Exhibit 13

| | |

| Five Year Selected Financial Highlights | | Dollars in thousands, except share data |

The following data, insofar as it relates to each of the years ended December 31, 2005, 2004, 2003 and 2002 and for the periods of November 14, 2001 through December 31, 2001, and January 1, 2001 through November 13, 2001, has been derived from annual consolidated financial statements, including the consolidated balance sheets and the related consolidated statements of operations, cash flows, and stockholders’ equity (deficiency) and the notes thereto. The information below should be read in conjunction with our consolidated financial statements and notes thereto including Note 2 related to the restatement of the consolidated statements of cash flows for the years ended December 31, 2004 and 2003, and Note 3 related to significant accounting policies.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Successor | | | Predecessor | |

| | | Year ended Dec. 31, 2005 | | | Year ended

Dec. 31, 2004(1) | | | Year ended

Dec. 31, 2003 | | Year ended

Dec. 31, 2002 | | | Nov. 14 through Dec. 31, 2001(3) | | | Jan. 1 through Nov. 13, 2001(3) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 1,107,379 | | | $ | 1,027,958 | | | $ | 781,100 | | $ | 687,180 | | | $ | 58,846 | | | $ | 559,007 | |

Gross margin | | | 366,518 | | | | 369,415 | | | | 232,756 | | | 173,458 | | | | (11,731 | ) | | | (39,757 | ) |

Marketing and administration | | | 76,316 | | | | 71,948 | | | | 57,203 | | | 65,786 | | | | 7,973 | | | | 61,747 | |

Research and development | | | 33,209 | | | | 37,975 | | | | 32,934 | | | 27,423 | | | | 7,535 | | | | 58,149 | |

Restructuring costs | | | — | | | | (996 | )(4) | | | — | | | 15,300 | (5) | | | 2,971 | (6) | | | 29,511 | (6) |

Operating income (loss) | | | 256,993 | | | | 260,488 | | | | 142,619 | | | 64,949 | | | | (30,210 | ) | | | (189,164 | ) |

Net income (loss) allocable to common stockholders | | | 249,353 | (7) | | | 226,201 | (7) | | | 116,617 | | | (22,097 | ) | | | (33,644 | ) | | | (489,025 | ) |

Basic income (loss) per share | | | 1.17 | | | | 1.09 | | | | 0.58 | | | (0.17 | ) | | | (0.48 | ) | | | (7.03 | ) |

Diluted income (loss) per share | | | 1.10 | | | | 1.02 | | | | 0.53 | | | (0.17 | ) | | | (0.48 | ) | | | (7.03 | ) |

Shares used in basic income (loss) per share computation | | | 213,513,110 | | | | 207,713,837 | | | | 202,439,828 | | | 129,810,012 | | | | 69,612,900 | | | | 69,612,900 | |

Shares used in diluted income (loss) per share computation | | | 226,449,944 | | | | 221,047,946 | | | | 218,719,459 | | | 129,810,012 | | | | 69,612,900 | | | | 69,612,900 | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | |

Cash, cash equivalents and short-term investments | | | 153,611 | | | | 92,314 | | | | 130,697 | | | 165,646 | | | | 107,159 | | | | NA | |

Working capital(2) | | | 211,369 | | | | 155,024 | | | | 92,256 | | | 71,942 | | | | 35,120 | | | | NA | |

Total assets | | | 1,148,103 | | | | 1,028,189 | | | | 726,752 | | | 631,682 | | | | 549,334 | | | | NA | |

Short-term borrowings (8) | | | 13,209 | | | | 20,001 | | | | 16,899 | | | 80,621 | | | | 44,760 | | | | NA | |

Long-term debt (including current portion of long-term debt) | | | 39,917 | | | | 138,727 | | | | 114,193 | | | 204,017 | | | | 175,856 | | | | NA | |

Stockholders’ equity (deficiency) | | | 711,337 | | | | 442,898 | | | | 193,623 | | | (24,680 | ) | | | (24,496 | ) | | | NA | |

Other Data: | | | | | | | | | | | | | | | | | | | | | | | |

Capital expenditures(9) | | | 162,738 | | | | 145,840 | | | | 67,396 | | | 21,952 | | | | 6,995 | | | | 42,842 | |

Employment | | | 5,400 | | | | 5,500 | | | | 4,900 | | | 4,700 | | | | 4,700 | | | | NA | |

| (1) | In the 2004 first quarter, we completed the acquisition of the remaining 55% interest in Taisil that we did not already own. As a result, the financial results of Taisil were consolidated with our results effective February 1, 2004. |

| (2) | Consistent with the reclassification of the current portion of pension and post-employment liabilities to accrued liabilities as of December 31, 2004 discussed in Note 3 to the consolidated financial statements, we have reduced our working capital $29.0 million, $5.7 million and $7.2 million as of December 31, 2003, 2002 and 2001, respectively. |

| (3) | On November 13, 2001, an investor group led by Texas Pacific Group (TPG) purchased from E.ON AG and its affiliates (E.ON) all of E.ON’s debt and equity holdings in MEMC. In addition, on that date, TPG and MEMC restructured MEMC’s debt acquired by TPG from E.ON. As a result of the purchase of E.ON’s equity interest by TPG and the rights possessed by TPG through its ownership of preferred stock, we applied purchase accounting and pushed down TPG’s nominal basis in MEMC to our accounting records, reflected in our consolidated financial statements subsequent to November 13, 2001. |

| (4) | During 2004, we reversed the remaining unused restructuring reserves of $1.0 million related to the 2002 restructuring charge. |

| (5) | During 2002, we incurred charges of $15.3 million primarily in connection with restructuring plans affecting approximately 450 salaried, hourly and temporary employees. |

| (6) | During 2001, we recorded restructuring costs totaling $32.5 million to close our small diameter wafer line at MEMC Southwest Inc. in Sherman, Texas and to reduce our workforce. |

| (7) | During 2005, we reversed $67 million of valuation allowances related to deferred tax assets. This represented the reversal of all remaining valuation allowances on deferred tax assets. During 2004, we reversed $137 million of valuation allowances related to deferred tax assets. |

| (8) | Short-term borrowings were increased by $18,247 as of December 31, 2004 related to factored receivables. See Note 3 to the consolidated financial statements. |

| (9) | Capital expenditures were reduced by $3,971 and $17,831 for the year ended December 31, 2004 and 2003, respectively, as a result of certain capital acquisitions that were unpaid and included as outstanding accounts payable as of December 31, 2004 and 2003. See Note 2 to the consolidated financial statements. |

1

Management’s Discussion and Analysis of Financial Condition and Results of Operations

COMPANY OVERVIEW

We are a leading worldwide producer of wafers for the semiconductor industry. We are one of four wafer suppliers having more than a 10% share of the overall market. We operate manufacturing facilities in every major semiconductor manufacturing region throughout the world, including Europe, Japan, Malaysia, South Korea, Taiwan and the United States. Our customers include virtually all of the major semiconductor device manufacturers in the world, including the major memory, microprocessor and applications specific integrated circuit, or ASIC, manufacturers, as well as the world’s largest foundries. We provide wafers in sizes ranging from 100 millimeters (4 inch) to 300 millimeters (12 inch) and in three general categories: prime polished, epitaxial and test/monitor. We produce polysilicon to fulfill our internal wafer manufacturing requirements.

On July 21, 2005, the Company entered into a revolving credit agreement with National City Bank of the Midwest, US Bank National Association, and such other lending institutions as may from time to time become lenders (the National City Agreement). The National City Agreement provides for a $200 million secured revolving credit facility and replaced the $150 million revolving credit facility from Citibank/UBS and the $35 million revolving credit facility from Texas Pacific Group and certain of its affiliates (TPG).

On August 7, 2006, the Audit Committee of the Board of Directors of the Company determined that the consolidated statements of cash flows for the years ended December 31, 2004 and 2003 should be restated as more fully described in Note 2 of Notes to Consolidated Financial Statements herein. Prior to completing the 2005 Form 10-K, the Company restated its Forms 10-Q for the first two quarters of 2005. Certain accounting errors, as outlined in the specific sections of this report pertaining to prior years, were recorded in 2005.

RESULTS OF OPERATIONS

| | | | | | | | | | | | |

Net Sales | | 2005 | | | 2004 | | | 2003 | |

| Dollars in millions | | | | | | | | | |

Net Sales | | $ | 1,107 | | | $ | 1,028 | | | $ | 781 | |

Percentage Change | | | 8 | % | | | 32 | % | | | 14 | % |

Our net sales increased by 8% to $1,107 million in 2005 from $1,028 million in 2004 resulting primarily from increased sales of polysilicon at higher prices and an increase in wafer product volume. Wafer average selling prices declined approximately 3% in 2005 compared to 2004. The worldwide polysilicon shortage in 2005 allowed us to sell excess polysilicon to solar customers. On a longer term basis, the Company is working to develop new relationships with solar customers to capitalize on our core competencies in wafer production. Polysilicon sales amounted to slightly less than 10% of total sales in 2005.

