PROGRESS THROUGH PARTNERSHIP Investor Update April 2020 Paul D. Nungester EVP & CFO Gary M. Small President Donald P. Hileman CEO Exhibit 99.2

PROGRESS THROUGH PARTNERSHIP Forward Looking Statements This document may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21 B of the Securities Exchange Act of 1934, as amended. Those statements may include, but are not limited to, all statements regarding intent, beliefs, expectations, projections, forecasts and plans of First Defiance Financial Corp. and its management, and specifically include statements regarding: changes in economic conditions; the nature, extent and timing of governmental actions and reforms; future movements of interest rates; the ability to benefit from a changing interest rate environment; the production levels of mortgage loan generation; the ability to continue to grow loans and deposits; the ability to sustain credit quality ratios at current or improved levels; continued strength in the market area for First Federal Bank of the Midwest; the ability to sell real estate owned properties; and the ability to grow in existing and adjacent markets. These forward-looking statements involve numerous risks and uncertainties, including: impacts from the novel coronavirus (COVID-19) pandemic on our business, operations, customers and capital position; higher default rates on loans made to our customers related to COVID-19 and its impact on our customers’ operations and financial condition; the impact of COVID-19 on local, national and global economic conditions; unexpected changes in interest rates or disruptions in the mortgage market related to COVID-19 or responses to the health crisis; the effects of various governmental responses to the COVID-19 pandemic; those inherent in general and local banking, insurance and mortgage conditions; competitive factors specific to markets in which First Defiance and its subsidiaries operate; future interest rate levels; legislative and regulatory decisions or capital market conditions; and other risks and uncertainties detailed from time to time in our Securities and Exchange Commission (SEC) filings, including our Annual Report on Form 10-K for the year ended December 31, 2019. One or more of these factors have affected or could in the future affect First Defiance’s business and financial results in future periods and could cause actual results to differ materially from plans and projections. Therefore, there can be no assurances that the forward-looking statements included in this news release will prove to be accurate. In light of the significant uncertainties in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by First Defiance or any other persons, that our objectives and plans will be achieved. All forward-looking statements made in this news release are based on information presently available to the management of First Defiance and speak only as of the date on which they are made. We assume no obligation to update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required by law. As required by U.S. GAAP, First Defiance will evaluate the impact of subsequent events through the issuance date of its December 31, 2019, consolidated financial statements as part of its Annual Report on Form 10-K to be filed with the SEC. Accordingly, subsequent events could occur that may cause First Defiance to update its critical accounting estimates and to revise its financial information from that which is contained in this news release. Non-GAAP Measures This communication contains certain non-GAAP financial measures of First Defiance and United Community determined by methods other than in accordance with generally accepted accounting principles. We use non-GAAP financial measures to provide meaningful supplemental information regarding our performance. We believe these non-GAAP measures are beneficial in assessing our operating results and related trends, and when planning and forecasting future periods. These non-GAAP disclosures should be considered in addition to, and not as a substitute for or preferable to, financial results determined in accordance with GAAP. The non-GAAP financial measures we use may differ from the non-GAAP financial measures other financial institutions use to measure their results of operations.

PROGRESS THROUGH PARTNERSHIP Company Overview

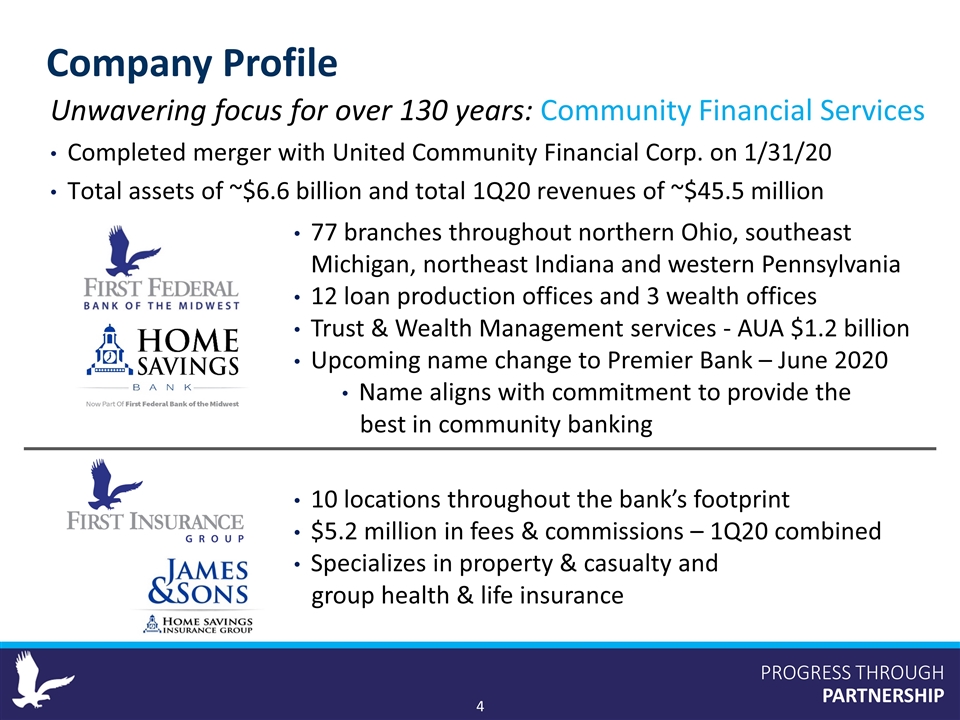

PROGRESS THROUGH PARTNERSHIP Company Profile Unwavering focus for over 130 years: Community Financial Services Completed merger with United Community Financial Corp. on 1/31/20 Total assets of ~$6.6 billion and total 1Q20 revenues of ~$45.5 million 77 branches throughout northern Ohio, southeast Michigan, northeast Indiana and western Pennsylvania 12 loan production offices and 3 wealth offices Trust & Wealth Management services - AUA $1.2 billion Upcoming name change to Premier Bank – June 2020 Name aligns with commitment to provide the best in community banking 10 locations throughout the bank’s footprint $5.2 million in fees & commissions – 1Q20 combined Specializes in property & casualty and group health & life insurance

PROGRESS THROUGH PARTNERSHIP Investment Highlights Market leader across northern Ohio deeply rooted in the communities we have served since the 1890s Growing presence in metro markets with a diversified geographic mix Experienced, disciplined management team Robust, diversified loan mix with a stable deposit base Consistently strong net interest margin with a diversified revenue mix Solid tangible capital levels with strong credit function

PROGRESS THROUGH PARTNERSHIP Positioned to outperform peers on long-term growth Management focus on leadership transition, system conversions and building talent within the organization Dedicated, experienced integration team Cultural integration to enhance employee engagement and retention especially in current uncertain environment Full system conversions expected by early in the third quarter of 2020 Enhanced products, services and technology while honoring our commitment to superior customer service, personalized financial solutions and unwavering community support Looking to the Future

PROGRESS THROUGH PARTNERSHIP Strategic Focus Near-term People Focused on our customer, employees and communities in the current uncertain environment Integration Focused on integration of teams, systems and processes for combined organization Long-term Profitability High performance objectives for revenue growth, expense control and maintaining strong asset quality Growth Organic and through acquisitions, targeting newer markets, new relationships, enhanced delivery and products in more established markets Shareholder Value Enhancement Effective capital management supporting growth, dividend increases and share repurchases Emphasis on the Community Bank Difference

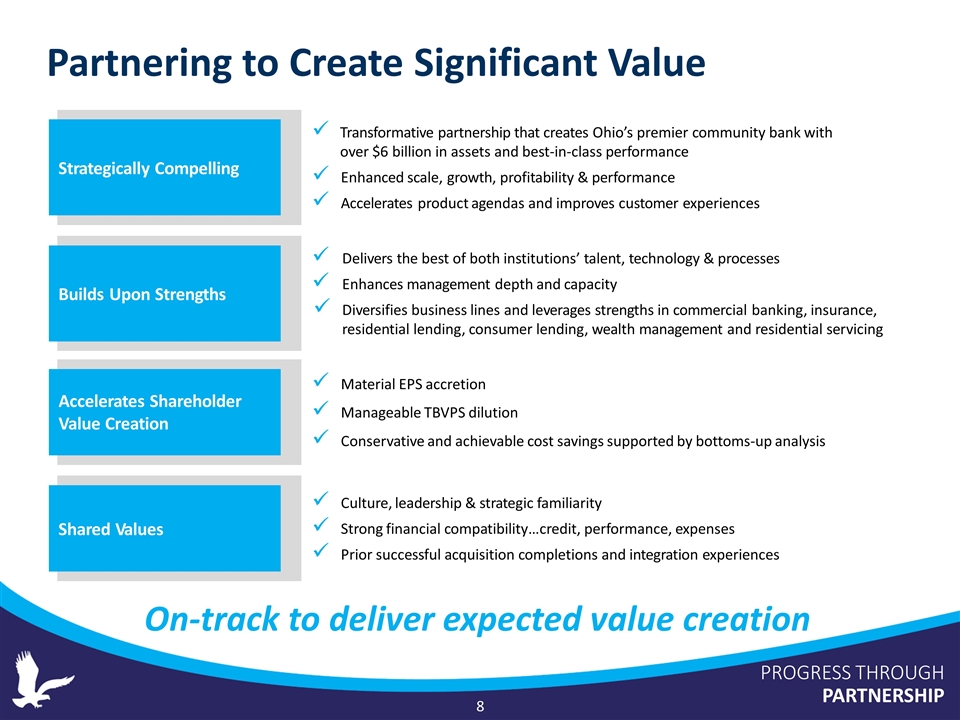

PROGRESS THROUGH PARTNERSHIP Culture, leadership & strategic familiarity Strong financial compatibility…credit, performance, expenses Prior successful acquisition completions and integration experiences Transformative partnership that creates Ohio’s premier community bank with over $6 billion in assets and best-in-class performance Enhanced scale, growth, profitability & performance Accelerates product agendas and improves customer experiences Delivers the best of both institutions’ talent, technology & processes Enhances management depth and capacity Diversifies business lines and leverages strengths in commercial banking, insurance, residential lending, consumer lending, wealth management and residential servicing Material EPS accretion Manageable TBVPS dilution Conservative and achievable cost savings supported by bottoms-up analysis Shared Values Strategically Compelling Builds Upon Strengths Accelerates Shareholder Value Creation On-track to deliver expected value creation Partnering to Create Significant Value

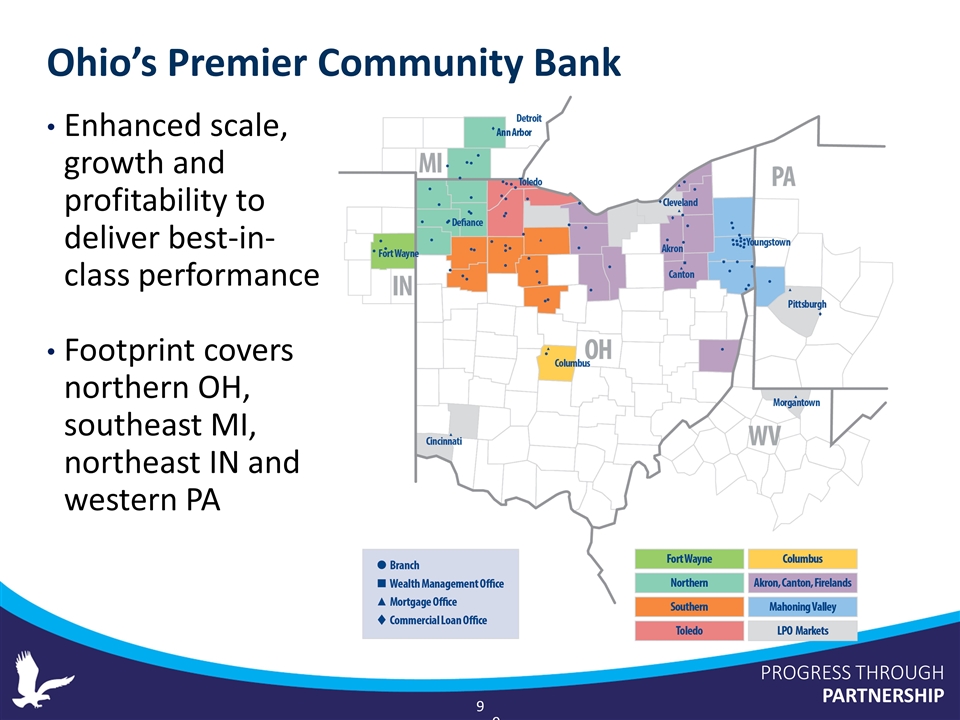

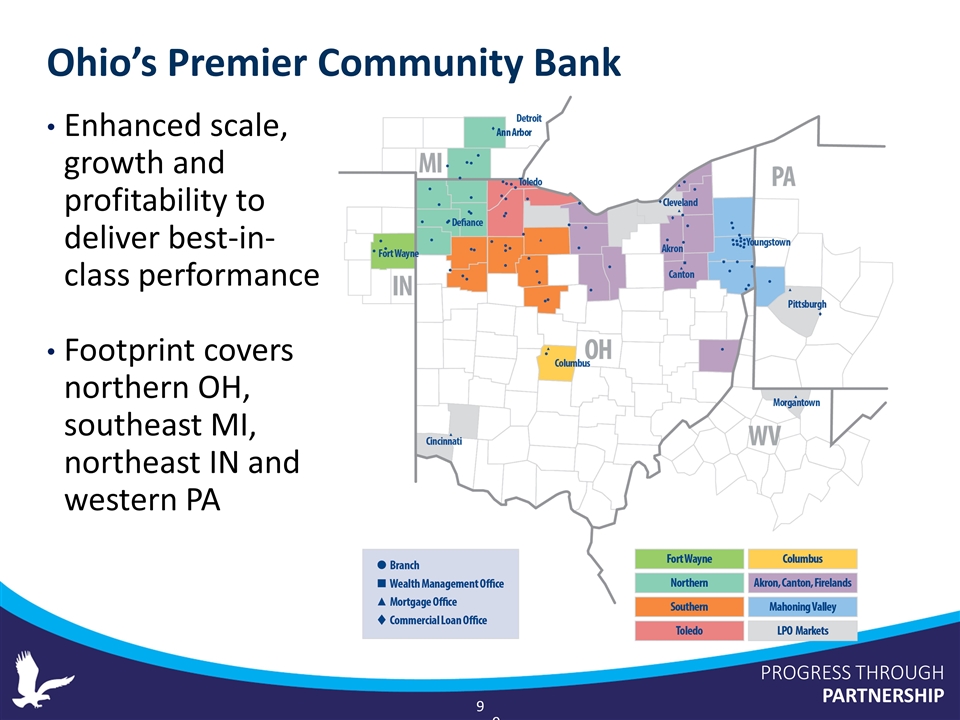

PROGRESS THROUGH PARTNERSHIP Enhanced scale, growth and profitability to deliver best-in-class performance Footprint covers northern OH, southeast MI, northeast IN and western PA Ohio’s Premier Community Bank

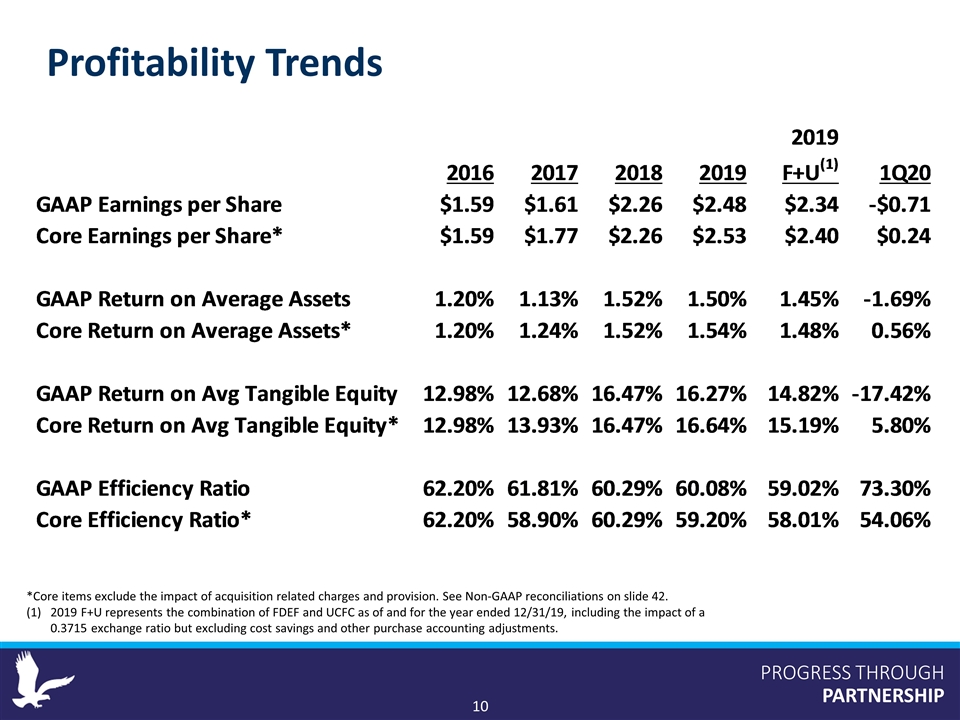

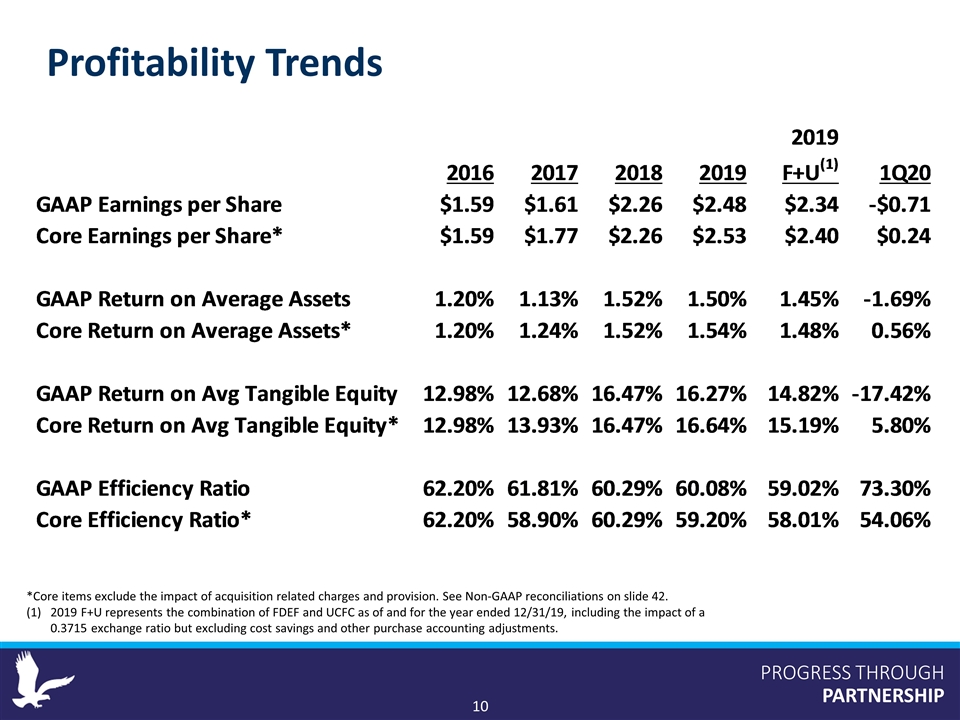

PROGRESS THROUGH PARTNERSHIP Profitability Trends *Core items exclude the impact of acquisition related charges and provision. See Non-GAAP reconciliations on slide 42. 2019 F+U represents the combination of FDEF and UCFC as of and for the year ended 12/31/19, including the impact of a 0.3715 exchange ratio but excluding cost savings and other purchase accounting adjustments.

