UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07319

Fidelity Covington Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | August 31 |

|

|

Date of reporting period: | February 29, 2024 |

Item 1.

Reports to Stockholders

Fidelity® High Yield Factor ETF

Fidelity® Preferred Securities & Income ETF

Semi-Annual Report

February 29, 2024

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-FIDELITY to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2024 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

| Top Bond Issuers (% of Fund's net assets) |

(with maturities greater than one year) |

| Mineral Resources Ltd. | 2.6 | |

| FMG Resources Pty Ltd. | 2.1 | |

| TransDigm, Inc. | 1.9 | |

| Northern Oil & Gas, Inc. | 1.8 | |

| CCO Holdings LLC/CCO Holdings Capital Corp. | 1.7 | |

| CVR Energy, Inc. | 1.6 | |

| New Fortress Energy, Inc. | 1.5 | |

| OneMain Finance Corp. | 1.5 | |

| Performance Food Group, Inc. | 1.4 | |

| Royal Caribbean Cruises Ltd. | 1.3 | |

| | 17.4 | |

| |

| Market Sectors (% of Fund's net assets) |

| |

| Energy | 18.2 | |

| Diversified Financial Services | 7.9 | |

| Metals/Mining | 5.3 | |

| Services | 4.9 | |

| Telecommunications | 4.7 | |

| |

Quality Diversification (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

Asset Allocation (% of Fund's net assets) |

|

|

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| |

Fidelity® High Yield Factor ETF

Showing Percentage of Net Assets

| Nonconvertible Bonds - 97.5% |

| | | Principal Amount (a) | Value ($) |

| Aerospace - 3.8% | | | |

| Bombardier, Inc.: | | | |

| 7.5% 2/1/29 (b) | | 1,697,000 | 1,721,258 |

| 7.875% 4/15/27 (b) | | 218,000 | 218,278 |

| 8.75% 11/15/30 (b) | | 450,000 | 471,380 |

| Hexcel Corp. 4.95% 8/15/25 | | 269,000 | 264,746 |

| Spirit Aerosystems, Inc.: | | | |

| 4.6% 6/15/28 | | 550,000 | 482,801 |

| 9.75% 11/15/30 (b) | | 1,797,000 | 1,925,229 |

| TransDigm, Inc.: | | | |

| 4.875% 5/1/29 | | 3,525,000 | 3,237,821 |

| 6.375% 3/1/29 (b) | | 1,000,000 | 1,004,520 |

| 6.875% 12/15/30 (b) | | 1,329,000 | 1,344,828 |

| VistaJet Malta Finance PLC / XO Management Holding, Inc. 9.5% 6/1/28 (b) | | 500,000 | 421,250 |

TOTAL AEROSPACE | | | 11,092,111 |

| Air Transportation - 1.5% | | | |

| Air Canada 3.875% 8/15/26 (b) | | 600,000 | 568,233 |

| Allegiant Travel Co. 7.25% 8/15/27 (b) | | 1,030,000 | 1,002,708 |

| American Airlines, Inc. 7.25% 2/15/28 (b) | | 265,000 | 267,206 |

| American Airlines, Inc. / AAdvantage Loyalty IP Ltd. 5.5% 4/20/26 (b) | | 484,226 | 479,787 |

| Bristow Group, Inc. 6.875% 3/1/28 (b) | | 166,000 | 162,514 |

| Rand Parent LLC 8.5% 2/15/30 (b) | | 300,000 | 291,350 |

| Spirit Loyalty Cayman Ltd. / Spirit IP Cayman Ltd. 8% 9/20/25 (b) | | 584,000 | 422,384 |

| United Airlines Holdings, Inc. 4.875% 1/15/25 | | 369,000 | 365,310 |

| United Airlines, Inc. 4.375% 4/15/26 (b) | | 874,900 | 842,060 |

TOTAL AIR TRANSPORTATION | | | 4,401,552 |

| Automotive & Auto Parts - 2.1% | | | |

| Allison Transmission, Inc. 3.75% 1/30/31 (b) | | 2,845,000 | 2,458,323 |

| Champions Financing, Inc. 8.75% 2/15/29 (b) | | 300,000 | 306,441 |

| EquipmentShare.Com, Inc. 9% 5/15/28 (b) | | 300,000 | 307,417 |

| Ford Motor Credit Co. LLC 6.95% 3/6/26 | | 900,000 | 916,204 |

| Gates Global LLC/Gates Global Co. 6.25% 1/15/26 (b) | | 175,000 | 174,404 |

| Jaguar Land Rover Automotive PLC 7.75% 10/15/25 (b) | | 175,000 | 176,518 |

| LCM Investments Holdings 8.25% 8/1/31 (b) | | 365,000 | 372,517 |

| Macquarie AirFinance Holdings 8.125% 3/30/29 (b) | | 460,000 | 478,285 |

| Tenneco, Inc. 8% 11/17/28 (b) | | 550,000 | 501,188 |

| Thor Industries, Inc. 4% 10/15/29 (b) | | 643,000 | 569,055 |

TOTAL AUTOMOTIVE & AUTO PARTS | | | 6,260,352 |

| Banks & Thrifts - 1.6% | | | |

| AG TTMT Escrow Issuer LLC 8.625% 9/30/27 (b) | | 500,000 | 514,669 |

| Freedom Mortgage Hold 9.25% 2/1/29 (b) | | 930,000 | 944,136 |

| PennyMac Financial Services, Inc.: | | | |

| 5.75% 9/15/31 (b) | | 900,000 | 827,552 |

| 7.875% 12/15/29 (b) | | 1,100,000 | 1,125,970 |

| UniCredit SpA: | | | |

| 5.459% 6/30/35 (b)(c) | | 1,150,000 | 1,062,623 |

| 7.296% 4/2/34 (b)(c) | | 149,693 | 152,774 |

TOTAL BANKS & THRIFTS | | | 4,627,724 |

| Broadcasting - 4.5% | | | |

| Clear Channel Outdoor Holdings, Inc. 9% 9/15/28 (b) | | 500,000 | 521,500 |

| DISH Network Corp. 11.75% 11/15/27 (b) | | 2,700,000 | 2,814,961 |

| Gray Television, Inc.: | | | |

| 5.375% 11/15/31 (b) | | 600,000 | 393,000 |

| 7% 5/15/27 (b) | | 30,000 | 27,111 |

| iHeartCommunications, Inc. 4.75% 1/15/28 (b) | | 500,000 | 360,000 |

| Nexstar Media, Inc. 4.75% 11/1/28 (b) | | 3,102,000 | 2,754,423 |

| Sinclair Television Group, Inc. 4.125% 12/1/30 (b) | | 958,000 | 700,059 |

| Sirius XM Radio, Inc. 3.125% 9/1/26 (b) | | 729,000 | 679,741 |

| TEGNA, Inc.: | | | |

| 4.625% 3/15/28 | | 1,339,000 | 1,202,154 |

| 5% 9/15/29 | | 1,460,000 | 1,284,800 |

| Univision Communications, Inc.: | | | |

| 7.375% 6/30/30 (b) | | 1,576,000 | 1,522,212 |

| 8% 8/15/28 (b) | | 920,000 | 924,913 |

TOTAL BROADCASTING | | | 13,184,874 |

| Building Materials - 2.1% | | | |

| AmeriTex Holdco Intermediate LLC 10.25% 10/15/28 (b) | | 300,000 | 314,250 |

| Beacon Roofing Supply, Inc. 6.5% 8/1/30 (b) | | 290,000 | 291,570 |

| Builders FirstSource, Inc. 6.375% 3/1/34 (b) | | 1,000,000 | 997,667 |

| Eco Material Technologies, Inc. 7.875% 1/31/27 (b) | | 165,000 | 164,631 |

| Emrld Borrower LP / Emerald Co. 6.625% 12/15/30 (b) | | 1,000,000 | 1,003,500 |

| Griffon Corp. 5.75% 3/1/28 | | 1,220,000 | 1,180,350 |

| Jeld-Wen, Inc. 4.625% 12/15/25 (b) | | 235,000 | 229,098 |

| Smyrna Ready Mix LLC 8.875% 11/15/31 (b) | | 600,000 | 635,870 |

| Standard Industries, Inc./New Jersey 4.375% 7/15/30 (b) | | 479,000 | 427,069 |

| Wesco Distribution, Inc. 6.375% 3/15/29 (b) | | 1,000,000 | 1,000,092 |

TOTAL BUILDING MATERIALS | | | 6,244,097 |

| Cable/Satellite TV - 3.3% | | | |

| CCO Holdings LLC/CCO Holdings Capital Corp.: | | | |

| 4.25% 1/15/34 (b) | | 861,000 | 643,733 |

| 4.5% 5/1/32 | | 1,669,000 | 1,318,518 |

| 6.375% 9/1/29 (b) | | 1,168,000 | 1,097,356 |

| 7.375% 3/1/31 (b) | | 2,000,000 | 1,937,500 |

| CSC Holdings LLC: | | | |

| 4.5% 11/15/31 (b) | | 1,350,000 | 1,002,375 |

| 11.25% 5/15/28 (b) | | 850,000 | 877,005 |

| DIRECTV Financing LLC 8.875% 2/1/30 (b) | | 450,000 | 452,999 |

| DIRECTV Financing LLC / DIRECTV Financing Co-Obligor, Inc. 5.875% 8/15/27 (b) | | 1,083,000 | 1,022,211 |

| Dolya Holdco 18 DAC 5% 7/15/28 (b) | | 450,000 | 415,200 |

| Ziggo BV 4.875% 1/15/30 (b) | | 1,200,000 | 1,068,974 |

TOTAL CABLE/SATELLITE TV | | | 9,835,871 |

| Capital Goods - 0.9% | | | |

| ATS Corp. 4.125% 12/15/28 (b) | | 440,000 | 401,566 |

| EnerSys 4.375% 12/15/27 (b) | | 1,238,000 | 1,165,268 |

| Husky Injection / Titan 9% 2/15/29 (b) | | 400,000 | 408,735 |

| Patrick Industries, Inc. 4.75% 5/1/29 (b) | | 886,000 | 810,814 |

TOTAL CAPITAL GOODS | | | 2,786,383 |

| Chemicals - 2.5% | | | |

| Avient Corp. 5.75% 5/15/25 (b) | | 105,000 | 104,386 |

| CVR Partners LP/CVR Nitrogen Finance Corp. 6.125% 6/15/28 (b) | | 380,000 | 359,320 |