As of December 31, 2005 we deferred revenue totaling $15 million, with an associated $1 million in deferred costs, resulting in $14 million of deferred gross margin. This revenue related to multiple element arrangements for polysilicon sales for which we received cash in 2005. We will not recognize the deferred revenue until all elements of the arrangement are satisfied. See “Critical Accounting Polices and Estimates-Revenue Recognition,” below.

Our net sales increased by 32% to $1,028 million in 2004 from $781 million in 2003, primarily as a result of an increase in product volumes. The increase in our product volumes in 2004 was primarily due to increased industry demand, the Taisil acquisition and increased sales of our newer products. Our overall wafer average selling prices declined by approximately 2% in 2004 compared to 2003 as a result of general price declines, partially offset by the favorable impact of currency fluctuations and a richer product mix.

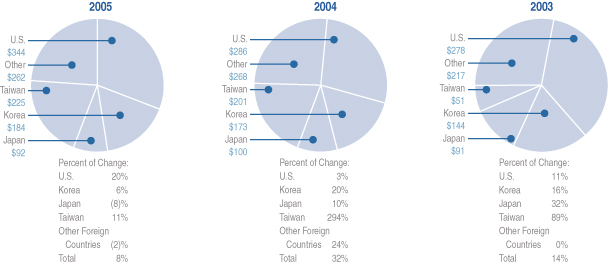

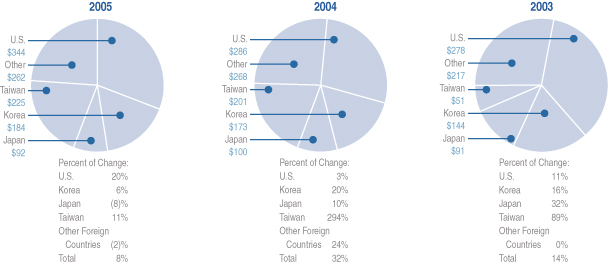

We operate in all the major semiconductor-producing regions of the world, with approximately 69% of our 2005 net sales to customers located outside North America. Net sales by geographic region for each of the last three years were as follows:

Net Sales by Geographic Area:

Dollars in millions

| | | | | | | | | | | | |

Gross Margin | | 2005 | | | 2004 | | | 2003 | |

| Dollars in millions | | | | | | | | | |

Cost of Goods Sold | | $ | 740 | | | $ | 659 | | | $ | 548 | |

Gross Margin | | | 367 | | | | 369 | | | | 233 | |

Gross Margin Percentage | | | 33 | % | | | 36 | % | | | 30 | % |

Our gross margin was $367 million in 2005 compared to $369 million in 2004 and decreased as a percentage of sales from 36% to 33%. This decrease was mainly due to the decrease in wafer average selling prices noted above, offset by increased margin on the sale of polysilicon. Additionally, in 2005 the Company changed its technology transfer process that isolated research and development (R&D) costs within manufacturing and reclassified them to R&D. See “Research and Development,” below. The change resulted in an increase in cost of goods sold with a corresponding decrease in R&D expense. The 2004 and 2003 comparable costs recorded were $6 million and $1 million, respectively.

2

Our gross margin improved to $369 million, or 36% of net sales, in 2004 compared to $233 million, or 30% of net sales, in 2003. The improvement in gross margin as a percentage of net sales was primarily a result of increased product volumes, continued cost savings and productivity improvements which lowered unit costs. Headcount, excluding increases from the acquisition of Taisil, remained relatively flat despite the increased volumes.

| | | | | | | | | | | | |

Marketing and Administration | | 2005 | | | 2004 | | | 2003 | |

| Dollars in millions | | | | | | | | | |

Marketing and Administration | | $ | 76 | | | $ | 72 | | | $ | 57 | |

As a Percentage of Net Sales | | | 7 | % | | | 7 | % | | | 7 | % |

Marketing and administration expenses were $76 million in 2005 compared to $72 million in 2004. As a percentage of net sales, marketing and administration expenses remained consistent with 2005, at 7%. In aggregate dollar amount, marketing and administration fees increased due to increased freight on customer shipments, higher professional fees and increased cost of providing sample wafers to customers. These increases were substantially offset by the termination of a management advisory agreement with Texas Pacific Group (TPG) in March 2005. Pursuant to the agreement, TPG provided management and financial advisory services to us as requested by our Board of Directors in exchange for a management advisory fee of $2 million per year plus related out-of-pocket expenses, and other additional compensation prior to the termination.

Marketing and administration expenses increased to $72 million in 2004 compared to $57 million in 2003. The increase was primarily due to customer freight expenses, which were reclassified from net sales to administration expense in the fourth quarter of 2003, and the acquisition of Taisil in February 2004. The remainder of the increase was attributable to improvements in quality systems, increased efforts devoted to sales and customer service and professional fees associated with compliance with Sarbanes-Oxley. As a percentage of net sales, marketing and administration expenses in 2004 stayed consistent with 2003, at 7%.

| | | | | | | | | | | | |

Research and Development | | 2005 | | | 2004 | | | 2003 | |

| Dollars in millions | | | | | | | | | |

Research and Development | | $ | 33 | | | $ | 38 | | | $ | 33 | |

As a Percentage of Net Sales | | | 3 | % | | | 4 | % | | | 4 | % |

R&D expenses consisted mainly of product and process development efforts to increase our capability in the areas of flatness, particles and crystal defectivity. Our R&D expenses decreased to $33 million in 2005 compared to $38 million in 2004, primarily due to the 2005 change in the classification of certain R&D costs. The Company changed its technology transfer process that isolated R&D costs within manufacturing and reclassified them to R&D. The Company determined that the difficulty of precisely measuring the impact of these actual costs warranted no longer classifying such costs as R&D. The comparable amounts recorded in 2004 and 2003 were $6 million and $1 million, respectively. Additionally, R&D costs decreased due to the favorable impact of a $3 million contract reimbursement discussed below.

In the second quarter of 2005 we were awarded a contract with the Department of Defense related to the development of thin film silicon-on-insulator (SOI) wafers. The total contract value was $12 million, representing the proposed development costs expected to be incurred by the Company during the nine month period from April 1 through December 31, 2005. The contract provided for the government to reimburse the Company $4 million of the total costs to be incurred of $12 million and was recognized on a proportionate cost basis. In 2005, the Company recognized $3 million as an offset of actual SOI costs incurred within research and development expenses.

Our research and development expenses increased to $38 million in 2004 compared to $33 million in 2003 primarily due to the development of next-generation products and efforts to increase our capability in the areas of flatness, particles and crystal defectivity.

| | | | | | | | | | | | |

Nonoperating (Income) Expense | | 2005 | | | 2004 | | | 2003 | |

| Dollars in millions | | | | | | | | | |

Interest Expense | | $ | 7 | | | $ | 14 | | | $ | 13 | |

Interest Income | | | (4 | ) | | | (5 | ) | | | (7 | ) |

Royalty Income | | | — | | | | — | | | | (4 | ) |

Currency (Gains) Losses | | | 1 | | | | 2 | | | | (14 | ) |

Loss on the Extinguishment of Debt | | | — | | | | 61 | | | | — | |

Other, Net | | | 1 | | | | (10 | ) | | | (1 | ) |

Interest expense in 2005 decreased to $7 million compared to $14 million in 2004. The decrease was primarily the result of the redemption in December 2004 of the senior subordinated secured notes as well as the reduction of South Korean debt throughout 2004.

Interest expense in 2004 remained consistent with 2003. An increase in interest expense in 2004 of approximately $3 million resulting from non-cash interest accretion on the senior subordinated secured notes payable to the investor group led by TPG was substantially offset by lower interest expense from lower outstanding indebtedness at our foreign subsidiaries. During 2004, we borrowed $60 million to finance the acquisition of Taisil and paid down over $143 million of other debt using cash from operations and the liquidation of short-term investments.

Royalty income in 2003 related to royalties received from Taisil, our previously unconsolidated joint venture in Taiwan. In February 2004, we completed the acquisition of the remaining 55% of Taisil that we did not already own. As a result, Taisil’s operating results have been consolidated with MEMC’s operating results effective February 1, 2004, and these royalties are no longer recognized in the consolidated statement of operations.

