Exhibit 10.12

FIRST AMENDMENT TO LEASE

THIS FIRST AMENDMENT TO LEASE (the “Amendment”) is made and executed on the dates set forth below, to be effective as of 9/5, 2003, by and between Keystone-Miami Property Holding Corp., a Florida corporation (“Landlord”), and Tiger Direct, Inc., a Delaware corporation, doing business as “Tiger Direct” (“Tenant”) for Space Number 35 and 33C in the Mall of the Americas, and Systemax, Inc. formerly known as Global Direct Mail, Inc., a New York Corporation (“Guarantor”).

W I T N E S S E T H:

WHEREAS, Landlord and Tenant are parties to that certain Lease Agreement dated as of September 17, 1998, as amended by that certain Settlement Agreement and Mutual Release dated as of June 8, 2001 (the “Lease”) pursuant to which Landlord leased to Tenant Space Number 35 and 33C, and such storage space and lobby areas as described in the Lease (“Premises”) in the Mall of the Americas, located at 7795 West Flagler Street, Miami, Florida 33144, Miami-Dade County, Florida, as more particularly described in the Lease;

WHEREAS, Landlord and Tenant entered into that certain Generator Agreement dated as of November 6, 2001 (“Generator License Agreement”) with respect to emergency generator services to the Premises;

WHEREAS, Tenant has requested that the Lease be modified as set forth herein, and the Landlord has agreed to modify the Lease, pursuant to the terms set forth herein.

NOW, THEREFORE, in consideration of the foregoing, the mutual covenants, representations, warranties and agreements contained herein and the sum of Ten and 00/100 ($10.00) Dollars, the receipt and sufficiency of which are hereby acknowledged, Landlord, Tenant and Guarantor agree as follows:

TERMS

1. Incorporation of Recitals. The foregoing recitals are true and correct and incorporated herein by reference. All terms not defined in this Amendment shall have the meanings ascribed in the Lease, unless the context clearly otherwise requires.

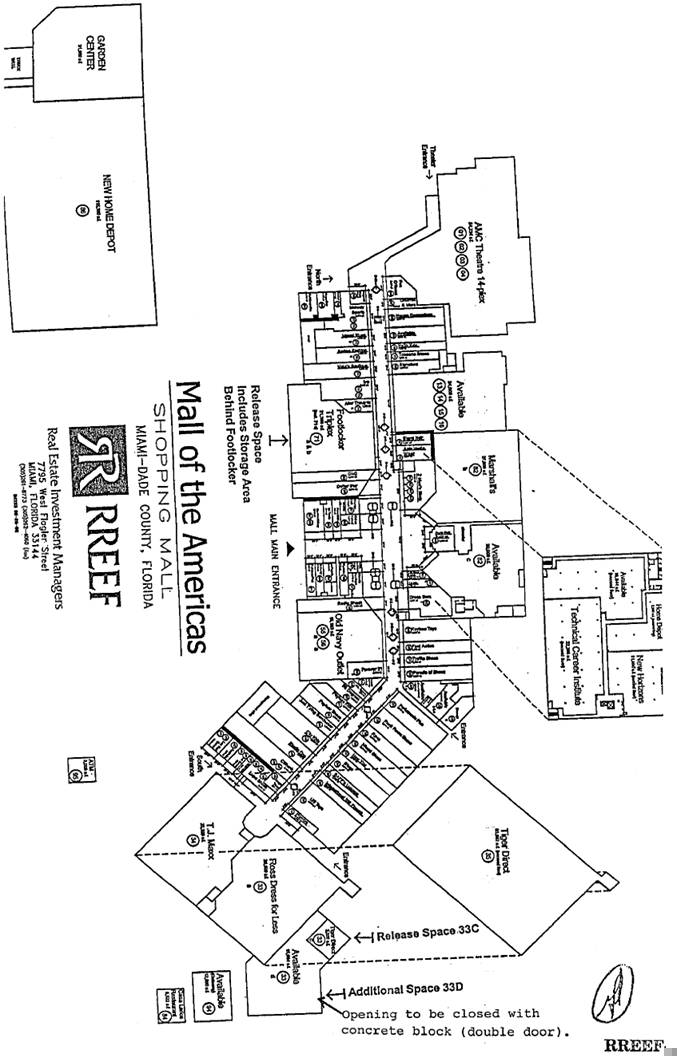

2. Exchange of Space 33C. Tenant agrees to vacate and release to Landlord Space 33C and the storage area located behind the current Foot Locker space (“Release Space”) and, in exchange thereof, lease Space 33D, as depicted on Amendment Exhibit “A” (“Additional Premises”), as part of the Premises under the Lease. The Landlord and Tenant acknowledge and agree that the Storage Area (also known as the loading dock) as set forth in the Lease is not included in the Release Space. The Commencement Date under the Lease with respect to the Additional

|

| RREEF |

|

|

1

Premises shall be the date that is 90 days after delivery of the Additional Premises to the Tenant (the “Exchange Date”). Prior to the Commencement Date, the Tenant shall continue to pay Rent as provided under the Lease, however, once the Tenant occupies and opens for business in the Additional Premises and returns the Release Space to Landlord as provided herein, Rent will be paid for the Additional Premises at the same rate as Tenant pays for the Premises until the Commencement Date. Upon the Commencement Date, the Tenant shall pay Rent as set forth herein. Upon the earlier to occur of (i) the Commencement Date with respect to the Additional Premises, or (ii) the date that the Tenant occupies and opens for business in the Additional Premises the Tenant shall immediately vacate and surrender the Release Space in the condition required at expiration under the Lease. The Additional Premises consists of approximately 15,984 square feet. The Premises Rentable Area set forth on the Reference Page of the Lease shall be modified to replace the total area of the Premises from 70,882 square feet to 79,866 square feet. The Lease shall expire with respect to the Additional Premises concurrently with the expiration of the Lease Term for the entire Premises. All of Tenant’s obligations, covenants, and conditions under the Lease with respect to the Premises as defined therein, including Options to Renew, shall apply to the Premises as expanded by the Additional Premises. For the purposes of the General Agreement, as of the Commencement Date, the term “Premises” therein shall mean the Premises and the Additional Premises.

