Dear Real Estate Account Investors, I wanted to update you regarding the TIAA Real Estate Account (“Account”) and my thoughts for the upcoming year. In summary, know that the Account: • Remains in good health. • Is performing exactly as it was designed; and • The TIAA Real Estate Account Portfolio Management Team continues to position the Account to try to maximize portfolio performance and resilience. 2023 Recap Regarding 2023 performance, the Account had generated a trailing 12-month total return of negative 13.62%. This is compared to a positive total return of 8.19% in 2022. As anticipated, the negative returns in 2023 were driven by property depreciation due to the impact of broader economy interest rate hikes. The depreciation occurred across all property types but was primarily concentrated within the traditional office, regional mall and industrial sectors. The TIAA Real Estate Account Portfolio Management Team remains comfortable with the Account’s exposure to these sectors for the reasons detailed below. Traditional Office: Has struggled since the onset of the pandemic due to the impacts of work from home and reduced investor appetite for the asset type. As of year-end 2023: • The Account’s office space was 85.3% leased compared to 81.7% for Class A office nationally. • The overall portfolio is Class A quality and geographically well-located. • The Account has invested $525 million into the portfolio since 2018 to ensure that it has up-to-date amenities including lobbies and conferencing facilities. • After removing life science and medical office investments, the allocation to traditional office is 19.0%. For context, this allocation was over 40% in 2018, but the Account had disposed of approximately $3.8 billion of traditional office assets since then. Regional Malls: Were challenged in the early stages of the pandemic but key barometers of retail asset health such as occupancy and gross in-line tenant (those less than 10,000 square feet) sales have rebounded since late 2022 buoyed by strong consumer spending. As of year-end 2023: • The Account’s regional mall portfolio was 91.8% leased and consisted of a total of four assets located in attractive trade areas: Fashion Show Mall (Las Vegas, NV), Florida International Mall (Orlando, FL), Miami International Mall (Miami, FL) and West Town Mall (Knoxville, TN). • Gross in-line tenant sales are generally exceeding pre-COVID levels. Exhibit 99.1