In 2005, we recognized currency losses of approximately $1 million, compared to losses of approximately $2 million in 2004 and gains of approximately $14 million in 2003. The currency gains in 2003 were primarily associated with the revaluation of a Yen-based intercompany loan. These currency gains resulted primarily from the significant strengthening of the Japanese Yen against the U.S. Dollar in 2003. On July 1, 2004, we designated the Yen-based intercompany loan as a long-term

3

investment with settlement not planned or anticipated in the foreseeable future. Since we no longer expect settlement of the intercompany loan, foreign currency gains and losses from this loan are no longer being recorded in the consolidated statement of operations.

On December 30, 2004, we redeemed in full our outstanding senior subordinated secured notes plus interest for $68 million. In order to redeem the notes, we negotiated an amendment to the note indenture to allow for this early redemption without a premium. As a result of this amendment, we recognized a non-operating debt extinguishment loss on a pre-tax basis of $61 million in the 2004 fourth quarter.

Other nonoperating expense, net was $1 million in 2005, compared to income of $10 million in 2004 and $1 million in 2003. The primary components of the other nonoperating income included in the 2004 period were the reversal into income of unused customer deposits following the expiration of contracts, a gain on the termination of a customer supply arrangement and a reimbursement recorded from a business interruption insurance recovery.

| | | | | | | | | | | | |

Income Taxes | | 2005 | | | 2004 | | | 2003 | |

| Dollars in millions | | | | | | | | | |

Income Taxes Expense (Benefit) | | $ | (3 | ) | | $ | (40 | ) | | $ | 37 | |

Income Tax Rate as a % of Income before Income Taxes | | | (1 | )% | | | (20 | )% | | | 24 | % |

In 2005 we recognized an income tax benefit of $3 million representing a benefit of 1% of income before income taxes, equity in joint venture and minority interests. The tax benefit was primarily due to reversal of valuation allowances, reassessments in reserves for changes of estimates of $30 million, effects of foreign operations on taxes offset by state income tax increases from rate changes and non-realizable state tax loss carry-forwards. We reversed $67 million of valuation allowances based on our projected future earnings because we believe it is more likely than not that certain deferred tax assets will be recognized in the future. In making this determination, we considered all available evidence including historical pre-tax and taxable income (losses), and the expected timing of the reversals of existing taxable temporary differences by taxable jurisdiction. We reassessed reserves for changes in estimates benefiting taxes by $30 million primarily for allowable depreciation deductions under IRS rules and an election to claim U.S. foreign tax credits. We expensed $10 million of state income taxes related to tax rate changes and non-realizable state net operating losses caused by a merger in 2005 for tax purposes. We recognized a tax benefit of $10 million primarily from our election to credit foreign taxes. We made certain prior period adjustments that netted to a tax expense of $3 million. See “Other Events” below.

In 2004, we recognized an income tax benefit of $40 million primarily due to the reversal of $108 million in valuation allowances against deferred tax assets related to our projected future earnings and $29 million related to current earnings in 2004. We reversed the valuation allowances related to future earnings because we believe that it is more likely than not that certain deferred tax assets will be realized, taking into consideration all available evidence including historical pre-tax and taxable income (losses), projected future pre-tax and taxable income (losses) and the expected timing of the reversals of existing temporary differences by taxable jurisdiction. Primarily as a result of the total valuation allowance reversals of $137 million related to current and future earnings, we had an income tax benefit rate as a percentage of income before income taxes of (20%) in 2004. We also recorded a $27 million tax liability in 2004 for the potential non-deductibility of the payment to TPG for the redemption of the subordinated note. Our income tax rate as a percentage of income before income taxes was 24% in 2003. In 2003, we reversed a portion of the valuation allowance related to net operating loss carry-forwards as a result of taxable income in certain tax jurisdictions.

| | | | | | | | | | |

Equity in Income (Loss) of Joint Venture | | 2005 | | 2004 | | | 2003 |

| Dollars in millions | | | | | | | |

Equity in Income (Loss) of Joint Venture | | $ | — | | $ | (2 | ) | | $ | 6 |

Equity in income (loss) of joint venture represents our interest in the net income (loss) of Taisil. In the first quarter of 2004, we completed the acquisition of the remaining 55% interest in Taisil that we did not already own. As a result, Taisil’s operating results were consolidated with MEMC’s operating results beginning February 1, 2004.

LIQUIDITY AND CAPITAL RESOURCES

| | | | | | | | | | | | |

| | | 2005 | | | 2004 as restated | | | 2003 as restated | |

| Dollars in millions | | | | | | | | | |

Net Cash Provided by (Used in): | | | | | | | | | | | | |

Operating Activities | | $ | 321 | | | $ | 258 | | | $ | 99 | |

Investing Activities | | | (153 | ) | | | (195 | ) | | | (42 | ) |

Financing Activities | | | (94 | ) | | | (65 | ) | | | (68 | ) |

In 2005, we generated $321 million of cash from operating activities, compared to $258 million in 2004 and $99 million in 2003. The year over year increases were primarily due to the improved operating results.

Our principal sources and uses of cash during 2005 were as follows:

Sources:

| | • | | Generated $321 million from operations; and |

| | • | | Received approximately $15 million from the exercise of stock options. |

4

Uses:

| | • | | Invested $163 million in capital expenditures; |

| | • | | Paid down $89 million under long-term debt agreements; and |

| | • | | Paid approximately $10 million as a dividend to a minority shareholder in our Korean subsidiary. |

Our accounts receivable decreased $34 million to $125 million at December 31, 2005, compared to $159 million at the end of 2004. Our overall days sales outstanding (DSO) was 38 days at December 31, 2005, compared to 54 days at the end of 2004 based on annualized fourth quarter sales for the respective years. As discussed below, at December 31, 2005 and 2004, we had factored $42 million and $52 million of receivables, respectively, of which $11 million and $18 million have been recorded as short-term borrowings and accounts receivable as of December 31, 2005 and 2004, respectively.

Our inventories decreased $8 million or 6% to $120 million over the prior year. The decrease was primarily due to the 8% increase in 2005 sales compared to 2004. Our annualized inventory turns, calculated as the ratio of annualized fourth quarter cost of goods sold divided by the year-end inventory balance, were approximately six times at December 31, 2005 versus approximately five times at December 31, 2004. We sell our products to certain customers under consignment arrangements. Generally, these consignment arrangements require us to maintain a certain quantity of product in inventory at the customer’s facility or at a storage facility designated by the customer. At December 31, 2005, we had $18 million of inventory held on consignment, compared to $22 million at December 31, 2004.

Our net deferred tax assets totaled $178 million at December 31, 2005 (of which $12 million was included in prepaid and other assets) compared to $128 million at December 31, 2004 (of which $8 million was included in prepaid and other assets). In 2005, we reversed $67 million in tax valuation allowances because we believe that it is more likely than not that the related deferred tax assets will be realized.

Our accounts payable decreased $18 million to $106 million at December 31, 2005, compared to $124 million at the end of 2004. The decrease was primarily due to the timing of capital equipment purchases in 2004.

We had deferred revenue totaling $15 million related to polysilicon sales as of December 31, 2005 with a corresponding deferred cost of $1 million, resulting in $14 million of deferred gross margin. We defer product revenue for multiple element arrangements based on a fair value per unit for the total arrangement when we receive cash in excess of fair value. We also defer revenue when pricing is not fixed and determinable or other revenue recognition criteria is not met. See “Critical Accounting Estimates – Revenue Recognition”.

Pension and post-employment liabilities decreased $4 million to $112 million at December 31, 2005, compared to $116 million at the end of 2004 (of which $21 million and $19 million were included in accrued liabilities at December 31, 2005 and 2004, respectively), primarily reflecting the funding of $13 million of minimum required contributions to our domestic defined benefit pension plan for the 2004 plan year and part of the 2005 plan year. The decrease from funding was partially offset by the increase in the benefit obligation.

Other noncurrent liabilities decreased $31 million to $41 million at December 31, 2005, compared to $72 million at December 31, 2004. The decrease primarily represents a reassessment of tax liabilities due to changes in estimate.

At December 31, 2005, we had approximately $54 million of committed capital expenditures. Capital expenditures in 2005 and committed capital expenditures for 2006 primarily related to increasing our capacity and capability for our next generation products. Consistent with previous years, the Company expects its capital expenditures to not exceed 15% of its net sales.

