- SVC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Service Properties Trust (SVC) DEF 14ADefinitive proxy

Filed: 31 Mar 03, 12:00am

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 | |

HOSPITALITY PROPERTIES TRUST | ||||

(Name of Registrant as Specified in its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

400 Centre Street

Newton, Massachusetts 02458

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 6, 2003

To the shareholders of Hospitality Properties Trust:

Notice is hereby given that the annual meeting of shareholders of Hospitality Properties Trust, a Maryland real estate investment trust, will be held at 1:30 P.M. on Tuesday, May 6, 2003, at 400 Centre Street, Newton, Massachusetts, for the following purposes:

The board of trustees has fixed the close of business on March 18, 2003, as the record date for determination of the shareholders entitled to notice of, and to vote at, the meeting.

By Order of the Board of Trustees,

JOHN G. MURRAY,Secretary

March 31, 2003

WHETHER OR NOT YOU EXPECT TO BE AT THE MEETING, PLEASE SIGN, DATE AND RETURN YOUR PROXY IN THE ENCLOSED ENVELOPE.

HOSPITALITY PROPERTIES TRUST

400 Centre Street

Newton, Massachusetts 02458

ANNUAL MEETING OF SHAREHOLDERS

To Be Held on Tuesday, May 6, 2003

A notice of the annual meeting of shareholders of Hospitality Properties Trust, a Maryland real estate investment trust, is set forth on the preceding page and a form of proxy solicited by our board of trustees is enclosed. We are paying the cost of this solicitation. In addition to solicitation by mail, our trustees and officers may solicit proxies personally or by telephone or telegram. This proxy statement is being first sent to shareholders on or about March 31, 2003, together with a copy of our annual report to shareholders for the year ended December 31, 2002 (including our audited financial statements).

The annual meeting record date is March 18, 2003. Only shareholders of record as of the close of business on March 18, 2003, are entitled to notice of, and to vote at, the meeting and any postponement or adjournment thereof. We had 62,574,925 common shares of beneficial interest, $.01 par value per share, outstanding on the record date and entitled to vote at the meeting. The holders of our common shares are entitled to one vote per common share.

Common shares represented by valid proxies will count for the purpose of determining the presence of a quorum to take action on the proposal set forth below and will be voted as specified in the proxies. If no specification is made by the shareholder, the common shares will be voted FOR the election of our board's nominees. To be elected, each nominee for our board must receive the affirmative vote of a majority of our common shares entitled to vote at the meeting. Common shares represented by valid proxies marked "Withhold" as to one or both nominees will not be counted as voting in favor of the applicable nominee or nominees for trustee. A shareholder giving a proxy may revoke it any time prior to its exercise by delivering to our Secretary a written revocation or a duly executed proxy bearing a later date, or by attending the meeting and voting his or her common shares in person.

If you do not give a proxy to vote your common shares, your brokerage firm may either leave your common shares unvoted or may vote your common shares on routine matters including the proposal before the meeting. If your brokerage firm signs and returns a proxy card on your behalf, but does not indicate how the common shares should be voted, the common shares represented on the proxy card will be voted FOR the election of our board's nominees.

Item 1. Election of two trustees in Group II of our board of trustees.

The number of our trustees is currently fixed at five, and our board of trustees is currently divided into three groups, with two trustees in Group I, two trustees in Group II and one trustee in Group III. Trustees in each group are elected for three year terms.

Our business is conducted under the general direction of our board of trustees as provided by our declaration of trust, our bylaws and the laws of the State of Maryland, the state in which we were organized on May 12, 1995.

Three of our trustees, John L. Harrington, Arthur G. Koumantzelis and William J. Sheehan, are our independent trustees within the meaning of our declaration of trust; that is, trustees who are not officers of ours or affiliates of either HRPT Properties Trust, our former parent, or Reit Management & Research LLC, or RMR, our investment manager.

Our independent trustees comprise the audit committee of our board of trustees. Our audit committee evaluates and makes recommendations to our board of trustees about the selection of our independent auditors, reviews our audited financial statements and discusses the adequacy of our internal controls with our management and auditors. Our audit committee operates under a written charter adopted by our board of trustees. We do not have a standing compensation committee or a nominating committee.

During 2002, our board of trustees held four meetings and our audit committee held eight meetings. During 2002, each trustee attended 75% or more of the total number of meetings of our board of trustees and any committee of which he was a member.

