UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07319

Fidelity Covington Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant’s telephone number, including area code: 617-563-7000

Date of fiscal year end: July 31

Date of reporting period: January 31, 2022

Item 1. Reports to Stockholders

Fidelity® MSCI Communication Services Index ETF

Fidelity® MSCI Consumer Discretionary Index ETF

Fidelity® MSCI Consumer Staples Index ETF

Fidelity® MSCI Energy Index ETF

Fidelity® MSCI Financials Index ETF

Fidelity® MSCI Health Care Index ETF

Fidelity® MSCI Industrials Index ETF

Fidelity® MSCI Information Technology Index ETF

Fidelity® MSCI Materials Index ETF

Fidelity® MSCI Real Estate Index ETF

Fidelity® MSCI Utilities Index ETF

Semi-Annual Report

January 31, 2022

To view a fund’s proxy voting guidelines and proxy voting record for the period ended June, 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission’s (SEC) web site at http://www.sec.gov. You may also call 1-800-FIDELITY to request a free copy of the proxy voting guidelines.

The funds or securities referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds or securities or any index on which such funds or securities are based. The prospectus contains a more detailed description of the limited relationship MSCI has with Fidelity and any related funds.

Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

© 2022 FMR LLC. All Rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund’s Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund’s portfolio holdings, view the most recent holdings listing on Fidelity’s web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of COVID-19 emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and corporate earnings. On March 11, 2020, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread. The pandemic prompted a number of measures to limit the spread of COVID-19, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. To help stem the turmoil, the U.S. government took unprecedented action – in concert with the U.S. Federal Reserve and central banks around the world – to help support consumers, businesses, and the broader economy, and to limit disruption to the financial system.

In general, the overall impact of the pandemic lessened in 2021, amid a resilient economy and widespread distribution of three COVID-19 vaccines granted emergency use authorization from the U.S. Food and Drug Administration (FDA) early in the year. Still, the situation remains dynamic, and the extent and duration of its influence on financial markets and the economy is highly uncertain, due in part to a recent spike in cases based on highly contagious variants of the coronavirus.

Extreme events such as the COVID-19 crisis are exogenous shocks that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets. Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we continue to take extra steps to be responsive to customer needs. We encourage you to visit us online, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Fidelity® MSCI Communication Services Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of January 31, 2022

| | % of fund's

net assets |

| Facebook, Inc. Class A | 17.4 |

| Alphabet, Inc. Class A | 11.6 |

| Alphabet, Inc. Class C | 10.9 |

| The Walt Disney Co. | 5.7 |

| Verizon Communications, Inc. | 4.9 |

| AT&T, Inc. | 4.8 |

| Comcast Corp. Class A | 4.7 |

| Netflix, Inc. | 3.1 |

| Charter Communications, Inc. Class A | 2.2 |

| T-Mobile US, Inc. | 2.0 |

| | 67.3 |

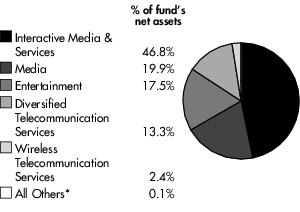

Industries as of January 31, 2022

* Includes short-term investments and net other assets.

Fidelity® MSCI Consumer Discretionary Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of January 31, 2022

| | % of fund's

net assets |

| Amazon.com, Inc. | 21.0 |

| Tesla, Inc. | 13.5 |

| The Home Depot, Inc. | 7.0 |

| McDonald's Corp. | 3.5 |

| NIKE, Inc. Class B | 3.4 |

| Lowe's Cos., Inc. | 3.0 |

| Starbucks Corp. | 2.1 |

| Target Corp. | 2.0 |

| Booking Holdings, Inc. | 1.9 |

| The TJX Cos., Inc. | 1.6 |

| | 59.0 |

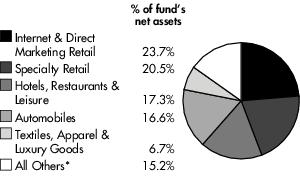

Industries as of January 31, 2022

* Includes short-term investments and net other assets.

Fidelity® MSCI Consumer Staples Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of January 31, 2022

| | % of fund's

net assets |

| The Procter & Gamble Co. | 13.9 |

| The Coca-Cola Co. | 8.4 |

| PepsiCo, Inc. | 8.1 |

| Costco Wholesale Corp. | 7.5 |

| Walmart, Inc. | 7.2 |

| Philip Morris International, Inc. | 4.8 |

| Mondelez International, Inc. Class A | 3.8 |

| Altria Group, Inc. | 3.7 |

| The Estee Lauder Cos., Inc. Class A | 2.9 |

| Colgate-Palmolive Co. | 2.7 |

| | 63.0 |

Industries as of January 31, 2022

* Includes short-term investments and net other assets.

Fidelity® MSCI Energy Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of January 31, 2022

| | % of fund's

net assets |

| Exxon Mobil Corp. | 21.3 |

| Chevron Corp. | 16.8 |

| ConocoPhillips | 7.9 |

| EOG Resources, Inc. | 4.3 |

| Schlumberger N.V. | 3.6 |

| Pioneer Natural Resources Co. | 3.4 |

| Marathon Petroleum Corp. | 3.0 |

| Phillips 66 | 2.5 |

| The Williams Cos., Inc. | 2.4 |

| Kinder Morgan, Inc. | 2.4 |

| | 67.6 |

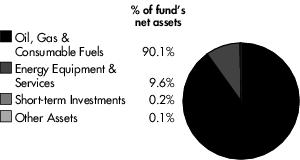

Industries as of January 31, 2022

* Includes short-term investments and net other assets.

Fidelity® MSCI Financials Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of January 31, 2022

| | % of fund's

net assets |

| JPMorgan Chase & Co. | 8.4 |

| Berkshire Hathaway, Inc. Class B | 7.8 |

| Bank of America Corp. | 6.6 |

| Wells Fargo & Co. | 4.1 |

| Morgan Stanley | 2.6 |

| Citigroup, Inc. | 2.5 |

| The Charles Schwab Corp. | 2.4 |

| BlackRock, Inc. | 2.3 |

| American Express Co. | 2.3 |

| Goldman Sachs Group, Inc. | 2.3 |

| | 41.3 |

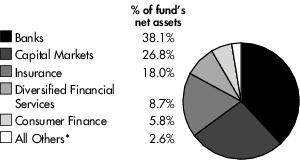

Industries as of January 31, 2022

* Includes short-term investments and net other assets.

Fidelity® MSCI Health Care Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of January 31, 2022

| | % of fund's

net assets |

| Johnson & Johnson | 7.8 |

| UnitedHealth Group, Inc. | 7.6 |

| Pfizer, Inc. | 5.1 |

| AbbVie, Inc. | 4.1 |

| Thermo Fisher Scientific, Inc. | 3.9 |

| Abbott Laboratories | 3.9 |

| Merck & Co., Inc. | 3.5 |

| Eli Lilly & Co. | 3.4 |

| Danaher Corp. | 3.1 |

| Bristol-Myers Squibb Co. | 2.5 |

| | 44.9 |

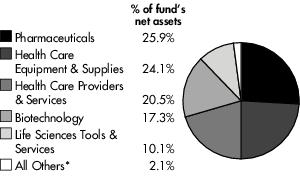

Industries as of January 31, 2022

* Includes short-term investments and net other assets.

Fidelity® MSCI Industrials Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of January 31, 2022

| | % of fund's

net assets |

| Union Pacific Corp. | 4.1 |

| United Parcel Service, Inc. Class B | 3.8 |

| Honeywell International, Inc. | 3.6 |

| Raytheon Technologies Corp. | 3.5 |

| The Boeing Co. | 2.8 |

| Deere & Co. | 2.8 |

| Caterpillar, Inc. | 2.8 |

| General Electric Co. | 2.6 |

| Lockheed Martin Corp. | 2.5 |

| 3M Co. | 2.4 |

| | 30.9 |

Industries as of January 31, 2022

* Includes short-term investments and net other assets.

Fidelity® MSCI Information Technology Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of January 31, 2022

| | % of fund's

net assets |

| Apple, Inc. | 23.0 |

| Microsoft Corp. | 17.6 |

| NVIDIA Corp. | 4.9 |

| Visa, Inc. Class A | 3.0 |

| Mastercard, Inc. Class A | 2.7 |

| Adobe, Inc. | 2.0 |

| Broadcom, Inc. | 1.9 |

| Cisco Systems, Inc. | 1.9 |

| Salesforce.com, Inc. | 1.8 |

| Accenture PLC Class A | 1.8 |

| | 60.6 |

Industries as of January 31, 2022

* Includes short-term investments and net other assets.

Fidelity® MSCI Materials Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of January 31, 2022

| | % of fund's

net assets |

| Linde PLC | 13.1 |

| The Sherwin-Williams Co. | 5.7 |

| Air Products & Chemicals, Inc. | 5.0 |

| Freeport-McMoRan, Inc. | 4.4 |

| Newmont Corp. | 3.9 |

| Ecolab, Inc. | 3.9 |

| Dow, Inc. | 3.5 |

| DuPont de Nemours, Inc. | 3.2 |

| PPG Industries, Inc. | 3.0 |

| Corteva, Inc. | 2.8 |

| | 48.5 |

Industries as of January 31, 2022

* Includes short-term investments and net other assets.

Fidelity® MSCI Real Estate Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of January 31, 2022

| | % of fund's

net assets |

| Prologis, Inc. | 7.3 |

| American Tower Corp. | 7.3 |

| Crown Castle International Corp. | 5.0 |

| Equinix, Inc. | 4.1 |

| Public Storage | 3.6 |

| Simon Property Group, Inc. | 3.1 |

| Digital Realty Trust, Inc. | 2.7 |

| Realty Income Corp. | 2.4 |

| Welltower, Inc. | 2.3 |

| SBA Communications Corp. | 2.3 |

| | 40.1 |

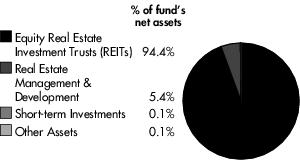

Industries as of January 31, 2022

* Includes short-term investments and net other assets.

Fidelity® MSCI Utilities Index ETF

Investment Summary (Unaudited)

Top Ten Stocks as of January 31, 2022

| | % of fund's

net assets |

| NextEra Energy, Inc. | 13.6 |

| Duke Energy Corp. | 7.2 |

| The Southern Co. | 6.5 |

| Dominion Energy, Inc. | 5.8 |

| Exelon Corp. | 5.0 |

| American Electric Power Co., Inc. | 4.0 |

| Sempra Energy | 3.9 |

| Xcel Energy, Inc. | 3.3 |

| Public Service Enterprise Group, Inc. | 3.0 |

| Eversource Energy | 2.7 |

| | 55.0 |

Industries as of January 31, 2022

* Includes short-term investments and net other assets.

