Exhibit 13

Five Year Selected Financial Highlights

The following data has been derived from our annual consolidated financial statements, including the consolidated balance sheets and the related consolidated statements of operations, cash flows, and stockholders’ equity and the notes thereto. The information below should be read in conjunction with our consolidated financial statements and notes thereto including Note 2 related to significant accounting policies.

| | | | | | | | | | | | | | | | | | |

| | | 2009(1) | | | 2008 | | 2007 | | | 2006 | | | 2005 |

| (in millions, except per share and employment data) | | | | | | | | | | | | | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | |

| | | | | |

Net sales | | $ | 1,163.6 | | | $ | 2,004.5 | | $ | 1,921.8 | | | $ | 1,540.6 | | | $ | 1,107.4 |

| | | | | |

Gross profit | | | 128.1 | | | | 1,004.8 | | | 1,000.5 | | | | 689.0 | | | | 366.5 |

| | | | | |

Marketing and administration(2) | | | 161.9 | | | | 106.5 | | | 111.3 | | | | 94.9 | | | | 76.3 |

| | | | | |

Research and development | | | 40.4 | | | | 40.8 | | | 39.3 | | | | 35.8 | | | | 33.2 |

| | | | | |

Restructuring and impairment costs(3) | | | 53.0 | | | | 4.3 | | | — | | | | — | | | | — |

| | | | | |

Operating (loss) income | | | (127.2 | ) | | | 853.2 | | | 849.9 | | | | 558.3 | | | | 257.0 |

| | | | | |

Non-operating (income) expense(4) | | | (27.0 | ) | | | 268.2 | | | (261.9 | ) | | | (32.2 | ) | | | 4.6 |

| | | | | |

Net (loss) income attributable to MEMC stockholders (5) | | | (68.3 | ) | | | 387.4 | | | 826.2 | | | | 369.3 | | | | 249.4 |

| | | | | |

Basic (loss) income per share | | | (0.31 | ) | | | 1.71 | | | 3.66 | | | | 1.66 | | | | 1.17 |

| | | | | |

Diluted (loss) income per share | | | (0.31 | ) | | | 1.69 | | | 3.56 | | | | 1.61 | | | | 1.10 |

| | | | | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | |

| | | | | |

Cash, cash equivalents, restricted cash and short-term and long-term investments | | | 1,074.6 | | | | 1,421.4 | | | 1,329.1 | | | | 588.2 | | | | 153.9 |

| | | | | |

Working capital | | | 740.5 | | | | 981.6 | | | 1,145.3 | | | | 641.7 | | | | 211.4 |

| | | | | |

Total assets | | | 3,566.5 | | | | 2,936.7 | | | 2,887.2 | | | | 1,765.5 | | | | 1,148.1 |

| | | | | |

Long-term debt and capital lease obligations (including current portion) | | | 416.6 | | | | 32.2 | | | 30.9 | | | | 34.4 | | | | 39.9 |

| | | | | |

Total MEMC Stockholders’ equity | | | 2,168.6 | | | | 2,082.0 | | | 2,035.0 | | | | 1,166.9 | | | | 711.3 |

| | | | | |

Other Data: | | | | | | | | | | | | | | | | | | |

| | | | | |

Capital expenditures and construction of solar energy systems | | | 253.4 | | | | 303.6 | | | 276.4 | | | | 148.4 | | | | 162.7 |

| | | | | |

Employees | | | 5,100 | | | | 4,900 | | | 5,400 | | | | 5,500 | | | | 5,400 |

| (1) | On November 20, 2009, we completed the acquisition of Sun Edison LLC (“SunEdison”). Results of operations subsequent to the acquisition date and SunEdison’s assets as of December 31, 2009 are included in the consolidated financial data above. |

| (2) | Effective January 1, 2006, we adopted the fair value recognition provisions for share-based payments. Our stock-based compensation expense recorded to marketing and administration expense was $27.3 million, $19.4 million and $25.1 million, $13.1 million in 2009, 2008, 2007 and 2006, respectively. The amount recorded to marketing and administration expense during 2005 was less than $4 million. |

| (3) | Restructuring and impairment costs include $4.3 million in 2008 previously included in Marketing and administration expenses. |

| (4) | Gains (losses) of $5.4 million, ($292.5) million and $220.8 million were recorded to non-operating income (expense) in 2009, 2008 and 2007, respectively, due to the mark to market adjustment related to a warrant received from a customer. |

| (5) | During 2009, we increased our reserve for uncertain tax positions and tax expense by $18.1 million, including related interest, related to various cost allocations and taxable income adjustments attributable to our foreign operations. During 2008, we decreased our reserve for uncertain tax positions and related income tax expense by $29.5 million due to the closure of the Internal Revenue Service examination in the United States of the 2004 and 2005 audit years. During 2005, we reversed $67.1 million of valuation allowances related to deferred tax assets. This represented the reversal of all remaining valuation allowances on deferred tax assets at that time. |

1

Management’s Discussion and Analysis of Financial Condition and Results of Operations

EXECUTIVE OVERVIEW

On November 20, 2009, we completed the acquisition of Sun Edison LLC (“SunEdison”). MEMC acquired all of the outstanding membership units in SunEdison for a purchase price of approximately $314.6 million consisting of cash, the issuance of MEMC common stock and contingent consideration. As a result of the acquisition, SunEdison became a wholly owned subsidiary of MEMC Holdings Corporation, which is a wholly owned subsidiary of MEMC.

Prior to the acquisition, we were engaged in one reportable segment—the design, manufacture and sale of silicon wafers. With the acquisition of SunEdison, we now also participate in the development and maintenance of solar energy systems and the sale of solar energy. Effective with the SunEdison acquisition, we were engaged in two reportable segments: Materials Business (includes the historical operations of MEMC) and Solar Energy Business (consists solely of SunEdison).

Our Materials Business was greatly affected by reduced consumer spending, limited access to credit and other effects of the macroeconomic environment in 2009. In the semiconductor market, all of this, combined with above normal inventory levels at our customers at the beginning of 2009, resulted in a significant reduction in wafer demand in 2009 compared to the prior year, resulting in lower volumes and pricing for our products.

While volumes for solar wafers in our Materials Business increased in 2009 due to incremental market share gains, a lack of financing for solar projects and continued oversupply of polysilicon contributed to pricing pressure on solar products throughout the value chain. Polysilicon revenues also continued to decline in 2009 compared to 2008 because we made a strategic decision to allocate more raw polysilicon to our wafering operations to meet customer needs as well as due to pricing declines caused by the oversupply discussed above. The combination of lower demand and subsequent lower prices resulted in gross profit being negatively impacted. Polysilicon revenues declined to less than 5% of total sales in 2009.

Although our 2009 fourth quarter revenues continued the downward trend compared to the same period in 2008, sequentially we saw the third quarterly improvement in revenue. As of year end 2009, pricing pressure moderated, product volumes continued to increase and our competitive position is improving.

During this economic downturn, we continue to evaluate our manufacturing capabilities to identify opportunities that could allow us to improve our efficiency in overall manufacturing costs and more effectively serve our customers. In 2009, we announced the termination or eventual termination of just over 1,000 manufacturing employees at our St. Peters, Missouri and Sherman, Texas facilities and our Japanese and Korean subsidiaries. The purpose of the workforce reductions was to better align our costs with short and long-term demand, as well as strategically position our manufacturing facilities geographically closer to a number of our customers. In addition, we continue to invest for growth by expanding our polysilicon manufacturing capabilities and initiating a project to build a solar wafer manufacturing plant.

During the third quarter of 2009, we amended two of our long-term solar wafer supply agreements. Under the amendments, the potential aggregate revenues to MEMC under the agreements in 2009 and over the remaining term of the agreements remain unchanged, but volume increases and price reductions for the remainder of 2009 were effectuated. The amendments also provide a deferral mechanism for a 2009 purchase shortfall by the customers (from the increased volume commitment), by allowing the customers to make up the purchase shortfall in subsequent years.

In January 2010, we reached an out of court settlement of a lawsuit related to our long-term solar wafer supply agreement with Conergy AG (“Conergy”). At the same time, we amended this agreement with Conergy, which amendment included a significant reduction in the minimum quantity of wafers that Conergy must purchase over the remaining eight plus years of the agreement, as well as a minimum market share commitment should Conergy’s demand exceed the reduced quantities. The amendment also modifies the pricing terms to be based on market rates similar to other MEMC long-term solar wafer supply agreements. The amendment includes MEMC permanently retaining a portion of the refundable deposits currently held by us.