PROGRESS THROUGH PARTNERSHIP Performance Recognition 2019 S&P Global Market Intelligence Best-Performing Community Banks (FFB) Analysis used and scored performance based on six financial metrics Ranked #29 amongst 50 community banks $3B-$10B for 2019 performance scores 2019 KBW Bank Honor Roll (FFB) Recognition of banks with more than $500 million in total assets that consistently deliver exceptional growth Based on 10 consecutive years of increases in reported EPS results One of only 15 banks admitted from a nearly 375 bank universe 2018 Sandler Bank & Thrift Sm-ALL Stars (HSB) Analysis used and scored performance based on seven financial metrics Ranked #21 amongst the country’s 30 top performing small-cap banks and thrifts

PROGRESS THROUGH PARTNERSHIP Demonstrating our core values in all interactions to create long-term, profitable relationships Enhancing customer experience through technology advancements Reaching more customers through digital channel development Growing our communities through our people Enhancing Trusted Advisor service delivery model Proactive customer outreach in uncertain environment Strong Sales & Service Delivery

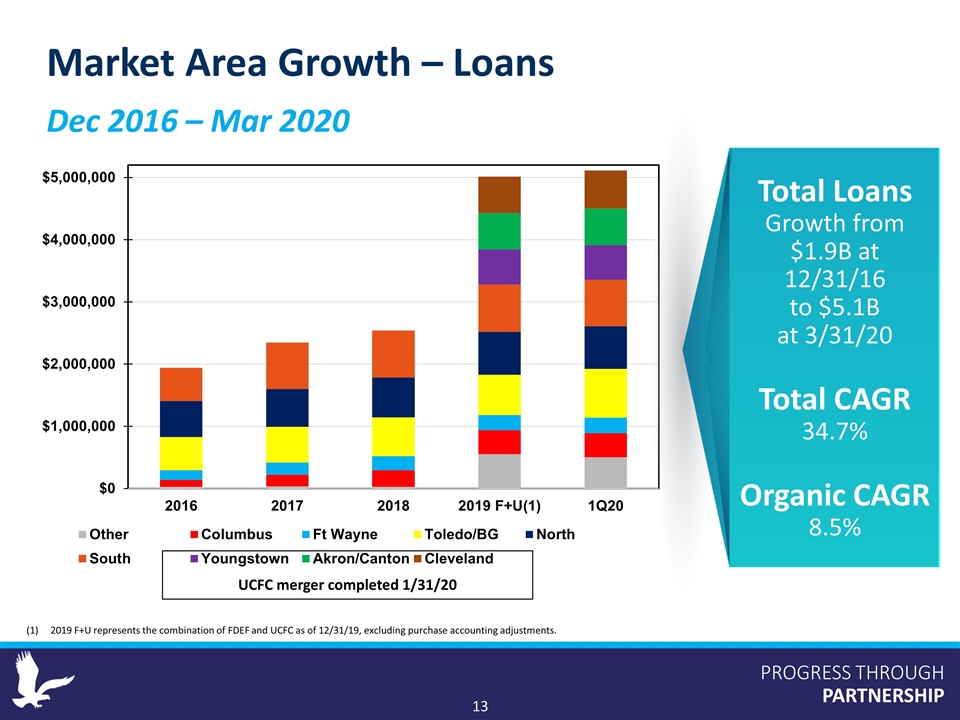

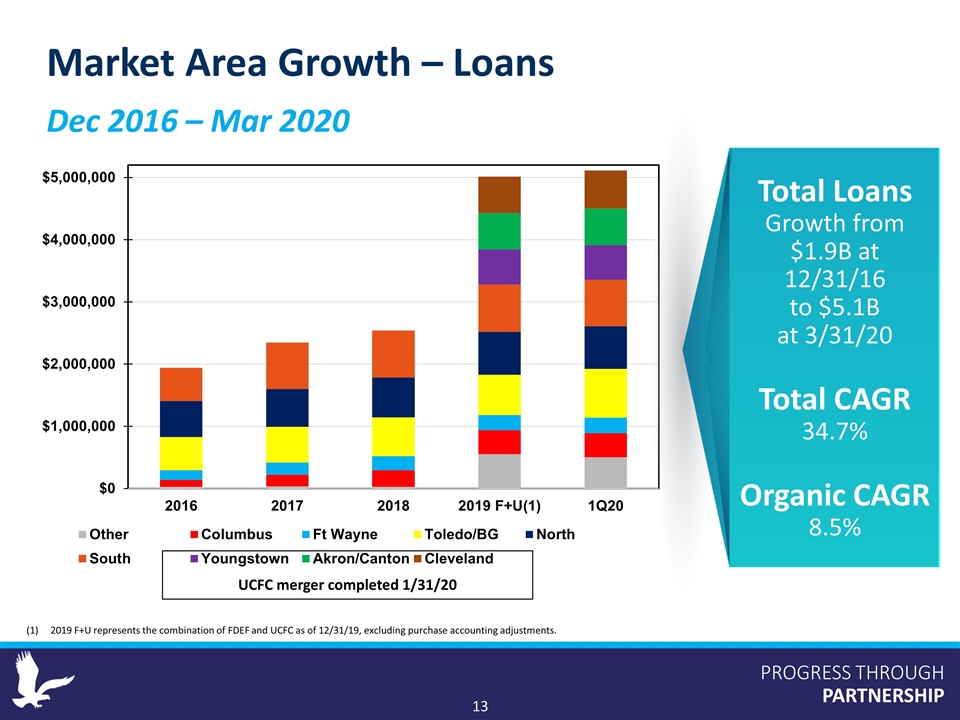

PROGRESS THROUGH PARTNERSHIP Dec 2016 – Mar 2020 Market Area Growth – Loans Total Loans Growth from $1.9B at 12/31/16 to $5.1B at 3/31/20 Total CAGR 34.7% Organic CAGR 8.5% UCFC merger completed 1/31/20 2019 F+U represents the combination of FDEF and UCFC as of 12/31/19, excluding purchase accounting adjustments.

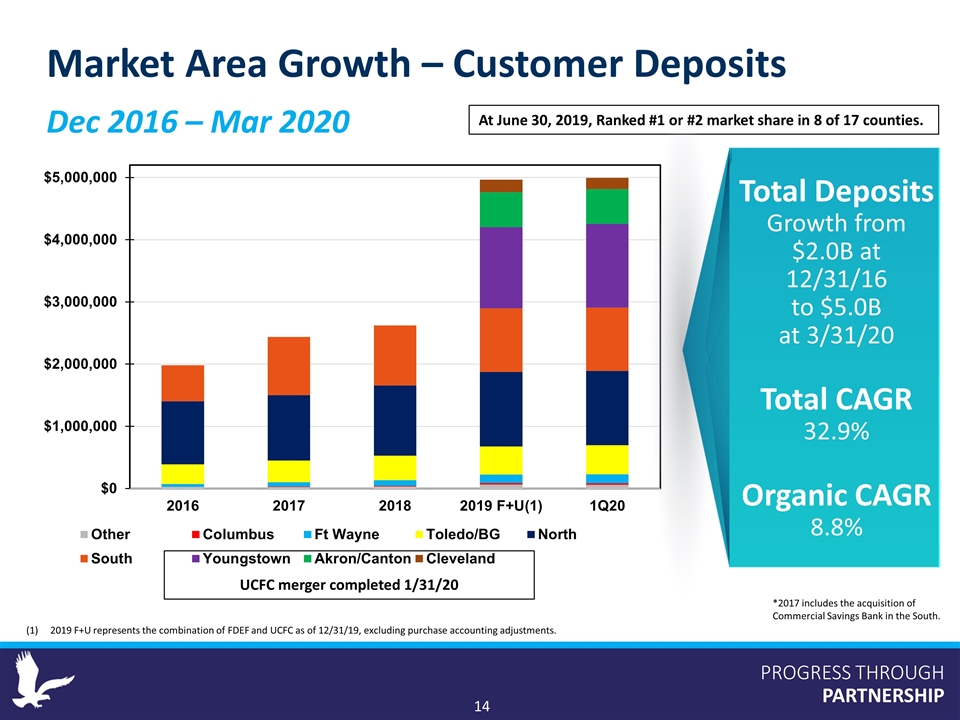

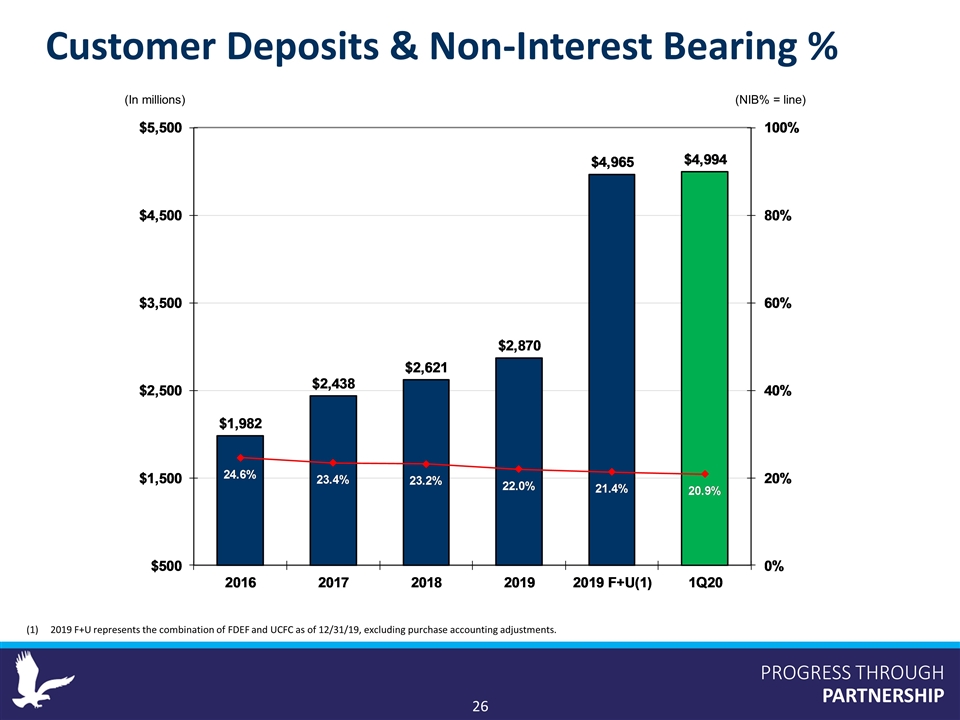

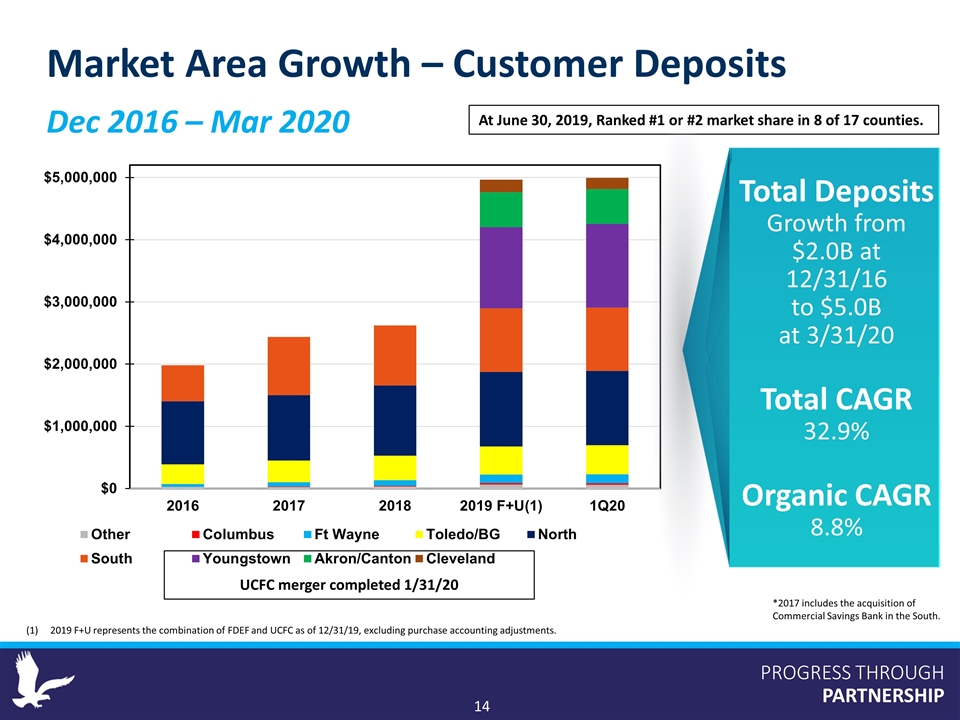

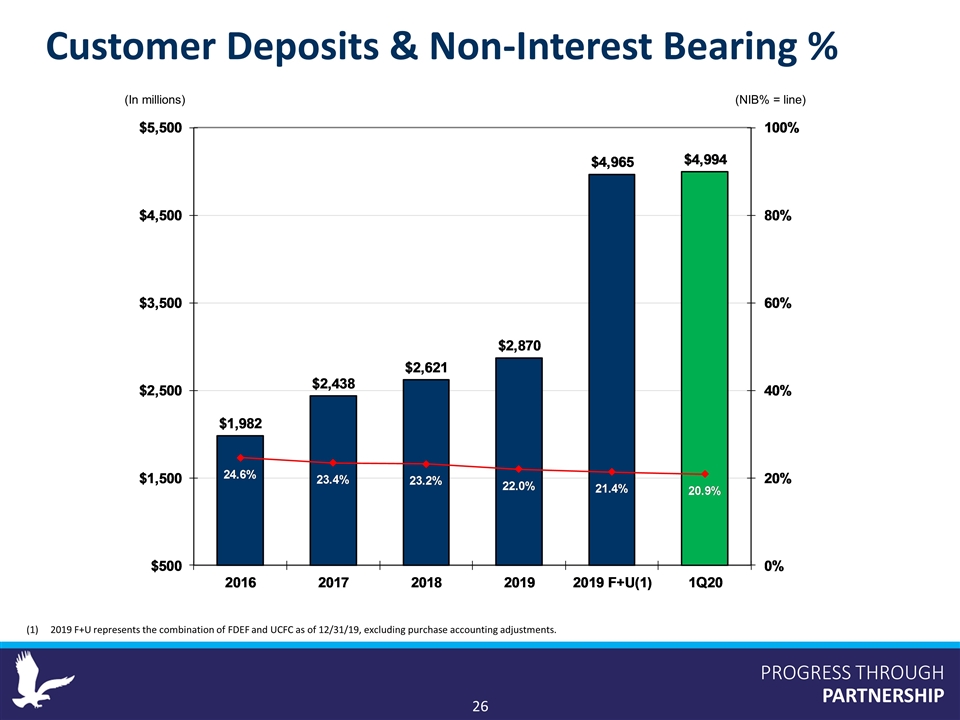

PROGRESS THROUGH PARTNERSHIP Dec 2016 – Mar 2020 Market Area Growth – Customer Deposits At June 30, 2019, Ranked #1 or #2 market share in 8 of 17 counties. *2017 includes the acquisition of Commercial Savings Bank in the South. Total Deposits Growth from $2.0B at 12/31/16 to $5.0B at 3/31/20 Total CAGR 32.9% Organic CAGR 8.8% UCFC merger completed 1/31/20 2019 F+U represents the combination of FDEF and UCFC as of 12/31/19, excluding purchase accounting adjustments.

