Exhibit 99.1

Presentation to Principals for the 2nd Lien Lenders

CONFIDENTIAL // Subject to FRE 408 March 17, 2016

DISCLAIMER

With the exception of historical information, the matters disclosed in this presentation are forward-looking statements. Such statements involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Potential risks and uncertainties are described in SunEdison’s filings with the Securities and Exchange Commission

(SEC), including Forms 10-K and Forms 10-Q, as well as other filings with the SEC, in addition to the risks and uncertainties described on page 2 of this presentation. These forward-looking statements represent SunEdison’s judgment as of the date of this presentation. SunEdison disclaims any intent or obligation to update these forward-looking statements, except as required by law. This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities nor shall there be any sale of securities in any state in which such solicitation or sale would be unlawful prior to registration or qualification of securities under the laws of any such state. This presentation contains financial information and data regarding SunEdison. No audit or review, including by SunEdison, has been undertaken by an independent third party of this financial information and data contained, presented or referred to in this presentation. In addition, this presentation contains certain projections relating to the possible future performance of SunEdison and its assets. Such projections reflect various assumptions which may or may not prove to be correct. No representations or warranties, express or implied, are made as to the accuracy or reasonableness of such assumptions and projections that have been based thereon. Non-GAAP Financial Measures Certain financial measures included in this presentation are supplemental measures of the Company’s performance and are not U.S. generally accepted accounting principles (“GAAP”) measures. Please refer to the Appendix hereto for a definition of the non GAAP measures used in this presentation.

P. 1 Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements involve estimates, expectations, projections, goals, assumptions, known and unknown risks, and uncertainties and typically include words or variations of words such as “expect,” “anticipate,” “believe,” “intend,” “plan,” “seek,” “estimate,” “predict,” “project,” “goal,” “guidance,” “outlook,” “objective,” “forecast,” “target,” “potential,” “continue,” “would,” “will,” “should,” “could,” or “may” or other comparable terms and phrases. All statements that address operating performance, events, or developments that SunEdison expects or anticipates will occur in the future are forward-looking statements. They may include estimates of expected cash available for distribution (CAFD), earnings, revenues, capital expenditures, liquidity, capital structure, future growth, and other financial performance items (including future dividends per share), descriptions of management’s plans or objectives for future operations, products, or services, or descriptions of assumptions underlying any of the above. Forward-looking statements provide SunEdison’s current expectations or predictions of future conditions, events, or results and speak only as of the date they are made. Although SunEdison believes its expectations and assumptions are reasonable, it can give no assurance that these expectations and assumptions will prove to have been correct and actual results may vary materially.

By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, delays or unexpected costs during the completion of projects under construction; regulatory requirements and incentives for production of renewable power; operating and financial restrictions under agreements governing indebtedness; the condition of capital markets and our ability to borrow additional funds and access capital markets; the impact of foreign exchange rate fluctuations; the ability to compete against traditional and renewable energy companies; challenges inherent in constructing and maintaining renewable energy projects; the success of ongoing research and development efforts; the ability to successfully integrate the businesses of acquired companies and realize the benefits of such acquisitions; and hazards customary to the power production industry and power generation operations, such as unusual weather conditions and outages. Furthermore, any dividends are subject to available capital, market conditions, and compliance with associated laws and regulations. Many of these factors are beyond SunEdison’s control.

SunEdison disclaims any obligation to update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data, or methods, future events, or other changes, except as required by law. The foregoing list of factors that might cause results to differ materially from those contemplated in the forward-looking statements should be considered in connection with information regarding risks and uncertainties which are described in SunEdison’s Form 10-K for the fiscal year ended December 31, 2014, as well as additional factors it may describe from time to time in other filings with the Securities and Exchange Commission. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.The information contained herein is as of the date on the cover of this presentation unless an earlier date is indicated, in which case the information is as of such earlier date.

P. 2

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

Contents

Status update & business overview

Discussion of recent headwinds

Path forward & next steps

P. 4

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

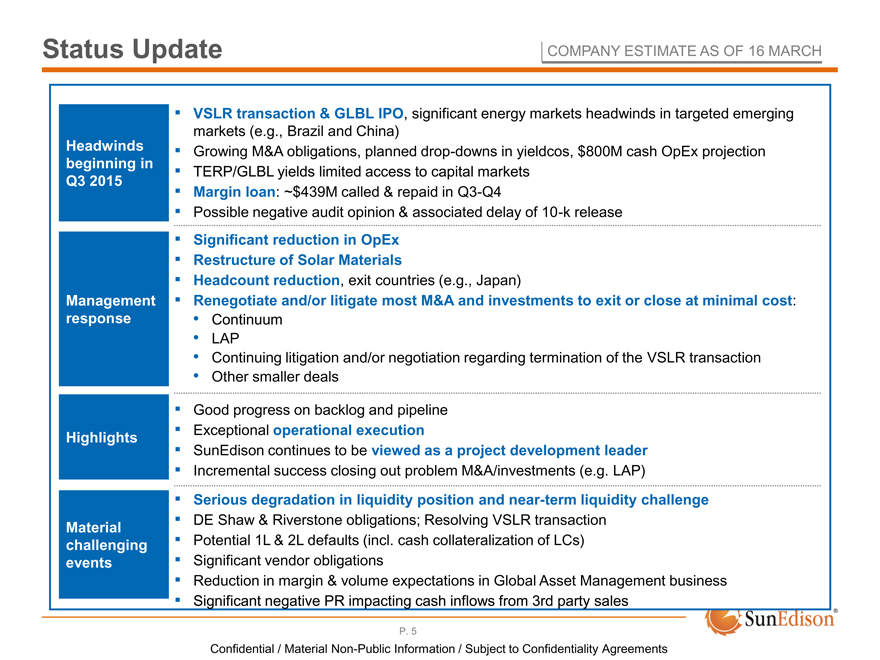

Status Update COMPANY ESTIMATE AS OF 16 MARCH

Headwinds beginning in Q3 2015

Management response

Highlights

Material challenging events

VSLR transaction & GLBL IPO, significant energy markets headwinds in targeted emerging markets (e.g., Brazil and China) Growing M&A obligations, planned drop-downs in yieldcos, $800M cash OpEx projection TERP/GLBL yields limited access to capital markets Margin loan: ~$439M called & repaid in Q3-Q4 Possible negative audit opinion & associated delay of 10-k release

Significant reduction in OpEx Restructure of Solar Materials

Headcount reduction, exit countries (e.g., Japan)

Renegotiate and/or litigate most M&A and investments to exit or close at minimal cost:

Continuum

LAP

Continuing litigation and/or negotiation regarding termination of the VSLR transaction

Other smaller deals

Good progress on backlog and pipeline Exceptional operational execution

SunEdison continues to be viewed as a project development leader

Incremental success closing out problem M&A/investments (e.g. LAP)

Serious degradation in liquidity position and near-term liquidity challenge

DE Shaw & Riverstone obligations; Resolving VSLR transaction Potential 1L & 2L defaults (incl. cash collateralization of LCs) Significant vendor obligations

Reduction in margin & volume expectations in Global Asset Management business Significant negative PR impacting cash inflows from 3rd party sales

P. 5

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

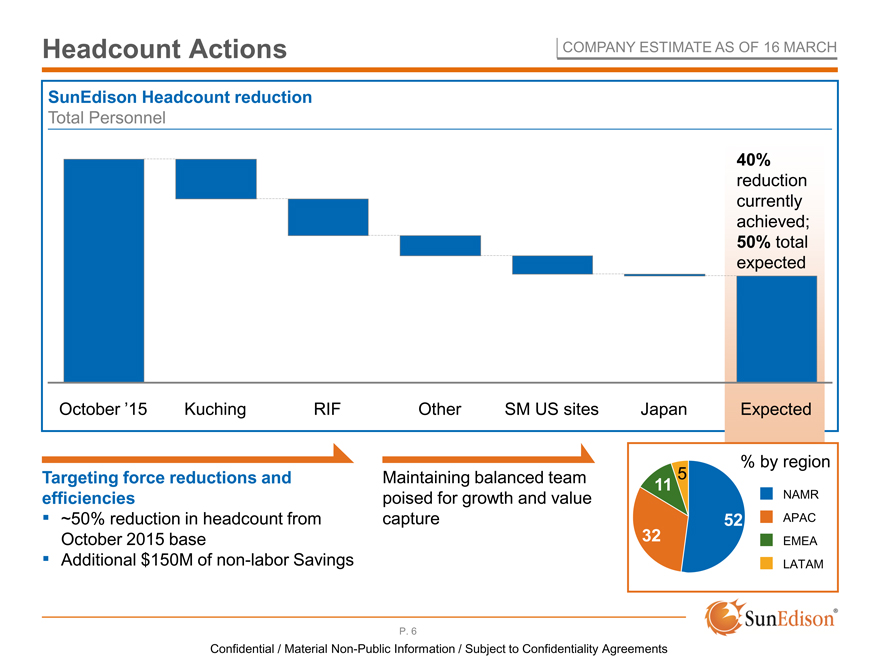

Headcount Actions COMPANY ESTIMATE AS OF 16 MARCH

SunEdison Headcount reduction

Total Personnel

40% reduction currently achieved; 50% total expected

October ’15 Kuching RIF Other SM US sites Japan Expected

Targeting force reductions and efficiencies

Maintaining balanced team poised for growth and value capture

~50% reduction in headcount from October 2015 base Additional $150M of non-labor Savings

