TIAA Real Estate Account 2022 Portfolio Manager FAQs September 2022 Frequently Asked Questions TIAA Real Estate Account 2022 Portfolio Manager Change Background On September 30, 2022, TIAA announced the appointment of Chris Burk as a co-portfolio manager of the TIAA Real Estate Account, assisting Randy Giraldo in managing the Account going forward. TIAA also announced that Randy Giraldo plans to step down as co-portfolio manager of the Account on December 30, 2022 and will move to a new role within Nuveen Real Estate. Mr. Burk is a senior member of the TIAA Real Estate Account portfolio management team, responsible for oversight and management of real estate assets in the Western and Southwestern United States, totaling approximately 40% of the total real estate assets of the Account. Prior to joining the TIAA Real Estate Account portfolio management team in 2018, Mr. Burk had served as a portfolio manager for the TIAA General Account and head of real estate acquisitions for the Western United States among other real estate related positions. Chris has been with TIAA/Nuveen since 2005 and has over 20 years of real estate investment experience. He holds a B.A. Degree from the University of Michigan and an M.B.A. from the University of Southern California. Additional information about these changes can be found below. Please reach out to your TIAA contact with any additional questions you may have. Q1. Will the Account’s investment strategy, objective or risks change as a result of this announcement? No. The investment strategy, objective and risks of the Account, as described in the currently effective prospectus found here, will not change as a result of this announcement. Q2. Has the change impacted the internal resources at TIAA or Nuveen available to the Account? No. Randy and Chris will co-lead a portfolio management team responsible for all investment management functions of the Account. This team approach to managing the assets of the Account has not changed. The Exhibit 99.1

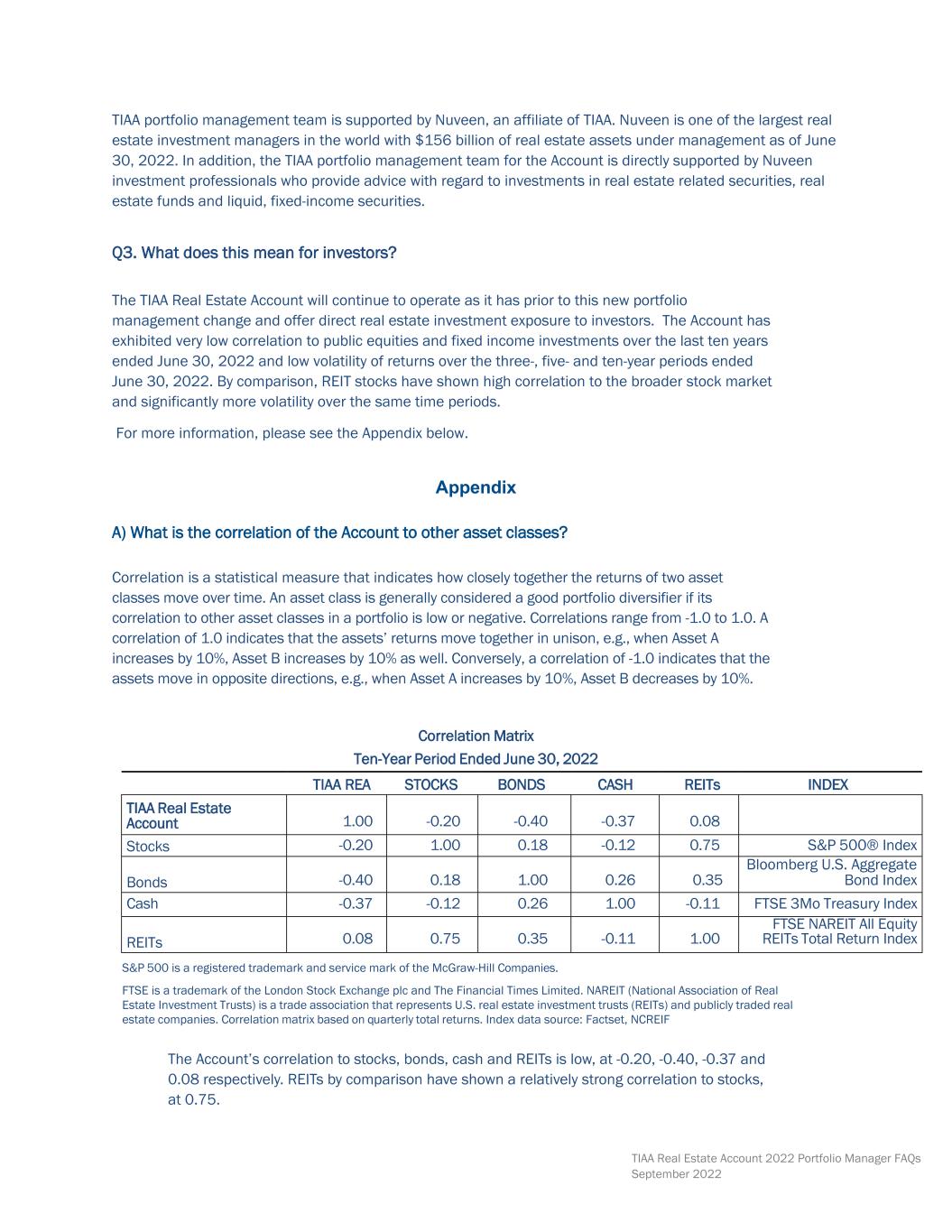

TIAA Real Estate Account 2022 Portfolio Manager FAQs September 2022 TIAA portfolio management team is supported by Nuveen, an affiliate of TIAA. Nuveen is one of the largest real estate investment managers in the world with $156 billion of real estate assets under management as of June 30, 2022. In addition, the TIAA portfolio management team for the Account is directly supported by Nuveen investment professionals who provide