SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13E-3

Rule 13e-3 Transaction Statement

Under Section 13(e) of the Securities Exchange Act of 1934

SportsLine.com, Inc.

(Name of the Issuer)

SportsLine.com, Inc.

Stargate Acquisition Corp. One

Stargate Acquisition Corp. Two

CBS Broadcasting Inc.

Westinghouse CBS Holding Company, Inc.

Viacom Inc.

NAIRI, Inc.

National Amusements, Inc.

Sumner M. Redstone

(Name of Person(s) Filing Statement)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

848-934-10-5

(CUSIP Number of Class of Securities)

| | |

SportsLine.com, Inc. 2200 W. Cypress Creek Road Fort Lauderdale, FL 33309 Attn: Michael Levy Tel. No.: (954) 489-4000 | | Viacom Inc. 1515 Broadway New York, NY 10036 Attn: Michael D. Fricklas Tel. No.: (212) 258-6000 |

(Name, Address and Telephone Numbers of Person Authorized to Receive Notices and Communications on Behalf of Persons Filing Statement)

copies to:

| | | | |

Hughes Hubbard & Reed LLP One Battery Park Plaza New York, NY 10004 Attn: Kenneth A. Lefkowitz Tel. No.: (212) 837-6000 | | Greenberg Traurig, P.A. 1221 Brickell Avenue Miami, FL 33131 Attn: Kenneth C. Hoffman Tel. No.: (305) 579-0500 | | Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, NY 10036 Attn: Thomas H. Kennedy Tel. No.: (212) 735-3000 |

This statement is filed in connection with (check the appropriate box):

| | | | |

| a. | | x | | The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

| | |

| b. | | ¨ | | The filing of a registration statement under the Securities Act of 1933. |

| | |

| c. | | ¨ | | A tender offer. |

| | |

| d. | | ¨ | | None of the above. |

Check the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies:x

Calculation of Filing Fees

| | |

| Transaction Valuation(1) | | Amount of Filing Fee(2) |

| $51,454,155 | | $6,519.24 |

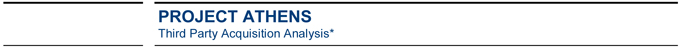

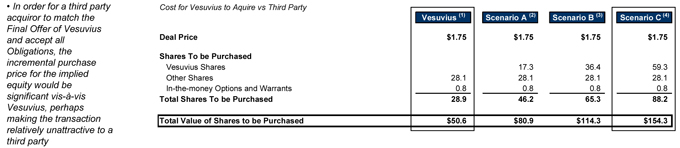

| (1) | For purposes of calculating the filing fee only. Pursuant to the terms of the Agreement and Plan of Merger, dated as of August 1, 2004 (the “Merger Agreement”), by and among SportsLine.com, Inc., Viacom Inc. and Stargate Acquisition Corp. Two, each share of SportsLine common stock, other than (1) shares owned by stockholders who are entitled to and have exercised and perfected appraisal rights, (2) shares held in SportsLine treasury and (3) shares held by Viacom or any of its subsidiaries, will be converted into the right to receive $1.75 in cash. In addition, pursuant to the Merger Agreement each outstanding stock option (whether or not vested and exercisable) and each outstanding warrant (to the extent vested), will be canceled in exchange for (1) the excess of $1.75 over the per share exercise price multiplied by (2) the number of shares of common stock subject to such option or warrant. The foregoing is based upon 28,603,868 issued and outstanding shares of common stock and an estimated aggregate cash payment of $1,397,386 to holders of outstanding options and warrants. |

| (2) | The filing fee, calculated in accordance with Regulation 0-11 under the Securities Exchange Act of 1934, as amended, equals 0.00012670 multiplied by the total Transaction Valuation. |

| x | Check the box if any part of the fee is offset as provided by Section 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

Amount Previously Paid: $6,519.24

Form or Registration No.: Schedule 14A – Preliminary Proxy Statement

Filing Party: SportsLine.com, Inc.

Date Filed: August 19, 2004

INTRODUCTION

This Rule 13e-3 transaction statement on Schedule 13E-3 is being filed with the Securities and Exchange Commission (the “Commission”) jointly by the following persons (collectively, the “filing persons”): SportsLine.com, Inc. (“SportsLine” or the “Issuer”), Stargate Acquisition Corp. One (“Stargate One”), Stargate Acquisition Corp. Two (“Stargate Two”), CBS Broadcasting Inc. (“CBSBI”), Westinghouse CBS Holding Company, Inc. (“W/CBS HCI”), Viacom Inc. (“Viacom”), NAIRI, Inc. (“NAIRI”), National Amusements, Inc. (“NAI”) and Mr. Sumner M. Redstone.

