Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| |

| Filed by the Registrant O | |

| Filed by a Party other than the Registrant G | |

| | |

| Check the appropriate box: | |

G Preliminary Proxy Statement

| G Confidential, For Use of the Commission Only (as

permitted by Rule 14a-6(e)(2). |

| O Definitive Proxy Statement | |

| G Definitive Additional Materials | |

| G Soliciting Material Under Rule 14a-12 | |

| | |

KLAMATH FIRST BANCORP, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)Payment of filing fee (Check the appropriate box):

O No fee required.

G Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

N/A

(2) Aggregate number of securities to which transactions applies:

N/A

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

N/A

(4) Proposed maximum aggregate value of transaction:

N/A

(5) Total fee paid:

N/A

G Fee paid previously with preliminary materials:

N/A

G Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which

the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or

schedule and the date of its filing.

(1) Amount previously paid:

N/A

(2) Form, schedule or registration statement no.:

N/A

(3) Filing party:

N/A

(4) Date filed:

N/A

<PAGE>

December 27, 2002

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Klamath First Bancorp, Inc. ("Company"), the holding company for Klamath First Federal Savings and Loan Association. The meeting will be held at the Shilo Inn, 2500 Almond Street, Klamath Falls, Oregon, on Wednesday, January 29, 2003, at 2:00 p.m., Pacific Time.

The Notice of Annual Meeting of Stockholders and the Proxy Statement appearing on the following pages describe the formal business to be transacted at the meeting. During the meeting, we will also report on the operations of the Company. Directors and officers of the Company, as well as a representative of Deloitte & Touche LLP, the Company's independent auditors, will be present to respond to any questions you may have.

It is important that your shares are represented at this meeting, whether or not you attend the meeting in person and regardless of the number of shares you own. To make sure your shares are represented, please sign, date and return the enclosed proxy card. If you attend the meeting, you may vote in person even if you have previously mailed a proxy card.

We look forward to seeing you at the meeting.

Sincerely,

/s/Kermit K. Houser

Kermit K. Houser

President and Chief Executive Officer

<PAGE>

KLAMATH FIRST BANCORP, INC.

540 Main Street

Klamath Falls, Oregon 97601

(541) 882-3444

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On January 29, 2003

NOTICE IS HEREBY GIVEN THAT the Annual Meeting of Stockholders ("Meeting") of Klamath First Bancorp, Inc. ("Company") will be held at the Shilo Inn, 2500 Almond Street, Klamath Falls, Oregon, on Wednesday, January 29, 2003, at 2:00 p.m., Pacific Time.

The Meeting is for the purpose of considering and acting upon:

1. The election of four directors of the Company;

2. The approval of the appointment of Deloitte & Touche LLP as the Company's independent auditors for

the fiscal year ending September 30, 2003; and

3. Such other matters as may properly come before the Meeting or any adjournments thereof.

NOTE: The Board of Directors is not aware of any other business to come before the Meeting.

Any action may be taken on the foregoing proposals at the Meeting on the date specified above or on any date or dates to which, by original or later adjournment, the Meeting may be adjourned. Stockholders of record at the close of business on November 29, 2002 are the stockholders entitled to receive notice of and to vote at the Meeting and any adjournments thereof.

You are requested to fill in and sign the enclosed form of proxy, which is solicited by the Board of Directors, and to mail it promptly in the enclosed envelope. The proxy will not be used if you attend the Meeting and vote in person.

| |

| BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| | |

| /s/ CRAIG M MOORE |

| CRAIG M MOORE

SECRETARY |

| | |

Klamath Falls, Oregon

December 27, 2002 | |

IMPORTANT: THE PROMPT RETURN OF PROXIES WILL SAVE THE COMPANY THE EXPENSE OF FURTHER REQUESTS FOR PROXIES IN ORDER TO ENSURE A QUORUM. A SELF-ADDRESSED ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

<PAGE>

PROXY STATEMENT

OF

KLAMATH FIRST BANCORP, INC.

