Exhibit 99.1

Service Properties Trust (Nasdaq: SVC) Investor Presentation November 2022

2 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Warning Concerning Forward - Looking Statements This presentation contains statements that constitute forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws . Whenever we use words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “will,” “may” and negatives or derivatives of these or similar expressions, we are making forward - looking statements . These forward - looking statements are based upon our present intent, beliefs or expectations, but forward - looking statements are not guaranteed to occur and may not occur . Forward - looking statements in this presentation relate to various aspects of our business, including our expectation about the ability of Sonesta Holdco Corporation and its subsidiaries, or Sonesta, to operate the hotels that have been or may be transitioned and rebranded to it, the likelihood and extent to which our managers and tenants will pay the contractual amounts of returns, rents or other obligations due to us, our ability to maintain sufficient liquidity during the current inflationary and increasing interest rate environment, and possible economic recession and other challenging economic and market conditions, if and when business transient hotel business will return to historical pre - COVID - 19 pandemic levels and whether any improved hotel industry conditions will continue, increase or be sustained, our ability to repay or refinance our debts as they mature or otherwise become due, potential defaults on, or non - renewal of, leases by our tenants, decreased rental rates or increased vacancies, our sales and acquisitions of properties, our policies and plans regarding investments, financings and dispositions, our ability to pay interest on and principal of our debt, our ability to pay distributions to our shareholders and to sustain the amount of such distributions, our ability to raise or appropriately balance the use of debt or equity capital, our intent to make improvements to certain of our properties, our ability to engage and retain qualified managers and tenants for our hotels and net lease properties on satisfactory terms, our ability to diversify our sources of rents and returns that improve the security of our cash flows, the future availability of borrowings under our revolving credit facility, our credit ratings, our expectation that we benefit from our relationships with The RMR Group LLC, or RMR LLC, Sonesta and TravelCenters of America Inc . , or TA, our qualification for taxation as a REIT, the impact of increasing labor costs and shortages and commodity and other price inflation due to supply chain challenges or other market conditions, our belief of the competitive advantages that the scale, geographic diversity, strategic locations and the variety of service levels of our hotels gives us, changes in federal or state tax laws, and other matters . Our actual results may differ materially from those contained in or implied by our forward - looking statements as a result of various factors, such as the impact of economic conditions, including the impact of the changed market practices that arose or increased in response to the COVID - 19 pandemic, increasing interest rates, inflation, labor costs and availability, and possible economic recession and the capital markets on us and our managers and tenants, competition within the real estate, hotel, transportation and travel center and other industries in which our managers and tenants operate, particularly in those markets in which our properties are located, compliance with, and changes to federal, state and local laws and regulations, accounting rules, tax laws and similar matters, limitations imposed on our business and our ability to satisfy complex rules in order for us to maintain our qualification for taxation as a REIT for U . S . federal income tax purposes, acts of terrorism, pandemics, or other man - made or natural disasters beyond our control and actual and potential conflicts of interest with our related parties including our Managing Trustees, TA, Sonesta, RMR LLC and others affiliated with them . Our Annual Report on Form 10 - K for the year ended December 31 , 2021 and our other filings with the Securities and Exchange Commission, or SEC, identify other important factors that could cause differences from our forward - looking statements . Our filings with the SEC are available on the SEC’s website at www . SEC . gov . You should not place undue reliance upon our forward - looking statements . Except as required by law, we do not intend to update or change any forward - looking statements as a result of new information, future events or otherwise . Non - GAAP Financial Measures This presentation contains Non - GAAP financial measures including, among others, “FFO”, “Normalized FFO”, “EBITDA”, “Hotel EBITDA”, “Adjusted Hotel EBITDA”, “EBITDAre”, and “Adjusted EBITDAre” . Reconciliations for those metrics to the most directly comparable financial measure calculated in accordance with U . S . generally accepted accounting principles, or GAAP, are included in the Appendix hereto . Unless otherwise noted, all data presented is as of and for the three months ended September 3 0 , 2022 . Please refer to page 30 for certain definitions of terms used throughout this presentation .

