UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07319

Fidelity Covington Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant’s telephone number, including area code: 617-563-7000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2020

| Item 1. | Reports to Stockholders |

Fidelity® Emerging Markets Multifactor ETF

(formerly Fidelity® Targeted Emerging Markets Factor ETF)

Fidelity® International High Dividend ETF

Fidelity® International Multifactor ETF

(formerly Fidelity® Targeted International Factor ETF)

Fidelity® International Value Factor ETF

Annual Report

October 31, 2020

See the inside front cover for important information

about access to your fund’s shareholder reports.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account Type | Website | Phone Number |

| Brokerage, Mutual Fund, or Annuity Contracts: | fidelity.com/mailpreferences | 1-800-343-3548 |

| Employer Provided Retirement Accounts: | netbenefits.fidelity.com/preferences (choose ‘no’ under Required Disclosures to continue print) | 1-800-343-0860 |

To view a fund’s proxy voting guidelines and proxy voting record for the period ended June, 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission’s (SEC) web site at http://www.sec.gov. You may also call 1-800-FIDELITY to request a free copy of the proxy voting guidelines.

Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

© 2020 FMR LLC. All Rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund’s Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund’s portfolio holdings, view the most recent holdings listing on Fidelity’s web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, global governments and central banks took unprecedented action to help support consumers, businesses, and the broader economies, and to limit disruption to financial systems.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

The MSCI ACWI (All Country World Index) ex USA Index returned -2.46% for the 12 months ending October 31, 2020, in what was a bumpy ride for non-U.S. equities, marked by a steep but brief decline due to the early-2020 outbreak and spread of the coronavirus, followed by a sharp upturn. Declared a pandemic on March 11, the crisis and containment efforts caused broad contraction in economic activity, elevated volatility and dislocation in financial markets. A historically rapid and expansive monetary- and fiscal-policy response around the world provided a partial offset to the economic disruption. Other supporting factors included resilient corporate earnings and near-term potential for a COVID-19 vaccine breakthrough. This was evident in the index’s 12.28% gain in the final six months of the year. Currency fluctuation generally boosted foreign developed-markets equities for the year, while the reverse was true for emerging-markets stocks. Late in the period, the index was pressured by a second wave of COVID-19 cases in some regions, and stretched valuations and crowded positioning in big tech. For the full year, the U.K. (-22%), Asia Pacific ex Japan (-8%), Canada (-5%) and Europe ex U.K. (-4%) notably lagged. Emerging markets (+9%) and Japan (+1%) outperformed. By sector, energy (-38%), financials and real estate (-20% each) lagged, whereas information technology (+ 25%) and communication services (+15%) topped the index.

Fidelity® Emerging Markets Multifactor ETF

Performance (Unaudited)

The information provided in the tables below shows you the performance of Fidelity® Emerging Markets Multifactor ETF, with comparisons over different time periods to the fund’s relevant benchmarks, including an appropriate broad-based market index. Seeing the returns over different time periods can help you assess the fund’s performance against relevant measurements. The performance information includes average annual total returns and is further explained in this section.*

The fund’s net asset value (NAV) performance is based on the NAV calculated each business day. It is calculated in accordance with the standard formula for valuing investment company shares as of the close of regular trading hours on Cboe BZX Exchange, Inc. (CboeBZX) (normally 4:00 p.m. Eastern Time). The fund’s market price performance is based on the daily closing price of the shares of the fund on CboeBZX. Since ETFs are bought and sold at prices set by the market – which can result in a premium or discount to NAV – the returns calculated using market price (market return) can differ from those calculated using NAV (NAV return). For information on these differences, please visit Fidelity.com or see the prospectus. The fund’s returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or selling of fund shares. How a fund did yesterday is no guarantee of how it will do tomorrow.

Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit fidelity.com/etfs/factor-etfs/overview or call Fidelity. The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate; therefore, you may have a gain or loss when you sell your shares.

Fiscal Periods Ended October 31, 2020

| Average Annual Total Returns | Past

1 Year | Life of

fund |

| Fidelity Emerging Markets Multifactor ETF – NAVA | -4.03% | -2.04% |

| Fidelity Emerging Markets Multifactor ETF – Market PriceB | -3.40% | -1.41% |

| Fidelity Emerging Markets Multifactor IndexA | -3.54% | -1.23% |

| MSCI Emerging Markets IndexA | 8.27% | 4.80% |

Average annual total returns represent just that – the average return on an annual basis for Fidelity® Emerging Markets Multifactor ETF and the fund’s benchmarks, assuming consistent performance over the periods shown, based on the cumulative return and the length of the period. This information represents returns as of the end of the fund’s fiscal period.

A

From February 26, 2019.

| B | From February 28, 2019, date initially listed on the CboeBZX exchange. |

| * | Total returns are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

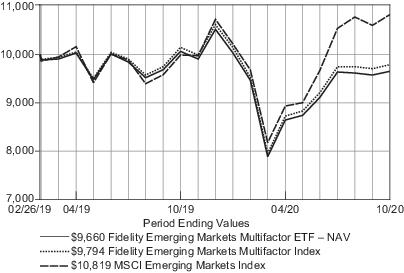

$10,000 Over Life of Fund

Let’s say hypothetically that $10,000 was invested in Fidelity Emerging Markets Multifactor ETF – NAV on February 26, 2019, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Fidelity Emerging Markets Multifactor Index and the MSCI Emerging Markets Index performed over the same period.

Fidelity® Emerging Markets Multifactor ETF

Management’s Discussion of Fund Performance

Comments from the Geode Capital Management, LLC, passive equity index team:

For the fiscal year ending October 31, 2020, the exchange-traded fund’s (ETF) net asset value returned -4.03%, and its market price generated a result of -3.40%. This compares with a return of -3.54% for the Fidelity Emerging Markets Multifactor Index, designed to reflect the performance of large and mid-capitalization emerging markets companies with attractive valuations, high quality profiles, positive momentum signals, lower volatility than the broader emerging markets equity market, and lower correlation to the U.S. equity market. Individually, the largest detractor was China Resources Pharmaceutical Group (-45%), a Hong Kong-based drug maker that in April reported earnings that trailed analysts’ expectations. Brazilian brewing company Ambev (-50%) struggled along with the country’s broader economy and also issued weak earnings guidance for the first quarter of 2020. Other notable detractors included Motus Holdings (-63%), a South African automotive-related holding company; airport operator Airports of Thailand (-35%); and Hong Kong-based utility Guangdong Investments (-29%). On the positive side, the biggest individual contributor was Alibaba Group (+38%), driven by favorable quarterly financial results announced in mid-August. Adding further value was Taiwan Semiconductor Manufacturing Co., whose shares rose 58%, aided by strong customer demand for chip manufacturing services, particularly among global technology companies. Indian pharmaceutical company Divi’s Laboratories (+72%) saw its stock rise sharply in August after the company reported strong quarterly profit growth. Of final note, South Korean semiconductor and electronics giant Samsung Electronics (+18%) benefited from strong customer demand as well as an expected recovery in memory pricing.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization, or Geode Capital Management, LLC, (the ETF’s subadviser) or any other person in the Geode organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity and Geode disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® Emerging Markets Multifactor ETF

Investment Summary (Unaudited)

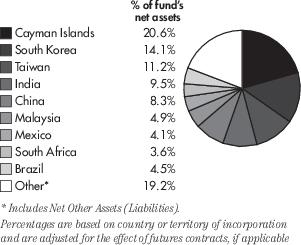

Geographic Diversification as of October 31, 2020

Top Ten Stocks as of October 31, 2020

| | % of fund's

net assets |

| Alibaba Group Holding Ltd. ADR | 5.8 |

| Tencent Holdings Ltd. | 4.8 |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 3.6 |

| Samsung Electronics Co. Ltd. | 3.5 |

| Divi's Laboratories Ltd. | 1.4 |

| Manila Electric Co. | 1.3 |

| Kumho Petrochemical Co. Ltd. | 1.3 |

| Pidilite Industries Ltd. | 1.2 |

| Petronas Gas Bhd | 1.1 |

| Lotte Chemical Corp. | 1.1 |

| | 25.1 |

Top Market Sectors as of October 31, 2020

| | % of fund's

net assets |

| Financials | 15.4 |

| Consumer Discretionary | 14.4 |

| Information Technology | 14.2 |

| Materials | 12.1 |

| Consumer Staples | 9.5 |

| Communication Services | 9.5 |

| Industrials | 9.1 |

| Health Care | 8.1 |

| Utilities | 6.3 |

| Energy | 1.2 |

Asset Allocation as of October 31, 2020

| | % of funds's

net assets |

| Stocks | 99.8% |

| Net Other Assets (Liabilities) | 0.2% |

Fidelity® International High Dividend ETF

Performance (Unaudited)

The information provided in the tables below shows you the performance of Fidelity® International High Dividend ETF, with comparisons over different time periods to the fund’s relevant benchmarks, including an appropriate broad-based market index. Seeing the returns over different time periods can help you assess the fund’s performance against relevant measurements. The performance information includes average annual total returns and is further explained in this section.*

The fund’s net asset value (NAV) performance is based on the NAV calculated each business day. It is calculated in accordance with the standard formula for valuing investment company shares as of the close of regular trading hours on NYSE Arca, Inc. (NYSE Arca) (normally 4:00 p.m. Eastern Time). The fund’s market price performance is based on the daily closing price of the shares of the fund on NYSE Arca. Since ETFs are bought and sold at prices set by the market – which can result in a premium or discount to NAV – the returns calculated using market price (market return) can differ from those calculated using NAV (NAV return). For information on these differences, please visit Fidelity.com or see the prospectus. The fund’s returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or selling of fund shares. How a fund did yesterday is no guarantee of how it will do tomorrow.

Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit fidelity.com/etfs/factor-etfs/overview or call Fidelity. The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate; therefore, you may have a gain or loss when you sell your shares.

Fiscal Periods Ended October 31, 2020

| Average Annual Total Returns | Past

1 Year | Life of

fund |

| Fidelity International High Dividend ETF – NAVA | -24.98% | -13.01% |

| Fidelity International High Dividend ETF – Market PriceB | -24.25% | -13.24% |

| Fidelity International High Dividend IndexA | -24.70% | -12.64% |

| MSCI World ex USA IndexA | -6.60% | -3.50% |

Average annual total returns represent just that – the average return on an annual basis for Fidelity® International High Dividend ETF and the fund’s benchmarks, assuming consistent performance over the periods shown, based on the cumulative return and the length of the period. This information represents returns as of the end of the fund’s fiscal period.

A

From January 16, 2018.

| B | From January 18, 2018, date initially listed on the NYSE ARCA exchange. |

| * | Total returns are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

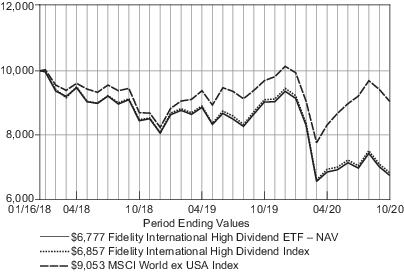

$10,000 Over Life of Fund

Let’s say hypothetically that $10,000 was invested in Fidelity International High Dividend ETF – NAV on January 16, 2018, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Fidelity International High Dividend Index and the MSCI World ex USA Index performed over the same period.

Fidelity® International High Dividend ETF

Management’s Discussion of Fund Performance

Comments from the Geode Capital Management, LLC, passive equity index team:

For the fiscal year ending October 31, 2020, the exchange-traded fund’s (ETF) net asset value returned -24.98%, and its market price generated a result of -24.25%. This compares with a return of -24.70% for the Fidelity International High Dividend Index, designed to reflect the performance of large and mid-capitalization developed international high dividend-paying stocks that are expected to continue to pay and grow their dividends. In a difficult market environment shaped by the COVID-19 pandemic, 10 of the 11 sectors in the Fidelity index fell in value over the 12 months, with energy (-46%) and real estate (-30%) faring the worst, while health care, generating a slightly-better-than-flat return, led the way. Within the energy sector, notable detractors included U.K.-based Royal Dutch Shell (-56%) and BP (-57%), as well as Spain’s Repsol (-59%) and France-based Total (-38%), as pandemic-driven oil-price weakness and sluggish demand weighed on these stocks. Within real estate, the largest detractor was French mall operator Klepierre (-57%); stocks of mall owners struggled as the pandemic led to less in-person shopping and more competition from online retailers. A cap on energy prices in the U.K., combined with a falling gas price, weighed on the shares of U.K. utility Centrica (-53%). The drop in the gas price also hampered Australian utility AGL Energy (-32%). On the positive side, U.K. energy company SSE (+4%) was a top contributor, producing a strong gain in June as the company issued favorable earnings. On several occasions, Canadian asset manager CI Financial (+33%) beat analysts’ consensus earnings estimates, contributing to results. Other notable contributors the past 12 months included Australian conglomerate Wesfarmers (+11%), as well as Danske Bank (+23%) and BNP Paribas (+11%), banks based in Denmark and France, respectively.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization, or Geode Capital Management, LLC, (the ETF’s subadviser) or any other person in the Geode organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity and Geode disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® International High Dividend ETF

Investment Summary (Unaudited)

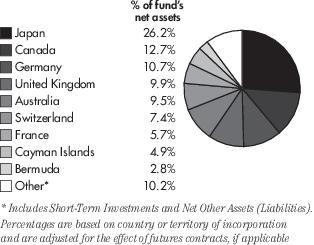

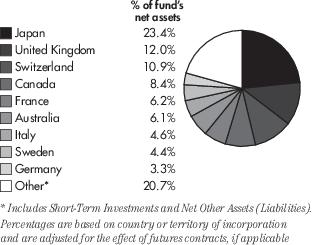

Geographic Diversification as of October 31, 2020

Top Ten Stocks as of October 31, 2020

| | % of fund's

net assets |

| Toyota Motor Corp. | 4.1 |

| E.ON SE | 3.9 |

| Daito Trust Construction Co. Ltd. | 3.7 |

| Daimler AG | 3.5 |

| SSE PLC | 3.5 |

| UBS Group AG | 2.9 |

| Bayerische Motoren Werke AG | 2.9 |

| Wharf Real Estate Investment Co. Ltd. | 2.7 |

| AGL Energy Ltd. | 2.7 |

| Honda Motor Co. Ltd. | 2.7 |

| | 32.6 |

Top Market Sectors as of October 31, 2020

| | % of fund's

net assets |

| Financials | 22.9 |

| Consumer Discretionary | 17.5 |

| Utilities | 12.7 |

| Real Estate | 12.6 |

| Energy | 12.3 |

| Health Care | 7.5 |

| Industrials | 7.3 |

| Consumer Staples | 5.7 |

| Materials | 0.5 |

| Information Technology | 0.4 |

Asset Allocation as of October 31, 2020

| | % of funds's

net assets |

| Stocks and Equity Futures | 100.0% |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.0% |

Percentages shown as 0.0% may reflect amounts less than 0.05%.

Fidelity® International Multifactor ETF

Performance (Unaudited)

The information provided in the tables below shows you the performance of Fidelity® International Multifactor ETF, with comparisons over different time periods to the fund’s relevant benchmarks, including an appropriate broad-based market index. Seeing the returns over different time periods can help you assess the fund’s performance against relevant measurements. The performance information includes average annual total returns and is further explained in this section.*

The fund’s net asset value (NAV) performance is based on the NAV calculated each business day. It is calculated in accordance with the standard formula for valuing investment company shares as of the close of regular trading hours on Cboe BZX Exchange, Inc. (CboeBZX) (normally 4:00 p.m. Eastern Time). The fund’s market price performance is based on the daily closing price of the shares of the fund on CboeBZX. Since ETFs are bought and sold at prices set by the market – which can result in a premium or discount to NAV – the returns calculated using market price (market return) can differ from those calculated using NAV (NAV return). For information on these differences, please visit Fidelity.com or see the prospectus. The fund’s returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or selling of fund shares. How a fund did yesterday is no guarantee of how it will do tomorrow.

Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit fidelity.com/etfs/factor-etfs/overview or call Fidelity. The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate; therefore, you may have a gain or loss when you sell your shares.

Fiscal Periods Ended October 31, 2020

| Average Annual Total Returns | Past

1 Year | Life of

fund |

| Fidelity International Multifactor ETF – NAVA | -5.73% | 0.36% |

| Fidelity International Multifactor ETF – Market PriceB | -5.34% | 0.79% |

| Fidelity International Multifactor IndexA | -5.37% | 0.91% |

| MSCI World ex USA IndexA | -6.60% | -3.50% |

Average annual total returns represent just that – the average return on an annual basis for Fidelity® International Multifactor ETF and the fund’s benchmarks, assuming consistent performance over the periods shown, based on the cumulative return and the length of the period. This information represents returns as of the end of the fund’s fiscal period.

A

From February 26, 2019.

| B | From February 28, 2019, date initially listed on the CboeBZX exchange. |

| * | Total returns are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

$10,000 Over Life of Fund

Let’s say hypothetically that $10,000 was invested in Fidelity International Multifactor ETF – NAV on February 26, 2019, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Fidelity International Multifactor Index and the MSCI World ex USA Index performed over the same period.

Fidelity® International Multifactor ETF

Management’s Discussion of Fund Performance

Comments from the Geode Capital Management, LLC, passive equity index team:

For the fiscal year ending October 31, 2020, the exchange-traded fund’s (ETF) net asset value returned -5.73%, and its market price generated a result of -5.34%. This compares with a return of -5.37% for the Fidelity International Multifactor Index, designed to reflect the performance of large and mid-capitalization developed international companies with attractive valuations, high quality profiles, positive momentum signals, lower volatility than the broader developed international equity market, and lower correlation to the U.S. equity market. Individually, several of the biggest detractors came from the real estate sector (-23%), which among benchmark segments trailed only energy (-41%). Around the world, owners of commercial real estate struggled as investors worried how the COVID-19 pandemic would affect building occupancies and rental-income growth. This led to significant challenges for various real estate-owning companies, including Japan Prime Realty Investment (-38%), an owner of offices and other commercial properties; Aedifica (-27%), a Belgium-based real estate company focused on health care properties, apartment buildings and hotels; Nippon Building Fund (-32%), a Japanese real estate investment trust (REIT); and Hong Kong-based Link Real Estate Investment Trust (-25%), which owns various property types in Hong Kong and mainland China. Elsewhere, U.K.-based contract foodservice company Compass Group (-42%) struggled as stay-at-home orders related to the spread of COVID-19 weighed on the firm’s financial results. Other notable detractors included utility companies Hera (-33%) and Electric Power Development (-32%), based in Italy and Japan, respectively. On the positive side, the biggest individual contributor was M3 (+148%), a Japanese medical-information provider that benefited from strong demand for health care services. Shares of Japanese wireless communications provider NTT Docomo (+39%) gained sharply in September after Nippon Telegraph and Telephone (NTT) agreed to purchase the roughly one-third of NTT Docomo it didn’t already own. Adding further value was Japanese conglomerate Sony (+24%), due largely to strength from the company’s video gaming business. Also contributing was Denmark-based jewelry manufacturer and retailer Pandora (+63%) and smokeless-tobacco company Swedish Match (+63%).

