Bank of America Merrill Lynch 2012 Megawatt Round Up Conference Houston, Texas Joe Nigro, Senior Vice President, Portfolio Strategy Ed Quinn, Senior Vice President, Wholesale Trading & Origination March 28, 2012 Exhibit 99.1 |

2 Cautionary Statements Regarding Forward-Looking Information This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. The factors that could cause actual results to differ materially from these forward-looking statements include those discussed herein as well as those discussed in (1) Exelon Corporation’s (Exelon) 2011Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and (c) ITEM 8. Financial Statements and Supplementary Data: Note 18; (2) Constellation Energy Group, Inc.’s 2011 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and (c) ITEM 8. Financial Statements and Supplementary Data: Note 12; and (3) other factors discussed in filings with the Securities and Exchange Commission by Exelon, Commonwealth Edison Company, PECO Energy Company, Baltimore Gas and Electric Company, and Exelon Generation Company, LLC (Companies). Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this presentation. None of the Companies undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this presentation. |

Commercial Background 3 3 Development and exploration of natural gas properties 10 assets in six states 294 Bcf of proved reserves ¹ Largest merchant power generation portfolio in the U.S. Over 34 GW of owned generation capacity ² Clean portfolio, well positioned for evolving regulatory requirements A leading competitive supplier of power in the U.S. 164 TWh of load and 382 bcf of gas delivered ³ Over 1 million residential and 100,000 business and public sector customers The merger creates the largest – and growing – competitive integrated energy company in the U.S. One of the largest and most experienced Load Response providers 1,730 MW of Demand Response under contract Over 4,000 energy savings projects implemented across the U.S. Scale, Scope and Flexibility Across the Energy Value Chain (1) Estimated proved reserves as of 12/31/2011. (2) Total owned generation capacity as of 12/31/2011, net of physical market mitigation (Brandon Shores, C.P. Crane and H.A. Wagner ~2,648 MW). (3) Actuals for 2011. Electric load and gas includes fixed price and indexed products. (4) DR estimate is as of February 2012. 4 |