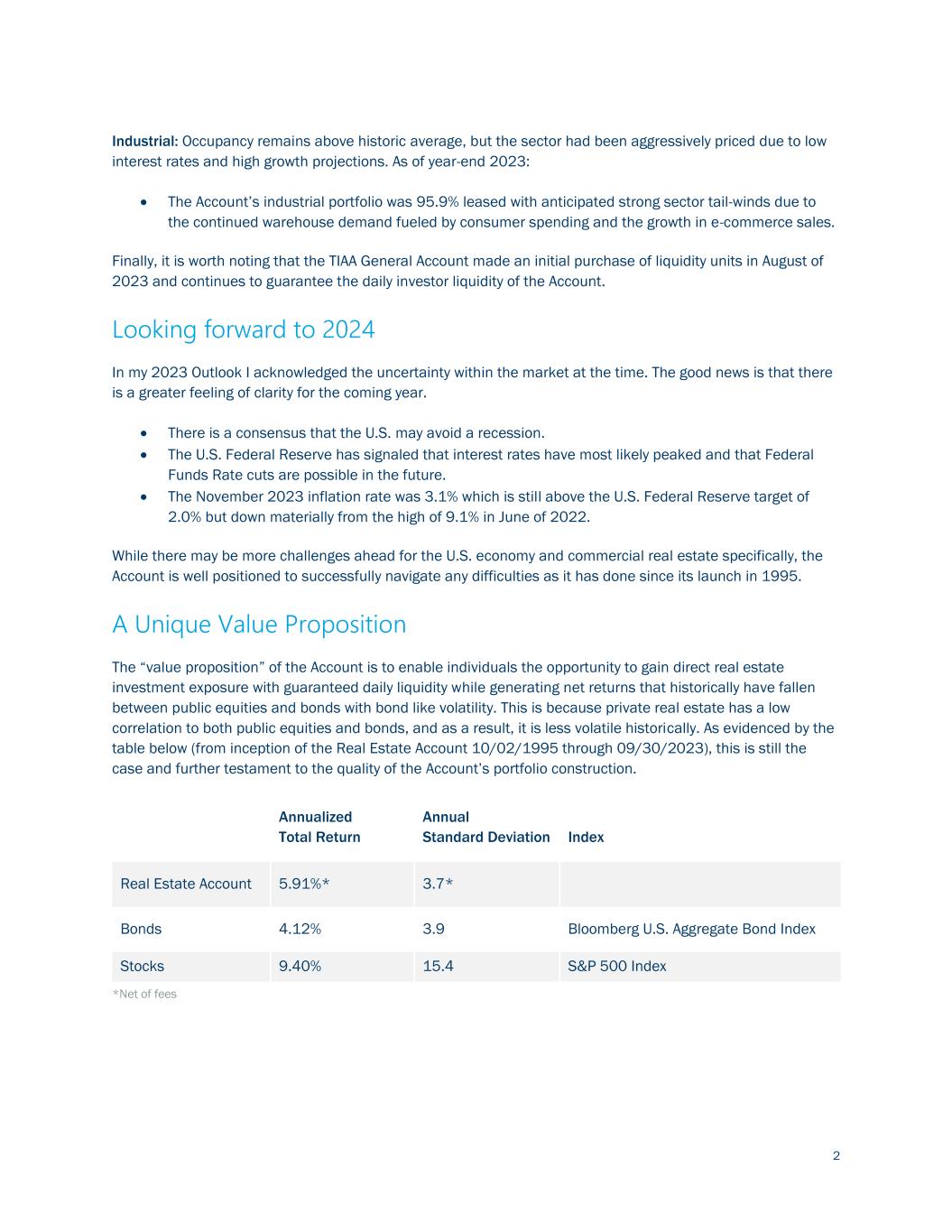

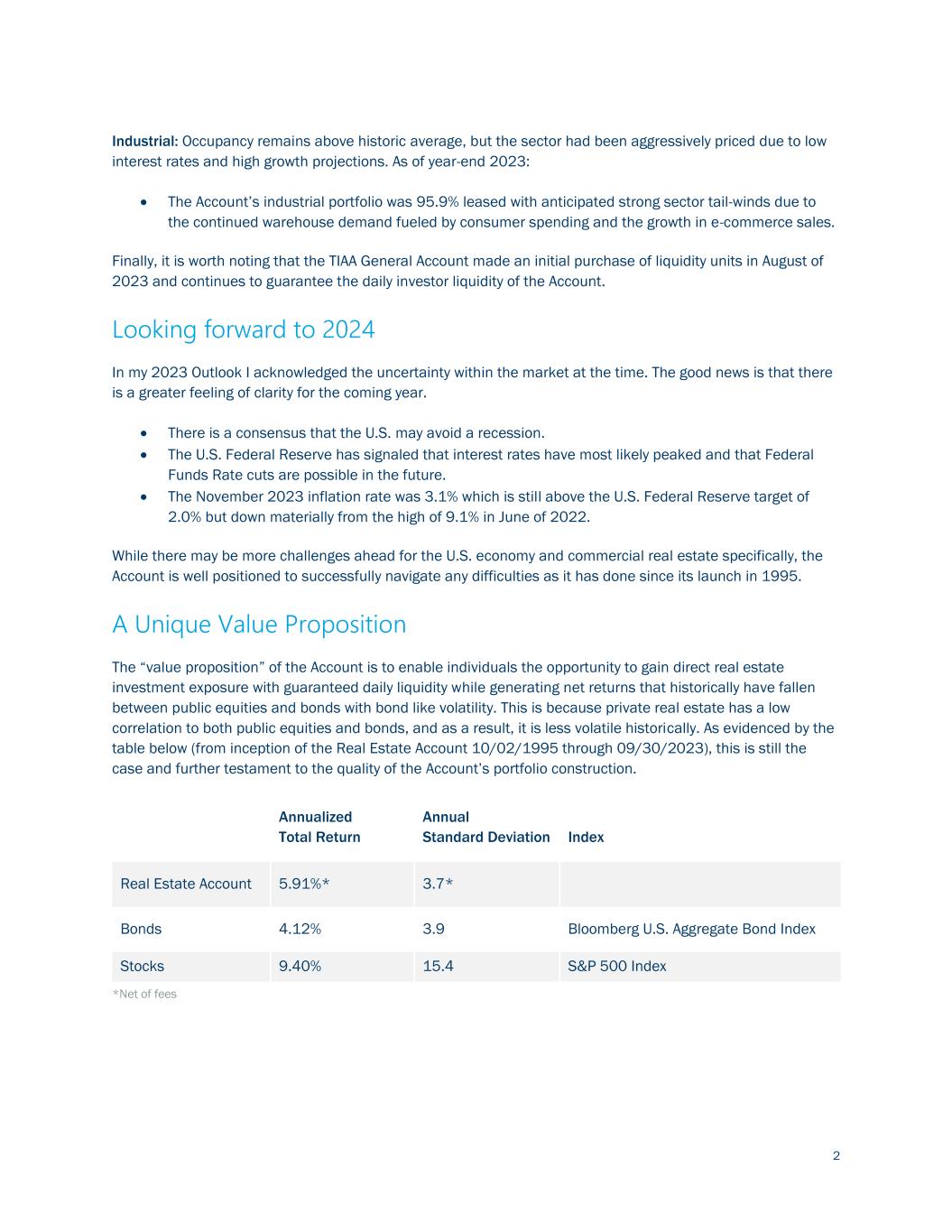

2 Industrial: Occupancy remains above historic average, but the sector had been aggressively priced due to low interest rates and high growth projections. As of year-end 2023: • The Account’s industrial portfolio was 95.9% leased with anticipated strong sector tail-winds due to the continued warehouse demand fueled by consumer spending and the growth in e-commerce sales. Finally, it is worth noting that the TIAA General Account made an initial purchase of liquidity units in August of 2023 and continues to guarantee the daily investor liquidity of the Account. Looking forward to 2024 In my 2023 Outlook I acknowledged the uncertainty within the market at the time. The good news is that there is a greater feeling of clarity for the coming year. • There is a consensus that the U.S. may avoid a recession. • The U.S. Federal Reserve has signaled that interest rates have most likely peaked and that Federal Funds Rate cuts are possible in the future. • The November 2023 inflation rate was 3.1% which is still above the U.S. Federal Reserve target of 2.0% but down materially from the high of 9.1% in June of 2022. While there may be more challenges ahead for the U.S. economy and commercial real estate specifically, the Account is well positioned to successfully navigate any difficulties as it has done since its launch in 1995. A Unique Value Proposition The “value proposition” of the Account is to enable individuals the opportunity to gain direct real estate investment exposure with guaranteed daily liquidity while generating net returns that historically have fallen between public equities and bonds with bond like volatility. This is because private real estate has a low correlation to both public equities and bonds, and as a result, it is less volatile historically. As evidenced by the table below (from inception of the Real Estate Account 10/02/1995 through 09/30/2023), this is still the case and further testament to the quality of the Account’s portfolio construction. Annualized Total Return Annual Standard Deviation Index Real Estate Account 5.91%* 3.7* Bonds 4.12% 3.9 Bloomberg U.S. Aggregate Bond Index Stocks 9.40% 15.4 S&P 500 Index *Net of fees

3 Portfolio Construction for the Long-Term The Account’s portfolio construction consists of three primary elements and is designed to generate attractive total returns over the moderate to long-term. As of December 31, 2023: Portfolio Diversification: The Account remained highly diversified with sector allocations of 30.5% industrial, 27.4% multifamily, 23.3% office, 12.2% retail and 6.6% storage. In addition, the Account owns 234 properties that have over 3,000 tenant leases. Portfolio diversification is important because it means that the Account’s performance is not dependent upon the health of any one sector. Low Leverage: As of December 31, 2023, leverage was 20.4% compared to a benchmark (NFI-ODCE) average of 25.3% as of September 30, 2023. Lower leverage reduces the risk profile of the Account and improves relative performance when asset values are on the decline as they were in 2023. A Core Profile: Portfolio occupancy was 92.5%. No single tenant had an annual contract rent that made up more than 2.5% of the rental income of the Account and no single property makes up more than 3.7% of the Portfolio. Finally, potential future investment activity will be consistent with Account’s multi-year strategy of reducing its exposure to higher capex and anticipated