In 2005, we used $94 million of cash for financing activities, compared to $65 million in 2004. Net activity under short-term borrowing arrangements resulted in the net payment of $9 million in 2005, compared to $12 million in 2004. Net activity under long-term credit facilities in 2005 was a paydown of $89 million. In 2004, the Company made payments under long-term credit facilities of $113 million and borrowed $60 million under long-term debt agreements to fund the acquisition of Taisil in the first quarter of 2004.

On July 21, 2005, the Company entered into a Revolving Credit Agreement with National City Bank of the Midwest (National City Bank), US Bank National Association, and such other lending institutions as may from time to time become lenders (the National City Agreement). The National City Agreement provides for a $200 million secured revolving credit facility and replaced the $150 million revolving credit facility from Citibank/UBS (the Citibank Facility) and the $35 million revolving credit facility from Texas Pacific Group and certain of its affiliates (the TPG Facility).

The National City Agreement has a term of five years. Interest on borrowings under the National City Agreement would be payable based on the our election at LIBOR plus an applicable margin (currently 1.0%) or at a defined prime rate plus an applicable margin (currently 0.0%). The National City Agreement also provides for the Company to pay various fees, including a commitment fee on the unused portion of the lenders’ commitments (such fee is currently set at 0.25% per annum). The National City Agreement contains covenants typical for credit arrangements of comparable size, such as minimum earnings before interest, taxes, depreciation and amortization and an interest coverage ratio.

As a result of not timely filing our 2005 Form 10-K, we would have been in technical default under the National City Agreement. The lenders granted waivers on March 30, 2006, June 30, 2006, and July 31, 2006 extending our deadline to deliver the 2005 Form 10-K to August 31, 2006.

On July 21, 2005 we borrowed an aggregate of $60 million under the National City Agreement and used those funds to repay all outstanding amounts under the Citibank Facility. The $60 million borrowing under the National City Agreement was paid off in December 2005.

The obligations of the Company under the National City Agreement are guaranteed by certain subsidiaries of the Company. The obligations of the Company and the guaranty obligations of the subsidiaries are secured by a pledge of the capital stock of certain domestic and foreign subsidiaries of the Company. The other assets of the Company are not pledged as security for the National City Agreement.

In connection with the execution of the National City Agreement, we terminated the Citibank Facility upon our repayment of all amounts then outstanding. In addition, we terminated the TPG Facility and the reimbursement agreement among MEMC and certain TPG entities. Those TPG entities had guaranteed our obligations under the Citibank Facility and the TPG Facility and in return, we had entered into a reimbursement agreement with those guarantors under which we agreed to reimburse them for any payment made under the guarantees.

On July 21, 2005, all of the liens and security interests of Citibank, UBS and the other lenders under the Citibank Facility and the TPG entities under the TPG Facility on and in our assets were released, as were the subsidiaries’ guarantees of MEMC’s repayment obligations.

5

The extinguishment of the Citibank/UBS and the TPG credit facilities resulted in the write-off of $2 million of deferred financing fees. This loss was recorded in nonoperating expenses in 2005.

We were accreting the senior subordinated secured notes up to their face value of $50 million over their maturity using the effective interest method. Interest expense related to the accretion of these notes was $4 million in 2004. In December 2004, we negotiated an amendment to the note indenture to allow for the early redemption without a premium. As a result of the amendment, we recognized a non-operating debt extinguishment loss on a pre-tax basis of $61 million in the 2004 fourth quarter. The notes were redeemed in full on December 30, 2004 for $68 million.

We and certain of our foreign subsidiaries have entered into agreements with various financial institutions whereby we sell on a continuous basis eligible trade accounts receivable. Each of the agreements has clauses covering sales of receivables with recourse and non-recourse. All of the receivables are sold on a recourse basis. These agreements have different terms, including options for renewal, none of which extend beyond one year. Such factoring is generally limited to $90 million by our revolving credit agreement. At December 31, 2005 and 2004, we had factored $42 million and $52 million of receivables, respectively, of which $11 million and $18 million have been recorded as short-term borrowings and accounts receivable as of December 31, 2005 and 2004, respectively, as the sale criteria under SFAS No. 140, “Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities” were not met for certain factored transactions.

Credit facilities and related borrowings outstanding at December 31, 2005 were as follows:

| | | | | | |

| | | Committed | | Outstanding |

| Dollars in millions | | | | |

Long-term Debt | | $ | 272 | | $ | 40 |

Short-term Borrowings | | | 91 | | | 13 |

| | | | | | |

Total | | $ | 363 | | $ | 53 |

| | | | | | |

Of the $272 million committed long-term credit facilities, $8 million is unavailable as it relates to the issuance of third party letters of credit. Our weighted average cost of borrowing, excluding accretion, was 2.6% and 2.7% at December 31, 2005 and December 31, 2004, respectively. Our short-term borrowings are subject to renewal annually with each financial institution through the course of the year. Our total debt to total capital ratio at December 31, 2005 was 7%, compared to 25% at December 31, 2004. The improvement in this ratio is due primarily to the payoff of debt and the higher stockholders’ equity in 2005 as compared to 2004.

Our contractual obligations as of December 31, 2005 were as follows:

| | | | | | | | | | | | | | | |

| | | Payments Due By Period |

Contractual Obligations | | Total | | Less than 1 Year | | 1-3

Years | | 4-5

Years | | After 5 Years |

| Dollars in millions | | | | | | | | | | |

Long-term Debt1 | | $ | 40 | | $ | 5 | | $ | 10 | | $ | 8 | | $ | 17 |

Short-term Borrowings | | | 13 | | | 13 | | | — | | | — | | | — |

Operating Leases | | | 18 | | | 5 | | | 5 | | | 3 | | | 5 |

Purchase Obligations2 | | | 137 | | | 90 | | | 37 | | | 4 | | | 6 |

Committed Capital Expenditures3 | | | 54 | | | 54 | | | — | | | — | | | — |

Pension Funding Obligation4 | | | 57 | | | 16 | | | 27 | | | 6 | | | 8 |

| | | | | | | | | | | | | | | |

Total Contractual Obligations | | $ | 319 | | $ | 183 | | $ | 79 | | $ | 21 | | $ | 36 |

| | | | | | | | | | | | | | | |

The contractual commitments shown above, except for our debt obligations, are not recorded on our consolidated balance sheet.

| 1 | Our long-term debt consists of foreign currency denominated plant expansion borrowings that have notes maturing over the next ten years. |

| 2 | Represents obligations for agreements to purchase goods or services that are enforceable and legally binding on the Company, including minimum quantities to be purchased, and outstanding purchases for goods or services as of December 31, 2005. |

| 3 | Committed capital expenditures represent commitments for construction or purchase of property, plant and equipment. They are not recorded as liabilities on our consolidated balance sheet as of December 31, 2005 as we have not yet received the related goods or services or taken title to the property. |

| 4 | Pension funding obligations represent the estimated payments assuming an annual expected rate of return on pension plan assets of 8%, and a discount rate on pension plan obligations of 5.5%. These estimated payments are subject to significant variation and the actual payments may be more or less than the amounts estimated. |

We have agreed to indemnify some of our customers against claims of infringement of the intellectual property rights of others in our sales contracts with these customers. The terms of most of these indemnification obligations generally do not provide for a limitation of our liability. We have not had any claims related to these indemnification obligations.

Our pension expense and pension liability are actuarially determined, and we use various actuarial assumptions, including the discount rate, rate of salary increase, and expected return on assets to estimate our pension costs and obligations. We determine the expected return on plan assets based on our pension plans’ actual asset mix as of the beginning of the year. While the assumed expected rate of return on plan assets in 2005 was 8%, the actual return experienced in our pension plan assets in the comparable period in 2005 was 10.7%. We consult with the plans’ actuaries to determine a discount rate assumption that reflects the characteristics of our plans, and utilize an analytical tool that incorporates the concept of a hypothetical yield curve, developed from corporate bond (Aa quality) yield information. Assuming a 100 basis point variation in these assumptions, our 2005 pension expense would have been approximately $2 million higher or lower.

Our total unfunded pension liability related to our various defined benefit pension plans at December 31, 2005 totaled $75 million. In addition, as of December 31, 2005, we had an unrecognized net actuarial loss of $41 million, primarily due to a change in our discount rate. We also recorded an additional minimum pension liability before tax of $33 million as of December 31, 2005. The non-cash adjustments to record the minimum pension liability do not impact our operating results. Our pension obligations are funded in accordance with provisions of federal law. Contributions to our pension plans in 2005 totaled approximately $15 million. We expect contributions to our pension plans in 2006 to be approximately $16 million.

We believe that we have the financial resources needed to meet business requirements for the next 12 months, including capital expenditures and working capital requirements.