% by region 5 11

NAMR

52 APAC

32 EMEA LATAM

P. 6

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

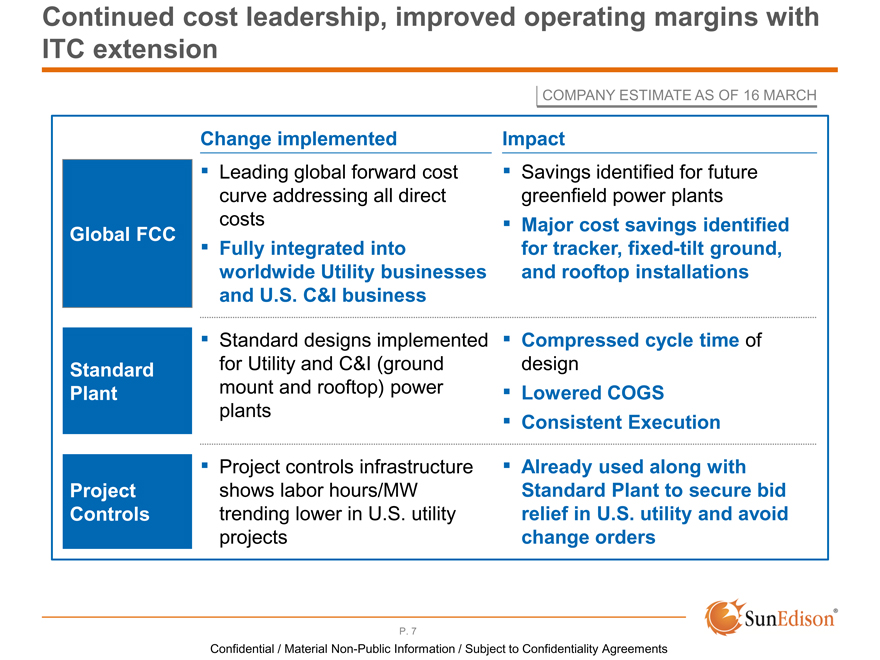

Continued cost leadership, improved operating margins with ITC extension

COMPANY ESTIMATE AS OF 16 MARCH

Change implemented Impact

Global FCC

Standard Plant

Project Controls

Leading global forward cost curve addressing all direct costs

Fully integrated into worldwide Utility businesses and U.S. C&I business

Standard designs implemented for Utility and C&I (ground mount and rooftop) power plants

Project controls infrastructure shows labor hours/MW trending lower in U.S. utility projects

Savings identified for future greenfield power plants

Major cost savings identified for tracker, fixed-tilt ground, and rooftop installations

Compressed cycle time of design

Lowered COGS Consistent Execution

Already used along with Standard Plant to secure bid relief in U.S. utility and avoid change orders

P. 7

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

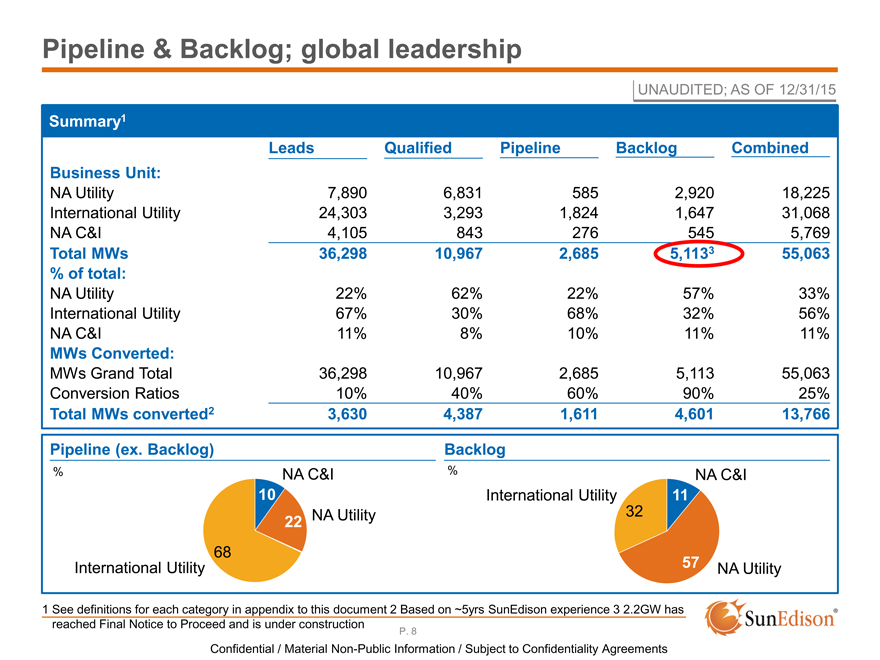

Pipeline & Backlog; global leadership

UNAUDITED; AS OF 12/31/15

Summary1

Leads Qualified Pipeline Backlog Combined Business Unit:

NA Utility 7,890 6,831 585 2,920 18,225 International Utility 24,303 3,293 1,824 1,647 31,068 NA C&I 4,105 843 276 545 5,769

Total MWs 36,298 10,967 2,685 5,1133 55,063 % of total:

NA Utility 22% 62% 22% 57% 33% International Utility 67% 30% 68% 32% 56% NA C&I 11% 8% 10% 11% 11%

MWs Converted:

MWs Grand Total 36,298 10,967 2,685 5,113 55,063 Conversion Ratios 10% 40% 60% 90% 25%

Total MWs converted2 3,630 4,387 1,611 4,601 13,766

Pipeline (ex. Backlog) Backlog

% NA C&I % NA C&I

10 International Utility 11 NA Utility 32

22

68

International Utility 57 NA Utility

1 See definitions for each category in appendix to this document 2 Based on ~5yrs SunEdison experience 3 2.2GW has reached Final Notice to Proceed and is under construction

P. 8

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

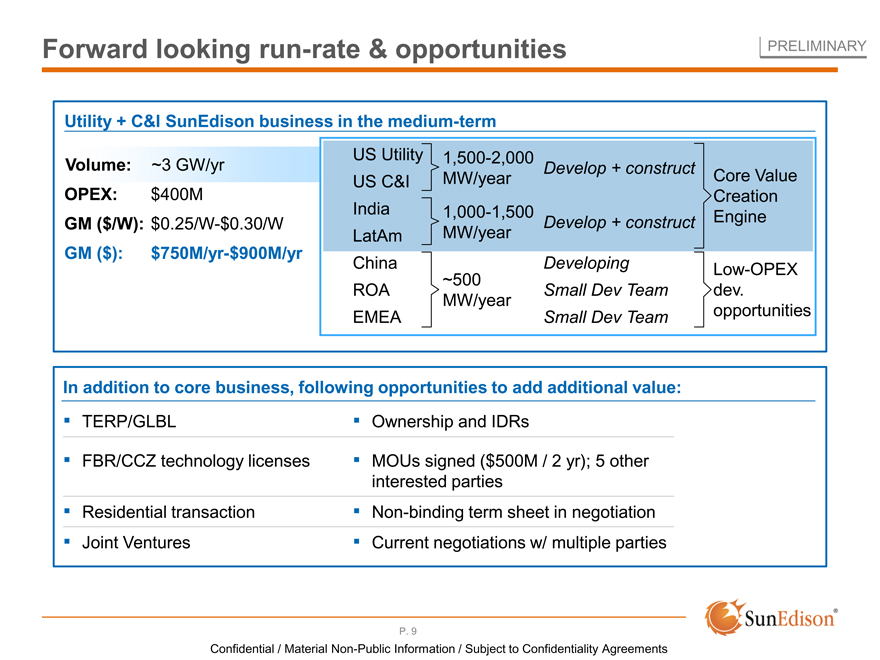

Forward looking run-rate & opportunities PRELIMINARY

Utility + C&I SunEdison business in the medium-term

US Utility 1,500-2,000

Volume: ~3 GW/yr Develop + construct

US C&I MW/year Core Value OPEX: $400M India Creation 1,000-1,500 Engine

GM ($/W): $0.25/W-$0.30/W Develop + construct

LatAm MW/year

GM ($): $750M/yr-$900M/yr

China Developing Low-OPEX ~500 ROA Small Dev Team dev.

MW/year

EMEA Small Dev Team opportunities

In addition to core business, following opportunities to add additional value:

TERP/GLBL

FBR/CCZ technology licenses

Residential transaction Joint Ventures

Ownership and IDRs

MOUs signed ($500M / 2 yr); 5 other interested parties Non-binding term sheet in negotiation Current negotiations w/ multiple parties

P. 9

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

Contents

Status update & business overview

Discussion of recent headwinds

Path forward & next steps

P. 10

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

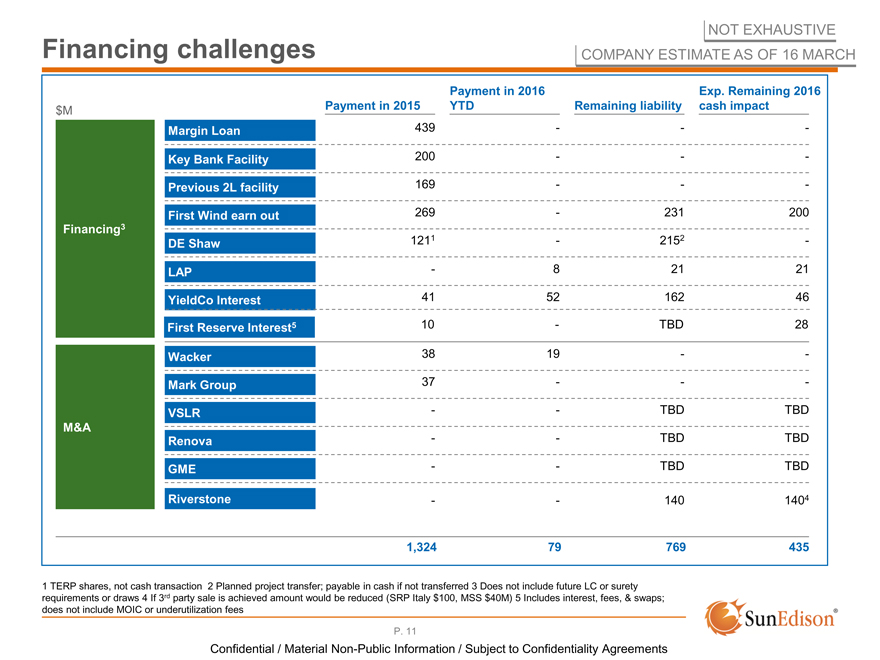

Financing challenges NOT EXHAUSTIVE

COMPANY ESTIMATE AS OF 16 MARCH

Payment in 2016 Exp. Remaining 2016 $M Payment in 2015 YTD Remaining liability cash impact Margin Loan 439 — -Key Bank Facility 200 — -Previous 2L facility 169 — -First Wind earn out 269—231 200 Financing3