| INEOS Finance PLC 7.5% 4/15/29 (b) | | 500,000 | 497,750 |

| INEOS Quattro Finance 2 PLC: | | | |

| 3.375% 1/15/26 (b) | | 480,000 | 453,124 |

| 9.625% 3/15/29 (b) | | 500,000 | 525,877 |

| NOVA Chemicals Corp.: | | | |

| 8.5% 11/15/28 (b) | | 380,000 | 401,225 |

| 9% 2/15/30 (b) | | 500,000 | 501,599 |

| Nufarm Australia Ltd. 5% 1/27/30 (b) | | 605,000 | 554,827 |

| Olin Corp. 5% 2/1/30 | | 1,861,300 | 1,739,625 |

| Olympus Water U.S. Holding Corp. 9.75% 11/15/28 (b) | | 900,000 | 956,292 |

| The Chemours Co. LLC: | | | |

| 4.625% 11/15/29 (b) | | 1,500,000 | 1,233,416 |

| 5.75% 11/15/28 (b) | | 70,000 | 61,393 |

TOTAL CHEMICALS | | | 7,388,834 |

| Consumer Products - 2.3% | | | |

| BlueLinx Corp. 6% 11/15/29 (b) | | 225,000 | 214,706 |

| Energizer Holdings, Inc. 4.75% 6/15/28 (b) | | 500,000 | 457,174 |

| Ferrellgas LP/Ferrellgas Finance Corp. 5.375% 4/1/26 (b) | | 556,000 | 550,457 |

| Grubhub Holdings, Inc. 5.5% 7/1/27 (b) | | 101,000 | 88,051 |

| Newell Brands, Inc. 6.375% 9/15/27 | | 300,000 | 290,612 |

| Rakuten Group, Inc. 11.25% 2/15/27 (b) | | 600,000 | 635,357 |

| Tempur Sealy International, Inc. 3.875% 10/15/31 (b) | | 3,003,000 | 2,497,736 |

| TripAdvisor, Inc. 7% 7/15/25 (b) | | 1,224,000 | 1,225,457 |

| Verde Purchaser LLC 10.5% 11/30/30 (b) | | 700,000 | 731,500 |

TOTAL CONSUMER PRODUCTS | | | 6,691,050 |

| Containers - 0.5% | | | |

| Ardagh Packaging Finance PLC/Ardagh MP Holdings U.S.A., Inc. 5.25% 4/30/25 (b) | | 361,000 | 356,987 |

| BWAY Holding Co. 7.875% 8/15/26 (b) | | 730,000 | 739,721 |

| LABL, Inc. 9.5% 11/1/28 (b) | | 300,000 | 300,072 |

TOTAL CONTAINERS | | | 1,396,780 |

| Diversified Financial Services - 7.9% | | | |

| BrightSphere Investment Group, Inc. 4.8% 7/27/26 | | 1,696,000 | 1,613,557 |

| Castlelake Aviation Finance 5% 4/15/27 (b) | | 414,000 | 392,770 |

| Credit Acceptance Corp. 6.625% 3/15/26 | | 1,351,000 | 1,346,070 |

| Enova International, Inc. 8.5% 9/15/25 (b) | | 325,000 | 321,891 |

| First Cash Financial Services, Inc. 5.625% 1/1/30 (b) | | 2,702,000 | 2,559,569 |

| Fortress Transportation & Infrastructure Investors LLC 7.875% 12/1/30 (b) | | 850,000 | 891,227 |

| Freedom Mortgage Corp.: | | | |

| 12% 10/1/28 (b) | | 300,000 | 325,004 |

| 12.25% 10/1/30 (b) | | 300,000 | 330,069 |

| GGAM Finance Ltd. 8% 2/15/27 (b) | | 775,000 | 794,353 |

| Gn Bondco LLC 9.5% 10/15/31 (b) | | 230,000 | 227,700 |

| goeasy Ltd. 9.25% 12/1/28 (b) | | 1,275,000 | 1,352,871 |

| Howden UK Refinance PLC / Howden UK Refinance 2 PLC / Howden U.S. Finance LLC 7.25% 2/15/31 (b) | | 500,000 | 500,625 |

| Icahn Enterprises LP/Icahn Enterprises Finance Corp. 4.375% 2/1/29 | | 1,418,000 | 1,196,423 |

| Jefferson Capital Holding 9.5% 2/15/29 (b) | | 500,000 | 505,019 |

| Ladder Capital Finance Holdings LLLP/Ladder Capital Finance Corp. 4.75% 6/15/29 (b) | | 713,000 | 639,877 |

| MidCap Financial Issuer Trust 5.625% 1/15/30 (b) | | 840,000 | 710,480 |

| Nationstar Mortgage Holdings, Inc.: | | | |

| 5.125% 12/15/30 (b) | | 500,000 | 446,303 |

| 5.5% 8/15/28 (b) | | 933,000 | 880,788 |

| 5.75% 11/15/31 (b) | | 700,000 | 641,346 |

| 6% 1/15/27 (b) | | 550,000 | 540,744 |

| Navient Corp. 9.375% 7/25/30 | | 758,000 | 792,146 |

| OneMain Finance Corp.: | | | |

| 3.875% 9/15/28 | | 1,857,000 | 1,622,449 |

| 6.625% 1/15/28 | | 731,000 | 726,849 |

| 7.875% 3/15/30 | | 450,000 | 457,665 |

| 9% 1/15/29 | | 1,592,000 | 1,671,982 |

| PRA Group, Inc. 8.375% 2/1/28 (b) | | 537,000 | 524,918 |

| StoneX Group, Inc. 8.625% 6/15/25 (b) | | 1,231,000 | 1,238,644 |

TOTAL DIVERSIFIED FINANCIAL SERVICES | | | 23,251,339 |

| Diversified Media - 0.0% | | | |

| Outfront Media Capital LLC / Corp. 4.25% 1/15/29 (b) | | 65,000 | 58,380 |

| Energy - 18.2% | | | |

| Aethon United BR LP / Aethon United Finance Corp. 8.25% 2/15/26 (b) | | 185,000 | 185,766 |

| AmeriGas Partners LP/AmeriGas Finance Corp. 9.375% 6/1/28 (b) | | 625,000 | 634,375 |

| Antero Midstream Partners LP/Antero Midstream Finance Corp. 5.375% 6/15/29 (b) | | 633,000 | 602,051 |

| Antero Resources Corp. 8.375% 7/15/26 (b) | | 275,000 | 285,078 |

| Baytex Energy Corp.: | | | |

| 8.5% 4/30/30 (b) | | 3,238,000 | 3,366,902 |

| 8.75% 4/1/27 (b) | | 195,000 | 202,283 |

| Buckeye Partners LP 4.5% 3/1/28 (b) | | 1,370,000 | 1,273,700 |

| California Resources Corp. 7.125% 2/1/26 (b) | | 140,000 | 140,738 |

| Chord Energy Corp. 6.375% 6/1/26 (b) | | 508,000 | 508,635 |

| Citgo Petroleum Corp.: | | | |

| 6.375% 6/15/26 (b) | | 715,000 | 719,457 |

| 7% 6/15/25 (b) | | 124,000 | 123,708 |

| 8.375% 1/15/29 (b) | | 650,000 | 682,610 |

| Civitas Resources, Inc.: | | | |

| 5% 10/15/26 (b) | | 1,131,000 | 1,095,877 |

| 8.375% 7/1/28 (b) | | 450,000 | 470,891 |

| 8.625% 11/1/30 (b) | | 860,000 | 920,270 |

| 8.75% 7/1/31 (b) | | 710,000 | 755,064 |

| CNX Midstream Partners LP 4.75% 4/15/30 (b) | | 553,000 | 483,794 |

| CNX Resources Corp. 7.25% 3/1/32 (b) | | 400,000 | 398,610 |

| Comstock Resources, Inc. 6.75% 3/1/29 (b) | | 300,000 | 276,732 |

| Coronado Finance Pty Ltd. 10.75% 5/15/26 (b) | | 160,000 | 165,729 |

| CQP Holdco LP / BIP-V Chinook Holdco LLC 7.5% 12/15/33 (b) | | 365,000 | 372,141 |

| CVR Energy, Inc.: | | | |

| 5.75% 2/15/28 (b) | | 2,910,000 | 2,701,091 |

| 8.5% 1/15/29 (b) | | 2,000,000 | 2,012,500 |

| Delek Logistics Partners LP/Delek Logistics Finance Corp.: | | | |

| 7.125% 6/1/28 (b) | | 1,975,000 | 1,891,063 |

| 8.625% 3/15/29 (b)(d) | | 500,000 | 500,532 |

| Energy Ventures GoM LLC / EnVen Finance Corp. 11.75% 4/15/26 (b) | | 150,000 | 155,325 |

| EQM Midstream Partners LP: | | | |

| 6.375% 4/1/29 (b) | | 1,000,000 | 1,002,871 |

| 7.5% 6/1/27 (b) | | 728,000 | 744,818 |

| Genesis Energy LP/Genesis Energy Finance Corp. 8.875% 4/15/30 | | 600,000 | 622,079 |

| Global Partners LP/GLP Finance Corp. 8.25% 1/15/32 (b) | | 170,000 | 174,369 |

| Harvest Midstream I LP 7.5% 9/1/28 (b) | | 50,000 | 50,404 |

| Howard Midstream Energy Partners LLC 8.875% 7/15/28 (b) | | 500,000 | 526,875 |

| Independence Energy Finance LLC 7.25% 5/1/26 (b) | | 402,000 | 400,533 |

| Kodiak Gas Services LLC 7.25% 2/15/29 (b) | | 500,000 | 509,038 |

| Matador Resources Co. 5.875% 9/15/26 | | 165,300 | 163,686 |

| Moss Creek Resources Holdings, Inc. 7.5% 1/15/26 (b) | | 362,000 | 359,899 |

| Nabors Industries, Inc.: | | | |

| 7.375% 5/15/27 (b) | | 200,000 | 199,264 |

| 9.125% 1/31/30 (b) | | 230,000 | 235,750 |

| New Fortress Energy, Inc. 6.5% 9/30/26 (b) | | 4,675,000 | 4,513,891 |

| NGL Energy Operating LLC/NGL Energy Finance Corp. 8.125% 2/15/29 (b) | | 600,000 | 605,656 |