In order to reduce our concentration of solar wafer customers, we continue to diversify our customer base by serving additional solar wafer customers beyond our long-term solar wafer supply agreements. By the fourth quarter of 2009, approximately 33% of our solar wafer sales were made to customers with whom we did not have long-term agreements.

In the 2009 third quarter, we finalized a formal joint venture agreement with Q-Cells SE (“Q-Cells”) for the purpose of building large scale solar energy systems. Each party has invested approximately $101.6 million in the venture in 2009. The joint venture company contracts with Q-Cells International to develop, acquire and build the plants. The first solar power plant project was fully constructed in the fourth quarter of 2009 and a contract was executed to sell it to a third party.

2

RESULTS OF OPERATIONS

As discussed in “Financial Condition” below, MEMC acquired SunEdison on November 20, 2009 for $314.6 million. Our results of operations for 2009 include the results of SunEdison from November 21, 2009 through December 31, 2009, which did not have a significant impact to the MEMC consolidated results of operations for the year ended December 31, 2009.

| | | | | | | | | | | | |

Net Sales | | 2009 | | | 2008 | | | 2007 | |

| Dollars in millions | | | | | | | | | |

| | | |

Materials Business: | | | | | | | | | | | | |

| | | |

Net Sales | | $ | 1,159.8 | | | $ | 2,004.5 | | | $ | 1,921.8 | |

| | | |

Percentage Change | | | (42 | )% | | | 4 | % | | | 25 | % |

| | | |

Solar Energy Business: | | | | | | | | | | | | |

Net Sales | | $ | 3.8 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | |

| | | |

Total: | | | | | | | | | | | | |

| | | |

Net Sales | | $ | 1,163.6 | | | $ | 2,004.5 | | | $ | 1,921.8 | |

| | | |

Percentage Change | | | (42 | )% | | | 4 | % | | | 25 | % |

The decrease in our Materials Business sales in 2009 compared to the prior year was primarily the result of pricing decreases of $729.2 million and volume decreases of $121.1 million. Price and volume declines occurred in nearly all products, except for 156 millimeter wafers where we experienced increases of approximately 34% in volumes compared to the prior year. Our overall wafer average selling prices were approximately 45% lower than the overall wafer average selling prices for 2008. This was due to price decreases for all wafers, and to a lesser extent, increases in volumes for 156 millimeter wafers, which have a lower average selling price per wafer. The decrease in sales also resulted from a decrease in polysilicon selling prices which were lower in the current period by approximately 77% compared to the average polysilicon selling prices for 2008, as well as lower volumes. Raw polysilicon sales are expected to remain low as our wafer sales grow and amounted to only 3% in 2009, down from 19% in 2008. While semiconductor demand was down year over year, we have recently seen increases in short-term demand. The significant declines we experienced in short-term pricing for solar wafers in 2009 are expected to moderate in 2010.

Our net sales increased by 4% to $2,004.5 million in 2008 from $1,921.8 million in 2007. This increase was driven by increases in product volumes totaling $108.7 million. Volumes for both 156 millimeter and 300 millimeter wafer shipments increased but were offset by decreases in volumes of all other products, including polysilicon. During 2008, sales for solar applications reached $1 billion. The overall increase in net sales was negatively impacted by pricing decreases of $49.5 million, driven by price decreases for semiconductor wafers, which were only partially offset by price increases for 156 millimeter wafers and intermediate products such as polysilicon, silane gas, ingots and scrap wafers. Our 2008 overall wafer average selling prices were approximately 43% lower than the average selling prices for 2007. This was due to a change in product mix, primarily attributable to the increase in 156 millimeter wafer shipments in 2008, which have a lower average selling price per wafer, as well as price decreases for nearly all diameters of semiconductor wafers. Sales of our excess polysilicon raw material amounted to approximately 19% and 22% of total sales in 2008 and 2007, respectively. Polysilicon selling prices for the year were approximately 15% higher than the average polysilicon selling prices for 2007.

3

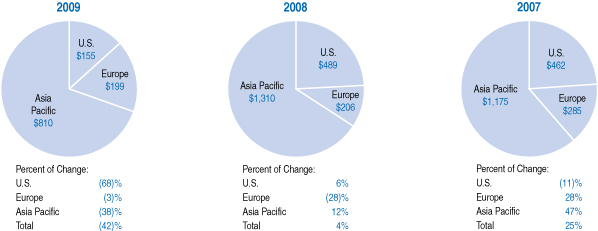

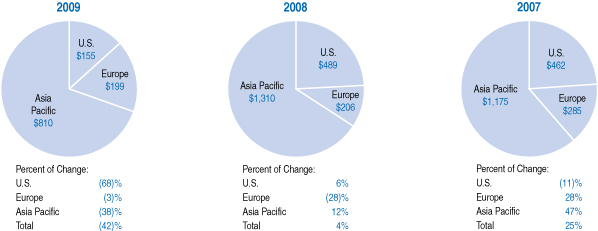

We operate in all the major semiconductor and solar-producing regions of the world, with approximately 87% of our 2009 net sales to customers located outside the United States. Net sales by geographic region for each of the last three years were as follows:

Net Sales by Geographic Area:

Dollars in millions

| | | | | | | | | | | | |

Gross Profit | | 2009 | | | 2008 | | | 2007 | |

| Dollars in millions | | | | | | | | | |

| | | |

Materials Business: | | | | | | | | | | | | |

| | | |

Cost of Goods Sold | | $ | 1,032.8 | | | $ | 999.7 | | | $ | 921.3 | |

| | | |

Gross Profit | | | 127.0 | | | | 1,004.8 | | | | 1,000.5 | |

| | | |

Gross Margin Percentage | | | 11 | % | | | 50 | % | | | 52 | % |

| | | |

Solar Energy Business: | | | | | | | | | | | | |

| | | |

Cost of Goods Sold | | $ | 2.7 | | | $ | — | | | $ | — | |

| | | |

Gross Profit | | | 1.1 | | | | — | | | | — | |

| | | |

Gross Margin Percentage | | | 29 | % | | | — | | | | — | |

| | | | | | | | | | | | |

| | | |

Total: | | | | | | | | | | | | |

| | | |

Cost of Goods Sold | | $ | 1,035.5 | | | $ | 999.7 | | | $ | 921.3 | |

| | | |

Gross Profit | | | 128.1 | | | | 1,004.8 | | | | 1,000.5 | |

| | | |

Gross Margin Percentage | | | 11 | % | | | 50 | % | | | 52 | % |

The decline in our Materials Business gross profit dollars and gross margin percentage for the year ended December 31, 2009 was primarily due to decreased wafer and polysilicon pricing and reduced volumes discussed above. Decreases in 2009 gross profit were also the result of increased costs compared to 2008 related to a lower of cost or market adjustment on our inventory of $2.2 million and increased charges for an adverse annual long-term purchase obligation of $2.2 million compared to the prior year. Finally, our factories were running at less than optimal manufacturing rates, resulting in higher per unit costs compared to the prior year periods.

In 2008 our gross profit increased to $1,004.8 million from $1,000.5 million in 2007 primarily due to improved volume and mix of 156 millimeter wafers and 300 millimeter wafers, partially offset by pricing declines as described above. The decrease in gross margin percentage of 2% is primarily the result of overall price declines across most diameters and decreases in polysilicon and intermediate product volumes, as well as the impact of abnormal costs of approximately $16 million in 2008 due to an adverse annual long-term purchase obligation and unallocated fixed overhead costs.