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization, or Geode Capital Management, LLC, (the ETF’s subadviser) or any other person in the Geode organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity and Geode disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® International Multifactor ETF

Investment Summary (Unaudited)

Geographic Diversification as of October 31, 2020

Top Ten Stocks as of October 31, 2020

| | % of fund's

net assets |

| Nestle S.A. | 2.6 |

| CLP Holdings Ltd. | 1.4 |

| PSP Swiss Property AG | 1.4 |

| Daito Trust Construction Co. Ltd. | 1.4 |

| Enel SpA | 1.3 |

| NTT DOCOMO, Inc. | 1.3 |

| Aedifica S.A. | 1.2 |

| Northland Power, Inc. | 1.1 |

| Roche Holding AG | 1.1 |

| Nippon Building Fund, Inc. | 1.1 |

| | 13.9 |

Top Market Sectors as of October 31, 2020

| | % of fund's

net assets |

| Consumer Staples | 16.0 |

| Financials | 12.5 |

| Materials | 12.5 |

| Industrials | 11.0 |

| Communication Services | 10.8 |

| Utilities | 8.6 |

| Health Care | 8.5 |

| Real Estate | 8.0 |

| Consumer Discretionary | 6.7 |

| Information Technology | 4.0 |

| Energy | 0.0 |

Percentages shown as 0.0% may reflect amounts less than 0.05%.

Asset Allocation as of October 31, 2020

| | % of funds's

net assets |

| Stocks and Equity Futures | 99.8% |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2% |

Fidelity® International Value Factor ETF

Performance (Unaudited)

The information provided in the tables below shows you the performance of Fidelity® International Value Factor ETF, with comparisons over different time periods to the fund’s relevant benchmarks, including an appropriate broad-based market index. Seeing the returns over different time periods can help you assess the fund’s performance against relevant measurements. The performance information includes average annual total returns and is further explained in this section.*

The fund’s net asset value (NAV) performance is based on the NAV calculated each business day. It is calculated in accordance with the standard formula for valuing investment company shares as of the close of regular trading hours on NYSE Arca, Inc. (NYSE Arca) (normally 4:00 p.m. Eastern Time). The fund’s market price performance is based on the daily closing price of the shares of the fund on NYSE Arca. Since ETFs are bought and sold at prices set by the market – which can result in a premium or discount to NAV – the returns calculated using market price (market return) can differ from those calculated using NAV (NAV return). For information on these differences, please visit Fidelity.com or see the prospectus. The fund’s returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or selling of fund shares. How a fund did yesterday is no guarantee of how it will do tomorrow.

Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit fidelity.com/etfs/factor-etfs/overview or call Fidelity. The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate; therefore, you may have a gain or loss when you sell your shares.

Fiscal Periods Ended October 31, 2020

| Average Annual Total Returns | Past

1 Year | Life of

fund |

| Fidelity International Value Factor ETF – NAVA | -16.32% | -8.49% |

| Fidelity International Value Factor ETF – Market PriceB | -15.69% | -8.81% |

| Fidelity International Value Factor IndexA | -15.82% | -8.03% |

| MSCI World ex USA IndexA | -6.60% | -3.50% |

Average annual total returns represent just that – the average return on an annual basis for Fidelity® International Value Factor ETF and the fund’s benchmarks, assuming consistent performance over the periods shown, based on the cumulative return and the length of the period. This information represents returns as of the end of the fund’s fiscal period.

A

From January 16, 2018.

| B | From January 18, 2018, date initially listed on the NYSE ARCA exchange. |

| * | Total returns are historical and include changes in share price and reinvestment of dividends and capital gains distributions, if any. |

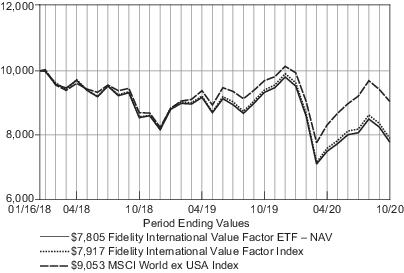

$10,000 Over Life of Fund

Let’s say hypothetically that $10,000 was invested in Fidelity International Value Factor ETF – NAV on January 16, 2018, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Fidelity International Value Factor Index and the MSCI World ex USA Index performed over the same period.

Fidelity® International Value Factor ETF

Management’s Discussion of Fund Performance

Comments from the Geode Capital Management, LLC, passive equity index team:

For the fiscal year ending October 31, 2020, the exchange-traded fund’s (ETF) net asset value returned -16.32%, and its market price generated a result of -15.69%. This compares with a return of -15.82% for the Fidelity International Value Factor IndexSM, designed to reflect the performance of large and mid-capitalization developed international stocks with attractive valuations. In a difficult market environment shaped by the COVID-19 pandemic, all of the 11 sectors in the Fidelity index fell in value the past 12 months, with energy (-45%), communication services (-26%) and financials (-23%) faring the worst. Within energy, notable detractors included U.K.-based Royal Dutch Shell (-56%) and France-based Total (-39%), as pandemic-driven oil-price weakness and sluggish demand weighed on these stocks. Within the financials sector, Spain-based Banco Santander was the biggest detractor, returning -47%. Airlines, including Air Canada (-66%), Spain’s International Consolidated Airlines Group (-69%) and Germany’s Lufthansa (-41%), encountered challenging business conditions as demand for air travel plunged with the spread of COVID-19. Similarly, demand for cruise travel dried up, weighing on the shares of U.K.-based cruise operator Carnival (-69%). In contrast, the leading contributor was Japanese conglomerate Sony, whose shares rose about 35% due largely to strength from the company’s video gaming business. Increased optimism about the prospect of recovery for Danish jewelry manufacturer Pandora (+37%) lifted the company’s stock. Other notable contributors included German residential property owner Vonovia (+24%) and French industrial company Schneider Electric (+36%), an operator of energy management systems that has benefited as demand has grown for its digital-automation and carbon-emissions-monitoring products.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization, or Geode Capital Management, LLC, (the ETF’s subadviser) or any other person in the Geode organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity and Geode disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity® International Value Factor ETF

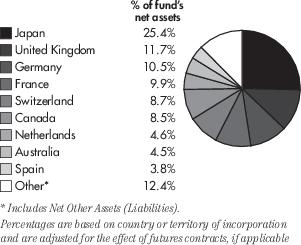

Investment Summary (Unaudited)