6

OTHER EVENTS

On October 26, 2005, the Audit Committee of the Board of Directors determined that the first two quarters of 2005 should be restated to reflect the Company’s conclusions relating to the tax deductibility of interest payments made in 2004. In the first quarter of 2005, we recognized a benefit related to a deduction for which we had previously established a $27 million reserve (in the fourth quarter of 2004) for the potential non-deductibility of a $68 million payment to TPG in connection with the redemption of our senior subordinated secured notes. After our review and analysis, we concluded that only the interest portion, or $17.7 million, of the redemption payment should be deductible and consequently adjusted the tax reserve. Also in November 2005, the Audit Committee of our Board undertook an investigation of revenue recognition issues related to the way the Company was recognizing revenue in connection with sales of polysilicon. This restatement and the Audit Committee investigation led to the Company’s delay in filing its quarterly report on Form 10-Q for the third quarter of 2005 and its 2005 Form 10-K. This review is now complete and the resolution of issues related to our accounting for revenue recognition is reflected in our audited financial statements for fiscal 2005. The Audit Committee’s review yielded information beneficial to our efforts to improve our internal control over financial reporting. As a result of the Audit Committee’s review, we instituted specific improvements and additional measures are planned for the third and fourth quarter of 2006.

Certain amounts were recorded in 2005 which related to previous periods. The amount of such adjustments was not material to our consolidated results of operations for 2004 or 2003 and prior periods, nor is the inclusion of the net expense in the results of operations for 2005 considered material. The effect of these adjustments on gross margin and net income for 2005 is as follows:

| | | | | | | | |

Prior Period Adjustments – increase (decrease) | | Impact on

Gross

Margin | | | Impact

on Net

Income | |

| Dollars in millions | | | | | | |

Income Taxes, net | | $ | 2 | | | $ | (3 | ) |

Other | | | (3 | ) | | | (2 | ) |

| | | | | | | | |

Total | | $ | (1 | ) | | $ | (5 | ) |

| | | | | | | | |

Included in the Income Taxes, net are prior period adjustments, including a benefit of $7 million related to the portion of the interest on senior subordinated notes deductible for tax purposes, additional expense of $3 million (tax expense of $7 million offset by less depreciation expense and other adjustments) related to the US GAAP treatment of fixed asset basis under the Korea Asset Revaluation Law, and additional expense of $6 million associated with non-qualified stock option deductions in prior periods, and additional expense of $1 million related to amended tax filings and reassessment of tax basis limitations.

Included in Other are primarily adjustments to cost of goods sold and inventory of approximately $2.4 million for profit not previously eliminated from inventory for product shipped between operations and other adjustments that are not individually significant.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions in certain circumstances that affect amounts reported in the accompanying consolidated financial statements and related footnotes. In preparing these financial statements, management has made its best estimates of certain amounts included in the financial statements. However, application of these accounting policies involves the exercise of judgment and use of assumptions as to future uncertainties and, as a result, actual results could differ from these estimates. MEMC’s significant accounting policies are more fully described in Note 3 of Notes to Consolidated Financial Statements herein.

Revenue Recognition

We record revenue for product sales when title transfers, the risks and rewards of ownership have been transferred to the customer, the fee is fixed and determinable and collection of the related receivable is reasonably assured, which is generally at the time of shipment for non-consignment orders. In the case of consignment orders, we recognize revenue based upon customer usage, defined as when the customer pulls the product from consignment inventory. Our wafers are generally made to customer specifications and we conduct rigorous quality control and testing procedures to ensure that the finished wafers meet the customer’s specifications before the product is shipped. We consider international shipping term definitions in our determination of when title passes. We defer revenue for multiple element arrangements based on an average fair value per unit for the total arrangement when we receive cash in excess of fair value. We also defer revenue when pricing is not fixed and determinable or other revenue recognition criteria is not met.

Inventory

Inventories, which consist of materials, labor and manufacturing overhead, are valued at the lower of cost or market. Inventory costs are based on a weighted average actual cost.

The valuation of inventory requires us to estimate excess and slow moving inventory. The determination of the value of excess and slow moving inventory is based upon assumptions of future demand and market conditions. If actual market conditions are less favorable than those projected by management, additional inventory write-downs may be required.

7

Property, Plant and Equipment

We depreciate our building, improvements, and machinery and equipment evenly over the assets’ estimated useful lives. Changes in circumstances such as technological advances, changes in our business model, or changes in our capital strategy could result in the actual useful lives differing from our estimates. In those cases where we determine that the useful life of property, plant and equipment should be shortened or lengthened, we depreciate the net book value over its revised remaining useful life.

Income Taxes

In determining taxable income for financial statement reporting purposes, we must make certain estimates and judgments. These estimates and judgments are applied in the calculation of certain tax liabilities and in the determination of the recoverability of deferred tax assets, which arise from temporary differences between the recognition of assets and liabilities for tax and financial statement reporting purposes. We regularly review our deferred tax assets for realizability and adjust the valuation allowance based upon our judgment as to whether it is more likely than not that some items recorded as deferred tax assets will be realized, taking into consideration all available evidence, both positive and negative, including historical pre-tax and taxable income (losses), projected future pre-tax and taxable income (losses) and the expected timing of the reversals of existing temporary differences. In arriving at these judgments, the weight given to the potential effect of all positive and negative evidence is commensurate with the extent to which it can be objectively verified.

We repatriate all or substantially all of our portion of the current year earnings of the Company’s South Korean subsidiary to the United States. We do not provide for U.S. income taxes on the remaining undistributed earnings of our foreign subsidiaries which would be payable if the undistributed earnings were distributed to the U.S., as we expect to reinvest these earnings overseas permanently.

The Company is subject to income taxes in both the U.S. and numerous foreign jurisdictions. Significant judgment is required in determining the worldwide provision for income taxes. We are subject to tax audits in these jurisdictions from time to time. While it is often difficult to predict the final outcome or the timing of resolution of any particular tax matter, we believe that our tax liabilities reflect the probable outcome of known contingencies.

Employee-Related Liabilities

We have a long-term liability for our defined benefit pension and other post-retirement benefit plans. Detailed information related to this liability is included in Note 17 of Notes to Consolidated Financial Statements herein. Our obligations are funded in accordance with provisions of federal law.

Our pension and other post-retirement liabilities are actuarially determined, and we use various actuarial assumptions, including the discount rate, rate of salary increase, and expected return on assets, to estimate our costs and obligations. If our assumptions do not materialize as expected, expenditures and costs that we incur could differ from our current estimates.

Stock-Based Compensation

We account for our stock-based compensation under Accounting Principles Board Opinion No. 25 (Opinion 25), Accounting for Stock Issued to Employees, and related interpretations. We record compensation expense related to restricted stock awards over the vesting periods of the awards and reflect the unearned portion of deferred compensation as a separate component of stockholders’ equity.

Compensation expense equal to the intrinsic value of the options has been recognized for options granted at a price below the market price on the date of the grant and deferred compensation has been recorded for the unearned portion of the options as a separate component of stockholders’ equity.

The Company is allowed a tax deduction for stock-based compensation to U.S. employees at the time of exercise of a non-qualified stock option. The deduction is the difference between the grant price and the market value on the exercise date. In 2005, the tax benefit associated with this tax deduction, recorded as an increase to equity, was $15 million plus an additional $6 million related to deductions in 2002, 2003 and 2004.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In December 2004, the FASB issued Statement of Financial Accounting Standards No. 123 (revised 2004), “Share-Based Payment” (“SFAS 123R”), which replaces SFAS No. 123, “Accounting for Stock-Based Compensation” (SFAS 123) and supersedes APB Opinion No. 25, “Accounting for Stock Issued to Employees”. SFAS 123R requires all share-based payments to employees, including grants of employee stock options, to be recognized in the financial statements based on their fair values, beginning in our fiscal year ending December 31, 2006. The pro forma disclosures previously permitted under SFAS 123 no longer will be an alternative to financial statement recognition. Under SFAS 123R, we must determine the appropriate fair value model to be used for valuing share-based payments, the amortization method for compensation cost and the transition method to be used at date of adoption. We will use the modified prospective method of adoption which requires that compensation expense be recorded for all unvested stock options and restricted stock at the beginning of the first quarter of adoption of SFAS 123R. MEMC expects that the adoption of SFAS 123R will have an estimated negative $0.04 to $0.05 impact on diluted earnings per share for the year ending December 31, 2006.

See Note 3 of the Consolidated Financial Statements in item (q) for a description of other recent accounting pronouncements, including the expected dates of adoption and estimated effects on results of operations and financial condition.