3. Rent Payments and Charges.

(a) Landlord and Tenant agree that commencing as of the Commencement Date, Annual Rent shall be paid at $958,392.00 per annum with $79,866.00 paid per month, excluding the applicable Rent for the Release Space, for which Annual Rent shall be paid at $10,000.00 per annum with $833.34 paid per month until such Release Space is surrendered to Landlord in accordance herewith. Prior to the Commencement Date, Annual Rent shall be paid as provided in the Lease. Annual Rent for the expanded Premises shall thereafter increase at the rates provided in the Lease. Direct Expenses shall continue to be paid by Tenant 100% for the Premises as set forth in the Lease and shall be paid by the Tenant for the Additional Premises, with the “Base Year” for the Additional Premises being calendar year 2004. Tenant’s Proportionate Share for payment of Taxes and for any other purposes under the Lease shall be increased to 12.27%. The “Base Year” with respect to the Additional Premises under the Lease shall be calendar year 2004.

(b) Tenant shall otherwise be and remain obligated to pay all of the “charges”, rents and additional rents as provided in the Lease, subject to increases as provided in the Lease.

4. Delivery of Additional Premises. The Additional Premises shall be delivered to Tenant as of the Exchange Date in is “as is” “with all faults” condition, except that (a) the air conditioning equipment, plumbing and electric lines will be in good working order, (b) Landlord will replace ceiling tiles, with like kind and quality, in the Additional Premises, (c) Landlord will weatherproof existing exterior doors and close one (1) opening, as identified on Amendment Exhibit “A”, with concrete block, and (d) Landlord will remove all display racks, two (2) counters and two (2) dressing rooms in the Additional Premises. The Landlord agrees to replace the roof over the Additional Premises. Tenant agrees to remove the existing carpet and tile in the Additional Premises

|

| RREEF |

|

|

2

and improve the Additional Premises in accordance with and subject to all obligations and conditions of the Lease. All such work shall be subject to Landlord’s prior approval, which approval shall not be unreasonably withheld or delayed, and which shall be done by Tenant in accordance with any reasonable requirements and reasonable standards of Landlord, and in a good and workmanlike manner.

5. Expansion Rights. Tenant’s “First Right of Notice to Lease” set forth in Section R-6 of the Rider to the Lease and Tenant’s “Expansion Rights” set forth in Section R-7 of the Rider to the Lease shall be modified to specifically exclude from such rights any portion of the Building leased to Technical Career Institute, Inc., its successors or permitted assigns, specifically being Spaces 230 and 240 of the Building.

6. Relocation of Additional Premises.

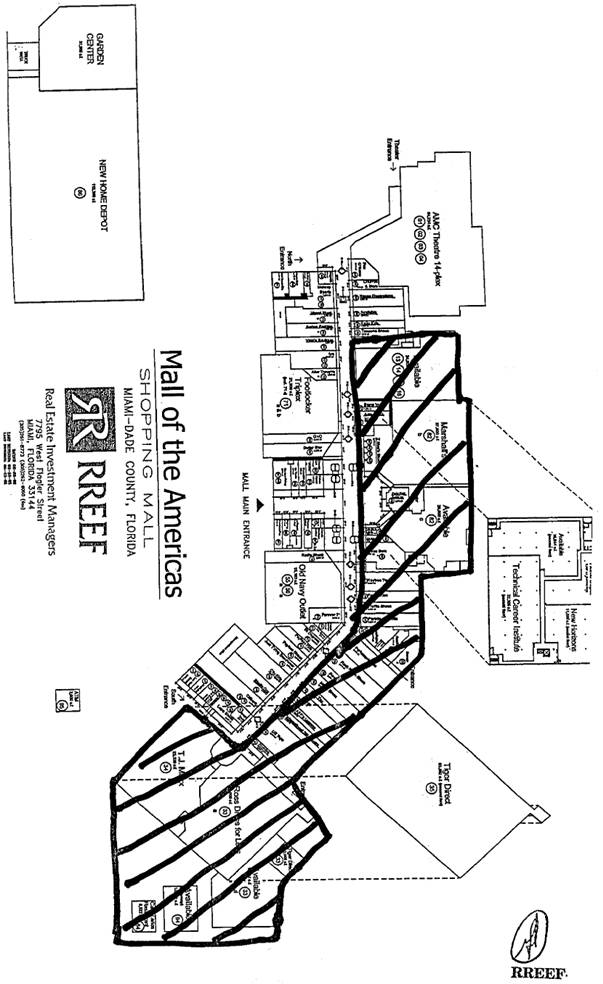

(a) On at least one hundred eighty (180) days’ prior written notice at any time during the Term, Landlord may require Tenant to move from the Additional Premises to another space of between 10,000 square feet to 16,000 square feet in the Shopping Center or Building in order to permit Landlord to consolidate or expand the Premises with adjoining space, or to expand or renovate the Shopping Center or the portion thereof in which the Premises are located, or for the rearrangement of tenant mix groupings or for any other aesthetic purposes. Such substitute premises shall provide an exterior double-door entrance for retail customer use and, unless Tenant otherwise consents, which consent shall not be unreasonably withheld, delayed or conditioned, shall be located in the “Permitted Relocation Area” on the sketch attached hereto as Amendment Exhibit “B”. Upon such notice, Tenant may elect not to move to the other space only by terminating this Lease with respect to the Additional Premises only, by delivering written notice to Landlord within sixty (60) days after the date of Landlord’s original notice of relocation, such termination to be effective upon the expiration of such one hundred eighty (180) day period.