Fidelity® MSCI Communication Services Index ETF

Schedule of Investments January 31, 2022 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks – 99.9% |

| | | Shares | Value |

| DIVERSIFIED TELECOMMUNICATION SERVICES – 13.3% |

| Alternative Carriers – 3.0% |

| Anterix, Inc. (a) | 9,806 | $ 502,656 |

| Bandwidth, Inc. Class A (a) | 16,748 | 1,048,592 |

| Cogent Communications Holdings, Inc. | 33,437 | 2,126,928 |

| EchoStar Corp. Class A (a) | 31,847 | 754,455 |

| Globalstar, Inc. (a) | 540,114 | 577,922 |

| Iridium Communications, Inc. (a) | 91,492 | 3,282,733 |

| Liberty Global PLC Class A (a) | 122,448 | 3,320,790 |

| Liberty Global PLC Class C (a) | 171,869 | 4,647,338 |

| Liberty Latin America Ltd. Class A (a) | 41,796 | 457,248 |

| Liberty Latin America Ltd. Class C (a) | 123,401 | 1,333,965 |

| Lumen Technologies, Inc. | 431,012 | 5,327,308 |

| | | | 23,379,935 |

| Integrated Telecommunication Services – 10.3% |

| AT&T, Inc. | 1,480,506 | 37,752,903 |

| ATN International, Inc. | 10,099 | 400,728 |

| Consolidated Communications Holdings, Inc. (a) | 62,189 | 447,139 |

| Frontier Communications Parent, Inc. (a) | 122,051 | 3,253,879 |

| IDT Corp. Class B (a) | 16,539 | 620,709 |

| Radius Global Infrastructure, Inc. (a) | 49,346 | 679,001 |

| Verizon Communications, Inc. | 721,174 | 38,388,092 |

| | | | 81,542,451 |

| TOTAL DIVERSIFIED TELECOMMUNICATION SERVICES | 104,922,386 |

| ENTERTAINMENT – 17.5% |

| Interactive Home Entertainment – 4.8% |

| Activision Blizzard, Inc. | 193,645 | 15,299,891 |

| Electronic Arts, Inc. | 76,770 | 10,184,308 |

| Skillz, Inc. (a) | 64,092 | 308,282 |

| Take-Two Interactive Software, Inc. (a) | 39,231 | 6,407,992 |

| Zynga, Inc. Class A (a) | 609,624 | 5,529,290 |

| | | | 37,729,763 |

| Movies & Entertainment – 12.7% |

| AMC Entertainment Holdings, Inc. Class A (a) | 167,886 | 2,696,249 |

| Cinemark Holdings, Inc. (a) | 74,918 | 1,131,262 |

| CuriosityStream, Inc. (a) | 12,836 | 56,863 |

| IMAX Corp. (a) | 37,290 | 643,253 |

| Liberty Media Corp-Liberty Braves Class A (a) | 7,660 | 214,863 |

| Liberty Media Corp-Liberty Braves Class C (a) | 31,037 | 837,999 |

| Liberty Media Corp-Liberty Formula One Class C (a) | 90,714 | 5,463,704 |

|

| | | Shares | Value |

|

|

| Lions Gate Entertainment Corp. Class A (a) | 43,711 | $ 685,388 |

| Lions Gate Entertainment Corp. Class B (a) | 90,616 | 1,321,181 |

| Live Nation Entertainment, Inc. (a) | 59,672 | 6,534,681 |

| Madison Square Garden Entertainment Corp. (a) | 18,183 | 1,287,902 |

| Madison Square Garden Sports Corp. Class A (a) | 11,496 | 1,909,141 |

| Netflix, Inc. (a) | 57,741 | 24,663,491 |

| Roku, Inc. (a) | 33,817 | 5,547,679 |

| The Marcus Corp. (a) | 15,124 | 254,839 |

| The Walt Disney Co. (a) | 317,444 | 45,384,969 |

| World Wrestling Entertainment, Inc. Class A | 35,202 | 1,757,988 |

| | | | 100,391,452 |

| TOTAL ENTERTAINMENT | 138,121,215 |

| INTERACTIVE MEDIA & SERVICES – 46.8% |

| Interactive Media & Services – 46.8% |

| Alphabet, Inc. Class A (a) | 33,872 | 91,660,003 |

| Alphabet, Inc. Class C (a) | 31,566 | 85,669,177 |

| Angi, Inc. (a) | 51,458 | 441,510 |

| Bumble, Inc. Class A (a) | 52,976 | 1,563,322 |

| Cargurus, Inc. (a) | 60,779 | 1,938,850 |

| Cars.com, Inc. (a) | 52,160 | 812,653 |

| Eventbrite, Inc. Class A (a) | 52,325 | 749,817 |

| EverQuote, Inc. Class A (a) | 12,466 | 205,190 |

| Facebook, Inc. Class A (a) | 436,961 | 136,882,403 |

| fuboTV, Inc. (a) | 32,603 | 350,156 |

| IAC/InterActive Corp. (a) | 37,367 | 5,102,090 |

| j2 Global, Inc. (a) | 32,872 | 3,453,532 |

| Match Group, Inc. (a) | 69,971 | 7,885,732 |

| MediaAlpha, Inc. Class A (a) | 9,897 | 146,971 |

| Pinterest, Inc. Class A (a) | 169,915 | 5,022,688 |

| QuinStreet, Inc. (a) | 37,812 | 608,395 |

| Snap, Inc. Class A (a) | 252,613 | 8,220,027 |

| TripAdvisor, Inc. (a) | 75,068 | 2,038,096 |

| TrueCar, Inc. (a) | 67,219 | 231,233 |

| Twitter, Inc. (a) | 209,136 | 7,844,692 |

| Vimeo, Inc. (a) | 109,031 | 1,597,304 |

| Yelp, Inc. (a) | 56,104 | 1,937,832 |

| ZipRecruiter, Inc. (a) | 16,558 | 359,143 |

| ZoomInfo Technologies, Inc. Class A (a) | 78,942 | 4,172,874 |

| TOTAL INTERACTIVE MEDIA & SERVICES | 368,893,690 |

| MEDIA – 19.9% |

| Advertising – 2.5% |

| Advantage Solutions, Inc. (a) | 46,476 | 338,345 |

| Boston Omaha Corp. Class A (a) | 12,281 | 324,096 |

See accompanying notes which are an integral part of the financial statements.

Fidelity® MSCI Communication Services Index ETF

Schedule of Investments (Unaudited)–continued

| Common Stocks – continued |

| | | Shares | Value |

| MEDIA – continued |

| Advertising – continued |

| Cardlytics, Inc. (a) | 24,199 | $ 1,623,753 |

| Clear Channel Outdoor Holdings, Inc. (a) | 238,020 | 728,341 |

| Loyalty Ventures, Inc. (a) | 14,449 | 423,500 |

| Magnite, Inc. (a) | 90,804 | 1,232,210 |

| Omnicom Group, Inc. | 85,963 | 6,478,172 |

| PubMatic, Inc. (a) | 5,112 | 125,500 |

| Stagwell, Inc. (a) | 44,382 | 331,534 |

| TechTarget, Inc. (a) | 18,993 | 1,575,279 |

| The Interpublic Group of Cos., Inc. | 160,671 | 5,710,247 |

| Thryv Holdings, Inc. (a) | 13,517 | 438,356 |

| | | | 19,329,333 |

| Broadcasting – 4.9% |

| AMC Networks, Inc. Class A (a) | 20,631 | 879,500 |

| Discovery, Inc. Class A (a) | 126,552 | 3,532,066 |

| Discovery, Inc. Class C (a) | 181,859 | 4,973,844 |

| Entercom Communications Corp. (a) | 81,780 | 197,908 |

| Fox Corp. Class A | 136,186 | 5,530,513 |

| Fox Corp. Class B | 108,595 | 4,037,562 |

| Gray Television, Inc. | 61,007 | 1,271,996 |

| Hemisphere Media Group, Inc. (a) | 12,622 | 81,917 |

| iHeartMedia, Inc. Class A (a) | 88,083 | 1,774,872 |

| Nexstar Media Group, Inc. Class A | 26,684 | 4,413,000 |

| Sinclair Broadcast Group, Inc. Class A | 37,235 | 1,023,218 |

| TEGNA, Inc. | 161,893 | 3,134,248 |

| The E.W. Scripps Co. Class A | 40,121 | 822,481 |

| ViacomCBS, Inc. Class B | 197,829 | 6,617,380 |

| | | | 38,290,505 |

| Cable & Satellite – 11.1% |

| Altice USA, Inc. Class A (a) | 168,423 | 2,428,660 |

| Cable One, Inc. | 2,805 | 4,332,968 |

| Charter Communications, Inc. Class A (a) | 29,584 | 17,553,370 |

| Comcast Corp. Class A | 745,195 | 37,252,298 |

| DISH Network Corp. Class A (a) | 130,987 | 4,112,992 |

| Liberty Broadband Corp. Class A (a) | 19,466 | 2,848,849 |

| Liberty Broadband Corp. Class C (a) | 47,258 | 7,013,560 |

| Liberty Media Corp-Liberty SiriusXM Class A (a) | 63,937 | 2,957,086 |

| Liberty Media Corp-Liberty SiriusXM Class C (a) | 92,423 | 4,300,442 |

|

| | | Shares | Value |

|

|

| Sirius XM Holdings, Inc. | 668,388 | $ 4,250,948 |

| WideOpenWest, Inc. (a) | 39,337 | 732,061 |

| | | | 87,783,234 |

| Publishing – 1.4% |

| Gannett Co., Inc. (a) | 94,735 | 460,412 |

| John Wiley & Sons, Inc. Class A | 34,652 | 1,758,589 |

| News Corp. Class A | 206,335 | 4,588,891 |

| Scholastic Corp. | 20,818 | 853,954 |

| The New York Times Co. Class A | 92,874 | 3,717,746 |

| | | | 11,379,592 |

| TOTAL MEDIA | 156,782,664 |

| WIRELESS TELECOMMUNICATION SERVICES – 2.4% |

| Wireless Telecommunication Services – 2.4% |

| Gogo, Inc. (a) | 37,448 | 466,228 |

| Shenandoah Telecommunications Co. | 39,168 | 891,855 |

| Telephone & Data Systems, Inc. | 76,722 | 1,519,096 |

| T-Mobile US, Inc. (a) | 143,862 | 15,561,552 |

| United States Cellular Corp. (a) | 12,600 | 385,812 |

| TOTAL WIRELESS TELECOMMUNICATION SERVICES | 18,824,543 |

TOTAL COMMON STOCKS

(Cost $693,898,585) | 787,544,498 |

| Money Market Fund – 0.1% |

| | | | |

State Street Institutional Treasury Plus Money Market Fund, Trust Class, 0.01% (b)

(Cost $1,088,000) | 1,088,000 | 1,088,000 |

TOTAL INVESTMENT IN SECURITIES – 100.0%

(Cost $694,986,585) | 788,632,498 |

| NET OTHER ASSETS (LIABILITIES) – 0.0% | 2,367 |

| NET ASSETS – 100.0% | $ 788,634,865 |

| Legend | |

| (a) | Non-income producing. |

| (b) | The rate quoted is the annualized seven-day yield of the fund at period end. |

See accompanying notes which are an integral part of the financial statements.

