UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-07319

Fidelity Covington Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

William C. Coffey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant’s telephone number, including area code:617-563-7000

Date of fiscal year end: August 31

Date of reporting period: February 28, 2019

| Item 1. | Reports to Stockholders |

Fidelity® High Yield Factor ETF

| | |

Semi-Annual Report February 28, 2019

| |  |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity’s web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| | | | |

| Account Type | | Website | | Phone Number |

Brokerage, Mutual Fund, or Annuity Contracts: | | fidelity.com/mailpreferences | | 1-800-343-3548 |

Employer Provided Retirement Accounts: | | netbenefits.fidelity.com/preferences (choose ‘no’ under Required Disclosures to continue print) | | 1-800-343-0860 |

Contents

To view a fund’s proxy voting guidelines and proxy voting record for the period ended June, 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission’s (SEC) web site at http://www.sec.gov. You may also call1-800-FIDELITY to request a free copy of the proxy voting guidelines.

Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

© 2019 FMR LLC. All Rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on FormN-Q. FormsN-Q are available on the SEC’s web site at http://www.sec.gov. A fund’s FormsN-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC’s Public Reference Room may be obtained by calling1-800-SEC-0330. For a complete list of a fund’s portfolio holdings, view the most recent holdings listing on Fidelity’s web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED• MAY LOSE VALUE• NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Investment Summary(Unaudited)

| | | | |

| Top Five Holdings as of February 28, 2019 | |

| |

| (by issuer, excluding cash equivalents) | | % of fund’s

net assets | |

Frontier Communications Corp. | | | 2.0 | |

Equinix, Inc. | | | 2.0 | |

Hilton Domestic Operating Co., Inc. | | | 2.0 | |

Open Text Corp. | | | 2.0 | |

Gartner, Inc. | | | 2.0 | |

| | | | |

| | | 10.0 | |

| | | | |

| | | | |

| Top Five Market Sectors as of February 28, 2019 | |

| | | % of fund’s

net assets | |

Consumer Discretionary | | | 15.3 | |

Energy | | | 14.6 | |

Industrials | | | 13.2 | |

Information Technology | | | 12.1 | |

Health Care | | | 8.8 | |

| | |

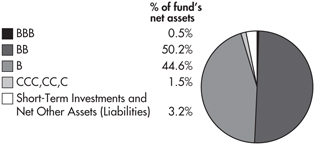

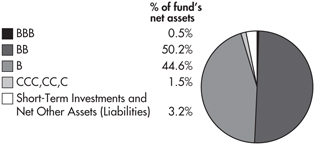

| Quality Diversification as of February 28, 2019 |

We have used ratings from Moody’s Investors Service, Inc. Where Moody’s® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

| | |

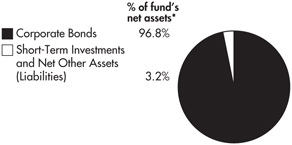

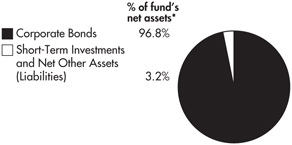

| Asset Allocation as of February 28, 2019 |

| * | Foreign investments – 12.5% |

Schedule of Investments February 28, 2019(Unaudited)

Showing Percentage of Net Assets

| | | | | | | | |

| Nonconvertible Bonds – 96.8% | |

| | |

| | | Principal

Amount | | | Value | |

COMMUNICATION SERVICES – 8.3% | |

Diversified Telecommunication Services – 4.9% | |

Altice France S.A.

7.375% 5/1/26 (a) | | $ | 150,000 | | | $ | 147,187 | |

CenturyLink, Inc.: | | | | | | | | |

6.75% 12/1/23 | | | 89,000 | | | | 92,421 | |

7.50% 4/1/24 | | | 88,000 | | | | 93,088 | |

Frontier Communications Corp.

8.50% 4/1/26 (a) | | | 440,000 | | | | 409,200 | |

Hughes Satellite Systems Corp.

6.625% 8/1/26 | | | 244,000 | | | | 240,035 | |

| | | | | | | | |

| | | | | | | 981,931 | |

| | | | | | | | |

Media – 1.8% | |

CSC Holdings LLC

5.375% 2/1/28 (a) | | | 150,000 | | | | 147,375 | |

DISH DBS Corp.

5.875% 11/15/24 | | | 100,000 | | | | 84,220 | |

Nexstar Broadcasting, Inc.

5.625% 8/1/24 (a) | | | 130,000 | | | | 129,025 | |

| | | | | | | | |

| | | | | | | 360,620 | |

| | | | | | | | |

Wireless Telecommunication Services – 1.6% | |

Sprint Corp.

7.625% 2/15/25 | | | 100,000 | | | | 104,750 | |

T-Mobile USA, Inc.

6.375% 3/1/25 | | | 200,000 | | | | 208,125 | |

| | | | | | | | |

| | | | | | | 312,875 | |

| | | | | | | | |

| |

TOTAL COMMUNICATION SERVICES | | | | 1,655,426 | |

| | | | | | | | |

|

CONSUMER DISCRETIONARY – 15.3% | |

Auto Components – 0.1% | | | | | | | | |

Delphi Technologies PLC

5.00% 10/1/25 (a) | | | 33,000 | | | | 29,364 | |

| | | | | | | | |

Hotels, Restaurants & Leisure – 8.7% | |

1011778 BC ULC / New Red Finance, Inc.

5.00% 10/15/25 (a) | | | 410,000 | | | | 397,597 | |

Eldorado Resorts, Inc.

6.00% 9/15/26 (a) | | | 5,000 | | | | 5,088 | |

GLP Capital LP / GLP Financing II, Inc.: | | | | | | | | |

5.25% 6/1/25 | | | 112,000 | | | | 115,975 | |

5.375% 4/15/26 | | | 99,000 | | | | 102,286 | |

5.75% 6/1/28 | | | 37,000 | | | | 38,396 | |

Hilton Domestic Operating Co., Inc.

