MEMC/SunEdison Capital Markets Day March 13, 2013

Capital Markets Day | March 13, 2013 2 Safe Harbor With the exception of historical information, the matters disclosed in this presentation are forward-looking statements. Such statements involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Potential risks and uncertainties are described in the Company’s filings with the Securities and Exchange Commission (SEC), including its 2012 Form 10-K, in addition to the risks and uncertainties described on pages 114-115 of this presentation. These forward- looking statements represent the Company’s judgment as of the date of this presentation. The Company disclaims, however, any intent or obligation to update these forward-looking statements. This presentation also includes non-GAAP financial measures. You can find a reconciliation of each of these non-GAAP measures to the most directly comparable GAAP financial measure in our earnings releases furnished with the Company’s Form 8-Ks filed on February 13, 2013, November 7, 2012, August 8, 2012, May 9, 2012 and February 15, 2012, and are incorporated herein by this reference. Each of these Form 8-Ks and copies of these reconciliations are available on the Company’s website at www.memc.com under the Investor Relations tab.

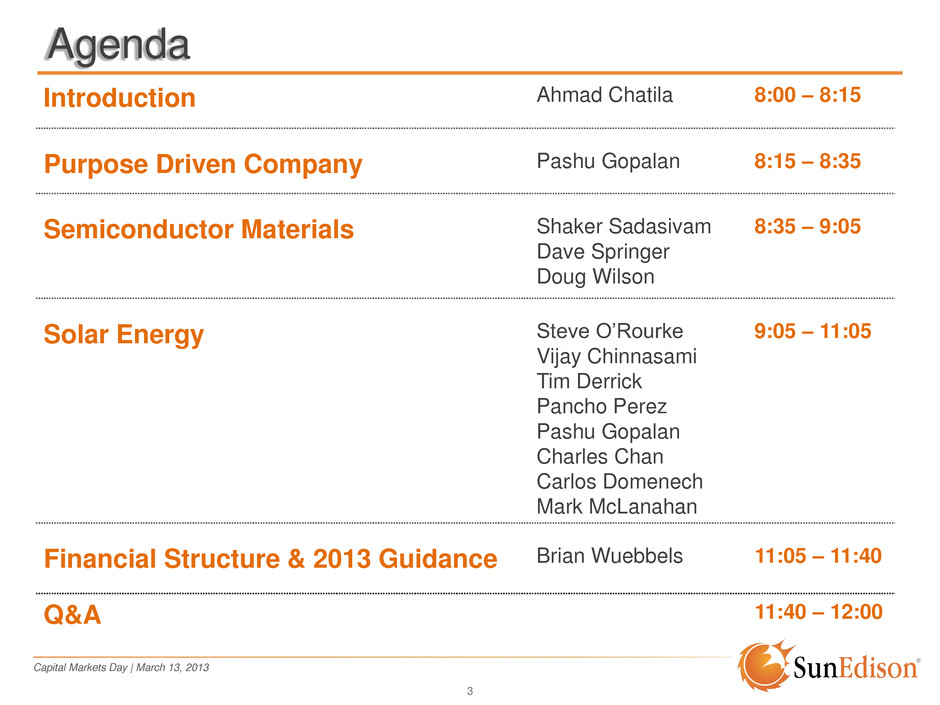

Capital Markets Day | March 13, 2013 3 Agenda Introduction Ahmad Chatila 8:00 – 8:15 Purpose Driven Company Pashu Gopalan 8:15 – 8:35 Semiconductor Materials Shaker Sadasivam Dave Springer Doug Wilson 8:35 – 9:05 Solar Energy Steve O’Rourke Vijay Chinnasami Tim Derrick Pancho Perez Pashu Gopalan Charles Chan Carlos Domenech Mark McLanahan 9:05 – 11:05 Financial Structure & 2013 Guidance Brian Wuebbels 11:05 – 11:40 Q&A 11:40 – 12:00

Capital Markets Day | March 13, 2013 Introduction Ahmad Chatila President, Chief Executive Officer

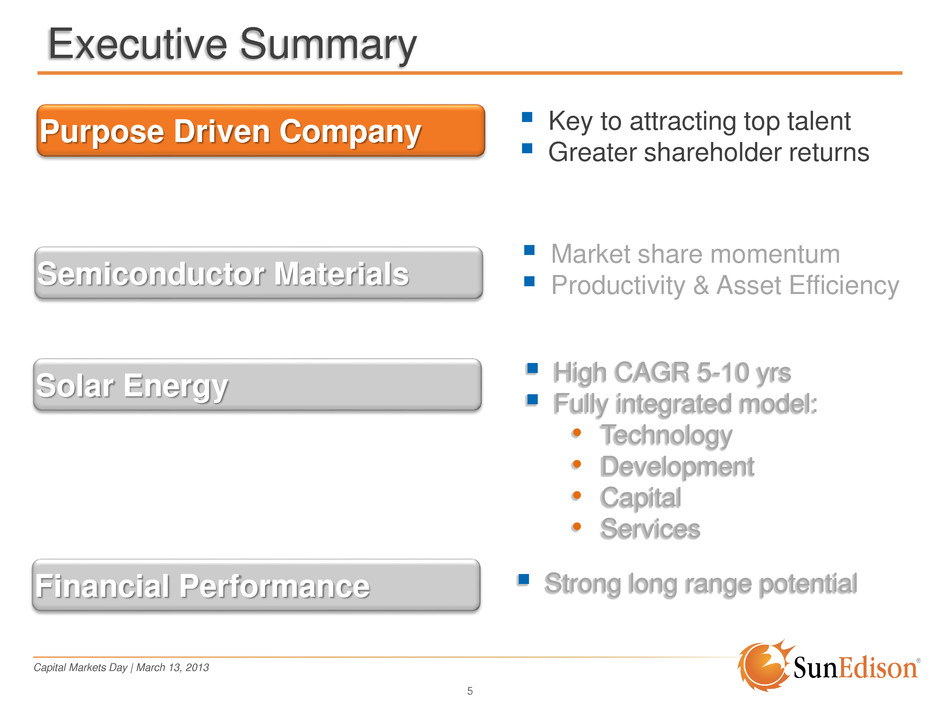

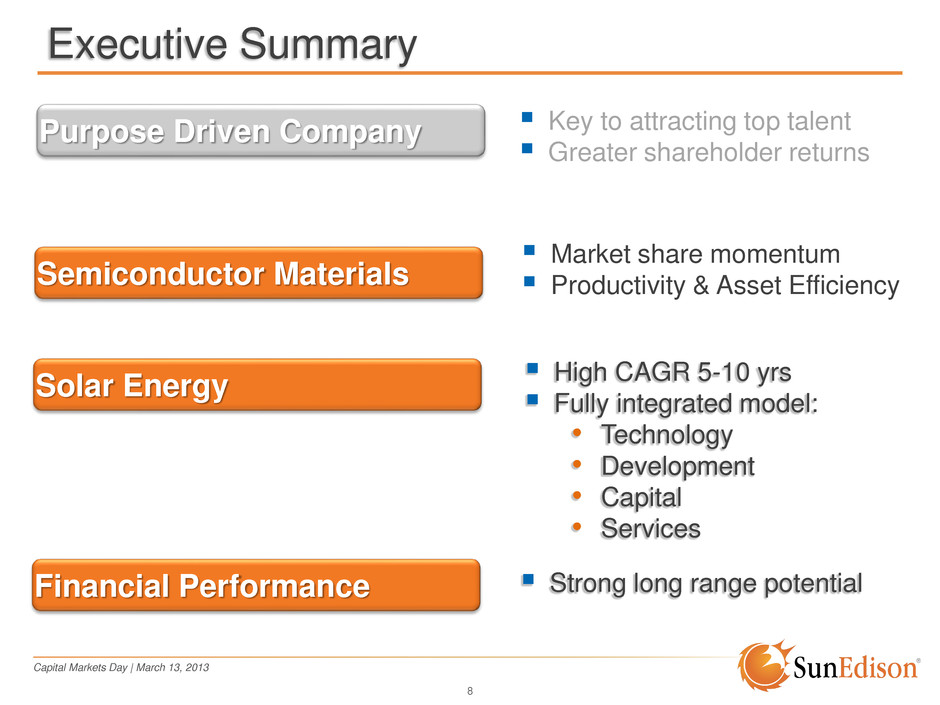

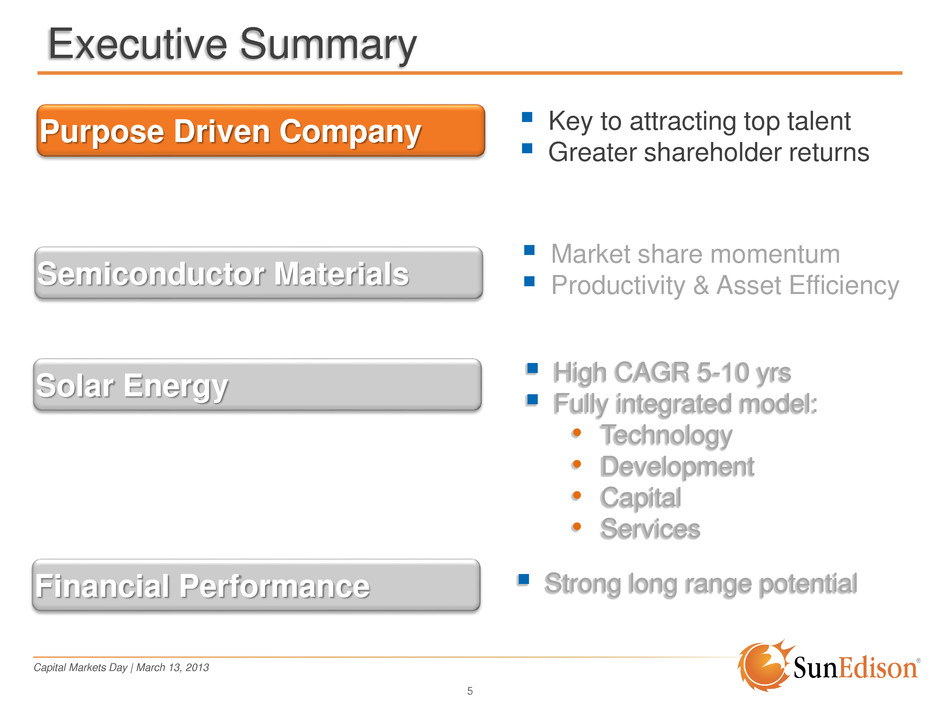

Capital Markets Day | March 13, 2013 5 Executive Summary Key to attracting top talent Greater shareholder returns Market share momentum Productivity & Asset Efficiency High CAGR 5-10 yrs Fully integrated model: • Technology • Development • Capital • Services Strong long range potential Purpose Driven Company Semiconductor Materials Solar Energy Financial Performance

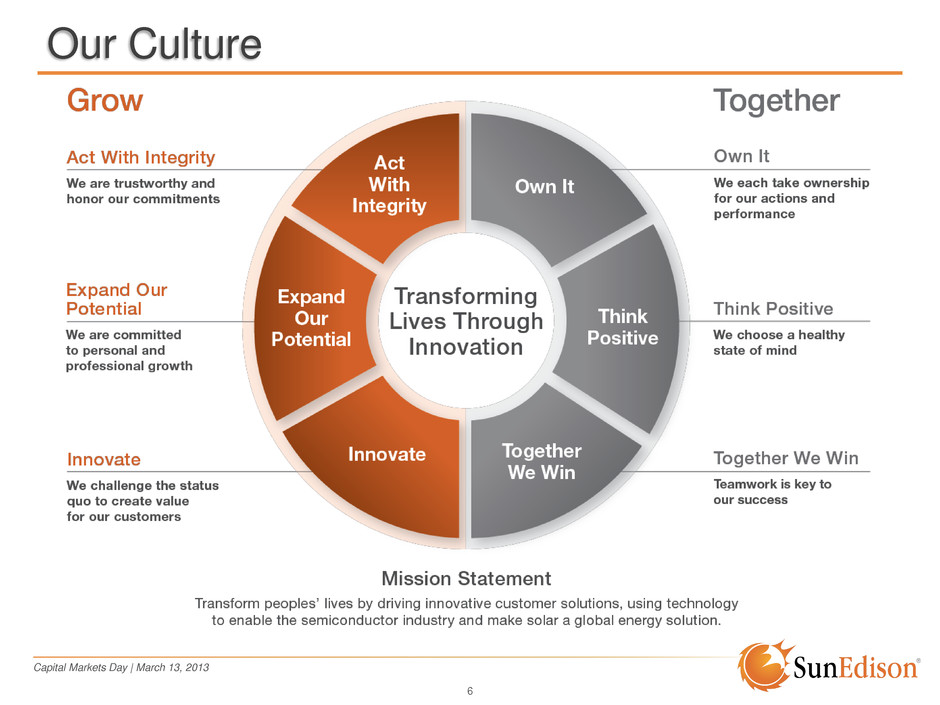

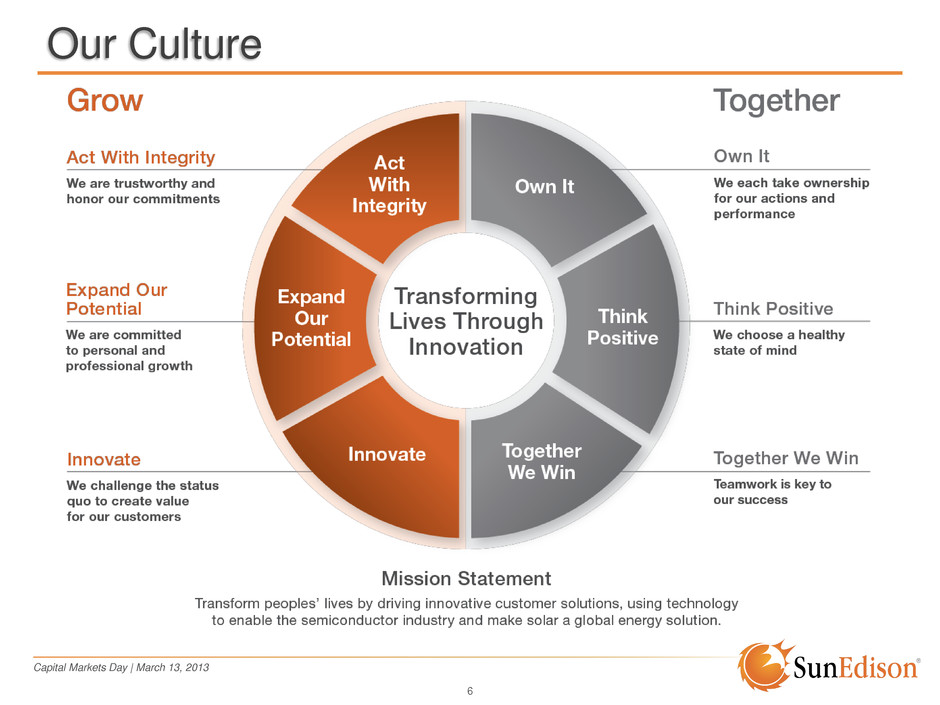

Capital Markets Day | March 13, 2013 6 Our Culture

Capital Markets Day | March 13, 2013 Proposing Name Change to “SunEdison” Brand No change in business strategy Business synergies We will seek shareholders’ approval effective May 30, 2013 Company Culture Name 7

Capital Markets Day | March 13, 2013 8 Executive Summary Key to attracting top talent Greater shareholder returns Market share momentum Productivity & Asset Efficiency High CAGR 5-10 yrs Fully integrated model: • Technology • Development • Capital • Services Strong long range potential Purpose Driven Company Semiconductor Materials Solar Energy Financial Performance

Capital Markets Day | March 13, 2013 Purpose Driven Company Pashu Gopalan VP, General Manager, SEA and SSA

Capital Markets Day | March 13, 2013 10 SunEdison Eradication of Darkness (SEED)

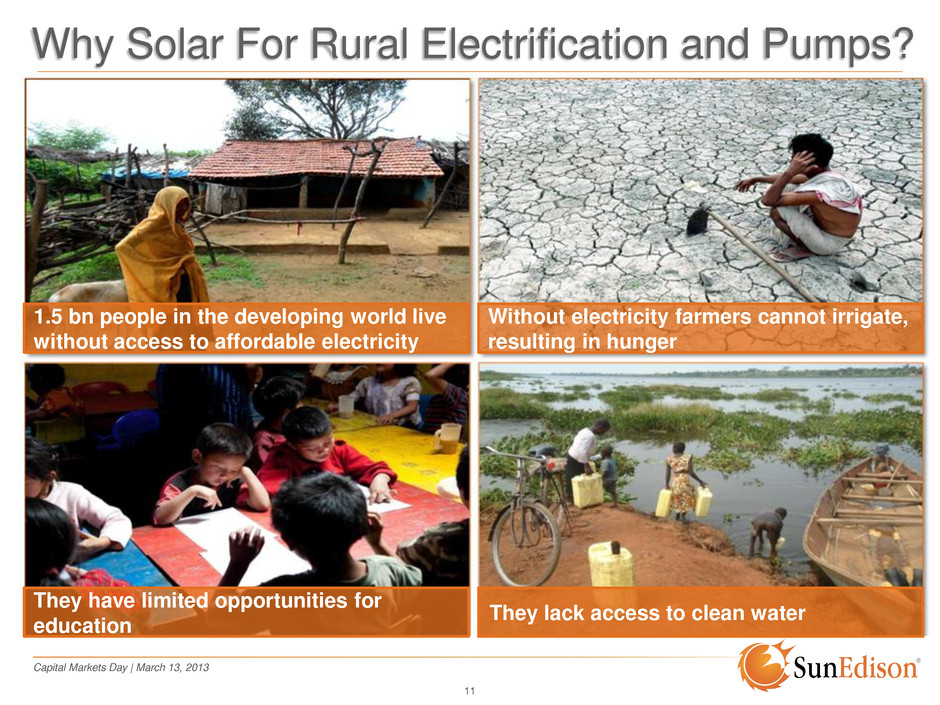

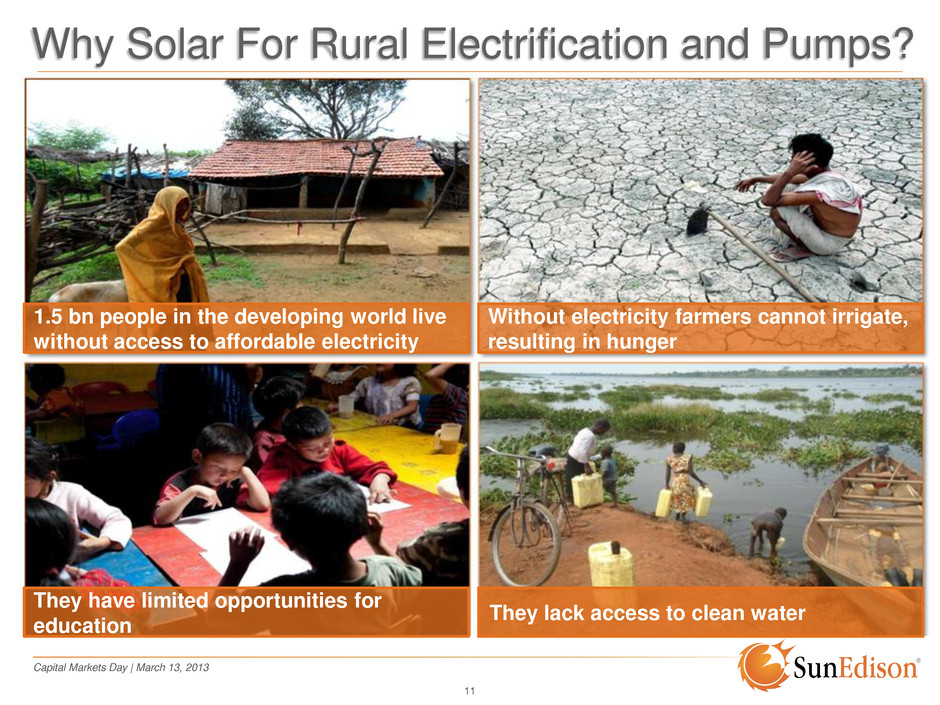

Capital Markets Day | March 13, 2013 Why Solar For Rural Electrification and Pumps? 11 Without electricity farmers cannot irrigate, resulting in hunger 1.5 bn people in the developing world live without access to affordable electricity They lack access to clean water They have limited opportunities for education

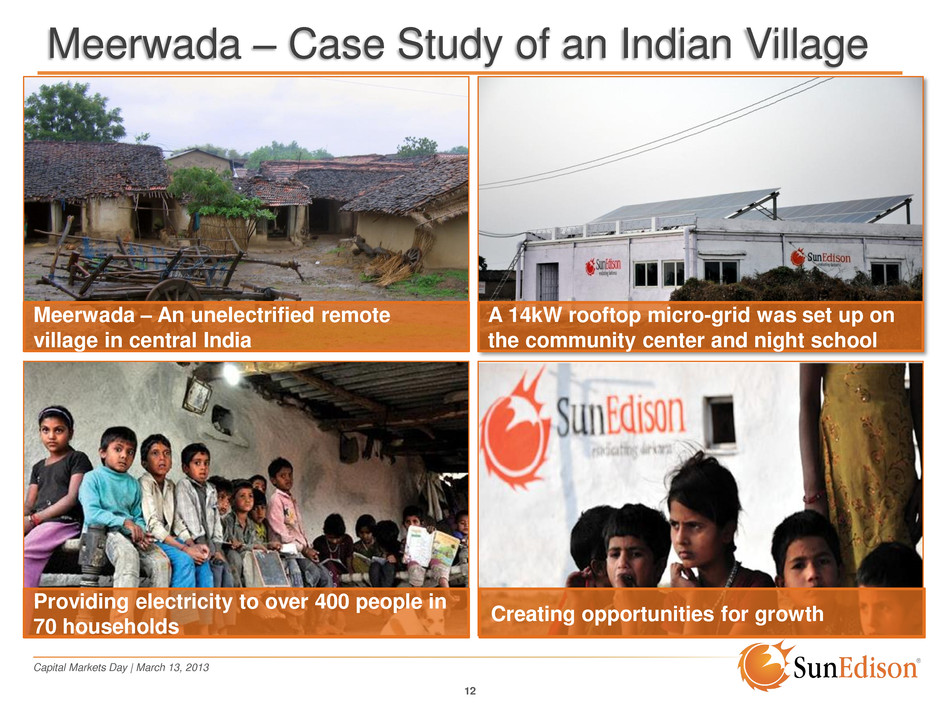

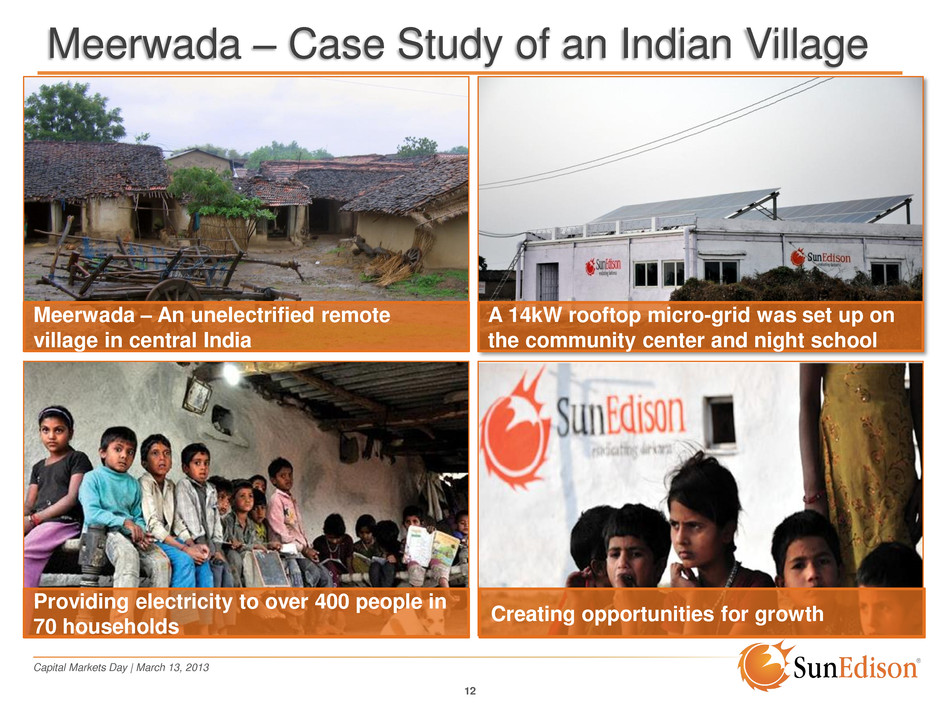

Capital Markets Day | March 13, 2013 Meerwada – An unelectrified remote village in central India 12 Meerwada – Case Study of an Indian Village A 14kW rooftop micro-grid was set up on the community center and night school Creating opportunities for growth Providing electricity to over 400 people in 70 households

Capital Markets Day | March 13, 2013 Solar for Transforming Lives Through Innovation 13 Generating livelihood options Providing clean drinking water for all Creating avenues for growth Plugging in to the world of opportunities

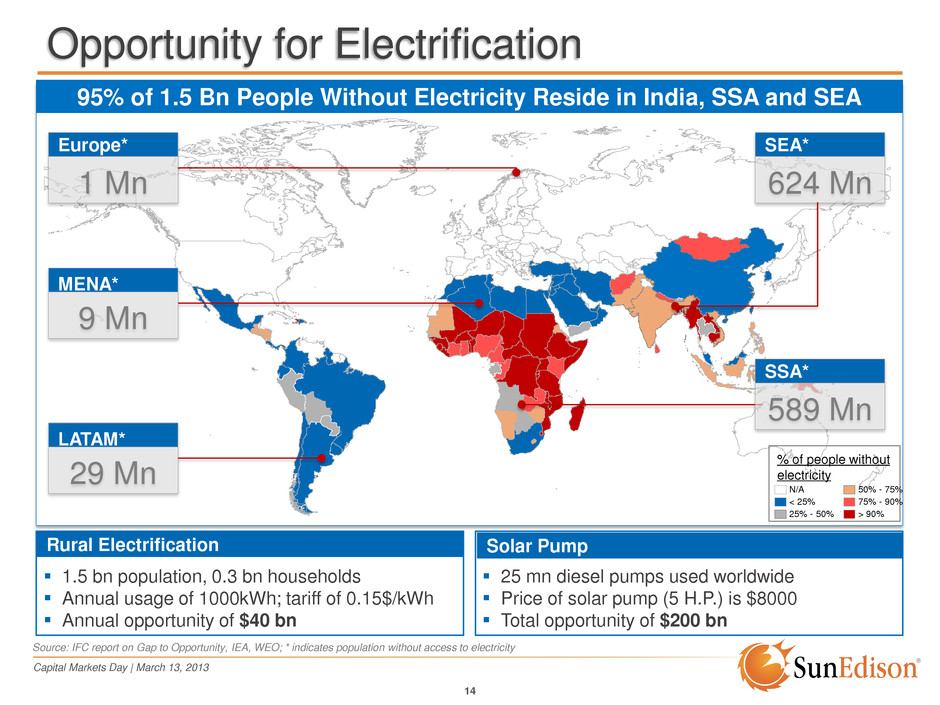

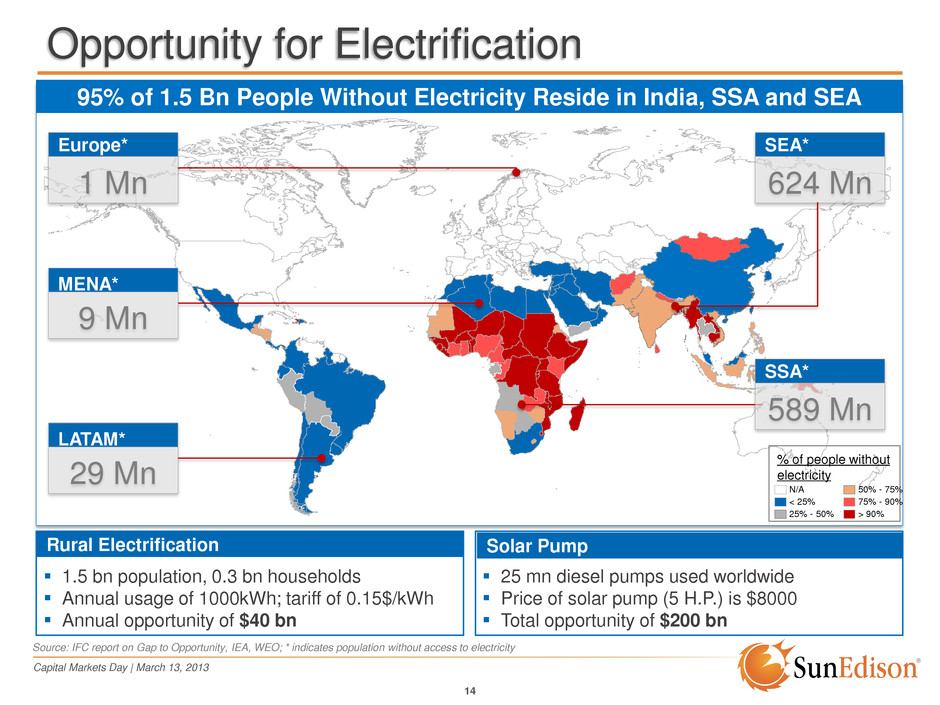

Capital Markets Day | March 13, 2013 14 95% of 1.5 Bn People Without Electricity Reside in India, SSA and SEA 1 Mn Europe* 9 Mn MENA* 29 Mn LATAM* 624 Mn SEA* 589 Mn SSA* % of people without electricity Source: IFC report on Gap to Opportunity, IEA, WEO; * indicates population without access to electricity Rural Electrification 1.5 bn population, 0.3 bn households Annual usage of 1000kWh; tariff of 0.15$/kWh Annual opportunity of $40 bn Solar Pump 25 mn diesel pumps used worldwide Price of solar pump (5 H.P.) is $8000 Total opportunity of $200 bn N/A < 25% 25% - 50% 50% - 75% 75% - 90% > 90% Opportunity for Electrification

Capital Markets Day | March 13, 2013 Semiconductor Materials Focused on Customers, Productivity & Asset Efficiency

Capital Markets Day | March 13, 2013 Semiconductor Materials Shaker Sadasivam Executive VP, President of Semiconductor Materials

Capital Markets Day | March 13, 2013 17 Semiconductor Market Environment Electronics End Markets >$1,400 Semiconductors $300 SemiCap $42 Materials $48 2012 Semiconductors/Electronics Ecosystem Dynamic & Growing End Markets: PC unit shipments slowed in 2H’12 Smart phones & tablets growth moderating Internet of Things – next growth driver Source: SEMI (In $ Billions) Memory prices start to stabilize after meaningful cutbacks in output Intel, AMD saw weaker 2H12 than expected (weaker PC shipments) 2012 CapEx down ~8% y/y Strong CapEx forecasted by Top 3 (Intel, Samsung, TSMC) for 2013 Consumers of semi wafers Adds Semi wafer production capacity Within this, semi wafers are ~$9B Volumes picked up, but pricing lagged, falling short of expectations Recovery expected to start in 2H13 Semiconductor Wafers are the Foundation of Silicon Technology