Geographic Diversification as of October 31, 2020

Top Ten Stocks as of October 31, 2020

| | % of fund's

net assets |

| Nestle S.A. | 2.7 |

| Roche Holding AG | 2.0 |

| Nutrien Ltd. | 1.8 |

| Novartis AG | 1.7 |

| Sony Corp. | 1.6 |

| Fiat Chrysler Automobiles N.V. | 1.4 |

| Shin-Etsu Chemical Co. Ltd. | 1.4 |

| Volvo AB Class B | 1.4 |

| UBS Group AG | 1.4 |

| AIA Group Ltd. | 1.3 |

| | 16.7 |

Top Market Sectors as of October 31, 2020

| | % of fund's

net assets |

| Financials | 17.4 |

| Industrials | 15.9 |

| Health Care | 12.7 |

| Consumer Staples | 11.1 |

| Consumer Discretionary | 11.0 |

| Materials | 8.5 |

| Information Technology | 7.7 |

| Communication Services | 4.7 |

| Utilities | 3.8 |

| Energy | 3.6 |

| Real Estate | 2.9 |

Asset Allocation as of October 31, 2020

| | % of funds's

net assets |

| Stocks and Equity Futures | 99.9% |

| Net Other Assets (Liabilities) | 0.1% |

Fidelity® Emerging Markets Multifactor ETF

Schedule of Investments October 31, 2020

Showing Percentage of Net Assets

| Common Stocks – 98.4% |

| | Shares | Value |

| BERMUDA – 1.0% |

| China Resources Gas Group Ltd. | 20,000 | $ 86,656 |

| Cosan Ltd. Class A | 403 | 5,533 |

| TOTAL BERMUDA | 92,189 |

| BRAZIL – 3.1% |

| Ambev S.A. | 34,700 | 73,300 |

| B3 S.A. - Brasil Bolsa Balcao | 4,800 | 42,497 |

| BB Seguridade Participacoes S.A. | 6,200 | 25,462 |

| Cosan S.A. | 500 | 5,636 |

| Lojas Renner S.A. | 5,970 | 38,775 |

| Vale S.A. | 9,500 | 99,762 |

| TOTAL BRAZIL | 285,432 |

| CAYMAN ISLANDS – 20.6% |

| Alibaba Group Holding Ltd. ADR (a) | 1,750 | 533,207 |

| ANTA Sports Products Ltd. | 5,000 | 54,998 |

| Arco Platform Ltd. Class A (a) | 26 | 886 |

| Autohome, Inc. ADR | 295 | 28,187 |

| Baozun, Inc. ADR (a) | 46 | 1,683 |

| China Medical System Holdings Ltd. | 74,000 | 77,484 |

| China Meidong Auto Holdings Ltd. | 12,000 | 48,976 |

| China Yuhua Education Corp. Ltd. (b) | 34,000 | 26,876 |

| Fu Shou Yuan International Group Ltd. | 32,000 | 32,929 |

| GSX Techedu, Inc. (a) | 23 | 1,528 |

| Hengan International Group Co. Ltd. | 10,000 | 69,311 |

| Huazhu Group Ltd. ADR | 122 | 4,835 |

| JD.com, Inc. ADR (a) | 975 | 79,482 |

| Kingboard Laminates Holdings Ltd. | 30,500 | 48,533 |

| Kingdee International Software Group Co. Ltd. (a) | 14,000 | 36,738 |

| NetEase, Inc. ADR | 615 | 53,376 |

| New Oriental Education & Technology Group, Inc. ADR (a) | 133 | 21,331 |

| NIO, Inc. ADR (a) | 910 | 27,828 |

| Parade Technologies Ltd. | 1,000 | 38,107 |

| Pinduoduo, Inc. ADR (a) | 405 | 36,442 |

| SINA Corp. (a) | 594 | 25,453 |

| TAL Education Group ADR (a) | 433 | 28,777 |

| Tencent Holdings Ltd. | 5,800 | 442,020 |

| Topsports International Holdings Ltd. (b) | 28,000 | 38,273 |

| Trip.com Group Ltd. ADR (a) | 477 | 13,719 |

| Vipshop Holdings Ltd. ADR (a) | 432 | 9,245 |

| Want Want China Holdings Ltd. | 112,000 | 73,946 |

| XD, Inc. (a) | 800 | 3,869 |

| Yadea Group Holdings Ltd. (b) | 34,000 | 48,491 |

| TOTAL CAYMAN ISLANDS | 1,906,530 |

| CHINA – 8.3% |

| Agricultural Bank of China Ltd. Class H | 97,000 | 32,772 |

|

| | Shares | Value |

|

| A-Living Services Co. Ltd. Class H (b) | 16,250 | $ 68,102 |

| Anhui Conch Cement Co. Ltd. Class H | 11,500 | 71,700 |

| Bank of China Ltd. Class H | 152,000 | 48,021 |

| China Construction Bank Corp. Class H | 139,000 | 95,895 |

| China Minsheng Banking Corp. Ltd. Class H | 37,000 | 20,230 |

| China Pacific Insurance Group Co. Ltd. Class H | 10,000 | 31,142 |

| China Shenhua Energy Co. Ltd. Class H | 7,500 | 12,960 |

| China Telecom Corp. Ltd. Class H | 26,000 | 8,181 |

| GF Securities Co. Ltd. Class H | 17,000 | 21,900 |

| Guotai Junan Securities Co. Ltd. Class H (b) | 12,600 | 16,378 |

| Industrial & Commercial Bank of China Ltd. Class H | 128,000 | 71,965 |

| Jiangsu Expressway Co. Ltd. Class H | 88,000 | 87,945 |

| Livzon Pharmaceutical Group, Inc. Class H | 18,700 | 82,470 |

| PICC Property & Casualty Co. Ltd. Class H | 30,000 | 20,271 |

| Postal Savings Bank of China Co. Ltd. Class H (b) | 44,000 | 21,561 |

| The People's Insurance Co. Group of China Ltd. Class H | 63,000 | 18,685 |

| TravelSky Technology Ltd. Class H | 18,000 | 37,788 |

| TOTAL CHINA | 767,966 |

| EGYPT – 0.3% |

| Commercial International Bank Egypt SAE | 7,121 | 27,690 |

| TOTAL EGYPT | 27,690 |

| GREECE – 0.2% |

| JUMBO S.A. | 1,617 | 22,603 |

| TOTAL GREECE | 22,603 |

| HONG KONG – 2.5% |

| China Everbright Ltd. | 12,000 | 15,815 |

| China Mobile Ltd. | 6,000 | 36,480 |

| China Resources Pharmaceutical Group Ltd. (b) | 157,500 | 78,599 |

| CNOOC Ltd. | 15,000 | 13,617 |

| Guangdong Investment Ltd. | 60,000 | 88,822 |

| TOTAL HONG KONG | 233,333 |

| HUNGARY – 1.0% |

| Richter Gedeon Nyrt | 4,437 | 90,507 |

| TOTAL HUNGARY | 90,507 |

| INDIA – 9.5% |

| Bajaj Auto Ltd. | 464 | 18,075 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks – continued |

| | Shares | Value |

| INDIA – continued |

| Coal India Ltd. | 6,476 | $ 9,980 |

| Divi's Laboratories Ltd. | 3,117 | 132,156 |

| Eicher Motors Ltd. | 620 | 17,449 |

| HCL Technologies Ltd. | 2,025 | 23,006 |

| HDFC Bank Ltd. (a) | 6,197 | 98,971 |

| HDFC Life Insurance Co. Ltd. (a)(b) | 2,920 | 23,237 |

| Hero MotoCorp Ltd. | 521 | 19,684 |

| Hindustan Unilever Ltd. | 3,306 | 92,403 |

| ICICI Lombard General Insurance Co. Ltd. (b) | 1,136 | 18,947 |

| ICICI Prudential Life Insurance Co. Ltd. (b) | 3,417 | 18,598 |

| Infosys Ltd. | 4,740 | 67,837 |

| Kotak Mahindra Bank Ltd. (a) | 2,320 | 48,443 |

| Nestle India Ltd. | 317 | 73,410 |

| Oil & Natural Gas Corp. Ltd. | 10,785 | 9,445 |

| Pidilite Industries Ltd. | 5,258 | 111,421 |

| Power Finance Corp. Ltd. | 17,636 | 20,728 |

| SBI Life Insurance Co. Ltd. (a)(b) | 2,002 | 20,778 |

| Tata Consultancy Services Ltd. | 1,387 | 49,875 |

| TOTAL INDIA | 874,443 |

| INDONESIA – 2.2% |

| Adaro Energy Tbk PT | 136,600 | 10,508 |

| Bank Central Asia Tbk PT | 23,300 | 46,122 |

| Bank Rakyat Indonesia Persero Tbk PT | 165,900 | 38,114 |

| Kalbe Farma Tbk PT | 970,300 | 101,177 |

| Telekomunikasi Indonesia Persero Tbk PT | 64,300 | 11,519 |

| TOTAL INDONESIA | 207,440 |

| JERSEY – 0.7% |

| Polymetal International PLC | 2,226 | 47,188 |

| WNS Holdings Ltd. ADR (a) | 300 | 17,292 |

| TOTAL JERSEY | 64,480 |

| MALAYSIA – 4.9% |

| DiGi.Com Bhd | 6,900 | 6,261 |

| Genting Bhd | 35,300 | 25,147 |

| Malayan Banking Bhd | 18,400 | 30,999 |

| Maxis Bhd | 5,200 | 6,007 |

| Nestle Malaysia Bhd | 2,000 | 67,100 |

| Petronas Chemicals Group Bhd | 37,800 | 53,220 |

| Petronas Dagangan Bhd | 2,200 | 9,128 |

| Petronas Gas Bhd | 27,400 | 103,797 |

| PPB Group Bhd | 15,200 | 68,775 |

| Telekom Malaysia Bhd | 4,600 | 4,639 |

| Westports Holdings Bhd | 82,600 | 77,531 |

| TOTAL MALAYSIA | 452,604 |

|

| | Shares | Value |

| MEXICO – 4.1% |

| America Movil S.A.B. de C.V. | 42,600 | $ 25,847 |

| Bolsa Mexicana de Valores S.A.B. de C.V. | 13,300 | 26,953 |

| Grupo Aeroportuario del Pacifico SAB de CV Class B | 11,800 | 97,900 |

| Grupo Aeroportuario del Sureste SAB de CV Class B (a) | 7,935 | 91,375 |

| Kimberly-Clark de Mexico SAB de CV Class A | 46,100 | 68,313 |

| Orbia Advance Corp. SAB de CV | 36,400 | 64,169 |

| TOTAL MEXICO | 374,557 |

| PHILIPPINES – 1.4% |

| Globe Telecom, Inc. | 110 | 4,614 |

| Manila Electric Co. | 19,370 | 120,062 |

| TOTAL PHILIPPINES | 124,676 |

| POLAND – 0.3% |

| Asseco Poland S.A. | 939 | 15,185 |

| Cyfrowy Polsat S.A. | 2,471 | 15,386 |

| TOTAL POLAND | 30,571 |

| QATAR – 0.5% |

| Qatar National Bank QPSC | 9,539 | 46,372 |

| TOTAL QATAR | 46,372 |

| RUSSIA – 3.0% |

| Gazprom PJSC | 4,790 | 9,341 |

| Inter RAO UES PJSC (a) | 1,457,000 | 93,189 |

| LUKOIL PJSC | 161 | 8,193 |

| MMC Norilsk Nickel PJSC | 261 | 61,934 |

| Mobile TeleSystems PJSC | 2,706 | 21,161 |

| Novatek PJSC | 437 | 5,250 |

| Sberbank of Russia PJSC | 20,720 | 52,403 |

| Surgutneftegas PJSC | 8,300 | 3,441 |

| Tatneft PJSC | 780 | 4,028 |

| VTB Bank PJSC | 47,810,000 | 19,695 |

| TOTAL RUSSIA | 278,635 |

| SAUDI ARABIA – 1.3% |

| Jarir Marketing Co. | 775 | 35,792 |

| Southern Province Cement Co. | 4,848 | 86,740 |

| TOTAL SAUDI ARABIA | 122,532 |

| SOUTH AFRICA – 3.6% |

| Anglo American Platinum Ltd. | 960 | 62,946 |

| AVI Ltd. | 16,067 | 72,727 |

| Capitec Bank Holdings Ltd. (a) | 1,085 | 76,123 |

| Kumba Iron Ore Ltd. | 2,174 | 64,263 |

See accompanying notes which are an integral part of the financial statements.