Each independent trustee receives an annual fee of $20,000 for services as a trustee, plus a fee of $500 for each meeting attended. Only one $500 fee is paid if a board meeting and board committee meeting are held on the same date. The chairperson of the audit committee receives an additional $2,000 annually; this position rotates periodically among our independent trustees. Each independent trustee automatically receives an annual grant of 300 of our common shares as part of his annual compensation. We reimburse all trustees for travel expenses incurred in connection with their duties as trustees.

The present trustees in Group II are Gerard M. Martin and William J. Sheehan. The terms of the Group II trustees elected at the meeting will expire at our 2006 annual meeting of shareholders. Our board of trustees has nominated Messrs. Martin and Sheehan for reelection as Group II trustees. The persons named in the enclosed proxy intend to exercise properly executed and delivered proxies for the election of Messrs. Martin and Sheehan, except to the extent that proxy cards indicate that the vote should be withheld for one or both nominees. HRPT Properties Trust, Mr. Martin and Mr. Portnoy, who have voting control over 4,409,362 of our common shares (7% of our common shares outstanding and entitled to vote at the meeting), intend to vote FOR the election of Messrs. Martin and Sheehan as Group II trustees.

The board of trustees recommends a vote FOR the election of Gerard M. Martin and William J. Sheehan as Group II trustees.

NOMINEES FOR TERMS EXPIRING IN 2006

The following are the recent principal occupations and ages as of March 18, 2003, of Messrs. Martin and Sheehan:

GERARD M. MARTIN, Age: 68

Mr. Martin has been one of our managing trustees since 1995. Mr. Martin is also a managing trustee of HRPT Properties Trust, or HRPT, and of Senior Housing Properties Trust, or SNH, and has been since 1986 and 1999, respectively. Mr. Martin is also a managing director of Five Star Quality Care, Inc., or Five Star, and has been since 2001. Mr. Martin is a director and 50% beneficial owner of RMR.

(2)

WILLIAM J. SHEEHAN, Age: 58

Mr. Sheehan has been one of our trustees since 1995. Since March 2003, Mr. Sheehan has been an independent consultant in the hotel and real estate industries. From 1995 until February 2003, Mr. Sheehan was employed by Ian Schrager Hotels LLC (formerly Ian Schrager Hotels, Inc.), serving as Executive Vice President of Finance from 1999 and, previously, as Chief Financial Officer. Mr. Sheehan is a certified hotel administrator, an Ambassador of the Educational Institute of the American Hotel and Motel Association and has been a speaker at various hotel industry conferences.

In addition to Messrs. Martin and Sheehan, the following persons currently serve on our board of trustees or as our executive officers. The following information is as of March 18, 2003:

ARTHUR G. KOUMANTZELIS, Age: 72

Mr. Koumantzelis has been one of our trustees since 1995. Mr. Koumantzelis has been the President and Chief Executive Officer of Gainesborough Investments LLC, a private investment company, since June 1998. Mr. Koumantzelis is also a trustee of a number of privately held trusts and has other business interests. Mr. Koumantzelis has been a trustee of SNH since 1999 and a director of Five Star since 2001. Mr. Koumantzelis is a certified public accountant. Mr. Koumantzelis is the Group III trustee and will serve until our 2004 annual meeting of shareholders.

JOHN L. HARRINGTON, Age: 66

Mr. Harrington has been one of our trustees since 1995. Mr. Harrington has been Executive Director and trustee of the Yawkey Foundation and a trustee of the JRY Trust for over five years. During that period and until February 27, 2002, Mr. Harrington was also the Chief Executive Officer of the Boston Red Sox Baseball Club. In addition, since March 2002, Mr. Harrington has been Chairman of the Board of Directors of the Yawkey Foundation. Mr. Harrington has been a trustee of SNH since 1999 and a director of Five Star since 2001. Mr. Harrington is a certified public accountant. Mr. Harrington is a Group I trustee and will serve until our 2005 annual meeting of shareholders.

BARRY M. PORTNOY, Age: 57

Mr. Portnoy has been one of our managing trustees since 1995. Mr. Portnoy is also a managing trustee of HRPT and SNH, and he has been since 1986 and 1999, respectively. Mr. Portnoy is also a managing director of Five Star and has been since 2001. Mr. Portnoy is also Chairman and 50% beneficial owner of RMR. Mr. Portnoy is a Group I trustee and will serve until our 2005 annual meeting of shareholders.

