Inc., and Inovise Medical, Inc. Dr. Martin is 63 years old.

Class II Directors. The term of office for the following Class II directors will end at the 2005 Annual Meeting:

Jay M. Haft

Mr. Haft was Chairman of the Board and Secretary of Healthcare Acquisition Corporation (“HCAC”) prior to the Merger and has served as a Director of the Company since the Merger. Mr. Haft is a director of a number of public and private corporations. He is currently of counsel to Reed & Smith. He was previously a senior corporate partner (1989-1994) and of counsel to (1995-2001) Parker Duryee Rosoff & Haft, in New York, New York, and prior to that a founding partner of Wofsey, Certilman, Haft et al. (1966-1988). He has served as a member of the Florida Commission for Government Accountability to the People and is a trustee of Florida International University Foundation as well as a member of the Advisory Board of the Wolfsonion Museum. Mr. Haft earned both his B.A. and J.D. degrees from Yale University. Mr. Haft is 67 years old.

6

Kenneth W. Davidson

Mr. Davidson became Chief Executive Officer and President of the Company in October 2000. He became Chairman of the Board of Directors of the Company on February 1, 2001. Mr. Davidson was a director of Encore Orthopedics from November 1996 until March 1997 and became a director of the Company in March 1997. Mr. Davidson served as Chairman, President and CEO of Maxxim Medical, Inc. from November 1986 to July 2000. Previously, Mr. Davidson held various positions with Intermedics, Inc., Baxter Laboratories, and Merck & Co. Mr. Davidson presently serves on the Board of Trustees for the Association of peri-Operative Registered Nurses (AORN). Mr. Davidson received a Bachelor of Science degree in Biology and Chemistry from Laurentian University, Sudbury Ontario, Canada. Mr. Davidson is 56 years old.

How are directors compensated?

Cash Compensation. Each Director is reimbursed his travel expenses for attending Board meetings. No other cash compensation is paid to the Directors.

Options. Each nonemployee director receives, pursuant to the terms of the 2000 Non-Employee Director Option Plan, a grant, on the date of the annual meeting for each year, of options to purchase 15,000 shares of Common Stock. For 2002, Messrs. Cindrich, Haft, Kanter, Shroff and Wesson and Drs. Abeles and Martin received grants under this plan. Each option grant, vesting in one year and having a 5-year term, permits the holder to purchase shares at the fair market value on the date of grant, which was $3.80 in the case of non-employee director options granted in 2002.

How often did the Board meet during 2002?

The Board met six times during 2002. Each director attended more than 75% of the total number of meetings of the Board and Committees on which he served.

What committees has the Board established?

The Board has standing Compensation, Audit and Nominating/Corporate Governance Committees.

7

BOARD COMMITTEE MEMBERSHIP

Name

| | Compensation Committee

| | Audit Committee

| | Nominating/ Corporate Governance Committee

|

John H. Abeles, M.D. | | | | * | | ** |

Jay M. Haft | | | | ** | | * |

Joel S. Kanter | | * | | * | | |

Richard O. Martin, Ph.D. | | ** | | | | * |

Zubeen Shroff | | * | | | | |

Compensation Committee. The Compensation Committee is charged with reviewing the Company’s general compensation strategy; establishing salaries and reviewing benefit programs (including pensions) for the Chief Executive Officer and other executives; reviewing, approving, recommending and administering the Company’s incentive compensation and stock option plans for employees and certain other compensation plans; advising the Board of Directors and making recommendations with respect to such plans; and approving certain employment contracts. In 2002, the Compensation Committee met four times.

Audit Committee. The Audit Committee met twelve times during 2002. Its functions are to recommend the appointment of independent accountants; review the arrangements for and scope of the audit by independent accountants; review the independence of the independent accountants; consider the adequacy of the system of internal accounting controls and review any proposed corrective actions; review and monitor the Company’s policies relating to ethics and conflicts of interests; and discuss with management and the independent accountants the Company’s draft annual and quarterly financial statements and key accounting and/or reporting matters. The Board, in light of the increased responsibilities placed on the Audit Committee during 2002 by the Sarbanes-Oxley Act and the SEC, adopted an Amended and Restated Charter in late 2002. A copy of this Charter can be found on the Company’s web site at www.encoremed.com or can be obtained from Encore at no charge. All current members of the Audit Committee are “independent” within the meaning of the new regulations from the SEC regarding audit committee membership. Since Mr. Wesson is a partner with Galen Associates, which through its related entities owns greater than 10% of the outstanding fully diluted ownership of Encore, Mr. Wesson may not have been deemed “independent” under such rules. Accordingly, Mr. Wesson resigned from the Audit Committee in September 2002.