(b) If Tenant relocates to the new space, this Lease shall remain in full force and effect and thereupon be deemed applicable to such new space except that:

(i) If the relocation is to substitute premises in the Shopping Center as such currently exists, the Landlord shall revise the Lease to reflect the new premises and any proportionate changes in the Annual Rent and Direct Costs and Taxes if any, effective as of the date of relocation, resulting from a difference in the floor area of the Additional Premises and such substituted premises.

(ii) If the relocation is to substitute premises in the Shopping Center after such has been substantially redeveloped, renovated or reconfigured (“substantially” being based on the total cost to Landlord of such redevelopment, renovation or reconfiguration being at least $20,000,000, which costs shall include without limitation, soft and hard costs of development and construction, cancellation fees, buy out costs, lost, abated or waived rent, relocation expenses, and any other costs and expenses associated therewith) rent for the substitute premises shall commence at the then current gross rent under the Lease without reduction of offset for the substitute space

|

| RREEF |

3

being less than the area of the Premises and Additional Premises, provided the substitute premises is between 11,500 square feet and 16,000 square feet.

(iii) Tenant’s pro rata share shall, as of the date of relocation, be adjusted pursuant to the provisions of the Lease.

(iv) There shall be no abatement of any Rent payable hereunder on account of Tenant’s relocation or any inconvenience or business loss caused to Tenant thereby, unless due to the negligence or willful misconduct of Landlord or unless the Tenant cannot operate its business during the physical relocation.

(c) In the event of Tenant’s relocation to the substitute premises pursuant to this Section, occasioned solely at Landlord’s requirement pursuant hereto, Landlord shall pay to Tenant all reasonable out-of-pocket expenses of moving Tenant to the substitute premises, including but not limited to moving trade fixtures and equipment, wiring of computers (including network connections to the main office), moving telephone equipment, printing of new stationery, moving of inventory, and construction of replacement tenant improvements in the substitute premises (of a scope and quality substantially similar to that originally constructed) and relocation of signs (if signs cannot be removed and relocated due to the reduced size of the facade or applicable sign ordinances, Landlord shall provide new signs of like kind, quality and style). Such payment shall be made so long as Tenant was otherwise in full compliance with the terms of this Lease, that there are no claims or charges due to Landlord from Tenant, and Tenant has vacated and surrendered the Additional Premises in accordance with the requirements of the Lease.

7. Ratification. Except as modified herein, the Lease remains in full force and effect without change, and the terms of the Lease are reaffirmed and ratified by the Tenant and the Guarantor. This is not a novation nor an accord and satisfaction of the Lease. The Tenant represent and warrant to the Landlord that, to the best of Tenant’s knowledge, there are no events of default, or events by the passage of time would become events of default, under the Lease by either the Landlord or the Tenant. In consideration of Landlord’s agreements herein, Tenant and Guarantor each hereby waive and release any and all setoffs, defenses, claims, and counterclaims which exist, or which may exist with respect to: (i) the Lease, (ii) the condition of the Premises and the Shopping Center and the Building and (iii) the business relations between Landlord and Tenant or between Landlord and Guarantor. The rights and remedies of Landlord set forth herein shall be in addition to any other right and remedy provided by the Lease or by law, and all such rights and remedies shall be cumulative.

8. Commissions. Each of the parties represents and warrants to the other that it has not dealt with any broker or finder in connection with this Lease, except Abood Wood Fay Real Estate Group LLC and NAI Miami. Tenant party indemnifies and holds the Landlord harmless from and against any commission fee or other compensation claimed by any broker based on a commitment allegedly made by Tenant.

|

| RREEF |

4

9. Exclusive Rights. Amendment Exhibit “C” is attached to and incorporated into the Lease. Tenant shall not violate or breach any exclusive right granted to any tenant as set forth in Amendment Exhibit “C” and, without limiting the foregoing, Tenant specifically agrees not to violate or breach the exclusive right granted to Gateway Computers, such agreement being a material inducement to Landlord to enter into this Amendment. Tenant specifically acknowledges and agrees that, in addition to any other remedies under the Lease for breach of this provision, the Landlord shall be entitled to specific performance to enforce the restrictions set forth herein.

