SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

SPORTSLINE.COM, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration No.: |

2200 West Cypress Creek Road

Fort Lauderdale, Florida 33309

April 29, 2004

Dear Stockholder:

You are cordially invited to attend our 2004 Annual Meeting of Stockholders, which will be held at 10:00 a.m. on Tuesday, June 22, 2004, at our offices located at 2200 West Cypress Creek Road, Fort Lauderdale, Florida 33309.

At the annual meeting, our stockholders will be asked to elect three members to our board of directors. The accompanying Notice of Annual Meeting of Stockholders and Proxy Statement describe in more detail the matters to be presented at the annual meeting.

The board of directors recommends that you vote in favor of the election of the nominated directors.

Please take this opportunity to become involved in the affairs of your company. Whether or not you expect to be present at the meeting, please promptly complete, date, sign and mail the enclosed proxy card in the envelope provided. No postage is required if mailed in the United States. Returning the proxy card does NOT deprive you of your right to attend the meeting and vote your shares in person. If you attend the meeting, you may withdraw your proxy and vote your own shares.

|

Sincerely, |

|

|

Michael Levy |

Chairman of the Board, President and Chief Executive Officer |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on June 22, 2004

To our Stockholders:

The 2004 annual meeting of stockholders of SportsLine.com, Inc. will be held at 10:00 a.m., local time, on Tuesday, June 22, 2004, at our offices located at 2200 West Cypress Creek Road, Fort Lauderdale, Florida 33309 for the purpose of considering and acting upon the following:

| | 1. | Election of three members to our board of directors to hold office until our 2007 annual meeting or until their successors are duly elected and qualified; and |

| | 2. | Any other matters that properly come before the meeting. |

The board of directors is not aware of any other business scheduled for the annual meeting. Any action may be taken on the foregoing proposals at the annual meeting on the date specified above or on any date or dates to which the annual meeting may be adjourned.

Stockholders of record at the close of business on April 26, 2004 are entitled to notice of, and to vote at, the meeting or at any postponements or adjournments of the meeting.

|

By Order of the Board of Directors, |

|

|

Kenneth W. Sanders |

| Secretary |

Fort Lauderdale, Florida

April 29, 2004

YOUR VOTE IS IMPORTANT

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. THEREFORE, WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING IN PERSON, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY OR PROXIES, AS THE CASE MAY BE, AS SOON AS POSSIBLE IN THE ENCLOSED POSTAGE PRE-PAID ENVELOPE.

TABLE OF CONTENTS

i

ii

2004 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

This proxy statement contains information related to our annual meeting of stockholders to be held on Tuesday, June 22, 2004, beginning at 10:00 a.m., local time, at our offices located at 2200 West Cypress Creek Road, Fort Lauderdale, Florida 33309 and at any adjournments or postponements thereof. The approximate date this proxy statement, the accompanying notice of annual meeting and the enclosed form of proxy are first being sent to stockholders is May 11, 2004.

You should review this information in conjunction with our Annual Report to Stockholders for the year ended December 31, 2003, which accompanies this proxy statement.

ABOUT THE MEETING

What is the purpose of the annual meeting?

At the annual meeting, stockholders will elect three directors and act upon any other matters that properly come before the meeting. In addition, our management will report on our performance during 2003 and respond to questions from our stockholders.

Who is entitled to notice of and to vote at the meeting?

Only stockholders of record at the close of business on the record date, April 26, 2004, are entitled to receive notice of the annual meeting and to vote shares of our common stock that they held on that date at the meeting or any postponements or adjournments of the meeting. Each outstanding share of common stock entitles its holder to cast one vote on each matter to be voted upon.

Who can attend the meeting?

All stockholders as of the record date, or their duly appointed proxies, may attend. Please note that if you hold shares in “street name” (that is, through a broker or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the record date.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of all of the shares of common stock outstanding on the record date will constitute a quorum, permitting us to conduct business at the meeting. As of the record date, 42,763,853 shares of our common stock were outstanding. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting, but will not be counted as votes cast “for” or “against” any given matter.

If less than a majority of outstanding shares entitled to vote are represented at the meeting, a majority of the shares present at the meeting, either in person or by proxy, may adjourn the meeting to another date, time and/or place, and notice need not be given of the new date, time and/or place if the new date, time or place is announced at the meeting before an adjournment is taken.

How do I vote?

If you complete and properly sign the accompanying proxy card and return it to us, it will be voted as you direct. If you are a registered stockholder and you attend the meeting, you may deliver your completed proxy card in person. “Street name” stockholders who wish to vote at the meeting will need to obtain a proxy from the institution that holds their shares.

Can I vote by telephone or electronically?

Many stockholders will have the option to submit their proxies or voting instructions electronically through the Internet or by telephone. Stockholders should review their proxy card or the voting instructions forwarded by their broker, bank or other holder of record to see which options are available. Stockholders submitting proxies or voting instructions via the Internet should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, that would be borne by the stockholder.

The deadline for voting by telephone or electronically is 11:59 p.m., local time, on June 21, 2004.

Can I change my vote after I return my proxy card?

Yes. Even after you have submitted your proxy card, you may change your vote at any time before the proxy is exercised by filing with our Secretary either a notice of revocation or a duly executed proxy bearing a later date. The powers of the proxy holders will be suspended if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

What are the board’s recommendations?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of our board of directors. The board recommends a votefor the election of the nominated slate of directors. See “Election of Directors” on page 6.

The board does not know of any other matters that may be brought before the meeting nor does it foresee or have reason to believe that the proxy holders will have to vote for substitute or alternate board nominees. In the event that any other matter should properly come before the meeting or any board nominee is not available for election, the proxy holders will vote as recommended by the board of directors or, if no recommendation is given, in accordance with their best judgment.

What vote is required to approve each item?

Election of Directors. The affirmative vote of a plurality of the votes cast at the meeting (either in person or by proxy) is required for the election of directors. A properly executed proxy marked “WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. Stockholders do not have the right to cumulate their votes for directors.

Other Items. In the event any other items are properly brought before the stockholders at the meeting, the affirmative vote of a majority of the votes cast at the meeting (either in person or by proxy) will be required for approval. A properly executed proxy marked “ABSTAIN” with respect to any such matter will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. Thus, if you do not give your broker or nominee specific instructions, your shares may not be voted on those matters and will not be counted in determining the number of shares necessary for approval. Shares represented by such “broker non-votes” will, however, be counted in determining whether there is a quorum.

2

Who pays for the preparation of the proxy?

We will pay the cost of preparing, assembling and mailing the proxy statement, notice of meeting and enclosed proxy card. In addition to the use of mail, our employees may solicit proxies personally and by telephone. Our employees will receive no compensation for soliciting proxies other than their regular salaries. We may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy material to the beneficial owners of our common stock and to request authority for the execution of proxies and we may reimburse such persons for their expenses incurred in connection with these activities.

Can I see a list of the stockholders entitled to vote?

Any stockholder of record as of the record date may look at the complete list of the stockholders that are entitled to vote at the annual meeting so long as it is for a purpose germane to the annual meeting. A list of stockholders entitled to vote at the annual meeting will be available for the abovementioned purposes, during normal business hours, at our offices located at 2200 West Cypress Creek Road, Fort Lauderdale, Florida 33309, for a period of ten days prior to the meeting and at the meeting itself.

3

STOCK OWNERSHIP

Who are the largest owners of our stock and how much stock do our directors and executive officers own?