(3)

JOHN G. MURRAY, Age: 42

Mr. Murray has been our President, Chief Operating Officer and Secretary for over five years. Mr. Murray is also Executive Vice President of RMR. Mr. Murray has served in various capacities for RMR and its affiliates for over five years.

THOMAS M. O'BRIEN, Age: 36

Mr. O'Brien is our Executive Vice President. Prior to his election as Executive Vice President in October 2002, Mr. O'Brien served as our Treasurer and Chief Financial Officer for over five years. Mr. O'Brien is also a Vice President of RMR and has been for over five years.

MARK L. KLEIFGES, Age: 42

Mr. Kleifges was elected Treasurer and Chief Financial Officer in October 2002 and has been a Vice President of RMR since May 2002. For over five years prior to May 2002, Mr. Kleifges was a partner in the Real Estate and Hospitality Services Group of Arthur Andersen LLP. Mr. Kleifges is a certified public accountant.

ETHAN S. BORNSTEIN, Age: 29

Mr. Bornstein was elected as our Vice President in 1999, is a Vice President of RMR and has been employed by RMR for over five years. Mr. Bornstein is married to Mr. Portnoy's daughter.

Except as noted, there are no family relationships among any of our trustees or executive officers. Our executive officers serve at the discretion of our board of trustees.

Compensation of Executive Officers

We do not have any employees. Services which otherwise would be provided by employees are provided by RMR. Payments by us to RMR for services during 2002 are described in "Certain Relationships and Related Party Transactions."

Except with respect to incentive share awards, we have not paid and have no current plans to pay compensation to our executive officers. RMR conducts our day to day operations and compensated Messrs. Martin, Portnoy, Murray, O'Brien, Kleifges and Bornstein in connection with their services to RMR and to us. None of our executive officers have employment agreements with RMR or with us. The following table provides summary long term compensation information for restricted share awards made for the past three years to our executive officers, except Mr. Kleifges, who was not an executive officer of ours at the time our board of trustees acted upon incentive share award recommendations in 2000, 2001 and 2002.

(4)

| Name and Principal Position | Year | Restricted Share Awards(1) | |||

|---|---|---|---|---|---|

| John G. Murray President and Chief Operating Officer | 2002 2001 2000 | $ $ $ | 73,000 56,180 50,000 | ||

Thomas M. O'Brien Executive Vice President | 2002 2001 2000 | $ $ $ | 54,700 42,135 37,500 | ||

Ethan S. Bornstein Vice President | 2002 2001 2000 | $ $ $ | 27,375 21,068 18,750 | ||

At December 31, 2002, Messrs. Murray, O'Brien and Bornstein owned 14,600, 11,100 and 2,250 common shares, respectively, which were granted under our incentive share award plan since 1995 and include both vested and unvested common shares. Based on a closing price of $35.20 per share for our common shares on December 31, 2002, these common shares had a value of $513,920, $390,720 and $79,200, respectively.

Compensation Committee Interlocks and Insider Participation

We do not have a standing compensation committee; rather, a committee comprised of our independent trustees (Messrs. Harrington, Sheehan and Koumantzelis) makes recommendations for grants of common shares under our incentive share award plan and these recommendations are acted upon by our board of trustees. Relationships between us and certain of our trustees are described under "Certain Relationships and Related Party Transactions."

(5)

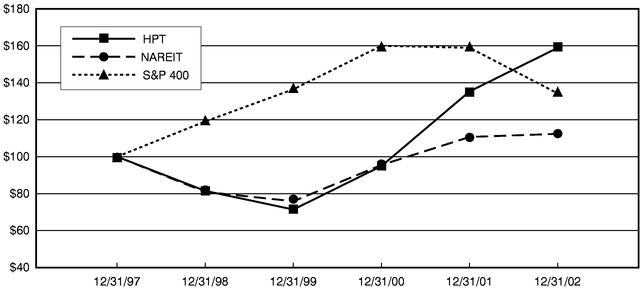

Performance Graph—Comparison of Cumulative Total Return

The graph below shows the cumulative total shareholder returns on our common shares (assuming a $100 investment on December 31, 1997) for the past five years as compared with (a) the National Association of Real Estate Investment Trust, Inc.'s (NAREIT) index of all tax qualified real estate investment trusts listed on the NYSE, the American Stock Exchange and the Nasdaq National Market System, and (b) the Standard & Poor's MidCap 400 Index in which we are included. The graph assumes reinvestment of all cash distributions on the distribution record dates.