advice with regard to investments in real estate related securities, real estate funds and liquid, fixed-income securities. Q3. What does this mean for investors? The TIAA Real Estate Account will continue to operate as it has prior to this new portfolio management change and offer direct real estate investment exposure to investors. The Account has exhibited very low correlation to public equities and fixed income investments over the last ten years ended June 30, 2022 and low volatility of returns over the three-, five- and ten-year periods ended June 30, 2022. By comparison, REIT stocks have shown high correlation to the broader stock market and significantly more volatility over the same time periods. For more information, please see the Appendix below. Appendix A) What is the correlation of the Account to other asset classes? Correlation is a statistical measure that indicates how closely together the returns of two asset classes move over time. An asset class is generally considered a good portfolio diversifier if its correlation to other asset classes in a portfolio is low or negative. Correlations range from -1.0 to 1.0. A correlation of 1.0 indicates that the assets’ returns move together in unison, e.g., when Asset A increases by 10%, Asset B increases by 10% as well. Conversely, a correlation of -1.0 indicates that the assets move in opposite directions, e.g., when Asset A increases by 10%, Asset B decreases by 10%. Correlation Matrix Ten-Year Period Ended June 30, 2022 TIAA REA STOCKS BONDS CASH REITs INDEX TIAA Real Estate Account 1.00 -0.20 -0.40 -0.37 0.08 Stocks -0.20 1.00 0.18 -0.12 0.75 S&P 500® Index Bonds -0.40 0.18 1.00 0.26 0.35 Bloomberg U.S. Aggregate Bond Index Cash -0.37 -0.12 0.26 1.00 -0.11 FTSE 3Mo Treasury Index REITs 0.08 0.75 0.35 -0.11 1.00 FTSE NAREIT All Equity REITs Total Return Index S&P 500 is a registered trademark and service mark of the McGraw-Hill Companies. FTSE is a trademark of the London Stock Exchange plc and The Financial Times Limited. NAREIT (National Association of Real Estate Investment Trusts) is a trade association that represents U.S. real estate investment trusts (REITs) and publicly traded real estate companies. Correlation matrix based on quarterly total returns. Index data source: Factset, NCREIF The Account’s correlation to stocks, bonds, cash and REITs is low, at -0.20, -0.40, -0.37 and 0.08 respectively. REITs by comparison have shown a relatively strong correlation to stocks, at 0.75.