On April 26, 2004 there were 42,763,853 shares of our common stock outstanding. The following table shows the amount of common stock beneficially owned as of April 26, 2004 by (i) each of our directors and nominees for director, (ii) each of our current executive officers named in the Summary Compensation Table below, (iii) all of our directors and executive officers as a group and (iv) each person known by us to beneficially own more than 5% of our outstanding common stock. Unless otherwise provided, the address of each holder named below is c/o SportsLine.com, Inc., 2200 W. Cypress Creek Road, Fort Lauderdale, Florida 33309.

| | | | | | | | | | |

Name

| | Outstanding

Shares

Beneficially

Owned (a)

| | Acquirable

Within 60 Days

(b)

| | Total Number of

Shares

Beneficially Owned

(columns (a)+(b))

| | | Percentage of

Shares

Outstanding (%)

| |

CBS Broadcasting Inc.(1) Westinghouse CBS Holding Company, Inc.(1) Viacom Inc.(1) NAIRI, Inc.(2) National Amusements, Inc.(2) Sumner M. Redstone(2) | | 17,326,740 | | — | | 17,326,740 | (3) | | 40.52 | % |

Bear Stearns Asset Management Inc.(4). | | 4,180,200 | | — | | 4,180,200 | (5) | | 9.78 | % |

Michael Levy | | 1,993,064 | | 309,895 | | 2,302,959 | (6) | | 5.35 | % |

Joseph Lacob | | 388,574 | | 38,500 | | 427,074 | (7) | | * | |

Mark J. Mariani | | 184,761 | | 114,403 | | 299,164 | | | * | |

Kenneth W. Sanders | | 181,141 | | 102,603 | | 283,744 | | | * | |

Gerry Hogan | | — | | 80,500 | | 80,500 | | | * | |

Michael P. Schulhof | | — | | 61,500 | | 61,500 | | | * | |

Stephen E. Snyder | | 49,756 | | 8,928 | | 58,684 | | | * | |

Richard B. Horrow | | 11,000 | | 40,500 | | 51,500 | | | * | |

Sherrill Hudson | | 18,000 | | 25,000 | | 43,000 | | | * | |

Andrew Nibley | | — | | 40,500 | | 40,500 | | | * | |

Thomas Cullen | | 800 | | 27,500 | | 28,300 | | | * | |

Sean McManus | | — | | — | | — | | | — | |

Peter Glusker | | — | | — | | — | | | — | |

All directors and executive officers as a group (14 persons) | | 2,838,795 | | 826,183 | | 3,664,978 | | | 8.41 | % |

| * | Represents less than 1% of our outstanding common stock. |

| (1) | The address for each of CBS Broadcasting Inc. (“CBSBI”), Westinghouse CBS Holding Company, Inc. (“W/ CBS HCI”) and Viacom Inc. (“Viacom”) is 1515 Broadway, New York, New York 10036. |

| (2) | The address for each of NAIRI, Inc. (“NAIRI”), National Amusements, Inc. (“NAI”) and Mr. Redstone is 200 Elm Street, Dedham, Massachusetts 02026. |

| (3) | This information is based on a Schedule 13D filed with the Securities and Exchange Commission, as amended through April 3, 2003, which was jointly filed by CBSBI, W/ CBS HCI, Viacom, NAIRI, NAI and Sumner M. Redstone (collectively, the “Viacom Reporting Persons”). 16,876,740 shares (the “CBS Shares”) are indirectly held by W/ CBS HCI thorough its ownership of 100% of the outstanding stock of CBSBI and are indirectly held by Viacom through its ownership of 100% of the outstanding stock of W/ CBS HCI. In addition, Viacom may also be deemed the beneficial owner of 450,000 |

4

| | shares (the “WWO Shares”) held by Westwood One, Inc. (“WWO”), as a result of an agreement between WWO and one of Viacom’s wholly-owned subsidiaries. Approximately 68% of Viacom’s voting stock is owned by NAIRI, which in turn is a wholly owned subsidiary of NAI. Beneficial ownership is attributed to Mr. Redstone as Mr. Redstone is the Chairman of the Board and the beneficial owner of a controlling interest in NAI. CBS and W/ CBS HCI have shared voting power and shared dispositive power over the CBS Shares. Viacom, NAIRI, NAI and Mr. Redstone each have shared voting power over the CBS Shares and the WWO Shares and shared dispositive power over the CBS Shares. For a description of our agreement with CBSBI, pursuant to which we are obligated to issue additional shares of common stock to CBSBI, see “Certain Relationships and Related Transactions – CBS Agreement” on page 23. |

| (4) | The address for Bear Stearns Asset Management Inc. is 383 Madison Avenue, New York, New York 10179. |

| (5) | This information is based on a Schedule 13G filed with the Securities and Exchange Commission by Bears Stearns Asset Management Inc. (“BSAM”) on February 11, 2004. According to a Schedule 13G filed with the Securities and Exchange Commission by Bear Stearns S&P STARS Portfolio (“STARS”) on February 17, 2004, STARS is the beneficial owner of 3,870,000 shares of our common stock which we believe are included in the reported beneficial ownership of common stock by BSAM. |

| (6) | Includes 60,000 shares of common stock held of record by a charitable non-profit corporation established for religious, charitable, scientific, educational and literary purposes, of which Mr. Levy is a director and the president. |

| (7) | Includes 9,281 shares of common stock held of record by a trust for the benefit of Mr. Lacob’s children for which Mr. Lacob disclaims beneficial ownership. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers, and persons who beneficially own more than ten percent of our common stock, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of our common stock. Directors, executive officers and greater than ten percent beneficial owners are required by the rules and regulations of the Securities and Exchange Commission to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies of filings furnished to us and written or oral representations that no other reports were required during the year ended December 31, 2003, we believe that all of our directors, executive officers and greater than ten percent beneficial owners complied with the reporting requirements of Section 16(a) of the Securities Exchange Act of 1934, as amended.

Equity Compensation Plans Information

The following table sets forth information as of December 31, 2003 about the securities authorized for issuance to our employees and directors under our equity compensation plans, which consist of the 1995 Stock Option Plan, the 1997 Incentive Compensation Plan and the 1997 Employee Stock Purchase Plan.

| | | | | | | |

Plan Category

| | Number of Securities to be

Issued upon Exercise of

Outstanding Options,

Warrants and Rights

| | Weighted Average Exercise Price

of Outstanding Options, Warrants and Rights

| | Number of Securities Remaining

Available for Future Issuance Under

Equity Compensation Plans

|

Equity Compensation Plans Approved by Security Holders | | 3,885,750 | | $ | 5.94 | | 2,427,724 |

Equity Compensation PlansNot Approved by Security Holders | | None | | | N/A | | None |

Total | | 3,885,750 | | $ | 5.94 | | 2,427,724 |

5

ELECTION OF DIRECTORS

Directors Standing for Election

Our Amended and Restated Certificate of Incorporation provides that the number of directors constituting the board of directors shall be at least three with the exact number of directors to be fixed from time to time by resolution of the board. The number of directors may be decreased at any time and from time to time by a majority of the directors then in office, but only to eliminate vacancies arising due to certain circumstances and never to shorten the term of an incumbent director. Following the annual meeting, our board of directors will consist of nine directors.

Our board of directors is divided into three classes and each class of directors serves for a three-year term or until successors of that class have been duly elected and qualified. At the annual meeting, the stockholders will elect three directors, each of whom will serve for a term expiring at the 2007 annual meeting of stockholders or until his or her successor has been duly elected and qualified.

The board has no reason to believe that any director nominee will refuse or be unable to serve if elected. However, if any director nominee should become unavailable to serve as director, the board may designate a substitute director nominee or the number of directors may be reduced in accordance with our by-laws. If the board designates a substitute director nominee, the persons named as proxies will vote for the substitute director nominee designated by the board.

