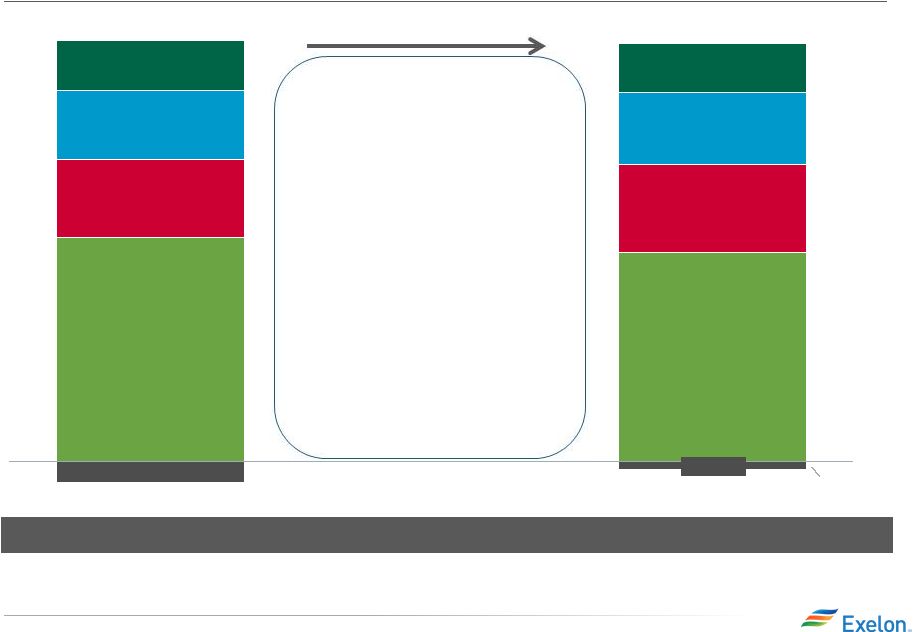

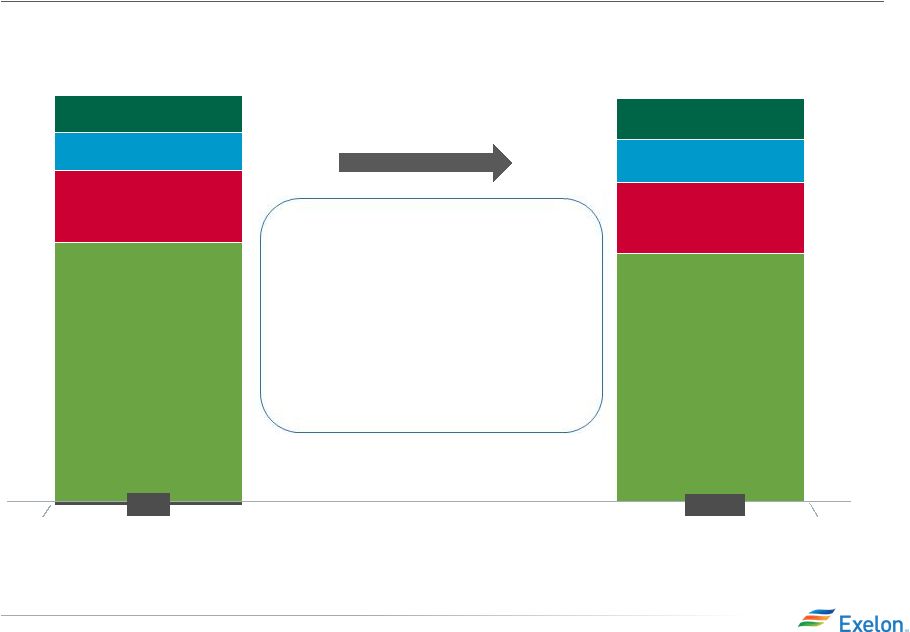

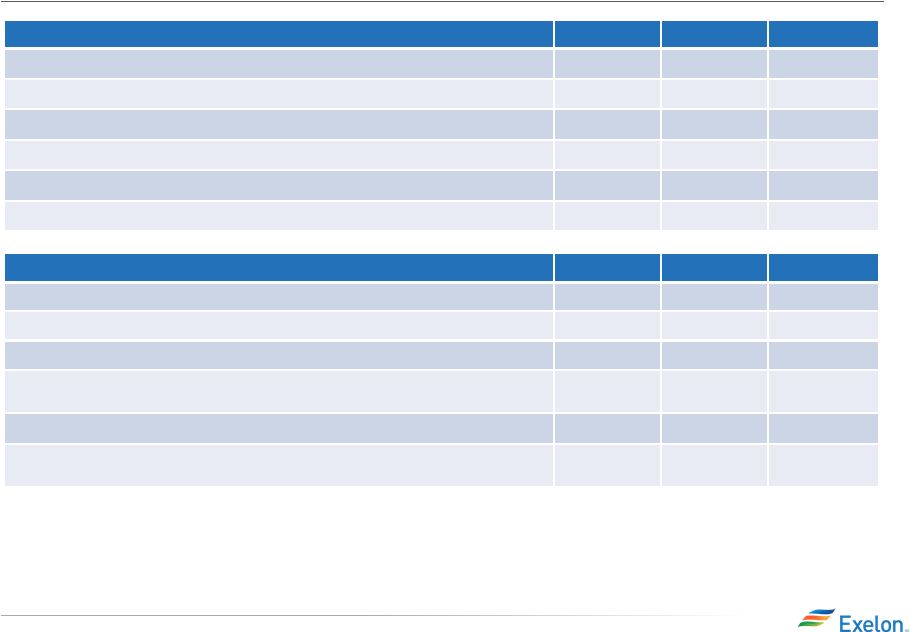

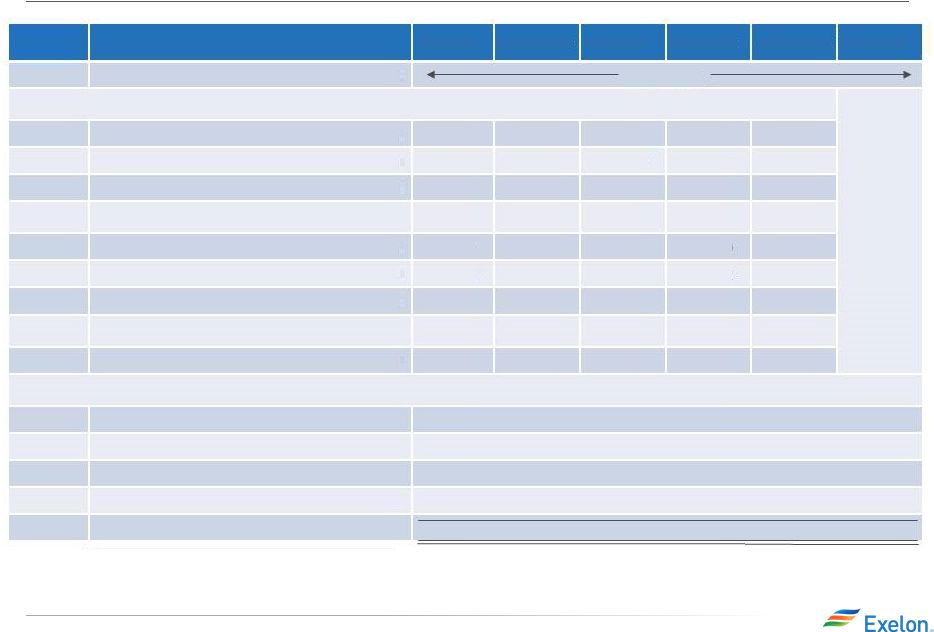

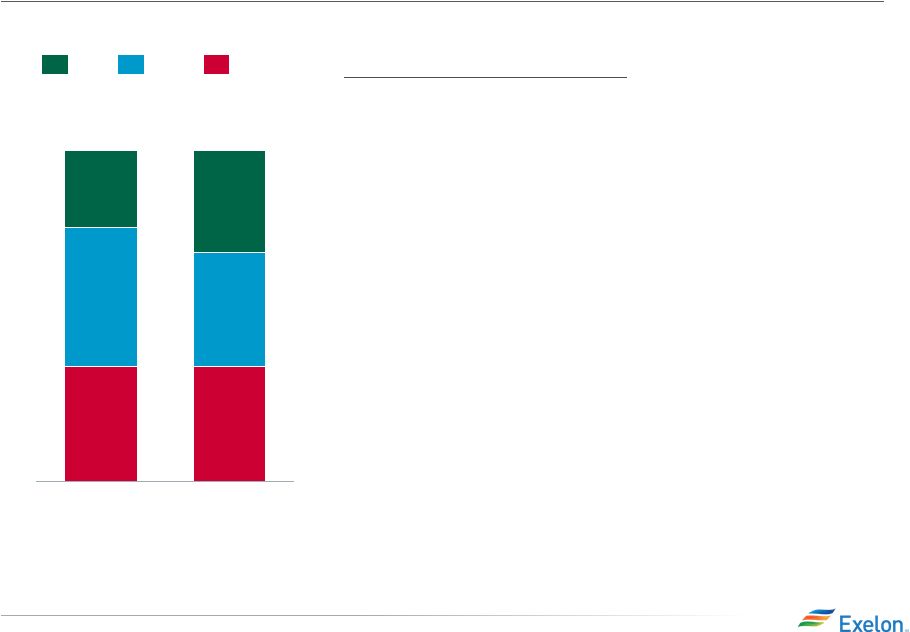

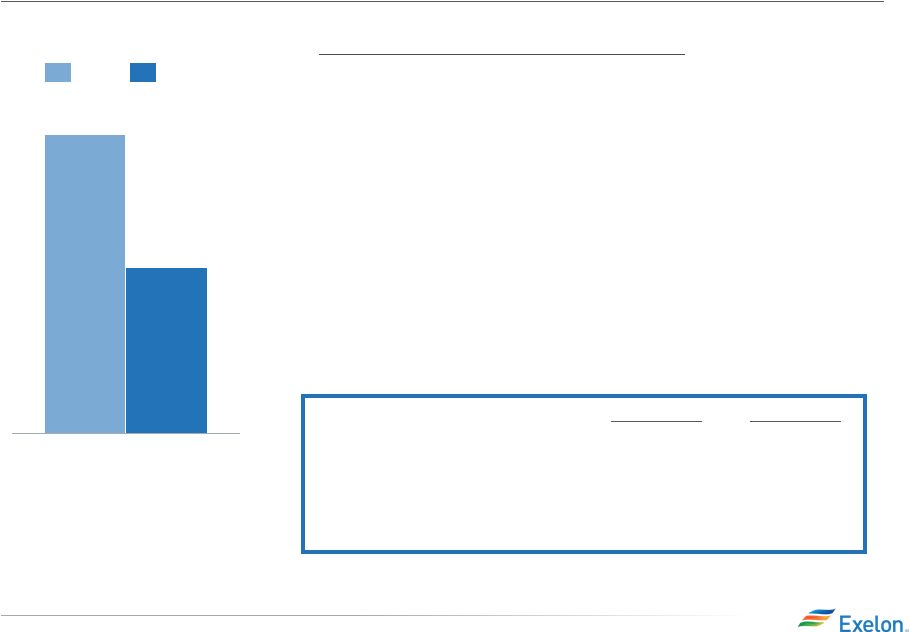

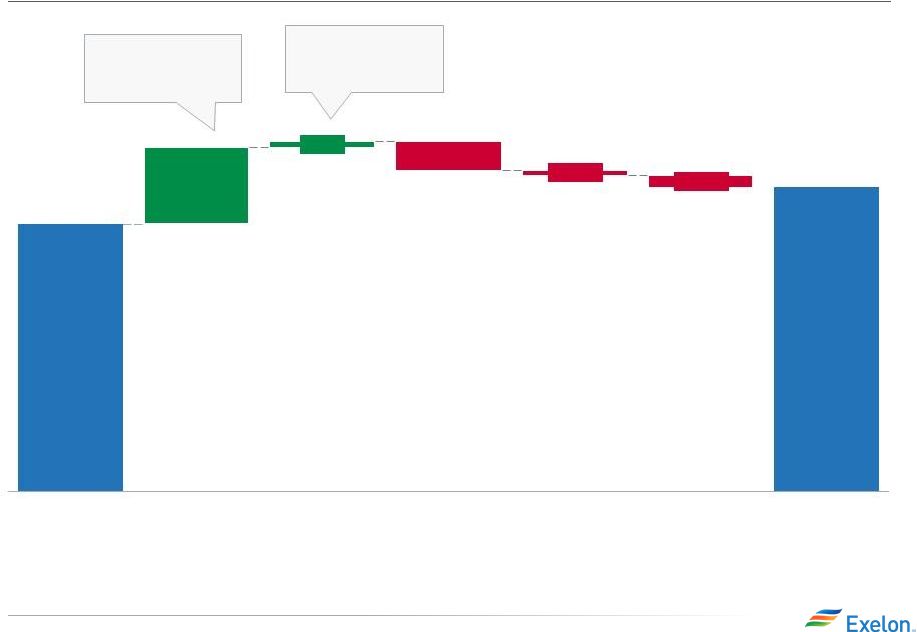

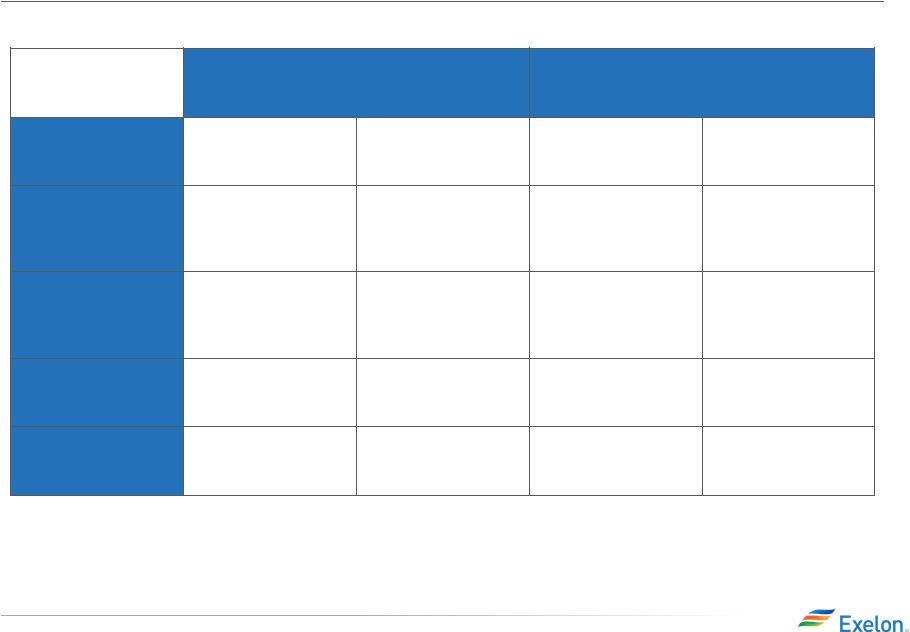

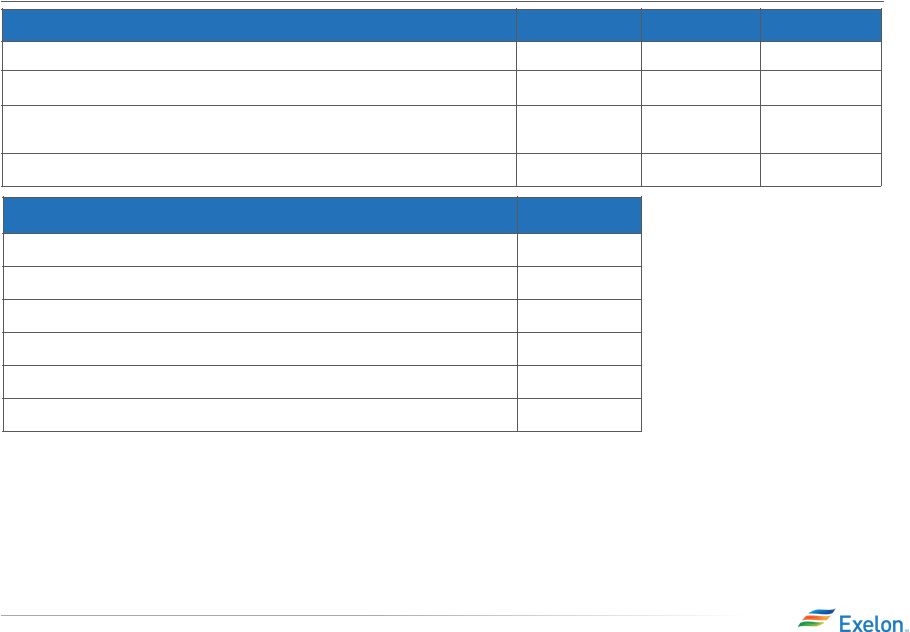

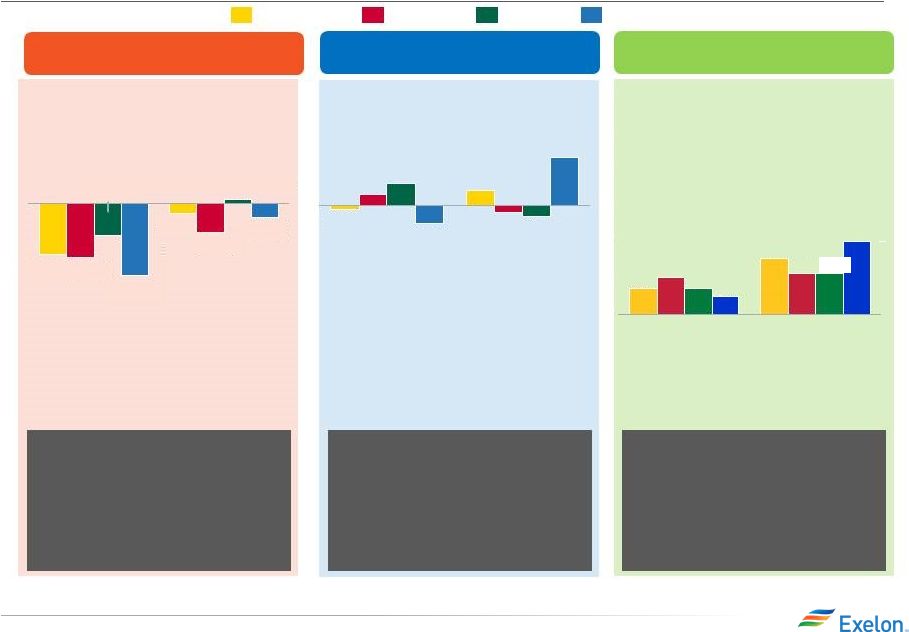

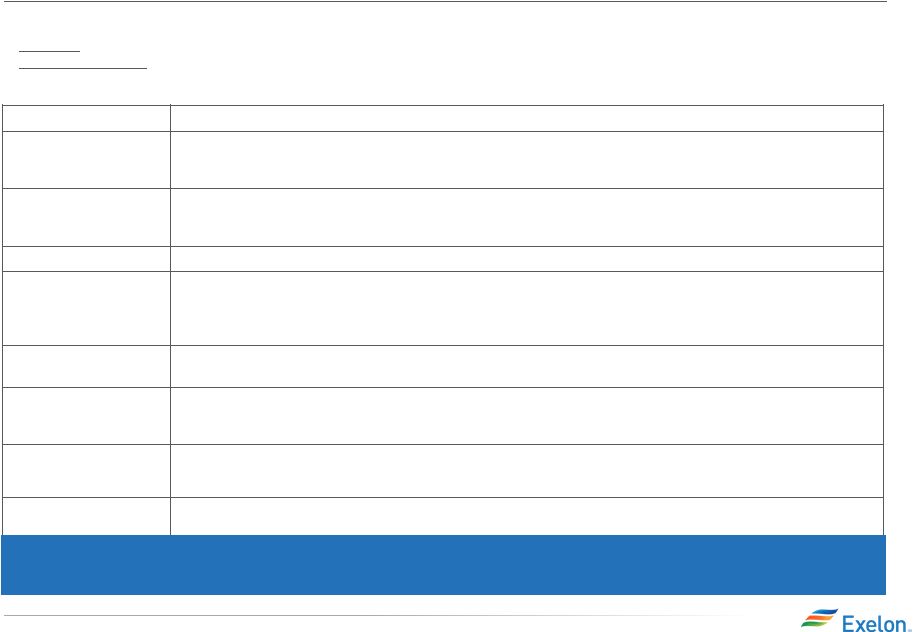