low yielding sectors such as traditional office and retail and increasing allocations to lower capex and anticipated higher yielding sectors such as industrial, housing and alternatives. The TIAA Real Estate Account Portfolio Management Team is particularly interested in increasing exposure to the alternatives sector which includes such property types as self-storage, data centers, life science, medical office and senior and student housing. The alternatives sector is considered a potential source of attractive total returns, and as of December 31, 2023, the Account had an alternatives portfolio with a net market value of $3.9 billion or 16.3% of NAV. Conclusion The TIAA Real Estate Account offers a unique value proposition and has long-track record of delivering on that value proposition through a range of challenging economic circumstances since its launch in 1995. If history is any indication, then the current economic cycle should prove to be no different. On behalf of TIAA and the TIAA Real Estate Account Portfolio Management Team, it continues to be a genuine honor serving the Account, and we hope you have a healthy, productive and profitable year ahead. Sincerely, Christopher Burk Chris Burk Portfolio Manager TIAA Real Estate Account

4 The real estate industry is subject to various risks including fluctuations in underlying property values, expenses and income, and potential environmental liabilities. The real estate industry is subject to various risks including fluctuations in underlying property values, expenses and income, and potential environmental liabilities. There are risks associated with investing in securities including possible loss of principal. In general, the value of the TIAA Real Estate Account will fluctuate based on the underlying value of the direct real estate or real estate-related securities in which it invests. The risks associated with investing in the Real Estate Account include the risks associated with real estate ownership including, among other things, fluctuations in underlying property values, higher expenses or lower income than expected, risks associated with borrowing and potential environmental problems and liability, as well as risks associated with participant flows and conflicts of interest. For a more complete discussion of these and other risks, please consult the prospectus. Please consider all risks carefully prior to investing. You should consider the investment objectives, risks, charges, and expenses carefully before investing. Please call 800-842- 2252 or go to TIAA.org/pdf/prospectuses/realestate_prosp.pdf for copies that contain this information. Please read the TIAA Real Estate Account prospectus carefully before investing. This material is for informational or educational purposes only and does not constitute fiduciary investment advice under ERISA, a securities recommendation under all securities laws, or an insurance product recommendation under state insurance laws or regulations. This material does not take into account any specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on the investor's own objectives and circumstances. Past performance does not guarantee future results. The TIAA Real Estate Account is an insurance separate account of Teachers Insurance and Annuity Association of America, New York, NY. TIAA-CREF Individual & Institutional Services, LLC, Member FINRA, distributes securities ©2024 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund, 730 Third Avenue, New York, NY 10017 3342739 (01/24)