4

| | | | | | | | | | | | |

Marketing and Administration | | 2009 | | | 2008 | | | 2007 | |

| Dollars in millions | | | | | | | | | |

| | | |

Materials Business: | | | | | | | | | | | | |

| | | |

Marketing and Administration | | $ | 150.6 | | | $ | 106.5 | | | $ | 111.3 | |

| | | |

As a Percentage of Materials Business Net Sales | | | 13 | % | | | 5 | % | | | 6 | % |

| | | |

Solar Energy Business: | | | | | | | | | | | | |

| | | |

Marketing and Administration | | $ | 11.3 | | | $ | — | | | $ | — | |

| | | |

As a Percentage of Solar Energy Business Net Sales | | | 297 | % | | | — | | | | — | |

| | | | | | | | | | | | |

| | | |

Total: | | | | | | | | | | | | |

| | | |

Marketing and Administration | | $ | 161.9 | | | $ | 106.5 | | | $ | 111.3 | |

| | | |

As a Percentage of Consolidated Net Sales | | | 14 | % | | | 5 | % | | | 6 | % |

The increase in marketing and administration expenses for our Materials Business for the year ended December 31, 2009 resulted from pre-operating start-up costs for our new manufacturing facility in Ipoh, Malaysia of $14.1 million, increased legal professional services costs of $5.2 million and increased selling costs of $4.6 million. Additional increases include an $8.8 million accrual for a lawsuit we recorded in the second quarter of 2009 compared to net favorable legal settlements in the prior year of $4.3 million. Excluding a benefit in 2008 recognized upon the resignation of a former executive officer of $15.5 million, our stock compensation expense decreased $9.2 million in 2009 compared to the prior year.

Marketing and administration expenses were $106.5 million in 2008 compared to $111.3 million in 2007. The change was primarily due to a decrease in stock compensation expense of $5.7 million driven by the forfeiture of stock options related to the resignation of a former executive officer of $15.5 million, slightly offset by the adjustment of estimated forfeiture rates and new award grants. The change was also due to an additional $5.7 million recorded to our allowance for doubtful accounts compared to the prior year and net favorable legal settlements of $4.3 million.

| | | | | | | | | | | | |

Research and Development | | 2009 | | | 2008 | | | 2007 | |

| Dollars in millions | | | | | | | | | |

| | | |

Materials Business: | | | | | | | | | | | | |

| | | |

Research and Development | | $ | 40.2 | | | $ | 40.8 | | | $ | 39.3 | |

| | | |

As a Percentage of Materials Business Net Sales | | | 3 | % | | | 2 | % | | | 2 | % |

| | | |

Solar Energy Business: | | | | | | | | | | | | |

| | | |

Research and Development | | $ | 0.2 | | | $ | — | | | $ | — | |

| | | |

As a Percentage of Solar Energy Business Net Sales | | | 5 | % | | | — | | | | — | |

| | | | | | | | | | | | |

| | | |

Total: | | | | | | | | | | | | |

| | | |

Research and Development | | $ | 40.4 | | | $ | 40.8 | | | $ | 39.3 | |

| | | |

As a Percentage of Consolidated Net Sales | | | 3 | % | | | 2 | % | | | 2 | % |

R&D expenses in our Materials Business consisted mainly of product and process development efforts to increase our capability in the areas of flatness, particles and crystal defectivity. During 2009, we shifted our silicon-on-insulator project from R&D to the production phase, which contributed to the decrease in spending compared to the prior year. Our research and development expenses increased to $40.8 million in 2008 compared to $39.3 million in 2007 mainly due to increased raw material and labor costs on next generation products and higher patent-related professional fees.

| | | | | | | | | | | |

Restructuring and Impairment Costs | | 2009 | | | 2008 | | | 2007 |

| Dollars in millions | | | | | | | | |

| | | |

Materials Business: | | | | | | | | | | | |

| | | |

Restructuring and Impairment Costs | | $ | 53.0 | | | $ | 4.3 | | | $ | — |

| | | |

As a Percentage of Materials Business Net Sales | | | 5 | % | | | 0.2 | % | | | — |

In order to better align manufacturing capabilities to projected manufacturing needs for the Materials Business, MEMC committed to workforce reductions during the second quarter of 2008 (the “2008 Plan”) and again in the first and second quarters of 2009 (the “2009 Global Plan”). In September 2009, MEMC committed to actions to reduce manufacturing costs by shifting manufacturing from our St. Peters, Missouri and Sherman, Texas facilities to other locations which are closer to a number of MEMC’s customers in the Asia Pacific region (the “2009 US Plan”).

5

The 2009 Global Plan actions reduced our workforce by approximately 500 employees, from 4,800 prior to the reductions. Severance and other costs associated with this plan totaled $12.3 million in 2009. We expect that the 2009 Global Plan reductions in force will result in annualized cost savings of approximately $30 million, primarily in cost of goods sold, because a majority of those affected are manufacturing facility employees. We began realizing some of these savings in the second quarter of 2009.

The 2009 US Plan actions are expected to affect approximately 540 employees in the United States. MEMC will provide severance benefits to those employees who will be terminated, and expects to incur total severance charges related to the terminations of approximately $19 million. We recorded $16.1 million of these charges in 2009 and expect to make the related severance payments at the time of the final production dates for the facilities through the second quarter of 2011. We also anticipate charges of approximately $15.6 million for other related move costs and contract terminations associated with the closings will be expensed as incurred until the final production date in the respective U.S. facilities. In total, we estimate we will incur approximately $34.6 million in cash costs classified as restructuring expenses associated with these announcements. We estimate that the facility closings will result in an annualized savings beginning in the third quarter of 2010 of approximately $10 million, rising to approximately $55 million of annualized savings beginning in the second quarter of 2011.

Due to the significance of the actions announced as part of the 2009 US Plan discussed above, we performed an asset impairment analysis of our St. Peters, Missouri and Sherman, Texas long-lived manufacturing asset groups during the third quarter of 2009. This analysis resulted in asset impairment charges of $24.6 million in the third quarter of 2009 related to these long-lived manufacturing asset groups. These charges were recorded in restructuring and impairment costs in our condensed consolidated statements of operations.

| | | | | | | | | | | | |

Non-operating (Income) Expense | | 2009 | | | 2008 | | | 2007 | |

| Dollars in millions | | | | | | | | | |

| | | |

Materials Business: | | | | | | | | | | | | |

| | | |

Interest Expense | | $ | 2.2 | | | $ | 1.8 | | | $ | 1.4 | |

| | | |

Interest Income | | | (26.5 | ) | | | (46.4 | ) | | | (45.0 | ) |

| | | |

Decline (Increase) in Fair Value of Warrant | | | (5.4 | ) | | | 292.5 | | | | (220.8 | ) |

| | | |

Other, Net | | | 1.0 | | | | 20.3 | | | | 2.5 | |

| | | | | | | | | | | | |

| | | |

Total | | $ | (28.7 | ) | | $ | 268.2 | | | $ | (261.9 | ) |

| | | |

Solar Energy Business: | | | | | | | | | | | | |

| | | |

Interest Expense | | $ | 1.8 | | | $ | — | | | $ | — | |

| | | |

Interest Income | | | — | | | | — | | | | — | |

| | | |

Other, Net | | | (0.1 | ) | | | — | | | | — | |

| | | | | | | | | | | | |

| | | |

Total | | $ | 1.7 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | |

| | | |

Consolidated Total | | $ | (27.0 | ) | | $ | 268.2 | | | $ | (261.9 | ) |

| | | | | | | | | | | | |

Interest income relates to returns on cash equivalents, restricted cash and investments. Interest income was lower in 2009 compared to 2008 and 2007 due to lower average cash equivalent and investment balances throughout the year as we adjusted our portfolio of investments to fund current and future operations and acquisitions.

Decline (increase) in fair value of warrant represents the mark-to-market adjustment for a warrant received from Suntech Power Holdings (“Suntech”). We recorded an increase in the estimated fair value of the warrant of $5.4 million in 2009 compared to a decrease of $292.5 million in 2008 and an increase of $220.8 million in 2007. The change in the estimated fair value of the warrant is driven by the change in the price of Suntech’s ordinary shares, which had a price per share of $16.63, $11.70 and $82.32 at December 31, 2009, 2008 and 2007, respectively.

Other, net expense for the Materials Business in 2009 and 2008 included $2.3 million and $14.5 million, respectively, of other than temporary impairments on our investments. There were no other than temporary impairments on our investments in 2007.

