At TIAA, we seek to provide you with timely insights and perspectives directly from the professionals whose everyday task is to manage your investments for the long term. Allow me to introduce myself. My name is Chris Burk, and I am the new Lead Portfolio Manager for the TIAA Real Estate Account (“Account”). I joined the Real Estate Account in 2018 as the senior most portfolio manager reporting to the former head of the Account – Randy Giraldo. As you may already be aware, Randy remains within the TIAA/Nuveen Real Estate organization but has been tasked with leading Nuveen Real Estate’s European business. Regarding my background, I have been with TIAA/Nuveen Real Estate since 2005 and have over 20 years of real estate investment experience. This includes previously serving as a portfolio manager for the TIAA General Account as well as the head of real estate acquisitions for the Western Region of the United States among other real estate related positions. It is a genuine honor to be serving the Account. I’d like to share some thoughts regarding the TIAA Real Estate Account and the current economic environment. In 2022, the Account performed exactly as it was designed. Despite negative 19.44% total returns in the S&P 500 Index and negative 24.95% in the FTSE NAREIT All Equity REITs Index, for the calendar year ending December 31, 2022, the REA generated an 8.19% total return (net of fees). This is because private real estate has a low correlation to public equities, and as a result, it is less volatile. Looking forward to 2023 There is a lot of uncertainty within the market. The U.S. economy is experiencing high inflation and interest rates have risen as a result. These interest rate increases are anticipated to place downward pressure on private real estate values, the extent