Nominating/Corporate Governance Committee. The Nominating/Corporate Governance Committee is responsible for evaluating and monitoring the composition of the Board, soliciting recommendations, including from shareholders, for candidates for the Board; developing continuity plans for directors and officers of the Company, developing and reviewing background information for candidates; and making recommendations to the Board regarding such candidates. It is also responsible for developing principles of corporate governance and recommending them to the Board for its approval and adoption, reviewing periodically theses principles of corporate governance to insure that they remain relevant and are being complied with and monitor on an on-going basis the governing instruments, policies and procedures of the Company to ascertain that they are in the best interest of the shareholders of the Company. Any shareholder wishing to propose a nominee should submit a recommendation in writing to the Company’s Corporate Secretary, indicating the nominee’s qualifications and other relevant biographical information and providing confirmation of the nominee’s consent to serve as a director. The Nominating/Corporate Governance Committee met once during 2002.

8

EXECUTIVE OFFICERS

Kenneth W. Davidson—Chairman, Chief Executive Officer and President

Mr. Davidson became Chief Executive Officer and President of the Company in October 2000. He became Chairman of the Board of Directors of the Company on February 1, 2001. Mr. Davidson was a director of Encore Orthopedics from November 1996 until March 1997 and became a director of the Company in March 1997. Mr. Davidson served as Chairman, President and CEO of Maxxim Medical, Inc. from November 1986 to July 2000. Previously, Mr. Davidson held various positions with Intermedics, Inc., Baxter Laboratories, and Merck & Co. Mr. Davidson presently serves on the Board of Trustees for the Association of peri-Operative Registered Nurses (AORN). Mr. Davidson received a Bachelor of Science degree in Biology and Chemistry from Laurentian University, Sudbury Ontario, Canada. Mr. Davidson is 56 years old.

Jack Cahill, Executive Vice President—President, Surgical Division

Mr. Cahill joined the Company as Executive Vice President – Sales and Marketing in January 2001. He was promoted to President, Surgical Division in March 2002. He has almost 20 years of prior experience with Johnson & Johnson in a variety of sales and marketing positions, including Director of Marketing for Johnson & Johnson Medical, Inc., Director of Sales for the Medical Specialties Division of Johnson & Johnson Medical, Inc., and Director of Sales and Marketing for the Sterile Design Division of Johnson & Johnson Medical, Inc. In addition, Mr. Cahill had over 7 years of experience with Maxxim Medical, Inc. as its Executive Vice President of Sales and Marketing where he oversaw a sales and marketing effort that grew Maxxim from $200 million in annual sales to almost $700 million in annual sales. Mr. Cahill has a B.A. from Westminster College (1971). Mr. Cahill is 52 years old.

Paul Chapman, Executive Vice President—President, Chattanooga Division

Mr. Chapman joined Chattanooga Group, Inc. in February 1994, as President and Chief Operating Officer. In January 1995, he was elected Chief Executive Officer. He joined the Company in February 2002 when Chattanooga Group, Inc. was acquired by Encore. Prior to joining Chattanooga Group, Mr. Chapman was employed by Stryker Corporation in Kalamazoo, Michigan. During his six years at Stryker he served as: Vice President and General Manager, Patient Care Division; Vice President of Marketing and New Business Development; Vice President of Sales, Medical Division; and Vice President of Operations, Medical Division. Mr. Chapman has a B.S. in Business Administration from Pepperdine University. Mr. Chapman is 44 years old.