PROGRESS THROUGH PARTNERSHIP Financial Highlights

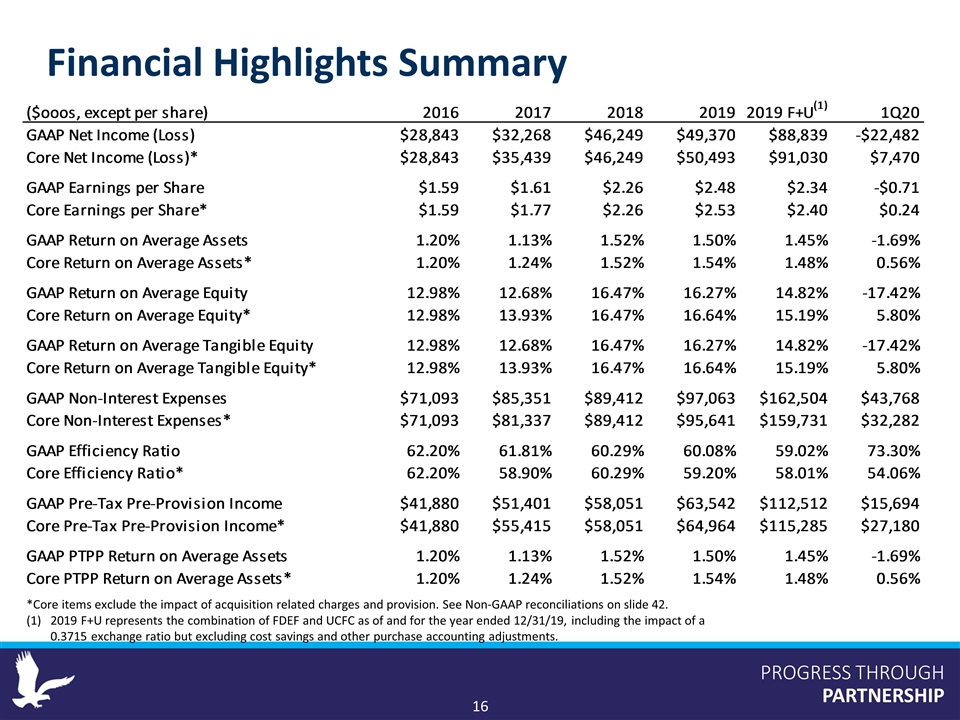

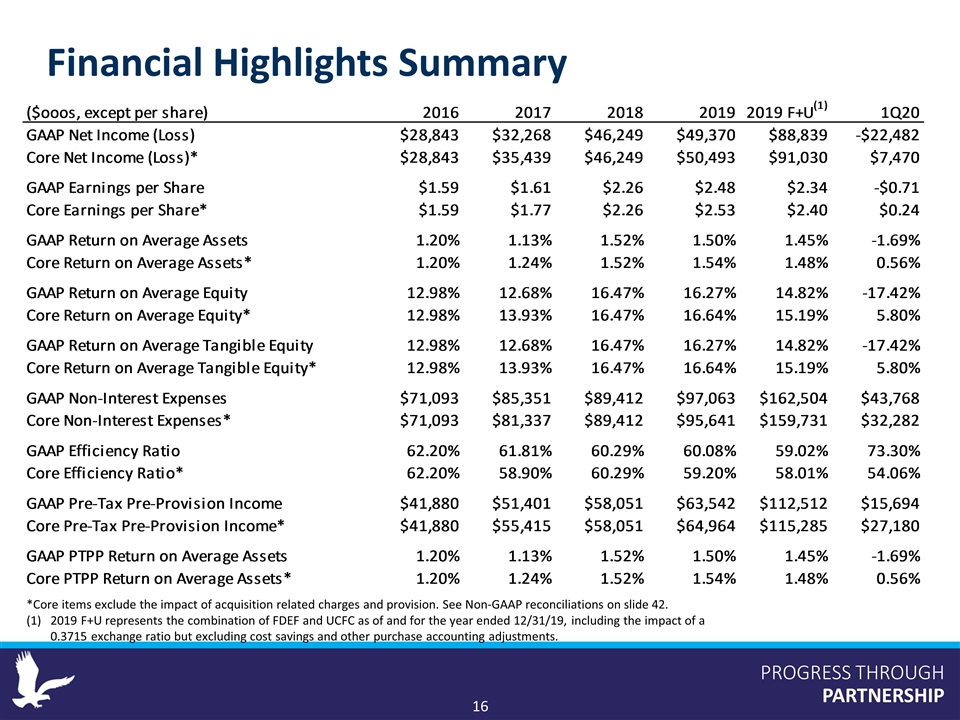

PROGRESS THROUGH PARTNERSHIP Financial Highlights Summary *Core items exclude the impact of acquisition related charges and provision. See Non-GAAP reconciliations on slide 42. 2019 F+U represents the combination of FDEF and UCFC as of and for the year ended 12/31/19, including the impact of a 0.3715 exchange ratio but excluding cost savings and other purchase accounting adjustments.

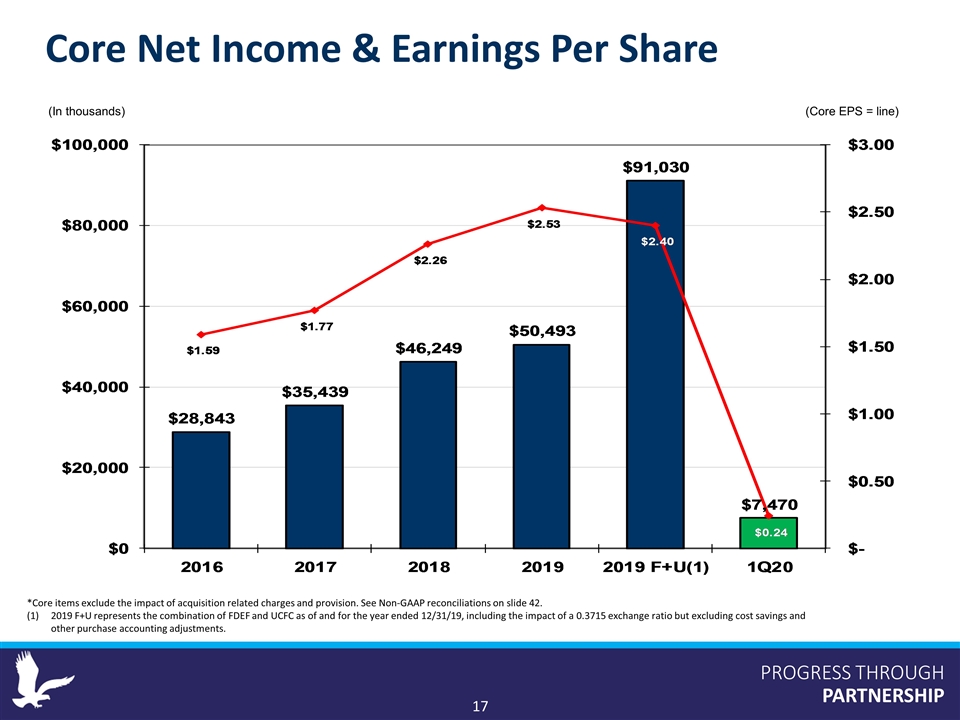

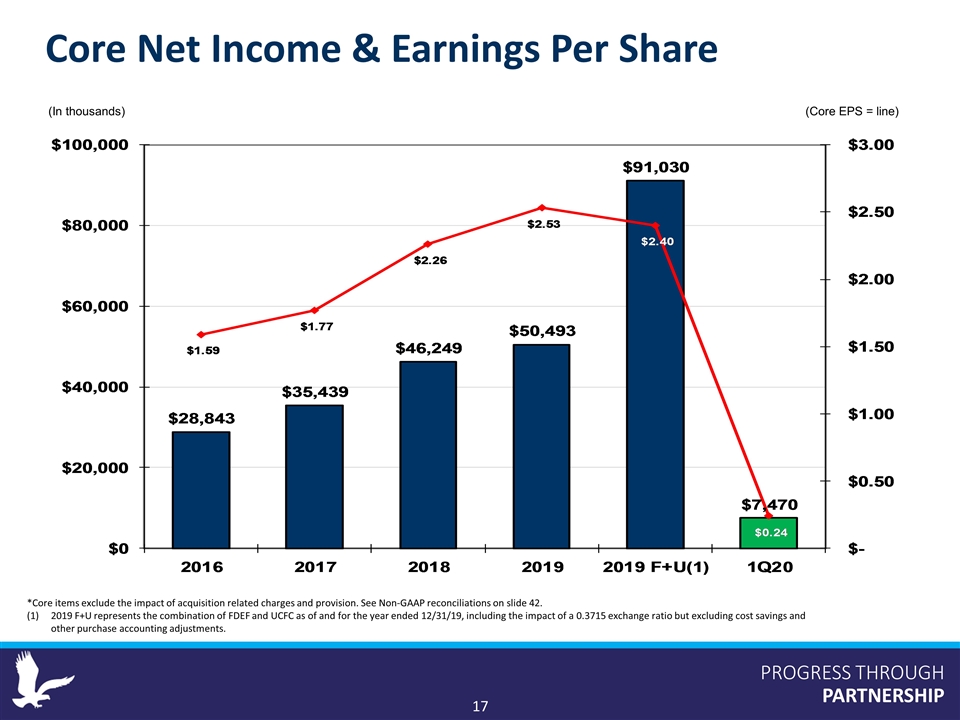

PROGRESS THROUGH PARTNERSHIP Core Net Income & Earnings Per Share *Core items exclude the impact of acquisition related charges and provision. See Non-GAAP reconciliations on slide 42. 2019 F+U represents the combination of FDEF and UCFC as of and for the year ended 12/31/19, including the impact of a 0.3715 exchange ratio but excluding cost savings and other purchase accounting adjustments. (In thousands) (Core EPS = line)

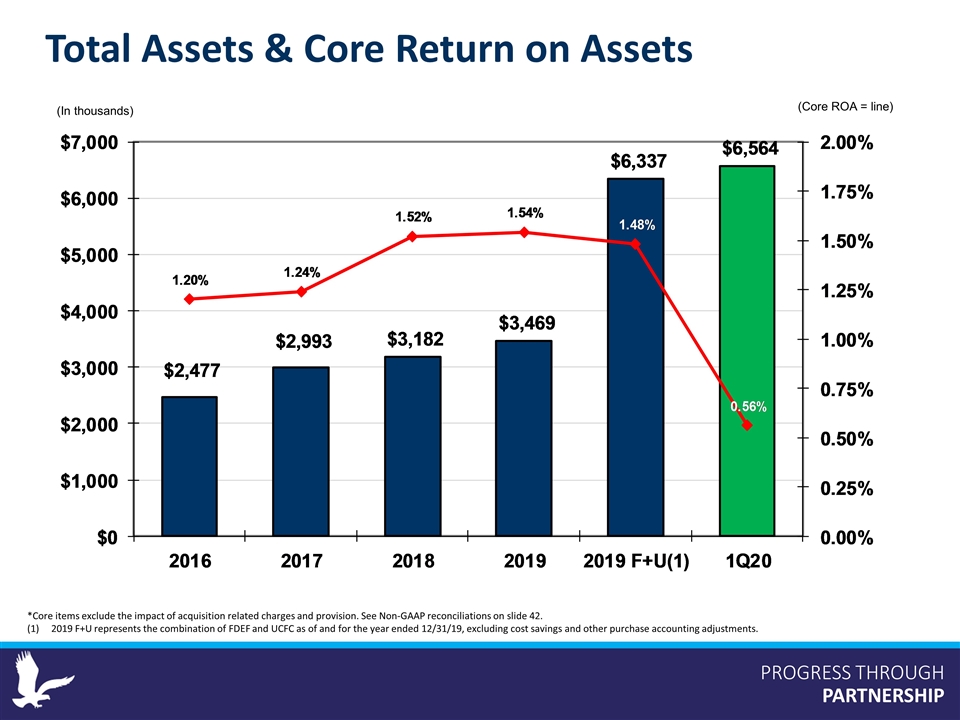

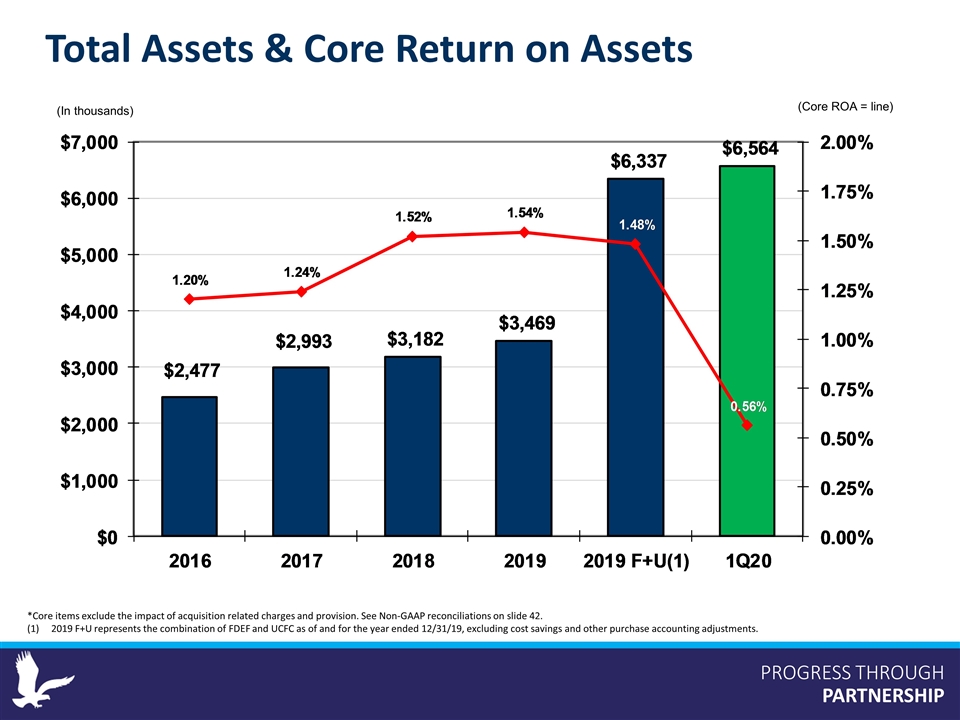

PROGRESS THROUGH PARTNERSHIP Total Assets & Core Return on Assets *Core items exclude the impact of acquisition related charges and provision. See Non-GAAP reconciliations on slide 42. 2019 F+U represents the combination of FDEF and UCFC as of and for the year ended 12/31/19, excluding cost savings and other purchase accounting adjustments. (In thousands) (Core ROA = line)

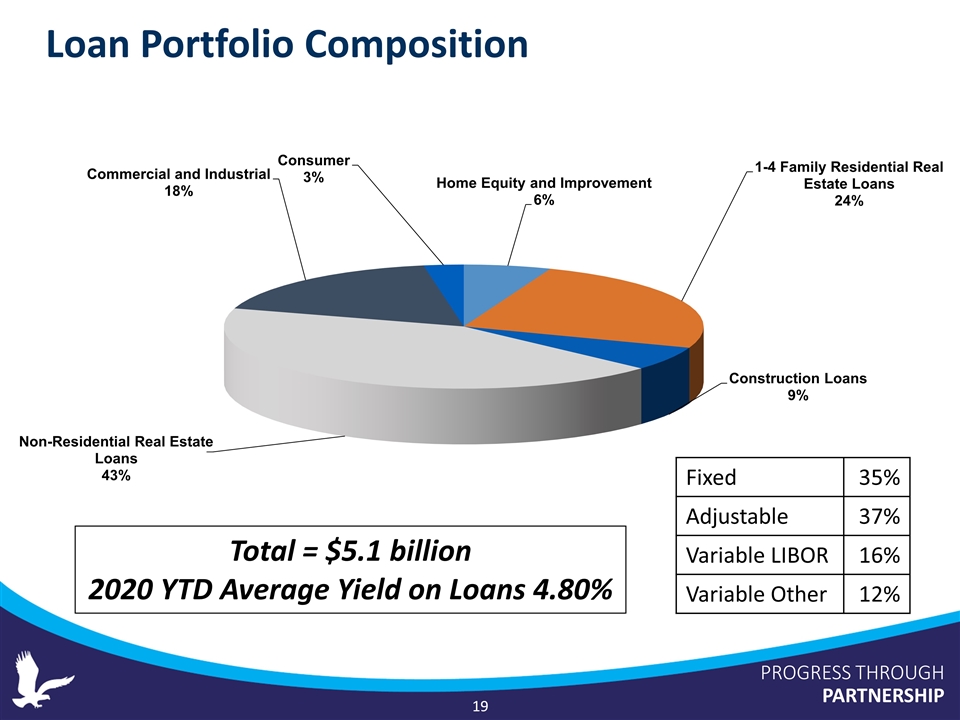

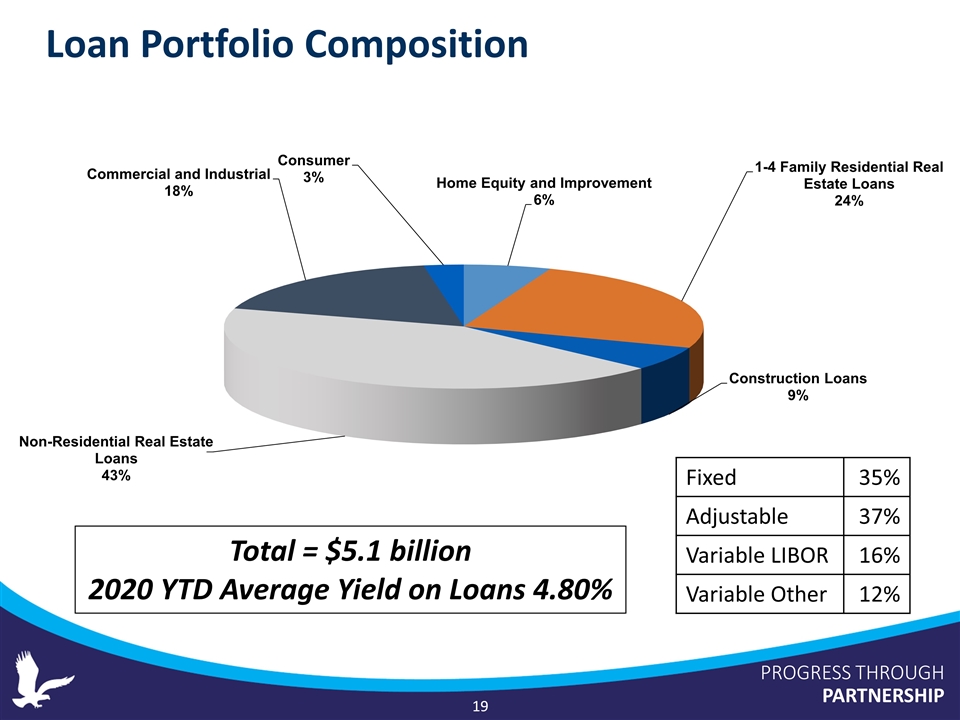

PROGRESS THROUGH PARTNERSHIP Loan Portfolio Composition Total = $5.1 billion 2020 YTD Average Yield on Loans 4.80% Fixed 35% Adjustable 37% Variable LIBOR 16% Variable Other 12%