6

| | | | | | | | | | | | |

Income Taxes | | 2009 | | | 2008 | | | 2007 | |

| Dollars in millions | | | | | | | | | |

| | | |

Materials Business: | | | | | | | | | | | | |

| | | |

Income Tax (Benefit) Expense | | $ | (38.5 | ) | | $ | 195.4 | | | $ | 282.2 | |

| | | |

Income Tax Rate as a % of Materials Business (Loss) Income before Income Taxes | | | 44 | % | | | 33 | % | | | 25 | % |

| | | |

Solar Energy Business: | | | | | | | | | | | | |

| | | |

Income Tax (Benefit) | | $ | (3.7 | ) | | $ | — | | | $ | — | |

| | | |

Income Tax Rate as a % of Solar Energy Business Loss before Income Taxes | | | 31 | % | | | — | | | | — | |

| | | |

Consolidated Total: | | | | | | | | | | | | |

| | | |

Income Tax (Benefit) Expense | | $ | (42.2 | ) | | $ | 195.4 | | | $ | 282.2 | |

| | | |

Income Tax Rate as a % of Consolidated (Loss) Income before Income Taxes | | | 42 | % | | | 33 | % | | | 25 | % |

In 2009, we recorded an income tax benefit of $42.2 million representing 42% of loss before income taxes and noncontrolling interests compared to income tax expense of $195.4 million representing 33% of income before income taxes and noncontrolling interests in 2008. The income tax benefit for 2009 resulted from tax losses in higher rate jurisdictions, which can be carried back and applied against prior taxable income, offset by taxable income in lower rate jurisdictions. The current tax benefit is partially offset by the net increase to the reserve for uncertain tax positions of $18.1 million including interest, primarily related to various cost allocations and taxable income adjustments attributable to our foreign operations. In addition, during the year ended December 31, 2009, we recorded additional tax expense of approximately $5.0 million primarily related to interest and penalties assessed by taxing authorities related to exams for the 2006 and 2007 tax years and deferred tax adjustments related to prior years.

The tax expense for 2008 is primarily a result of the non-taxable loss for the mark-to-market adjustment associated with the Suntech warrant. This expense was partially offset by a decrease in the reserve for uncertain tax positions of $44.0 million, including related interest, reducing income tax expense by $29.5 million and increasing income taxes payable by $14.5 million. This was due to the closure of the Internal Revenue Service examination in the United States of the 2004 and 2005 audit years, as well as earnings generated by foreign subsidiaries whose earnings are being permanently reinvested abroad and taxed at lower rates. The 2008 increase in the effective tax rate of 8.0 percentage points as compared to 2007 is a result of the non-taxable loss in 2008 for the mark-to-market adjustment associated with the Suntech warrant for 2008 compared to the non-taxable gain in 2007.

Certain of our Asian subsidiaries have been granted a concessionary tax rate of between 0% and 10% on all qualifying income for a period of up to five to seven years based on investments in certain machinery and equipment and other development and expansion activities, resulting in a tax benefit for 2009 and 2008 of approximately $9.6 million and $37.0 million, respectively. There was no similar tax benefit in 2007. Under the awards, the income tax rate for qualifying income will be taxed at an incentive tax rate lower than the corporate tax rate. The last of these incentives are scheduled to expire in 2016.

We are currently under examination in the U.S. and Italy for the 2006 through 2009 tax years. During the year ended December 31, 2009, we received proposed adjustments from certain taxing authorities related to various cost allocations and taxable income adjustments attributable to our foreign operations during the periods under audit. We disagree with these adjustments and intend to vigorously contest them. We believe it is reasonably possible that the examination could be completed within the next twelve months. The amount of adjustment, if any, and the timing of such adjustment, however, are not reasonably estimable at this time.

We believe our tax positions are in compliance with applicable tax laws and regulations. We routinely review our estimate for our uncertain tax positions and during the year ended December 31, 2009 increased the unrecognized benefit by $18.1 million, including amounts related to interest and penalties for previously identified issues. There is a risk that the amounts ultimately resolved could be materially different from the amounts previously included or reserved for in our income tax liabilities, which could therefore have a material impact on our tax provision, net income, tax liabilities and cash flows in future periods.

| | | | | | | | | | |

Equity in Earnings of Joint Venture, Net of Tax | | 2009 | | | 2008 | | 2007 |

| Dollars in millions | | | | | | | |

| | | |

Materials Business: | | | | | | | | | | |

| | | |

Equity in earnings of joint venture, net of tax | | $ | (11.8 | ) | | $ | — | | $ | — |

In August 2009, we entered into a formal joint venture agreement with Q-Cells SE, a major solar cell producer, to form a joint venture for the purpose of constructing and selling solar energy systems. We sell solar wafers to the solar cell producer and eliminate our pro rata share of the profit on these sales, which is recorded to equity in earnings of joint venture, net of tax in the statement of operations.

7

We expect to recognize the profit on these sales once the solar project is sold to a third party. The first solar power plant project was fully constructed in the fourth quarter of 2009 and a contract was executed to sell it to a third party. The joint venture did not record revenue from the sale of the solar power plant in 2009 because certain administrative prerequisites will not be completed until early 2010. Once all revenue recognition criteria have been met, we will recognize deferred profit of $8.8 million in equity of earnings of joint venture, net of tax. This contract resulted in the joint venture also recognizing an impairment on the solar power plant assets. MEMC’s share of the impairment was approximately $3.0 million, which impairment was recorded in equity in earnings of joint venture as of December 31, 2009. The sale contract requires the majority of payment to be completed by the end of the second quarter of 2010. The parties can then return the proceeds of that sale to the joint venture partners or leave the investment in the entity for one or more future solar power plant projects.

FINANCIAL CONDITION

MEMC acquired SunEdison on November 20, 2009 for $314.6 million by paying cash, issuing MEMC common stock and providing contingent consideration. We recorded $285.3 million of goodwill as a result of our preliminary allocation of the total consideration to tangible and intangible assets acquired and liabilities assumed from SunEdison based on our estimate of their respective fair values at the acquisition date.

Cash and cash equivalents decreased $355.6 million from $988.3 million at December 31, 2008 to $632.7 million at December 31, 2009. See additional discussion in “Liquidity and Capital Resources” below.

Current restricted cash of $37.4 million and non-current restricted cash of $21.0 million at December 31, 2009 consists of cash on deposit in financial institutions restricted from use in operations relating mainly to our Solar Energy Business segment.

Short-term and long-term investments of $383.5 million at December 31, 2009 decreased $49.6 million from $433.1 million at December 31, 2008. This decrease was primarily due to sales and maturities of available for sale investments of $272.5 million and sales of trading securities of $10.9 million, slightly offset by net purchases of cost and equity method investments of $121.7 million and available for sale investments of $10.9 million during the period. The remaining difference is mainly due to net increases in the fair value of our investments compared to the prior year. As of December 31, 2009, we classified $21.1 million of corporate bonds, asset-backed and mortgage-backed securities as non-current assets due to the current conditions in the general debt markets as further discussed in “Liquidity and Capital Resources” below. In addition, at December 31, 2009 we held $110.8 million in fixed income funds with the intent of holding them for a period exceeding 12 months.

Our accounts receivable decreased $24.0 million to $173.3 million at December 31, 2009, compared to $197.3 million at the end of 2008. As a result of the purchase of SunEdison, our accounts receivable balance increased $6.0 million on November 20, 2009. Our overall days sales outstanding was 44 days at December 31, 2009 compared to 42 days at the end of 2008, based on annualized fourth quarter sales for the respective years. The decrease in accounts receivable was primarily attributable to the decrease in sales of $69.0 million, offset by a decrease in past due amounts.

Our inventories at December 31, 2009 increased $79.5 million or 98% to $160.8 million from the prior year. As a result of the purchase of SunEdison, our inventories increased $36.4 million on November 20, 2009. Materials Business inventories increased primarily due to higher production volumes, more continuous production cycles and our decision to build inventories to enhance product availability for our customers. Our Materials Business annualized inventory turns, calculated as the ratio of annualized fourth quarter cost of goods sold divided by the year-end inventory balance, were approximately nine times at December 31, 2009 versus approximately 11 times at December 31, 2008. We sell our products to certain customers under consignment arrangements. Generally, these consignment arrangements require us to maintain a certain quantity of product in inventory at the customer’s facility or at a storage facility designated by the customer. At December 31, 2009, we had $18.9 million of inventory held on consignment, compared to $15.1 million at December 31, 2008.

Income taxes receivable of $72.5 million at December 31, 2009 primarily consist of U.S. net operating losses that can be carried back, resulting in expected future refunds for tax amounts previously paid.