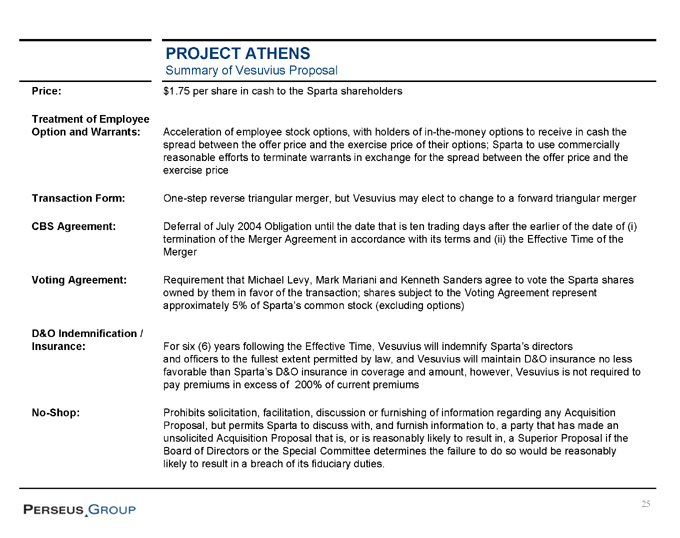

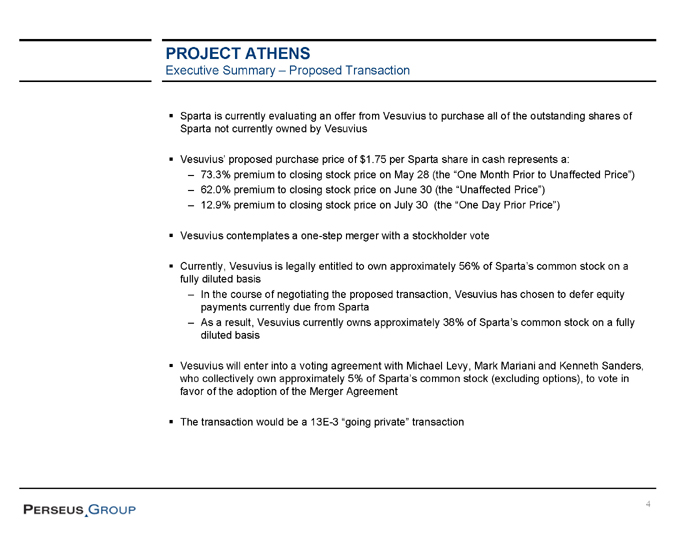

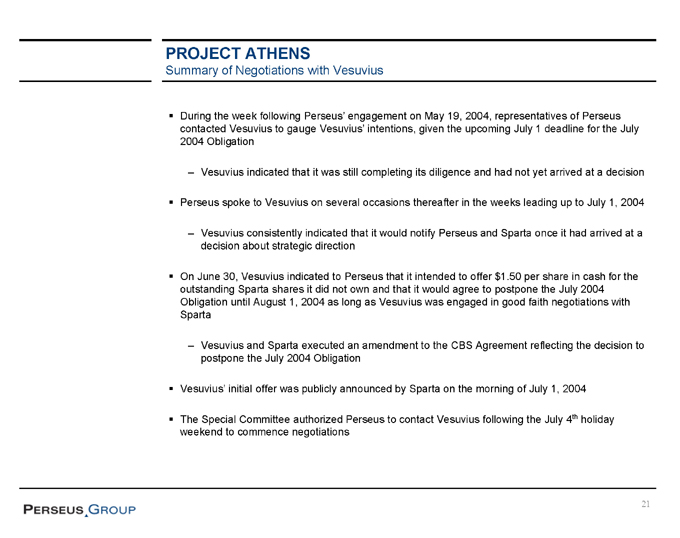

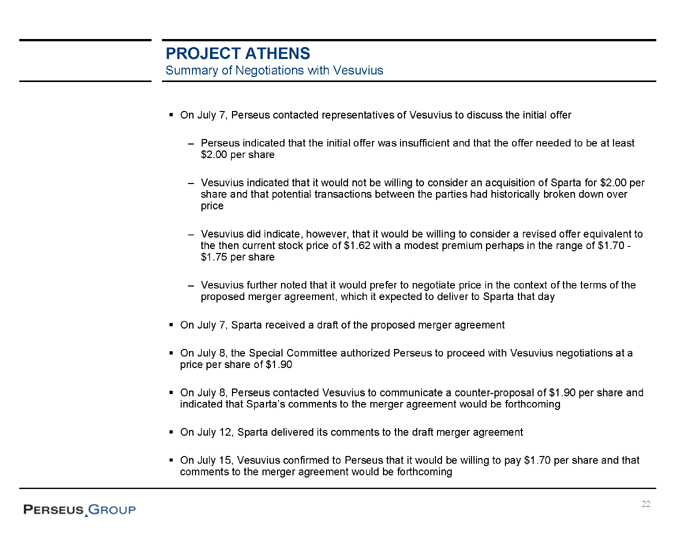

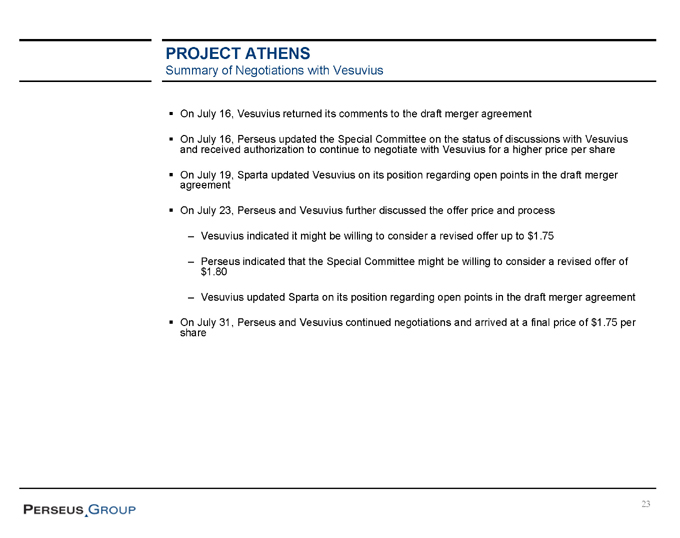

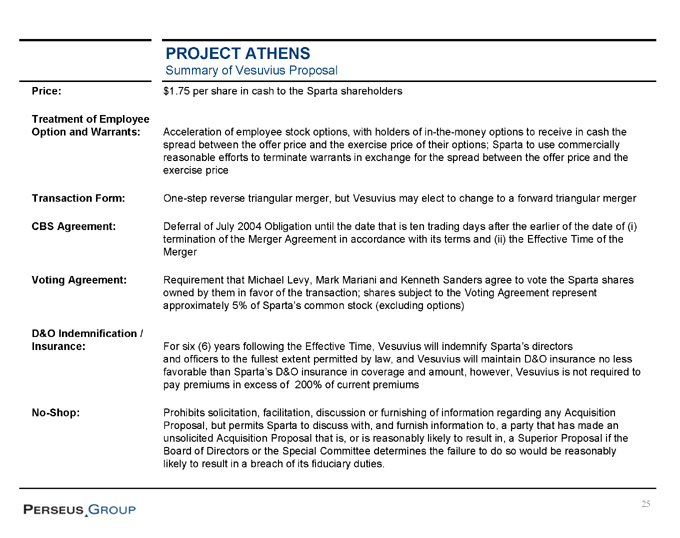

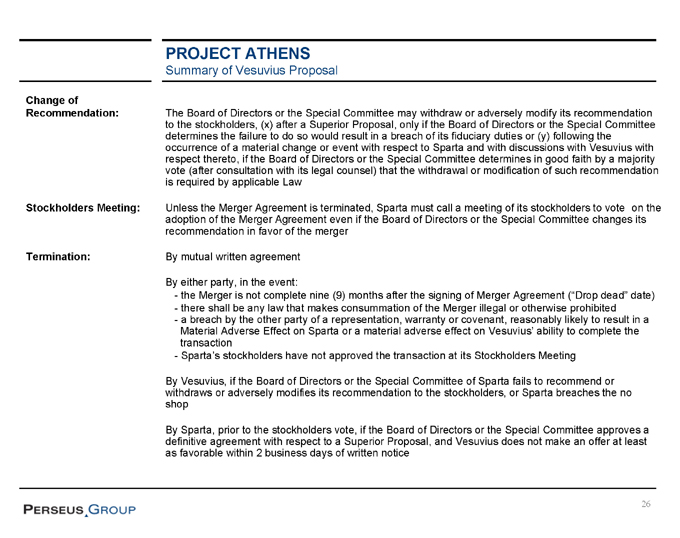

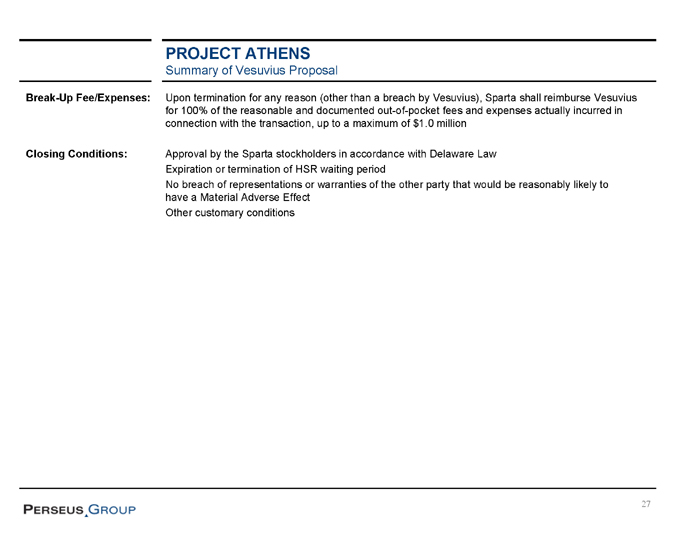

On August 1, 2004, Viacom, Stargate Two and SportsLine entered into an Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which Stargate Two, an indirect wholly-owned subsidiary of Viacom, will be merged with SportsLine and, at the option of Viacom, either SportsLine or Stargate Two will be the surviving corporation (the “Merger”). Following the consummation of the Merger, the surviving corporation will be an indirect wholly-owned subsidiary of Viacom. Under the terms of the Merger Agreement, each existing share of SportsLine’s common stock, par value $0.01 per share (“Common Stock”), other than shares held by Viacom or its controlled affiliates, treasury shares and dissenting shares, will be converted into the right to receive $1.75 in cash, without interest (the “Merger Consideration”). The Merger remains subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement, including obtaining approval of the existing stockholders of SportsLine and the expiration or termination of any applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976.

Concurrently with the filing of this Schedule 13E-3, SportsLine is filing with the Commission a preliminary proxy statement on Schedule 14A pursuant to Section 14(a) of the Exchange Act of 1934 (the “Proxy Statement”) relating to a special meeting of stockholders of SportsLine. At the meeting, stockholders of SportsLine will consider and vote upon, among other things, a proposal to adopt the Merger Agreement. A copy of the Proxy Statement is attached hereto as Exhibit (a)(1). The Proxy Statement is in preliminary form and is subject to completion or amendment. A copy of the Merger Agreement is attached as Appendix A to the Proxy Statement.

The information contained in this Schedule 13E-3 and the Proxy Statement concerning SportsLine was supplied by SportsLine and none of the other filing persons takes responsibility for the accuracy of such information. Similarly, the information contained in this Schedule 13E-3 and the Proxy Statement concerning each filing person other than SportsLine was supplied by each such filing person and no other filing person, takes responsibility for the accuracy of any information not supplied by such filing person.

| Item 1. | Summary Term Sheet. |

Item 1001 of Regulation M-A:

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET” and “QUESTIONS AND ANSWERS ABOUT THE MERGER TRANSACTION.”

| Item 2. | Subject Company Information. |

Item 1002 of Regulation M-A:

| (a) | Name And Address. The information set forth in the Proxy Statement under the caption “THE PARTICIPANTS” is incorporated herein by reference. |

| (b) | Securities. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “THE SPECIAL MEETING – Record Date; Voting Rights” and “SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS.” The exact title of the subject class of equity securities is “common stock, par value $0.01 per share.” |

| (c) | Trading Market and Price. The information set forth in the Proxy Statement under the caption “MARKET PRICE AND DIVIDEND INFORMATION” is incorporated herein by reference. |

| (d) | Dividends. The information set forth in the Proxy Statement under the caption “MARKET PRICE AND DIVIDEND INFORMATION” is incorporated herein by reference. |

| (e) | Prior Public Offerings. The information set forth in the Proxy Statement under the caption “SPECIAL FACTORS – Prior Public Offerings and Prior Stock Purchases” is incorporated herein by reference. |

| (f) | Prior Stock Purchases. The information set forth in the Proxy Statement under the caption “SPECIAL FACTORS – Prior Public Offerings and Prior Stock Purchases” is incorporated herein by reference. |

| Item 3. | Identity and Background of Filing Persons. |

Item 1003 of Regulation M-A:

With respect to SportsLine, Stargate One, Stargate Two, CBSBI, W/CBS HCI and Viacom, the information set forth in the Proxy Statement under the caption “THE PARTICIPANTS” is incorporated herein by reference. SportsLine is the subject company. The business telephone number for Stargate One, Stargate Two, CBSBI and W/CBS HCI is the same as the business telephone number for Viacom set forth in the Proxy Statement under the caption “THE PARTICIPANTS.”

The business address of Sumner M. Redstone is c/o Viacom Inc., 1515 Broadway, New York, NY 10036. The business address of NAI is 200 Elm Street, Dedham, MA 02026. The business address of NAIRI is 200 Elm Street, Dedham, MA 02026.

Attached as Annex I through VIII hereto is a list of the directors and executive officers of each filing person that is an entity, as well as the business address of each such director and executive officer.

| (b) | Business and background of entities: |

With respect to SportsLine, Stargate One, Stargate Two, CBSBI, W/CBS HCI and Viacom, the information set forth in the Proxy Statement under the caption “THE PARTICIPANTS” is incorporated herein by reference.

NAIRI, a Delaware corporation, has its principal office at 200 Elm Street, Dedham, MA 02026, and its principal business is exhibiting motion pictures in the United States and holding the shares of Viacom Class A Common Stock and Class B Common Stock. 100% of the issued and outstanding stock of NAIRI is owned by NAI.

NAI, a Maryland corporation, has its principal office at 200 Elm Street, Dedham, MA 02026. NAI’s principal business is owning and operating movie theaters in the United States, United

2

Kingdom and South America and holding the common stock of NAIRI. Mr. Redstone is the controlling stockholder of NAI.

