Statements of Operations. The Account’s portion of its cost basis (excluding selling costs) in the property at the date of the sale was $2.0 million (excluding debt) according to the records of the Account. Concurrent with the DDR joint venture’s sale of the property located in Augusta, Georgia, the DDR joint venture settled debt associated with the property with proceeds from the sale. The Account’s proportionate share of the debt was $0.7 million.

On April 1, 2011, two storage facilities located in Orem, Utah and Euless, Texas were sold by the Account’s Storage Portfolio I, LLC joint venture (“Storage Portfolio”). The Account holds a 75% interest in the Storage Portfolio. The Account’s portion of the net sales price was $5.4 million. The Account realized a gain from the sale of $1.3 million, the majority of which had been previously recognized as an unrealized gain in the Account’s Statements of Operations. The Account’s portion of its cost basis (excluding selling costs) in the property at the date of the sale was $4.1 million (excluding debt) according to the records of the Account. Concurrent with the sale of the facilities located in Utah and Texas, the Storage Portfolio settled debt associated with the property with proceeds from the sale. The Account’s proportionate share of the debt was $3.7 million.

On September 30, 2010 the Account repaid a total of $326.0 million of its mortgage loans payable associated with its wholly owned real estate investments at 701 Brickell and Four Oaks Place.

During February 2011, the revolving line of credit agreement held in the Account’s investment within the DDR joint venture was amended to extend the maturity date from February 2011 to February 2012. The maximum amount that may be drawn under this revolving line of credit agreement is $213.0 million, reduced by any outstanding letters of credit.

On April 1, 2011, the Storage Portfolio refinanced its debt obligation of $115.0 million (the Account’s 75% proportionate share of this debt pay-off was $86.3 million) by concurrently entering into a new loan agreement in the amount of $100.0 million (the Account’s 75% proportionate share is $75.0 million).

On August 10, 2010, a joint venture located in Orlando, Florida, in which the Account maintains a 50% ownership interest, obtained approximately $375.0 million in financing through two loans of approximately $187.5 million. A portion of the proceeds was used to repay an existing debt obligation within the joint venture of $240.6 million that had a fixed interest rate of 7.55%. These new obligations mature in 10 years and have fixed interest rates of 5.25%.

On July 2, 2010, the Account entered into a mortgage agreement in the principal amount of $24.0 million with a fixed interest rate of 4.43% for a period of 5 years.

San Montego Apartments—Houston, TX

On July 2, 2010, the Account entered into a mortgage agreement in the principal amount of $21.8 million with a fixed interest rate of 4.47% for a period of 5 years.

Montecito Apartments—Houston, TX

On July 2, 2010, the Account entered into a mortgage agreement in the principal amount of $20.3 million with a fixed interest rate of 4.47% for a period of 5 years.

Phoenician Apartments—Houston, TX

On July 2, 2010, the Account entered into a mortgage agreement in the principal amount of $21.3 million with a fixed interest rate of 4.47% for a period of 5 years.

Ashford Meadows—Herndon, VA

On July 2, 2010, the Account entered into a mortgage agreement in the principal amount of $44.6 million with a fixed interest rate of 5.17% for a period of 10 years.

The Legend at Kierland—Phoenix, AZ

On July 9, 2010, the Account entered into a mortgage agreement in the principal amount of $21.8 million with a fixed interest rate of 4.97% for a period of 7 years.

The Tradition at Kierland—Phoenix, AZ

On July 9, 2010, the Account entered into a mortgage agreement in the principal amount of $25.8 million with a fixed interest rate of 4.97% for a period of 7 years.

Red Canyon at Palomino Park—Denver, CO

On July 9, 2010, the Account entered into a mortgage agreement in the principal amount of $27.1 million with a fixed interest rate of 5.34% for a period of 10 years.

Green River at Palomino Park—Denver, CO

On July 9, 2010, the Account entered into a mortgage agreement in the principal amount of $33.2 million with a fixed interest rate of 5.34% for a period of 10 years.

Blue Ridge at Palomino Park—Denver, CO

On July 9, 2010, the Account entered into a mortgage agreement in the principal amount of $33.4 million with a fixed interest rate of 5.34% for a period of 10 years.

For additional details concerning these and other of the Account’s mortgage loans payable, see Note 8—Mortgage Loans Payable in the Account’s audited financial statements appearing elsewhere in this prospectus.

VALUING THE ACCOUNT’S ASSETS

We value the Account’s assets as of the close of each valuation day by taking the sum of:

| | |

| • | the value of the Account’s cash, cash equivalents, and short-term and other debt instruments; |

| | |

| • | the value of the Account’s other securities and other non-real estate assets; |

| | |

| • | the value of the individual real properties (based on the most recent valuation of that property) and other real estate-related investments owned by the Account; |

| | |

|

| • | an estimate of the net operating income accrued by the Account from its properties, other real estate-related investments and non-real estate-related |

TIAA Real Estate Account § Prospectus 55

| | |

|

| | investments (including short-term marketable securities) since the end of the prior valuation day; and |

| | |

| • | actual net operating income earned from the Account’s properties, other real estate-related investments and non-real estate-related investments (but only to the extent any such item of income differs from the estimated income accrued for on such investments), |

and then reducing the sum by the Account’s liabilities, including the daily investment management, administration and distribution fees and certain other fees and expenses attributable to operating the Account. Daily estimates of net operating income are adjusted to reflect actual net operating income on a monthly basis, at which time such adjustments (if any) are reflected in the Account’s unit value. See “Expense Deductions” on page 62.

Fair value for the Account’s assets is based upon quoted market prices in active exchange markets, where available. If listed prices or quotes in such markets are not available, fair value is based upon vendor-provided, evaluated prices or internally developed models that primarily use market-based or independently sourced market data, including interest rate yield curves, market spreads, and currency rates. Valuation adjustments may be made to reflect credit quality, a counterparty’s creditworthiness, the Account’s creditworthiness, liquidity, and other observable and unobservable data that are applied consistently over time.

The methods described above are considered to produce a fair value calculation that represents a good faith estimate as to what an unaffiliated buyer in the market place would pay to purchase the asset or receive to transfer the liability. Since fair value calculations involve significant professional judgment in the application of both observable and unobservable attributes, actual realizable values or future fair values may differ from amounts reported. Furthermore, while the Account believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments, while reasonable, could result in different estimates of fair value at the reporting date.

VALUING REAL ESTATE INVESTMENTS

Valuing Real Property: Investments in real estate properties are stated at fair value, as determined in accordance with policies and procedures reviewed by the Investment Committee of the TIAA Board of Trustees (the “Board”) and in accordance with the responsibilities of the Board as a whole. Accordingly, the Account does not record depreciation.

Fair value for real estate properties is defined as the price that would be received to sell the asset in an orderly transaction between market participants at the measurement date. Determination of fair value involves significant levels of judgment because the actual market value of real estate can be determined only by negotiation between the parties in a sales transaction. Property and investment values are affected by, among other things, the availability of capital, occupancy rates, rental rates, and interest and inflation rates. As a result, determining real estate and investment values involves many assumptions. Amounts ultimately realized from

56 Prospectus § TIAA Real Estate Account

each investment may vary significantly from the market value presented. Actual results could differ from those estimates. See “Risk Factors — Risks Associated with Real Estate Investing — Valuation and Appraisal Risks” on page 18.

In accordance with the Account’s procedures designed to comply with Fair Value Measurements and Disclosures in U.S. Generally Accepted Accounting Principles, the Account values real estate properties purchased by the Account initially based on an independent appraisal at the time of the closing of the purchase, which may result in a potential unrealized gain or loss reflecting the difference between an investment’s fair value (i.e.,exit price) and its cost basis (which is inclusive of transaction costs).

Subsequently, each property will be valued each quarter by an independent appraiser and the property value is updated as appropriate. In general, the Account obtains independent appraisals of its real estate properties spread out throughout the quarter, which is intended to result in appraisal adjustments, and thus, adjustments to the valuations of its holdings (to the extent such adjustments are made), that happen regularly throughout each quarter and not on one specific day in each quarter.