Executive Compensation Report

We developed and implemented our incentive share award plan in recognition of the following circumstances. First, our common shares are primarily a yield vehicle for shareholders and do not appreciate in value in the same manner as other equity securities. Therefore, a conventional stock option plan would not provide appropriate incentives for management. Second, because our executive officers are employees of RMR and not of ours, and receive their salary compensation from RMR, the trustees wished to establish an arrangement which would, among other things, (a) foster a continuing identity of interest between management and our shareholders, and (b) recognize that our executive officers perform certain duties on our behalf, primarily with regard to shareholder relations and investor communications, which fall outside of the scope of services covered by the advisory agreement between us and RMR. In granting incentive share awards, our trustees consider factors such as the amount and terms of our incentive shares previously granted to executive officers and the amount of time spent and complexity of the duties performed by executive officers on our behalf. The trustees imposed, and may impose, vesting and other conditions on the granted common shares, which may encourage recipients of share awards to remain with us and RMR.

In 2002, Mr. Murray, our President, Chief Operating Officer and Secretary, received a grant of 2,000 common shares under our incentive share award plan, 666 of which vested immediately upon grant and 667 of which will vest in each of 2003 and 2004. In 2002, Mr. O'Brien, our Executive Vice President, received a grant of 1,500 common shares, 500 of which vested immediately upon grant and

(6)

500 of which will vest in each of 2003 and 2004. In 2002, Mr. Bornstein, our Vice President, received a grant of 750 common shares, 250 of which vested immediately upon grant and 250 of which will vest in each of 2003 and 2004. In addition to shares granted to our executive officers listed above, 4,600 of our common shares were granted to other employees of RMR in 2002. The determination of the number of common shares granted to these individuals was based on the number of common shares previously granted to them, the fair market value of the common shares granted, and the trustees' opinion as to the value of the services to us performed by each individual.

Payments by us to RMR are described in "Certain Relationships and Related Party Transactions."

BOARD OF TRUSTEES

John L. Harrington

Arthur G. Koumantzelis

Gerard M. Martin

Barry M. Portnoy

William J. Sheehan

Audit Committee Report

Our audit committee is comprised of three trustees. None of these trustees are officers of ours. All members of our audit committee are independent as defined by currently applicable NYSE rules. Our board of trustees has adopted a written charter for our audit committee.

In the course of its oversight of our financial reporting process, our audit committee has: (i) reviewed and discussed with management our audited financial statements for the year ended December 31, 2002; (ii) discussed with Ernst & Young LLP, our independent auditors, the matters required to be discussed by Statement on Accounting Standards No. 61,Communication with Audit Committees; (iii) received the written disclosures and the letter from our auditors required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees; (iv) discussed with our auditors their independence; and (v) considered whether the provision of nonaudit services by our auditors is compatible with maintaining their independence and has concluded that it is compatible at this time.

Based on the foregoing review and discussions, our audit committee recommended to our board of trustees that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2002, for filing with the SEC.

AUDIT COMMITTEE

John L. Harrington, Chairman

Arthur G. Koumantzelis

William J. Sheehan

(7)

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information regarding the beneficial ownership of our common shares by each person or entity known to us to be the beneficial owner of more than 5% of our common shares, and by each of our trustees and executive officers, individually and as a group, as of March 18, 2003. Unless otherwise indicated, each owner named below has sole voting and investment power for all common shares shown to be beneficially owned by that person or entity, subject to the matters set forth in the footnotes to the table below.

| | Beneficial Ownership(1) | ||||

|---|---|---|---|---|---|

| Name and Address(2) | Number of Shares | Percent | |||

| Beneficial Owners of More than 5% of our Common Shares | |||||

| HRPT Properties Trust(3) | 4,000,000 | 6.4 | % | ||

Trustees and Executive Officers | |||||

| Ethan S. Bornstein(4) | 2,250 | * | |||

| John L. Harrington(5) | 3,620 | * | |||

| Mark L. Kleifges | — | * | |||

| Arthur G. Koumantzelis(5) | 3,564 | * | |||

| Gerard M. Martin(6) | 4,204,681 | 6.7 | % | ||

| John G. Murray(4) | 14,600 | * | |||

| Thomas M. O'Brien(4) | 12,576 | * | |||

| Barry M. Portnoy(6) | 4,204,681 | 6.7 | % | ||

| William J. Sheehan(5) | 3,634 | * | |||

| All trustees and executive officers as a group (nine persons)(3)(4)(5)(6) | 4,449,606 | 7.1 | % | ||