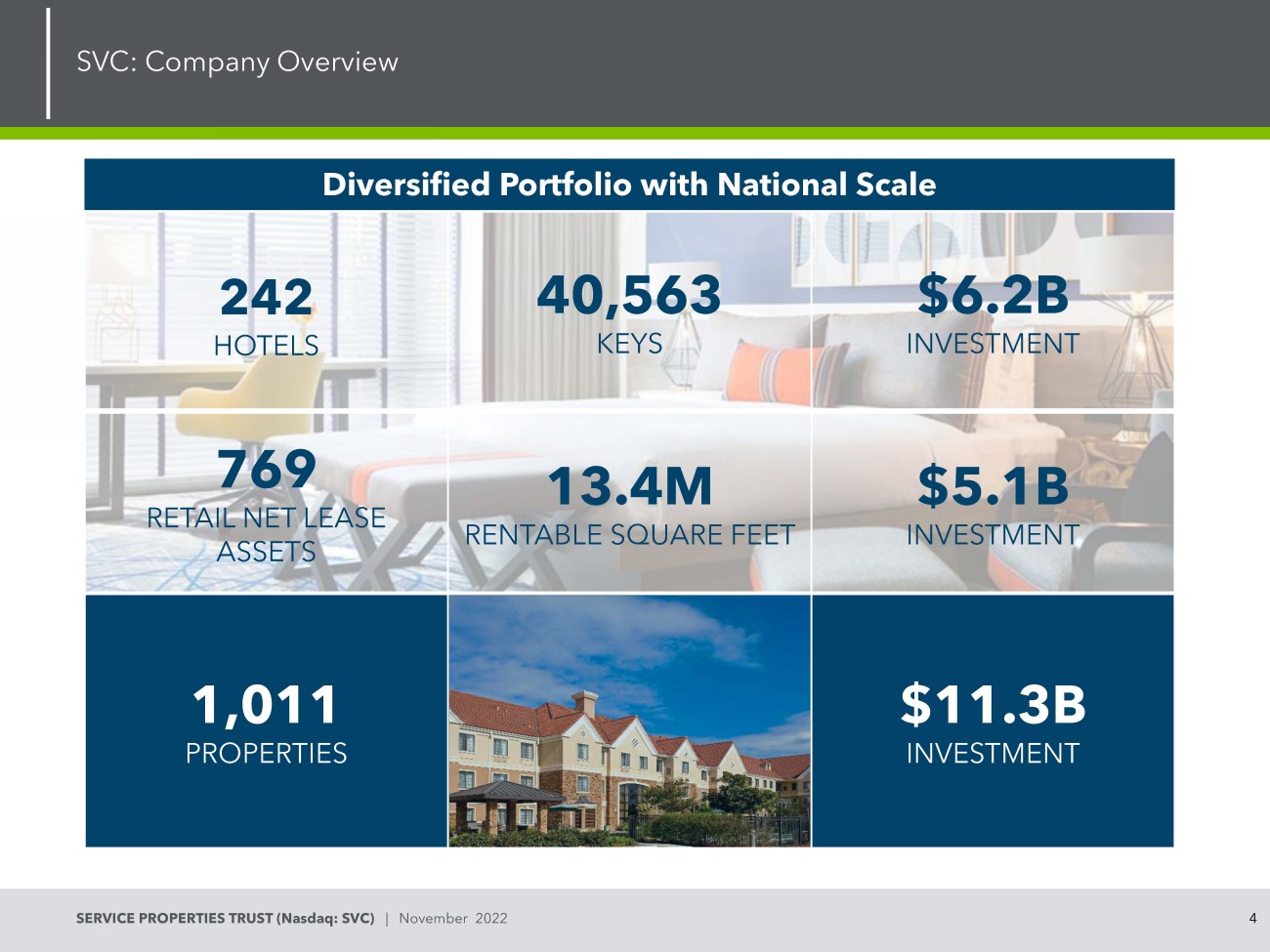

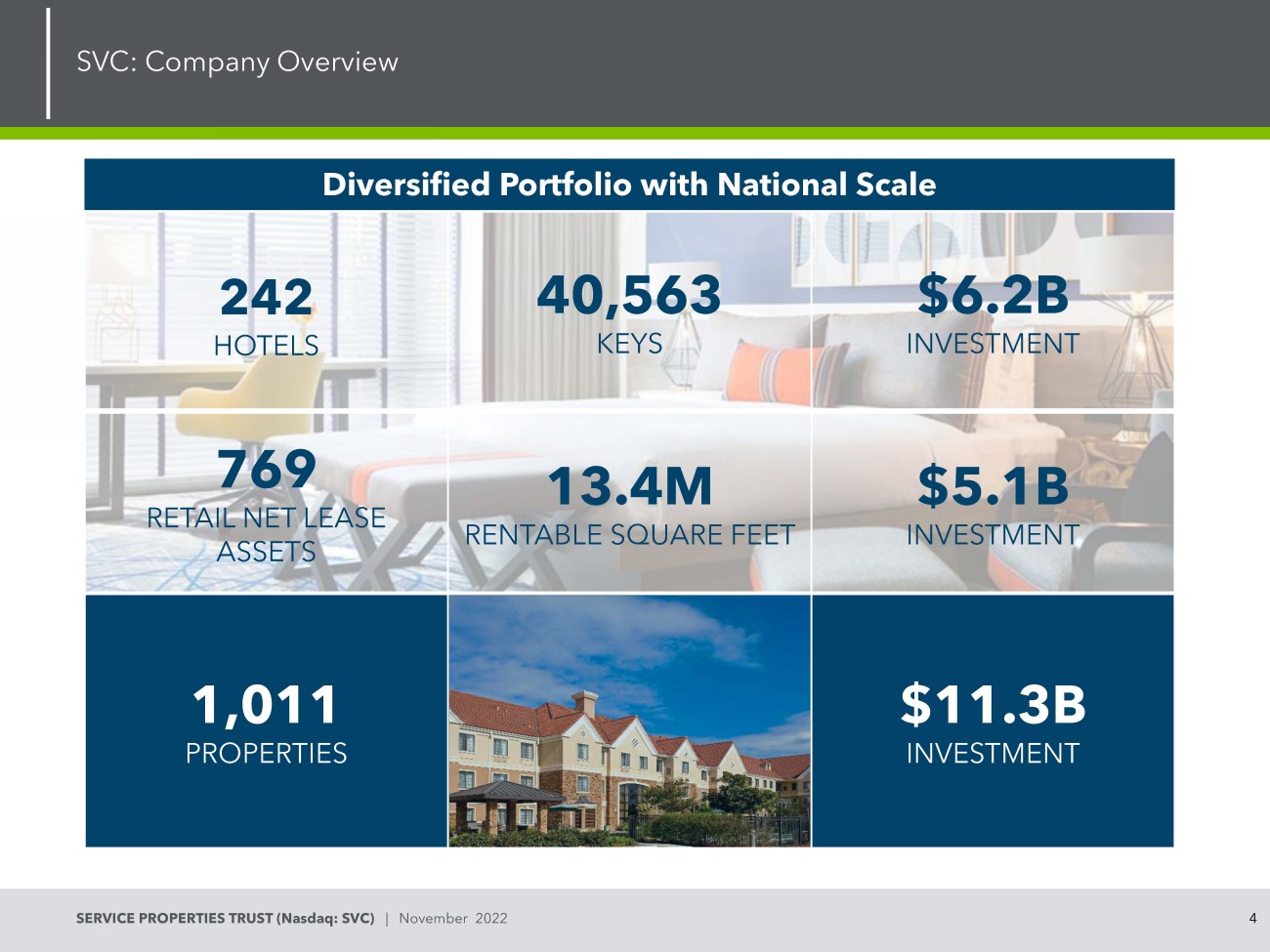

3 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 SVC: Company Overview SVC invests in two asset categories: hotels and service - focused retail net lease properties to provide diversification to its cash flows. Necessity - based retail assets with strong rent coverage , low capex requirements and long lease terms produce stable cash flows that balance the cyclicality of the hotel portfolio. Diversified by location and industry: properties in 22 industries with 147 brands located across 46 states , Washington, DC, Puerto Rico and Canada. Hotel portfolio weighted toward extended stay , which generally have lower fixed costs and higher margins .

4 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 SVC: Company Overview 242 HOTELS 40,563 KEYS $6.2B INVESTMENT 769 RETAIL NET LEASE ASSETS 13.4M RENTABLE SQUARE FEET $5.1B INVESTMENT 1,011 PROPERTIES $11.3B INVESTMENT Diversified Portfolio with National Scale

5 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 SVC: Recent Events Property Sales : Sold 80 properties for $532 million YTD Line of Credit : Extended maturity date to July 2023 Quarterly Dividend Increased: To $0.20 per share Hotel Portfolio Improv ement: Q3 RevPAR increased 29.6% from prior year third quarter Stead y Net Lease Portfolio: Continued stable cash flows Rent coverage increased to 2.88x