DE Shaw 1211—2152 -LAP—8 21 21

YieldCo Interest 41 52 162 46

First Reserve Interest5 10—TBD 28 Wacker 38 19 —

Mark Group 37 — -

VSLR — TBD TBD M&A — TBD TBD

Renova

GME — TBD TBD

Riverstone — 140 1404

1,324 79 769 435

1 TERP shares, not cash transaction 2 Planned project transfer; payable in cash if not transferred 3 Does not include future LC or surety requirements or draws 4 If 3rd party sale is achieved amount would be reduced (SRP Italy $100, MSS $40M) 5 Includes interest, fees, & swaps; does not include MOIC or underutilization fees

P. 11

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

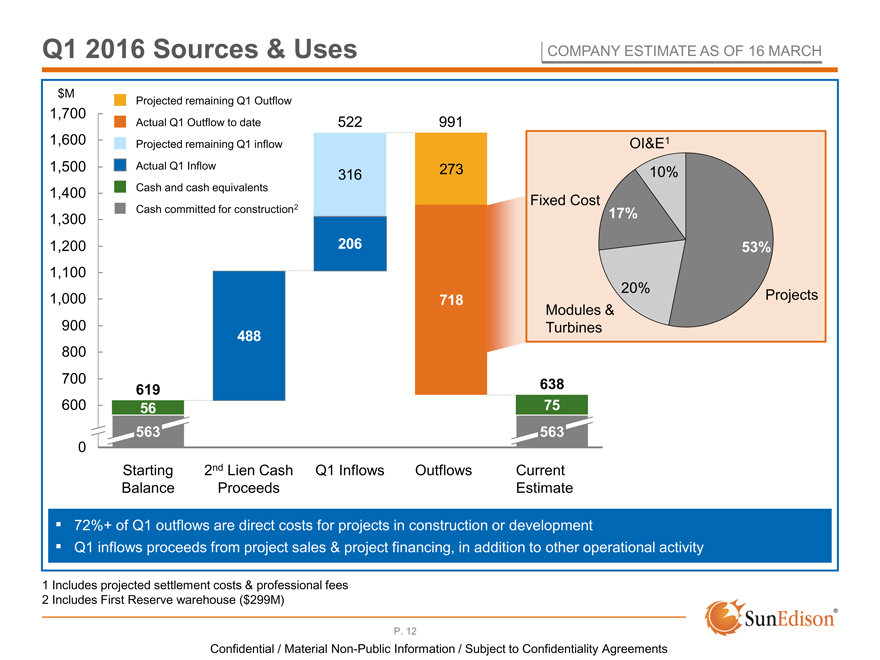

Q1 2016 Sources & Uses COMPANY ESTIMATE AS OF 16 MARCH

$M

Projected remaining Q1 Outflow

1,700

Actual Q1 Outflow to date 522 991

1,600 Projected remaining Q1 inflow OI&E1 1,500 Actual Q1 Inflow 273 10%

316

1,400 Cash and cash equivalents

Fixed Cost

Cash committed for construction2 17%

1,300

1,200 206 53% 1,100 20%

1,000 718 Projects Modules & 900 Turbines

488

800

700 638 619 600 56 75 563 563

0

Starting 2nd Lien Cash Q1 Inflows Outflows Current Balance Proceeds Estimate

? 72%+ of Q1 outflows are direct costs for projects in construction or development

? Q1 inflows proceeds from project sales & project financing, in addition to other operational activity

1 Includes projected settlement costs & professional fees

2 Includes First Reserve warehouse ($299M)

P. 12

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

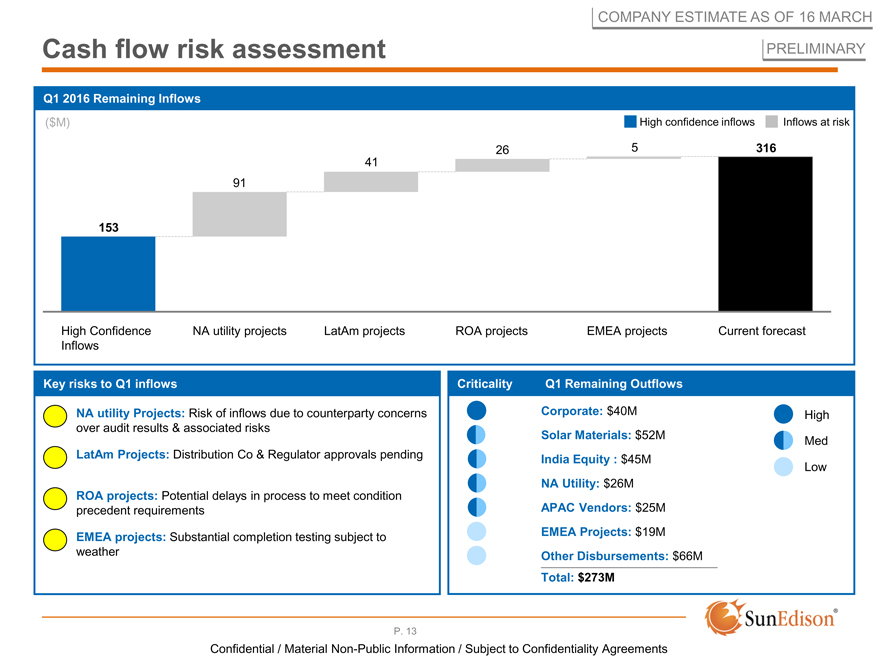

COMPANY ESTIMATE AS OF 16 MARCH

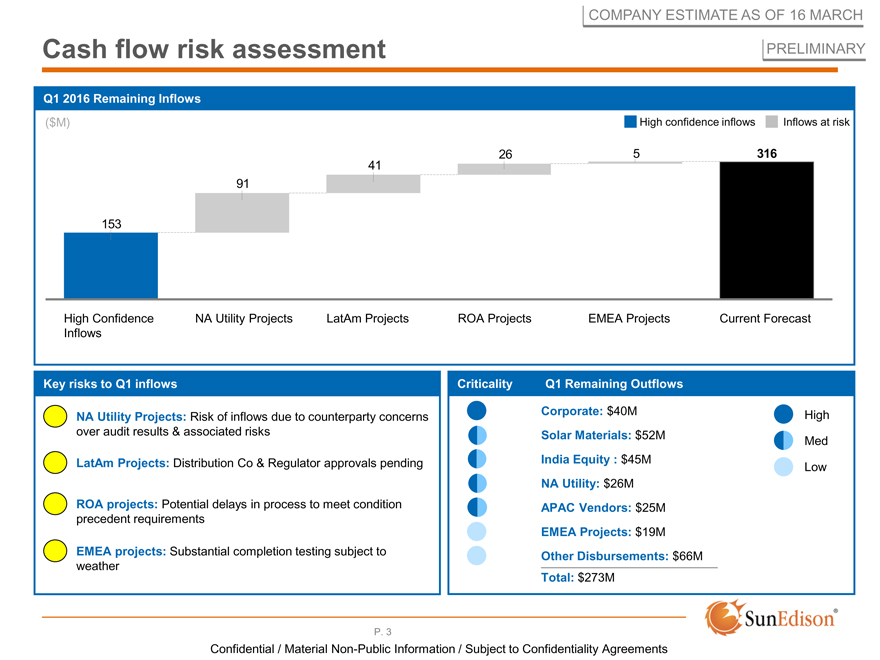

Cash flow risk assessment PRELIMINARY

Q1 2016 Remaining Inflows

($M) High confidence inflows Inflows at risk

26 5 316 41 91

153

High Confidence NA utility projects LatAm projects ROA projects EMEA projects Current forecast Inflows

Key risks to Q1 inflows Criticality Q1 Remaining Outflows

NA utility Projects: Risk of inflows due to counterparty concerns over audit results & associated risks

LatAm Projects: Distribution Co & Regulator approvals pending

ROA projects: Potential delays in process to meet condition precedent requirements

EMEA projects: Substantial completion testing subject to weather

Corporate: $40M

Solar Materials: $52M

India Equity : $45M NA Utility: $26M APAC Vendors: $25M EMEA Projects: $19M

Other Disbursements: $66M Total: $273M

High Med Low

P. 13

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

Contents

Status update & business overview

Discussion of recent headwinds

Path forward & next steps

P. 14

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

COMPANY ESTIMATE AS OF 16 MARCH

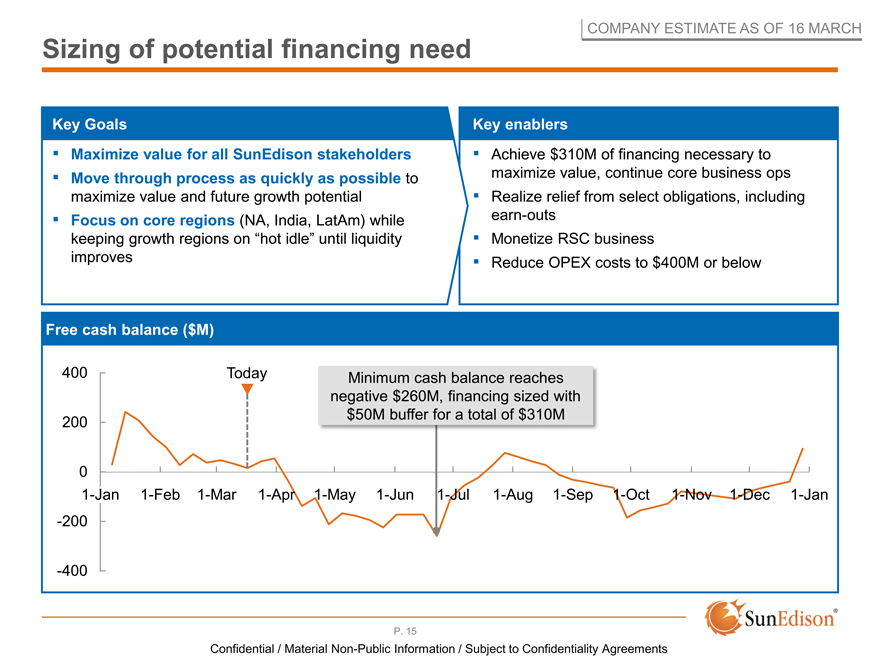

Sizing of potential financing need

Key Goals Key enablers

Maximize value for all SunEdison stakeholders

Move through process as quickly as possible to maximize value and future growth potential Focus on core regions (NA, India, LatAm) while keeping growth regions on “hot idle” until liquidity improves