August Faske, Executive Vice President—Chief Financial Officer

Mr. Faske joined Encore Orthopedics in April 1992 with four years prior experience in the orthopedics industry and now has a total of 27 years experience in finance and accounting. Prior to joining Encore, he served from 1988 to April 1992 as Vice President—Finance and Controller for Intermedics Orthopedics, Inc. (“Intermedics”). Prior to joining Intermedics, Mr. Faske was the Manager of Financial Accounting for Cooper Industries, Inc. and Internal Staff Auditor and Factory Accounting Manager for Hughes Tool Company. Mr. Faske has a B.B.A. in Accounting from Southwest Texas State University (1974). He is a Certified Public Accountant and is a member of the Texas Society of Certified Public Accountants and the American Institute of Certified Public Accountants. Mr. Faske is 49 years old.

Kathy Wiederkehr, Executive Vice President—Human Resources

Mrs. Wiederkehr joined Encore Orthopedics in 1995 as Director of Human Resources, was promoted to Vice President–Human Resources in December 1998 and became Executive Vice President – Human Resources in January 2001. Mrs. Wiederkehr has over 20 years experience in human resources. Prior to Encore, she was Director, Human Resources, Code Alarm, Inc.–Tessco Division from September 1994 to December 1995 and Manager of Human Resources for Kewaunee Scientific from May 1991 to September 1994. She has also worked for Fortune 500 companies including Emerson Electric, Inc. and Cooper Industries, Inc. Mrs. Wiederkehr has a B.B.A. (with honors) in Marketing from the University of Texas at Austin (1976) and an M.B.A. (with honors) from the University of Texas at Austin (1990). Mrs. Wiederkehr is 47 years old.

Harry L. Zimmerman, Executive Vice President—General Counsel

Mr. Zimmerman joined Encore Orthopedics in April 1994 with 12 years of experience in the private practice of corporate, real estate and tax law. From 1992 to April 1994, Mr. Zimmerman was associated with the law firm of Winstead Sechrest & Minick, P.C., a law firm based in Texas, where he was responsible for the corporate, tax and real estate practices. Mr. Zimmerman was a partner in the law firm of Bissex & Hedricks, P.C. from 1991 to 1992. He has a B.S. (with honors) in Economics from the Wharton School of the University of Pennsylvania (1977) and a J.D. (with honors) from the University of Texas School of Law (1982). He is also licensed as a Certified Public Accountant. Mr. Zimmerman is 47 years old.

9

EXECUTIVE COMPENSATION

The following Report of the Compensation Committee and the performance graphs included elsewhere in this proxy statement do not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates this Report or the performance graphs by reference therein.

Report of the Compensation Committee on Executive Compensation

The Compensation Committee of the Board has furnished the following report on executive compensation for 2002.

What is the Company’s philosophy of executive compensation?

The Company’s compensation program for executives consists of three key elements:

| | • | | A performance-based annual bonus, and |

| | • | | Periodic grants of stock options. |

The Committee believes that this three-part approach best serves the interests of the Company and its stockholders. It enables the Company to meet the requirements of the highly competitive environment in which the Company operates while ensuring that executive officers are compensated in a way that advances both the short-and long-term interests of stockholders. Under this approach, compensation for these officers involves a high proportion of pay that is “at risk” – namely, the annual bonus and stock options. The variable annual bonus permits individual performance to be recognized on an annual basis, and is based, in significant part, on an evaluation of the contribution made by the officer to Company performance. Stock options relate a significant portion of long-term remuneration directly to stock price appreciation realized by all of the Company’s stockholders.

Base Salary. Base salaries for the Company’s executive officers, as well as changes in such salaries, are set by the Compensation Committee, taking into account such factors as competitive industry salaries; a subjective assessment of the nature of the position; the contribution and experience of the officers, and the length of the officer’s service. The Chief Executive Officer reviews any salary recommendations for executives other than himself with the Compensation Committee. The base salary for the Chief Executive Officer is set by the Compensation Committee.

Annual Bonus. Annual bonuses, if any, for 2002 paid to executive officers of the Company were governed by the Company’s Annual Bonus Performance Plan (the “Bonus Plan”). The Bonus Plan provides for performance-based bonuses for all executive employees of the Company.

Under the Bonus Plan, executive employees are entitled to a non-discretionary bonus if certain preset revenue and earnings before taxes, interest, depreciation, and amortization amounts are achieved. The base bonus is set as a percentage of an executive’s salary and varies based on the employee’s position in the Company. If the targets are exceeded, then the amount of the bonus is increased. If these targets are not met, then the bonus amounts, if any, are at the discretion of the Compensation Committee.

