the Account and the contracts, distribute the contracts and to cover certain risks borne by TIAA. Investment management, administration and distribution services are provided “at cost” by TIAA and Services. Currently, TIAA provides investment management services and administration services for the Account, and Services provides distribution services for the Account. In addition, TIAA charges the Account a fee to bear certain mortality and expense risks, and risks associated with providing the liquidity guarantee. TIAA guarantees that in the aggregate, the expense charges will never be more than 2.50% of average net assets per year.

The estimated annual expense deduction rate that appears in the expense table below reflects an estimate of the amount we currently expect to deduct to approximate the costs that the Account will incur from May 1, 2017 through April 30, 2018. Actual expenses may be higher or lower. The expenses identified in the table below do not include any fees which may be imposed by your employer under a plan maintained by your employer.

Since expenses for services provided to the Account are charged to the Account at cost, they are estimates for the year based on projected expense and asset levels. Administration charges include certain costs associated with the provision by TIAA entities of recordkeeping and other services for retirement plans and other pension products in addition to the Account. A portion of these expenses are allocated to the Account in accordance with applicable allocation procedures.

At the end of every quarter, we reconcile the amount deducted from the Account during that quarter as discussed above with the expenses the Account actually incurred. If there is a difference, we add it to or deduct it from the Account in equal daily installments over the remaining days in the immediately following quarter, provided that material differences may be repaid in the current calendar quarter in accordance with GAAP. Our at-cost deductions are based on projections of Account assets and overall expenses, and the size of any adjusting payments will be directly affected by how different our projections are from the Account’s actual assets or expenses. The expenses identified in the table above

do not include any fees which may be imposed by your employer under a plan maintained by your employer.

The size of the Account’s assets can be affected by many factors, including changes in the value of portfolio holdings, net income earned on the Account’s investments, premium activity and participant transfers into or out of the Account and participant cash withdrawals from the Account. In addition, our operating expenses can fluctuate based on a number of factors including participant transaction volume, operational efficiency, and technological, personnel and other infrastructure costs. Historically, the adjusting payments have resulted in both upward and downward adjustments to the Account’s expense deductions for the following quarter.

The Board can revise the estimated expense rates (the daily deduction rate before the quarterly adjustment referenced above) for the Account from time to time, usually on an annual basis, to keep deductions as close as possible to actual expenses.

Currently there are no deductions from premiums, transfers or withdrawals, but we reserve the right to change this in the future. Any such deductions would only be assessed to the extent the relevant contract provided for such deductions at the time the contract was issued.

Employer plan fee withdrawals

Your employer may, in accordance with the terms of your plan, and in accordance with TIAA’s policies and procedures, withdraw amounts from your Account accumulation under your Retirement Choice or Retirement Choice Plus contract, and, on a limited basis, under your GA, GSRA, GRA or Keogh contract, to pay fees associated with the administration of the plan. These fees are separate from the expense deductions of the Account and are not included for purposes of TIAA’s guarantee that the total annual expense deduction of the Account will not exceed 2.50% of average net assets per year.

The amount and the effective date of an employer plan fee withdrawal will be in accordance with the terms of your plan. TIAA will determine all values as of the end of the effective date. An employer plan fee withdrawal cannot be revoked after its effective date. Each employer plan fee withdrawal will be made on a pro rata basis from all your available TIAA and CREF accounts. An employer plan fee withdrawal reduces the accumulation from which it is paid by the amount withdrawn.

Certain relationships with TIAA

As noted elsewhere in this prospectus, the TIAA General Account plays a significant role in operating the Account, including providing a liquidity guarantee and investment advisory, administration and other services. In addition, Services, a wholly owned subsidiary of TIAA, provides distribution services for the Account.

Liquidity Guarantee. As noted above under the section entitled “Establishing and managing the Account — The role of TIAA — Liquidity guarantee,” if the

62Prospectus ¡ TIAA Real Estate Account |

Account’s liquid assets and its cash flow from operating activities and participant transactions are insufficient to fund redemption requests, the TIAA General Account has agreed to purchase liquidity units. TIAA thereby guarantees that a participant can redeem accumulation units at their net asset value next determined.

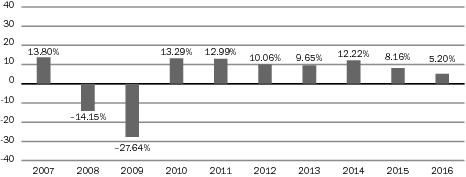

In the years ended December 31, 2008 and December 31, 2009, TIAA purchased liquidity units in a number of separate transactions at a purchase price equal to $155.6 million and approximately $1.1 billion, respectively. Since January 1, 2010 and through the date of this prospectus, the TIAA General Account has purchased no additional liquidity units. These liquidity units are valued in the same manner as are accumulation units held by the Account’s participants.

For the years ended December 31, 2016, December 31, 2015 and December 31, 2014, the Account expensed $38.4 million, $31.7 million and $29.2 million, respectively, for this liquidity guarantee from TIAA through a daily deduction from the net assets of the Account.

Investment Advisory, Administration and Distribution Services/Mortality and Expense Risks Borne by TIAA. As noted above under the section entitled “Expense deductions”, deductions are made each valuation day from the net assets of the Account for various services required to manage investments, administer the Account and distribute the contracts. These services are performed at cost by TIAA and Services. Deductions are also made each valuation day to cover mortality and expense risks borne by TIAA.

For the years ended December 31, 2016, December 31, 2015 and December 31, 2014, the Account expensed $72.6 million, $69.3 million and $70.7 million, respectively, for investment management services and $1.2 million, $1.1 million and $0.9 million, respectively, for mortality and expense risks provided/borne by TIAA. For the same period, the Account expensed $89.8 million, $80.8 million and $62.2 million, respectively, for administrative and distribution services provided by TIAA and Services, as applicable.

Legal proceedings

The Account is party to various claims and routine litigation arising in the ordinary course of business. As of the date of this prospectus, management of the Account does not believe that the results of any such claims or litigation, individually or in the aggregate, will have a material effect on the Account’s business, financial position or results of operations.

The contracts

TIAA offers the Real Estate Account as a variable option for the annuity contracts described below. Some employer plans may not offer the Real Estate Account as an option for RA, GA, SRA, GRA, GSRA (including institutionally owned GSRA), Retirement Choice, Retirement Choice Plus or Keogh contracts. CREF is a companion organization to TIAA. A companion CREF contract may have been

TIAA Real Estate Account ¡Prospectus63 |

issued to you when you received the TIAA contract offering the Account. For more information about the CREF annuity contracts, the TIAA Traditional Annuity, the TIAA Access variable annuity accounts, other TIAA annuities and separate accounts offered from time to time and particular funds and investment options offered under the terms of your plan, please see the applicable contracts and respective prospectuses for those investment options.

Importantly, neither TIAA nor CREF guarantee the investment performance of the Account nor do they guarantee the value of your units at any time.

RA (Retirement Annuity) and GRA (Group Retirement Annuity)

RA and GRA contracts are used mainly for employee retirement plans. RA contracts are issued directly to you. GRA contracts, which are group contracts, are issued through an agreement between your employer and TIAA.

Depending on the terms of your employer’s plan, RA premiums can be paid by your employer, you, or both. GRA premiums can only be paid by your employer (though some such premiums may be paid by your employer pursuant to a salary reduction agreement). If you’re paying some or all of the entire periodic premium, your contributions can be in either pre-tax dollars by salary reduction or after-tax dollars by payroll deduction. Your employer may offer you the option of making contributions in the form of after-tax Roth IRA-style contributions, though you won’t be able to take tax deductions for these contributions. You can also transfer accumulations from another investment choice under your employer’s plan to your contract. Your GRA premiums can be from pre-tax or after-tax contributions. Ask your employer for more information about these contracts. As with RAs, you can transfer your accumulations from another investment choice under your employer’s plan to your GRA contract.