| (c) | Business and background of natural persons: |

| | 1. | The current principal occupation or employment, and the name, principal business and address of any corporation or other organization in which the employment or occupation is conducted, of each member of the board of directors of each filing person that is an entity is as set forth in Annex I through VIII hereto. |

| | 2. | The current principal occupation or employment, and the principal business and address of any corporation or other organization in which the employment or occupation is conducted, of each executive officer of each filing person that is an entity is as set forth in Annex I through VIII hereto. |

| | 3. | Mr. Redstone’s current principal occupation or employment, and the name, principal business and address of any corporation or other organization in which the employment or occupation is conducted is as listed on Annex VI hereto. |

| | 4. | The material occupations, positions, offices or employment during the past five years of each of the individuals referred to in Item 3(c)(1) and (2) above is as set forth on Annex I through VIII hereto. |

| | 5. | None of the persons specified in this Item 3(c) have been convicted in a criminal proceeding during the past five years (excluding traffic violations or similar misdemeanors). |

| | 6. | Unless otherwise disclosed in the Proxy Statement, no person specified in this Item 3(c) was a party to any judicial or administrative proceeding during the past five years (except for matters that were dismissed without sanction or settlement) that resulted in a judgment, decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state securities laws. |

| | 7. | Each of the persons specified in this Item 3(c) is a citizen of the United States, except for Jan Leschly, who is a Danish citizen. |

| Item 4. | Terms of the Transaction. |

Item 1004 of Regulation M-A:

| (a) (1) | Material Terms.Tender Offers. Not Applicable. |

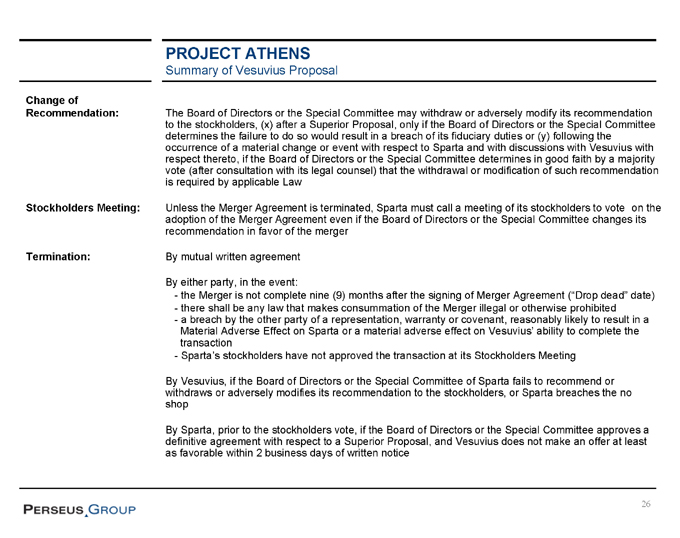

| | (2) | Material Terms.Mergers or Similar Transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET,” “QUESTIONS AND ANSWERS ABOUT THE MERGER TRANSACTION, “THE SPECIAL MEETING,” “SPECIAL FACTORS,” “THE MERGER AGREEMENT,” “THE VOTING AGREEMENTS,” “SPORTSLINE’S AGREEMENT WITH CBS BROADCASTING INC.,” “Appendix A – Agreement and Plan of Merger, dated as of August 1, 2004, by and among SportsLine.com Inc., Viacom Inc. and Stargate Acquisition Corp. Two” and “Appendix D – Form of Voting Agreement between Viacom Inc., on the one hand, and each of Michael Levy, Mark J. Mariani and Kenneth W. Sanders, on the other hand.” |

3

| (c) | Different Terms. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET,” “QUESTIONS AND ANSWERS ABOUT THE MERGER TRANSACTION,” “SPECIAL FACTORS – Purposes, Alternatives, Reasons and Effects of the Merger,” “SPECIAL FACTORS – Merger Financing,” “SPECIAL FACTORS – Interests of SportsLine Directors and Officers in the Merger,” “THE MERGER AGREEMENT – Stock Options and Warrants,” “THE VOTING AGREEMENTS” and “SPORTSLINE’S AGREEMENT WITH CBS BROADCASTING INC.” |

| (d) | Appraisal Rights. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET,” “QUESTIONS AND ANSWERS ABOUT THE MERGER TRANSACTION,” “SPECIAL FACTORS – Dissenters’ Right of Appraisal,” and “Appendix C – Section 262 of the Delaware General Corporation Law.” |

| (e) | Provisions For Unaffiliated Security Holders. There have been no provisions in connection with this transaction to grant unaffiliated security holders access to the corporate files of any of the filing persons or to obtain counsel or appraisal services at the expense of the filing persons. |

| (f) | Eligibility for Listing or Trading. Not applicable. |

| Item 5. | Past Contacts, Transactions, Negotiations and Agreements. |

Item 1005 of Regulation M-A:

| (a) | Transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SPECIAL FACTORS – Interests of SportsLine Directors and Officers in the Merger,” “SPECIAL FACTORS – Prior Public Offerings and Prior Stock Purchases” and “SPORTSLINE’S AGREEMENT WITH CBS BROADCASTING INC.” |

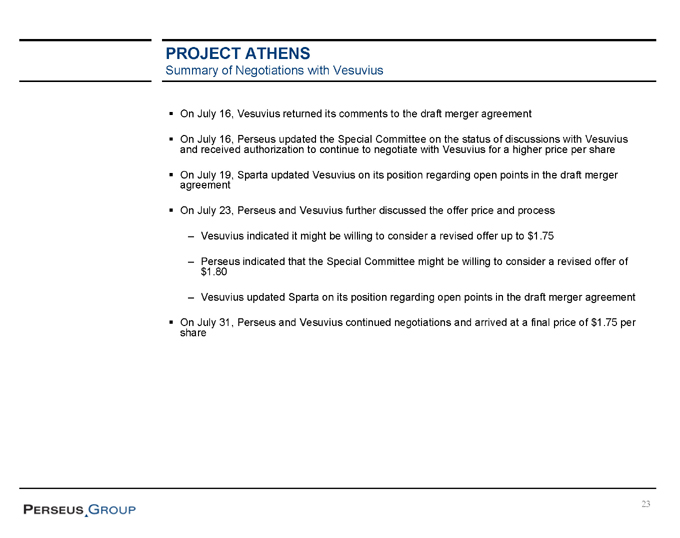

| (b) | Significant Corporate Events. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SPECIAL FACTORS – Background of the Merger,” “SPECIAL FACTORS – Interests of SportsLine Directors and Officers in the Merger,” and “THE MERGER AGREEMENT.” |

| (c) | Negotiations or Contacts. The information set forth in the Proxy Statement under the caption “SPECIAL FACTORS – Background of the Merger” is incorporated herein by reference. |

| (e) | Agreements Involving the Subject Company’s Securities. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET,” “QUESTIONS AND ANSWERS ABOUT THE MERGER TRANSACTION,” “THE SPECIAL MEETING – Record Date; Voting Rights,” “SPECIAL FACTORS – Position of SportsLine as to the Fairness of the Merger; Recommendation by the SportsLine’s Special Committee and Board of Directors,” “SPECIAL FACTORS – Purposes, Alternatives, Reasons and Effects of the Merger,” “SPECIAL FACTORS – Plans for SportsLine After the Merger,” “SPECIAL FACTORS – Merger Financing,” “SPECIAL FACTORS – Interests of SportsLine Directors and Officers in the Merger,” “THE MERGER AGREEMENT,” “THE VOTING AGREEMENTS” and “SPORTSLINE’S AGREEMENT WITH CBS BROADCASTING INC.” |

| Item 6. | Purposes of the Transaction and Plans or Proposals |

Item 1006 of Regulation M-A:

| (b) | Use of Securities Acquired. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET,” “QUESTIONS |

4

| | AND ANSWERS ABOUT THE MERGER TRANSACTION,” “THE SPECIAL MEETING – General,” “SPECIAL FACTORS – Purposes, Alternatives, Reasons and Effects of the Merger,” “SPECIAL FACTORS – Plans for SportsLine After the Merger” and “THE MERGER AGREEMENT.” |

| (c)(1)-(8) | | Plans. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET,” “QUESTIONS AND ANSWERS ABOUT THE MERGER TRANSACTION,” “SPECIAL FACTORS – Background of the Merger,” “SPECIAL FACTORS – Purposes, Alternatives, Reasons and Effects of the Merger” and “SPECIAL FACTORS – Plans for SportsLine After the Merger.” To include discussion of possible forward subsidiary merger into Stargate One. “SPECIAL FACTORS – Interests of SportsLine Directors and Officers in the Merger,” and “THE MERGER AGREEMENT.” |

| Item 7. | Purposes, Alternatives, Reasons and Effects. |

Item 1013 of Regulation M-A:

| (a) | Purposes. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET,” “QUESTIONS AND ANSWERS ABOUT THE MERGER TRANSACTION,” “SPECIAL FACTORS – Background of the Merger,” “SPECIAL FACTORS – Position of SportsLine as to the Fairness of the Merger; Recommendation by the SportsLine’s Special Committee and Board of Directors,” “SPECIAL FACTORS – Position of Viacom and Acquisition Corp. as to the Fairness of the Merger,” “SPECIAL FACTORS – Purposes, Alternatives, Reasons and Effects of the Merger” and “SPECIAL FACTORS – Plans for SportsLine After the Merger.” |

| (b) | Alternatives. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SPECIAL FACTORS – Background of the Merger,” “SPECIAL FACTORS – Position of SportsLine as to the Fairness of the Merger; Recommendation by the SportsLine’s Special Committee and Board of Directors,” “SPECIAL FACTORS – Position of Viacom and Acquisition Corp. as to the Fairness of the Merger” and “SPECIAL FACTORS – Purposes, Alternatives and Efforts of the Merger.” |

| (c) | Reasons. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET,” “QUESTIONS AND ANSWERS ABOUT THE MERGER TRANSACTION,” “SPECIAL FACTORS – Background of the Merger,” “SPECIAL FACTORS – Position of SportsLine as to the Fairness of the Merger; Recommendation by the SportsLine’s Special Committee and Board of Directors,” “SPECIAL FACTORS – Purposes, Alternatives, Reasons and Effects of the Merger” and “SPECIAL FACTORS – Opinion of the Special Committee’s Financial Advisor,” |

| (d) | Effects. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET,” “QUESTIONS AND ANSWERS ABOUT THE MERGER TRANSACTION,” “SPECIAL FACTORS – Position of SportsLine as to the Fairness of the Merger; Recommendation by the SportsLine’s Special Committee and Board of Directors,” “SPECIAL FACTORS – Purposes, Alternatives, Reasons and Effects of the Merger,” “SPECIAL FACTORS – Plans for SportsLine After the Merger,” “SPECIAL FACTORS – Interests of SportsLine Directors and Officers in the Merger,” “SPECIAL FACTORS – Material U.S. Federal Income Tax Consequences” and “THE MERGER AGREEMENT.” |