Stock Options. Stock option grants may be made to executive officers upon initial employment, upon promotion to a new, higher level position that entails increased responsibility and accountability, in connection with the execution of a new employment agreement, and/or whenever the Compensation Committee or Board determines option grants are warranted. Using these guidelines, the Chief Executive Officer recommends the number of options to be granted, within a range associated with the individual’s salary level, and presents this to the Compensation Committee for review and approval. The Chief Executive Officer may make recommendations that deviate from the guidelines where he deems it appropriate. While options typically vest over a four-year period, options granted to certain executive officers may have shorter vesting periods, or may vest immediately.

How is the Company’s Chief Executive Officer compensated?

As Chief Executive Officer, Mr. Davidson was compensated during 2002 pursuant to an employment agreement entered into on June 12, 2001. The agreement, which has a term until December 31, 2003, subject to earlier termination under certain circumstances, provides for an annual base salary of $275,000.Mr. Davidson did not earn a bonus for 2002.

How is the Company addressing Internal Revenue Code limits on deductibility of compensation?

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to public corporations for compensation over $1,000,000 paid for any fiscal year to the corporation’s Chief Executive Officer and four other most highly compensated executive officers as of the end of any fiscal year. However, the statute exempts qualifying performance-based compensation from the deduction limit if certain requirements are met. No executive of the Company receives compensation at a level that would invoke the provision of Section 162(m).

10

The Board and the Compensation Committee reserve the authority to award non-deductible compensation in other circumstances as they deem appropriate. Further, because of ambiguities and uncertainties as to the application and interpretation of Section 162(m) and the regulations issued thereunder, no assurance can be given, notwithstanding the Company’s efforts, that compensation intended by the Company to satisfy the requirements for deductibility under Section 162(m) does in fact do so.

Members of the Compensation Committee:

Richard O. Martin, Ph.D. (chair)

Joel S. Kanter

Zubeen Shroff

Compensation Committee Interlocks and Insider Participation

None of the members of the Board’s Compensation Committee is or has been an officer or employee of the Company.

Executive Compensation Summary Table

The following table sets forth information concerning total compensation earned or paid to the Chief Executive Officer and the five other most highly compensated executive officers of the Company who served in such capacities as of December 31, 2002 (the “named executive officers”) for services rendered to the Company during each of the last three years.

EXECUTIVE COMPENSATION SUMMARY TABLE*

Name and principal position

| | Annual Compensation

| | Long Term Compensation Awards Securities underlying options

|

| | Year

| | Salary ($)

| | Bonus ($)

| | Other annual compensation

| |

Kenneth W. Davidson Chief Executive Officer | | 2002 2001 2000 | | $ $ $ | 275,000 241,538 50,000 | | $ $ $ | 0 216,525 0 | | $ 58,107(1) $249,154(1) * | | 0 0 300,000 |

|

Craig L. Smith Chief Scientific Officer | | 2002 2001 2000 | | $ $ $ | 188,500 181,852 173,600 | | $ $ $ | 0 166,716 0 | | * * * | | 0 0 0 |

|

Jack Cahill Executive Vice President — President, Surgical Division | | 2002 2001 | | $ $ | 190,423 158,823 | | $ $ | 0 72,993 | | * * | | 0 30,000 |

|

Paul Chapman Executive Vice President — President, Chattanooga Group | | 2002 | | $ | 187,933 | | $ | 104,500 | | * | | 50,000 |

|

August Faske Executive Vice President — Chief Financial Officer | | 2002 2001 2000 | | $ $ $ | 170,000 153,582 133,200 | | $ $ $ | 0 202,440 0 | | * * * | | 0 0 0 |

|

Harry L. Zimmerman Executive Vice President — General Counsel | | 2002 2001 2000 | | $ $ $ | 170,000 153,582 133,200 | | $ $ $ | 0 252,927 0 | | * * * | | 0 0 0 |

| * | | Amounts totaling less than $50,000 have been omitted and there were no awards of restricted stock under long-term incentive plans made during the three-year period ending December 31, 2002. |

| (1) | | Relocation and related tax reimbursement accounts for $235,719 of this amount in 2001 and $41,916 in 2002. |