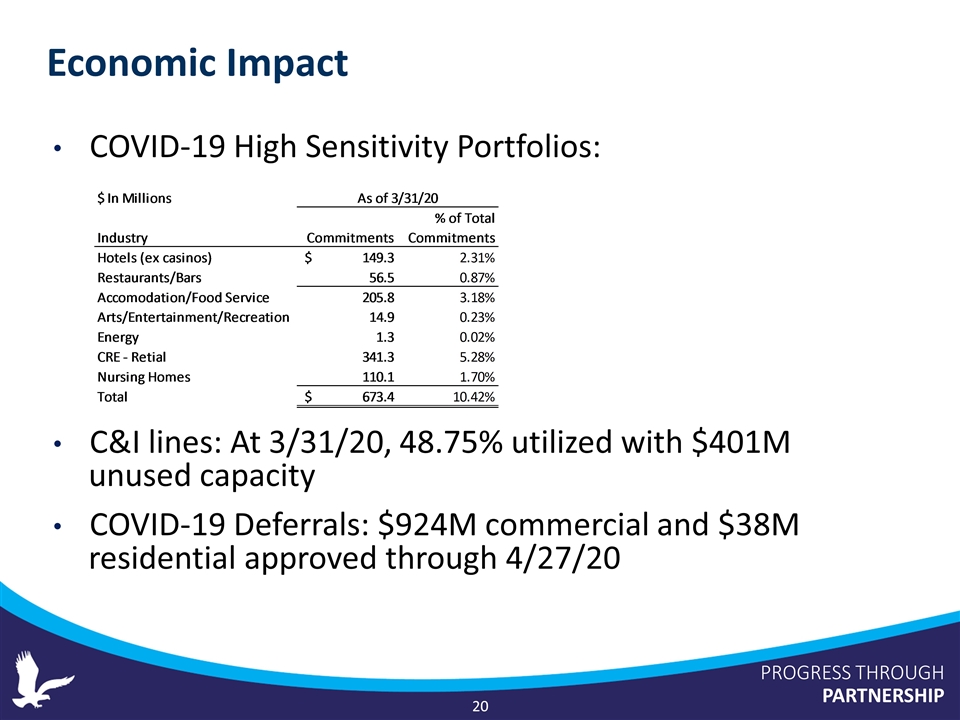

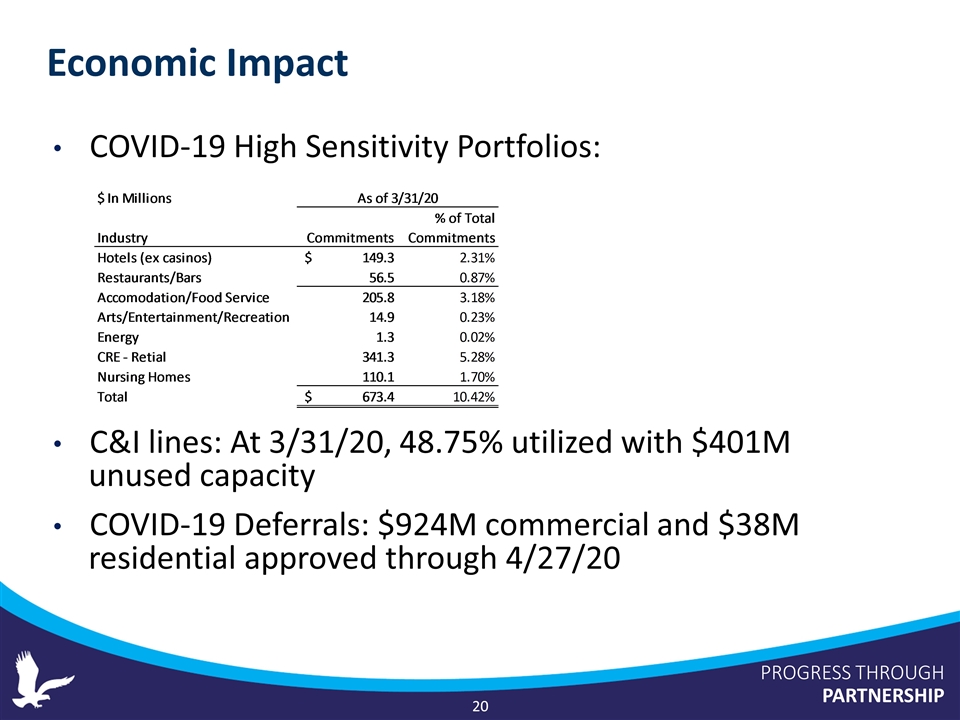

PROGRESS THROUGH PARTNERSHIP COVID-19 High Sensitivity Portfolios: C&I lines: At 3/31/20, 48.75% utilized with $401M unused capacity COVID-19 Deferrals: $924M commercial and $38M residential approved through 4/27/20 Economic Impact

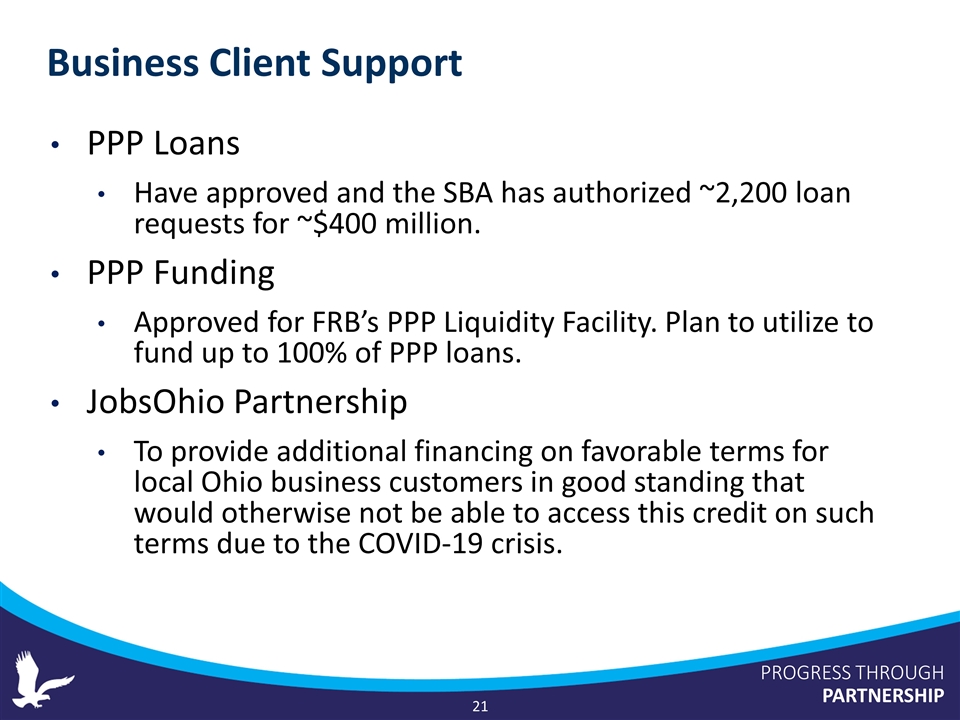

PROGRESS THROUGH PARTNERSHIP 2 PPP Loans Have approved and the SBA has authorized ~2,200 loan requests for ~$400 million. PPP Funding Approved for FRB’s PPP Liquidity Facility. Plan to utilize to fund up to 100% of PPP loans. JobsOhio Partnership To provide additional financing on favorable terms for local Ohio business customers in good standing that would otherwise not be able to access this credit on such terms due to the COVID-19 crisis. Business Client Support

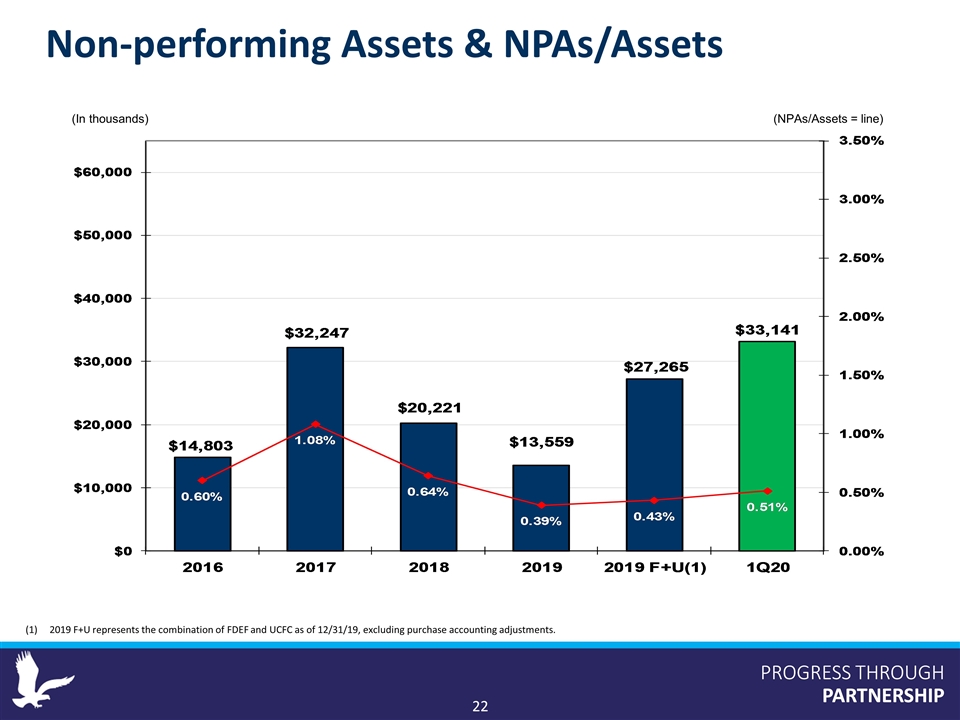

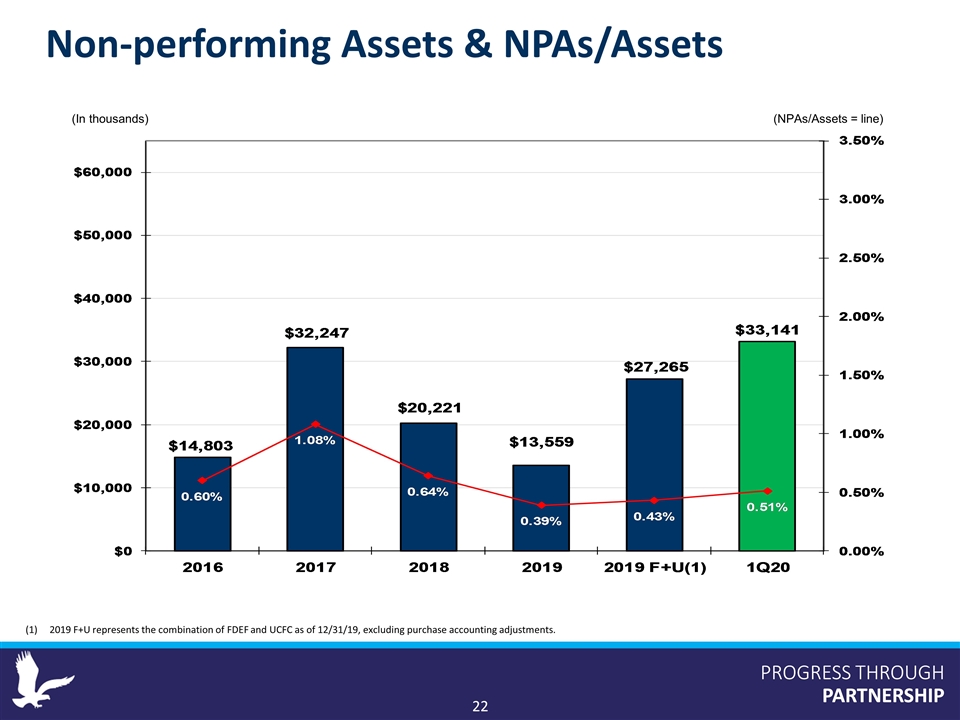

PROGRESS THROUGH PARTNERSHIP PROGRESS THROUGH PARTNERSHIP Non-performing Assets & NPAs/Assets (In thousands) (NPAs/Assets = line) 2019 F+U represents the combination of FDEF and UCFC as of 12/31/19, excluding purchase accounting adjustments.