Further, management reserves the right to order an appraisal and/or conduct another valuation outside of the normal quarterly process when facts or circumstances at a specific property change (for example, under certain circumstances a valuation adjustment could be made when bids are obtained for properties held for sale). The Account’s independent fiduciary, Real Estate Research Corporation, oversees the Account’s entire appraisal process and, among other things, must approve all independent appraisers used by the Account. TIAA’s internal appraisal staff oversees the entire appraisal process and reviews each independent quarterly appraisal, in conjunction with the Account’s independent fiduciary, prior to the value reflected in that appraisal being recorded in the Account. Any differences in the conclusions of TIAA’s internal appraisal staff and the independent appraiser will be reviewed by the independent fiduciary, which will make a final determination on the matter (which may include ordering a subsequent independent appraisal).

Real estate appraisals are estimates of property values based on a professional’s opinion. All appraisals are performed in accordance with Uniform Standards of Professional Appraisal Practices (USPAP), the real estate appraisal industry standards created by The Appraisal Foundation. Appraisals of properties held outside of the U.S. are performed in accordance with industry standards commonly applied in the applicable jurisdiction. Further, these independent appraisers (as well as TIAA’s internal appraisal staff) are always expected to be MAI-designated members of the Appraisal Institute (or its European equivalent, Royal Institute of Chartered Surveyors) and state certified appraisers from national or regional firms with relevant property type experience and market knowledge. Under the Account’s current procedures, each independent appraisal firm will be rotated off of a particular property at least every three years, although such appraisal firm may perform appraisals of other Account properties subsequent to such rotation.

We intend that the overarching principle and primary objective when valuing our real estate investments will be to produce a valuation that represents a fair and accurate estimate of the fair value of our investments. Implicit in our

TIAA Real Estate Account § Prospectus 57

definition of fair value is the consummation of a sale as of a specified date and the passing of title from seller to buyer under conditions whereby:

| | |

| • | Buyer and seller are typically motivated; |

| | |

| • | Both parties are well informed or well advised, and acting in what they consider their best interests; |

| | |

| • | A reasonable time is allowed for exposure in the open market; |

| | |

| • | Payment is made in terms of cash or in terms of financial arrangements comparable thereto; and |

| | |

| • | The price represents the normal consideration for the property sold unaffected by special or creative financing or sales concessions granted by anyone associated with the sale. |

The Account’s net asset value will include the value of any note receivable (an amount that someone else owes the Account) from selling a real estate-related investment. We’ll estimate the value of the note by applying a discount rate appropriate to then-current market conditions.

Development Properties.Development properties will be carried at fair value, which is anticipated initially to equal the Account’s cost, and the value will be adjusted as additional development costs are incurred. At a minimum, once a property receives a certificate of occupancy, within one year from the initial funding by the Account, or the property is substantially leased, whichever is earlier, the property will be appraised by an independent external appraiser, approved by the independent fiduciary. We may also have the properties independently appraised earlier if circumstances warrant.

Property Portfolios.The Account may, at times, value individual properties together (whether or not purchased at the same time) in a portfolio as a single asset, to the extent we believe that the property may be sold as one portfolio. The Account may also realize efficiencies in property management by pooling a number of properties into a portfolio. The value assigned to the portfolio as a whole may be more or less than the valuation of each property individually. The Account will also, from time to time, sell one or more individual properties that comprise a portfolio, with the Account retaining title to the remaining individual properties comprising that portfolio. In such a circumstance, the Account could determine to no longer designate such remaining properties as one portfolio.

Because of the nature of real estate assets and because the fair value of our investments is not reduced by transaction costs that will be incurred to sell the investments, the Account’s net asset value won’t necessarily reflect the net realizable value of its real estate assets (i.e.,what the Account would receive if it sold them). See “—Valuation Adjustments” below.

Valuing Real Property Subject to a Mortgage: When a real estate property is subject to a mortgage, the mortgage is valued independently of the property and its fair value is reported separately. The independent fiduciary reviews and approves all mortgage valuation adjustments before such adjustments are recorded by the Account. The Account will continue to use the revised value for

58 Prospectus § TIAA Real Estate Account

each real estate property and mortgage loan payable to calculate the Account’s daily net asset value until the next valuation review or appraisal.

Valuing Mortgage Loans Receivable (i.e.,the Account as a creditor):Mortgage loans receivable are stated at fair value and are initially valued at the face amount of the mortgage loan funding. Subsequently, mortgage loans receivable are valued at least quarterly based on market factors, such as market interest rates and spreads for comparable loans, the liquidity for mortgage loans of similar characteristics, the performance of the underlying collateral and the credit quality of the counterparty.

Valuing Mortgage Loans Payable (i.e., the Account as a debtor): Mortgage loans payable are stated at fair value. The estimated fair value of mortgage loans payable is generally based on the amount at which the liability could be transferred in a current transaction, exclusive of transaction costs. Fair values are estimated based on market factors, such as market interest rates and spreads on comparable loans, the liquidity for mortgage loans of similar characteristics, the performance of the underlying collateral (such as the loan-to-value ratio and the cash flow of the underlying collateral), the maturity date of the loan, the return demands of the market, and the credit quality of the Account. Different assumptions or changes in future market conditions could significantly affect estimated fair values. At times, the Account may assume debt in connection with the purchase of real estate.

Valuing Real Estate Joint Ventures: Real estate joint ventures are stated at the fair value of the Account’s ownership interests in the underlying entities. The Account’s ownership interests are valued based on the fair value of the underlying real estate, any related mortgage loans payable, and other factors, such as ownership percentage, ownership rights, buy/sell agreements, distribution provisions and capital call obligations. In addition, any restrictions on the right of the Account to transfer its ownership interest to third parties could adversely affect the value of the Account’s interest. Upon the disposition of all real estate investments by an investee entity, the Account will continue to state its equity in the remaining net assets of the investee entity during the wind down period, if any, that occurs prior to the dissolution of the investee entity.

Valuing Real Estate Limited Partnerships: Limited partnerships are stated at the fair value of the Account’s ownership in the partnership, which is based on the most recent net asset value of the partnership, as reported by the sponsor. Since market quotations are not readily available, the limited partnership interests are valued at fair value as determined in good faith under the direction of the Investment Committee of the Board and in accordance with the responsibilities of the Board as a whole. As circumstances warrant, prior to the receipt of financial statements of the limited partnership, the Account will estimate the value of its interests in good faith and will from time to time seek input from the issuer or the sponsor of the investment vehicle.

Net Operating Income: The Account usually receives operating income from its investments intermittently, not daily. In fairness to participants, we estimate the Account’s net operating income rather than applying it when we actually receive it, and assume that the Account has earned (accrued) a proportionate

TIAA Real Estate Account § Prospectus 59

amount of that estimated amount daily. You bear the risk that, until we adjust the estimates when we receive actual items of income, the Account’s net assets could be under- or over-valued.

Every year, we prepare a month-by-month estimate of the revenues and expenses (estimated net operating income) for each of the Account’s properties. Each day, we add the appropriate fraction of the estimated net operating income for the month to the Account’s net asset value.

Every month, the Account receives a report of the actual operating results for the prior month for each property (actual net operating income). We then recognize the actual net operating income on the accounting records of the Account and adjust the outstanding daily accrued receivable accordingly. As the Account actually receives income from a property, we’ll adjust the daily accrued receivable and other accounts appropriately.

Valuation Adjustments:General.Management reserves the right to order an appraisal and/or conduct another valuation outside of the normal quarterly process when facts or circumstances at a specific property change. Also, the independent fiduciary can require additional appraisals if it believes a property’s value may have changed materially and such change is not reflected in the quarterly valuation review, or otherwise to ensure that the Account is valued appropriately. For example, under certain circumstances a valuation adjustment could be made when bids are obtained for properties held for sale by the Account. In addition, adjustments may be made for events or circumstances indicating an impairment of a tenant’s ability to pay amounts due to the Account under a lease (including due to a bankruptcy filing of that tenant). Also, adjustments may be made to reflect factors (such as sales values for comparable properties or local employment rate) bearing uniquely on a particular region in which the Account holds properties. We may not always be aware of each event that might require a valuation adjustment, and because our evaluation is based on subjective factors and we give different weight to different factors, we may not in all cases make a valuation adjustment where changing conditions could potentially affect the value of an investment.