| Northern Oil & Gas, Inc.: | | | |

| 8.125% 3/1/28 (b) | | 866,000 | 876,938 |

| 8.75% 6/15/31 (b) | | 4,107,000 | 4,291,815 |

| NuStar Logistics LP 5.625% 4/28/27 | | 160,000 | 158,354 |

| PBF Holding Co. LLC/PBF Finance Corp.: | | | |

| 6% 2/15/28 | | 465,000 | 452,213 |

| 7.875% 9/15/30 (b) | | 450,000 | 461,106 |

| Perenti Finance Pty Ltd. 6.5% 10/7/25 (b) | | 555,000 | 547,369 |

| Prairie Acquiror LP 9% 8/1/29 (b)(d) | | 500,000 | 503,805 |

| Rockies Express Pipeline LLC 4.8% 5/15/30 (b) | | 504,000 | 466,830 |

| Seadrill Finance Ltd. 8.375% 8/1/30 (b) | | 120,000 | 123,320 |

| Sitio Royalties OP / Sitio Finance Corp. 7.875% 11/1/28 (b) | | 500,000 | 511,050 |

| SM Energy Co. 6.75% 9/15/26 | | 450,000 | 447,486 |

| Summit Midstream Holdings LLC 9% 10/15/26 (b) | | 300,000 | 296,797 |

| Sunnova Energy Corp. 11.75% 10/1/28 (b) | | 200,000 | 168,270 |

| Sunoco LP/Sunoco Finance Corp. 7% 9/15/28 (b) | | 879,000 | 900,264 |

| Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp. 6% 9/1/31 (b) | | 500,000 | 458,017 |

| Talos Production, Inc. 9% 2/1/29 (b) | | 555,000 | 567,245 |

| Transocean Aquila Ltd. 8% 9/30/28 (b) | | 560,000 | 570,500 |

| Transocean Titan Finance Ltd. 8.375% 2/1/28 (b) | | 222,000 | 227,828 |

| Transocean, Inc. 8.75% 2/15/30 (b) | | 405,000 | 415,863 |

| U.S.A. Compression Partners LP/U.S.A. Compression Finance Corp.: | | | |

| 6.875% 4/1/26 | | 1,870,000 | 1,867,454 |

| 6.875% 9/1/27 | | 400,000 | 397,945 |

| Valaris Ltd. 8.375% 4/30/30 (b) | | 300,000 | 307,616 |

| Venture Global Calcasieu Pass LLC 6.25% 1/15/30 (b) | | 820,000 | 818,702 |

| Venture Global LNG, Inc.: | | | |

| 8.125% 6/1/28 (b) | | 924,000 | 938,698 |

| 9.5% 2/1/29 (b) | | 650,000 | 693,039 |

| 9.875% 2/1/32 (b) | | 972,000 | 1,023,400 |

| Vital Energy, Inc.: | | | |

| 7.75% 7/31/29 (b) | | 214,000 | 212,857 |

| 9.75% 10/15/30 | | 1,060,000 | 1,135,386 |

| 10.125% 1/15/28 | | 676,000 | 707,519 |

| Weatherford International Ltd. 8.625% 4/30/30 (b) | | 1,922,000 | 1,992,703 |

TOTAL ENERGY | | | 53,574,444 |

| Entertainment/Film - 0.6% | | | |

| Live Nation Entertainment, Inc. 4.875% 11/1/24 (b) | | 1,195,000 | 1,185,082 |

| Resorts World Las Vegas LLC / RWLV Capital, Inc. 8.45% 7/27/30 (b) | | 515,000 | 548,434 |

TOTAL ENTERTAINMENT/FILM | | | 1,733,516 |

| Environmental - 1.2% | | | |

| GFL Environmental, Inc. 4% 8/1/28 (b) | | 3,730,000 | 3,419,933 |

| Food & Drug Retail - 1.3% | | | |

| Albertsons Companies LLC/Safeway, Inc./New Albertson's, Inc./Albertson's LLC 6.5% 2/15/28 (b) | | 878,000 | 883,452 |

| Murphy Oil U.S.A., Inc. 4.75% 9/15/29 | | 2,526,000 | 2,355,205 |

| Parkland Corp. 5.875% 7/15/27 (b) | | 614,000 | 602,569 |

TOTAL FOOD & DRUG RETAIL | | | 3,841,226 |

| Food/Beverage/Tobacco - 3.3% | | | |

| HLF Financing SARL LLC / Herbalife International, Inc. 4.875% 6/1/29 (b) | | 500,000 | 357,630 |

| KeHE Distributor / Nextwave 9% 2/15/29 (b) | | 200,000 | 200,587 |

| Lamb Weston Holdings, Inc. 4.125% 1/31/30 (b) | | 883,000 | 800,063 |

| Performance Food Group, Inc. 4.25% 8/1/29 (b) | | 4,521,000 | 4,103,051 |

| Post Holdings, Inc.: | | | |

| 4.5% 9/15/31 (b) | | 383,000 | 340,985 |

| 6.25% 2/15/32 (b) | | 800,000 | 804,136 |

| Turning Point Brands, Inc. 5.625% 2/15/26 (b) | | 1,421,000 | 1,392,807 |

| Vector Group Ltd. 5.75% 2/1/29 (b) | | 2,012,000 | 1,843,238 |

TOTAL FOOD/BEVERAGE/TOBACCO | | | 9,842,497 |

| Gaming - 1.6% | | | |

| Caesars Entertainment, Inc.: | | | |

| 6.25% 7/1/25 (b) | | 300 | 300 |

| 6.5% 2/15/32 (b) | | 500,000 | 503,741 |

| 8.125% 7/1/27 (b) | | 250,000 | 256,697 |

| Carnival Corp. 10.5% 6/1/30 (b) | | 340,000 | 370,951 |

| Churchill Downs, Inc.: | | | |

| 5.5% 4/1/27 (b) | | 246,000 | 241,602 |

| 5.75% 4/1/30 (b) | | 1,066,000 | 1,024,272 |

| International Game Technology PLC 4.125% 4/15/26 (b) | | 205,000 | 197,855 |

| Las Vegas Sands Corp. 3.9% 8/8/29 | | 250,000 | 226,100 |

| Light & Wonder International, Inc. 7.5% 9/1/31 (b) | | 210,000 | 218,787 |

| MGM Resorts International 6.75% 5/1/25 | | 151,000 | 151,210 |

| Ontario Gaming GTA LP 8% 8/1/30 (b) | | 145,000 | 147,887 |

| Premier Entertainment Sub LLC 5.625% 9/1/29 (b) | | 400,000 | 288,056 |

| Raptor Acquisition Corp. / Raptor Co-Issuer LLC 4.875% 11/1/26 (b) | | 677,000 | 651,625 |

| Wynn Resorts Finance LLC / Wynn Resorts Capital Corp. 7.125% 2/15/31 (b) | | 377,000 | 389,322 |

TOTAL GAMING | | | 4,668,405 |

| Healthcare - 4.2% | | | |

| AMN Healthcare 4% 4/15/29 (b) | | 866,000 | 759,915 |

| Bausch + Lomb Corp. 8.375% 10/1/28 (b) | | 400,000 | 418,000 |

| Bausch Health Companies, Inc. 4.875% 6/1/28 (b) | | 2,495,000 | 1,421,474 |

| Community Health Systems, Inc.: | | | |

| 4.75% 2/15/31 (b) | | 1,751,000 | 1,332,441 |

| 10.875% 1/15/32 (b) | | 250,000 | 254,575 |

| CTR Partnership LP/CareTrust Capital Corp. 3.875% 6/30/28 (b) | | 545,000 | 492,892 |

| DaVita, Inc. 4.625% 6/1/30 (b) | | 2,867,000 | 2,521,948 |

| Medline Borrower LP: | | | |

| 3.875% 4/1/29 (b) | | 456,000 | 408,865 |

| 5.25% 10/1/29 (b) | | 345,000 | 319,120 |

| ModivCare Escrow Issuer, Inc. 5% 10/1/29 (b) | | 65,000 | 47,938 |

| Organon & Co. / Organon Foreign Debt Co-Issuer BV 5.125% 4/30/31 (b) | | 260,000 | 222,851 |

| Owens & Minor, Inc. 6.625% 4/1/30 (b) | | 195,000 | 188,426 |

| RegionalCare Hospital Partners Holdings, Inc.: | | | |

| 9.875% 8/15/30 (b) | | 300,000 | 311,246 |

| 11% 10/15/30 (b) | | 800,000 | 846,242 |

| Star Parent, Inc. 9% 10/1/30 (b) | | 400,000 | 422,148 |

| Tenet Healthcare Corp. 4.375% 1/15/30 | | 2,625,000 | 2,404,222 |

TOTAL HEALTHCARE | | | 12,372,303 |

| Homebuilders/Real Estate - 3.9% | | | |

| Anywhere Real Estate Group LLC 7% 4/15/30 (b) | | 304,000 | 275,485 |

| Arcosa, Inc. 4.375% 4/15/29 (b) | | 230,000 | 212,289 |

| Ardonagh Finco Ltd. 7.75% 2/15/31 (b) | | 300,000 | 297,390 |

| Brookfield Property REIT, Inc./BPR Nimbus LLC/BPR Cumulus LLC/GGSI Sellco LLC: | | | |

| 4.5% 4/1/27 (b) | | 500,000 | 439,548 |

| 5.75% 5/15/26 (b) | | 950,000 | 916,265 |

| Cushman & Wakefield U.S. Borrower LLC 8.875% 9/1/31 (b) | | 535,000 | 557,069 |

| Greystar Real Estate Partners 7.75% 9/1/30 (b) | | 130,000 | 134,868 |

| HAT Holdings I LLC/HAT Holdings II LLC 6% 4/15/25 (b) | | 790,000 | 781,972 |

| Howard Hughes Corp. 4.125% 2/1/29 (b) | | 800,000 | 710,152 |

| Kennedy-Wilson, Inc. 4.75% 2/1/30 | | 1,306,000 | 1,033,373 |

| LGI Homes, Inc.: | | | |

| 4% 7/15/29 (b) | | 860,000 | 737,474 |

| 8.75% 12/15/28 (b) | | 525,000 | 550,266 |

| MPT Operating Partnership LP/MPT Finance Corp. 3.5% 3/15/31 | | 1,000,000 | 669,698 |

| RHP Hotel Properties LP/RHP Finance Corp. 7.25% 7/15/28 (b) | | 400,000 | 409,671 |

| Service Properties Trust: | | | |

| 4.75% 10/1/26 | | 889,000 | 825,306 |

| 5.25% 2/15/26 | | 181,000 | 175,784 |

| 7.5% 9/15/25 | | 408,300 | 413,656 |

| 8.625% 11/15/31 (b) | | 500,000 | 528,056 |

| Starwood Property Trust, Inc. 4.375% 1/15/27 (b) | | 502,000 | 470,625 |

| Uniti Group LP/Uniti Group Finance, Inc./CSL Capital LLC 10.5% 2/15/28 (b) | | 1,173,000 | 1,214,170 |