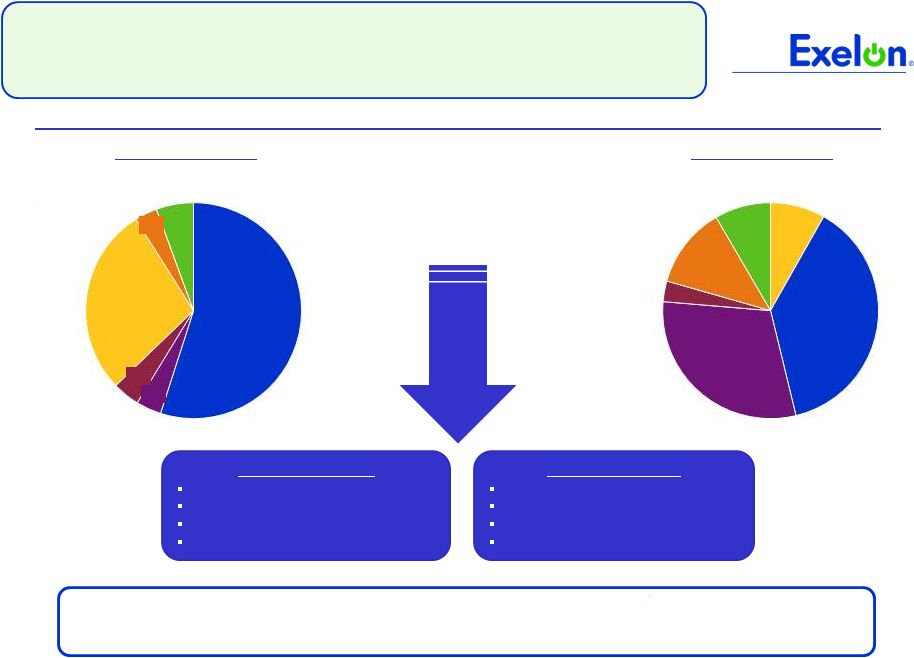

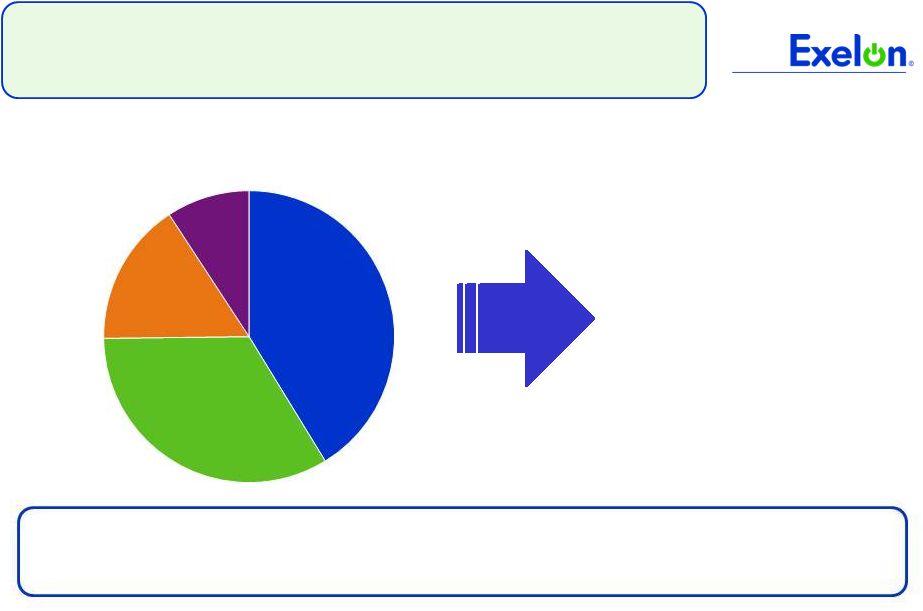

Commercial Background: Generation 4 Power Generation Capacity –Technologically and Regionally Diverse Fleet Other 9% ERCOT 12% NYISO 3% PJM West 30% PJM East 38% NEPOOL Owned Generation (Technology Type) 6% Wind/Solar/Other 3% Gas Oil 4% Coal (2) 4% Nuclear 55% Hydro One of the largest and cleanest fleets in the U.S., with unparalleled upside from tightening power markets Owned Generation Capacity (1) : ~ 34,650 MW Owned Generation (ISO) Multiple Channels Retail - Residential, C&I Wholesale / POLR Over The Counter Mid Marketing & Origination Multiple Products Load - fixed shape, full requirement Standard products, basis Options - Power, Gas & Heat Rate Emission credits, RECs (1) Total owned generation capacity as of 12/31/2011, net of physical market mitigation (Brandon Shores, C.P. Crane and H.A. Wagner ~2,648 MW). (2) Coal capacity shown above does not include Eddystone 2 (309 MW) to be retired on 6/1/2012. 28% 8% |