Required Approvals.The independent fiduciary will need to approve adjustments to any valuation of one or more properties or real estate-related assets that:

| | | | |

| • | is made within three months of the annual independent appraisal, or |

| | | | |

| • | results in an increase or decrease of: |

| | | | |

| | • | more than 6 percent of the value of any of the Account’s properties since the last independent annual appraisal; |

| | | | |

| | • | more than 2 percent in the value of the Account since the prior calendar month; and/or |

| | | | |

| | • | more than 4 percent in the value of the Account within any calendar quarter. |

Right to Change Valuation Methods: If we decide that a different valuation method would reflect the value of a real estate-related investment more accurately, we may use that method if the independent fiduciary consents. Changes in TIAA’s valuation methods could change the Account’s net asset value and change the values at which participants purchase or redeem Account interests.

60 Prospectus § TIAA Real Estate Account

VALUING OTHER INVESTMENTS (INCLUDING CERTAIN REAL ESTATE-RELATED INVESTMENTS)

Debt Securities and Money Market Instruments: We value debt securities (excluding money market instruments) for which market quotations are readily available based on the most recent bid price or the equivalent quoted yield for such securities (or those of comparable maturity, quality and type). We derive these values utilizing an independent pricing service, such as FT Interactive Data Corp, Reuters and Bloomberg, except when we believe the prices do not accurately reflect the security’s fair value. We value money market instruments with maturities of one year or less in the same manner as debt securities, or by using a pricing matrix that has various types of money market instruments along one axis and various maturities along the other. Debt securities for which market quotations are not readily available are valued at fair value as determined in good faith by the Investment Committee of the Board and in accordance with the responsibilities of the Board as a whole.

Equity Securities: We value equity securities (including REITs) listed or traded on the New York Stock Exchange (or any of its affiliated exchanges) at their last sale price on the valuation day. If no sale is reported that day, we use the mean of the last bid and asked prices, exclusive of transaction costs. Equity securities listed or traded on any other exchange are valued in a comparable manner on the principal exchange where traded.

We value equity securities traded on the Nasdaq Stock Market at the Nasdaq Official Closing Price on the valuation day. If no sale is reported that day, we use the mean of the last bid and asked prices, exclusive of transaction costs. Other U.S. over-the-counter equity securities are valued at the mean of the last bid and asked prices.

Mortgage-Backed Securities: We value mortgage-backed securities, including CMBS and RMBS, in the same manner in which we value debt securities, as described above.

Foreign Securities: To value equity and fixed income securities traded on a foreign exchange or in foreign markets, we use their closing values under the generally accepted valuation method in the country where traded, as of the valuation date. We convert this to U.S. dollars at the exchange rate in effect on the valuation day. Under certain circumstances (for example, if there are significant movements in the United States markets and there is an expectation the securities traded on foreign markets will adjust based on such movements when the foreign markets open the next day), the Account may adjust the value of equity or fixed income securities that trade on a foreign exchange or market after the foreign exchange or market has closed.

Investments Lacking Current Market Quotations: We value securities or other assets for which current market quotations are not readily available at fair value as determined in good faith under the direction of the Investment Committee of TIAA’s Board of Trustees and in accordance with the responsibilities of TIAA’s Board as a whole. In evaluating fair value for the Account’s interest in certain commingled investment vehicles, the Account will generally look to the value periodically assigned to interests by the issuer. When possible, the Account will seek to have input in formulating the issuer’s valuation methodology.

TIAA Real Estate Account § Prospectus 61

EXPENSE DEDUCTIONS

Expense deductions are made each Valuation Day from the net assets of the Account for various services to manage the Account’s investments, administer the Account and the contracts, distribute the contracts and to cover certain risks borne by TIAA. Investment management, administration and distribution services are provided “at cost” by TIAA and Services. Currently, TIAA provides investment management services and administration services for the Account, and Services provides distribution services for the Account. In addition, TIAA charges the Account a fee to bear certain mortality and expense risks, and risks associated with providing the liquidity guarantee. TIAA guarantees that in the aggregate, the expense charges will never be more than 2.50% of average net assets per year.

|

|

The estimated annual expense deduction rate that appears in the expense table below reflects an estimate of the amount we currently expect to deduct to approximate the costs that the Account will incur from May 1, 2011 through April 30, 2012. Actual expenses may be higher or lower. The expenses identified in the table below do not include any fees which may be imposed by your employer under a plan maintained by your employer. |

| | | | | |

Type of Expense Deduction | | Estimated

Percent of Net

Assets Annually | | | Services Performed |

| | | | | | |

Investment Management | | 0.410 | % | | For investment advisory, investment management, portfolio accounting, custodial and similar services, including independent fiduciary and appraisal fees |

| | | | | |

Administration | | 0.265 | % | | For administration and operations of the Account and the contracts, including administrative services such as receiving and allocating premiums and calculating and making annuity payments |

| | | | | |

Distribution | | 0.075 | % | | For services and expenses associated with distributing the annuity contracts |

| | | | | |

Mortality and Expense Risk | | 0.050 | % | | For TIAA’s bearing certain mortality and expense risks |

| | | | | |

Liquidity Guarantee | | 0.210 | % | | For TIAA’s liquidity guarantee |

| | | | | |

Total Annual Expense Deduction1,2 | | 1.010 | % | | Total |

| | | | | | |

|

| |

1 | TIAA guarantees that the total annual expense deduction will not exceed an annual rate of 2.50% of average net assets. |

|

|

2 | Property-level expenses, including property management fees and transfer taxes, are not reflected in the table above; instead these expenses are charged directly to the Account’s properties. |

|

Since expenses for services provided to the Account are charged to the Account at cost, they are estimates for the year based on projected expense and asset levels. Administration charges include certain costs associated with the provision by TIAA entities of recordkeeping and other services for retirement plans and other pension products in addition to the Account. A portion of these expenses are allocated to the Account in accordance with applicable allocation procedures. In limited circumstances, TIAA may pay third parties for providing certain recordkeeping services for the Account.

At the end of every quarter, we reconcile the amount deducted from the Account during that quarter as discussed above with the expenses the Account actually incurred. If there is a difference, we add it to or deduct it from the

62 Prospectus § TIAA Real Estate Account

Account in equal daily installments over the remaining days in the immediately following quarter, provided that material differences may be repaid in the current calendar quarter in accordance with generally accepted accounting principles (GAAP). Our at-cost deductions are based on projections of Account assets and overall expenses, and the size of any adjusting payments will be directly affected by how different our projections are from the Account’s actual assets or expenses. The expenses identified in the table above do not include any fees which may be imposed by your employer under a plan maintained by your employer.

The size of the Account’s assets can be affected by many factors, including changes in the value of portfolio holdings, net income earned on the Account’s investments, premium activity and participant transfers into or out of the Account and participant cash withdrawals from the Account. In addition, our operating expenses can fluctuate based on a number of factors including participant transaction volume, operational efficiency, and technological, personnel and other infrastructure costs. Historically, the adjusting payments have resulted in both upward and downward adjustments to the Account’s expense deductions for the following quarter.

TIAA’s Board of Trustees can revise the estimated expense rates (the daily deduction rate before the quarterly adjustment referenced above) for the Account from time to time, usually on an annual basis, to keep deductions as close as possible to actual expenses.

|

|

Currently there are no deductions from premiums, transfers or withdrawals, but we reserve the right to change this in the future. Any such deductions would only be assessed to the extent the relevant contract provided for such deductions at the time the contract was issued. |

|

EMPLOYER PLAN FEE WITHDRAWALS

Your employer may, in accordance with the terms of your plan, and in accordance with TIAA’s policies and procedures, withdraw amounts from your Real Estate Account accumulation under your Retirement Choice or Retirement Choice Plus contract, and, on a limited basis, under your GA, GSRA, GRA or Keogh contract, to pay fees associated with the administration of the plan. These fees are separate from the expense deductions of the Account, and are not included for purposes of TIAA’s guarantee that the total annual expense deduction of the Account will not exceed 2.50% of average net assets per year.

The amount and the effective date of an employer plan fee withdrawal will be in accordance with the terms of your plan. TIAA will determine all values as of the end of the effective date. An employer plan fee withdrawal cannot be revoked after its effective date. Each employer plan fee withdrawal will be made on a pro rata basis from all your available TIAA and CREF accounts. An employer plan fee withdrawal reduces the accumulation from which it is paid by the amount withdrawn.

CERTAIN RELATIONSHIPS WITH TIAA

As noted elsewhere in this prospectus, the TIAA General Account plays a significant role in operating the Real Estate Account, including providing a liquidity guarantee,

TIAA Real Estate Account § Prospectus 63

and investment advisory, administration and other services. In addition, Services, a wholly owned subsidiary of TIAA, provides distribution services for the Account.