| Futures Contracts |

| | Number of

contracts | Expiration

Date | Notional

Amount | Value | Unrealized

Appreciation/

(Depreciation) |

| Purchased | | | | | |

| Equity Index Contract | | | | | |

| CME E-mini S&P Communication Services Select Sector Index Contracts (United States) | 11 | March 2022 | $1,062,600 | $(35,355) | $(35,355) |

The notional amount of futures purchased as a percentage of Net Assets is 0.1%

Investment Valuation

The following is a summary of the inputs used, as of January 31, 2022, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

Valuation Inputs at Reporting Date:

| Description | | Total | | Level 1 | | Level 2 | Level 3 | |

| Investments in Securities: | | | | | | | | |

| Common Stocks | | $ 787,544,498 | | $ 787,544,498 | | $ — | $ — | |

| Money Market Funds | | 1,088,000 | | 1,088,000 | | — | — | |

| Total Investments in Securities: | | $ 788,632,498 | | $ 788,632,498 | | $ — | $ — | |

| Derivative Instruments: | | | | | | | | |

| Liabilities | | | | | | | | |

| Futures Contracts | | $ (35,355) | | $ (35,355) | | $ — | $ — | |

| Total Liabilities | | $ (35,355) | | $ (35,355) | | $ — | $ — | |

| Total Derivative Instruments: | | $ (35,355) | | $ (35,355) | | $ — | $ — | |

Value of Derivative Instruments

The following table is a summary of the Fund’s value of derivative instruments by primary risk exposure as of January 31, 2022. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk/ Derivative Type | Value |

| | Asset | | Liabilities |

| Equity Risk | | | |

| Futures Contracts(a) | $0 | | $(35,355) |

| Total Equity Risk | 0 | | (35,355) |

| Total Value of Derivatives | $0 | | $(35,355) |

| (a) | Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in total accumulated earnings (loss). |

See accompanying notes which are an integral part of the financial statements.

Fidelity® MSCI Consumer Discretionary Index ETF

Schedule of Investments January 31, 2022 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks – 99.9% |

| | | Shares | Value |

| AUTO COMPONENTS – 2.5% |

| Auto Parts & Equipment – 2.4% |

| Adient PLC (a) | 36,345 | $ 1,525,400 |

| American Axle & Manufacturing Holdings, Inc. (a) | 74,467 | 606,161 |

| Aptiv PLC (a) | 81,582 | 11,142,470 |

| Autoliv, Inc. | 28,916 | 2,863,841 |

| BorgWarner, Inc. | 81,492 | 3,573,424 |

| Dana, Inc. | 59,725 | 1,293,644 |

| Dorman Products, Inc. (a) | 12,159 | 1,138,447 |

| Fox Factory Holding Corp. (a) | 15,312 | 2,037,568 |

| Gentex Corp. | 84,057 | 2,639,390 |

| Gentherm, Inc. (a) | 15,316 | 1,338,465 |

| Holley, Inc. (a) | 3,963 | 46,922 |

| LCI Industries | 10,617 | 1,307,696 |

| Lear Corp. | 19,383 | 3,243,164 |

| Luminar Technologies, Inc. (a) | 6,844 | 100,196 |

| Modine Manufacturing Co. (a) | 4,847 | 44,350 |

| Patrick Industries, Inc. | 1,093 | 70,389 |

| Standard Motor Products, Inc. | 15,328 | 733,751 |

| Stoneridge, Inc. (a) | 20,990 | 396,081 |

| Tenneco, Inc. Class A (a) | 54,524 | 572,502 |

| Veoneer, Inc. (a) | 44,445 | 1,564,909 |

| Visteon Corp. (a) | 11,087 | 1,125,441 |

| XPEL, Inc. (a) | 1,798 | 112,123 |

| | | | 37,476,334 |

| Tires & Rubber – 0.1% |

| The Goodyear Tire & Rubber Co. (a) | 114,795 | 2,379,700 |

| TOTAL AUTO COMPONENTS | 39,856,034 |

| AUTOMOBILES – 16.6% |

| Automobile Manufacturers – 16.5% |

| Canoo, Inc. (a) | 17,096 | 104,628 |

| Electric Last Mile Solutions, Inc. (a) | 12,023 | 62,640 |

| Faraday Future Intelligent Electric, Inc. (a) | 10,665 | 45,646 |

| Fisker, Inc. (a) | 6,284 | 74,214 |

| Ford Motor Co. | 1,155,709 | 23,460,893 |

| General Motors Co. (a) | 383,845 | 20,240,147 |

| Lucid Group, Inc. (a) | 1,116 | 32,799 |

| Rivian Automotive, Inc. (a) | 1,794 | 117,938 |

| Tesla, Inc. (a) | 226,932 | 212,571,743 |

| Thor Industries, Inc. | 19,765 | 1,869,571 |

| Winnebago Industries, Inc. | 15,166 | 978,510 |

| | | | 259,558,729 |

| Motorcycle Manufacturers – 0.1% |

| Harley-Davidson, Inc. | 55,244 | 1,909,785 |

| TOTAL AUTOMOBILES | 261,468,514 |

|

| | | Shares | Value |

| DISTRIBUTORS – 1.1% |

| Distributors – 1.1% |

| Funko, Inc. Class A (a) | 3,237 | $ 55,936 |

| Genuine Parts Co. | 46,300 | 6,168,549 |

| LKQ Corp. | 93,979 | 5,158,507 |

| Pool Corp. | 12,744 | 6,069,330 |

| | | | 17,452,322 |

| Internet Retail – 0.0% |

| ThredUp, Inc. (a) | 6,728 | 62,368 |

| TOTAL DISTRIBUTORS | 17,514,690 |

| DIVERSIFIED CONSUMER SERVICES – 1.3% |

| Education Services – 0.6% |

| Adtalem Global Education, Inc. (a) | 25,671 | 755,241 |

| American Public Education, Inc. (a) | 18,531 | 396,378 |

| Bright Horizons Family Solutions, Inc. (a) | 20,193 | 2,592,983 |

| Coursera, Inc. (a) | 6,571 | 133,457 |

| Duolingo, Inc. (a) | 1,005 | 100,510 |

| Graham Holdings Co. Class B | 1,885 | 1,121,801 |

| Grand Canyon Education, Inc. (a) | 17,647 | 1,476,701 |

| Houghton Mifflin Harcourt Co. (a) | 5,897 | 106,205 |

| Laureate Education, Inc. Class A | 56,581 | 715,749 |

| Perdoceo Education Corp. (a) | 47,354 | 521,841 |

| PowerSchool Holdings, Inc. (a) | 4,734 | 77,543 |

| Strategic Education, Inc. | 10,242 | 611,038 |

| Stride, Inc. (a) | 26,469 | 928,268 |

| | | | 9,537,715 |

| Specialized Consumer Services – 0.7% |

| Carriage Services, Inc. | 16,381 | 824,292 |

| European Wax Center, Inc. (a) | 4,050 | 98,982 |

| Frontdoor, Inc. (a) | 32,318 | 1,173,143 |

| H&R Block, Inc. | 75,003 | 1,714,569 |

| Mister Car Wash, Inc. (a) | 7,598 | 130,686 |

| OneSpaWorld Holdings Ltd. (a) | 69,417 | 716,383 |

| Rover Group, Inc. (a) | 12,557 | 81,997 |

| Service Corp. International | 57,448 | 3,545,691 |

| Terminix Global Holdings, Inc. (a) | 47,090 | 2,031,463 |

| The Beachbody Co., Inc. (a) | 27,693 | 50,401 |

| WW International, Inc. (a) | 32,495 | 409,437 |

| | | | 10,777,044 |

| TOTAL DIVERSIFIED CONSUMER SERVICES | 20,314,759 |

| HOTELS, RESTAURANTS & LEISURE – 17.3% |

| Casinos & Gaming – 2.0% |

| Accel Entertainment, Inc. (a) | 51,436 | 648,608 |

| Bally's Corp. (a) | 18,921 | 676,237 |

| Boyd Gaming Corp. (a) | 31,724 | 1,886,309 |

| Caesars Entertainment, Inc. (a) | 59,480 | 4,528,807 |

| Churchill Downs, Inc. | 12,416 | 2,611,085 |

| Everi Holdings, Inc. (a) | 52,764 | 1,043,144 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks – continued |