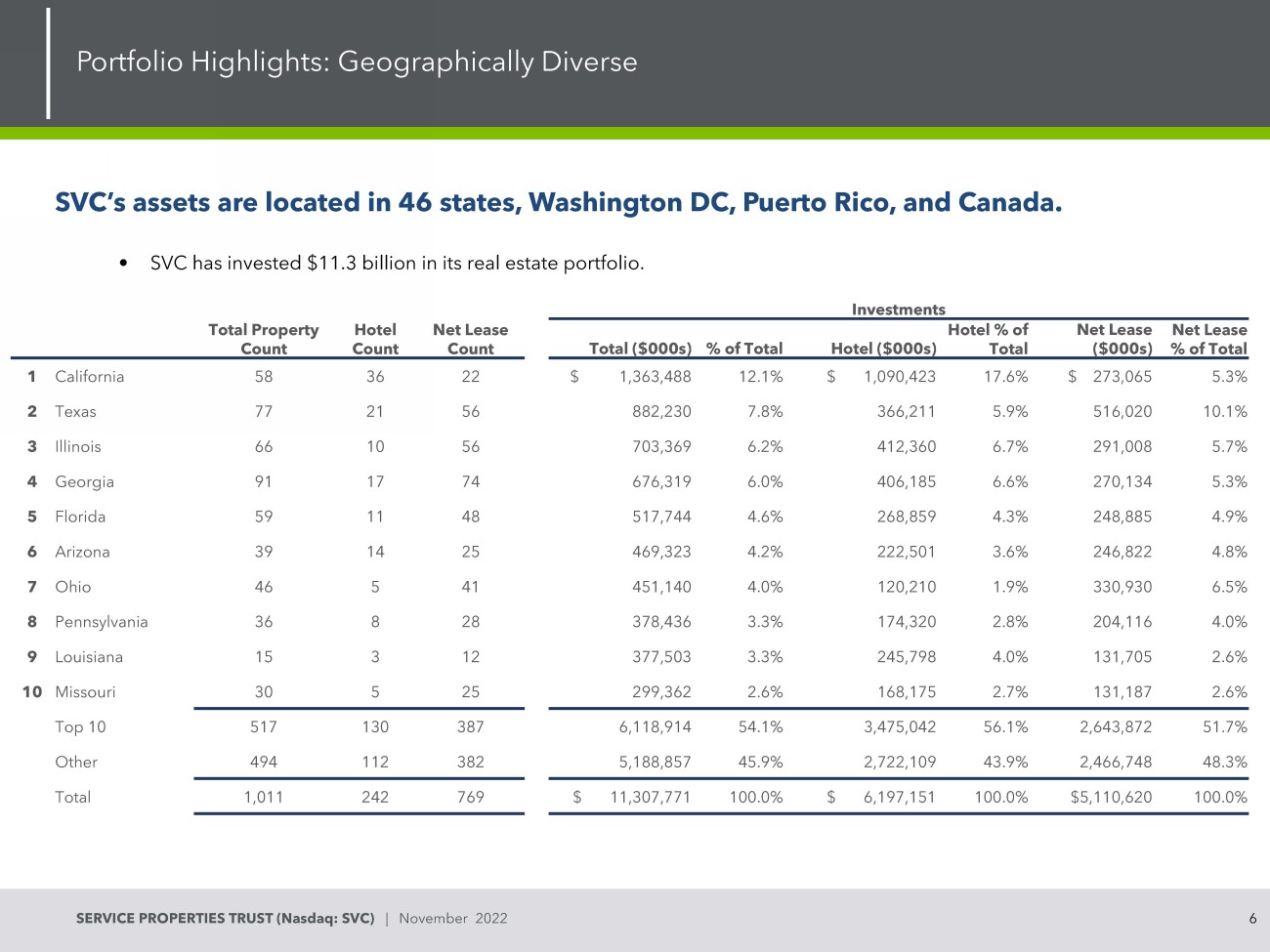

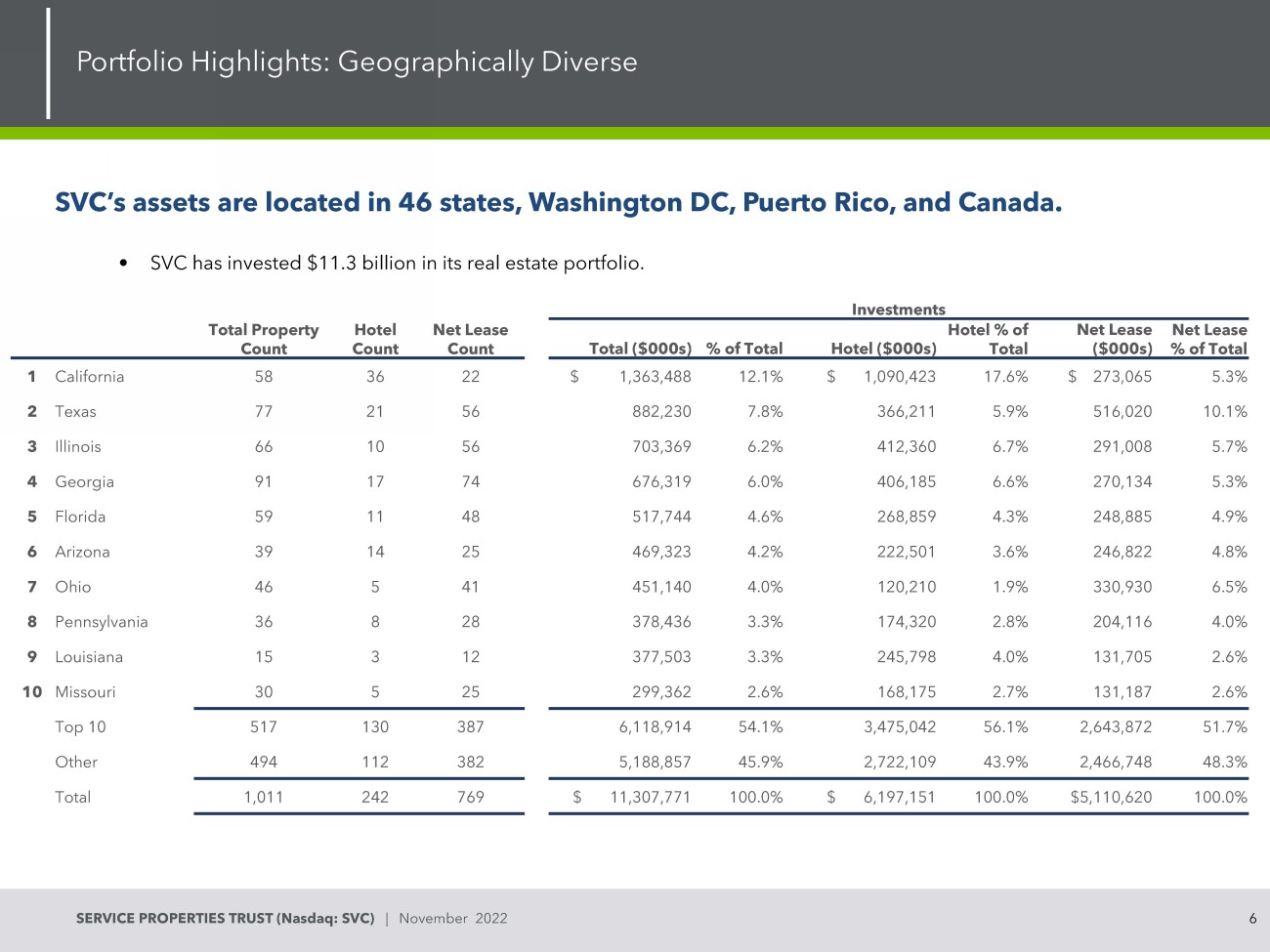

6 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 SVC’s assets are located in 4 6 states, Washington DC, Puerto Rico, and Canada. Portfolio Highlights: Geographically Diverse • SVC has invested $1 1 . 3 billion in its real estate portfolio. • SVC’s investments are located in various markets near demand generators. • SVC believes geographic diversity mitigates market risk. Investments Total Property Count Hotel Count Net Lease Count Total ($000s) % of Total Hotel ($000s) Hotel % of Total Net Lease ($000s) Net Lease % of Total 1 California 58 36 22 $ 1,363,488 12.1% $ 1,090,423 17.6% $ 273,065 5.3% 2 Texas 77 21 56 882,230 7.8% 366,211 5.9% 516,020 10.1% 3 Illinois 66 10 56 703,369 6.2% 412,360 6.7% 291,008 5.7% 4 Georgia 91 17 74 676,319 6.0% 406,185 6.6% 270,134 5.3% 5 Florida 59 11 48 517,744 4.6% 268,859 4.3% 248,885 4.9% 6 Arizona 39 14 25 469,323 4.2% 222,501 3.6% 246,822 4.8% 7 Ohio 46 5 41 451,140 4.0% 120,210 1.9% 330,930 6.5% 8 Pennsylvania 36 8 28 378,436 3.3% 174,320 2.8% 204,116 4.0% 9 Louisiana 15 3 12 377,503 3.3% 245,798 4.0% 131,705 2.6% 10 Missouri 30 5 25 299,362 2.6% 168,175 2.7% 131,187 2.6% Top 10 517 130 387 6,118,914 54.1% 3,475,042 56.1% 2,643,872 51.7% Other 494 112 382 5,188,857 45.9% 2,722,109 43.9% 2,466,748 48.3% Total 1,011 242 769 $ 11,307,771 100.0% $ 6,197,151 100.0% $5,110,620 100.0%

SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Hotel Portfolio

8 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 BY SERVICE LEVEL (1) BY CHAIN SCALE (1) BY LOCATION Full Service , 37.2% Select Service , 27.2% Extended Stay , 35.6% Upscale , 50.2% Upper Upscale , 14.0% Upper Midscale/ Midscale , 35.8% Location Keys % of Portfolio Suburban 20,573 50.7% Urban 9,193 22.7% Airport 7,611 18.8% Resort 2,852 7.0% Small Metro 121 0.3% Interstate 213 0.5% Total 40,563 100.0% Hotel Portfolio: Diversified by Location and Service Level 1) Percent based on number of keys.

9 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Hotel Portfolio: Monthly Operating Metrics vs. 2019 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% - 10.00 20.00 30.00 40.00 50.00 60.00 70.00 80.00 90.00 100.00 RevPAR vs 2019 (All 242 Hotels) RevPAR As a Percent of 2019 Full Service September 2022 As a Pct. of September 2019 Select Service September 2022 As a Pct. of September 2019 Extended Stay September 2022 As a Pct. of September 2019 Occupancy 65.0% 87.5% Occupancy 60.4% 83.5% Occupancy 71.9% 90.3% ADR $187.08 110.1% ADR $120.66 94.2% ADR $110.62 97.5% RevPAR $121.60 96.3% RevPAR $72.88 78.7% RevPAR $79.54 88.1%

10 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Hotel Portfolio: Monthly Operating Metrics ( All 242 Hotels) Monthly Hotel EBITDA ($ in Millions) 62.3% 56.2% 59.6% 60.1% 55.0% 50.2% 44.7% 52.7% 61.5% 65.2% 65.5% 69.5% 68.00% 63.10% 66.20% $123 $118 $118 $121 $114 $116 $110 $121 $128 $134 $137 $145 $145 $134 $141 $77 $66 $71 $73 $63 $58 $49 $64 $79 $88 $90 $101 $98 $85 $93 $0 $50 $100 $150 $200 $250 0% 10% 20% 30% 40% 50% 60% 70% 80% Jul '21 Aug '21 Sep '21 Oct '21 Nov '21 Dec '21 Jan '22 Feb '22 Mar '22 Apr '22 May '22 Jun '22 Jul '22 Aug '22 Sep '22 Occupancy ADR RevPAR $21.5 $12.5 $11.3 $17.2 $6.9 $3.2 - $11.6 $1.6 $17.5 $24.1 $29.2 $37.4 $34.4 $17.0 $29.1 -$20 -$10 $0 $10 $20 $30 $40 Jul '21 Aug '21 Sep '21 Oct '21 Nov '21 Dec '21 Jan '22 Feb '22 Mar '22 Apr '22 May '22 Jun '22 Jul '22 Aug '22 Sep '22

11 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Hotel Portfolio: By Service Level Top 5 Hotel EBITDA Generators # of Keys Hotel EBITDA ( (000’s) Royal Sonesta Kaua’i 356 $ 5,473 Sonesta Hilton Head, SC 340 4,610 Royal Sonesta Cambridge/Boston, MA 400 4,542 Royal Sonesta Toronto (Yorkville), ON 212 2,132 Royal Sonesta San Juan, PR 402 1,826 Total 1,710 $ 18,583 Q3 Hotel EBITDA by Service Level • C onsolidated portfolio of 242 hotels generated hotel EBITDA of $80.6 million, resulting in a net margin of 20.2 %. • Full - service hotels generated $39 million of hotel EBITDA during the quarter, a 186% increase over the prior year period. • Extended stay hotels generated $27.2 million of hotel EBITDA during the quarter, a 14.6% increase over the prior year period. • Select service hotels also improved, generating hotel EBITDA of $14.4 million in the third quarter, an increase of 81% compared to the prior year period. $14 $8 $24 $39 $14 $27 18.5% 18.3% 24.9% 9.7% 13.0% 24.8% 0% 20% 40% 60% 80% 100% 120% $- $5 $10 $15 $20 $25 $30 $35 $40 $45 Full-Service Select Service Extended Stay 2021 EBITDA 2022 EBITDA 2022 Net Margin 2021 Net Margin 2022 Hotel EBITDA 2021 Hotel EBITDA