4.25% 9/1/24 | | | 410,000 | | | | 403,850 | |

Hilton Worldwide Finance LLC / Hilton Worldwide Finance Corp.: | | | | | | | | |

4.625% 4/1/25 | | | 133,000 | | | | 132,335 | |

4.875% 4/1/27 | | | 174,000 | | | | 173,130 | |

International Game Technology PLC

6.25% 1/15/27 (a) | | | 10,000 | | | | 10,413 | |

| | | | | | | | |

| | |

| | |

| | | Principal

Amount | | | Value | |

Six Flags Entertainment Corp.

5.50% 4/15/27 (a) | | $ | 112,000 | | | $ | 110,040 | |

Wynn Las Vegas LLC / Wynn Las Vegas Capital Corp.: | | | | | | | | |

5.25% 5/15/27 (a) | | | 56,000 | | | | 53,567 | |

5.50% 3/1/25 (a) | | | 194,000 | | | | 193,088 | |

| | | | | | | | |

| | | | | | | 1,735,765 | |

| | | | | | | | |

Household Durables – 1.5% | |

Lennar Corp.: | | | | | | | | |

4.125% 1/15/22 | | | 25,000 | | | | 24,875 | |

4.75% 11/15/22 to 5/30/25 | | | 38,000 | | | | 38,475 | |

PulteGroup, Inc.: | | | | | | | | |

5.00% 1/15/27 | | | 93,000 | | | | 89,048 | |

5.50% 3/1/26 | | | 157,000 | | | | 158,177 | |

| | | | | | | | |

| | | | | | | 310,575 | |

| | | | | | | | |

Internet & Direct Marketing Retail – 1.1% | |

Netflix, Inc.: | | | | | | | | |

5.875% 2/15/25 | | | 96,000 | | | | 101,760 | |

5.875% 11/15/28 (a) | | | 21,000 | | | | 21,873 | |

6.375% 5/15/29 (a) | | | 100,000 | | | | 106,219 | |

| | | | | | | | |

| | | | | | | 229,852 | |

| | | | | | | | |

Leisure Products – 0.6% | |

Mattel, Inc.

6.75% 12/31/25 (a) | | | 122,000 | | | | 120,170 | |

| | | | | | | | |

Media – 2.6% | | | | | | | | |

AMC Networks, Inc.: | | | | | | | | |

4.75% 8/1/25 | | | 19,000 | | | | 18,477 | |

5.00% 4/1/24 | | | 103,000 | | | | 102,196 | |

CCO Holdings LLC / CCO Holdings Capital Corp.: | | | | | | | | |

5.50% 5/1/26 (a) | | | 120,000 | | | | 122,365 | |

5.875% 4/1/24 (a) | | | 80,000 | | | | 83,300 | |

Sirius XM Radio, Inc.: | | | | | | | | |

5.375% 4/15/25 (a) | | | 37,000 | | | | 37,705 | |

6.00% 7/15/24 (a) | | | 155,000 | | | | 160,619 | |

| | | | | | | | |

| | | | | | | 524,662 | |

| | | | | | | | |

Specialty Retail – 0.5% | |

L Brands, Inc.

5.25% 2/1/28 | | | 112,000 | | | | 96,880 | |

| | | | | | | | |

Textiles, Apparel & Luxury Goods – 0.2% | | | | | |

The William Carter Co.

5.625% 3/15/27 (b) | | | 30,000 | | | | 30,000 | |

| | | | | | | | |

| |

TOTAL CONSUMER DISCRETIONARY | | | | 3,077,268 | |

| | | | | | | | |

|

CONSUMER STAPLES – 4.4% | |

Food Products – 1.3% | | | | | | | | |

Lamb Weston Holdings, Inc.

4.625% 11/1/24 (a) | | | 100,000 | | | | 100,500 | |

See accompanying notes which are an integral part of the financial statements.

Schedule of Investments (Unaudited) – continued

| | | | | | | | |

| Nonconvertible Bonds – continued | |

| | |

| | | Principal

Amount | | | Value | |

CONSUMER STAPLES – continued | | | | | | | | |

Food Products – continued | | | | | | | | |

Pilgrim’s Pride Corp.

5.75% 3/15/25 (a) | | $ | 161,000 | | | $ | 161,000 | |

| | | | | | | | |

| | | | | | | 261,500 | |

| | | | | | | | |

Household Products – 0.7% | | | | | | | | |

Energizer Holdings, Inc.

6.375% 7/15/26 (a) | | | 130,000 | | | | 131,300 | |

| | | | | | | | |

Personal Products – 1.4% | | | | | | | | |

HLF Financing Sarl LLC / Herbalife International, Inc.

7.25% 8/15/26 (a) | | | 285,000 | | | | 290,714 | |

| | | | | | | | |

Tobacco – 1.0% | | | | | | | | |

Vector Group Ltd.

6.125% 2/1/25 (a) | | | 226,000 | | | | 200,010 | |

| | | | | | | | |

| |

TOTAL CONSUMER STAPLES | | | | 883,524 | |

| | | | | | | | |

|

ENERGY – 14.6% | |

Energy Equipment & Services – 2.6% | |

Calfrac Holdings LP

8.50% 6/15/26 (a) | | | 125,000 | | | | 92,500 | |

Diamond Offshore Drilling, Inc.

7.875% 8/15/25 | | | 112,000 | | | | 105,840 | |

Ensco PLC

7.75% 2/1/26 | | | 60,000 | | | | 50,400 | |

KLX Energy Services Holdings, Inc.

11.50% 11/1/25 (a) | | | 15,000 | | | | 15,600 | |

McDermott Technology Americas, Inc. / McDermott Technology US, Inc.

10.625% 5/1/24 (a) | | | 18,000 | | | | 14,940 | |

Nine Energy Service, Inc.

8.75% 11/1/23 (a) | | | 195,000 | | | | 195,000 | |

Noble Holding International Ltd.