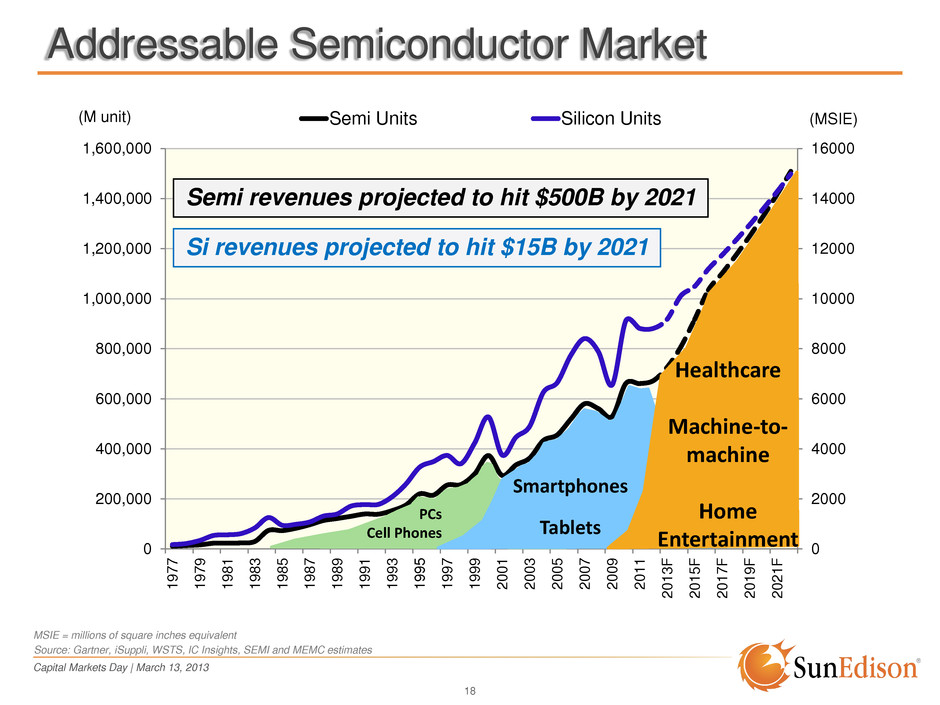

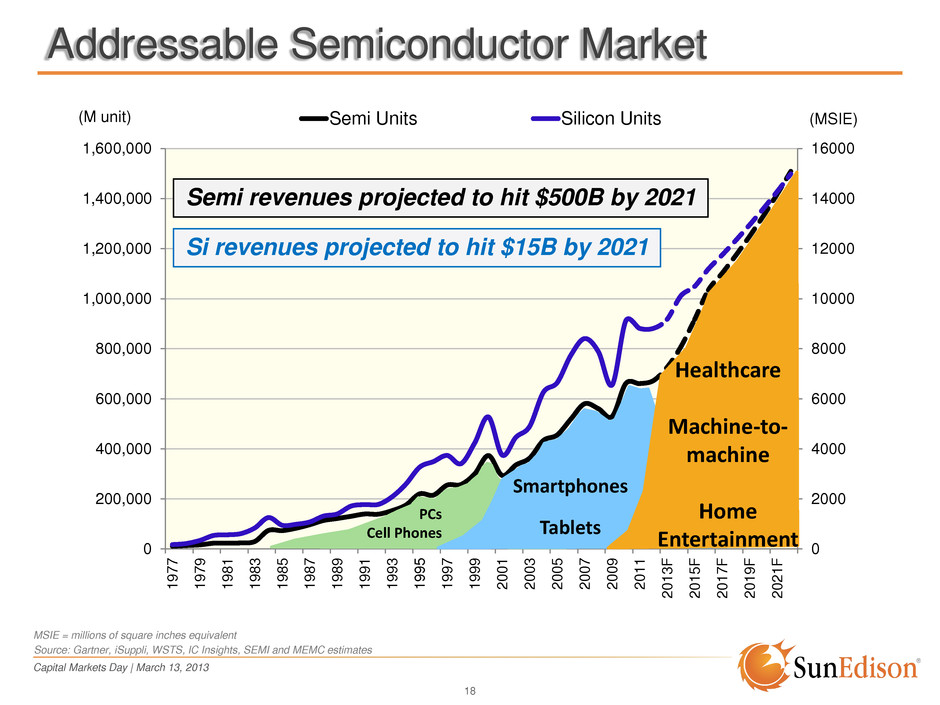

Capital Markets Day | March 13, 2013 0 2000 4000 6000 8000 10000 12000 14000 16000 0 200,000 400,000 600,000 800,000 1,000,000 1,200,000 1,400,000 1,600,000 1 9 7 7 1 9 7 9 1 9 8 1 1 9 8 3 1 9 8 5 1 9 8 7 1 9 8 9 1 9 9 1 1 9 9 3 1 9 9 5 1 9 9 7 1 9 9 9 2 0 0 1 2 0 0 3 2 0 0 5 2 0 0 7 2 0 0 9 2 0 1 1 2 0 1 3 F 2 0 1 5 F 2 0 1 7 F 2 0 1 9 F 2 0 2 1 F (MSIE) (M unit) Semi Units Silicon Units 18 Addressable Semiconductor Market Si revenues projected to hit $15B by 2021 Semi revenues projected to hit $500B by 2021 PCs Cell Phones Smartphones Tablets Healthcare Machine-to- machine Home Entertainment Source: Gartner, iSuppli, WSTS, IC Insights, SEMI and MEMC estimates MSIE = millions of square inches equivalent

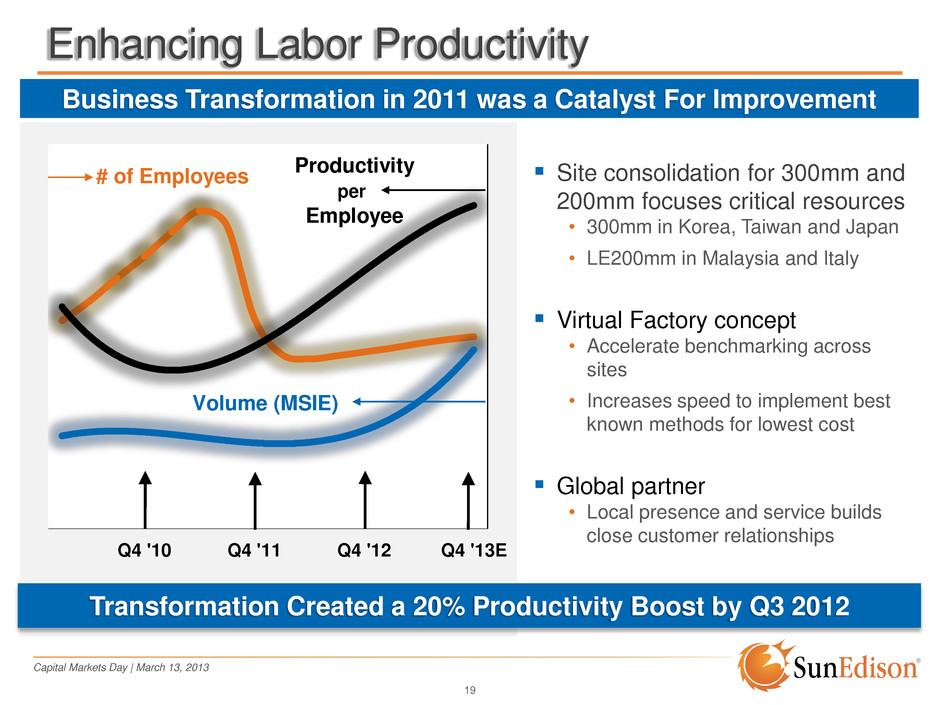

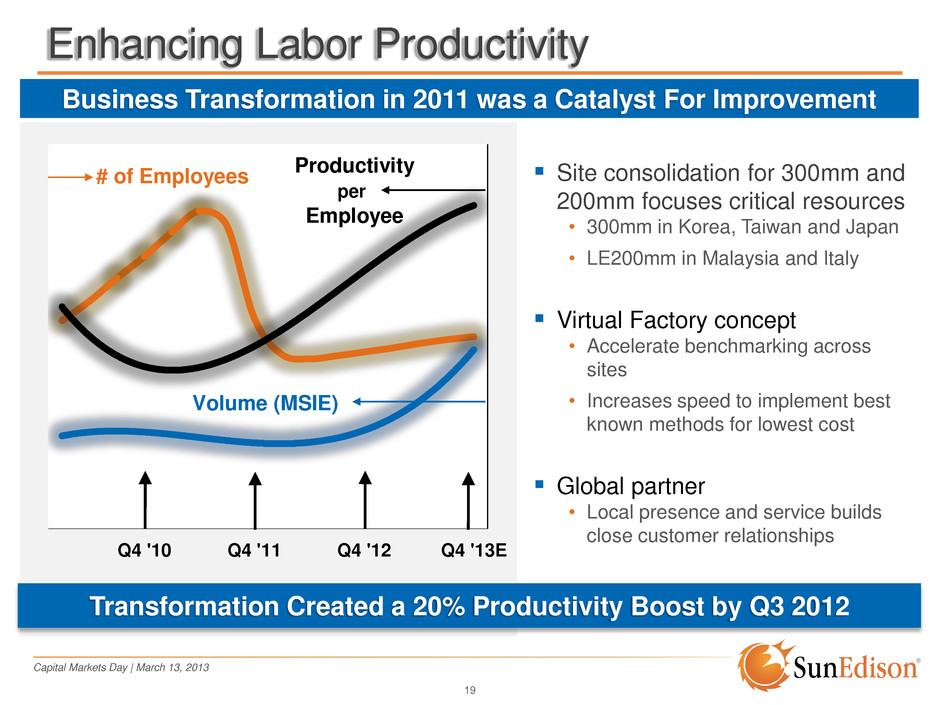

Capital Markets Day | March 13, 2013 Enhancing Labor Productivity 19 Business Transformation in 2011 was a Catalyst For Improvement Site consolidation for 300mm and 200mm focuses critical resources • 300mm in Korea, Taiwan and Japan • LE200mm in Malaysia and Italy Virtual Factory concept • Accelerate benchmarking across sites • Increases speed to implement best known methods for lowest cost Global partner • Local presence and service builds close customer relationships Transformation Created a 20% Productivity Boost by Q3 2012 Q4 '10 Q4 '11 Q4 '12 Q4 '13E Productivity per Employee Volume (MSIE) # of Employees

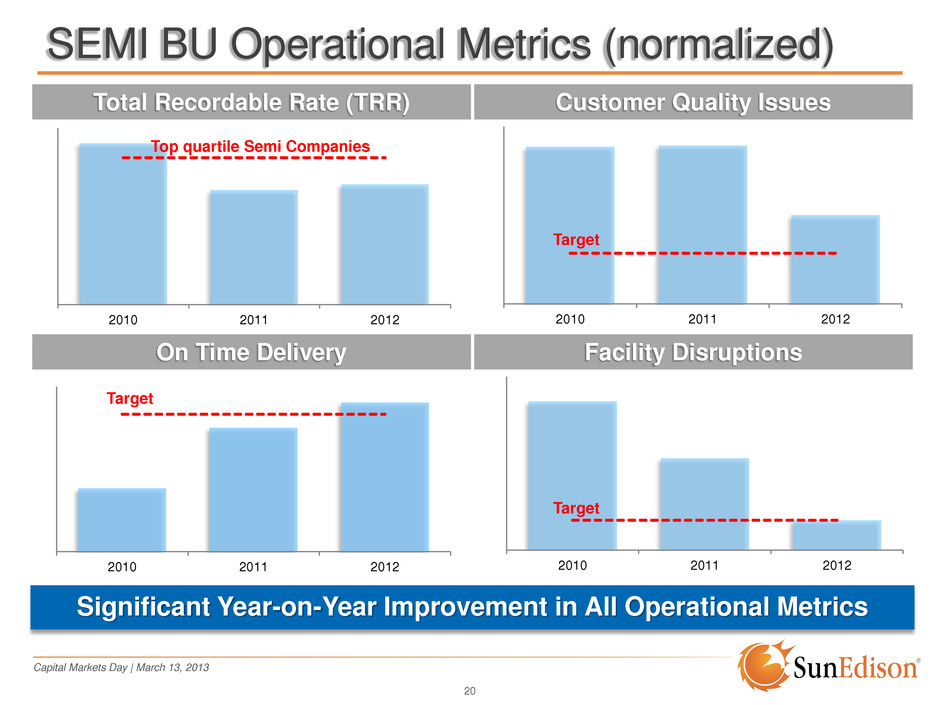

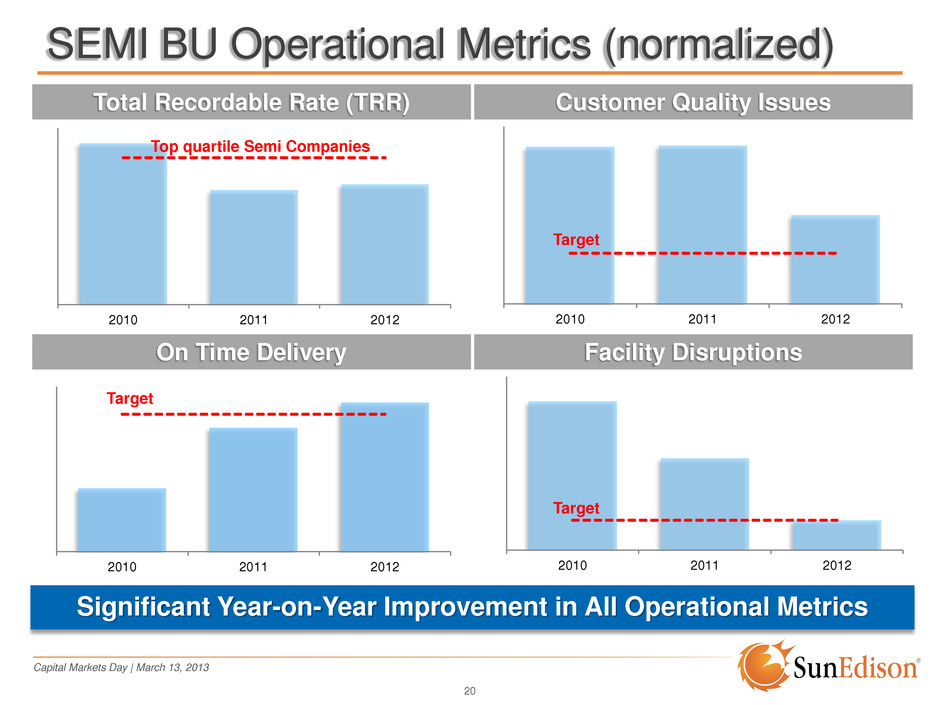

Capital Markets Day | March 13, 2013 2010 2011 2012 2010 2011 2012 2010 2011 2012 2010 2011 2012 Total Recordable Rate (TRR) Customer Quality Issues On Time Delivery Facility Disruptions 20 SEMI BU Operational Metrics (normalized) Significant Year-on-Year Improvement in All Operational Metrics Target Target Top quartile Semi Companies Target

Capital Markets Day | March 13, 2013 21 Progress Recognized by Customers

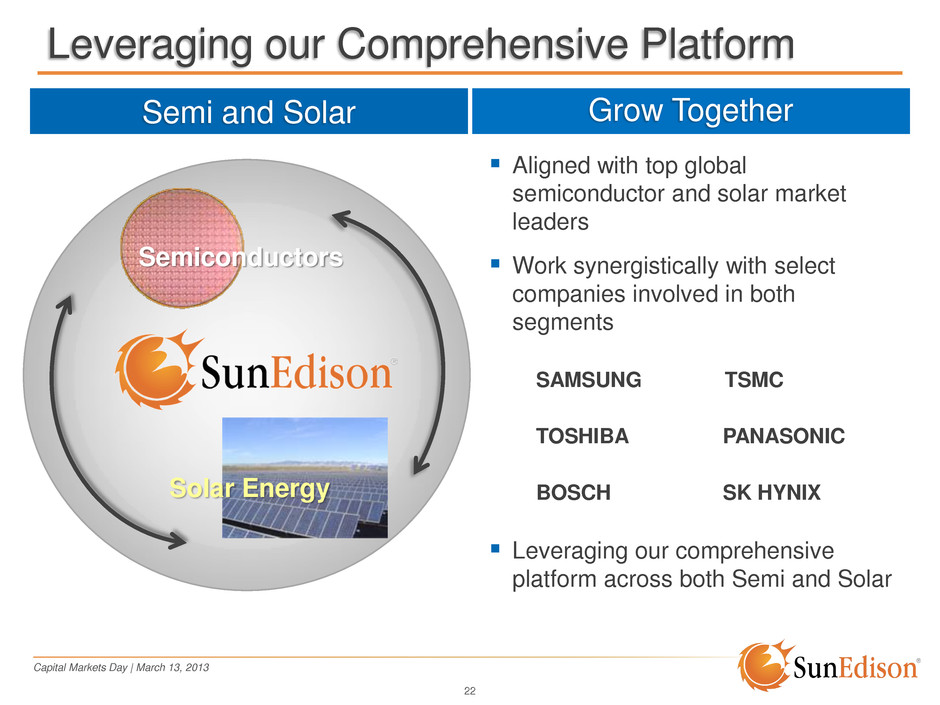

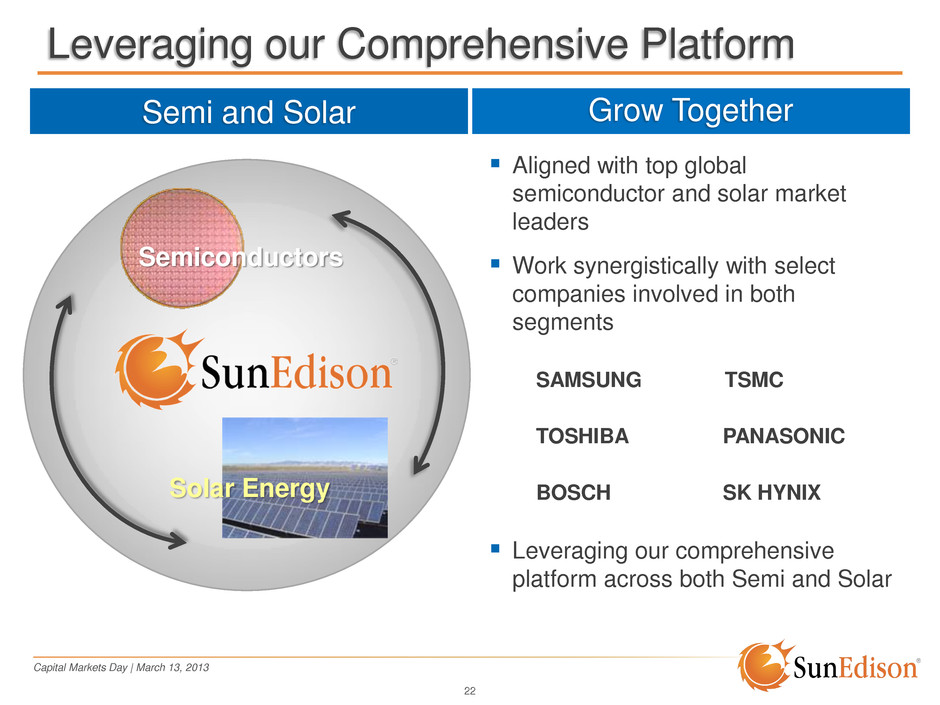

Capital Markets Day | March 13, 2013 Semi and Solar Grow Together Aligned with top global semiconductor and solar market leaders Work synergistically with select companies involved in both segments SAMSUNG TSMC TOSHIBA PANASONIC BOSCH SK HYNIX Leveraging our comprehensive platform across both Semi and Solar 22 Leveraging our Comprehensive Platform Semiconductors Solar Energy

Capital Markets Day | March 13, 2013 23 Semi Market Share Trend Source: Company Financial reports converted to US$ using quarterly average FX rate, and MEMC internal estimates Share Gains in a Tough Market Driven by Disciplined Execution 0% 2% 4% 6% 8% 10% 12% 14% 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4QE C2008 C2009 C2010 C2011 C2012 Revenue Mkt Share (%) Top 5 Suppliers Only

Capital Markets Day | March 13, 2013 Our Lean Journey David Springer VP, LE200mm Operations

Capital Markets Day | March 13, 2013 25 What is Lean? Continuous improvement philosophy that aligns people and processes • Reduce waste, standardize work and reduce variation Reduce lead time across the entire Value Chain • New product introduction, manufacturing, and business processes Create a culture with a shared way of thinking and engage all employees within an organization (a common lens) Establish a competitive advantage to drive growth in sales and profitability • Improving safety, quality, cost, and delivery (SQDC) Lean Enables Operational Excellence

Capital Markets Day | March 13, 2013 26 Investing in LEAN Process We are deploying LEAN methodologies to: Eliminate human error Significantly improve equipment reliability Minimize manufacturing variability

Capital Markets Day | March 13, 2013 Four Phases of Lean Manufacturing 27 Expansion & Focus Integration & Reinforcement Reinforcement & Momentum Building Foundation Building the Foundation • 75% learning, 25% getting results • Defining success for business (Ideal State) • Develop Roadmap • Create leaders and teachers within org • Preparing the Organization • Explain WHY 1 • Part of culture, embedded in everything • Not a separate thing we call Lean • Less training, more coaching Integration and Reinforcement 3 2 Expansion & Focus • Refine plan, focus on business issues • More focus on results • Active leadership • Continue with education of the organization • More ownership in the operations Reinforcement and Momentum • Momentum cannot be stopped • Across the enterprise 4 Current Status

Capital Markets Day | March 13, 2013 Advancing Equipment Productivity Doug Wilson VP, 300mm Operations

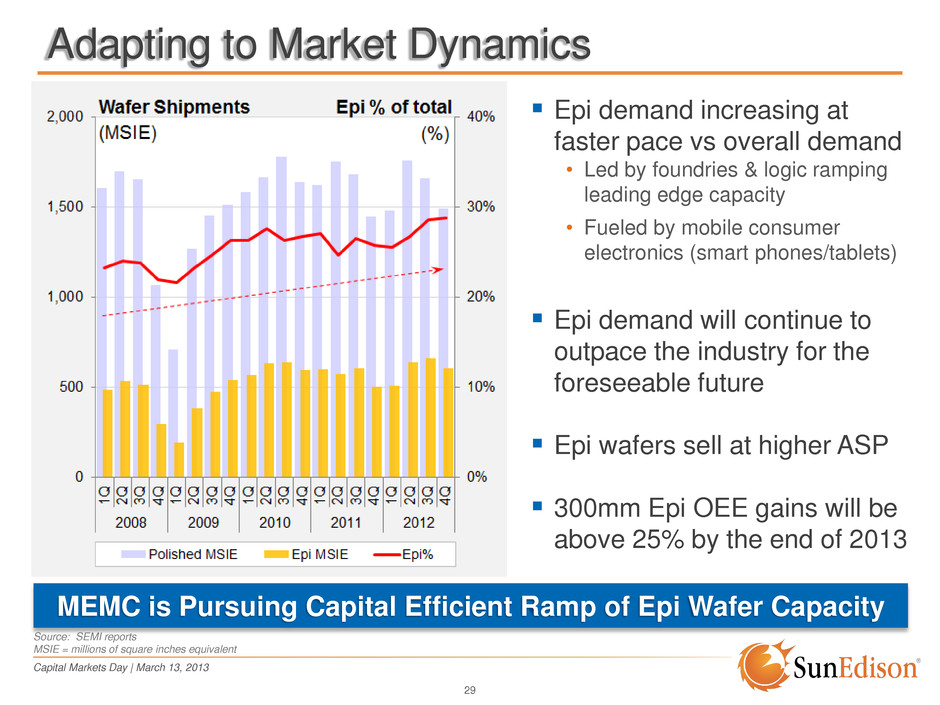

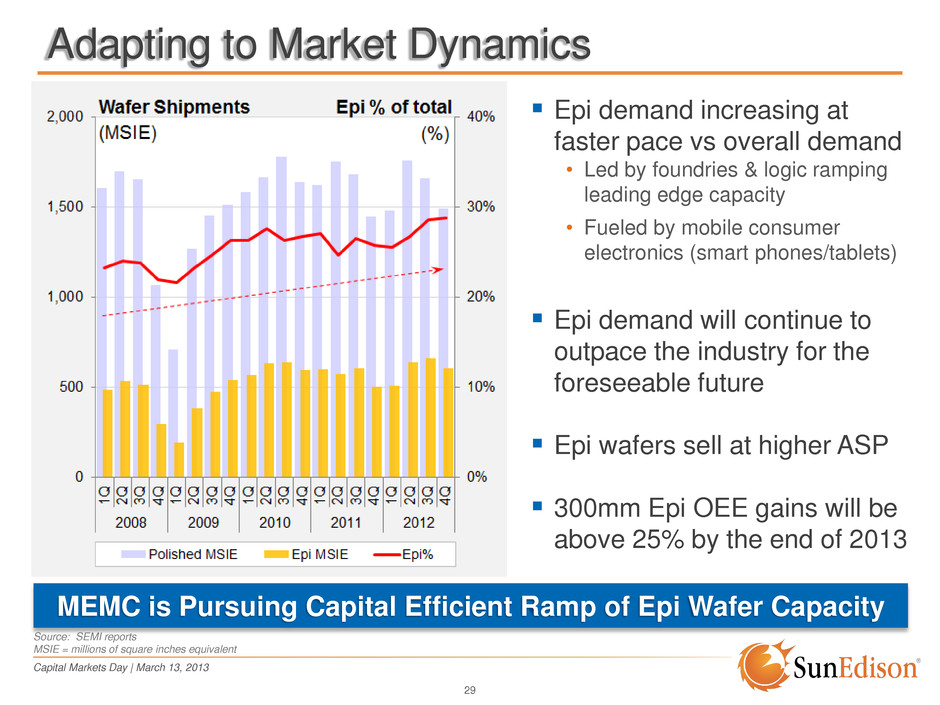

Capital Markets Day | March 13, 2013 Adapting to Market Dynamics 29 Source: SEMI reports MSIE = millions of square inches equivalent MEMC is Pursuing Capital Efficient Ramp of Epi Wafer Capacity Epi demand increasing at faster pace vs overall demand • Led by foundries & logic ramping leading edge capacity • Fueled by mobile consumer electronics (smart phones/tablets) Epi demand will continue to outpace the industry for the foreseeable future Epi wafers sell at higher ASP 300mm Epi OEE gains will be above 25% by the end of 2013

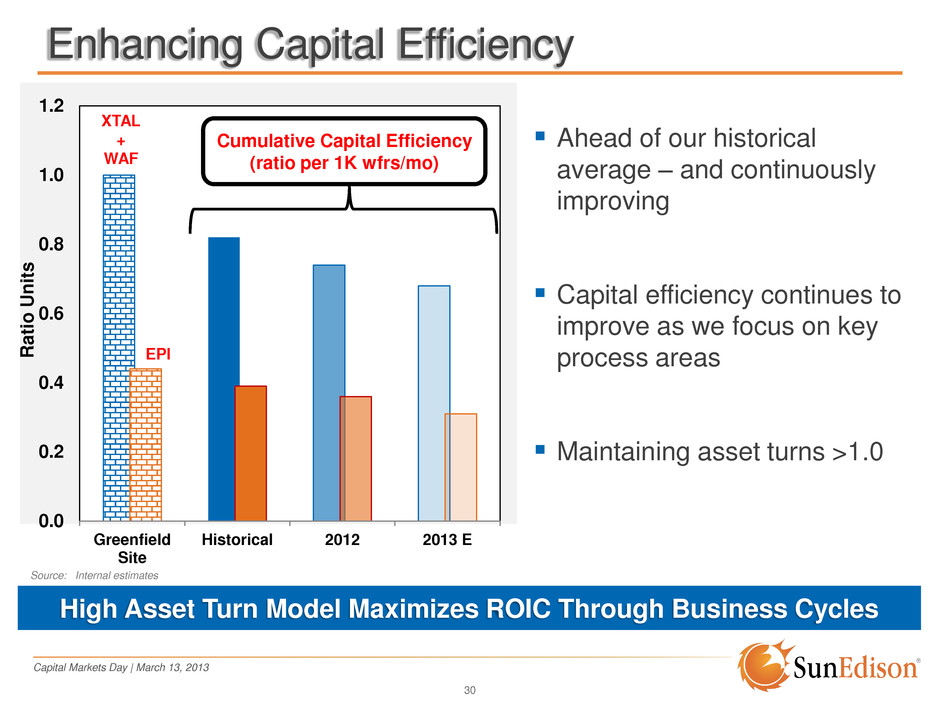

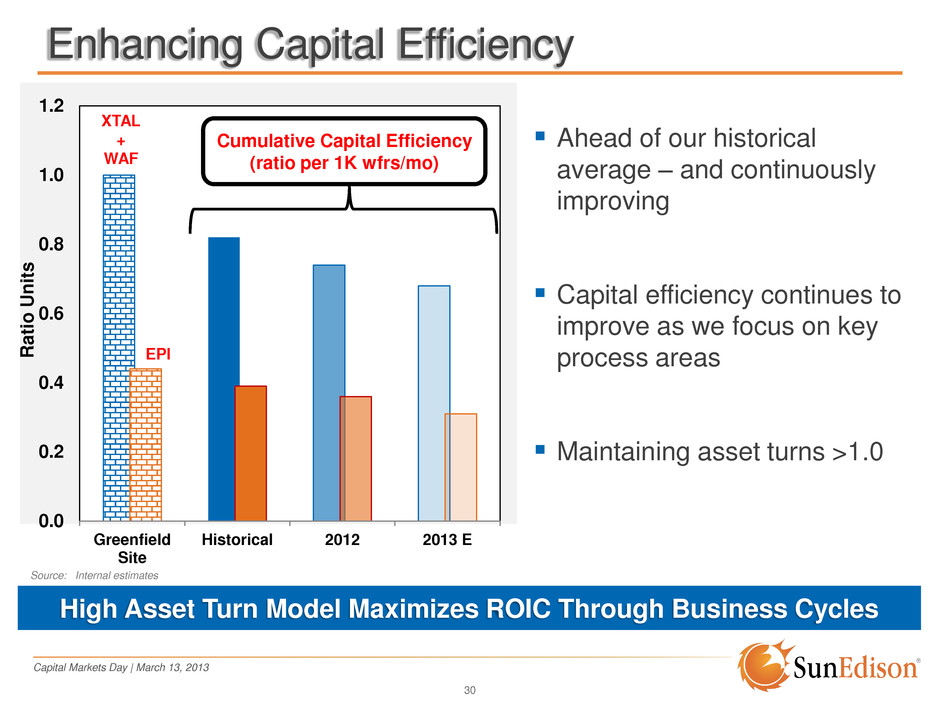

Capital Markets Day | March 13, 2013 Enhancing Capital Efficiency 30 Ahead of our historical average – and continuously improving Capital efficiency continues to improve as we focus on key process areas Maintaining asset turns >1.0 High Asset Turn Model Maximizes ROIC Through Business Cycles 0.0 0.2 0.4 0.6 0.8 1.0 1.2 Greenfield Site Historical 2012 2013 E EPI Cumulative Capital Efficiency (ratio per 1K wfrs/mo) XTAL + WAF Source: Internal estimates R at io U n it s

Capital Markets Day | March 13, 2013 Solar Energy Technology, Development, Capital, Services

Capital Markets Day | March 13, 2013 Solar Market Opportunity Steve O’Rourke Senior VP, Chief Strategy Officer

Capital Markets Day | March 13, 2013 33 Transition to Incentive-Free Markets US average retail price: $0.115/kWh Germany (Resi), €0.23/kWh ($0.33/kWhr) Germany (Ind) €0.11/kWh ($0.16/kWhr) Italy (Resi) €0.21/kWh ($0.30/kWhr) Italy (Ind) €0.14/kWh ($0.21/kWhr) India, diesel genset = $0.50/kWh w/ $3.00/gal fuel cost India ~$0.09/kWh (subsidized) China ~$0.08/kWh (subsidized) (1) Includes ~1% of O&M costs (2) 6% financing (3) Fixed mount (4) No incentives Source: Internal estimates 0.50 LCoE ($/kWh) Grid Parity (no incentive) Santa Maria, CA ~6.0 kWh/m2/day Calcutta, India ~5.0 kWh/m2/day 0.10 0.20 0.30 0.40 1.00 1.50 2.00 2.50 3.00 3.50 4.00 Installed Cost ($)/Wp

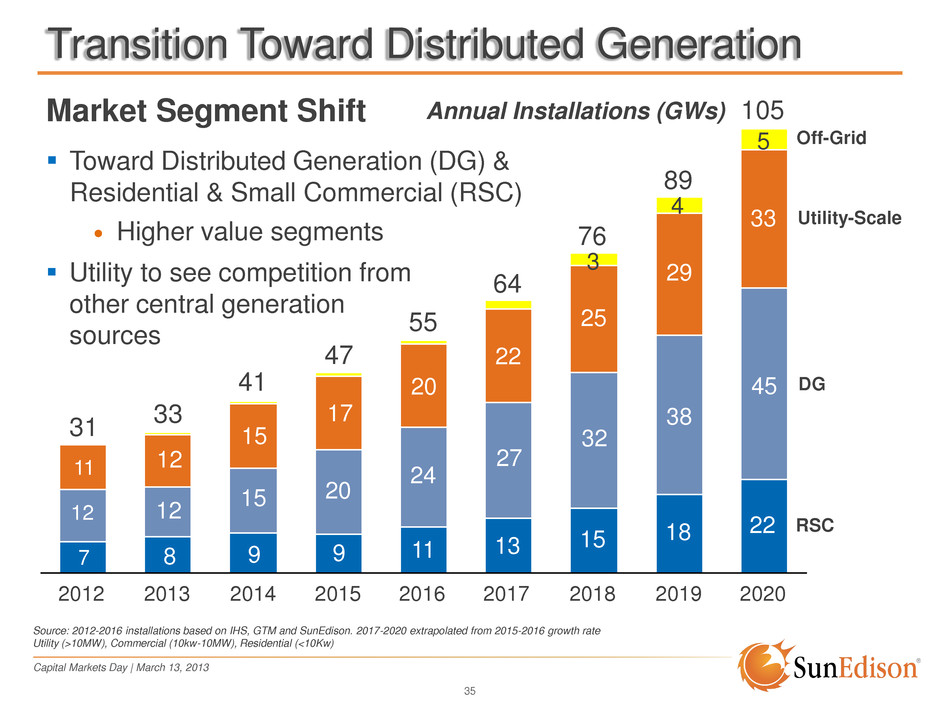

Capital Markets Day | March 13, 2013 Addressable Solar PV Market is Large ROW Middle East LatAm Germany Japan India China USA 2020 105 2019 89 2018 76 2017 64 2016 55 2015 47 2014 41 2013 33 2012 31 Annual Installations (GWs) Source: 2012-2016 installations based on IHS, GTM and SunEdison. 2017-2020 extrapolated from 2015-2016 growth rate Addressable Market Through 2020 Nears: 500 GW, and $1 Trillion (cumulatively) 34