| | | Shares | Value |

| HOTELS, RESTAURANTS & LEISURE – continued |

| Casinos & Gaming – continued |

| Golden Entertainment, Inc. (a) | 1,358 | $ 61,083 |

| Golden Nugget Online Gaming, Inc. (a) | 11,932 | 95,933 |

| Las Vegas Sands Corp. (a) | 108,762 | 4,763,776 |

| MGM Resorts International | 128,282 | 5,480,207 |

| Monarch Casino & Resort, Inc. (a) | 10,436 | 645,988 |

| Penn National Gaming, Inc. (a) | 55,280 | 2,521,321 |

| Red Rock Resorts, Inc. Class A | 31,902 | 1,420,277 |

| Rush Street Interactive, Inc. (a) | 8,955 | 90,804 |

| Scientific Games Corp. Class A (a) | 25,610 | 1,477,697 |

| Wynn Resorts Ltd. (a) | 33,829 | 2,890,688 |

| | | | 30,841,964 |

| Hotels, Resorts & Cruise Lines – 5.7% |

| Airbnb, Inc. Class A (a) | 12,499 | 1,924,471 |

| Booking Holdings, Inc. (a) | 11,986 | 29,439,174 |

| Carnival Corp. (a) | 224,109 | 4,439,599 |

| Choice Hotels International, Inc. | 14,323 | 2,053,918 |

| Expedia Group, Inc. (a) | 42,954 | 7,873,039 |

| Hilton Grand Vacations, Inc. (a) | 34,311 | 1,676,436 |

| Hilton Worldwide Holdings, Inc. (a) | 84,979 | 12,331,303 |

| Hyatt Hotels Corp. Class A (a) | 1,323 | 121,200 |

| Lindblad Expeditions Holdings, Inc. (a) | 29,630 | 499,858 |

| Marriott International, Inc. Class A (a) | 84,064 | 13,544,392 |

| Marriott Vacations Worldwide Corp. | 14,720 | 2,390,234 |

| Membership Collective Group, Inc. (a) | 5,858 | 51,960 |

| Norwegian Cruise Line Holdings Ltd. (a) | 135,768 | 2,828,047 |

| Playa Hotels & Resorts N.V. (a) | 91,307 | 696,672 |

| Royal Caribbean Cruises Ltd. (a) | 71,720 | 5,580,533 |

| Travel + Leisure Co. | 32,837 | 1,865,142 |

| Wyndham Hotels & Resorts, Inc. | 33,745 | 2,832,893 |

| | | | 90,148,871 |

| Leisure Facilities – 0.6% |

| F45 Training Holdings, Inc. (a) | 5,095 | 63,739 |

| Planet Fitness, Inc. Class A (a) | 28,966 | 2,567,546 |

| SeaWorld Entertainment, Inc. (a) | 23,440 | 1,396,555 |

| Six Flags Entertainment Corp. (a) | 31,974 | 1,262,653 |

| Vail Resorts, Inc. | 13,231 | 3,666,310 |

| | | | 8,956,803 |

| Restaurants – 9.0% |

| Aramark | 78,273 | 2,683,981 |

| BJ's Restaurants, Inc. (a) | 14,809 | 445,603 |

| Bloomin' Brands, Inc. (a) | 37,585 | 764,103 |

| Brinker International, Inc. (a) | 21,072 | 699,801 |

| Chipotle Mexican Grill, Inc. (a) | 8,066 | 11,982,688 |

| Chuys Holdings, Inc. (a) | 1,859 | 46,865 |

|

| | | Shares | Value |

|

|

| Cracker Barrel Old Country Store, Inc. | 9,276 | $ 1,105,143 |

| Darden Restaurants, Inc. | 41,677 | 5,829,362 |

| Dave & Buster's Entertainment, Inc. (a) | 22,576 | 807,995 |

| Denny's Corp. (a) | 43,205 | 669,677 |

| Dine Brands Global, Inc. | 9,718 | 659,366 |

| Domino's Pizza, Inc. | 12,204 | 5,548,548 |

| El Pollo Loco Holdings, Inc. (a) | 22,496 | 300,097 |

| Jack in the Box, Inc. | 10,095 | 919,150 |

| Krispy Kreme, Inc. | 3,839 | 57,547 |

| McDonald's Corp. | 214,241 | 55,584,827 |

| Papa John's International, Inc. | 12,667 | 1,563,741 |

| Ruth's Hospitality Group, Inc. (a) | 27,936 | 559,558 |

| Shake Shack, Inc. Class A (a) | 15,197 | 1,004,066 |

| Starbucks Corp. | 340,847 | 33,512,077 |

| Texas Roadhouse, Inc. | 24,212 | 2,067,463 |

| The Cheesecake Factory, Inc. (a) | 20,588 | 734,580 |

| The Wendy's Co. | 73,968 | 1,703,483 |

| Wingstop, Inc. | 11,191 | 1,715,021 |

| Yum! Brands, Inc. | 90,016 | 11,267,303 |

| | | | 142,232,045 |

| TOTAL HOTELS, RESTAURANTS & LEISURE | 272,179,683 |

| HOUSEHOLD DURABLES – 4.8% |

| Consumer Electronics – 0.5% |

| Garmin Ltd. | 45,488 | 5,659,617 |

| GoPro, Inc. Class A (a) | 74,291 | 658,218 |

| Snap One Holdings Corp. (a) | 2,323 | 43,696 |

| Sonos, Inc. (a) | 38,712 | 976,317 |

| Universal Electronics, Inc. (a) | 11,091 | 393,619 |

| | | | 7,731,467 |

| Home Furnishings – 0.6% |

| Ethan Allen Interiors, Inc. | 22,328 | 562,889 |

| La-Z-Boy, Inc. | 23,269 | 854,205 |

| Leggett & Platt, Inc. | 48,536 | 1,934,160 |

| Mohawk Industries, Inc. (a) | 19,984 | 3,154,874 |

| Tempur Sealy International, Inc. | 68,451 | 2,725,034 |

| The Lovesac Co. (a) | 3,390 | 182,552 |

| | | | 9,413,714 |

| Homebuilding – 3.0% |

| Cavco Industries, Inc. (a) | 4,305 | 1,159,939 |

| Century Communities, Inc. | 15,373 | 1,012,312 |

| D.R. Horton, Inc. | 104,719 | 9,343,029 |

| Dream Finders Homes, Inc. (a) | 2,971 | 55,379 |

| Green Brick Partners, Inc. (a) | 27,108 | 641,918 |

| Hovnanian Enterprises, Inc. (a) | 644 | 62,391 |

| Installed Building Products, Inc. | 10,290 | 1,140,029 |

| KB Home | 33,437 | 1,412,713 |

| Lennar Corp. Class A | 84,897 | 8,159,451 |

| LGI Homes, Inc. (a) | 8,978 | 1,117,851 |

See accompanying notes which are an integral part of the financial statements.

Fidelity® MSCI Consumer Discretionary Index ETF

Schedule of Investments (Unaudited)–continued

| Common Stocks – continued |

| | | Shares | Value |

| HOUSEHOLD DURABLES – continued |

| Homebuilding – continued |

| M.D.C. Holdings, Inc. | 25,008 | $ 1,267,656 |

| M/I Homes, Inc. (a) | 15,988 | 847,204 |

| Meritage Homes Corp. (a) | 15,613 | 1,592,994 |

| NVR, Inc. (a) | 1,104 | 5,881,251 |

| PulteGroup, Inc. | 87,284 | 4,598,994 |

| Skyline Champion Corp. (a) | 24,415 | 1,644,106 |

| Taylor Morrison Home Corp. (a) | 50,575 | 1,552,147 |

| Toll Brothers, Inc. | 42,823 | 2,525,272 |

| TopBuild Corp. (a) | 11,680 | 2,717,352 |

| Tri Pointe Homes, Inc. (a) | 57,277 | 1,363,765 |

| | | | 48,095,753 |

| Household Appliances – 0.5% |

| Cricut, Inc. (a) | 2,188 | 43,279 |

| Helen of Troy Ltd. (a) | 9,260 | 1,938,396 |

| iRobot Corp. (a) | 12,134 | 795,020 |

| Traeger, Inc. (a) | 10,037 | 102,277 |

| Weber, Inc. | 13,935 | 151,055 |

| Whirlpool Corp. | 20,482 | 4,305,111 |

| | | | 7,335,138 |

| Housewares & Specialties – 0.2% |

| Newell Brands, Inc. | 131,853 | 3,060,308 |

| Tupperware Brands Corp. (a) | 4,681 | 72,181 |

| | | | 3,132,489 |

| TOTAL HOUSEHOLD DURABLES | 75,708,561 |

| INTERNET & DIRECT MARKETING RETAIL – 23.7% |

| Internet & Direct Marketing Retail – 23.7% |

| 1-800-FLOWERS.com, Inc. Class A (a) | 20,324 | 346,118 |

| Amazon.com, Inc. (a) | 110,398 | 330,252,305 |

| CarParts.com, Inc. (a) | 8,435 | 77,602 |

| Chewy, Inc. Class A (a) | 2,864 | 136,355 |

| ContextLogic, Inc. Class A (a) | 36,927 | 97,857 |

| DoorDash, Inc. Class A (a) | 1,089 | 123,591 |

| Duluth Holdings, Inc. Class B (a) | 6,078 | 91,656 |

| eBay, Inc. | 196,321 | 11,793,002 |

| Etsy, Inc. (a) | 37,765 | 5,932,126 |

| Groupon, Inc. (a) | 17,293 | 528,128 |

| Lands' End, Inc. (a) | 15,079 | 276,398 |

| MercadoLibre, Inc. (a) | 13,279 | 15,032,625 |

| Overstock.com, Inc. (a) | 15,834 | 759,082 |

| PetMed Express, Inc. | 16,588 | 428,468 |

| Porch Group, Inc. (a) | 9,397 | 99,138 |

| Quotient Technology, Inc. (a) | 51,549 | 366,513 |

| Qurate Retail, Inc. Class A | 145,394 | 1,022,120 |

| Revolve Group, Inc. (a) | 16,896 | 833,311 |

| Shutterstock, Inc. | 10,446 | 1,012,949 |

| Stitch Fix, Inc. Class A (a) | 23,543 | 386,812 |

| The Original BARK Co. (a) | 28,808 | 108,606 |

|

| | | Shares | Value |

|

|

| The RealReal, Inc. (a) | 24,763 | $ 234,010 |

| Wayfair, Inc. Class A (a) | 21,247 | 3,312,832 |

| | | | 373,251,604 |

| Internet Retail – 0.0% |

| Xometry, Inc. (a) | 1,477 | 76,213 |

| TOTAL INTERNET & DIRECT MARKETING RETAIL | 373,327,817 |

| INTERNET SOFTWARE & SERVICES – 0.0% |

| Internet Software & Services – 0.0% |

| Liquidity Services, Inc. (a) | 1,992 | 37,908 |

| LEISURE PRODUCTS – 1.2% |

| Leisure Products – 1.2% |

| Acushnet Holdings Corp. | 19,805 | 924,893 |

| AMMO, Inc. (a) | 13,503 | 62,654 |

| Brunswick Corp. | 27,631 | 2,508,618 |

| Callaway Golf Co. (a) | 46,110 | 1,100,185 |

| Clarus Corp. | 1,689 | 38,053 |

| Hasbro, Inc. | 42,907 | 3,968,039 |

| Hayward Holdings, Inc. (a) | 1,931 | 38,021 |

| Johnson Outdoors, Inc. Class A | 4,740 | 427,643 |

| Latham Group, Inc. (a) | 2,398 | 39,999 |

| Malibu Boats, Inc. Class A (a) | 11,874 | 779,647 |

| Mattel, Inc. (a) | 124,978 | 2,614,540 |

| Polaris, Inc. | 20,566 | 2,315,526 |

| Smith & Wesson Brands, Inc. | 38,434 | 656,453 |

| Sturm Ruger & Co., Inc. | 10,947 | 735,967 |

| Vinco Ventures, Inc. (a) | 22,197 | 73,028 |

| Vista Outdoor, Inc. (a) | 28,404 | 1,095,826 |

| YETI Holdings, Inc. (a) | 29,520 | 1,935,922 |

| TOTAL LEISURE PRODUCTS | 19,315,014 |

| MEDIA – 0.0% |

| Broadcasting – 0.0% |

| Media General, Inc. (a)(b) | 7,026 | 0 |

| MULTILINE RETAIL – 4.2% |

| Department Stores – 0.6% |

| Dillard's, Inc. Class A | 4,383 | 1,112,055 |

| Kohl's Corp. | 54,787 | 3,271,332 |

| Macy's, Inc. | 114,356 | 2,927,514 |

| Nordstrom, Inc. (a) | 43,705 | 983,362 |

| | | | 8,294,263 |

| General Merchandise Stores – 3.6% |

| Big Lots, Inc. | 17,653 | 739,837 |

| Dollar General Corp. | 70,153 | 14,625,498 |

| Dollar Tree, Inc. (a) | 70,687 | 9,275,548 |

| Franchise Group, Inc. | 2,462 | 123,272 |

| Ollie's Bargain Outlet Holdings, Inc. (a) | 22,219 | 1,065,179 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks – continued |