and duration of which are unclear. That being said, the Account’s Portfolio Management Team remains optimistic about real estate as an asset class due to its track record of generating total returns that consistently fall somewhere between public equities and bonds as you can see in the table below. Chris Burk Portfolio Manager TIAA Real Estate Account Exhibit 99.1

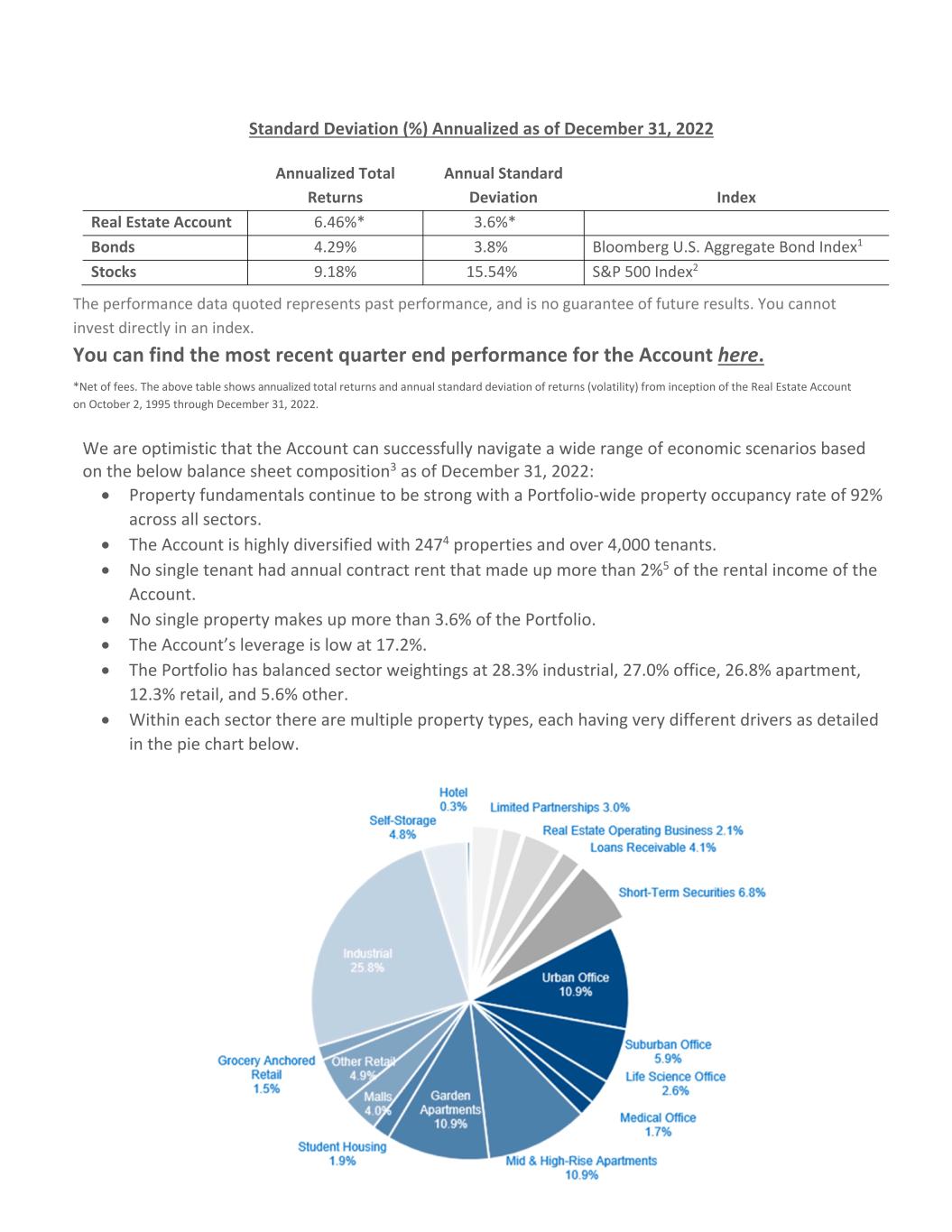

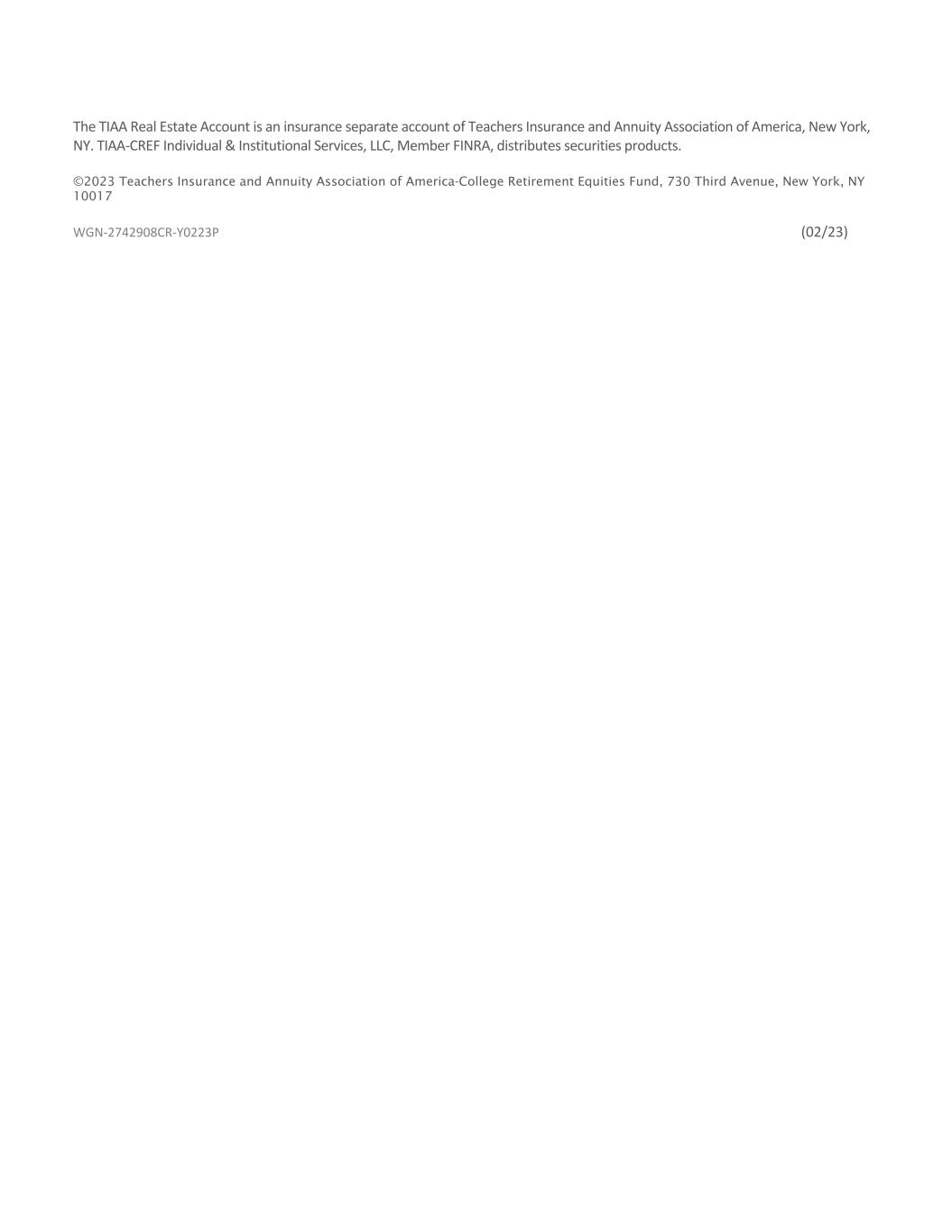

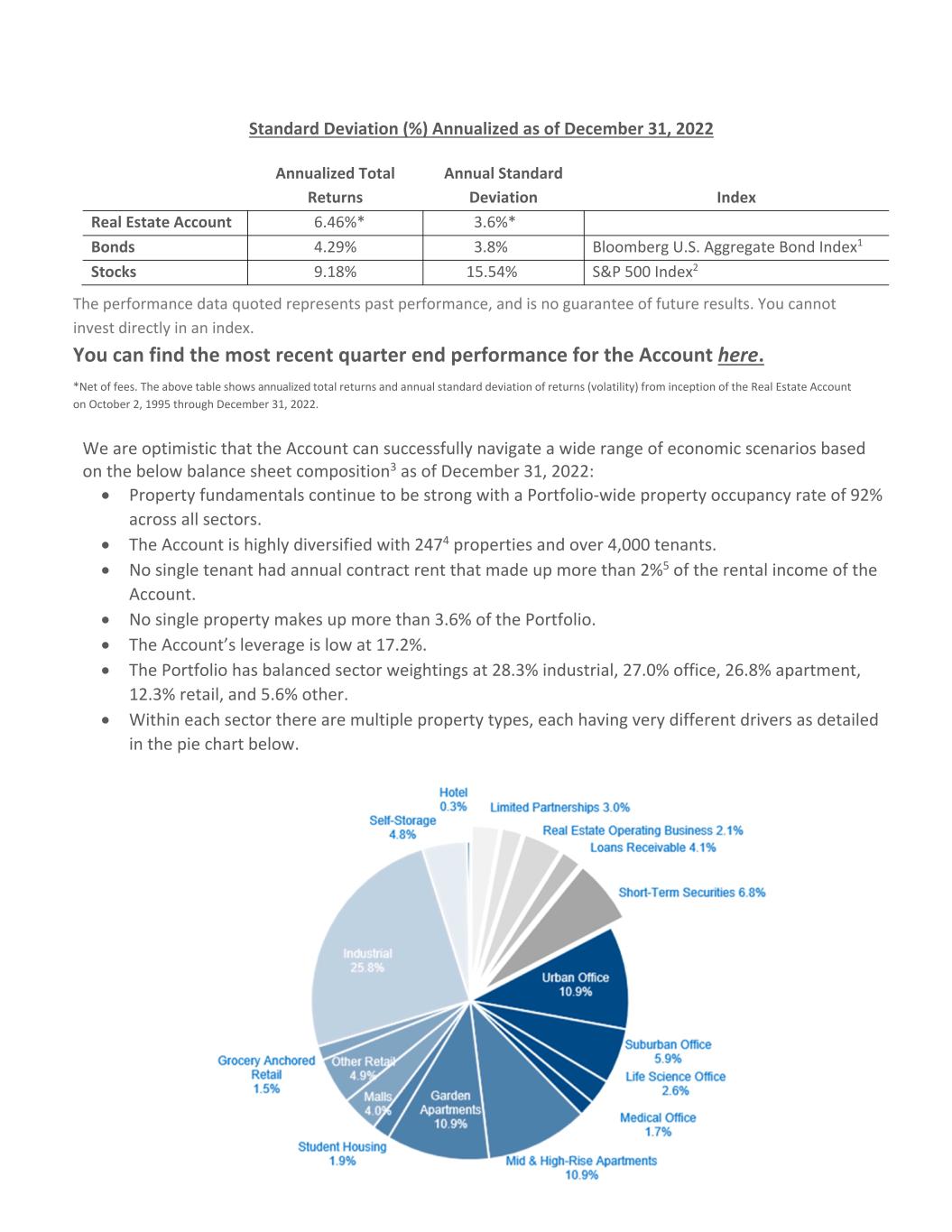

Standard Deviation (%) Annualized as of December 31, 2022 Annualized Total Returns Annual Standard Deviation Index Real Estate Account 6.46%* 3.6%* Bonds 4.29% 3.8% Bloomberg U.S. Aggregate Bond Index1 Stocks 9.18% 15.54% S&P 500 Index2 The performance data quoted represents past performance, and is no guarantee of future results. You cannot invest directly in an index. You can find the most recent quarter end performance for the Account here. *Net of fees. The above table shows annualized total returns and annual standard deviation of returns (volatility) from inception of the Real Estate Account on October 2, 1995 through December 31, 2022. We are optimistic that the Account can successfully navigate a wide range of economic scenarios based on the below balance sheet composition3 as of December 31, 2022: Property fundamentals continue to be strong with a Portfolio‐wide property occupancy rate of 92% across all sectors. The Account is highly diversified with 2474 properties and over 4,000 tenants. No single tenant had annual contract rent that made up more than 2%5 of the rental income of the Account. No single property makes up more than 3.6% of the Portfolio. The Account’s leverage is low at 17.2%. The Portfolio has balanced sector weightings at 28.3% industrial, 27.0% office, 26.8% apartment, 12.3% retail, and 5.6% other. Within each sector there are multiple property types, each having very different drivers as detailed in the pie chart below.