TOTAL HOMEBUILDERS/REAL ESTATE | | | 11,353,117 |

| Hotels - 1.3% | | | |

| Carnival Holdings (Bermuda) Ltd. 10.375% 5/1/28 (b) | | 75,000 | 81,822 |

| Hilton Grand Vacations Borrower Escrow LLC: | | | |

| 5% 6/1/29 (b) | | 500,000 | 463,245 |

| 6.625% 1/15/32 (b) | | 2,000,000 | 1,999,994 |

| Travel+Leisure Co.: | | | |

| 4.5% 12/1/29 (b) | | 80,000 | 73,266 |

| 6.625% 7/31/26 (b) | | 370,000 | 373,922 |

| Wyndham Hotels & Resorts, Inc. 4.375% 8/15/28 (b) | | 805,000 | 748,451 |

TOTAL HOTELS | | | 3,740,700 |

| Insurance - 0.8% | | | |

| Alliant Holdings Intermediate LLC/Alliant Holdings Co.-Issuer 7% 1/15/31 (b) | | 725,000 | 722,165 |

| AmWINS Group, Inc. 6.375% 2/15/29 (b) | | 500,000 | 500,326 |

| National Financial Partners Corp. 8.5% 10/1/31 (b) | | 250,000 | 275,956 |

| NMI Holdings, Inc. 7.375% 6/1/25 (b) | | 725,000 | 730,873 |

TOTAL INSURANCE | | | 2,229,320 |

| Leisure - 2.7% | | | |

| Carnival Corp.: | | | |

| 4% 8/1/28 (b) | | 1,408,000 | 1,298,682 |

| 6% 5/1/29 (b) | | 422,000 | 411,706 |

| 7.625% 3/1/26 (b) | | 102,000 | 103,327 |

| NCL Corp. Ltd. 8.125% 1/15/29 (b) | | 1,775,000 | 1,867,446 |

| Royal Caribbean Cruises Ltd.: | | | |

| 5.5% 8/31/26 (b) | | 1,202,000 | 1,188,247 |

| 6.25% 3/15/32 (b)(d) | | 375,000 | 376,073 |

| 8.25% 1/15/29 (b) | | 250,000 | 265,170 |

| 11.625% 8/15/27 (b) | | 1,879,000 | 2,032,418 |

| Viking Cruises Ltd. 9.125% 7/15/31 (b) | | 300,000 | 324,774 |

TOTAL LEISURE | | | 7,867,843 |

| Metals/Mining - 5.3% | | | |

| Arsenal AIC Parent LLC 8% 10/1/30 (b) | | 170,000 | 178,075 |

| Cleveland-Cliffs, Inc. 5.875% 6/1/27 | | 596,000 | 589,674 |

| Eldorado Gold Corp. 6.25% 9/1/29 (b) | | 325,000 | 304,521 |

| First Quantum Minerals Ltd. 9.375% 3/1/29 (b) | | 330,000 | 341,983 |

| FMG Resources Pty Ltd.: | | | |

| 4.375% 4/1/31 (b) | | 353,000 | 316,341 |

| 5.875% 4/15/30 (b) | | 5,903,000 | 5,777,406 |

| HudBay Minerals, Inc. 4.5% 4/1/26 (b) | | 282,000 | 271,747 |

| Mineral Resources Ltd.: | | | |

| 8% 11/1/27 (b) | | 650,000 | 662,032 |

| 8.125% 5/1/27 (b) | | 909,000 | 917,072 |

| 8.5% 5/1/30 (b) | | 2,706,000 | 2,779,102 |

| 9.25% 10/1/28 (b) | | 3,343,000 | 3,505,971 |

TOTAL METALS/MINING | | | 15,643,924 |

| Paper - 0.3% | | | |

| Ardagh Metal Packaging Finance U.S.A. LLC/Ardagh Metal Packaging Finance PLC 6% 6/15/27 (b) | | 360,000 | 353,484 |

| Louisiana-Pacific Corp. 3.625% 3/15/29 (b) | | 483,000 | 433,306 |

| Mercer International, Inc. 12.875% 10/1/28 (b) | | 200,000 | 214,479 |

TOTAL PAPER | | | 1,001,269 |

| Restaurants - 0.7% | | | |

| 1011778 BC Unlimited Liability Co./New Red Finance, Inc. 4% 10/15/30 (b) | | 2,201,000 | 1,933,367 |

| Services - 4.9% | | | |

| Allied Universal Holdco LLC 7.875% 2/15/31 (b) | | 300,000 | 297,924 |

| Allied Universal Holdco LLC / Allied Universal Finance Corp. 6.625% 7/15/26 (b) | | 335,000 | 333,985 |

| Aramark Services, Inc. 5% 4/1/25 (b) | | 150,000 | 149,043 |

| Artera Services LLC 8.5% 2/15/31 (b) | | 300,000 | 306,466 |

| Avis Budget Car Rental LLC/Avis Budget Finance, Inc. 5.75% 7/15/27 (b) | | 918,000 | 872,085 |

| Brand Industrial Services, Inc. 10.375% 8/1/30 (b) | | 400,000 | 425,371 |

| Bread Financial Holdings, Inc. 9.75% 3/15/29 (b) | | 700,000 | 715,925 |

| CoreCivic, Inc. 8.25% 4/15/26 | | 429,000 | 438,404 |

| Iron Mountain, Inc.: | | | |

| 5% 7/15/28 (b) | | 2,389,000 | 2,261,756 |

| 5.25% 7/15/30 (b) | | 1,054,000 | 986,312 |

| Neptune BidCo U.S., Inc. 9.29% 4/15/29 (b) | | 700,000 | 656,250 |

| Ritchie Bros. Holdings, Inc. 7.75% 3/15/31 (b) | | 1,792,000 | 1,883,840 |

| Sabre GLBL, Inc. 8.625% 6/1/27 (b) | | 406,000 | 357,347 |

| TriNet Group, Inc. 3.5% 3/1/29 (b) | | 2,322,000 | 2,055,992 |

| WASH Multifamily Acquisition, Inc. 5.75% 4/15/26 (b) | | 601,000 | 582,970 |

| Williams Scotsman, Inc. 4.625% 8/15/28 (b) | | 2,392,000 | 2,246,136 |

TOTAL SERVICES | | | 14,569,806 |

| Steel - 0.5% | | | |

| ATI, Inc. 7.25% 8/15/30 | | 883,000 | 907,609 |

| Carpenter Technology Corp. 7.625% 3/15/30 | | 500,000 | 516,395 |

TOTAL STEEL | | | 1,424,004 |

| Super Retail - 2.4% | | | |

| Asbury Automotive Group, Inc. 4.75% 3/1/30 | | 1,362,000 | 1,239,461 |

| Bath & Body Works, Inc.: | | | |

| 6.75% 7/1/36 | | 597,000 | 586,740 |

| 6.875% 11/1/35 | | 187,000 | 187,094 |

| 9.375% 7/1/25 (b) | | 858,000 | 894,155 |

| EG Global Finance PLC 12% 11/30/28 (b) | | 300,000 | 316,725 |

| Gap, Inc. 3.625% 10/1/29 (b) | | 500,000 | 422,342 |

| Group 1 Automotive, Inc. 4% 8/15/28 (b) | | 2,289,000 | 2,089,405 |

| QVC, Inc. 4.375% 9/1/28 | | 500,000 | 410,116 |

| Sally Holdings LLC: | | | |

| 5.625% 12/1/25 | | 105,000 | 104,932 |

| 6.75% 3/1/32 | | 300,000 | 299,138 |

| Sonic Automotive, Inc. 4.625% 11/15/29 (b) | | 65,000 | 57,359 |

| Staples, Inc. 7.5% 4/15/26 (b) | | 500,000 | 480,707 |

TOTAL SUPER RETAIL | | | 7,088,174 |

| Technology - 3.2% | | | |

| Alteryx, Inc. 8.75% 3/15/28 (b) | | 585,000 | 593,267 |

| Atkore, Inc. 4.25% 6/1/31 (b) | | 1,017,000 | 893,394 |

| Clarivate Science Holdings Corp. 4.875% 7/1/29 (b) | | 250,000 | 226,728 |

| Cloud Software Group, Inc. 6.5% 3/31/29 (b) | | 1,009,000 | 939,639 |

| CNT PRNT/CDK GLO II/FIN 8% 6/15/29 (b) | | 300,000 | 307,482 |

| CommScope, Inc. 4.75% 9/1/29 (b) | | 500,000 | 342,500 |

| Consensus Cloud Solutions, Inc. 6.5% 10/15/28 (b) | | 1,141,000 | 1,015,056 |

| Gen Digital, Inc. 5% 4/15/25 (b) | | 193,000 | 191,070 |

| Iron Mountain Information Management Services, Inc. 5% 7/15/32 (b) | | 3,282,000 | 2,934,224 |

| MicroStrategy, Inc. 6.125% 6/15/28 (b) | | 195,000 | 188,019 |

| NCR Atleos Corp. 9.5% 4/1/29 (b) | | 730,000 | 772,190 |

| PTC, Inc. 3.625% 2/15/25 (b) | | 440,000 | 429,480 |

| Seagate HDD Cayman 3.125% 7/15/29 | | 203 | 168 |

| UKG, Inc. 6.875% 2/1/31 (b) | | 355,000 | 358,692 |

| Xerox Corp. 4.8% 3/1/35 | | 250,000 | 189,664 |

| Xerox Holdings Corp. 5% 8/15/25 (b) | | 105,000 | 103,269 |

TOTAL TECHNOLOGY | | | 9,484,842 |

| Telecommunications - 4.7% | | | |

| Altice Financing SA 5.75% 8/15/29 (b) | | 800,000 | 689,016 |

| Altice France SA: | | | |

| 5.5% 10/15/29 (b) | | 1,860,000 | 1,408,335 |

| 8.125% 2/1/27 (b) | | 199,000 | 182,895 |

| C&W Senior Financing Designated Activity Co. 6.875% 9/15/27 (b) | | 165,000 | 155,513 |