(8)

Certain Relationships and Related Party Transactions

We have an agreement with RMR to provide investment, management and administrative services to us. RMR is compensated at an annual rate equal to 0.7% of our average real estate investments, as defined, up to the first $250 million of our average real estate investments and 0.5% thereafter plus an incentive fee based upon increases in cash available for distribution per share, as defined. The incentive fee payable to RMR is paid in common shares. Aggregate fees paid to RMR for services during 2002 were $14.5 million, including $938,077 (based upon a per share price of $34.0157) paid in 27,577 restricted common shares as an incentive fee. RMR's incentive shares for 2002 were issued to RMR and purchased from RMR by Messrs. Martin and Portnoy in March 2003, at their then current market value. RMR is owned by Messrs. Martin and Portnoy who are our managing trustees. Messrs. Martin and Portnoy each have material interests in the transactions between us and RMR described above. All transactions between us and RMR are approved by our independent trustees.

Until March 31, 1997, Mr. Portnoy was a partner of Sullivan & Worcester LLP, our counsel and counsel to HRPT, SNH, Five Star, RMR and affiliates of each of the foregoing, and he received payments from that firm during 2002 in respect of his retirement.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires that our trustees, executive officers and persons who own more than 10% of a registered class of our equity securities file reports of ownership and changes in ownership of securities with the SEC and the NYSE. Our executive officers, trustees and greater than 10% shareholders are required to furnish us with copies of all forms they file pursuant to Section 16(a). Based solely on our review of the copies of these reports furnished to us or written representations that no such reports were required, we believe that, during 2002, all filing requirements applicable to our executive officers, trustees and greater than 10% shareholders were timely met.

We are not required to submit the selection of our auditors to a shareholder vote. In July 2002, our board of trustees appointed Ernst & Young LLP as our independent auditors for 2002, and dismissed Arthur Andersen LLP. The change was based on the unanimous recommendation of our audit committee. The decision was not the result of any disagreement between us and Arthur Andersen on any matter. A representative of Ernst & Young is expected to be present at our annual meeting, with the opportunity to make a statement if he or she desires to do so. This representative will be available to respond to appropriate questions from shareholders who are present at our annual meeting.

The aggregate fees for services of Ernst & Young for the audit of our 2002 financial statements and of that firm and our predecessor accounting firm for reviews of our financial statements included

(9)

in our 2002 quarterly reports were as set forth below under "Audit Fees." The fees for other services provided by Ernst & Young to us during 2002 are also set forth below:

| Audit Fees. | $ | 85,460 | ||

| Financial Information Systems Design and Implementation Fees | — | |||

| All Other Fees: | ||||

| Audit Related(1) | $ | 30,000 | ||

| All Other | $ | 32,036 | ||

SHAREHOLDER NOMINATIONS AND PROPOSALS

To be eligible for consideration at our 2004 annual meeting, shareholder nominations of a person (or persons) to be elected as a trustee (or trustees) must be received at our principal executive office no earlier than December 2, 2003, and no later than January 1, 2004. Shareholder nominations must also be made in compliance with the other requirements for shareholder nominations set forth in our bylaws. Shareholder nominations which meet the requirements of our bylaws will not be included in our proxy for the 2004 annual meeting unless those nominations are also supported by our board of trustees, but they may be considered at the annual meeting whether or not they are supported by our board of trustees.

Under the rules and regulations of the Securities and Exchange Commission, to be eligible for inclusion in our proxy statement for our 2004 annual meeting, proposals of shareholders other than nominations must be received at our principal executive office no later than December 2, 2003, and must otherwise satisfy the conditions established by the Securities and Exchange Commission for inclusion. Proposals of shareholders other than nominations intended for presentation at the 2004 annual meeting but not intended to be included in our proxy statement for that meeting must be received at our principal executive office no earlier than December 2, 2003, and no later than January 1, 2004, and must meet all other requirements set forth in our bylaws.