540 Main Street

Klamath Falls, Oregon 97601

(541) 882-3444

ANNUAL MEETING OF STOCKHOLDERS

JANUARY 29, 2003

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Klamath First Bancorp, Inc. ("Company"), the holding company for Klamath First Federal Savings and Loan Association ("Association"), to be used at the Annual Meeting of Stockholders of the Company ("Meeting"). The Meeting will be held at the Shilo Inn, 2500 Almond Street, Klamath Falls, Oregon, on Wednesday, January 29, 2003, at 2:00 p.m., Pacific Time. The accompanying Notice of Annual Meeting of Stockholders, this Proxy Statement and the enclosed form of Proxy are being first mailed to stockholders on or about December 27, 2002.

VOTING AND PROXY PROCEDURE

Stockholders Entitled to Vote at Meeting. Stockholders of record at the close of business on November 29, 2002 ("Record Date") are entitled to one vote for each share of common stock of the Company ("Common Stock") then held. As of the close of business on the Record Date, the Company had 6,744,040 shares of Common Stock issued and outstanding.

As provided in the Company's Articles of Incorporation, record holders of Common Stock who beneficially own, either directly or indirectly, in excess of 10% of the Company's outstanding shares are entitled to cast one one-hundredth of a vote for each share held in excess of the 10% limit.

If you are a beneficial owner of Common Stock held by a broker, bank or other nominee (i.e., in "street name"), you will need proof of ownership to be admitted to the Meeting. A recent brokerage statement or letter from a bank or broker are examples of proof of ownership. If you want to vote your shares of Common Stock held in street name in person at the Meeting, you will have to get a written proxy in your name from the broker, bank or other nominee who holds your shares.

Quorum Requirement. The presence, in person or by proxy, of at least a majority of the total number of outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum at the Meeting. Abstentions will be counted as shares present and entitled to vote at the Meeting for purposes of determining the existence of a quorum. Broker non-votes will not be considered shares present and will not be included in determining whether a quorum is present.

Proxies; Proxy Revocation Procedures. The Board of Directors solicits proxies so that each stockholder has the opportunity to vote on the proposals to be considered at the Meeting. When a proxy card is returned properly signed and dated, the shares represented thereby will be voted in accordance with the instructions on the proxy card. Where a proxy card is properly signed but no instructions are indicated, proxies will be voted FOR the nominees for directors set forth below and FOR the approval of the appointment of Deloitte & Touche LLP as the Company's independent auditors. If a stockholder attends the Meeting, he or she may vote by ballot. The Board recommends a vote FOR the election of the nominees for director and FOR the appointment of Deloitte & Touche LLP as the Company's independent auditors for the fiscal year ending September 30, 2003.

Stockholders who execute proxies retain the right to revoke them at any time. Proxies may be revoked by written notice delivered in person or mailed to the Secretary of the Company or by filing a later dated proxy before a

<PAGE>

vote being taken on a particular proposal at the Meeting. Attendance at the Meeting will not automatically revoke a proxy, but a stockholder in attendance may request a ballot and vote in person, thereby revoking a prior granted proxy.

If your Common Stock is held in street name, you will receive instructions from your broker, bank or other nominee that you must follow in order to have your shares voted. If you wish to change your voting instructions after you have returned your voting instruction form to your broker or bank, you must contact your broker or bank.

Participants in the Klamath First Federal Savings and Loan Association ESOP. If a stockholder is a participant in the Klamath First Federal Savings and Loan Association Employee Stock Ownership Plan ("ESOP"), the proxy card represents a voting instruction to the trustees of the ESOP as to the number of shares in the participant's plan account. Each participant in the ESOP may direct the trustees as to the manner in which shares of Common Stock allocated to the participant's plan account are to be voted. Unallocated shares of Common Stock held by the ESOP, and allocated shares for which no voting instructions are received from participants, will be voted by the trustees in the same proportion as shares for which the trustees have received voting instructions.