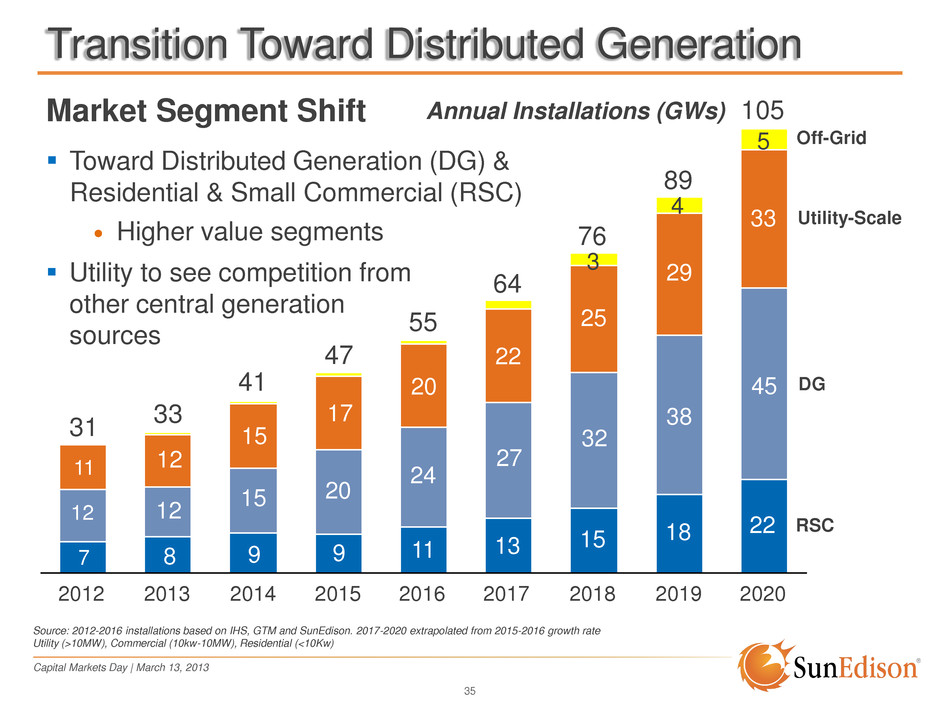

Capital Markets Day | March 13, 2013 35 Transition Toward Distributed Generation 20 24 2015 47 9 17 20 2014 41 9 15 15 2013 33 8 12 12 2012 31 7 11 12 22 33 45 2019 89 4 18 29 38 2018 76 3 15 25 32 2017 64 11 22 27 2016 55 13 RSC Utility-Scale DG 2020 105 5 Off-Grid Source: 2012-2016 installations based on IHS, GTM and SunEdison. 2017-2020 extrapolated from 2015-2016 growth rate Utility (>10MW), Commercial (10kw-10MW), Residential (<10Kw) Annual Installations (GWs) Market Segment Shift Toward Distributed Generation (DG) & Residential & Small Commercial (RSC) • Higher value segments Utility to see competition from other central generation sources

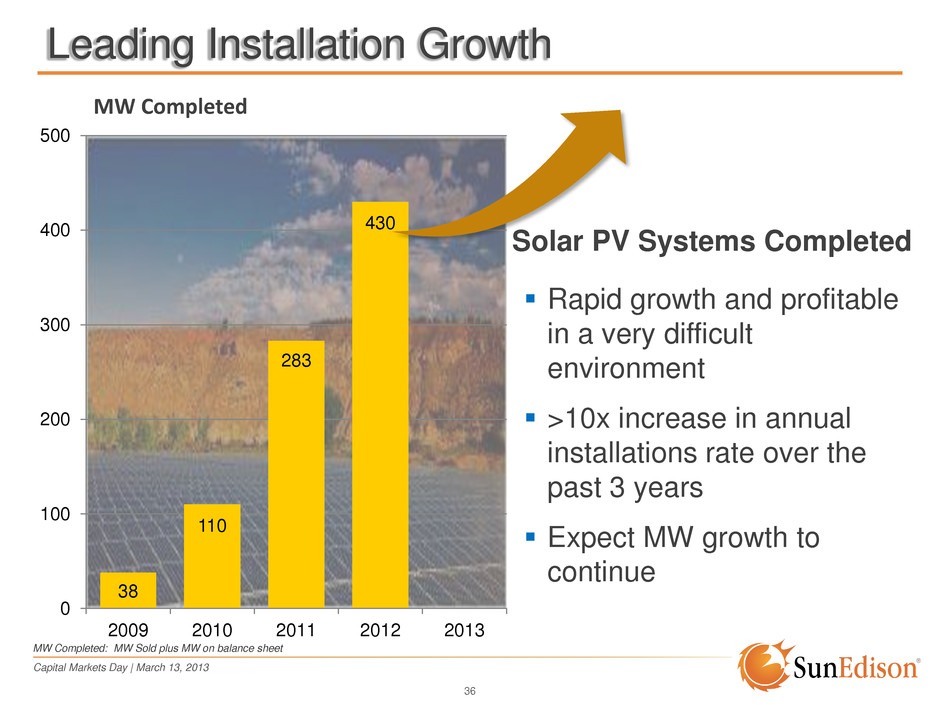

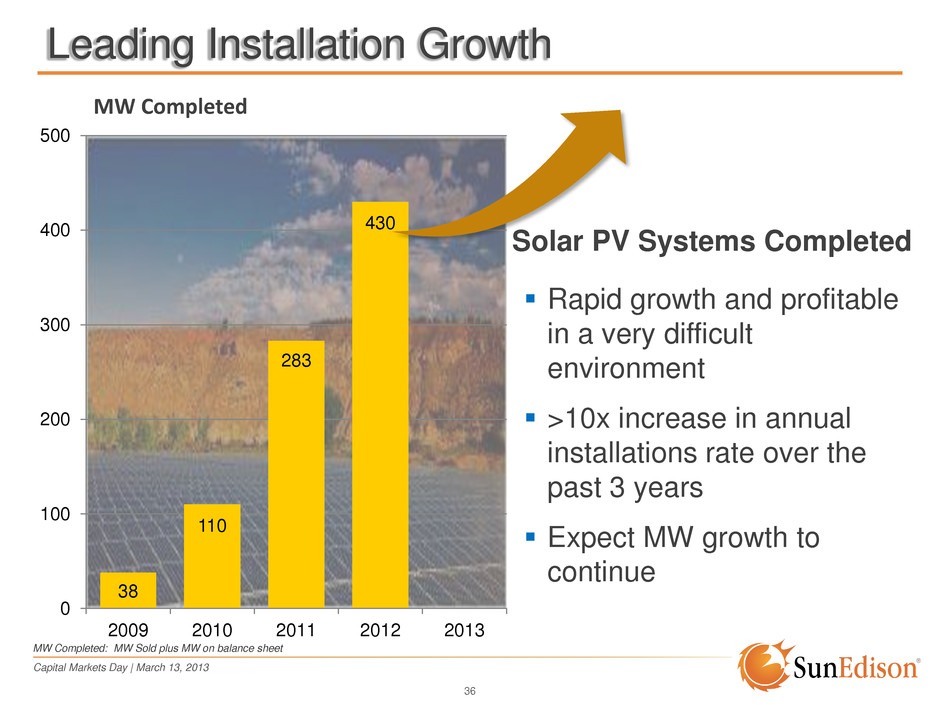

Capital Markets Day | March 13, 2013 36 Leading Installation Growth Solar PV Systems Completed Rapid growth and profitable in a very difficult environment >10x increase in annual installations rate over the past 3 years Expect MW growth to continue MW Completed 38 110 283 430 0 100 200 300 400 500 2009 2010 2011 2012 2013 MW Completed: MW Sold plus MW on balance sheet

Capital Markets Day | March 13, 2013 37 Market Share Leader Company Location 2012 installs Utility (>10MW) DG (0.5 – 10MW) RSC (<0.5MW) Comments Company A USA 498MW C C Primarily USA, expanding SunEdison USA 430MW Globally deployed; extending leadership in Utility & DG Company C China 380MW C C China Focus Company D USA 360MW Majority USA, some global deployment Company E Germany 350MW C Mainly Europe Company F Germany 324MW C Global EPC provider Company G China 300MW C C China Focus Company H China 300MW C C China Focus Company I China 250MW C C China Focus Company J India 200MW C India Focus C Established No position Emerging position Source: IMS “PV Integrators & Projects – 4Q12”

Capital Markets Day | March 13, 2013 38 Four Critical Success Factors #4 Services #3 Capital #2 Development #1 Technology Approach Accomplishments Trajectory 2016 High Efficiency / Low Cost 330Wp Module @ $0.65/Wp Cost 400Wp @ $0.40/Wp by 2016 Diversification Globally & by Market Segment 430MW Completed in 2012 Globally Emphasis on Flow Businesses Continued Growth Ample Access to Low Cost Capital $2.3B Raised in 2012 Aligning & Structuring Capital to Support Growth Public Markets / PE Funds Superior Asset Returns >1 GW of Assets Under Management Global Leader With >5GW Under Management

Capital Markets Day | March 13, 2013 Technology Vijay Chinnasami Senior VP, GM Solar Materials #4 Services #3 Capital #2 Development #1 Technology

Capital Markets Day | March 13, 2013 Solar Materials Mandate 40 Optionality: captive capacity and leverage low cost 3rd party modules Aggressive cost roadmap: drive lowest in the industry to enable pipeline growth Technology: invest in technology, implement asset light Controlling Our Destiny

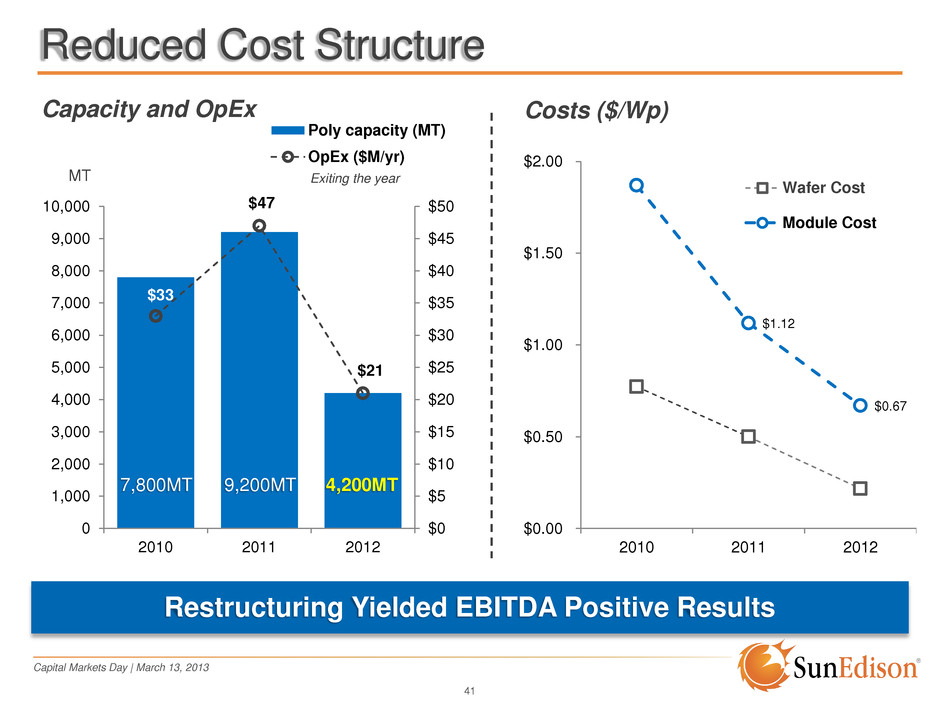

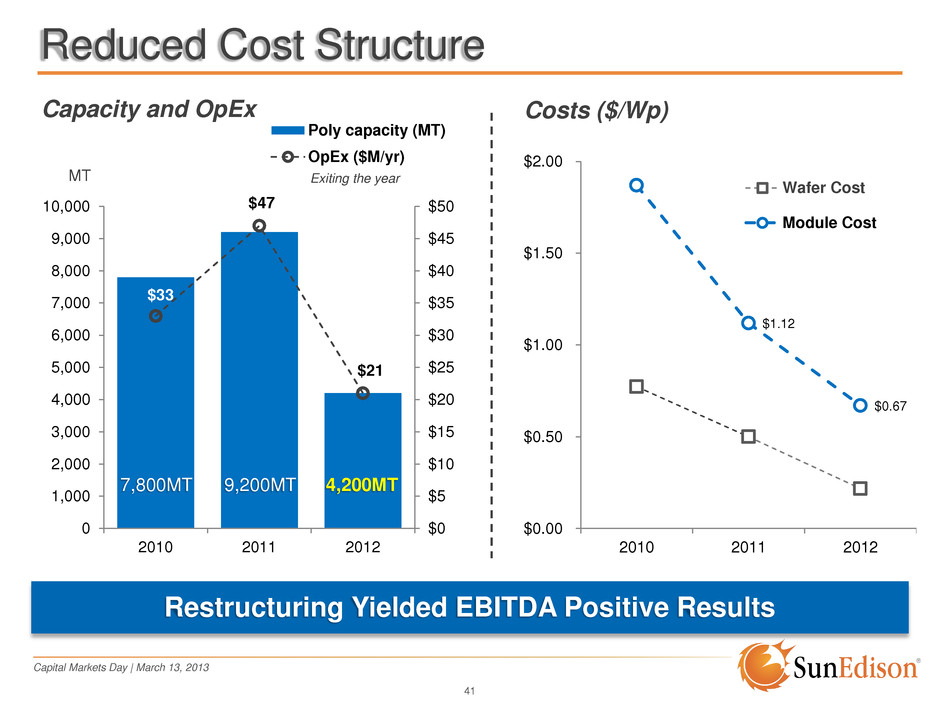

Capital Markets Day | March 13, 2013 41 Restructuring Yielded EBITDA Positive Results Reduced Cost Structure $33 $47 $21 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 $50 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 2010 2011 2012 Poly capacity (MT) OpEx ($M/yr) 7,800MT 9,200MT 4,200MT Capacity and OpEx Exiting the year MT $1.12 $0.67 $0.00 $0.50 $1.00 $1.50 $2.00 2010 2011 2012 Wafer Cost Module Cost Costs ($/Wp)

Capital Markets Day | March 13, 2013 Be Opportunistic But Careful $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $/Wp Std c-Si Modules Average Cost Stack Cash B/E Price ~$0.95/Wp Market Price ~$0.60/Wp Cash Burn per Watt Non-Silicon Mfg Cost OpEx Poly Cost @ $18/kg Debt Service CAPX + Maint Si Margin $0 $10 $20 $30 Production Cost OpEx Debt Service Largest p-Si Manufacturer Cash B/E ~$29/kg Market Price ~$18/kg Source: Third party company reports Cash Burn ($/kg) Present module ASPs below production cost Risk of module availability, quality and pricing volatility Trade wars evolving 42

Capital Markets Day | March 13, 2013 Flexible Business Model 43 Business Model Strategy Current Operating Level Surplus / (Deficit) Module Contract Manufacturing Trade war protection & local content Flexible to meet internal demand (130) MW Cell Toll Trade war protection & high efficiency focus Flexible, sufficient to meet internal demand (0) MW Wafer Internal JV Toll High efficiency advanced technology & lowest cost Toll: Flexible, up to 450 MW/yr Internal: 300 MW 50 MW PolySi Internal JV Purchase Competitive cost semi poly, support solar cost roadmap Internal Semi Grade: 2600 MT Internal Solar Grade: 1600 MT Semi: (500) MT Solar: (2500) MT

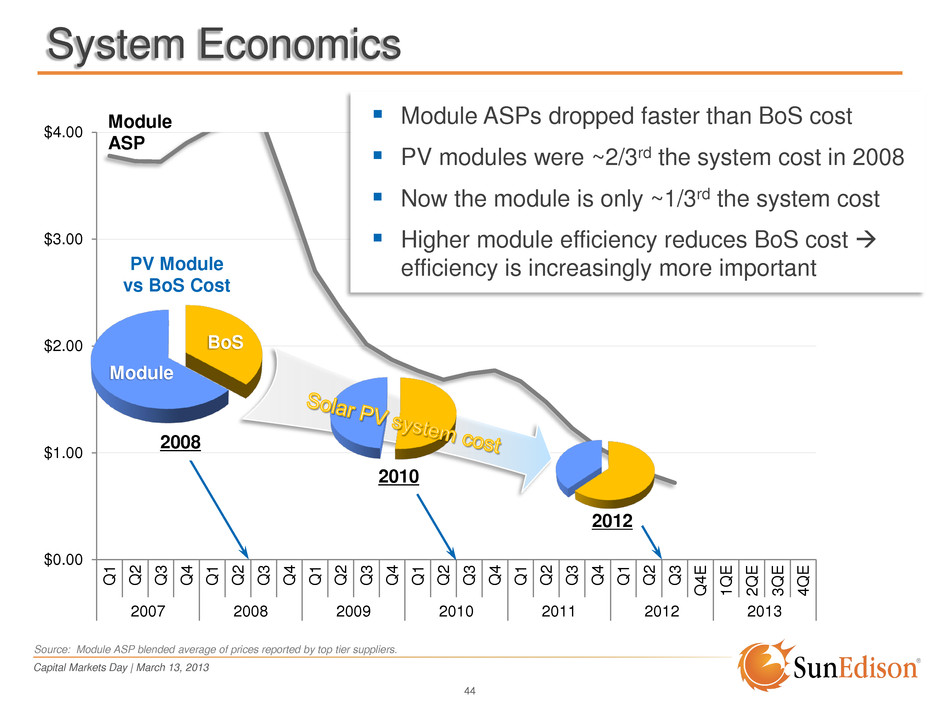

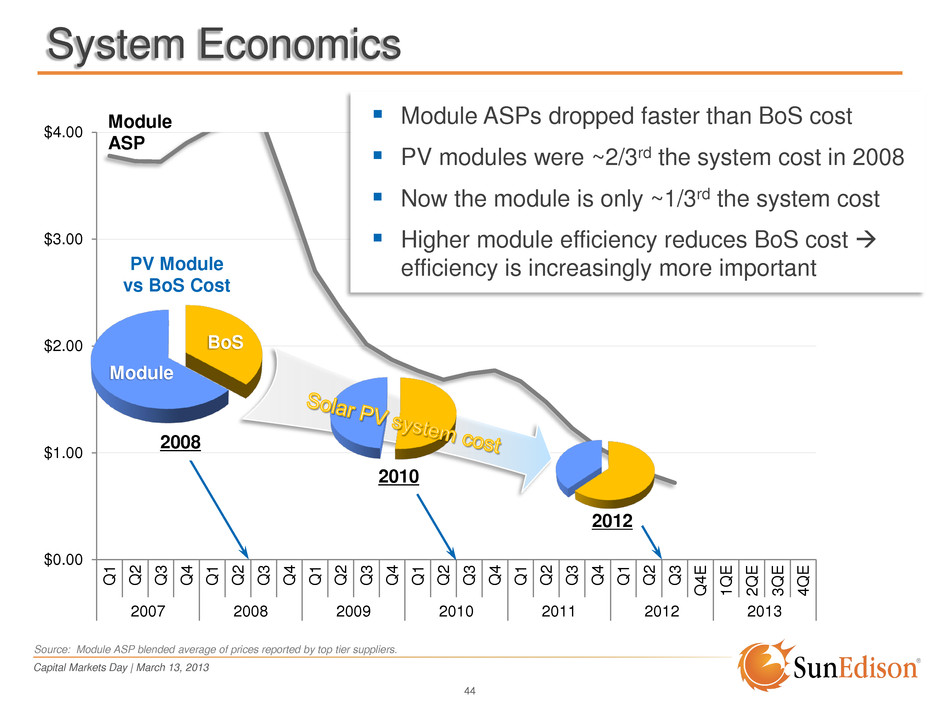

Capital Markets Day | March 13, 2013 System Economics 44 $0.00 $1.00 $2.00 $3.00 $4.00 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 Q 1 Q 2 Q 3 Q 4 E 1 Q E 2 Q E 3 Q E 4 Q E 2007 2008 2009 2010 2011 2012 2013 Module ASP Module ASPs dropped faster than BoS cost PV modules were ~2/3rd the system cost in 2008 Now the module is only ~1/3rd the system cost Higher module efficiency reduces BoS cost efficiency is increasingly more important 2008 BoS Module 2010 PV Module vs BoS Cost Source: Module ASP blended average of prices reported by top tier suppliers. 2012

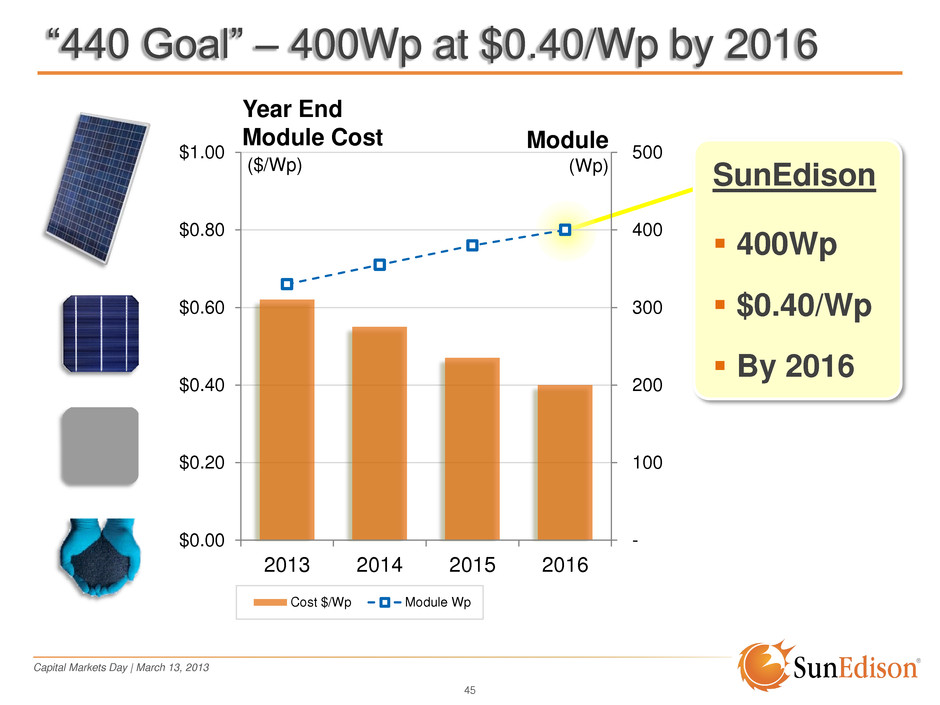

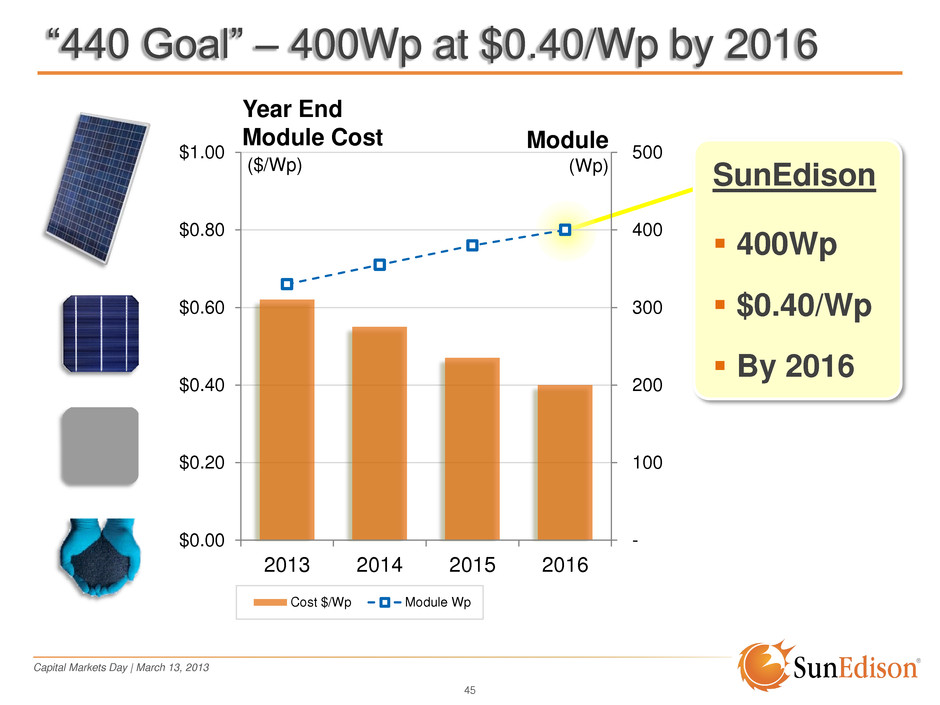

Capital Markets Day | March 13, 2013 - 100 200 300 400 500 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 2013 2014 2015 2016 Cost $/Wp Module Wp “440 Goal” – 400Wp at $0.40/Wp by 2016 45 Year End Module Cost ($/Wp) Module (Wp) SunEdison 400Wp $0.40/Wp By 2016

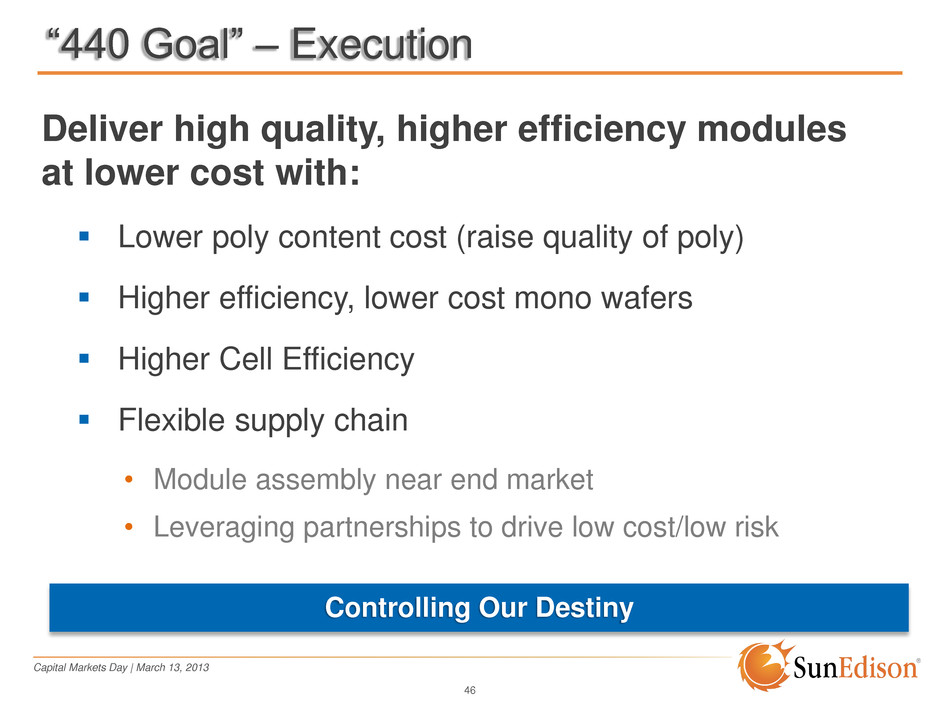

Capital Markets Day | March 13, 2013 “440 Goal” – Execution 46 Deliver high quality, higher efficiency modules at lower cost with: Lower poly content cost (raise quality of poly) Higher efficiency, lower cost mono wafers Higher Cell Efficiency Flexible supply chain • Module assembly near end market • Leveraging partnerships to drive low cost/low risk Controlling Our Destiny

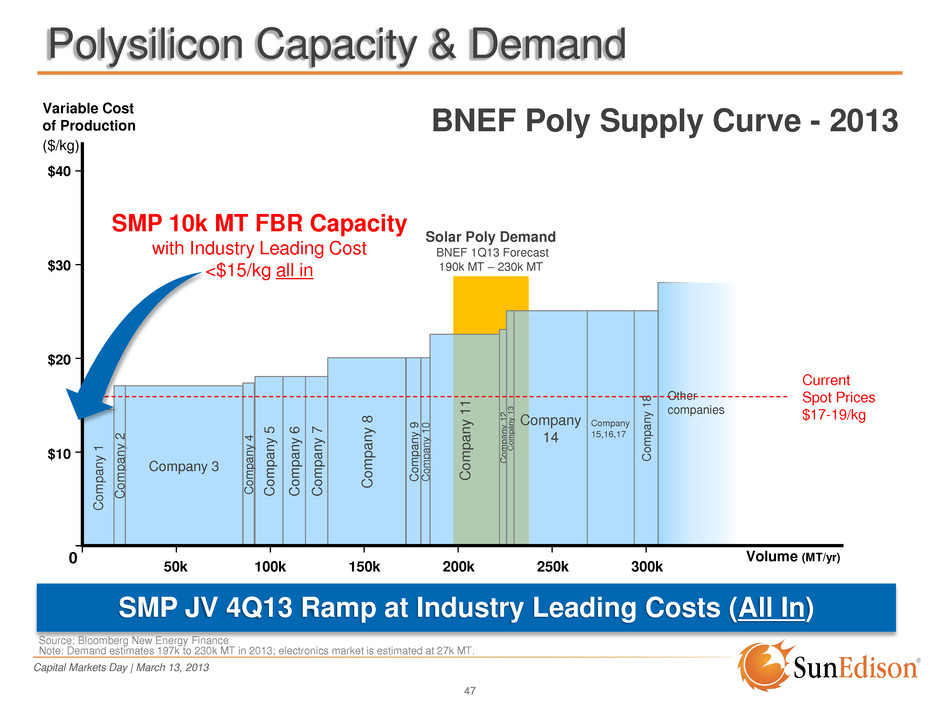

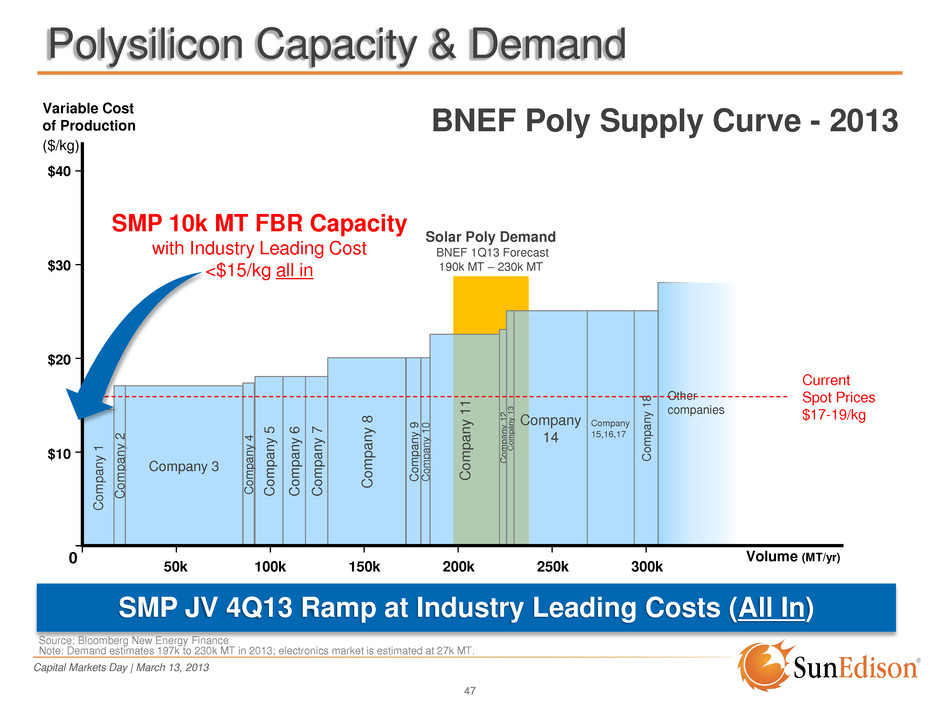

Capital Markets Day | March 13, 2013 Company 15,16,17 Co m p a n y 1 8 Company 14 Co m p a n y 1 2 Co m p a n y 1 3 Co m p a n y 9 C o m pan y 6 C o m pan y 7 C o m pan y 5 Co m p a n y 2 Polysilicon Capacity & Demand 47 Co m p a n y 4 Other companies Co m p a n y 1 C o m p a n y 1 0 C ompan y 1 1 C ompan y 8 Company 3 Variable Cost of Production ($/kg) Volume (MT/yr) Current Spot Prices $17-19/kg 50k 100k 150k 200k 250k 300k 0 $40 $30 $20 $10 Source: Bloomberg New Energy Finance Note: Demand estimates 197k to 230k MT in 2013; electronics market is estimated at 27k MT. Solar Poly Demand BNEF 1Q13 Forecast 190k MT – 230k MT SMP 10k MT FBR Capacity with Industry Leading Cost <$15/kg all in BNEF Poly Supply Curve - 2013 SMP JV 4Q13 Ramp at Industry Leading Costs (All In)