11

Option Grants for Fiscal 2002

The following table sets forth information with respect to option grants to the named executive officers during 2002 and the potential realizable value of such option grants:

| | • | | The number of shares of Common Stock underlying options granted during the year; |

| | • | | The percentage that such options represent of all options granted to employees during the year; |

| | • | | The expiration date; and |

| | • | | The hypothetical present value, as of the grant date, of the options under the option pricing model discussed below. |

The hypothetical value of the options as of their date of grant has been calculated below, using the Black-Scholes option pricing model, as permitted by the rules of the Securities and Exchange Commission, based upon a set of assumptions set forth in the footnote to the table. It should be noted that this model is only one method of valuing options, and the Company’s use of the model should not be interpreted as an endorsement of its accuracy. The actual value of the options may be significantly different, and the value actually realized, if any, will depend upon the excess of the market value of the Common Stock over the option exercise price at the time of exercise.

OPTION GRANTS DURING 2002

Name

| | Number of Options Granted

| | % of Total Options Granted to Employees in Fiscal Year

| | | Exercise Price ($/Share)

| | Expiration Date (1)

| | Hypothetical Value at Grant Date (2)

|

Kenneth W. Davidson | | 0 | | 0 | % | | | — | | — | | | — |

Craig L. Smith | | 0 | | 0 | % | | | — | | — | | | — |

Jack Cahill | | 0 | | 0 | % | | | — | | — | | | — |

Paul Chapman | | 50,000 | | 10.3 | % | | $ | 3.00 | | 2/7/2012 | | $ | 129,525 |

Harry L. Zimmerman | | 0 | | 0 | % | | | — | | — | | | — |

August Faske | | 0 | | 0 | % | | | — | | — | | | — |

| (1) | | The Compensation Committee, which administers the Company’s employee stock option and incentive plans, has general authority to accelerate, extend or otherwise modify benefits under option grants in certain circumstances within overall plan limits, and, with the consent of the affected optionee, to change the exercise price to a price not less than 100% of the market value of the stock on the effective date of the amendment. The Committee has no current intention to exercise that authority with respect to these options. |

| (2) | | The estimated present value at grant date of options granted during 2002 has been calculated using the Black-Scholes option pricing model, based upon the following assumptions: estimated time until exercise of 10 years; a risk-free interest rate ranging from 2.2% to 4.93%, representing the interest rate on a U.S. Government zero-coupon bond on the date of grant with a maturity corresponding to the estimated time until exercise; a volatility rate of 85.7%; and a dividend yield of 0%. The approach used in developing the assumptions upon which the Black-Scholes valuation was done is consistent with the requirements of Statement of Financial Accounting Standards No. 123, “Accounting for Stock-Based Compensation.” |

Option Exercises and Values for 2002

The table below sets forth the following information with respect to option exercises during 2002 by each of the named executive officers and the status of their options at December 31, 2002:

| | • | | The number of shares of Common Stock acquired upon exercise of options during 2002; |

| | • | | The aggregate dollar value realized upon the exercise of such options; |

| | • | | The total number of exercisable and non-exercisable stock options held at December 31, 2002; and |

| | • | | The aggregate dollar value of in-the-money exercisable options at December 31, 2002. |

12

AGGREGATED OPTION EXERCISES DURING 2002

AND

OPTION VALUES ON DECEMBER 31, 2002

Name

| | Shares Acquired On Exercise of Option

| | Value Realized Upon Exercise

| | Number of securities under- lying unexercised options at December 31, 2002

| | Value of unexercised acquired in-the-money options December 31, 2002(1)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Kenneth W. Davidson | | -0- | | -0- | | -0- | | -0- | | $-0- | | $-0- |