12 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Hotel Portfolio: Dispositions Improving Overall Quality of Hotel Portfolio (1) $88 $101 $111 $110 $113 $119 $113 $108 $106 $112 $93 $76 $51 $59 $71 $79 $88 $93 $86 $85 $80 $88 $67 $51 Jan '19 Feb '19 Mar '19 Apr '19 May '19 Jun '19 Jul '19 Aug '19 Sep '19 Oct '19 Nov '19 Dec '19 Monthly RevPAR: Full Year 2019 Retained Hotels Exit Hotels $50 $65 $81 $89 $91 $103 $100 $86 $95 $36 $42 $53 $66 $70 $77 $74 $72 $68 Jan '22 Feb '22 Mar '22 Apr '22 May '22 Jun '22 Jul '22 Aug '22 Sep '22 Monthly RevPAR: YTD 2022 Retained Hotels Exit Hotels $200M $6M Retained Hotels Exit Hotels Hotel EBITDA: LTM Ended 9/30/22 $459M $17M Retained Hotels Exit Hotels Hotel EBITDA: Full Year 2019 (1) Retained Hotels portfolio consist of 220 hotels. Exit Hotels consist of five hotels sold during the quarter, one hotel sold s ubs equent to September 30, 2022 and 16 hotels under agreement for sale as of September 30, 2022.