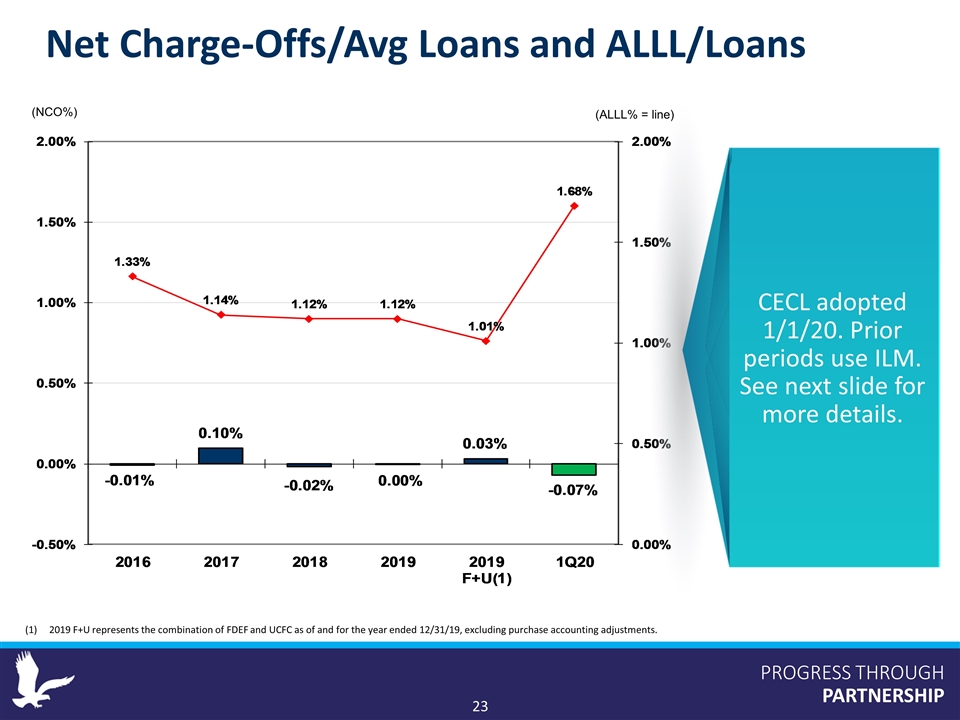

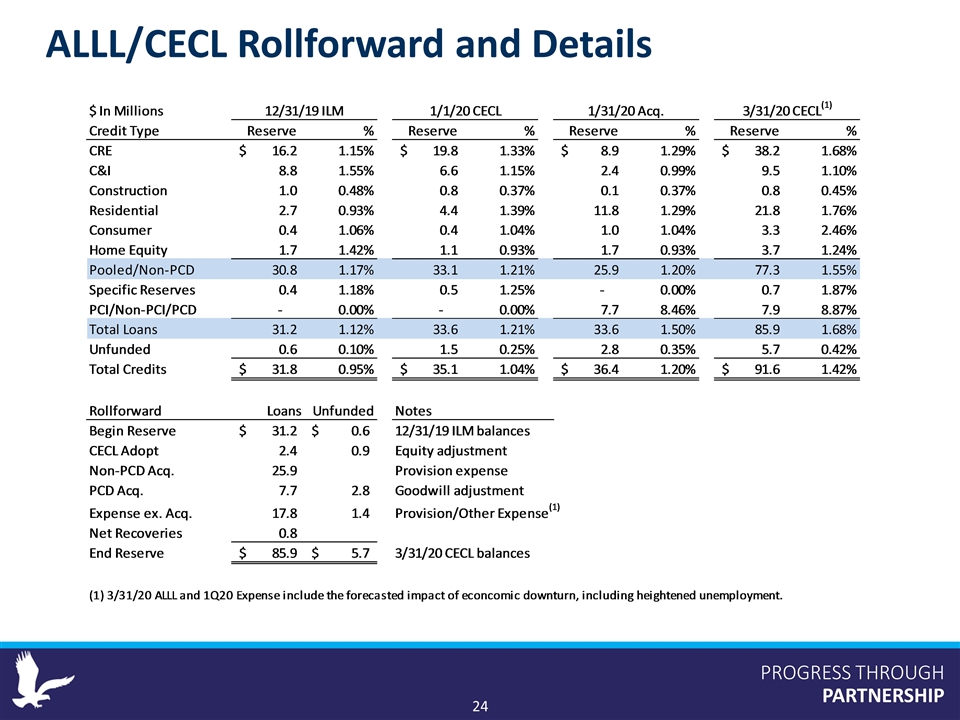

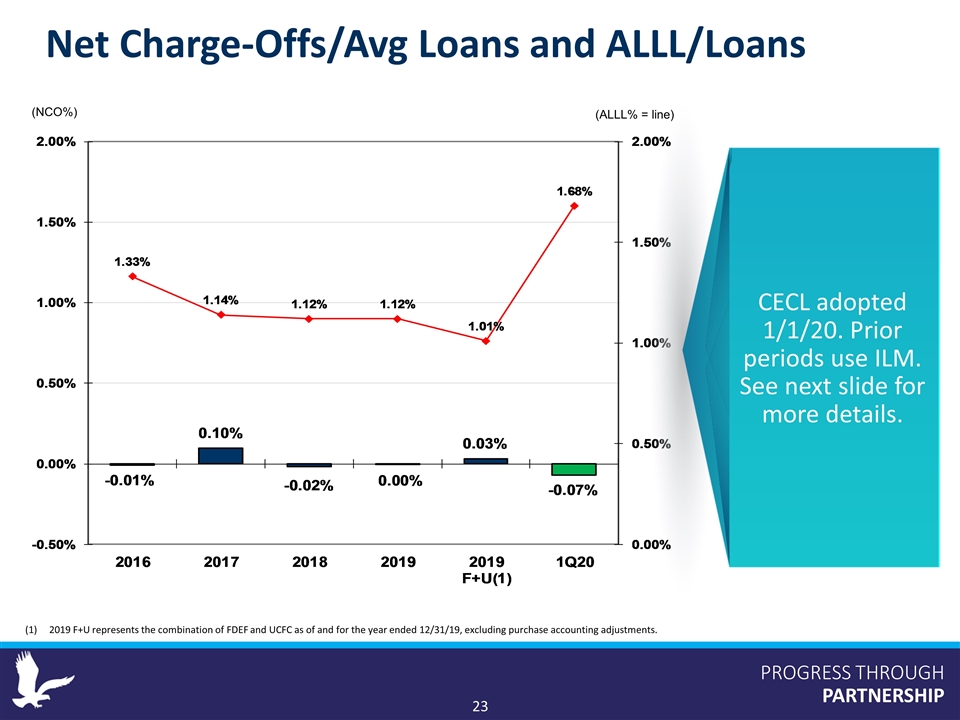

PROGRESS THROUGH PARTNERSHIP Net Charge-Offs/Avg Loans and ALLL/Loans (ALLL% = line) (NCO%) 2019 F+U represents the combination of FDEF and UCFC as of and for the year ended 12/31/19, excluding purchase accounting adjustments. CECL adopted 1/1/20. Prior periods use ILM. See next slide for more details.

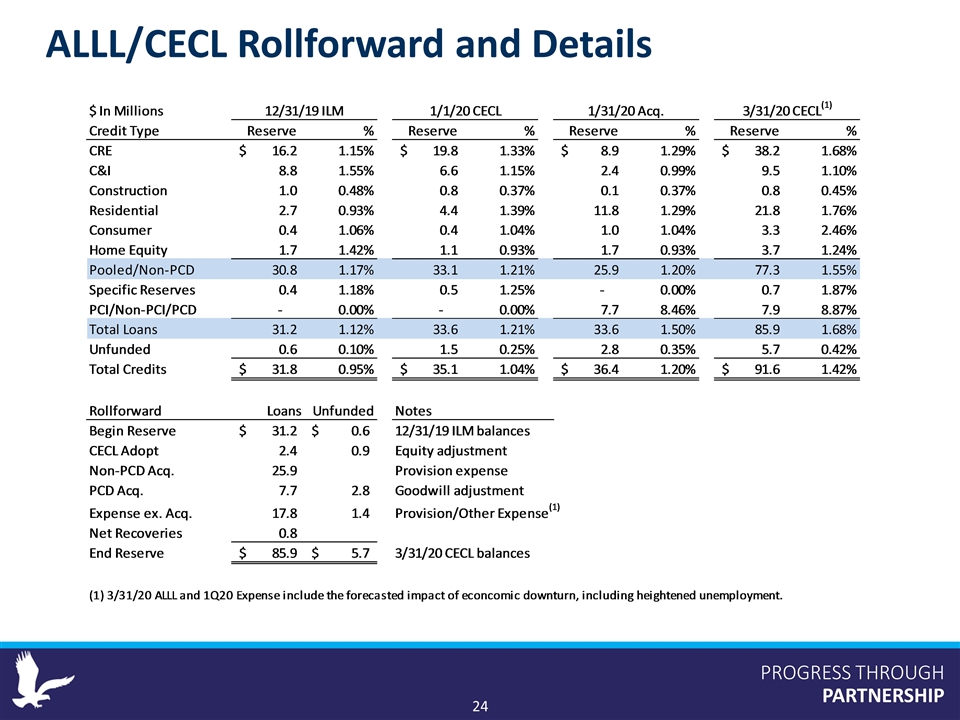

PROGRESS THROUGH PARTNERSHIP ALLL/CECL Rollforward and Details

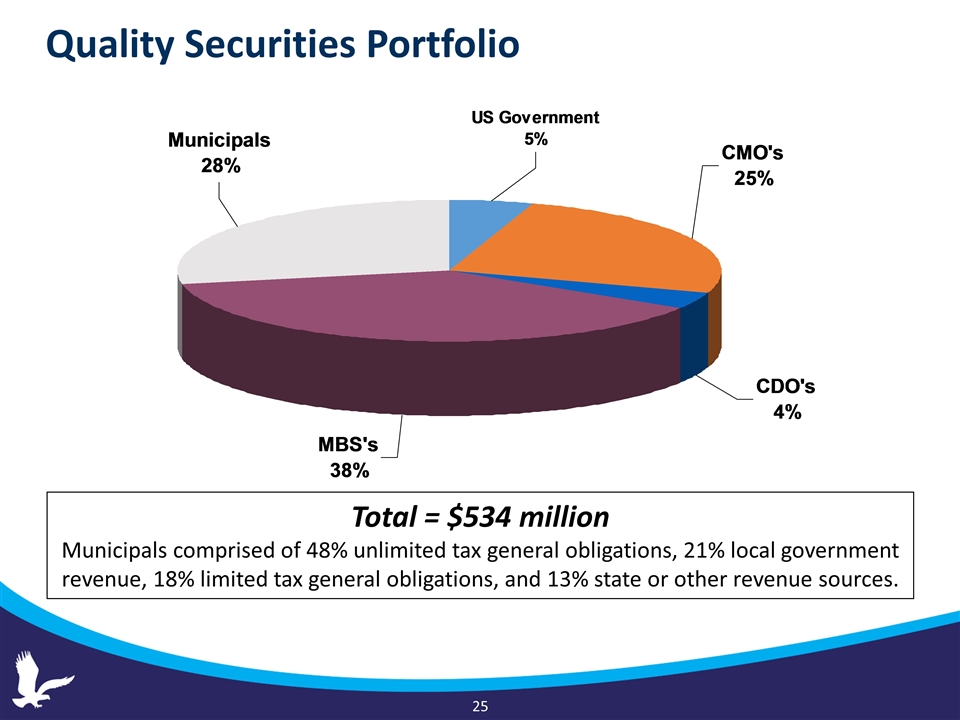

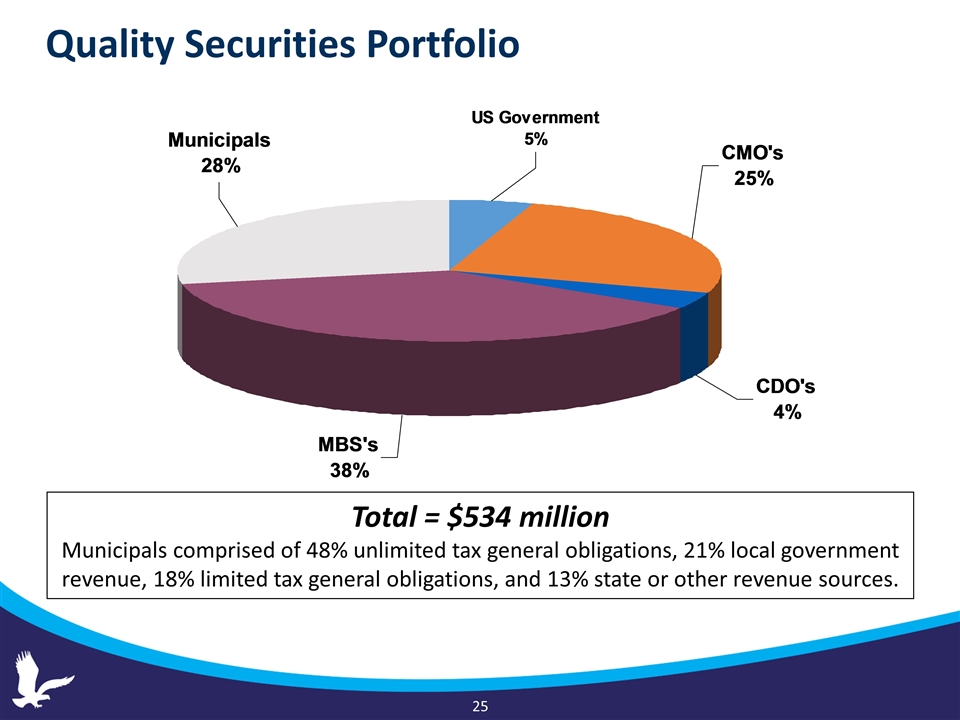

Total = $534 million Municipals comprised of 48% unlimited tax general obligations, 21% local government revenue, 18% limited tax general obligations, and 13% state or other revenue sources. Quality Securities Portfolio

PROGRESS THROUGH PARTNERSHIP Customer Deposits & Non-Interest Bearing % (In millions) (NIB% = line) 2019 F+U represents the combination of FDEF and UCFC as of 12/31/19, excluding purchase accounting adjustments.

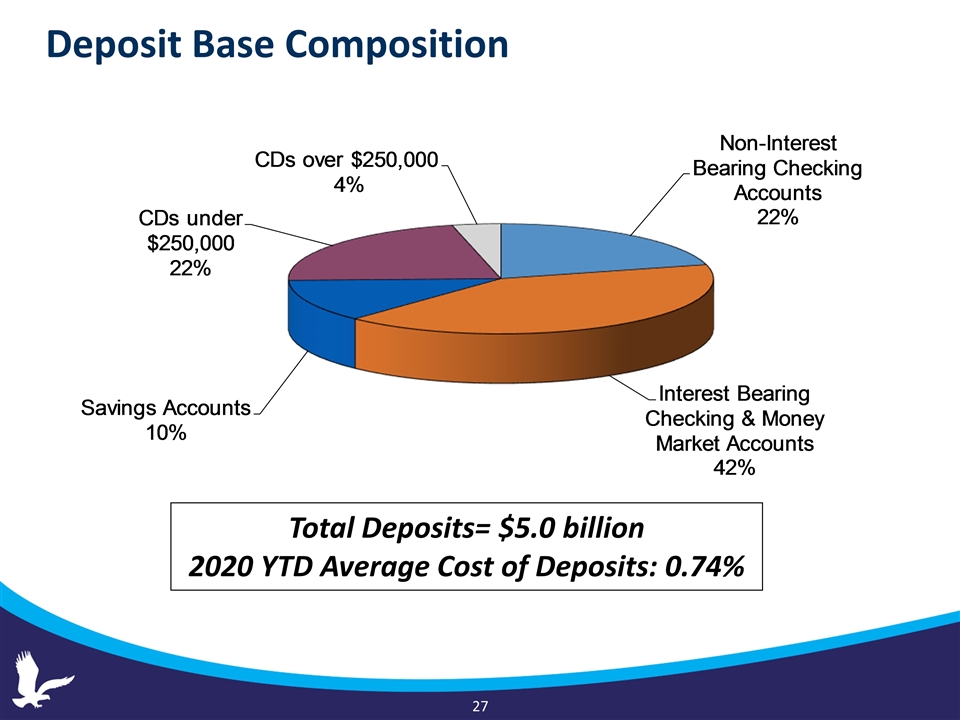

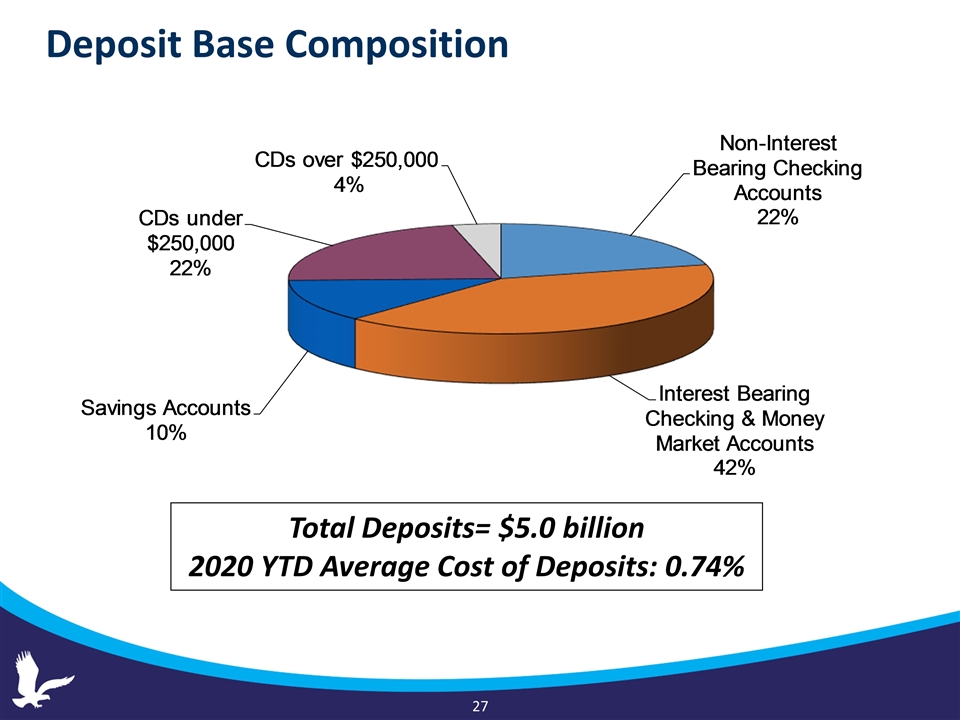

Total Deposits= $5.0 billion 2020 YTD Average Cost of Deposits: 0.74% Deposit Base Composition

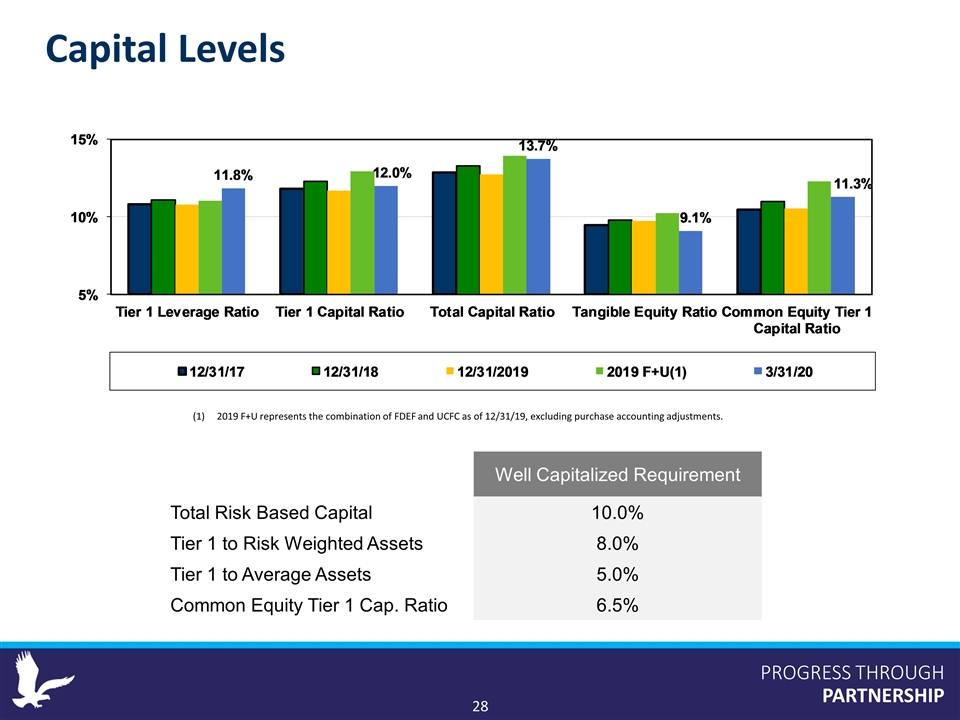

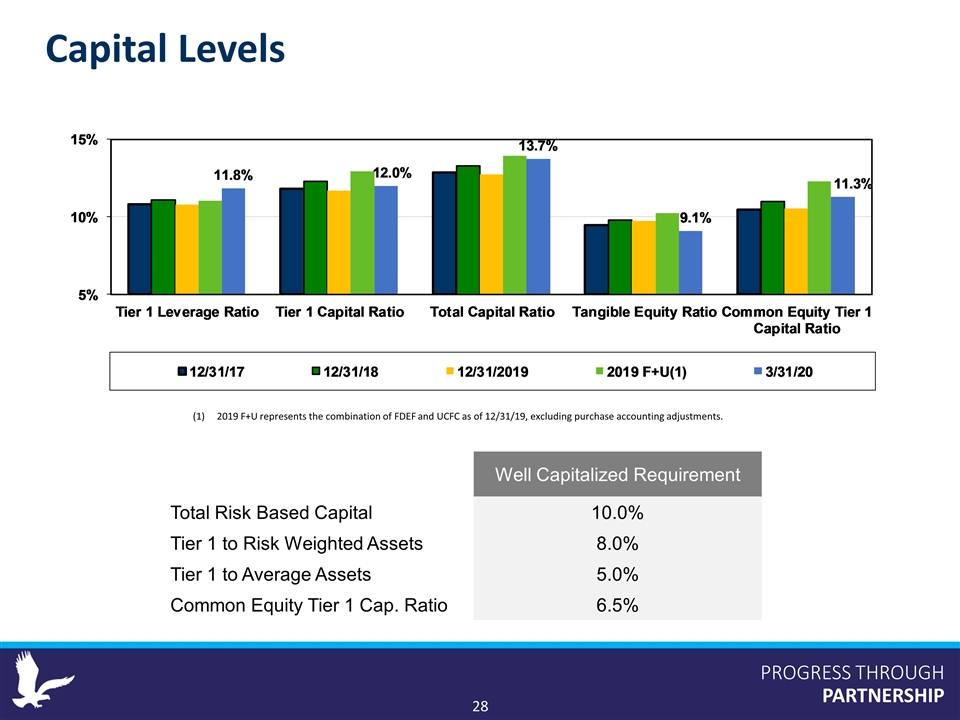

PROGRESS THROUGH PARTNERSHIP Capital Levels Well Capitalized Requirement Total Risk Based Capital 10.0% Tier 1 to Risk Weighted Assets 8.0% Tier 1 to Average Assets 5.0% Common Equity Tier 1 Cap. Ratio 6.5% 2019 F+U represents the combination of FDEF and UCFC as of 12/31/19, excluding purchase accounting adjustments.