Craig L. Smith | | -0- | | -0- | | -0- | | -0- | | $-0- | | $-0- |

Jack Cahill | | -0- | | -0- | | -0- | | -0- | | $-0- | | $-0- |

Paul Chapman | | -0- | | -0- | | -0- | | 50,000 | | $-0- | | $7,500 |

Harry L. Zimmerman | | -0- | | -0- | | -0- | | -0- | | $-0- | | $-0- |

August Faske | | -0- | | -0- | | -0- | | -0- | | $-0- | | $-0- |

| (1) | | Values are calculated by subtracting the exercise price from the fair market value of the underlying Common Stock. For purposes of this table, fair market value is deemed to be $3.15, the closing Common Stock price reported on the Nasdaq National Market on December 31, 2002. |

Contractual Arrangements with Named Executive Officers

Messrs. Davidson, Smith, Cahill, Faske and Zimmerman, effective June 12, 2001, entered into agreements that provide for the base salaries noted below, participation in all of the benefit programs available to the other executive employees of the Company, and one year of severance pay in the event of termination without cause by the Company. Mr. Chapman had entered into an employment agreement dated November 26, 2001 with Chattanooga Group, Inc. This agreement was replaced with one effective as of February 8, 2002 between Mr. Chapman and Encore. Each of these executive officers is subject to a one year non-compete restriction. The base annual salaries for Messrs. Davidson, Smith, Cahill, Chapman, Faske and Zimmerman are $275,000, $188,500, $198,500, $210,000, $170,000 and $170,000, respectively.

Each of Messrs. Davidson, Smith, Cahill, Faske and Zimmerman purchased from the Company shares of Common Stock (noted below) at a price of $1.02 per share. These shares are restricted, with the restrictions lapsing ratably over a 36-month period. If the employee leaves the Company prior to the end of the 36-month period, he would be required to sell back to the Company those shares that are still restricted at the same $1.02 per share purchase price. The Company has made a full recourse, 8% interest bearing secured loan to each of these executive officers to allow them to purchase the shares. The number of shares that Messrs. Davidson, Smith, Cahill, Faske and Zimmerman purchased is 550,000, 100,000, 100,000, 150,000 and 150,000 shares, respectively.

13

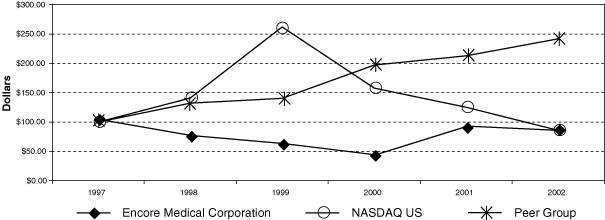

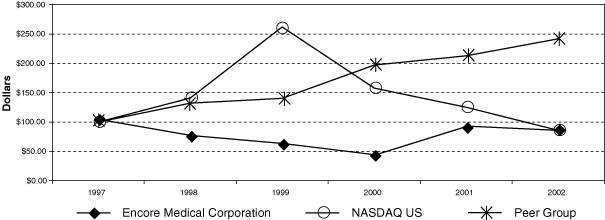

PERFORMANCE GRAPH

The following chart shows a comparison of the cumulative total stockholder return among the Company, the NASDAQ CRSP Index and a peer group comprised of other small and micro-cap orthopedic companies (Biomet Inc., Bionx Implants, Inc., Exactech Inc., Interpore International, Inc., Orthologic Corp., Osteotech Inc., Stryker Corp., Centerpulse Ltd, dj Orthopedics, Inc., Wright Medical Group, Inc., Zimmer Holdings, Inc., Dynatronics Corp., Regeneration Technologies, Inc., and Smith & Nephew, PLC):(1)

Comparison of 5 Year Cumulative Total Return

Assumes Initial Investment of $100

December 2002

| | | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

|

Encore Medical Corporation | | $ | 100.00 | | $ | 71.42 | | $ | 57.93 | | $ | 38.89 | | $ | 86.34 | | $ | 82.53 |

NASDAQ US | | $ | 100.00 | | $ | 140.99 | | $ | 262.00 | | $ | 157.59 | | $ | 125.05 | | $ | 85.83 |

Peer Group | | $ | 100.00 | | $ | 132.19 | | $ | 140.17 | | $ | 197.16 | | $ | 213.02 | | $ | 242.02 |

| (1) | | The total return on investment (change in year end stock price plus reinvested dividends) assumes $100 invested on January 1, 1997 in the Company, in the NASDAQ CRSP Index, and in each of the peer group companies. |

14

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The following Report of the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates this Report or the performance graphs by reference therein.