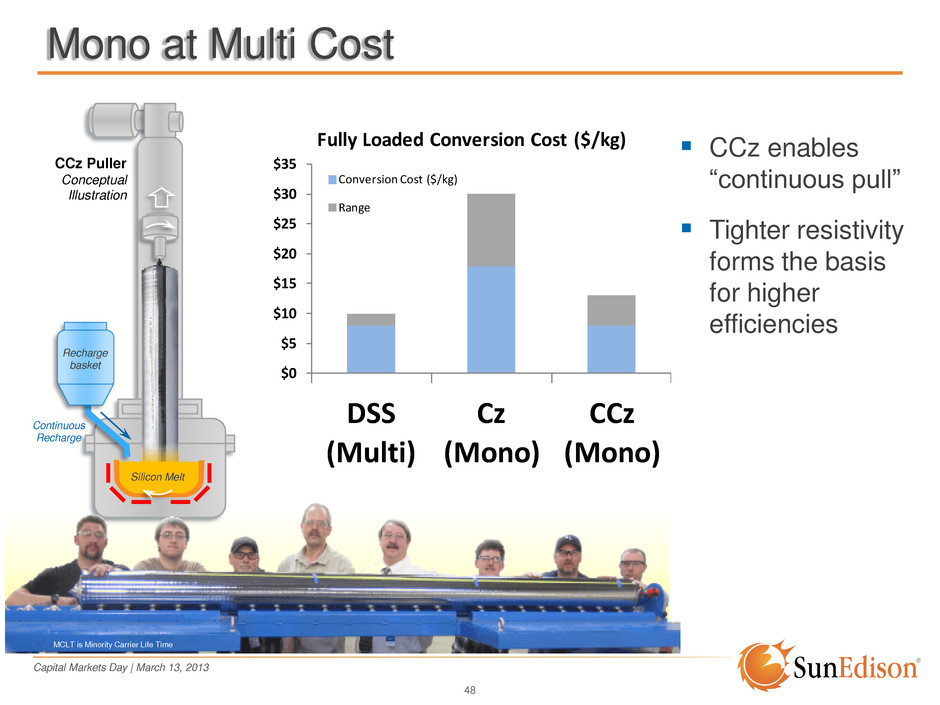

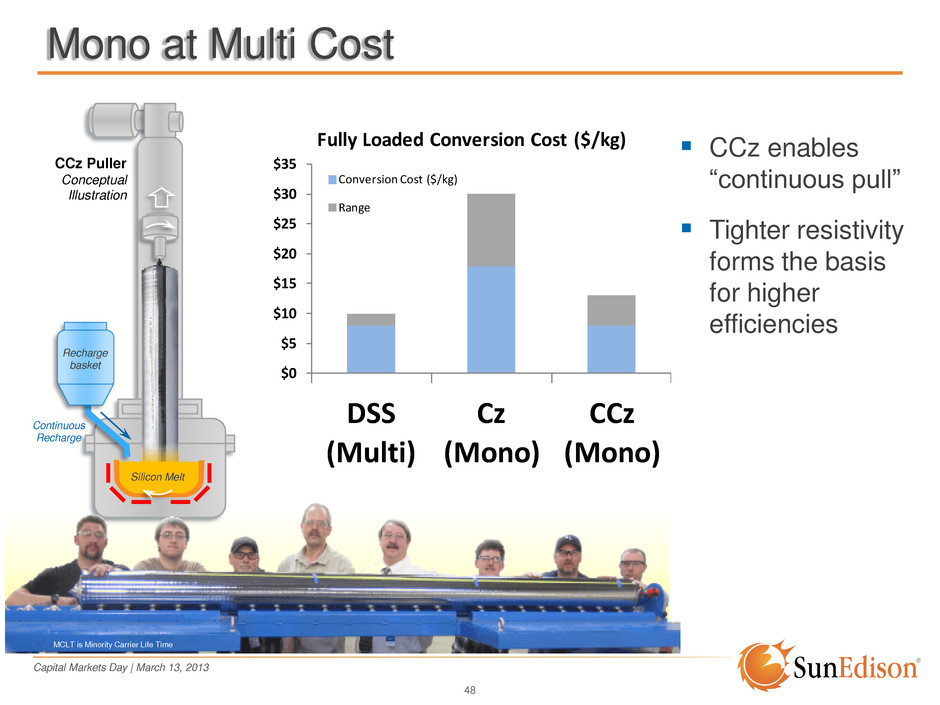

Capital Markets Day | March 13, 2013 CCz Puller Conceptual Illustration Recharge basket Silicon Melt Mono at Multi Cost CCz enables “continuous pull” Tighter resistivity forms the basis for higher efficiencies 48 Continuous Recharge MCLT is Minority Carrier Life Time $0 $5 $10 $15 $20 $25 $30 $35 DSS (Multi) Cz (Mono) CCz (Mono) Fully Loaded Conversion Cost ($/kg) Conversion Cost ($/kg) Range

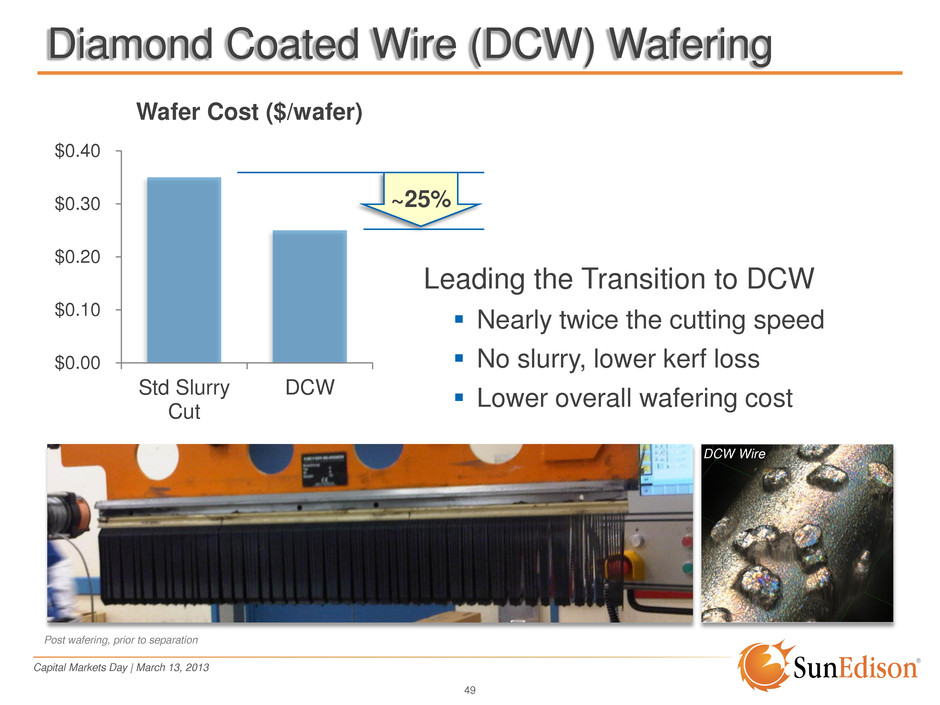

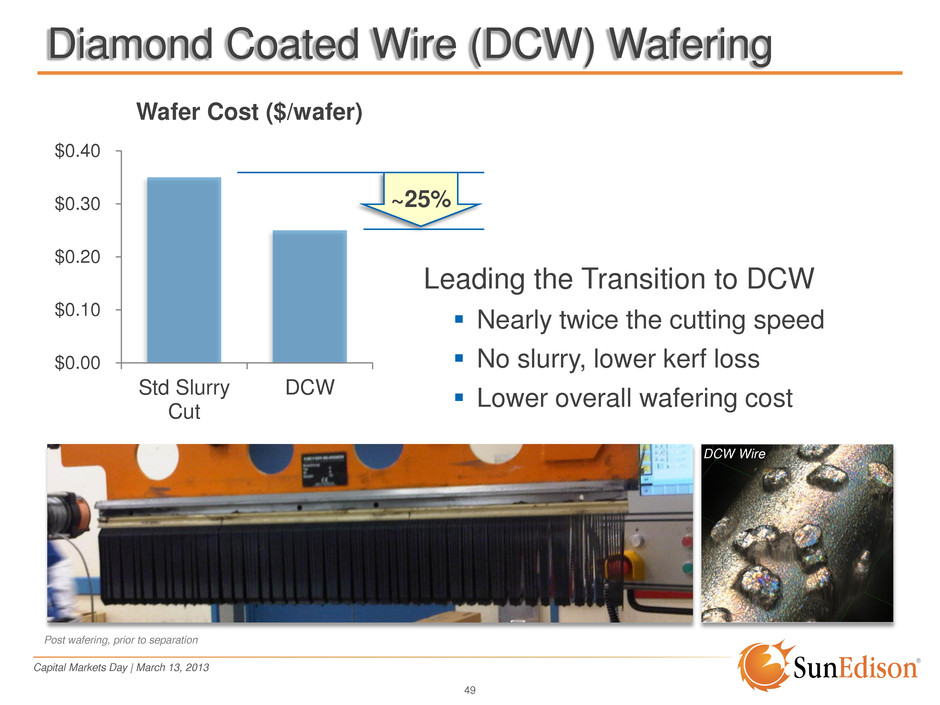

Capital Markets Day | March 13, 2013 Diamond Coated Wire (DCW) Wafering DCW Wire Post wafering, prior to separation 49 $0.00 $0.10 $0.20 $0.30 $0.40 Std Slurry Cut DCW Wafer Cost ($/wafer) ~25% Leading the Transition to DCW Nearly twice the cutting speed No slurry, lower kerf loss Lower overall wafering cost

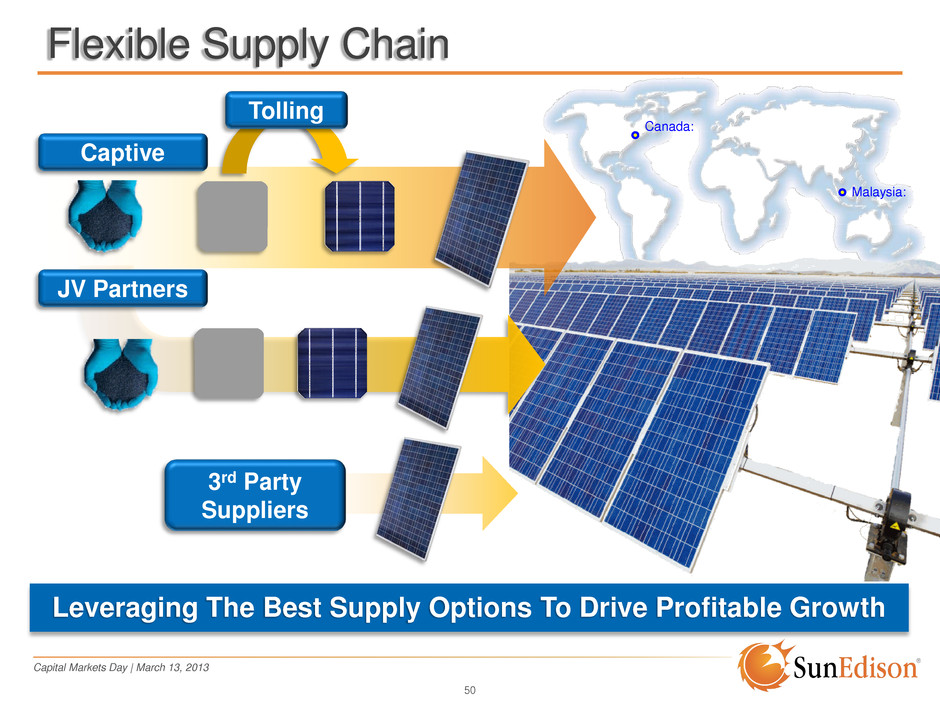

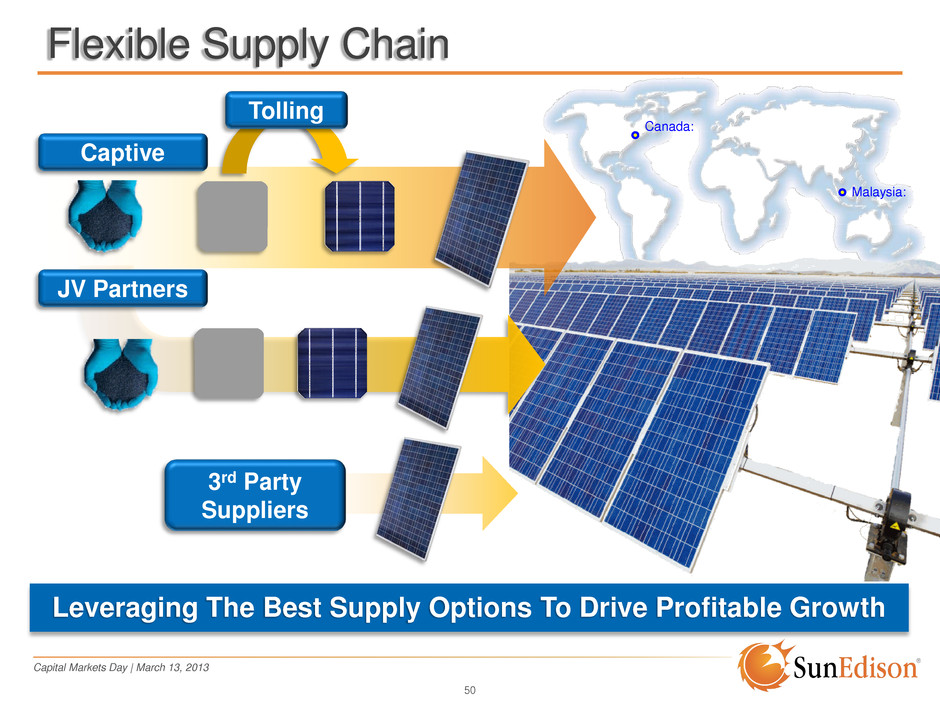

Capital Markets Day | March 13, 2013 Canada: Malaysia: Flexible Supply Chain Tolling JV Partners Captive 3rd Party Suppliers Leveraging The Best Supply Options To Drive Profitable Growth 50

Capital Markets Day | March 13, 2013 “440 Goal” – 400Wp at $0.40/Wp by 2016 51 “440 Goal” 400Wp Module at $0.40/Wp by 2016 Note : Cost includes opex, silicon, son-silicon, depreciation, warranty and inbound freight and excludes corporate general & admin. expenses)

Capital Markets Day | March 13, 2013 Development Global, Multi-Channel Focused #4 Services #3 Capital #2 Development #1 Technology

Capital Markets Day | March 13, 2013 Development – Regional View Tim Derrick General Manager, North America

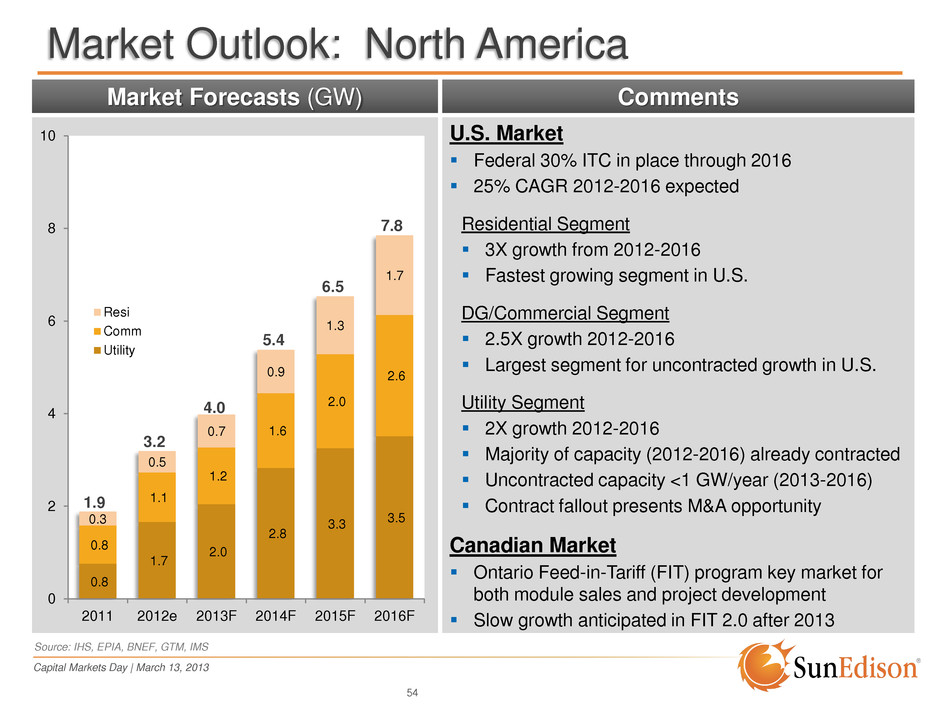

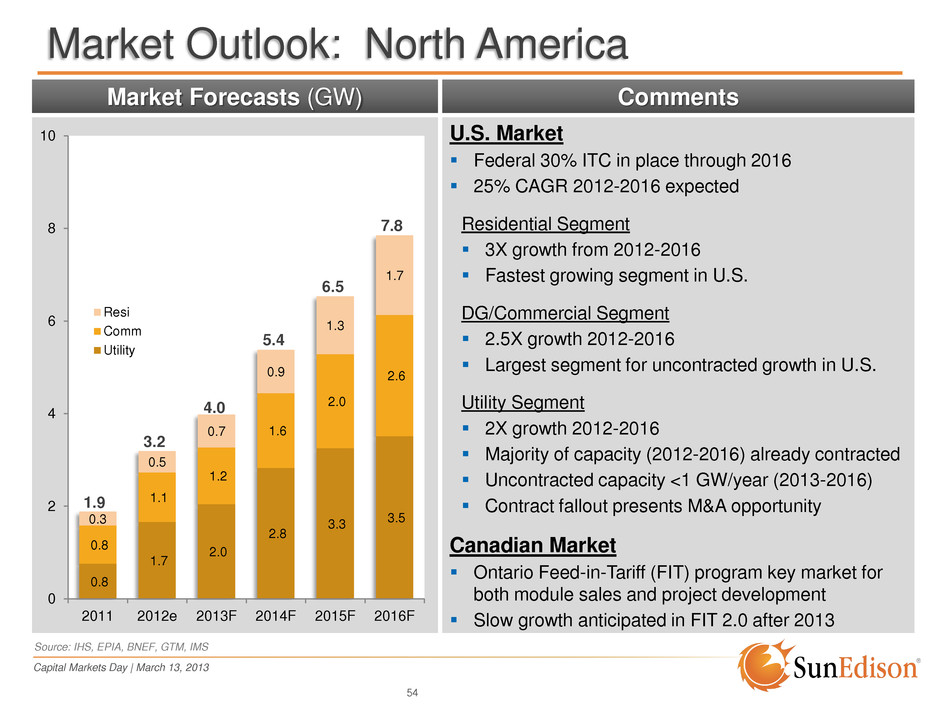

Capital Markets Day | March 13, 2013 Market Forecasts (GW) Comments U.S. Market Federal 30% ITC in place through 2016 25% CAGR 2012-2016 expected Residential Segment 3X growth from 2012-2016 Fastest growing segment in U.S. DG/Commercial Segment 2.5X growth 2012-2016 Largest segment for uncontracted growth in U.S. Utility Segment 2X growth 2012-2016 Majority of capacity (2012-2016) already contracted Uncontracted capacity <1 GW/year (2013-2016) Contract fallout presents M&A opportunity Canadian Market Ontario Feed-in-Tariff (FIT) program key market for both module sales and project development Slow growth anticipated in FIT 2.0 after 2013 0.8 1.7 2.0 2.8 3.3 3.5 0.8 1.1 1.2 1.6 2.0 2.6 0.3 0.5 0.7 0.9 1.3 1.7 0 2 4 6 8 10 2011 2012e 2013F 2014F 2015F 2016F Resi Comm Utility 54 Market Outlook: North America Source: IHS, EPIA, BNEF, GTM, IMS 7.8 4.0 3.2 1.9 6.5 5.4

Capital Markets Day | March 13, 2013 55 Key Accomplishments 223MW of projects in 2012 3rd Largest Solar developer in North America Retail grid parity achieved in select DG markets (e.g. Hawaii, Puerto Rico) 160 MW of California utility projects to start construction in 2013 Focus on scaling DG platform Las Cruces, New Mexico (16MW) Picture Rocks, Tucson, AZ (25MW)

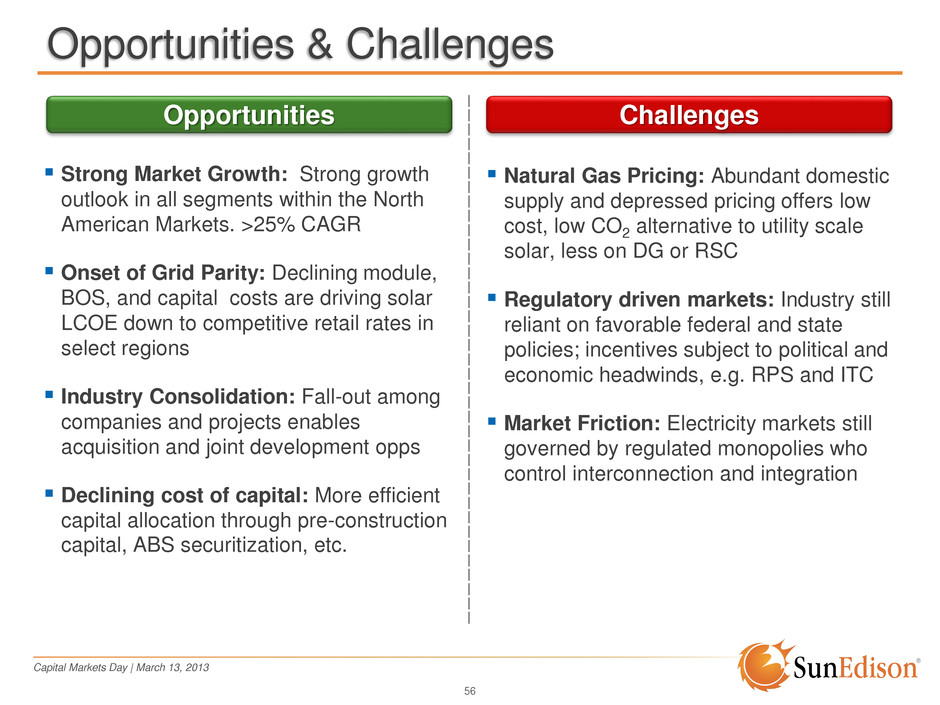

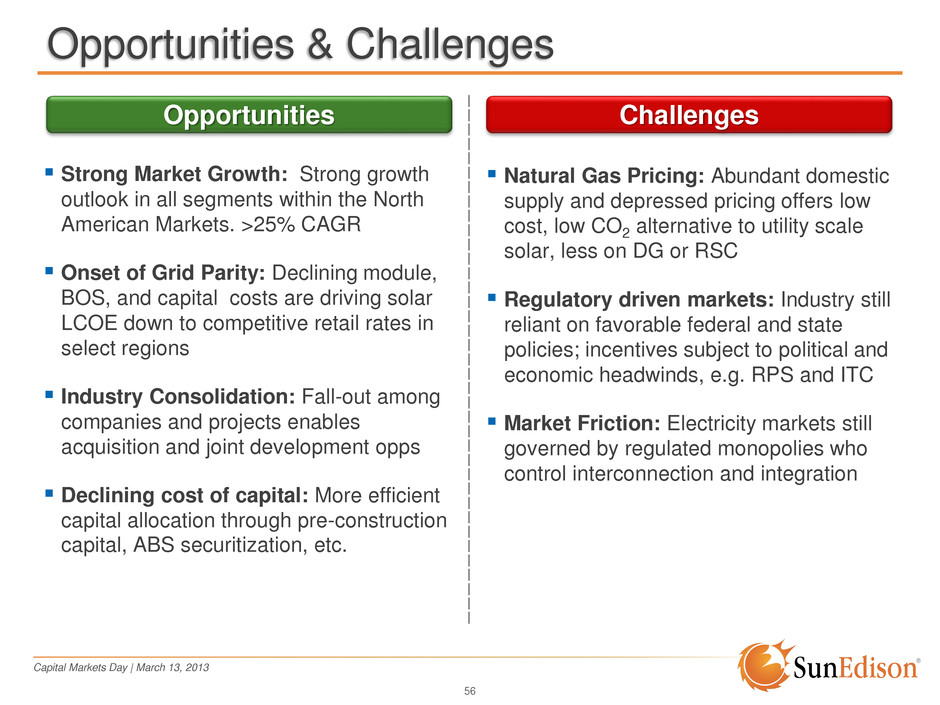

Capital Markets Day | March 13, 2013 56 Opportunities & Challenges Opportunities Challenges Natural Gas Pricing: Abundant domestic supply and depressed pricing offers low cost, low CO2 alternative to utility scale solar, less on DG or RSC Regulatory driven markets: Industry still reliant on favorable federal and state policies; incentives subject to political and economic headwinds, e.g. RPS and ITC Market Friction: Electricity markets still governed by regulated monopolies who control interconnection and integration Strong Market Growth: Strong growth outlook in all segments within the North American Markets. >25% CAGR Onset of Grid Parity: Declining module, BOS, and capital costs are driving solar LCOE down to competitive retail rates in select regions Industry Consolidation: Fall-out among companies and projects enables acquisition and joint development opps Declining cost of capital: More efficient capital allocation through pre-construction capital, ABS securitization, etc..

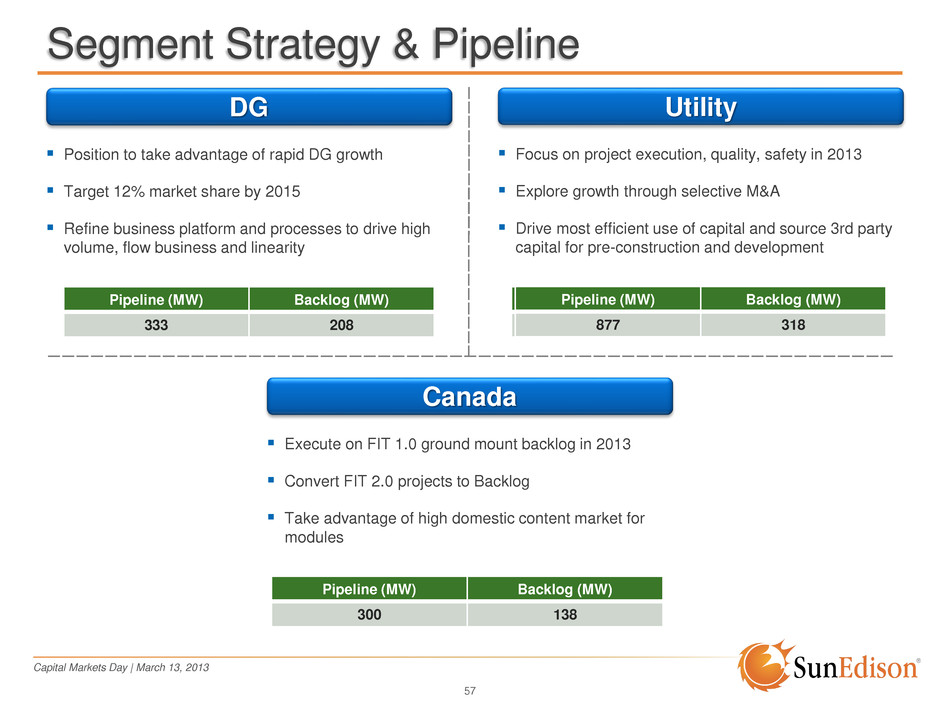

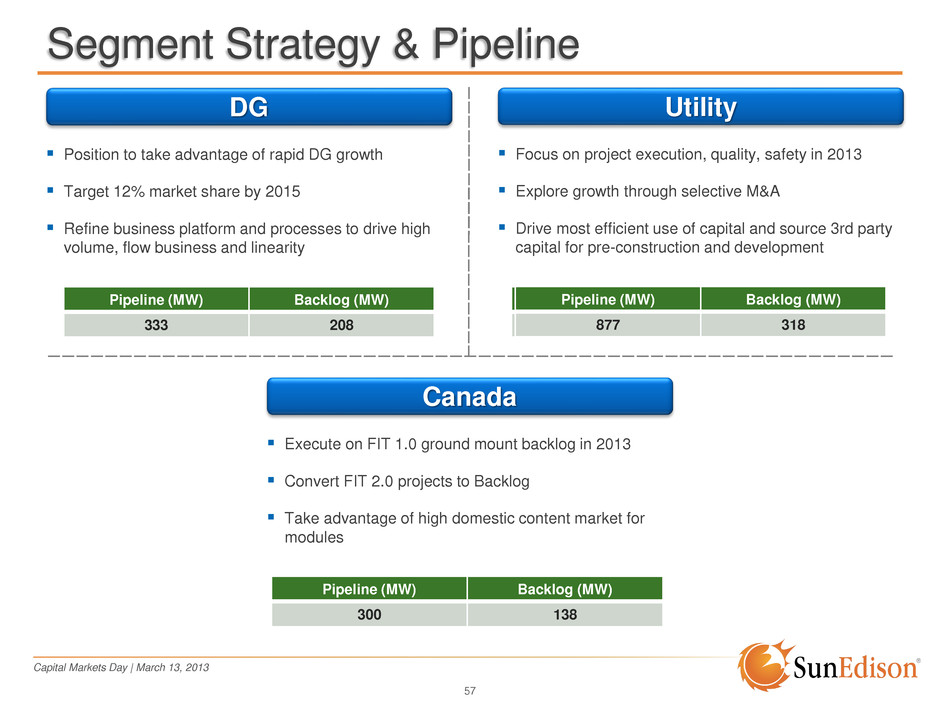

Capital Markets Day | March 13, 2013 57 Segment Strategy & Pipeline DG Position to take advantage of rapid DG growth Target 12% market share by 2015 Refine business platform and processes to drive high volume, flow business and linearity Utility Focus on project execution, quality, safety in 2013 Explore growth through selective M&A Drive most efficient use of capital and source 3rd party capital for pre-construction and development Canada Execute on FIT 1.0 ground mount backlog in 2013 Convert FIT 2.0 projects to Backlog Take advantage of high domestic content market for modules Pipeline (MW) Backlog (MW) 333 208 Pipeline (MW) Backlog (MW) i eline (MW) acklog (MW) 877 318 Pipeline (MW) Backlog (MW) 300 138

Capital Markets Day | March 13, 2013 Development – Regional View Pancho Pérez General Manager, Europe, LatAm, MENA and Japan

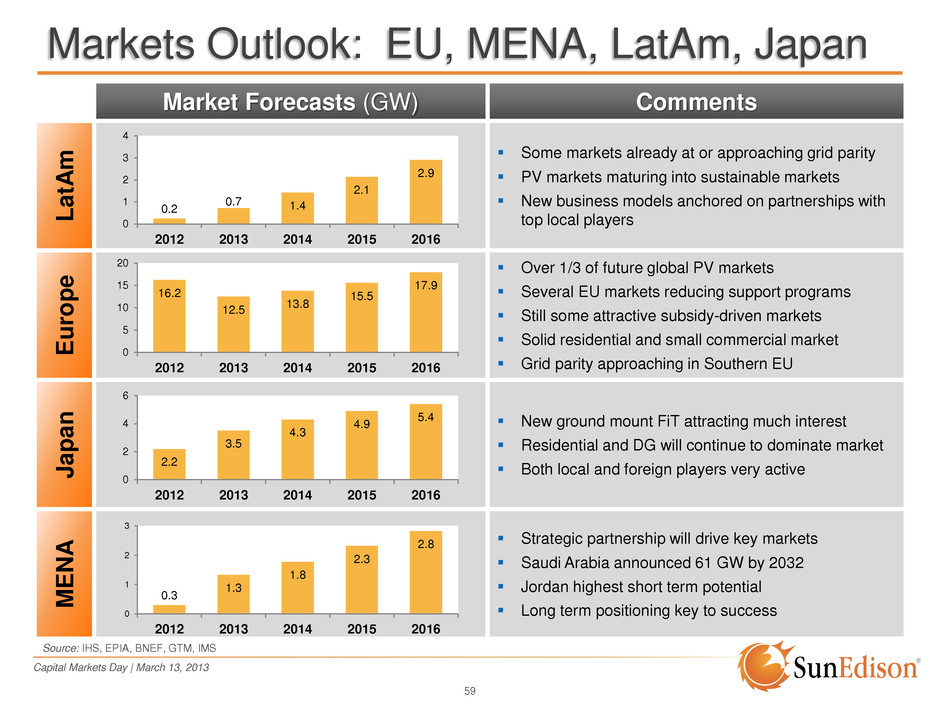

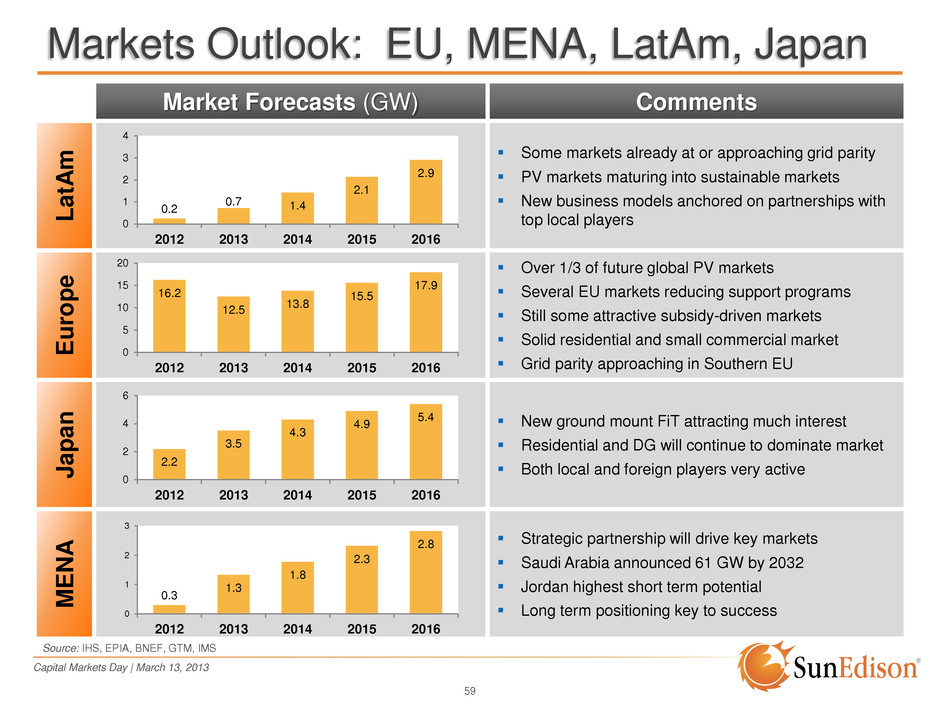

Capital Markets Day | March 13, 2013 59 Markets Outlook: EU, MENA, LatAm, Japan Market Forecasts (GW) Comments Lat A m Some markets already at or approaching grid parity PV markets maturing into sustainable markets New business models anchored on partnerships with top local players Europ e Over 1/3 of future global PV markets Several EU markets reducing support programs Still some attractive subsidy-driven markets Solid residential and small commercial market Grid parity approaching in Southern EU J a pa n New ground mount FiT attracting much interest Residential and DG will continue to dominate market Both local and foreign players very active ME N A Strategic partnership will drive key markets Saudi Arabia announced 61 GW by 2032 Jordan highest short term potential Long term positioning key to success 0.2 0.7 1.4 2.1 2.9 0 1 2 3 4 2012 2013 2014 2015 2016 16.2 12.5 13.8 15.5 17.9 0 5 10 15 20 2012 2013 2014 2015 2016 2.2 3.5 4.3 4.9 5.4 0 2 4 6 2012 2013 2014 2015 2016 0.3 1.3 1.8 2.3 2.8 0 1 2 3 2012 2013 2014 2015 2016 Source: IHS, EPIA, BNEF, GTM, IMS