Liquidity Guarantee.As noted above under “Establishing and Managing the Account — The Role of TIAA — Liquidity Guarantee,” if the Account’s liquid assets and its cash flow from operating activities and participant transactions are insufficient to fund redemption requests, the TIAA General Account has agreed to purchase liquidity units. TIAA thereby guarantees that a participant can redeem accumulation units at their net asset value next determined.

In the years ended December 31, 2008 and December 31, 2009, TIAA purchased liquidity units in a number of separate transactions at a purchase price equal to $155.6 million and approximately $1.1 billion, respectively. Since January 1, 2010 and through the date of this prospectus, the TIAA General Account has purchased no additional liquidity units. These liquidity units are valued in the same manner as are accumulation units held by the Account’s participants.

For the years ended December 31, 2010, December 31, 2009 and December 31, 2008, the Account expensed $13.1 million, $12.4 million and $19.7 million, respectively, for this liquidity guarantee from TIAA through a daily deduction from the net assets of the Account.

|

|

Investment Advisory, Administration and Distribution Services/Mortality and Expense Risks Borne by TIAA.As noted above under “Expense Deductions” on page 62, deductions are made each Valuation Day from the net assets of the Account for various services required to manage investments, administer the Account and distribute the contracts. These services are performed at cost by TIAA and Services. Deductions are also made each Valuation Day to cover mortality and expense risks borne by TIAA. |

|

For the years ended December 31, 2010, December 31, 2009 and December 31, 2008, the Account expensed $50.2 million, $42.5 million and $47.6 million, respectively, for investment advisory services and $4.4 million, $4.7 million and $8.1 million, respectively, for mortality and expense risks provided/borne by TIAA. For the same period, the Account expensed $28.1 million, $35.8 million and $77.6 million, respectively, for administrative and distribution services provided by TIAA and Services, as applicable.

LEGAL PROCEEDINGS

The Account is party to various claims and routine litigation arising in the ordinary course of business. As of the date of this prospectus, management of the Account does not believe that the results of any such claims or litigation, individually or in the aggregate, will have a material effect on the Account’s business, financial position or results of operations.

64 Prospectus § TIAA Real Estate Account

SELECTED FINANCIAL DATA

The following selected financial data should be considered in conjunction with the Account’s financial statements and notes provided in this prospectus (amounts in thousands except for per accumulation unit amounts).

| | | | | | | | | | | | | | | | |

| | Years Ended December 31, | |

| | | |

| | 2010 | | 2009 | | 2008 | | 2007 | | 2006 | |

| | | | | | | | | | | | | | | | | |

Investment income: | | | | | | | | | | | | | | | | |

Real estate income, net | | $ | 421,162 | | $ | 479,657 | | $ | 500,434 | | $ | 529,412 | | $ | 444,783 | |

Income from real estate joint ventures and limited partnerships | | | 89,268 | | | 114,578 | | | 116,889 | | | 93,724 | | | 60,789 | |

Dividends and interest | | | 8,581 | | | 1,733 | | | 81,523 | | | 141,914 | | | 135,407 | |

| | | | | | | | | | | | | | | | | |

Total investment income | | | 519,011 | | | 595,968 | | | 698,846 | | | 765,050 | | | 640,979 | |

Expenses | | | 95,779 | | | 95,473 | | | 153,040 | | | 140,294 | | | 83,449 | |

| | | | | | | | | | | | | | | | | |

Investment income, net | | | 423,232 | | | 500,495 | | | 545,806 | | | 624,756 | | | 557,530 | |

Net realized and unrealized gains (losses) on investments and mortgage loans payable | | | 756,968 | | | (3,612,505 | ) | | (2,513,024 | ) | | 1,438,435 | | | 1,056,671 | |

| | | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 1,180,200 | | | (3,112,010 | ) | | (1,967,218 | ) | | 2,063,191 | | | 1,614,201 | |

Participant transactions | | | 1,743,026 | | | (1,575,700 | ) | | (4,339,995 | ) | | 1,464,653 | | | 1,969,781 | |

TIAA Purchase of Liquidity Units | | | — | | | 1,058,700 | | | 155,600 | | | — | | | — | |

| | | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets | | $ | 2,923,226 | | $ | (3,629,010 | ) | $ | (6,151,613 | ) | $ | 3,527,844 | | $ | 3,583,982 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | Years Ended December 31, | |

| | | |

| | 2010 | | 2009 | | 2008 | | 2007 | | 2006 | |

| | | | | | | | | | | | | | | | | |

Total assets | | $ | 12,839,962 | | $ | 9,912,703 | | $ | 13,576,954 | | $ | 19,232,767 | | $ | 15,759,961 | |

Total liabilities | | | 2,036,822 | | | 2,032,789 | | | 2,068,030 | | | 1,572,230 | | | 1,627,268 | |

| | | | | | | | | | | | | | | | | |

Total net assets | | $ | 10,803,140 | | $ | 7,879,914 | | $ | 11,508,924 | | $ | 17,660,537 | | $ | 14,132,693 | |

| | | | | | | | | | | | | | | | | |

Number of accumulation units outstanding | | | 48,070 | | | 39,473 | | | 41,542 | | | 55,106 | | | 50,146 | |

| | | | | | | | | | | | | | | | | |

Net asset value, per accumulation unit | | $ | 219.173 | | $ | 193.454 | | $ | 267.348 | | $ | 311.410 | | $ | 273.650 | |

| | | | | | | | | | | | | | | | | |

Mortgage loans payable | | $ | 1,860,157 | | $ | 1,858,110 | | $ | 1,830,040 | | $ | 1,392,093 | | $ | 1,437,149 | |

| | | | | | | | | | | | | | | | | |

TIAA Real Estate Account § Prospectus 65

QUARTERLY SELECTED FINANCIAL INFORMATION

The following quarterly selected unaudited financial data for each full quarter of 2010 and 2009 are derived from the financial statements of the Account for the years ended December 31, 2010 and 2009 (amounts in thousands).

| | | | | | | | | | | | | | | | |

| | 2010 | | Year Ended

December 31,

2010 | |

| | | | |

| | For the Three Months Ended | | |

| | | | |

| | March 31 | | June 30 | | September 30 | | December 31 | | |

| | | | | | | | | | | | | | | | | |

Investment income, net | | $ | 96,557 | | $ | 115,940 | | $ | 112,639 | | $ | 98,096 | | $ | 423,232 | |

Net realized and unrealized (loss) gain on investments and mortgage loans payable | | | (249,065 | ) | | 240,970 | | | 300,772 | | | 464,291 | | | 756,968 | |

| | | | | | | | | | | | | | | | | |

Net (decrease) increase in net assets resulting from operations | | $ | (152,508 | ) | $ | 356,910 | | $ | 413,411 | | $ | 562,387 | | $ | 1,180,200 | |

| | | | | | | | | | | | | | | | | |

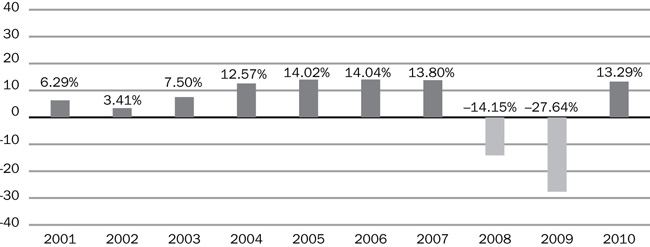

Total return | | | –1.94 | % | | 4.44 | % | | 4.68 | % | | 5.68 | % | | 13.29 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | 2009 | | Year Ended

December 31,

2009 | |

| | | | |

| | For the Three Months Ended | | |

| | | | |

| | March 31 | | June 30 | | September 30 | | December 31 | | |

| | | | | | | | | | | | | | | | | |

Investment income, net | | $ | 119,440 | | $ | 130,429 | | $ | 135,536 | | $ | 115,090 | | $ | 500,495 | |

Net realized and unrealized loss on investments and mortgage loans payable | | | (1,074,437 | ) | | (1,166,159 | ) | | (836,451 | ) | | (535,458 | ) | | (3,612,505 | ) |

| | | | | | | | | | | | | | | | | |

Net decrease in net assets resulting from operations | | $ | (954,997 | ) | $ | (1,035,730 | ) | $ | (700,915 | ) | $ | (420,368 | ) | $ | (3,112,010 | ) |

| | | | | | | | | | | | | | | | | |

Total return | | | –8.36 | % | | –9.96 | % | | –7.64 | % | | –5.05 | % | | –27.64 | % |

| | | | | | | | | | | | | | | | | |

66 Prospectus § TIAA Real Estate Account

MANAGEMENT’S DISCUSSION AND ANALYSIS OF THE ACCOUNT’S FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read together with our financial statements and notes contained in this prospectus and with consideration to the sub-section entitled “Forward-Looking Statements,” which begins below, and the section entitled “Risk Factors.” The past performance of the Account is not indicative of future results.