| | | Shares | Value |

| MULTILINE RETAIL – continued |

| General Merchandise Stores – continued |

| Target Corp. | 141,377 | $ 31,163,732 |

| | | | 56,993,066 |

| TOTAL MULTILINE RETAIL | 65,287,329 |

| SPECIALTY RETAIL – 20.5% |

| Apparel Retail – 3.5% |

| Abercrombie & Fitch Co. Class A (a) | 29,954 | 1,168,206 |

| American Eagle Outfitters, Inc. | 59,317 | 1,354,207 |

| Boot Barn Holdings, Inc. (a) | 15,091 | 1,387,919 |

| Burlington Stores, Inc. (a) | 20,819 | 4,932,646 |

| Caleres, Inc. | 2,068 | 49,591 |

| Citi Trends, Inc. (a) | 556 | 27,088 |

| Designer Brands, Inc. Class A (a) | 44,423 | 585,051 |

| Foot Locker, Inc. | 36,242 | 1,619,293 |

| Genesco, Inc. (a) | 13,049 | 839,442 |

| Guess?, Inc. | 27,212 | 626,420 |

| Ross Stores, Inc. | 107,167 | 10,475,574 |

| Shoe Carnival, Inc. | 19,992 | 682,927 |

| The Buckle, Inc. | 19,108 | 719,225 |

| The Children's Place, Inc. (a) | 9,789 | 692,572 |

| The Gap, Inc. | 80,802 | 1,460,092 |

| The TJX Cos., Inc. | 352,213 | 25,348,770 |

| Urban Outfitters, Inc. (a) | 31,144 | 894,456 |

| Victoria's Secret & Co. (a) | 28,780 | 1,606,787 |

| Zumiez, Inc. (a) | 14,651 | 658,562 |

| | | | 55,128,828 |

| Automotive Retail – 3.5% |

| Advance Auto Parts, Inc. | 21,603 | 5,001,311 |

| America's Car-Mart, Inc. (a) | 4,775 | 453,243 |

| Arko Corp. (a) | 8,759 | 71,999 |

| Asbury Automotive Group, Inc. (a) | 8,780 | 1,413,317 |

| AutoNation, Inc. (a) | 20,138 | 2,195,042 |

| AutoZone, Inc. (a) | 6,567 | 13,044,360 |

| Camping World Holdings, Inc. Class A | 21,884 | 726,549 |

| CarMax, Inc. (a) | 51,610 | 5,737,484 |

| Carvana Co. (a) | 20,486 | 3,319,961 |

| Group 1 Automotive, Inc. | 7,762 | 1,318,065 |

| Lithia Motors, Inc. | 9,862 | 2,880,986 |

| Monro, Inc. | 16,067 | 799,012 |

| Murphy USA, Inc. | 11,047 | 2,172,503 |

| O'Reilly Automotive, Inc. (a) | 20,952 | 13,655,466 |

| Penske Automotive Group, Inc. | 14,623 | 1,486,135 |

| Sonic Automotive, Inc. Class A | 15,608 | 796,164 |

| TravelCenters of America, Inc. (a) | 927 | 42,253 |

| | | | 55,113,850 |

| Computer & Electronics Retail – 0.6% |

| Best Buy Co., Inc. | 70,129 | 6,962,407 |

|

| | | Shares | Value |

|

|

| GameStop Corp. Class A (a) | 19,516 | $ 2,125,878 |

| Rent-A-Center, Inc. | 22,118 | 932,274 |

| | | | 10,020,559 |

| Home Improvement Retail – 10.2% |

| Floor & Decor Holdings, Inc. Class A (a) | 28,981 | 3,150,814 |

| GrowGeneration Corp. (a) | 11,987 | 101,170 |

| Lowe's Cos., Inc. | 199,017 | 47,236,685 |

| Lumber Liquidators Holdings, Inc. (a) | 3,603 | 52,027 |

| The Home Depot, Inc. | 299,669 | 109,972,530 |

| | | | 160,513,226 |

| Homefurnishing Retail – 0.6% |

| Bed Bath & Beyond, Inc. (a) | 51,637 | 838,585 |

| Haverty Furniture Companies, Inc. | 15,799 | 466,386 |

| RH (a) | 5,572 | 2,244,513 |

| Sleep Number Corp. (a) | 11,671 | 834,476 |

| The Aaron's Co., Inc. | 13,515 | 286,113 |

| Williams-Sonoma, Inc. | 25,455 | 4,086,546 |

| | | | 8,756,619 |

| Specialty Stores – 2.1% |

| Academy Sports & Outdoors, Inc. (a) | 2,156 | 83,868 |

| Bath & Body Works, Inc. | 85,019 | 4,767,015 |

| Dick's Sporting Goods, Inc. | 24,354 | 2,810,452 |

| Five Below, Inc. (a) | 18,628 | 3,054,992 |

| Hibbett, Inc. | 11,069 | 682,404 |

| Leslie's, Inc. (a) | 4,199 | 87,465 |

| MarineMax, Inc. (a) | 15,398 | 724,630 |

| National Vision Holdings, Inc. (a) | 34,167 | 1,396,747 |

| Party City Holdings, Inc. (a) | 7,691 | 36,378 |

| Petco Health & Wellness Co., Inc. (a) | 2,181 | 40,894 |

| Sally Beauty Holdings, Inc. (a) | 55,771 | 957,588 |

| Signet Jewelers Ltd. | 23,236 | 2,001,317 |

| Sportsman's Warehouse Holdings, Inc. (a) | 5,004 | 54,844 |

| The Container Store Group, Inc. (a) | 4,205 | 42,891 |

| The ODP Corp. (a) | 24,658 | 1,090,623 |

| Tractor Supply Co. | 36,126 | 7,886,667 |

| Ulta Beauty, Inc. (a) | 16,573 | 6,028,263 |

| Winmark Corp. | 3,032 | 653,154 |

| | | | 32,400,192 |

| TOTAL SPECIALTY RETAIL | 321,933,274 |

| TEXTILES, APPAREL & LUXURY GOODS – 6.7% |

| Apparel, Accessories & Luxury Goods – 2.6% |

| Capri Holdings Ltd. (a) | 52,164 | 3,133,491 |

| Carter's, Inc. | 17,101 | 1,592,445 |

| Columbia Sportswear Co. | 12,780 | 1,186,879 |

| G-III Apparel Group Ltd. (a) | 26,501 | 720,032 |

See accompanying notes which are an integral part of the financial statements.

Fidelity® MSCI Consumer Discretionary Index ETF

Schedule of Investments (Unaudited)–continued

| Common Stocks – continued |

| | | Shares | Value |

| TEXTILES, APPAREL & LUXURY GOODS – continued |

| Apparel, Accessories & Luxury Goods – continued |

| Hanesbrands, Inc. | 125,100 | $ 2,014,110 |

| Kontoor Brands, Inc. | 21,585 | 1,063,925 |

| Levi Strauss & Co. Class A | 33,697 | 738,975 |

| Lululemon Athletica, Inc. (a) | 35,848 | 11,964,629 |

| Movado Group, Inc. | 1,731 | 64,168 |

| Oxford Industries, Inc. | 10,078 | 830,326 |

| PVH Corp. | 25,236 | 2,397,672 |

| Ralph Lauren Corp. | 17,951 | 1,989,689 |

| Tapestry, Inc. | 92,521 | 3,511,172 |

| Under Armour, Inc. Class A (a) | 73,555 | 1,385,041 |

| Under Armour, Inc. Class C (a) | 83,133 | 1,329,297 |

| VF Corp. | 102,756 | 6,700,719 |

| | | | 40,622,570 |

| Footwear – 4.1% |

| Crocs, Inc. (a) | 23,233 | 2,384,170 |

| Deckers Outdoor Corp. (a) | 9,597 | 3,073,247 |

| NIKE, Inc. Class B | 365,738 | 54,154,826 |

| Skechers U.S.A., Inc. Class A (a) | 50,163 | 2,106,846 |

| Steven Madden Ltd. | 34,437 | 1,416,738 |

| Wolverine World Wide, Inc. | 35,510 | 940,660 |

| | | | 64,076,487 |

| TOTAL TEXTILES, APPAREL & LUXURY GOODS | 104,699,057 |

TOTAL COMMON STOCKS

(Cost $1,316,246,341) | 1,571,642,640 |

| Money Market Fund – 0.1% |

| | | Shares | Value |

State Street Institutional Treasury Plus Money Market Fund, Trust Class, 0.01% (c)

(Cost $1,810,000) | 1,810,000 | $ 1,810,000 |

TOTAL INVESTMENT IN SECURITIES – 100.0%

(Cost $1,318,056,341) | 1,573,452,640 |

| NET OTHER ASSETS (LIABILITIES) – 0.0% | 661,265 |

| NET ASSETS – 100.0% | $1,574,113,905 |

| Legend | |

| (a) | Non-income producing. |

| (b) | Level 3 security. |

| (c) | The rate quoted is the annualized seven-day yield of the fund at period end. |

| Futures Contracts |

| | Number of

contracts | Expiration

Date | Notional

Amount | Value | Unrealized

Appreciation/

(Depreciation) |

| Purchased | | | | | |

| Equity Index Contracts | | | | | |

| CME E-mini Russell 2000 Index Contracts (United States) | 4 | March 2022 | $ 404,880 | $ (22,414) | $ (22,414) |

| CME E-mini S&P Consumer Discretionary Select Sector Index Contracts (United States) | 10 | March 2022 | 1,866,400 | (114,692) | (114,692) |

| Total Equity Index Contracts | | | | | $ (137,106) |

The notional amount of futures purchased as a percentage of Net Assets is 0.1%

See accompanying notes which are an integral part of the financial statements.

Investment Valuation

The following is a summary of the inputs used, as of January 31, 2022, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

Valuation Inputs at Reporting Date:

| Description | | Total | | Level 1 | | Level 2 | Level 3 | |

| Investments in Securities: | | | | | | | | |

| Common Stocks | | $ 1,571,642,640 | | $ 1,571,642,640 | | $ — | $ — | |

| Money Market Funds | | 1,810,000 | | 1,810,000 | | — | — | |

| Total Investments in Securities: | | $ 1,573,452,640 | | $ 1,573,452,640 | | $ — | $ — | |

| Derivative Instruments: | | | | | | | | |

| Liabilities | | | | | | | | |

| Futures Contracts | | $ (137,106) | | $ (137,106) | | $ — | $ — | |

| Total Liabilities | | $ (137,106) | | $ (137,106) | | $ — | $ — | |

| Total Derivative Instruments: | | $ (137,106) | | $ (137,106) | | $ — | $ — | |

Value of Derivative Instruments

The following table is a summary of the Fund’s value of derivative instruments by primary risk exposure as of January 31, 2022. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk/ Derivative Type | Value |

| | Asset | | Liabilities |

| Equity Risk | | | |

| Futures Contracts(a) | $0 | | $(137,106) |

| Total Equity Risk | 0 | | (137,106) |

| Total Value of Derivatives | $0 | | $(137,106) |

| (a) | Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in total accumulated earnings (loss). |

See accompanying notes which are an integral part of the financial statements.

