Exhibit 4.1

THIRD AMENDMENT TO CREDIT AGREEMENT

THIS AMENDMENT TO CREDIT AGREEMENT (this "Amendment") is entered into as of June 20, 2014, by and between BALLANTYNE STRONG, INC., a Delaware corporation ("Borrower"), and WELLS FARGO BANK, NATIONAL ASSOCIATION ("Bank").

RECITALS

WHEREAS, Borrower is currently indebted to Bank pursuant to the terms and conditions of that certain Credit Agreement between Borrower and Bank dated as of June 30, 2010, as amended from time to time ("Credit Agreement").

WHEREAS, Bank and Borrower have agreed to certain changes in the terms and conditions set forth in the Credit Agreement and have agreed to amend the Credit Agreement to reflect said changes.

NOW, THEREFORE, for valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree that the Credit Agreement shall be amended as follows:

1. Section 1.1. (a) is hereby amended by deleting "June 30, 2014" as the last day on which Bank will make advances under the Line of Credit, and by substituting for said date "June 30, 2015," with such change to be effective upon the execution and delivery to Bank of a promissory note dated as of June 20, 2014 (which promissory note shall replace and be deemed the Line of Credit Note defined in and made pursuant to the Credit Agreement) and all other contracts, instruments and documents required by Bank to evidence such change.

2. Section 1.1. (b) is hereby amended by deleting "Ten Dollars ($10,000,000.00)" as the maximum principal amount available under the Letter of Credit Subfeature, and by substituting for said amount "Two Million Five Hundred Thousand Dollars ($2,500,000.00)."

3. Section 1.4. is hereby deleted in its entirety, and the following substitutedtherefor:

"SECTION 1.4. GUARANTIES. The payment and performance of all indebtedness and other obligations of Borrower to Bank shall be guaranteed jointly and severally by STRONG WESTREX, INC., STRONG TECHNICAL SERVICES, INC., STRONG/MDI SCREEN SYSTEMS INC., CONVERGENT MEDIA SYSTEMS CORPORATION and CONVERGENT CORPORATION, as evidenced by and subject to the terms of guaranties in form and substance satisfactory to Bank."

4. Section 4.9. (a) is hereby deleted in its entirety, and the following substitutedtherefor:

"(a) Minimum Net Profit before taxes, plus or minus non cash equity in income of Digital Link, II joint venture, of $1.00, measured quarterly, on a rolling 4-quarter basis, commencing with fiscal quarter ended December 31, 2014 and continuing eachfiscal quarter thereafter."

5. The following is hereby added to the Credit Agreement as Section 4.9. (c):

"(c) Working Capital not less than $20,000,000.00 at any time, with "Working Capital" defined as total current assets minus total current liabilities."

6. Section 5.2. is hereby deleted in its entirety, and the following substituted therefor:

"SECTION 5.3. LEASE EXPENDITURES. Incur operating lease expense in any fiscal year in excess of an aggregate of $2,000,000.00."

7. The address of the Borrower within Section 7.2. (a) is hereby deleted in its entirety, and the following substituted therefor:

"BORROWER: BALLANTYNE STRONG, INC.

13710 FNB Parkway, Suite 400

Omaha, Nebraska 68154"

8. Except as specifically provided herein, all terms and conditions of the Credit Agreement remain in full force and effect, without waiver or modification. All terms defined in the Credit Agreement shall have the same meaning when used in this Amendment. This Amendment and the Credit Agreement shall be read together, as one document.

9. Borrower hereby remakes all representations and warranties contained in the Credit Agreement and reaffirms all covenants set forth therein. Borrower further certifies that as of the date of this Amendment there exists no Event of Default as defined in the Credit Agreement, nor any condition, act or event which with the giving of notice or the passage of time or both would constitute any such Event of Default.

A CREDIT AGREEMENT MUST BE IN WRITING TO BE ENFORCEABLE UNDER NEBRASKA LAW. TO PROTECT THE PARTIES FROM ANY MISUNDERSTANDINGS OR DISAPPOINTMENTS, ANY CONTRACT, PROMISE, UNDERTAKING OR OFFER TO FOREBEAR REPAYMENT OF MONEY OR TO MAKE ANY OTHER FINANCIAL ACCOMMODATION IN CONNECTION WITH THIS LOAN OF MONEY OR GRANT OR EXTENSION OF CREDIT, OR ANY AMENDMENT OF, CANCELLATION OF, WAIVER OF, OR SUBSTITUTION FOR ANY OR ALL OF THE TERMS OR PROVISIONS OF ANYINSTRUMENT OR DOCUMENT EXECUTED IN CONNECTION WITH THIS LOAN OF MONEYOR GRANT OR EXTENSION OF CREDIT, MUST BE IN WRITING TO BE EFFECTIVE.

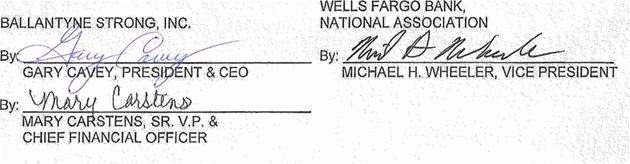

INWITNESSWHEREOF,the parties hereto havecausedthisAmendment to be executed as of the day and year first writtenabove.