Searchable text section of graphics shown above

Creating the Premier

Competitive Energy Company

Employee Meetings

1

Safe Harbor Language

This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, for example, statements regarding benefits of the proposed merger, integration plans, and expected synergies, anticipated future financial and operating performance and results, including estimates for growth. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made herein. These risks and uncertainties include, for example, the ability to obtain governmental approvals of the transaction on the proposed terms and schedule; the failure of FPL Group or Constellation Energy stockholders to approve the transaction; the risk that the businesses will not be integrated successfully or that anticipated synergies will not be achieved or will take longer to achieve than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees, suppliers or governmental entities; unexpected transaction costs or liabilities; economic conditions; and other specific factors discussed in documents filed with the Securities and Exchange Commission by both FPL Group and Constellation Energy.

These risks, as well as other risks associated with the merger, will be more fully discussed in the joint proxy statement/prospectus that will be included in the Registration Statement on Form S-4 that Constellation Energy will file with the SEC in connection with the proposed merger. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Neither Constellation Energy nor FPL undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this presentation.

2

Non-Solicitation

This communication is not a solicitation of a proxy from any security holder of Constellation Energy or FPL Group. Constellation Energy intends to file with the Securities and Exchange Commission a registration statement that will include a joint proxy statement/prospectus and other relevant documents to be mailed to security holders in connection with the proposed merger of Constellation Energy and FPL Group. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT Constellation Energy, FPL GROUP AND THE PROPOSED MERGER. Investors and security holders will be able to obtain these materials (when they are available) and other documents filed with the SEC free of charge at the SEC’s website, www.sec.gov. In addition, a copy of the joint proxy statement/prospectus (when it becomes available) may be obtained free of charge from Constellation Energy, Shareholder Services, 750 E. Pratt Street, Baltimore, MD 21201, or from FPL Group, Shareholder Services, P.O. Box 14000, 700 Universe Blvd., Juno Beach, Florida 33408-0420.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

The respective directors and executive officers of Constellation Energy and FPL Group and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Constellation Energy’s directors and executive officers is available in its 2004 Form 10-K and the proxy statement filed with the SEC by Constellation Energy on April 13, 2005. Information regarding FPL Group’s directors and executive officers is available in its 2004 Form 10-K, the proxy statement filed with the SEC by FPL Group on April 5, 2005, and the Form 10-Q for the quarterly period ended September 30, 2005. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

3

Agenda

The FPL – Constellation Energy Merger

Announcement

Why We Are Merging

What the Merger Means for Employees

Next Steps

Questions

4

Why FPL and Constellation Energy are Merging

• Build the leading platform in the competitive energy sector

• Create a world-class competitive electricity business

• Build a bigger, stronger, more diversified regulated utility business

• Build a combined enterprise well-positioned for long-term strength, growth, success

….Creating America’s Premier Energy Company

5

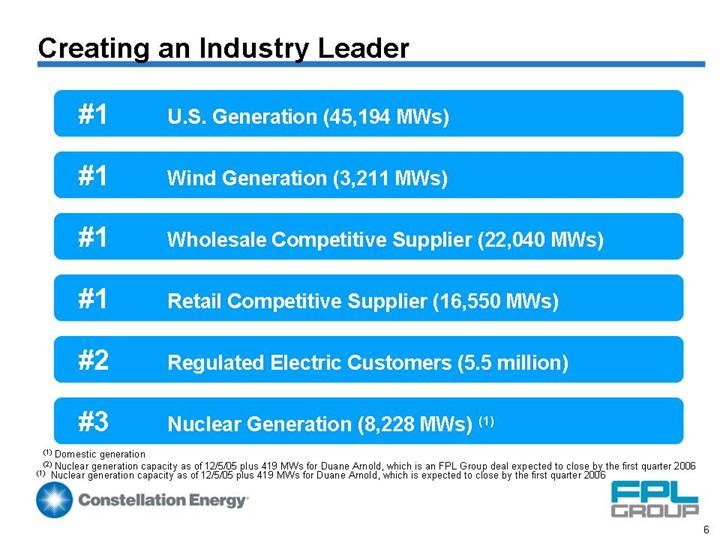

Creating an Industry Leader

#1 U.S. Generation (45,194 MWs)