Achieve $310M of financing necessary to maximize value, continue core business ops Realize relief from select obligations, including earn-outs Monetize RSC business Reduce OPEX costs to $400M or below

Free cash balance ($M)

400 Today Minimum cash balance reaches negative $260M, financing sized with $50M buffer for a total of $310M

200

0

1-Jan 1-Feb 1-Mar 1-Apr 1-May 1-Jun 1-Jul 1-Aug 1-Sep 1-Oct 1-Nov 1-Dec 1-Jan

-200

-400

P. 15

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

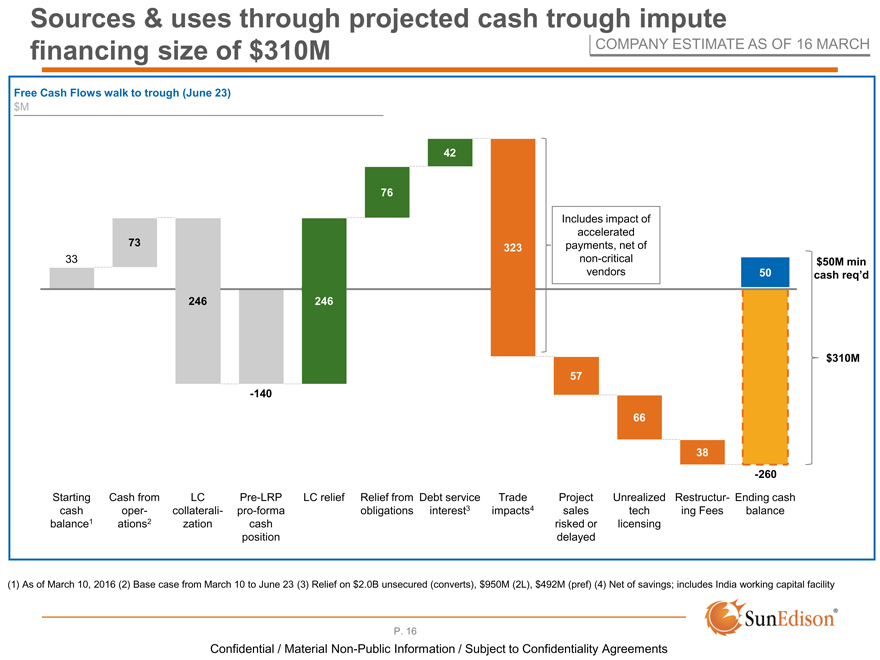

Sources & uses through projected cash trough impute

financing size of $310M COMPANY ESTIMATE AS OF 16 MARCH

Free Cash Flows walk to trough (June 23) $M

42

76

Includes impact of accelerated 73 payments, net of

323

33 non-critical $50M min vendors 50 cash req’d

246 246

$310M 57 -140

66

38

-260

Starting Cash from LC Pre-LRP LC relief Relief from Debt service Trade Project Unrealized Restructur- Ending cash cash oper- collaterali- pro-forma obligations interest3 impacts4 sales tech ing Fees balance balance1 ations2 zation cash risked or licensing position delayed

(1) As of March 10, 2016 (2) Base case from March 10 to June 23 (3) Relief on $2.0B unsecured (converts), $950M (2L), $492M (pref) (4) Net of savings; includes India working capital facility

P. 16

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

COMPANY ESTIMATE AS OF 16 MARCH

Proposed guarantors & collateral

SunEdison contemplates that the financing will be secured by all of the assets that currently secure the 1L and 2L debt, as well as certain unencumbered assets including but not limited to:

All assets pledged by subsidiaries that own various operating projects

All assets pledged by subsidiaries that own various projects being sold

All assets pledged by subsidiaries that own various projects under development Assets of the Residential Services business Unencumbered real estate

P. 17

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

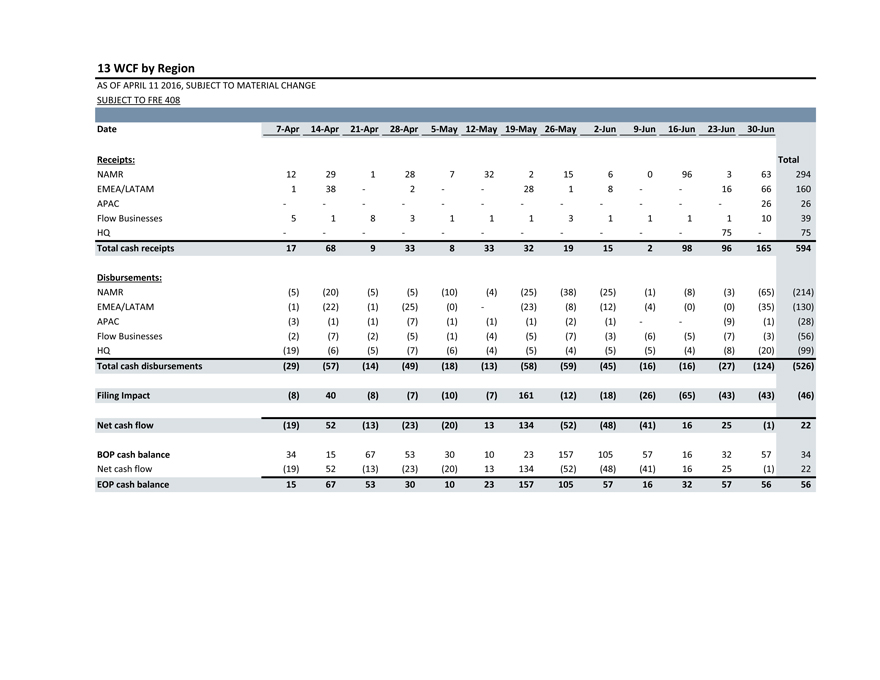

13 WCF by Region

AS OF APRIL 11 2016, SUBJECT TO MATERIAL CHANGE

SUBJECT TO FRE 408

Date 7-Apr 14-Apr 21-Apr28-Apr5-May12-May19-May26-May2-Jun9-Jun16-Jun23-Jun30-Jun

Receipts: Total

NAMR 12 291287322156096363294

EMEA/LATAM 1 38-2--2818--1666160

APAC - -----------2626

Flow Businesses 5 183111311111039

HQ - ----------75-75

Total cash receipts 17 6893383332191529896165594

Disbursements:

NAMR (5) (20)(5)(5)(10)(4)(25)(38)(25)(1)(8)(3)(65)(214)

EMEA/LATAM (1) (22)(1)(25)(0)-(23)(8)(12)(4)(0)(0)(35)(130)

APAC (3) (1)(1)(7)(1)(1)(1)(2)(1)--(9)(1)(28)

Flow Businesses (2) (7)(2)(5)(1)(4)(5)(7)(3)(6)(5)(7)(3)(56)

HQ (19) (6)(5)(7)(6)(4)(5)(4)(5)(5)(4)(8)(20)(99)

Total cash disbursements (29) (57)(14)(49)(18)(13)(58)(59)(45)(16)(16)(27)(124)(526)

Filing Impact (8) 40(8)(7)(10)(7)161(12)(18)(26)(65)(43)(43)(46)

Net cash flow (19) 52(13)(23)(20)13134(52)(48)(41)1625(1)22

BOP cash balance 34 1567533010231571055716325734

Net cash flow (19) 52(13)(23)(20)13134(52)(48)(41)1625(1)22

EOP cash balance 15 6753301023157105571632575656

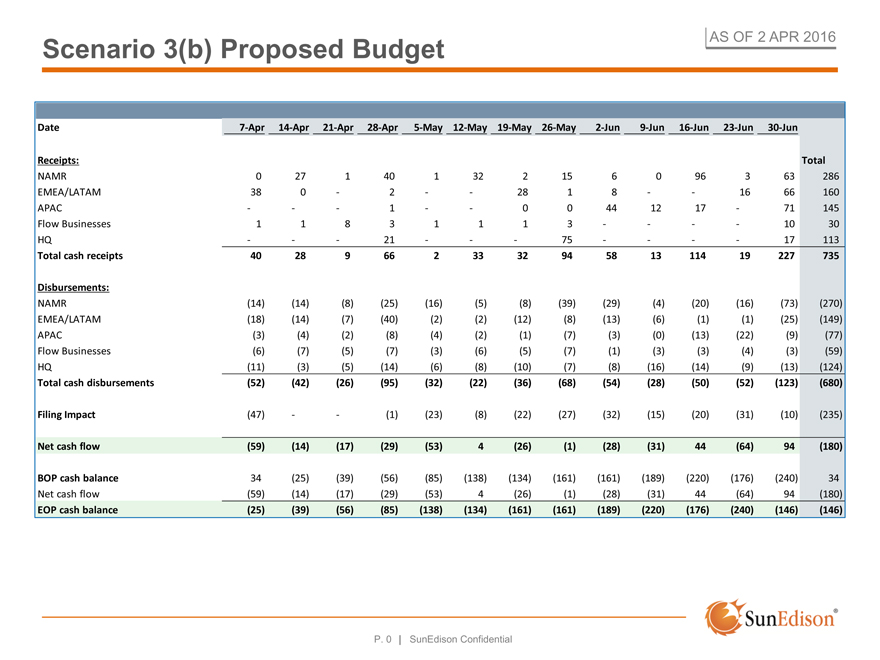

Scenario 3(b) Proposed Budget

AS OF 2 APR 2016

Date 7-Apr 14-Apr21-Apr28-Apr5-May 12-May 19-May 26-May2-Jun9-Jun 16-Jun 23-Jun 30-Jun