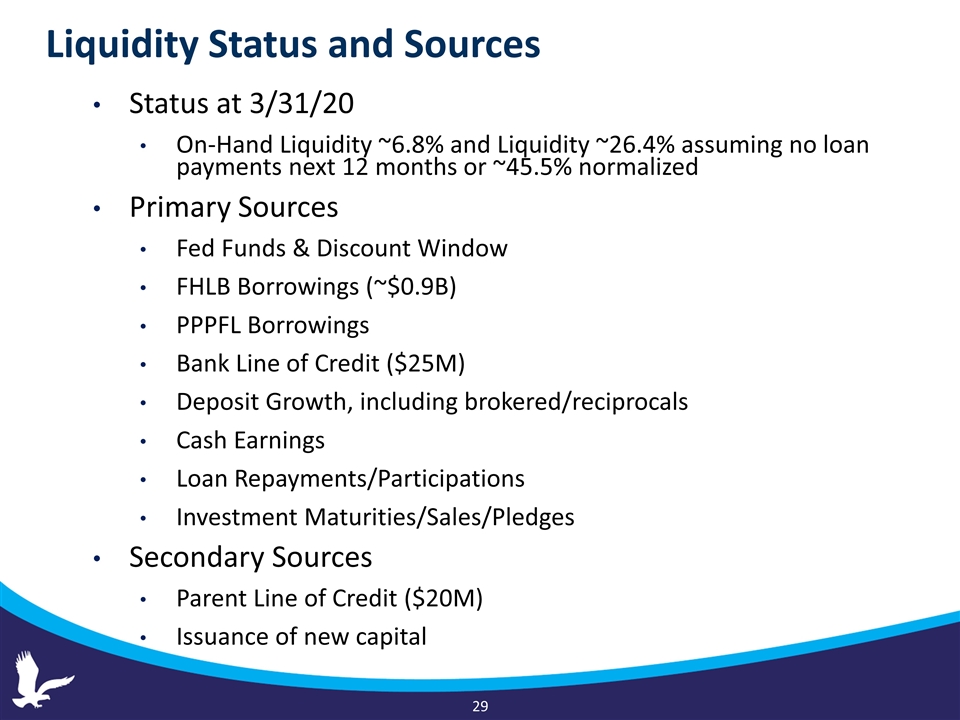

Liquidity Status and Sources Status at 3/31/20 On-Hand Liquidity ~6.8% and Liquidity ~26.4% assuming no loan payments next 12 months or ~45.5% normalized Primary Sources Fed Funds & Discount Window FHLB Borrowings (~$0.9B) PPPFL Borrowings Bank Line of Credit ($25M) Deposit Growth, including brokered/reciprocals Cash Earnings Loan Repayments/Participations Investment Maturities/Sales/Pledges Secondary Sources Parent Line of Credit ($20M) Issuance of new capital

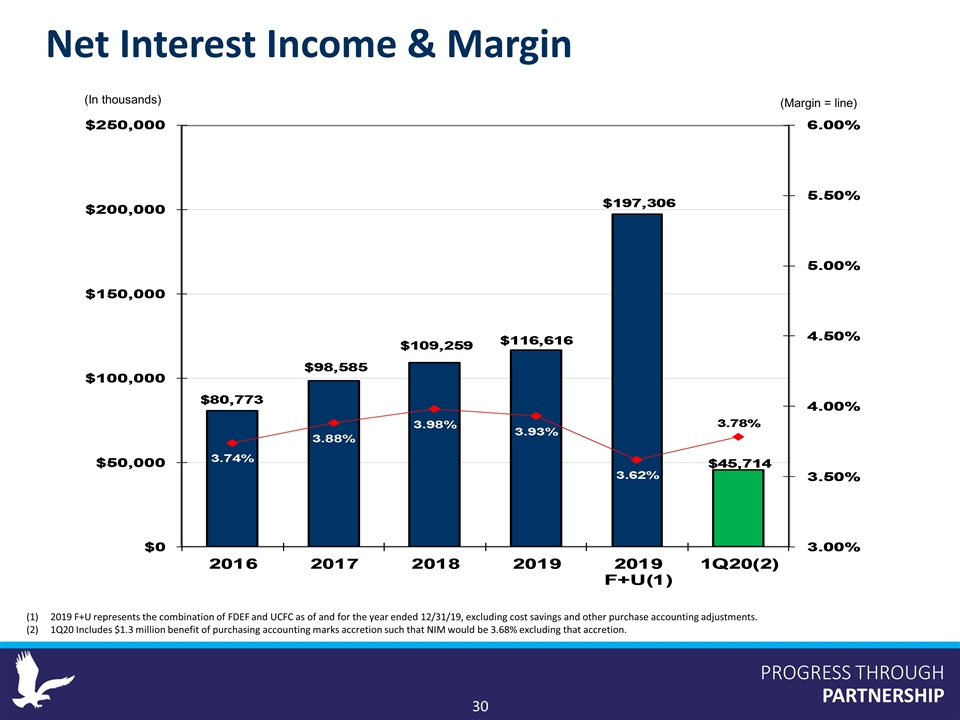

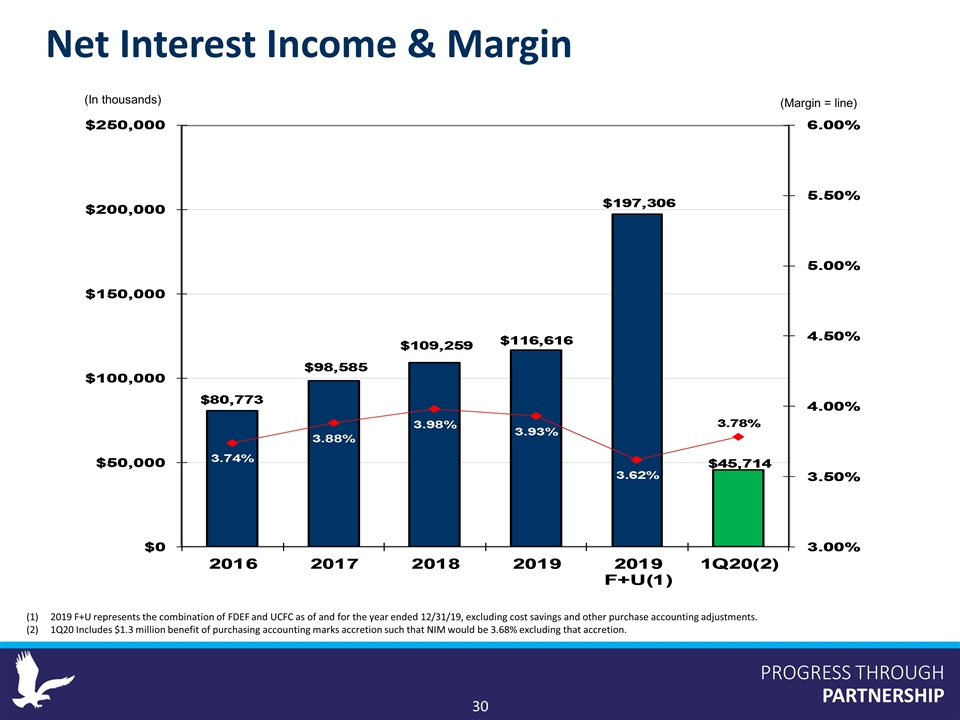

PROGRESS THROUGH PARTNERSHIP Net Interest Income & Margin (In thousands) (Margin = line) 2019 F+U represents the combination of FDEF and UCFC as of and for the year ended 12/31/19, excluding cost savings and other purchase accounting adjustments. 1Q20 Includes $1.3 million benefit of purchasing accounting marks accretion such that NIM would be 3.68% excluding that accretion.

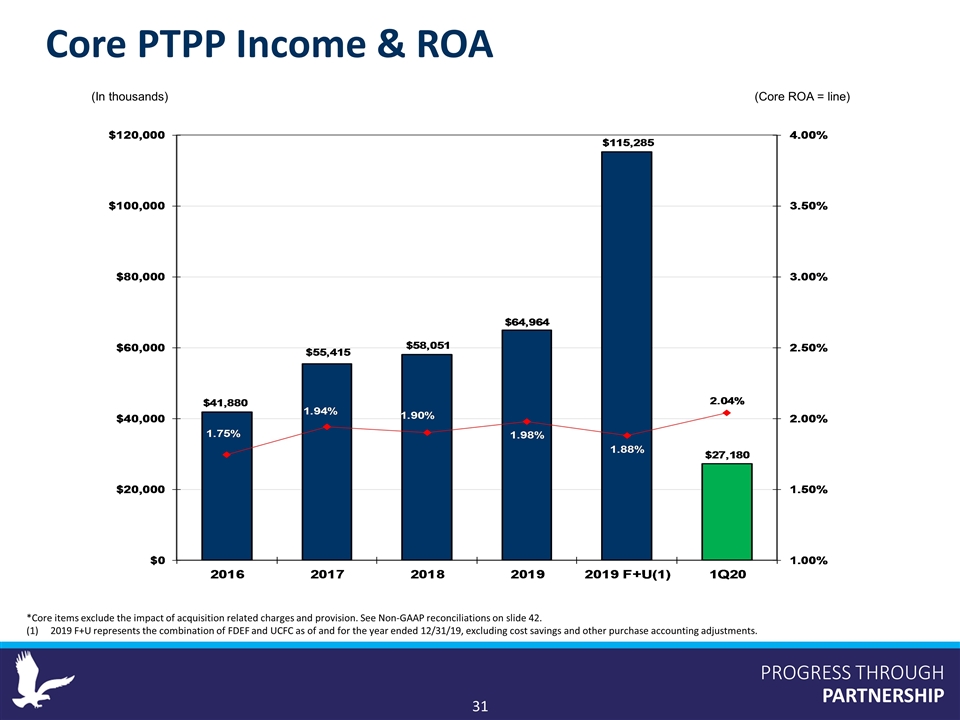

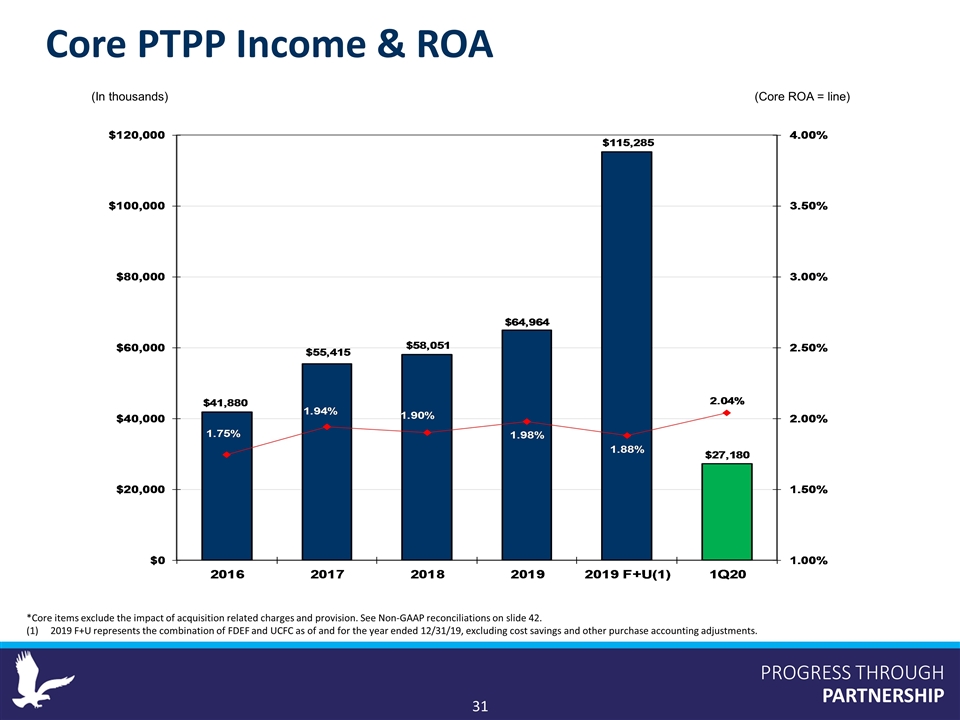

PROGRESS THROUGH PARTNERSHIP (In thousands) (Core ROA = line) *Core items exclude the impact of acquisition related charges and provision. See Non-GAAP reconciliations on slide 42. 2019 F+U represents the combination of FDEF and UCFC as of and for the year ended 12/31/19, excluding cost savings and other purchase accounting adjustments. Core PTPP Income & ROA

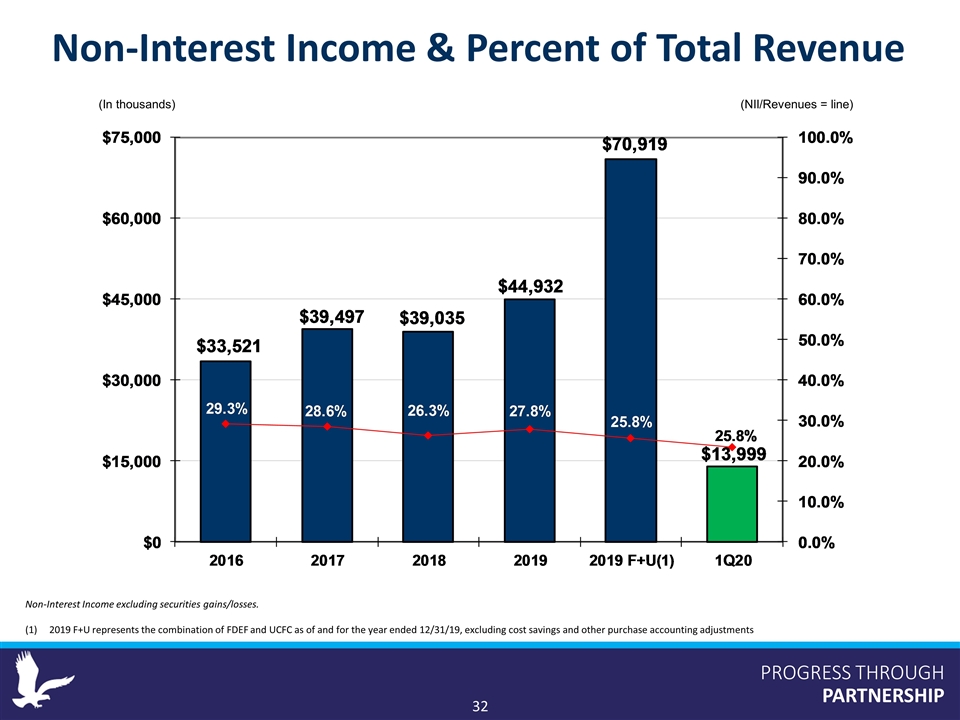

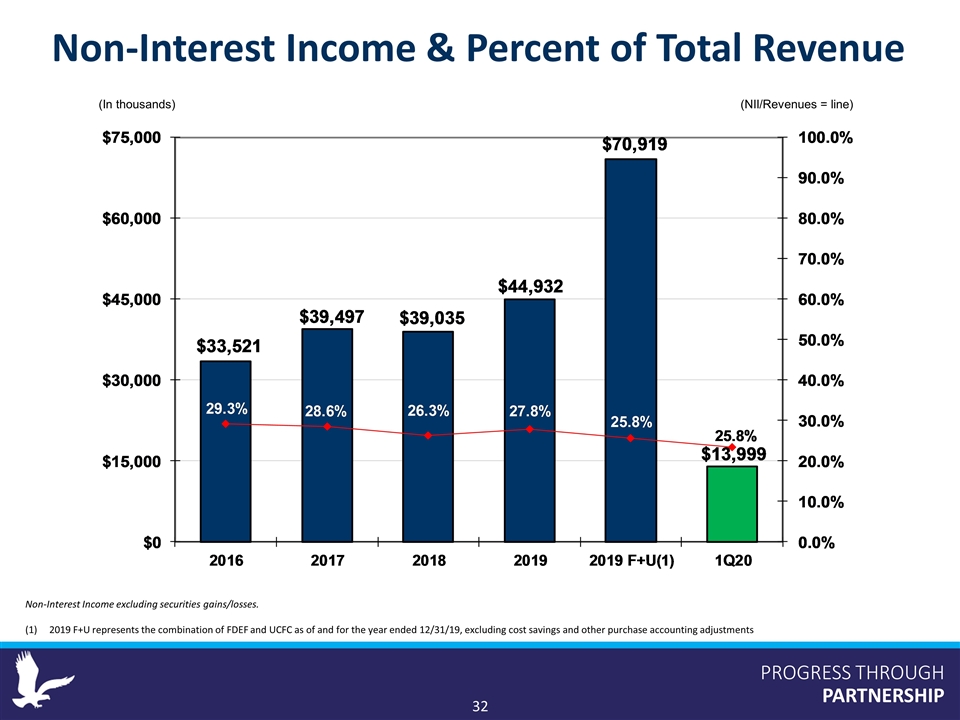

PROGRESS THROUGH PARTNERSHIP Non-Interest Income & Percent of Total Revenue Non-Interest Income excluding securities gains/losses. 2019 F+U represents the combination of FDEF and UCFC as of and for the year ended 12/31/19, excluding cost savings and other purchase accounting adjustments (In thousands) (NII/Revenues = line)