FORWARD-LOOKING STATEMENTS

Some statements in this prospectus which are not historical facts may be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about management’s expectations, beliefs, intentions or strategies for the future, include the assumptions and beliefs underlying these forward-looking statements, and are based on current expectations, estimates and projections about the real estate industry, domestic and global economic conditions, including conditions in the credit and capital markets, the sectors and markets in which the Account invests and operates, and the transactions described in this prospectus. While management believes the assumptions underlying any of its forward-looking statements and information to be reasonable, such information may be subject to uncertainties and may involve certain risks which may be difficult to predict and are beyond management’s control. These risks and uncertainties could cause actual results to differ materially from those contained in any forward-looking statement. These risks and uncertainties include, but are not limited to, the following:

| | |

| • | Acquiring and Owning Real Estate:The risks associated with acquiring and owning real property, including general economic and real estate market conditions, the availability of, and economic cost associated with, financing the Account’s properties, the risk that the Account’s properties become too concentrated (whether by geography, sector or by tenant mix), competition for acquiring real estate properties, leasing risk (including tenant defaults) and the risk of uninsured losses at properties (including due to terrorism and acts of violence); |

| | |

| • | Selling Real Estate:The risk that the sales price of a property might differ, perhaps significantly, from its estimated or appraised value, leading to losses or reduced profits to the Account, the risk that the Account might not be able to sell a property at a particular time for a price which management believes represents its fair or full value, the lack of availability of financing (for potential purchasers of the Account’s properties), disruptions in the credit and capital markets, and the risk that the Account may be required to make significant expenditures before the Account is able to market and/or sell a property; |

| | |

| • | Valuation:The risks associated with property valuations, including the fact that appraisals can be subjective in a number of respects, the fact that the Account’s appraisals are generally obtained on a quarterly basis and there may be periods in between appraisals of a property during which the value |

TIAA Real Estate Account § Prospectus 67

| | |

| | attributed to the property for purposes of the Account’s daily accumulation unit value may be more or less than the actual realizable value of the property; |

| | |

| • | Borrowing:Risks associated with financing the Account’s properties, including the risk of default on loans secured by the Account’s properties (which could lead to foreclosure), the risk associated with high loan to value ratios on the Account’s properties (including the fact that the Account may have limited, or no net value in such a property), the risk that significant sums of cash could be required to make principal and interest payments on the loans and the risk that the Account may not have the ability to obtain financing or refinancing on favorable terms (or at all), which may be aggravated by general disruptions in credit and capital markets; |

| | |

| • | Participant Transactions and Cash Management:Investment risk associated with participant transactions, in particular that (i) significant net participant transfers out of the Account may impair our ability to pursue or consummate new investment opportunities that are otherwise attractive to the Account and/or may result in sales of real estate-related assets to generate liquidity and (ii) significant net participant transfers into the Account may result, on a temporary basis, in our cash holdings and/or holdings in liquid real estate- related investments exceeding our long-term targeted holding levels; |

| | |

| • | Joint Venture Investments:The risks associated with joint venture partnerships, including the risk that a co-venturer may have interests or goals inconsistent with that of the Account, that a co-venturer may have financial difficulties, and the risk that the Account may have limited rights with respect to operation of the property and transfer of the Account’s interest; |

| | |

|

| • | Regulatory Matters:Uncertainties associated with environmental liability and regulations and other governmental regulatory matters such as zoning laws, rent control laws, and property taxes; |

| | |

| • | Foreign Investments:The risks associated with purchasing, owning and disposing foreign investments (primarily real estate properties), including political risk, the risk associated with currency fluctuations, regulatory and taxation risks and risks of enforcing judgments; |

|

| | |

| • | Conflicts of Interests:Conflicts of interest associated with TIAA serving as investment manager of the Account and provider of the liquidity guarantee at the same time as TIAA and its affiliates are serving as an investment manager to other real estate accounts or funds, including conflicts associated with satisfying its fiduciary duties to all such accounts and funds associated with purchasing, selling and leasing of properties; |

| | |

|

| • | Required Property Sales:The risk that, if TIAA were to own too large a percentage of the Account’s accumulation units through funding the liquidity guarantee (as determined by the independent fiduciary), the independent fiduciary could require the sales of properties to reduce TIAA’s ownership interest, which sales could occur at times and at prices that depress the sale proceeds to the Account; |

|

68 Prospectus § TIAA Real Estate Account

| | |

|

| • | Government and Government Agency Securities:Risks associated with investment securities issued by U.S. government agencies and U.S. government-sponsored entities, including the risk that the issuer may not have their securities backed by the full faith and credit of the U.S. government, and that transaction activity may fluctuate significantly from time to time, which could negatively impact the value of the securities and the Account’s ability to dispose of a security at a favorable time; and |

| | |

| • | Liquid Assets and Securities:Risks associated with investments in real estate-related liquid assets (which could include, from time to time, REIT securities and CMBS), and non-real estate-related liquid assets, including: |

| | |

| | |

| • | Financial/credit risk — Risks that the issuer will not be able to pay principal and interest when due or that the issuer’s earnings will fall; |

| | |

| • | Market volatility risk — Risk that the changing conditions in financial markets may cause the Account’s investments to experience price volatility; |

| | |

| • | Interest rate volatility risk — Risk that interest rate volatility may affect the Account’s current income from an investment; and |

| | |

| • | Deposit/money market risk — Risk that the Account could experience losses if banks fail. |

|

More detailed discussions of certain of these risk factors are contained in the section of this prospectus entitled “Risk Factors” and in this section below and also in the section entitled “Quantitative and Qualitative Disclosures About Market Risk,” that could cause actual results to differ materially from historical experience or management’s present expectations.

Caution should be taken not to place undue reliance on management’s forward-looking statements, which represent management’s views only as of the date of this prospectus. Neither management nor the Account undertake any obligation to update publicly or revise any forward-looking statement, whether as a result of new information, changed assumptions, future events or otherwise.

Commercial real estate market statistics discussed in this section are obtained by the Account from sources that management considers reliable, but some of the data are preliminary for the year or quarter ended December 31, 2010 and may be subsequently revised. Prior period data may have been adjusted to reflect updated calculations. Investors should not rely exclusively on the data presented below in forming a judgment regarding the current or prospective performance of the commercial real estate market generally.

2010 U.S. ECONOMIC AND COMMERCIAL REAL ESTATE OVERVIEW

Economic and Capital Markets Overview and Outlook

While the U.S. economic recovery slowed during the second half of the year, there were indications that it was back on track as 2010 came to a close. Federal Reserve Chairman Ben Bernanke noted in a January 7, 2011, testimony before the U.S. Senate Committee on the Federal Budget that there was “…increased evidence that a self-sustaining recovery in consumer and business spending may be taking hold.” The housing market remains weak and the unemployment rate elevated, but the increase in consumer and business spending in the fourth quarter of 2010

TIAA Real Estate Account § Prospectus 69

suggested “…the pace of economic recovery seems likely to be moderately stronger in 2011 than it was in 2010.” For 2010 as a whole, gross domestic product (“GDP”) grew 2.9%, including 2.6% growth in the third quarter and a preliminary estimate of 3.2% GDP growth in the fourth quarter. The increase in growth during the fourth quarter provided solid evidence that the recovery is on a self-sustaining pace, but the U.S. economy has so far been unable to produce the job growth needed to absorb the large numbers of unemployed. In 2010, 1.1 million net new jobs were generated, leaving considerable ground to make up after the 8.5 million jobs that were lost during the recession. Despite the official end to the recession in June 2009, the unemployment rate stood at an elevated 9.4% as 2010 drew to a close.