SRA (Supplemental Retirement Annuity) and GSRA (Group Supplemental Retirement Annuity)

These are generally limited to supplemental voluntary tax-deferred annuity (“TDA”) plans and supplemental 401(k) plans. SRA contracts are issued directly to you. GSRA contracts, which are group contracts, are issued through an agreement between your employer and TIAA. Generally, your employer pays premiums in pre-tax dollars through salary reduction. Your employer may offer you the option of making contributions in the form of after-tax Roth IRA-style contributions, though you won’t be able to take tax deductions for these contributions. Although you can’t pay premiums directly, you can transfer amounts from other TDA plans subject to the terms of the plan.

Retirement Choice/Retirement Choice Plus annuities

These are very similar in operation to the GRAs and GSRAs, respectively, except that, unlike GRAs, they are issued directly to your employer or your plan’s trustee, and they may be issued to your employer directly without participant

64Prospectus ¡ TIAA Real Estate Account |

recordkeeping. Among other rights, the employer retains the right to transfer accumulations under these contracts to alternate funding vehicles.

Classic IRA and Roth IRA

Classic IRAs are individual contracts issued directly to you. You and your spouse can each open a Classic IRA with an annual contribution of up to $5,500 or by rolling over funds from another IRA or eligible retirement plan, if you meet the Account’s eligibility requirements. If you are age 50 or older, you may contribute up to $6,500. The combined limit for your contributions to a Classic IRA and a Roth IRA for a single year is $5,500, or $6,500 if you are age 50 or older, excluding rollovers. (The dollar limits listed are for 2017; different dollar limits may apply in future years.)

Roth IRAs are also individual contracts issued directly to you. You and your spouse can each open a Roth IRA with an annual contribution up to $5,500 or with a rollover from another IRA or a Classic IRA issued by TIAA if you meet the Account’s eligibility requirements, subject to rules applicable to Roth IRA conversions. If you are age 50 or older you may contribute up to $6,500. The combined limit for your contributions to a Classic IRA and a Roth IRA for a single year is $5,500, or $6,500 if you are age 50 or older, excluding rollovers. (The dollar limits listed are for 2017; different dollar limits may apply in future years.)

We can’t issue a joint Classic IRA or Roth IRA contract. Your employer may offer SEP IRAs (Simplified Employee Retirement Plans), which are subject to different rules.

Classic and Roth IRAs may together be referred to as “IRAs” in this prospectus.

GA (Group Annuity) and institutionally owned GSRAs

These are used exclusively for employer retirement plans and are issued directly to your employer or your plan’s trustee. Your employer pays premiums directly to TIAA (you can’t pay the premiums directly to TIAA) and your employer or the plan’s trustee may control the allocation of contributions and transfers to and from these contracts including withdrawing completely from the Account. If a GA or Institutionally Owned GSRA contract is issued pursuant to your plan, the rules relating to transferring and withdrawing your money, receiving any annuity income or death benefits, and the timing of payments may be different, and are determined by your plan. Ask your employer or plan administrator for more information.

Keogh contracts

TIAA offered contracts under Keogh plans. If you are a self-employed individual who owns an unincorporated business, you could, prior to 2013, use the Account’s Keogh contracts for a Keogh plan, and cover common law employees, subject to the Account’s eligibility requirements. Note, however, that while TIAA will offer new contracts for new entrants into Keogh plans established prior to 2013, it will no longer offer contracts for Keogh plans that the Account is not currently funding.

TIAA Real Estate Account ¡Prospectus65 |

ATRA (after-tax retirement annuity)

The after-tax retirement annuities (“ATRA”) are individual non-qualified deferred annuity contracts, issued to participants who are eligible and would like to remit personal premiums under the contractual provisions of their RA contract. To be eligible, you must have an active and premium-paying or paid up RA contract.

Note that the tax rules governing these non-qualified contracts differ significantly from the treatment of qualified contracts. Please see the section below entitled “Taxes” for more information.

Eligibility for IRA and Keogh contracts

Each of you and your spouse can open a Classic or Roth IRA or a Keogh, subject to the limitations described above, if you’re a current or retired employee or trustee of an Eligible Institution, or if you own a TIAA or CREF annuity contract or a TIAA individual insurance contract. To be considered a retired employee for this purpose, an individual must be at least 55 years old and have completed at least three years of service at an Eligible Institution. In the case of partnerships, at least half the partners must be eligible individuals and the partnership itself must be primarily engaged in education or research. Eligibility may be restricted by certain income limits on opening Roth IRA contracts.

State regulatory approval

State regulatory approval may be pending for certain of these contracts, and these contracts may not currently be available in your state.

Starting out

Generally, we’ll issue you a TIAA contract when we receive a completed application or enrollment form in good order. “Good order” means actual receipt of the transaction request along with all information and supporting legal documentation necessary to effect the transaction. This information and documentation generally includes your complete application and any other information or supporting documentation we may require. With respect to purchase requests, “good order” also generally includes receipt of sufficient funds by us to effect the transaction. We may, in our sole discretion, determine whether any particular transaction request is in good order and reserve the right to change or waive any good order requirement at any time either in general or with respect to a particular plan, contract or transaction.

If your application is incomplete and we do not receive the necessary information and signed application in good order within five business days of our receipt of the initial premium, we will return the initial premium at that time.

If we receive premiums from your employer and, where applicable, a completed application from you before we receive your specific allocation instructions (or if your allocation instructions violate employer plan restrictions or do not total 100%), we will invest all premiums remitted on your behalf in the default option your employer has designated. It is possible that the default option will not be the Real

66Prospectus ¡ TIAA Real Estate Account |

Estate Account but will be another investment option available under your plan. We consider your employer’s designation of a default option to be an instruction to us to allocate your premiums to that option as described above. You should consult your plan documents or sales representative to determine your employer’s designated default option and to obtain information about that option. Further, to the extent you hold an IRA contract, the default option will be that fund or account specified in your IRA forms.

When we receive complete allocation instructions from you in good order, we’ll follow your instructions for future premiums. However, if you want the premiums previously allocated to the default option (and earnings and losses on them) to be transferred to the options identified in your instructions, you must specifically request that we transfer these amounts from the default option to your investment option choices.

Amounts may be invested in an account other than the Real Estate Account (absent a participant’s specific instructions) only in the limited circumstances identified in the paragraph immediately above and the circumstances outlined under the section below entitled “How to transfer and withdraw your money — Restrictions on premiums and transfers to the Account”, namely: (1) we receive premiums before we receive your completed application or allocation instructions, (2) a participant’s allocations violate employer plan restrictions or do not total 100%, or (3) we stop accepting premiums for and/or transfers into the Account.

TIAA doesn’t generally restrict the amount or frequency of payment of premiums to your contract, although we may in the future. Your employer’s retirement plan may limit your premium amounts. There also may be restrictions on remitting premiums on an IRA. In addition, the Code limits the total annual premiums you may invest in plans qualified for favorable tax treatment. If you want to directly contribute personal premiums under the contractual provisions of your RA contract, you will be issued an ATRA contract. Premiums and any earnings on the ATRA contract will not be subject to your employer’s retirement plan. The restrictions relating to these premiums are in the contract itself.

