Please refer to the next page for important disclosure information. TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 6/30/2022 Portfolio Net Assets $31.4 Billion Inception Date 10/02/1995 Symbol QREARX Estimated Annual Expenses 1 2 0.77% Investment Description The Account seeks to generate favorable total returns primarily through the rental income and appreciation of a diversified portfolio of directly held, private real estate investments and real estate-related investments while offering investors guaranteed daily liquidity. The Account intends to have between 75% and 85% of its net assets invested directly in real estate or real estate–related investments. The remainder of its investments will be invested in liquid, fixed- income investments. Learn More For more information please contact: 800-842-2252 Weekdays, 8 a.m. to 10 p.m. (ET), or visit TIAA.org Performance Total Return Average Annual Total Return QTD YTD 1 Year 3 Years 5 Years 10 Years Since Inception TIAA Real Estate Account 5.11% 10.82% 23.04% 9.87% 7.96% 8.08% 6.68% The returns quoted represent past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance information, including performance to the most recent month-end, please visit TIAA.org, or call 800-842-2252. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower. 1 The total annual expense deduction, which includes investment management, administration, and distribution expenses, mortality and expense risk charges, and the liquidity guarantee, is estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. Historically, adjustments have been small. 2 The Account's total annual expense deduction appears in the Account's prospectus, and may be different than that shown herein due to rounding. Please refer to the prospectus for further details. Hypothetical Growth of $10,000 The chart illustrates the performance of a hypothetical $10,000 investment on June 30, 2012 and redeemed on June 30, 2022. — TIAA Real Estate Account $21,759 The total returns are not adjusted to reflect sales charges, the effects of taxation or redemption fees, but are adjusted to reflect actual ongoing expenses, and assume reinvestment of dividends and capital gains, net of all recurring costs. Properties by Type (As of 6/30/2022) % of Real Estate Investments3 4 Office 29.6 Industrial 27.2 Apartment 26.2 Retail 12.3 Other 4.7 Properties by Region (As of 6/30/2022) % of Real Estate Investments3 West 39.5 South 29.8 East 26.9 Midwest 3.7 Foreign 0.1 3 Wholly owned properties are represented at fair value and gross of any debt, while joint venture properties are represented at the net equity value. 4 Other properties represents interests in Storage Portfolio investments, a hotel investment and land. 6/22 $1,500 $6,500 $11,500 $16,500 $21,500 $26,500 6/12 12/13 6/15 12/16 6/18 12/19 6/21 Exhibit 99.1

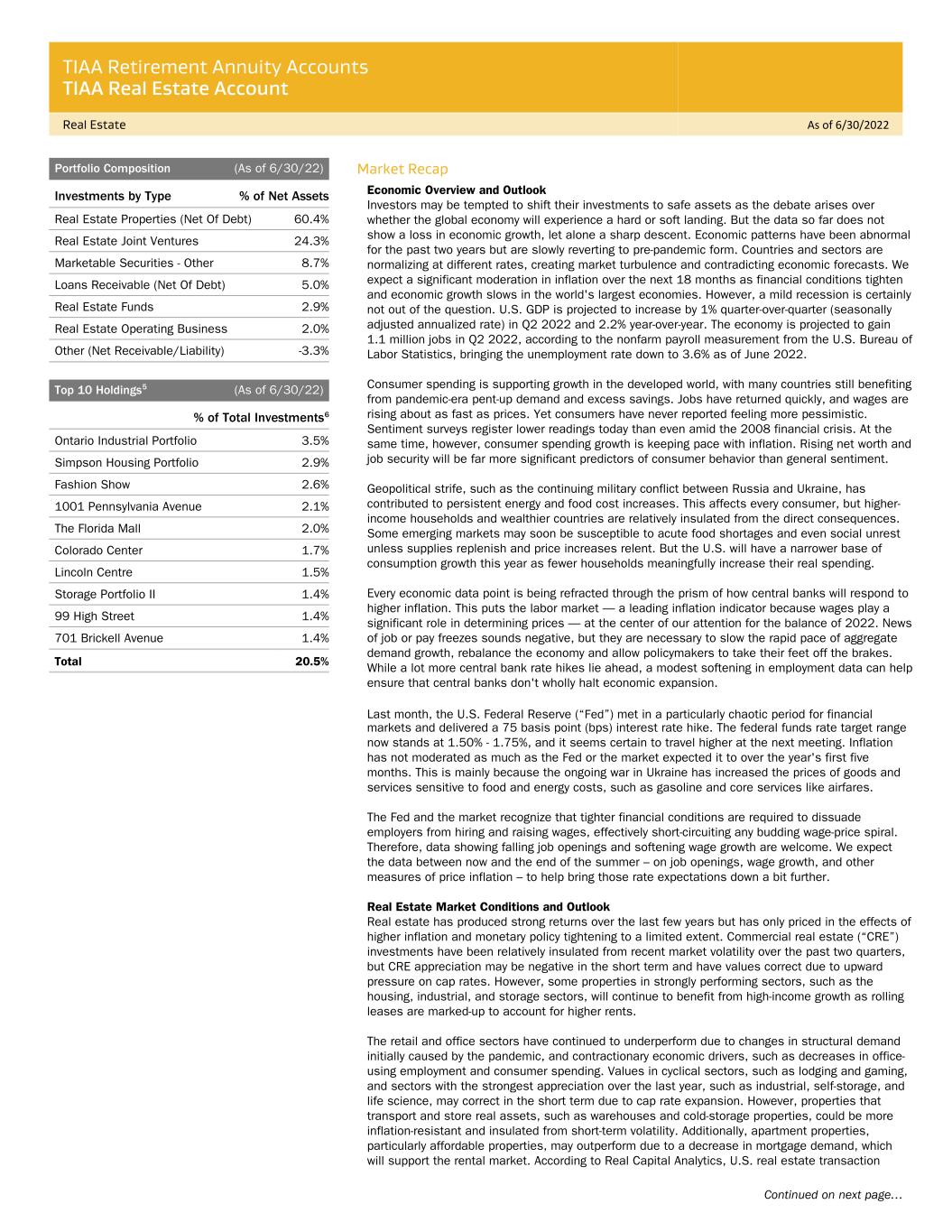

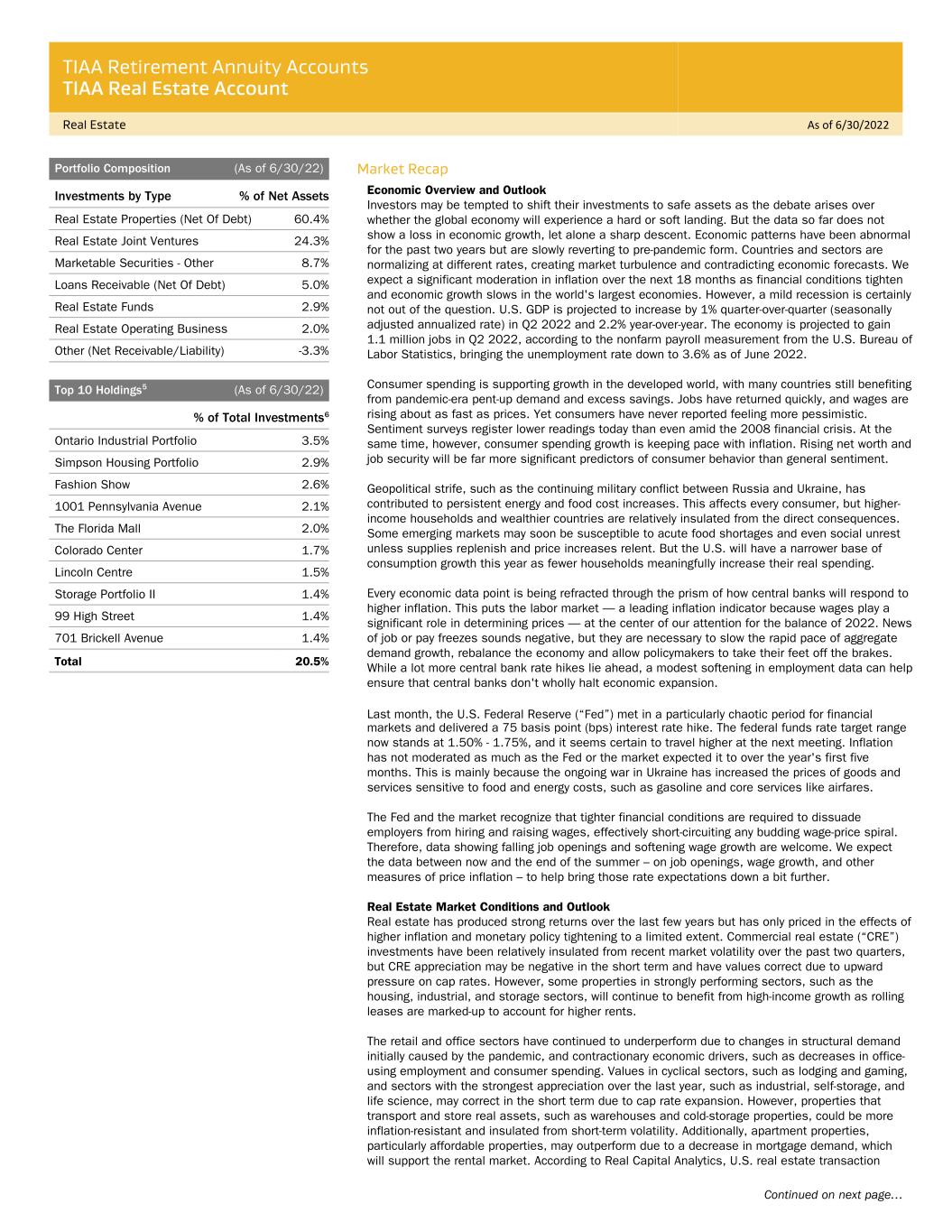

TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 6/30/2022 Continued on next page… Portfolio Composition (As of 6/30/22) Investments by Type % of Net Assets Real Estate Properties (Net Of Debt) 60.4% Real Estate Joint Ventures 24.3% Marketable Securities - Other 8.7% Loans Receivable (Net Of Debt) 5.0% Real Estate Funds 2.9% Real Estate Operating Business 2.0% Other (Net Receivable/Liability) -3.3% Top 10 Holdings 5 (As of 6/30/22) % of Total Investments 6 Ontario Industrial Portfolio 3.5% Simpson Housing Portfolio 2.9% Fashion Show 2.6% 1001 Pennsylvania Avenue 2.1% The Florida Mall 2.0% Colorado Center 1.7% Lincoln Centre 1.5% Storage Portfolio II 1.4% 99 High Street 1.4% 701 Brickell Avenue 1.4% Total 20.5% Market Recap Economic Overview and Outlook Investors may be tempted to shift their investments to safe assets as the debate arises over whether the global economy will experience a hard or soft landing. But the data so far does not show a loss in economic growth, let alone a sharp descent. Economic patterns have been abnormal for the past two years but are slowly reverting to pre-pandemic form. Countries and sectors are normalizing at different rates, creating market turbulence and contradicting economic forecasts. We expect a significant moderation in inflation over the next 18 months as financial conditions tighten and economic growth slows in the world's largest economies. However, a mild recession is certainly not out of the question. U.S. GDP is projected to increase by 1% quarter-over-quarter (seasonally adjusted annualized rate) in Q2 2022 and 2.2% year-over-year. The economy is projected to gain 1.1 million jobs in Q2 2022, according to the nonfarm payroll measurement from the U.S. Bureau of Labor Statistics, bringing the unemployment rate down to 3.6% as of June 2022. Consumer spending is supporting growth in the developed world, with many countries still benefiting from pandemic-era pent-up demand and excess savings. Jobs have returned quickly, and wages are rising about as fast as prices. Yet consumers have never reported feeling more pessimistic. Sentiment surveys register lower readings today than even amid the 2008 financial crisis. At the same time, however, consumer spending growth is keeping pace with inflation. Rising net worth and job security will be far more significant predictors of consumer behavior than general sentiment. Geopolitical strife, such as the continuing military conflict between Russia and Ukraine, has contributed to persistent energy and food cost increases. This affects every consumer, but higher- income households and wealthier countries are relatively insulated from the direct consequences. Some emerging markets may soon be susceptible to acute food shortages and even social unrest unless supplies replenish and price increases relent. But the U.S. will have a narrower base of consumption growth this year as fewer households meaningfully increase their real spending. Every economic data point is being refracted through the prism of how central banks will respond to higher inflation. This puts the labor market — a leading inflation indicator because wages play a significant role in determining prices — at the center of our attention for the balance of 2022. News of job or pay freezes sounds negative, but they are necessary to slow the rapid pace of aggregate demand growth, rebalance the economy and allow policymakers to take their feet off the brakes. While a lot more central bank rate hikes lie ahead, a modest softening in employment data can help ensure that central banks don't wholly halt economic expansion. Last month, the U.S. Federal Reserve (“Fed”) met in a particularly chaotic period