Fidelity® Emerging Markets Multifactor ETF

Schedule of Investments–continued

| Common Stocks – continued |

| | Shares | Value |

| SOUTH AFRICA – continued |

| Mr Price Group Ltd. | 4,129 | $ 31,223 |

| Vodacom Group Ltd. | 3,082 | 23,241 |

| TOTAL SOUTH AFRICA | 330,523 |

| SOUTH KOREA – 14.1% |

| Chong Kun Dang Pharmaceutical Corp. | 696 | 93,540 |

| Com2uSCorp | 42 | 4,131 |

| Daelim Industrial Co. Ltd. | 1,230 | 84,551 |

| DB HiTek Co. Ltd. | 52 | 1,464 |

| DB Insurance Co. Ltd. | 900 | 35,097 |

| Douzone Bizon Co. Ltd. | 25 | 2,197 |

| Hyundai Marine & Fire Insurance Co. Ltd. | 1,778 | 36,510 |

| Iljin Materials Co. Ltd. | 28 | 1,054 |

| Kangwon Land, Inc. | 1,943 | 36,130 |

| KMW Co. Ltd. (a) | 35 | 1,922 |

| KT&G Corp. | 1,235 | 88,160 |

| Kumho Petrochemical Co. Ltd. | 997 | 116,860 |

| LEENO Industrial, Inc. | 14 | 1,499 |

| LG Innotek Co. Ltd. | 18 | 2,411 |

| Lotte Chemical Corp. | 499 | 102,465 |

| NAVER Corp. | 160 | 40,892 |

| NCSoft Corp. | 21 | 14,361 |

| Pearl Abyss Corp. (a) | 28 | 4,948 |

| S-1 Corp. | 1,110 | 79,824 |

| Samsung Electro-Mechanics Co. Ltd. | 69 | 8,118 |

| Samsung Electronics Co. Ltd. | 6,559 | 327,170 |

| Samsung SDI Co. Ltd. | 63 | 24,540 |

| Samsung SDS Co. Ltd. | 42 | 6,237 |

| Seegene, Inc. | 436 | 100,864 |

| SK Hynix, Inc. | 602 | 42,390 |

| SK Telecom Co. Ltd. | 49 | 9,241 |

| WONIK IPS Co. Ltd. (a) | 47 | 1,327 |

| Woongjin Coway Co. Ltd. | 589 | 36,024 |

| TOTAL SOUTH KOREA | 1,303,927 |

| TAIWAN – 11.2% |

| Catcher Technology Co. Ltd. | 3,000 | 18,931 |

| Cathay Financial Holding Co. Ltd. | 31,000 | 41,617 |

| Chicony Electronics Co. Ltd. | 5,000 | 15,051 |

| Chunghwa Telecom Co. Ltd. | 5,000 | 18,704 |

| E.Sun Financial Holding Co. Ltd. | 46,295 | 39,330 |

| Elan Microelectronics Corp. | 3,000 | 14,159 |

| Far EasTone Telecommunications Co. Ltd. | 4,000 | 8,391 |

| Formosa Plastics Corp. | 24,000 | 66,370 |

| Foxconn Technology Co. Ltd. | 8,000 | 14,012 |

| Lite-On Technology Corp. | 10,000 | 16,274 |

| Novatek Microelectronics Corp. | 2,000 | 18,669 |

| Pegatron Corp. | 9,000 | 19,351 |

|

| | Shares | Value |

|

| Pou Chen Corp. | 34,000 | $ 29,954 |

| Powertech Technology, Inc. | 5,000 | 14,754 |

| Radiant Opto-Electronics Corp. | 4,000 | 15,732 |

| Simplo Technology Co. Ltd. | 1,000 | 11,135 |

| Sino-American Silicon Products, Inc. | 5,000 | 17,411 |

| Taichung Commercial Bank Co. Ltd. | 77,620 | 29,443 |

| Taiwan Cement Corp. | 38,800 | 55,005 |

| Taiwan Cooperative Financial Holding Co. Ltd. | 52,202 | 35,040 |

| Taiwan Mobile Co. Ltd. | 3,000 | 10,247 |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 22,000 | 332,267 |

| Tripod Technology Corp. | 4,000 | 15,872 |

| Uni-President Enterprises Corp. | 35,000 | 75,008 |

| United Microelectronics Corp. | 27,000 | 28,979 |

| Voltronic Power Technology Corp. | 2,257 | 77,328 |

| TOTAL TAIWAN | 1,039,034 |

| THAILAND – 1.7% |

| Advanced Info Service PCL | 1,200 | 6,642 |

| Airports of Thailand PCL | 61,000 | 101,283 |

| Intouch Holdings PCL Class F | 2,200 | 3,776 |

| The Siam Cement PCL | 4,100 | 44,463 |

| TOTAL THAILAND | 156,164 |

| TURKEY – 1.9% |

| Akbank T.A.S. (a) | 37,047 | 21,080 |

| BIM Birlesik Magazalar AS | 7,843 | 62,497 |

| Enka Insaat ve Sanayi AS | 78,769 | 67,747 |

| Turkiye Garanti Bankasi AS (a) | 26,826 | 21,120 |

| TOTAL TURKEY | 172,444 |

| UNITED ARAB EMIRATES – 0.8% |

| Dubai Islamic Bank PJSC | 21,888 | 24,789 |

| Emirates NBD Bank PJSC | 9,922 | 25,662 |

| Emirates Telecommunications Group Co. PJSC | 5,380 | 24,724 |

| TOTAL UNITED ARAB EMIRATES | 75,175 |

| UNITED STATES OF AMERICA – 0.2% |

| Yum China Holdings, Inc. | 419 | 22,303 |

| TOTAL UNITED STATES OF AMERICA | 22,303 |

TOTAL COMMON STOCKS

(Cost $9,263,497) | 9,102,130 |

| Preferred Stock – 1.4% |

| | |

| BRAZIL – 1.4% |

| Cia Paranaense de Energia | 8,900 | 95,329 |

See accompanying notes which are an integral part of the financial statements.

| Preferred Stock – continued |

| | Shares | Value |

| BRAZIL – continued |

| Itausa - Investimentos Itau S.A. | 20,200 | $ 31,845 |

| TOTAL BRAZIL | 127,174 |

| RUSSIA – 0.0% |

| Transneft PJSC | 1 | 1,662 |

| TOTAL RUSSIA | 1,662 |

TOTAL PREFERRED STOCKS

(Cost $159,615) | 128,836 |

TOTAL INVESTMENT IN SECURITIES – 99.8%

(Cost $9,423,112) | 9,230,966 |

| NET OTHER ASSETS (LIABILITIES) – 0.2% | 17,930 |

| NET ASSETS – 100.0% | $ 9,248,896 |

| Categorizations in the Schedule of Investments are based on country or territory of incorporation. | |

| Legend | |

| (a) | Non-income producing. |

| (b) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $379,840 or 4.1% of net assets. |

Investment Valuation

The following is a summary of the inputs used, as of October 31, 2020, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

Valuation Inputs at Reporting Date:

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | | | | | |

| Equities: | | | | | | | | |

| Communication Services | | $ 862,298 | | $ 862,298 | | $ — | | $ — |

| Consumer Discretionary | | 1,342,665 | | 1,342,665 | | — | | — |

| Consumer Staples | | 884,950 | | 884,950 | | — | | — |

| Energy | | 107,060 | | 107,060 | | — | | — |

| Financials | | 1,406,455 | | 1,406,455 | | — | | — |

| Health Care | | 756,797 | | 756,797 | | — | | — |

| Industrials | | 833,586 | | 833,586 | | — | | — |

| Information Technology | | 1,307,287 | | 1,307,287 | | — | | — |

| Materials | | 1,108,506 | | 1,108,506 | | — | | — |

| Utilities | | 492,526 | | 492,526 | | — | | — |

| Preferred Stock | | 128,836 | | 128,836 | | — | | — |

| Total Investments in Securities: | | $ 9,230,966 | | $ 9,230,966 | | $ — | | $ — |

See accompanying notes which are an integral part of the financial statements.