Receipts: Total

NAMR 0 271401322156096363286

EMEA/LATAM 38 0-2--2818--1666160

APAC - --1--00441217-71145

Flow Businesses 1 1831113----1030

HQ - --21---75----17113

Total cash receipts 40 289662333294581311419227735

Disbursements:

NAMR (14) (14)(8)(25)(16)(5)(8)(39)(29)(4)(20)(16)(73)(270)

EMEA/LATAM (18) (14)(7)(40)(2)(2)(12)(8)(13)(6)(1)(1)(25)(149)

APAC (3) (4)(2)(8)(4)(2)(1)(7)(3)(0)(13)(22)(9)(77)

Flow Businesses (6) (7)(5)(7)(3)(6)(5)(7)(1)(3)(3)(4)(3)(59)

HQ (11) (3)(5)(14)(6)(8)(10)(7)(8)(16)(14)(9)(13)(124)

Total cash disbursements (52) (42)(26)(95)(32)(22)(36)(68)(54)(28)(50)(52)(123)(680)

Filing Impact (47) --(1)(23)(8)(22)(27)(32)(15)(20)(31)(10)(235)

Net cash flow (59) (14)(17)(29)(53)4(26)(1)(28)(31)44(64)94(180)

BOP cash balance 34 (25)(39)(56)(85)(138)(134)(161)(161)(189)(220)(176)(240)34

Net cash flow (59) (14)(17)(29)(53)4(26)(1)(28)(31)44(64)94(180)

EOP cash balance (25) (39)(56)(85)(138)(134)(161)(161)(189)(220)(176)(240)(146)(146)

P. 0 | SunEdison Confidential

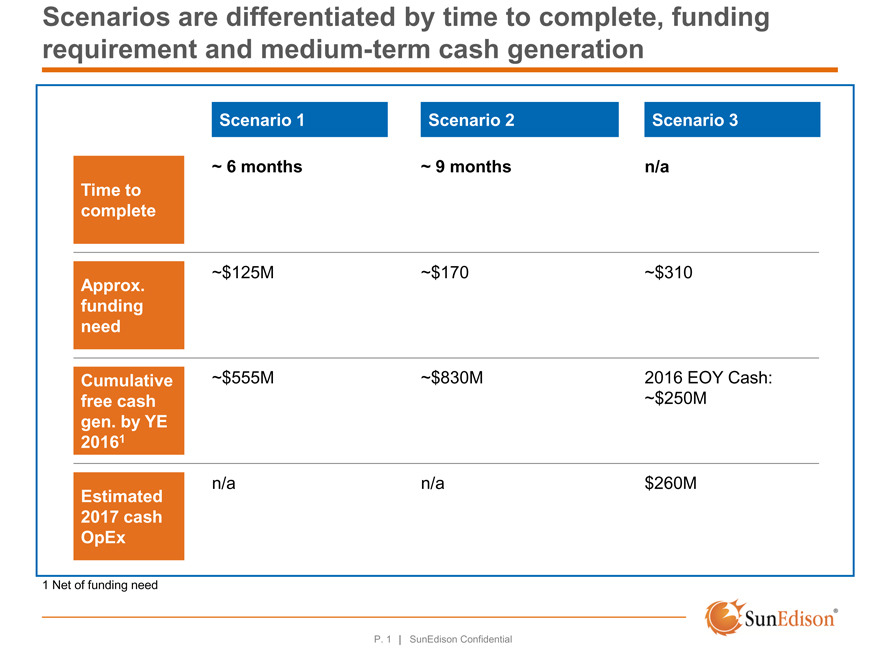

Business Plan Scenarios

Discussion document March 30, 2016

Scenarios are differentiated by time to complete, funding requirement and medium-term cash generation

Scenario 1 Scenario 2Scenario 3

~ 6 months ~ 9 monthsn/a

Time to

complete

~$125M ~$170~$310

Approx.

funding

need

Cumulative ~$555M ~$830M2016 EOY Cash:

free cash ~$250M

gen. by YE

20161

n/a n/a$260M

Estimated

2017 cash

OpEx

1 Net of funding need

P. 1 | SunEdison Confidential

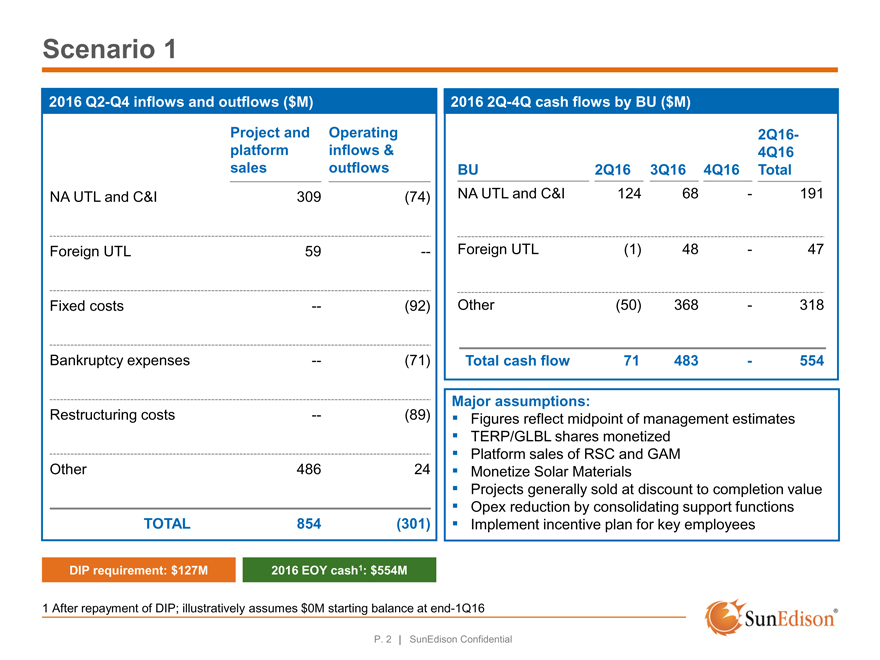

Scenario 1

2016 Q2-Q4 inflows and outflows ($M)

Project and Operating

platform inflows &

sales outflows

NA UTL and C&I 309 (74)

Foreign UTL 59 —

Fixed costs — (92)

Bankruptcy expenses — (71)

Restructuring costs — (89)

Other 486 24

TOTAL 854 (301)

2016 2Q-4Q cash flows by BU ($M)

2Q16-

4Q16

BU 2Q16 3Q164Q16Total

NA UTL and C&I 124 68-191

Finance Stack

Foreign UTL (1) 48-47

Other (50) 368-318

Total cash flow 71 483-554

Major assumptions:

Figures reflect midpoint of management estimates

TERP/GLBL shares monetized

Platform sales of RSC and GAM

Monetize Solar Materials

Projects generally sold at discount to completion value

Opex reduction by consolidating support functions

Implement incentive plan for key employees

DIP requirement: $127M 2016 EOY cash1: $554M

1 After repayment of DIP; illustratively assumes $0M starting balance at end-1Q16

P. 2 | SunEdison Confidential

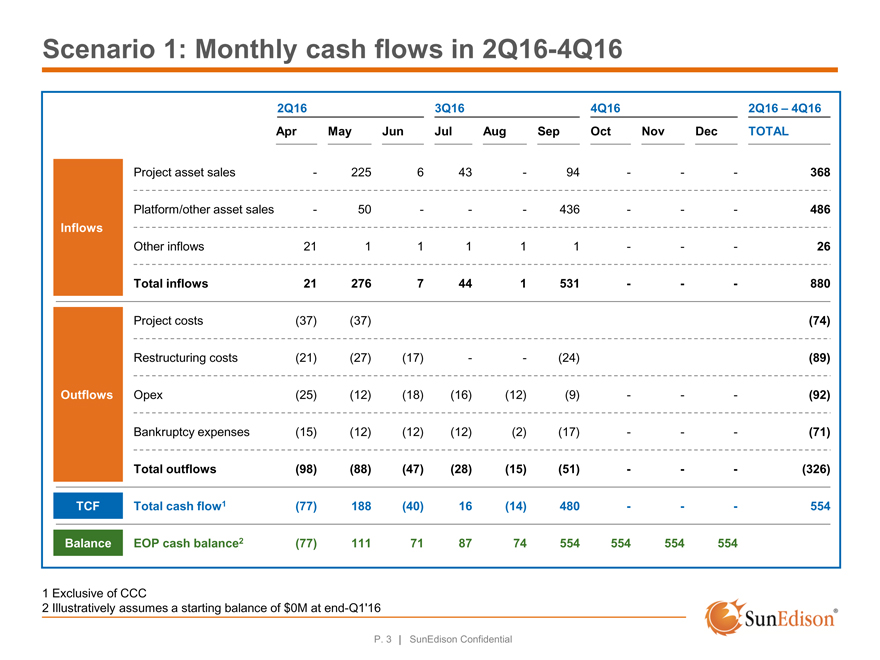

Scenario 1: Monthly cash flows in 2Q16-4Q16

2Q163Q164Q162Q16 – 4Q16

AprMayJunJulAugSepOctNovDecTOTAL

Project asset sales -225643-94---368

Platform/other asset sales -50---436---486

Inflows

Other inflows 2111111---26

Total inflows 212767441531---880

Project costs (37)(37)(74)