Prepaid and other current assets at December 31, 2009 increased $48.1 million to $87.0 million over the prior year which included an increase of $13.6 million related to the acquired balance from SunEdison. The remaining increase was primarily due to deferred tax assets recorded for net operating losses in foreign taxing jurisdictions.

Our net property, plant and equipment at December 31, 2009 increased $419.5 million to $1,460.7 million over the prior year. As a result of the purchase of SunEdison, we increased our property, plant and equipment by $325.6 million, which included $248.9 million of solar energy systems. The remaining increase was primarily due to capital expenditures of $225.4 million related to expansions at our plants in Merano, Italy, Pasadena, Texas, Ipoh, Malaysia and Hsinchu, Taiwan, construction of solar energy systems of $28.0 million and foreign currency changes, offset by depreciation expense of $122.8 million and asset impairments of $24.6 million. Included in property, plant and equipment is $109.8 million in capital leases related to the Solar Energy Business segment at December 31, 2009.

8

Our net deferred tax assets totaled $127.1 million at December 31, 2009 (of which $31.8 million of current deferred tax assets was included in prepaid and other assets) compared to $70.7 million at December 31, 2008 (of which $1.0 million of current deferred tax assets was included in prepaid and other assets). In 2009, the increase of $56.4 million in net deferred tax assets is primarily attributed to additional deferred tax assets associated with the purchase of SunEdison and net operating losses which cannot be carried back and will be utilized against future income. At December 31, 2009, we have valuation allowances of $21.4 million, primarily related to net operating losses acquired through the purchase of SunEdison, reducing our net deferred tax assets to $127.1 million. We believe that it is more likely than not, with our projections of future taxable income, that we will generate sufficient taxable income to realize the benefits of the net deferred tax assets (which have not been offset by a valuation allowance) at December 31, 2009.

Customer warrant increased from $13.8 million at December 31, 2008 to $19.2 million at December 31, 2009. The current year increase represents the change in the estimated fair value of the Suntech warrant and is mainly due to the increase in the price of Suntech’s ordinary shares.

Goodwill and intangible assets at December 31, 2009 consist of goodwill of $285.3 million and intangibles of $41.8 million, net of amortization of $0.4 million, recorded as a result of the purchase of SunEdison on November 20, 2009.

Other assets increased $23.7 million to $91.1 million at December 31, 2009 from $67.4 million at December 31, 2008. This increase is mainly due to an income tax receivable of $16.4 million related to revised estimates and interest as well as an increase in our U.S. pension asset.

Current portion of long-term debt and capital leases increased $26.1 million to $32.2 million at December 31, 2009. This increase was due to the purchase of SunEdison on November 20, 2009. SunEdison’s current portion of long-term debt and capital leases of $28.0 million at December 31, 2009 relates primarily to solar energy systems.

Accrued liabilities increased $39.3 million to $106.8 million at December 31, 2009 from $67.5 million at December 31, 2008. As a result of the purchase of SunEdison on November 20, 2009, we had SunEdison accrued liabilities of $11.4 million at December 31, 2009. In addition, accrued liabilities increased by $15.2 million due to the restructuring accrual for the plant closures announced in the third quarter of 2009, $8.8 million for the elimination of profit related to the Q-Cells joint venture and $8.8 million due to the accrual for a lawsuit. These increases were partially offset by a $12.8 million payment for accrued withholding taxes.

Short-term customer deposits decreased $103.4 million to $83.6 million at December 31, 2009, primarily due to repayments of refundable customer deposits related to long-term supply agreements of $36.0 million, the application of $44.1 million of deposits against outstanding accounts receivable balances and reclassifications to long-term liabilities based on the amendment of one of our long-term customer agreements. Under the amendment, we will now retain an additional $11.6 million of previously refundable deposits as deferred revenue. In addition, deposits of $12.3 million previously due on January 1, 2010 are no longer due within twelve months of December 31, 2009. These decreases were all slightly offset by a reclassification from other long-term liabilities for the current portion of the refundable customer deposits that are scheduled to be repaid in January 2010.

Long-term debt and capital leases, less current portion increased $358.3 million to $384.4 million at December 31, 2009. This increase is due to the purchase of SunEdison which had long-term debt and capital leases of $363.2 million at December 31, 2009.

Long-term deferred revenue relates to long-term customer supply agreements and the original estimated fair value of the warrant described above. We will recognize the deferred revenue on a pro-rata basis as product is shipped over the life of the agreements. The increase in deferred revenue from $88.8 million at December 31, 2008 to $106.3 million at December 31, 2009 is primarily the result of an amendment to a long-term solar wafer supply agreement. As a result of the amendment, we recorded an additional $11.6 million in deferred revenue to recognize deposits previously provided that are no longer refundable by us, as well as $5.6 million related to the fair value of other consideration received. The remaining difference was due to increased non-refundable deposits of $4.0 million received in connection with our long-term supply agreements, offset by deferred revenue recognized in 2009 of $3.7 million.

Other non-current liabilities increased $127.2 million to $313.3 million at December 31, 2009, compared to $186.1 million at December 31, 2008. As a result of the purchase of SunEdison on November 20, 2009, we assumed other non-current liabilities related to SunEdison of $89.7 million at December 31, 2009. Of this amount, $77.4 million is an estimate of contingent consideration discussed below. The remaining increase was primarily due to an increase of $18.1 million in unrecognized tax benefits related to revised estimates and interest, an increase of $12.3 million due to a reclassification of customer deposits discussed above and an accrual for a lawsuit we recorded in the second quarter of 2009.

The contingent consideration is to be paid to the former SunEdison unit holders if certain operational criteria are met from January 1, 2010 through December 31, 2010. This consideration is to be paid in the form of a combination of cash and MEMC common stock. In order for the full consideration to be paid, the surviving SunEdison entity would have to install 150 megawatts of solar photovoltaic projects and achieve certain profitability thresholds. This would entitle the former SunEdison unit holders to an additional $89.0 million of cash and MEMC common stock. If SunEdison completes less than 80 megawatts of solar photovoltaic projects in 2010, no contingent consideration will be paid. If 80 megawatts or more is completed, the SunEdison unit holders will receive between $25.0 million and $89.0 million of cash and MEMC common stock, based on the terms of the merger agreement. MEMC has estimated and

9

recorded the fair value of the contingent consideration at $77.0 million, which reflects a discount at a credit adjusted interest rate for the period of the contingency, as of the acquisition date. Any future revisions to the estimated fair value of the contingent consideration will be recorded to the statement of operations.

LIQUIDITY AND CAPITAL RESOURCES

| | | | | | | | | | | | |

| | | 2009 | | | 2008 | | | 2007 | |

| Dollars in millions | | | | | | | | | |

| | | |

Net Cash Provided by (Used in): | | | | | | | | | | | | |

| | | |

Operating Activities | | $ | 33.0 | | | $ | 640.9 | | | $ | 917.2 | |

| | | |

Investing Activities | | | (299.8 | ) | | | (335.4 | ) | | | (688.9 | ) |

| | | |

Financing Activities | | | (91.7 | ) | | | (153.3 | ) | | | 76.9 | |

In 2009, we generated $33.0 million of cash from operating activities, compared to $640.9 million in 2008 and $917.2 million in 2007. This decrease in 2009 compared to 2008 was a result of a substantial decrease in operating income slightly offset by favorable changes in working capital and non-current assets and liabilities, as well as a decrease in pension and post-employment contributions. The decrease was also offset by the application of $44.1 million of refundable deposits against outstanding receivables related to supply agreements in year ended December 31, 2009 and $11.6 million of previously refundable deposits that are no longer refundable due to a solar wafer supply agreement amended in the third quarter of 2009.

In 2008, we generated $640.9 million of cash from operating activities, compared to $917.2 million in 2007. The year over year decrease was due to contributions of $76.3 million to our pension and post-employment plans and changes in working capital, including changes in income taxes payable and inventories, as well as non-current assets and liabilities and deferred revenue.