The directors standing for re-election are:

| | • | Michael Levy, 57, has served as our Chairman of the Board, President and Chief Executive Officer since our inception in February 1994. From 1979 through March 1993, Mr. Levy served as President, Chief Executive Officer and as a director of Lexicon Corporation, a high technology company specializing in data communications and signal processing technology. From January 1988 to June 1993, Mr. Levy also served as Chairman of the Board and Chief Executive Officer of Sports-Tech International, Inc., a company engaged in the development, acquisition, integration and sale of computer software, equipment and computer-aided video systems used by professional, collegiate and high school sports programs. Between June 1993 and February 1994, Mr. Levy was a private investor. |

| | • | Sherrill Hudson, 60, was appointed as one of our directors in September 2003 and qualifies as an “audit committee financial expert” under Securities and Exchange Commission regulations. He retired from Deloitte & Touche, LLP in August 2002, after 37 years, including the last 19 in Miami as managing partner for South Florida, including oversight responsibility for Deloitte’s Florida and Puerto Rico offices for most of that time. Mr. Hudson also serves as a member of the board of directors of TECO Energy, Inc., Publix Super Markets, Inc. Standard Register Company, and MasTec, Inc. |

| | • | Andrew Nibley, 52, was appointed as one of our directors in March 1996. In January, 2003, Nibley became Chairman of Marsteller, the creative and advertising arm of Burson-Marsteller, a public relations firm owned by WPP. From October 1999 to December 2001, Mr. Nibley ran Vivendi Universal’s global Internet music business and served as President and Chief Executive Officer of both GetMusic LLC and Rollingstone.com. From January 1998 to September 1999, Mr. Nibley served as President of Reuters NewMedia, Inc., a company he co-founded in 1994, and of which he had been a director since January 1994. From January 1994 to January 1998, Mr. Nibley served as Editor of Reuters, America Inc. as well as Senior Vice President News and Television. Mr. Nibley also currently serves on the Board of Directors of several privately held companies in the online and offline media businesses. |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL NOMINEES NAMED ABOVE.

6

Directors Continuing in Office

The terms of the following directors expire at the annual meeting of stockholders in 2005:

| | • | Thomas Cullen, 44, was appointed as one of our directors in April 1997. Mr. Cullen has been Senior Vice President – Advanced Services & Business Development for Charter Communications, since August 2003. Charter Communications is a broadband communications company, providing a range of services to homes and businesses, including digital cable television, cable modem Internet access and telephony services. From July 2000 through August 2003, Mr. Cullen was a private investor and business consultant. Mr. Cullen served as President of MediaOne Ventures, Inc. from April 1997 until its purchase by AT&T Corp. in June 2000. From 1981 through 1997, Mr. Cullen held various senior positions with US WEST and MediaOne in the areas of business development, new product initiatives and strategic investments. |

| | • | Richard B. Horrow, 49, was appointed as one of our directors in September 1994. Mr. Horrow is an attorney and sports development consultant and has served as President of Horrow Sports Ventures, Inc., a sports consulting firm, since its inception in May 1988. Mr. Horrow also currently serves as a consultant for various sports-related matters to the National Football League, International Speedway Corporation, the PGA TOUR, the Baltimore Orioles, Major League Soccer, the cities of Richmond, Virginia; Birmingham, Alabama; and Charlotte, North Carolina; and the State of West Virginia. Mr. Horrow is a visiting expert on sports law at the Harvard Law School and is the sports business, law and marketing expert for CNN and USA Today/XM Satellite Radio. Mr. Horrow also serves as a member of the board of directors of GPS Industries, Inc. |

| | • | Peter Glusker, 42, was appointed as one of our directors in March 2004. He has served as Senior Vice President of Viacom Interactive Ventures, a division of Viacom Inc. and formerly known as CBS Internet Group, since February 2000. From November 1999 through February 2000, Mr. Glusker was Managing Partner of The Accelerator Group, LLC. From September 1998 to November 1999, Mr. Glusker was a self-employed consultant. Mr. Glusker also serves as a member of the board of directors of MarketWatch.com, Inc. |

The terms of the following directors expire at the annual meeting of stockholders in 2006:

| | • | Gerry Hogan, 58, was appointed as one of our directors in November 1996. Mr. Hogan is currently a private investor and has been Chairman of Endurance Business Media, a publisher of real estate magazines, since September 2003. From May 1997 to June 2000, he served as Chairman and Chief Executive Officer of Cygnus Business Media, Inc., a magazine publishing and trade show company. He served as President and Chief Executive Officer of the Home Shopping Network from February 1993 to September 1995. Prior thereto, Mr. Hogan served as Vice Chairman of Whittle Communications, L.P. from October 1990 to February 1993. From October 1971 to September 1987, Mr. Hogan held various positions at Turner Entertainment Networks and most recently served as President. |

| | • | Sean McManus, 49, was appointed as one of our directors in March 1997. Mr. McManus has served as President of CBS Sports since December 1996. From October 1987 to December 1996, Mr. McManus was Senior Vice President U.S. Television Sales and Programming at Trans World International, the television division of International Management Group. From August 1981 to October 1987, Mr. McManus was Vice President Planning and Development at NBC Sports. From September 1979 to August 1981, Mr. McManus served as Associate Producer and Producer at NBC Sports and from August 1977 to September 1979 he was a Production Assistant at ABC Sports. |

| | • | Michael P. Schulhof, 60, was appointed as one of our directors in November 1997. Mr. Schulhof is currently a private investor focused on high technology, new media and Internet companies. |

7

| | From June 1974 to January 1996, Mr. Schulhof held various positions at Sony Corporation of America, Inc. and most recently served as President and Chief Executive Officer from June 1993 to January 1996. Mr. Schulhof is a trustee of Brandeis University, New York University Medical Center, the International Tennis Hall of Fame and the Brookings Institution. Mr. Schulhof also serves on the Board of Directors of the Center on Addiction and Substance Abuse at Columbia University and The American Hospital of Paris Foundations and is a member of the Council on Foreign Relations. Mr. Schulhof is a director of j2 Global Communications, Inc. |

The following director has decided not to stand for re-election:

| | • | Joseph Lacob, 48, was appointed as one of our directors in May 1995. He has served as a general partner of Kleiner Perkins Caufield & Byers, a venture capital partnership, since May 1987. Mr. Lacob also serves on the Board of Directors of Corixa, Inc. and Align Technology, Inc. as well as several other privately held companies. |

How are directors compensated?

Compensation.Each non-employee director, other than directors employed by an entity with an ownership interest in us in excess of ten percent (10%) of our outstanding voting securities, receives an annual cash retainer of $10,000 as well as $2,000 for each board meeting attended by such director in person (limited to one such fee per quarter) and $500 for each committee meeting attended by such director (limited to four such fees per year for audit committee members and two such fees per year for compensation committee members for fiscal year 2003 with such fee limits increasing to eight and four, respectively, commencing in 2004). The compensation that would otherwise be payable to a director that is employed by an entity with an ownership interest in us in excess of ten percent (10%) of our outstanding voting securities is paid directly to such entity.

Options. During 2003, each non-employee director received annual grant of 6,250 options pursuant to our 1997 Incentive Compensation Plan; however, upon joining the Board as Chairman of the Audit Committee in September 2003, Mr. Hudson received a grant of 12,500 options pursuant to the Plan at that time. Commencing in 2004, the Chairman of the audit committee and each other member of the audit committee will receive an annual grant of 12,500 and 11,000 options, respectively, and each other non-employee director will receive an annual grant of 10,000 options, pursuant to our 1997 Incentive Compensation Plan.