for financial markets and delivered a 75 basis point (bps) interest rate hike. The federal funds rate target range now stands at 1.50% - 1.75%, and it seems certain to travel higher at the next meeting. Inflation has not moderated as much as the Fed or the market expected it to over the year's first five months. This is mainly because the ongoing war in Ukraine has increased the prices of goods and services sensitive to food and energy costs, such as gasoline and core services like airfares. The Fed and the market recognize that tighter financial conditions are required to dissuade employers from hiring and raising wages, effectively short-circuiting any budding wage-price spiral. Therefore, data showing falling job openings and softening wage growth are welcome. We expect the data between now and the end of the summer – on job openings, wage growth, and other measures of price inflation – to help bring those rate expectations down a bit further. Real Estate Market Conditions and Outlook Real estate has produced strong returns over the last few years but has only priced in the effects of higher inflation and monetary policy tightening to a limited extent. Commercial real estate (“CRE”) investments have been relatively insulated from recent market volatility over the past two quarters, but CRE appreciation may be negative in the short term and have values correct due to upward pressure on cap rates. However, some properties in strongly performing sectors, such as the housing, industrial, and storage sectors, will continue to benefit from high-income growth as rolling leases are marked-up to account for higher rents. The retail and office sectors have continued to underperform due to changes in structural demand initially caused by the pandemic, and contractionary economic drivers, such as decreases in office- using employment and consumer spending. Values in cyclical sectors, such as lodging and gaming, and sectors with the strongest appreciation over the last year, such as industrial, self-storage, and life science, may correct in the short term due to cap rate expansion. However, properties that transport and store real assets, such as warehouses and cold-storage properties, could be more inflation-resistant and insulated from short-term volatility. Additionally, apartment properties, particularly affordable properties, may outperform due to a decrease in mortgage demand, which will support the rental market. According to Real Capital Analytics, U.S. real estate transaction

TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 6/30/2022 Continued on next page… volumes are up 17% year-to-year as of June 2022. Over the past year, apartments and industrial have captured approximately 63% of total U.S. transaction volumes, illustrating the strong investor interest in these two property types. The Account earned a net 5.11% return in the second quarter of 2022 and 23.04% over the last year. The strong performance resulted from materially positive appreciation within the industrial, housing, and alternative real estate sectors over both periods. Favorable borrowing costs and attractive supply and demand fundamentals resulted in increased investor demand, which was the dominant contributor to appreciation. However, current market conditions and rising interest rates