| Cogent Communications Group, Inc. 7% 6/15/27 (b) | | 2,356,000 | 2,352,749 |

| Consolidated Communications, Inc. 5% 10/1/28 (b) | | 450,000 | 371,705 |

| Dycom Industries, Inc. 4.5% 4/15/29 (b) | | 975,000 | 897,226 |

| Frontier Communications Holdings LLC: | | | |

| 5% 5/1/28 (b) | | 1,216,000 | 1,125,352 |

| 6% 1/15/30 (b) | | 555,000 | 474,522 |

| 8.75% 5/15/30 (b) | | 483,000 | 492,646 |

| Intelsat Jackson Holdings SA 6.5% 3/15/30 (b) | | 700,000 | 651,268 |

| Level 3 Financing, Inc. 10.5% 5/15/30 (b) | | 415,000 | 425,375 |

| Sabre GLBL, Inc. 9.25% 4/15/25 (b) | | 900 | 842 |

| Telecom Italia Capital SA 7.2% 7/18/36 | | 1,541,000 | 1,531,684 |

| ViaSat, Inc.: | | | |

| 5.625% 4/15/27 (b) | | 700,000 | 657,125 |

| 7.5% 5/30/31 (b) | | 200,000 | 140,500 |

| Virgin Media Finance PLC 5% 7/15/30 (b) | | 700,000 | 604,261 |

| Virgin Media Secured Finance PLC 5.5% 5/15/29 (b) | | 800,000 | 749,593 |

| Windstream Escrow LLC 7.75% 8/15/28 (b) | | 500,000 | 466,812 |

| Zayo Group Holdings, Inc. 4% 3/1/27 (b) | | 400,000 | 333,000 |

TOTAL TELECOMMUNICATIONS | | | 13,710,419 |

| Textiles/Apparel - 0.0% | | | |

| Foot Locker, Inc. 4% 10/1/29 (b) | | 127,000 | 107,472 |

| Kontoor Brands, Inc. 4.125% 11/15/29 (b) | | 50,000 | 44,714 |

TOTAL TEXTILES/APPAREL | | | 152,186 |

| Transportation Ex Air/Rail - 0.9% | | | |

| RXO, Inc. 7.5% 11/15/27 (b) | | 1,702,000 | 1,757,314 |

| Stena International SA 7.625% 2/15/31 (b) | | 500,000 | 502,103 |

| XPO, Inc. 7.125% 2/1/32 (b) | | 500,000 | 508,327 |

TOTAL TRANSPORTATION EX AIR/RAIL | | | 2,767,744 |

| Utilities - 2.5% | | | |

| Calpine Corp. 5.25% 6/1/26 (b) | | 105,000 | 103,445 |

| NextEra Energy Partners LP 7.25% 1/15/29 (b) | | 564,000 | 573,301 |

| NRG Energy, Inc. 3.375% 2/15/29 (b) | | 1,065,000 | 929,567 |

| PG&E Corp. 5.25% 7/1/30 | | 2,199,000 | 2,067,188 |

| Talen Energy Supply LLC 8.625% 6/1/30 (b) | | 450,000 | 474,769 |

| Vistra Operations Co. LLC: | | | |

| 5.625% 2/15/27 (b) | | 757,000 | 737,658 |

| 7.75% 10/15/31 (b) | | 2,523,000 | 2,609,784 |

TOTAL UTILITIES | | | 7,495,712 |

| TOTAL NONCONVERTIBLE BONDS (Cost $288,701,824) | | | 287,134,098 |

| | | | |

| Money Market Funds - 2.4% |

| | | Shares | Value ($) |

Fidelity Cash Central Fund 5.39% (e) (Cost $7,078,419) | | 7,077,003 | 7,078,419 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 99.9% (Cost $295,780,243) | 294,212,517 |

NET OTHER ASSETS (LIABILITIES) - 0.1% | 409,196 |

| NET ASSETS - 100.0% | 294,621,713 |

| | |

Legend

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $242,149,073 or 82.2% of net assets. |

| (c) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (d) | Security or a portion of the security purchased on a delayed delivery or when-issued basis. |

| (e) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.39% | 6,320,516 | 61,388,418 | 60,630,515 | 81,121 | - | - | 7,078,419 | 0.0% |

| Total | 6,320,516 | 61,388,418 | 60,630,515 | 81,121 | - | - | 7,078,419 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of February 29, 2024, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Corporate Bonds | 287,134,098 | - | 287,134,098 | - |

|

| Money Market Funds | 7,078,419 | 7,078,419 | - | - |

| Total Investments in Securities: | 294,212,517 | 7,078,419 | 287,134,098 | - |

Fidelity® High Yield Factor ETF

| Statement of Assets and Liabilities |

| | | | February 29, 2024 (Unaudited) |

| | | | | |

| Assets | | | | |

| Investment in securities, at value - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $288,701,824) | $ | 287,134,098 | | |

Fidelity Central Funds (cost $7,078,419) | | 7,078,419 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $295,780,243) | | | $ | 294,212,517 |

| Cash | | | | 265,225 |

| Receivable for investments sold | | | | 1,678,515 |

| Receivable for fund shares sold | | | | 2,375,942 |

| Interest receivable | | | | 4,837,890 |

| Distributions receivable from Fidelity Central Funds | | | | 21,756 |

Total assets | | | | 303,391,845 |

| Liabilities | | | | |

| Payable for investments purchased | | | | |

Regular delivery | $ | 5,655,961 | | |

Delayed delivery | | 1,375,000 | | |

| Distributions payable | | 1,629,750 | | |

| Accrued management fee | | 109,421 | | |

| Total Liabilities | | | | 8,770,132 |

| Commitments and contingent liabilities (see Commitments note) | | | | |

| Net Assets | | | $ | 294,621,713 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 328,145,998 |

| Total accumulated earnings (loss) | | | | (33,524,285) |

| Net Assets | | | $ | 294,621,713 |

Net Asset Value, offering price and redemption price per share ($294,621,713 ÷ 6,200,000 shares) | | | $ | 47.52 |

| Statement of Operations |

| | | | Six months ended February 29, 2024 (Unaudited) |

| Investment Income | | | | |

| Interest | | | $ | 10,010,571 |

| Income from Fidelity Central Funds | | | | 81,121 |

| Total Income | | | | 10,091,692 |

| Expenses | | | | |

| Management fee | $ | 624,393 | | |

| Independent trustees' fees and expenses | | 714 | | |

| Total expenses before reductions | | 625,107 | | |

| Expense reductions | | (377) | | |

| Total expenses after reductions | | | | 624,730 |

| Net Investment income (loss) | | | | 9,466,962 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (1,771,429) | | |

| Redemptions in-kind | | (671,179) | | |

| Total net realized gain (loss) | | | | (2,442,608) |

| Change in net unrealized appreciation (depreciation) on investment securities | | | | 7,275,684 |

| Net gain (loss) | | | | 4,833,076 |

| Net increase (decrease) in net assets resulting from operations | | | $ | 14,300,038 |

| Statement of Changes in Net Assets |

| |

| | Six months ended February 29, 2024 (Unaudited) | | Year ended August 31, 2023 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 9,466,962 | $ | 16,330,455 |

| Net realized gain (loss) | | (2,442,608) | | (17,127,374) |

| Change in net unrealized appreciation (depreciation) | | 7,275,684 | | 18,328,525 |

| Net increase (decrease) in net assets resulting from operations | | 14,300,038 | | 17,531,606 |

| Distributions to shareholders | | (9,396,950) | | (16,489,950) |

| | | | | |

| Share transactions | | | | |

| Proceeds from sales of shares | | 49,807,245 | | 46,271,158 |

| Cost of shares redeemed | | (48,338,542) | | (34,058,789) |

| | | | | |

Net increase (decrease) in net assets resulting from share transactions | | 1,468,703 | | 12,212,369 |

| Total increase (decrease) in net assets | | 6,371,791 | | 13,254,025 |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 288,249,922 | | 274,995,897 |

| End of period | $ | 294,621,713 | $ | 288,249,922 |

| | | | | |

| Other Information | | | | |

| Shares | | | | |

| Sold | | 1,050,000 | | 1,000,000 |

| Redeemed | | (1,050,000) | | (750,000) |

| Net increase (decrease) | | - | | 250,000 |

| | | | | |

Financial Highlights

| Fidelity® High Yield Factor ETF |

| |

| | Six months ended (Unaudited) February 29, 2024 | | Years ended August 31, 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 46.49 | $ | 46.22 | $ | 56.07 | $ | 54.49 | $ | 52.32 | $ | 50.21 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | 1.594 | | 2.781 | | 2.383 | | 2.250 | | 2.518 | | 2.589 |

| Net realized and unrealized gain (loss) | | 1.028 | | .297 | | (8.748) | | 2.335 | | 2.323 | | 2.006 |

| Total from investment operations | | 2.622 | | 3.078 | | (6.365) | | 4.585 | | 4.841 | | 4.595 |

| Distributions from net investment income | | (1.592) | | (2.808) | | (2.355) | | (2.195) | | (2.429) | | (2.485) |

| Distributions from net realized gain | | - | | - | | (1.128) | | (.808) | | (.242) | | - |

| Total distributions | | (1.592) | | (2.808) | | (3.483) | | (3.003) | | (2.671) | | (2.485) |

| Net asset value, end of period | $ | 47.52 | $ | 46.49 | $ | 46.22 | $ | 56.07 | $ | 54.49 | $ | 52.32 |

Total Return C,D,E | | 5.75% | | 6.90% | | (11.85)% | | 8.66% | | 9.61% | | 9.48% |

Ratios to Average Net Assets B,F,G | | | | | | | | | | | | |

| Expenses before reductions | | .45% H | | .45% | | .45% | | .45% | | .45% | | .44% I |

| Expenses net of fee waivers, if any | | .45% H | | .45% | | .45% | | .45% | | .45% | | .44% I |

| Expenses net of all reductions | | .45% H | | .45% | | .45% | | .45% | | .45% | | .44% I |

| Net investment income (loss) | | 6.87% H | | 6.02% | | 4.64% | | 4.07% | | 4.84% | | 5.03% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 294,622 | $ | 288,250 | $ | 274,996 | $ | 277,532 | $ | 114,421 | $ | 68,016 |

Portfolio turnover rate J | | 47% H,K | | 84% K | | 72% K | | 177% K | | 179% K | | 76% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns for periods of less than one year are not annualized.

DTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

EBased on net asset value.

FFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

GExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

HAnnualized.