#1 Wind Generation (3,211 MWs)

#1 Wholesale Competitive Supplier (22,040 MWs)

#1 Retail Competitive Supplier (16,550 MWs)

#2 Regulated Electric Customers (5.5 million)

#3 Nuclear Generation (8,228 MWs) (1)

(1) Domestic generation

(2) Nuclear generation capacity as of 12/5/05 plus 419 MWs for Duane Arnold, which is an FPL Group deal expected to close by the first quarter 2006

(1) Nuclear generation capacity as of 12/5/05 plus 419 MWs for Duane Arnold, which is expected to close by the first quarter 2006

6

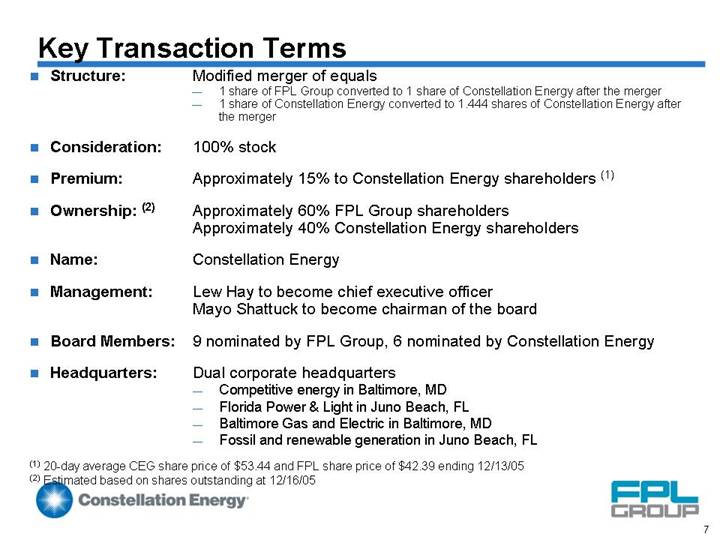

Key Transaction Terms

• | Structure: | | Modified merger of equals |

| | | • | 1 share of FPL Group converted to 1 share of Constellation Energy after the merger |

| | | • | 1 share of Constellation Energy converted to 1.444 shares of Constellation Energy after the merger |

| | | |

• | Consideration: | | 100% stock |

| | | |

• | Premium: | | Approximately 15% to Constellation Energy shareholders (1) |

| | | |

• | Ownership: (2) | | Approximately 60% FPL Group shareholders |

| | | Approximately 40% Constellation Energy shareholders |

| | | |

• | Name: | | Constellation Energy |

| | | |

• | Management: | | Lew Hay to become chief executive officer |

| | | Mayo Shattuck to become chairman of the board |

| | | |

• | Board Members: | | 9 nominated by FPL Group, 6 nominated by Constellation Energy |

| | | |

• | Headquarters: | | Dual corporate headquarters |

| | | • | Competitive energy in Baltimore, MD |

| | | • | Florida Power & Light in Juno Beach, FL |

| | | • | Baltimore Gas and Electric in Baltimore, MD |

| | | • | Fossil and renewable generation in Juno Beach, FL |

(1) 20-day average CEG share price of $53.44 and FPL share price of $42.39 ending 12/13/05