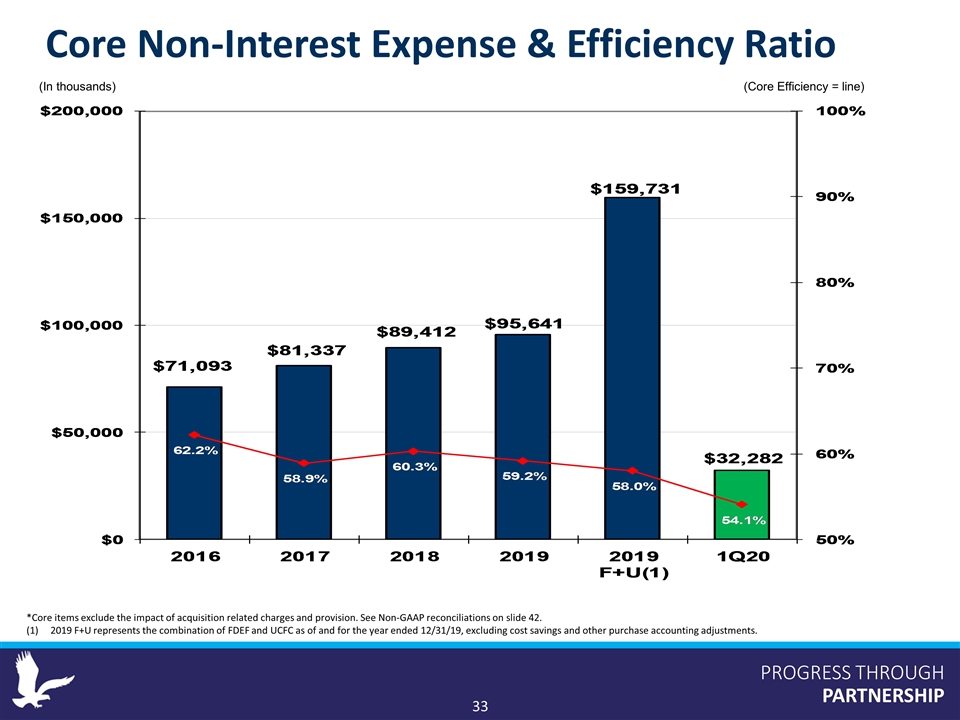

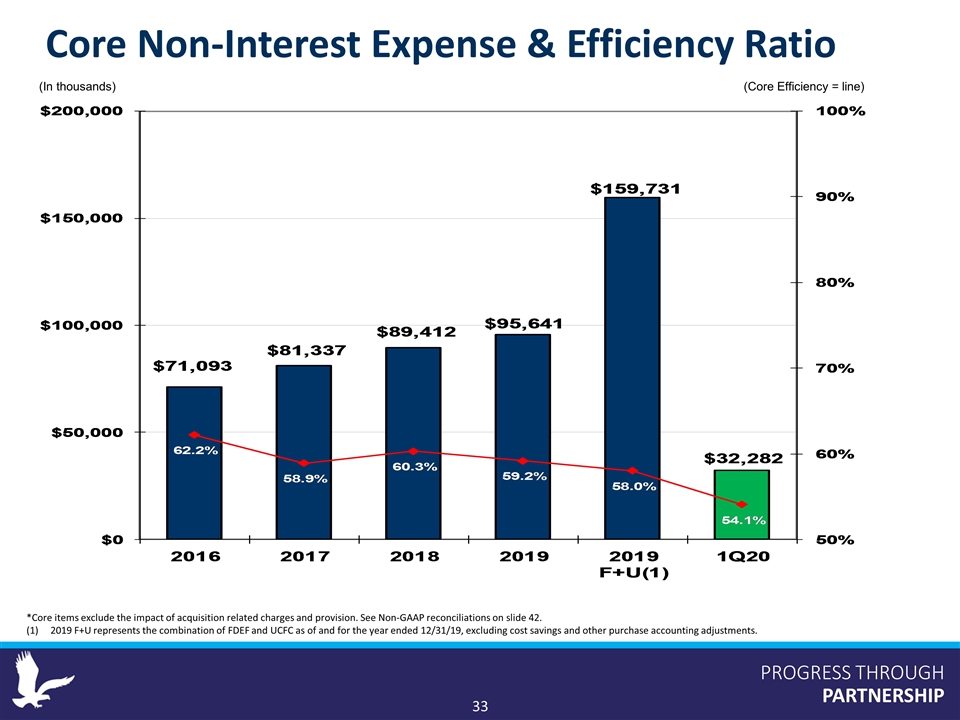

PROGRESS THROUGH PARTNERSHIP Core Non-Interest Expense & Efficiency Ratio (In thousands) (Core Efficiency = line) *Core items exclude the impact of acquisition related charges and provision. See Non-GAAP reconciliations on slide 42. 2019 F+U represents the combination of FDEF and UCFC as of and for the year ended 12/31/19, excluding cost savings and other purchase accounting adjustments.

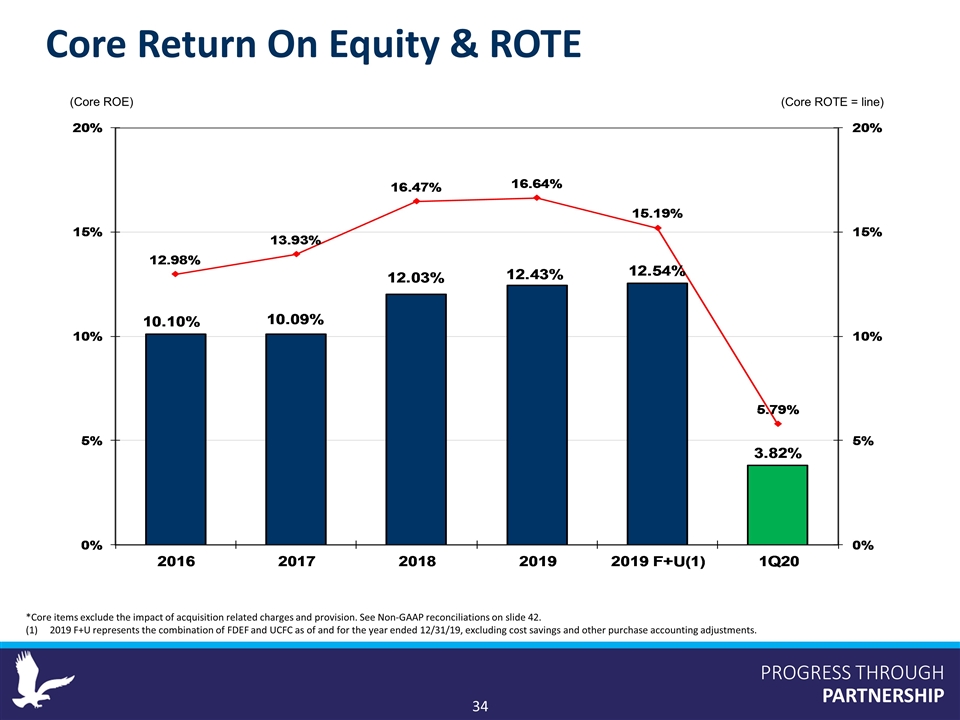

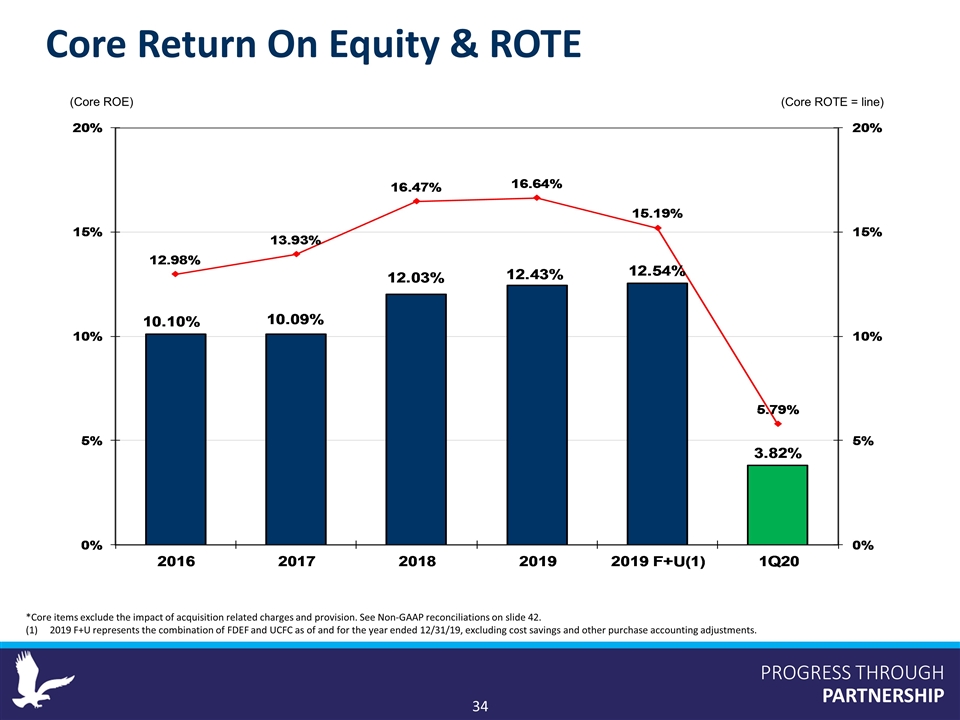

PROGRESS THROUGH PARTNERSHIP Core Return On Equity & ROTE (Core ROTE = line) (Core ROE) *Core items exclude the impact of acquisition related charges and provision. See Non-GAAP reconciliations on slide 42. 2019 F+U represents the combination of FDEF and UCFC as of and for the year ended 12/31/19, excluding cost savings and other purchase accounting adjustments.

PROGRESS THROUGH PARTNERSHIP Shareholder Value

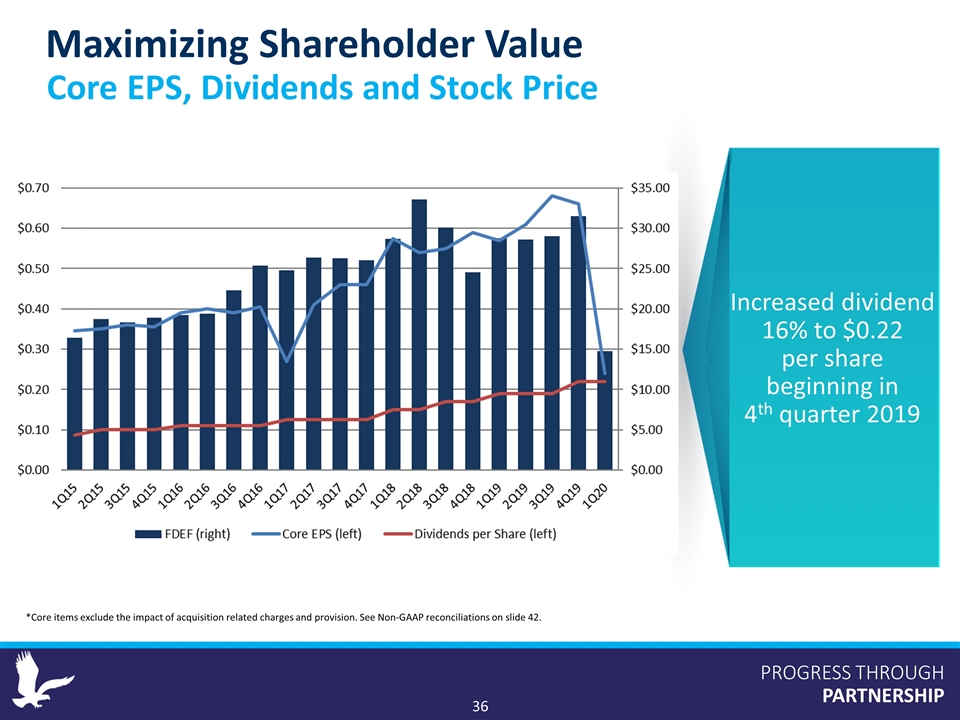

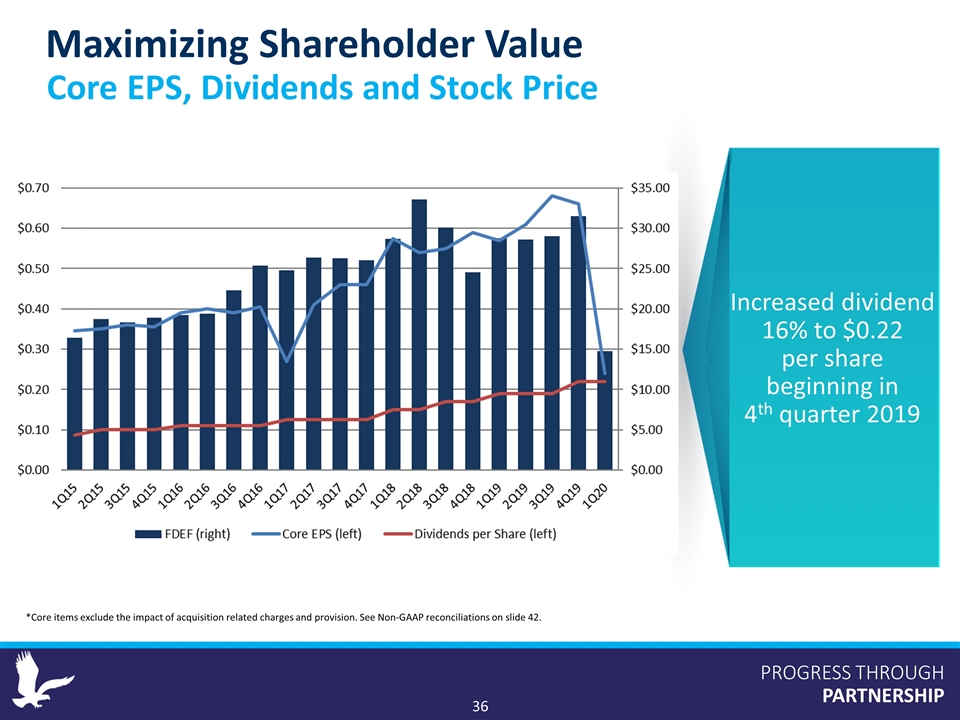

PROGRESS THROUGH PARTNERSHIP Maximizing Shareholder Value Core EPS, Dividends and Stock Price Increased dividend 16% to $0.22 per share beginning in 4th quarter 2019 *Core items exclude the impact of acquisition related charges and provision. See Non-GAAP reconciliations on slide 42.