IThe size and fluctuation of net assets and expense amounts may cause ratios to differ from contractual rates.

JAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

KPortfolio turnover rate excludes securities received or delivered in-kind.

Top Holdings (% of Fund's net assets) |

| |

| U.S. Treasury Bonds 3.875% 2/15/43 | 4.2 | |

| Bank of America Corp. 5.875% | 2.8 | |

| Charles Schwab Corp. 4% | 2.0 | |

| PNC Financial Services Group, Inc. 5% | 1.5 | |

| Citigroup, Inc. 6.3% | 1.5 | |

| BP Capital Markets PLC 4.875% | 1.5 | |

| Energy Transfer LP 7.125% | 1.4 | |

| JPMorgan Chase & Co. 4.55% | 1.4 | |

| Goldman Sachs Group, Inc. 4.4% | 1.4 | |

| Wells Fargo & Co. 5.9% | 1.4 | |

| | 19.1 | |

| |

| Market Sectors (% of Fund's net assets) |

| |

| Financials | 60.5 | |

| Utilities | 12.6 | |

| Energy | 10.0 | |

| Communication Services | 4.4 | |

| Industrials | 3.6 | |

| Real Estate | 2.3 | |

| Consumer Discretionary | 0.7 | |

| |

Quality Diversification (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

Asset Allocation (% of Fund's net assets) |

|

|

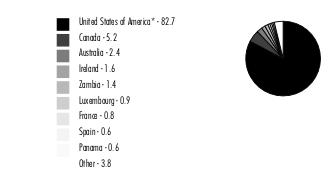

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| |

Fidelity® Preferred Securities & Income ETF

Showing Percentage of Net Assets

| Nonconvertible Bonds - 19.4% |

| | | Principal Amount (a) | Value ($) |

| COMMUNICATION SERVICES - 1.7% | | | |

| Media - 0.5% | | | |

| Paramount Global: | | | |

| 6.25% 2/28/57 (b) | | 80,000 | 65,910 |

| 6.375% 3/30/62 (b) | | 125,000 | 108,438 |

| | | | 174,348 |

| Wireless Telecommunication Services - 1.2% | | | |

| Vodafone Group PLC 7% 4/4/79 (b) | | 400,000 | 409,890 |

TOTAL COMMUNICATION SERVICES | | | 584,238 |

| ENERGY - 3.1% | | | |

| Oil, Gas & Consumable Fuels - 3.1% | | | |

| Enbridge, Inc. 8.5% 1/15/84 (b) | | 250,000 | 266,580 |

| Energy Transfer LP 8% 5/15/54 (b) | | 35,000 | 36,365 |

| Enterprise Products Operating LP: | | | |

| CME Term SOFR 3 Month Index + 2.980% 8.5733% 8/16/77 (b)(c) | | 33,000 | 33,123 |

| 5.25% 8/16/77 (b) | | 126,000 | 119,528 |

| 5.375% 2/15/78 (b) | | 67,000 | 61,936 |

| Transcanada Trust: | | | |

| 5.3% 3/15/77 (b) | | 161,000 | 148,042 |

| 5.5% 9/15/79 (b) | | 128,000 | 114,455 |

| 5.6% 3/7/82 (b) | | 200,000 | 175,004 |

| 5.875% 8/15/76 (b) | | 129,000 | 123,719 |

| | | | 1,078,752 |

| FINANCIALS - 10.6% | | | |

| Capital Markets - 0.2% | | | |

| Ares Finance Co. III LLC 4.125% 6/30/51 (b)(d) | | 75,000 | 67,755 |

| Financial Services - 0.9% | | | |

| Apollo Management Holdings LP 4.95% 1/14/50 (b)(d) | | 324,000 | 300,666 |

| Insurance - 9.5% | | | |

| American International Group, Inc. 5.75% 4/1/48 (b) | | 129,000 | 126,730 |

| Assurant, Inc. 7% 3/27/48 (b) | | 61,000 | 61,785 |

| Liberty Mutual Group, Inc.: | | | |

| 4.125% 12/15/51 (b)(d) | | 150,000 | 131,686 |

| 4.3% 2/1/61 (d) | | 125,000 | 79,521 |

| Meiji Yasuda Life Insurance Co.: | | | |

| 5.1% 4/26/48 (b)(d) | | 200,000 | 195,233 |

| 5.2% 10/20/45 (b)(d) | | 200,000 | 196,577 |

| MetLife, Inc.: | | | |

| 6.4% 12/15/66 (b) | | 319,000 | 323,817 |

| 10.75% 8/1/69 (b) | | 128,000 | 172,012 |

| Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen 5.875% 5/23/42 (b)(d) | | 200,000 | 201,600 |