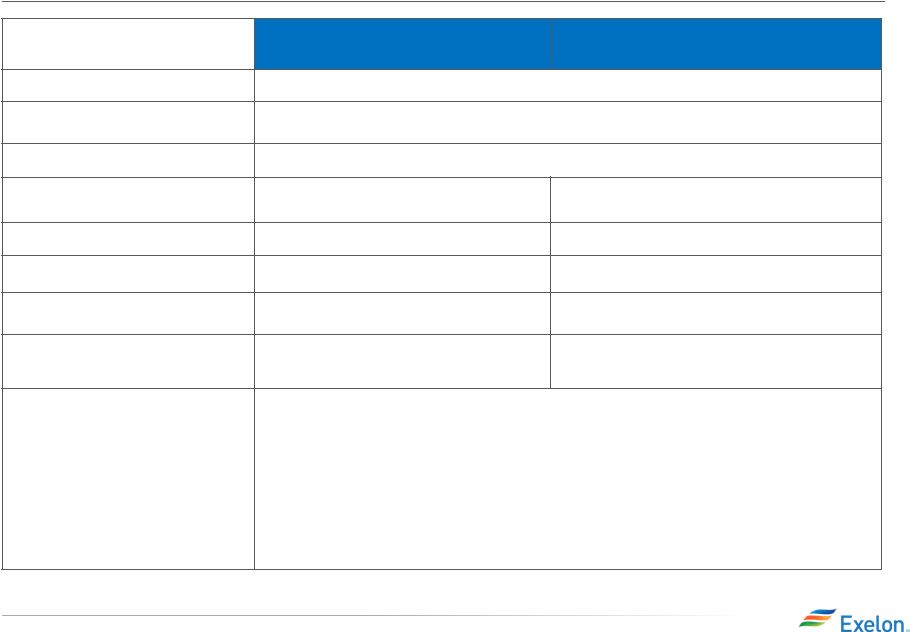

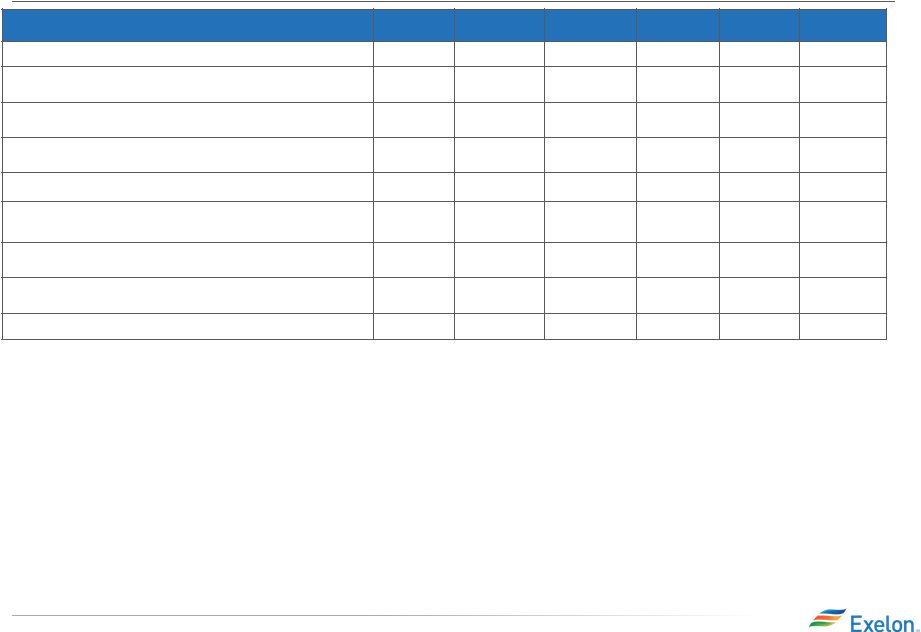

27 Q4 2015 Earnings Release Slides 2016 Projected Sources and Uses of Cash (1) All amounts rounded to the nearest $25M. Figures may not add due to rounding. (2) Excludes counterparty collateral activity. (3) Adjusted Cash Flow from Operations (non-GAAP) primarily includes net cash flows from operating activities and net cash flows from investing