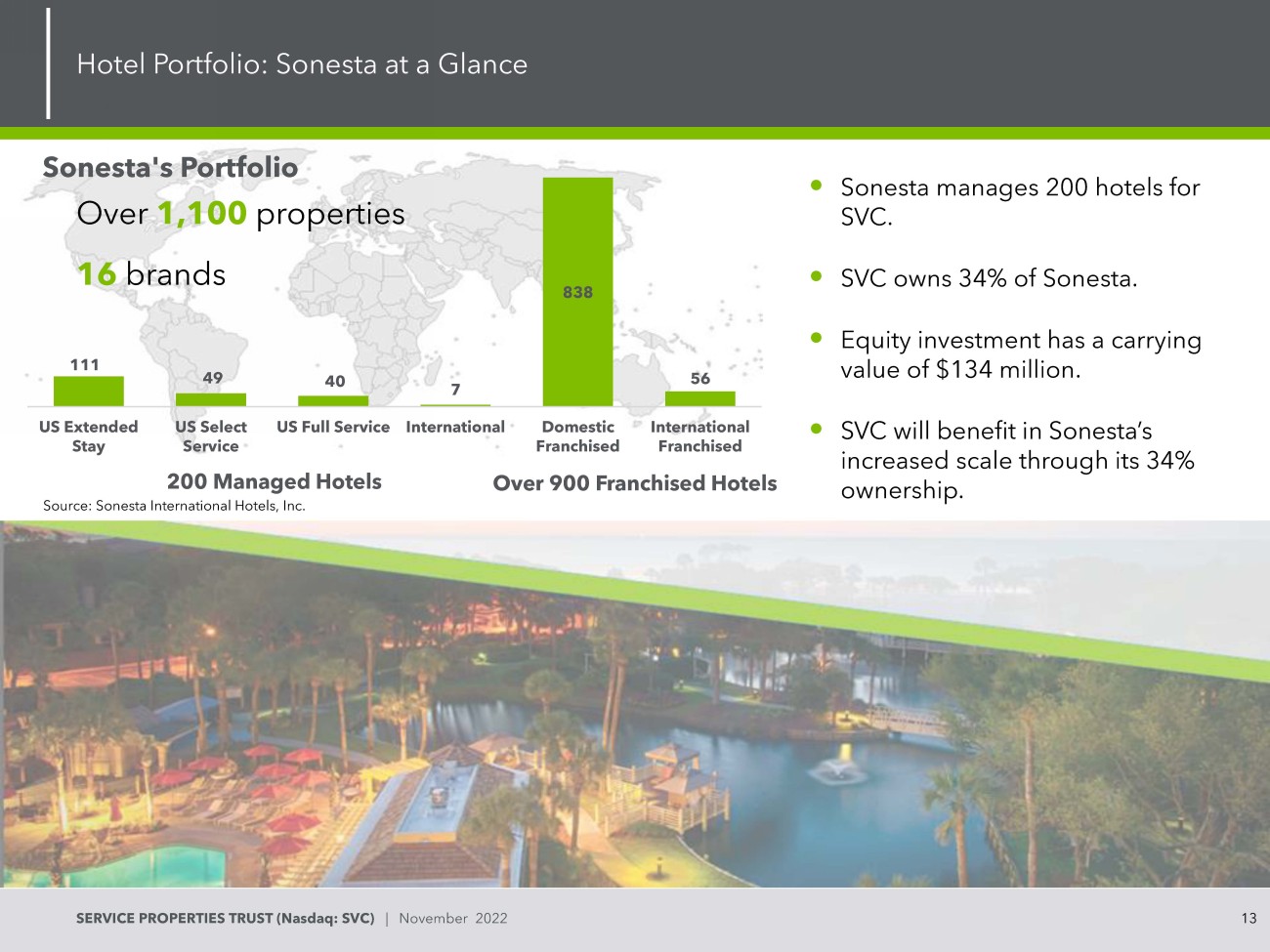

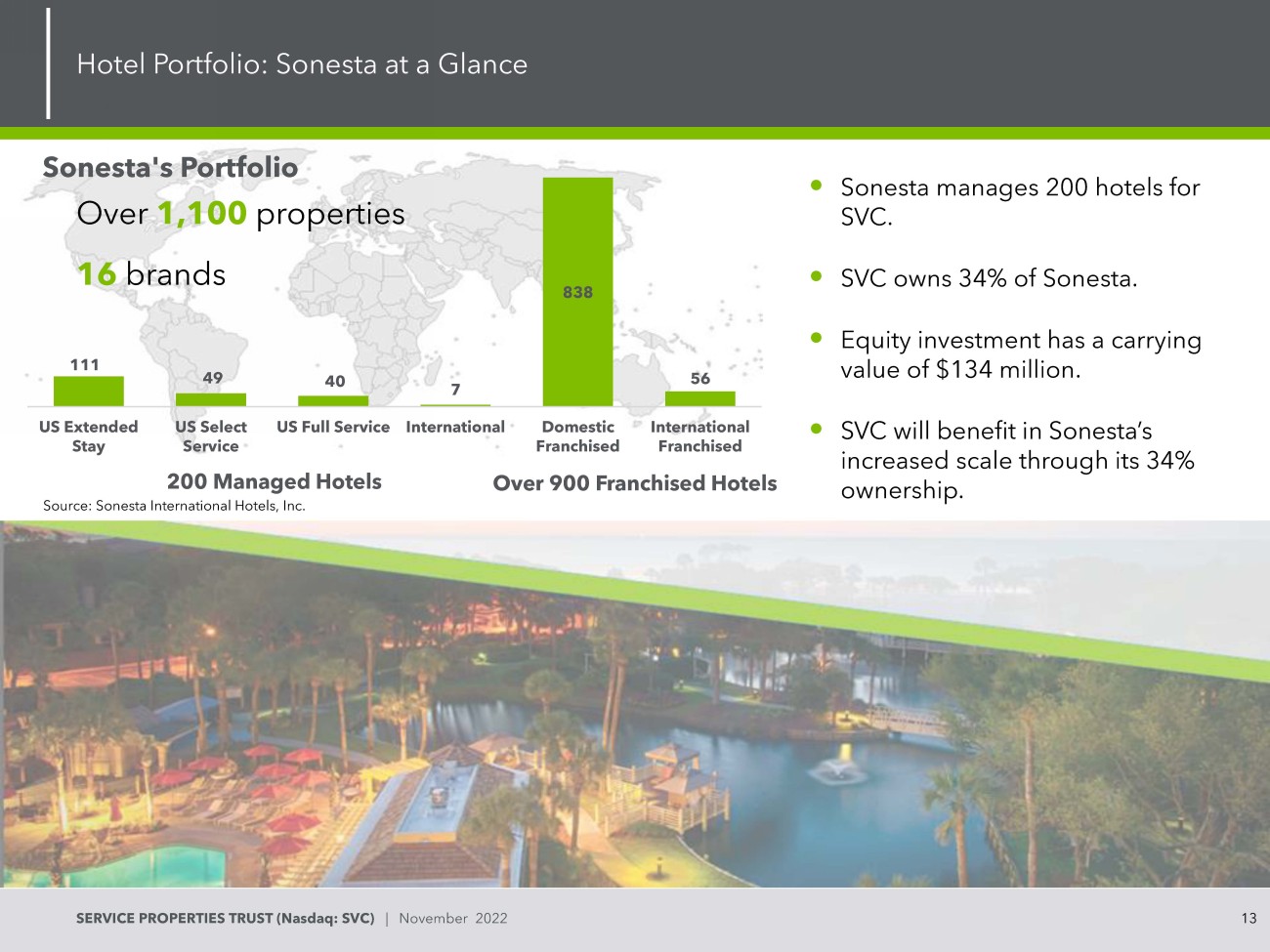

13 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 111 49 40 7 838 56 US Extended Stay US Select Service US Full Service International Domestic Franchised International Franchised • Sonesta manages 2 00 hotels for SVC. • SVC owns 34% of Sonesta. • Equity investment has a carrying value of $134 million. • SVC will benefit in Sonesta’s increased scale through its 34% ownership. Hotel Portfolio: Sonesta at a Glance Over 1,1 00 properties 1 6 brands Source: Sonesta International Hotels, Inc. Sonesta's Portfolio 2 00 Managed Hotels Over 900 Franchised Hotels

SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Net Lease Portfolio

15 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Net Lease Portfolio: High - Quality Service & Necessity Based Assets Net Lease Portfolio Statistics 7 69 $37 3 mm Properties Annual ized Minimum Rent 13. 4 mm 9.8 Rentable Square Feet Weighted Average Lease Term (1) 9 8.1 % 2. 88x Occupancy Rent Coverage Diverse Geographical Footprint (1) (1) By annual ized minimum rent. 2 1 Industries | 1 36 Brands % of Annual Minimum Rent <1% >8. 6 %