5

| Item 8. | Fairness of the Transaction. |

Item 1014 of Regulation M-A:

| (a) | Fairness. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET,” “QUESTIONS AND ANSWERS ABOUT THE MERGER TRANSACTION,” “SPECIAL FACTORS – Background of the Merger,” “SPECIAL FACTORS – Position of SportsLine as to the Fairness of the Merger; Recommendation by the SportsLine’s Special Committee and Board of Directors,” “SPECIAL FACTORS – Position of Viacom and Acquisition Corp. as to the Fairness of the Merger,” “SPECIAL FACTORS – Purposes, Alternatives, Reasons and Effects of the Merger,” “SPECIAL FACTORS – Plans for SportsLine After the Merger,” “SPECIAL FACTORS – Opinion of the Special Committee’s Financial Advisor” and “Appendix B – Opinion of Perseus Group.” |

| (b) | Factors Considered in Determining Fairness. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SPECIAL FACTORS – Position of SportsLine as to the Fairness of the Merger; Recommendation by the SportsLine’s Special Committee and Board of Directors,” “SPECIAL FACTORS – Position of Viacom and Acquisition Corp. as to the Fairness of the Merger,” “SPECIAL FACTORS – Purposes, Alternatives, Reasons and Effects of the Merger,” “SPECIAL FACTORS – Plans for SportsLine After the Merger,” “SPECIAL FACTORS – Opinion of the Special Committee’s Financial Advisor” and “Appendix B – Opinion of Perseus Group.” |

| (c) | Approval of Security Holders. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET,” “QUESTIONS AND ANSWERS ABOUT THE MERGER TRANSACTION,” “THE SPECIAL MEETING – Record Date; Voting Rights,” “THE SPECIAL MEETING – Quorum,” “THE SPECIAL MEETING – Required Vote,” “THE MERGER AGREEMENT – Additional Covenants – Viacom’s Agreement to Vote,” “THE MERGER AGREEMENT – Conditions to Consummation of the Merger” and “THE MERGER AGREEMENT – Termination and the Effects of Termination.” |

The transaction is not structured to require approval of at least a majority of unaffiliated security holders.

| (d) | Unaffiliated Representative. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET,” “SPECIAL FACTORS – Background of the Merger,” “SPECIAL FACTORS – Position of SportsLine as to the Fairness of the Merger; Recommendation by the SportsLine’s Special Committee and Board of Directors,” “SPECIAL FACTORS – Opinion of the Special Committee’s Financial Advisor” and “Appendix B – Opinion of Perseus Group.” |

| (e) | Approval of Directors. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET,” “SPECIAL FACTORS – Background of the Merger” and “SPECIAL FACTORS – Position of SportsLine as to the Fairness of the Merger; Recommendation by the SportsLine’s Special Committee and Board of Directors.” |

| (f) | Other Offers. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET,” “SPECIAL FACTORS – Background of the Merger” and “SPECIAL FACTORS – Position of SportsLine as to the Fairness of the Merger; Recommendation by the Sportsline’s Special Committee and Board of Directors.” |

6

| Item 9. | Reports, Opinions, Appraisals and Negotiations. |

Item 1015 of Regulation M-A:

| (a) | Report, Opinion or Appraisal. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET,” “SPECIAL FACTORS – Background of the Merger,” “SPECIAL FACTORS – Position of SportsLine as to the Fairness of the Merger; Recommendation by the Sportsline’s Special Committee and Board of Directors,” “SPECIAL FACTORS – Position of Viacom and Acquisition Corp. as to Fairness of the Merger,” “SPECIAL FACTORS – Opinion of the Special Committee’s Financial Advisor” and “Appendix B – Opinion of Perseus Group.” |

| (b) | Preparer and Summary of the Report, Opinion or Appraisal. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET,” “SPECIAL FACTORS – Background of the Merger,” “SPECIAL FACTORS – Position of SportsLine as to the Fairness of the Merger; Recommendation by the Sportsline’s Special Committee and Board of Directors,” “SPECIAL FACTORS – Opinion of the Special Committee’s Financial Advisor” and “Appendix B – Opinion of Perseus Group.” |

| (c) | Availability of Documents. The reports, opinions or appraisal referenced in this Item 9 will be made available for inspection and copying at the principal executive officers of SportsLine during its regular business hours by any interested holder of Common Stock or any representative who has been designated in writing. |

| Item 10. | Source and Amount of Funds or Other Consideration. |

Item 1007 of Regulation M-A:

| (a)-(d) | SOURCE OF FUNDS; CONDITIONS; EXPENSES; BORROWED FUNDS. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SUMMARY TERM SHEET,” “QUESTIONS AND ANSWERS ABOUT THE MERGER TRANSACTION,” “THE SPECIAL MEETING – Solicitation of Proxies,” “SPECIAL FACTORS – Purposes, Alternatives, Reasons and Effects of the Merger,” “SPECIAL FACTORS – Merger Financing,” “SPECIAL FACTORS – Interests of SportsLine Directors and Officers in the Merger,” “SPECIAL FACTORS – Estimated Fees and Expenses” and “THE MERGER AGREEMENT – Expenses.” |

There are no alternative financing arrangements or alternative financing plans.

| Item 11. | Interest in Securities of the Subject Company. |

Item 1008 of Regulation M-A:

| (a) | Securities Ownership. The information set forth in the Proxy Statement under the caption “THE VOTING AGREEMENTS” and “SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS” is incorporated herein by reference. |

| (b) | Securities Transactions. The information set forth in the Proxy Statement under the caption “SPECIAL FACTORS – Prior Public Offerings and Prior Stock Purchases,” “THE VOTING AGREEMENTS” and “SPORTSLINE’S AGREEMENT WITH CBS BROADCASTING INC.” is incorporated herein by reference. |

7

| Item 12. | Solicitation or Recommendation. |

Item 1012(d) and (e) of Regulation M-A:

| (d) | Intent to Tender or Vote in a Going-Private Transaction. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “QUESTIONS AND ANSWERS ABOUT THE MERGER TRANSACTION,” “THE SPECIAL MEETING – Record Date; Voting Rights,” “SPECIAL FACTORS – Position of SportsLine as to the Fairness of the Merger; Recommendation by the SportsLine’s Special Committee and Board of Directors,” “SPECIAL FACTORS – Position of Viacom and Acquisition Corp. as to the Fairness of the Merger,” “SPECIAL FACTORS – Interests of SportsLine Directors and Officers in the Merger,” “THE MERGER AGREEMENT – Additional Covenants – Viacom’s Agreement to Vote” and “THE VOTING AGREEMENTS.” |

| (e) | Recommendation of Others. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “QUESTIONS AND ANSWERS ABOUT THE MERGER TRANSACTION,” “SPECIAL FACTORS – Position of SportsLine as to the Fairness of the Merger; Recommendation by the SportsLine’s Special Committee and Board of Directors” and “SPECIAL FACTORS – Position of Viacom and Acquisition Corp. as to the Fairness of the Merger.” |

| Item 13. | Financial Statements. |

Item 1010(a) and (b) of Regulation M-A:

| (a) | Financial Information. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “SELECTED HISTORICAL FINANCIAL INFORMATION” and “WHERE YOU CAN FIND MORE INFORMATION.” The information contained in the Consolidated Financial Statements included in SportsLine’s annual report on Form 10-K for the fiscal year ended December 31, 2003 and in its quarterly report on Form 10-Q for its quarter ended June 30, 2004 is incorporated herein by reference. |

| (b) | Pro Forma Information. Not applicable. |

| Item 14. | Persons/Assets, Retained, Employed, Compensated or Used. |

Item 1009 of Regulation M-A:

| (a)-(b) | Solicitations or Recommendations; Employees and Corporate Assets. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: “THE SPECIAL MEETING – Solicitation of Proxies,” “SPECIAL FACTORS – Background of the Merger,” “SPECIAL FACTORS – Position of SportsLine as to the Fairness of the Merger; Recommendation by the SportsLine’s Special Committee and Board of Directors,” “SPECIAL FACTORS – Opinion of the Special Committee’s Financial Advisor,” “SPECIAL FACTORS – Interests of SportsLine Directors and Officers in the Merger,” “SPECIAL FACTORS – Estimated Fees and Expenses,” and “Appendix B – Opinion of Perseus Group.” |

8

| Item 15. | Additional Information. |

Item 1011(b) of Regulation M-A:

| (b) | Other Material Information. The entirety of the Proxy Statement, including all Appendices thereto, is incorporated herein by reference. |

Item 1016(a) through (d), (f) and (g) of Regulation M-A:

| | |

| (a)(1) | | Preliminary Proxy Statement filed with the Commission on August 19, 2004. |

| |

| (a)(2) | | Form of Proxy Card, filed with the Commission along with the Proxy Statement. |

| |

| (a)(3) | | Letter to Stockholders, filed with the Commission along with the Proxy Statement. |

| |

| (a)(4) | | Notice of Special Meeting of Stockholders, filed with the Commission along with the Proxy Statement. |

| |

| (a)(5) | | Press Release dated August 2, 2004 (filed as Exhibit 99.1 to SportsLine’s Current Report on Form 8-K dated (date of earliest event reported) August 1, 2004 and incorporated herein by reference). |

| |

| (a)(6) | | Form of Voting and Irrevocable Proxy Agreement dated as of August 1, 2004 entered into by each of Michael Levy, Mark J. Mariani and Kenneth W. Sanders with Viacom and Stargate Two (attached as Appendix D to the Proxy Statement). |

| |

| (a)(7) | | Letter Agreement dated August 1, 2004 from CBSBI to SportsLine (filed as Exhibit 99.3 to SportsLine’s Current Report on Form 8-K dated (date of earliest event reported) August 1, 2004 and incorporated herein by reference). |

| |

| (a)(8) | | Letter Agreement dated August 1, 2004 from Viacom to Michael Levy (filed as Exhibit 99.4 to SportsLine’s Current Report on Form 8-K dated (date of earliest event reported) August 1, 2004 and incorporated herein by reference). |

| |

| (a)(9) | | Letter Agreement dated August 1, 2004 from Viacom to Mark J. Mariani (filed as Exhibit 99.6 to SportsLine’s Current Report on Form 8-K dated (date of earliest event reported) August 1, 2004 and incorporated herein by reference). |

| |

| (a)(10) | | Letter Agreement dated August 1, 2004 from Viacom to Kenneth W. Sanders (filed as Exhibit 99.5 to SportsLine’s Current Report on Form 8-K dated (date of earliest event reported) August 1, 2004 and incorporated herein by reference). |

| |

| (a)(11) | | Memorandum of Understanding dated August 1, 2004 among counsel to the plaintiffs and counsel to the defendants in the various class action lawsuits instituted by certain purported stockholders of SportsLine. |

| |

| (c)(1) | | Opinion of Perseus Group (attached as Appendix B to the Proxy Statement). |