Restructuring costs (21)(27)(17)--(24)(89)

Outflows Opex (25)(12)(18)(16)(12)(9)---(92)

Bankruptcy expenses (15)(12)(12)(12)(2)(17)---(71)

Total outflows (98)(88)(47)(28)(15)(51)---(326)

TCF Total cash flow1 (77)188(40)16(14)480---554

Balance EOP cash balance2 (77)111718774554554554554

1 Exclusive of CCC

2 Illustratively assumes a starting balance of $0M at end-Q1’16

P. 3 | SunEdison Confidential

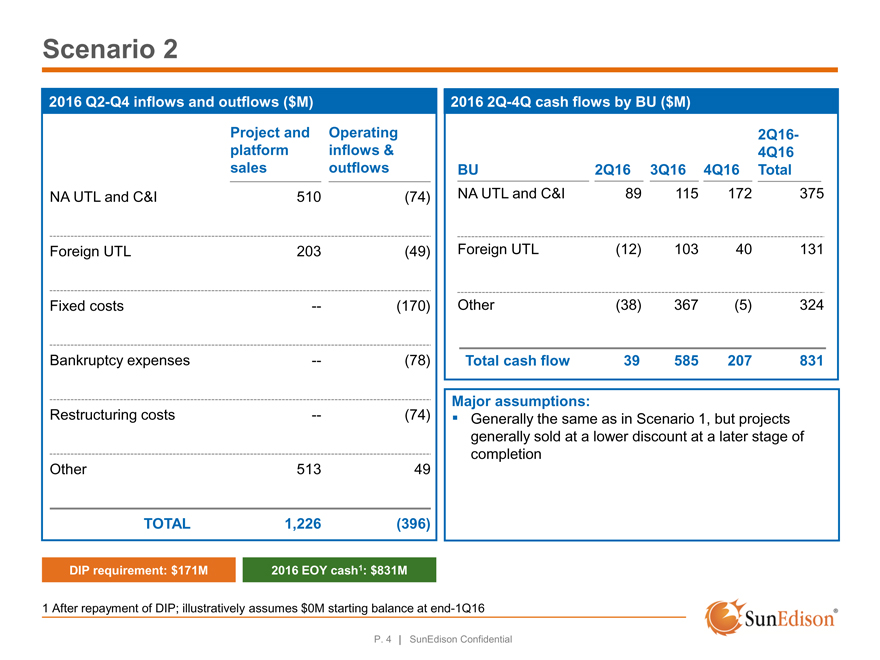

Scenario 2

2016 Q2-Q4 inflows and outflows ($M)

Project and Operating

platform inflows &

sales outflows

NA UTL and C&I 510 (74)

Foreign UTL 203 (49)

Fixed costs — (170)

Bankruptcy expenses — (78)

Restructuring costs — (74)

Other 513 49

TOTAL 1,226 (396)

2016 2Q-4Q cash flows by BU ($M)

2Q16-

4Q16

BU 2Q16 3Q164Q16Total

NA UTL and C&I 89 115172375

Finance Stack

Foreign UTL (12) 10340131

Other (38) 367(5)324

Total cash flow 39 585207831

Major assumptions:

? Generally the same as in Scenario 1, but projects generally sold at a lower discount at a later stage of completion

DIP requirement: $171M 2016 EOY cash1: $831M

1 After repayment of DIP; illustratively assumes $0M starting balance at end-1Q16

P. 4 | SunEdison Confidential

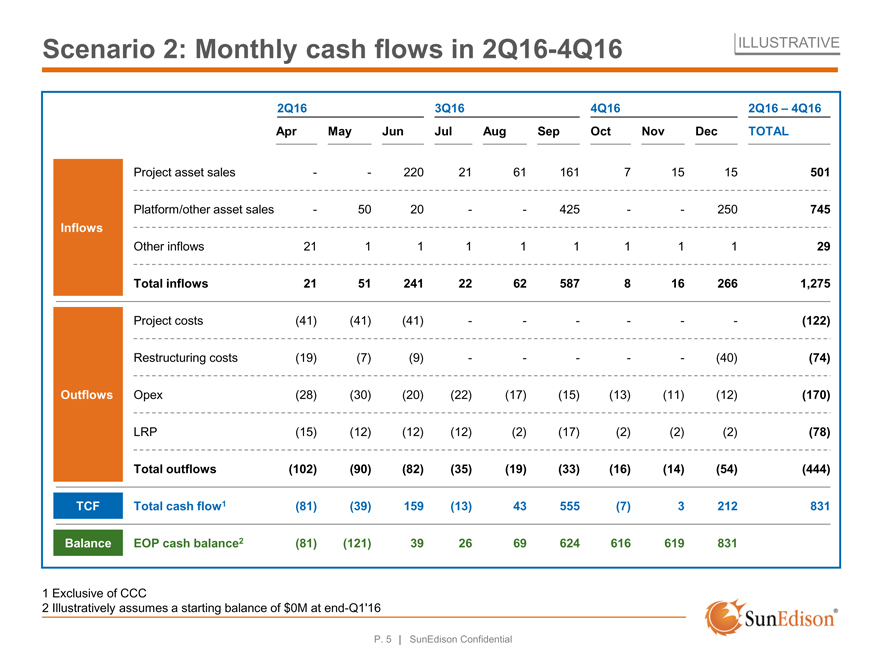

Scenario 2: Monthly cash flows in 2Q16-4Q16

ILLUSTRATIVE

2Q163Q164Q162Q16 – 4Q16

AprMayJunJulAugSepOctNovDecTOTAL

Project asset sales --220216116171515501

Platform/other asset sales -5020--425--250745

Inflows

Other inflows 211111111129

Total inflows 215124122625878162661,275

Project costs (41)(41)(41)------(122)

Restructuring costs (19)(7)(9)-----(40)(74)

Outflows Opex (28)(30)(20)(22)(17)(15)(13)(11)(12)(170)

LRP (15)(12)(12)(12)(2)(17)(2)(2)(2)(78)

Total outflows (102)(90)(82)(35)(19)(33)(16)(14)(54)(444)

TCF Total cash flow1 (81)(39)159(13)43555(7)3212831

Balance EOP cash balance2 (81)(121)392669624616619831

1 Exclusive of CCC

2 Illustratively assumes a starting balance of $0M at end-Q1’16

P. 5 | SunEdison Confidential

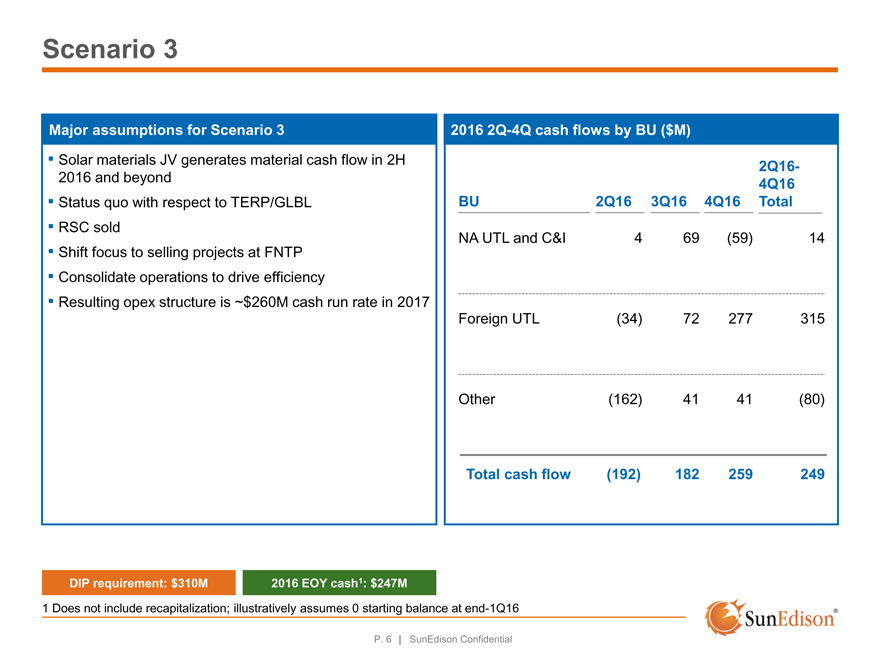

Scenario 3

Major assumptions for Scenario 3

Solar materials JV generates material cash flow in 2H 2016 and beyond

Status quo with respect to TERP/GLBL

RSC sold

Shift focus to selling projects at FNTP

Consolidate operations to drive efficiency

Resulting opex structure is ~$260M cash run rate in 2017

2016 2Q-4Q cash flows by BU ($M)

2Q16-

4Q16

BU 2Q16 3Q164Q16Total

NA UTL and C&I 4 69(59)14

FinanceForeign StackUTL (34) 72277315

Other (162) 4141(80)