(2) Estimated based on shares outstanding at 12/16/05

7

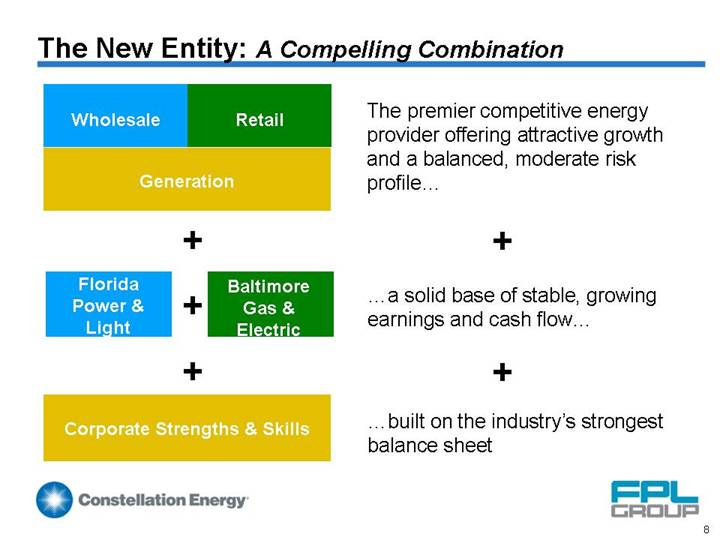

The New Entity: A Compelling Combination

Wholesale | Retail | The premier competitive energy provider offering attractive growth and a balanced, moderate risk profile... |

Generation | |

| |

+ | + |

| |

Florida

Power &

Light | + | Baltimore

Gas &

Electric | …a solid base of stable, growing earnings and cash flow… |

| |

+ | + |

| |

Corporate Strengths & Skills | …built on the industry’s strongest balance sheet |

| | | | |

8

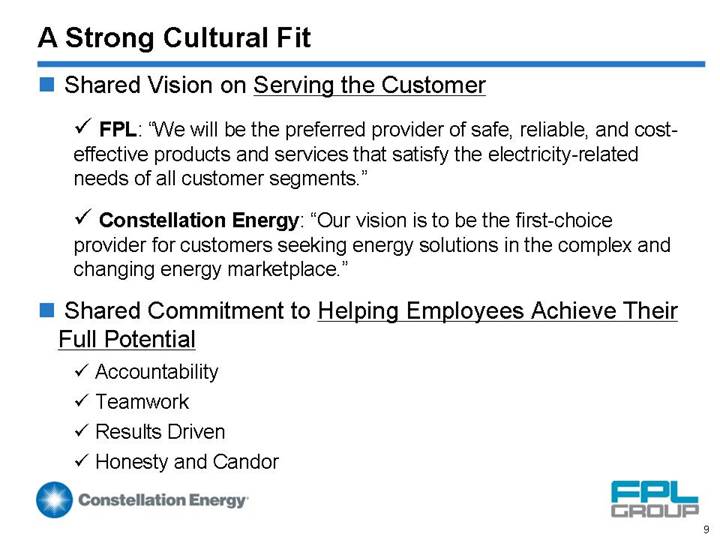

A Strong Cultural Fit

• Shared Vision on Serving the Customer

• FPL: “We will be the preferred provider of safe, reliable, and cost-effective products and services that satisfy the electricity-related needs of all customer segments.”

• Constellation Energy: “Our vision is to be the first-choice provider for customers seeking energy solutions in the complex and changing energy marketplace.”

• Shared Commitment to Helping Employees Achieve Their Full Potential

• Accountability

• Teamwork

• Results Driven

• Honesty and Candor

9

The New Constellation Energy’s Senior Leadership Team

Lew Hay

CEO

[GRAPHIC]

Currently FPL Group

Chairman and CEO

Mayo Shattuck

Chairman of the Board

[GRAPHIC]