Our principal sources and uses of cash during 2009 were as follows:

Sources:

| | • | | Generated $33.0 million from operations; |

| | • | | Received $283.4 million from investments; and |

| | • | | Received $78.1 million from the financing and sale/leaseback of solar energy systems. |

Uses:

| | • | | Invested $253.4 million in capital expenditures and solar energy systems; |

| | • | | Paid $188.5 million to purchase SunEdison, net of cash acquired; |

| | • | | Repaid $15.6 million related to the financing and sale/leaseback of solar energy systems; |

| | • | | Purchased $132.6 million of investments; and |

| | • | | Refunded $90.4 million, net in customer deposits related to long-term supply agreements. |

At December 31, 2009, we had approximately $115.5 million of committed capital expenditures in our Materials Business. Capital expenditures in 2009 and committed capital expenditures for 2010 primarily relate to increasing our capacity and expanding capability for our next generation products and polysilicon capacity. We currently expect our 2010 capital expenditures in our Materials Business to be approximately 20% of our consolidated revenue.

Our SunEdison business will require access to significant capital resources to fund its expected rapid growth. During the construction phase of solar power plants, we will provide temporal financial support to a project LLC to fund engineering, procurement and installation costs. Once complete, we will either directly sell the project in its entirety to a third party or obtain more permanent capital on behalf of the LLC through debt, sale/leaseback or other financing structures that will typically be secured by the energy producing assets and by the expected cash flows from energy sale.

The total capital necessary will be directly related to the amount of megawatts of energy producing assets installed and interconnected. The company expects its existing liquidity position which includes a revolving credit facility will provide sufficient capital to support the construction phase of its current backlog of projects for 2010 and 2011. The company expects its continuing and concerted effort to secure more permanent sources of non-recourse project capital to generate sufficient resources to support its growth, but the ultimate rate of growth in this business will be dependent upon the market’s appetite for solar project backed debt and the rate associated with that debt.

10

In 2009, cash used in financing activities was $91.7 million, compared to $153.3 million in 2008. The decrease was mainly due to repurchases of our common stock of $15.8 million in 2009 compared to $321.0 million in 2008. Additionally, we repaid approximately $90.4 million, net, in connection with customer deposits related to supply agreements in 2009 compared to $138.0 million received in 2008. These deposits are either refundable to the customer over two years, at the end of the contract or are applied against a portion of current sales on credit. Deposits that are refundable over two years are scheduled to be replaced each year with new deposits based on volume commitments stated in the contract to reduce our risks associated with nonfulfillment of the contract by the customers. The net repayment of customer deposits also includes $11.6 million of previously refundable deposits that are no longer refundable due to a solar wafer supply agreement amended in the third quarter of 2009. Decreases in refundable deposits were also due to application of $44.1 million against outstanding receivables related to supply agreements in the year ended December 31, 2009. Also contributing to the decrease in cash used in financing activities was the excess tax benefits from share-based payment arrangements decrease to $0.3 million in 2009, compared to $19.0 million in 2008, and decrease to $0.7 million in 2009 received in connection with stock option exercises, compared to $19.9 million in 2008.

On July 21, 2005, we entered into a five-year, $200.0 million revolving credit facility agreement with National City Bank of the Midwest, US Bank National Association, and such other lending institutions. This agreement was terminated on December 23, 2009 and replaced with a new revolver with a separate lead bank (see below). Due to the termination of the facility, we recorded additional interest expense of $0.2 million in the quarter ended December 31, 2009 to write-off the remaining balance of the deferred debt issue costs associated with this facility.

On December 23, 2009, we entered into a new corporate revolving credit agreement with Bank of America, N.A., PNC Bank, National Association, US Bank National Association and other lenders named therein and such other lending institutions as may from time to time become lenders (the “Corporate Credit Facility”). The Corporate Credit Facility provides for a $250.0 million revolving credit facility and has a term of three years. The new facility contains an accordion feature, allowing us to request an increase in the size of the facility, up to an aggregate of $400.0 million, upon terms to be agreed upon by the parties at the time of such request.

Interest on borrowings under the Corporate Credit Facility will be based on our election at LIBOR plus an applicable margin (currently 2.50%) or at a defined prime rate plus an applicable margin (currently 1.50%). The Corporate Credit Facility also provides for us to pay various fees, including a commitment fee (currently 0.50%) on the lenders’ commitments. The Corporate Credit Facility contains certain covenants typical for credit arrangements of this size, including covenants relating to a consolidated interest charge ratio, consolidated leverage ratio and a minimum liquidity ratio. Repayment of any amounts borrowed under the new facility is guaranteed by certain of our subsidiaries. The obligations of MEMC and the guaranty obligations of the subsidiaries are secured by a pledge of the capital stock of certain domestic and foreign subsidiaries of MEMC. The other assets of MEMC are not pledged as security for the facility. As of December 31, 2009, we had no outstanding borrowings under this facility, although we had approximately $83.5 million of outstanding third party letters of credit backed by this facility at such date. We met all covenants under this facility at December 31, 2009.

Our solar energy systems for which we have capital lease and finance obligations are included in separate legal entities. The capital lease and finance obligations have recourse to those entities but limited or no recourse to the MEMC parent or SunEdison parent legal entities.

Credit facilities and related borrowings outstanding excluding solar energy system financing at December 31, 2009 were as follows:

| | | | | | |

| | | Committed | | Outstanding |

| Dollars in millions | | | | |

| | |

Long-term Debt | | $ | 316.9 | | $ | 28.4 |

| | |

Short-term Borrowings | | | 26.9 | | | — |

| | | | | | |

| | |

Total | | $ | 343.8 | | $ | 28.4 |

| | | | | | |

Of the $316.9 million in committed long-term financing arrangements, $93.2 million is unavailable because it relates to the issuance of third party letters of credit. Our weighted-average cost of borrowing was 3.0% at December 31, 2009 and 2.2% at December 31, 2008, respectively. Our short-term borrowings are subject to renewal annually with each financial institution through the course of the year.

11

Our contractual obligations as of December 31, 2009 were as follows:

| | | | | | | | | | | | | | | |

| | | Payments Due By Period |

Contractual Obligations | | Total | | Less than

1 Year | | 1-3

Years | | 4-5

Years | | After 5

Years |

| Dollars in millions | | | | | | | | | | |

| | | | | |

Capital Leases | | $ | 185.9 | | $ | 19.7 | | $ | 36.5 | | $ | 19.1 | | $ | 110.6 |

| | | | | |

Long-term Debt | | | 273.5 | | | 16.7 | | | 27.1 | | | 24.7 | | | 205.0 |

| | | | | |

Operating Leases | | | 28.3 | | | 7.2 | | | 9.6 | | | 5.5 | | | 6.0 |

| | | | | |

Purchase Obligations1 | | | 850.1 | | | 98.5 | | | 187.1 | | | 162.2 | | | 402.3 |

| | | | | |

Committed Capital Expenditures2 | | | 121.1 | | | 121.1 | | | — | | | — | | | — |

| | | | | |

Employee Related Liabilities3 | | | 73.3 | | | 0.3 | | | — | | | — | | | — |

| | | | | |

Other Long-term Liabilities—Uncertain Tax Positions4 | | | 74.0 | | | 74.0 | | | — | | | — | | | — |

| | | | | |

Customer Deposits5 | | | 200.0 | | | 83.0 | | | 117.0 | | | — | | | — |

| | | | | |

Contingent Consideration Liability6 | | | 77.4 | | | — | | | 77.4 | | | — | | | — |

| | | | | | | | | | | | | | | |

| | | | | |

Total Contractual Obligations | | $ | 1,883.6 | | $ | 420.5 | | $ | 454.7 | | $ | 211.5 | | $ | 723.9 |

| | | | | | | | | | | | | | | |

The contractual commitments shown above, except for our debt obligations, capital leases, employee related liabilities, uncertain tax positions and customer deposits, are not recorded on our consolidated balance sheet.

| 1 | Represents obligations for agreements to purchase goods or services that are enforceable and legally binding on the Company, including minimum quantities to be purchased, and outstanding purchases for goods or services as of December 31, 2009. |

| 2 | Committed capital expenditures represent commitments for construction or purchase of property, plant and equipment. They are not recorded as liabilities on our consolidated balance sheet as of December 31, 2009 because we have not yet received the related goods or services or taken title to the property. |

| 3 | Employee related liabilities include pension, health and welfare benefits and other post-employment benefits. Other than pensions, the employee related liabilities are paid as incurred and accordingly, specific future years’ payments are not reasonably estimable. Amounts in the table due in less than one year relate to required pension funding obligations which represent the estimated contribution planned during 2010. Funding projections beyond the next twelve months as of December 31, 2009 are not practical to estimate due to the rules affecting tax-deductible contributions and the impact from the plan asset performance, interest rates and potential U.S. and international legislation. |

| 4 | As of December 31, 2009, $74.0 million of unrecognized tax benefits were included as a component of other long-term liabilities. Due to the inherent uncertainty of the underlying tax positions, we are unable to reasonably estimate in which future periods these unrecognized tax benefits will be settled. |

| 5 | Customer deposits consist of amounts provided in connection with long-term supply agreements which must be refunded to the customers according to the terms of the agreements. |

| 6 | In connection with our acquisition of SunEdison, we agreed to make contingent payments to the former SunEdison unit holders if certain operational targets are reached in fiscal 2010. See “Results of Operations” above. |

We have agreed to indemnify some of our Materials Business customers against claims of infringement of the intellectual property rights of others in our sales contracts with these customers. The terms of most of these indemnification obligations generally do not provide for a limitation of our liability. We have not had any claims related to these indemnification obligations as of December 31, 2009.