While macroeconomic conditions in the U.S. slightly strengthened in the fourth quarter, growth in Europe weakened, and prospects for the European economy in 2011 grew more tenuous as a result of the ongoing sovereign debt crisis. After the bailouts of Greece and Ireland were completed, focus was directed to Portugal, Spain, and Italy, which also have sizeable deficits. Recently successful bond sales have temporarily assuaged fears of a further spread in the crisis, but investors remain skeptical that economic growth will be strong enough to achieve mandated deficit reductions, particularly given the planned cutbacks in government spending. The European Central Bank has pledged to make use of all of the tools at its disposal, but the uncertainty associated with these countries poses significant risk for global capital markets. While growth in emerging markets has been robust, concerns about a real estate bubble in China along with rising inflation in China, India and other developing nations has some potential to slow the global economy.

Despite the uncertain macroeconomic environment, the Dow Jones Industrial Average added 7% in the fourth quarter of 2010 and gained 11% for 2010 as a whole. Similarly, the S&P 500 added 10% during the fourth quarter and 11% for the year. Investors responded positively to strong earnings reports from U.S. companies, and particularly those with sizeable international operations. At the same time, gold prices soared due to surging demand from the developing world, the perception of gold as a safe haven in times of economic uncertainty and speculation. Following reports that the economic recovery had stalled, yields on the 10-year Treasury hit a 2010 low of 2.38% early in the fourth quarter of 2010, but subsequently rose to close to 3.50% following the Federal Reserve’s announcement of additional Treasury purchases and the expectation that extension of the Bush-era tax cuts and other stimulus programs would produce stronger economic growth in 2011. The dollar weakened against the euro and most other major currencies, giving up the gains from the first half of the year. Still, U.S. exports remained relatively strong during the second half of 2010 which benefited the manufacturing sector.

Notwithstanding the various potential downside risks, most economists expect the U.S. economy to grow at a modest pace in 2011, and for economic activity to strengthen over the course of the year. Prospects for 2011 are encouraging due in part to the recent pickup in consumer spending which is expected to continue in 2011. Consumer spending is expected to grow 2.6% in 2011 vs. 1.7% in 2010. The real driving force behind growth, however, is expected to remain with the business sector where investment spending will continue to thrive. Corporate profits

70 Prospectus § TIAA Real Estate Account

soared in 2010 leaving businesses flush with cash and the appetite for investment in equipment and software to improve operational efficiency. Economists expect capital spending to taper off over the course of 2011, but with businesses increasing hiring in order to meet growing demand for their products.

The December 2010 consensus of economists surveyed by the Blue Chip Economic Indicators publication is for GDP to grow 2.6% in 2011, with GDP growing at a modest 2.5–2.7% rate in the first half of the year and at a slightly stronger 3.0–3.2% rate in the second half of the year. Again, growth of this magnitude would not be strong enough to significantly reduce the unemployment rate. The mediocre growth expectations for 2011 reflect the ongoing drag from the depressed housing market, weak consumer confidence, tight credit for consumers and small businesses and the waning effects of 2009’s fiscal stimulus. At the same time, the recently passed extension of Bush-era tax cuts and the fiscal stimulus accompanying it will add positively to growth as will the ongoing accommodative stance of monetary policy. The Fed’s second round of quantitative easing is under way, targeting $600 billion in purchases of longer-term Treasuries. More importantly, this easing is intended to signal the Fed’s commitment to raising inflation closer to its target. Higher inflation expectations should stimulate spending or at least counteract any drag on growth from deflation fears.

Recent trends in key economic indicators are summarized in the table below. The fourth quarter of 2010 saw a net gain of 384,000 jobs in the United States as compared to a loss of 91,000 during the third quarter of 2010. Growth in private sector employment (not shown below) has been relatively strong, growing by 372,000 and 385,000 in the third and fourth quarters of 2010, respectively. In 2010 as a whole, the private sector generated 1.35 million jobs as compared with a loss of 222,000 government sector jobs (of which a large number were temporary 2010 Census workers). Still, private sector employment grew by 112,000 per month in 2010 which is short of the job growth that is necessary to absorb the 150,000 persons that entered the labor force each month. However, stronger employment growth is expected in 2011, with job gains expected to total 2.2 million in 2011, or over 180,000 per month, as shown in the table below.

ECONOMIC INDICATORS*

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | Forecast | |

| | | | | | | | | | | | | | | | | | |

| | 2010 | | 2010Q1 | | 2010Q2 | | 2010Q3 | | 2010Q4 | | 2011 | | 2012 | |

| | | | | | | | | | | | | | | | |

Economy(1) | | | | | | | | | | | | | | | | | | | | | | |

Gross Domestic Product (GDP) | | | 2.9% | | | 3.7% | | | 1.7% | | | 2.6% | | | 3.2% | | | 3.1% | | | 3.2% | |

Employment Growth (Thousands) | | | 1,124 | | | 261 | | | 570 | | | –91 | | | 384 | | | 2,200 | | | 3,200 | |

Interest Rates(2) | | | | | | | | | | | | | | | | | | | | | | |

10 Year Treasury | | | 3.22% | | | 3.72% | | | 3.49% | | | 2.79% | | | 2.86% | | | 3.50% | | | 4.20% | |

Federal Funds Rate | | | 0.0–0.25% | | | 0.0–0.25% | | | 0.0–0.25% | | | 0.0–0.25% | | | 0.0–0.25% | | | N/A | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | |

| |

Sources: BEA, BLS, Federal Reserve, Blue Chip Consensus Forecasts, and Economy.com. |

* | Data subject to revision. |

(1) | GDP growth rates are annual rates. |

(2) | The Treasury rates are an average over the stated time period. The Federal Funds rates are as of the end of the stated time period. |

N/A indicates data not available. |

TIAA Real Estate Account § Prospectus 71

Other indicators of U.S. economic activity, such as those summarized in the table below, highlight the weaknesses that remain in the U.S. economy. Consumer confidence in 2010 inched up from its 2009 lows, but remained at a historically low level and was indicative of consumers’ cautious approach given the state of the U.S. economy and job market. Consumer confidence has also been affected by the lackluster recovery of the housing market. While existing home sales rose 12.3% in December 2010, sales ran at a seasonally adjusted annual rate of 5.28 million homes, still 3% below the December 2009 level. Prices of existing homes were stagnant in 2010 and the National Association of Realtors expects only minimal growth in home values in 2011. Similarly, new home sales in December 2010 were 8% below December 2009’s seasonally adjusted annual rate, and housing construction remains at historic lows as builders wait for the overhang of vacant and foreclosed homes to be absorbed. The unemployment rate remained elevated at 9.4% as of December 2010.

BROAD ECONOMIC INDICATORS*

| | | | | | | | | | | | | | | | |

| | Full Year | | | | | | | | | | |

| | | | | | | | | |

| | | | October

2010 | | November

2010 | | December

2010 | |

| | 2009 | | 2010 | | | | |

| | | | | | | | | | | | |

Consumer Confidence (1985 = 100) | | | 45.2 | | | 53.3 | | | 49.9 | | | 54.3 | | | 53.3 | |

% Change from prior month or year | | | | | | | | | | | | | | | | |

Inflation (Consumer Price Index) | | | –0.4% | | | 1.6% | | | 0.2% | | | 0.1% | | | 0.5% | |

Retail Sales (excl. auto, parts & gas) | | | –2.0% | | | 4.5% | | | 0.8% | | | 0.6% | | | 0.4% | |

Existing Home Sales | | | 4.9% | | | –4.8% | | | –2.2% | | | 6.1% | | | 12.3% | |

New Home Sales | | | –22.7% | | | –14.4% | | | –11.7% | | | 0.0% | | | 17.5% | |

Single-family Housing Starts | | | –28.4% | | | 5.8% | | | –3.1% | | | 5.8% | | | –9.0% | |

Annual or Monthly Average | | | | | | | | | | | | | | | | |

Unemployment Rate | | | 9.3% | | | 9.6% | | | 9.7% | | | 9.8% | | | 9.4% | |

| | | | | | | | | | | | | | | | | |

| |

* | Data subject to revision |

Inflation is the year-over-year percentage change in the unadjusted annual average. |

Sources: Conference Board, Census Bureau, Bureau of Labor Statistics, National Association of Realtors |

Reports from the twelve Federal Reserve Districts (“Districts”) contained in the January 2011 Beige Book indicated that economic growth continued to expand moderately in all Districts during the November to December 2010 period. Improvements were noted in the manufacturing, retail, and non-financial services sectors in each of the twelve Districts. Manufacturing activity was characterized by a strong flow of new orders, with capacity utilization rates trending higher and approaching normal rates in a number of Districts. Consumer spending picked up, with retailers in most Districts reporting that 2010 holiday sales were above those in 2009. Non-financial services’ activity increased steadily, with increased demand for information technology, advertising and consulting, and legal services. However, residential real estate markets remained weak in all Districts, and commercial real estate markets were mixed, with increased leasing activity in several Districts, but “slow” and “subdued” construction in all Districts. Similarly, banking and financial services activity was mixed with loan demand either “stable,” “slightly softer,” or “slowly improving” despite improved credit quality. Labor markets firmed across the country, with no upward pressure on wages. All Districts reported employment levels that were rising modestly in at least some sectors. Similarly, in eight of the twelve Districts, business contacts reportedly planned to continue or increase the pace of

72 Prospectus § TIAA Real Estate Account

hiring in 2011. In short, reports from the 12 Districts provided anecdotal confirmation of a modest improvement in economic activity during the fourth quarter of 2010.