Vote Required. The four directors to be elected at the Meeting will be elected by a plurality of the votes cast by stockholders present in person or by proxy and entitled to vote. Stockholders are not permitted to cumulate their votes for the election of directors. Votes may be cast for or withheld from each nominee for election as director. Votes that are withheld and broker non-votes will have no effect on the outcome of the election because directors will be elected by a plurality of votes cast.

The approval of the appointment of Deloitte & Touche LLP as the Company's independent auditors for the fiscal year ending September 30, 2003 requires the affirmative vote of a majority of the outstanding shares of the Common Stock present in person or by proxy and entitled to vote at the Meeting. Abstentions are not affirmative votes and, therefore, will have the same effect as a vote against the proposal and broker non-votes will be disregarded and will have no effect on the outcome of the vote.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Persons and groups who beneficially own in excess of 5% of the outstanding shares of the Common Stock are required to file certain reports with the Securities and Exchange Commission ("SEC"), and provide a copy to the Company, disclosing such ownership pursuant to the Securities Exchange Act of 1934, as amended ("Exchange Act"). Based solely upon the receipt of such reports, other than as set forth in the following table, management knows of no person who owned more than 5% of the outstanding shares of Common Stock as of the Record Date. In addition, the following table sets forth, as of the Record Date, information as to the shares of the Common Stock beneficially owned by each director and named executive officer and by all executive officers and directors of the Company as a group.

| | |

Name

| Number of Shares

Beneficially Owned (1)

| Percent of Shares

Outstanding

|

| Beneficial owners of more than 5% | | |

| | | |

Dimensional Fund Advisors, Inc. (2)

1299 Ocean Avenue, 11th Floor

Santa Monica, California 90401 | 573,500 | 8.5% |

| | | |

Thomson Horstmann & Bryant, Inc. (3)

Park 80 West, Plaza Two

Saddle Brook, New Jersey 07663 | 479,100 | 7.10% |

2

<PAGE>

| | |

Name

| Number of Shares

Beneficially Owned (1)

| Percent of Shares

Outstanding

|

| | | |

Tontine Financial Partners, L.P. (4)

Tontine Management, L.L.C.

Tontine Overseas Associates, L.L.C.

Mr. Jeffrey L. Gendell

237 Park Avenue, 9th Floor

New York, New York 10017 | 366,950 | 5.44% |

| | | |

| Directors and Named Executive Officers (5) | | |

| | | |

| Rodney N. Murray | 94,129 (6) | 1.40% |

| Kermit K. Houser | 116,455 (7) | 1.73% |

| Bernard Z. Agrons | 70,447 (8) | 1.04% |

| Timothy A. Bailey | 70,348 (9) | 1.04% |

| Donald N. Bauhofer | 0 (10) | * |

| James D. Bocchi | 78,616 (11) | 1.17% |

| William C. Dalton | 52,570 (12) | * |

| Dianne E. Spires | 29,409 (13) | * |

| Marshall J. Alexander | 170,270 (14) | 2.52% |

| M. Isabel Castellanos | 13,127 (15) | * |

| Frank X. Hernandez | 43,361 (16) | * |

| Craig M Moore | 12,148 (17) | * |

| All Executive Officers and Directors as a Group (16 persons) | 787,616 (18) | 11.68% |

| _________________________ | | |

| |

| * | Less than 1% of shares outstanding. |

| (1) | In accordance with Rule 13d-3 under the Exchange Act, a person is deemed to be the beneficial owner, for purposes of this table, of any shares of Common Stock if he or she has voting and/or investment power with respect to such security or has a right to acquire, through the exercise of outstanding options or otherwise, beneficial ownership at any time within 60 days from the Record Date. The table includes shares owned by spouses or other immediate family members in trust, shares held in retirement accounts or funds for the benefit of the named individuals, and other forms of ownership, over which shares the persons named in the table possess voting and/or investment power. |

| (2) | Based on an amended Schedule 13G dated January 30, 2002 and filed with the SEC on February 12, 2002. According to this filing, Dimensional Fund Advisors Inc., an investment adviser registered under the Investment Advisers Act of 1940, has sole voting power and sole dispositive power with respect to these shares. |