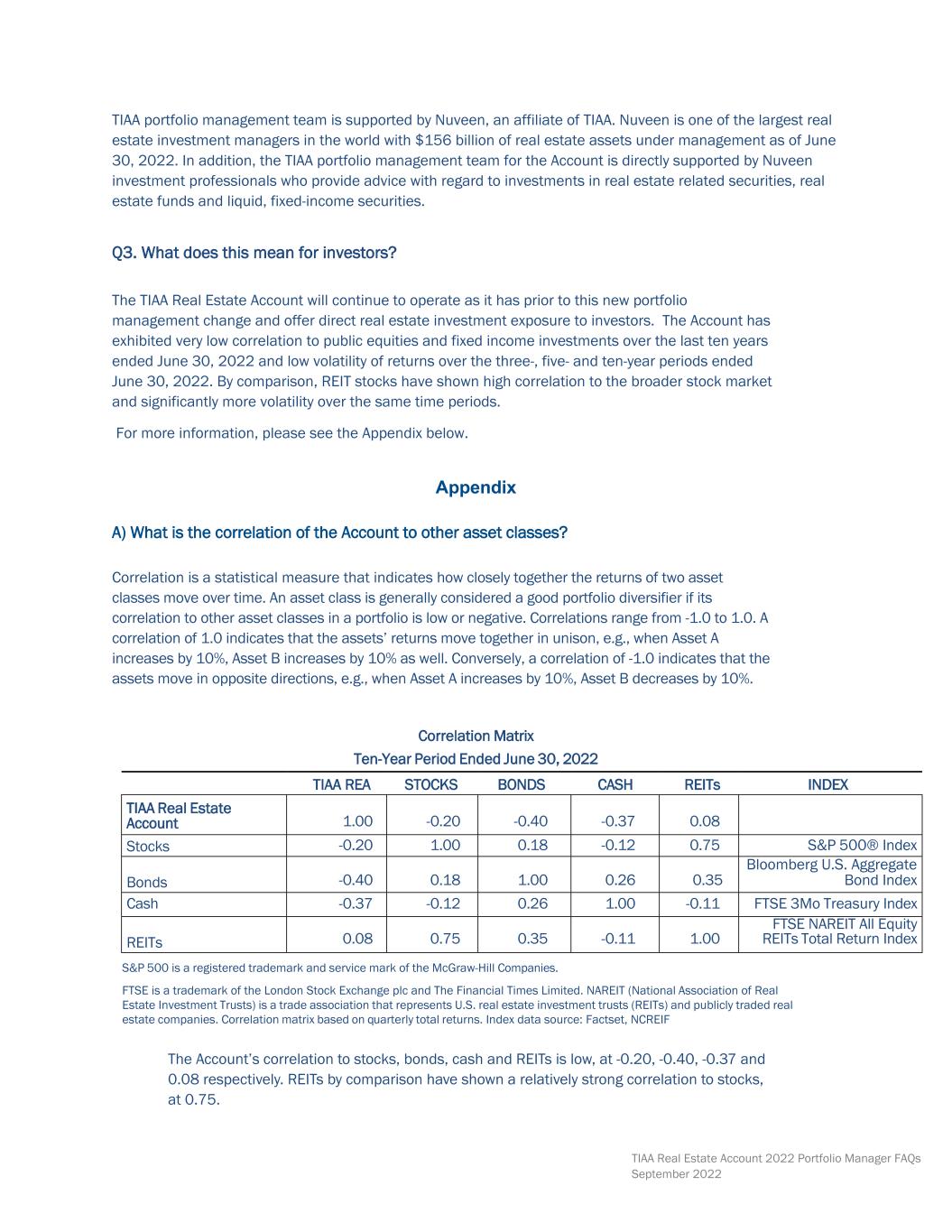

TIAA Real Estate Account 2022 Portfolio Manager FAQs September 2022 B) What is the Real Estate Account’s volatility, and how does it compare to that of other asset classes? When investors measure risk, they typically refer to the volatility of returns over time. Volatility is captured in the statistical measurement of standard deviation, which illustrates the degree to which returns tend to deviate from an average over a specific period of time. Clearly, the smaller the standard deviation, the less variability in returns from period to period, and theoretically, the less “risky” the investment. Of course, volatility characteristics may change over time. There may be periods of stability followed by periods of turbulence over the history of an asset class. The following table shows the volatility of annualized 3-, 5- and 10-year returns of various asset classes compared to that of the Account. STANDARD DEVIATION (%) ANNUALIZED AS OF JUNE 30, 2022 S&P 500 is a registered trademark and service mark of the McGraw-Hill Companies. FTSE is a trademark of the London Stock Exchange plc and The Financial Times Limited. NAREIT (National Association of Real Estate Investment Trusts) is a trade association that represents U.S. real estate investment trusts (REITs) and publicly traded real estate companies. Calculations based on monthly total returns. Index data source: Factset As outlined in the table above, the volatility of the Account has been 3.0% over the past three years and 2.5% over the past five years, compared to the ten-year volatility of 2.0%. The Account’s volatility over these periods is considerably below that of stocks and REITs as measured by the S&P 500 Index and the FTSE NAREIT All Equity REITs Total Return Index, respectively. The Account’s volatility is below that of bonds over the past three years, five, and ten years as measured by the Bloomberg U.S. Aggregate Bond Index and, as expected, considerably above cash as measured by the FTSE 3 Month Treasury Bill Index. There is no guarantee that such relative low volatility compared to stocks and REITs will continue going forward. Please reach out to your TIAA contact with any additional questions you may have. 3 YEARS 7/1/19 – 6/30/22 5 YEARS 7/1/17 – 6/30/22 10 YEARS 7/1/12 – 6/30/22 TIAA Real Estate Account 3.0 2.5 2.0 Stocks 18.6 16.9 13.7 S&P 500® Index Bonds 4.6 4.0 3.5 Bloomberg U.S. Aggregate Bond Index Cash 0.2 0.3 0.2 FTSE 3Mo Treasury Bill Index REITs 19.9 17.6 15.4 FTSE NAREIT All Equity REITs Index

TIAA Real Estate Account 2022 Portfolio Manager FAQs September 2022 Past performance is no guarantee of future results. The TIAA Real Estate Account is a variable annuity product and an insurance separate account of TIAA. Please note that withdrawals of earnings from an annuity are subject to ordinary income tax, plus a possible federal 10% penalty if you make a withdrawal before age 59½. This material is for informational or educational purposes only and does not constitute fiduciary investment advice under ERISA, a securities recommendation under all securities laws, or an insurance product recommendation under state insurance laws or regulations. This material does not take into