Capital Markets Day | March 13, 2013 Other Key Accomplishments 2012 – 2013 Signed LOI with Gov. of Sonora to build a 50 MW plant in Mexico Awarded 35 MW tender Pre-assigned 20 MW in Ma’an tender in Jordan Contracted 2.2 MW with ECL/GDF-Suez in Chile Contracted 1.1 MW project with Petrobras in Brazil Over 350 MW of solar projects under O&M contracts in Europe Europe’s largest PV Plant: 70 MW in Italy 82 MW built and Interconnected in Europe 2010 2010 89 MW built and Interconnected in Europe 2011 First SunEdison project in Mexico 2012 First SunEdison project in Brazil with CPFL 2012 Sign PPA agreement to build 100 MW in Chile 2013 2012 124 MW built and Interconnected in Europe & LatAm 2012 Key Accomplishments 60 Bulgaria: 60 MW built, Interconnected, financed and sold in less than 9 months 60

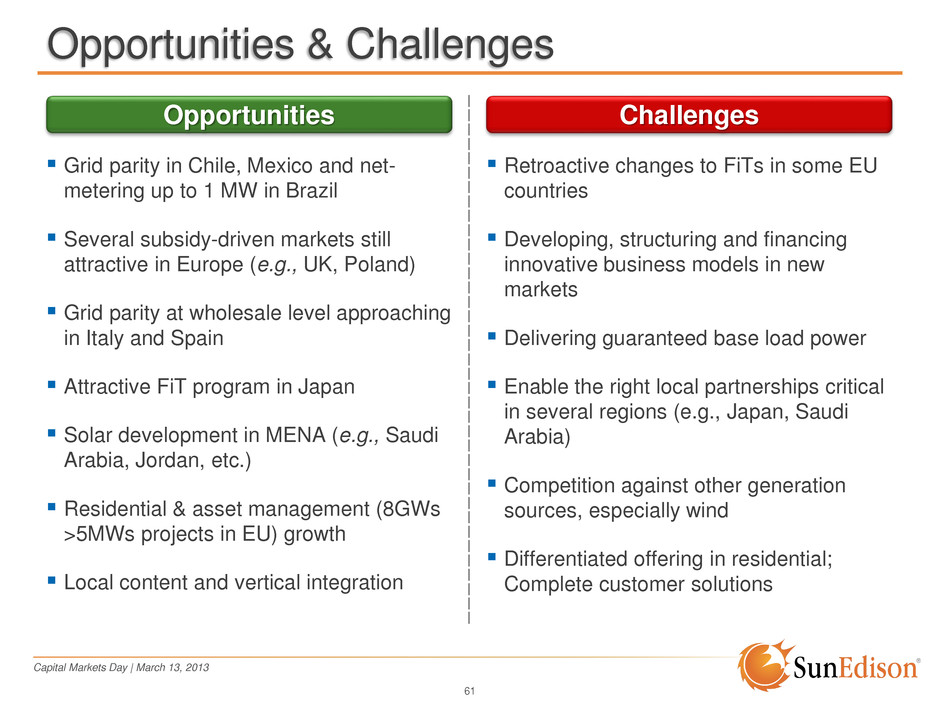

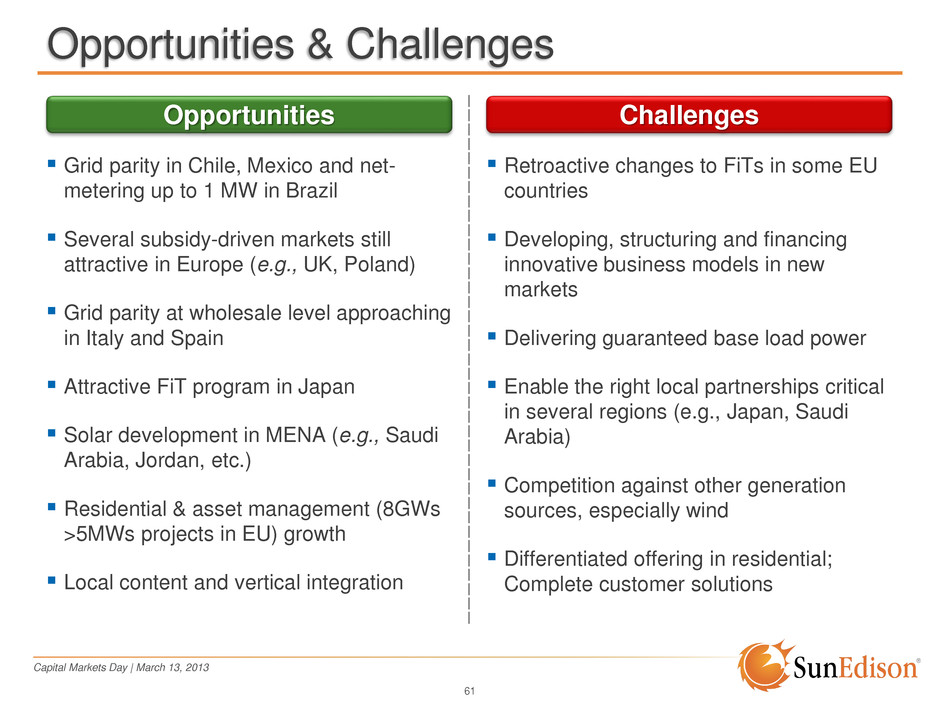

Capital Markets Day | March 13, 2013 61 Opportunities & Challenges Opportunities Grid parity in Chile, Mexico and net- metering up to 1 MW in Brazil Several subsidy-driven markets still attractive in Europe (e.g., UK, Poland) Grid parity at wholesale level approaching in Italy and Spain Attractive FiT program in Japan Solar development in MENA (e.g., Saudi Arabia, Jordan, etc.) Residential & asset management (8GWs >5MWs projects in EU) growth Local content and vertical integration Challenges Retroactive changes to FiTs in some EU countries Developing, structuring and financing innovative business models in new markets Delivering guaranteed base load power Enable the right local partnerships critical in several regions (e.g., Japan, Saudi Arabia) Competition against other generation sources, especially wind Differentiated offering in residential; Complete customer solutions

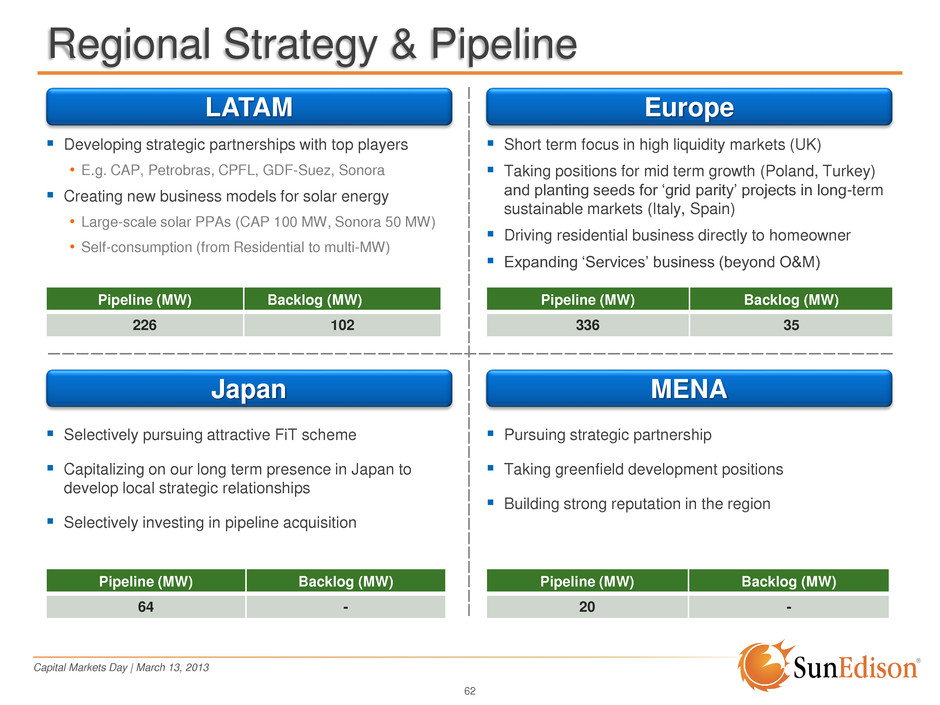

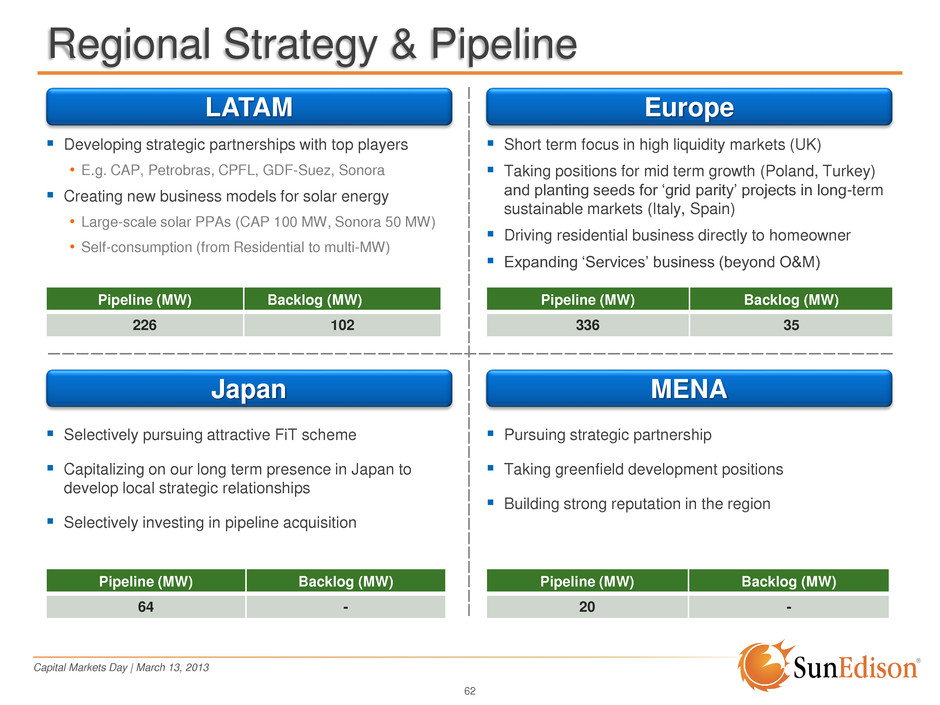

Capital Markets Day | March 13, 2013 62 Regional Strategy & Pipeline LATAM Developing strategic partnerships with top players • E.g. CAP, Petrobras, CPFL, GDF-Suez, Sonora Creating new business models for solar energy • Large-scale solar PPAs (CAP 100 MW, Sonora 50 MW) • Self-consumption (from Residential to multi-MW) Pipeline (MW) Backlog (MW) 226 102 Europe Short term focus in high liquidity markets (UK) Taking positions for mid term growth (Poland, Turkey) and planting seeds for ‘grid parity’ projects in long-term sustainable markets (Italy, Spain) Driving residential business directly to homeowner Expanding ‘Services’ business (beyond O&M) Pipeline (MW) Backlog (MW) 336 35 Japan Selectively pursuing attractive FiT scheme Capitalizing on our long term presence in Japan to develop local strategic relationships Selectively investing in pipeline acquisition Pipeline (MW) Backlog (MW) 64 - MENA Pursuing strategic partnership Taking greenfield development positions Building strong reputation in the region Pipeline (MW) Backlog (MW) 20 -

Capital Markets Day | March 13, 2013 Development – Regional View Pashu Gopalan General Manager, South Asia and Sub-Saharan Africa

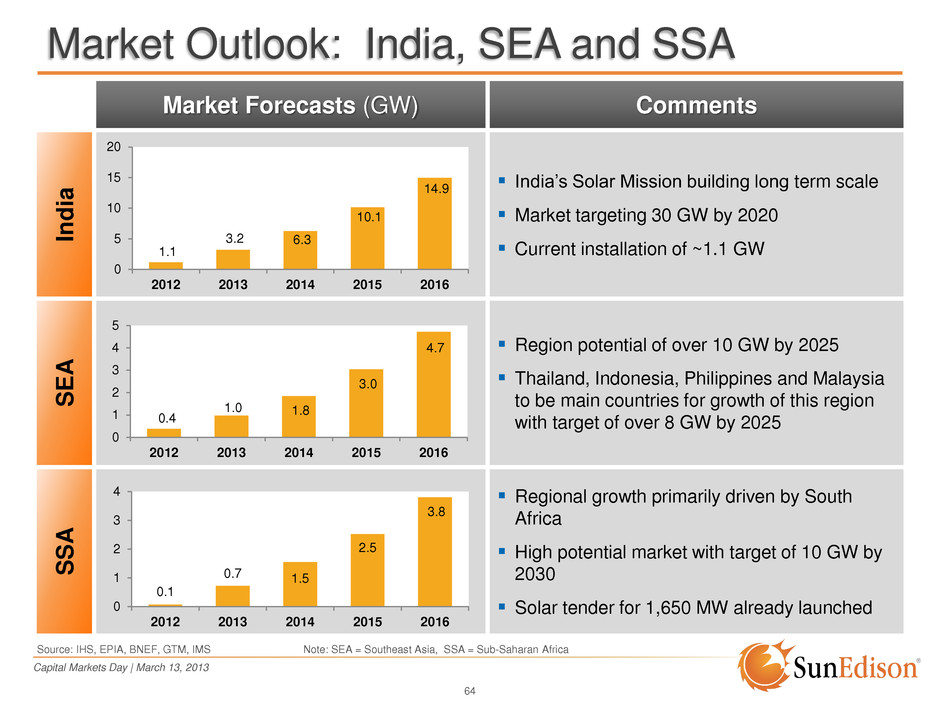

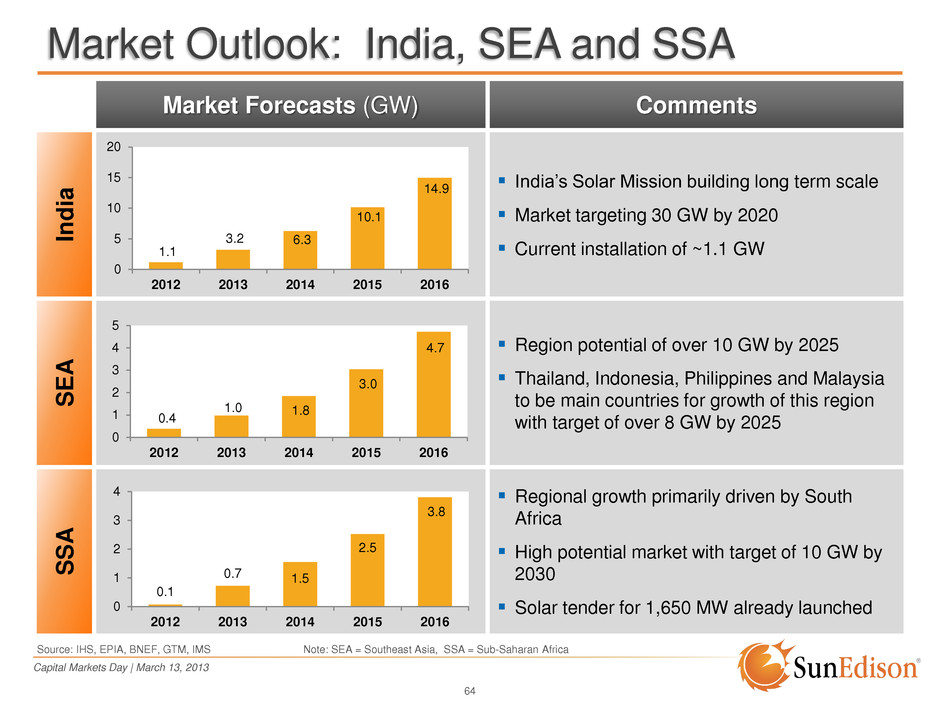

Capital Markets Day | March 13, 2013 64 Market Outlook: India, SEA and SSA Market Forecasts (GW) Comments In d ia India’s Solar Mission building long term scale Market targeting 30 GW by 2020 Current installation of ~1.1 GW S E A Region potential of over 10 GW by 2025 Thailand, Indonesia, Philippines and Malaysia to be main countries for growth of this region with target of over 8 GW by 2025 S S A Regional growth primarily driven by South Africa High potential market with target of 10 GW by 2030 Solar tender for 1,650 MW already launched Source: IHS, EPIA, BNEF, GTM, IMS 0.4 1.0 1.8 3.0 4.7 0 1 2 3 4 5 2012 2013 2014 2015 2016 0.1 0.7 1.5 2.5 3.8 0 1 2 3 4 2012 2013 2014 2015 2016 1.1 3.2 6.3 10.1 14.9 0 5 10 15 20 2012 2013 2014 2015 2016 Note: SEA = Southeast Asia, SSA = Sub-Saharan Africa

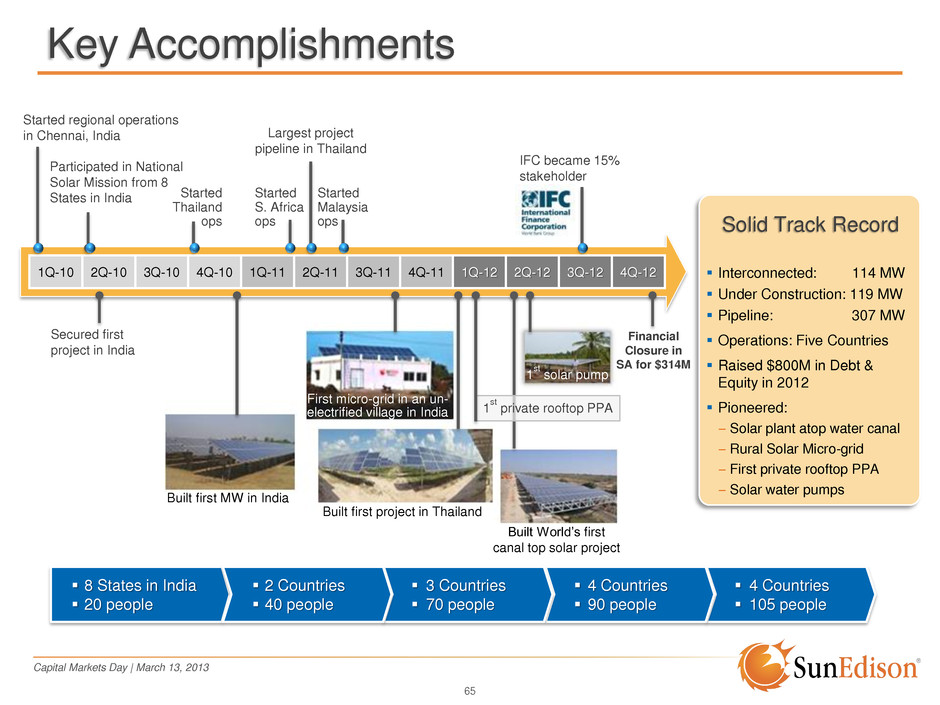

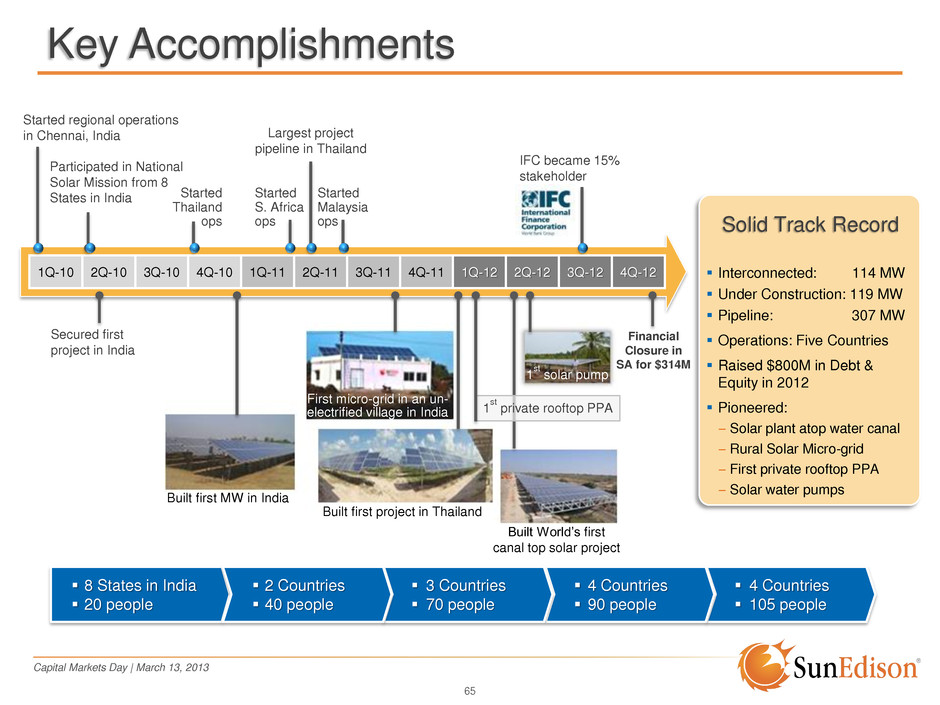

Capital Markets Day | March 13, 2013 Interconnected: 114 MW Under Construction: 119 MW Pipeline: 307 MW Operations: Five Countries Raised $800M in Debt & Equity in 2012 Pioneered: – Solar plant atop water canal – Rural Solar Micro-grid – First private rooftop PPA – Solar water pumps 1Q-10 2Q-10 3Q-10 4Q-10 1Q-11 2Q-11 3Q-11 4Q-11 1Q-12 2Q-12 3Q-12 4Q-12 65 Key Accomplishments IFC became 15% stakeholder Largest project pipeline in Thailand Built World’s first canal top solar project 1 st private rooftop PPA Participated in National Solar Mission from 8 States in India 4 Countries 105 people 8 States in India 20 people 4 Countries 90 people 3 Countries 70 people 2 Countries 40 people Started regional operations in Chennai, India Secured first project in India Started Thailand ops Started S. Africa ops Started Malaysia ops Financial Closure in SA for $314M Built first project in Thailand Built first MW in India First micro-grid in an un- electrified village in India 1 st solar pump Solid Track Record

Capital Markets Day | March 13, 2013 66 Key Accomplishments – Largest in SA/SSA Millennium, Gujarat (9.27 MW, Azimuth Tracker) Solar Park, Gujarat (25 MW, Fixed tilt) Azure, Gujarat (5 MW, Thin Film Fixed Tilt) Sri Sa Ket, Thailand (16.8 MW, Single Axis Tracker) GERMI, Gujarat (1 MW, showcase of all technologies) >114 MW Commissioned Across the Region NSM - 24, Rajasthan (24 MW, Thin film) NVVN, Rajasthan (5 MW, Fixed tilt) Sara Buri, Thailand (9.5 MW, Single Axis Tracker) Roi Et, Thailand (9.6 MW, Single Axis Tracker)

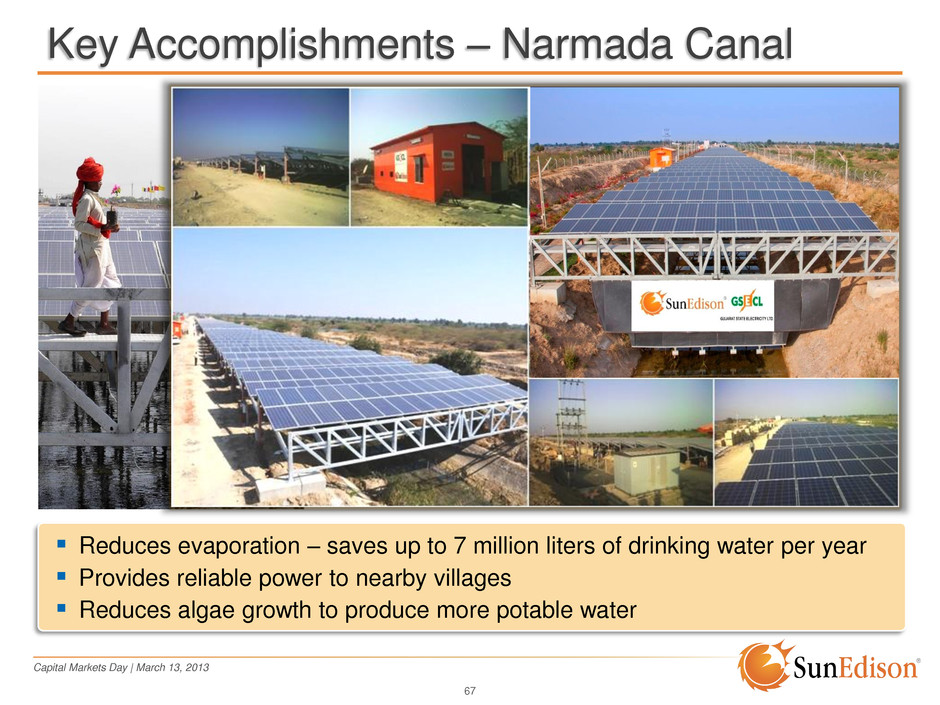

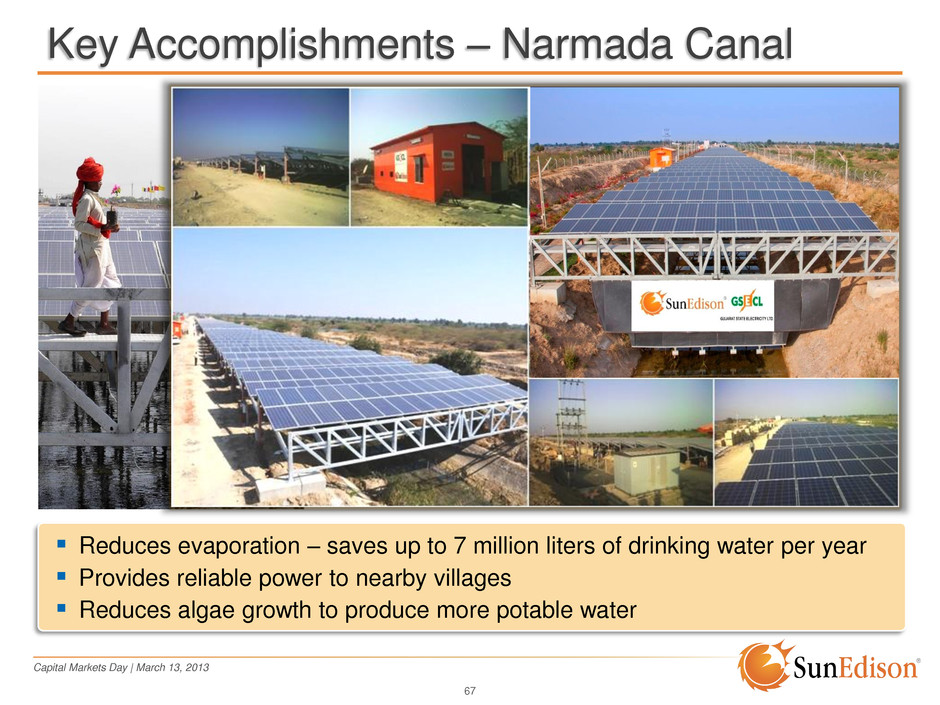

Capital Markets Day | March 13, 2013 67 Key Accomplishments – Narmada Canal Reduces evaporation – saves up to 7 million liters of drinking water per year Provides reliable power to nearby villages Reduces algae growth to produce more potable water

Capital Markets Day | March 13, 2013 68 “Best Solar Power Producer in India” 2012 Chosen from over 20 top solar providers in India Eminent jury consisting of former secretaries from the Ministry of Power, Renewable Energy and Commerce Deloitte was the knowledge partner for the award

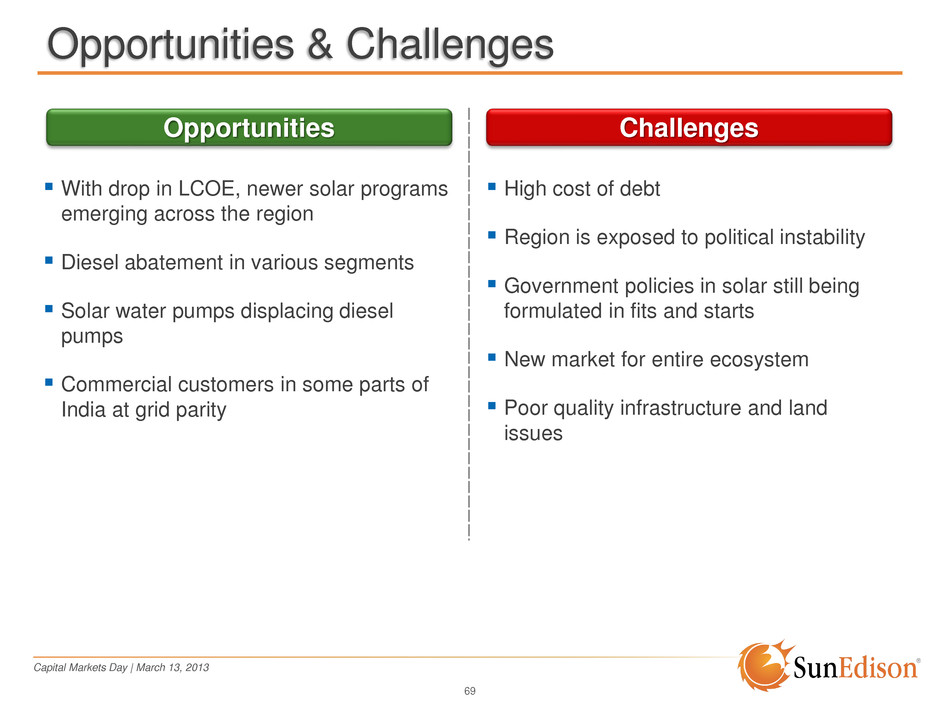

Capital Markets Day | March 13, 2013 69 Opportunities & Challenges Opportunities With drop in LCOE, newer solar programs emerging across the region Diesel abatement in various segments Solar water pumps displacing diesel pumps Commercial customers in some parts of India at grid parity Challenges High cost of debt Region is exposed to political instability Government policies in solar still being formulated in fits and starts New market for entire ecosystem Poor quality infrastructure and land issues

Capital Markets Day | March 13, 2013 70 Regional Strategy & Pipeline India Sub-Saharan Africa South East Asia Focus on the flow business - DG and Pumps Strengthen the channel network Make SunEdison "go to" solar brand in the region Build a strong presence in Sub-Saharan Africa region • Expand into other potential countries (Botswana, Mozambique, Ghana, etc.) Build a strong presence in the DG / Rooftop market Build a strong presence in South-East Asia • Expand into other potential countries (Indonesia, Philippines, etc.) Pipeline (MW) Backlog (MW) 6 5 Pipeline (MW) Backlog (MW) 368 64 Pipeline (MW) Backlog (MW) 55 54

Capital Markets Day | March 13, 2013 Development – Regional View Charles Chan General Manager, China

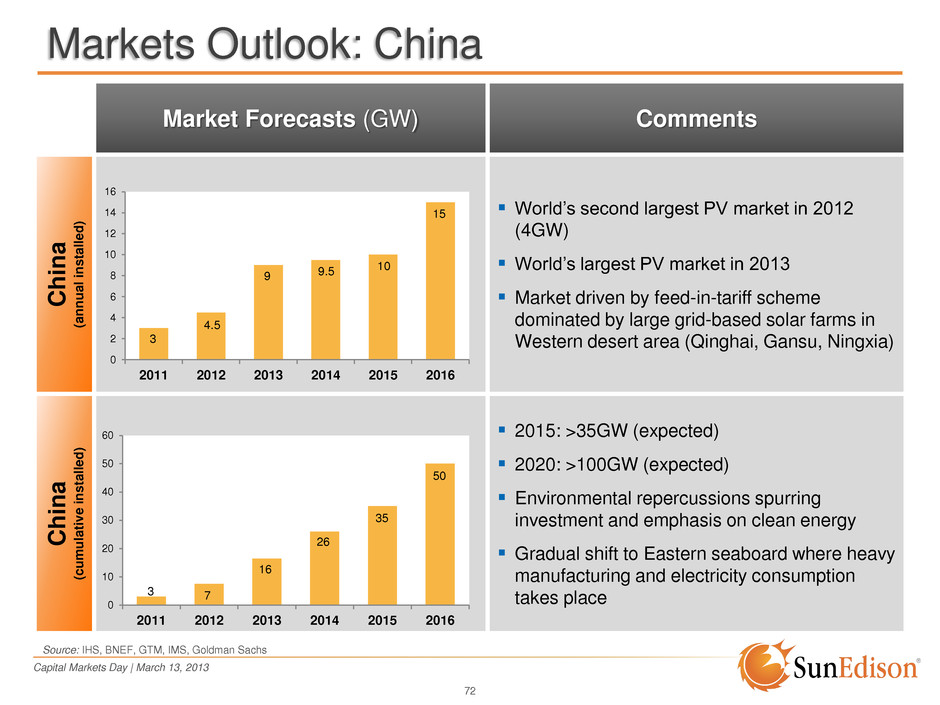

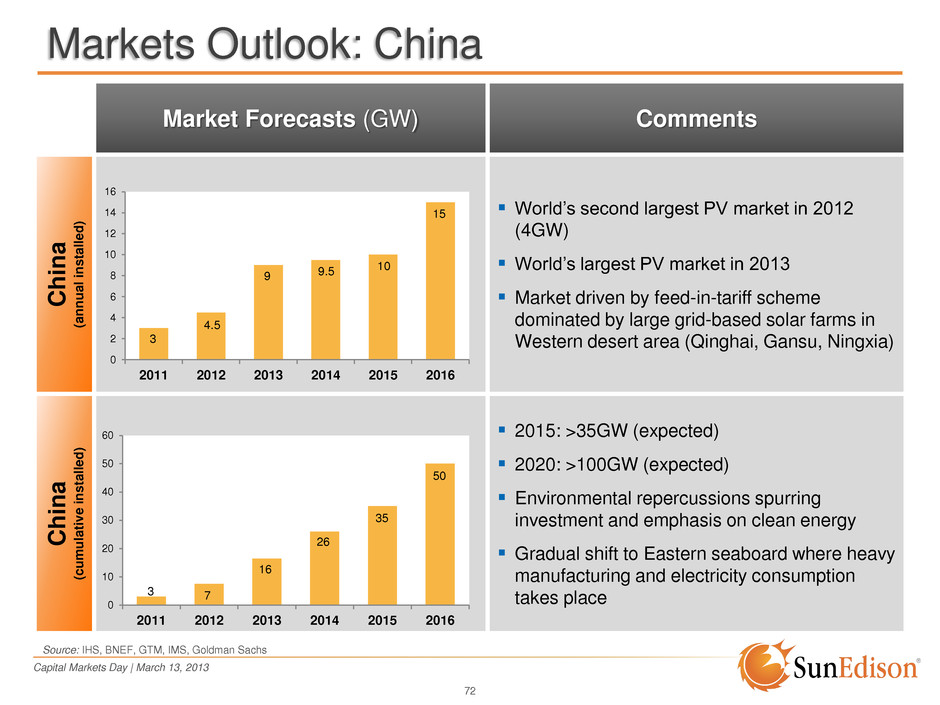

Capital Markets Day | March 13, 2013 72 Markets Outlook: China Market Forecasts (GW) Comments Chin a (an n u a l ins tal led ) World’s second largest PV market in 2012 (4GW) World’s largest PV market in 2013 Market driven by feed-in-tariff scheme dominated by large grid-based solar farms in Western desert area (Qinghai, Gansu, Ningxia) Chin a (cu m u lati v e ins tal led ) 2015: >35GW (expected) 2020: >100GW (expected) Environmental repercussions spurring investment and emphasis on clean energy Gradual shift to Eastern seaboard where heavy manufacturing and electricity consumption takes place 0 2 4 6 8 10 12 14 16 2011 2012 2013 2014 2015 2016 0 10 20 30 40 50 60 2011 2012 2013 2014 2015 2016 3 4.5 9 9.5 10 15 3 7 16 26 35 50 Source: IHS, BNEF, GTM, IMS, Goldman Sachs