| (3) | Based on an amended Schedule 13G dated January 18, 2002 and filed with the SEC on January 23, 2002. According to this filing, Thomson Horstmann & Bryant, Inc., an investment adviser registered under the Investment Advisers Act of 1940, has sole voting power with respect to 283,100 shares and sole dispositive power with respect to 479,100 shares. |

| (4) | Based on a Schedule 13G dated and filed with the SEC on October 28, 2002. According to this filing, Tontine Financial Partners, L.P., Tontine Management, L.L.C., Tontine Overseas Associates, L.L.C. and Mr. Gendell have shared voting power and shared dispositive power with respect to these shares. |

| (5) | Under SEC regulations, the term "named executive officer(s)" is defined to include the chief executive officer, regardless of compensation level, and the four most highly compensated executive officers, other than the chief executive officer, whose total annual salary and bonus for the last completed fiscal year exceeded $100,000. Messrs. Houser, Alexander, Hernandez and Moore and Ms. Castellanos were the Company's "named executive officers" for the fiscal year ended September 30, 2002. |

| (6) | Includes 61,167 shares underlying stock options exercisable within 60 days of the Record Date. |

| (7) | Includes 100,000 shares underlying stock options exercisable within 60 days of the Record Date. |

3

<PAGE>

| |

| (8) | Includes 45,670 shares underlying stock options exercisable within 60 days of the Record Date. |

| (9) | Includes 45,670 shares underlying stock options exercisable within 60 days of the Record Date. |

| (10) | Mr. Bauhofer was appointed to the Board of Directors on November 21, 2002 to fill the vacancy created by the death of J. Gillis Hannigan, who passed away in July 2002. |

| (11) | Includes 45,670 shares underlying stock options exercisable within 60 days of the Record Date. |

| (12) | Includes 41,670 shares underlying stock options exercisable within 60 days of the Record Date. |

| (13) | Includes 13,243 shares underlying stock options exercisable within 60 days of the Record Date. |

| (14) | Includes 117,651 shares underlying stock options exercisable within 60 days of the Record Date. Includes unvested restricted shares issued under the Company's Management Recognition and Development Plan ("MRDP"). Participants in the MRDP exercise all rights incidental to ownership, including voting rights. |

| (15) | Includes 4,000 shares underlying stock options exercisable within 60 days of the Record Date. Includes unvested shares in the Company's MRDP. Participants in the MRDP exercise all rights incidental to ownership, including voting rights. |

| (16) | Includes 13,786 shares underlying stock options exercisable within 60 days of the Record Date. Includes unvested shares in the Company's MRDP. Participants in the MRDP exercise all rights incidental to ownership, including voting rights. |

| (17) | Includes 3,000 shares underlying stock options exercisable within 60 days of the Record Date. Includes unvested shares in the Company's MRDP. Participants in the MRDP exercise all rights incidental to ownership, including voting rights. |

| (18) | Includes 514,527 shares underlying stock options exercisable within 60 days of the Record Date. |

PROPOSAL I -- ELECTION OF DIRECTORS

The Company's Board of Directors consists of eight directors as required by the Company's Bylaws. The Company's Bylaws also provide that directors will be elected for three-year staggered terms with approximately one-third of the directors elected each year.

The nominees for election this year are Timothy A. Bailey, James D. Bocchi, William C. Dalton and Donald N. Bauhofer, all of whom are current members of the Board of Directors. Messrs. Bailey, Bocchi and Dalton have each been nominated to serve for a three-year term. Mr. Bauhofer has been nominated to serve for a two-year term because he was appointed to fill the vacancy created by the death of Mr. Hannigan, who passed away in July 2002. Mr. Hannigan's term would have expired in two years.

It is intended that the proxies solicited by the Board of Directors will be voted for the election of the above- named nominees for the terms specified in the table below. If any nominee is unable to serve, the shares represented by all valid proxies will be voted for the election of such substitute as the Board of Directors may recommend. At this time, the Board of Directors knows of no reason why any of the nominees might be unavailable to serve.