| Nippon Life Insurance Co.: | | | |

| 2.75% 1/21/51 (b)(d) | | 200,000 | 165,058 |

| 3.4% 1/23/50 (b)(d) | | 100,000 | 87,799 |

| 4.7% 1/20/46 (b)(d) | | 200,000 | 194,938 |

| 6.25% 9/13/53 (b)(d) | | 200,000 | 207,246 |

| PartnerRe Finance B LLC 4.5% 10/1/50 (b) | | 67,000 | 59,735 |

| Prudential Financial, Inc.: | | | |

| 3.7% 10/1/50 (b) | | 200,000 | 174,691 |

| 5.125% 3/1/52 (b) | | 150,000 | 140,226 |

| 6% 9/1/52 (b) | | 200,000 | 199,459 |

| 6.75% 3/1/53 (b) | | 250,000 | 259,895 |

| Sumitomo Life Insurance Co. 4% 9/14/77 (b)(d) | | 270,000 | 253,398 |

| | | | 3,231,406 |

TOTAL FINANCIALS | | | 3,599,827 |

| UTILITIES - 4.0% | | | |

| Electric Utilities - 2.2% | | | |

| Edison International 7.875% 6/15/54 (b) | | 15,000 | 15,292 |

| Emera, Inc. 6.75% 6/15/76 (b) | | 125,000 | 122,486 |

| NextEra Energy Capital Holdings, Inc. 5.65% 5/1/79 (b) | | 104,000 | 99,757 |

| Southern Co.: | | | |

| 3.75% 9/15/51 (b) | | 125,000 | 117,232 |

| 4% 1/15/51 (b) | | 400,000 | 384,124 |

| | | | 738,891 |

| Multi-Utilities - 1.8% | | | |

| CMS Energy Corp.: | | | |

| 3.75% 12/1/50 (b) | | 409,000 | 327,132 |

| 4.75% 6/1/50 (b) | | 300,000 | 274,893 |

| Sempra 4.125% 4/1/52 (b) | | 25,000 | 22,937 |

| | | | 624,962 |

TOTAL UTILITIES | | | 1,363,853 |

| TOTAL NONCONVERTIBLE BONDS (Cost $6,723,083) | | | 6,626,670 |

| | | | |

| U.S. Treasury Obligations - 5.6% |

| | | Principal Amount (a) | Value ($) |

| U.S. Treasury Bonds: | | | |

| 3.875% 2/15/43 | | 1,575,000 | 1,441,921 |

| 3.875% 5/15/43 | | 500,000 | 456,953 |

| TOTAL U.S. TREASURY OBLIGATIONS (Cost $1,820,953) | | | 1,898,874 |

| | | | |

| Preferred Stocks - 25.1% |

| | | Shares | Value ($) |

| Convertible Preferred Stocks - 1.2% | | | |

| FINANCIALS - 1.2% | | | |

| Banks - 1.2% | | | |

| Wells Fargo & Co. 7.50% | | 350 | 413,246 |

| | | | |

| Nonconvertible Preferred Stocks - 23.9% | | | |

| COMMUNICATION SERVICES - 2.7% | | | |

| Diversified Telecommunication Services - 1.5% | | | |

| AT&T, Inc.: | | | |

| 4.75% | | 21,000 | 435,960 |

| 5.35% | | 3,500 | 84,595 |

| | | | 520,555 |

| Wireless Telecommunication Services - 1.2% | | | |

| Telephone & Data Systems, Inc.: | | | |

| 6.00% | | 3,500 | 56,350 |

| 6.625% | | 1,500 | 27,870 |

| U.S. Cellular Corp. | | 3,500 | 66,395 |

| U.S. Cellular Corp.: | | | |

| 5.50% | | 3,500 | 67,025 |

| 6.25% | | 8,500 | 177,225 |

| | | | 394,865 |

TOTAL COMMUNICATION SERVICES | | | 915,420 |

| | | | |

| ENERGY - 0.6% | | | |

| Oil, Gas & Consumable Fuels - 0.6% | | | |

| Energy Transfer LP 7.60% (b) | | 8,000 | 201,360 |

| | | | |

| FINANCIALS - 14.7% | | | |

| Banks - 4.2% | | | |

| Bank of America Corp.: | | | |

| 4.25% | | 5,500 | 108,845 |

| 4.375% | | 19,000 | 386,460 |

| Cadence Bank 5.50% | | 2,000 | 41,820 |

| Citizens Financial Group, Inc. Series E, 5.00% | | 2,000 | 42,580 |

| Fifth Third Bancorp Series K 4.95% | | 800 | 19,032 |

| JPMorgan Chase & Co.: | | | |

| 4.55% | | 22,900 | 491,892 |

| Series MM, 4.20% | | 1,700 | 33,796 |

| KeyCorp: | | | |

| 6.125%(b) | | 3,000 | 70,530 |

| 6.20%(b) | | 2,000 | 45,600 |

| Regions Financial Corp.: | | | |

| 4.45% | | 500 | 9,100 |

| 5.75%(b) | | 3,000 | 69,810 |

| U.S. Bancorp Series M, 4.00% | | 2,000 | 37,620 |

| Webster Financial Corp. Series F, 5.25% | | 750 | 14,719 |

| Western Alliance Bancorp. (b) | | 1,500 | 26,370 |

| Wintrust Financial Corp. 6.50% (b) | | 2,000 | 46,880 |

| | | | 1,445,054 |

| Capital Markets - 3.8% | | | |

| Affiliated Managers Group, Inc. 4.75% | | 3,000 | 59,040 |

| Charles Schwab Corp. 4.45% | | 4,500 | 95,220 |

| Morgan Stanley: | | | |

| Series K, 5.85%(b) | | 16,000 | 403,520 |

| Series O, 4.50% | | 4,300 | 84,581 |

| Northern Trust Corp. Series E, 4.70% | | 1,500 | 34,860 |

| Oaktree Capital Group LLC: | | | |

| 6.55% | | 7,000 | 157,430 |

| Series A, 6.625% | | 7,000 | 156,800 |

| SCE Trust III 5.75% (b) | | 1,550 | 39,246 |

| State Street Corp. Series G, 5.35% (b) | | 1,000 | 23,960 |

| Stifel Financial Corp. Series D, 4.50% | | 13,000 | 235,300 |

| | | | 1,289,957 |

| Consumer Finance - 0.1% | | | |

| Navient Corp. 6.00% | | 1,500 | 31,800 |

| | | | |

| Financial Services - 1.1% | | | |

| Carlyle Finance LLC 4.625% | | 2,500 | 49,300 |

| Equitable Holdings, Inc.: | | | |

| 4.30% | | 1,000 | 18,540 |

| Series A 5.25% | | 3,000 | 68,370 |

| KKR Group Finance Co. IX LLC 4.625% | | 5,000 | 101,500 |

| Voya Financial, Inc. Series B, 5.35% (b) | | 5,000 | 124,650 |

| | | | 362,360 |

| Insurance - 5.5% | | | |

| Aegon Funding Co. LLC 5.10% | | 3,950 | 87,967 |

| Allstate Corp.: | | | |

| 5.10% | | 10,000 | 234,300 |

| Series I, 4.75% | | 2,000 | 47,720 |

| American Financial Group, Inc. 4.50% | | 6,000 | 119,880 |

| Arch Capital Group Ltd.: | | | |

| 5.45% | | 2,000 | 48,240 |

| Series G, 4.55% | | 2,250 | 47,273 |

| Assurant, Inc. 5.25% | | 2,500 | 53,425 |

| Athene Holding Ltd.: | | | |

| 7.25%(b) | | 8,800 | 220,000 |

| Series A, 6.35%(b) | | 2,500 | 61,375 |

| Series C, 6.375%(b) | | 9,000 | 225,450 |

| Series D, 4.875% | | 4,000 | 74,480 |

| Brighthouse Financial, Inc. | | 4,000 | 77,120 |

| Brighthouse Financial, Inc.: | | | |

| Series A, 6.60% | | 2,000 | 48,780 |

| Series B, 6.75% | | 2,000 | 50,080 |

| Series D, 0.00% | | 4,000 | 65,200 |

| Globe Life, Inc. Series D, 4.25% | | 2,500 | 51,375 |

| Prudential Financial, Inc. 5.625% | | 1,500 | 37,470 |

| Reinsurance Group of America, Inc. 7.125% (b) | | 4,000 | 104,560 |

| RenaissanceRe Holdings Ltd. Series G, 4.20% | | 1,550 | 28,830 |

| Unum Group 6.25% | | 3,500 | 86,424 |

| W.R. Berkley Corp. 4.25% | | 5,000 | 109,400 |

| | | | 1,879,349 |

TOTAL FINANCIALS | | | 5,008,520 |

| | | | |

| INDUSTRIALS - 1.6% | | | |

| Trading Companies & Distributors - 1.6% | | | |

| FTAI Aviation Ltd.: | | | |

| 8.00%(b) | | 2,000 | 51,340 |

| 8.25%(b) | | 2,000 | 51,000 |

| 8.25%(b) | | 8,000 | 208,240 |

| WESCO International, Inc. (b) | | 9,000 | 243,900 |

| | | | 554,480 |

| REAL ESTATE - 2.3% | | | |

| Equity Real Estate Investment Trusts (REITs) - 2.3% | | | |

| American Homes 4 Rent 6.25% | | 1,000 | 24,940 |

| Digital Realty Trust, Inc.: | | | |

| 5.25% | | 1,750 | 39,323 |

| Series L, 5.20% | | 10,000 | 222,900 |

| Public Storage: | | | |

| 4.00% | | 20,000 | 386,200 |

| Series H, 5.60% | | 1,500 | 37,740 |

| Series I, 4.875% | | 1,500 | 35,610 |

| SITE Centers Corp. 6.375% | | 1,000 | 23,380 |

| Summit Hotel Properties, Inc. Series F, 5.875% | | 775 | 15,748 |

| | | | 785,841 |

| UTILITIES - 2.0% | | | |

| Electric Utilities - 1.2% | | | |

| Entergy Louisiana LLC 4.875% | | 1,000 | 22,910 |

| SCE Trust V 5.45% (b) | | 1,550 | 38,177 |

| SCE Trust VII 7.75% | | 5,000 | 134,100 |

| Southern Co.: | | | |

| 4.20% | | 3,500 | 71,925 |

| Series A, 4.95% | | 5,000 | 116,950 |

| | | | 384,062 |

| Independent Power and Renewable Electricity Producers - 0.1% | | | |

| Brookfield Renewable Partners LP 5.25% | | 2,395 | 43,062 |

| | | | |

| Multi-Utilities - 0.7% | | | |

| Algonquin Power & Utilities Corp. Series A, 6.20% (b) | | 3,000 | 75,720 |

| Brookfield Infrastructure Partners LP: | | | |

| 5.125% | | 825 | 15,263 |

| Class A 5.00% | | 825 | 14,545 |

| DTE Energy Co.: | | | |

| 4.375% | | 1,000 | 21,400 |

| 4.375% | | 2,825 | 59,254 |

| SCE Trust VI | | 2,375 | 48,925 |

| | | | 235,107 |

TOTAL UTILITIES | | | 662,231 |

| | | | |

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | | | 8,127,852 |

| TOTAL PREFERRED STOCKS (Cost $8,458,696) | | | 8,541,098 |

| | | | |

| Preferred Securities - 49.6% |

| | | Principal Amount (a) | Value ($) |

| CONSUMER DISCRETIONARY - 0.7% | | | |

| Automobiles - 0.7% | | | |

| General Motors Financial Co., Inc. 5.7% 12/31/99 (b)(e) | | 252,000 | 241,918 |

| ENERGY - 6.3% | | | |

| Oil, Gas & Consumable Fuels - 6.3% | | | |

| BP Capital Markets PLC: | | | |

| 4.375% (b)(e) | | 125,000 | 125,590 |

| 4.875% (b)(e) | | 525,000 | 500,363 |

| 6.45% (b)(e) | | 215,000 | 215,482 |

| Enbridge, Inc.: | | | |

| 5.5% 7/15/77 (b) | | 126,000 | 118,008 |

| 5.75% 7/15/80 (b) | | 126,000 | 118,416 |

| 6% 1/15/77 (b) | | 68,000 | 66,577 |

| 6.25% 3/1/78 (b) | | 123,000 | 121,239 |

| Energy Transfer LP: | | | |

| 3 month U.S. LIBOR + 4.020% 9.5966% (b)(c)(e) | | 240,000 | 238,059 |

| 6.625% (b)(e) | | 50,000 | 46,457 |

| 7.125% (b)(e) | | 500,000 | 492,407 |

| Plains All American Pipeline LP CME Term SOFR 3 Month Index + 4.110% 9.6786% (b)(c)(e) | | 100,000 | 99,851 |

| | | | 2,142,449 |

| FINANCIALS - 34.0% | | | |

| Banks - 19.3% | | | |

| Bank of America Corp.: | | | |

| 5.875% (b)(e) | | 943,000 | 939,295 |

| 6.1% (b)(e) | | 200,000 | 205,428 |

| 6.125% (b)(e) | | 100,000 | 100,454 |

| Citigroup, Inc.: | | | |

| 3.875% (b)(e) | | 400,000 | 376,182 |

| 4.15% (b)(e) | | 89,000 | 80,363 |

| 5.95% (b)(e) | | 393,000 | 396,515 |

| 6.3% (b)(e) | | 495,000 | 501,698 |

| Fifth Third Bancorp 4.5% (b)(e) | | 50,000 | 47,888 |

| Huntington Bancshares, Inc. 5.625% (b)(e) | | 226,000 | 206,101 |

| JPMorgan Chase & Co.: | | | |

| 4.6% (b)(e) | | 300,000 | 293,147 |

| 5% (b)(e) | | 401,000 | 400,334 |

| 6.1% (b)(e) | | 321,000 | 328,721 |

| 6.125% (b)(e) | | 150,000 | 152,874 |

| KeyCorp 5% (b)(e) | | 100,000 | 86,260 |

| M&T Bank Corp. 5.125% (b)(e) | | 50,000 | 44,539 |

| PNC Financial Services Group, Inc. 5% (b)(e) | | 542,000 | 523,016 |

| Regions Financial Corp. 5.75% 12/31/99 (b) | | 75,000 | 73,836 |

| Truist Financial Corp.: | | | |

| 4.95% (b)(e) | | 135,000 | 132,938 |

| 5.1% (b)(e) | | 403,000 | 377,792 |

| 5.125% 12/31/99 (b)(e) | | 60,000 | 52,755 |

| U.S. Bancorp: | | | |

| 3.7% (b)(e) | | 400,000 | 343,164 |

| 5.3% (b)(e) | | 115,000 | 108,037 |

| Wells Fargo & Co.: | | | |

| 3.9% (b)(e) | | 266,000 | 252,485 |

| 5.9% (b)(e) | | 471,000 | 474,626 |

| 7.625% (b)(e) | | 75,000 | 80,569 |

| | | | 6,579,017 |

| Capital Markets - 8.9% | | | |

| Bank of New York Mellon Corp.: | | | |

| 3.7% (b)(e) | | 425,000 | 402,000 |

| 3.75% (b)(e) | | 96,000 | 86,664 |

| 4.625% (b)(e) | | 200,000 | 193,537 |

| 4.7% (b)(e) | | 65,000 | 65,008 |

| Charles Schwab Corp.: | | | |

| 4% (b)(e) | | 831,000 | 692,704 |

| 4% (b)(e) | | 200,000 | 186,213 |

| 5% (b)(e) | | 100,000 | 93,502 |

| Goldman Sachs Group, Inc.: | | | |

| 4.125% (b)(e) | | 29,000 | 26,853 |

| 4.4% (b)(e) | | 500,000 | 480,497 |

| 5.3% (b)(e) | | 79,000 | 79,369 |

| Morgan Stanley 5.875% (b)(e) | | 400,000 | 403,235 |

| Northern Trust Corp. 4.6% (b)(e) | | 60,000 | 58,954 |

| State Street Corp. CME Term SOFR 3 Month Index + 2.800% 8.1852% (b)(c)(e) | | 248,000 | 252,449 |