Total cash flow (192) 182259249

DIP requirement: $310M 2016 EOY cash1: $247M

1 Does not include recapitalization; illustratively assumes 0 starting balance at end-1Q16

P. 6 | SunEdison Confidential

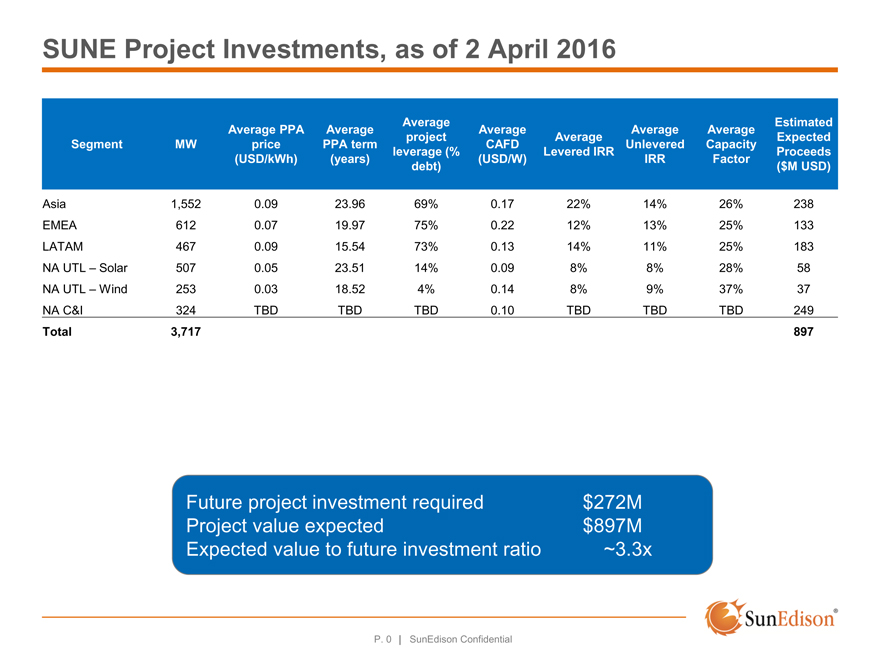

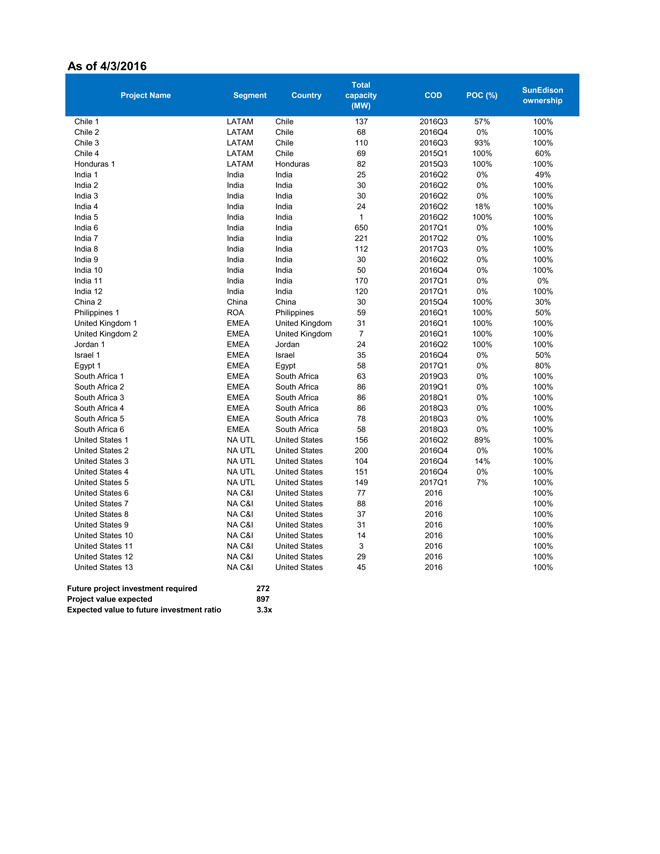

SUNE Project Investments, as of 2 April 2016

AverageEstimated

Average PPAAverageAverageAverageAverage

projectAverageExpected

Segment MW pricePPA termCAFDUnleveredCapacity

leverage (%Levered IRRProceeds

(USD/kWh)(years)(USD/W)IRRFactor

debt)($M USD)

Asia 1,552 0.0923.9669%0.1722%14%26%238

EMEA 612 0.0719.9775%0.2212%13%25%133

LATAM 467 0.0915.5473%0.1314%11%25%183

NA UTL – Solar 507 0.0523.5114%0.098%8%28%58

NA UTL – Wind 253 0.0318.524%0.148%9%37%37

NA C&I 324 TBDTBDTBD0.10TBDTBDTBD249

Total 3,717 897

Future project investment required $272M Project value expected $897M Expected value to future investment ratio ~3.3x