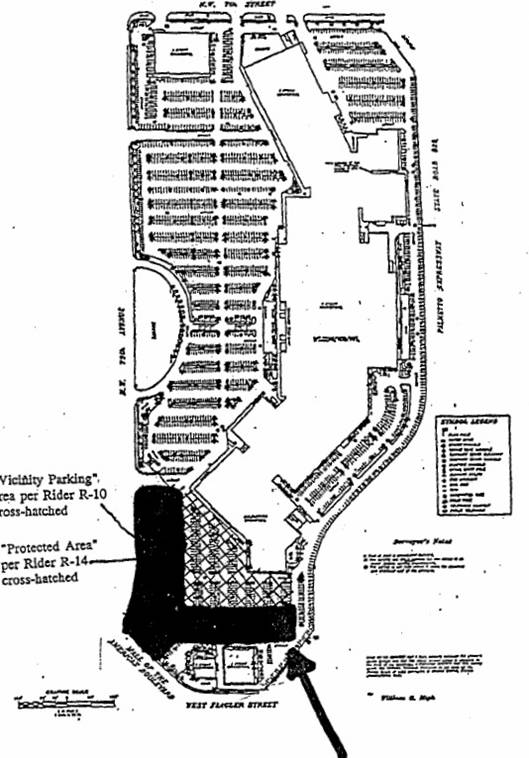

10. Protected Parking Area. The Tenant acknowledges and agrees that, notwithstanding any contrary provision contained in the Lease and without the consent of the Tenant, the Landlord shall be entitled to construct or permit others to construct an additional 20,000 square feet of gross leasable area as a “Permanent Building” under the Lease, whether by the addition of new buildings or expansion or replacement of existing buildings, in the portion of the parking lot designated as “Protected Area” as shown on Amendment Exhibit “D” hereto. Further, the Landlord may construct, with the Tenant’s consent, which shall not be unreasonably withheld, delayed or conditioned, greater than such 20,000 square feet of gross leasable area as a “Permanent Building” within the Protected Area (such excess above the 20,000 square feet being defined herein as the “Excess GLA”) so long as (a) the parking spaces in the Protected Area removed are replaced with a parking structure, (b) the parking spaces replaced are reserved in the parking structure for the exclusive use of Tenant, (c) the parking structure provides direct access to Tenant’s second floor portion of the Premises (the location of which direct access shall be subject to Tenant’s approval, which shall not be unreasonably withheld, delayed or conditioned and any zoning or building codes), and (d) a minimum of 100 surface parking spaces will remain for use by customers of Tenant, 25 of which shall be designated as Tenant customer parking and remain located in the area immediately in front of Tenant’s main entrance as reasonably agreed by both Landlord and Tenant. If Tenant does not provide specific reasonable written objections to the configuration of the Excess GLA within ten (10) days from receipt of a location sketch from Landlord, such Excess GLA shall be deemed approved by Tenant.

11. Signage. The Tenant acknowledges and agrees that, notwithstanding any contrary provision contained in the Lease, upon vacation of the Release Space, the Tenant shall have no right to signage in connection therewith and all signage installed by Tenant in connection with the Release Space shall be removed by Tenant, at Tenant’s sole cost and expense. The Tenant may have exterior signage with respect to the Additional Premises as permitted under applicable law, ordinances and codes, without variance or special exception, and as approved by the Landlord in writing as to size, style, design, color, lighting, and other factors in accordance with Section R-9 of the Lease. In connection with such signage, the provisions of Section R-9 of the Lease shall apply, except that the second and third sentences thereof are deemed deleted hereby.

[Signature Page continues]

|

| RREEF |

5

IN WITNESS WHEREOF, Landlord and Tenant have executed this Amendment on the dates specified below.

WITNESSES: | | LANDLORD: |

| | |

| | KEYSTONE-MIAMI PROPERTY HOLDING CORP., a Florida corporation, |

| | |

/s/ [ILLEGIBLE] | | By: RREEF MANAGEMENT COMPANY, a Delaware corporation |

| | |

[ILLEGIBLE] | | By: | /s/ [ILLEGIBLE] |

| | Name: | [ILLEGIBLE] |

[ILLEGIBLE] | | Title: | General Manager |

| | Date: | 9/5, 2003 |

| | | |

| | | |

| | TENANT: |

| | | |

/s/ [ILLEGIBLE] | | TIGER DIRECT, INC., a Delaware corporation |

| | | |

| | | |

/s/ Andrea Fongyee | | By: | /s/ Gilbert Fiorentino |

| | Name: | Gilbert Fiorentino |

| | Title: | CEO |

| | Date: | 8/22, 2003 |

| | | |

| | guarantor: |

| | | |

/s/ [ILLEGIBLE] | | SYSTEMAX, INC. formerly known as Global Direct Mail, Inc., a New York Corporation |

| |

| | | |

| | | |

/s/ [ILLEGIBLE] | | By: | /s/ Steven Goldschein |

| | Name: | Steven Goldschein |

| | Title: | SRVP |

| | Date: | 8/8/03, 2003 |

|

| RREEF |

6

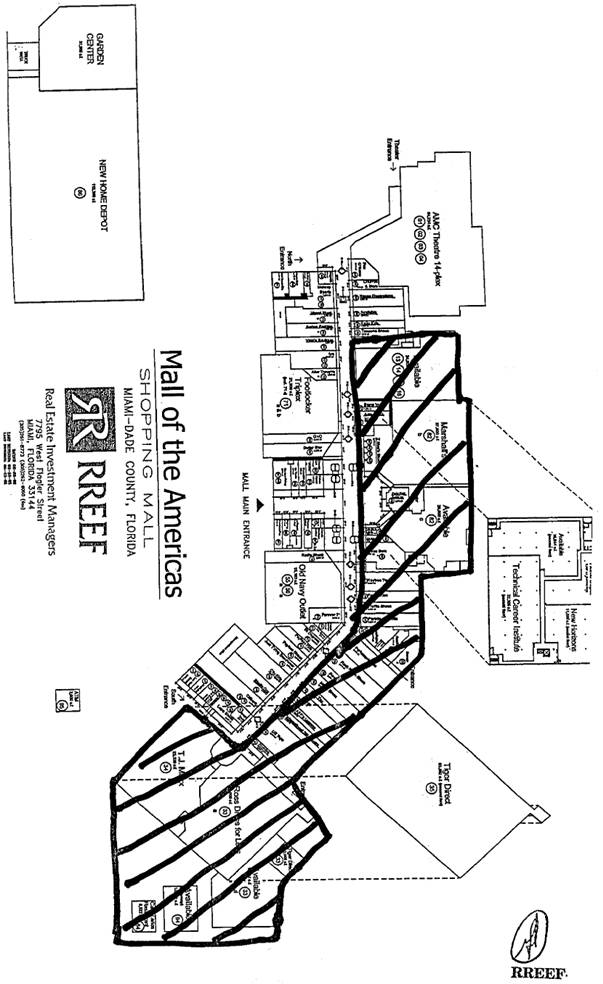

Amendment Exhibit “A”

Attached to and made part of First Amendment to Lease

Reference Date of September 5th, 2003 between Keystone-

Miami Property Holding Corp., as Landlord and Tiger District,

Inc., as Tenant and Systemax, Inc. as Guarantor

Amendment Exhibit “B”

Permitted Relocation Area

The crosshatched area is the

Permitted Relocation Area

Attached to and made part of First Amendment to Lease

Reference Date of September 5th, 2003 between Keystone-

Miami Property Holding Corp., as Landlord and Tiger District,

Inc., as Tenant and Systemax, Inc. as Guarantor

Mall of the Americas

Exhibit C

Exclusives/Restrictive Covenants

attached to and made part of First Amendment to Lease bearing the Reference

Date of 9/5, 2003 between Keystone-Miami Property Holding Corp., as Landlord

and Tiger Direct, Inc., as Tenant and Systemax, Inc. as Guarantor.