The Board of Directors recommends a vote "FOR" the election of Messrs. Bailey, Bocchi, Dalton and Bauhofer.

The following table sets forth certain information regarding the nominees for election at the Meeting and the directors continuing in office after the Meeting.

4

<PAGE>

| | | | |

Name

|

Age (1)

|

Principal Occupation During Last Five Years

| Year First

Elected or

Appointed (2)

|

Term to

Expire

|

| | | | | |

| | BOARD NOMINEES | | |

| | | | | |

| Timothy A. Bailey | 56 | Executive Director, KMSB Foundation; Member, Oregon State Bar; former Senior Vice President, Klamath Operations for Regence Blue Cross/Blue Shield of Oregon. | 1993 | 2006 (3) |

| James D. Bocchi | 78 | Retired; former President and Chief Executive Officer of the Association, 1984-1994; employed by the Association, 1950-1994. | 1983 | 2006 (3) |

| William C. Dalton | 71 | Retired; former owner of W.C. Dalton Company (farming). | 1972 | 2006 (3) |

| Donald N. Bauhofer | 51 | Founder and President, The Pennbrook Company (real estate development), Bend, Oregon; Founder and Chief Executive Officer, Pennbrook Homes, Inc. and Praxis Medical Group; Co-owner, Arrowood Development, LLC; Co-owner and Director, Pacific Education Corporation. | 2002 | 2005 (3) |

| | | | | |

| | DIRECTORS CONTINUING IN OFFICE | | |

| | | | | |

| Rodney N. Murray | 74 | Chairman of the Board; owner and operator, Rod Murray Ranch, Klamath Falls, Oregon; former owner and operator, Klamath Falls Creamery/Crater Lake Dairy Products. | 1976 | 2004 |

| Kermit K. Houser | 59 | President and Chief Executive Officer of the Company and the Association, November 2000-present. Prior to joining the Company, employed by Bank of America, 1983-2000, in various positions, including senior vice president and manager for commercial banking, executive vice president and senior credit officer, and most recently, senior vice president and market executive for Bank of America's South Valley commercial banking, in Fresno, California. | 2000 | 2005 |

| Bernard Z. Agrons | 80 | Retired; former State Representative, Oregon State Legislature, 1983-1991; former Vice President for the Eastern Oregon Region, Weyerhaeuser Company, until 1981. | 1974 | 2004 |

| Dianne E. Spires | 48 | Certified Public Accountant; Partner, Rusth, Spires & Menefee, LLP, Klamath Falls, Oregon. | 1997 | 2005 |

| _________________________ | | | |

(1) As of September 30, 2002.

(2) Includes service on the Board of Directors of the Association.

(3) Assuming election at the Meeting.

5

<PAGE>

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Boards of Directors of the Company and the Association conduct their business through meetings of the Boards and through their committees. During the year ended September 30, 2002, the Board of Directors of the Company held 12 regular meetings and three special meetings, and took one action by written consent. The Board of Directors of the Association held 12 regular meetings and three special meetings. No director of the Company or the Association attended fewer than 75% of the total meetings of the Boards and committees on which such person served during this period.

The Boards of Directors of the Company and the Association have established various committees, including Executive, Audit, Compensation and Nominating Committees.

The Executive Committee consists of Messrs. Bocchi, Dalton, Houser and Murray. The Executive Committee has the power and authority to act on behalf of the Board of Directors on matters between regularly scheduled Board meetings unless specific Board of Directors' action is otherwise required. The Executive Committee met three times during the year ended September 30, 2002.

The Audit Committee consists of Messrs. Agrons, Dalton and Murray and Ms. Spires. The Audit Committee reviews the internal auditors' reports and results of their examination prior to review by and with the entire Board of Directors and retains and establishes the scope of engagement of the Company's independent auditors. The Audit Committee met five times during the year ended September 30, 2002. For additional information regarding the Audit Committee, see "Audit Committee Matters" below.