have reduced investor appetite in these sectors. As of June 30, 2022, the Account's leverage position was 17.2%. Low relative leverage allows the Account to remain highly selective regarding capital deployment. The Account has been focused on improving portfolio diversification, targeting a reduction of lower productivity assets, and acquiring assets with greater economic resiliency. Important Information 5 The commercial real property holdings listed are subject to change and may not be representative of the Account’s current or future investments. The property holdings listed are part of the Account’s long-term investments and exclude liquid, fixed-income investments and other securities held by the Account. The property holdings do not include the Account’s entire investment portfolio and should not be considered a recommendation to buy, sell or hold a particular security or other investment. 6Real estate fair value is presented gross of debt. Investments in joint ventures are represented at net equity value. Simpson Housing Portfolio is held in a joint venture with Simpson Housing LP, in which the Account holds an 80% interest, and is presented gross of debt. As of June 30, 2022, the debt had a fair value of $388.7 million. Fashion Show is held in a joint venture with General Growth Properties, in which the Account holds 50% interest, and is presented gross of debt. As of June 30, 2022, the debt had a fair value of $414.4million. 1001 Pennsylvania Avenue is presented gross of debt. As of June 30, 2022, the debt had a fair value of $304.7 million. The Florida Mall is held in a joint venture with Simon Property Group, LP, in which the Account holds a 50% interest, and is presented gross of debt. As of June 30, 2022, the debt had a fair value of $298.6 million. Colorado Center is held in a joint venture with EOP Operating LP, in which the Account holds a 50% interest, and is presented gross of debt. As of June 30, 2022, the debt had a fair value of $262.2 million. Storage Portfolio II is held in a joint venture with Extra Space Properties 134, LLC, in which the Account holds a 90% interest, and is presented gross of debt. As of June 30, 2022, the debt had a fair value of $172.5 million. 99 High Street is presented gross of debt. As of June 30, 2022, the debt had a fair value of $261.5 million. 701 Brickell Avenue is presented gross of debt. As of June 30, 2022, the debt had a fair value of $176.9 million. Real estate investment portfolio turnover rate for the Account was 7.6% for the year ended 12/31/2021. Real estate investment portfolio turnover rate is calculated by dividing the lesser of purchases or sales of real estate property investments (including contributions to, or return of capital distributions received from, existing joint venture and limited partnership investments) by the average value of the portfolio of real estate investments held during the period. Marketable securities portfolio turnover rate for the Account was 0% for the year ended 12/31/2021. Marketable securities portfolio turnover rate is calculated by dividing the lesser of purchases or sales of securities, excluding securities having maturity dates at acquisition of one year or less, by the average value of the portfolio securities held during the period. Teachers Insurance and