“Tenant hereby expressly acknowledges that the exclusive uses set forth below are in existence at the Shopping Center and have been previously granted to other Tenants prior to the commencement of this lease. Licensee shall not violate and shall at all times herein, abide by and recognize the exclusive uses set forth below or any other exclusives granted by Licensor, so long as such future exclusives do not impede or reduce the uses granted Licensee herein. Should Licensor grant an exclusive that violates Licensee’s use clause, such exclusive, only to the extent that it violates Licensee’s use clause, shall not be binding on Licensee”.

| AMC | Kay Bee Toys |

| Citibank | Mail Boxes, Etc. |

| Citicorp ATM | Marshalls |

| Cohen’s Fashion Optical | Pizza USA |

| Electronics Boutique | Subway |

| F.Y.E | TCI |

| Gateway | T.J. Maxx |

| Home Depot | |

AMC

Landlord will not use any other premises or equipment owned or controlled by Landlord and located on the Entire Premises in such manner as would result in any noise or vibration interfering with the acoustics required by Tenant in its use of Tenant’s Building, or as would result in any offensive odors penetrating Tenant’s Building.

Landlord will not sell or permit to be sold video cassettes or discs or any candy or popcorn in or from any premises located within 150 feet from any wall of Tenant’s Building or in from any part of the parking area or other Common Facilities located within the Restricted Area.

The foregoing limitation on sales from premises within 150 feet of Tenant’s Building shall not be applicable to the premises currently occupied by the tenants doing business under the names of Woolworth, Waldenbooks or Judy’s Hallmark (“Unrestricted Tenants”) during the continuance of Landlord’s leases with each such Unrestricted Tenant.

CITIBANK

Provided that Tenant is not in default under any of the terms of this Lease, Landlord agrees, during the term of this Lease or any extensions hereof, not to enter into any leases for space in the southern half of the Shopping Center, as now existing, as said southern half is depicted on Exhibit “B” attached hereto and made part hereof, for use as a savings and loan institution or for banking services.

CITICORP SAVINGS ATM

Provided that the demised premises are used solely for a drive-through ATM and Tenant is not in default under this Lease, Landlord agrees that during the entire term of this Lease (i) it shall not enter into any lease, ground lease or sale agreement with any bank, savings and loan association or similar financial institution for any outparcels located in the southern one-half of the Shopping Center as now existing or hereafter altered and developed, to be used as a free standing banking or ATM facility; and (ii) it shall not agree or permit an ATM facility to be installed in the Shopping Center buildings

|

| RREEF |

1

(exclusive outparcels) by any party other than Tenant. Subparagraph (ii) hereof shall not be construed to prohibit the construction and installation of any ATM to which Landlord has heretofore given consent or to require any ATM already installed and in existence to be removed or relocated.

COHEN’S OPTICAL

During the term of this Lease (as the same may be earlier terminated or extended), and so long as Tenant (including its successors and assigns if and as herein permitted) is in possession of the demised premises and not in default (after the expiration of applicable cure periods), Landlord agrees hereafter not to enter into any lease or suffer or permit the use or occupancy of any person or entity for mall space in the Shopping Center with any tenant or occupant whose primary business (i.e., gross sales therefrom shall constitute more than 50% of the gross sales of such tenant’s or occupant’s business in such space at the Shopping Center) is the sale of prescription eyeglasses, contact lenses and/or sunglasses (“Prohibited Items”). In no event shall any occupant or tenant perform eye examinations. Nothing contained herein shall prevent, restrict, impair or otherwise affect any leases existing as of the date hereof; provided however that Landlord agrees not to enter into any modification of an existing lease for such mall space in the Shopping Center in contravention of the foregoing provisions of this paragraph. Landlord represents and warrants that the Optica USA Lease has been terminated and that Landlord will use commercially reasonable efforts to cause such Tenant to vacate its premises on or before the opening date of Tenant. Landlord further represents that as of the date hereof Landlord has not entered into any lease with a Tenant whose primary business is (a) the sale of the Prohibited Items or (b) the conducting of eye examinations. Landlord agrees that it shall use commercially reasonable efforts to enforce such restrictive covenants against all tenants in the Shopping Center.

ELECTRONICS BOUTIQUE

EXCLUSIVE RIGHT: So long as no Event of Default (or event which with the notice and/or lapse of time could become an Event of Default) has occurred under this Lease, Landlord agrees that it shall not, at any time during the Term of the Lease, enter into any lease of space in the Shopping Center with any tenant whose primary business is the sale of hand-held game hardware, electronic board games, or video game hardware and software. The term “primary business” as used in this Article, shall mean sales aggregating at least seventy percent (70%) of such tenant’s gross sales. Any existing leases in the Shopping Center on the Commencement Date and any future leases to tenants leasing at least 7,500 square feet of space in the Shopping Center, including their respective renewal options, are not subject to the above-described exclusive right. Landlord agrees it shall not lease space to “GameStop”.

FYE

Provided Tenant is not in default, Landlord agrees, during the term of this Lease (subject to termination prior to its expiration, if applicable), that hereafter it shall not enter into a lease for space in the building of which the demised premises forms a part with any other tenant whose primary business (i.e., occupying more than fifty (50%) percent of its gross leasable area and constituting more than fifty (50%) percent of its annual gross sales) is the sale and display of pre-recorded music, including record albums, cassette tapes and compact discs. Except as expressly aforesaid, there shall be no restrictions on Landlord’s right to lease space in the Shopping Center to any tenant and for whatever use Landlord shall deem appropriate, in Landlord’s sole discretion. Nothing contained in this Rider Paragraph shall restrict Landlord’s ability freely to lease space in the out parcels or any other portion of the Shopping Center, not a part of the building for which the demised premises forms a part.