account any specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on the investor’s own objectives and circumstances. You should consider the investment objectives, risks, charges, and expenses carefully before investing. Please call 877-518-9161 or go to TIAA.org for current product and fund prospectuses that contain this and other information. Please read the TIAA Real Estate Account prospectus carefully before investing. The real estate industry is subject to various risks including fluctuations in underlying property values, expenses and income, and potential environmental liabilities. There are risks associated with investing in securities including possible loss of principal. In general, the value of the TIAA Real Estate Account will fluctuate based on the underlying value of the direct real estate or real estate-related securities in which it invests. The risks associated with investing in the Real Estate Account include the risks associated with real estate ownership including, among other things, fluctuations in underlying property values, higher expenses or lower income than expected, risks associated with borrowing and potential environmental problems and liability, as well as risks associated with participant flows and conflicts of interest. For a more complete discussion of these and other risks, please consult the prospectus. Annuity contracts contain exclusions, limitations, reductions of benefits, and may contain terms for keeping them in force. We can provide you with costs and complete details. Investment, insurance, and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value. TIAA-CREF Individual & Institutional Services, LLC, Member FINRA, distributes securities products. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association of America (TIAA) and College Retirement Equities Fund (CREF), New York, NY. Each of the foregoing is solely responsible for its own financial condition and contractual obligations. A variable annuity is an insurance contract and includes underlying investments whose value, similar to a mutual fund, is tied to market performance. When markets are up, you can capture the gains, but you may also experience losses when markets are down. When you retire, you can choose to receive income for life and/or other income options. Annuities are designed for retirement and other long-term goals. They offer several payment options, including lifetime income. When you contribute to an annuity, your money must remain in it until you reach age 59-1/2. If you withdraw earnings before then, you may be subject to a 10% early withdrawal penalty. You may also pay ordinary income tax on other withdrawals from a qualified annuity. Depending on the issuing company, product and available options, the income may be fixed or variable. Guarantees and fixed-income payments are based on the claims- paying ability of the issuer. Variable annuity income varies based on the performance of the sub- accounts. Please note that with variable annuities, your money will be subject to the risks associated with investing in securities, including loss of principal. ©2022 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund, 730 Third Avenue, New York, NY 10017 2445439 (09/22)