Currently Constellation Energy

Chairman and CEO

10

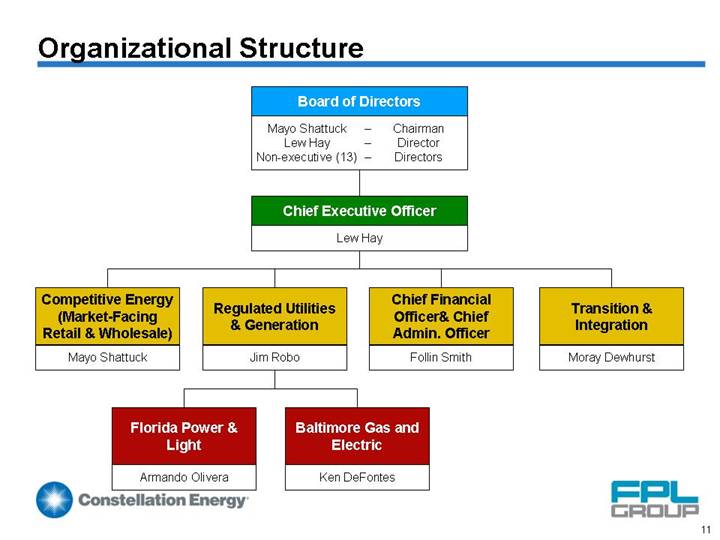

Organizational Structure

| Board of Directors | |

| Mayo Shattuck | – | Chairman | |

| Lew Hay | – | Director | |

| Non-executive (13) | – | Directors | |

| | |

| Chief Executive Officer | |

| Lew Hay | |

| | |

Competitive Energy

(Market-Facing

Retail & Wholesale) | Regulated Utilities

& Generation | Chief Financial

Officer& Chief

Admin. Officer | Transition &

Integration |

Mayo Shattuck | Jim Robo | Follin Smith | Moray Dewhurst |

| | |

| Florida Power &

Light | Baltimore Gas and

Electric | |

| Armando Olivera | Ken DeFontes | |

| | | | | | | | | | |

11

What the Merger Means for Employees

• Enhanced Opportunity

• Larger, more diversified company

• Greater financial strength

• Key Objectives

• Contribute to new company’s success

• Build a new enterprise

• Impact on Jobs

• Co-headquarters in Baltimore and Juno Beach, Fla. for a minimum of 5 years

• Workforce reductions <10% to eliminate merger- related redundancies

• Reductions to be achieved by normal attrition wherever possible

• Business as usual for 2006

• Deal is expected to take 9-12 months to obtain necessary regulatory approvals

• It’s imperative for employees to stay focused on current responsibilities

12

Summary

• Compelling opportunity to create U.S. market-leading competitive energy provider

• Well-matched, complementary contributions from two strong companies

• Multiple channels of growth, balanced by strong base of moderate risk cash flow and earnings

• Multiple sources of synergy

• Combined entity well positioned for the opportunities and challenges of the decade ahead

13

Next Steps

• Timetable to Complete Merger: 9 to 12 months

• We must stay focused, continue to do our jobs and serve our customers

• FPL Group and Constellation Energy remain separate, stand-alone companies until merger closes

• We must continue to execute on 2005 / 2006 business plans

• Management will:

• Provide updates to employees as merger process continues

• Be direct and forthright, “tell it like it is”