The Company’s Board has adopted a written charter for the Audit Committee which was amended in late 2002 to take into account the added responsibilities placed on audit committees by the Sarbanes-Oxley Act and the SEC, a copy of which can be obtained without cost from the Company or from the Company’s web site at www.encoremed.com.

The Audit Committee hereby reports as follows:

1. The Audit Committee has reviewed and discussed the audited financial statements with the Company’s management and the Company’s independent auditors. During fiscal 2002, management advised the Committee that each set of financial statements reviewed had been prepared in accordance with generally accepted accounting principles, and reviewed significant accounting and disclosure issues with the Audit Committee.

2. The Audit Committee has discussed with KPMG LLP, the Company’s independent accountants, the matters required to be discussed by SAS 61 (Communication with Audit Committees), including the quality of the Company’s accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

3. The Audit Committee has received the written disclosures and the letter from KPMG LLP required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and has discussed with KPMG LLP their independence.

4. Based on the review and discussion referred to in paragraphs (1) through (3) above, the Audit Committee recommended to the Board, and the Board has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2002, for filing with the Securities and Exchange Commission.

Members of the Audit Committee

Jay M. Haft (chair)

John H. Abeles, M.D.

Joel S. Kanter

15

INDEPENDENT ACCOUNTANTS

KPMG LLP serves as the Company’s independent auditor. In addition, KPMG LLP provides tax advice to the Company and its subsidiaries. The Audit Committee of the Board has considered whether the provision of non-audit services is compatible with maintaining KPMG LLP’s independence.

The accounting firm of PricewaterhouseCoopers LLP (“PricewaterhouseCoopers”) served as independent accountant for the Company from 1992 until dismissed by the Company on September 19, 2001. The decision to change accountants was recommended by the Audit Committee of the Board. PricewaterhouseCoopers’ report on the financial statements of the Company for the years ended December 31, 2000 and 1999 contained no adverse opinion or disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope or accounting principles, or as to any other matter. Furthermore, during the Company’s two most recent fiscal years and any subsequent interim periods prior to the dismissal of PricewaterhouseCoopers, there were no disagreements with PricewaterhouseCoopers on any matter of accounting principles or practices, financial statement disclosure or accounting scope or procedure, which disagreement if not resolved to the satisfaction of PricewaterhouseCoopers would have caused them to make reference thereto in their reports on the financial statements of the Company for such years. Additionally, no reportable event as defined in paragraph 304 of Regulations S-K promulgated by the Securities and Exchange Commission occurred during the years ended December 31, 2000 and 1999 or any subsequent interim period.

Audit Fees

The aggregate fees billed by KPMG LLP to the Company for the year ended December 31, 2002 are as follows:

Audit fees, excluding audit related (1) | | $ | 367,000 |

|

Financial information systems design and implementation | | $ | 0 |

|

All other fees: | | | |

Audit related fees (2) | | $ | 60,000 |

Other non-audit services (3) | | | 173,000 |

| | |

|

|

Total all other fees | | $ | 233,000 |

| | |

|

|

| | (1) | | Audit services include (a) the annual audit (including required quarterly reviews), subsidiary audits and other procedures required to be performed by the independent auditor to be able to form an opinion on the Company’s consolidated financial statements, and (b) services that only the independent auditor reasonably can provide, such as services associated with SEC registration statements, periodic reports and other documents filed with the SEC or related thereto. |

| | (2) | | Audit related fees consisted principally of services rendered in connection with the filing of the Company’s 8-K relating to the acquisition of the Chattanooga Group, Inc. Audit-related services are assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements or that are traditionally performed by the independent auditor. |

| | (3) | | Other non-audit fees consisted of tax compliance and tax consulting services. Permissible tax services include tax compliance, tax planning and tax advice that do not impair the independence of the auditor and that are consistent with the SEC’s rules on auditor independence. |

16

OTHER MATTERS

As of the date of this proxy statement, the Company knows of no business that will be presented for consideration at the annual meeting other than the items referred to above. In the event that any other matter is properly brought before the meeting for action by stockholders, proxies in the enclosed form returned to the Company will be voted in accordance with the recommendation of the Board of Directors or, in the absence of such a recommendation, in accordance with the judgment of the proxy holder.