P. 0 | SunEdison Confidential

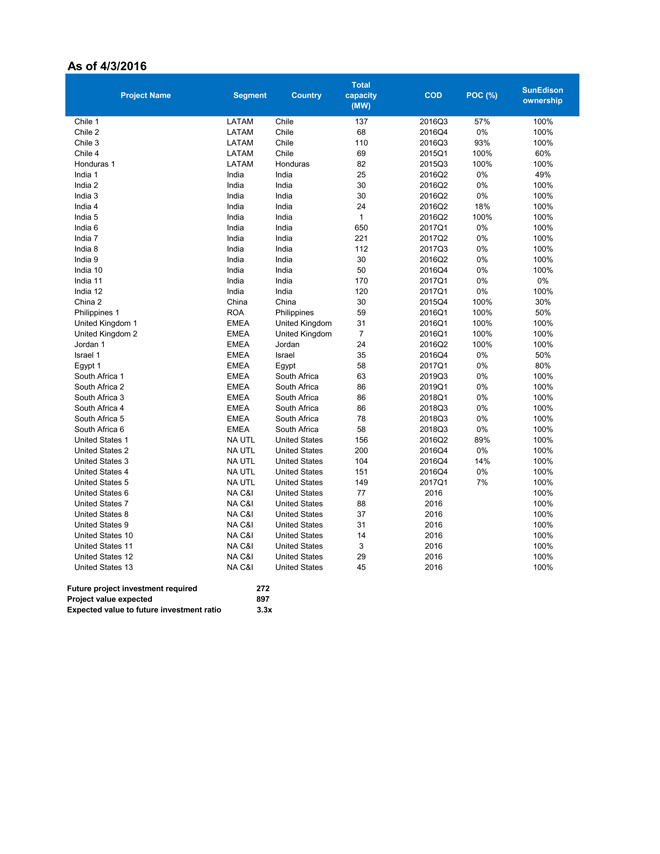

As of 4/3/2016

Total

Project Name Segment CountrycapacityCODPOC (%)SunEdison

(MW)ownership

Chile 1 LATAM Chile1372016Q357%100%

Chile 2 LATAM Chile682016Q40%100%

Chile 3 LATAM Chile1102016Q393%100%

Chile 4 LATAM Chile692015Q1100%60%

Honduras 1 LATAM Honduras822015Q3100%100%

India 1 India India252016Q20%49%

India 2 India India302016Q20%100%

India 3 India India302016Q20%100%

India 4 India India242016Q218%100%

India 5 India India12016Q2100%100%

India 6 India India6502017Q10%100%

India 7 India India2212017Q20%100%

India 8 India India1122017Q30%100%

India 9 India India302016Q20%100%

India 10 India India502016Q40%100%

India 11 India India1702017Q10%0%

India 12 India India1202017Q10%100%

China 2 China China302015Q4100%30%

Philippines 1 ROA Philippines592016Q1100%50%

United Kingdom 1 EMEA United Kingdom312016Q1100%100%

United Kingdom 2 EMEA United Kingdom72016Q1100%100%

Jordan 1 EMEA Jordan242016Q2100%100%

Israel 1 EMEA Israel352016Q40%50%

Egypt 1 EMEA Egypt582017Q10%80%

South Africa 1 EMEA South Africa632019Q30%100%

South Africa 2 EMEA South Africa862019Q10%100%

South Africa 3 EMEA South Africa862018Q10%100%

South Africa 4 EMEA South Africa862018Q30%100%

South Africa 5 EMEA South Africa782018Q30%100%

South Africa 6 EMEA South Africa582018Q30%100%

United States 1 NA UTL United States1562016Q289%100%

United States 2 NA UTL United States2002016Q40%100%

United States 3 NA UTL United States1042016Q414%100%

United States 4 NA UTL United States1512016Q40%100%

United States 5 NA UTL United States1492017Q17%100%

United States 6 NA C&I United States772016100%

United States 7 NA C&I United States882016100%

United States 8 NA C&I United States372016100%

United States 9 NA C&I United States312016100%

United States 10 NA C&I United States142016100%

United States 11 NA C&I United States32016100%

United States 12 NA C&I United States292016100%

United States 13 NA C&I United States452016100%

Future project investment required 272

Project value expected 897

Expected value to future investment ratio 3.3x

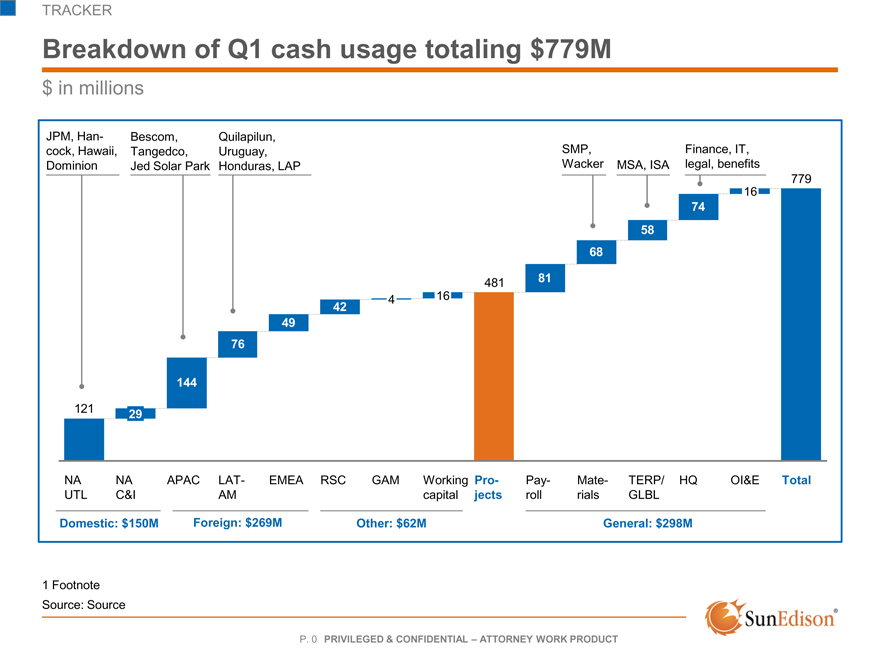

TRACKER

Breakdown of Q1 cash usage totaling $779M

$ in millions

JPM, Han- Bescom, Quilapilun,

cock, Hawaii, Tangedco, Uruguay, SMP,Finance, IT,

Dominion Jed Solar Park Honduras, LAPWackerMSA, ISAlegal, benefits

779

16

74

58

68

48181

416

42

49

76

144

1 2 1 29

NA NA APACLAT-EMEARSCGAMWorkingPro-Pay-Mate-TERP/HQOI&ETotal

UTL C&I AMcapitaljectsrollrialsGLBL

Domestic: $150M Foreign: $269M Other: $62MGeneral: $298M

1 Footnote Source: Source

P. 0 PRIVILEGED & CONFIDENTIAL – ATTORNEY WORK PRODUCT

Presentation to Principals’ Steering

Committee for the 2nd Lien Lenders–Cash Update

DRAFT & SUBJECT TO CHANGE

CONFIDENTIAL // Subject to FRE 408

15 March 2016

DISCLAIMER

With the exception of historical information, the matters disclosed in this presentation are forward-looking statements. Such statements involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Potential risks and uncertainties are described in SunEdison’s filings with the Securities and Exchange Commission

(SEC), including Forms 10-K and Forms 10-Q, as well as other filings with the SEC, in addition to the risks and uncertainties described on page 2 of this presentation. These forward-looking statements represent SunEdison’s judgment as of the date of this presentation. SunEdison disclaims any intent or obligation to update these forward-looking statements, except as required by law. This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities nor shall there be any sale of securities in any state in which such solicitation or sale would be unlawful prior to registration or qualification of securities under the laws of any such state. This presentation contains financial information and data regarding SunEdison. No audit or review, including by SunEdison, has been undertaken by an independent third party of this financial information and data contained, presented or referred to in this presentation. In addition, this presentation contains certain projections relating to the possible future performance of SunEdison and its assets. Such projections reflect various assumptions which may or may not prove to be correct. No representations or warranties, express or implied, are made as to the accuracy or reasonableness of such assumptions and projections that have been based thereon. Non-GAAP Financial Measures Certain financial measures included in this presentation are supplemental measures of the Company’s performance and are not U.S. generally accepted accounting principles (“GAAP”) measures. Please refer to the Appendix hereto for a definition of the non GAAP measures used in this presentation.

P. 1

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements involve estimates, expectations, projections, goals, assumptions, known and unknown risks, and uncertainties and typically include words or variations of words such as “expect,” “anticipate,” “believe,” “intend,” “plan,” “seek,” “estimate,” “predict,” “project,” “goal,” “guidance,” “outlook,” “objective,” “forecast,” “target,” “potential,” “continue,” “would,” “will,” “should,” “could,” or “may” or other comparable terms and phrases. All statements that address operating performance, events, or developments that SunEdison expects or anticipates will occur in the future are forward-looking statements. They may include estimates of expected cash available for distribution (CAFD), earnings, revenues, capital expenditures, liquidity, capital structure, future growth, and other financial performance items (including future dividends per share), descriptions of management’s plans or objectives for future operations, products, or services, or descriptions of assumptions underlying any of the above. Forward-looking statements provide SunEdison’s current expectations or predictions of future conditions, events, or results and speak only as of the date they are made. Although SunEdison believes its expectations and assumptions are reasonable, it can give no assurance that these expectations and assumptions will prove to have been correct and actual results may vary materially.

By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, delays or unexpected costs during the completion of projects under construction; regulatory requirements and incentives for production of renewable power; operating and financial restrictions under agreements governing indebtedness; the condition of capital markets and our ability to borrow additional funds and access capital markets; the impact of foreign exchange rate fluctuations; the ability to compete against traditional and renewable energy companies; challenges inherent in constructing and maintaining renewable energy projects; the success of ongoing research and development efforts; the ability to successfully integrate the businesses of acquired companies and realize the benefits of such acquisitions; and hazards customary to the power production industry and power generation operations, such as unusual weather conditions and outages. Furthermore, any dividends are subject to available capital, market conditions, and compliance with associated laws and regulations. Many of these factors are beyond SunEdison’s control.

SunEdison disclaims any obligation to update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data, or methods, future events, or other changes, except as required by law. The foregoing list of factors that might cause results to differ materially from those contemplated in the forward-looking statements should be considered in connection with information regarding risks and uncertainties which are described in SunEdison’s Form 10-K for the fiscal year ended December 31, 2014, as well as additional factors it may describe from time to time in other filings with the Securities and Exchange Commission. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

The information contained herein is as of the date on the cover of this presentation unless an earlier date is indicated, in which case the information is as of such earlier date.

P. 2

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

Cash flow risk assessment

COMPANY ESTIMATE AS OF 16 MARCH

PRELIMINARY

Q1 2016 Remaining Inflows

($M) High confidence inflowsInflows at risk

265316

41

91

153

High Confidence NA Utility Projects LatAm ProjectsROA ProjectsEMEA ProjectsCurrent Forecast

Inflows

Key risks to Q1 inflows

NA Utility Projects: Risk of inflows due to counterparty concerns

over audit results & associated risks

LatAm Projects: Distribution Co & Regulator approvals pending

ROA projects: Potential delays in process to meet condition

precedent requirements

EMEA projects: Substantial completion testing subject to

weather

Criticality Q1 Remaining Outflows

Corporate: $40M High

Solar Materials: $52M Med

India Equity : $45M Low

NA Utility: $26M

APAC Vendors: $25M

EMEA Projects: $19M

Other Disbursements: $66M

Total: $273M

P. 3

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements

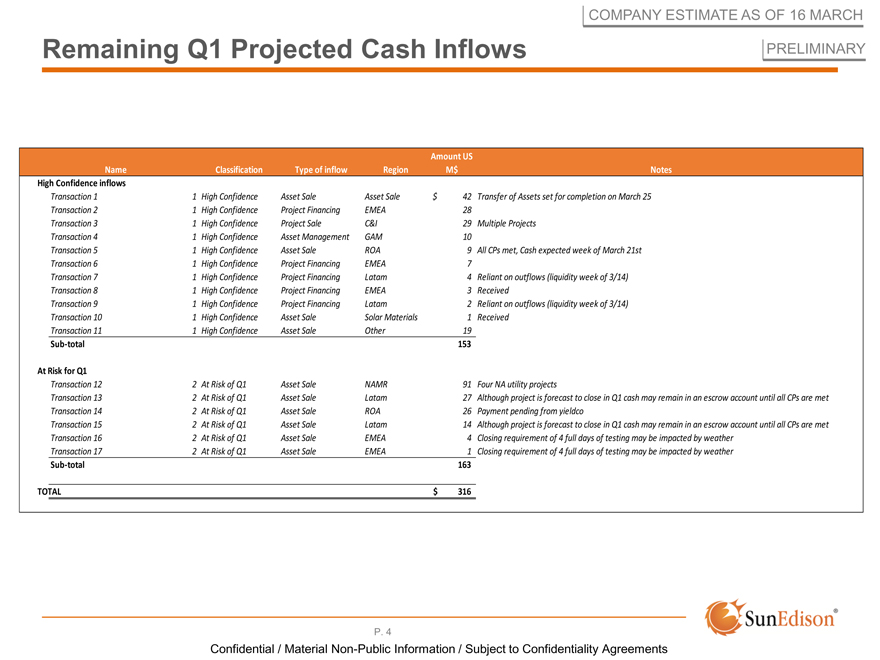

Remaining Q1 Projected Cash Inflows

COMPANY ESTIMATE AS OF 16 MARCH

PRELIMINARY

Amount US

Name Classification Type of inflowRegionM$Notes

High Confidence inflows

Transaction 1 1 High Confidence Asset SaleAsset Sale$42Transfer of Assets set for completion on March 25

Transaction 2 1 High Confidence Project FinancingEMEA28

Transaction 3 1 High Confidence Project SaleC&I29Multiple Projects

Transaction 4 1 High Confidence Asset ManagementGAM10

Transaction 5 1 High Confidence Asset SaleROA9All CPs met, Cash expected week of March 21st

Transaction 6 1 High Confidence Project FinancingEMEA7

Transaction 7 1 High Confidence Project FinancingLatam4Reliant on outflows (liquidity week of 3/14)

Transaction 8 1 High Confidence Project FinancingEMEA3Received

Transaction 9 1 High Confidence Project FinancingLatam2Reliant on outflows (liquidity week of 3/14)

Transaction 10 1 High Confidence Asset SaleSolar Materials1Received

Transaction 11 1 High Confidence Asset SaleOther19

Sub-total 153

At Risk for Q1

Transaction 12 2 At Risk of Q1 Asset SaleNAMR91Four NA utility projects

Transaction 13 2 At Risk of Q1 Asset SaleLatam27Although project is forecast to close in Q1 cash may remain in an escrow account until all CPs are met

Transaction 14 2 At Risk of Q1 Asset SaleROA26Payment pending from yieldco

Transaction 15 2 At Risk of Q1 Asset SaleLatam14Although project is forecast to close in Q1 cash may remain in an escrow account until all CPs are met

Transaction 16 2 At Risk of Q1 Asset SaleEMEA4Closing requirement of 4 full days of testing may be impacted by weather

Transaction 17 2 At Risk of Q1 Asset SaleEMEA1Closing requirement of 4 full days of testing may be impacted by weather

Sub-total 163

TOTAL $316

P. 4

Confidential / Material Non-Public Information / Subject to Confidentiality Agreements