Fidelity® International High Dividend ETF

Schedule of Investments October 31, 2020

Showing Percentage of Net Assets

| Common Stocks – 99.4% |

| | Shares | Value |

| AUSTRALIA – 9.5% |

| AGL Energy Ltd. | 140,120 | $ 1,228,023 |

| Australia & New Zealand Banking Group Ltd. | 64,706 | 854,723 |

| BHP Group Ltd. | 1,863 | 44,194 |

| Sonic Healthcare Ltd. | 14,391 | 351,894 |

| Westpac Banking Corp. | 69,544 | 874,676 |

| Woodside Petroleum Ltd. | 56,420 | 694,159 |

| Woolworths Group Ltd. | 8,804 | 235,928 |

| TOTAL AUSTRALIA | 4,283,597 |

| BERMUDA – 2.8% |

| Hongkong Land Holdings Ltd. | 265,525 | 974,477 |

| Jardine Matheson Holdings Ltd. | 6,182 | 274,419 |

| TOTAL BERMUDA | 1,248,896 |

| CANADA – 12.7% |

| Canadian Apartment Properties REIT | 29,475 | 946,799 |

| Canadian Imperial Bank of Commerce | 11,300 | 842,235 |

| Enbridge, Inc. | 40,773 | 1,122,569 |

| Inter Pipeline Ltd. | 81,813 | 727,718 |

| Nutrien Ltd. | 964 | 39,157 |

| SNC-Lavalin Group, Inc. | 20,719 | 289,648 |

| The Bank of Nova Scotia | 19,488 | 808,985 |

| The Toronto-Dominion Bank | 22,025 | 970,960 |

| TOTAL CANADA | 5,748,071 |

| CAYMAN ISLANDS – 4.9% |

| Sands China Ltd. | 274,400 | 960,684 |

| Wharf Real Estate Investment Co. Ltd. | 324,000 | 1,242,964 |

| TOTAL CAYMAN ISLANDS | 2,203,648 |

| DENMARK – 0.6% |

| Novo Nordisk A/S Class B | 4,606 | 295,863 |

| TOTAL DENMARK | 295,863 |

| FINLAND – 0.2% |

| Orion Oyj Class B | 1,834 | 78,510 |

| TOTAL FINLAND | 78,510 |

| FRANCE – 5.7% |

| Bouygues S.A. | 12,889 | 422,637 |

| Danone S.A. | 2,648 | 146,206 |

| Klepierre S.A. (a) | 62,443 | 791,012 |

| Sanofi | 3,135 | 282,540 |

| TOTAL S.A. | 32,052 | 964,009 |

| TOTAL FRANCE | 2,606,404 |

| GERMANY – 10.7% |

| BASF SE | 676 | 37,065 |

|

| | Shares | Value |

|

| Bayer AG | 2,918 | $ 137,185 |

| Bayerische Motoren Werke AG | 19,041 | 1,301,516 |

| Daimler AG | 30,262 | 1,565,130 |

| E.ON SE | 170,373 | 1,776,604 |

| SAP SE | 370 | 39,432 |

| TOTAL GERMANY | 4,856,932 |

| HONG KONG – 1.7% |

| BOC Hong Kong Holdings Ltd. | 277,500 | 769,357 |

| TOTAL HONG KONG | 769,357 |

| JAPAN – 26.2% |

| Asahi Group Holdings Ltd. | 5,500 | 169,567 |

| Astellas Pharma, Inc. | 24,300 | 333,561 |

| Canon, Inc. | 1,000 | 17,223 |

| Daito Trust Construction Co. Ltd. | 18,600 | 1,688,483 |

| Haseko Corp. | 88,000 | 1,049,703 |

| Honda Motor Co. Ltd. | 52,100 | 1,213,540 |

| Japan Post Holdings Co. Ltd. | 119,500 | 817,204 |

| Japan Tobacco, Inc. | 12,700 | 239,325 |

| Komatsu Ltd. | 21,200 | 474,739 |

| Mitsubishi Corp. | 19,600 | 436,003 |

| Mitsui & Co. Ltd. | 27,600 | 430,342 |

| Otsuka Holdings Co. Ltd. | 9,000 | 331,883 |

| Sojitz Corp. | 131,000 | 286,962 |

| SUMCO Corp. | 1,600 | 24,259 |

| Sumitomo Corp. | 30,200 | 330,629 |

| Sumitomo Mitsui Financial Group, Inc. | 36,104 | 994,984 |

| The Kansai Electric Power Co., Inc. | 127,300 | 1,157,926 |

| Tokyo Electron Ltd. | 100 | 26,688 |

| Toyota Motor Corp. | 28,367 | 1,845,999 |

| TOTAL JAPAN | 11,869,020 |

| NETHERLANDS – 2.6% |

| ASML Holding N.V. | 154 | 55,969 |

| BE Semiconductor Industries N.V. | 450 | 18,184 |

| ING Groep N.V. (b) | 97,953 | 668,515 |

| Koninklijke Ahold Delhaize N.V. | 6,954 | 191,087 |

| Unilever N.V. | 4,610 | 260,711 |

| TOTAL NETHERLANDS | 1,194,466 |

| NORWAY – 0.2% |

| Mowi ASA | 5,957 | 93,884 |

| TOTAL NORWAY | 93,884 |

| SINGAPORE – 1.9% |

| DBS Group Holdings Ltd. | 56,100 | 836,057 |

| Venture Corp. Ltd. | 1,100 | 15,515 |

| TOTAL SINGAPORE | 851,572 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks – continued |

| | Shares | Value |

| SPAIN – 2.4% |

| Banco Santander S.A. (b) | 295,150 | $ 588,182 |

| Repsol S.A. | 78,075 | 485,650 |

| TOTAL SPAIN | 1,073,832 |

| SWITZERLAND – 7.4% |

| Adecco Group AG | 5,901 | 289,722 |

| Nestle S.A. | 6,263 | 704,506 |

| Novartis AG | 6,069 | 473,376 |

| Roche Holding AG | 1,726 | 555,058 |

| UBS Group AG | 114,225 | 1,326,633 |

| TOTAL SWITZERLAND | 3,349,295 |

| UNITED KINGDOM – 9.9% |

| AstraZeneca PLC | 3,476 | 349,041 |

| Babcock International Group PLC | 53,798 | 151,086 |

| BHP Group PLC | 1,906 | 36,725 |

| BP PLC | 255,581 | 649,697 |

| British American Tobacco PLC | 7,713 | 244,137 |

| GlaxoSmithKline PLC | 13,659 | 228,146 |

| Imperial Brands PLC | 8,803 | 139,319 |

| Rio Tinto PLC | 801 | 45,125 |

| Royal Dutch Shell PLC Class B | 76,152 | 914,736 |

| SSE PLC | 96,372 | 1,563,843 |

| Wm Morrison Supermarkets PLC | 76,214 | 160,529 |

| TOTAL UNITED KINGDOM | 4,482,384 |

TOTAL COMMON STOCKS

(Cost $55,074,759) | 45,005,731 |

| Money Market Funds – 2.1% |

| | Shares | Value |

| Fidelity Cash Central Fund, 0.10% (c) | 10,117 | $ 10,119 |

| Fidelity Securities Lending Cash Central Fund, 0.11% (c)(d) | 933,207 | 933,300 |

TOTAL MONEY MARKET FUNDS

(Cost $943,419) | 943,419 |

TOTAL INVESTMENT IN SECURITIES – 101.5%

(Cost $56,018,178) | 45,949,150 |

| NET OTHER ASSETS (LIABILITIES) – (1.5%) | (658,788) |

| NET ASSETS – 100.0% | $ 45,290,362 |

| Categorizations in the Schedule of Investments are based on country or territory of incorporation. | |

| Legend | |

| (a) | Security or a portion of the security is on loan at period end. |

| (b) | Non-income producing. |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| (d) | Investment made with cash collateral received from securities on loan. |

| Futures Contracts |

| | Number of

contracts | Expiration

Date | Notional

Amount | Value | Unrealized

Appreciation/

(Depreciation) |

| Purchased | | | | | |

| Equity Index Contract | | | | | |

| ICE MSCI EAFE Index Future Contracts | 3 | December 2020 | $267,585 | $(14,963) | $(14,963) |

The notional amount of futures purchased as a percentage of Net Assets is 0.6%

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $ 864 |

| Fidelity Securities Lending Cash Central Fund | 11,137 |

| Total | $12,001 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received from lending certain types of securities.

See accompanying notes which are an integral part of the financial statements.