MARKET RISK

The overall objective of our financial risk management program is to reduce the potential negative earnings effects from changes in foreign exchange and interest rates arising in our business activities. We manage these financial exposures through operational means and by using various financial instruments. These practices may change as economic conditions change.

To mitigate financial market risks of foreign currency exchange rates, we utilize currency forward contracts. We do not use derivative financial instruments for speculative or trading purposes. All of the potential changes noted below are based on sensitivity analyses performed on our financial positions at December 31, 2005 and 2004. Actual results may differ materially.

We generally hedge transactional currency risks with currency forward contracts. Gains and losses on these foreign currency exposures are generally offset by corresponding losses and gains on the related hedging instruments, resulting in negligible net exposure to MEMC.

Our debt obligations are primarily of a fixed-rate nature. An adverse change (defined as a 100 basis point change) in interest rates on our total variable-rate debt outstanding would result in a decline in income before taxes of approximately $0, $1 million and $2 million as of the end of 2005, 2004 and 2003, respectively.

A substantial majority of our revenue and capital spending is transacted in U.S. Dollars. However, we do enter into these transactions in other currencies, primarily, the Euro, the Japanese Yen, and certain other Asian currencies. To protect against reductions in value and volatility of future cash flows caused by changes in foreign exchange rates, we have established transaction-based hedging programs. Our hedging programs reduce, but do not always eliminate, the impact of foreign currency exchange rate movements. In addition to the direct effects of changes in exchange rates, such changes typically affect the volume of sales or the foreign currency sales price as competitors’ products become more or less attractive.

Our Taiwan based subsidiary uses the U.S. Dollar as its functional currency for US GAAP purposes and does not hedge New Taiwanese Dollar exposures.

8

| | | | | | | | | | | | |

| Consolidated Statements of Operations | | | Dollars in thousands, except share data | |

| |

| | | For the year ended December 31, | |

| | | 2005 | | | 2004 | | | 2003 | |

Net sales | | $ | 1,107,379 | | | $ | 1,027,958 | | | $ | 781,100 | |

Cost of goods sold | | | 740,861 | | | | 658,543 | | | | 548,344 | |

| | | | | | | | | | | | |

Gross margin | | | 366,518 | | | | 369,415 | | | | 232,756 | |

Operating expenses: | | | | | | | | | | | | |

Marketing and administration | | | 76,316 | | | | 71,948 | | | | 57,203 | |

Research and development | | | 33,209 | | | | 37,975 | | | | 32,934 | |

Restructuring costs | | | — | | | | (996 | ) | | | — | |

| | | | | | | | | | | | |

Operating income | | | 256,993 | | | | 260,488 | | | | 142,619 | |

| | | | | | | | | | | | |

Nonoperating (income) expense: | | | | | | | | | | | | |

Interest expense | | | 7,256 | | | | 13,512 | | | | 12,931 | |

Interest income | | | (4,156 | ) | | | (5,003 | ) | | | (7,290 | ) |

Royalty income | | | — | | | | (105 | ) | | | (4,056 | ) |

Currency (gains) losses | | | 441 | | | | 1,907 | | | | (13,928 | ) |

Loss on the extinguishment of debt | | | — | | | | 61,403 | | | | — | |

Other, net | | | 1,077 | | | | (9,757 | ) | | | (925 | ) |

| | | | | | | | | | | | |

Total nonoperating (income) expense | | | 4,618 | | | | 61,957 | | | | (13,268 | ) |

| | | | | | | | | | | | |

Income before income tax expense (benefit), equity in income (loss) of joint venture and minority interests | | | 252,375 | | | | 198,531 | | | | 155,887 | |

Income tax expense (benefit) | | | (2,808 | ) | | | (40,119 | ) | | | 36,864 | |

| | | | | | | | | | | | |

Income before equity in income (loss) of joint venture and minority interests | | | 255,183 | | | | 238,650 | | | | 119,023 | |

Equity in income (loss) of joint venture | | | — | | | | (1,717 | ) | | | 6,235 | |

Minority interests | | | (5,830 | ) | | | (10,732 | ) | | | (8,641 | ) |

| | | | | | | | | | | | |

Net income | | $ | 249,353 | | | $ | 226,201 | | | $ | 116,617 | |

| | | | | | | | | | | | |

Basic income per share | | $ | 1.17 | | | $ | 1.09 | | | $ | 0.58 | |

| | | | | | | | | | | | |

Diluted income per share | | $ | 1.10 | | | $ | 1.02 | | | $ | 0.53 | |

| | | | | | | | | | | | |

Weighted average shares used in computing basic income per share | | | 213,513,110 | | | | 207,713,837 | | | | 202,439,828 | |

Weighted average shares used in computing diluted income per share | | | 226,449,944 | | | | 221,047,946 | | | | 218,719,459 | |

See accompanying notes to consolidated financial statements.

9

| | |

| Consolidated Balance Sheets | | Dollars in thousands, except share data |

| | | | | | | | |

| | | As of December 31, | |

| | | 2005 | | | 2004 | |

Assets | | | | | | | | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 126,494 | | | $ | 49,519 | |

Short-term investments | | | 27,117 | | | | 42,795 | |

Accounts receivable, less allowance for doubtful accounts of $1,411 and $2,408 in 2005 and 2004, respectively | | | 125,183 | | | | 158,975 | |

Inventories | | | 119,956 | | | | 127,564 | |

Prepaid and other current assets | | | 37,528 | | | | 29,724 | |

| | | | | | | | |

Total current assets | | | 436,278 | | | | 408,577 | |

Property, plant and equipment, net | | | 494,927 | | | | 444,670 | |

Deferred tax assets, net | | | 165,570 | | | | 119,835 | |

Other assets | | | 51,328 | | | | 55,107 | |

| | | | | | | | |

Total assets | | $ | 1,148,103 | | | $ | 1,028,189 | |

| | | | | | | | |

Liabilities and Stockholders’ Equity | | | | | | | | |

Current liabilities: | | | | | | | | |

Short-term borrowings and current portion of long-term debt | | $ | 18,305 | | | $ | 42,646 | |

Accounts payable | | | 105,500 | | | | 124,083 | |

Accrued liabilities | | | 48,938 | | | | 55,662 | |

Accrued wages and salaries | | | 25,987 | | | | 19,117 | |

Deferred revenue | | | 14,558 | | | | — | |

Customer deposits | | | — | | | | 1,763 | |

Income taxes payable | | | 11,621 | | | | 10,282 | |

| | | | | | | | |

Total current liabilities | | | 224,909 | | | | 253,553 | |

Long-term debt, less current portion | | | 34,821 | | | | 116,082 | |

Pension and post-employment liabilities | | | 91,028 | | | | 96,745 | |

Other liabilities | | | 41,362 | | | | 72,432 | |

| | | | | | | | |

Total liabilities | | | 392,120 | | | | 538,812 | |

| | | | | | | | |

Minority interests | | | 44,646 | | | | 46,479 | |

Commitments and contingencies | | | | | | | | |

Stockholders’ equity: | | | | | | | | |

Preferred stock, $.01 par value, 50,000,000 shares authorized, none issued or outstanding at December 31, 2005 or 2004 | | | — | | | | — | |

Common stock, $.01 par value, 300,000,000 shares authorized, 222,258,808 and 209,108,105 issued at December 31, 2005 and December 31, 2004, respectively | | | 2,223 | | | | 2,091 | |

Additional paid-in capital | | | 191,663 | | | | 154,736 | |

Retained earnings | | | 557,704 | | | | 308,351 | |

Accumulated other comprehensive loss | | | (35,854 | ) | | | (17,389 | ) |

Deferred compensation | | | (128 | ) | | | (1,263 | ) |

Treasury stock: 741,580 and 714,205 shares at 2005 and 2004, respectively | | | (4,271 | ) | | | (3,628 | ) |

| | | | | | | | |

Total stockholders’ equity | | | 711,337 | | | | 442,898 | |

| | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 1,148,103 | | | $ | 1,028,189 | |

| | | | | | | | |

See accompanying notes to consolidated financial statements.