GATEWAY

Landlord covenants and agrees that, during the Term, Tenant has the exclusive in the Shopping Center (or any property contiguous or adjacent to the Shopping Center), owned

|

| RREEF |

2

or leased by Landlord (or any affiliate of Landlord), or in which Landlord (or any affiliate of Landlord), has an interest directly or indirectly to (a) the sale and rental of personal computer hardware and software as well a related and complimentary products and services. (b) The delivery of computer software training programs and (c) The service and repairs of such type of product that is permitted to be sold and rented as outlined in (a) all of the forgoing in clauses (a) through (c) are hereinafter collectively referred to as outlined in (a) all the forgoing (or any affiliate of Landlord) has an interest, directly or indirectly, during the term of this lease. Landlord agrees, subject to the limitations set forth below, that upon written notice by Tenant of a violation of Tenant’s Exclusive Right, Landlord shall enforce Tenant’s Exclusive Right against other tenants in the Shopping Center using all reasonable legal means. In the event of a breach by Landlord under this Article 1.D., Tenant shall be entitled to injunctive relief as well as all other remedies available at law or in equity. Notwithstanding the foregoing, in the event any tenant violates Tenant’s Exclusive Right, Landlord shall not be required to expend in excess of $25,000.00 in enforcing Tenant’s Exclusive Right; provided, however, Tenant may elect, at its option, to pay any cost in excess of $25,000.00, in which event landlord shall continue enforcing Tenant’s Exclusive Right if requested by Tenant. Notwithstanding any provision of this Article 1.D. to the contrary, it is understood and agreed that: (i) Tenant’s Exclusive Right shall not apply to or be enforceable against any tenants of the Shopping Center (or their respective successors and assigns) under leases in effect as of the date of full execution of this Lease and which leases permit such Tenant’s to violate Tenant’s Exclusive Right; (ii) any future tenant of the Shopping Center that occupies at least 25,000 square feet of gross leasable area shall be permitted to use not more than fifteen percent (15%) of its gross leasable area for computer and computer-related sales and rentals, but no event shall any such tenant sell or rent “custom built” computers; and (iii) Landlord shall be permitted to lease space in the Shopping Center to an electronics retailer such as Best Buy, Circuit City or BrandsMart or to other tenants for the purpose of operating electronic stores that sell computers or computer-related items.

HOME DEPOT

No portion of the Shopping Center outside of the Premises may be used for home improvements sales, meaning for the sale of any one or more of the following items exclusive of the sales of electronics... lumber, hardware items, plumbing supplies, electrical supplies, paint, wallpaper, carpeting, floor coverings, cabinets, siding, ceiling fans, gardening supplies, (exclusive of the sale of electronics), plants, nursery products, Christmas trees or other related items customarily carried as of the date hereof by a home improvement center (the “Home Improvement Restriction”) except that (i) business or occupants of less than a total of three thousand (3,000) square feet of gross leasable area shall be exempt from the foregoing Home Improvement Restriction; and (ii) the sale of any restricted items under the Home Improvement Restriction, if made in any single “major” premises (a “major” premises being defined for the purpose hereof as premises that are in excess of 20,000 square feet) and if ancillary to another primary use, within a retail sales area that does not exceed the lesser of ten (10%) percent of the retail sales area of such major premises or five thousand (5,000) square feet) shall be exempt from the foregoing Home Improvement Restriction (the foregoing Home Improvement Restriction as affected by exceptions (i) and (ii) in this sentence is hereinafter referred to as the “Home Improvement Exclusive”). [Par. 8.2]

KAY BEE TOYS

Landlord is not permitted to Lease any other premises in the Shopping Center for use as a toy or hobby store.

MAILBOXES, ETC.

To provide the following products and services: Answering service; mail box rental; postal and parcel shipping; rapid air via UPS, DHL, Federal Express, Airborne, Emery, US Postal Service; Western Union; copying service to the general public; secretarial Desktop publishing/resume service (collectively, “Primary Business”) and as incident thereto provide printing, electronic typesetting, electronic mail message transmission,

|

| RREEF |

3

notary public services, laminating services and the sale of packing and general office supplies (collectively, “Incidental Business”), and for no other use.

Provided Tenant is not in default of any of the terms and conditions of the Lease Agreement, Landlord agrees, during the term of this Lease (subject to termination prior to the expiration, if applicable), that hereafter it shall not enter into a Lease for space in the building of which the demised premises forms a part, with any other tenant whose primary business is to provide the same products and: services as outlined under primary business of the Tenant contained in this Rider paragraph. Notwithstanding the above, existing Tenant and their respective successor or assigns are specifically excluded from this provision of this Rider, R-1.

MARSHALLS

During the term of this lease, as the same may be extended, Landlord specifically agrees with Tenant as follows:

In recognition of the fact that the following types of operations would unduly burden to parking areas serving the demised premises and would hamper the use of said parking areas by customers of Tenant, Landlord will not lease, sell, or otherwise permit any structure within the Shopping Center to be used in whole or in part as a:

food supermarket (except within the premises shown and identified on the Site Plan as “Winn Dixie”); restaurant (except within (I) the areas shown and identified on the Site Plan as “Food Court,” (ii) the accessory restaurants currently operated within the premises shown and identified on the Site Plan as “Woolworth’s” and “Walgreen”, (iii) those portions of the Shopping Center located outside of the “Prohibited Restaurant Area” shown on the Site Plan and (iv) the free-standing structures shown on the Site Plan);

(a) bar (unless such bar is included within permitted restaurant premises which derive at least fifty percent (50%) of their annual gross revenues from the sale of food for on-premises consumption);

(b) theatre of any kind (except within the premises shown and identified on the Site Plan as “AMC Theatre 8-Plex;

(c) bowling alley (except within the premises shown and identified on the Site Plan as (i) “Winn Dixie”, “T.J. Maxx”, “Lurias” or (ii) the northerly forty thousand (40,000) square feet of the premises identified as “Home Depot”);

(d) skating rink (except within the premises shown and identified on the Site Plan as (i) “Winn Dixie”, “T.J. Maxx”, “Lurias” or (ii) the northerly forty thousand (40,000) square feet of the premises identified as “Home Depot”);

(e) amusement park;

(f) carnival;

(g) meeting hall;

(h) bingo parlor (except within the premises shown and identified on the Site Plan as “West Side Amusement Bingo”);

(i) “Disco” or other dance hall;

(j) sporting event or other sports facility;

(k) auditorium or any other like place of public assembly.