activities excluding capital expenditures. (4) Figures reflect cash CapEx and CENG fleet at 100% (5) Other Financing primarily includes expected changes in short-term debt and tax sharing from the parent. (6) Acquisitions and Divestitures and Equity Investments previously captured in Adjusted Cash Flow from Operations (7) Dividends are subject to declaration by the Board of Directors. (8) Includes cash flow activity from Holding Company, eliminations, and other corporate entities. Consistent and reliable free cash flows Enable growth & value creation Supported by a strong balance sheet Strong balance sheet enables flexibility to raise and deploy capital for growth Exelon intends to return capital to shareholders and bondholders, if the merger is not approved Operational excellence and financial discipline drives free cash flow reliability Generating ~$3.7B of free cash flow in 2016, including $1.3B at ExGen and $2.9B at the Utilities Creating value for customers, communities and shareholders Investing $5.3B, with $4.0B at the Utilities and $1.3B at ExGen ($ in millions) (1) BGE ComEd PECO Total Utilities ExGen Corp (8) Exelon 2016E Cash Balance Beginning Cash Balance (2) 7,750 Adjusted Cash Flow from Operations (2,3) 650 1,575 700 2,925 3,725 (425) 6,225 Base CapEx and Nuclear Fuel (4) 0 0 0 0 (2,475) (100) (2,550) Free