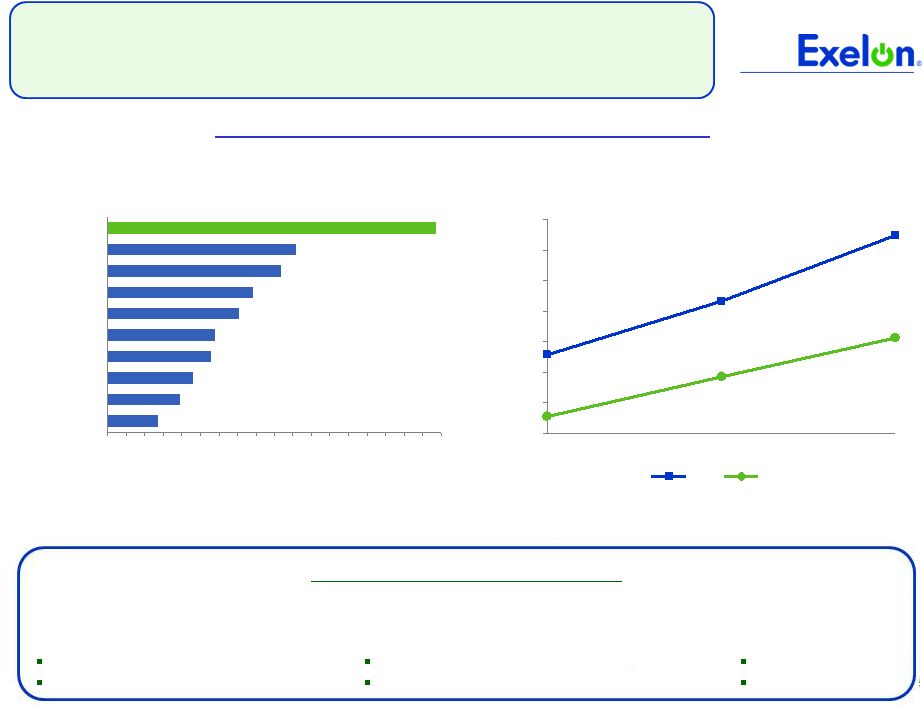

Leading Retail Electric Business in the U.S. Commercial Background: Retail 5 The “Constellation Difference” National Coverage (Energy Value & Services for all US Facilities) Supply & Demand Side Services Power & Gas Commodity Demand Response Energy Efficiency Real-time Energy Management On Site Solar Renewables (1) Exelon and Constellation combined retail businesses Source: KEMA, “The Retailer Yearbook”, December 2011 Trends in Switched Retail Power Market (Est. Switched Rates, % Eligible U.S. MWhs) (2) (2) Eligible retail power market defined as “universe that can be sold to competitively, excluding Muni/Co-Op”; Switched market defined as “capacity that has switched to a retail service provider”; Source: KEMA. 90 80 70 60 50 40 30 20 10 0 Constellation 1 Leadership Position in Electric Sales (Est. Annual Sales, Top 10 Non-residential North American Retailers) 2011 Annualized Volume (TWh) 0% 10% 20% 30% 40% 50% 60% 70% Projected 2012 2008 2003 Residential C&I |

Portfolio Matches Generation with Load in Key Competitive Markets 6 MISO (TWh) PJM (1) (TWh) South (2) (TWh) ISO-NE & NY ISO (3) (TWh) West (4) (TWh) Note: Data for Exelon and Constellation represents actual generation (owned and contracted) and actual electric sales for 2011. Generation is adjusted for assets that have long term PPAs sold by Exelon or Constellation, including but not limited to wind and South assets. Exelon load doesn’t include the ComEd swap (~26 TWh). Index load, which is a pass through load product with no price or volumetric risk to the seller, is not included in the load estimate. (1)Constellation generation includes output from assets to be mitigated (Brandon Shores, C.P. Crane and H.A. Wagner with total generation ~8.4 TWh). (2)Represents load and generation in ERCOT, SERC and SPP. (3)Constellation load includes ~0.7 TWh of load served in Ontario. (4)Constellation generation includes ~0.4 TWh of generation in Alberta. Load 74.8 41.3 33.5 Generation 175.1 29.4 145.7 Former Constellation Exelon Load 5.8 5.2 0.6 Generation 8.6 8.6 Load 26.6 Generation 24.2 16.6 7.6 Load 1.9 Generation 0.6 Load 29.1 29.1 Generation 33.5 33.5 The combination establishes an industry-leading platform with regional diversification of the generation fleet and customer-facing load business |

Pricing and Portfolio Management Approach 7 Transmission Ancillaries Renewable Load Shape Basis Block Energy Capacity Hedged primarily with generation – baseload, intermediate & peaking Hedged via market based products – blocks, fixed load shapes, options, RECs Fixed or determinable Transmission & Capacity Block Energy, Basis, Load Shape, Renewables & Ancillaries Pricing Build Up (Illustrative)* 1. Full requirements pricing build up is for illustrative purpose and not reflective of any one particular product or zone. Margins are not shown in the build up. Constellation's model will be an integrated approach to load management, selling the products that closely tie to the asset portfolio Full Requirements Components 1 Pricing and Portfolio Management Approach Integrated Portfolio Pure Play Retail |