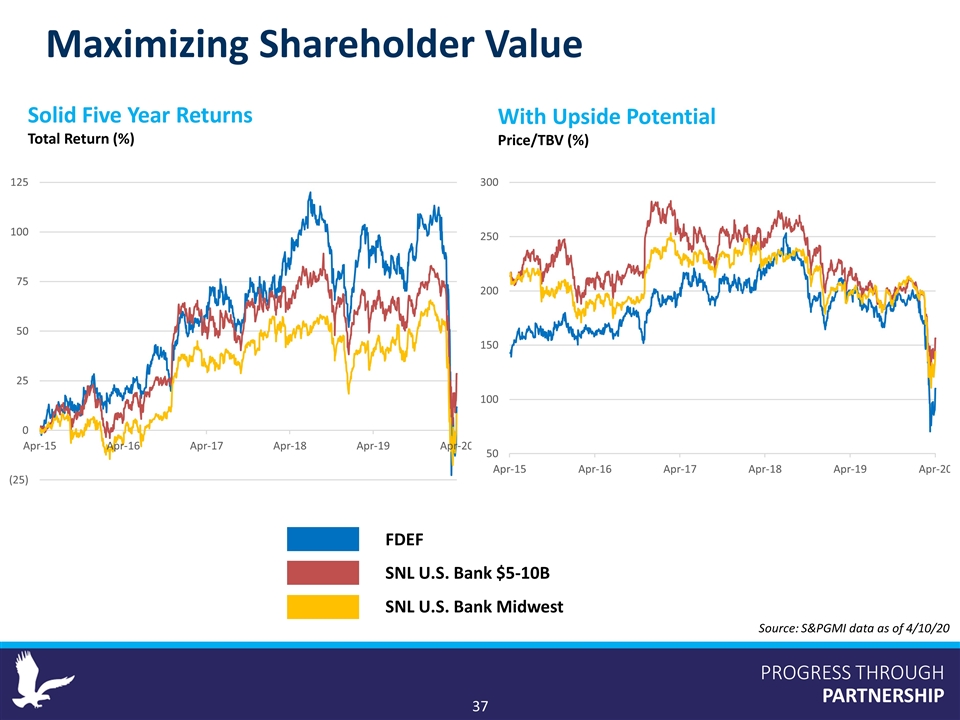

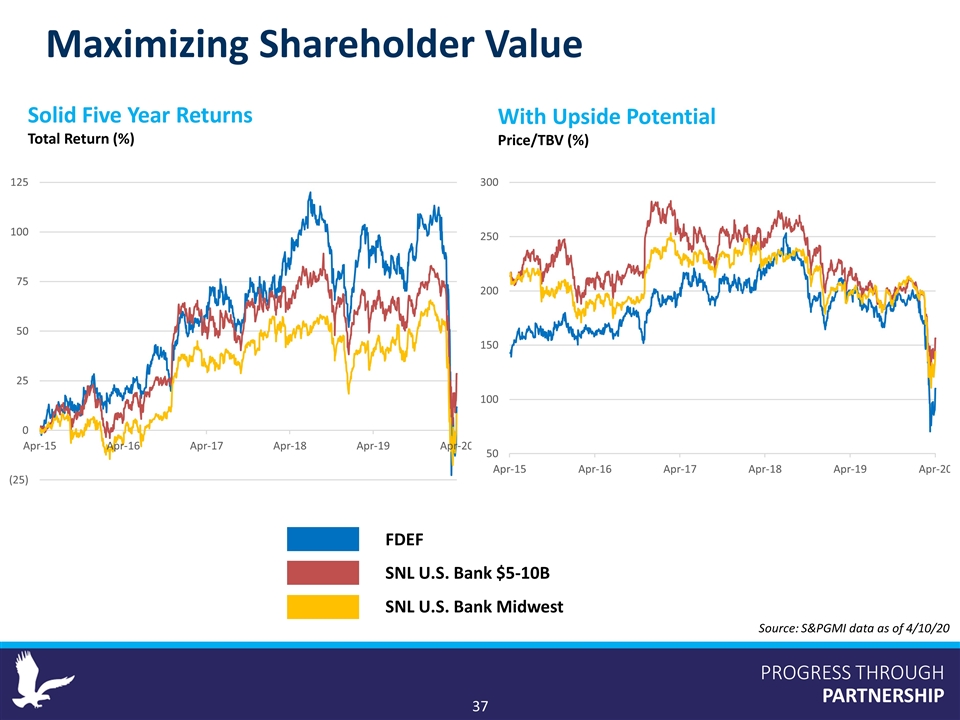

PROGRESS THROUGH PARTNERSHIP Maximizing Shareholder Value Source: S&PGMI data as of 4/10/20 FDEF SNL U.S. Bank $5-10B SNL U.S. Bank Midwest Solid Five Year Returns Total Return (%) With Upside Potential Price/TBV (%)

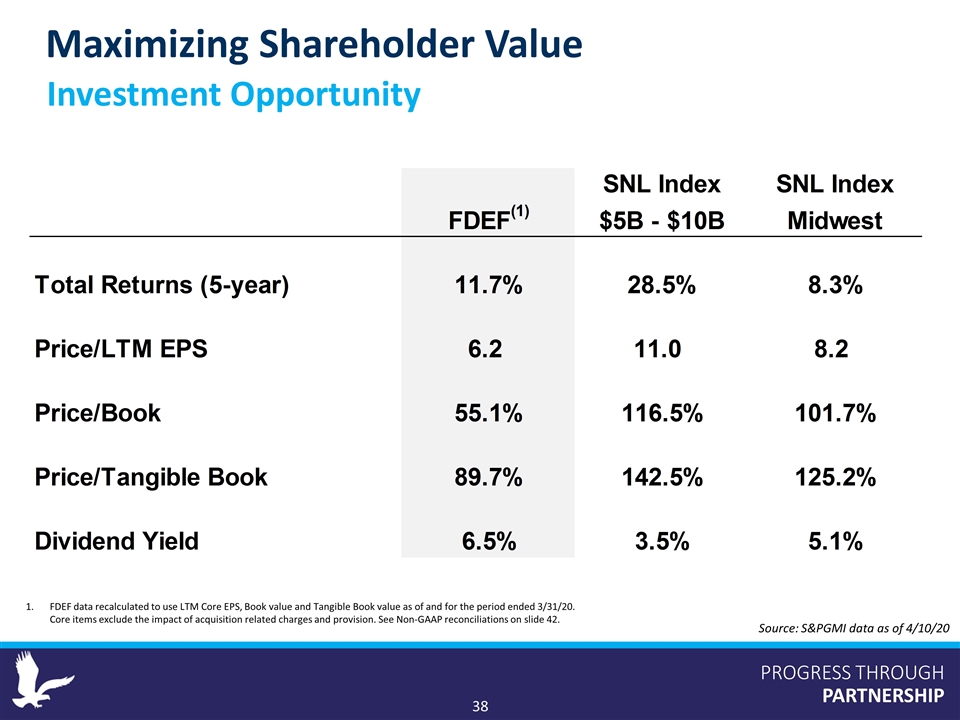

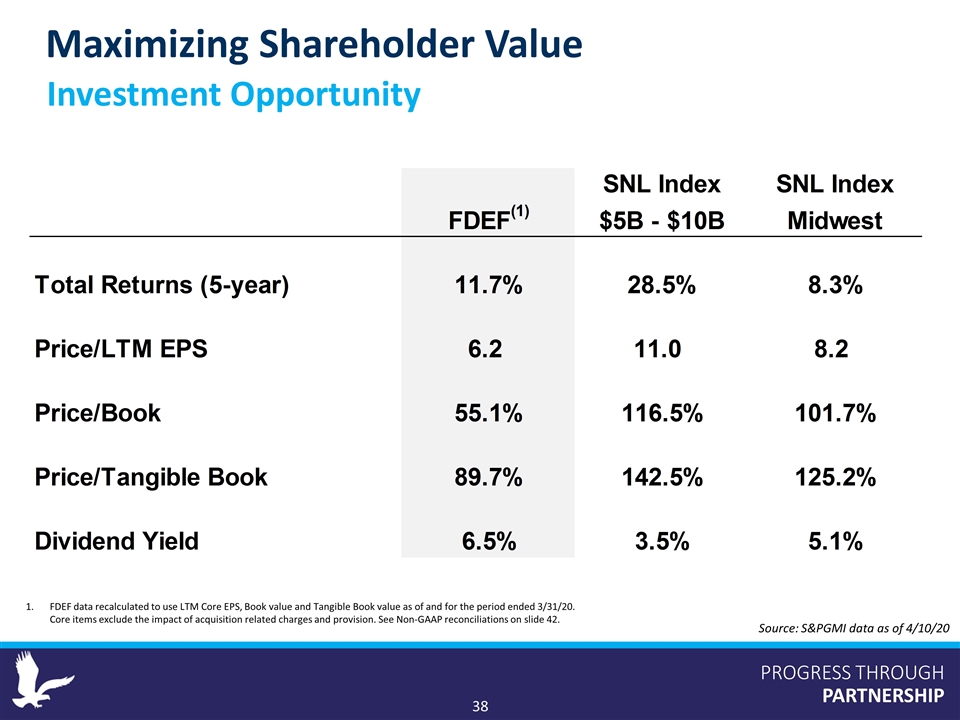

PROGRESS THROUGH PARTNERSHIP Source: S&PGMI data as of 4/10/20 Investment Opportunity Maximizing Shareholder Value FDEF data recalculated to use LTM Core EPS, Book value and Tangible Book value as of and for the period ended 3/31/20. Core items exclude the impact of acquisition related charges and provision. See Non-GAAP reconciliations on slide 42.

Disciplined management team with proven track record Reputation of focusing on fundamentals and poised to generate above peer profitability long-term Balance sheet strength – attractive core deposit base and strong capital levels Diversified loan portfolio with a disciplined approach to lending Well-positioned to grow our balance sheet and geographic footprint, enhancing long-term shareholder value Focused on customer and employee relations in current uncertain environment Summary

PROGRESS THROUGH PARTNERSHIP Appendix

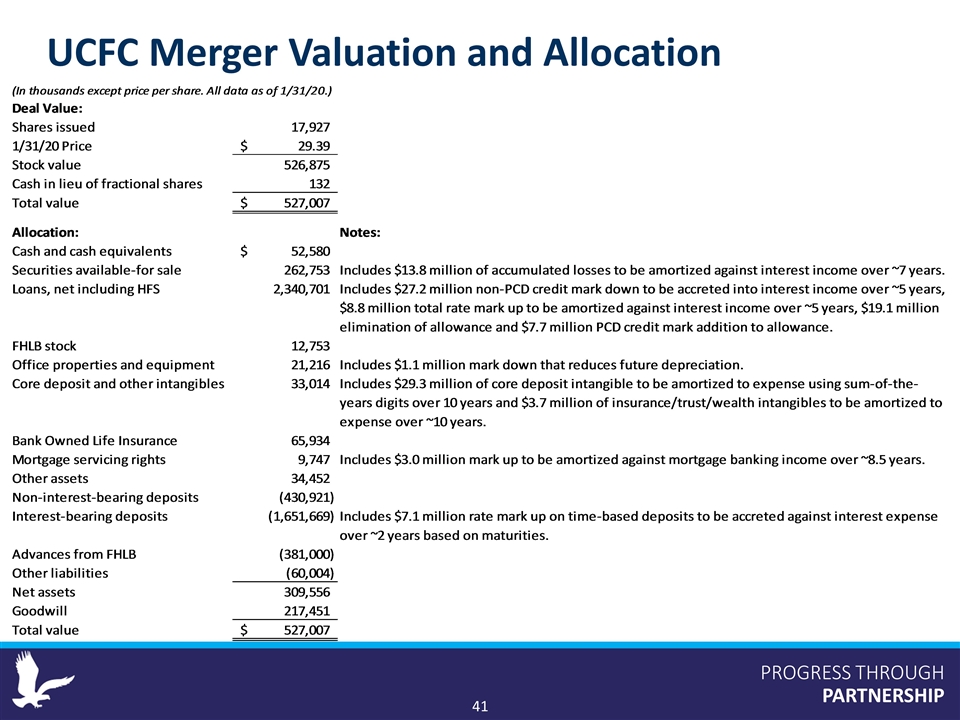

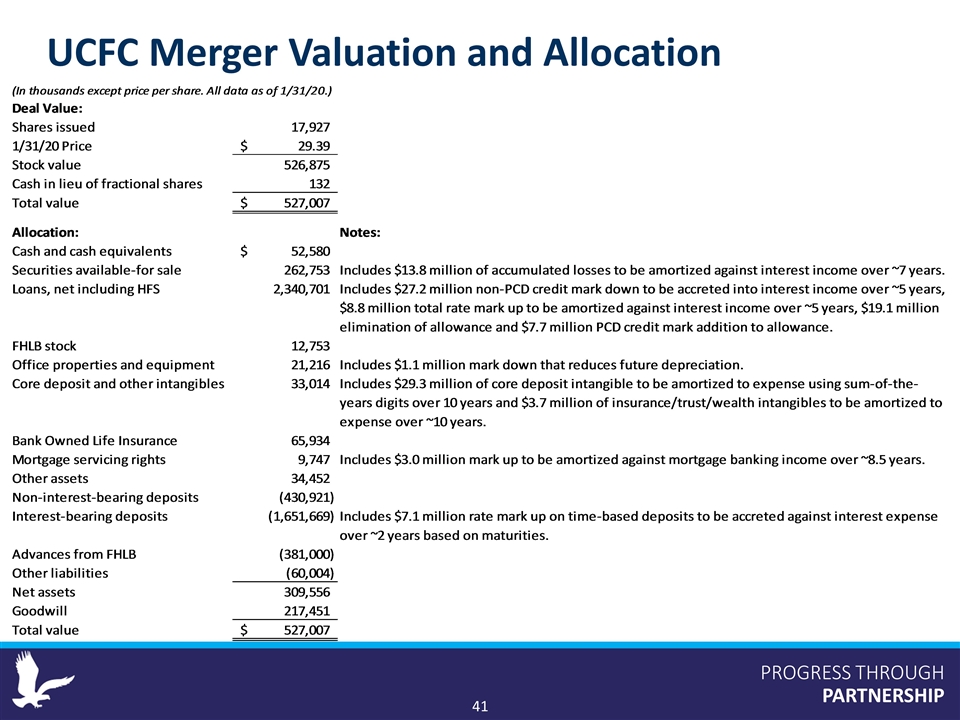

PROGRESS THROUGH PARTNERSHIP UCFC Merger Valuation and Allocation

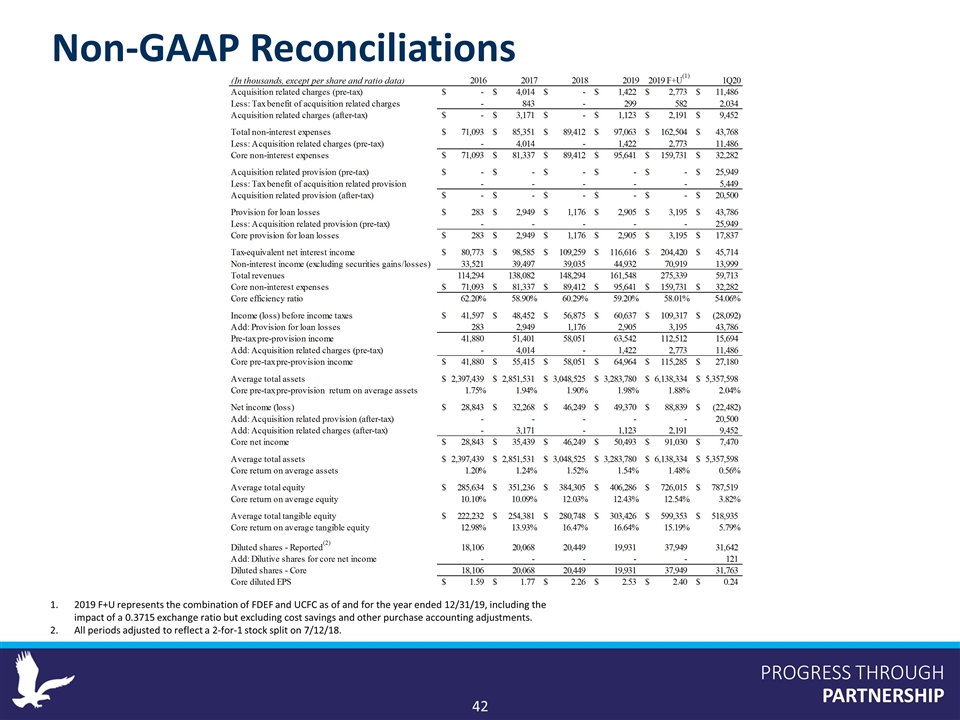

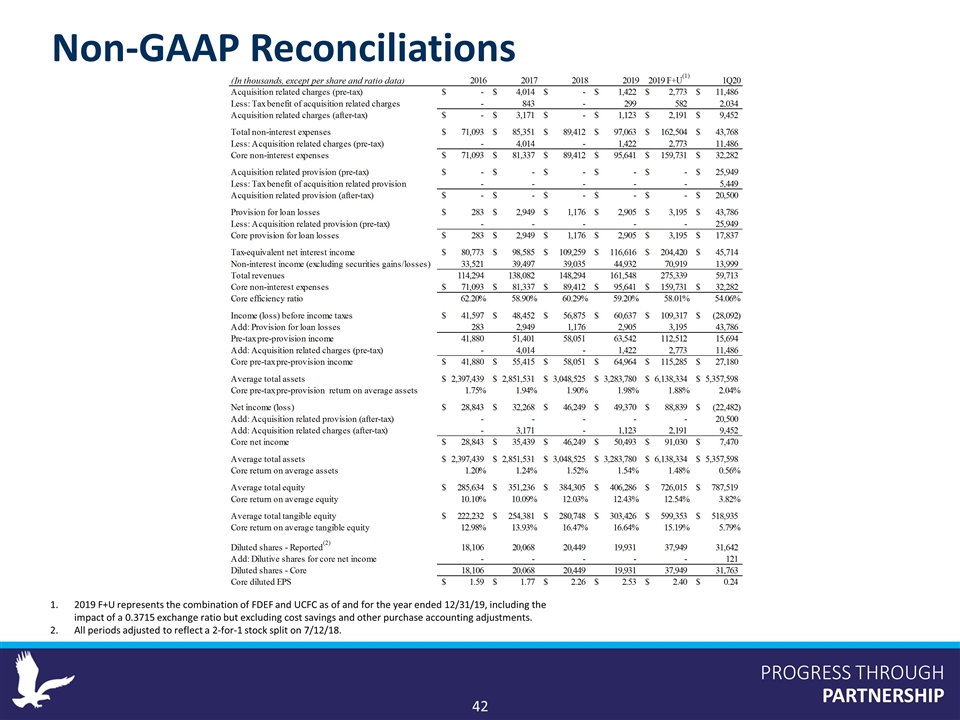

PROGRESS THROUGH PARTNERSHIP 2019 F+U represents the combination of FDEF and UCFC as of and for the year ended 12/31/19, including the impact of a 0.3715 exchange ratio but excluding cost savings and other purchase accounting adjustments. All periods adjusted to reflect a 2-for-1 stock split on 7/12/18. Non-GAAP Reconciliations

Thank you. Donald P. Hileman | CEO 419-785-2210 | dhileman@first-fed.com Gary M. Small | President 330-742-0655 | gsmall@first-fed.com Paul D. Nungester | EVP & CFO 419-785-8700 | pnungester@first-fed.com