Capital Markets Day | March 13, 2013 73 Key Accomplishments One of the First Foreign Companies to Complete a Project in China Strategic Relationships: • Module & BOS Companies • International & Local Banks • Grid Companies • Power Generation Companies • National Development and Reform Commission (NDRC)

Capital Markets Day | March 13, 2013 74 Opportunities & Challenges Opportunities Utility Market Growth: 9 GW total market for 2013 Distributed Generation Market Growth: High retail electricity prices in Eastern region, millions of square miles of rooftop space, high concentration of factories Declining Costs: Closer to LCOE leading to better project economics, system costs below $1.50 per watt Policy Support: Increasing standardization of grid connection, strong local and national level government support, implementation of past learning Challenges Transmission and Distribution: Limited grid capacity for fast growing renewable energy, no net metering Market Friction: Industry level trade wars, anti-dumping, materials overcapacity, and possible consolidation within industry Financing: Domestic commercial banks have limited non-recourse project financing experience in renewables Feed-in-Tariff: National Development and Reform Commission (NDRC) adjustments according to changes in investment costs and improvements in technology, ability to collect tariff on-time

Capital Markets Day | March 13, 2013 75 Regional Strategy China Strategy • Position to take advantage of rapid growth in China • Efficient use of capital and secure 3rd party capital for development • Develop strategic partnership with top domestic PV players • Establish SunEdison brand in China with quality and technology Leverage • Localization: ̶ Experienced Chinese team ̶ Strong governmental relations • Quality: ̶ Design and engineering specifications ̶ Equipment warranty and certification ̶ Testing and commissioning ̶ Operations and maintenance • Technology

Capital Markets Day | March 13, 2013 Capital Carlos Domenech Executive VP, President of SunEdison Capital #4 Services #3 Capital #2 Development #1 Technology

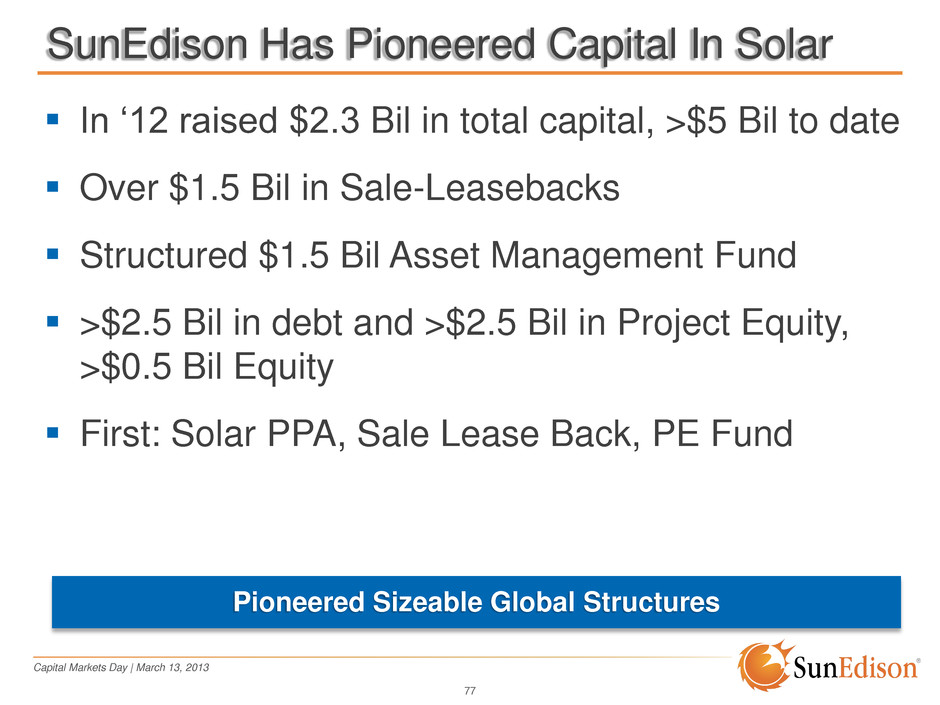

Capital Markets Day | March 13, 2013 SunEdison Has Pioneered Capital In Solar In ‘12 raised $2.3 Bil in total capital, >$5 Bil to date Over $1.5 Bil in Sale-Leasebacks Structured $1.5 Bil Asset Management Fund >$2.5 Bil in debt and >$2.5 Bil in Project Equity, >$0.5 Bil Equity First: Solar PPA, Sale Lease Back, PE Fund 77 Pioneered Sizeable Global Structures

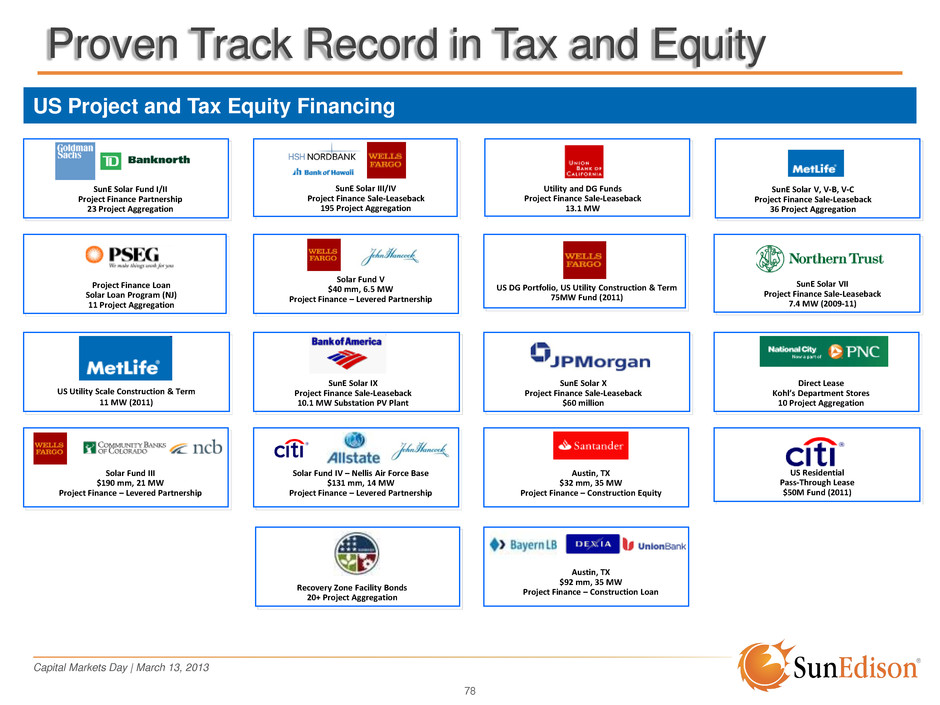

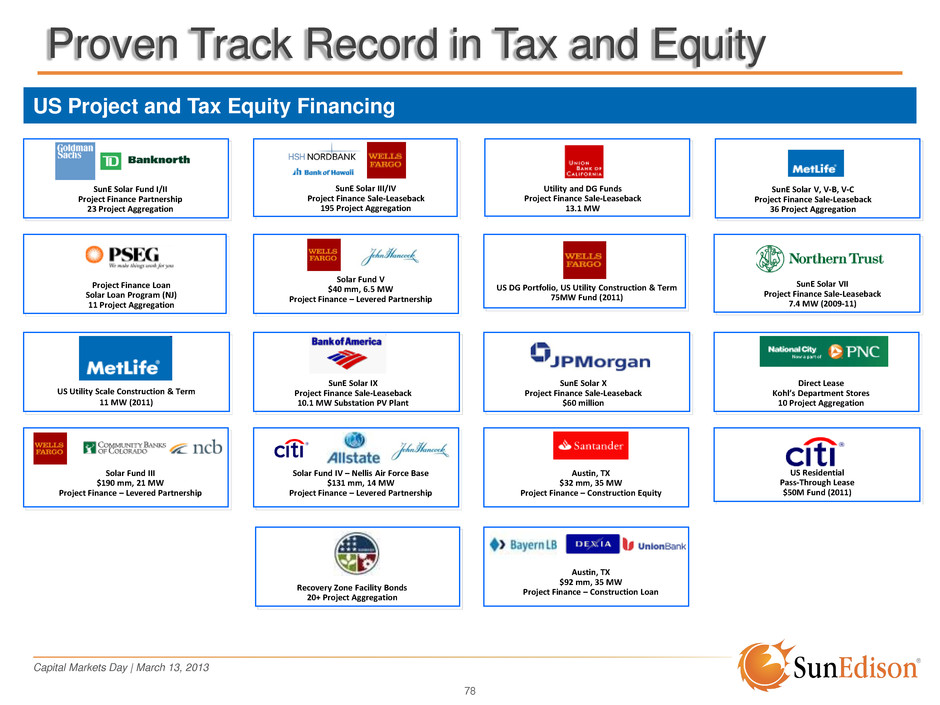

Capital Markets Day | March 13, 2013 78 Proven Track Record in Tax and Equity Utility and DG Funds Project Finance Sale-Leaseback 13.1 MW SunE Solar V, V-B, V-C Project Finance Sale-Leaseback 36 Project Aggregation SunE Solar Fund I/II Project Finance Partnership 23 Project Aggregation SunE Solar III/IV Project Finance Sale-Leaseback 195 Project Aggregation Recovery Zone Facility Bonds 20+ Project Aggregation Austin, TX $92 mm, 35 MW Project Finance – Construction Loan US Project and Tax Equity Financing SunE Solar IX Project Finance Sale-Leaseback 10.1 MW Substation PV Plant SunE Solar X Project Finance Sale-Leaseback $60 million Direct Lease Kohl’s Department Stores 10 Project Aggregation US Utility Scale Construction & Term 11 MW (2011) SunE Solar VII Project Finance Sale-Leaseback 7.4 MW (2009-11) Project Finance Loan Solar Loan Program (NJ) 11 Project Aggregation Solar Fund V $40 mm, 6.5 MW Project Finance – Levered Partnership US DG Portfolio, US Utility Construction & Term 75MW Fund (2011) Austin, TX $32 mm, 35 MW Project Finance – Construction Equity Solar Fund IV – Nellis Air Force Base $131 mm, 14 MW Project Finance – Levered Partnership US Residential Pass-Through Lease $50M Fund (2011) Solar Fund III $190 mm, 21 MW Project Finance – Levered Partnership

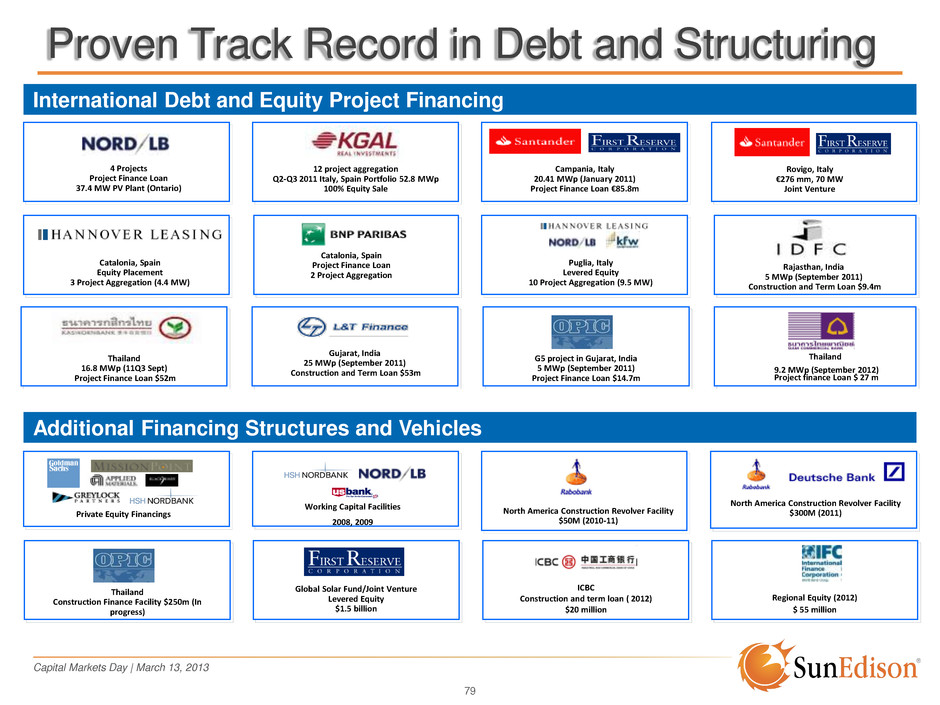

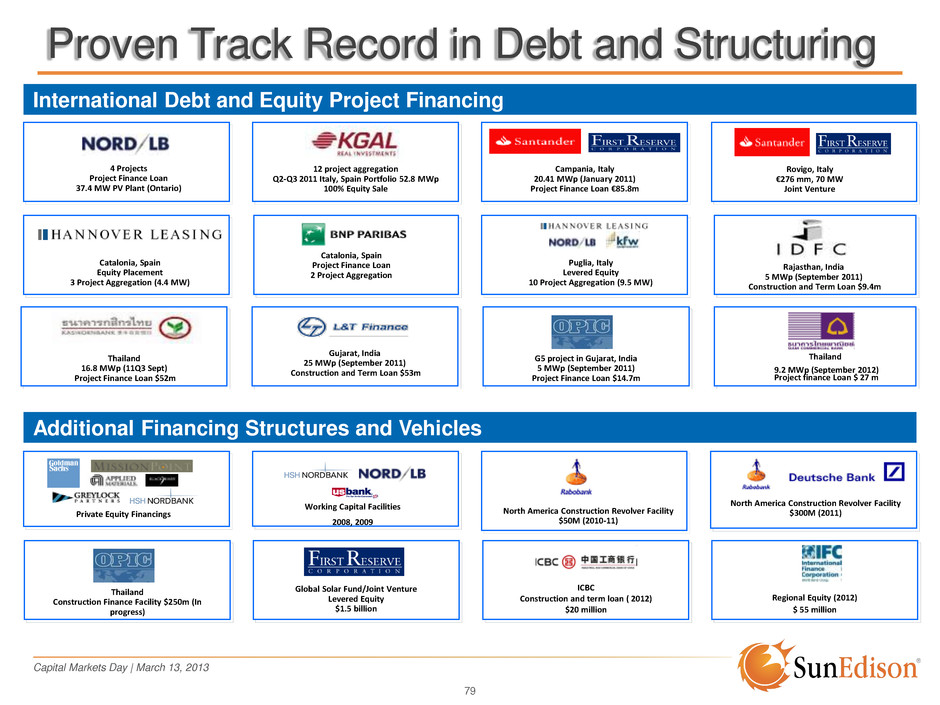

Capital Markets Day | March 13, 2013 79 Proven Track Record in Debt and Structuring Gujarat, India 25 MWp (September 2011) Construction and Term Loan $53m G5 project in Gujarat, India 5 MWp (September 2011) Project Finance Loan $14.7m Campania, Italy 20.41 MWp (January 2011) Project Finance Loan €85.8m Rajasthan, India 5 MWp (September 2011) Construction and Term Loan $9.4m Thailand Construction Finance Facility $250m (In progress) North America Construction Revolver Facility $50M (2010-11) North America Construction Revolver Facility $300M (2011) Thailand 16.8 MWp (11Q3 Sept) Project Finance Loan $52m 12 project aggregation Q2-Q3 2011 Italy, Spain Portfolio 52.8 MWp 100% Equity Sale Working Capital Facilities 2008, 2009 Private Equity Financings Global Solar Fund/Joint Venture Levered Equity $1.5 billion Rovigo, Italy €276 mm, 70 MW Joint Venture Catalonia, Spain Equity Placement 3 Project Aggregation (4.4 MW) Puglia, Italy Levered Equity 10 Project Aggregation (9.5 MW) Catalonia, Spain Project Finance Loan 2 Project Aggregation 4 Projects Project Finance Loan 37.4 MW PV Plant (Ontario) International Debt and Equity Project Financing Additional Financing Structures and Vehicles Thailand 9.2 MWp (September 2012) Project finance Loan $ 27 m Regional Equity (2012) $ 55 million ICBC Construction and term loan ( 2012) $20 million

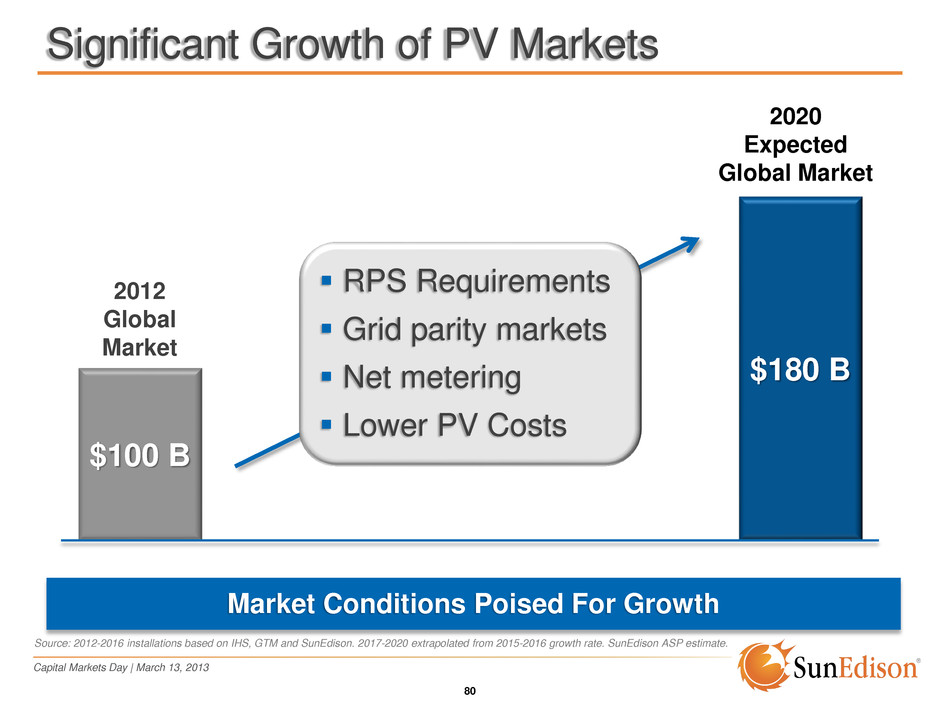

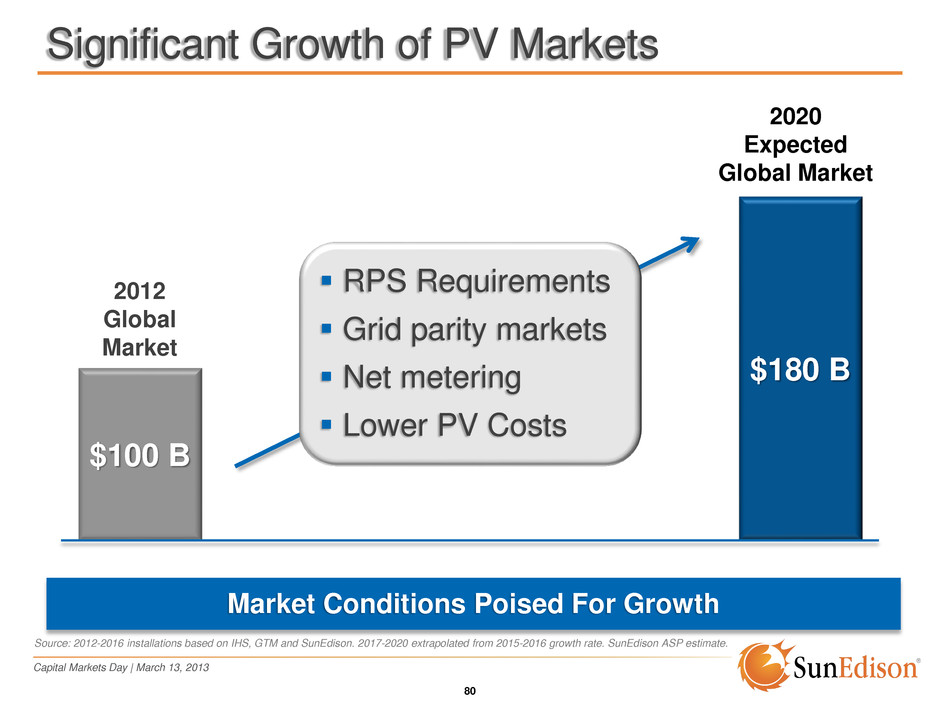

Capital Markets Day | March 13, 2013 80 Significant Growth of PV Markets $100 B $180 B 2012 Global Market 2020 Expected Global Market RPS Requirements Grid parity markets Net metering Lower PV Costs Market Conditions Poised For Growth Source: 2012-2016 installations based on IHS, GTM and SunEdison. 2017-2020 extrapolated from 2015-2016 growth rate. SunEdison ASP estimate.

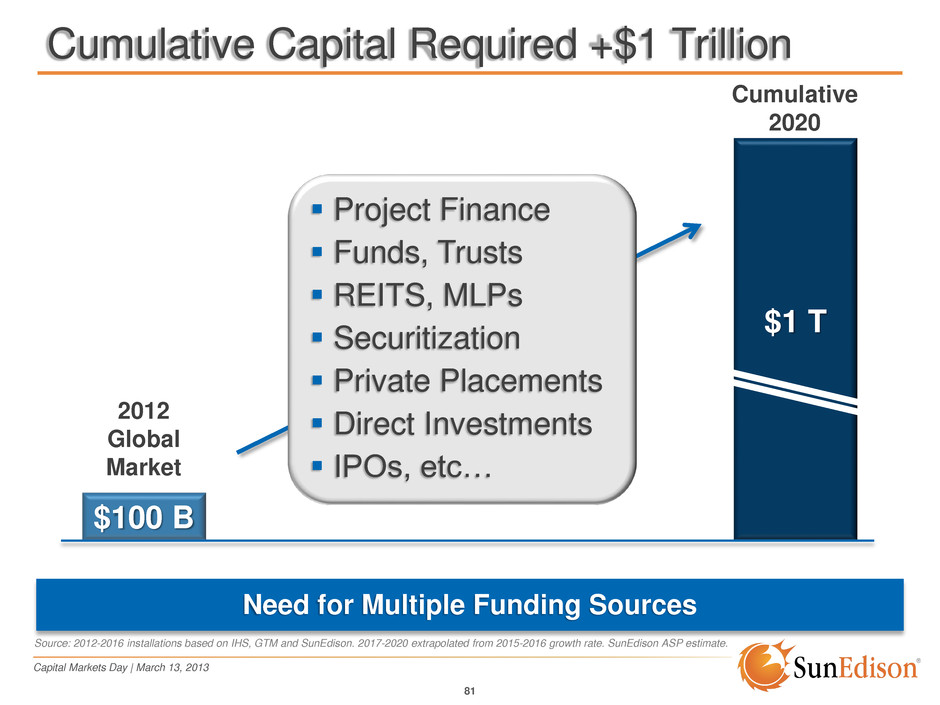

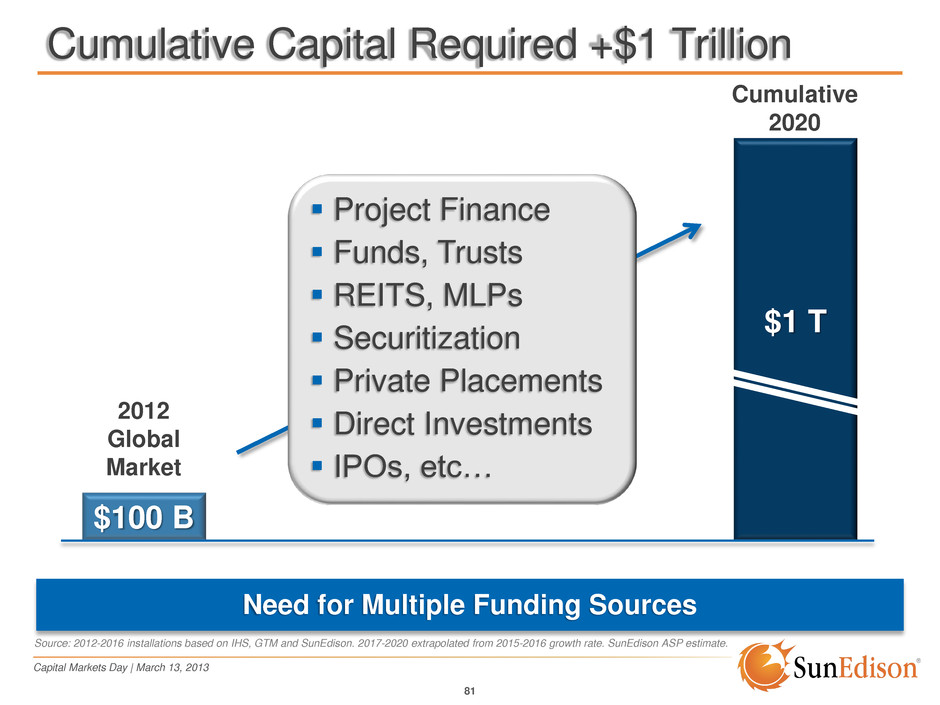

Capital Markets Day | March 13, 2013 81 Cumulative Capital Required +$1 Trillion $100 B $1 T Project Finance Funds, Trusts REITS, MLPs Securitization Private Placements Direct Investments IPOs, etc… 2012 Global Market Cumulative 2020 Need for Multiple Funding Sources Source: 2012-2016 installations based on IHS, GTM and SunEdison. 2017-2020 extrapolated from 2015-2016 growth rate. SunEdison ASP estimate.

Capital Markets Day | March 13, 2013 82 Expected Growth Exceeds Capitalization $1 T Aggregate Capital Required Solar PV Players IPPs $53 B Unlevered Equity Returns <8% WACC 15% WACC 11% Utilities $262 B WACC 10% Top 10 Cumulative Market Capitalization $4 B WACC Varies vs. Expected Returns Source: 2012-2016 installations based on IHS, GTM and SunEdison. 2017-2020 extrapolated from 2015-2016 growth rate. SunEdison ASP estimate.

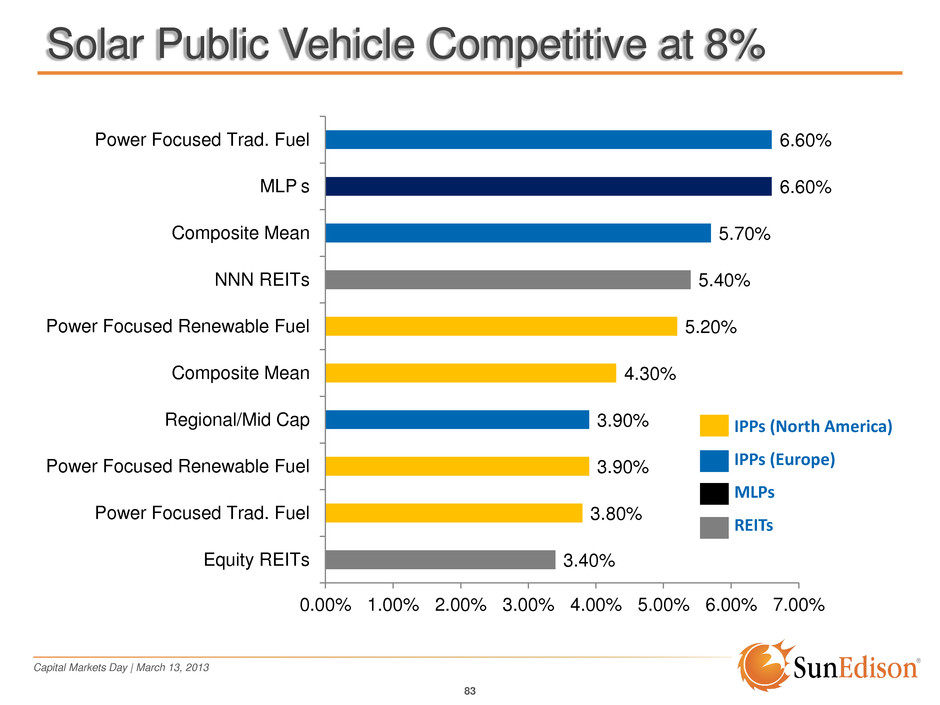

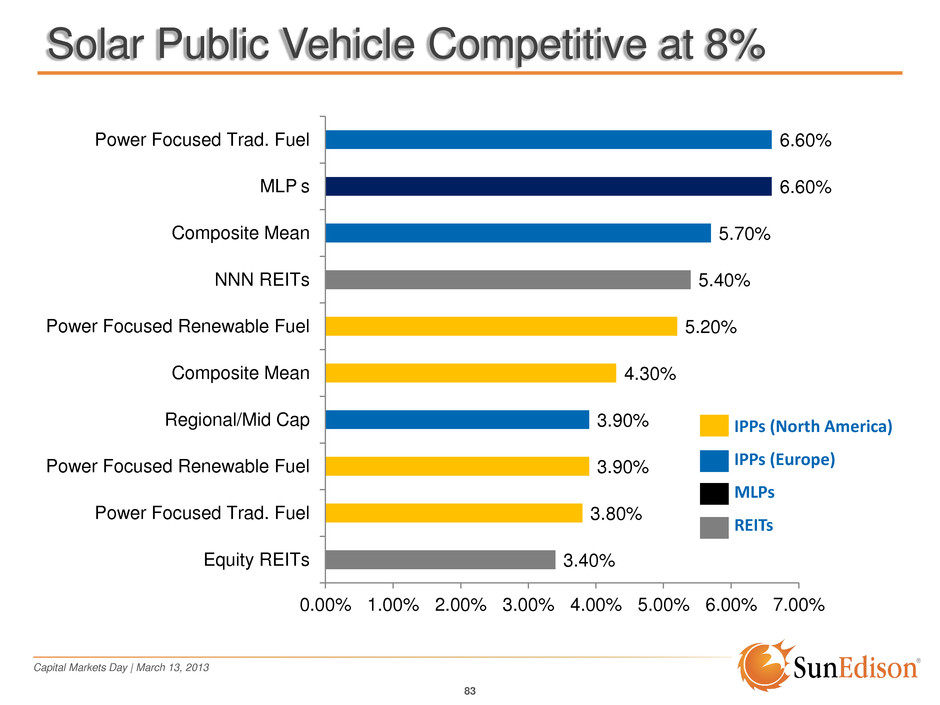

Capital Markets Day | March 13, 2013 3.40% 3.80% 3.90% 3.90% 4.30% 5.20% 5.40% 5.70% 6.60% 6.60% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% Equity REITs Power Focused Trad. Fuel Power Focused Renewable Fuel Regional/Mid Cap Composite Mean Power Focused Renewable Fuel NNN REITs Composite Mean MLP's Power Focused Trad. Fuel 83 Solar Public Vehicle Competitive at 8% IPPs (North America) IPPs (Europe) MLPs REITs

Capital Markets Day | March 13, 2013 84 Expanding Our Scope EverStream Adds Significant Funding Avenues

Capital Markets Day | March 13, 2013 85 What is EverStream? Accessing Scalable and Competitive Capital Independent Asset Management Firm JV with SunEdison as minority shareholder SunEdison provides visibility to pipeline Starting with a $300 million fund, set up for multiple funds Capabilities to launch and manage private & public vehicles Will fund third parties