| |

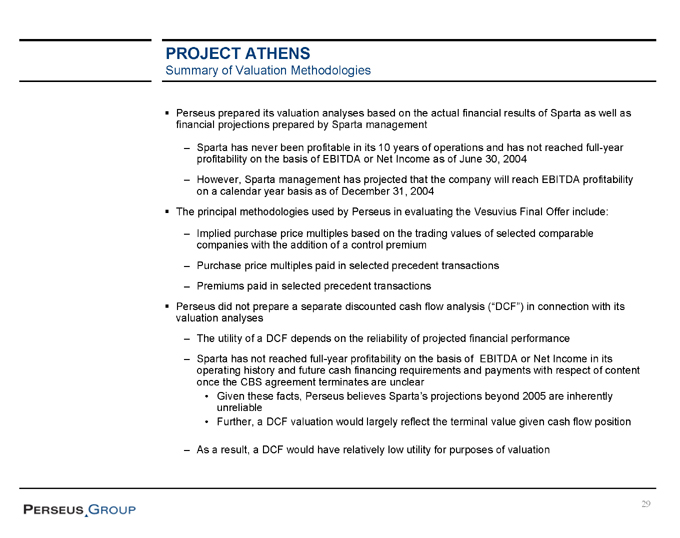

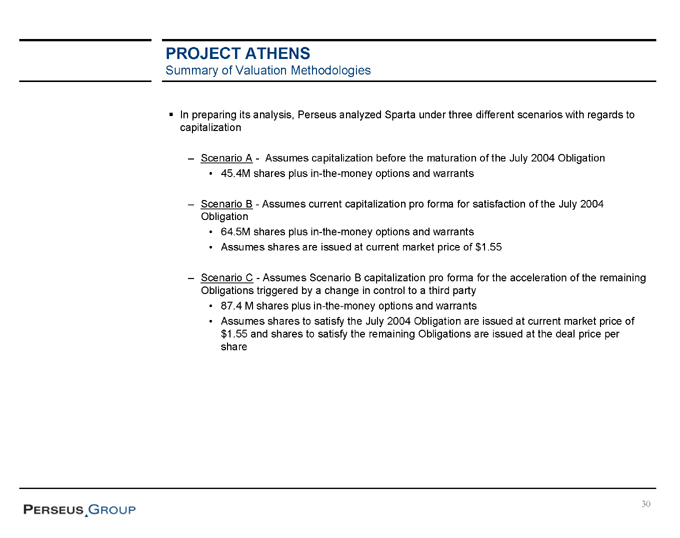

| (c)(2) | | Presentation materials, dated as of August 1, 2004, prepared by Perseus Group. |

| |

| (d)(1) | | Agreement and Plan of Merger dated as of August 1, 2004 among Viacom, Stargate Two and SportsLine (attached as Appendix A to the Proxy Statement). |

| |

| (f) | | Section 262 of the Delaware General Corporation Law (attached as Appendix C to the Proxy Statement). |

9

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 19, 2004

| | |

SPORTSLINE.COM, INC. |

| |

By: | | /s/ MICHAEL LEVY |

| | | Michael Levy |

| | | President and Chief Executive Officer |

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 19, 2004

| | |

STARGATE ACQUISITION CORP. ONE |

| |

By: | | /s/ MICHAEL D. FRICKLAS |

| | | Michael D. Fricklas |

| | | Executive Vice President |

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 19, 2004

| | |

STARGATE ACQUISITION CORP. TWO |

| |

By: | | /s/ MICHAEL D. FRICKLAS |

| | | Michael D. Fricklas |

| | | Executive Vice President |

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 19, 2004

| | |

CBS BROADCASTING INC. |

| |

By: | | /s/ MICHAEL D. FRICKLAS |

| | | Michael D. Fricklas |

| | | Executive Vice President |

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 19, 2004

| | |

WESTINGHOUSE CBS HOLDING

COMPANY, INC. |

| |

By: | | /s/ MICHAEL D. FRICKLAS |

| | | Michael D. Fricklas |

| | | Executive Vice President |

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 19, 2004

| | |

VIACOM INC. |

| |

By: | | /s/ MICHAEL D. FRICKLAS |

| | | Michael D. Fricklas |

| | | Executive Vice President |

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 19, 2004

| | |

NAIRI, INC. |

| |

By: | | /s/ SUMNER M. REDSTONE |

| | | Sumner M. Redstone |

| | | Chairman and President |

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 19, 2004

| | |

NATIONAL AMUSEMENTS, INC. |

| |

By: | | /s/ SUMNER M. REDSTONE |

| | | Sumner M. Redstone |

| | | Chairman and Chief Executive Officer |

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 19, 2004

|

|

| /s/ SUMNER M. REDSTONE |

| Sumner M. Redstone |

| Individually |

ANNEX I

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

SportsLine.com, Inc.

DIRECTORS

| | |

Name and Business Address

| | Material Five-Year Employment History

|

Michael Levy SportsLine.com, Inc. 2200 West Cypress Creek Road Fort Lauderdale, FL 33309 | | Mr. Levy has served as SportsLine’s Chairman of the Board, President and Chief Executive Officer since its inception in February 1994. From 1979 through March 1993, Mr. Levy served as President, Chief Executive Officer and as a director of Lexicon Corporation, a high technology company specializing in data communications and signal processing technology. From January 1988 to June 1993, Mr. Levy also served as Chairman of the Board and Chief Executive Officer of Sports-Tech International, Inc., a company engaged in the development, acquisition, integration and sale of computer software, equipment and computer-aided video systems used by professional, collegiate and high school sports programs. Between June 1993 and February 1994, Mr. Levy was a private investor. |

| |

Thomas Cullen Charter Communications 6399 S. Fiddler’s Green Circle Suite 600 Greenwood Village, CO 80111 | | Mr. Cullen has been a director of SportsLine since 1997. Mr. Cullen has been Executive Vice President – Advanced Services & Business Development for Charter Communications since August 2004 and was Senior Vice President – Advanced Services & Business Development for Charter Communications from August 2003 until August 2004. Charter Communications is a broadband communications company, providing a range of services to homes and businesses, including digital cable television, cable modem Internet access and telephony services. From July 2000 through August 2003, Mr. Cullen was a private investor and business consultant. Mr. Cullen served as President of MediaOne Ventures, Inc. from April 1997 until its purchase by AT&T Corp. in June 2000. From 1981 through 1997, Mr. Cullen held various senior positions with US WEST and MediaOne in the areas of business development, new product initiatives and strategic investments. |

| |

Peter Glusker Viacom Interactive Ventures 1515 Broadway New York, NY 10036 | | Mr. Glusker has been a director of SportsLine since March 2004. He has served as Senior Vice President of Viacom Digital Media Group, a division of Viacom, formerly known as Viacom Interactive Ventures and CBS Internet Group, since February 2000. From November 1999 through February 2000, Mr. Glusker was Managing Partner of The Accelerator Group, LLC. From September 1998 to November 1999, Mr. Glusker was a self-employed consultant. Mr. Glusker also serves as a member of the board of directors of MarketWatch.com, Inc. |

I-1

ANNEX I

(Continued)

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

SportsLine.com, Inc.

| | |

Name and Business Address

| | Material Five-Year Employment History

|

Richard B. Horrow Horrow Sports Ventures, Inc. 6800 SW 40th St., Suite 174 Miami, FL 33155 | | Mr. Horrow has been a director of SportsLine since September 1994. Mr. Horrow is an attorney and sports development consultant and has served as President of Horrow Sports Ventures, Inc., a sports consulting firm, since its inception in May 1988. Mr. Horrow also currently serves as a consultant for various sports-related matters to the National Football League, International Speedway Corporation, the PGA TOUR, the Baltimore Orioles, Major League Soccer, the cities of Richmond, Virginia; Birmingham, Alabama; and Charlotte, North Carolina; and the State of West Virginia. Mr. Horrow also serves as a member of the board of directors of GPS Industries, Inc. |

| |

Sean McManus Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. McManus has been a director of SportsLine since March 1997. Mr. McManus has served as President of CBS Sports since December 1996. From October 1987 to December 1996, Mr. McManus was Senior Vice President U.S. Television Sales and Programming at Trans World International, the television division of International Management Group. From August 1981 to October 1987, Mr. McManus was Vice President Planning and Development at NBC Sports. From September 1979 to August 1981, Mr. McManus served as Associate Producer and Producer at NBC Sports and from August 1977 to September 1979 he was a Production Assistant at ABC Sports. |

| |

Andrew Nibley Marsteller 230 Park Ave South, Third Fl. New York, NY 10003 | | Mr. Nibley has been a director of SportsLine since March 1996. In January, 2003, Mr. Nibley became Chairman of Marsteller, the creative and advertising arm of Burson-Marsteller, a public relations firm owned by WPP. From October 1999 to December 2001, Mr. Nibley ran Vivendi Universal’s global Internet music business and served as President and Chief Executive Officer of both GetMusic LLC and Rollingstone.com. From January 1998 to September 1999, Mr. Nibley served as President of Reuters NewMedia, Inc., a company he co-founded in 1994, and of which he had been a director since January 1994. From January 1994 to January 1998, Mr. Nibley served as Editor of Reuters, America Inc. as well as Senior Vice President News and Television. Mr. Nibley also currently serves on the Board of Directors of several privately held companies in the online and offline media businesses. |

I-2

ANNEX I

(Continued)

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

SportsLine.com, Inc.

| | |

Name and Business Address

| | Material Five-Year Employment History

|

Michael P. Schulhof Private Investor 375 Park Avenue, Suite 1505 New York, NY 10152 | | Mr. Schulhof has been a director of SportsLine since November 1997. Mr. Schulhof is currently a private investor focused on high technology, new media and Internet companies. From June 1974 to January 1996, Mr. Schulhof held various positions at Sony Corporation of America, Inc. and most recently served as President and Chief Executive Officer from June 1993 to January 1996. Mr. Schulhof is a trustee of Brandeis University, New York University Medical Center, the International Tennis Hall of Fame and the Brookings Institution. Mr. Schulhof also serves on the Board of Directors of the Center on Addiction and Substance Abuse at Columbia University and The American Hospital of Paris Foundations and is a member of the Council on Foreign Relations. Mr. Schulhof is a director of j2 Global Communications, Inc. |

I-3

ANNEX I

(Continued)

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

SportsLine.com, Inc.