Notwithstanding anything to the contrary set forth above in subsection A of this Section 2, Landlord agrees that in no event will Landlord lease, sell or otherwise permit more than a total of thirty thousand (30,000) square feet of floor area (exclusive of the areas identified on the Site Plan as “Food Court” and the free-standing structures shown in the Site Plan) to be used for restaurant purposes within the Shopping Center nor, further, will Landlord lease, sell or otherwise permit any single restaurant operation within the Shopping Center to occupy more than ten thousand (10,000) square feet of floor area.

Landlord agrees during the term of this lease that it will not lease, sell or otherwise permit any structure within the Shopping Center to be used in whole or in part for any manufacturing operation; as a factory; for any industrial usage; as a warehouse (except as

|

| RREEF |

4

incidental to an otherwise permitted use), processing or rendering plant; for any establishment selling cars (new or used) (provided, however, that a new car showroom or leasing gallery for automobiles may be permitted within the areas shown and identified on the Site Plan as “Permitted Showroom Areas”), trailers, mobiles homes; for the operation of a billiard parlor, amusement center (other than one such center consisting of no more than seven thousand (7,000) square feet of floor area provided the same is located outside of the areas shown and identified on the Site Plan as the “Food Court” and the “Prohibited Restaurant Area”), flea market, massage parlor; for a so-called “off-track betting” operation (other than operations having no direct access to their premises from the Mall); lottery ticket sales (unless located within areas of the Shopping center outside of the area identified on the Site Plan as “Food Court” and the area identified on the Site Plan as “Prohibited Restaurant Area”); for the sale or display of pornographic materials; or for any other purpose which would be considered to be inconsistent with the use of the Shopping Center as a community oriented retail shopping center.

Landlord agrees that the term of this lease it will not lease, sell or otherwise permit any portion of the Shopping Center to be used for office purposes (other than incidental to a primary retail use) except within those areas which are currently used for office purposes and those areas which are identified on the Site Plan as “Southern Bell” on the second floor of the Shopping Center. Similarly, Landlord agrees that during the term of this lease it will not lease, sell or otherwise permit any portion of the Shopping Center to be used for medical offices other than those premises currently so used and identified on the Site Plan as such.

Landlord permits any one occupant of the Shopping Center (or any affiliate of such occupant), other than Tenant, to use premises consisting of more than twenty-seven thousand (27,000) square feet of floor area for the sale or display at discount prices of more than two of the following in combination (i) brand-name men’s clothing, (ii) brand-name woman’s clothing, (iii) brand-name children’s clothing, (iv) brand-name shoes, (v) brand-name giftware, or brand-name domestics, then minimum rent payable pursuant hereto shall be reduced to forty percent (40%) of the amount provided for Section 1 of ARTICLE III, and such reduction in minimum rent shall remain effective for so long as such use continues.

PIZZA USA

During the term of this Lease (as the same may be earlier terminated or extended), Landlord agrees hereafter not to enter into any lease for in-line (that is, space with an entrance directly into the enclosed Mall) space in the Shopping Center owned by Landlord with any tenant whose permitted use includes the right to sell at retail cooked and prepared ready to eat hot pizza only; subject however to the following terms and conditions including those relating to restaurants. In addition to the foregoing agreement whereby Landlord shall not enter into any lease, Landlord further agrees not to enter into any modification of an existing lease for such in-line space as provided above in contravention of the foregoing provisions of this Rider R-3. Nothing contained in this Rider R-3 shall limit, impair or otherwise affect (i) Landlord’s leases, tenants or the uses by such tenants under such leases existing on the date of this Lease, and extensions thereof or (ii) the space reserved for “majors” (i.e. spaces containing 20,000 sq. ft. of gross leasable area or more), (iii) any space in or upon so-called “outparcels” of the Shopping Center (that is, spaces which do not have entrances leading directly into the enclosed Mall, including parcels surrounded by or abutting portions of the common areas which are exterior to the enclosed mall), or (iv) Landlord’s leases, tenants or their uses respecting the operation of a full service (eat in and take out) restaurant, including an Italian restaurant, unless such restaurant’s “primary business” (hereafter defined) is comprised entirely of the sale of cooked and prepared ready to eat hot pizza (for purpose of this sentence, “primary business” shall refer to such a restaurant where more than fifteen (15%) percent of its gross sales are derived from the sale at retail of such cooked and prepared ready to eat hot pizza).

SUBWAY

Provided Tenant is not in default, Landlord agrees, during the term of this Lease (subject to termination prior to its expiration, if applicable), that hereafter it shall not enter into a

|

| RREEF |

5

lease for space in the building of which the demised premises forms a part with any other tenant whose primary business (i.e., occupying more than fifty (50%) percent of its gross leasable area and constituting more than fifty (50%) percent of its annual gross sales) is the sale of submarine and/or hoagie sandwiches. Except as expressly aforesaid, there shall be no restrictions on Landlord’s right to lease space in the Shopping Center to any tenant and for whatever use Landlord shall deem appropriate, in Landlord’s sole discretion. Nothing contained in this Rider Paragraph shall restrict Landlord’s ability freely to lease space in the outparcels or any other portion of the Shopping Center, not a part of the building of which the demised premises forms a part. Any present food tenant, its successors or assigns, may continue to sell submarine and/or Hoagie type sandwiches, however, Landlord will not permit future food tenants to sell submarine/hoagie type sandwiches

TCI (TECHNICAL CAREER INSTITUTE)