Proxy Solicitation Costs. The proxies being solicited hereby are being solicited by the Company. The cost of soliciting proxies in the enclosed form will be borne by the Company. Officers and regular employees of the Company may, but without compensation other than their regular compensation, solicit proxies by further mailing or personal conversations, or by telephone, telex, facsimile or electronic means. The Company will, upon request, reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of stock.

Proposals of Stockholders. If you wish to submit a proposal for possible inclusion in the Company’s 2004 proxy material, the Company must receive your notice, in accordance with the rules of the Securities and Exchange Commission, including SEC Rule 14a-8, on or before December 2, 2003. The proxy committee designated by the Board may vote on a discretionary basis on any other stockholder proposal presented at the 2004 Annual Meeting of Stockholders if that proposal is not brought to the Company’s notice before February 14, 2004. Proposals should be sent to Corporate Secretary, Encore Medical Corporation, 9800 Metric Blvd., Austin, Texas 78758.

17

INCORPORATION OF DOCUMENTS BY REFERENCE

The following information is incorporated by reference from the Company’s annual Report on Form 10-K for the fiscal year ended December 31, 2002, a copy of which accompanies this proxy statement:

| | (i) | | Independent Auditors Reports. |

| | (ii) | | Consolidated Balance Sheets as of December 31, 2002 and 2001. |

| | (iii) | | Consolidated Statements of Operations for the years ended December 31, 2002, 2001 and 2000. |

| | (iv) | | Consolidated Statements of Changes in Stockholders’ Equity for the years ended December 31, 2002, 2001 and 2000. |

| | (v) | | Consolidated Statements of Cash Flow for the years ended December 31, 2002, 2001 and 2000. |

| | (vi) | | Notes to Consolidated Financial Statements. |

| | (b) | | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

Any statement contained in a document incorporated or deemed to be incorporated by reference herein will be deemed to be modified or superseded for purposes of this document to the extent that a statement contained herein which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this document.

By order of the Board of Directors, |

|

|

Harry L. Zimmerman Corporate Secretary |

April 2, 2003

18

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

Encore® Medical Corporation

The undersigned hereby appoints Kenneth W. Davidson and Harry L. Zimmerman, and each of them, as proxies, with full power of substitution and resubstitution in each, and hereby authorizes them to represent and vote, as designated on the other side of this Proxy, all the shares of common stock of Encore Medical Corporation standing in the name of the undersigned with all powers that the undersigned would possess if present in person at the Annual Meeting of Stockholders of the Company to be held May 13, 2003, or any adjournment or postponement thereof. In their discretion, the proxies may vote upon such other business as may properly come before the meeting.

(CONTINUED AND TO BE MARKED, DATED AND SIGNED, ON THE OTHER SIDE)

PLEASE MARK YOUR VOTES AS INDICATED IN THIS EXAMPLEx

ENCORE® MEDICAL CORPORATION PROXY

Company #

Control #

TO VOTE YOUR PROXY,

Mark, sign and date your proxy card and return it in the postage-paid envelope we’ve provided or return it to Encore Medical Corporation, c/o Shareowner Services, P.O. Box 64873, St. Paul, MN 55164-0873

The Board of Directors Recommends a Vote FOR Item 1.

1. Election of Directors: | 01 Joel S. Kanter |

¨ Vote FOR all nominees (except as marked) | ¨ Vote WITHHELD from all nominees |

| |

|

(Instructions: To withhold authority to vote for any indicated nominee, write the number(s) of the nominee(s) in the box provided to the right.) | | |

| |

|

THISPROXYWHENPROPERLYEXECUTEDWILLBEVOTEDASDIRECTEDOR,IFNODIRECTIONISGIVEN,WILLBEVOTEDFOREACHPROPOSAL.

Address Change? Mark Box¨

Indicate changes below: | Date |

SIGNATURE(S)IN BOX

| | | Please sign exactly as your name(s) appear on Proxy; if held in joint tenancy, all persons must sign. Trustee, administrators, etc., should include title and authority. Corporations should provide full name of corporation and title of authorized officer signing the Proxy. |