EXECUTIVE OFFICERS

| | |

Name and Business Address

| | Material Five-Year Employment History

|

Michael Levy SportsLine.com, Inc. 2200 West Cypress Creek Road Fort Lauderdale, FL 33309 | | Mr. Levy has served as SportsLine’s Chairman of the Board, President and Chief Executive Officer since its inception in February 1994. From 1979 through March 1993, Mr. Levy served as President, Chief Executive Officer and as a director of Lexicon Corporation, a high technology company specializing in data communications and signal processing technology. From January 1988 to June 1993, Mr. Levy also served as Chairman of the Board and Chief Executive Officer of Sports-Tech International, Inc., a company engaged in the development, acquisition, integration and sale of computer software, equipment and computer-aided video systems used by professional, collegiate and high school sports programs. Between June 1993 and February 1994, Mr. Levy was a private investor. |

| |

Sharon M. Glickman SportsLine.com, Inc. 2200 West Cypress Creek Road Fort Lauderdale, FL 33309 | | Ms. Glickman has served as SportsLine’s Chief Financial Officer since February 2004. Ms. Glickman joined SportsLine in September 1996 and served as Assistant Controller until April 1998 when she was promoted to Corporate Controller. Between August 1985 and May 1996, Ms. Glickman was employed by Alamo Rent-A-Car, Inc. in various financial and accounting capacities. |

| |

Mark J. Mariani SportsLine.com, Inc. 2200 West Cypress Creek Road Fort Lauderdale, FL 33309 | | Mr. Mariani has served as President, Sales and Marketing, since June 1999. He joined SportsLine in April 1996 as Executive Vice President, Sales. From August 1991 to March 1996, Mr. Mariani served as Executive Vice President of Sports Sales for Turner Broadcasting Sales, Inc. From June 1990 to August 1991, Mr. Mariani served as Senior Vice President and National Sales Manager for CNN in New York and, from May 1986 to June 1990, Mr. Mariani served as Vice President for CNN Sales Midwest. Prior to joining Turner Broadcasting, Mr. Mariani served as an Account Executive for WBBM, a television station in Chicago, Illinois, owned and operated by CBS television. |

I-4

ANNEX I

(Continued)

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

SportsLine.com, Inc.

| | |

Name and Business Address

| | Material Five-Year Employment History

|

Kenneth W. Sanders SportsLine.com, Inc. 2200 West Cypress Creek Road Fort Lauderdale, FL 33309 | | Mr. Sanders has served as SportsLine’s Executive Vice President, Strategic and Financial Planning since February 2004. Mr. Sanders joined SportsLine in September 1997 and was its President of Finance and Administration and Chief Financial Officer from January 2001 to February 2004 and its Vice President and Chief Financial Officer from September 1997 until October 1998. From January 1996 to August 1997, Mr. Sanders served as Senior Vice President, Chief Financial Officer of Paging Network, Inc., the world’s largest paging company during the 1990s. From May 1993 to December 1995, Mr. Sanders served as Executive Vice President, Chief Financial Officer and a director of CellStar Corporation, an integrated wholesaler and retailer of cellular phones and related products. Between July 1979 and April 1993, Mr. Sanders was employed by KPMG Peat Marwick, most recently as an Audit Partner from July 1990 to April 1993. |

| |

Stephen E. Snyder SportsLine.com, Inc. 2200 West Cypress Creek Road Fort Lauderdale, FL 33309 | | Mr. Snyder has served as SportsLine’s Executive Vice President, Product Development and Operations since November 2003. From July 1999 to November 2001, he served as vice president of production, from November 2001 to May 2002 he was vice president of strategic product development and from May 2002 to November 2003 he was vice president of marketing. Mr. Snyder joined SportsLine in January 1998 as director of infrastructure engineering when SportsLine acquired GolfWeb of which he was director of site development. |

I-5

ANNEX II

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

Stargate Acquisition Corp. One

DIRECTORS

| | |

Name and Business Address

| | Material Five-Year Employment History

|

Robert G. Freedline Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Freedline has been Senior Vice President, Treasurer of Viacom since May 2002. Prior to that, he served as Vice President and Treasurer of Viacom from May 2000 to May 2002. From May 1998 to May 2000, he served as Vice President and Controller of CBS Corporation. Mr. Freedline also served as Director of Business Planning and Development of CBS from June 1996 to May 1998. |

| |

Michael D. Fricklas Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Fricklas has been Executive Vice President, General Counsel and Secretary of Viacom since May 2000. From October 1998 to May 2000, he served as Senior Vice President, General Counsel and Secretary of Viacom and from July 1993 to October 1998, he served as Vice President, Deputy General Counsel of Viacom. Mr. Fricklas is a director of Blockbuster Inc., a majority-owned subsidiary of Viacom. |

| |

Susan C. Gordon Viacom Inc. 1515 Broadway New York, NY 10036 | | Ms. Gordon has been Senior Vice President, Controller and Chief Accounting Officer of Viacom since May 2002. Prior to that, she served as Vice President, Controller and Chief Accounting Officer of Viacom from April 1995 to May 2002 and as Vice President, Internal Audit from October 1986 to April 1995. From June 1985 to October 1986, Ms. Gordon served as Controller of Viacom Broadcasting. She joined the Company in 1981 and has held various positions in the corporate finance area. |

II-1

ANNEX II

(Continued)

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

Stargate Acquisition Corp. One

EXECUTIVE OFFICERS

| | |

Name and Business Address

| | Material Five-Year Employment History

|

Leslie Moonves Viacom Inc. 7800 Beverly Boulevard Los Angeles, CA 90036 | | Mr. Moonves has been Co-President and Co-Chief Operating Officer of Viacom since June 2004. Prior to that, he served as Chairman and Chief Executive Officer of CBS, a unit of Viacom, since 2003 and as President and Chief Executive Officer of CBS since 1998. Mr. Moonves joined CBS in 1995 as President, CBS Entertainment. Prior to that, Mr. Moonves was President of Warner Bros. Television since July 1993. |

| |

Richard J. Bressler Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Bressler has been Senior Executive Vice President and Chief Financial Officer of Viacom since May 2001. Before joining Viacom, Mr. Bressler was Executive Vice President of AOL Time Warner Inc. and Chief Executive Officer of AOL Time Warner Investments. Prior to that, Mr. Bressler served in various capacities with Time Warner Inc., including as Chairman and Chief Executive Officer of Time Warner Digital Media. He also served as Executive Vice President and Chief Financial Officer of Time Warner Inc. from March 1995 to June 1999. Mr. Bressler serves on the National Advisory Committee of JPMorgan Chase and is a director of Blockbuster Inc., a majority-owned subsidiary of Viacom. |

| |

Michael D. Fricklas Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Fricklas has been Executive Vice President, General Counsel and Secretary of Viacom since May 2000. From October 1998 to May 2000, he served as Senior Vice President, General Counsel and Secretary of Viacom and from July 1993 to October 1998, he served as Vice President, Deputy General Counsel of Viacom. Mr. Fricklas is a director of Blockbuster Inc., a majority-owned subsidiary of Viacom. |

| |

Harry Isaacs CBS Broadcasting Inc. 7800 Beverly Blvd. Los Angeles, CA 90036 | | Mr. Isaacs has been Senior Vice President, CBS Industrial Relations for CBS Broadcasting Inc. since October 2000. Prior to that, he served as Vice President, Labor Relations of Paramount Pictures from January 1997 to October 2000. |

II-2

ANNEX II

(Continued)

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

Stargate Acquisition Corp. One

| | |

Name and Business Address

| | Material Five-Year Employment History

|

Fredric G. Reynolds Viacom Television Stations Group 513 West 57th Street New York, NY 10019 | | Mr. Reynolds has been the President and Chief Executive Officer of Viacom Television Stations Group since 2001. Prior to that, he served as Executive Vice President and Chief Financial Officer of Viacom from 2000 to 2001. From 1994 to 2000, Mr. Reynolds served as Executive Vice President and Chief Financial Officer of CBS Corporation. |

| |

Dennis Swanson Viacom Television Stations Group 513 West 57th Street New York, NY 10019 | | Mr. Swanson has been the Executive Vice President and Chief Operating Officer of Viacom Television Stations Group since July 2002. Prior to that, he was the co-chair to NBC Olympics from October 1998 to July 2002. From July 1996 to July 2002, Mr. Swanson was the President of WNBC. |

| |

William A. Roskin Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Roskin was elected Senior Vice President, Human Resources and Administration of Viacom in July 1992. Prior to that, he served as Vice President, Human Resources and Administration of Viacom from April 1988 to July 1992. From May 1986 to April 1988, he was Senior Vice President, Human Resources at Coleco Industries, Inc. From 1976 to 1986, he held various executive positions at Warner Communications Inc., serving most recently as Vice President, Industrial and Labor Relations. |

| |

Robert G. Freedline Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Freedline has been Senior Vice President, Treasurer of Viacom since May 2002. Prior to that, he served as Vice President and Treasurer of Viacom from May 2000 to May 2002. From May 1998 to May 2000, he served as Vice President and Controller of CBS Corporation. Mr. Freedline also served as Director of Business Planning and Development of CBS from June 1996 to May 1998. |

| |

Susan C. Gordon Viacom Inc. 1515 Broadway New York, NY 10036 | | Ms. Gordon has been Senior Vice President, Controller and Chief Accounting Officer of Viacom since May 2002. Prior to that, she served as Vice President, Controller and Chief Accounting Officer of Viacom from April 1995 to May 2002 and as Vice President, Internal Audit from October 1986 to April 1995. From June 1985 to October 1986, Ms. Gordon served as Controller of Viacom Broadcasting. She joined the Company in 1981 and has held various positions in the corporate finance area. |

II-3

ANNEX II

(Continued)

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

Stargate Acquisition Corp. One

| | |

Name and Business Address

| | Material Five-Year Employment History

|

Bruce Taub CBS Television Network 51 West 52nd Street New York, NY 10019 | | Mr. Taub has been the Chief Financial Officer of CBS Television Network for the last five years. |