Copies of our bylaws, including the provisions which concern the requirements for shareholder nominations and proposals, may be obtained by writing to our Secretary, Hospitality Properties Trust, 400 Centre Street, Newton, MA 02458.

HOUSEHOLDING OF ANNUAL MEETING MATERIALS

Some banks, brokers and other nominee record holders may participate in the practice of "householding" proxy statements and annual reports. This means that unless shareholders give contrary instructions only one copy of our proxy statement or annual report may be sent to multiple shareholders in each household. We will promptly deliver a separate copy of either document to you if you call or write to us at the following address or telephone number: Investor Services, Hospitality Properties Trust, 400 Centre Street, Newton, MA 02458, telephone (617) 964-8389. If you want to receive separate copies of our proxy statement or annual report in the future, or if you receive multiple copies and would like to receive one copy per household, you should contact your bank, broker or nominee record holder, or you may contact us at the above address or telephone number.

(10)

At this time, we know of no other matters which will be brought before our annual meeting. However, if other matters properly come before our annual meeting or any postponement or adjournment thereof, and if discretionary authority to vote with respect thereto has been conferred by the enclosed proxy, the persons named in the proxy will vote the proxy in accordance with their discretion on those matters.

By Order of the Board of Trustees

JOHN G. MURRAY,Secretary

Newton, Massachusetts

March 31, 2003

(11)

HOSPITALITY PROPERTIES TRUST

400 Centre Street, Newton, Massachusetts 02458

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF TRUSTEES

The undersigned shareholder of Hospitality Properties Trust, a Maryland real estate investment trust (the "Company"), hereby appoints JOHN G. MURRAY, GERARD M. MARTIN and BARRY M. PORTNOY, or any of them, as proxies for the undersigned, with full power of substitution in each of them, to attend the annual meeting of shareholders of the Company to be held at the Company's offices at 400 Centre Street, Newton, Massachusetts on Tuesday, May 6, 2003, at 1:30 p.m., and any adjournment or postponement thereof, to cast on behalf of the undersigned all the votes that the undersigned is entitled to cast at the meeting and otherwise to represent the undersigned at the meeting with all powers possessed by the undersigned if personally present at the meeting. The undersigned hereby acknowledges receipt of the notice of the annual meeting of shareholders and of the accompanying Proxy Statement and revokes any proxy heretofore given with respect to the meeting.

THE VOTES ENTITLED TO BE CAST BY THE UNDERSIGNED WILL BE CAST AS INSTRUCTED ON THE REVERSE SIDE HEREOF. IF THIS PROXY IS EXECUTED BUT NO INSTRUCTION IS GIVEN, THE VOTES ENTITLED TO BE CAST BY THE UNDERSIGNED WILL BE CAST "FOR" EACH OF THE NOMINEES FOR TRUSTEE AND IN THE DISCRETION OF THE PROXY HOLDER ON ANY OTHER MATTER THAT MAY PROPERLY COME BEFORE THE MEETING OR ANY ADJOURNMENT OR POSTPONEMENT THEREOF.

PLEASE VOTE, DATE AND SIGN ON THE REVERSE SIDE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE.

NOTE: Please sign exactly as name(s) appear(s) hereon. Joint owners should both sign. When signing as attorney, executor, administrator, trustee or guardian, please give your full title.

| HAS YOUR ADDRESS CHANGED? | DO YOU HAVE ANY COMMENTS? | |

ý PLEASE MARK

VOTES AS IN

THIS EXAMPLE

HOSPITALITY PROPERTIES TRUST

| 1. | Election of Trustees in Group II: | 2. | In their discretion, the Proxies are authorized to vote and otherwise represent the undersigned on such other business as may properly come before the meeting. | |||

| Nominees: (01) Gerard M. Martin (02) William J. Sheehan |

| FOR BOTH NOMINEES | o | o | WITHHOLD AS TO BOTH |

| FOR BOTH EXCEPT | o | |||

| If you do not wish your shares voted "FOR" a particular nominee, write the name of that nominee on the line provided above. Your shares will be voted for the remaining nominee. | ||||

Mark box at right if an address change or o comment has been noted on the reverse side of this card. | ||||

Please be sure to sign and date this Proxy. |

| Shareholder or authorized agent sign here: ______________________ | Date:__________ | Co-owner or authorized agent sign here: ______________________ | Date:__________ |