Fidelity® International High Dividend ETF

Schedule of Investments–continued

Investment Valuation

The following is a summary of the inputs used, as of October 31, 2020, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

Valuation Inputs at Reporting Date:

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | | | | | |

| Equities: | | | | | | | | |

| Consumer Discretionary | | $ 7,936,572 | | $ 7,936,572 | | $ — | | $ — |

| Consumer Staples | | 2,585,199 | | 2,585,199 | | — | | — |

| Energy | | 5,558,538 | | 5,558,538 | | — | | — |

| Financials | | 10,352,511 | | 10,352,511 | | — | | — |

| Health Care | | 3,417,057 | | 3,417,057 | | — | | — |

| Industrials | | 3,386,187 | | 3,386,187 | | — | | — |

| Information Technology | | 197,270 | | 197,270 | | — | | — |

| Materials | | 202,266 | | 202,266 | | — | | — |

| Real Estate | | 5,643,735 | | 5,643,735 | | — | | — |

| Utilities | | 5,726,396 | | 5,726,396 | | — | | — |

| Money Market Funds | | 943,419 | | 943,419 | | — | | — |

| Total Investments in Securities: | | $ 45,949,150 | | $ 45,949,150 | | $ — | | $ — |

| Derivative Instruments: | | | | | | | | |

| Liabilities | | | | | | | | |

| Futures Contracts | | $ (14,963) | | $ (14,963) | | $ — | | $ — |

| Total Liabilities | | $ (14,963) | | $ (14,963) | | $ — | | $ — |

| Total Derivative Instruments: | | $ (14,963) | | $ (14,963) | | $ — | | $ — |

Value of Derivative Instruments

The following table is a summary of the Fund’s value of derivative instruments by primary risk exposure as of October 31, 2020. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk/ Derivative Type | Value |

| | Asset | | Liabilities |

| Equity Risk | | | |

| Futures Contracts(a) | $0 | | $(14,963) |

| Total Equity Risk | 0 | | (14,963) |

| Total Value of Derivatives | $0 | | $(14,963) |

| (a) | Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in total accumulated earnings (loss). |

See accompanying notes which are an integral part of the financial statements.

Fidelity® International Multifactor ETF

Schedule of Investments October 31, 2020

Showing Percentage of Net Assets

| Common Stocks – 98.6% |

| | Shares | Value |

| AUSTRALIA – 6.1% |

| Ampol Ltd. | 22 | $ 401 |

| ASX Ltd. | 344 | 19,237 |

| BHP Group Ltd. | 2,714 | 64,381 |

| Coca-Cola Amatil Ltd. | 8,201 | 71,586 |

| Coles Group Ltd. | 4,128 | 51,455 |

| Commonwealth Bank of Australia | 945 | 45,803 |

| Fortescue Metals Group Ltd. | 3,466 | 42,279 |

| JB Hi-Fi Ltd. | 477 | 15,888 |

| Magellan Financial Group Ltd. | 423 | 16,368 |

| Medibank Pvt Ltd. | 9,040 | 16,950 |

| Rio Tinto Ltd. | 630 | 40,893 |

| Sonic Healthcare Ltd. | 1,093 | 26,726 |

| Wesfarmers Ltd. | 769 | 24,820 |

| TOTAL AUSTRALIA | 436,787 |

| BELGIUM – 2.0% |

| Aedifica S.A. | 837 | 84,238 |

| Etablissements Franz Colruyt N.V. | 499 | 29,540 |

| Sofina S.A. | 77 | 20,002 |

| UCB S.A. | 96 | 9,471 |

| TOTAL BELGIUM | 143,251 |

| BERMUDA – 0.6% |

| Jardine Matheson Holdings Ltd. | 477 | 21,174 |

| Jardine Strategic Holdings Ltd. | 910 | 19,738 |

| TOTAL BERMUDA | 40,912 |

| CANADA – 8.4% |

| Barrick Gold Corp. | 2,412 | 64,436 |

| BCE, Inc. | 1,886 | 75,731 |

| Canadian Apartment Properties REIT | 1,535 | 49,307 |

| Canadian Pacific Railway Ltd. | 137 | 40,908 |

| CI Financial Corp. | 1,731 | 20,162 |

| Constellation Software, Inc. | 20 | 20,979 |

| Enbridge, Inc. | 24 | 661 |

| Great-West Lifeco, Inc. | 1,383 | 28,161 |

| Imperial Oil Ltd. | 21 | 279 |

| Intact Financial Corp. | 278 | 28,693 |

| Kirkland Lake Gold Ltd. | 918 | 41,791 |

| Manulife Financial Corp. | 2,337 | 31,654 |

| Northland Power, Inc. | 2,559 | 82,700 |

| Parkland Corp. | 12 | 293 |

| Power Corp. of Canada | 1,469 | 27,951 |

| Stantec, Inc. | 786 | 22,554 |

| TMX Group Ltd. | 260 | 25,244 |

| Wheaton Precious Metals Corp. | 1,012 | 46,405 |

| TOTAL CANADA | 607,909 |

|

| | Shares | Value |

| DENMARK – 2.3% |

| Coloplast A/S Class B | 78 | $ 11,384 |

| Novo Nordisk A/S Class B | 630 | 40,468 |

| Novozymes A/S Class B | 850 | 51,081 |

| Pandora A/S | 312 | 24,710 |

| SimCorp A/S | 145 | 17,287 |

| Tryg A/S | 721 | 20,001 |

| TOTAL DENMARK | 164,931 |

| FINLAND – 1.4% |

| Elisa Oyj | 1,152 | 56,682 |

| Kone Oyj Class B | 413 | 32,877 |

| Orion Oyj Class B | 182 | 7,791 |

| TOTAL FINLAND | 97,350 |

| FRANCE – 6.2% |

| Air Liquide S.A. | 493 | 72,071 |

| BioMerieux | 54 | 8,039 |

| BNP Paribas S.A. (a) | 868 | 30,186 |

| Bureau Veritas S.A. (a) | 780 | 17,127 |

| Dassault Systemes SE | 121 | 20,656 |

| Edenred | 366 | 17,070 |

| Eiffage S.A. (a) | 193 | 14,010 |

| Hermes International | 21 | 19,545 |

| La Francaise des Jeux SAEM (b) | 294 | 11,021 |

| Legrand S.A. | 267 | 19,743 |

| L'Oreal S.A. | 200 | 64,696 |

| LVMH Moet Hennessy Louis Vuitton SE | 100 | 46,862 |

| Sanofi | 439 | 39,565 |

| Sartorius Stedim Biotech | 29 | 10,999 |

| Sodexo S.A. | 159 | 10,205 |

| Teleperformance | 68 | 20,412 |

| TOTAL S.A. | 23 | 692 |

| Vinci S.A. | 342 | 27,018 |

| TOTAL FRANCE | 449,917 |

| GERMANY – 3.3% |

| Allianz SE | 241 | 42,407 |

| Beiersdorf AG | 291 | 30,474 |

| Deutsche Boerse AG | 180 | 26,492 |

| Fresenius Medical Care AG & Co. KGaA | 147 | 11,229 |

| Knorr-Bremse AG | 207 | 23,975 |

| Merck KGaA | 92 | 13,626 |

| Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen | 126 | 29,472 |

| Scout24 AG (b) | 774 | 62,345 |

| TOTAL GERMANY | 240,020 |

See accompanying notes which are an integral part of the financial statements.