II-4

ANNEX III

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

Stargate Acquisition Corp. Two

DIRECTORS

| | |

Name and Business Address

| | Material Five-Year Employment History

|

| |

Robert G. Freedline Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Freedline has been Senior Vice President, Treasurer of Viacom since May 2002. Prior to that, he served as Vice President and Treasurer of Viacom from May 2000 to May 2002. From May 1998 to May 2000, he served as Vice President and Controller of CBS Corporation. Mr. Freedline also served as Director of Business Planning and Development of CBS from June 1996 to May 1998. |

| |

Michael D. Fricklas Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Fricklas has been Executive Vice President, General Counsel and Secretary of Viacom since May 2000. From October 1998 to May 2000, he served as Senior Vice President, General Counsel and Secretary of Viacom and from July 1993 to October 1998, he served as Vice President, Deputy General Counsel of Viacom. Mr. Fricklas is a director of Blockbuster Inc., a majority-owned subsidiary of Viacom. |

| |

Susan C. Gordon Viacom Inc. 1515 Broadway New York, NY 10036 | | Ms. Gordon has been Senior Vice President, Controller and Chief Accounting Officer of Viacom since May 2002. Prior to that, she served as Vice President, Controller and Chief Accounting Officer of Viacom from April 1995 to May 2002 and as Vice President, Internal Audit from October 1986 to April 1995. From June 1985 to October 1986, Ms. Gordon served as Controller of Viacom Broadcasting. She joined the Company in 1981 and has held various positions in the corporate finance area. |

III-1

ANNEX III

(Continued)

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

Stargate Acquisition Corp. Two

EXECUTIVE OFFICERS

| | |

Name and Business Address

| | Material Five-Year Employment History

|

| |

Leslie Moonves Viacom Inc. 7800 Beverly Boulevard Los Angeles, CA 90036 | | Mr. Moonves has been Co-President and Co-Chief Operating Officer of Viacom since June 2004. Prior to that, he served as Chairman and Chief Executive Officer of CBS, a unit of Viacom, since 2003 and as President and Chief Executive Officer of CBS since 1998. Mr. Moonves joined CBS in 1995 as President, CBS Entertainment. Prior to that, Mr. Moonves was President of Warner Bros. Television since July 1993. |

| |

Richard J. Bressler Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Bressler has been Senior Executive Vice President and Chief Financial Officer of Viacom since May 2001. Before joining Viacom, Mr. Bressler was Executive Vice President of AOL Time Warner Inc. and Chief Executive Officer of AOL Time Warner Investments. Prior to that, Mr. Bressler served in various capacities with Time Warner Inc., including as Chairman and Chief Executive Officer of Time Warner Digital Media. He also served as Executive Vice President and Chief Financial Officer of Time Warner Inc. from March 1995 to June 1999. Mr. Bressler serves on the National Advisory Committee of JPMorgan Chase and is a director of Blockbuster Inc., a majority-owned subsidiary of Viacom. |

| |

Michael D. Fricklas Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Fricklas has been Executive Vice President, General Counsel and Secretary of Viacom since May 2000. From October 1998 to May 2000, he served as Senior Vice President, General Counsel and Secretary of Viacom and from July 1993 to October 1998, he served as Vice President, Deputy General Counsel of Viacom. Mr. Fricklas is a director of Blockbuster Inc., a majority-owned subsidiary of Viacom. |

| |

Harry Isaacs CBS Broadcasting Inc. 7800 Beverly Blvd. Los Angeles, CA 90036 | | Mr. Isaacs has been Senior Vice President, CBS Industrial Relations for CBS Broadcasting Inc. since October 2000. Prior to that, he served as Vice President, Labor Relations of Paramount Pictures from January 1997 to October 2000. |

III-2

ANNEX III

(Continued)

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

Stargate Acquisition Corp. Two

| | |

Name and Business Address

| | Material Five-Year Employment History

|

| |

Fredric G. Reynolds Viacom Television Stations Group 513 West 57th Street New York, NY 10019 | | Mr. Reynolds has been the President and Chief Executive Officer of Viacom Television Stations Group since 2001. Prior to that, he served as Executive Vice President and Chief Financial Officer of Viacom from 2000 to 2001. From 1994 to 2000, Mr. Reynolds served as Executive Vice President and Chief Financial Officer of CBS Corporation. |

| |

Dennis Swanson Viacom Television Stations Group 513 West 57th Street New York, NY 10019 | | Mr. Swanson has been the Executive Vice President and Chief Operating Officer of Viacom Television Stations Group since July 2002. Prior to that, he was the co-chair to NBC Olympics from October 1998 to July 2002. From July 1996 to July 2002, Mr. Swanson was the President of WNBC. |

| |

William A. Roskin Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Roskin was elected Senior Vice President, Human Resources and Administration of Viacom in July 1992. Prior to that, he served as Vice President, Human Resources and Administration of Viacom from April 1988 to July 1992. From May 1986 to April 1988, he was Senior Vice President, Human Resources at Coleco Industries, Inc. From 1976 to 1986, he held various executive positions at Warner Communications Inc., serving most recently as Vice President, Industrial and Labor Relations. |

| |

Robert G. Freedline Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Freedline has been Senior Vice President, Treasurer of Viacom since May 2002. Prior to that, he served as Vice President and Treasurer of Viacom from May 2000 to May 2002. From May 1998 to May 2000, he served as Vice President and Controller of CBS Corporation. Mr. Freedline also served as Director of Business Planning and Development of CBS from June 1996 to May 1998. |

| |

Susan C. Gordon Viacom Inc. 1515 Broadway New York, NY 10036 | | Ms. Gordon has been Senior Vice President, Controller and Chief Accounting Officer of Viacom since May 2002. Prior to that, she served as Vice President, Controller and Chief Accounting Officer of Viacom from April 1995 to May 2002 and as Vice President, Internal Audit from October 1986 to April 1995. From June 1985 to October 1986, Ms. Gordon served as Controller of Viacom Broadcasting. She joined the Company in 1981 and has held various positions in the corporate finance area. |

III-3

ANNEX III

(Continued)

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

Stargate Acquisition Corp. Two

| | |

Name and Business Address

| | Material Five-Year Employment History

|

Bruce Taub CBS Television Network 51 West 52nd Street New York, NY 10019 | | Mr. Taub has been the Chief Financial Officer of CBS Television Network for the last five years. |

III-4

ANNEX IV

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

CBS Broadcasting Inc.

DIRECTORS

| | |

Name and Business Address

| | Material Five-Year Employment History

|

Robert G. Freedline Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Freedline has been Senior Vice President, Treasurer of Viacom since May 2002. Prior to that, he served as Vice President and Treasurer of Viacom from May 2000 to May 2002. From May 1998 to May 2000, he served as Vice President and Controller of CBS Corporation. Mr. Freedline also served as Director of Business Planning and Development of CBS from June 1996 to May 1998. |

| |

Michael D. Fricklas Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Fricklas has been Executive Vice President, General Counsel and Secretary of Viacom since May 2000. From October 1998 to May 2000, he served as Senior Vice President, General Counsel and Secretary of Viacom and from July 1993 to October 1998, he served as Vice President, Deputy General Counsel of Viacom. Mr. Fricklas is a director of Blockbuster Inc., a majority-owned subsidiary of Viacom. |

| |

Susan C. Gordon Viacom Inc. 1515 Broadway New York, NY 10036 | | Ms. Gordon has been Senior Vice President, Controller and Chief Accounting Officer of Viacom since May 2002. Prior to that, she served as Vice President, Controller and Chief Accounting Officer of Viacom from April 1995 to May 2002 and as Vice President, Internal Audit from October 1986 to April 1995. From June 1985 to October 1986, Ms. Gordon served as Controller of Viacom Broadcasting. She joined the Company in 1981 and has held various positions in the corporate finance area. |

IV-1

ANNEX IV

(Continued)

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

CBS Broadcasting Inc.

EXECUTIVE OFFICERS

| | |

Name and Business Address

| | Material Five-Year Employment History

|

Leslie Moonves Viacom Inc. 7800 Beverly Boulevard Los Angeles, CA 90036 | | Mr. Moonves has been Co-President and Co-Chief Operating Officer of Viacom since June 2004. Prior to that, he served as Chairman and Chief Executive Officer of CBS, a unit of Viacom, since 2003 and as President and Chief Executive Officer of CBS since 1998. Mr. Moonves joined CBS in 1995 as President, CBS Entertainment. Prior to that, Mr. Moonves was President of Warner Bros. Television since July 1993. |

| |

Richard J. Bressler Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Bressler has been Senior Executive Vice President and Chief Financial Officer of Viacom since May 2001. Before joining Viacom, Mr. Bressler was Executive Vice President of AOL Time Warner Inc. and Chief Executive Officer of AOL Time Warner Investments. Prior to that, Mr. Bressler served in various capacities with Time Warner Inc., including as Chairman and Chief Executive Officer of Time Warner Digital Media. He also served as Executive Vice President and Chief Financial Officer of Time Warner Inc. from March 1995 to June 1999. Mr. Bressler serves on the National Advisory Committee of JPMorgan Chase and is a director of Blockbuster Inc., a majority-owned subsidiary of Viacom. |

| |

Michael D. Fricklas Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Fricklas has been Executive Vice President, General Counsel and Secretary of Viacom since May 2000. From October 1998 to May 2000, he served as Senior Vice President, General Counsel and Secretary of Viacom and from July 1993 to October 1998, he served as Vice President, Deputy General Counsel of Viacom. Mr. Fricklas is a director of Blockbuster Inc., a majority-owned subsidiary of Viacom. |

| |

Harry Isaacs CBS Broadcasting Inc. 7800 Beverly Blvd. Los Angeles, CA 90036 | | Mr. Isaacs has been Senior Vice President, CBS Industrial Relations for CBS Broadcasting Inc. since October 2000. Prior to that, he served as Vice President, Labor Relations of Paramount Pictures from January 1997 to October 2000. |

| |

Fredric G. Reynolds Viacom Television Stations Group 513 West 57th Street New York, NY 10019 | | Mr. Reynolds has been the President and Chief Executive Officer of Viacom Television Stations Group since 2001. Prior to that, he served as Executive Vice President and Chief Financial Officer of Viacom from 2000 to 2001. From 1994 to 2000, Mr. Reynolds served as Executive Vice President and Chief Financial Officer of CBS Corporation. |

IV-2

ANNEX IV

(Continued)

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

CBS Broadcasting Inc.