Fidelity® MSCI Consumer Staples Index ETF

Schedule of Investments January 31, 2022 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks – 99.7% |

| | | Shares | Value |

| BEVERAGES – 22.8% |

| Brewers – 0.6% |

| Molson Coors Beverage Co. Class B | 84,919 | $4,047,239 |

| The Boston Beer Co., Inc. Class A (a) | 4,508 | 1,897,102 |

| | | | 5,944,341 |

| Distillers & Vintners – 2.7% |

| Brown-Forman Corp. Class B | 125,682 | 8,474,737 |

| Constellation Brands, Inc. Class A | 66,673 | 15,851,506 |

| MGP Ingredients, Inc. | 15,865 | 1,200,346 |

| The Duckhorn Portfolio, Inc. (a) | 30,431 | 607,403 |

| | | | 26,133,992 |

| Soft Drinks – 19.5% |

| Celsius Holdings, Inc. (a) | 22,242 | 1,061,611 |

| Coca-Cola Bottling Co. Consolidated | 3,540 | 2,028,420 |

| Keurig Dr Pepper, Inc. | 283,809 | 10,770,551 |

| Monster Beverage Corp. (a) | 159,607 | 13,841,119 |

| National Beverage Corp. | 26,533 | 1,185,229 |

| PepsiCo, Inc. | 448,708 | 77,859,812 |

| The Coca-Cola Co. | 1,333,804 | 81,375,382 |

| | | | 188,122,124 |

| TOTAL BEVERAGES | 220,200,457 |

| FOOD & STAPLES RETAILING – 22.1% |

| Drug Retail – 1.6% |

| Rite Aid Corp. (a) | 71,231 | 755,761 |

| Walgreens Boots Alliance, Inc. | 293,764 | 14,617,697 |

| | | | 15,373,458 |

| Food Distributors – 2.9% |

| Performance Food Group Co. (a) | 75,191 | 3,172,308 |

| SpartanNash Co. | 47,023 | 1,155,355 |

| Sysco Corp. | 199,916 | 15,623,435 |

| The Andersons, Inc. | 34,067 | 1,297,953 |

| The Chefs' Warehouse, Inc. (a) | 36,859 | 1,099,873 |

| United Natural Foods, Inc. (a) | 48,999 | 1,900,181 |

| US Foods Holding Corp. (a) | 99,862 | 3,521,134 |

| | | | 27,770,239 |

| Food Retail – 2.3% |

| Casey's General Stores, Inc. | 17,168 | 3,224,322 |

| Grocery Outlet Holding Corp. (a) | 57,868 | 1,468,690 |

| Ingles Markets, Inc. Class A | 18,189 | 1,399,280 |

| Sprouts Farmers Market, Inc. (a) | 71,269 | 1,934,241 |

| The Kroger Co. | 298,177 | 12,997,535 |

| Weis Markets, Inc. | 18,393 | 1,107,994 |

| | | | 22,132,062 |

| Hypermarkets & Super Centers – 15.3% |

| BJ's Wholesale Club Holdings, Inc. (a) | 64,852 | 3,986,452 |

| Costco Wholesale Corp. | 143,521 | 72,496,763 |

| PriceSmart, Inc. | 17,553 | 1,253,460 |

|

| | | Shares | Value |

|

|

| Walmart, Inc. | 498,504 | $ 69,695,844 |

| | | | 147,432,519 |

| TOTAL FOOD & STAPLES RETAILING | 212,708,278 |

| FOOD PRODUCTS – 20.1% |

| Agricultural Products – 3.3% |

| AppHarvest, Inc. (a) | 82,536 | 246,782 |

| Archer-Daniels-Midland Co. | 224,394 | 16,829,550 |

| Bunge Ltd. | 62,152 | 6,144,347 |

| Darling Ingredients, Inc. (a) | 74,187 | 4,730,905 |

| Fresh Del Monte Produce, Inc. | 34,763 | 967,454 |

| Ingredion, Inc. | 32,804 | 3,106,539 |

| | | | 32,025,577 |

| Packaged Foods & Meats – 16.8% |

| B&G Foods, Inc. | 46,726 | 1,453,179 |

| Beyond Meat, Inc. (a) | 26,972 | 1,756,686 |

| Calavo Growers, Inc. | 19,961 | 826,585 |

| Cal-Maine Foods, Inc. | 32,249 | 1,257,711 |

| Campbell Soup Co. | 88,965 | 3,925,136 |

| Conagra Brands, Inc. | 200,056 | 6,953,947 |

| Flowers Foods, Inc. | 102,012 | 2,869,598 |

| Freshpet, Inc. (a) | 22,055 | 2,051,777 |

| General Mills, Inc. | 238,916 | 16,408,751 |

| Hormel Foods Corp. | 125,303 | 5,948,133 |

| Hostess Brands, Inc. (a) | 90,843 | 1,864,098 |

| J&J Snack Foods Corp. | 9,817 | 1,489,141 |

| John B Sanfilippo & Son, Inc. | 11,037 | 873,027 |

| Kellogg Co. | 106,099 | 6,684,237 |

| Lamb Weston Holdings, Inc. | 64,703 | 4,154,580 |

| Lancaster Colony Corp. | 10,779 | 1,711,382 |

| McCormick & Co., Inc. (non-vtg.) | 100,608 | 10,091,988 |

| Mission Produce, Inc. (a) | 21,115 | 301,311 |

| Mondelez International, Inc. Class A | 546,219 | 36,613,060 |

| Pilgrim's Pride Corp. (a) | 42,725 | 1,195,018 |

| Post Holdings, Inc. (a) | 28,516 | 3,017,563 |

| Sanderson Farms, Inc. | 11,095 | 2,041,480 |

| Seaboard Corp. | 284 | 1,084,877 |

| Tattooed Chef, Inc. (a) | 56,606 | 718,896 |

| The Hain Celestial Group, Inc. (a) | 60,800 | 2,221,024 |

| The Hershey Co. | 59,695 | 11,764,094 |

| The JM Smucker Co. | 46,800 | 6,579,144 |

| The Kraft Heinz Co. | 270,362 | 9,678,960 |

| The Simply Good Foods Co. (a) | 56,069 | 1,975,311 |

| Tootsie Roll Industries, Inc. | 23,691 | 804,309 |

| TreeHouse Foods, Inc. (a) | 39,298 | 1,522,011 |

| Tyson Foods, Inc. Class A | 118,424 | 10,763,557 |

| Utz Brands, Inc. | 60,395 | 972,963 |

| Vital Farms, Inc. (a) | 23,936 | 395,662 |

| | | | 161,969,196 |

| TOTAL FOOD PRODUCTS | 193,994,773 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks – continued |

| | | Shares | Value |

| HOUSEHOLD PRODUCTS – 21.4% |

| Household Products – 21.4% |

| Central Garden and Pet Co. (a) | 14,352 | $ 665,789 |

| Central Garden and Pet Co. Class A (a) | 31,720 | 1,374,428 |

| Church & Dwight Co., Inc. | 103,281 | 10,601,795 |

| Colgate-Palmolive Co. | 314,641 | 25,942,150 |

| Energizer Holdings, Inc. | 40,017 | 1,505,039 |

| Kimberly-Clark Corp. | 134,507 | 18,514,889 |

| Reynolds Consumer Products, Inc. | 46,348 | 1,402,954 |

| Spectrum Brands Holdings, Inc. | 25,924 | 2,317,087 |

| The Clorox Co. | 51,767 | 8,689,609 |

| The Procter & Gamble Co. | 833,503 | 133,735,556 |

| WD-40 Co. | 8,694 | 1,932,328 |

| TOTAL HOUSEHOLD PRODUCTS | 206,681,624 |

| PERSONAL PRODUCTS – 4.4% |

| Personal Products – 4.4% |

| BellRing Brands, Inc. Class A (a) | 35,695 | 869,530 |

| Coty, Inc. Class A (a) | 188,274 | 1,596,564 |

| Edgewell Personal Care Co. | 34,500 | 1,580,100 |

| elf Beauty, Inc. (a) | 40,383 | 1,193,722 |

| Herbalife Nutrition Ltd. (a) | 56,160 | 2,387,362 |

| Inter Parfums, Inc. | 15,732 | 1,556,996 |

| Medifast, Inc. | 7,437 | 1,477,806 |

| Nu Skin Enterprises, Inc. Class A | 31,791 | 1,532,008 |

| The Beauty Health Co. (a) | 46,591 | 661,592 |

| The Estee Lauder Cos., Inc. Class A | 88,658 | 27,642,678 |

| The Honest Co., Inc. (a) | 40,670 | 263,948 |

| USANA Health Sciences, Inc. (a) | 11,561 | 1,105,000 |

| Veru, Inc. (a) | 95,397 | 496,065 |

| TOTAL PERSONAL PRODUCTS | 42,363,371 |

|

| | | Shares | Value |

| TOBACCO – 8.9% |

| Tobacco – 8.9% |

| Altria Group, Inc. | 705,122 | $ 35,876,608 |

| Philip Morris International, Inc. | 455,712 | 46,869,979 |

| Turning Point Brands, Inc. | 21,339 | 751,773 |

| Universal Corp. | 22,933 | 1,248,243 |

| Vector Group Ltd. | 95,408 | 1,059,983 |

| TOTAL TOBACCO | 85,806,586 |

TOTAL COMMON STOCKS

(Cost $817,375,313) | 961,755,089 |

| Money Market Fund – 0.2% |

| | | | |

State Street Institutional Treasury Plus Money Market Fund, Trust Class, 0.01% (b)

(Cost $1,650,000) | 1,650,000 | 1,650,000 |

TOTAL INVESTMENT IN SECURITIES – 99.9%

(Cost $819,025,313) | 963,405,089 |

| NET OTHER ASSETS (LIABILITIES) – 0.1% | 1,262,459 |

| NET ASSETS – 100.0% | $ 964,667,548 |

| Legend | |

| (a) | Non-income producing. |

| (b) | The rate quoted is the annualized seven-day yield of the fund at period end. |

| Futures Contracts |

| | Number of

contracts | Expiration

Date | Notional

Amount | Value | Unrealized

Appreciation/

(Depreciation) |

| Purchased | | | | | |

| Equity Index Contracts | | | | | |

| CME E-mini Russell 2000 Index Contracts (United States) | 1 | March 2022 | $ 101,220 | $ (3,412) | $ (3,412) |

| CME E-mini S&P Consumer Staples Select Sector Index Contracts (United States) | 35 | March 2022 | 2,673,300 | (1,305) | (1,305) |

| Total Equity Index Contracts | | | | | $ (4,717) |

The notional amount of futures purchased as a percentage of Net Assets is 0.3%

See accompanying notes which are an integral part of the financial statements.

Fidelity® MSCI Consumer Staples Index ETF

Schedule of Investments (Unaudited)–continued

Investment Valuation

The following is a summary of the inputs used, as of January 31, 2022, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

Valuation Inputs at Reporting Date:

| Description | | Total | | Level 1 | | Level 2 | Level 3 | |

| Investments in Securities: | | | | | | | | |

| Common Stocks | | $ 961,755,089 | | $ 961,755,089 | | $ — | $ — | |

| Money Market Funds | | 1,650,000 | | 1,650,000 | | — | — | |

| Total Investments in Securities: | | $ 963,405,089 | | $ 963,405,089 | | $ — | $ — | |

| Derivative Instruments: | | | | | | | | |

| Liabilities | | | | | | | | |

| Futures Contracts | | $ (4,717) | | $ (4,717) | | $ — | $ — | |

| Total Liabilities | | $ (4,717) | | $ (4,717) | | $ — | $ — | |

| Total Derivative Instruments: | | $ (4,717) | | $ (4,717) | | $ — | $ — | |

Value of Derivative Instruments

The following table is a summary of the Fund’s value of derivative instruments by primary risk exposure as of January 31, 2022. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk/ Derivative Type | Value |

| | Asset | | Liabilities |

| Equity Risk | | | |

| Futures Contracts(a) | $0 | | $(4,717) |

| Total Equity Risk | 0 | | (4,717) |

| Total Value of Derivatives | $0 | | $(4,717) |

| (a) | Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in total accumulated earnings (loss). |

See accompanying notes which are an integral part of the financial statements.