LIMITED EXCLUSIVE RIGHT. The parties acknowledge Landlord leases space to another postsecondary school (“New Horizons”) that is currently not accredited or eligible to offer Federal student aid funds to its students under Title IV of the Federal Higher Education Act (“Education Act”), however, the Tenant acknowledges that such accreditation is not prohibited under the New Horizons lease. Landlord agrees that if Landlord should hereafter (a) lease any portion of the Building to a tenant that primarily provides postsecondary educational services under the Education Act and has obtained accreditation (including pre-accreditation, candidacy for accreditation or any similar type of approval) from any accrediting agency that (i) qualify such school to become eligible to participate in the Federal student aid programs authorized under Education Act, and (ii) is recognized by the U.S. Department of Education as offering a form of accreditation required for a school to become eligible to participate in the Federal student aid programs authorized under the Education Act or (b) permit New Horizons to provide postsecondary educational services under the Education Act and New Horizons has obtained accreditation (including pre-accreditation, candidacy for accreditation or any similar type of approval) from any accrediting agency that (i) qualify such school to become eligible to participate in the Federal student aid programs authorized under the Education Act, and (ii) is recognized by the U.S. Department of Education as offering a form of accreditation required for a school to become eligible to participate in the Federal student aid programs authorized under the Education Act for programs or specialties not currently permitted under New Horizons’ lease, Tenant, may terminate this Lease after the twenty-fourth (24th) month of the Lease term, by providing written notice to Landlord of its intent to terminate, upon which notice, the Landlord shall have ninety (90) days to cure such, and failing such cure, such termination shall become effective six (6) months after the expiration of such ninety (90) day cure period and upon the payment to the Landlord of an amount, in cleared and collected funds, and the unamortized value of all tenant improvements made by or paid for by the Landlord based on a five-year straight-line amortization and unamortized broker commission based on a five-year straight-line amortization. Tenant acknowledges that if New Horizons obtains accreditation under Title IV for any use permitted under its lease, including computer and computer training classes, such shall not be a violation under this Section nor trigger Tenant’s termination right pursuant hereto.

T.J. MAXX

Landlord agrees that as long as any retail sales activity shall be conducted in the Demised Premises the Shopping Center shall not be used for any non-retail purposes (repairs, alterations and offices incidental to retailing, and banks and small loan offices, not being deemed non-retail), or for any entertaining purposes such as a bowling alley, skating rink, cinema, bar, nightclub, discotheque, amusement gallery, poolroom, health club, massage parlor or off-track betting club except as existing on the date thereof and any replacement of any existing on the date hereof and except for a cinema in the location labeled AMC Theatre 8 Plex upon the Lease Plan except for a health club in the location labeled Proposed Health Spa or other Retail upon the Lease Plan and except for one (1) amusement gallery containing not more than two thousand (2,000) square feet of floor area and located within either area on the easterly and westerly sides of the Mall labeled Designated Area for Video Game Arcade upon the Lease Plan and except incidental dancing within a restaurant situated more than one hundred fifty (150) feet from the

|

| RREEF |

6

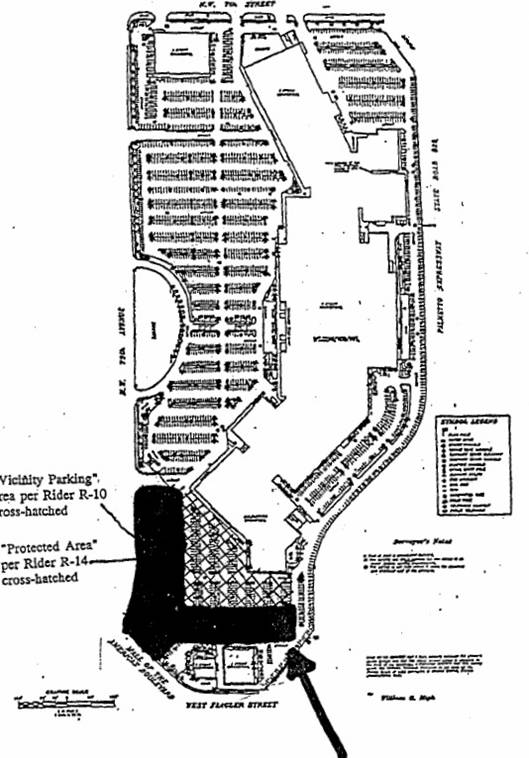

Amendment Exhibit “D”

Attached to and made part of First Amendment to Lease

Reference Date of September 5th, 2003 between Keystone-

Miami Property Holding Corp., as Landlord and Tiger Direct,

Inc., as Tenant and Systemax, Inc. as Guarantor

The solid colored area within the crosshatched Protected Area is the approved area for construction of an addition 20,000 SF of gross leasable area as a “Permanent Building” per Item 10 of the First Amendment to Lease.

This Exhibit is a representative diagram and is intended solely for the purpose of identifying the general location of the Premises and the current configuration. Landlord reserves the right at all times herein to (i) change, modify or relocate any tenant location in the Shopping Center, (ii) change the name, identity or type of other tenants or occupants at the Shopping Center, (iii) change the name and address of the Shopping Center, and/or (iv) change modify, relocate, add to or subtract from the number of structures, rooms, storerooms, parking spaces, entrances, service areas, common areas or other portions or parts of the Shopping Center, and otherwise change or alter the configuration of all or any part of the Shopping Center as Landlord, in its, sole discretion, deems necessary or appropriate.

“Parking Area” comprised of Protected Area and other parking space areas reflected hereon, subject expressly to Landlord’s rights under the Lease, including without limitation, those mentioned in Rider R-10.

|

| RREEF |

Demised Premises and except for ten thousand (10,000) square feet of floor area for non-retail offices situated more than one hundred fifty (150) feet from the Demised Premises and except for the second floor area presently leased to Southern Bell for offices in the Shopping center as shown upon the Lease Plan.

|

| RREEF |

7