| | |

Name and Business Address

| | Material Five-Year Employment History

|

Dennis Swanson Viacom Television Stations Group 513 West 57th Street New York, NY 10019 | | Mr. Swanson has been the Executive Vice President and Chief Operating Officer of Viacom Television Stations Group since July 2002. Prior to that, he was the co-chair to NBC Olympics from October 1998 to July 2002. From July 1996 to July 2002, Mr. Swanson was the President of WNBC. |

| |

William A. Roskin Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Roskin was elected Senior Vice President, Human Resources and Administration of Viacom in July 1992. Prior to that, he served as Vice President, Human Resources and Administration of Viacom from April 1988 to July 1992. From May 1986 to April 1988, he was Senior Vice President, Human Resources at Coleco Industries, Inc. From 1976 to 1986, he held various executive positions at Warner Communications Inc., serving most recently as Vice President, Industrial and Labor Relations. |

| |

Robert G. Freedline Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Freedline has been Senior Vice President, Treasurer of Viacom since May 2002. Prior to that, he served as Vice President and Treasurer of Viacom from May 2000 to May 2002. From May 1998 to May 2000, he served as Vice President and Controller of CBS Corporation. Mr. Freedline also served as Director of Business Planning and Development of CBS from June 1996 to May 1998. |

| |

Susan C. Gordon Viacom Inc. 1515 Broadway New York, NY 10036 | | Ms. Gordon has been Senior Vice President, Controller and Chief Accounting Officer of Viacom since May 2002. Prior to that, she served as Vice President, Controller and Chief Accounting Officer of Viacom from April 1995 to May 2002 and as Vice President, Internal Audit from October 1986 to April 1995. From June 1985 to October 1986, Ms. Gordon served as Controller of Viacom Broadcasting. She joined the Company in 1981 and has held various positions in the corporate finance area. |

| |

Bruce Taub CBS Television Network 51 West 52nd Street New York, NY 10019 | | Mr. Taub has been the Chief Financial Officer of CBS Television Network for the last five years. |

IV-3

ANNEX V

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

Westinghouse CBS Holding Company, Inc.

DIRECTORS

| | |

Name and Business Address

| | Material Five-Year Employment History

|

Robert G. Freedline Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Freedline has been Senior Vice President, Treasurer of Viacom since May 2002. Prior to that, he served as Vice President and Treasurer of Viacom from May 2000 to May 2002. From May 1998 to May 2000, he served as Vice President and Controller of CBS Corporation. Mr. Freedline also served as Director of Business Planning and Development of CBS from June 1996 to May 1998. |

| |

Michael D. Fricklas Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Fricklas has been Executive Vice President, General Counsel and Secretary of Viacom since May 2000. From October 1998 to May 2000, he served as Senior Vice President, General Counsel and Secretary of Viacom and from July 1993 to October 1998, he served as Vice President, Deputy General Counsel of Viacom. Mr. Fricklas is a director of Blockbuster Inc., a majority-owned subsidiary of Viacom. |

| |

Susan C. Gordon Viacom Inc. 1515 Broadway New York, NY 10036 | | Ms. Gordon has been Senior Vice President, Controller and Chief Accounting Officer of Viacom since May 2002. Prior to that, she served as Vice President, Controller and Chief Accounting Officer of Viacom from April 1995 to May 2002 and as Vice President, Internal Audit from October 1986 to April 1995. From June 1985 to October 1986, Ms. Gordon served as Controller of Viacom Broadcasting. She joined the Company in 1981 and has held various positions in the corporate finance area. |

V-1

ANNEX V

(Continued)

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

Westinghouse CBS Holding Company, Inc.

EXECUTIVE OFFICERS

| | |

Name and Business Address

| | Material Five-Year Employment History

|

Leslie Moonves Viacom Inc. 7800 Beverly Boulevard Los Angeles, CA 90036 | | Mr. Moonves has been Co-President and Co-Chief Operating Officer of Viacom since June 2004. Prior to that, he served as Chairman and Chief Executive Officer of CBS, a unit of Viacom, since 2003 and as President and Chief Executive Officer of CBS since 1998. Mr. Moonves joined CBS in 1995 as President, CBS Entertainment. Prior to that, Mr. Moonves was President of Warner Bros. Television since July 1993. |

| |

Richard J. Bressler Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Bressler has been Senior Executive Vice President and Chief Financial Officer of Viacom since May 2001. Before joining Viacom, Mr. Bressler was Executive Vice President of AOL Time Warner Inc. and Chief Executive Officer of AOL Time Warner Investments. Prior to that, Mr. Bressler served in various capacities with Time Warner Inc., including as Chairman and Chief Executive Officer of Time Warner Digital Media. He also served as Executive Vice President and Chief Financial Officer of Time Warner Inc. from March 1995 to June 1999. Mr. Bressler serves on the National Advisory Committee of JPMorgan Chase and is a director of Blockbuster Inc., a majority-owned subsidiary of Viacom. |

| |

Michael D. Fricklas Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Fricklas has been Executive Vice President, General Counsel and Secretary of Viacom since May 2000. From October 1998 to May 2000, he served as Senior Vice President, General Counsel and Secretary of Viacom and from July 1993 to October 1998, he served as Vice President, Deputy General Counsel of Viacom. Mr. Fricklas is a director of Blockbuster Inc., a majority-owned subsidiary of Viacom. |

| |

Fredric G. Reynolds Viacom Television Stations Group 513 West 57th Street New York, NY 10019 | | Mr. Reynolds has been the President and Chief Executive Officer of Viacom Television Stations Group since 2001. Prior to that, he served as Executive Vice President and Chief Financial Officer of Viacom from 2000 to 2001. From 1994 to 2000, Mr. Reynolds served as Executive Vice President and Chief Financial Officer of CBS Corporation. |

V-2

ANNEX V

(Continued)

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

Westinghouse CBS Holding Company, Inc.

| | |

Name and Business Address

| | Material Five-Year Employment History

|

Dennis Swanson Viacom Television Stations Group 513 West 57th Street New York, NY 10019 | | Mr. Swanson has been the Executive Vice President and Chief Operating Officer of Viacom Television Stations Group since July 2002. Prior to that, he was the co-chair to NBC Olympics from October 1998 to July 2002. From July 1996 to July 2002, Mr. Swanson was the President of WNBC. |

| |

William A. Roskin Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Roskin was elected Senior Vice President, Human Resources and Administration of Viacom in July 1992. Prior to that, he served as Vice President, Human Resources and Administration of Viacom from April 1988 to July 1992. From May 1986 to April 1988, he was Senior Vice President, Human Resources at Coleco Industries, Inc. From 1976 to 1986, he held various executive positions at Warner Communications Inc., serving most recently as Vice President, Industrial and Labor Relations. |

| |

Robert G. Freedline Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Freedline has been Senior Vice President, Treasurer of Viacom since May 2002. Prior to that, he served as Vice President and Treasurer of Viacom from May 2000 to May 2002. From May 1998 to May 2000, he served as Vice President and Controller of CBS Corporation. Mr. Freedline also served as Director of Business Planning and Development of CBS from June 1996 to May 1998. |

| |

Susan C. Gordon Viacom Inc. 1515 Broadway New York, NY 10036 | | Ms. Gordon has been Senior Vice President, Controller and Chief Accounting Officer of Viacom since May 2002. Prior to that, she served as Vice President, Controller and Chief Accounting Officer of Viacom from April 1995 to May 2002 and as Vice President, Internal Audit from October 1986 to April 1995. From June 1985 to October 1986, Ms. Gordon served as Controller of Viacom Broadcasting. She joined the Company in 1981 and has held various positions in the corporate finance area. |

| |

Bruce Taub CBS Television Network 51 West 52nd Street New York, NY 10019 | | Mr. Taub has been the Chief Financial Officer of CBS Television Network for the last five years. |

V-3

ANNEX VI

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

Viacom Inc.

DIRECTORS

| | |

Name and Business Address

| | Material Five-Year Employment History

|

George S. Abrams Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Abrams has been a director of Viacom since 1987. He has been an attorney associated with the law firm of Winer and Abrams in Boston, Massachusetts since 1969. Mr. Abrams is also a trustee of the Museum of Fine Arts in Boston. Mr. Abrams is a director of National Amusements and Sonesta International Hotels Corporation. |

| |

David R. Andelman Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Andelman has been a director of Viacom since December 2000. He has been an attorney associated with the law firm of Lourie & Cutler, P.C. in Boston, Massachusetts since 1964. Mr. Andelman also serves as a director and treasurer of Lourie & Cutler. He is a director of National Amusements. |

| |

Joseph A. Califano, Jr. Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Califano has been a director of Viacom since 2003. He has been Chairman of the Board and President of The National Center on Addiction and Substance Abuse at Columbia University since 1992. Mr. Califano has served as Adjunct Professor of Public Health at Columbia University’s Medical School and School of Public Health since 1992 and is a member of the Institute of Medicine of the National Academy of Sciences. Mr. Califano was senior partner of the Washington, D.C. office of the law firm Dewey Ballantine from 1983 to 1992. Mr. Califano served as the United States Secretary of Health, Education and Welfare from 1977 to 1979, and he served as President Lyndon B. Johnson’s Assistant for Domestic Affairs from 1965 to 1969. He is the author of ten books. He is a director of Automatic Data Processing, Inc., Willis Group Holdings Limited and Midway Games, Inc. |

| |

William S. Cohen Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Cohen has been a director of Viacom since 2003. He has been the Chairman and Chief Executive Officer of The Cohen Group, a business consulting firm, since January 2001. Prior to founding The Cohen Group, Mr. Cohen served as the United States Secretary of Defense from January 1997 to 2001. He also served as a United States Senator from 1979 to 1997 and as a member of the United States House of Representatives from 1973 to 1979. Mr. Cohen is also a director of American International Group, Inc. and Head N.V. |

VI-1

ANNEX VI

(Continued)

Name, business address, present principal occupation or

employment and material five-year employment history of the directors and executive officers of

Viacom Inc.

| | |

Name and Business Address

| | Material Five-Year Employment History

|

Philippe P. Dauman Viacom Inc. 1515 Broadway New York, NY 10036 | | Mr. Dauman has been a director of Viacom since 1987. He has been the Co-Chairman and Chief Executive Officer of DND Capital Partners, L.L.C., a private equity firm, since May 2000. Mr. Dauman served as Viacom’s Deputy Chairman from 1996 until May 2000 and Executive Vice President from 1994 until May 2000. From 1993 to 1998, Mr. Dauman also served as General Counsel and Secretary of Viacom. Mr. Dauman is a director of National Amusements. He is also a director of Blockbuster Inc., a majority-owned subsidiary of Viacom, and Lafarge North America Inc. |

| |