10

| | |

| Consolidated Statements of Cash Flows | | Dollars in thousands |

| | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2005 | | | 2004 (as restated) | | | 2003 (as restated) | |

Cash flows from operating activities: | | | | | | | | | | | | |

Net income | | $ | 249,353 | | | $ | 226,201 | | | $ | 116,617 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | | | |

Depreciation and amortization | | | 57,182 | | | | 44,135 | | | | 31,049 | |

Interest accretion | | | — | | | | 5,248 | | | | 2,824 | |

Minority interests | | | 5,830 | | | | 10,732 | | | | 8,641 | |

Equity in (income) loss of joint venture | | | — | | | | 1,717 | | | | (6,235 | ) |

Currency (gains) losses | | | 441 | | | | 1,907 | | | | (13,928 | ) |

Restructuring costs | | | — | | | | (996 | ) | | | 488 | |

Stock compensation | | | 2,156 | | | | 2,310 | | | | 3,509 | |

Loss on the extinguishment of debt | | | 1,929 | | | | 61,403 | | | | — | |

(Benefit from) provision for deferred taxes | | | (44,114 | ) | | | (105,306 | ) | | | 12,333 | |

Tax benefits of stock compensation | | | 21,218 | | | | — | | | | — | |

Other | | | 13,294 | | | | (4,467 | ) | | | 104 | |

Changes in assets and liabilities: | | | | | | | | | | | | |

Short-term investments – trading securities | | | 8,396 | | | | 31,965 | | | | 1,608 | |

Accounts receivable | | | 27,831 | | | | (45,283 | ) | | | (3,171 | ) |

Inventories | | | 1,258 | | | | (14,035 | ) | | | (18,498 | ) |

Prepaid and other current assets | | | (7,018 | ) | | | 2,877 | | | | (1,714 | ) |

Accounts payable | | | 6,451 | | | | 23,455 | | | | 4,259 | |

Accrued liabilities | | | (4,331 | ) | | | (1,023 | ) | | | (7,576 | ) |

Accrued wages and salaries | | | 8,562 | | | | (4,710 | ) | | | (3,489 | ) |

Deferred revenue | | | 14,558 | | | | — | | | | — | |

Customer deposits | | | (1,765 | ) | | | (14,310 | ) | | | (15,412 | ) |

Income taxes payable | | | 2,548 | | | | 6,355 | | | | (12,161 | ) |

Pension and related liabilities | | | (11,403 | ) | | | (18,423 | ) | | | 10,184 | |

Other noncurrent assets and liabilities | | | (31,380 | ) | | | 48,275 | | | | (10,696 | ) |

| | | | | | | | | | | | |

Net cash provided by operating activities | | | 320,996 | | | | 258,027 | | | | 98,736 | |

| | | | | | | | | | | | |

Cash flows from investing activities: | | | | | | | | | | | | |

Proceeds from sale of time deposits | | | 46,254 | | | | 34,323 | | | | 49,789 | |

Purchases of time deposits | | | (37,885 | ) | | | (26,032 | ) | | | (24,841 | ) |

Capital expenditures | | | (162,738 | ) | | | (145,840 | ) | | | (67,396 | ) |

Purchase of Taisil, net of cash acquired | | | — | | | | (57,226 | ) | | | — | |

Proceeds from sale of property, plant and equipment | | | 21 | | | | 91 | | | | 200 | |

Other | | | 1,736 | | | | — | | | | — | |

| | | | | | | | | | | | |

Net cash used in investing activities | | | (152,612 | ) | | | (194,684 | ) | | | (42,248 | ) |

| | | | | | | | | | | | |

Cash flows from financing activities: | | | | | | | | | | | | |

Net repayments on short-term borrowings | | | (9,054 | ) | | | (11,564 | ) | | | (64,928 | ) |

Proceeds from issuance of long-term debt | | | 60,000 | | | | 60,014 | | | | — | |

Principal payments on long-term debt | | | (149,476 | ) | | | (113,407 | ) | | | (102,098 | ) |

Debt financing fees | | | (1,184 | ) | | | — | | | | — | |

Dividend to minority interest | | | (9,546 | ) | | | (4,765 | ) | | | (2,510 | ) |

Proceeds from issuance of common stock | | | 14,817 | | | | 4,826 | | | | 101,076 | |

| | | | | | | | | | | | |

Net cash used in financing activities | | | (94,443 | ) | | | (64,896 | ) | | | (68,460 | ) |

| | | | | | | | | | | | |

Effect of exchange rate changes on cash and cash equivalents | | | 3,034 | | | | (3,822 | ) | | | 3,196 | |

| | | | | | | | | | | | |

Net increase (decrease) in cash and cash equivalents | | | 76,975 | | | | (5,375 | ) | | | (8,776 | ) |

Cash and cash equivalents at beginning of period | | | 49,519 | | | | 54,894 | | | | 63,670 | |

| | | | | | | | | | | | |

Cash and cash equivalents at end of period | | $ | 126,494 | | | $ | 49,519 | | | $ | 54,894 | |

| | | | | | | | | | | | |

Supplemental disclosures of cash flow information: | | | | | | | | | | | | |

Interest payments, net of amount capitalized | | $ | 6,407 | | | $ | 13,098 | | | $ | 12,797 | |

Income taxes paid | | $ | 27,906 | | | $ | 14,567 | | | $ | 32,076 | |

Supplemental schedule of non-cash investing and financing activities: | | | | | | | | | | | | |

Accounts payable incurred (relieved) for acquisition of fixed assets | | $ | (16,133 | ) | | $ | 3,971 | | | $ | 17,831 | |

See accompanying notes to consolidated financial statements.

11

| | |

| Consolidated Statements of Stockholders’ Equity (Deficiency) | | Dollars in thousands (except share data) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common Stock

Issued | | Additional

Paid-in

Capital | | | Retained

Earnings

(Deficit) | | | Accumulated

Other

Comprehensive

Loss | | | Deferred

Compensation | | | Common Stock

Held in Treasury | | | Total

Stockholders’

Equity

(Deficiency) | | | Total

Comprehensive

Income (Loss) | |

| | | Shares | | Amount | | | | | | Shares | | | Amount | | | |

Balance at December 31, 2002 | | 196,456,334 | | $ | 1,965 | | $ | 26,965 | | | $ | (34,467 | ) | | $ | (7,329 | ) | | $ | (7,094 | ) | | (929,205 | ) | | $ | (4,720 | ) | | $ | (24,680 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | | | — | | | — | | | | 116,617 | | | | — | | | | — | | | — | | | | | | | | 116,617 | | | | 116,617 | |

Net translation adjustment | | | | | — | | | — | | | | — | | | | (10,228 | ) | | | — | | | — | | | | | | | | (10,228 | ) | | | (10,228 | ) |

Minimum pension liability (net of $0 tax) | | | | | — | | | — | | | | — | | | | (15,781 | ) | | | — | | | — | | | | | | | | (15,781 | ) | | | (15,781 | ) |

Stock plans, net | | 1,421,698 | | | 14 | | | 5,738 | | | | — | | | | — | | | | 4,178 | | | 53,750 | | | | 273 | | | | 10,203 | | | | — | |

Contingent performance purchase price | | 10,000,000 | | | — | | | 23,476 | | | | — | | | | — | | | | — | | | — | | | | | | | | 23,476 | | | | — | |

Issuance of common stock | | | | | 100 | | | 93,916 | | | | — | | | | — | | | | — | | | — | | | | | | | | 94,016 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 90,608 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2003 | | 207,878,032 | | $ | 2,079 | | $ | 150,095 | | | $ | 82,150 | | | $ | (33,338 | ) | | $ | (2,916 | ) | | (875,455 | ) | | $ | (4,447 | ) | | $ | 193,623 | | | | | |

Comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | | | — | | | — | | | | 226,201 | | | | — | | | | — | | | — | | | | | | | | 226,201 | | | | 226,201 | |

Net translation adjustment | | | | | — | | | — | | | | — | | | | 22,308 | | | | — | | | — | | | | | | | | 22,308 | | | | 22,308 | |

Minimum pension liability (net of $0 tax) | | | | | — | | | — | | | | — | | | | (6,359 | ) | | | — | | | — | | | | | | | | (6,359 | ) | | | (6,359 | ) |

Stock plans, net | | 1,230,073 | | | 12 | | | 4,641 | | | | — | | | | — | | | | 1,653 | | | 161,250 | | | | 819 | | | | 7,125 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 242,150 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2004 | | 209,108,105 | | $ | 2,091 | | $ | 154,736 | | | $ | 308,351 | | | $ | (17,389 | ) | | $ | (1,263 | ) | | (714,205 | ) | | $ | (3,628 | ) | | $ | 442,898 | | | | | |

Comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | | | — | | | — | | | | 249,353 | | | | — | | | | — | | | — | | | | | | | | 249,353 | | | | 249,353 | |

Net translation adjustment | | | | | — | | | — | | | | — | | | | (22,035 | ) | | | — | | | — | | | | | | | | (22,035 | ) | | | (22,035 | ) |

Minimum pension liability (net of $12,135 tax) | | | | | — | | | — | | | | — | | | | 3,570 | | | | — | | | — | | | | | | | | 3,570 | | | | 3,570 | |

Stock plans, net | | 3,150,703 | | | 32 | | | 37,027 | | | | — | | | | — | | | | 1,135 | | | (27,375 | ) | | | (643 | ) | | | 37,551 | | | | — | |

Net exercise of warrants | | 10,000,000 | | | 100 | | | (100 | ) | | | — | | | | — | | | | — | | | — | | | | | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 230,888 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2005 | | 222,258,808 | | $ | 2,223 | | $ | 191,663 | | | $ | 557,704 | | | $ | (35,854 | ) | | | (128 | ) | | (741,580 | ) | | $ | (4,271 | ) | | $ | 711,337 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

See accompanying notes to consolidated financial statements.