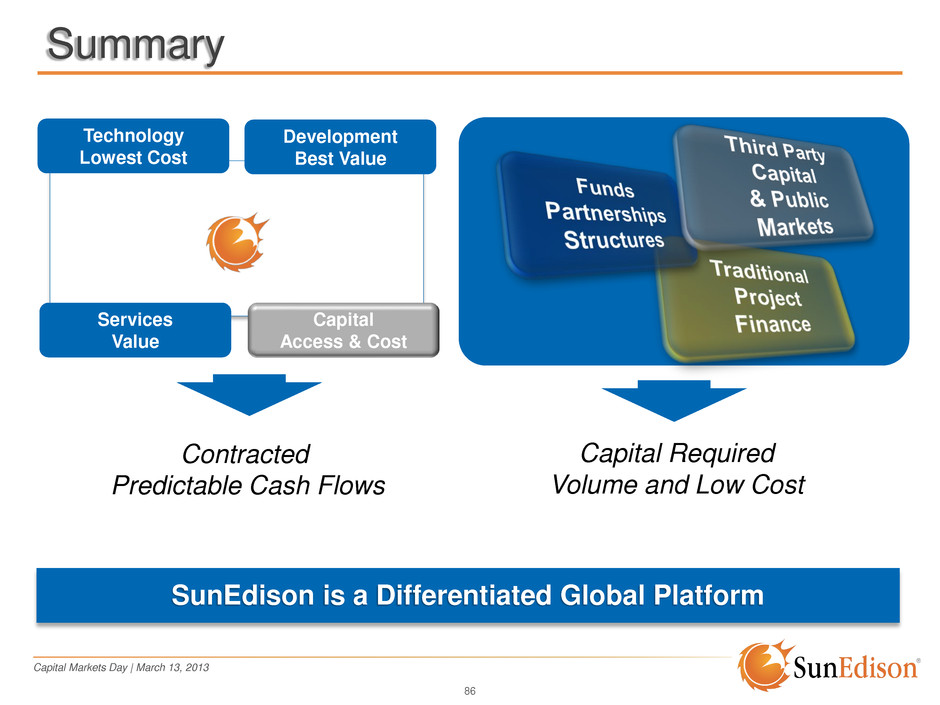

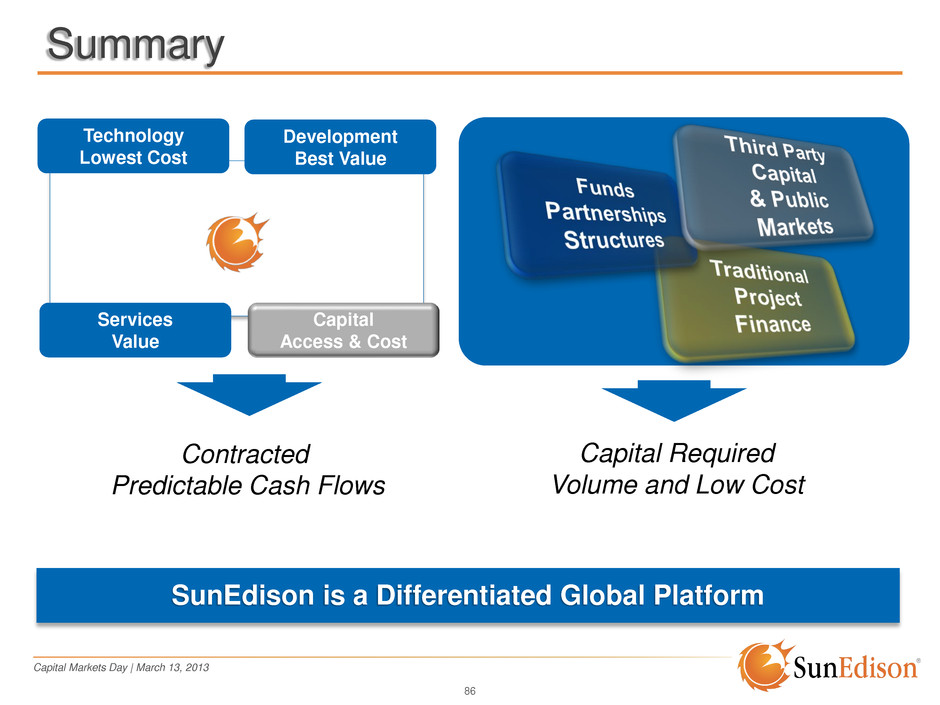

Capital Markets Day | March 13, 2013 86 Summary SunEdison is a Differentiated Global Platform Technology Lowest Cost Development Best Value Capital Access & Cost Services Value Contracted Predictable Cash Flows Capital Required Volume and Low Cost

Capital Markets Day | March 13, 2013 Services Mark McLanahan Vice President – Global Services #4 Services #3 Capital #2 Development #1 Technology

Capital Markets Day | March 13, 2013 88 Global Services from SunEdison Significant Market Opportunity Comprehensive Services Solution Uniquely Positioned to Capitalize Key Strategic Initiatives

Capital Markets Day | March 13, 2013 89 Significant Market Opportunity Market Size: $10-$20 billion per year by 2020 Market Need: b Comprehensive, safe, reliable service Manage risks and anticipate operational issues Industry best practices and standards Credible and professional asset management

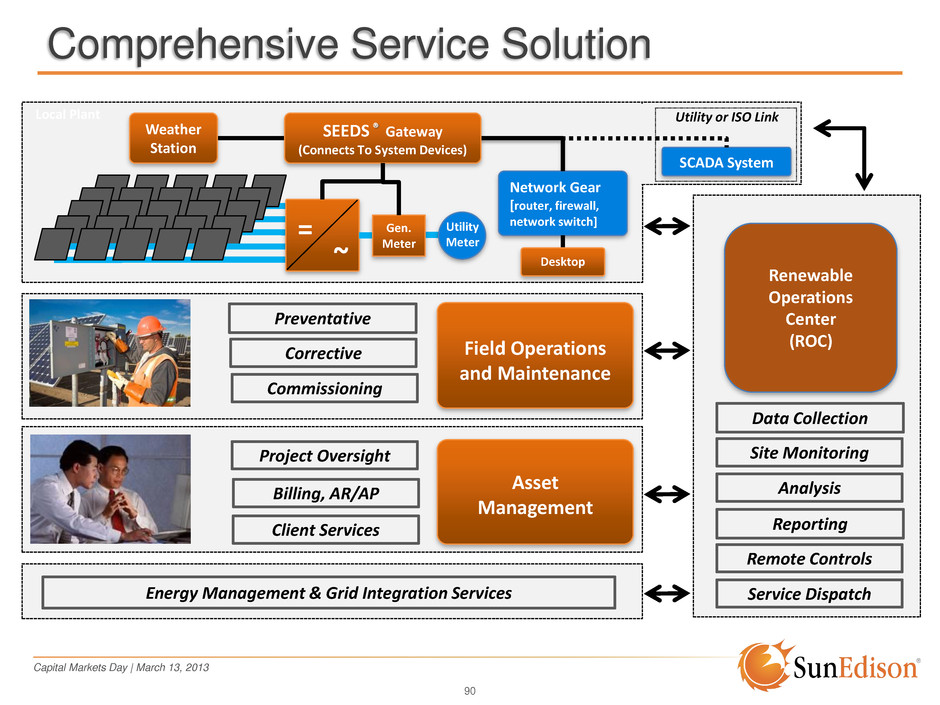

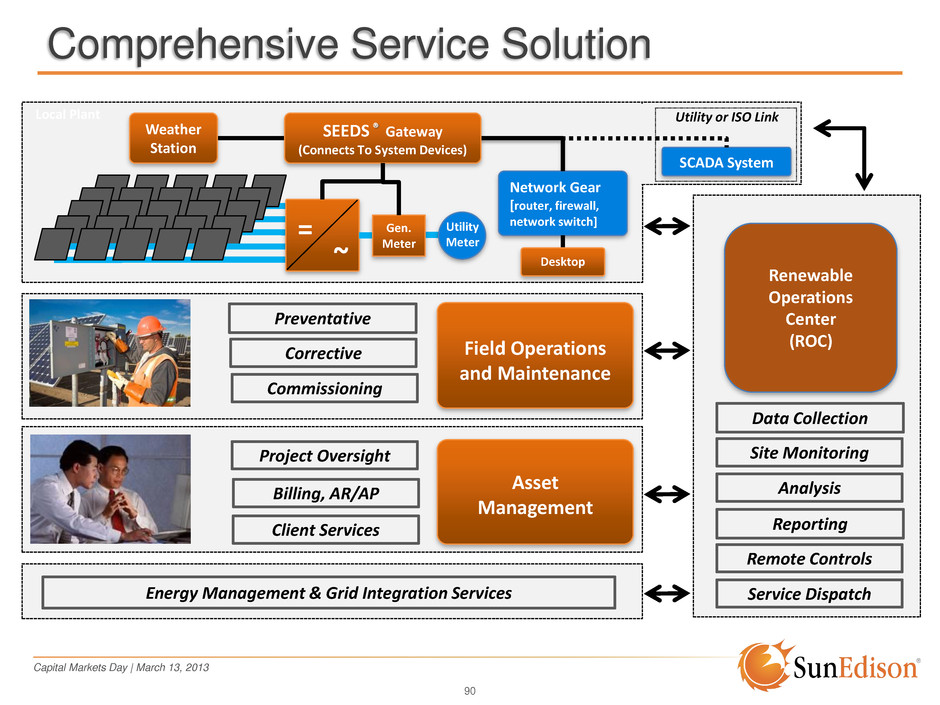

Capital Markets Day | March 13, 2013 90 Comprehensive Service Solution = ~ Local Plant Network Gear [router, firewall, network switch] Gen. Meter SEEDS ® Gateway (Connects To System Devices) Weather Station Field Operations and Maintenance Asset Management Utility Meter Preventative Corrective Commissioning Billing, AR/AP Client Services Project Oversight Desktop Renewable Operations Center (ROC) Data Collection Site Monitoring Analysis Reporting Remote Controls Service Dispatch Energy Management & Grid Integration Services Utility or ISO Link SCADA System

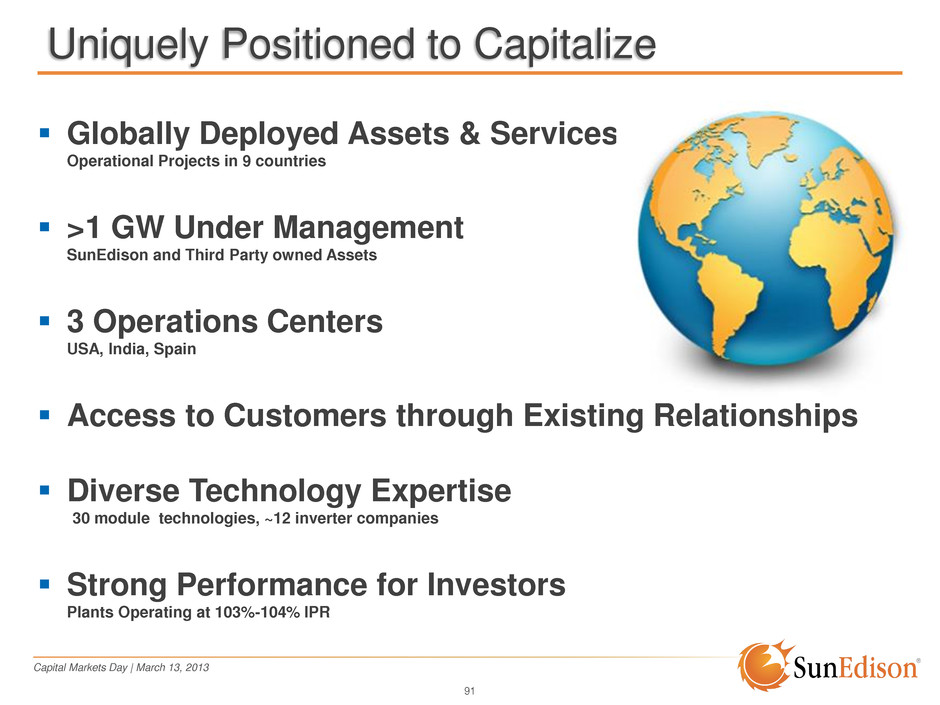

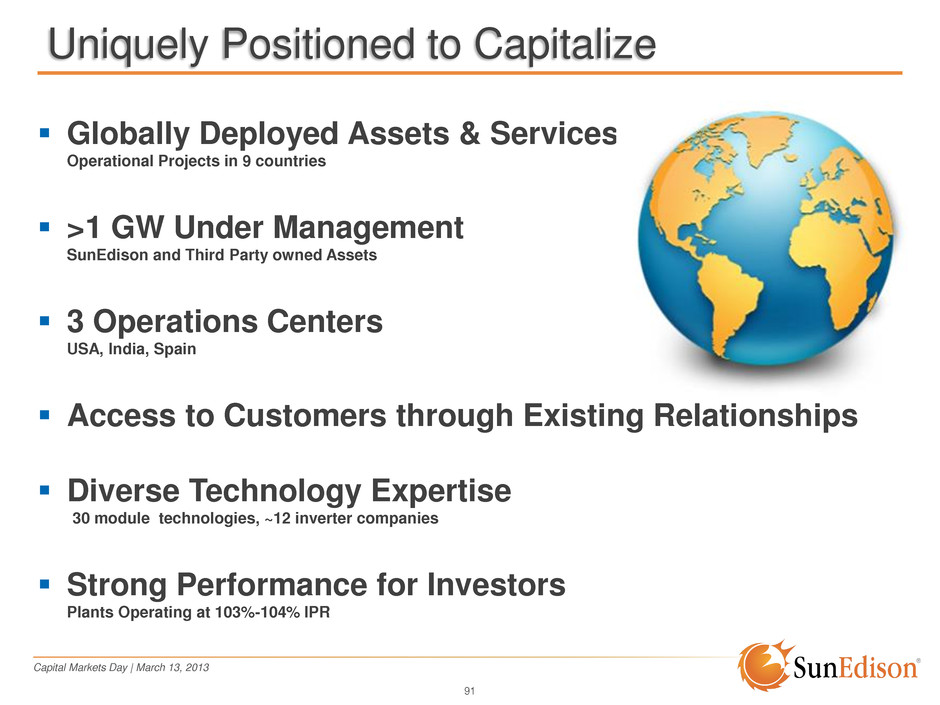

Capital Markets Day | March 13, 2013 91 Uniquely Positioned to Capitalize Globally Deployed Assets & Services Operational Projects in 9 countries >1 GW Under Management SunEdison and Third Party owned Assets 3 Operations Centers USA, India, Spain Access to Customers through Existing Relationships Diverse Technology Expertise 30 module technologies, ~12 inverter companies Strong Performance for Investors Plants Operating at 103%-104% IPR

Capital Markets Day | March 13, 2013 92 Strategy: Scale Platform Annual Installations (GWs) 1. Takeover existing portfolios in established markets 2. Subcontract to builders of new projects 3. Build portfolio for high service-density 4. Safety & Process 5. Add new revenue categories

Capital Markets Day | March 13, 2013 93 Strategy: Deliver End-to-End Solution 1. Data Acquisition & Quality Control 2. Active Monitoring and Response 4. In-depth Analysis and Reporting 3. Preventative and Corrective Maintenance 5. Warranty Claims & Spares Inventory 6. Financial Asset Mgmt & Oversight

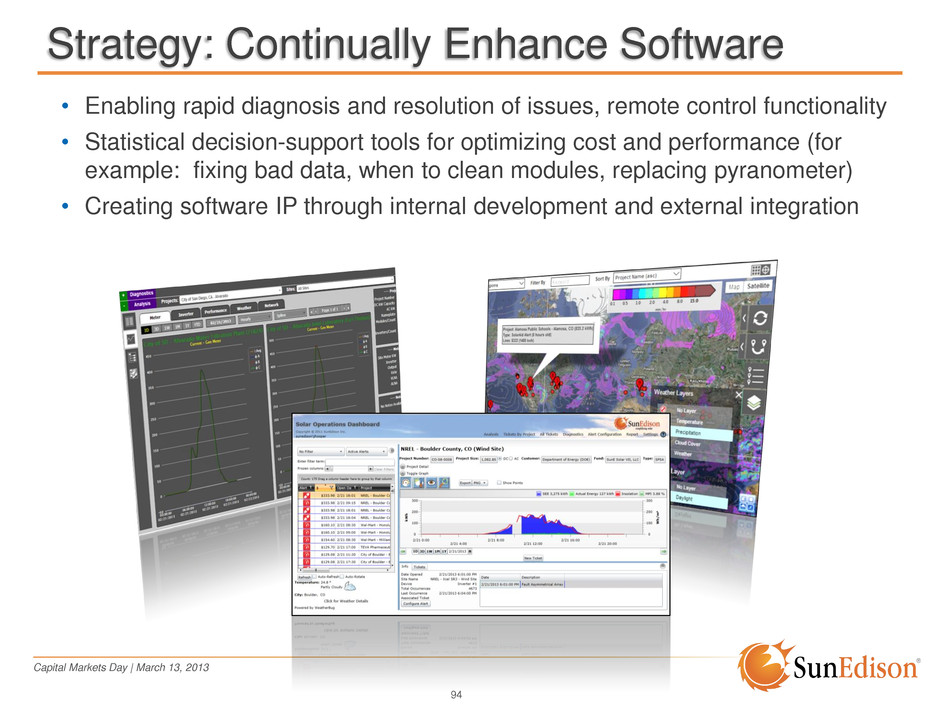

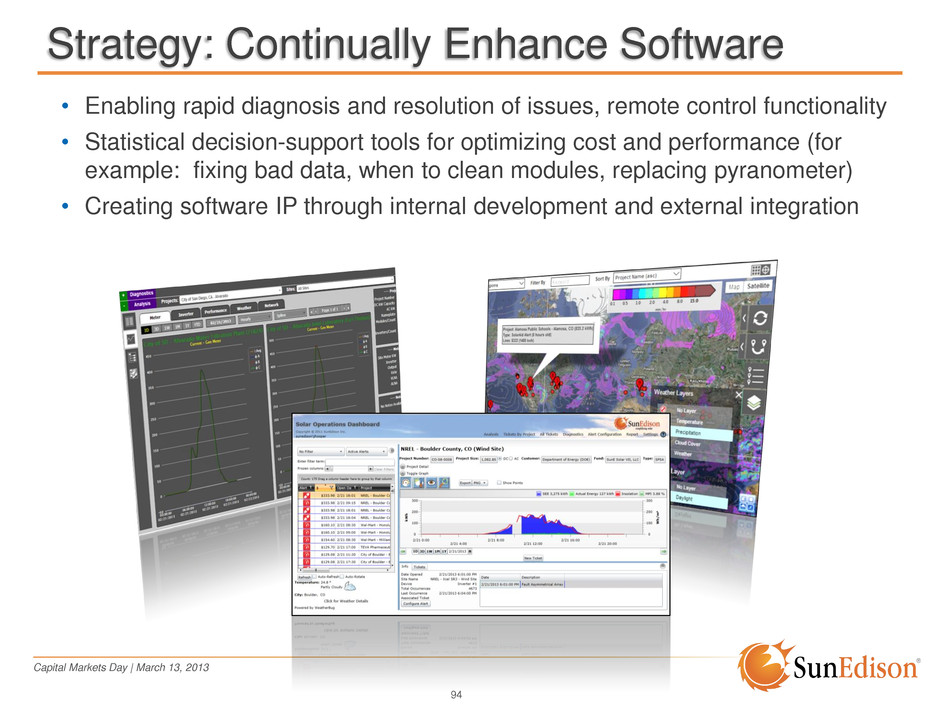

Capital Markets Day | March 13, 2013 94 Strategy: Continually Enhance Software • Enabling rapid diagnosis and resolution of issues, remote control functionality • Statistical decision-support tools for optimizing cost and performance (for example: fixing bad data, when to clean modules, replacing pyranometer) • Creating software IP through internal development and external integration

Capital Markets Day | March 13, 2013 95 Summary Significant Opportunity: SunEdison is well-positioned in a fast-growing market segment with estimated revenues up to $20B/yr by 2020 Strong Platform for Growth: existing global portfolio over 1GW, fleet performance above proforma, diverse technology experience Winning Strategy: Ready access to customers, building comprehensive solution, pushing technology advancements

Capital Markets Day | March 13, 2013 Financials Brian Wuebbels Executive VP, Chief Financial Officer

Capital Markets Day | March 13, 2013 97 Executive Summary Purpose Driven Company = Durable Financial Model • Financially de-risked business model during 2012 • Cultural alignment will yield superior financial results Semiconductor Materials = Improved Asset Efficiency & Cash Flow • Management focused on maximizing asset efficiency • Recent market share wins based on customer focus Solar Energy = Minimal Exposure to Upstream While Positioning for Growth and Financial Upside in Downstream • Technology focused, asset light = operating leverage • Development pipeline = growing future cash flows • Capital innovation = capital at lower cost • Services/flow business = recurring revenue streams

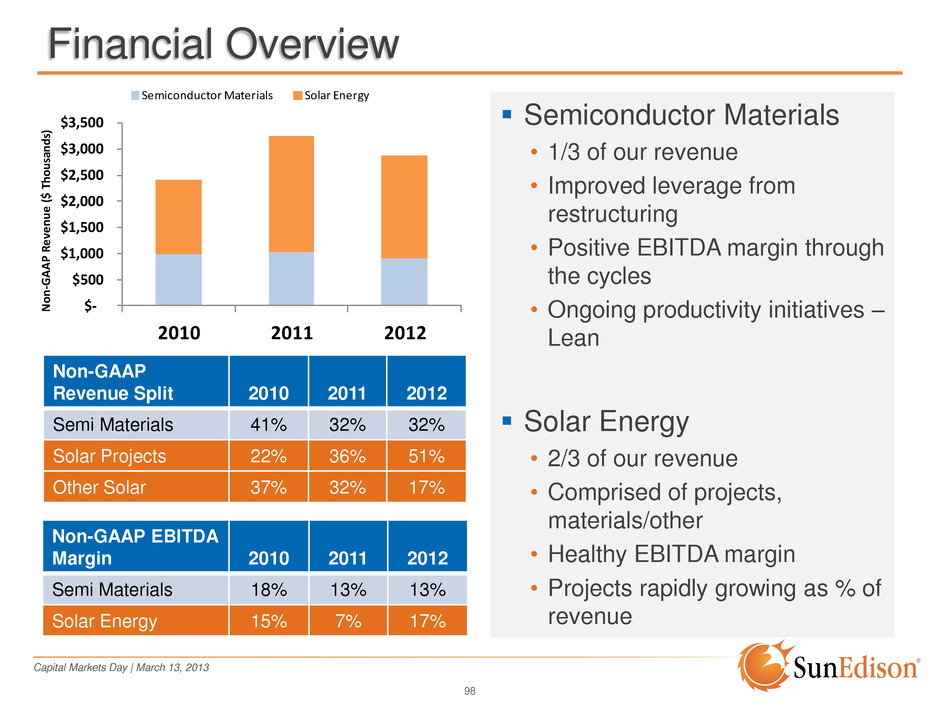

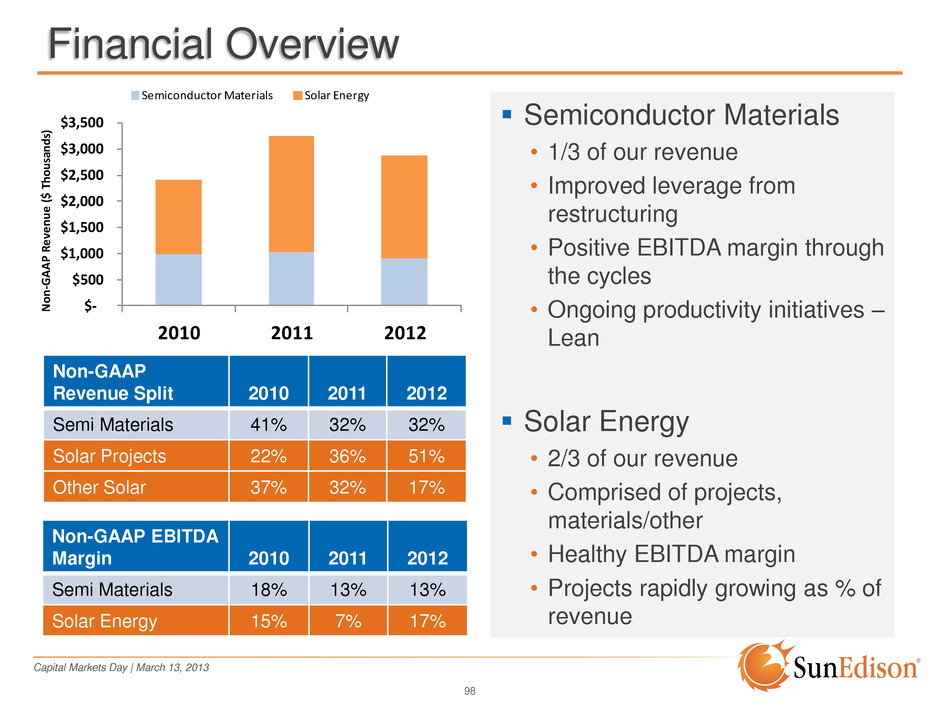

Capital Markets Day | March 13, 2013 98 Financial Overview Semiconductor Materials • 1/3 of our revenue • Improved leverage from restructuring • Positive EBITDA margin through the cycles • Ongoing productivity initiatives – Lean Solar Energy • 2/3 of our revenue • Comprised of projects, materials/other • Healthy EBITDA margin • Projects rapidly growing as % of revenue Non-GAAP Revenue Split 2010 2011 2012 Semi Materials 41% 32% 32% Solar Projects 22% 36% 51% Other Solar 37% 32% 17% Non-GAAP EBITDA Margin 2010 2011 2012 Semi Materials 18% 13% 13% Solar Energy 15% 7% 17% $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 2010 2011 2012 No n- GA AP Re ve nu e ( $ T hou sa nd s) Semiconductor Materials Solar Energy

Capital Markets Day | March 13, 2013 -10% -5% 0% 5% 10% 15% 20% $- $50 $100 $150 $200 $250 $300 Re ve nu e ( $M illi on s) Revenue Adj. Op. Exp. % Adj. Op. Margin % 99 Semiconductor Materials Financial Summary Revenue / OpEx / OM Volume/Share Restructuring actions have repositioned business for greater profitability Maintaining disciplined capital deployment strategy Opportunity to generate significant cash through cycles Gaining share in soft market Share source: Company reports, guidance, and internal estimates Market share results shown based on top five suppliers’ revenue converted to US$ using quarterly average FX rates 3.0% 5.0% 7.0% 9.0% 11.0% 13.0% - 50 100 150 200 250 300 350 MS I Volume (MSI) Share %

Capital Markets Day | March 13, 2013 100 Solar Energy Financial Summary (Non-GAAP) Revenue/MW Operating Profit / Project GM Transformed business in 2011/2012 from materials business to projects Massive restructuring focused on minimizing exposure to upstream Projects business now positioned as top 2 in the world Focus on services/flow business to address non- linearity in late 2013 & into 2014 - 50 100 150 200 $0 $100 $200 $300 $400 $500 $600 $700 $800 MW No n-G AA P R ev ($ M illi on s) Other Solar Revenue Project Revenue MW -10% 0% 10% 20% 30% 40% OM % (Adj) Project GM% (Adj. for Amortization)

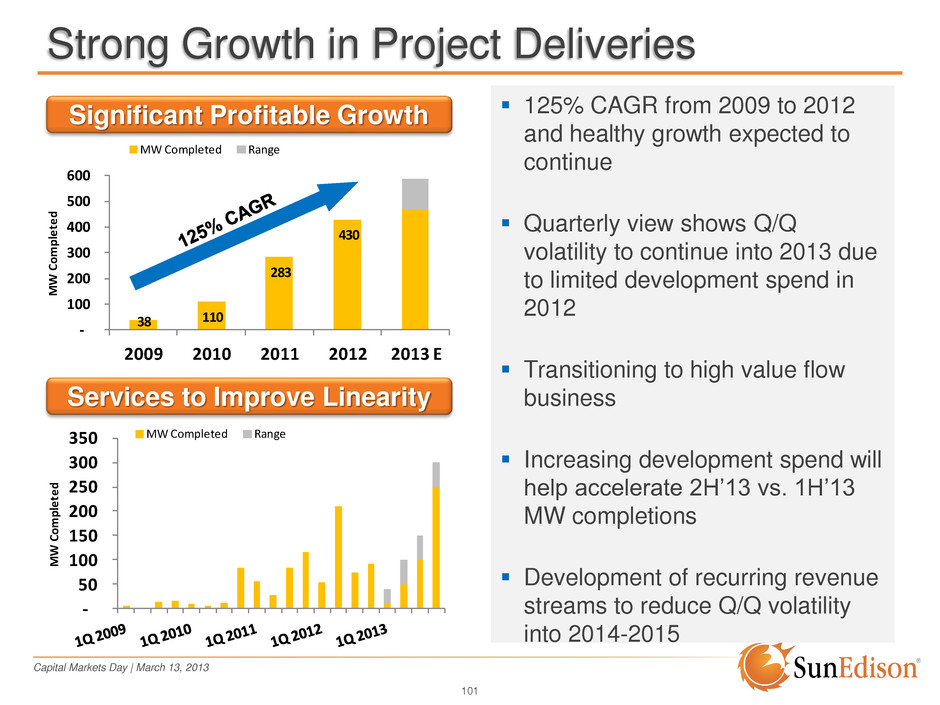

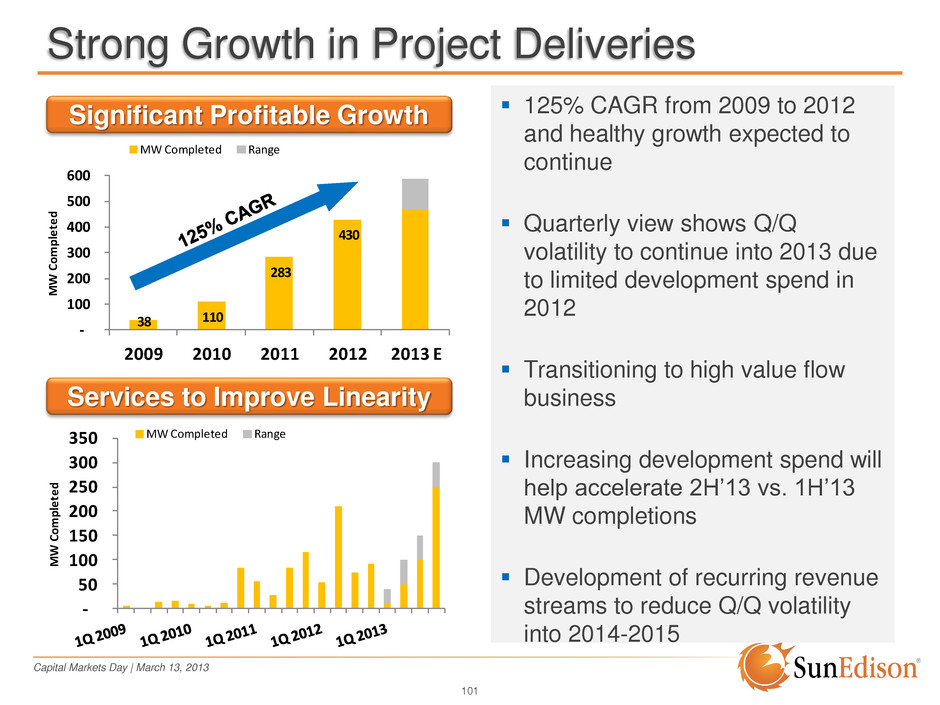

Capital Markets Day | March 13, 2013 38 110 283 430 - 100 200 300 400 500 600 2009 2010 2011 2012 2013 E MW Co mp let ed MW Completed Range - 50 100 150 200 250 300 350 M W Co m ple te d MW Completed Range 101 Strong Growth in Project Deliveries 125% CAGR from 2009 to 2012 and healthy growth expected to continue Quarterly view shows Q/Q volatility to continue into 2013 due to limited development spend in 2012 Transitioning to high value flow business Increasing development spend will help accelerate 2H’13 vs. 1H’13 MW completions Development of recurring revenue streams to reduce Q/Q volatility into 2014-2015 Significant Profitable Growth Services to Improve Linearity

Capital Markets Day | March 13, 2013 102 Recurring Revenue Streams MW under management has historically grown as a function of projects completed Now growing portfolio with third party projects Services Distributed Generation Distributed Generation projects have shorter pipeline to sale cycles Growing the Global Distributed Generation business is one key to our flow model - 1,000 2,000 3,000 2009 2010 2011 2012 2013 E 2014 E MW Un de r M an age me nt Range - 50 100 150 200 250 300 2009 2010 2011 2012 2013 E 2014 E MW Co mp let ed Range

Capital Markets Day | March 13, 2013 $- $20 $40 $60 $80 $100 $120 $140 $160 2010 2011 2012 2013 E G ro s s I n v e s tm e n t in P ro je c t D e v e lo p m e n t ($ M il li o n s ) Range 103 Investment in Project Development Investment in project development critical to driving future MW completed Accelerated in 2H’12 to support future growth Higher 2013 gross spend drives 2H’13-2015 projects Net spend lower than gross spend because brand strength allow us to fund projects pre-construction • Net $25 mil - $75 mil in 2013 Development Spend: Investment in projects that are capitalized as incurred and then expensed to COGS when project is sold. Includes site acquisition, D&E, and interconnection.