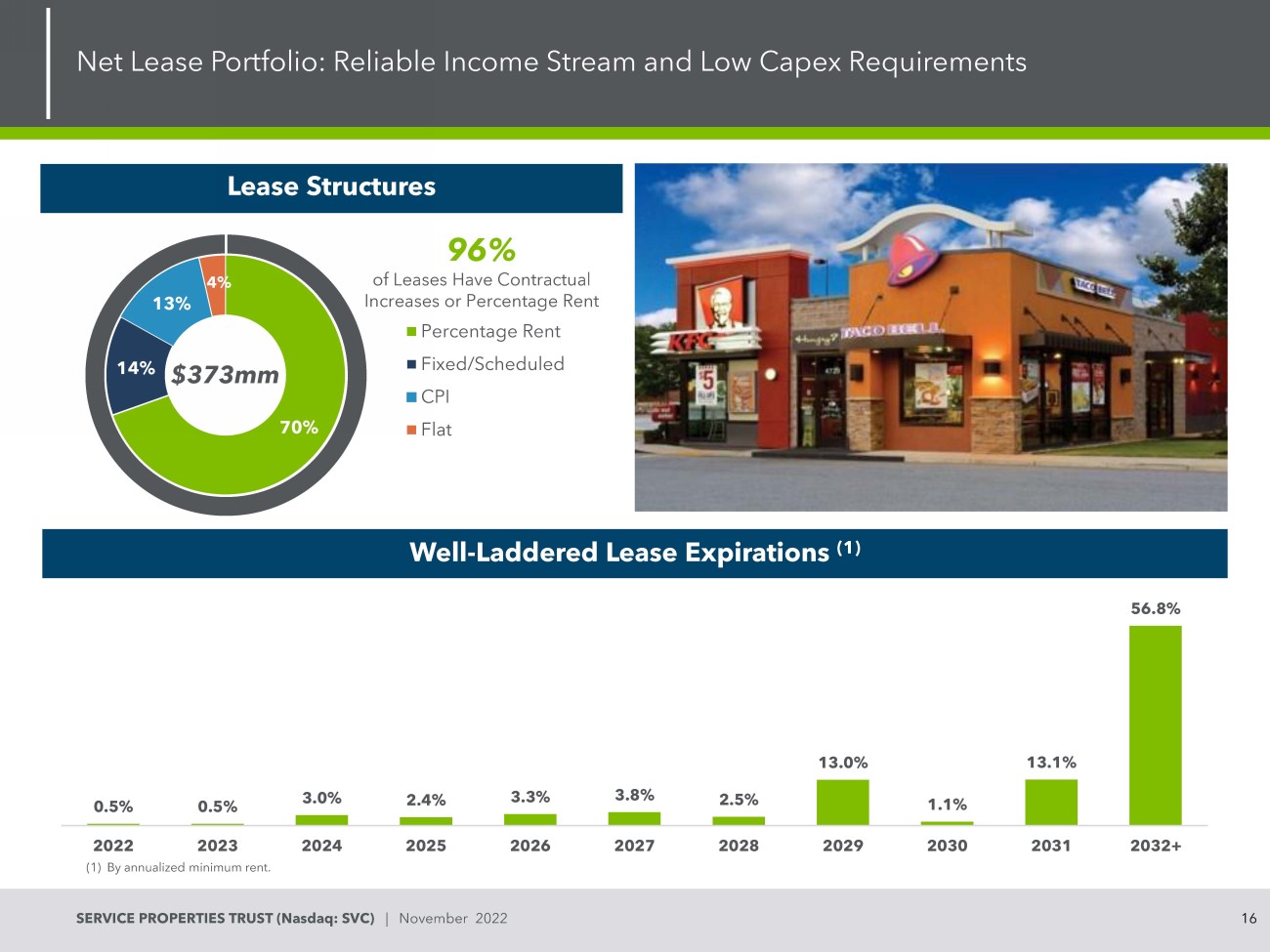

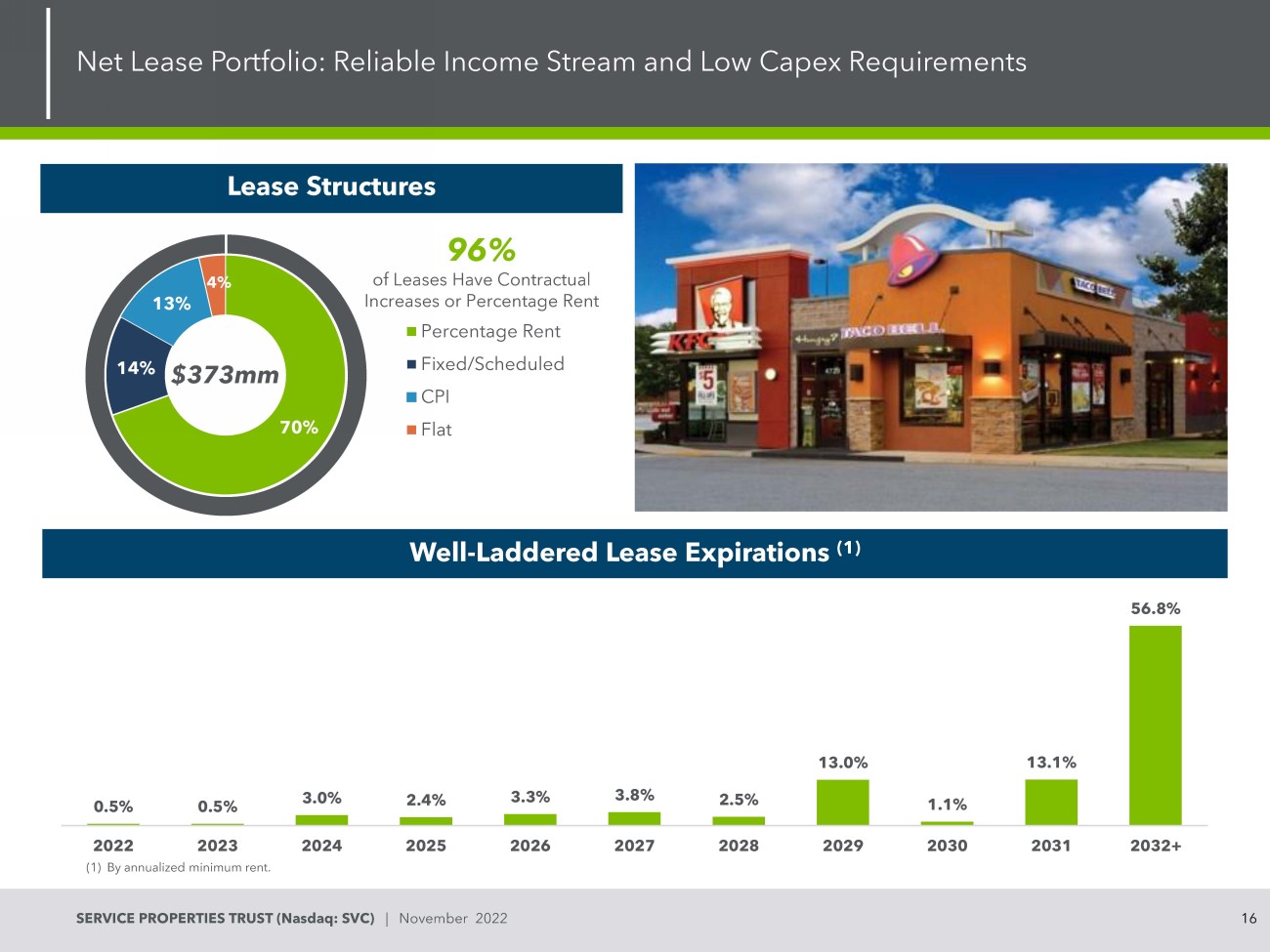

16 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 70% 14% 13% 4% Percentage Rent Fixed/Scheduled CPI Flat (1) By annual ized minimum rent. Net Lease Portfolio: Reliable Income Stream and Low Capex Requirements Well - Laddered Lease Expirations (1) 9 6 % of Leases Have Contractual Increases or Percentage Rent Lease Structures $37 3 m m 0.5% 0.5% 3.0% 2.4% 3.3% 3.8% 2.5% 13.0% 1.1% 13.1% 56.8% 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032+

17 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Net Lease Portfolio: Diversified Tenants & Industries Mitigate Risk (1) By annualized minimum rent . Tenants by Brand (1) Tenants by Industry (1) Travel Centers , 66.9% Restaurants - Quick Service , 5.3% Movie Theaters , 3.7% Restaurants - Casual Dining , 3.2% Health and Fitness , 2.9% Medical, Dental Office , 2.7% Grocery Stores , 2.5% Home Goods and Leisure , 2.1% Automotive Equipment & Services , 1.9% Automotive Dealers , 1.3% Other , 7.5% Brand % of Annualized Minimum Rent Rent Coverage TravelCenters of America / Petro Stopping Centers 66.1% 2.54x The Great Escape 2.1% 7.79x AMC Theatres 1.8% 1.01x Life Time Fitness 1.5% 1.81x Buehler's Fresh Foods 1.5% 5.90x Heartland Dental 1.2% 4.42x Regal Cinemas 1.0% 0.70x Express Oil Change 1.0% 4.34x Norms 1.0% 2.34x Flying J Travel Plaza 0.9% 5.86x Other 21.9% 2.61x 100% 2. 88 x

18 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 • Represents approximately 30 % of SVC’s portfolio based on investment. • Rent comprised of annual minimum cash payments of $24 6 million , plus a percentage rent based on increases in certain sales . • LTM rent coverage of 2. 54x through September 30 , 2022 , improved from 2.10x during the prior year period . • TA recently reporting an increase of 45% in adjusted EBITDA, to $320 million, for the LTM ended September 30, 2022 versus the prior year period. • TA is investing significant capital into SVC’s travel centers, including customer - focused enhancements and system improvements to drive efficiency and performance. • TA is expanding its geographical footprint and market share, having acquired five travel centers, two truck service facilities, and signing 16 franchise agreements in 2022. Net Lease Portfolio: Recent Developments Portfolio Updates - TravelCenters of America

SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Financial Information

20 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Balance Sheet Overview as of September 3 0 , 2022 Well Laddered Debt Maturities Book Capitalization Leverage/Coverage Ratios Net Debt / Total Gross Assets 5 4 . 2 % Net Debt / Gross Book Value of Real Estate Assets 5 6 . 5 % Adjusted EBITDA re / Interest Expense (1) 1. 6 x Net Debt / EBITDA re ( 1 ) (2) 1 0.1 x Strong Balance Sheet Floating Rate Debt 1% Unsecured Fixed Rate Debt 7 9 % Shareholder’s Equity 20 % (1) Represents the twelve months ended September 3 0 , 2022 (2) The ratio of net debt to annualized adjusted EBITDA re for the three months ended September 30, 2022 was 8.3x . • Unsecured fixed rate senior notes: $ 5.7 billion with a weighted average interest rate of 5.07% . • $ 800 m illion r evolving credit facility: ◦ Maturity date extended to July 2023. ◦ Repaid $705 million in Q3 2022. • No derivatives, off - balance sheet liabilities, or material adverse change clauses or ratings triggers. $0 $400 $800 $1,200 $1,600 2022 2023 2024 2025 2026 2027 2028 2029 2030 Millions Fixed Rate Debt Revolving Credit Facility - 1% 79% 20%

21 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Public Debt Covenants Metric Covenant September 3 0 , 2022 Total Debt / Adjusted Total Assets Allowable Maximum: 60.0% 5 3 . 8 % Secured Debt / Adjusted Total Assets Allowable Maximum: 40.0% 0.9 % Consolidated Income Available for Debt Service / Debt Service Required Minimum: 1.50x 1. 72 x Total Unencumbered Assets / Unsecured Debt Required Minimum: 150% 1 61 . 0 %

22 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Financial Services: Real Estate Services: Business Services: Accounting Acquisitions/ Dispositions Administration Capital Markets Asset Management Human Resources Compliance/ Audit Construction/ Development Information Technology (IT) Finance/ Planning Engineering Investor Relations Treasury Leasing Marketing Tax Property Management Legal/ Risk Management ~$37 Billion in AUM Approximately 600 CRE Professionals More than 30 Offices Throughout the U.S. More than 38 ,000 Employees Over 2,100 Properties $12 Billion in Annual Revenues Combined RMR Managed Companies: SVC IS MANAGED BY THE RMR GROUP, AN ALTERNATIVE ASSET MANAGER Strong Management Platform and Affiliate Advantages 22 National Multi - Sector Investment Platform Office Industrial Government Medical Office Life Science Senior Housing Hotels Retail

23 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 RMR base management fee tied to SVC share price performance. RMR incentive fees contingent on total shareholder return (1) outperformance. • Equal to 12% of value generated by SVC in excess of the benchmark index total returns ( MSCI U.S. REIT/HOTEL & RESORT REIT Index ) per share over a three year period, subject to a cap (1.5% of equity market cap). • Absolute dollar outperformance must be positive to receive an incentive fee: it can’t be negative but better than the index. • Shareholders keep 100% of benchmark returns and 88% of returns in excess of the benchmark. Alignment of Interests If SVC’s stock price goes up and its total market cap exceeds its historical cost of real estate, RMR base management fee is capped at 50 bps of historical cost of real estate. If total market cap is less than historical cost of real estate, base fee fluctuates with share price. Incentive fee structure keeps RMR focused on increasing total shareholder return. Members of RMR senior management and RMR are holders of SVC stock, RMR is subject to long term lock up agreements. SVC shareholders have visibility into RMR, a publicly traded company. SVC benefits from RMR’s national footprint and economies of scale of $3 7 billion platform. (1) To determine final share price in SVC’s Total Return calculation, the business management agreement requires that the hig hes t ten day share price average within the last 30 trading days of the measurement period be used. In the past, this and other less significant factors have resulted in differences between the MSCI calculation of SVC’s total return percentage and the total return percentage computed under the agreement. The RMR Group LLC and Shareholder Alignment 23 Other fees . • Property management fee consists of an annual fee based on 3.0% of rents collected at SVC’s managed retail net lease properties (excluding TA). • Consists of an annual fee equal to generally 50 bps multiplied by the lower of: (1) SVC's historical cost of real estate, or (2) SVC's total market capitalization. • There is no incentive fee for RMR to complete any transaction that could reduce share price.

SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Appendix

25 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Calculation of Funds From Operations (FFO) and Normalized FFO See accompanying notes on page 29 . Three Months Ended For the Nine Months Ended (amounts in thousands, except per share data) 9/30/22 6/30/22 3/31/22 12/31/21 9/30/21 9/30/22 9/30/21 Net income (loss) $ 7,500 $ 11,350 $ (119,822) $ (198,793) $ (59,714) $ (100,972) $ (345,814) Add (Less): Depreciation and amortization 101,514 100,520 104,113 115,757 124,163 306,147 370,208 Loss on asset impairment, net (1) 1,172 3,048 5,500 76,510 - 9,720 2,110 Loss (gain) on sale of real estate, net (2) 164 (38,851) (5,548) (588) (94) (44,235) (10,934) Unrealized (gains) losses on equity securities, net (3) (23,056) 10,059 10,260 (2,168) (24,348) (2,737) (20,367) Adjustments to reflect our share of FFO attributable to an investee (4) 1,103 905 666 737 369 2,674 1,868 FFO $ 88,397 $ 87,031 $ (4,831) $ (8,545) $ 40,376 $ 170,597 $ (2,929) Add (Less): Loss on early extinguishment of debt (5) - 791 - - - 791 - Adjustments to reflect our share of Normalized FFO attributable to an investee (4) 61 593 245 651 256 899 1,619 Transaction related costs (6) - 743 1,177 35,830 3,149 1,920 28,934 Normalized FFO $ 88,458 $ 89,158 $ (3,409) $ 27,936 $ 43,781 $ 174,207 $ 27,624 Weighted average shares outstanding (basic and diluted) 164,745 164,667 164,667 164,667 164,590 164,697 164,532 Basic and diluted per share common share amounts: Net income (loss) $ 0.05 $ 70.00 $ (0.73) $ (1.21) $ (0.36) $ (0.61) $ (2.10) FFO $ 0.54 $ 0.53 $ (0.03) $ (0.05) $ 0.25 $ 1.04 $ (0.02) Normalized FFO $ 0.54 $ 0.54 $ (0.02) $ 0.17 $ 0.27 $ 1.06 $ 0.17

26 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Calculation of EBITDA, EBITDA re and Adjusted EBITDA re See accompanying notes on page 29 . (dollars in thousands) 9/30/22 6/30/22 3/31/22 12/31/21 9/30/21 9/30/22 9/30/21 $ 7,500 $ 11,350 $ (119,822) $ (198,793) $ (59,714) $ (100,972) $ (345,814) Interest expense 81,740 89,820 92,344 92,494 92,458 263,904 273,227 Income tax (benefit) expense 390 473 695 (1,950) (55) 1,558 1,009 Depreciation and amortization 101,514 100,520 104,113 115,757 124,163 306,147 370,208 191,144 202,163 77,330 7,508 156,852 470,637 298,630 Loss on asset impairment, net (1) 1,172 3,048 5,500 76,510 - 9,720 2,110 (Gain) Loss on sale of real estate, net (2) 164 (38,851) (5,548) (588) (94) (44,235) (10,934) Adjustments to reflect our share of EBITDAre attributable to an investee (4) 2,787 2,074 680 781 464 5,541 2,123 195,267 168,434 77,962 84,211 157,222 441,663 291,929 Unrealized (gains) losses on equity securities, net (3) (23,056) 10,059 10,260 (2,168) (24,348) (2,737) (20,367) Loss on early extinguishment of debt (5) - 791 - - - 791 - Adjustments to reflect our share of Adjusted EBITDAre attributable to an investee (4) 272 1,014 280 651 256 1,566 1,619 Transaction related costs (6) - 743 1,177 35,830 3,149 1,920 28,934 General and administrative expense paid in common shares (7) 972 832 462 473 1,045 2,266 2,490 $ 173,455 $ 181,873 $ 90,141 $ 118,997 $ 137,324 $ 445,469 $ 304,605 EBITDA Adjusted EBITDAre Add (Less): EBITDAre Add (less): Three Months Ended For the NineMonths Ended Net income (loss) Add (Less):

27 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Calculation and Reconciliation of Hotel EBITDA and Adjusted Hotel EBITDA - Comparable Hotels See accompanying notes on page 29 . (dollars in thousands) For the Three Months Ended For Nine Months Ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 9/30/2022 9/30/2021 Number of hotels 240 240 240 240 240 239 239 Room revenues $ 339,106 $ 336,263 $ 228,436 $ 234,647 $ 257,885 $ 891,053 $ 596,479 Food and beverage revenues 42,624 44,171 25,441 30,641 25,151 110,115 51,062 Other revenues 16,669 17,496 12,511 12,777 13,485 45,812 33,246 Hotel operating revenues - comparable hotels 398,399 397,930 266,388 278,065 296,521 1,046,980 680,787 Rooms expenses 103,580 98,923 77,692 78,299 80,589 273,928 196,795 Food and beverage expenses 34,497 32,222 22,838 25,879 20,851 86,475 43,897 Other direct and indirect expenses 131,456 128,902 113,185 109,517 110,795 367,242 300,147 Management fees 14,847 14,749 10,214 10,847 10,826 39,341 24,042 Real estate taxes, insurance and other 30,246 29,865 32,041 25,223 26,226 90,700 79,589 FF&E reserves (8) 2,621 2,600 1,794 1,236 1,411 7,016 3,224 Hotel operating expenses - comparable hotels 317,247 307,261 257,764 251,001 250,698 864,702 647,694 Hotel EBITDA 81,152 90,669 8,624 27,064 45,823 182,278 33,093 Hotel EBITDA Margin 20.4% 22.8% 3.2% 9.7% 15.5% 17.4% 4.9% Hotel operating revenues (GAAP) (9) 400,453 418,984 297,406 317,215 338,375 1,116,843 787,463 Add (less) Hotel operating revenues from non - comparable hotels (2,054) (21,054) (31,018) (39,150) (41,854) (69,863) (106,676) Hotel operating revenues - comparable hotels $ 398,399 $ 397,930 $ 266,388 $ 278,065 $ 296,521 $ 1,046,980 $ 680,787 - - - - - - - Hotel operating expenses (GAAP) (9) $ 318,266 $ 325,194 $ 290,343 $ 286,968 $ 285,233 $ 933,803 $ 723,769 Add (less) Hotel operating expenses from non - comparable hotels (4,261) (21,154) (34,994) (37,824) (36,567) (76,738) (95,618) Reduction for security deposit and guaranty fundings, net (10) - - - - - - 15,698 FF&E reserves from managed hotel operations (8) 2,621 2,600 1,794 1,236 1,411 7,016 3,224 Other (11) 621 621 621 621 621 621 621 Hotel operating expenses - comparable hotels $ 317,247 $ 307,261 $ 257,764 $ 251,001 $ 250,698 $ 864,702 $ 647,694

28 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Calculation and Reconciliation of Hotel EBITDA and Adjusted Hotel EBITDA - All Hotels See accompanying notes on page 29 . (dollars in thousands) For the Three Months Ended For the Nine Months Ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 9/30/2022 9/30/2021 Number of hotels 242 247 298 303 304 242 304 Room revenues $ 341,106 $ 357,117 $ 258,620 $ 272,458 $ 298,607 $ 956,843 $ 699,953 Food and beverage revenues 42,636 44,256 25,902 31,503 25,822 112,794 52,927 Other revenues 16,711 17,611 12,884 13,254 13,946 47,206 34,583 Hotel operating revenues 400,453 418,984 297,406 317,215 338,375 1,116,843 787,463 Rooms expenses 104,761 106,982 88,743 90,705 93,035 300,486 230,523 Food and beverage expenses 34,497 32,333 23,234 26,768 21,415 90,064 46,116 Other direct and indirect expenses 130,470 136,099 127,017 126,208 125,080 393,586 332,378 Management fees 14,362 15,240 11,332 11,869 12,710 40,934 28,609 Real estate taxes, insurance and other 34,797 35,161 40,638 32,039 33,614 110,592 103,702 FF&E reserves (8) 2,622 3,172 1,222 1,236 1,411 7,016 3,310 Hotel operating expenses 321,509 328,987 292,186 288,825 287,265 942,678 744,638 Hotel EBITDA $ 78,944 $ 89,997 $ 5,220 $ 28,390 $ 51,110 $ 174,165 $ 42,825 Hotel EBITDA Margin 19.7% 21.5% 1.8% 8.9% 15.1% 15.6% 5.4% Hotel operating expenses (GAAP) (9) $ 318,266 $ 325,194 $ 290,343 $ 286,968 $ 285,233 $ 933,803 $ 723,769 Add (less) Reduction for security deposit and guaranty fundings, net (10) - - - - - - 15,696 FF&E reserves from managed hotel operations (8) 2,622 3,172 1,222 1,236 1,411 7,016 3,310 Other (11) 621 621 621 621 621 1,863 1,863 Hotel operating expenses $ 321,509 $ 328,987 $ 292,186 $ 288,825 $ 287,265 $ 942,682 $ 744,638