In most cases (subject to any restriction we may impose, as described in this prospectus), TIAA accepts premiums to a contract during your accumulation period. Once your first premium has been paid, your TIAA contract can’t lapse or be forfeited for nonpayment of premiums. However, TIAA can stop accepting premiums to the Real Estate Account at any time.

You may remit premium payments to the following address: P.O. Box 1259, Charlotte, N.C. 28201.

Note that we cannot accept money orders or travelers checks. In addition, we will not accept a third-party check where the relationship of the payor to the account owner cannot be identified from the face of the check.

You will receive a confirmation statement each time you make a transfer to, a transfer out, or a cash withdrawal from the Account. The statement will show the date and amount of each transaction. However, if you’re remitting premiums through an employer or other qualified plan, using an automatic investment plan

TIAA Real Estate Account ¡Prospectus67 |

or systematic withdrawal plan, you may instead receive a statement confirming those transactions following the end of each calendar quarter.

If you have any accumulations in the Account, you will be sent a statement in each quarter which sets forth the following information:

|

| | (1) | | Premiums paid during the quarter; |

|

| | (2) | | The number and dollar value of accumulation units in the Account credited to you during the quarter and in total; |

|

| | (3) | | Cash withdrawals, if any, from the Account during the quarter; and |

|

| | (4) | | Any transfers during the quarter. |

You also will receive reports containing the financial statements of the Account and certain information about the Account’s investments.

Important information about procedures for opening a new account

To help the U.S. government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account.

What this means for you: When you open an account, we will ask for your name, street address (not a post office box), date of birth, Social Security number and other information that will allow us to identify you, such as your home telephone number and driver’s license or certain other identifying documents. Until you provide us with the information needed, we may not be able to open an account or effect any transactions for you. Furthermore, if we are unable to verify your identity, or that of another person authorized to act on your behalf, or if it is believed that potentially criminal activity has been identified, we reserve the right to take such action as deemed appropriate, which may include closing your account.

Choosing among investment accounts

Once an account is opened on your behalf, you may allocate all or part of your premiums to the Real Estate Account, unless your employer’s plan precludes that choice. You can also allocate premiums to TIAA’s Traditional Annuity, the CREF variable investment accounts, the TIAA Access variable annuity accounts, other TIAA annuities and separate accounts offered from time to time (if available under the terms of your employer’s plan) and, in some cases, certain funds if the account or fund is available under your employer’s plan.

You can change your allocation choices for future premiums by:

|

| | • | | writing to our office at P.O. Box 1259, Charlotte, N.C. 28201; |

|

| | • | | using the TIAA Web Center’s account access feature at www.tiaa.org; or |

|

| | • | | calling our Automated Telephone Service (24 hours a day) at 800-842-2252. |

The right to cancel your contract

Generally, you may cancel any RA, SRA, GSRA, Classic IRA, Roth IRA, ATRA or Keogh contract in accordance with the contract’s Right to Examine provision

68Prospectus ¡ TIAA Real Estate Account |

(unless we have begun making annuity payments from it) and subject to the time period regulated by the state in which the contract is issued. Although the contract terms and state law provisions differ, you will generally have between 10 and 60 days to exercise this cancellation right. To cancel a contract, you must mail or deliver the contract with your cancellation instructions (or signed Notice of Cancellation when such has been provided with your contract) to our home office. We’ll cancel the contract, then send either the current accumulation or the premium, depending on the state in which your contract was issued, to whomever originally submitted the premiums. Unless we are returning premiums paid as required by state law, you will bear the investment risk during this period.

Determining the value of your interest in the account — accumulation units

Each payment to the Real Estate Account buys a number of accumulation units. Similarly, any withdrawal from the Account results in the redemption of a number of accumulation units. The price you pay for accumulation units, and the price you receive for accumulation units when you redeem accumulation units, is the value of the accumulation units calculated for the business day on which we receive your purchase, redemption or transfer request in good order (unless you ask for a later date for a redemption or transfer). This date is called the “effective date.” Therefore, if we receive your purchase, redemption or transfer request in good order before the NYSE closes, that business day will be considered the effective date of your order. If we receive your request in good order after the NYSE closes, the next business day will be considered the effective date of your order.

Payments and orders to redeem accumulation units (or adjustments thereto) may be processed after the effective date. “Processed” means when amounts are credited or debited to you in the Account. In the event there are market fluctuations between the effective date and the processing date and the price of accumulation units on the processing date is higher or lower than your price on the effective date, that difference will be paid or retained by Services, the Account’s distributor. This amount, which may be positive or negative, together with similar amounts paid or retained by Services in connection with transactions involving other investment products offered under pension plans administered by TIAA or its affiliates and the amount of interest, if any, paid by Services to participants in connection with certain delayed payments, is apportioned to the Account pursuant to an agreement with Services, under which the Account reimburses Services for the services it has provided to the Account.

The accumulation unit value reflects the Account’s investment experience (i.e., the real estate net operating income accrued, as well as dividends, interest and other income accrued), realized and unrealized capital gains and losses, as well as Account expense charges.

Calculating Accumulation Unit Values: We calculate the Account’s accumulation unit value at the end of each valuation day. To do that, we multiply

TIAA Real Estate Account ¡Prospectus69 |

the previous day’s value by the net investment factor for the Account. The net investment factor is calculated asA divided byB, whereA andB are defined as:

|

| | A. | | The value of the Account’s net assets at the end of the current valuation period, less premiums received during the current valuation period. |

|

| | B. | | The value of the Account’s net assets at the end of the previous valuation period, plus the net effect of transactions made at the start of the current valuation period. |

How to transfer and withdraw your money

Generally, depending on the terms of your plan, contracts, tax law and applicable governing documents, TIAA allows you to move your money to and from the Real Estate Account in the following ways:

|

| | • | | from the Real Estate Account to the following accounts if available under your employer’s plan or IRA: a CREF investment account, a TIAA Access variable account or TIAA’s Traditional Annuity; |

|

| | • | | to the Real Estate Account from the following accounts if available under your employer’s plan or IRA: a CREF investment account, a TIAA Access variable account or TIAA’s Traditional Annuity (transfers from TIAA’s Traditional Annuity under RA, GRA or Retirement Choice contracts are subject to restrictions); |

|

| | • | | from the Real Estate Account to a fund (including TIAA-CREF affiliated funds), if available under your plan or IRA; |

|

| | • | | to the Real Estate Account from a TIAA-CREF affiliated fund, if available under your plan or IRA; |

|

| | • | | depending on the terms of your plan, contracts and governing instruments, to the Real Estate Account from other TIAA annuity products and separate accounts, and/or from the Real Estate Account to other TIAA annuity products and separate accounts; |

|

| | • | | from the Real Estate Account to investment options offered by other companies, if available under your plan or IRA; |

|

| | • | | to the Real Estate Account from other companies/plans; |

|

| | • | | by withdrawing cash; and |

|

| | • | | by setting up a program of automatic withdrawals or transfers. |

For more information regarding the transfer policies of CREF, TIAA Access, TIAA’s Traditional Annuity or another investment option listed above, please see the respective contract, prospectus or other governing instrument. These options may be limited by the terms of your employer’s plan, by current tax law, or by the terms of your contract, as set forth below.

Currently, transfers from the Real Estate Account to any TIAA annuity offered by your employer’s plan, to one of the CREF accounts or to funds offered under the terms of your plan must generally be at least $1,000 (except for systematic transfers, which must be at least $100) or your entire accumulation, if less. In the future, we may eliminate these minimum transaction levels. Lump sum cash

70Prospectus ¡ TIAA Real Estate Account |

withdrawals from the Real Estate Account and transfers to other companies are not subject to a minimum amount. Transfers and cash withdrawals are currently free. TIAA can place restrictions on transfers or charge fees for transfers and/or withdrawals in the future.

As indicated, transfers and cash withdrawals are effective at the end of the business day we receive your request and all required documentation in good order. You can also choose to have transfers and withdrawals take effect at the close of any future valuation day. For any transfers to TIAA’s Traditional Annuity, the crediting rate will be the rate in effect at the close of business of the first day that you participate in TIAA’s Traditional Annuity, which is the next business day after the effective date of the transfer.

To request a transfer or to withdraw cash, you may:

|

| | • | | write to TIAA’s office at P.O. Box 1259, Charlotte, N.C. 28201; |

|

| | • | | call us at 800-842-2252; or |

|

| | • | | use the TIAA Web Center’s account access feature at www.tiaa.org. |

If you are married, and all or part of your accumulation is attributable to contributions made under

|

| | • | | an employer plan subject to ERISA; or |

|

| | • | | an employer plan that provides for spousal rights to benefits, then only to the extent required by the Internal Revenue Code the (“Code”) or ERISA or the terms of your employer plan, your rights to choose certain benefits are restricted by the rights of your spouse to benefits. |

You may be required to complete and return certain forms (in good order) to effect these transactions. We can limit, suspend or terminate your ability to transact by telephone, over the Internet, or by fax at any time, for any reason.

Before you transfer or withdraw cash, please make sure that you consult the terms of your employer’s plan, as it may contain additional restrictions. In addition, please make sure you understand the possible federal and other income tax consequences. Please see the section below entitled “Taxes.”

Transfers to and from other TIAA-CREF accounts and funds

Transfers from the Real Estate Account. Once every calendar quarter you can transfer some or all of your accumulation in the Real Estate Account to the following accounts if offered by your employer’s plan or IRA: TIAA’s Traditional Annuity, to another TIAA annuity, to one of the CREF accounts, to a TIAA Access variable annuity account or to funds (which may include TIAA-CREF affiliated funds). Transfers to TIAA’s Traditional Annuity or other TIAA annuities or accounts, a CREF account or to certain other options may be restricted by your employer’s plan, current tax law or by the terms of your contract. In addition, there are important exceptions to this once per calendar quarter limitation, as outlined in the section below entitled “How to transfer and withdraw your money — Market timing/excessive trading policy.”

Transfers to the Real Estate Account. Currently, you can also transfer some or all of your accumulation in TIAA’s Traditional Annuity, in your CREF accounts, TIAA

TIAA Real Estate Account ¡Prospectus71 |

Access variable annuity accounts or in the funds or TIAA annuities offered under the terms of your plan to the Real Estate Account, if your employer’s plan offers the Account; subject to the terms of the plan, current tax law and the terms of your contract. Transfers from TIAA’s Traditional Annuity to the Real Estate Account under RA, GRA or Retirement Choice contracts can only be effected over a period of time (up to 10 annual installments) and may be subject to other limitations, as specified in your contract. Amounts held under an ATRA contract cannot be transferred to or from any retirement plan contract.

Currently, these transfers must generally be at least $1,000 (except for systematic transfers, which must be at least $100) or your entire accumulation, if less. Because excessive transfer activity can hurt Account performance and other participants, subject to applicable state law and the terms of your contract, we may seek to further limit how often, or in what amounts, you may make transfers, or we may otherwise modify the transfer privilege generally. Please see the section below entitled “How to transfer and withdraw your money — Restrictions on premiums and transfers to the Account.”

Transfers to other companies

Generally you may transfer funds from the Real Estate Account to a company other than TIAA or CREF, subject to certain tax restrictions. This right may be limited by your employer’s plan or the terms of your contract. If your employer participates in our special transfer services program, we can make automatic monthly transfers from your RA or GRA contract to another company. Roth amounts in a 403(b) or 401(a) plan can only be rolled over to another Roth account under such plan or to a Roth IRA, as permitted by applicable law and the terms of the plans. IRA to IRA rollover rules have recently changed. See the section below entitled “Taxes” for more information on these developments.

Under the Retirement Choice and Retirement Choice Plus contracts, your employer could transfer monies from the Account and apply it to another account or investment option, subject to the terms of your plan, and without your consent.

Transfers from other companies/plans

Subject to your employer’s plan and federal tax law, you can usually transfer or roll over money from another 403(b), 401(a)/403(a) or governmental 457(b) retirement plan to your qualified TIAA contract. You may also roll over before-tax amounts in a Traditional IRA to 403(b) plans, 401(a)/403(a) plans or eligible governmental 457(b) plans, provided such employer plans agree to accept the rollover. Roth amounts in a 403(b) or 401(a) plan can only be rolled over to another Roth account under such plan or to a Roth IRA, as permitted by applicable law and the terms of the plans. Funds in a private 457(b) plan can be transferred to another private 457(b) plan only. Accumulations in private 457(b) plans may not be rolled over to a qualified plan (e.g., a 401(a) plan), a 403(b) plan, a governmental 457(b) plan or an IRA. IRA to IRA rollover rules have recently changed. See the section below entitled “Taxes” for more information on these developments.

72Prospectus ¡ TIAA Real Estate Account |

Withdrawing cash

You may withdraw cash from your SRA, GSRA, IRA, ATRA or Keogh Real Estate Account accumulation at any time during the accumulation period, provided federal tax law and the terms of your employer’s plan permit it (see below). Normally, you can’t withdraw money from a contract if you’ve already applied that money to begin receiving lifetime annuity income. Current federal tax law restricts your ability to make cash withdrawals from your accumulation under most voluntary salary reduction agreements. In addition, if you are married, you may be required by law or your employer’s plan to show us advance written consent from your spouse before TIAA makes certain transactions on your behalf.

Withdrawals are generally available only if you reach age 591/2, leave your job, become disabled, die, satisfy requirements related to qualified reservist distributions or if your employer terminates its retirement plan. If your employer’s plan permits, you may also be able to withdraw money if you encounter hardship, as defined by the IRS, but hardship withdrawals can be from contributions only, and not investment earnings. You may be subject to a 10% penalty tax if you make a withdrawal before you reach age 591/2, unless an exception applies to your situation.

Under current federal tax law, you are not permitted to withdraw from 457(b) plans earlier than the calendar year in which you reach age 701/2, leave your job or are faced with an unforeseeable emergency (as defined by law). There are generally no early withdrawal tax penalties if you withdraw under any of these circumstances (i.e., no 10% tax on distributions prior to age 591/2).

Special rules and restrictions apply to Classic and Roth IRAs.

If you request a withdrawal, we will send the proceeds by check to the address of record, or by electronic funds transfer to the bank account on file. A letter of instruction with a bank signature guarantee is required if the withdrawal is sent to an address other than the address of record, or to an address of record that has been changed within either the last 30 or 14 calendar days, depending on the service model applicable to your plan. You may obtain a signature guarantee from some commercial or savings banks, credit unions, trust companies, or member firms of a U.S. stock exchange. A notary public cannot provide a signature guarantee. Proceeds directed to a bank account not on file have similar restrictions that require completion of a verification process. Please contact us for further information. We reserve the right to require a signature guarantee on any redemption.

Systematic withdrawals and transfers

If your employer’s plan allows, you can set up a program to make cash withdrawals or transfers automatically by specifying that we withdraw from your Real Estate Account accumulation, or transfer to or from the Real Estate Account, any fixed number of accumulation units, dollar amount, or percentage of accumulation until you tell us to stop or until your accumulation is exhausted. Currently, the program must be set up so that at least $100 is automatically transferred or

TIAA Real Estate Account ¡Prospectus73 |

withdrawn at a time. In the future, we may eliminate this minimum transfer amount. Further, a systematic plan of this type may allow pre-specified transfers or withdrawals to be made more often than quarterly, depending on the terms of your employer’s plan. Additional restrictions on systematic transfers may apply for Account participants with accumulation amounts exceeding $150,000. See “Restrictions on premiums and transfers to the Account” below.

Withdrawals to pay financial advisor fees

If permitted by your employer’s plan, you may authorize a series of systematic withdrawals to pay the fees of a financial advisor. Such systematic withdrawals are subject to all provisions applicable to systematic withdrawals, except as otherwise described in this section. One series of systematic withdrawals to pay financial advisor fees may be in effect at the same time that one other series of systematic withdrawals is also in effect. Systematic withdrawals to pay financial advisor fees must be scheduled to be made quarterly only, on the first day of each calendar quarter. The amount withdrawn from each investment account must be specified in dollars or as a percentage of accumulation, and will be in proportion to the accumulations in each account at the end of the business day prior to the withdrawal. The financial advisor may request that we stop making withdrawals. We reserve the right to determine the eligibility of financial advisors for this type of fee reimbursement. Before you set up this program, make sure you understand the possible tax consequences of these withdrawals. Please see the discussion in the section below entitled “Taxes.”

Restrictions on premiums and transfers to the Account

From time to time we may stop accepting premiums for and/or transfers into the Account. We might do so if, for example, we can’t find sufficient appropriate real estate-related investment opportunities at a particular time. Whenever reasonably possible, we will notify you before we decide to restrict premiums and/or transfers. However, because we may need to respond quickly to changing market conditions or to the liquidity needs and demands of the Account, we reserve the right (subject to the terms of some contracts) to stop accepting premiums and/or transfers at any time without prior notice.

Individual participants are limited from making internal funding vehicle transfers into their Account accumulation if, after giving effect to such transfer, the total value of such participant’s Account accumulation (under all contracts issued to such participant) would exceed $150,000.

As of the date of this prospectus, all jurisdictions in which the Account is offered have approved this limitation, but the effective date of the limitation as applies to an individual participant will be reflected on his or her applicable contract or endorsement form. These contracts or endorsements will contain important details with respect to this limitation.

Under this limitation, an internal funding vehicle transfer means the movement (or attempted movement) of accumulations from any of the following to the Account:

74Prospectus ¡ TIAA Real Estate Account |

|

| | • | | a TIAA Traditional Annuity accumulation, |

|

| | • | | a Real Estate Account accumulation (from one contract to another), |

|

| | • | | a companion CREF certificate, |

|

| | • | | other TIAA separate account accumulations, and |

|

| | • | | any other funding vehicle accumulation which is administered by TIAA or CREF on the same record-keeping system as the contract. |

The following transfers are currently not subject to this limitation:

|

| | • | | systematic transfers and withdrawals, |

|

| | • | | automatic rebalancing activity, |

|

| | • | | any transaction arising from a TIAA-sponsored advice product or service, and |

|

| | • | | Transfer Payout Annuity payments directed to the Account. |

This limitation does not apply to most types of premium contributions and certain group contracts recordkept on non-TIAA platforms. Minimum Distribution Option (“MDO”) contracts will be subject to this limitation, but the limitation does not apply to other annuity pay-out contracts.

A transfer which cannot be applied pursuant to this limitation, along with any other attempted movements of funds submitted as part of a noncompliant transfer request into the Account, will be rejected in its entirety, and therefore the funds that were to be transferred will remain in the investment option from which the transfer was to be made. The Account accumulation unit values used in applying this provision will be those calculated as of the valuation day preceding the day on which the proposed transfer is to be effective. A participant will not be required to reduce his or her accumulation to a level at or below $150,000 if the total value of the participant’s Account accumulation under all contracts exceeds $150,000 on the effective date as indicated in the contract or contract endorsement. TIAA reserves the right in the future to modify the nature of this limitation and to include categories of transactions associated with services that may be introduced in the future.

If we decide to stop accepting premiums into the Account, amounts that would otherwise be allocated to the Account will be allocated to the default option designated by your employer instead (or the default option specified on your IRA forms), unless you give us other allocation instructions. We will not transfer these amounts out of the default option designated by your employer when the restriction period is over, unless you request that we do so. However, we will resume allocating premiums to the Account on the date we remove the restrictions.

Additional limitations

Federal law requires us to obtain, verify and record information that identifies each person who opens an account. Until we receive the information we need, we may not be able to effect transactions for you. Furthermore, if we are unable to verify your identity, or that of another person authorized to act on your behalf, or if we believe that we have identified potentially criminal activity, we reserve the right to take such action as we deem appropriate, which may include closing your account.

TIAA Real Estate Account ¡Prospectus75 |

Market timing/excessive trading policy

There are participants who may try to profit from making transactions back and forth among the CREF accounts, the Account, the TIAA Access variable account and the funds or other investment options available under the terms of your plan in an effort to “time” the market or for other reasons. As money is shifted in and out of these accounts, the accounts or funds may incur transaction costs, including, among other things, expenses for buying and selling securities. These costs are borne by all participants, including long-term investors who do not generate these costs. In addition, excessive trading can interfere with efficient portfolio management and cause dilution if traders are able to take advantage of pricing inefficiencies. Consequently, the Account is not appropriate for market timing or frequent trading and you should not invest in the Account if you want to engage in such activity.

To discourage this activity, transfers of accumulations from the Real Estate Account to a CREF or TIAA account, or another investment option, are limited to once every calendar quarter. A few limited exceptions to this once per calendar quarter limitation apply, including:

|

| | (i) | | systematic transfers out of the Real Estate Account (as described in the section above entitled “How to transfer and withdraw your money — Systematic withdrawals and transfers”), |

|

| | (ii) | | annual portfolio rebalancing activities, |

|

| | (iii) | | plan or plan-sponsor initiated transactions, including transfers and rollovers made to external carriers, |

|

| | (iv) | | participants enrolled in TIAA’s qualified managed account for retirement plan assets, |

|

| | (v) | | single-sum distributions where funds are moved from one TIAA annuity contract or certificate to another, as well as those made directly to a participant, |

|

| | (vi) | | asset allocation programs and similar programs approved by TIAA’s management, |

|

| | (vii) | | death and hardship withdrawals or withdrawals made pursuant to a qualified domestic relations order (“QDRO”), and |

|

| | (viii) | | certain transactions made within a retirement or employee benefit plan, such as contributions, mandatory (or minimum) distributions and loans. |

TIAA reserves the right to reject any purchase or exchange request with respect to the Account, including when it is believed that a request would be disruptive to the Account’s efficient portfolio management. TIAA also may suspend or terminate your ability to transact in the Account by telephone, fax or over the Internet for any reason, including the prevention of excessive trading. A purchase or exchange request could be rejected or electronic trading privileges could be suspended because of the timing or amount of the investment or because of a history of excessive trading by the participant. Because TIAA has discretion in applying this policy, it is possible that similar transaction activity could be handled differently because of the surrounding circumstances.

76Prospectus ¡ TIAA Real Estate Account |

Notwithstanding such discretion, TIAA seeks to apply its excessive trading policies and procedures uniformly to all Account participants. As circumstances warrant, TIAA may request transaction data from intermediaries from time to time to verify whether the Account’s policies are being followed and/or to instruct intermediaries to take action against participants who have violated the Account’s policies. TIAA has the right to modify these policies and procedures at any time without advance notice.

The Account is not appropriate for excessive trading. You should not invest in the Account if you want to engage in excessive trading or market timing activity. Participants seeking to engage in excessive trading may deploy a variety of strategies to avoid detection, and, despite TIAA’s efforts to discourage excessive trading, there is no guarantee that TIAA or its agents will be able to identify all such participants or curtail their trading practices.

If you invest in the Account through an intermediary, including through a retirement or employee benefit plan, you may be subject to additional market timing or excessive trading policies implemented by the intermediary or plan. Please contact your intermediary or plan sponsor for more details.

When you are ready to receive annuity income

The annuity period in general

You can receive an income stream from all or part of an accumulation in the Account. Generally, once distributions are permitted to begin under your plan or contract, you may begin to receive income from a lifetime annuity. You should be at least age 591/2 to begin receiving annuity income other than from a lifetime annuity. Otherwise, you may have to pay a 10% penalty tax on the taxable amount, except under certain circumstances. In addition, you cannot begin receiving income later than permitted under the minimum distribution rules of the Code. See “Taxes” for more information. Also, under the terms of the contract, you cannot begin a life annuity after age 90 or a joint life annuity after either you or your annuity partner reaches age 90.

Your income payments may be paid out from the Accountthrough a variety of income options. You can pick a different income option for different portions of your accumulation, but once you’ve started payments you usually cannot change your income option or annuity partner for that payment stream. Usually income payments are monthly. You can choose quarterly, semiannual and annual payments as well. TIAAhas the right to not make payments at any interval that would cause the initial payment to be less than $100.) We will send your payments by mail to your home address or, on your request, by mail or electronic funds transfer to your bank.

Your initial income payments are based on the value of your accumulation on the last valuation day before the annuity starting date. We calculate initial income based on:

|

| | • | | the amount of money you have accumulated in the Account |

TIAA Real Estate Account ¡Prospectus77 |

|

| | • | | the income option or options you choose; and |

|

| | • | | an assumed annual investment return of 4% and, for life annuities, mortality assumptions for you and your annuity partner, if you have one. |

On your annuity starting date, for any payout annuities denominated in annuity units, all of your accumulation units will be converted to annuity units of the Account.

There are two income change methods for annuity payments: annual and monthly. Under the annual income change method, payments change each May 1, based on the net investment results of the Account during the prior year (from the day following the last Valuation Day in March of the prior year through the last Valuation Day in March of the current year). Under the monthly income change method, payments change every month, based on the net investment results during the previous valuation period. Under this method, we value annuity units on the 20th of each month or on the preceding Business Day if the 20th is not a Business Day. The total value of your annuity payments may be more or less than your total premiums.

Impact of mortality experience on annuity payments

How much you or your beneficiary receive in annuity payments from any Account will depend in part on the mortality experience of the annuity fund (annually revalued or monthly revalued) from which the payments are made. For example, if the people receiving income from an Account’s annually revalued annuity fund live longer, as a group, than expected, the amount payable to each will be less than if they as a group die sooner than expected. So the “mortality risk” of each Account’s annuity fund falls on those who receive income from it and is not guaranteed by TIAA.

Annuity starting date

Ordinarily, annuity payments begin on the date you designate as your annuity starting date, provided we have received all documentation necessary for the income option you have picked. If something is missing, we will defer your annuity starting date until we receive the missing information. Your first annuity check may be delayed while we process your choice of income options and calculate the amount of your initial payment. You may designate any future date for your annuitization request, in accordance with our procedures and as long as it is one on which we process annuitizations.

Any premiums received within 70 days after payments begin may be used to provide additional annuity income. Premiums received after 70 days will remain in your accumulating annuity contract until you have given further instructions. Ordinarily, your first annuity payment can be made on any business day between the first and twentieth of any month.

Annuity income options

Both the number of annuity units you purchase and the amount of your income payments will depend on which income option(s) you pick. Your employer’s plan,

78Prospectus ¡ TIAA Real Estate Account |

tax law and ERISA may limit which income options you can use to receive income from an RA, GRA, SRA, GSRA, Retirement Choice, Retirement Choice Plus, or Keogh Contract. Ordinarily, you will choose your income options shortly before you want payments to begin, but you can make or change your choice any time before your annuity starting date.

All of the income options provide variable payments, and the amount of income you receive depends in part on the investment experience of the investment accounts selected by you. The current options are:

|

| | • | | One-Life Annuity with or without Guaranteed Period: Pays income as long as you live. If you opt for a guaranteed period (10, 15 or 20 years) and you die before it’s over, income payments will continue to your beneficiary until the end of the period. If you don’t opt for a guaranteed period, all payments end at your death, so, it’s possible for you to receive only one payment if you die less than a month after payments start. (The 15-year guaranteed period is not available under all contracts.) |

|

| | • | | Annuity for a Fixed Period: Pays income for any period you choose from five to 30 years (two to 30 years for RAs, GRAs, and SRAs). This option is not available under all contracts. |

|

| | • | | Two-Life Annuities: Pays income to you as long as you live, then continues at either the same or a reduced level for the life of your annuity partner. There are four types of two-life annuity options, all available with or without a guaranteed period-Full Benefit to Survivor, Two-Thirds Benefit to Survivor, 75% Benefit to Annuity Partner and a Half-Benefit to Annuity Partner. Under the Two-Thirds Benefit to Survivor option, payments to you will be reduced upon the death of your annuity partner. |

|

| | • | | Minimum Distribution Option (“MDO”): Generally available only if you must begin annuity payments under the IRC minimum distribution requirements. (Some employer plans allow you to elect this option earlier-contact TIAA for more information.) The option, if elected, automatically pays an amount designed to fulfill the distribution requirements under federal tax law. (The option is not available under all contracts.) You must apply your entire accumulation under a contract if you want to use the MDO. It is possible that income under the MDO will cease during your lifetime. Prior to age 90, and subject to applicable plan and legal restrictions, you can apply any remaining part of an accumulation applied to the MDO to any other income option for which you’re eligible. Using the MDO will not affect your right to take a cash withdrawal of any accumulation not yet distributed (to the extent that a cash withdrawal was available to you under your contract and under the terms of your employer’s plan). This automatic payout option is not available under the Retirement Choice or Retirement Choice Plus Contracts or IRA contracts issued after October 11, 2010. Instead, required minimum distributions will be paid directly from these contracts pursuant to the terms of your employer’s plan. |

TIAA Real Estate Account ¡Prospectus79 |

|

| | • | | Income Test Drive (expected to be available by the second quarter of 2018): Income Test Drive is an optional feature that lets you try variable income payments for a 2-year period without making an irrevocable decision. You retain your accumulation during the Income Test Drive, and payments made during the Income Test Drive are withdrawals from your accumulation. Payments are calculated to approximate the amount you would receive under a lifetime income unit-annuity for the income option and income change method you select, adjusted to reflect the Income Test Drive. |

|

| | | | You can change your mind during the Income Test Drive, and future payments will stop when you notify us of your decision. At the end of the Income Test Drive, if you have not decided to stop payments, your remaining accumulation applied to the Income Test Drive feature will be converted to annuity units payable under the income option you chose when you started this feature. Once the conversion to annuity units takes place, it is irrevocable. If you decide before the end of the Income Test Drive that you want to begin annuity income immediately, you may do so subject to certain election procedures. The conversion of accumulation units to annuity units may result in annuity payments that are greater or lesser than the amount of the last payment during the Income Test Drive. |

|

| | | | State regulatory approval may be pending for the Income Test Drive and it may not currently be available in your state. We may stop providing the Income Test Drive feature at any time. For information about withdrawals from your contract, see “How to transfer and withdraw your money.” |

For any of the income options described above, current federal tax law provides that your guaranteed period can’t exceed the joint life expectancy of you and your beneficiary or annuity partner. Other code stipulations may make some income options unavailable to you. If you are married at your annuity start date, you may be required by law to choose an income option that provides survivor annuity income to your spouse, unless your spouse waives the right.

Receiving Lump-Sum Payments (Retirement Transition Benefit): If your employer’s plan allows, you may be able to receive a single sum payment of up to 10% of the value of any part of an accumulation being converted to annuity income on the annuity starting date. Such employer plan and 10% limitations do not apply to IRAs.Of course, if your employer’s plan allows cash withdrawals, you can take a larger amount (up to 100%) of your accumulation as a cash payment. The retirement transition benefit will be subject to current federal income tax requirements and possible early distribution penalties. See “Taxes.”

Other income options may become available in the future, subject to the terms of your retirement plan and relevant federal and state laws. TIAA may stop offering certain income options in the future. For more information about any annuity option, please contact TIAA.

80Prospectus ¡ TIAA Real Estate Account |

Transfers during the annuity period

After you begin receiving annuity income, you can transfer all or part of the future annuity income (which is the actuarial present value of the payments based on the applicable interest rate and the mortality basis associated with that fund at the time of the transfer) payable once each calendar quarter (i) from the Real Estate Account into a “comparable annuity” payable from a CREF or TIAA account or TIAA’s Traditional Annuity, or (ii) from a CREF or TIAA variable account into a comparable annuity payable from the Real Estate Account. Comparable annuities are those which are payable under the same income option and have the same first and second annuitant, and remaining guaranteed period.

We’ll process your transfer on the business day we receive your request in good order. You can also choose to have a transfer take effect at the close of any future business day. Transfers under the annual income payment method will affect your annuity payments beginning on the May 1 following the March 31 which is on or after the effective date of the transfer. Transfers under the monthly income payment method and all transfers into TIAA’s Traditional Annuity will affect your annuity payments beginning with the first payment due after the monthly payment valuation day that is on or after the transfer date. You can switch between the annual and monthly income change methods, and the switch will go into effect on the last valuation day of March. Although the payout streams are actuarially equivalent and there is no charge for engaging in such a transfer, it is possible that the new funds may apply different mortality or interest assumptions, and could therefore result in variation between the initial payments from the new fund and the payments that were being made out of the original fund.

Annuity payments

The amount of annuity payments we pay you or your beneficiary (annuitant) will depend upon the number and value of the annuity units payable. The number of annuity units is first determined on the day before the annuity starting date. The amount of the annuity payments will change according to the income change method chosen.

Under the annual income change method, the value of an annuity unit for payments is redetermined on March 31 of each year (or, if March 31 is not a valuation day, the immediately preceding valuation day). This date is called the “annual payment valuation day.” Annuity payments change beginning May 1. The change reflects the net investment experience of the Real Estate Account. The net investment experience for the twelve months following the annual payment valuation day will be reflected in the annuity unit value determined on the next year’s annual payment valuation day.

Under the monthly income change method, the value of an annuity unit for payments is determined on the payment valuation day, which is the 20th day of the month preceding the payment due date or, if the 20th is not a business day, the preceding business day. The monthly changes in the value of an annuity unit reflect

TIAA Real Estate Account ¡Prospectus81 |

the net investment experience of the Real Estate Account. The formulas for calculating the number and value of annuity units payable are described below.

Calculating the Number of Annuity Units Payable: When a participant or a beneficiary converts the value of all or a portion of his or her accumulation into an income-paying contract, the number of annuity units payable from the Real Estate Account under an income change method is determined by dividing the value of the Account accumulation to be applied to provide the annuity payments by the product of the annuity unit value for that income change method and an annuity factor. The annuity factor as of the annuity starting date is the value of an annuity in the amount of $1.00 per month beginning on the first day such annuity units are payable, and continuing for as long as such annuity units are payable.

The annuity factor will reflect interest assumed at the effective annual rate of 4%, and the mortality assumptions for the person(s) on whose life (lives) the annuity payments will be based. Mortality assumptions will be based on the then-current settlement mortality schedules for this Account. Annuitants bear no mortality risk under their contracts — actual mortality experience will not reduce annuity payments after they have started. TIAA may change the mortality assumptions used to determine the number of annuity units payable for any future accumulations converted to provide annuity payments.

The number of annuity units payable under an income change method under your contract will be reduced by the number of annuity units you transfer out of that income change method under your contract. The number of annuity units payable will be increased by any internal transfers you make to that income change method under your contract.

Value of Annuity Units: The Real Estate Account’s annuity unit value is calculated separately for each income change method for each valuation day. The annuity unit value for each income change method is determined by updating the annuity unit value from the previous valuation day to reflect the net investment performance of the Account for the current valuation period relative to the 4% assumed investment return. In general, your payments will increase if the performance of the Account is greater than 4% and decrease if the value is less than 4%. The value is further adjusted to take into account any changes expected to occur in the future at revaluation either once a year or once a month, assuming the Account will earn the 4% assumed investment return in the future.

The initial value of the annuity unit for a new annuitant is the value determined as of the valuation day before annuity payments start.

For participants under the annual income change method, the value of the annuity unit for payment remains level until the following May 1. For those who have already begun receiving annuity income as of March 31, the value of the annuity unit for payments due on and after the next succeeding May 1 is equal to the annuity unit value determined as of the last valuation day in March.

For participants under the monthly income change method, the value of the annuity unit for payments changes on the payment valuation day of each month for the payment due on the first of the following month.

82Prospectus ¡ TIAA Real Estate Account |

Further, certain variable annuity payouts might not be available if issuing the payout annuity would violate state law.

TIAA reserves the right, subject to approval by the Board of Trustees, to modify the manner in which the number and/or value of annuity units is calculated in the future. No such modification will reduce any participant’s benefit once the participant’s annuitization period has commenced.

Death benefits

Choosing beneficiaries

Subject to the terms of your employer’s plan, death benefits under TIAAcontracts are payable to the beneficiaries you name. When you purchase your annuity contract, you name one or more beneficiaries to receive the death benefit if you die. You can generally change your beneficiaries any time before you die, and, unless you instruct otherwise, your annuity partner can do the same after your death.

Amount of death benefit

If you die during the accumulation period, the death benefit is the amount of your accumulation. If you and your annuity partner die during the annuity period while payments are still due under a fixed-period annuity or for the remainder of a guaranteed period, the death benefit is the present value, based on an specified effective annual interest rate, of the unit annuity payments due for the remainder of the period.

Payment of death benefit

To authorize payment and pay a death benefit, we must have received all necessary forms and documentation (in good order), including proof of death and the selection of the method of payment.

Every state has some form of unclaimed property laws that impose varying legal and practical obligations on insurers and, indirectly, on contract owners, insureds, beneficiaries and other payees of proceeds. Unclaimed property laws generally provide for escheatment to the state of unclaimed proceeds under various circumstances.

Contract ownersare urged to keep their own, as well as their insureds’, beneficiaries’ and other payees’, information up to date, including full names, postal and electronic media addresses, telephone numbers, dates of birth, and Social Security numbers. Such updates should be communicated in writing to TIAA at P.O. Box 1259, Charlotte, NC 28201, by calling our Automated Telephone Service (24 hours a day) at 800-842-2252 or via www.tiaa.org.

Methods of payment of death benefits

Generally, you can choose for your beneficiary the method we will use to pay the death benefit, but few participants do this. If you choose a payment method,

TIAA Real Estate Account ¡Prospectus83 |

you can also prevent your beneficiaries from changing it. Most people leave the choice to their beneficiaries. We can prevent any choice if its initial payment is less than $25. If your beneficiary does not specifically instruct us to start paying death benefits within a year of your death, we can start making payments to them over five years using the fixed-period annuity method of payment.

Payments during accumulation period: Currently, the available methods of payment for death benefits from funds in the accumulation period are:

|

| | • | | Single-Sum Payment, in which the entire death benefit is paid to your beneficiary at once; |

|

| | • | | One-Life Annuity With or Without Guaranteed Period, in which the death benefit is paid for the life of the beneficiary or through the guaranteed period; |

|

| | • | | Annuity for a Fixed Period of 5 to 30 years (not available under Retirement Choice and Retirement Choice Plus contracts or IRA contracts that are issued or opened on or after October 11, 2010), in which the death benefit is paid for a fixed period; |

|

| | • | | Minimum Distribution Payments, in which the beneficiary can elect to have payments made automatically in the amounts necessary to satisfy the Internal Revenue Code’s minimum distribution requirements. It is possible under this method that your beneficiary will not receive income for life. |

Death benefits are usually paid monthly (unless you chose a single-sum method of payment), but your beneficiary can switch them to quarterly, semiannual or annual payments. Note that for Retirement Choice and Retirement Choice Plus contracts, beneficiaries may only receive either a single-sum payment or a one-life annuity (with or without a guaranteed benefit in the plan).

Payments during annuity period:If you and your annuity partner die during the annuity period, your beneficiary can choose to receive any remaining guaranteed periodic payments due under your contract. Alternatively, your beneficiary can choose to receive the commuted value of those payments in a single sum unless you have indicated otherwise. The amount of the commuted value will be different from the total of the periodic payments that would otherwise be paid.

Ordinarily, death benefits are subject to federal tax. If taken as a lump sum, death benefits would be taxed like complete withdrawals. If taken as annuity benefits, the death benefit would be taxed like annuity payments. For more information, see the discussion under “Taxes” below.

Employer plan fee withdrawals

Your employer may, in accordance with the terms of your plan, and with TIAA’s approval, withdraw amounts from your accumulations under your Retirement Choice or Retirement Choice Plus contract, and, if your certificate so provides, on your GRA or GSRA, or GA contract, to pay fees associated with the administration of the plan. TIAA also reserves the right to suspend or reinstate its approval for a plan to make such withdrawals. The amount and the effective date of an

84Prospectus ¡ TIAA Real Estate Account |

employer plan fee withdrawal will be in accordance with the terms of your plan. TIAA will determine all values as of the end of the effective date under the plan.

An employer plan fee withdrawal cannot be revoked after its effective date under the plan. Each employer plan fee withdrawal will be made on a pro-rata basis from all your available TIAA and CREF Accounts. An employer plan fee withdrawal reduces the accumulation from which it is paid by the amount withdrawn. If allowed by your contract, your employer may also charge a fee on your Account to pay fees associated with administering the plan.

Your spouse’s rights to death benefits

In general, your choice of beneficiary for death benefits may, in some cases, be subject to the consent of your spouse. Similarly, if you are married at the time of your death, federal law may generally require a portion of the death benefit be paid to your spouse even if you have named someone else as beneficiary. If you die without having named any beneficiary, any portion of your death benefit not payable to your spouse will generally go to your estate unless your employer’s plan provides otherwise.

If you are married, and all or part of your accumulation is attributable to contributions made under:

|

| | A. | | an employer plan subject to ERISA; or |

|

| | B. | | an employer plan that provides for spousal rights to benefits, then, only to the extent required by the IRC or ERISA or the terms of your employer plan, your rights to choose certain benefits are restricted by the rights of your spouse to benefits as follows: |

|

| | • | | Spouse’s survivor retirement benefit. If you are married on your annuity starting date, your income benefit must be paid under a two-life annuity with your spouse as second annuitant. |

|

| | • | | Spouse’s survivor death benefit. If you die before your annuity starting date and your spouse survives you, the payment of the death benefit to your named beneficiary may be subject to your spouse’s right to receive a death benefit. Under an employer plan subject to ERISA, your spouse has the right to a death benefit of at least 50% of any part of your accumulation attributable to contributions made under such a plan. Under an employer plan not subject to ERISA, your spouse may have the right to a death benefit in the amount stipulated in the plan. |

Your spouse may consent to a waiver of his or her rights to these benefits.

Waiver of spouse’s rights to death benefits

If you are married, and all or part of your accumulation is attributable to contributions made under:

|

| | A. | | an employer plan subject to ERISA; or |

|

| | B. | | an employer plan that provides for spousal rights to benefits, then, only to the extent required by the IRC or ERISA or the terms of your employer plan, |

TIAA Real Estate Account ¡Prospectus85 |

|

| | | | your spouse must consent to a waiver of his or her rights to survivor benefits before you can choose: |

|

| | • | | an income option other than a two-life annuity with your spouse as second annuitant; or |

|

| | • | | beneficiaries who are not your spouse for more than the percentage of the death benefit allowed by the employer plan; or |

|

| | • | | a lump-sum benefit. |

In order to waive the rights to spousal survivor benefits, we must receive, in a form satisfactory to us, your spouse’s consent, or a satisfactory verification that your spouse cannot be located. A waiver of rights with respect to an income option or a lump-sum benefit must be made in accordance with the IRC and ERISA, or the applicable provisions of your employer plan. A waiver of the survivor death benefit may not be effective if it is made prior to the earlier of the plan year in which you reach age 35 or your severance from employment of your employer.

Verification of your marital status may be required, in a form satisfactory to us, for purposes of establishing your spouse’s rights to benefits or a waiver of these rights. (For more information about the definition of a “spouse”, see “Taxes-Federal Defense of Marriage Act.”) You may revoke a waiver of your spouse’s rights to benefits at any time during your lifetime and before the annuity starting date. Your spouse may not revoke a consent to a waiver after the consent has been given.

Taxes

This section offers general information concerning federal taxes. It doesn’t cover every situation. Tax treatment varies depending on the circumstances, and state and local taxes may also be involved. For complete information on your personal tax situation, check with a qualified tax advisor.

How the Real Estate Account is treated for tax purposes

The Account is not a separate taxpayer for purposes of the Code — its earnings are taxed as part of TIAA’s operations. Although TIAA is not expected to owe any federal income taxes on the Account’s earnings, if TIAA does incur taxes attributable to the Account, it may make a corresponding charge against the Account.

Taxes in general

During the accumulation period, Real Estate Account premiums paid in before-tax dollars, employer contributions and earnings attributable to these amounts are not taxed until they’re withdrawn. Annuity payments, single-sum withdrawals, systematic withdrawals, and death benefits are usually taxed as ordinary income. Premiums paid in after-tax dollars aren’t taxable when withdrawn, but earnings attributable to these amounts are taxable unless those amounts are contributed as Roth contributions to a 401(a), 403(b) or governmental 457(b) plan and

86Prospectus ¡ TIAA Real Estate Account |

certain criteria are met before the amounts (and the income on the amounts) are withdrawn. Generally, transfers between qualified retirement plans are not taxed.