Fidelity® MSCI Energy Index ETF

Schedule of Investments January 31, 2022 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks – 99.7% |

| | | Shares | Value |

| ENERGY EQUIPMENT & SERVICES – 9.6% |

| Oil & Gas Drilling – 0.7% |

| Helmerich & Payne, Inc. | 87,885 | $ 2,522,299 |

| Nabors Industries Ltd. (a) | 6,045 | 625,718 |

| Noble Corp. (a) | 36,839 | 909,555 |

| Patterson-UTI Energy, Inc. | 152,877 | 1,522,655 |

| Transocean Ltd. (a) | 502,513 | 1,582,916 |

| Valaris Ltd. (a) | 21,440 | 889,546 |

| | | | 8,052,689 |

| Oil & Gas Equipment & Services – 8.9% |

| Archrock, Inc. | 102,110 | 861,808 |

| Aspen Aerogels, Inc. (a) | 22,081 | 655,806 |

| Baker Hughes Co. | 674,304 | 18,502,902 |

| Bristow Group, Inc. (a) | 6,089 | 200,024 |

| Cactus, Inc. Class A | 47,613 | 2,307,326 |

| ChampionX Corp. (a) | 165,418 | 3,705,363 |

| Core Laboratories N.V. | 37,810 | 1,008,393 |

| DMC Global, Inc. (a) | 15,651 | 631,361 |

| Dril-Quip, Inc. (a) | 27,600 | 698,004 |

| Expro Group Holdings N.V. (a) | 21,757 | 340,715 |

| Halliburton Co. | 724,288 | 22,264,613 |

| Helix Energy Solutions Group, Inc. (a) | 120,154 | 424,143 |

| Liberty Oilfield Services, Inc. Class A (a) | 79,692 | 964,273 |

| NexTier Oilfield Solitions, Inc. (a) | 134,949 | 812,393 |

| NOV, Inc. | 315,123 | 5,174,320 |

| Oceaneering International, Inc. (a) | 82,414 | 1,073,854 |

| ProPetro Holding Corp. (a) | 64,490 | 677,790 |

| RPC, Inc. (a) | 55,332 | 327,012 |

| Schlumberger N.V. | 1,138,898 | 44,496,745 |

| Select Energy Services, Inc. Class A (a) | 54,222 | 361,661 |

| TechnipFMC PLC (a) | 345,669 | 2,243,392 |

| US Silica Holdings, Inc. (a) | 62,091 | 592,969 |

| Weatherford International PLC (a) | 56,556 | 1,696,680 |

| | | | 110,021,547 |

| TOTAL ENERGY EQUIPMENT & SERVICES | 118,074,236 |

| OIL, GAS & CONSUMABLE FUELS – 90.1% |

| Coal & Consumable Fuels – 0.3% |

| Arch Resources, Inc. | 12,655 | 1,197,669 |

| Centrus Energy Corp. (a) | 8,377 | 363,981 |

| CONSOL Energy, Inc. (a) | 27,198 | 591,285 |

| Peabody Energy Corp. (a) | 70,959 | 766,357 |

| Uranium Energy Corp. (a) | 192,922 | 503,526 |

| | | | 3,422,818 |

| Integrated Oil & Gas – 40.5% |

| Chevron Corp. | 1,577,019 | 207,109,905 |

| Exxon Mobil Corp. | 3,452,369 | 262,241,949 |

|

| | | Shares | Value |

|

|

| Occidental Petroleum Corp. | 761,228 | $ 28,675,459 |

| | | | 498,027,313 |

| Oil & Gas Exploration & Production – 30.2% |

| Antero Resources Corp. (a) | 230,548 | 4,502,603 |

| APA Corp. | 307,717 | 10,219,282 |

| Berry Corp. | 47,211 | 410,264 |

| Brigham Minerals, Inc. Class A | 37,581 | 813,253 |

| Cabot Oil & Gas Corp. | 628,992 | 13,774,925 |

| California Resources Corp. | 33,668 | 1,434,930 |

| Callon Petroleum Co. (a) | 38,066 | 1,881,983 |

| Centennial Resource Development, Inc. Class A (a) | 149,935 | 1,170,992 |

| Chesapeake Energy Corp. | 61,954 | 4,223,404 |

| Civitas Resources, Inc. | 41,506 | 2,262,077 |

| CNX Resources Corp. (a) | 177,007 | 2,625,014 |

| Comstock Resources, Inc. (a) | 67,737 | 526,994 |

| ConocoPhillips | 1,091,966 | 96,770,027 |

| Crescent Energy, Inc. (a) | 18,715 | 248,348 |

| Denbury, Inc. (a) | 41,138 | 3,091,109 |

| Devon Energy Corp. | 524,997 | 26,549,098 |

| Diamondback Energy, Inc. | 140,460 | 17,720,434 |

| EOG Resources, Inc. | 475,714 | 53,032,597 |

| EQT Corp. (a) | 261,408 | 5,554,920 |

| Gulfport Energy Corp. (a) | 10,204 | 667,852 |

| Hess Corp. | 227,119 | 20,960,813 |

| Kosmos Energy Ltd. (a) | 331,925 | 1,437,235 |

| Laredo Petroleum, Inc. (a) | 11,137 | 747,961 |

| Magnolia Oil & Gas Corp. Class A | 115,355 | 2,495,129 |

| Marathon Oil Corp. | 641,941 | 12,498,591 |

| Matador Resources Co. | 95,705 | 4,284,713 |

| Murphy Oil Corp. | 126,420 | 3,994,872 |

| Northern Oil and Gas, Inc. | 49,919 | 1,174,095 |

| Oasis Petroleum, Inc. | 16,573 | 2,244,481 |

| Ovintiv, Inc. | 213,408 | 8,280,230 |

| PDC Energy, Inc. | 80,977 | 4,799,507 |

| Pioneer Natural Resources Co. | 189,052 | 41,381,592 |

| Range Resources Corp. (a) | 201,519 | 3,879,241 |

| SM Energy Co. | 94,358 | 3,095,886 |

| Southwestern Energy Co. (a) | 554,751 | 2,440,904 |

| Talos Energy, Inc. (a) | 22,833 | 242,943 |

| Tellurian, Inc. (a) | 310,528 | 779,425 |

| Texas Pacific Land Corp. | 5,070 | 5,450,250 |

| Viper Energy Partners LP | 47,736 | 1,290,781 |

| Whiting Petroleum Corp. (a) | 31,836 | 2,363,823 |

| | | | 371,322,578 |

| Oil & Gas Refining & Marketing – 8.8% |

| Alto Ingredients, Inc. (a) | 58,515 | 303,108 |

| Clean Energy Fuels Corp. (a) | 135,469 | 822,297 |

| CVR Energy, Inc. | 25,274 | 493,601 |

| Delek US Holdings, Inc. (a) | 55,088 | 854,966 |

| Gevo, Inc. (a) | 162,798 | 556,769 |

See accompanying notes which are an integral part of the financial statements.

Fidelity® MSCI Energy Index ETF

Schedule of Investments (Unaudited)–continued

| Common Stocks – continued |

| | | Shares | Value |

| OIL, GAS & CONSUMABLE FUELS – continued |

| Oil & Gas Refining & Marketing – continued |

| Green Plains, Inc. (a) | 37,085 | $ 1,132,576 |

| HollyFrontier Corp. | 125,469 | 4,411,490 |

| Marathon Petroleum Corp. | 520,920 | 37,376,010 |

| Par Pacific Holdings, Inc. (a) | 36,973 | 521,319 |

| PBF Energy, Inc. Class A (a) | 79,366 | 1,257,157 |

| Phillips 66 | 357,026 | 30,272,235 |

| Renewable Energy Group, Inc. (a) | 41,227 | 1,659,799 |

| REX American Resources Corp. (a) | 4,499 | 433,839 |

| Valero Energy Corp. | 333,342 | 27,657,386 |

| World Fuel Services Corp. | 51,607 | 1,455,833 |

| | | | 109,208,385 |

| Oil & Gas Storage & Transportation – 10.3% |

| Antero Midstream Corp. | 254,608 | 2,533,350 |

| Cheniere Energy, Inc. | 197,537 | 22,104,390 |

| Dorian LPG Ltd. | 26,557 | 315,763 |

| DTE Midstream LLC (a) | 79,199 | 4,094,588 |

| EnLink Midstream LLC | 220,850 | 1,757,966 |

| Equitrans Midstream Corp. | 334,458 | 2,712,454 |

| Hess Midstream LP | 26,818 | 787,376 |

| International Seaways, Inc. | 31,945 | 466,078 |

| Kinder Morgan, Inc. | 1,661,422 | 28,842,286 |

| ONEOK, Inc. | 364,099 | 22,093,527 |

| Plains GP Holdings LP Class A | 151,525 | 1,747,083 |

|

| | | Shares | Value |

|

|

| Targa Resources Corp. | 168,556 | $ 9,958,289 |

| The Williams Cos., Inc. | 992,498 | 29,715,390 |

| | | | 127,128,540 |

| TOTAL OIL, GAS & CONSUMABLE FUELS | 1,109,109,634 |

TOTAL COMMON STOCKS

(Cost $960,170,092) | 1,227,183,870 |

| Money Market Fund – 0.2% |

| | | | |

State Street Institutional Treasury Plus Money Market Fund, Trust Class, 0.01% (b)

(Cost $1,920,000) | 1,920,000 | 1,920,000 |

TOTAL INVESTMENT IN SECURITIES – 99.9%

(Cost $962,090,092) | 1,229,103,870 |

| NET OTHER ASSETS (LIABILITIES) – 0.1% | 1,161,701 |

| NET ASSETS – 100.0% | $1,230,265,571 |

| Legend | |

| (a) | Non-income producing. |

| (b) | The rate quoted is the annualized seven-day yield of the fund at period end. |

| Futures Contracts |

| | Number of

contracts | Expiration

Date | Notional

Amount | Value | Unrealized

Appreciation/

(Depreciation) |

| Purchased | | | | | |

| Equity Index Contract | | | | | |

| CME E-mini S&P Energy Select Sector Index Contracts (United States) | 42 | March 2022 | $2,883,300 | $253,753 | $253,753 |

The notional amount of futures purchased as a percentage of Net Assets is 0.2%

See accompanying notes which are an integral part of the financial statements.

Investment Valuation

The following is a summary of the inputs used, as of January 31, 2022, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

Valuation Inputs at Reporting Date:

| Description | | Total | | Level 1 | | Level 2 | Level 3 | |

| Investments in Securities: | | | | | | | | |

| Common Stocks | | $ 1,227,183,870 | | $ 1,227,183,870 | | $ — | $ — | |

| Money Market Funds | | 1,920,000 | | 1,920,000 | | — | — | |

| Total Investments in Securities: | | $ 1,229,103,870 | | $ 1,229,103,870 | | $ — | $ — | |

| Derivative Instruments: | | | | | | | | |

| Assets | | | | | | | | |

| Futures Contracts | | $ 253,753 | | $ 253,753 | | $ — | $ — | |

| Total Assets | | $ 253,753 | | $ 253,753 | | $ — | $ — | |

| Total Derivative Instruments: | | $ 253,753 | | $ 253,753 | | $ — | $ — | |

Value of Derivative Instruments

The following table is a summary of the Fund’s value of derivative instruments by primary risk exposure as of January 31, 2022. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk/ Derivative Type | Value |

| | Asset | | Liabilities |

| Equity Risk | | | |

| Futures Contracts(a) | $253,753 | | $0 |

| Total Equity Risk | 253,753 | | 0 |

| Total Value of Derivatives | $253,753 | | $0 |

| (a) | Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in total accumulated earnings (loss). |

See accompanying notes which are an integral part of the financial statements.