29 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Notes to Calculations of FFO, Normalized FFO, EBITDA, EBITDAre, Adjusted EBITDAre, Hotel EBITDA and Adjusted Hotel EBITDA 29 1) We recorded a loss on asset impairment of $1,172 to reduce the carrying value of three hotels and one net lease property to t hei r estimated fair value less costs to sell during the three months ended September 30, 2022, $3,048 to reduce the carrying value of two hotels and four net lease properties to their estima ted fair value less costs to sell during the three months ended June 30, 2022, $5,500 to reduce the carrying value of 25 hotels to their estimated fair value less costs to sell during th e three months ended March 31, 2022, $76,510 to reduce the carrying value of 35 net lease properties and 21 hotels to their estimated fair value less costs to sell during the three mon ths ended December 31, 2021 and $2,110 to to reduce the carrying value of five net lease properties to their estimated fair value less costs to sell during the nine months ended Sep tem ber 30, 2021. 2) We recorded a $164 net loss on sale of real estate during the three months ended September 30, 2022 in connection with the sale of five hotels and six net lease properties. We recorded a $38,851 net gain on sale of real estate during the three months ended June 30, 2022 in connection with the sale of 51 hotels a nd 11 net lease properties, a $5,548 net gain on sale of real estate during the three months ended March 31, 2022 in connection with the sale of five hotels and two net lease properties , a $588 net gain on sale of real estate during the three months ended December 31, 2021 in connection with the sale of one hotel and six net lease properties, and a $10,934 net gain on sale of real estate during the nine months ended September 30, 2021 in connection with the sale of six hotels and five net lease properties. 3) Unrealized gain or loss on equity securities, net represents the adjustment required to adjust the carrying value of our inve stm ent in shares of TA common stock to their fair value. 4) Represents our proportionate share from our equity investment in Sonesta. 5) We recorded a $791 loss on extinguishment of debt during the three months ended June 30, 2022 related to the write off of def err ed financing costs and unamortized discounts relating to our amendment to our revolving credit facility and the repayment of $500,000 of unsecured senior notes. 6) Transaction related costs for the three months ended June 30, 2022 and March 31, 2022 of $743 and $1,177, respectively, prima ril y consisted of costs related to our exploration of possible financing transactions. Transaction related costs for the three months ended December 31, 2021 of $35,830 primarily con sisted of working capital advances we previously funded under our agreements with Marriott International Inc., or Marriott, and InterContinental Hotels Group, plc, or IHG, th at we expensed as a result of the amounts no longer expected to be recoverable. Transaction related costs for the three months ended September 30, 2021 of $3,149 are primarily related to le gal costs related to our arbitration proceeding with Marriott. Transaction related costs for the three months ended June 30, 2021 included $3,700 of working capital we previously fu nded under our agreement with Hyatt Hotels Corporation, or Hyatt, that we expensed as a result of the amount no longer expected to be recoverable, $1,110 of legal costs re lated to our arbitration proceeding with Marriott and $1,341 of hotel manager transaction costs. Transaction related costs for the three months ended March 31, 2021 include $19,63 5 o f hotel manager transition related costs resulting from the rebranding of 88 hotels during the period. 7) Amounts represent the equity compensation for our Trustees, and officers and certain other employees of our manager. 8) Various percentages of total sales at certain of our hotels are escrowed as reserves for future renovations or refurbishments , o r FF&E reserve escrows. We own all the FF&E reserve escrows for our hotels. 9) As of September 30, 2022, we owned 242 hotels. Our condensed consolidated statements of income (loss) include hotel operating re venues and expenses of our managed hotels. 10) When managers of our hotels are required to fund the shortfalls of owner’s priority return under the terms of our management agr eements or their guarantees, we reflect such fundings in our condensed consolidated statements of income (loss) as a reduction of hotel operating expenses. There were no net reductio ns to hotel operating expenses during the three and nine months ended September 30, 2022. The net reductions to hotel operating expenses were $15,696 for the nine months ended September 30, 2021, respectively. 11) We are amortizing a liability we recorded for the fair value of our initial investment in Sonesta as a reduction to hotel ope rat ing expenses in our condensed consolidated statements of income (loss). We reduced hotel operating expenses by $621 for each of the three months ended September 30, 2022 and 2021, and $ 1,863 for each of the nine months ended September 30, 2022 and 2021, respectively, for this liability.

30 SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2022 Non - GAAP Financial Measures Definitions 30 Non - GAAP Financial Measures: We present certain “non - GAAP financial measures” within the meaning of the applicable Securities and Exchange Commission, or SEC , rules, including FFO, Normalized FFO, EBITDA, Hotel EBITDA, Adjusted Hotel EBITDA, EBITDA re and Adjusted EBITDA re . These measures do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income (loss) as indicators of our operating performance or as measures of our liquidity. These measures should be considered in conjunction with net income (loss) as presented in our condensed consolidat ed statements of income (loss). We consider these non - GAAP measures to be appropriate supplemental measures of operating performance for a REIT, along with net income (loss ). We believe these measures provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation and amor tiz ation expense, they may facilitate a comparison of our operating performance between periods and with other REITs and, in the case of Hotel EBITDA, reflecting only those income and expense items that are generated and incurred at the hotel level may help both investors and management to understand the operations of our hotels. FFO and Normalized FFO : We calculate funds from operations, or FFO, and Normalized FFO as shown on page 24 . FFO is calculated on the basis defined by The National Association of Real Estate Investment Trusts, or Nareit, which is net income (loss), calculated in accordance with GAAP, excl udi ng any gain or loss on sale of properties and loss on impairment of real estate assets, if any, plus real estate depreciation and amortization, less any unrealized gains and lo sse s on equity securities, as well as adjustments to reflect our share of FFO attributable to an investee and certain other adjustments currently not applicable to us. In calcula tin g Normalized FFO, we adjust for the items shown on page 24 . FFO and Normalized FFO are among the factors considered by our Board of Trustees when determining the amount of distributio ns to our shareholders. Other factors include, but are not limited to, requirements to satisfy our REIT distribution requirements, limitations in our credi t a greement and public debt covenants, the availability to us of debt and equity capital, our distribution rate as a percentage of the trading price of our common shares, or dividen d y ield, and to the dividend yield of other REITs, our expectation of our future capital requirements and operating performance and our expected needs for and availability of cash to pay our obligations. Other real estate companies and REITs may calculate FFO and Normalized FFO differently than we do. EBITDA, EBITDAre and Adjusted EBITDAre: We calculate earnings before interest, taxes, depreciation and amortization, or EBITDA, EBITDA for real estate, or EBITDA re, and Adjusted EBITDA re as shown on page 26 . EBITDA re is calculated on the basis defined by Nareit, which is EBITDA, excluding gains and losses on the sale of real estate, loss on impairment of real estate assets, if any, and adjustments to reflect our share of EBITDAre attributable to an investee. In ca lcu lating Adjusted EBITDA re , we adjust for the items shown on page 26 . Other real estate companies and REITs may calculate EBITDA, EBITDA re and Adjusted EBITDA re differently than we do. Hotel EBITDA and Adjusted Hotel EBITDA : We calculate Hotel EBITDA as hotel operating revenues less hotel operating expenses of all managed and leased hotels, prior t o any adjustments required for presentation in our condensed consolidated statements of income (loss) in accordance with GAAP. Adj usted Hotel EBITDA excludes certain items we believe do not reflect the ongoing operating performance of our hotels. We believe that Hotel EBITDA and Adjusted Hotel EB ITD A provide useful information to management and investors as key measures of the profitability of our hotel operations. Rent Coverage: We define rent coverage as earnings before interest, taxes, depreciation, amortization and rent, or EBITDAR, divided by the a nnu al minimum rent due to us weighted by the minimum rent of the property to total minimum rents of the net lease portfolio. EBITDAR amounts used to deter min e rent coverage are generally for the latest twelve - month period reported based on the most recent operating information, if any, furnished by the tenant. Operating statemen ts furnished by the tenant often are unaudited and, in certain cases, may not have been prepared in accordance with GAAP and are not independently verified by us. Te nants that do not report operating information are excluded from the coverage calculations. In instances where we do not have financial information for the most re cent quarter from our tenants, we have calculated an implied EBITDAR for the 2022 third quarter using industry benchmark data to reflect current operating trends. We believe using this industry benchmark data provides a reasonable estimate of recent operating results and rent coverage for those tenants. Investment: We define hotel investment as historical cost of our properties plus capital improvements funded by us less impairment write - dow ns, if any, and excludes capital improvements made from FF&E reserves funded from hotel operations that do not result in increases in minimum returns or rents . W e define net lease investment as historical cost of our properties plus capital improvements funded by us less impairment write - downs, if any. Debt : Debt amounts reflect the principal balance as of the date reported . Net debt means total debt less unrestricted cash and cash equivalents as of the date reported .

Service Properties Trust (Nasdaq: SVC) Investor Presentation November 2022 Two Newton Place 255 Washington Street, Suite 300 Newton, MA 02458 SVCREIT.COM