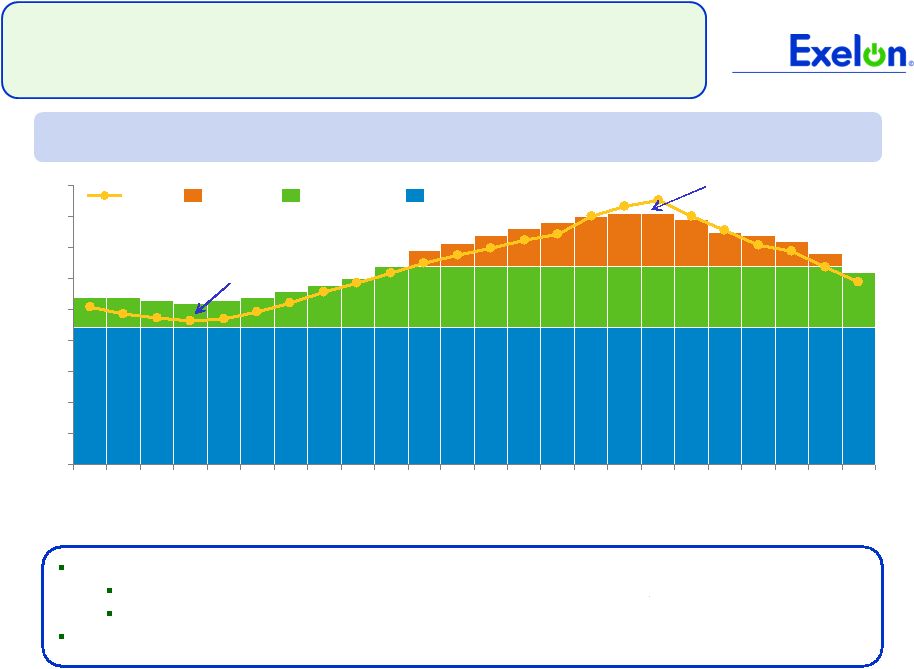

Load and Generation Match 8 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 24 22 20 18 16 14 12 10 8 6 4 2 MW Hour Ending Baseload Intermediate Peaking Load Our generation portfolio is low cost, flexible and diverse Large portion of a load following contract is ATC or Peak blocks, which we own Adequate intermediate and peaking capacity within the portfolio for managing peaking load Any residual shortfall can be supplemented by market products (physical and or financial) Surplus: sell into the market Deficit : Buy from the market Matching Load with Generation (illustrative*) * Generation and load matching diagram is for illustrative purpose and is not reflective of actual load or generation positions |