SunEdison generally warrants the operations of its solar energy systems. Due to the absence of historical material warranty claims and expected future claims, we have not recorded a warranty accrual related to solar energy systems as of December 31, 2009.

Our pension expense and pension liability are actuarially determined. See “Critical Accounting Policies and Estimates.” Effective January 2, 2002, we amended our defined benefit plan to discontinue future benefit accruals for certain participants. In addition,

12

effective January 2, 2002, no new participants will be added to the plan. Our total net unfunded pension liability related to our various defined benefit pension plans at December 31, 2009 totaled $14.4 million. Our pension obligations are funded in accordance with provisions of federal law. Contributions to our pension plans in 2009 totaled approximately $2.3 million. We expect contributions to our pension plans in 2010 to be approximately $0.9 million.

The fair value of our corporate debt securities, auction rate securities and asset-backed and mortgage-backed securities, using Level 3 inputs as prescribed by fair value accounting guidance, may fluctuate based on varying assumptions used in their valuations, which include the tax status (taxable vs. tax-exempt), type of security (type of issuer, collateralization, subordination, etc.), credit quality, duration, likelihood of redemption, insurance coverage and degree of liquidity in the current credit markets. Due to the lack of observable inputs, active markets or transparency to the underlying assets, we may rely on qualitative factors to estimate the fair values of the investments, including general macro-economic information and other data supplied by our investment advisers and brokers.

As of December 31, 2009, we held $64.0 million in a portfolio comprised of corporate bonds and asset-backed and mortgage-backed securities, net of temporary impairments of $2.3 million and other than temporary impairments of $16.8 million, of which $0.3 million is related to non-credit losses and is recorded in accumulated other comprehensive income. As of December 31, 2008, this portfolio had $159.5 million of investments, net of temporary impairments of $14.5 million and other than temporary impairments of $14.5 million. A majority of these investments maintain a floating interest rate based on a range of spreads to the one and three month LIBOR rate. While we believe the decline in fair value related to the temporary impairments to be directly attributable to the current global credit conditions, we believe the time to reach the original carrying value to be greater than 12 months. Accordingly, we have classified $21.1 million of those investments as non-current assets. We do not anticipate having to sell these securities below our cost in order to operate our business. The asset backed securities are collateralized by various types of assets including auto, consumer, home equity, student loan and credit card loans. The collateralized mortgage obligations are collateralized primarily by residential mortgages. Many of these issuances have varying tranches and subordinations and our investments are typically in investment grade and more senior, higher priority tranches.

The credit ratings for our investments in debt securities as of December 31, 2009 are as follows:

| | | | | | | | | | | | |

| | | | | Credit Ratings |

| Dollars in millions | | Fair

Value | | AAA | | AA+

to A- | | BBB+

and Below |

| | | | |

Corporate debt securities | | $ | 23.0 | | $ | — | | $ | 20.1 | | $ | 2.9 |

| | | | |

Asset-backed securities | | | 16.9 | | | 10.5 | | | 6.2 | | | 0.2 |

| | | | |

Mortgage-backed securities | | | 24.1 | | | 18.5 | | | 2.7 | | | 2.9 |

| | | | |

Auction rate securities | | | 38.4 | | | 38.4 | | | — | | | — |

| | | | | | | | | | | | |

| | | | |

| | $ | 102.4 | | $ | 67.4 | | $ | 29.0 | | $ | 6.0 |

| | | | | | | | | | | | |

We take into consideration the credit ratings of the individual securities when evaluating the financial condition and near term prospects of the issuer in determining whether the impairment is temporary or other than temporary. See “Critical Accounting Policies and Estimates” related to our process of evaluating investments for impairment and balance sheet classification.

As of December 31, 2009, we held $38.4 million of short-term investments related to auction rate securities (“ARS”), net of unrealized losses of $2.1 million. As of December 31, 2008, we held $44.1 million of investments related to auction rate securities, net of unrealized losses of $7.3 million. These securities are classified as trading securities and all changes in fair value are recorded to non-operating (income) expense, other. The ARS are comprised of interest bearing state sponsored student loan revenue bonds and municipal bonds with varying maturity periods and typically provide short-term liquidity via an auction process that also resets the applicable interest rate at predetermined calendar intervals (typically every 7, 28 or 35 days). The student loan revenue bonds are collateralized and serviced by underlying student loans and the municipal bonds are serviced through revenue generated by the issuing municipal entity. In the event of an auction failing to settle on its respective settlement date, these funds remain invested at a “failed” interest rate which is typically higher than the previous market rate until the next successful auction. For those auctions that fail to settle, we will not be able to access those funds until the next successful auction, another buyer is found outside of the auction process, the issuer redeems the security or the security matures. We do not anticipate having to sell these securities below our cost in order to operate our business. The ARS are insured through two different monoline insurers that presently maintain a credit rating of AAA or similar designation by S&P, Moody’s and/or Fitch as of December 31, 2009 or by a U.S. government backed student loan program. During November 2008, we accepted an offer from our investment broker to receive an ARS right (the “ARS Right”) that would substantially ensure recovery to par of our ARS between June 2010 and July 2012. As of December 31, 2009, all ARS and the ARS Right were classified as current because we intend to exercise the ARS Right in June 2010.

13

We have elected the fair value option for the ARS Right and have recorded the ARS Right at fair value to other assets and non-operating income, other. At the same time, we reclassified the ARS from the available-for-sale category to trading. As of December 31, 2009, the ARS Right had a value of $2.0 million, which substantially offset the mark-to-market adjustment of our outstanding ARS of $2.1 million. See “Critical Accounting Policies and Estimates” related to our process of evaluating investments for impairment.

We believe that, based on our current cash, cash equivalents, restricted cash and investment balances of approximately $1.1 billion at December 31, 2009 and expected operating cash flows, the current liquidity concerns in the credit and capital markets will not have a material impact on our liquidity, cash flow, financial flexibility or our ability to fund our operations.

We believe that we have the financial resources needed to meet business requirements for at least the next 12 months, including capital expenditures and working capital requirements.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires us to make estimates and assumptions in certain circumstances that affect amounts reported in the accompanying consolidated financial statements and related footnotes. In preparing these financial statements, we have made our best estimates of certain amounts included in the financial statements. Application of these accounting policies and estimates, however, involves the exercise of judgment and use of assumptions as to future uncertainties and, as a result, actual results could differ from these estimates. In arriving at our critical accounting estimates, factors we consider include how accurate the estimate or assumptions have been in the past, how much the estimate or assumptions have changed and how reasonably likely such change may have a material impact. Our significant accounting policies are more fully described in Note 2 of Notes to Consolidated Financial Statements herein.

Revenue Recognition

Materials Business

Revenue is recognized in our Materials Business segment for product sales when title transfers, the risks and rewards of ownership have been transferred to the customer, the fee is fixed and determinable and collection of the related receivable is reasonably assured, which is generally at the time of shipment for non-consignment orders. In the case of consignment orders, title passes when the customer pulls the product from the assigned storage facility or storage area or, if the customer does not pull the product within a contractually stated period of time (generally 60–90 days), at the end of that period, or when the customer otherwise agrees to take title to the product. Our wafers are generally made to customer specifications and we conduct rigorous quality control and testing procedures to ensure that the finished wafers meet the customer’s specifications before the product is shipped. We consider international shipping term definitions in our determination of when title passes. We defer revenue for multiple element arrangements based on an average fair value per unit for the total arrangement when we receive cash in excess of fair value. We also defer revenue when pricing is not fixed and determinable or other revenue recognition criteria is not met.