12

| | |

| Notes to Consolidated Financial Statements | | Dollars in thousands, except share data |

1. NATURE OF OPERATIONS

We are a leading worldwide producer of wafers for the semiconductor industry. We operate manufacturing facilities in every major semiconductor manufacturing region throughout the world, including Europe, Japan, Malaysia, South Korea, Taiwan and the United States. Our customers include virtually all of the major semiconductor device manufacturers in the world, including the major memory, microprocessor and applications specific integrated circuit, or ASIC, manufacturers, as well as the world’s largest foundries. We provide wafers in sizes ranging from 100 millimeters (4 inch) to 300 millimeters (12 inch) and in three general categories: prime polished, epitaxial and test/monitor.

2. RESTATEMENT OF CONSOLIDATED FINANCIAL STATEMENTS

On August 7, 2006, the Audit Committee of the Board of Directors of the Company determined that the consolidated statements of cash flows for the years ended December 31, 2004 and 2003 should be restated to properly reflect transactions that were incorrectly classified as operating cash flows by the Company. These transactions relate to the classification within the cash flow statements of capital expenditures and factored receivables. In addition, the Company is restating the consolidated statements of cash flows for changes to the amounts recorded for operating and investing cash flows, exchange rate changes and cash and cash equivalent balances due to an error in classification of cash equivalents and short-term investments.

The following table presents the impact of the restatement on the consolidated statement of cash flows for the company, showing previously reported and restated amounts, for the years ended December 31, 2004 and 2003, respectively (in thousands):

| | | | | | | | | | | | | | | | |

| | | Year Ended

December 31, 2004 | | | Year Ended

December 31, 2003 | |

| | | as previously reported | | | as restated | | | as previously reported | | | as

restated | |

Cash flows from operating activities: | | | | | | | | | | | | | | | | |

Short-term investments – trading securities [2] | | | 34,764 | | | | 31,965 | | | | 12,263 | | | | 1,608 | |

Accounts receivable [1] | | | (27,036 | ) | | | (45,283 | ) | | | (3,171 | ) | | | (3,171 | ) |

Accounts payable [3] | | | 27,426 | | | | 23,455 | | | | 22,090 | | | | 4,259 | |

Net cash provided by operating activities | | | 283,044 | | | | 258,027 | | | | 127,222 | | | | 98,736 | |

| | | | | | | | | | | | | | | | |

Cash flows from investing activities: | | | | | | | | | | | | | | | | |

Proceeds from sale of time deposits [2] | | | — | | | | 34,323 | | | | — | | | | 49,789 | |

Purchases of time deposits [2] | | | — | | | | (26,032 | ) | | | — | | | | (24,841 | ) |

Capital expenditures [3] | | | (149,811 | ) | | | (145,840 | ) | | | (85,227 | ) | | | (67,396 | ) |

Net cash used in investing activities | | | (206,946 | ) | | | (194,684 | ) | | | (85,027 | ) | | | (42,248 | ) |

| | | | | | | | | | | | | | | | |

Cash flows from financing activities: | | | | | | | | | | | | | | | | |

Net short-term borrowings [1] | | | (29,811 | ) | | | (11,564 | ) | | | (64,928 | ) | | | (64,928 | ) |

Net cash provided by financing activities | | | (83,143 | ) | | | (64,896 | ) | | | (68,460 | ) | | | (68,460 | ) |

| | | | | | | | | | | | | | | | |

Effect of exchange rate changes on cash and cash equivalents | | | 2,500 | | | | (3,822 | ) | | | 3,473 | | | | 3,196 | |

| | | | | | | | | | | | | | | | |

Net increase in cash and cash equivalents | | | (4,545 | ) | | | (5,375 | ) | | | (22,792 | ) | | | (8,776 | ) |

Cash and cash equivalents at beginning of period [2] | | | 96,859 | | | | 54,894 | | | | 119,651 | | | | 63,670 | |

Cash and cash equivalents at end of period [2] | | $ | 92,314 | | | $ | 49,519 | | | $ | 96,859 | | | $ | 54,894 | |

| [1] | For the year ended December 31, 2004, the Company did not appropriately account for factored receivables under SFAS 140, “Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities-a replacement of FASB Statement No. 125.” As a result, the Company incorrectly recorded operating cash inflows of $18,247 that should have been recorded as financing cash inflows. |

| [2] | At December 31, 2004 and 2003, the Company incorrectly excluded time deposits with original maturities exceeding three months from investing activities and trading securities from operating activities as these items were incorrectly classified as cash equivalents. |

| [3] | For the years ended December 31, 2004 and 2003, the Company incorrectly recorded non-cash activities related to the financing and payment of fixed asset purchases. Assets acquired but unpaid and accrued in accounts payable were $24,498 and $20,527 as of December 31, 2004 and 2003, respectively. |

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Use of Estimates

In preparing the financial statements, we use estimates and assumptions that may affect reported amounts and disclosures. Estimates are used when accounting for depreciation, amortization, employee benefits and asset valuation allowances. Our actual results could differ from those estimates.

(b) Reclassifications

December 31, 2004 balances have been reclassified to conform with the current period presentation including 1) $42,795 from cash and cash equivalents to short-term investments, 2) increase in accounts receivable and short-term borrowings of $18,247 and 3) $19,682 from pension and post-employment liabilities to accrued liabilities.

(c) Principles of Consolidation

Our consolidated financial statements include the accounts of MEMC Electronic Materials, Inc. and our wholly and majority-owned subsidiaries. We account for investments of less than 50% but greater than 20% in joint venture companies using the equity method. All significant intercompany balances and transactions among

13

our subsidiaries have been eliminated. Following the acquisition of Taisil effective February 1, 2004, we no longer have any significant investments in less than 50% joint venture companies.

(d) Cash Equivalents

Cash equivalents include items such as overnight investments and short-term time deposits with maturity periods of three months or less when purchased.

(e) Short-term Investments

Short-term investments are held by our Korean subsidiary and consist of the following:

| | | | | | |

| | | As of December 31, |

| | | 2005 | | 2004 |

| Dollars in thousands | | | | |

Time deposits | | $ | 19,151 | | $ | 26,825 |

Marketable securities | | | 7,966 | | | 15,970 |

| | | | | | |

| | $ | 27,117 | | $ | 42,795 |

Time deposits are comprised mainly of demand deposits with commercial banks or investment companies having fixed original maturities exceeding three months but less than or equal to one year with fixed interest rates including pre-payment penalties for early withdrawal. Marketable securities are comprised primarily of debt investments with varying maturities and are classified as trading securities and recorded at their fair values. Unrealized gains included in short-term investments at December 31, 2005 and 2004 were $394 and $910, respectively. Unrealized gains or losses were recognized in the Consolidated Statement of Operations as non-operating (income) expense. Total net unrealized gains of $389, $829 and $613 have been included in earnings for the years ended December 31, 2005, 2004 and 2003, respectively.

(f) Inventories

Inventories, which consist of materials, labor and manufacturing overhead, are valued at the lower of cost or market. Inventory costs are based on a weighted average actual cost.

The valuation of inventory requires us to estimate excess and slow moving inventory. The determination of the value of excess and slow moving inventory is based upon assumptions of future demand and market conditions. If actual market conditions are less favorable than those projected by management, additional inventory write-downs may be required.

(g) Property, Plant and Equipment

We record property, plant and equipment at cost and depreciate it evenly over the assets’ estimated useful lives as follows:

| | |

| | | Years |

Buildings and improvements | | 4-60 |

Machinery and equipment | | 1-15 |

Depreciation expense for the years ended December 31, 2005, 2004 and 2003 was $55,305, $42,042 and $27,806, respectively.

Effective in 2003, we prospectively changed our accounting principles to depreciate the cost of significant long-lived spare parts when placed in service, consistent with our fixed asset capitalization policy. Depreciation is recognized evenly over the estimated useful lives of the spare parts. Prior to 2003, we directly expensed the full cost of spare parts when placed in service.