Fidelity® MSCI Financials Index ETF

Schedule of Investments January 31, 2022 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks – 99.7% |

| | | Shares | Value |

| BANKS – 38.1% |

| Diversified Banks – 23.1% |

| Bank of America Corp. | 2,757,006 | $ 127,208,257 |

| Citigroup, Inc. | 737,440 | 48,022,093 |

| JPMorgan Chase & Co. | 1,087,617 | 161,619,886 |

| US Bancorp | 513,246 | 29,865,784 |

| Wells Fargo & Co. | 1,495,106 | 80,436,703 |

| | | | 447,152,723 |

| Regional Banks – 15.0% |

| 1st Source Corp. | 8,186 | 408,318 |

| Allegiance Bancshares, Inc. | 6,913 | 304,379 |

| Amalgamated Financial Corp. | 5,700 | 96,957 |

| Amerant Bancorp, Inc. | 8,173 | 277,882 |

| Ameris Bancorp | 25,046 | 1,235,018 |

| Arrow Financial Corp. | 7,111 | 251,587 |

| Associated Banc-Corp. | 62,708 | 1,498,721 |

| Atlantic Union Bankshares Corp. | 30,184 | 1,229,092 |

| Banc of California, Inc. | 20,088 | 388,100 |

| Bancfirst Corp. | 7,309 | 547,810 |

| Bank First Corp. | 2,797 | 195,762 |

| Bank of Hawaii Corp. | 16,445 | 1,415,421 |

| Bank of Marin Bancorp | 6,507 | 242,646 |

| Bank OZK | 45,374 | 2,125,772 |

| BankUnited, Inc. | 28,307 | 1,181,817 |

| Banner Corp. | 7,992 | 496,383 |

| Bar Harbor Bankshares | 6,091 | 186,019 |

| Berkshire Hills Bancorp, Inc. | 15,531 | 459,562 |

| BOK Financial Corp. | 11,422 | 1,171,326 |

| Brookline Bancorp, Inc. | 17,341 | 296,531 |

| Byline Bancorp, Inc. | 9,987 | 259,662 |

| Cadence Bank | 55,513 | 1,730,340 |

| Camden National Corp. | 6,761 | 335,751 |

| Capital City Bank Group, Inc. | 6,105 | 168,864 |

| Cathay General Bancorp | 29,071 | 1,312,846 |

| CBTX, Inc. | 6,810 | 200,418 |

| Central Pacific Financial Corp. | 5,914 | 172,097 |

| Citizens Financial Group, Inc. | 155,839 | 8,021,033 |

| City Holding Co. | 3,499 | 280,655 |

| Columbia Banking System, Inc. | 26,291 | 914,138 |

| Comerica, Inc. | 49,521 | 4,594,558 |

| Commerce Bancshares, Inc. | 41,958 | 2,891,326 |

| Community Bank System, Inc. | 17,089 | 1,220,496 |

| Community Trust Bancorp, Inc. | 7,906 | 349,366 |

| ConnectOne Bancorp, Inc. | 14,047 | 449,644 |

| CrossFirst Bankshares, Inc. (a) | 18,388 | 284,278 |

| Cullen/Frost Bankers, Inc. | 22,526 | 3,176,391 |

| Customers Bancorp, Inc. (a) | 11,010 | 641,883 |

| CVB Financial Corp. | 46,312 | 1,020,253 |

| Dime Community Bancshares, Inc. | 13,386 | 467,975 |

| Eagle Bancorp, Inc. | 8,214 | 492,594 |

| East West Bancorp, Inc. | 52,341 | 4,519,122 |

|

| | | Shares | Value |

|

|

| Eastern Bankshares, Inc. | 62,628 | $ 1,333,350 |

| Enterprise Financial Services Corp. | 14,180 | 702,477 |

| FB Financial Corp. | 12,477 | 555,476 |

| Fifth Third Bancorp | 252,100 | 11,251,223 |

| First Bancorp | 12,741 | 559,457 |

| First BanCorp | 62,566 | 910,335 |

| First Busey Corp. | 21,851 | 609,206 |

| First Citizens BancShares, Inc. Class A | 4,382 | 3,413,929 |

| First Commonwealth Financial Corp. | 21,144 | 350,145 |

| First Community Bankshares, Inc. | 7,685 | 239,849 |

| First Financial Bancorp | 23,110 | 582,603 |

| First Financial Bankshares, Inc. | 50,064 | 2,352,507 |

| First Financial Corp. | 5,498 | 246,805 |

| First Foundation, Inc. | 18,254 | 477,342 |

| First Hawaiian, Inc. | 50,028 | 1,418,294 |

| First Horizon Corp. | 202,779 | 3,469,549 |

| First Interstate Bancsystem, Inc. Class A | 16,760 | 615,930 |

| First Merchants Corp. | 22,148 | 939,740 |

| First Mid Bancshares, Inc. | 6,547 | 269,409 |

| First Midwest Bancorp, Inc. | 36,342 | 754,823 |

| First Republic Bank | 64,414 | 11,181,626 |

| Flushing Financial Corp. | 10,795 | 254,870 |

| FNB Corp. | 128,645 | 1,662,093 |

| Fulton Financial Corp. | 69,380 | 1,245,371 |

| German American Bancorp, Inc. | 9,871 | 390,892 |

| Glacier Bancorp, Inc. | 38,632 | 2,006,160 |

| Great Southern Bancorp, Inc. | 5,650 | 335,271 |

| Great Western Bancorp, Inc. | 19,345 | 597,374 |

| Hancock Whitney Corp. | 32,505 | 1,713,664 |

| Harborone Bancorp, Inc. | 22,710 | 322,482 |

| Heartland Financial USA, Inc. | 16,268 | 846,424 |

| Heritage Commerce Corp. | 26,082 | 324,982 |

| Heritage Financial Corp. | 7,803 | 189,301 |

| Hilltop Holdings, Inc. | 24,296 | 802,497 |

| Home BancShares, Inc. | 58,878 | 1,387,166 |

| HomeStreet, Inc. | 4,801 | 234,049 |

| Hope Bancorp, Inc. | 32,600 | 546,050 |

| Horizon Bancorp, Inc. | 15,013 | 320,227 |

| Huntington Bancshares, Inc. | 540,326 | 8,137,310 |

| Independent Bank Corp. | 8,920 | 218,362 |

| Independent Bank Corp./MA | 15,394 | 1,298,484 |

| Independent Bank Group, Inc. | 14,341 | 1,088,769 |

| International Bancshares Corp. | 20,616 | 866,490 |

| Investors Bancorp, Inc. | 86,033 | 1,404,059 |

| KeyCorp | 350,486 | 8,783,179 |

| Lakeland Bancorp, Inc. | 26,191 | 495,796 |

| Lakeland Financial Corp. | 9,231 | 737,834 |

| Live Oak Bancshares, Inc. | 11,868 | 698,550 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks – continued |

| | | Shares | Value |

| BANKS – continued |

| Regional Banks – continued |

| M&T Bank Corp. | 47,377 | $ 8,024,716 |

| Mercantile Bank Corp. | 7,454 | 286,755 |

| Meta Financial Group, Inc. | 7,728 | 459,507 |

| Metropolitan Bank Holding Corp. (a) | 3,623 | 362,300 |

| Midland States Bancorp, Inc. | 9,906 | 285,986 |

| MidWestOne Financial Group, Inc. | 7,013 | 223,925 |

| National Bank Holdings Corp. Class A | 6,487 | 294,510 |

| NBT Bancorp, Inc. | 11,425 | 441,919 |

| Nicolet Bankshares, Inc. (a) | 4,889 | 455,117 |

| OceanFirst Financial Corp. | 23,955 | 543,779 |

| OFG Bancorp | 13,558 | 375,150 |

| Old National Bancorp | 46,343 | 849,467 |

| Origin Bancorp, Inc. | 8,755 | 374,014 |

| Pacific Premier Bancorp, Inc. | 29,158 | 1,115,294 |

| PacWest Bancorp | 43,214 | 2,006,426 |

| Park National Corp. | 5,956 | 806,800 |

| Peapack-Gladstone Financial Corp. | 7,939 | 292,473 |

| Peoples Bancorp, Inc. | 11,050 | 366,308 |

| People's United Financial, Inc. | 160,454 | 3,109,599 |

| Pinnacle Financial Partners, Inc. | 28,024 | 2,710,201 |

| Popular, Inc. | 30,247 | 2,697,125 |

| Preferred Bank | 2,271 | 177,274 |

| Prosperity Bancshares, Inc. | 34,878 | 2,554,813 |

| QCR Holdings, Inc. | 6,425 | 366,482 |

| Regions Financial Corp. | 348,770 | 8,000,784 |

| Renasant Corp. | 15,826 | 582,080 |

| Republic Bancorp, Inc. Class A | 4,337 | 212,600 |

| S&T Bancorp, Inc. | 8,188 | 252,272 |

| Sandy Spring Bancorp, Inc. | 19,187 | 907,737 |

| Seacoast Banking Corp. of Florida | 20,017 | 730,621 |

| ServisFirst Bancshares, Inc. | 18,186 | 1,543,446 |

| Signature Bank | 22,140 | 6,744,508 |

| Silvergate Capital Corp. (a) | 10,894 | 1,173,720 |

| Simmons First National Corp. Class A | 37,934 | 1,084,912 |

| Southside Bancshares, Inc. | 10,862 | 455,118 |

| SouthState Corp. | 25,850 | 2,181,998 |

| Sterling Bancorp | 72,788 | 1,913,597 |

| Stock Yards Bancorp, Inc. | 9,500 | 566,010 |

| SVB Financial Group (a) | 21,367 | 12,476,191 |

| Synovus Financial Corp. | 53,756 | 2,674,899 |

| Texas Capital Bancshares, Inc. (a) | 18,824 | 1,180,265 |

| The Bancorp, Inc. (a) | 18,083 | 539,235 |

| The First Bancshares, Inc. | 9,020 | 325,351 |

| The First of Long Island Corp. | 10,460 | 229,179 |

| The PNC Financial Services Group, Inc. | 155,198 | 31,969,236 |

|

| | | Shares | Value |

|

|

| Tompkins Financial Corp. | 6,023 | $ 479,190 |

| Towne Bank | 30,297 | 950,720 |

| Trico Bancshares | 12,039 | 523,335 |

| TriState Capital Holdings, Inc. (a) | 10,632 | 335,865 |

| Triumph Bancorp, Inc. (a) | 8,758 | 766,150 |