7.75% 1/15/24 | | | 60,000 | | | | 53,400 | |

| | | | | | | | |

| | | | | | | 527,680 | |

| | | | | | | | |

Independent Power and Renewable Electricity Producers – 2.1% | |

Clearway Energy Operating LLC

5.75% 10/15/25 (a) | | | 15,000 | | | | 14,738 | |

NRG Energy, Inc.: | | | | | | | | |

6.625% 1/15/27 | | | 53,000 | | | | 56,445 | |

7.25% 5/15/26 | | | 319,000 | | | | 345,716 | |

| | | | | | | | |

| | | | | | | 416,899 | |

| | | | | | | | |

Oil, Gas & Consumable Fuels – 7.3% | | | | | |

Ascent Resources Utica Holdings LLC / ARU Finance Corp.

7.00% 11/1/26 (a) | | | 119,000 | | | | 114,835 | |

DCP Midstream LP

7.375% (c)(d) | | | 112,000 | | | | 107,750 | |

Diamondback Energy, Inc.

5.375% 5/31/25 | | | 160,000 | | | | 165,600 | |

| | | | | | | | |

| | |

| | |

| | | Principal

Amount | | | Value | |

Genesis Energy LP / Genesis Energy Finance Corp.

6.50% 10/1/25 | | $ | 50,000 | | | $ | 47,875 | |

Holly Energy Partners LP / Holly Energy Finance Corp.

6.00% 8/1/24 (a) | | | 192,000 | | | | 196,800 | |

Matador Resources Co.

5.875% 9/15/26 | | | 110,000 | | | | 109,450 | |

Murphy Oil Corp.

6.875% 8/15/24 | | | 116,000 | | | | 122,718 | |

Parkland Fuel Corp.

6.00% 4/1/26 (a) | | | 202,000 | | | | 198,465 | |

Parsley Energy LLC / Parsley Finance Corp.

5.375% 1/15/25 (a) | | | 200,000 | | | | 200,500 | |

Peabody Energy Corp.

6.00% 3/31/22 (a) | | | 60,000 | | | | 60,525 | |

W&T Offshore, Inc.

9.75% 11/1/23 (a) | | | 149,000 | | | | 147,510 | |

| | | | | | | | |

| | | | | | | 1,472,028 | |

| | | | | | | | |

Pipeline – 2.6% | | | | | | | | |

Antero Midstream Partners LP / Antero Midstream Finance Corp.

5.375% 9/15/24 | | | 198,000 | | | | 198,000 | |

Cheniere Energy Partners LP: | | | | | | | | |

5.25% 10/1/25 | | | 126,000 | | | | 127,575 | |

5.625% 10/1/26 (a) | | | 75,000 | | | | 76,406 | |

PBF Logistics LP / PBF Logistics Finance Corp.

6.875% 5/15/23 | | | 100,000 | | | | 101,780 | |

Targa Resources Partners LP / Targa Resources Partners Finance Corp.

6.50% 7/15/27 (a) | | | 10,000 | | | | 10,575 | |

| | | | | | | | |

| | | | | | | 514,336 | |

| | | | | | | | |

| |

TOTAL ENERGY | | | | 2,930,943 | |

| | | | | | | | |

|

FINANCIALS – 7.4% | |

Capital Markets – 1.0% | |

LPL Holdings, Inc.

5.75% 9/15/25 (a) | | | 202,000 | | | | 204,273 | |

| | | | | | | | |

Consumer Finance – 3.2% | | | | | | | | |

Ally Financial, Inc.: | | | | | | | | |

4.25% 4/15/21 | | | 280,000 | | | | 283,150 | |

5.75% 11/20/25 | | | 112,000 | | | | 118,720 | |

CIT Group, Inc.

5.25% 3/7/25 | | | 30,000 | | | | 31,350 | |

Enova International, Inc.

8.50% 9/15/25 (a) | | | 50,000 | | | | 47,375 | |

See accompanying notes which are an integral part of the financial statements.

| | | | | | | | |

| Nonconvertible Bonds – continued | |

| | |

| | | Principal

Amount | | | Value | |

FINANCIALS – continued | |

Consumer Finance – continued | |

Springleaf Finance Corp.

6.125% 3/15/24 | | $ | 150,000 | | | $ | 151,687 | |

| | | | | | | | |

| | | | | | | 632,282 | |

| | | | | | | | |

Diversified Financial Services – 1.2% | | | | | |

Icahn Enterprises LP / Icahn Enterprises Finance Corp.

6.25% 2/1/22 | | | 238,000 | | | | 245,092 | |

| | | | | | | | |

Mortgage Real Estate Investment Trust (REITs) – 2.0% | |

Starwood Property Trust, Inc.

3.625% 2/1/21 | | | 400,000 | | | | 397,500 | |

| | | | | | | | |

| |

TOTAL FINANCIALS | | | | 1,479,147 | |

| | | | | | | | |

|

HEALTH CARE – 8.8% | |

Health Care Equipment & Supplies – 1.0% | | | | | |

Mallinckrodt International Finance S.A. / Mallinckrodt CB LLC

5.50% 4/15/25 (a) | | | 100,000 | | | | 81,500 | |

Teleflex, Inc.

4.625% 11/15/27 | | | 112,000 | | | | 111,411 | |

| | | | | | | | |

| | | | | | | 192,911 | |

| | | | | | | | |

Health Care Providers & Services – 5.4% | | | | | |

Centene Corp.

4.75% 5/15/22 | | | 62,000 | | | | 63,162 | |

DaVita, Inc.: | | | | | | | | |

5.00% 5/1/25 | | | 52,000 | | | | 50,164 | |

5.125% 7/15/24 | | | 199,000 | | | | 197,010 | |

HCA, Inc.: | | | | | | | | |

5.375% 9/1/26 | | | 365,000 | | | | 373,833 | |

5.625% 9/1/28 | | | 20,000 | | | | 20,622 | |

MEDNAX, Inc.: | | | | | | | | |

5.25% 12/1/23 (a) | | | 168,000 | | | | 169,890 | |

6.25% 1/15/27 (a) | | | 200,000 | | | | 201,110 | |

WellCare Health Plans, Inc.