Conclusion While 2023 may have its challenges, we anticipate the TIAA Real Estate Account to continue to deliver attractive total returns for our investors as it has done successfully since its launch in 1995. On behalf of TIAA and the Real Estate Account portfolio team, we hope you have a healthy, productive, and profitable year ahead. Sincerely, Christopher Burk Chris Burk Portfolio Manager TIAA Real Estate Account 1The Bloomberg US Aggregate Bond Index is a broad‐based flagship benchmark that measures the investment grade, US dollar‐ denominated, fixed‐rate taxable bond market. The index includes Treasuries, government‐related and corporate securities, fixed‐ rate agency MBS, ABS and CMBS (agency and non‐ agency) 2The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. 3Data as of December 31, 2022. Balance sheet chart depicts net ownership share as a percent of net asset value. The data above is provided for informational purpose only. Allocations and occupancy at the time of investment may be different. 4 Including investments that are wholly owned, joint ventures, limited partnerships, real estate operating companies and loans receivable. 5Year‐one direct cap rate for the real estate portfolio. The real estate industry is subject to various risks including fluctuations in underlying property values, expenses and income, and potential environmental liabilities. The real estate industry is subject to various risks including fluctuations in underlying property values, expenses and income, and potential environmental liabilities. There are risks associated with investing in securities including possible loss