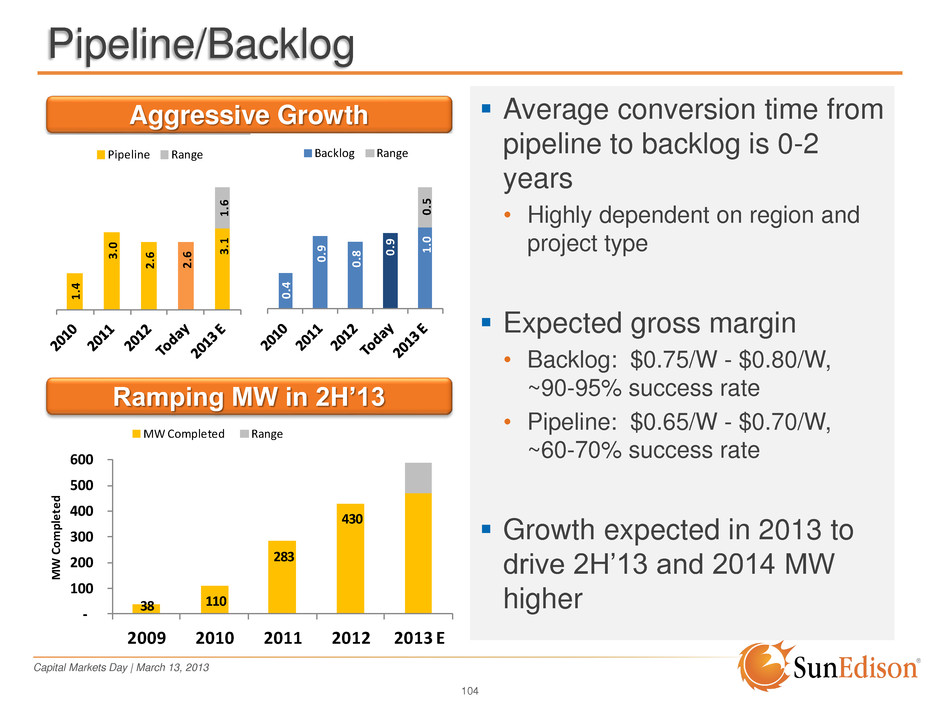

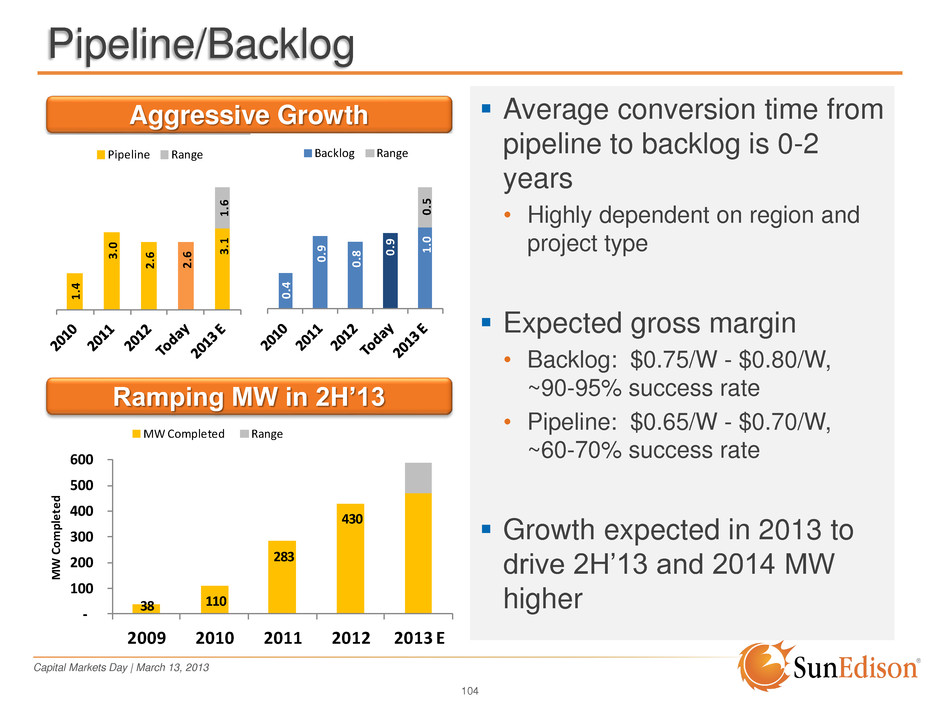

Capital Markets Day | March 13, 2013 104 Pipeline/Backlog Average conversion time from pipeline to backlog is 0-2 years • Highly dependent on region and project type Expected gross margin • Backlog: $0.75/W - $0.80/W, ~90-95% success rate • Pipeline: $0.65/W - $0.70/W, ~60-70% success rate Growth expected in 2013 to drive 2H’13 and 2014 MW higher Aggressive Growth Ramping MW in 2H’13 38 110 283 430 - 100 200 300 400 500 600 2009 2010 2011 2012 2013 E MW Co mp let ed MW Completed Range 1 .4 3 .0 2 .6 2 .6 3 .1 1 .6 Pipeline Range 0 .4 0 .9 0 .8 0 .9 1 .0 0 .5 Backlog Range

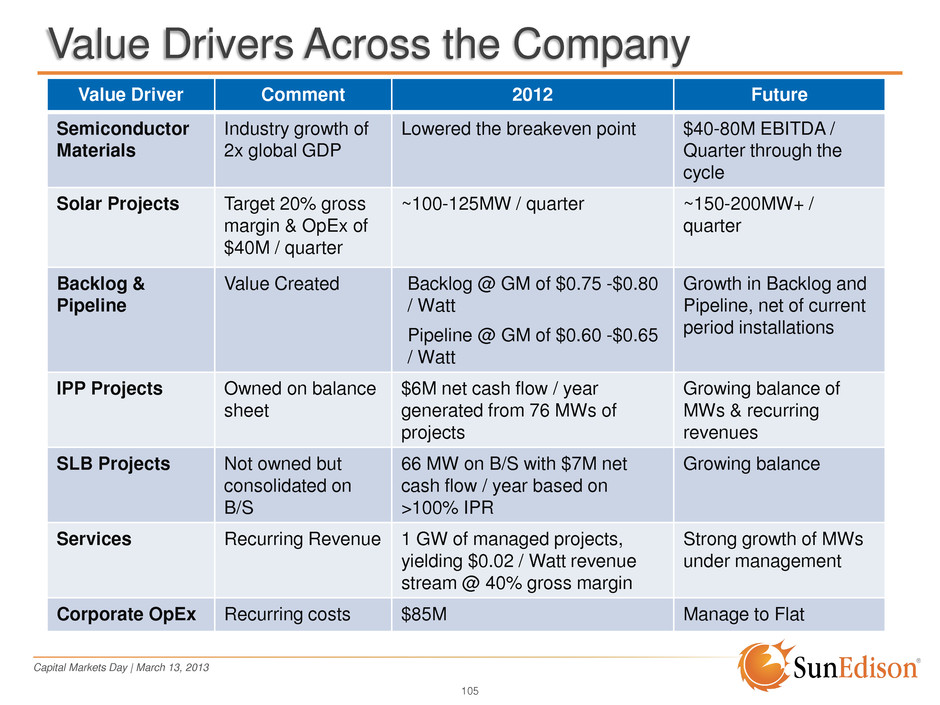

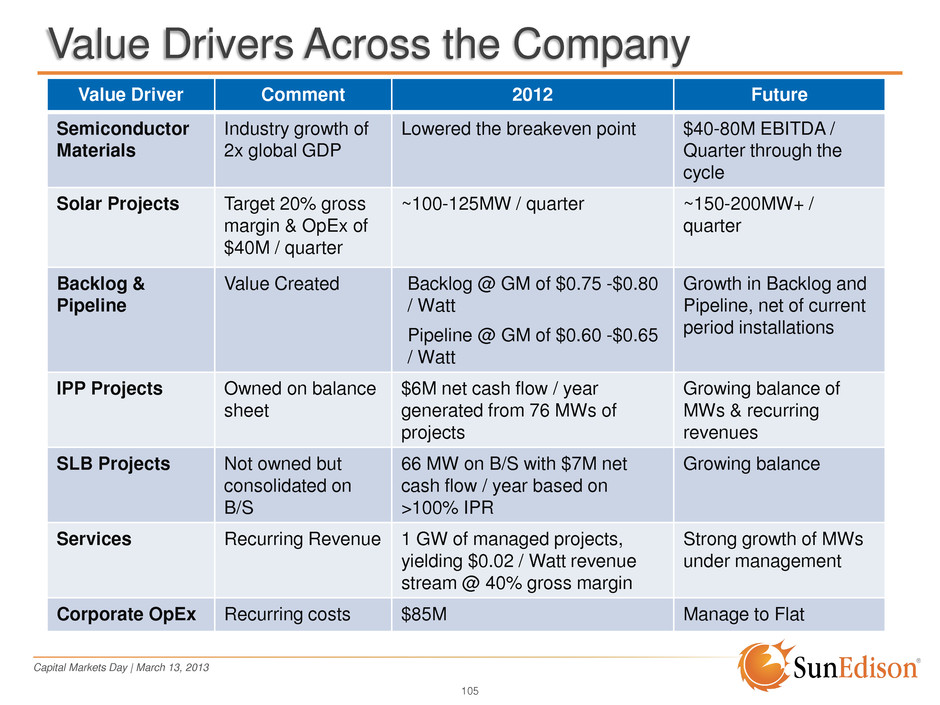

Capital Markets Day | March 13, 2013 105 Value Drivers Across the Company Value Driver Comment 2012 Future Semiconductor Materials Industry growth of 2x global GDP Lowered the breakeven point $40-80M EBITDA / Quarter through the cycle Solar Projects Target 20% gross margin & OpEx of $40M / quarter ~100-125MW / quarter ~150-200MW+ / quarter Backlog & Pipeline Value Created Backlog @ GM of $0.75 -$0.80 / Watt Pipeline @ GM of $0.60 -$0.65 / Watt Growth in Backlog and Pipeline, net of current period installations IPP Projects Owned on balance sheet $6M net cash flow / year generated from 76 MWs of projects Growing balance of MWs & recurring revenues SLB Projects Not owned but consolidated on B/S 66 MW on B/S with $7M net cash flow / year based on >100% IPR Growing balance Services Recurring Revenue 1 GW of managed projects, yielding $0.02 / Watt revenue stream @ 40% gross margin Strong growth of MWs under management Corporate OpEx Recurring costs $85M Manage to Flat

Capital Markets Day | March 13, 2013 106 2013 Q1 and FY Outlook Key Metrics 2012 Actual 1Q 2013 Outlook FY 2013 Outlook Comments Semiconductor Revenue ($ Millions) $918 $228 to $235 $940 to $990 Slower 1H 2013, stronger 2H 2013 expected based on industry recovery Solar Energy Systems MW Sold (Non-GAAP) 383 10 to 38 420 to 490 2H 2013 stronger due to stronger development spend in 2H 2012 Solar Energy Systems MW Retained on Bal. Sheet 47 0 to 2 50 to 100 Focus on recurring revenue streams Solar Energy Systems Avg. Price ($/Wdc) $3.79 $3.50 to $3.60 $3.10 to $3.40 Highly dependent on project type and geographic mix Capex ($M) $139 $30 to $40 $120 to $140 Continuing to focus on Semiconductor Materials

Capital Markets Day | March 13, 2013 107 Cash Flow Generation GAAP CFFO does not capture solar project financings Cash flow before growth investments positive 2012-2013 capex lower than recent history One-time items have burdened TCF TCF in 2013 assumes 50-100 MW of B/S projects and $25M stock buyback 2011 2012 Low High EBITDA (1,073)$ 304$ Working Capital, Deferred Revenue & Other 1,058 (544) Cash Flow from Operations (CFFO) (15) (240) Addback: Solar Project Development Spend w/in CFFO 27 8 Maintenance Capital Expenditures (122) (72) (50) (50) Construction of Solar Energy Systems (596) (344) Solar Energy System Non-Recourse Financing, Net 805 658 Other (49) 51 Free Cash Flow Before Growth Investments 50 61 Solar Project Development Spend, Net (30) (11) (75) (25) Growth Capital Expenditures (330) (56) (90) (70) Evonik - (35) (59) (59) Free Cash Flow (FCF) (310) (41) Net Recourse Financing Proceeds 536 185 0 0 Contingent Consideration Paid (50) (69) Samsung JV 68 (39) (35) (30) Other (366) (49) Total Cash Flow (TCF) (122)$ (13)$ (50)$ 50$ 2013 E

Capital Markets Day | March 13, 2013 Q&A

Capital Markets Day | March 13, 2013 Appendix

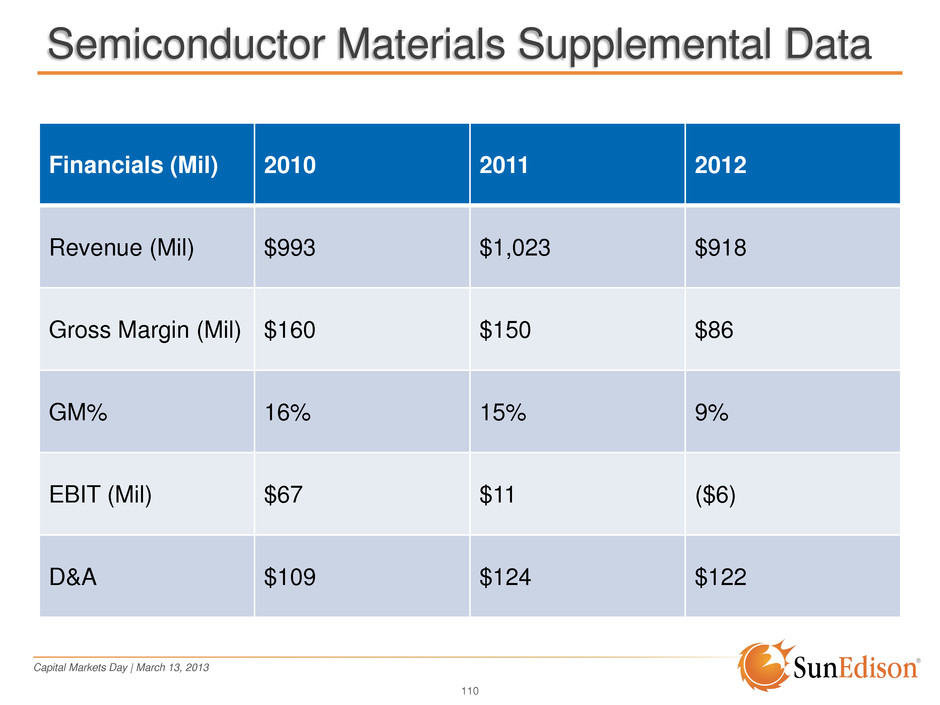

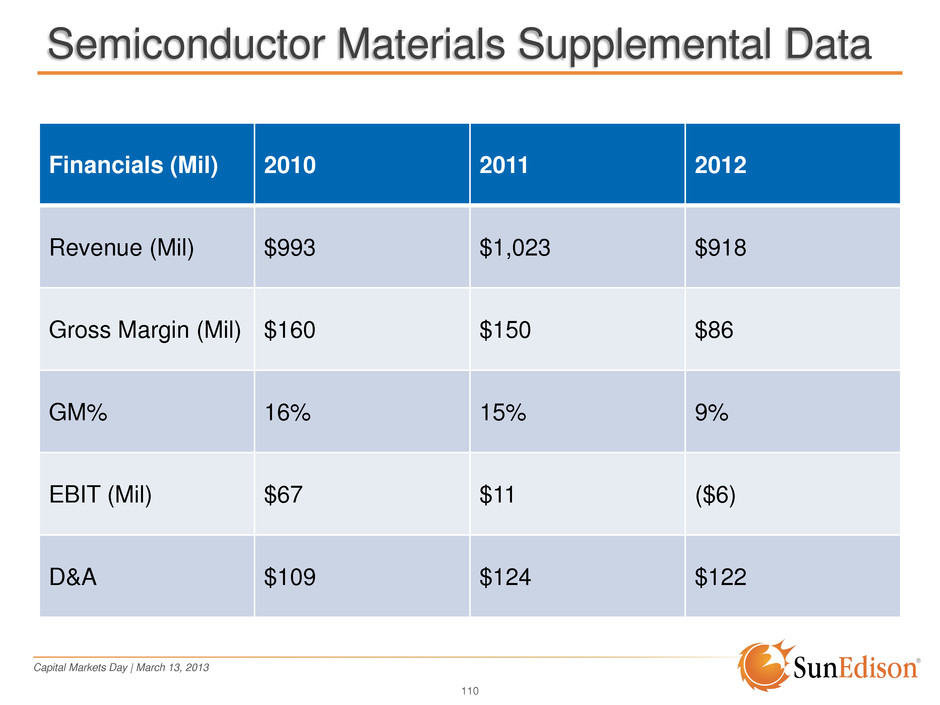

Capital Markets Day | March 13, 2013 110 Semiconductor Materials Supplemental Data Financials (Mil) 2010 2011 2012 Revenue (Mil) $993 $1,023 $918 Gross Margin (Mil) $160 $150 $86 GM% 16% 15% 9% EBIT (Mil) $67 $11 ($6) D&A $109 $124 $122

Capital Markets Day | March 13, 2013 111 Solar Energy Supplemental Data Metrics 2010 2011 2012 Project MW – Sold 103 274 383 Project MW – Direct Sale 83 181 317 Project MW – SLB 20 93 66 Project ASP/w $5.27 $4.28 $3.79 Project GM% 25% 22% 19% Ext. Wafers Sold 877 1,051 469 Ext. Wafer ASP $0.83 $0.67 $0.27 Ext. Modules Sold - - 101 Ext. Module ASP - - $1.41 MW on B/S – SLB 20 93 66 MW on B/S – Held 7 9 47 MW Completed 110 283 430 Financials (Mil) 2010 2011 2012 Revenue $1,423 $2,220 $1,953 Projects $543 $1,173 $1,452 Services/Energy $54 $91 $135 Materials/Other $826 $956 $366 Gross Margin $258 $411 $305 GM% 18% 19% 16% EBIT $152 $54 $208 D&A $55 $103 $119

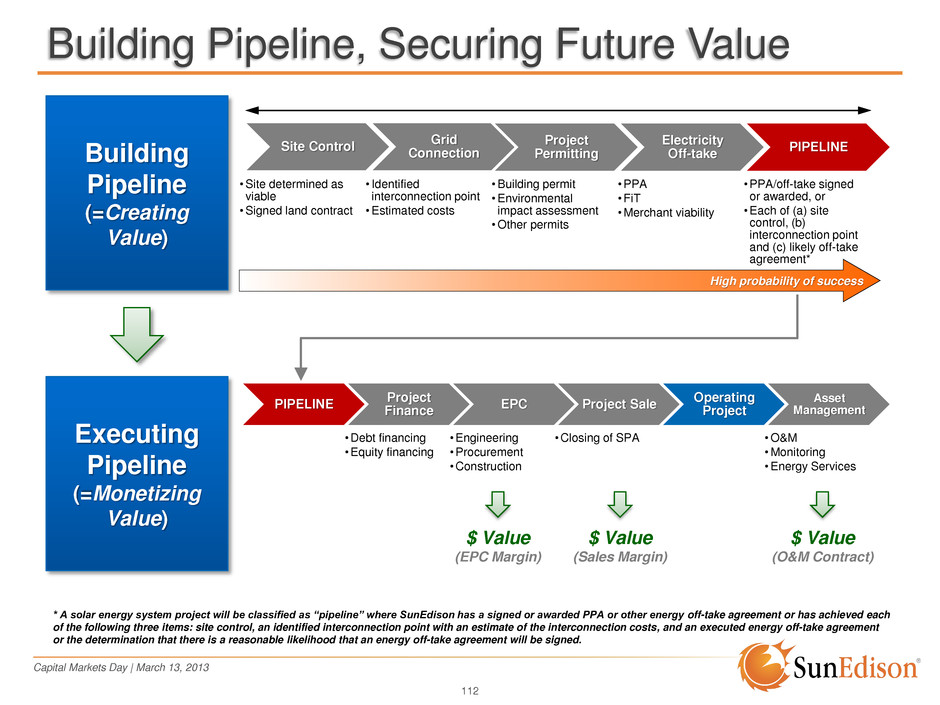

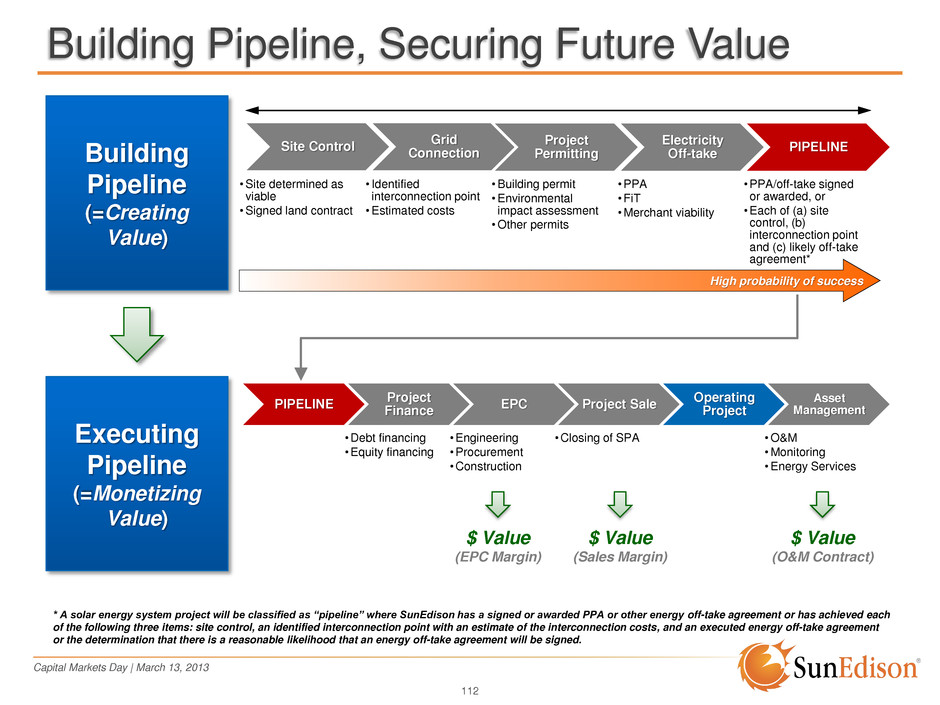

Capital Markets Day | March 13, 2013 Building Pipeline, Securing Future Value Building Pipeline (=Creating Value) Executing Pipeline (=Monetizing Value) Site Control •Site determined as viable •Signed land contract Grid Connection • Identified interconnection point •Estimated costs Project Permitting •Building permit •Environmental impact assessment •Other permits Electricity Off-take •PPA •FiT •Merchant viability PIPELINE •PPA/off-take signed or awarded, or •Each of (a) site control, (b) interconnection point and (c) likely off-take agreement* * A solar energy system project will be classified as “pipeline” where SunEdison has a signed or awarded PPA or other energy off-take agreement or has achieved each of the following three items: site control, an identified interconnection point with an estimate of the interconnection costs, and an executed energy off-take agreement or the determination that there is a reasonable likelihood that an energy off-take agreement will be signed. Low probability of success High probability of success 12 – 24 months PIPELINE Project Finance •Debt financing •Equity financing EPC •Engineering • Procurement •Construction Project Sale • Closing of SPA Operating Project Asset Management •O&M •Monitoring •Energy Services $ Value (EPC Margin) $ Value (Sales Margin) $ Value (O&M Contract) 112

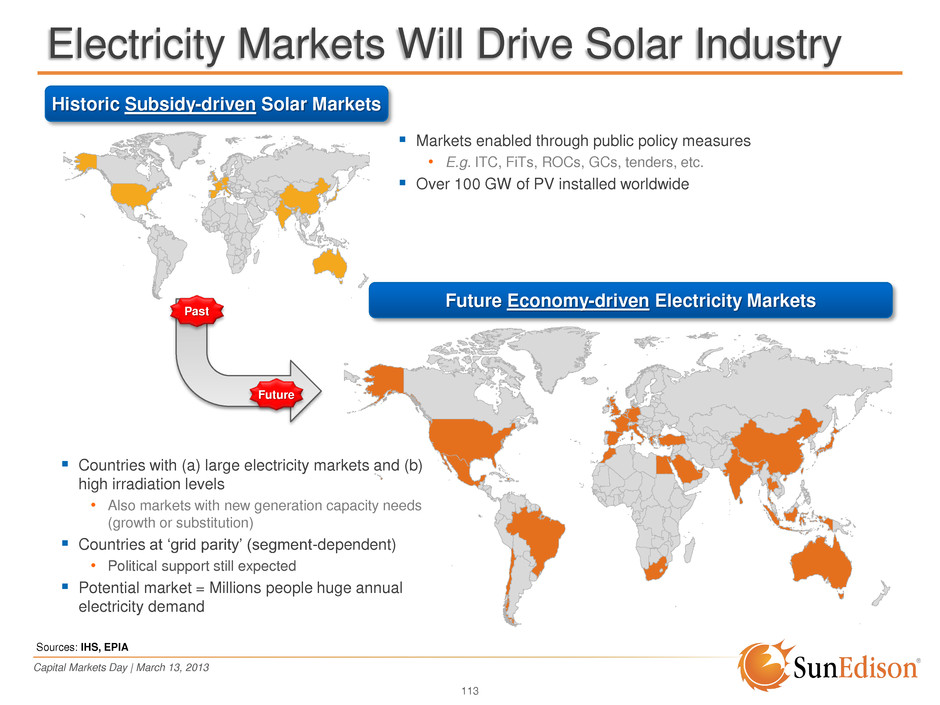

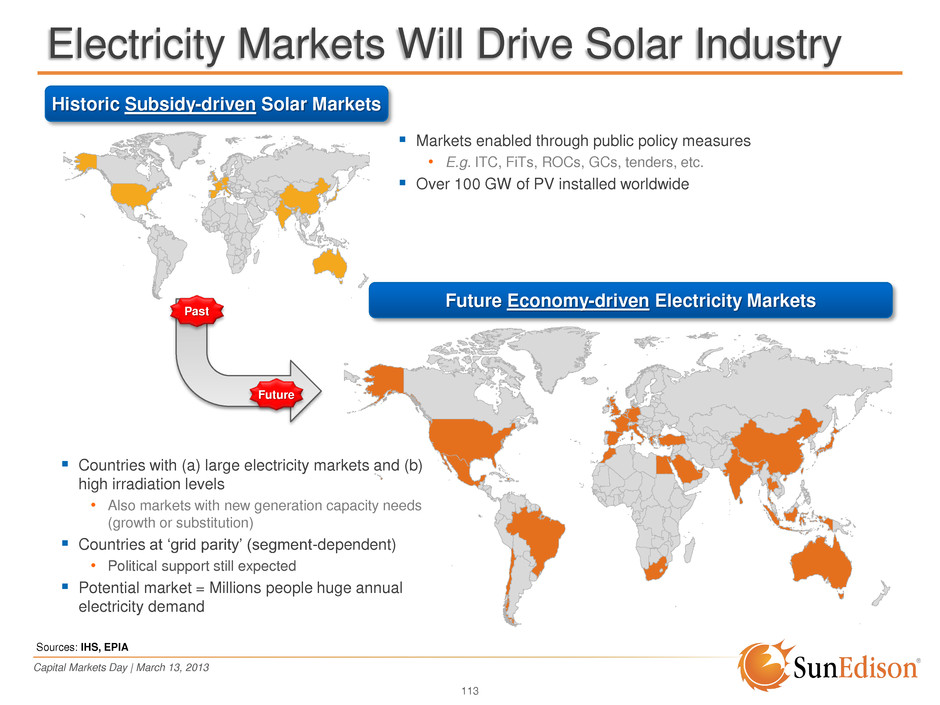

Capital Markets Day | March 13, 2013 Electricity Markets Will Drive Solar Industry Sources: IHS, EPIA Historic Subsidy-driven Solar Markets Future Economy-driven Electricity Markets Countries with (a) large electricity markets and (b) high irradiation levels • Also markets with new generation capacity needs (growth or substitution) Countries at ‘grid parity’ (segment-dependent) • Political support still expected Potential market = Millions people huge annual electricity demand Markets enabled through public policy measures • E.g. ITC, FiTs, ROCs, GCs, tenders, etc. Over 100 GW of PV installed worldwide Transition period 2-5 years Past Future 113

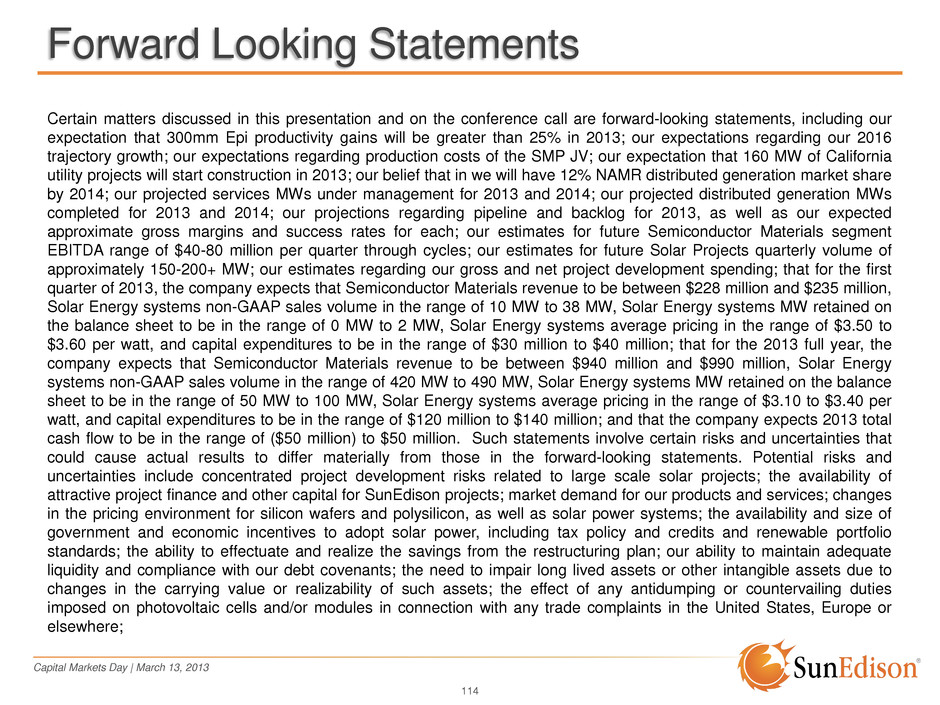

Capital Markets Day | March 13, 2013 Forward Looking Statements Certain matters discussed in this presentation and on the conference call are forward-looking statements, including our expectation that 300mm Epi productivity gains will be greater than 25% in 2013; our expectations regarding our 2016 trajectory growth; our expectations regarding production costs of the SMP JV; our expectation that 160 MW of California utility projects will start construction in 2013; our belief that in we will have 12% NAMR distributed generation market share by 2014; our projected services MWs under management for 2013 and 2014; our projected distributed generation MWs completed for 2013 and 2014; our projections regarding pipeline and backlog for 2013, as well as our expected approximate gross margins and success rates for each; our estimates for future Semiconductor Materials segment EBITDA range of $40-80 million per quarter through cycles; our estimates for future Solar Projects quarterly volume of approximately 150-200+ MW; our estimates regarding our gross and net project development spending; that for the first quarter of 2013, the company expects that Semiconductor Materials revenue to be between $228 million and $235 million, Solar Energy systems non-GAAP sales volume in the range of 10 MW to 38 MW, Solar Energy systems MW retained on the balance sheet to be in the range of 0 MW to 2 MW, Solar Energy systems average pricing in the range of $3.50 to $3.60 per watt, and capital expenditures to be in the range of $30 million to $40 million; that for the 2013 full year, the company expects that Semiconductor Materials revenue to be between $940 million and $990 million, Solar Energy systems non-GAAP sales volume in the range of 420 MW to 490 MW, Solar Energy systems MW retained on the balance sheet to be in the range of 50 MW to 100 MW, Solar Energy systems average pricing in the range of $3.10 to $3.40 per watt, and capital expenditures to be in the range of $120 million to $140 million; and that the company expects 2013 total cash flow to be in the range of ($50 million) to $50 million. Such statements involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Potential risks and uncertainties include concentrated project development risks related to large scale solar projects; the availability of attractive project finance and other capital for SunEdison projects; market demand for our products and services; changes in the pricing environment for silicon wafers and polysilicon, as well as solar power systems; the availability and size of government and economic incentives to adopt solar power, including tax policy and credits and renewable portfolio standards; the ability to effectuate and realize the savings from the restructuring plan; our ability to maintain adequate liquidity and compliance with our debt covenants; the need to impair long lived assets or other intangible assets due to changes in the carrying value or realizability of such assets; the effect of any antidumping or countervailing duties imposed on photovoltaic cells and/or modules in connection with any trade complaints in the United States, Europe or elsewhere; 114

Capital Markets Day | March 13, 2013 115 Forward Looking Statements (Cont’d) the result of any Chinese government investigations of unfair trade practices in connection with polysilicon exported from the United States or South Korea into China; changes to accounting interpretations or accounting rules; existing or new regulations and policies governing the electric utility industry; our ability to convert SunEdison pipeline and backlog into completed projects in accordance with our current expectations; dependence on single and limited source suppliers; utilization of our manufacturing volume and capacity; the terms of any potential future amendments to or terminations of our long-term agreements with our solar wafer customers or any of our suppliers; general economic conditions, including interest rates; the ability of our customers to pay their debts as they become due; changes in the composition of worldwide taxable income and applicable tax laws and regulations, including our ability to utilize any net operating losses; failure of third-party subcontractors to construct and install our solar energy systems efficiently in terms of cost and time; quarterly fluctuations in our SunEdison business; the impact of competitive products and technologies; inventory levels of our customers; supply chain difficulties or problems; interruption of production; outcome of pending and future litigation matters; good working order of our manufacturing facilities; our ability to reduce manufacturing and operating costs; assumptions underlying management's financial estimates; actions by competitors, customers and suppliers; changes in the retail industry; damage to our brand; acquisitions of pipeline in our Solar Energy segment; changes in product specifications and manufacturing processes; changes in financial market conditions; changes in foreign economic and political conditions; changes in technology; changes in currency exchange rates and other risks described in the company’s filings with the Securities and Exchange Commission. These forward-looking statements represent the company’s judgment as of the date of this press release. The company disclaims, however, any intent or obligation to update these forward-looking statements.