| | | | 3,020,985 |

| Consumer Finance - 3.6% | | | |

| Ally Financial, Inc.: | | | |

| 4.7% (b)(e) | | 470,000 | 403,968 |

| 4.7% (b)(e) | | 220,000 | 173,131 |

| American Express Co. 3.55% (b)(e) | | 217,000 | 197,430 |

| Capital One Financial Corp. 3.95% (b)(e) | | 400,000 | 355,906 |

| Discover Financial Services 5.5% 12/31/99 (b)(e) | | 100,000 | 85,931 |

| | | | 1,216,366 |

| Financial Services - 0.2% | | | |

| Equitable Holdings, Inc. 4.95% (b)(e) | | 75,000 | 73,500 |

| Insurance - 2.0% | | | |

| Dai-Ichi Life Insurance Co. Ltd. 4% 12/31/99 (b)(d) | | 200,000 | 191,781 |

| Markel Group, Inc. 6% (b)(e) | | 200,000 | 201,629 |

| MetLife, Inc. 3.85% (b)(e) | | 275,000 | 268,199 |

| SBL Holdings, Inc. 6.5% 12/31/99 (b)(d)(e) | | 34,000 | 24,565 |

| | | | 686,174 |

TOTAL FINANCIALS | | | 11,576,042 |

| INDUSTRIALS - 2.0% | | | |

| Trading Companies & Distributors - 2.0% | | | |

| AerCap Holdings NV 5.875% 10/10/79 (b) | | 50,000 | 50,629 |

| Air Lease Corp.: | | | |

| 4.125% (b)(e) | | 56,000 | 48,402 |

| 4.65% (b)(e) | | 300,000 | 284,084 |

| Aircastle Ltd. 5.25% (b)(d)(e) | | 326,000 | 310,045 |

| | | | 693,160 |

| UTILITIES - 6.6% | | | |

| Electric Utilities - 3.6% | | | |

| Duke Energy Corp. 4.875% (b)(e) | | 325,000 | 329,029 |

| Edison International: | | | |

| 5% (b)(e) | | 324,000 | 315,121 |

| 5.375% (b)(e) | | 366,000 | 361,850 |

| Electricite de France SA 9.125% (b)(d)(e) | | 200,000 | 225,751 |

| | | | 1,231,751 |

| Independent Power and Renewable Electricity Producers - 1.2% | | | |

| Vistra Corp.: | | | |

| 7% (b)(d)(e) | | 295,000 | 289,758 |

| 8% (b)(d)(e) | | 100,000 | 102,994 |

| | | | 392,752 |

| Multi-Utilities - 1.8% | | | |

| Dominion Energy, Inc.: | | | |

| 4.35% (b)(e) | | 225,000 | 213,586 |

| 4.65% (b)(e) | | 80,000 | 78,662 |

| Sempra 4.875% (b)(e) | | 325,000 | 324,090 |

| | | | 616,338 |

TOTAL UTILITIES | | | 2,240,841 |

| TOTAL PREFERRED SECURITIES (Cost $17,082,480) | | | 16,894,410 |

| | | | |

| Money Market Funds - 1.5% |

| | | Shares | Value ($) |

Fidelity Cash Central Fund 5.39% (f) (Cost $520,619) | | 520,515 | 520,619 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 101.2% (Cost $34,605,831) | 34,481,671 |

NET OTHER ASSETS (LIABILITIES) - (1.2)% | (422,088) |

| NET ASSETS - 100.0% | 34,059,583 |

| | |

Legend

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (c) | Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors. |

| (d) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $3,226,371 or 9.5% of net assets. |

| (e) | Security is perpetual in nature with no stated maturity date. |

| (f) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.39% | 325,515 | 4,089,339 | 3,894,235 | 13,340 | - | - | 520,619 | 0.0% |

| Total | 325,515 | 4,089,339 | 3,894,235 | 13,340 | - | - | 520,619 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of February 29, 2024, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Equities: | | | | |

Communication Services | 915,420 | 915,420 | - | - |

Energy | 201,360 | 201,360 | - | - |

Financials | 5,421,766 | 4,788,520 | 633,246 | - |

Industrials | 554,480 | 554,480 | - | - |

Real Estate | 785,841 | 785,841 | - | - |

Utilities | 662,231 | 662,231 | - | - |

|

| Corporate Bonds | 6,626,670 | - | 6,626,670 | - |

|

| U.S. Government and Government Agency Obligations | 1,898,874 | - | 1,898,874 | - |

|

| Preferred Securities | 16,894,410 | - | 16,894,410 | - |

|

| Money Market Funds | 520,619 | 520,619 | - | - |

| Total Investments in Securities: | 34,481,671 | 8,428,471 | 26,053,200 | - |

Fidelity® Preferred Securities & Income ETF

| Statement of Assets and Liabilities |

| | | | February 29, 2024 (Unaudited) |

| | | | | |

| Assets | | | | |

| Investment in securities, at value - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $34,085,212) | $ | 33,961,052 | | |

Fidelity Central Funds (cost $520,619) | | 520,619 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $34,605,831) | | | $ | 34,481,671 |

| Cash | | | | 17,616 |

| Dividends receivable | | | | 40,720 |

| Interest receivable | | | | 113,192 |

| Distributions receivable from Fidelity Central Funds | | | | 2,020 |

| Other receivables | | | | 50 |

Total assets | | | | 34,655,269 |

| Liabilities | | | | |

| Payable for investments purchased | $ | 435,000 | | |

| Distributions payable | | 144,000 | | |

| Accrued management fee | | 16,686 | | |

| Total Liabilities | | | | 595,686 |

| Net Assets | | | $ | 34,059,583 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 39,147,209 |

| Total accumulated earnings (loss) | | | | (5,087,626) |

| Net Assets | | | $ | 34,059,583 |

Net Asset Value, offering price and redemption price per share ($34,059,583 ÷ 1,600,000 shares) | | | $ | 21.29 |

| Statement of Operations |

| | | | Six months ended February 29, 2024 (Unaudited) |

| Investment Income | | | | |

| Dividends | | | $ | 773,253 |

| Interest | | | | 185,933 |

| Income from Fidelity Central Funds | | | | 13,340 |

| Total Income | | | | 972,526 |

| Expenses | | | | |

| Management fee | $ | 96,037 | | |

| Independent trustees' fees and expenses | | 83 | | |

| Total expenses before reductions | | 96,120 | | |

| Expense reductions | | (163) | | |

| Total expenses after reductions | | | | 95,957 |

| Net Investment income (loss) | | | | 876,569 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (308,449) | | |

| Total net realized gain (loss) | | | | (308,449) |

| Change in net unrealized appreciation (depreciation) on investment securities | | | | 2,247,425 |

| Net gain (loss) | | | | 1,938,976 |

| Net increase (decrease) in net assets resulting from operations | | | $ | 2,815,545 |

| Statement of Changes in Net Assets |

| |

| | Six months ended February 29, 2024 (Unaudited) | | Year ended August 31, 2023 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 876,569 | $ | 1,456,762 |

| Net realized gain (loss) | | (308,449) | | (3,256,717) |

| Change in net unrealized appreciation (depreciation) | | 2,247,425 | | 2,451,438 |

| Net increase (decrease) in net assets resulting from operations | | 2,815,545 | | 651,483 |

| Distributions to shareholders | | (851,200) | | (1,416,301) |

| Distributions to shareholders from tax return of capital | | - | | (195,299) |

| | | | | |

| Total Distributions | | (851,200) | | (1,611,600) |

| Share transactions | | | | |

| Proceeds from sales of shares | | - | | 1,002,305 |

| Cost of shares redeemed | | - | | (1,015,599) |

| | | | | |

Net increase (decrease) in net assets resulting from share transactions | | - | | (13,294) |

| Total increase (decrease) in net assets | | 1,964,345 | | (973,411) |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 32,095,238 | | 33,068,649 |

| End of period | $ | 34,059,583 | $ | 32,095,238 |

| | | | | |

| Other Information | | | | |

| Shares | | | | |

| Sold | | - | | 50,000 |

| Redeemed | | - | | (50,000) |

| | | | | |

Financial Highlights

| Fidelity® Preferred Securities & Income ETF |

| |

| | Six months ended (Unaudited) February 29, 2024 | | Years ended August 31, 2023 | | 2022 | | 2021 A |

Selected Per-Share Data | | | | | | | | |

| Net asset value, beginning of period | $ | 20.06 | $ | 20.67 | $ | 25.20 | $ | 25.00 |

| Income from Investment Operations | | | | | | | | |

Net investment income (loss) B,C | | .548 | | .937 | | .886 | | .170 |

| Net realized and unrealized gain (loss) | | 1.214 | | (.510) | | (4.485) | | .187 |

| Total from investment operations | | 1.762 | | .427 | | (3.599) | | .357 |

| Distributions from net investment income | | (.532) | | (.856) | | (.931) | | (.157) |

| Distributions from tax return of capital | | - | | (.181) | | - | | - |

| Total distributions | | (.532) | | (1.037) | | (.931) | | (.157) |

| Net asset value, end of period | $ | 21.29 | $ | 20.06 | $ | 20.67 | $ | 25.20 |

Total Return D,E,F | | 8.92% | | 2.19% | | (14.50)% | | 1.44% |

Ratios to Average Net Assets C,G,H | | | | | | | | |

| Expenses before reductions | | .59% I | | .59% | | .59% | | .59% I |

| Expenses net of fee waivers, if any | | .59% I | | .59% | | .59% | | .59% I |

| Expenses net of all reductions | | .59% I | | .59% | | .59% | | .59% I |

| Net investment income (loss) | | 5.42% I | | 4.65% | | 3.98% | | 3.16% I |

| Supplemental Data | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 34,060 | $ | 32,095 | $ | 33,069 | $ | 6,300 |

Portfolio turnover rate J | | 38% I | | 50% | | 21% | | -% |

AFor the period June 15, 2021 (commencement of operations) through August 31, 2021.

BCalculated based on average shares outstanding during the period.

CNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

DTotal returns for periods of less than one year are not annualized.

ETotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

FBased on net asset value.

GFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

HExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

IAnnualized.

JAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

For the period ended February 29, 2024

1. Organization.

Fidelity High Yield Factor ETF and Fidelity Preferred Securities & Income ETF (the Funds) are exchange-traded funds of Fidelity Covington Trust (the Trust) and are authorized to issue an unlimited number of shares. Fidelity Preferred Securities & Income ETF is a non-diversified exchange-traded fund. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense RatioA |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

A Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Significant Accounting Policies.

Each Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. Each Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of each Fund: