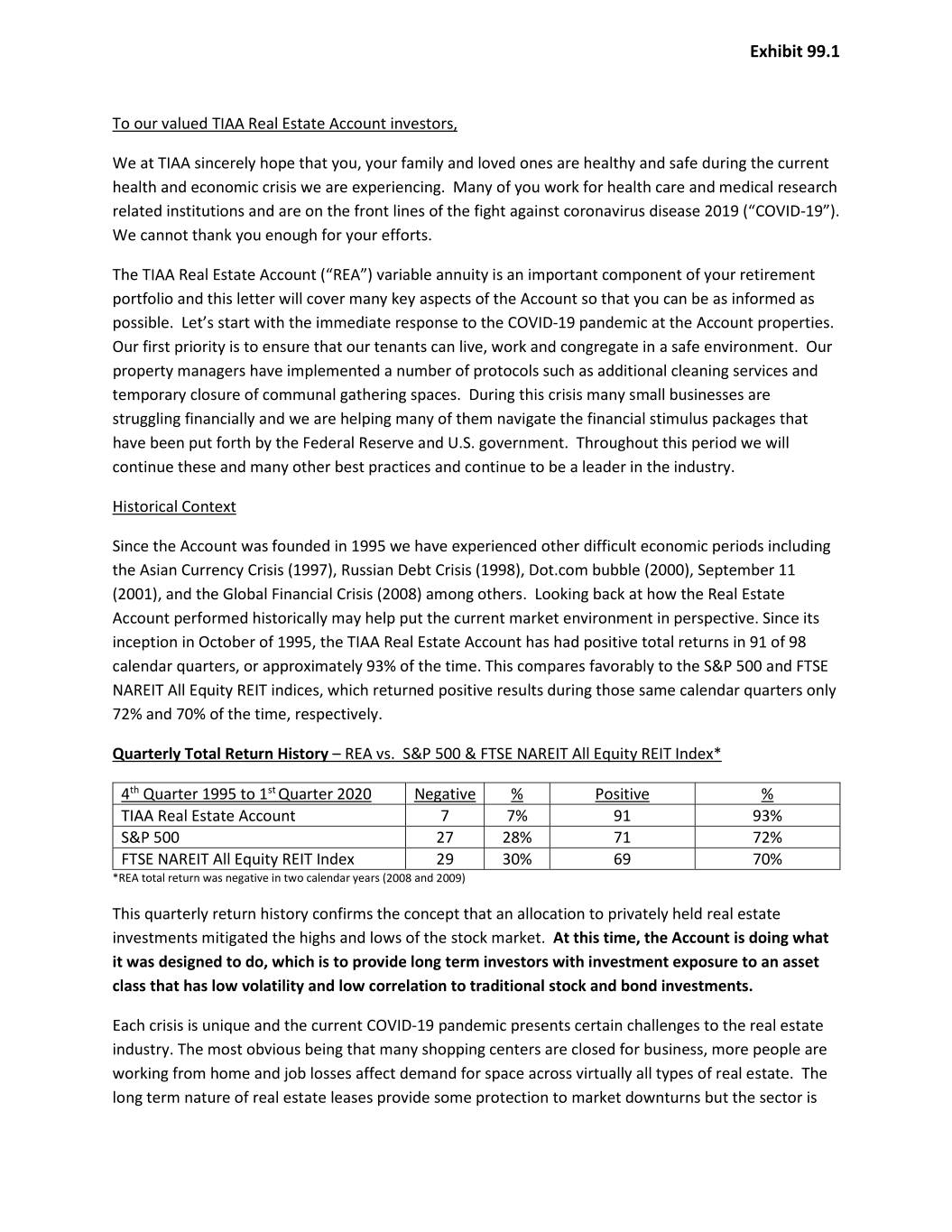

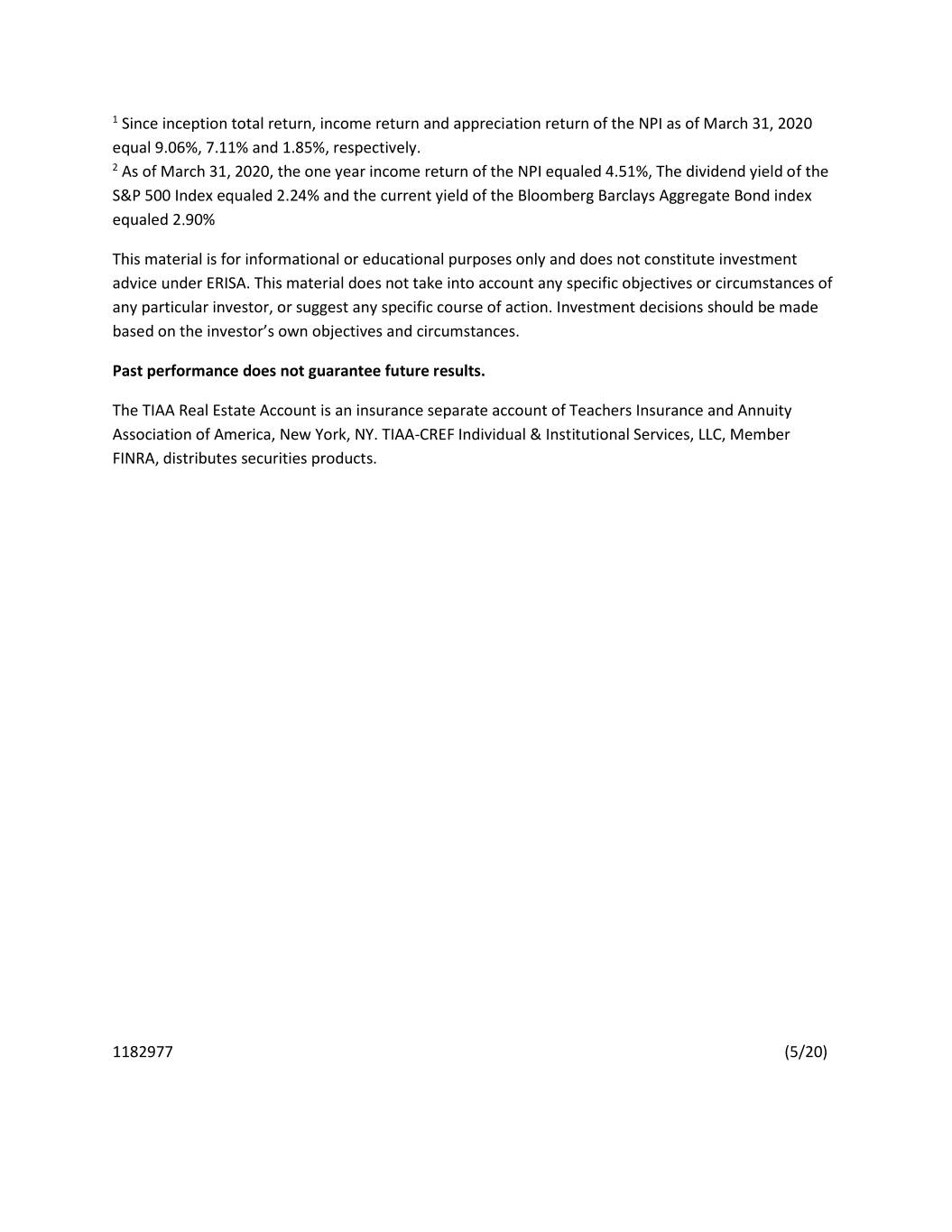

Exhibit 99.1 To our valued TIAA Real Estate Account investors, We at TIAA sincerely hope that you, your family and loved ones are healthy and safe during the current health and economic crisis we are experiencing. Many of you work for health care and medical research related institutions and are on the front lines of the fight against coronavirus disease 2019 (“COVID-19”). We cannot thank you enough for your efforts. The TIAA Real Estate Account (“REA”) variable annuity is an important component of your retirement portfolio and this letter will cover many key aspects of the Account so that you can be as informed as possible. Let’s start with the immediate response to the COVID-19 pandemic at the Account properties. Our first priority is to ensure that our tenants can live, work and congregate in a safe environment. Our property managers have implemented a number of protocols such as additional cleaning services and temporary closure of communal gathering spaces. During this crisis many small businesses are struggling financially and we are helping many of them navigate the financial stimulus packages that have been put forth by the Federal Reserve and U.S. government. Throughout this period we will continue these and many other best practices and continue to be a leader in the industry. Historical Context Since the Account was founded in 1995 we have experienced other difficult economic periods including the Asian Currency Crisis (1997), Russian Debt Crisis (1998), Dot.com bubble (2000), September 11 (2001), and the Global Financial Crisis (2008) among others. Looking back at how the Real Estate Account performed historically may help put the current market environment in perspective. Since its inception in October of 1995, the TIAA Real Estate Account has had positive total returns in 91 of 98 calendar quarters, or approximately 93% of the time. This compares favorably to the S&P 500 and FTSE NAREIT All Equity REIT indices, which returned positive results during those same calendar quarters only 72% and 70% of the time, respectively. Quarterly Total Return History – REA vs. S&P 500 & FTSE NAREIT All Equity REIT Index* 4th Quarter 1995 to 1st Quarter 2020 Negative % Positive % TIAA Real Estate Account 7 7% 91 93% S&P 500 27 28% 71 72% FTSE NAREIT All Equity REIT Index 29 30% 69 70% *REA total return was negative in two calendar years (2008 and 2009) This quarterly return history confirms the concept that an allocation to privately held real estate investments mitigated the highs and lows of the stock market. At this time, the Account is doing what it was designed to do, which is to provide long term investors with investment exposure to an asset class that has low volatility and low correlation to traditional stock and bond investments. Each crisis is unique and the current COVID-19 pandemic presents certain challenges to the real estate industry. The most obvious being that many shopping centers are closed for business, more people are working from home and job losses affect demand for space across virtually all types of real estate. The long term nature of real estate leases provide some protection to market downturns but the sector is

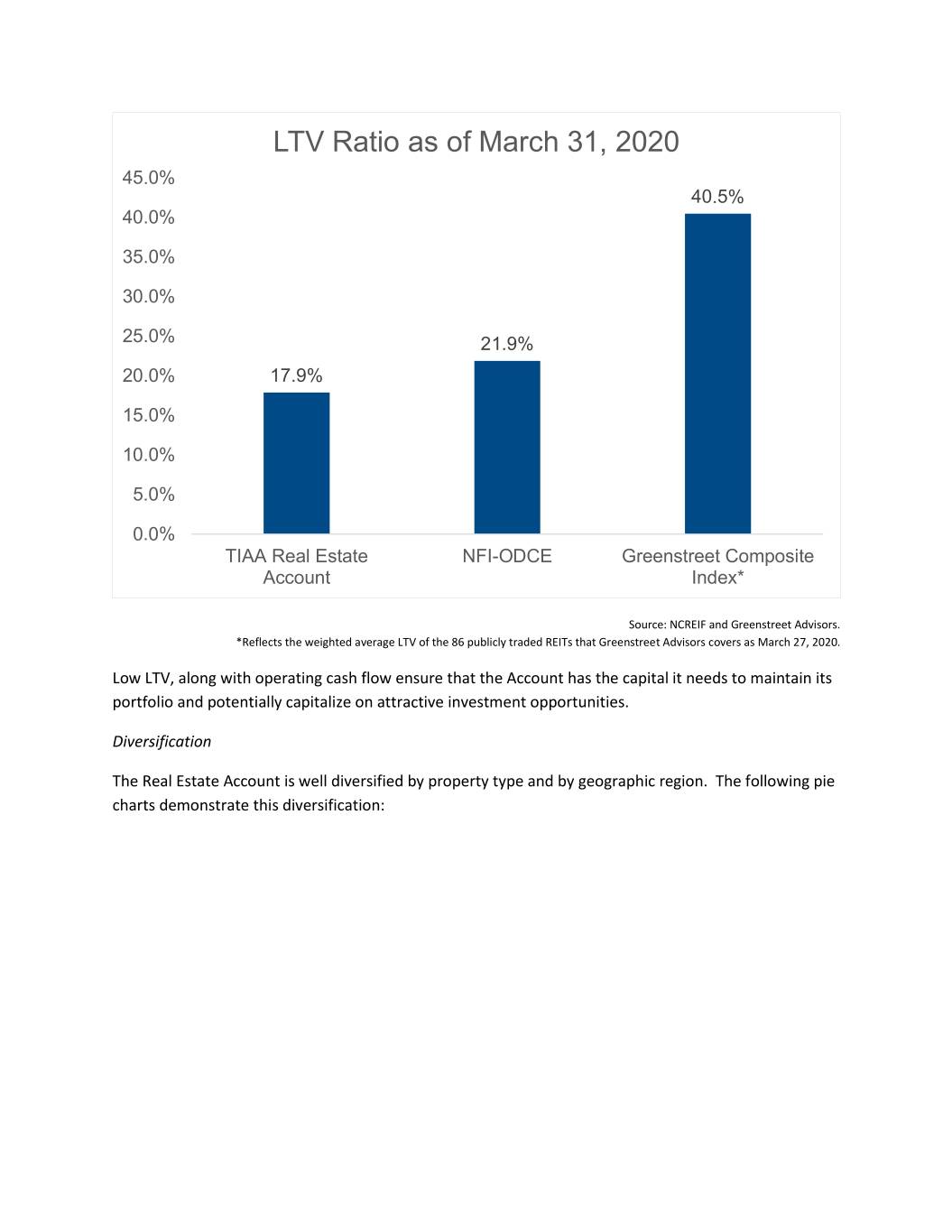

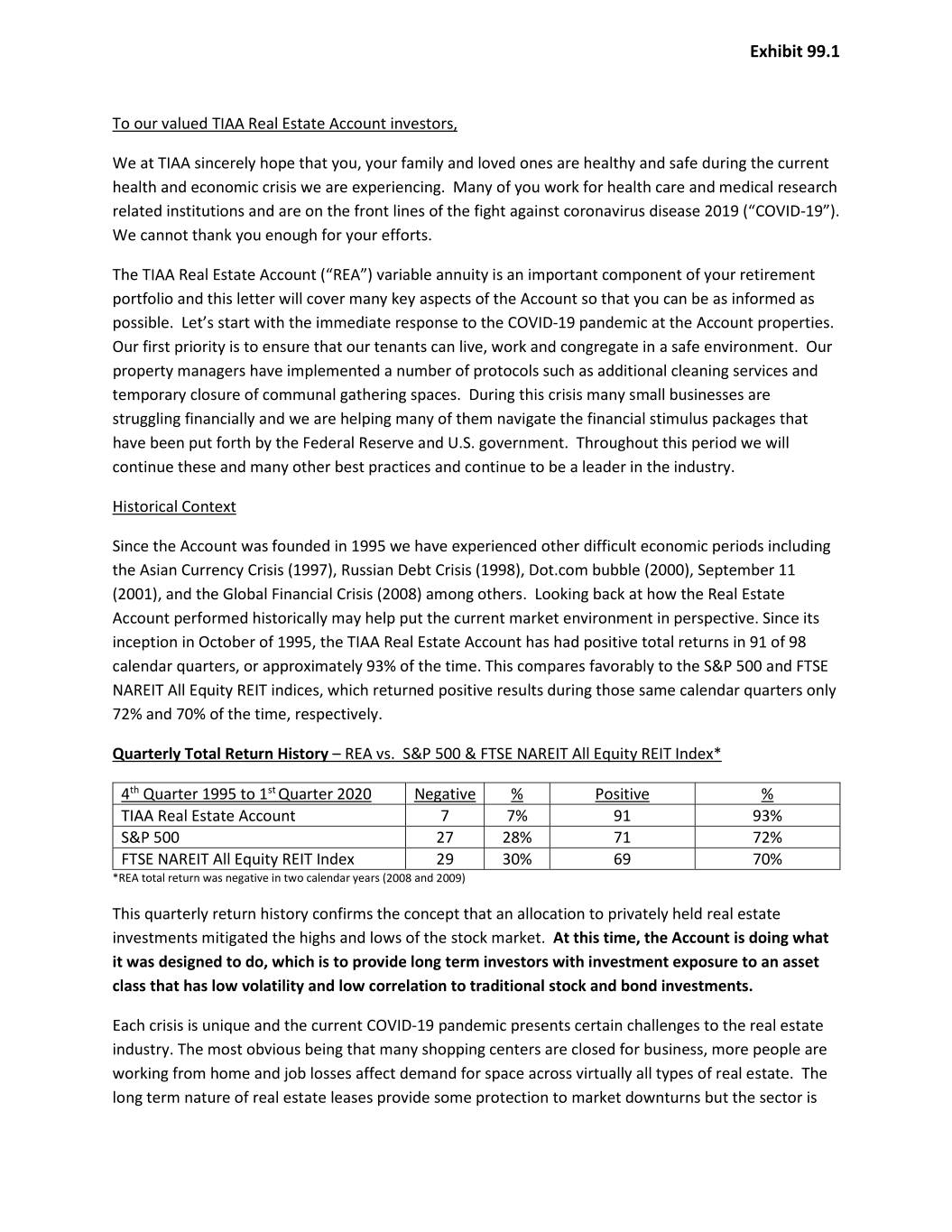

not immune. We are all unsure about how long and severe this market downturn will last or how swift the future recovery will be but there are certain factors that could lead to a sharp recovery for the real estate sector. These include: - Historically low interest rates: The Fed Funds target interest rate is near zero, just as it was from 2009 through 2015. It is possible that this target rate will persist for a long time and until clear signs of persistent economic strength return. Real estate values are influenced by prevailing market interest rates. Normally, when rates are low, real estate yields tend to compress and prices increase. - Decreasing Supply: Near-term growth of additional real estate supply is expected to decrease sharply due to the anticipated economic impact of COVID-19, a lack of construction financing and labor force disruption. Lower supply typically leads to higher rents. - Greater Diversification: The Account property portfolio includes many niche property types including medical office buildings, self-storage properties, data centers, laboratory and life- science campuses and student housing among others. Many of these property types have proven to be more resilient during economic downturns. Account Attributes During times of market and other crises, we believe that the Real Estate Account can provide three critically important investment attributes that investors should consider: liquidity, low leverage, and diversification. Liquidity Investor liquidity in the Real Estate Account is guaranteed. First, because the Account holds a meaningful portion of its assets in professionally managed, liquid, investment grade fixed income securities. Second, if the Account can’t fund investor redemption requests from its own cash flow and liquid investments, AAA rated TIAA will purchase units of the Account in order to fund such requests. The key thing to remember is that because of these features, which no other private real estate investment vehicle can claim, your investment in the Real Estate Account will remain liquid at all times. Investors are encouraged to maintain a long-term view of their allocation to the Real Estate Account. The Account is not appropriate for market timing and frequent trading and in order to discourage this activity, transfers of accumulations out of the Account are restricted to once per calendar quarter. Low Leverage The Account began 2020 with relatively low leverage. As of March 31, 2020 its Loan to Value (“LTV”) ratio was 17.9%. The graph below compares the Account’s leverage to that of its peer group, the NCREIF Fund Index – ODCE (“NFI-ODCE”) as well as to public REIT stocks as represented by the Greenstreet Composite Index.

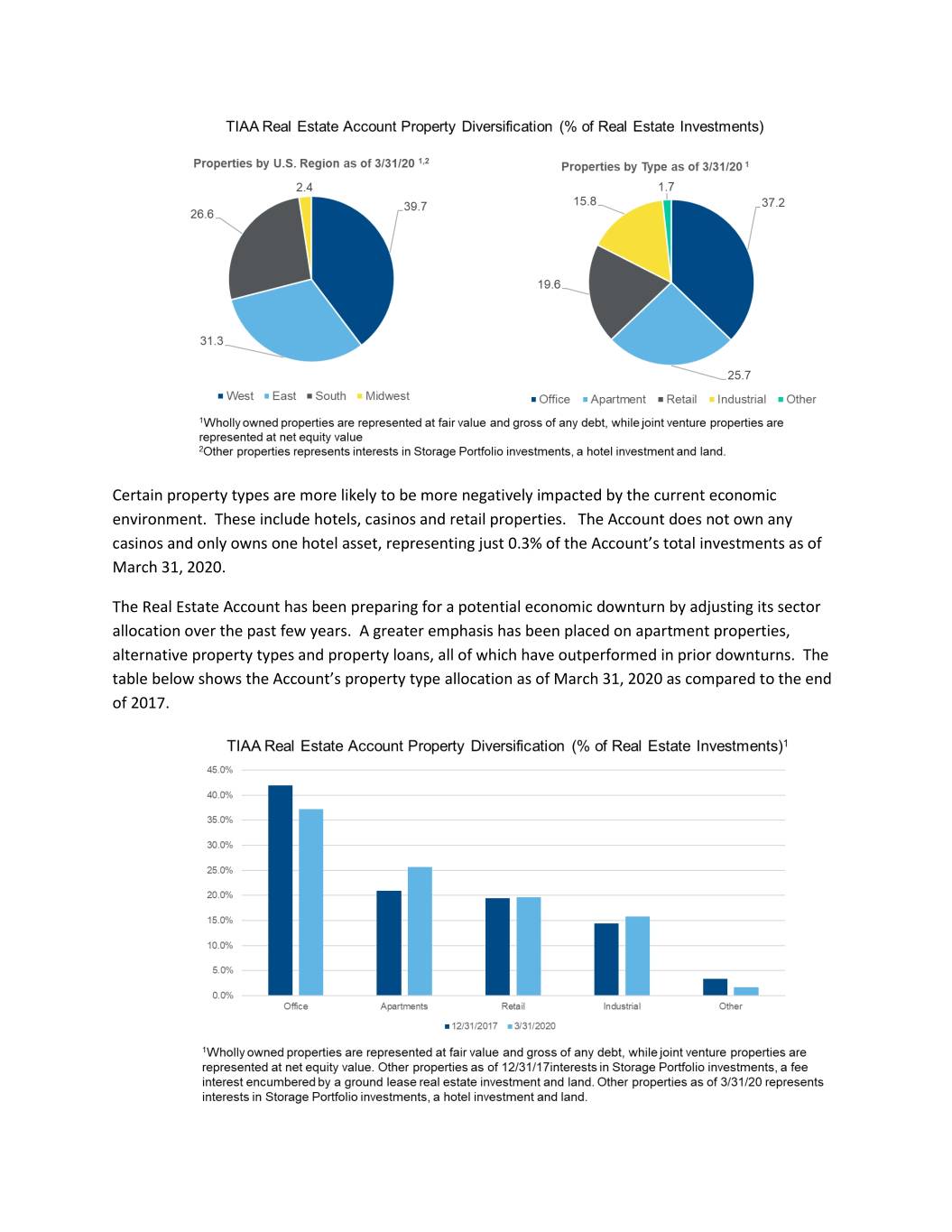

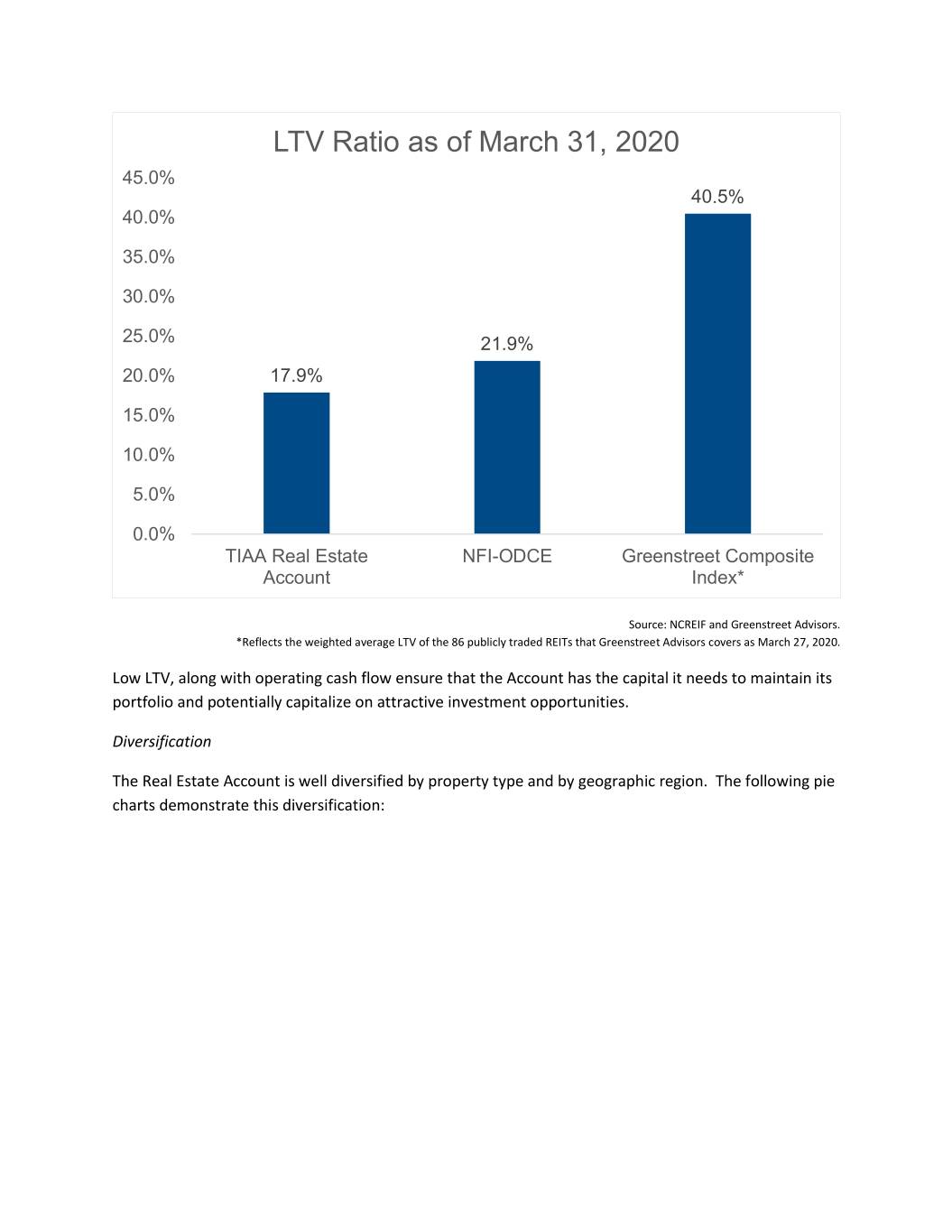

LTV Ratio as of March 31, 2020 45.0% 40.5% 40.0% 35.0% 30.0% 25.0% 21.9% 20.0% 17.9% 15.0% 10.0% 5.0% 0.0% TIAA Real Estate NFI-ODCE Greenstreet Composite Account Index* Source: NCREIF and Greenstreet Advisors. *Reflects the weighted average LTV of the 86 publicly traded REITs that Greenstreet Advisors covers as March 27, 2020. Low LTV, along with operating cash flow ensure that the Account has the capital it needs to maintain its portfolio and potentially capitalize on attractive investment opportunities. Diversification The Real Estate Account is well diversified by property type and by geographic region. The following pie charts demonstrate this diversification:

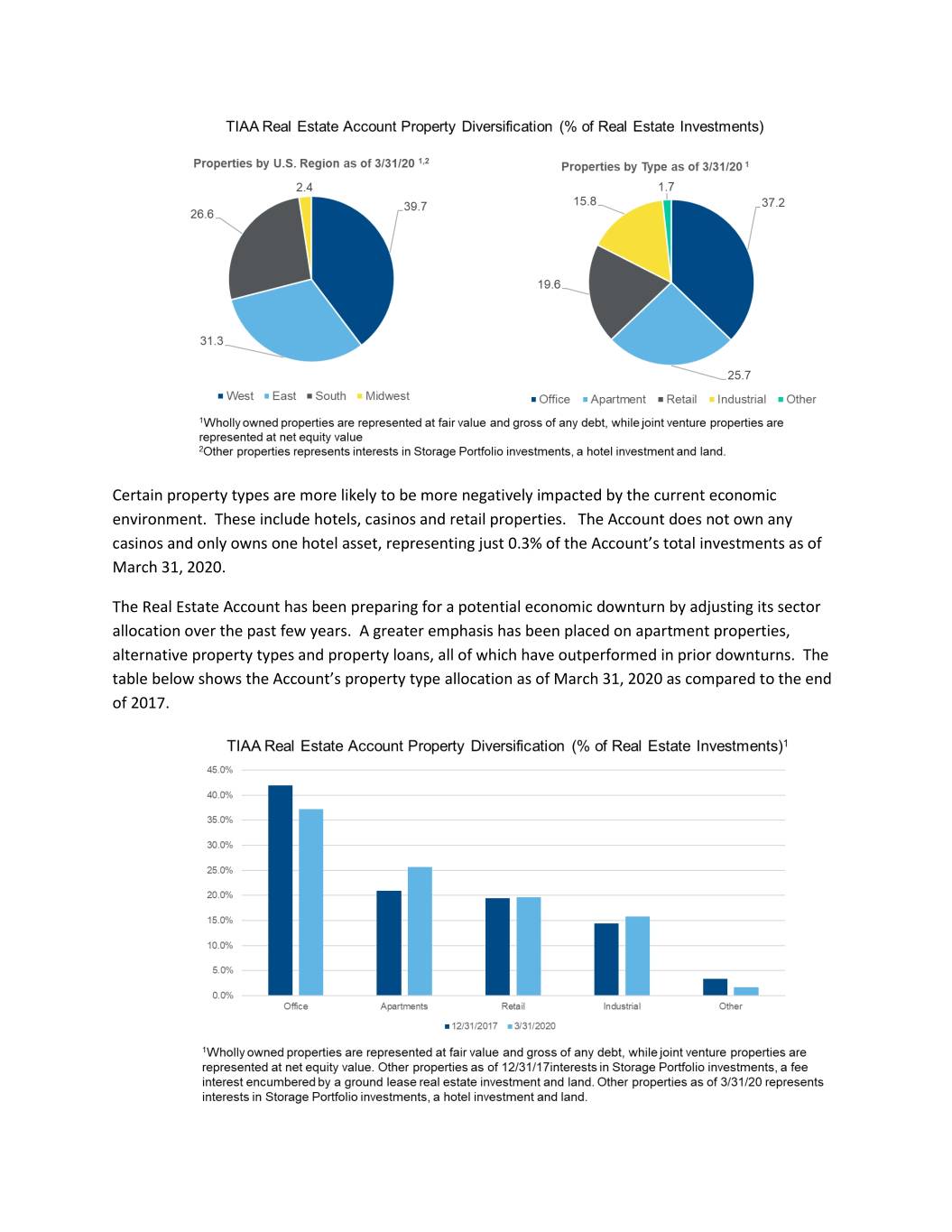

Certain property types are more likely to be more negatively impacted by the current economic environment. These include hotels, casinos and retail properties. The Account does not own any casinos and only owns one hotel asset, representing just 0.3% of the Account’s total investments as of March 31, 2020. The Real Estate Account has been preparing for a potential economic downturn by adjusting its sector allocation over the past few years. A greater emphasis has been placed on apartment properties, alternative property types and property loans, all of which have outperformed in prior downturns. The table below shows the Account’s property type allocation as of March 31, 2020 as compared to the end of 2017.

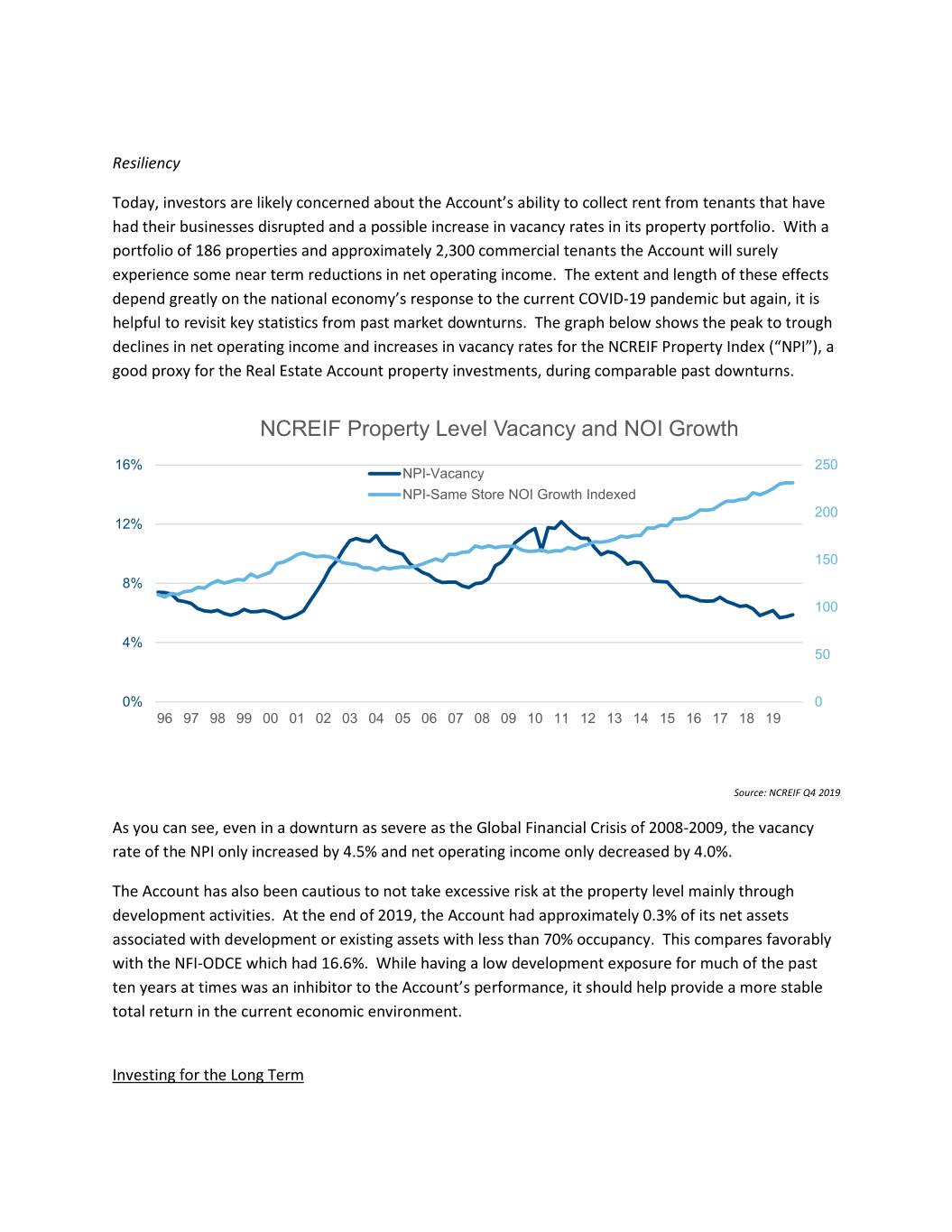

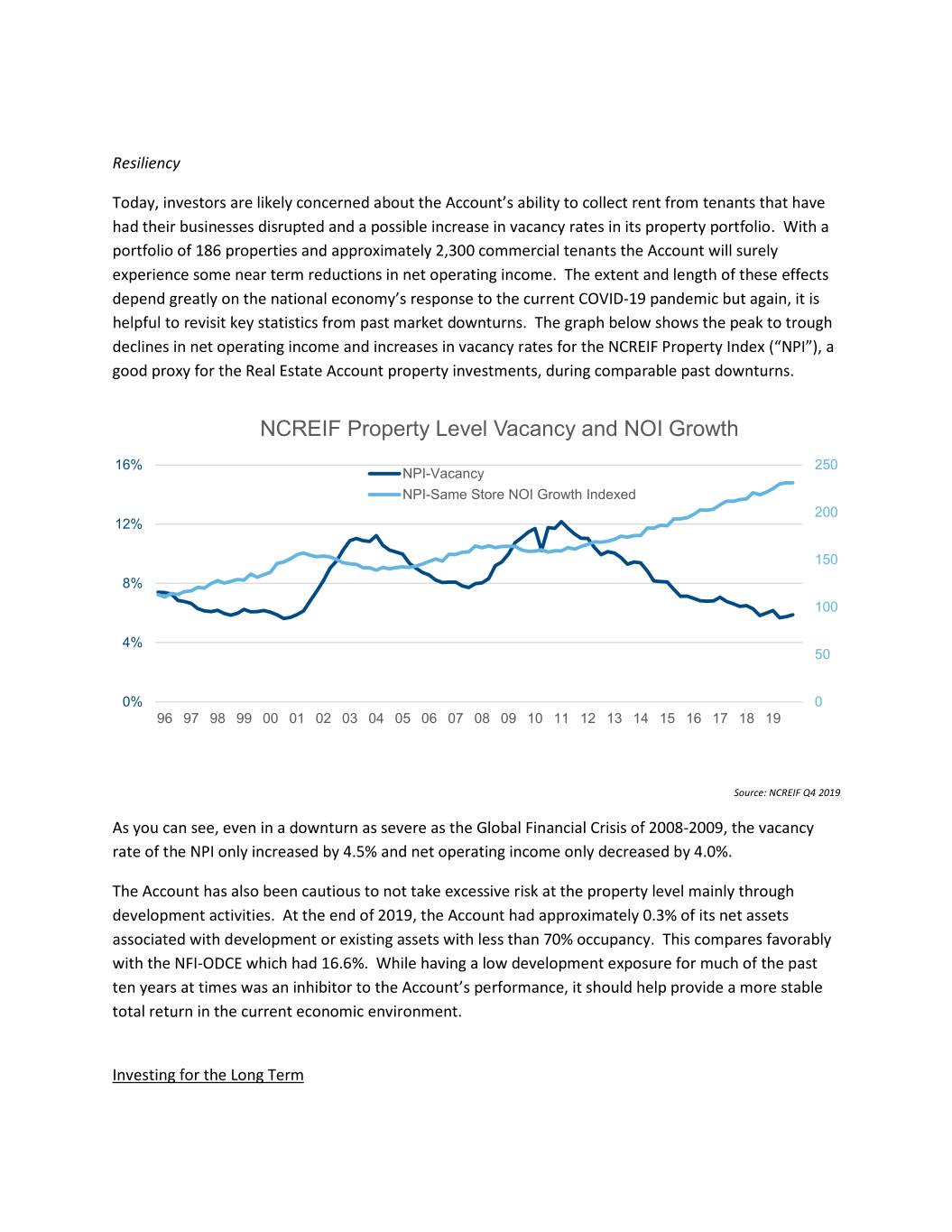

Resiliency Today, investors are likely concerned about the Account’s ability to collect rent from tenants that have had their businesses disrupted and a possible increase in vacancy rates in its property portfolio. With a portfolio of 186 properties and approximately 2,300 commercial tenants the Account will surely experience some near term reductions in net operating income. The extent and length of these effects depend greatly on the national economy’s response to the current COVID-19 pandemic but again, it is helpful to revisit key statistics from past market downturns. The graph below shows the peak to trough declines in net operating income and increases in vacancy rates for the NCREIF Property Index (“NPI”), a good proxy for the Real Estate Account property investments, during comparable past downturns. NCREIF Property Level Vacancy and NOI Growth 16% 250 NPI-Vacancy NPI-Same Store NOI Growth Indexed 200 12% 150 8% 100 4% 50 0% 0 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 Source: NCREIF Q4 2019 As you can see, even in a downturn as severe as the Global Financial Crisis of 2008-2009, the vacancy rate of the NPI only increased by 4.5% and net operating income only decreased by 4.0%. The Account has also been cautious to not take excessive risk at the property level mainly through development activities. At the end of 2019, the Account had approximately 0.3% of its net assets associated with development or existing assets with less than 70% occupancy. This compares favorably with the NFI-ODCE which had 16.6%. While having a low development exposure for much of the past ten years at times was an inhibitor to the Account’s performance, it should help provide a more stable total return in the current economic environment. Investing for the Long Term

Why do people invest in real estate? We’ve covered some of the more technical aspects such as low correlation to stock and bond investments, but another key factor is income. There are two components to the total return of real estate investments: income return and appreciation return. Since inception of the NPI in 1978, income has produced nearly 80% of the index’s total return1. The chart below shows the annual income return and appreciation return of the NPI since inception. The income return tends to decline during long periods of positive appreciation returns. It also tends to rise during shorter periods of negative appreciation returns. This tendency to offset negative appreciation returns can help mitigate volatility in the market value of real estate investments. Real Estate income returns are typically higher than those of stocks and can be higher than those of bond investments2. Some individual investors seeking extra income and appreciation try to achieve these goals by purchasing an investment property. They quickly learn about how time consuming, volatile and stressful that approach can be. An investment in the Real Estate Account, with a long term approach, may achieve this with much more diversification and investment exposure to property types that would otherwise be unavailable. The Account does not pay a dividend or income yield. Income from the Account’s investments is re-invested, which can create a compounding effect that over time can lead to significant growth in your accumulation. We hope that you have found these points informative and we appreciate the opportunity to help you with your retirement objectives. Most of all, we wish you continued health and well-being throughout the balance of 2020 and beyond.

1 Since inception total return, income return and appreciation return of the NPI as of March 31, 2020 equal 9.06%, 7.11% and 1.85%, respectively. 2 As of March 31, 2020, the one year income return of the NPI equaled 4.51%, The dividend yield of the S&P 500 Index equaled 2.24% and the current yield of the Bloomberg Barclays Aggregate Bond index equaled 2.90% This material is for informational or educational purposes only and does not constitute investment advice under ERISA. This material does not take into account any specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on the investor’s own objectives and circumstances. Past performance does not guarantee future results. The TIAA Real Estate Account is an insurance separate account of Teachers Insurance and Annuity Association of America, New York, NY. TIAA-CREF Individual & Institutional Services, LLC, Member FINRA, distributes securities products. 1182977 (5/20)