of principal. In general, the value of the TIAA Real Estate Account will fluctuate based on the underlying value of the direct real estate or real estate‐related securities in which it invests. The risks associated with investing in the Real Estate Account include the risks associated with real estate ownership including, among other things, fluctuations in underlying property values, higher expenses or lower income than expected, risks associated with borrowing and potential environmental problems and liability, as well as risks associated with participant flows and conflicts of interest. For a more complete discussion of these and other risks, please consult the prospectus. Please consider all risks carefully prior to investing. You should consider the investment objectives, risks, charges, and expenses carefully before investing. Please call 800‐842‐2252 or go to TIAA.org/pdf/prospectuses/realestate_prosp.pdf for copies that contain this information. Please read the prospectus carefully before investing. This material is for informational or educational purposes only and does not constitute fiduciary investment advice under ERISA, a securities recommendation under all securities laws, or an insurance product recommendation under state insurance laws or regulations. This material does not take into account any specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on the investor's own objectives and circumstances.

The TIAA Real Estate Account is an insurance separate account of Teachers Insurance and Annuity Association of America, New York, NY. TIAA‐CREF Individual & Institutional Services, LLC, Member FINRA, distributes securities products. ©2023 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund, 730 Third Avenue, New York, NY 10017 WGN‐2742908CR‐Y0223P (02/23)