5.375% 8/15/26 (a) | | | 10,000 | | | | 10,288 | |

| | | | | | | | |

| | | | | | | 1,086,079 | |

| | | | | | | | |

Life Sciences Tools & Services – 1.5% | | | | | |

Change Healthcare Holdings LLC / Change Healthcare Finance, Inc.

5.75% 3/1/25 (a) | | | 250,000 | | | | 243,988 | |

IQVIA, Inc.

4.875% 5/15/23 (a) | | | 62,000 | | | | 62,930 | |

| | | | | | | | |

| | | | | | | 306,918 | |

| | | | | | | | |

Pharmaceuticals – 0.9% | | | | | | | | |

Bausch Health Americas, Inc.

8.50% 1/31/27 (a)(b) | | | 15,000 | | | | 15,534 | |

Bausch Health Cos., Inc.: | | | | | | | | |

5.75% 8/15/27 (a)(b) | | | 5,000 | | | | 5,044 | |

5.875% 5/15/23 (a) | | | 46,000 | | | | 45,770 | |

| | | | | | | | |

| | |

| | |

| | | Principal

Amount | | | Value | |

Charles River Laboratories International, Inc.

5.50% 4/1/26 (a) | | $ | 112,000 | | | $ | 116,480 | |

| | | | | | | | |

| | | | | | | 182,828 | |

| | | | | | | | |

| |

TOTAL HEALTH CARE | | | | 1,768,736 | |

| | | | | | | | |

|

INDUSTRIALS – 13.2% | |

Aerospace & Defense – 1.5% | | | | | | | | |

TransDigm, Inc.

6.25% 3/15/26 (a) | | | 300,000 | | | | 307,500 | |

| | | | | | | | |

Air Freight & Logistics – 0.3% | | | | | | | | |

XPO Logistics, Inc.

6.125% 9/1/23 (a) | | | 60,000 | | | | 59,850 | |

| | | | | | | | |

Building Products – 0.3% | | | | | | | | |

Griffon Corp.

5.25% 3/1/22 | | | 63,000 | | | | 62,213 | |

| | | | | | | | |

Commercial Services & Supplies – 4.5% | | | | | |

HD Supply, Inc.

5.375% 10/15/26 (a) | | | 20,000 | | | | 20,300 | |

KAR Auction Services, Inc.

5.125% 6/1/25 (a) | | | 213,000 | | | | 207,143 | |

Nielsen Finance LLC / Nielsen Finance Co.

5.00% 4/15/22 (a) | | | 251,000 | | | | 250,372 | |

Refinitiv US Holdings, Inc.

6.25% 5/15/26 (a) | | | 25,000 | | | | 25,250 | |

Ritchie Bros Auctioneers, Inc.

5.375% 1/15/25 (a) | | | 112,000 | | | | 113,960 | |

Tervita Escrow Corp.

7.625% 12/1/21 (a) | | | 200,000 | | | | 199,500 | |

United Rentals North America, Inc.

6.50% 12/15/26 | | | 80,000 | | | | 83,500 | |

| | | | | | | | |

| | | | | | | 900,025 | |

| | | | | | | | |

Construction & Engineering – 0.5% | | | | | | | | |

AECOM

5.125% 3/15/27 | | | 100,000 | | | | 94,875 | |

| | | | | | | | |

Containers & Packaging – 3.2% | | | | | | | | |

Ardagh Packaging Finance PLC / Ardagh Holdings USA, Inc.

6.00% 2/15/25 (a) | | | 200,000 | | | | 197,500 | |

Ball Corp.: | | | | | | | | |

4.875% 3/15/26 | | | 309,000 | | | | 314,407 | |

5.25% 7/1/25 | | | 73,000 | | | | 76,650 | |

Intertape Polymer Group, Inc.

7.00% 10/15/26 (a) | | | 60,000 | | | | 60,450 | |

| | | | | | | | |

| | | | | | | 649,007 | |

| | | | | | | | |

Diversified Financial Services – 0.0% | | | | | |

Park Aerospace Holdings Ltd.

5.50% 2/15/24 (a) | | | 5,000 | | | | 5,169 | |

| | | | | | | | |

See accompanying notes which are an integral part of the financial statements.

Schedule of Investments (Unaudited) – continued

| | | | | | | | |

| Nonconvertible Bonds – continued | |

| | |

| | | Principal

Amount | | | Value | |

INDUSTRIALS – continued | | | | | | | | |

Machinery – 2.9% | | | | | | | | |

Allison Transmission, Inc.

5.00% 10/1/24 (a) | | $ | 395,000 | | | $ | 397,469 | |

Colfax Corp.

6.00% 2/15/24 (a) | | | 50,000 | | | | 51,750 | |

EnPro Industries, Inc.

5.75% 10/15/26 (a) | | | 120,000 | | | | 120,900 | |

| | | | | | | | |

| | | | | | | 570,119 | |

| | | | | | | | |

| |

TOTAL INDUSTRIALS | | | | 2,648,758 | |

| | | | | | | | |

|

INFORMATION TECHNOLOGY – 12.1% | |

Communications Equipment – 0.4% | | | | | |

ViaSat, Inc.

5.625% 9/15/25 (a) | | | 84,000 | | | | 81,900 | |

| | | | | | | | |

Internet Software & Services – 3.7% | | | | | |

j2 Cloud Services LLC / j2 GlobalCo-Obligor, Inc.

6.00% 7/15/25 (a) | | | 146,000 | | | | 149,903 | |

Star Merger Sub, Inc.

6.875% 8/15/26 (a) | | | 200,000 | | | | 200,692 | |

VeriSign, Inc.: | | | | | | | | |

4.75% 7/15/27 | | | 123,000 | | | | 121,463 | |

5.25% 4/1/25 | | | 262,000 | | | | 271,256 | |

| | | | | | | | |

| | | | | | | 743,314 | |

| | | | | | | | |

IT Services – 2.0% | | | | | | | | |

Gartner, Inc.