14

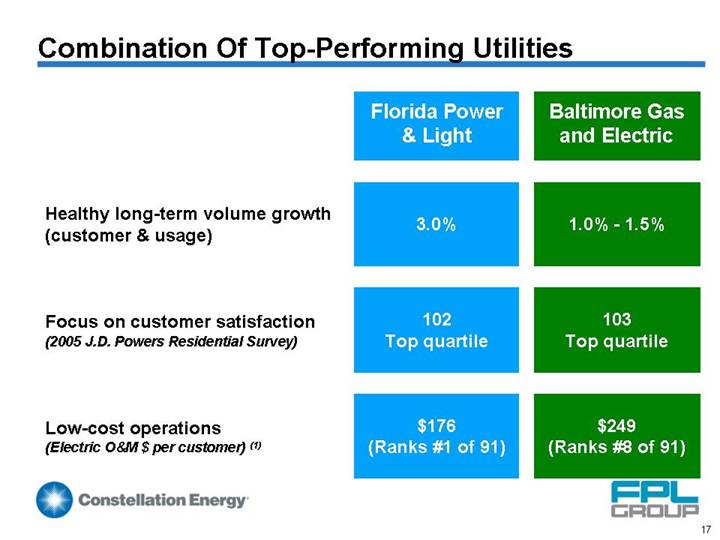

Combination Of Top-Performing Utilities

| | Florida Power

& Light | | Baltimore Gas

and Electric | |

| | | | | |

Healthy long-term volume growth | | 3.0% | | 1.0% - 1.5% | |

(customer & usage) | | | | | |

| | | | | |

Focus on customer satisfaction | | 102 | | 103 | |

(2005 J.D. Powers Residential Survey) | | Top quartile | | Top quartile | |

| | | | | |

Low-cost operations | | $ | 176 | | $ | 249 | |

(Electric O&M $ per customer) (1) | | (Ranks #1 of 91) | | (Ranks #8 of 91) | |

| | | | | | | |

17

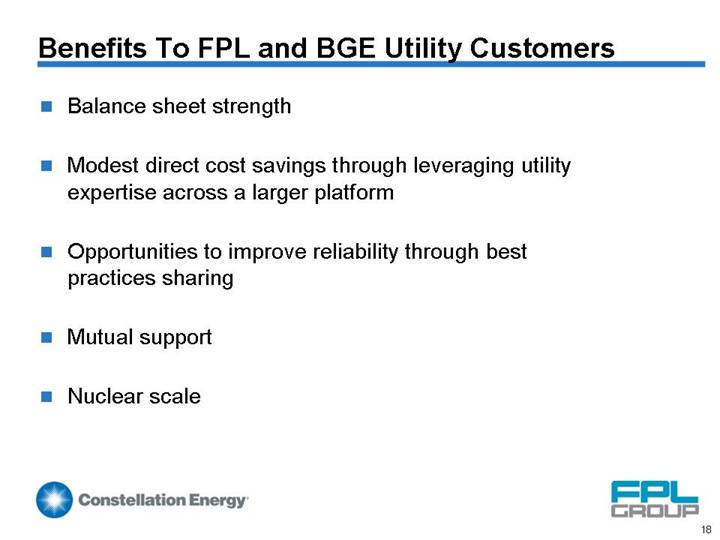

Benefits To FPL and BGE Utility Customers

• Balance sheet strength

• Modest direct cost savings through leveraging utility expertise across a larger platform

• Opportunities to improve reliability through best practices sharing

• Mutual support

• Nuclear scale

18

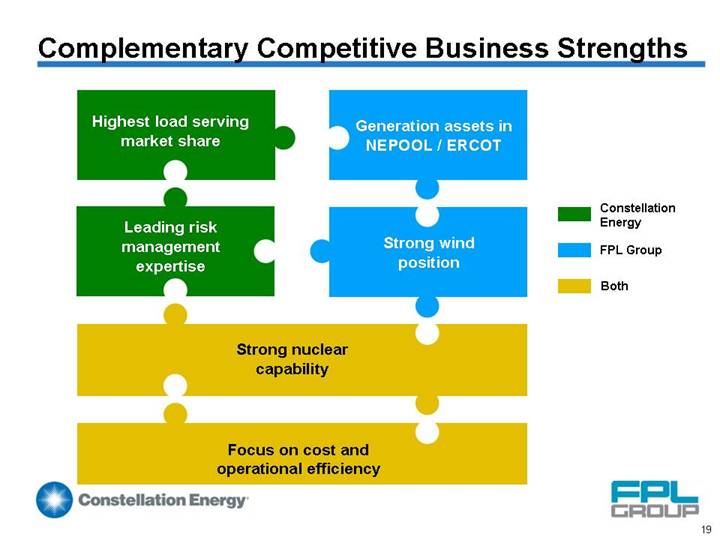

Complementary Competitive Business Strengths

[CHART]

19

Complementary Generation and Customer Businesses

| | FPL Group | | Constellation Energy | | Combined | |

| | Peak

Load

Served (1) | | Generation (2) | | Peak

Load

Served (1) | | Generation (2) | | Peak

Load

Served (1) | | Generation (2) | |

| | (MW) | | (MW) | | (MW) | | (MW) | | (MW) | | (MW) | |

NEPOOL | | 900 | | 2,793 | | 9,800 | | — | | 10,700 | | 2,793 | |

| | | | | | | | | | | | | |

PJM | | 600 | | 1,159 | | 13,200 | | 6,413 | | 13,800 | | 7,572 | |

| | | | | | | | | | | | | |

ERCOT | | 1,500 | | 3,679 | | 6,300 | | 800 | | 7,800 | | 4,479 | |

| | | | | | | | | | | | | |

TOTAL | | 3,000 | | 7,631 | | 29,300 | | 7,213 | | 32,300 | | 14,844 | |

Constellation Energy’s customer market shares combined with FPL Group’s deregulated assets create a balanced footprint

(1) Peak load served as of 9/30/05

(2) Generation megawatts as of 12/5/05

20