Fidelity® International Multifactor ETF

Schedule of Investments–continued

| Common Stocks – continued |

| | Shares | Value |

| HONG KONG – 3.3% |

| BOC Hong Kong Holdings Ltd. | 7,000 | $ 19,407 |

| CLP Holdings Ltd. | 11,000 | 101,137 |

| Hong Kong Exchanges & Clearing Ltd. | 800 | 38,190 |

| Sino Land Co. Ltd. | 68,000 | 80,322 |

| TOTAL HONG KONG | 239,056 |

| ISRAEL – 0.6% |

| Bank Leumi Le-Israel BM | 4,680 | 22,187 |

| Nice Ltd. (a) | 85 | 19,472 |

| TOTAL ISRAEL | 41,659 |

| ITALY – 4.6% |

| Enel SpA | 11,700 | 93,139 |

| Eni SpA | 39 | 273 |

| Hera SpA | 19,975 | 62,823 |

| Italgas SpA | 11,711 | 67,690 |

| Moncler SpA (a) | 542 | 21,693 |

| Recordati Industria Chimica e Farmaceutica SpA | 159 | 8,240 |

| Snam SpA | 15,289 | 74,621 |

| TOTAL ITALY | 328,479 |

| JAPAN – 23.4% |

| Astellas Pharma, Inc. | 1,800 | 24,708 |

| Central Japan Railway Co. | 200 | 24,077 |

| Dai Nippon Printing Co. Ltd. | 1,200 | 22,257 |

| Daito Trust Construction Co. Ltd. | 1,100 | 99,856 |

| Daiwa Securities Group, Inc. | 6,000 | 24,163 |

| FUJIFILM Holdings Corp. | 500 | 25,435 |

| Haseko Corp. | 1,500 | 17,893 |

| Hikari Tsushin, Inc. | 100 | 23,350 |

| Hisamitsu Pharmaceutical Co., Inc. | 500 | 23,795 |

| Hoya Corp. | 300 | 33,863 |

| ITOCHU Corp. | 1,500 | 35,871 |

| Japan Exchange Group, Inc. | 1,100 | 26,753 |

| Kajima Corp. | 2,100 | 22,338 |

| Kakaku.com, Inc. | 2,700 | 71,568 |

| Kao Corp. | 900 | 63,880 |

| KDDI Corp. | 2,500 | 66,781 |

| Kobayashi Pharmaceutical Co. Ltd. | 600 | 58,370 |

| K's Holdings Corp. | 1,400 | 17,865 |

| M3, Inc. | 500 | 33,609 |

| Mitsui & Co. Ltd. | 1,900 | 29,625 |

| Nexon Co. Ltd. | 2,300 | 64,221 |

| Nippon Building Fund, Inc. | 16 | 80,811 |

| Nippon Telegraph & Telephone Corp. | 3,000 | 63,019 |

| Nissan Chemical Corp. | 1,200 | 63,363 |

| Nomura Research Institute Ltd. | 800 | 23,685 |

| NTT DOCOMO, Inc. | 2,500 | 92,955 |

|

| | Shares | Value |

|

| Obayashi Corp. | 2,400 | $ 19,973 |

| Obic Co. Ltd. | 100 | 17,744 |

| Oji Holdings Corp. | 15,200 | 63,830 |

| Oracle Corp. Japan | 100 | 10,006 |

| ORIX Corp. | 2,400 | 27,905 |

| Otsuka Corp. | 400 | 18,443 |

| Pan Pacific International Holdings Corp. | 900 | 19,129 |

| Rinnai Corp. | 200 | 19,705 |

| Secom Co. Ltd. | 300 | 25,239 |

| Sekisui House Ltd. | 1,100 | 18,167 |

| Shionogi & Co. Ltd. | 500 | 23,551 |

| Skylark Holdings Co. Ltd. | 1,200 | 17,069 |

| Sohgo Security Services Co. Ltd. | 500 | 23,221 |

| Sony Corp. | 600 | 49,784 |

| Sumitomo Mitsui Trust Holdings, Inc. | 1,000 | 26,626 |

| Suntory Beverage & Food Ltd. | 1,500 | 51,655 |

| Taisei Corp. | 800 | 24,833 |

| Toppan Printing Co. Ltd. | 1,500 | 18,983 |

| Toyo Suisan Kaisha Ltd. | 800 | 39,793 |

| Trend Micro, Inc. | 300 | 16,788 |

| USS Co. Ltd. | 1,200 | 21,925 |

| TOTAL JAPAN | 1,688,480 |

| JERSEY – 0.7% |

| Centamin PLC | 13,308 | 21,328 |

| Experian PLC | 832 | 30,305 |

| TOTAL JERSEY | 51,633 |

| NETHERLANDS – 2.8% |

| ASM International N.V. | 116 | 16,593 |

| Euronext N.V. (b) | 204 | 21,280 |

| Heineken Holding N.V. | 387 | 29,910 |

| Koninklijke Ahold Delhaize N.V. | 1,399 | 38,443 |

| Unilever N.V. | 1,159 | 65,545 |

| Wolters Kluwer N.V. | 371 | 30,070 |

| TOTAL NETHERLANDS | 201,841 |

| NEW ZEALAND – 0.4% |

| Fisher & Paykel Healthcare Corp. Ltd. | 1,114 | 25,768 |

| TOTAL NEW ZEALAND | 25,768 |

| NORWAY – 0.4% |

| Equinor ASA | 20 | 254 |

| Orkla ASA | 3,122 | 29,421 |

| TOTAL NORWAY | 29,675 |

| PORTUGAL – 0.0% |

| Galp Energia SGPS S.A. | 21 | 170 |

| TOTAL PORTUGAL | 170 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks – continued |

| | Shares | Value |

| SINGAPORE – 1.6% |

| Mapletree Industrial Trust | 34,500 | $ 76,807 |

| Oversea-Chinese Banking Corp. Ltd. | 3,795 | 23,401 |

| Singapore Exchange Ltd. | 2,800 | 17,757 |

| TOTAL SINGAPORE | 117,965 |

| SPAIN – 3.2% |

| Aena SME S.A. (a)(b) | 186 | 25,046 |

| Amadeus IT Group S.A. | 402 | 19,194 |

| Enagas S.A. | 3,037 | 65,553 |

| Industria de Diseno Textil S.A. (a) | 1,005 | 24,807 |

| Red Electrica Corp. S.A. | 4,001 | 70,491 |

| Viscofan S.A. | 398 | 26,866 |

| TOTAL SPAIN | 231,957 |

| SWEDEN – 4.4% |

| Atlas Copco AB Class A | 816 | 36,019 |

| Epiroc AB Class A | 1,891 | 28,255 |

| Essity AB Class B | 1,106 | 32,045 |

| Evolution Gaming Group AB (b) | 289 | 21,461 |

| Hennes & Mauritz AB Class B | 1,383 | 22,467 |

| Holmen AB Class B | 1,333 | 50,528 |

| Industrivarden AB Class A (a) | 900 | 24,206 |

| L E Lundbergforetagen AB Class B (a) | 434 | 19,532 |

| Svenska Cellulosa AB SCA Class B (a) | 3,922 | 53,204 |

| Swedish Match AB | 436 | 32,848 |

| TOTAL SWEDEN | 320,565 |

| SWITZERLAND – 10.9% |

| Banque Cantonale Vaudoise | 221 | 21,412 |

| Belimo Holding AG | 3 | 22,323 |

| Cembra Money Bank AG | 216 | 23,967 |

| EMS-Chemie Holding AG | 55 | 48,366 |

| Galenica AG (b) | 114 | 7,202 |

| Geberit AG | 53 | 30,185 |

| Givaudan S.A. | 14 | 57,066 |

| Kuehne + Nagel International AG | 144 | 28,767 |

| Nestle S.A. | 1,651 | 185,716 |

| Novartis AG | 884 | 68,951 |

| Partners Group Holding AG | 34 | 30,663 |

| PSP Swiss Property AG | 833 | 100,791 |

| Roche Holding AG | 255 | 82,005 |

| Swisscom AG | 134 | 68,173 |

| Tecan Group AG | 20 | 9,492 |

| TOTAL SWITZERLAND | 785,079 |

| UNITED KINGDOM – 12.0% |

| Admiral Group PLC | 729 | 25,921 |

| AstraZeneca PLC | 478 | 47,998 |

| Auto Trader Group PLC (b) | 9,270 | 69,400 |

|

| | Shares | Value |

|

| Avast PLC (b) | 2,163 | $ 13,268 |

| BHP Group PLC | 2,580 | 49,712 |

| British American Tobacco PLC | 1,984 | 62,799 |

| Diageo PLC | 1,989 | 64,269 |

| Direct Line Insurance Group PLC | 5,295 | 18,040 |

| GlaxoSmithKline PLC | 1,953 | 32,621 |

| Halma PLC | 629 | 19,259 |

| Hikma Pharmaceuticals PLC | 288 | 9,347 |

| Howden Joinery Group PLC (a) | 3,088 | 25,426 |

| IG Group Holdings PLC | 2,286 | 22,494 |

| Legal & General Group PLC | 9,192 | 21,964 |

| London Stock Exchange Group PLC | 300 | 32,110 |

| Next PLC | 267 | 20,162 |

| Persimmon PLC | 636 | 19,210 |

| RELX PLC | 1,566 | 30,929 |

| Rightmove PLC (a) | 8,836 | 70,606 |

| Rio Tinto PLC | 1,112 | 62,646 |

| Royal Dutch Shell PLC Class B | 71 | 853 |

| Smith & Nephew PLC | 620 | 10,714 |

| Tate & Lyle PLC | 3,711 | 28,560 |

| The Sage Group PLC | 1,857 | 15,261 |

| Unilever PLC | 1,046 | 59,563 |

| Wm Morrison Supermarkets PLC | 13,227 | 27,860 |

| TOTAL UNITED KINGDOM | 860,992 |

TOTAL COMMON STOCKS

(Cost $7,223,678) | 7,104,396 |

| Money Market Fund – 0.1% |

| | |

Fidelity Cash Central Fund, 0.10% (c)

(Cost $3,691) | 3,691 | 3,691 |

TOTAL INVESTMENT IN SECURITIES – 98.7%

(Cost $7,227,369) | 7,108,087 |

| NET OTHER ASSETS (LIABILITIES) – 1.3% | 93,592 |

| NET ASSETS – 100.0% | $ 7,201,679 |

See accompanying notes which are an integral part of the financial statements.

Fidelity® International Multifactor ETF

Schedule of Investments–continued

| Categorizations in the Schedule of Investments are based on country or territory of incorporation. | |

| Legend | |

| (a) | Non-income producing. |

| (b) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $231,023 or 3.2% of net assets. |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| Futures Contracts |

| | Number of

contracts | Expiration

Date | Notional

Amount | Value | Unrealized

Appreciation/

(Depreciation) |

| Purchased | | | | | |

| Equity Index Contract | | | | | |

| ICE MSCI EAFE Index Future Contracts | 1 | December 2020 | $89,195 | $(3,797) | $(3,797) |

The notional amount of futures purchased as a percentage of Net Assets is 1.2%

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $34 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable.

See accompanying notes which are an integral part of the financial statements.

Investment Valuation

The following is a summary of the inputs used, as of October 31, 2020, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

Valuation Inputs at Reporting Date:

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | | | | | |

| Equities: | | | | | | | | |

| Communication Services | | $ 761,481 | | $ 761,481 | | $ — | | $ — |

| Consumer Discretionary | | 487,738 | | 487,738 | | — | | — |

| Consumer Staples | | 1,145,294 | | 1,145,294 | | — | | — |

| Energy | | 3,876 | | 3,876 | | — | | — |

| Financials | | 916,761 | | 916,761 | | — | | — |

| Health Care | | 621,162 | | 621,162 | | — | | — |

| Industrials | | 793,278 | | 793,278 | | — | | — |

| Information Technology | | 291,140 | | 291,140 | | — | | — |

| Materials | | 893,380 | | 893,380 | | — | | — |