5.125% 4/1/25 (a) | | | 400,000 | | | | 403,000 | |

| | | | | | | | |

Office Electronics – 1.3% | | | | | | | | |

CDW LLC / CDW Finance Corp.: | | | | | | | | |

5.00% 9/1/25 | | | 100,000 | | | | 101,125 | |

5.50% 12/1/24 | | | 160,000 | | | | 166,800 | |

| | | | | | | | |

| | | | | | | 267,925 | |

| | | | | | | | |

Semiconductors & Semiconductor Equipment – 2.0% | |

Qorvo, Inc.

5.50% 7/15/26 (a) | | | 390,000 | | | | 397,800 | |

| | | | | | | | |

Software – 2.7% | | | | | | | | |

CDK Global, Inc.

4.875% 6/1/27 | | | 135,000 | | | | 132,666 | |

Open Text Corp.: | | | | | | | | |

5.625% 1/15/23 (a) | | | 180,000 | | | | 184,725 | |

5.875% 6/1/26 (a) | | | 208,000 | | | | 218,832 | |

| | | | | | | | |

| | | | | | | 536,223 | |

| | | | | | | | |

| |

TOTAL INFORMATION TECHNOLOGY | | | | 2,430,162 | |

| | | | | | | | |

|

MATERIALS – 6.5% | |

Chemicals – 2.7% | |

Axalta Coating Systems LLC

4.875% 8/15/24 (a) | | | 400,000 | | | | 397,000 | |

| | | | | | | | |

| | |

| | |

| | | Principal

Amount | | | Value | |

CVR Partners LP / CVR Nitrogen Finance Corp.

9.25% 6/15/23 (a) | | $ | 145,000 | | | $ | 152,961 | |

| | | | | | | | |

| | | | | | | 549,961 | |

| | | | | | | | |

Metals & Mining – 3.3% | | | | | | | | |

ArcelorMittal

6.125% 6/1/25 | | | 92,000 | | | | 100,553 | |

FMG Resources August 2006 Pty Ltd.: | | | | | | | | |

4.75% 5/15/22 (a) | | | 168,000 | | | | 168,000 | |

5.125% 3/15/23 (a) | | | 234,000 | | | | 233,415 | |

Rain CII Carbon LLC / CII Carbon Corp.

7.25% 4/1/25 (a) | | | 110,000 | | | | 95,150 | |

Steel Dynamics, Inc.

5.50% 10/1/24 | | | 60,000 | | | | 61,650 | |

| | | | | | | | |

| | | | | | | 658,768 | |

| | | | | | | | |

Paper & Forest Products – 0.5% | | | | | | | | |

Mercer International, Inc.

7.375% 1/15/25 (a) | | | 50,000 | | | | 52,250 | |

Schweitzer-Mauduit International, Inc.

6.875% 10/1/26 (a) | | | 50,000 | | | | 49,125 | |

| | | | | | | | |

| | | | | | | 101,375 | |

| | | | | | | | |

| |

TOTAL MATERIALS | | | | 1,310,104 | |

| | | | | | | | |

|

REAL ESTATE – 6.2% | |

Equity Real Estate Investment Trusts (REITs) – 4.0% | |

Equinix, Inc.: | | | | | | | | |

5.75% 1/1/25 | | | 59,000 | | | | 61,434 | |

5.875% 1/15/26 | | | 329,000 | | | | 344,627 | |

Iron Mountain, Inc.: | | | | | | | | |

4.875% 9/15/27 (a) | | | 79,000 | | | | 74,754 | |

5.25% 3/15/28 (a) | | | 185,000 | | | | 177,138 | |

SBA Communications Corp.

4.875% 7/15/22 to 9/1/24 | | | 130,000 | | | | 131,241 | |

| | | | | | | | |

| | | | | | | 789,194 | |

| | | | | | | | |

Real Estate Management & Development – 2.2% | |

Kennedy-Wilson, Inc.

5.875% 4/1/24 | | | 401,000 | | | | 394,468 | |

Newmark Group, Inc.

6.125% 11/15/23 (a) | | | 50,000 | | | | 50,248 | |

| | | | | | | | |

| | | | | | | 444,716 | |

| | | | | | | | |

| |

TOTAL REAL ESTATE | | | | 1,233,910 | |

| | | | | | | | |

| |

TOTAL NONCONVERTIBLE BONDS

(Cost $19,209,530) | | | | 19,417,978 | |

| | | | | | | | |

See accompanying notes which are an integral part of the financial statements.

| | | | | | | | |

| Money Market Funds – 3.4% | |

| | |

| | | Shares | | | Value | |

Fidelity Cash Central Fund, 2.44% (e)

(Cost $681,102) | | | 680,966 | | | $ | 681,102 | |

| | | | | | | | |

| |

TOTAL INVESTMENT IN SECURITIES – 100.2%

(Cost $19,890,632) | | | | 20,099,080 | |

| |

NET OTHER ASSETS (LIABILITIES) – (0.2%) | | | | (31,321 | ) |

| | | | | | | | |

| |

NET ASSETS – 100.0% | | | $ | 20,067,759 | |

| | | | | | | | |

Legend

| (a) | | Security is exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $10,814,301 or 53.9% of net assets. |

| (b) | | Security or a portion of the security purchased on a delayed delivery or when-issued basis. |

| (c) | | Security is perpetual in nature with no stated maturity date. |

| (d) | | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (e) | | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualizedseven-day yield of the fund at period end. A complete unaudited listing of the fund’s holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund’s financial statements are available on the SEC’s website or upon request. |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| | | | |

| Fund | | Income earned | |

| |

| Fidelity Cash Central Fund | | $ | 7,392 | |

| | | | |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations if applicable.

Investment Valuation

The following is a summary of the inputs used, as of February 28, 2019, involving the Fund’s assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Valuation Inputs at Reporting Date: | |

| Description | | Total | | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities: | | | | | | | | | | | | | | | | |

| | | | |

Corporate Bonds | | $ | 19,417,978 | | | $ | — | | | $ | 19,417,978 | | | $ | — | |

| | | | |

Money Market Funds | | | 681,102 | | | | 681,102 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities: | | $ | 20,099,080 | | | $ | 681,102 | | | $ | 19,417,978 | | | $ | — | |

| | | | | | | | | | | | | | | | |

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| | | | |

| |

United States | | | 87.7 | |

| |

Canada | | | 7.1 | |

| |

Australia | | | 2.0 | |

| |

Ireland | | | 1.0 | |

| |

Others (Individually Less Than 1%) | | | 2.4 | |

| | | | |

| | | 100.2 | % |

| | | | |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

| | | | |

| Statement of Assets and Liabilities | |

| |

| February 28, 2019 (Unaudited) | | | |

| |

Assets | | | | |

| |

Investments in securities, at value – See accompanying schedule: | | | | |

Unaffiliated issuers | | $ | 19,417,978 | |

Fidelity Central Funds | | | 681,102 | |

| | | | |

| |

Total Investments in Securities | | $ | 20,099,080 | |

| |

Distributions receivable from Fidelity Central Funds | | | 1,837 | |

| |

Interest receivable | | | 320,692 | |

| | | | |

| |

Total assets | | | 20,421,609 | |

| | | | |

| |

Liabilities | | | | |

| |

Payable for investments purchased | | | | |

Regular delivery | | | 204,528 | |

Delayed delivery | | | 50,622 | |

| |

Distributions payable | | | 91,200 | |

| |

Accrued management fees | | | 7,500 | |

| | | | |

| |

Total liabilities | | | 353,850 | |

| | | | |

| |

Net Assets | | $ | 20,067,759 | |

| | | | |

| |

Net Assets consist of: | | | | |

| |

Paid in capital | | | 19,979,725 | |

| |

Total distributable earnings (loss) | | | 88,034 | |

| | | | |

| |

Net Assets | | $ | 20,067,759 | |

| | | | |

| |

Shares outstanding | | | 400,000 | |

| | | | |

| |

Net Asset Value, offering price and redemption price per share | | $ | 50.17 | |

| | | | |

| |

Investments at cost – Unaffiliated issuers | | $ | 19,209,530 | |

| |

Investments at cost – Fidelity Central Funds | | | 681,102 | |

| | | | |

| |

Investments at cost | | $ | 19,890,632 | |

| | | | |

See accompanying notes which are an integral part of the financial statements.

| | | | |

| Statement of Operations | | | |

| |

| For the six months ended February 28, 2019 (Unaudited) | | | |

| |

Investment Income | | | | |

| |

Interest | | $ | 425,831 | |

| |

Income from Fidelity Central Funds | | | 7,392 | |

| | | | |

| |

Total income | | | 433,223 | |

| | | | |

| |

Expenses | | | | |

| |

Management fees | | | 33,242 | |

| |

Independent trustees’ compensation | | | 36 | |

| | | | |

| |

Total expenses before reductions | | | 33,278 | |

| |

Expense reductions | | | (260 | ) |

| | | | |

| |

Total expenses | | | 33,018 | |

| | | | |

| |

Net investment income (loss) | | | 400,205 | |

| | | | |

| |

Realized and Unrealized Gain (Loss) | | | | |

| |

Net realized gain (loss) on investment securities | | | (124,921 | ) |

| | | | |

| |

Total net realized gain (loss) | | | (124,921 | ) |

| | | | |

| |

Change in net unrealized appreciation (depreciation) on investment securities | | | 206,564 | |

| | | | |

| |

Net gain (loss) | | | 81,643 | |

| | | | |

| |

Net increase (decrease) in net assets resulting from operations | | $ | 481,848 | |

| | | | |

See accompanying notes which are an integral part of the financial statements.

Financial Statements – continued

| | | | | | | | |

| Statements of Changes in Net Assets | |

| | |

| | | Six months ended

February 28, 2019

(Unaudited) | | | Year ended

August 31, 2018A | |

| | |

Increase (Decrease) in Net Assets | | | | | | | | |

| | |

Operations | | | | | | | | |

Net investment income (loss) | | $ | 400,205 | | | $ | 144,598 | |

Net realized gain (loss) | | | (124,921 | ) | | | 4,254 | |

Change in net unrealized appreciation (depreciation) | | | 206,564 | | | | 1,884 | |

| | | | | | | | |

| | |

Net increase (decrease) in net assets resulting from operations | | | 481,848 | | | | 150,736 | |

| | | | | | | | |

| | |

Distributions to shareholders | | | (400,300 | ) | | | — | |

| | |

Distributions to shareholders from net investment income | | | — | | | | (144,250 | ) |

| | | | | | | | |

| | |

Total distributions | | | (400,300 | ) | | | (144,250 | ) |

| | | | | | | | |

| | |

Share transactions | | | | | | | | |

Proceeds from sales of shares | | | 7,433,045 | | | | 12,546,680 | |

| | | | | | | | |

| | |

Net increase (decrease) in net assets resulting from share transactions | | | 7,433,045 | | | | 12,546,680 | |

| | | | | | | | |

| | |

Total increase (decrease) in net assets | | | 7,514,593 | | | | 12,553,166 | |

| | |

Net Assets | | | | | | | | |

Beginning of period | | | 12,553,166 | | | | — | |

| | | | | | | | |

End of period | | $ | 20,067,759 | | | $ | 12,553,166 | |

| | | | | | | | |

| | |

Undistributed net investment income end of period | | | | | | $ | 348 | |

| | | | | | | | |

| | |

Other Information | | | | | | | | |

| | |

Shares | | | | | | | | |

Sold | | | 150,000 | | | | 250,000 | |

Redeemed | | | — | | | | — | |

| | | | | | | | |

| | |

Net increase (decrease) | | | 150,000 | | | | 250,000 | |

| | | | | | | | |

| A | | For the period June 12, 2018 (commencement of operations) to August 31, 2018. |

See accompanying notes which are an integral part of the financial statements.

| | | | | | | | |

| Financial Highlights | | | | | | |

| | |

| | | Six months ended

February 28, 2019

(Unaudited) | | | Year ended

August 31, 2018A | |

| | |

SelectedPer-Share Data | | | | | | | | |

| | |

Net asset value, beginning of period | | $ | 50.21 | | | $ | 50.00 | |

| | | | | | | | |

| | |

Income from Investment Operations | | | | | | | | |

Net investment income (loss)B | | | 1.348 | | | | 0.578 | |

Net realized and unrealized gain (loss) | | | (0.108 | )C | | | 0.209 | |

| | | | | | | | |

Total from investment operations | | | 1.240 | | | | 0.787 | |

| | | | | | | | |

| | |

Distributions from net investment income | | | (1.280 | ) | | | (0.577 | ) |

| | | | | | | | |

Total distributions | | | (1.280 | ) | | | (0.577 | ) |

| | | | | | | | |

| | |

Net asset value, end of period | | $ | 50.17 | | | $ | 50.21 | |

| | | | | | | | |

| | |

Total ReturnD,E | | | 2.55 | % | | | 1.59 | % |

| | |

Ratios to Average Net AssetsF,G,H | | | | | | | | |

Expense before reductions | | | .46 | % | | | .45 | % |

Expenses net of fee waivers, if any | | | .45 | % | | | .45 | % |

Expenses net of all reductions | | | .45 | % | | | .45 | % |

Net investment income (loss) | | | 5.49 | % | | | 5.21 | % |

| | |

Supplemental Data | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 20,068 | | | $ | 12,553 | |

Portfolio turnover rateI,J | | | 33 | % | | | 8 | % |

| A | | For the period June 12, 2018 (commencement of operations) to August 31, 2018. |

| B | | Calculated based on average shares outstanding during the period. |

| C | | The amount shown for a share outstanding does not correspond with the aggregate net gain (loss) on investments for the period due to the timing of share transactions in relation to fluctuating market values of the investments of a Fund. |

| D | | Total returns for periods of less than one year are not annualized. |

| E | | Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown. |

| G | | Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to the reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund but do not include expenses of the investment companies in which the fund invests. |

| H | | Fees and expenses of any underlying Fidelity Central Funds are not included in the Funds’ expense ratio. The Fund indirectly bears its proportionate share of expenses of any underlying Fidelity Central Funds. |

| I | | Amount does not include the portfolio activity of any underlying funds. |

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended February 28, 2019 (Unaudited)

1. Organization.

Fidelity High Yield Factor ETF (the Fund) is an exchange-traded fund of Fidelity Covington Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as anopen-end management investment company organized as a Massachusetts business trust.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which areopen-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund’s Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund’s investments to the Fair Value Committee (the Committee) established by the Fund’s investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund’s valuation policies and procedures and reports to the Board on the Committee’s activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund’s investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 – quoted prices in active markets for identical investments

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 – unobservable inputs (including the Fund’s own assumptions based on the best information available)

Valuation techniques used to value the Fund’s investments by major category are as follows:

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Corporate bonds are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. For foreign debt securities, when significant market or security specific events arise, valuations may be determined in good faith in accordance with procedures adopted by the Board. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances. The Fund invests a significant portion of its assets in below investment grade securities. The value of these securities can be more volatile due to changes in the credit quality of the issuer and is sensitive to changes in economic, market and regulatory conditions.

Investments inopen-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

3. Significant Accounting Policies – continued

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of February 28, 2019, is included at the end of the Fund’s Schedule of Investments.

Investment Transactions and Income. For financial reporting purposes, the Fund’s investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of NYSE Arca, normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded onex-dividend date. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Debt obligations may be placed onnon-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. A debt obligation is removed fromnon-accrual status when the issuer resumes interest payments or when collectability of interest is reasonably assured.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund’s federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Distributions are declared and recorded on theex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanentbook-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporarybook-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| | | | | | | | | | | | | | | | |

| | | Tax cost | | | Gross unrealized

appreciation | | | Gross unrealized

depreciation | | | Net unrealized

appreciation

(depreciation) on

securities and

other investments | |

Fidelity High Yield Factor ETF | | $ | 19,899,081 | | | $ | 282,783 | | | $ | (82,784 | ) | | $ | 199,999 | |

Delayed Delivery Transactions and When-Issued Securities. During the period, the Fund transacted in securities on a delayed delivery or when-issued basis. Payment and delivery may take place after the customary settlement period for that security. The price of the underlying securities and the date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. The securities purchased on a delayed delivery or when-issued basis are identified as such in the Fund’s Schedule of Investments. The Fund may receive compensation for interest forgone in the purchase of a delayed delivery or when-issued security. With respect to purchase commitments, the Fund identifies securities as segregated in its records with a value at least equal to the amount of the commitment. Losses may arise due to changes in the value of the underlying securities or if the counterparty does not perform under the contract’s terms, or if the issuer does not issue the securities due to political, economic or other factors.

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund’s Schedule of Investments.

New Rule Issuance. During August 2018, the U.S. Securities and Exchange Commission issued Final Rule ReleaseNo. 33-10532, Disclosure Update and Simplification. This Final Rule includes amendments specific to registered investment companies that are intended to eliminate overlap in disclosure requirements between RegulationS-X and GAAP. In accordance with these amendments, certain line-items in the Fund’s financial statements have been combined or removed for the current period as outlined in the table below.

Notes to Financial Statements – continued

3. Significant Accounting Policies – continued

| | | | |

| Financial Statement | | Current Line-Item Presentation | | Prior Line-Item Presentation |

| | |

| Statement of Assets and Liabilities | | Total distributable earnings (loss) | | Undistributed/Distributions in excess of/Accumulated net investment income (loss) |

| | |

| | | | Accumulated/Undistributed net realized gain (loss) |

| | |

| | | | Net unrealized appreciation (depreciation) |

| | |

| Statement of Changes in Net Assets | | N/A – removed | | Undistributed/Distributions in excess of/Accumulated net investment income (loss) end of period |

| | |

| Statement of Changes in Net Assets | | Distributions to shareholders | | Distributions to shareholders from net investment income |

| | |

| | | | Distributions to shareholders from net realized gain |

New Accounting Pronouncement. In March 2017, the Financial Accounting Standards Board (FASB) issued an Accounting Standards Update (ASU), ASU2017-08, which amends the amortization period for certain callable debt securities that are held at a premium. The amendment requires the premium to be amortized to the earliest call date. The amendments do not require an accounting change for securities held at a discount. The ASU is effective for annual periods beginning after December 15, 2018. Management is currently evaluating the potential impact of these changes to the financial statements.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and U.S. government securities, aggregated $11,988,501 and $4,786,135, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee. FMR Co., Inc. (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee that is based on an annual rate of .45% of average net assets. Under the management contract, the investment adviser pays all other expenses, except the compensation of the independent Trustees and certain miscellaneous expenses such as proxy and shareholders meeting expenses.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

6. Expense Reductions.

Through arrangements with the Fund’s custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund’s management fee. During the period, these credits reduced management fees by $260.

7. Share Transactions.

The Fund issues and redeems shares at NAV only with certain authorized participants in large increments known as Creation Units. Purchases of Creation Units are made by tendering a basket of designated securities and cash to the fund and redemption proceeds are paid with a basket of securities from the fund’s portfolio with a balancing cash component to equate the market value of the basket of securities delivered or redeemed to the NAV per Creation Unit on the transaction date. Cash may be substituted equivalent to the value of certain securities generally when they are not available in sufficient quantity for delivery. The fund’s shares are available in smaller increments to investors in the secondary market at market prices and may be subject to commissions. Authorized participants pay a transaction fee to the shareholder servicing agent when purchasing and redeeming Creation Units of the fund. The transaction fee is used to defray the costs associated with the issuance and redemption of Creation Units.

8. Other.

The Fund’s organizational documents provide former and current directors and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Shareholder Expense Example(Unaudited)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested for theone-half year period (September 1, 2018 to February 28, 2019).

Actual Expenses

For the fund, the first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for the Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear itspro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund’s annualized expense ratio used to calculate the expense estimates in the table below.

Hypothetical Example for Comparison Purposes

For the fund, the second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear itspro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund’s annualized expense ratio used to calculate the expense estimates in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | |

| | | Annualized

Expense RatioA | | | Beginning

Account Value

September 1, 2018 | | | Ending

Account Value

February 28, 2019 | | | Expenses Paid

During PeriodB

September 1, 2018

to February 28, 2019 | |

| | | | |

Fidelity High Yield Factor ETF | | | 0.45% | | | | | | | | | | | | | |

| | | | |

Actual | | | | | | $ | 1,000.00 | | | $ | 1,025.50 | | | $ | 2.26 | |

| | | | |

HypotheticalC | | | | | | $ | 1,000.00 | | | $ | 1,022.56 | | | $ | 2.26 | |

| A | Annualized expense ratio reflects expenses net of applicable fee waivers. |

| B | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect theone-half year period). |

| C | 5% return per year before expenses. |

[THIS PAGE INTENTIONALLY LEFT BLANK]

| | | | |

| | | |  |

HIE-SANN-0419 1.9887635.100 | | | | Corporate Headquarters 245 Summer St., Boston, MA 02210 www.fidelity.com |

Not applicable.

| Item 3. | Audit Committee Financial Expert |

Not applicable.

| Item 4. | Principal Accountant Fees and Services |

Not applicable.

| Item 5. | Audit Committee of Listed Registrants |

Not applicable.

| Item 7. | Disclosure of Proxy Voting Policies and Procedures forClosed-End Management Investment Companies |

Not applicable.

| Item 8. | Portfolio Managers ofClosed-End Management Investment Companies |

Not applicable.

| Item 9. | Purchase of Equity Securities byClosed-End Management Investment Company and Affiliated Purchasers |

Not applicable.

| Item 10. | Submission of Matters to a Vote of Security Holders |

There were no material changes to the procedures by which shareholders may recommend nominees to the Fidelity Covington Trust’s Board of Trustees.

| Item 11. | Controls and Procedures |

(a)(i) The President and Treasurer and the Chief Financial Officer have concluded that the Fidelity Covington Trust’s (the “Trust”) disclosure controls and procedures (as defined in Rule30a-3(c) under the Investment Company Act) provide reasonable assurances that material information relating to the Trust is made known to them by the appropriate persons, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(a)(ii) There was no change in the Trust’s internal control over financial reporting (as defined in Rule30a-3(d) under the Investment Company Act) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust’s internal control over financial reporting.

| Item 12. | Disclosure of Securities Lending Activities for Closed-End Management Investment Companies |

Not applicable.

| | | | |

| (a) | | (1) | | Not applicable. |

| | |

| (a) | | (2) | | Certification pursuant to Rule30a-2(a) under the Investment Company Act of 1940 (17 CFR270.30a-2(a)) is filed and attached hereto as Exhibit 99.CERT. |

| | |

| (a) | | (3) | | Not applicable. |

| | |

| (b) | | | | Certification pursuant to Rule30a-2(b) under the Investment Company Act of 1940 (17 CFR270.30a-2(b)) is furnished and attached hereto as Exhibit 99.906CERT. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Fidelity Covington Trust

| | |

| By: | | /s/ Stacie M. Smith |

| | Stacie M. Smith |

| | President and Treasurer |

| |

| Date: | | April 24, 2019 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | |

By: | | /s/ Stacie M. Smith |

| | Stacie M. Smith |

| | President and Treasurer |

| |

| Date: | | April 24, 2019 |

| |

| By: | | /s/ John J. Burke III |

| | John J. Burke III |

| | Chief Financial Officer |

| |

| Date: | | April 24, 2019 |