How often did the board meet during 2003?

During 2003 our board of directors met six times, including telephonic meetings, and took action by unanimous written consent once. Each director attended more than 75% of the total number of meetings of the board and committees on which he or she served.

What committees has the board established?

Our board of directors has a standing compensation committee, audit committee and nominating committee.

Compensation Committee. Messrs. Hudson and Nibley are the current members of our compensation committee. The compensation committee reviews and approves the compensation of our directors, officers and employees, including salaries, bonuses, commission, and benefit plans, and administers our stock plans, including the 1995 Stock Option Plan, the 1997 Incentive Compensation Plan and the 1997 Employee Stock Purchase Plan. During 2003, the compensation committee met three times and took action by unanimous written consent four times. The functions of the compensation committee and its activities during the year ended December 31, 2003 are described below under the heading “Report of the Compensation Committee” on page 10. A copy of our compensation committee charter is available on our website at www.sportsline.com/info/ir/corporate_governance.

Audit Committee. Messrs. Cullen, Hudson, Lacob and Schulhof are the current members of our audit committee and Mr. Hudson is the chairman. The members of our audit committee are independent as defined by the rules and regulations of the Nasdaq Stock Market. During 2003, the audit committee met thirteen times and took action by unanimous written consent twice. The audit committee represents the board in its relations with our

8

independent public accountants and oversees the financial reporting and disclosures prepared by our management. The functions of the audit committee and its activities during the year ended December 31, 2003 are described below under the heading “Report of the Audit Committee” on page 12. A copy of our audit committee charter is available on our website at www.sportsline.com/info/ir/corporate_governance and is attached to this proxy statement as Appendix A.

Corporate Governance/Nominating Committee. Messrs. Hudson and Hogan are the current members of our corporate governance/nominating committee. The corporate governance/nominating committee was formed in December 2003 and did not meet during 2003. The purpose of the corporate governance/nominating committee is to define the basic responsibilities and qualifications of individuals nominated and elected to serve as members of our board of directors, to identify and nominate individuals qualified to become directors in accordance with these policies and guidelines, oversee the selection and composition of committees of our board of directors and establish, implement and monitor policies and processes regarding principles of corporate governance in order to ensure our board of director’s compliance with its fiduciary duties to the company and our stockholders. The corporate governance/nominating committee is governed by a charter adopted by our board of directors. This charter is available on our website at www.sportsline.com/info/ir/corporate_governance.

9

Report of the Compensation Committee

The following Report of the Compensation Committee, the Report of the Audit Committee and the performance graph included elsewhere in this proxy statement do not constitute soliciting material and should not be deemed filed or incorporated by reference into any other filing by us under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent we specifically incorporate either report or the performance graph by reference therein.

Compensation Philosophy and Review. Our compensation philosophy for executive officers serves two principal purposes:

| | • | to provide a total compensation package for officers that is competitive and enables us to attract and retain key executive and employee talent needed to accomplish our long-term business objectives; and |

| | • | to directly link compensation to improvements in our performance and increases in stockholder value as measured principally by the attainment of positive earnings before interest, taxes, depreciation and amortization and other non-cash charges, or EBITDA, the trading price of our common stock and an individual’s contribution and personal performance. |

The compensation committee reviews, recommends and approves changes to our compensation policies and benefits programs, administers our stock option plans, including approving stock option grants, and otherwise seeks to ensure that our compensation philosophy is consistent with our best interests and is properly implemented.

Elements of Executive Officer Compensation. Our executive compensation consists primarily of base salary, health insurance and similar benefits, cash bonuses, the award of stock options and restricted stock designed to provide long-term incentive and eligibility to participate in compensation and benefit programs available to other employees, including our Employee Stock Purchase Plan. In addition, the compensation committee may recommend the grant of discretionary bonuses to our executive officers. The compensation committee believes that in the highly competitive, emerging markets in which we operate, equity-based compensation provides the greatest incentive for outstanding executive performance and the greatest alignment of management and stockholder long-term interests. In addition, the compensation committee believes that the compensation paid to our executives is well within the range of compensation paid to similarly situated executives at other companies in similar industries or at companies having similar market capitalization. Given our executive officers’ compensation, our compensation committee does not believe that it is necessary to incur the expense of formal studies or market analysis.

Officer Salaries. The compensation committee reviews the annual salary of the executive officers, including the President and Chief Executive Officer. In determining the appropriate salary levels, the compensation committee considers, among other factors, the officer’s scope of responsibility, prior experience, past accomplishments, data on prevailing compensation levels in relevant markets for executive talent and for each executive officer, other than the Chief Executive Officer, the evaluations and recommendations of the President and Chief Executive Officer. Executive officer salaries for fiscal 2003 were determined by the compensation committee after considering these factors. The final determination, after reviewing these factors, was subjective.

We have entered into an employment agreement with Michael Levy, our President and Chief Executive Officer and Chairman of the Board of Directors. See “Executive Compensation and Other Information – Employment Agreements” on page 16. All aspects of Mr. Levy’s fiscal year 2003 compensation were governed by this employment agreement, including the grant of options to purchase 175,000 shares of common stock. Pursuant to the terms of this employment agreement, Mr. Levy’s salary was increased from $495,000 to $544,500 for the fiscal year 2003.

Stock Option Grants and Restricted Stock. We have utilized long-term equity compensation as an important element for compensating and providing incentives to our executive officers. It is our practice to set option exercise prices for officers at not less than 100% of the stock’s fair market value on the date of grant. Thus, the value of the stockholders’ investment in us must appreciate before an optionee receives any financial benefit from the option. Options are generally granted for a term of ten years. Options granted to executive officers

10

generally provide that they are not exercisable until one year after the date of grant, at which time they become exercisable on a cumulative basis at a maximum annual rate of 25% of the total number of shares underlying the option grant. In determining the size of the stock option grants, the compensation committee considers various subjective factors primarily relating to the responsibilities of the individual officers and their expected future contributions as well as the number of shares owned by such officer or which continue to be subject to vesting under outstanding options. The compensation committee also examines the level of equity incentives held by each officer relative to the other officers’ equity positions along with their tenure, responsibilities, experience and value to us. For additional information regarding the grant of options during fiscal 2003, see the table under the section heading “Option Grants in Last Fiscal Year” below.

Annual Cash Bonuses. Annual cash bonus awards are based on both individual performance and our performance relative to an annual financial plan prepared before the beginning of each fiscal year and approved by the board of directors, reflecting appropriate progress toward our long-term goals. Bonus awards generally vary depending on the officer’s base salary. Cash bonuses were not awarded to the executive officers for 2003, other than to the Executive Vice President, Product Development and Operations in recognition of the assumption of additional duties assumed by such officer during the year.

Summary. The compensation committee believes that our compensation programs are competitive with those of other technology and Internet companies.

Policy on Deductibility of Compensation. Section 162(m) of the U.S. Internal Revenue Code of 1986, as amended limits the tax deductibility by a corporation of compensation in excess of $1,000,000 paid to the Chief Executive Officer and any other of its four most highly compensated executive officers. Certain performance-based compensation is not subject to the limitation on deductibility.

It is our policy to qualify, to the extent reasonable, our executive officers’ compensation for deductibility under applicable tax law. We intend, however, to retain the flexibility necessary to provide total compensation in line with competitive practice, our compensation philosophy and our best interests and the best interests of our stockholders. Consequently, we may from time to time pay compensation to our executive officers that may not be deductible.

Submitted by the Compensation Committee of the Board of Directors.

Members of the Compensation Committee

Gerry Hogan, Andrew Nibley

11

Report of the Audit Committee

The audit committee’s role is to act on behalf of the board of directors in the oversight of all material aspects of our corporate financial reporting and our external audit, including, among other things, our internal control structure, the results and scope of the annual audit and other services provided by our independent auditors and our compliance with legal requirements that have a significant impact on our financial reports. Although management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls, the audit committee consults with management and our independent auditors regarding the preparation of financial statements and, as appropriate, initiates inquiries into aspects of our financial affairs. In addition, the audit committee has the responsibility to retain, review fee arrangements with and, if necessary, dismiss, our independent auditors. A full description of the audit committee’s primary responsibilities, operating principles and relationship with internal and external auditors is contained in the Charter of the Audit Committee adopted by our board of directors, a copy of which is attached as Appendix A to this proxy statement. During the year ended December 31, 2003, the audit committee met thirteen times and took action by unanimous written consent twice.

In fulfilling its oversight responsibilities, the audit committee reviewed the audited financial statements for the year ended December 31, 2003 with management, including a discussion of the quality of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. The audit committee reviewed the financial statements for the year ended December 31, 2003 with the independent auditors and discussed with them all of the matters required to be discussed by Statement of Auditing Standards No. 61, including the auditors’ judgments as to the quality, not just the acceptability, of our accounting principles. In addition, the audit committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, and has discussed with the independent auditors their independence from us and our management. Finally, the audit committee has considered whether the provision by the independent auditors of non-audit services to us is compatible with maintaining the auditors’ independence.

As reported during 2003, the audit committee, with management, made a determination to restate our previously issued historical financial statements for 2001, 2002 and the first six months of 2003 primarily to correct an error in the way we had previously accounted for employee stock option grants. During the course of the re-audit of 2001 by our current auditors, certain additional adjustments to our previously issued financial statements which were audited by our prior auditors were identified.

During 2003, the audit committee reviewed and approved all audit services and permissible non-audit services provided by the independent auditors, along with the associated fees for those services. In approving non-audit services, the audit committee considered whether the provision of such services was consistent with the auditor’s independence and the SEC rules regarding auditor independence. Additionally, the audit committee considered whether the independent auditors were best positioned and qualified to provide the most effective and efficient service, based on factors such as the independent auditors’ familiarity with our business, personnel, systems or risk profile and whether provision of the service by the independent auditors would enhance our ability to manage or control risk or improve audit quality or would otherwise be beneficial to us.

In reliance on the reviews, meetings and discussions referred to above, and subject to the limitations on its role and responsibilities referred to above and in the Charter of the Audit Committee, the audit committee recommended to the board of directors that the audited financial statements for the year ended December 31, 2003 be included in SportsLine.com’s Annual Report on Form 10-K filed with the Securities and Exchange Commission for the year ended December 31, 2003.

Submitted by the Audit Committee of the Board of Directors.

Members of the Audit Committee

Sherrill Hudson, Thomas Cullen, Joseph Lacob, Michael Schulhof

12

MANAGEMENT

Executive Officers

Our current executive officers are:

| | | | |

Name

| | Age

| | Position

|

| Michael Levy | | 57 | | Chairman of the Board, President and Chief Executive Officer |

| Sharon M. Glickman | | 42 | | Chief Financial Officer |

| Mark J. Mariani | | 47 | | President, Sales and Marketing |

| Kenneth W. Sanders | | 47 | | Executive Vice President, Strategic and Financial Planning |

| Stephen E. Snyder | | 37 | | Executive Vice President, Product Development and Operations |

| | • | Michael Levy. See “Directors Standing for Election” on page 6. |

| | • | Sharon M. Glickman. Ms. Glickman has served as our Chief Financial Officer since February 2004. Ms. Glickman joined SportsLine in September 1996 and served as Assistant Controller until April 1998 when she was promoted to Corporate Controller. Between August 1985 and May 1996, Ms. Glickman was employed by Alamo Rent-A-Car, Inc. in various financial and accounting capacities. Ms. Glickman, who is a certified public accountant, received a bachelor of arts with a dual major of Economics and English from the University of Pennsylvania and a master of business administration from Duke University. |

| | • | Mark J. Mariani. Mr. Mariani has served as President, Sales and Marketing, since June 1999. He joined us in April 1996 as Executive Vice President, Sales. Mr. Mariani is responsible for Sales, Marketing, Radio Operations and Vegas Insider. From August 1991 to March 1996, Mr. Mariani served as Executive Vice President of Sports Sales for Turner Broadcasting Sales, Inc. From June 1990 to August 1991, Mr. Mariani served as Senior Vice President and National Sales Manager for CNN in New York and, from May 1986 to June 1990, Mr. Mariani served as Vice President for CNN Sales Midwest. Prior to joining Turner Broadcasting, Mr. Mariani served as an Account Executive for WBBM, a television station in Chicago, Illinois, owned and operated by CBS television. |

| | • | Kenneth W. Sanders. Mr. Sanders has served as our Executive Vice President, Strategic and Financial Planning since February 2004. Mr. Sanders joined SportsLine in September 1997 and was our President of Finance and Administration and Chief Financial Officer from January 2001 to February 2004 and our Vice President and Chief Financial Officer from September 1997 until October 1998. From January 1996 to August 1997, Mr. Sanders served as Senior Vice President, Chief Financial Officer of Paging Network, Inc., the world’s largest paging company during the 1990s. From May 1993 to December 1995, Mr. Sanders served as Executive Vice President, Chief Financial Officer and a director of CellStar Corporation, an integrated wholesaler and retailer of cellular phones and related products. Between July 1979 and April 1993, Mr. Sanders was employed by KPMG Peat Marwick, most recently as an Audit Partner from July 1990 to April 1993. |

| | • | Stephen E. Snyder. Mr. Snyder has served as our Executive Vice President, Product Development and Operations since November 2003. Mr. Snyder is responsible for overseeing programming, production, fantasy products, operations and technology. From July 1999 to November 2001, he served as vice president of production, from November 2001 to May 2002 he was vice president of strategic product development and from May 2002 to November 2003 he was vice president of marketing. Mr. Snyder joined SportsLine.com in January 1998 as director of infrastructure engineering when we acquired GolfWeb of which he was director of site development. Mr. Snyder has a degree in aerospace engineering from Cal Poly Pomona and a master of business administration from Stanford University. |

13

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Executive Compensation

The following table sets forth information concerning the compensation paid by us for the three fiscal years ended December 31, 2003 to (i) our Chief Executive Officer, (ii) each other person serving as an executive officer at December 31, 2003; and (iii) one former executive officer.

Summary Compensation Table

| | | | | | | | | | | | | | | | | |

| | | Year

| | Annual Compensation ($)(1)

| | Long Term Compensation Awards

| | All Other Compensation ($)

| |

Name and Principal Position

| | | Salary

| | Bonus

| | Restricted Stock

Awards ($)(2)

| | Securities Underlying

Options (#)

| |

Michael Levy

Chairman, President and

Chief Executive Officer | | 2003

2002

2001 | | $

| 544,500

495,000

450,000 | | $

| —

247,500

120,000 | | $ | 552,500 | | 175,000

175,000

175,000 | | $

| 20,292

26,847

26,846 | (3)

(3)

(3) |

| | | | | | |

Mark J. Mariani

President, Sales and Marketing | | 2003

2002

2001 | |

| 385,000

350,000

350,000 | |

| —

175,000

80,000 | | | 208,050 | | 50,000

75,000

50,000 | | | | |

| | | | | | |

Kenneth W. Sanders

Executive Vice President,

Strategic and Financial Planning | | 2003

2002

2001 | |

| 407,000

370,000

370,000 | |

| —

185,000

100,000 | | | 222,300 | | 50,000

75,000

50,000 | | | | |

| | | | | | |

Stephen E. Snyder

Executive Vice President, Product Development and Operations | | 2003

2002

2001 | |

| 167,167

150,000

150,000 | |

| 25,000

32,500

— | | | 44,818 | | 15,000

10,000

— | | | | |

| | | | | | |

Peter Pezaris(4)

Former President of Operations and

Product Development | | 2003

2002

2001 | |

| 286,667

250,000

223,333 | |

| —

140,000

40,000 | | | 18,525 | | 50,000

75,000

— | |

| 191,350

—

35,250 | (5)

(6) |

| (1) | The aggregate value of perquisites and other personal benefits received by the named executive officers are not reflected because the amounts are below the reporting requirements established by the rules of the Securities and Exchange Commission. |

| (2) | In August 2001, we made offers to our executive officers and certain other key employees who held stock options with an exercise price of more than $6.00 per share to exchange these stock options for restricted shares of common stock at an exchange ratio of one share of restricted stock for each two shares subject to options exchanged. Pursuant to such offer, Messrs. Levy, Mariani, Pezaris, Sanders and Snyder agreed to the cancellation of options covering 1,105,000, 365,000, 39,000, 380,000 and 76,612 shares, respectively, in exchange for 552,500, 182,500, 19,500, 190,000 and 38,306 restricted shares, respectively. The market value of the restricted shares as of the applicable grant date is included in this column. All such restricted stock was granted under the 1997 Incentive Compensation Plan and vests as follows: 10% of the total number of shares of restricted stock granted to each executive officer will vest each quarter for which we reports positive EBITDA (“performance vesting”); provided, that if pursuant to the performance vesting less than 25% of the total number of shares of restricted stock granted to an executive officer vest during any year, a number of shares equal to 25% of the total number of shares of restricted stock granted to the executive officer less the amount of shares that vested during the previous 12 months as a result of performance vesting will vest on each anniversary of the grant date. Under the terms of the 1997 Incentive Compensation Plan and our employment agreements with each of Messrs. Levy, Mariani and Sanders, the shares of restricted stock will vest immediately in the event of certain change of control transactions. All shares of restricted stock held by Mr. Pezaris vested on November 21, 2003, upon the termination of his employment. At December 31, 2003, the value of the aggregate restricted stock granted to Messrs. Levy, Mariani, Sanders and Snyder, based on the closing price of our common stock on the Nasdaq National Market on that date ($1.27), was $701,675, $231,775, $241,300 and $48,649, respectively. As of December 31, 2003, 60% of the restricted stock had vested. Dividends, if any, are required to be paid on the restricted stock reported in the table above. |

| (3) | Represents premiums paid for life and disability insurance policies for the benefit of Mr. Levy. |

| (4) | Mr. Pezaris’ employment with SportsLine.com was terminated effective November 21, 2003. |

| (5) | Includes the following amounts paid to Mr. Pezaris during 2003 in connection with the termination of his employment pursuant to the terms of his employment agreement: (i) $172,889 of severance and (ii) $18,461 of accrued paid time off. |

| (6) | Represents bonus paid in connection with relocation from New York, New York to Fort Lauderdale, Florida. |

14

Stock Option Information

The following table sets forth, with respect to our Chief Executive Officer and the other executive officers named in the Summary Compensation Table, certain information concerning the grant of stock options in 2003.

Option Grants in Last Fiscal Year

| | | | | | | | | | | | | | | | | | | |

Name

| | Date of

Grant

| | Individual Grants

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for

Option Term(2)

|

| | | Number of Securities Underlying Options

Granted (1)

| | | % of Total

Options

Granted to

Employees in Fiscal

Year

| | | Exercise

Price ($/share)

| | Expiration Date

| |

| | | | | | | 5%($)

| | 10%($)

|

Michael Levy | | 1/22/2003 | | 175,000 | | | 16.93 | % | | $ | 1.01 | | 01/21/2013 | | $ | 111,157 | | $ | 281,694 |

Mark J. Mariani | | 1/22/2003 | | 50,000 | | | 4.84 | | | | 1.01 | | 01/21/2013 | | | 31,759 | | | 80,484 |

Peter Pezaris | | 1/22/2003 | | 50,000 | (3) | | 4.84 | | | | 1.01 | | 11/20/2004 | | | 31,759 | | | 80,484 |

Kenneth W. Sanders | | 1/22/2003 | | 50,000 | | | 4.84 | | | | 1.01 | | 01/21/2013 | | | 31,759 | | | 80,484 |

Stephen E. Snyder | | 6/11/2003 | | 15,000 | | | 1.45 | | | | 1.44 | | 6/11/2013 | | | 13,584 | | | 34,425 |

| (1) | All such options were granted under the 1997 Incentive Compensation Plan and become exercisable in installments over four years. Under our 1997 Incentive Compensation Plan, these options will become immediately exercisable in the event of certain change of control transactions. |

| (2) | Potential realizable value assumes that the stock price increases from the date of grant until the end of the option term (10 years) at the annual rate specified (5% and 10%). The 5% and 10% assumed annual rates of appreciation are mandated by rules of the Securities and Exchange Commission and do not represent our estimate or projection of the future price of our common stock. We do not believe that this method accurately illustrates the potential value of a stock option. |

| (3) | All such options vested upon the termination of Mr. Pezaris’ employment with SportsLine.com on November 21, 2003 and expire one year after such date. |

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth certain information concerning the unexercised options held by our Chief Executive Officer and the other executive officers named in the Summary Compensation Table at December 31, 2003 and the value thereof, based on a value per share of common stock of $1.27, the closing price of the common stock on the Nasdaq National Market System on December 31, 2003. No stock options were exercised by such persons during 2003.

| | | | | | | | | | | | | | |

Name

| | Shares

Acquired

on Exercise(#)

| | Value Realized($)

| | Number of Securities

Underlying Unexercised

Options at December 31,

2003 (#)

| | Value of Unexercised In-

the-Money Options at

December 31, 2003 ($)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Michael Levy | | — | | — | | 204,166 | | 320,834 | | $ | — | | $ | 45,500 |

Mark J. Mariani | | — | | — | | 81,070 | | 105,730 | | | 7,611 | | | 13,000 |

Peter Pezaris | | — | | — | | 175,000 | | — | | | 13,000 | | | — |

Kenneth W. Sanders | | — | | — | | 69,270 | | 105,730 | | | — | | | 13,000 |

Stephen E. Snyder | | — | | — | | 3,928 | | 21,459 | | | 1,062 | | | 1,938 |

15

Employment Agreements

We have entered into an employment agreement with Michael Levy, our President and Chief Executive Officer and Chairman of the Board of Directors. The term of the agreement is three years and is automatically extended by one day for each day elapsed so that at all times the term shall be for a three-year period. Mr. Levy will receive an annual base salary of at least $385,000 for each fiscal year beginning January 1, 2000. On January 1, 2001 and on each January 1 thereafter, such Base Salary shall be increased by an amount equal to 10% of the base salary payable to Mr. Levy during the preceding calendar year. Effective January 1, 2004, Mr. Levy’s base salary has been set to $598,950. In addition, Mr. Levy shall receive an annual bonus equal to 50% of his base salary for each fiscal year for which we achieve our budgeted EBITDA target, as approved by the compensation committee, and such other bonuses as may be awarded from time to time by the board or the compensation committee. During each calendar year of the term of the agreement, we will grant Mr. Levy options to purchase at least 175,000 shares of Common Stock at exercise prices to be determined at the time of grant. If Mr. Levy’s employment is terminated by us, other than by reason of death, Disability (as defined in the agreement) or Cause (as defined in the agreement), or by Mr. Levy for Good Reason (generally defined as a material breach by us of the agreement), we will pay Mr. Levy within five days of such termination the sum of (i) his accrued base salary and vacation pay through the date of termination, (ii) a pro rata portion of his most recent bonus, (iii) an amount equal to three times his current annual base salary, and (iv) an amount equal to three times the greater of the average bonus received by Mr. Levy for the prior three years or the most recent bonus paid to Mr. Levy; and maintain certain benefits for Mr. Levy for a period of three years. In addition, upon such termination by us, other than by reason of death, Disability or Cause, or by Mr. Levy for Good Reason or upon the happening of a Change of Control (as defined in the agreement), at the time his employment is so terminated or on the date of such Change of Control, as the case may be, all shares of restricted stock held by Mr. Levy shall no longer be subject to forfeiture and all unvested stock options held by Mr. Levy will immediately vest and be exercisable for one year following the date of termination or Change of Control, as applicable, or, if earlier, until the then scheduled expiration date(s) of such options. In addition, upon a change of control caused by CBS Broadcasting Inc., or any of its affiliates, becoming the beneficial owner of forty percent (40%) or more of our outstanding voting securities as a result of the issuance of such securities by us, Mr. Levy shall be entitled, at his discretion, to surrender any out-of-the-money stock options held by him at such time for shares of common stock issued pursuant to the 1997 Incentive Compensation Plan at an exchange rate of one share of common stock for every two options surrendered. We are also obligated to make certain payments to Mr. Levy or his estate, as the case may be, in the event that his employment is terminated as a result of Disability or death. During his employment and for a period of two years after termination, Mr. Levy is prohibited from competing with us or soliciting employees or former employees of ours.

We have entered into employment agreements with certain of our other executive officers, specifically Kenneth W. Sanders (Executive Vice President, Strategic and Financial Planning) and Mark J. Mariani (President, Sales and Marketing). Each agreement is for a term of three years and is automatically extended by one day for each day elapsed so that at all times the term is for a three-year period. Messrs. Mariani and Sanders will receive annual base salaries of at least $270,000 and $315,000 respectively; an annual bonus equal to 50% of their base salary for each fiscal year for which we achieve our budgeted EBITDA target (or revenue target, in the case of Mr. Mariani’s agreement), as approved by the compensation committee; and such other bonuses as may be awarded from time to time by the board or the compensation committee. During each calendar year, we will grant each of the foregoing executives options to purchase at least 50,000 shares of Common Stock, in each case at exercise prices to be determined at the time of grant. If either of these executive’s employment is terminated by us, other than by reason of death, Disability (as defined in the agreement) or Cause (as defined in the agreement), or by the executive for Good Reason (generally defined as a material breach by us of the agreement), we will pay such executive within thirty (30) days of such termination the sum of such executives accrued base salary and any accrued incentive compensation plus a pro rata portion of his most recent bonus and pay to the executive in bi-weekly installments for a period of two years an aggregate amount equal to two times his current base salary plus an amount equal to two

16

times the greater of the average bonus received by such executive for the prior three years or the most recent bonus paid to such executive and maintain certain benefits for him for a period of two years. In addition, upon such termination by us, other than by reason of death, Disability or Cause, or by the executive for Good Reason or upon the happening of a Change of Control (as defined in the agreement), at the time his employment is so terminated or on the date of such Change of Control, as the case may be, all shares of restricted stock held by such executive shall no longer be subject to forfeiture and all unvested stock options held by him will immediately vest and be exercisable for one year following the date of termination or Change of Control, as applicable, or, if earlier, until the then scheduled expiration date(s) of such options. In addition, upon a change of control caused by CBS Broadcasting Inc., or any of its affiliates, becoming the beneficial owner of forty percent (40%) or more of our outstanding voting securities as a result of the issuance of such securities by us, each executive shall be entitled, at his discretion, to surrender any out-of-the-money stock options held by him at such time for shares of common stock issued pursuant to the 1997 Incentive Compensation Plan at an exchange rate of one share of common stock for every two options surrendered. During each executive’s employment and for a period of two years after termination, each executive is prohibited from competing with us or soliciting employees or former employees of ours. The agreement with Mr. Sanders was amended in February 2004 to provide that his relinquishment of the Chief Financial Officer position would not constitute Good Reason and to provide that if he terminates the agreement for any reason upon thirty (30) days’ written notice at any time after December 31, 2004, such termination will be deemed to have been for Good Reason.

Upon the resignation of Peter Pezaris, our former President of Operations and Product Development, on November 21, 2003, we entered into an agreement with Mr. Pezaris pursuant to which Mr. Pezaris agreed to expand the scope of the non-compete provision contained in his employment agreement and extend the term of such provision from one year to two years in exchange for our agreement to guarantee to Mr. Pezaris that if he refrained from selling the 572,773 shares of our common stock held by him as of the date of the agreement until November 2005, he would receive proceeds upon the sale of such shares of at least $721,694 based on the market price of our stock on the date of his resignation ($1.26 per share). As the termination of Mr. Pezaris’s employment was for reasons other than cause, as defined in his employment agreement, he was also entitled to the compensation and benefits provided for in the agreement upon termination.

Compensation Committee Interlocks and Insider Participation

The compensation committee is comprised of Gerry Hogan and Andrew Nibley. No member of the compensation committee is a present or former officer or employee of ours. No interlocking relationship exists between the members of the compensation committee and the board of directors or compensation committee of any other company.

17

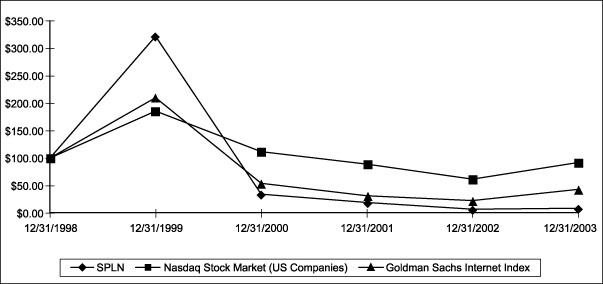

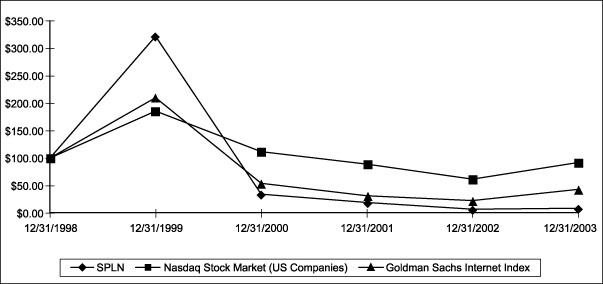

PERFORMANCE GRAPH

The following graph compares, for the period from December 31, 1998 to December 31, 2003, the cumulative total stockholder return on our common stock with the Nasdaq Stock Market (U.S. companies) Index and the Goldman Sachs Internet Index. The graph assumes that $100 was invested on December 31, 1998 in our common stock, the Nasdaq Stock Market Index and the Goldman Sachs Internet Index, and further assumes no payment or reinvestment of dividends. The stock price performance on the following graph is historical and not necessarily indicative of future stock price performance.

| | | | | | | | | | | | | | | | | | |

| | | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

|

SPLN | | $ | 100.00 | | $ | 322.08 | | $ | 34.14 | | $ | 18.76 | | $ | 6.43 | | $ | 8.16 |

Nasdaq Stock Market Index | | $ | 100.00 | | $ | 185.43 | | $ | 111.83 | | $ | 88.77 | | $ | 61.37 | | $ | 91.75 |

Goldman Sachs Internet Index | | $ | 100.00 | | $ | 210.31 | | $ | 53.62 | | $ | 30.98 | | $ | 22.05 | | $ | 42.71 |

18

CORPORATE GOVERNANCE

We operate within a comprehensive plan of corporate governance for the purpose of defining responsibilities, setting high standards of professional and personal conduct and assuring compliance with such responsibilities and standards. We regularly monitor developments in the area of corporate governance. In July 2002, Congress passed the Sarbanes-Oxley Act of 2002, which, among other things, establishes, or provides the basis for, a number of new corporate governance standards and disclosure requirements. In addition, Nasdaq has recently enacted changes to its corporate governance and listing requirements, which changes have been approved by the Securities and Exchange Commission. In response to these actions, our board of directors has initiated the below actions consistent with certain of the proposed rules.