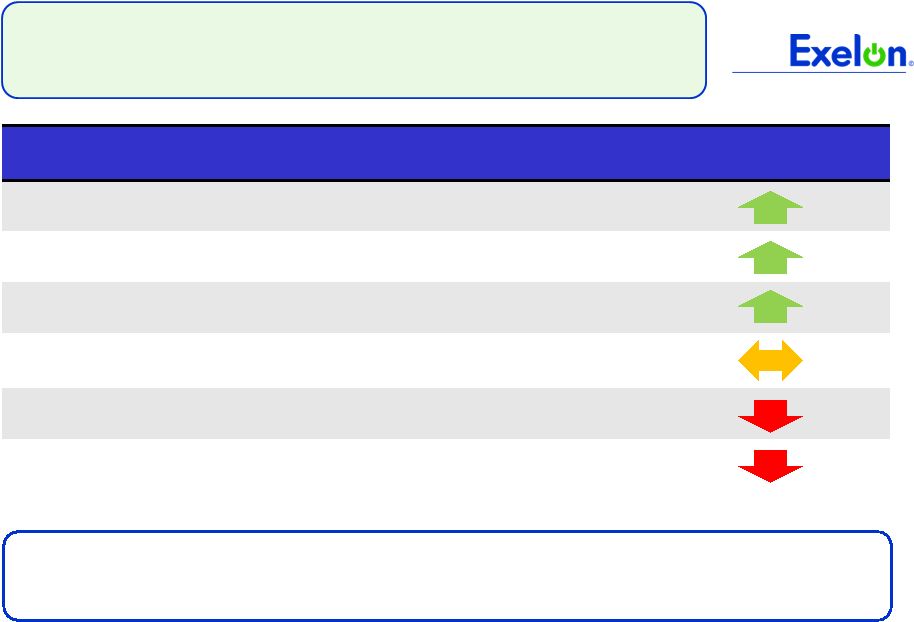

9 9 Factors Influencing PJM RPM Capacity Auction (Comparison of PY 15/16 and PY 14/15 Price Drivers) Exelon Price Impact Incremental Coal Retirements New Jersey High Electric Demand Day (HEDD) rules Higher Net ACRs for Coal Units Import Transmission Limits and Objectives (muted impact on portfolio revenues due to regional diversification) New Generation, with exemptions Peak Load 2015/16 PJM Capacity Auction: Expected Changes Since Planning Year 2014/15 We continue to believe that supply bidding behavior will have the greatest impact on clearing price RPM = Reliability Pricing Model; Net ACR: Net Avoided Cost Rate |

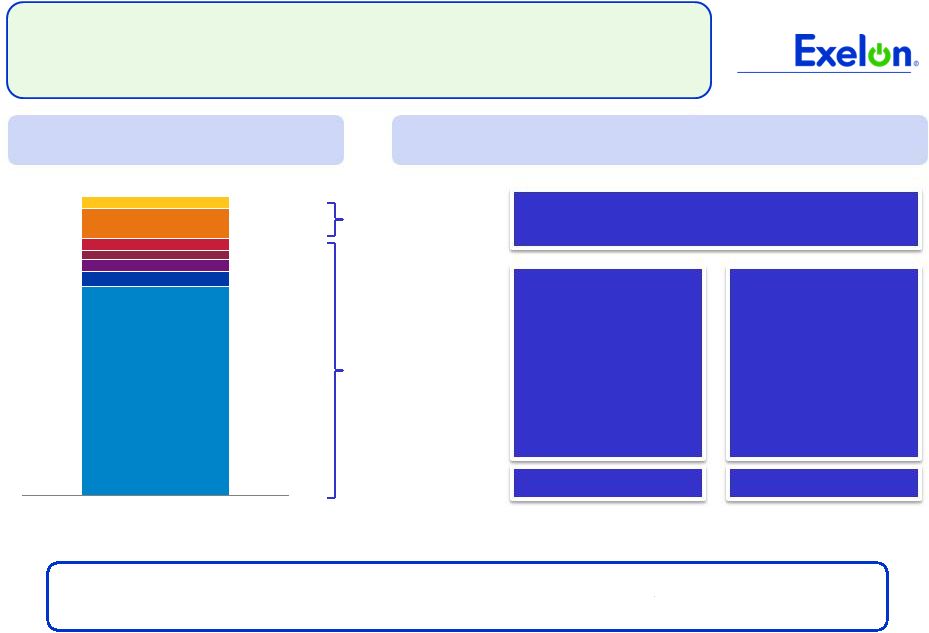

10 10 Generation Capacity Position in PJM SWMAAC 9% EMAAC 16% MAAC 34% RTO 41% Exelon has a sizeable and well balanced capacity portfolio offering stable cash flows in the near term and upside in the medium to long term. PY 14/15 Eligible Capacity (1) : ~ 27,500 MW (1) Capacity values are in installed capacity terms (summer ratings) located in the areas and adjusted for mid-year PPA roll-offs and net of market mitigation assumed to be 2,648 MW. $10 / MW – Day increase in prices translates to approximately $100 million increase in revenues RTO = Regional Transmission Organization (i.e. Rest of Pool), MAAC = Mid-Atlantic Area Council, EMAAC = Eastern Mid-Atlantic Area Council ; SWMAAC = South West Mid-Atlantic Area Council |