Real Estate Market Conditions and Outlook

Commercial real estate market statistics discussed in this section are obtained by the Account from sources that management considers reliable, but some of the data is preliminary for the quarter ended December 31, 2010 and may subsequently be revised. Prior period numbers may have been adjusted to reflect updated data. Industry sources such as CB Richard Ellis Economic Advisors (“CBRE-EA”) calculate vacancy based on square footage. Except where otherwise noted, the Account’s vacancy data is calculated as a percentage of net rentable space leased, weighted by square footage, in keeping with industry standards. Investors should not rely exclusively on the data presented below in forming a judgment regarding the current or prospective performance of the real estate market generally.

Capital flows to commercial real estate picked up significantly over the course of 2010, culminating in property sales of $52 billion in the fourth quarter of 2010. According to Real Capital Analytics, commercial real estate sales totaled $132 billion in 2010 as a whole, which was double the volume in 2009. Still, 2010 sales remained some 75% below sales activity at the 2007 market peak. The increase in activity in 2010 was evidenced by an increase in the number of larger deals, an increase in the number of properties sold, and an increase in average deal size. Activity in New York, Washington, DC and San Francisco was particularly strong and relatively stronger in other top markets. Office property sales saw a sizeable increase with a total $40 billion of property sold in the year, which represented an increase of 130% compared with 2009. Similarly, apartment property sales volume doubled while gains for retail and industrial property were more modest. Aggregate sales volume increased in part because of distressed property sales which totaled some $24 billion. Still, Real Capital Analytics noted that the amount of distressed property declined modestly in the fourth quarter of 2010, which potentially signals a turning point in the market.

In addition to stronger sales activity, commercial property prices increased among all property types in the fourth quarter of 2010, as indicated by the Moody’s REAL Commercial Property Price Index (“Moody’s CPPI”) shown below. During the early part of 2011, however, commercial property prices at the national level retreated slightly, declining 3.3% in February, which followed a modest 1.2% decline in January. Moody’s CPPI is still down over 40% compared with the October 2007 peak.

| | | | | | | | | | |

| | Sales Price Change | |

| | | |

| | National | | Top 10 MSAs* | |

| | | | | |

| | Jan 2011–

Feb 2011 | | 3Q10–

4Q10 | | 3Q10–

4Q10 | |

| | | | | | | | |

All Property Types | | | -3.3% | | | | | | | |

Apartments | | | | | | 3.6% | | | 9.5% | |

Industrial | | | | | | 4.9% | | | 6.1% | |

Office | | | | | | 5.1% | | | 3.5% | |

Retail | | | | | | 8.4% | | | –0.3% | |

| | | | | | | | | | | |

| | | | | | | | | | |

| |

* | Based on the total value of property sold by Metropolitan Statistical Area (“MSA”) |

Source: Moody’s/REAL CPPI |

TIAA Real Estate Account § Prospectus 73

By comparison, Green Street Advisors’ Commercial Property Price Index (“GSA CPPI”) indicated sizeable price increases in 2010 and from the market’s trough. The GSA CPPI increased 1% in December 2010, and was up 22% compared with December 2009; however, it is still 18% below the August 2007 cyclical peak. The difference between Moody’s and Green Street’s indices is primarily due to methodology as Moody’s index uses property sales in combination with econometric models to estimate “same property” values. Moody’s results also include distressed property sales which have contributed to the index’s modest recovery. By comparison, Green Street uses recent sales activity, changes in REIT company and property values, and anecdotal information from industry contacts to estimate overall commercial real estate values. Moreover, recent acquisitions by REITs, the greater interest in commercial real estate from institutional buyers, foreign buyers and funds along with improved credit market conditions collectively suggest that prices have probably increased measurably from their lows. According to Green Street, three factors are responsible for the rebound in prices: (1) plunging return hurdles across most asset classes; (2) a dearth of distressed sellers; and (3) a quicker than expected rebound in fundamentals in some major property sectors.

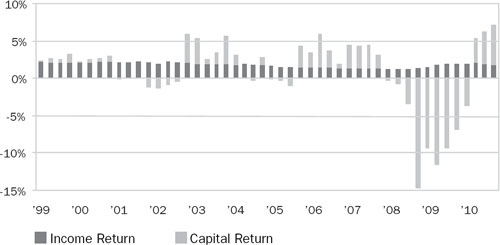

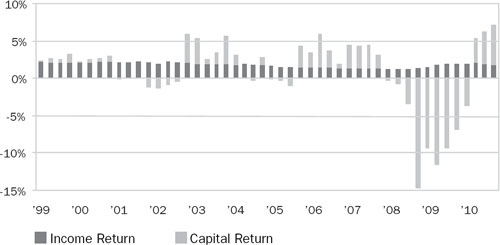

Commercial real estate investment returns improved steadily over the course of 2010 even though economic growth was lackluster. For the four quarter period ending December 2010, NCREIF Property Index returns were 4.6%, consisting of a 1.6% income return and a 3.0% capital return. Returns were positive for every quarter of 2010 and across all property types.

The rapid recovery of property values in the face of modest improvement in macroeconomic conditions and real estate market fundamentals has caused some analysts to voice concern. However, buyers are acting on the belief that economic conditions will continue to strengthen in 2011 and that real estate market fundamentals will benefit from stronger economic growth. Indeed, real estate market conditions have already started to improve, albeit very slowly. Vacancy rates remain elevated, but they have largely stabilized and have inched down in a number of markets. Similarly, rents remain under downward pressure, but leasing activity has picked up. Capitalization rates are still slightly higher than they were at the market peak such that cash-on-cash income returns for new acquisitions remain relatively attractive. In addition, pricing still appears attractive compared to replacement costs for most property types. Further, with rents at a trough, prospects for rent growth over the longer term are promising given a pickup in employment growth, the dearth of construction, and expectations that construction will remain modest over the next several years.

|

|

Data for the Account’s top five markets in terms of market value as of December 31, 2010 are provided below. These markets represent 42% of the Account’s total real estate portfolio and occupancies of the properties owned in all of these markets except Boston–Quincy, MA remained above 90% overall. However, Account vacancies in the Boston office market are in-line with market vacancies as shown below. Information for the top five markets in each sector below reflect market values as of December 31, 2010. |

|

74 Prospectus § TIAA Real Estate Account

| | | | | | | | | | | | | |

|

Metropolitan Area | | Account % Leased

Market Value

Weighted* | | # of Property

Investments | | Metro Area as a

% of Total Real

Estate Portfolio | | Metro Area as a

% of Total

Investments | |

| | | | | | | | | | |

Washington-Arlington-Alexandria DC-VA-MD-WV | | | 96.2 | % | | 8 | | | 14.2 | % | | 10.6 | % |

Boston-Quincy MA | | | 87.2 | % | | 5 | | | 7.4 | % | | 5.5 | % |

Los Angeles-Long Beach-Glendale CA | | | 93.4 | % | | 8 | | | 7.2 | % | | 5.4 | % |

San Francisco-San Mateo-Redwood City CA | | | 92.8 | % | | 4 | | | 6.7 | % | | 5.0 | % |

Houston-Bay Town-Sugar Land TX | | | 94.6 | % | | 3 | | | 6.4 | % | | 4.8 | % |

| | | | | | | | | | | | | | |

|

| |

* | Weighted by market value, which differs from the calculations provided for market comparisons to CBRE-EA data and are used here to reflect the fair market value of the Account’s monetary investments in those markets. |

Office

According to CBRE-EA, the national office vacancy rate averaged 16.4% in the fourth quarter of 2010 as compared to 16.6% in the third quarter of 2010. By comparison, the vacancy rate for the Account’s office portfolio was 13.3% as of the fourth quarter of 2010, as compared with 14.2% in the third quarter of 2010. As shown in the table below, the average vacancy rates of the Account’s properties in its top markets generally declined or remained stable in the fourth quarter, with the exception of Washington, DC which increased slightly but still compared favorably to the 12.9% vacancy rate for the overall metro area. The vacancy rate for the Account’s properties in Seattle, which declined sharply in the fourth quarter to 8.1%, is similarly well below the 16.8% for the overall metro area. Demand for office space is driven largely by job growth in the financial sector, where employment grew by a mere 3,000 jobs in the fourth quarter of 2010, and professional and business services sectors, where employment grew by 96,000 jobs during the fourth quarter. The modest growth in office-using employment is a positive sign for U.S. office markets which were battered by sizeable job losses in the financial and professional and business services sectors in 2008 and 2009. With stronger employment growth expected in 2011, office properties in the Account’s top markets appear well positioned to benefit.