Cash Flow 650 1,575 700 2,925 1,250 (525) 3,650 Debt Issuances 750 950 450 2,150 0 0 2,150 Debt Retirements (300) (675) (300) (1,275) 0 (1,875) (3,150) Project Financing n/a n/a n/a n/a 100 n/a 100 Equity Buyback 0 0 0 0 0 (1,600) (1,600) Contribution from Parent 0 475 0 475 0 (475) 0 Other Financing (5) (75) 450 25 400 0 1,075 1,475 Financing 375 1,200 175 1,750 100 (2,875) (1,025) Total Free Cash Flow and Financing Growth 1,025 2,775 850 4,675 1,375 (3,400) 2,625 Utility Investment (825) (2,425) (675) (3,950) 0 0 (3,950) ExGen Growth (4) 0 0 0 0 (1,325) 0 (1,325) Acquisitions and Divestitures (6) 0 0 0 0 0 0 0 Equity Investments (6) 0 0 0 0 (125) 0 (125) Dividend (7) 0 0 0 0 0 (1,150) (1,150) Other CapEx and Dividend (825) (2,425) (675) (3,950) (1,450) (1,150) (6,550) Total Cash Flow, excl. Collateral 200 350 175 725 (100) (4,550) (3,900) Ending Cash Balance (2) 3,850 |