Annuity Association of America (TIAA), New York, NY, issues annuity contracts and certificates. This material is for informational or educational purposes only and does not constitute investment advice under ERISA, a securities recommendation under federal securities laws, or an insurance product recommendation under state insurance laws or regulations. This material is intended to provide you with information to help you make informed decisions. You should not view or construe the availability of this information as a suggestion that you take or refrain from taking a particular course of action, as the advice of an impartial fiduciary, as an offer to sell or a solicitation to buy or hold any securities, as a recommendation of any securities transactions or investment strategy involving securities (including account recommendations), a recommendation to rollover or transfer assets to TIAA or a recommendation to purchase an insurance product. In making this information available to you, TIAA assumes that you are capable of evaluating the information and exercising independent judgment. As such, you should consider your other assets, income and investments and you should not rely on the information as the primary basis for making investment or insurance product purchase or contribution decisions. The information that you may derive from this material is for illustrative purposes only and is not individualized or based on your particular needs. This material does not take into account your specific objectives or circumstances, or suggest any specific course of action. Investment, insurance product purchase or contribution decisions should be made based on your own objectives and circumstances. The purpose of this material is not to predict future returns, but to be used as education only. Contact your tax advisor regarding the tax implications. You should read all associated disclosures. TIAA-CREF Individual & Institutional Services, LLC, Member FINRA and SIPC, distributes securities products. Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity and may lose value. THIS MATERIAL MUST BE PRECEDED OR ACCOMPANIED BY A CURRENT PROSPECTUS FOR THE TIAA REAL ESTATE ACCOUNT. PLEASE CAREFULLY CONSIDER THE INVESTMENT OBJECTIVES, RISKS, CHARGES, AND EXPENSES BEFORE INVESTING AND CAREFULLY READ THE PROSPECTUS. ADDITIONAL COPIES OF THE PROSPECTUS CAN BE OBTAINED BY CALLING 877-518-9161.

TIAA Retirement Annuity Accounts TIAA Real Estate Account Real Estate As of 6/30/2022 Continued on next page… A Note About Risks In general, the value of the TIAA Real Estate Account will fluctuate based on the underlying value of the direct real estate or real estate-related securities in which it invests. The risks associated with investing in the TIAA Real Estate Account include the risks associated with real estate ownership including among other things fluctuations in property values, higher expenses or lower income than expected, risks associated with borrowing and potential environmental problems and liability, as well as risks associated with participant flows and conflicts of interest. For a more complete discussion of these and other risks, please consult the prospectus. ©2022 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund, 730 Third Avenue, New York, NY 10017 2274487