In connection with our long-term solar wafer supply agreements and subsequent amendments, we have received various equity instruments and other forms of additional consideration. In each case, we have recorded the estimated fair value of the additional consideration to long-term deferred revenue and will recognize the deferred revenue on a pro-rata basis as product is shipped over the life of the agreements.

Solar Energy Business

For solar energy systems under construction for which a third-party construction contract has not been executed and for which we do not anticipate retaining ownership, the construction costs associated with these in-process solar energy systems are recognized in inventory as work-in-process. We may enter into a sale agreement to sell a completed solar energy system to a third party. In these transactions, we recognize the sale of the solar energy system at the time a sale arrangement with the third party is executed, delivery has occurred and we have determined that the sales price is fixed or determinable and collectible.

We often construct solar energy systems for which we do not have a fixed-price construction contract and, in certain instances, we may construct a system and retain ownership of the system. For these projects, we earn revenues associated with the energy generated by the solar energy system, capitalize the cost of construction to property and equipment and depreciate the system over its estimated useful life. For solar energy systems under construction for which we intend to retain ownership and finance the system, we recognize all costs incurred as construction-in-progress, a component of property, plant and equipment.

We are party to master lease agreements that provide for the sale and simultaneous leaseback of certain solar energy systems constructed by us. Because the terms of the solar energy systems lease schedule may differ from the terms applicable to other solar energy systems, we must determine the appropriate classification of the sale/leaseback on a project-by-project basis. The terms of the lease schedule may result in either one of the following sale/leaseback classifications:

Sale/Capital Leaseback – Sale/capital leaseback classification occurs when the terms of the lease schedule for a solar energy system result in a capital lease classification. Generally, this classification occurs when the term of the lease is greater than 75% of the estimated economic life of the solar energy systems.

14

Failed Sale/Leaseback (Financing) – The financing method is applicable when we have determined that the assets under the lease are real estate. Generally, this occurs due to either the lease involving land or the determination that the leased equipment is integral equipment. If we have concluded the leased asset is real estate, our option to repurchase the assets under our master lease agreements constitutes continuing involvement and the transaction must be accounted for as a financing transaction. This accounting is most often applicable to the land-mounted systems because they either include land in the lease or are deemed integral equipment due to the estimated cost to uninstall, move and reinstall the system and for any diminution in value of the system.

The classification of a sale/leaseback transaction as a capital lease results in the deferral of any profit on the sale. The profit is recognized over the term of the lease as a reduction to depreciation expense. Under a sale/leaseback transaction classified as a failed sale/leaseback (financing transaction), we have no profit to recognize because a sale is not recognized. The full amount of the financing proceeds is recorded as a liability and lease payments are classified as interest expense. Because the payments to the lessor under the financing transaction for the minimum lease payments are considered interest expense, we expect to recognize a gain on the extinguishment of debt at the end of the lease term.

Operations and maintenance revenue is billed and recognized as services are performed. Energy services revenue, generated by energy system rentals, is agreed to be paid by the customer for the electricity generated. We also provide and maintenance and monitoring services.

For MEMC-owned solar energy systems, including those capitalized under capital leases and failed sale/leasebacks classified as financing obligations, we may receive incentives or subsidies from various state governmental jurisdictions that are deferred. Revenue from Solar Renewable Energy Certificates (“SREC”) is recognized when the SRECs are received or generated if we have executed a contract relating to the sale of the SRECs to a third party. Revenue relating to other incentives that are based on the level of energy produced by the solar energy systems is recognized as revenue in the periods in which the incentives are earned. All other incentive revenue is recognized on a straight-line basis over the depreciable life of the solar energy system.

Inventories

Our Materials Business inventories, which consist of raw materials, labor and manufacturing overhead, are valued at the lower of cost or market. Fixed overheads are allocated to the costs of conversion based on the normal capacity of our production facilities. Unallocated overheads during periods of abnormally low production levels are recognized as cost of goods sold in the period in which they are incurred. Materials Business raw materials are stated at weighted-average cost and Materials Business goods in process and finished goods inventories are stated at standard cost as adjusted for variances, which approximates weighted-average actual cost. The valuation of inventory requires us to estimate excess and slow moving inventory. The determination of the value of excess and slow moving inventory is based upon assumptions of future demand and market conditions. If actual market conditions are less favorable than those projected by management, additional inventory write-downs may be required.

Solar Energy Business inventories consist primarily of raw materials (primarily solar panels) and work-in-process. Work-in-process includes materials and other capitalizable costs incurred to construct solar energy systems not under contract to be sold nor expected to be transferred to property and equipment upon completion. The cost of SunEdison inventories is based on the first-in, first-out (FIFO) method for raw material and project-specific cost identification for work-in-process. If SunEdison executes a contract with a customer in which the system will be retained or there will be a capitalized leased asset, the solar panel inventory is reclassified to property plant and equipment – construction in progress when the materials are issued to a jobsite.

Property, Plant and Equipment and Capitalized Leased Solar Energy Systems

We depreciate our building, improvements, and machinery and equipment evenly over the assets’ estimated useful lives. Changes in circumstances such as technological advances, changes in our business model, or changes in our capital strategy could result in the actual useful lives differing from our estimates. In those cases where we determine that the useful life of property, plant and equipment should be shortened or lengthened, we depreciate the net book value over its revised remaining useful life. Concurrent with our polysilicon expansion in 2008, we assessed the useful lives of certain new polysilicon related property, plant and equipment placed in service in 2008, and based on historical experience with similar existing assets, determined that a useful life of 25 years was appropriate. Previously existing polysilicon production assets were depreciated over an estimated useful life of 10 years and have immaterial net book values at December 31, 2009.

When we are entitled to incentive tax credits for property, plant and equipment, we reduce the asset carrying value by the amount of the credit, which reduces future depreciation.

15

Expenditures for repairs and maintenance are charged to income as incurred. Additions and betterments are capitalized. The cost and related accumulated depreciation on property and equipment sold or otherwise disposed of are removed from the capital accounts and any gain or loss is reported in current-year operations.

We may sell a solar energy system and simultaneously lease back the solar energy system from the buyor/lessor under our master lease arrangements or other sale/leaseback arrangements. The gain, if any, on the sale/leaseback transaction is recorded as a deferred gain and is recorded as a contra-asset that reduces the cost of the solar energy system, thereby reducing depreciation expense over the term of the lease. Generally, as a result of various tax attributes that accrue to the benefit of the lessor/tax owner, the cost of the solar energy system is recorded as the net present value of the future minimum lease payments because this amount is lower than the fair market value of the solar energy system at the lease inception date. Solar energy systems that have failed sale treatment and have been leased back under a capital lease are recorded at the lower of the original cost to construct the system or its fair value.

We periodically assess the impairment of long-lived assets/asset groups when conditions indicate a possible loss. Reviews are performed to determine whether the carrying value of an asset is impaired, based on comparisons to undiscounted expected future cash flows or some other fair value measure. If this comparison indicates that there is impairment, the impaired asset is written down to fair value, which is typically calculated using: (i) quoted market prices or (ii) discounted expected future cash flows utilizing an appropriate discount rate. Impairment is based on the excess of the carrying amount over the fair value of those assets.

In September 2009, MEMC committed to actions to reduce manufacturing costs by shifting manufacturing from our St. Peters, Missouri and Sherman, Texas facilities to other locations which are closer to a number of MEMC’s customers. Due to the significance of these actions, we performed an asset impairment analysis of our St. Peters, Missouri and Sherman, Texas long-lived manufacturing asset groups during the third quarter of 2009. Accordingly, we recorded asset impairment charges of $24.6 million in the third quarter of 2009 related to these asset groups. We recorded asset impairment charges of $1.1 million in 2008. There were no asset impairment charges in 2007.

We operate under solar power services agreements with customers that include a requirement for the removal of the solar energy systems at the end of the term of the agreement. These and other asset retirement obligations are recognized at fair value in the period in which they are incurred and the carrying amount of the related long-lived asset is correspondingly increased. Over time, the liability is accreted to its future value. The corresponding asset capitalized at inception is depreciated over the useful life of the asset.