Independent Directors

Assuming the election of all of the director nominees at the annual meeting to their seats on our board, a majority of the members of our board of directors will be independent according to the new Nasdaq Corporate Governance rules. In particular, our nominating committee or the board of directors periodically evaluates and reports to our board of directors on the independence of each member of the board of directors.

The committee or board analyzes whether a director is independent by evaluating, among other factors, the following:

| | 1. | Whether the member of the board of directors has any material relationship with us, either directly, or as a partner, stockholder or officer of an organization that has a relationship with us; |

| | 2. | Whether the member of the board of directors is a current employee of ours or was an employee of ours within three years preceding the date of determination; |

| | 3. | Whether the member of the board of directors is, or in the three years preceding the date of determination has been, affiliated with or employed by (i) a present internal or external auditor of ours or any affiliate of such auditor, or (ii) any former internal or external auditor of ours or any affiliate of such auditor, which performed services for us within three years preceding the date of determination; |

| | 4. | Whether the member of the board of directors is, or in the three years preceding the date of determination has been, part of an interlocking directorate, in which an executive officer of ours serves on the compensation committee of another company that concurrently employs the member as an executive officer; |

| | 5. | Whether the member of the board of directors receives any consulting, advisory or other compensatory fee from us, other than in his or her capacity as a member of our audit committee, our board of directors or any other board committee or fixed amounts of compensation under a retirement plan (including deferred compensation for prior service with us) and reimbursement for reasonable expenses incurred in connection with such service and for reasonable educational expenses associated with board or committee membership matters; |

| | 6. | Whether the member is an executive officer of ours or owns specified amounts of our securities – for purposes of this determination, a member will not lose his or her independent status due to levels of stock ownership so long as the member owns 10% or less of our voting securities or we determine that this member’s ownership above the 10% level does not affect his independence; |

| | 7. | Whether an immediate family member of the member of the board of directors is a current executive officer of ours or was an executive officer of ours within three years preceding the date of determination; |

19

| | 8. | Whether an immediate family member of the member of the board of directors is, or in the three years preceding the date of determination has been, affiliated with or employed in a professional capacity by (i) a present internal or external auditor of ours or any affiliate of ours or (ii) any former internal or external auditor of ours or any affiliate of ours which performed services for us within three years preceding the date of determination; and |

| | 9. | Whether an immediate family member of the member of the board of directors is, or in the three years preceding the date of determination has been, part of an interlocking directorate in which an executive officer of ours serves on the compensation committee of another company that concurrently employs the immediate family member of the member of the board of directors as an executive officer. |

The above list is not exhaustive and the committee considers all other factors which could assist it in its determination that a director has no material relationship with us that could compromise that director’s independence.

As a result of this review, our board of directors affirmatively determined that Thomas Cullen, Gerry Hogan, Richard B. Horrow, Sherrill Hudson, Joseph Lacob, Andrew Nibley and Michael P. Schulhof are independent of us and our management under the standards set forth above. Michael Levy is considered an inside director because of his position as our President and Chief Executive Officer.

Audit Committee

Our audit committee is currently comprised of four non-employee members of our board of directors; however one of the committee’s members, Joseph Lacob, will not be standing for re-election as a director and his term will expire at the Annual Meeting. After reviewing the qualifications of the current members of our audit committee and any relationships they may have with us that might affect their independence from us, our board of directors has determined that:

| | (1) | all current committee members are “independent” as that concept is defined in the applicable rules and regulations of Nasdaq and the Securities and Exchange Commission, |

| | (2) | all current committee members are financially literate, and |

| | (3) | Mr. Hudson qualifies as an “audit committee financial expert” under the applicable rules of the Securities and Exchange Commission. In making the determination as to Mr. Hudson’s status as an audit committee financial expert, our board of directors determined he has accounting and related financial management expertise within the meaning of the aforementioned rules as well as the listing standards of Nasdaq. |

Assuming our stockholders elect all of the directors nominated for election at the annual meeting, beginning immediately after the annual meeting, six members of our board of directors will meet the appropriate tests for independence according to Nasdaq and Securities and Exchange Commission rules. Ernst & Young LLP, our independent auditors, reports directly to the audit committee. Any allowable work to be performed by Ernst & Young outside of the scope of the regular audit will be pre-approved by the audit committee. The audit committee will not approve any work to be performed that is in violation of the Securities Exchange Act of 1934, as amended.

The audit committee, consistent with the Sarbanes-Oxley Act of 2002 and the rules adopted thereunder, meets with management and the auditors prior to the filing of officers’ certifications with the Securities and Exchange Commission to receive information concerning, among other things, significant deficiencies in the design or operation of internal controls.

The audit committee has established procedures for the confidential and anonymous reporting of improper activities directly to the audit committee.

The audit committee is governed by a charter which is available on our website at www.sportsline.com/info/ir/corporate_governance. A copy of this charter may be obtained for no cost upon request

20

from our Corporate Secretary. Our Internet website and the information contained in it are not incorporated into this proxy statement.

Please refer to the Report of the Audit Committee, which is set forth on page 12, for a further description of the audit committee’s responsibilities and its recommendation with respect to our audited consolidated financial statements for the year ended December 31, 2003.

Compensation Committee

Our compensation committee is comprised of two non-employee members of our board of directors.

This committee is governed by a charter which is available on our website at www.sportsline.com/info/ir/corporate_governance. A copy of this charter may be obtained for no cost upon request from our Corporate Secretary. Our Internet website and the information contained in it are not incorporated into this proxy statement.

Please refer to the Report of the Compensation Committee, which is set forth on page 10, for a further description of the compensation committee’s responsibilities and its compensation philosophy and a description of considerations underlying each component of compensation paid to our executive officers for 2003.

Nominating Committee and Procedures

Our corporate governance/nominating committee is comprised of two non-employee members of our board of directors.

The corporate governance/nominating committee considers candidates for board membership suggested by its members and other board members, as well as management and stockholders. This committee also has the sole authority to retain and to terminate any search firm to be used to assist in identifying candidates to serve as directors from time to time. A stockholder who wishes to recommend a prospective nominee for the board should notify our Corporate Secretary or any member of our corporate governance/nominating committee in writing with whatever supporting material the stockholder considers appropriate. The corporate governance/nominating committee will also consider whether to nominate any person nominated by a stockholder under the provisions of our bylaws relating to stockholder nominations as described in “Stockholder Proposals for the 2005 Annual Meeting” on page 26. The corporate governance/nominating committee does not solicit director nominations.