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Account Weighted

Average Vacancy | | Metropolitan Area

Vacancy** | |

| | | | | | | | | | | |

Sector | | Metropolitan Area | | Total Sector

by Metro Area

($M)* | | % of Total

Investments | | 2010Q3 | | 2010Q4 | | 2010Q3 | | 2010Q4 | |

| | | | | | | | | | | | | | | | | | | | | | |

Office | | National | | | | | | | | | 14.2 | % | | 13.3 | % | | 16.6 | % | | 16.4 | % |

| | | | | | | | | | | | | | | | | | | | | | |

1 | | Washington-Arlington-Alexandria DC-VA-MD-WV | | $ | 1,171.5 | | | 9.3 | % | | 5.8 | % | | 6.1 | % | | 13.1 | % | | 12.9 | % |

2 | | Boston-Quincy MA | | $ | 675.9 | | | 5.4 | % | | 13.9 | % | | 13.8 | % | | 13.2 | % | | 13.0 | % |

3 | | San Francisco-San Mateo-Redwood City CA | | $ | 560.8 | | | 4.4 | % | | 9.0 | % | | 8.4 | % | | 14.1 | % | | 13.7 | % |

4 | | Seattle-Bellevue-Everett WA | | $ | 471.8 | | | 3.7 | % | | 9.3 | % | | 8.1 | % | | 16.8 | % | | 16.8 | % |

5 | | Los Angeles-Long Beach-Glendale CA | | $ | 404.7 | | | 3.2 | % | | 20.5 | % | | 20.3 | % | | 17.2 | % | | 17.3 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| |

* | Subsequent to December 31, 2010, the Houston-Bay Town-Sugar Land TX metropolitan area became the fifth largest market by asset value. |

** | Source: CBRE-EA. Vacancy is defined as the percentage of space vacant. The Account’s vacancy is defined as the weighted percentage of unleased space. |

|

TIAA Real Estate Account § Prospectus 75

Industrial

|

|

Conditions in the industrial market are influenced to a large degree by GDP growth, industrial production and international trade flows. Despite five consecutive quarters of GDP growth, growth in industrial production, and a pickup in trade, U.S. industrial market conditions remained weak. However, industrial availabilities have declined for two consecutive quarters, which suggests that a recovery is slowly under way. According to CBRE-EA, the national industrial availability rate was 14.3% during the fourth quarter of 2010 as compared to 14.6% during the third quarter of 2010. By comparison, the vacancy rate for the Account’s industrial property portfolio declined more sharply and averaged 7.2% in the fourth quarter of 2010 as compared with 9.2% in the third quarter of 2010. As shown in the table below, the average vacancy rate of the Account’s properties in all but one of its major markets was well below the comparative market vacancy rate. The only exception was Los Angeles, where the average vacancy of the Account’s properties declined in the fourth quarter of 2010, but at 11.7% was still above the metro area average of 7.5%, as the re-leasing of space due to the expiration and default of several small tenants continues. During the first quarter of 2011, the Account’s industrial vacancy rate increased to average 9.5%, primarily due to increased vacancies in the Account’s properties located in the Riverside, Los Angeles and Atlanta metropolitan areas. |

|

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Account Weighted

Average Vacancy | | Metropolitan Area

Vacancy* | |

| | | | | | | | | | | |

Sector | | Metropolitan Area | | Total Sector

by Metro Area

($M) | | % of Total

Investments | | 2010Q3 | | 2010Q4 | | 2010Q3 | | 2010Q4 | |

| | | | | | | | | | | | | | | | |

Industrial | | National | | | | | | | | | 9.2 | % | | 7.2 | % | | 14.6 | % | | 14.3 | % |

| | | | | | | | | | | | | | | | | | | | | | |

1 | | Riverside-San Bernardino-Ontario CA | | $ | 380.6 | | | 3.0 | % | | 0.0 | % | | 0.2 | % | | 15.5 | % | | 14.8 | % |

2 | | Dallas-Plano-Irving TX | | $ | 179.0 | | | 1.4 | % | | 8.9 | % | | 7.2 | % | | 16.5 | % | | 15.9 | % |

3 | | Chicago-Naperville-Joliet IL | | $ | 109.7 | | | 0.9 | % | | 1.9 | % | | 2.2 | % | | 15.8 | % | | 15.8 | % |

4 | | Los Angeles-Long Beach-Glendale CA | | $ | 95.5 | | | 0.8 | % | | 15.8 | % | | 11.7 | % | | 7.8 | % | | 7.5 | % |

5 | | Atlanta-Sandy Springs-Marietta GA | | $ | 87.8 | | | 0.7 | % | | 5.0 | % | | 5.0 | % | | 19.6 | % | | 19.0 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| |

* | Source: CBRE-EA. Availability is defined as the percentage of space available for rent. The Account’s vacancy is defined as the weighted percentage of unleased space. |

Multi-Family

Preliminary data from CBRE-EA indicate that the recovery in the apartment market strengthened during the second half of 2010. Apartment vacancies averaged 6.0% as of fourth quarter 2010 as compared to 7.4% at year-end 2009. (Year-over-year comparisons are necessary to account for seasonal leasing patterns.) The improvement in market conditions has been due to a decline in home-ownership rates resulting from the housing crisis and an increase in household formations as a result of modest job growth. Markets have also benefited from modest apartment construction. The vacancy rate of the Account’s multi-family portfolio averaged 3.3% in the fourth quarter of 2010 versus 2.7% in the third quarter of 2010. As shown in the table below, the average vacancy rates for the Account’s properties in its top apartment markets were all well below their comparative market averages.

76 Prospectus § TIAA Real Estate Account

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Account Weighted

Average Vacancy | | Metropolitan Area

Vacancy* | |

| | | | | | | | | | | |

Sector | | Metropolitan Statistical Area | | Total Sector

by Metro Area

($M) | | % of Total

Investments | | 2010Q3 | | 2010Q4 | | 2010Q3 | | 2010Q4 | |

| | | | | | | | | | | | | | | | |

Apartment | | National | | | | | | | | | 2.7% | | | 3.3% | | | 5.8% | | | 6.0% | |

| | | | | | | | | | | | | | | | | | | | | | |

1 | | Houston-Bay Town-Sugar Land TX | | $ | 224.5 | | | 1.8% | | | 3.3% | | | 3.0% | | | 9.7% | | | 9.9% | |

2 | | Denver-Aurora CO | | $ | 208.4 | | | 1.7% | | | 2.5% | | | 4.7% | | | 4.8% | | | 4.7% | |

3 | | Atlanta-Sandy Springs-Marietta GA | | $ | 128.1 | | | 1.0% | | | 1.9% | | | 2.7% | | | 9.3% | | | 9.5% | |

5 | | New York-Wayne-White Plains NY-NJ | | $ | 123.0 | | | 1.0% | | | 0.0% | | | 0.0% | | | 5.8% | | | 5.5% | |

4 | | Phoenix-Mesa-Scottsdale AZ | | $ | 119.0 | | | 0.9% | | | 3.4% | | | 3.2% | | | 9.6% | | | 9.1% | |

| | | | | | | | | | | | | | | | | | | | | | |

| |

* | Source: CBRE-EA. Vacancy is defined as the percentage of units vacant. The Account’s vacancy is defined as the weighted percentage of unleased space. |

Retail

|

|