The Compensation Committee, consisting of Messrs. Bailey and Agrons and Ms. Spires, reviews and recommends compensation arrangements for management and other personnel. The Compensation Committee met twice during the year ended September 30, 2002.

The Nominating Committee, consisting of the Company's full Board of Directors, selects the nominees for election as directors. During the year ended September 30, 2002, the Nominating Committee met once to nominate the nominees for directors at the Meeting.

DIRECTORS' COMPENSATION

Fees. The Company and the Association each pay fees to its directors, and each director of the Company is a director of the Association. Each director of the Company receives a quarterly fee of $1,000, except that the Chairman of the Board receives a quarterly fee of $1,250. Each director of the Association other than the Chairman of the Board receives an annual retainer of $10,900 and a fee of $1,550 per month for attendance at regular Board meetings. In addition to the annual retainer, the Chairman of the Board of the Association also receives a fee of $1,950 per month for attendance at regular Board meetings. Mr. Houser, President, Chief Executive Officer and a director of the Company and the Association, does not receive any fees for attending Board meetings of the Company and the Association. The Company and the Association paid total fees to directors of $237,200 for the fiscal year ended September 30, 2002, and $16,800 was paid to one director emeritus.

Supplemental Benefit Plan. The Association also maintains an unfunded supplemental benefit plan to provide retirement benefits to members of the Board of Directors. Payments are based on directors' fees paid by the Association and continue for a period of five years following a director's retirement, except for directors who served at January 1, 1992, who receive this fee for life.

6

<PAGE>

EXECUTIVE COMPENSATION

Summary Compensation Table. The following table shows the compensation paid during the last three fiscal years to the Company's Chief Executive Officer and the four highest paid executive officers of the Company who received salary and incentive compensation in excess of $100,000 during the fiscal year ended September 30, 2002.

| | | | | | |

| | Annual

Compensation (1)

| Long-Term

Compensation Awards

| |

Name and Position

|

Year

|

Salary

|

Bonus

| Restricted

Stock

Awards (2)

|

Number of

Options (3)

| All Other

Compen-

sation (4)

|

| Kermit K. Houser (5) | 2002 | $200,000 | $60,000 | $ -- | -- | $ -- |

President and Chief

Executive Officer and

Director | 2001 | 175,000 | -- | 232,500 | 100,000 | -- |

| | | | | | | |

| Marshall J. Alexander | 2002 | $114,600 | $30,000 | $ -- | -- | $22,314 |

Executive Vice President

and Chief Financial Officer | 2001

2000 | 104,220

89,352 | --

1,789 | 147,481

-- | 20,000

-- | 34,132

32,435 |

| | | | | | | |

Frank X. Hernandez

Senior Vice President and

Chief Operating Officer | 2002

2001

2000 | $103,980

103,980

94,542 | $25,000

--

1,891 | $ --

130,630

-- | --

20,000

-- | $20,036

28,616

21,306 |

| | | | | | | |

M. Isabel Castellanos (6)

Senior Vice President of

Retail Banking | 2002

2001 | $103,550

56,513 | $17,000

-- | $ --

135,000 | --

20,000 | $ --

-- |

| | | | | | | |

Craig M Moore

Senior Vice President,

Chief Auditor, General

Counsel and Secretary | 2001

2001

2000 | $95,000

81,583

58,200 | $20,000

--

3,640 | $ --

65,315

-- | --

15,000

-- | $16,773

$16,377

$12,536 |

| ______________________ | | | | | | |

| (1) | All compensation is paid by the Association. Excludes certain additional benefits which did not exceed the lesser of $50,000 or 10% of salary and bonus. |

| (2) | Represents the total value of the award of shares of restricted Common Stock on the award date, pursuant to the MRDP. Mr. Houser was awarded 20,000 shares on November 15, 2000, Mr. Alexander was awarded 11,290 shares on April 9, 2001, Mr. Hernandez was awarded 10,000 shares on April 9, 2001, Ms. Castellanos was awarded 10,000 shares on February 26, 2001 and Mr. Moore was awarded 5,000 shares on April 1, 2001. Dividends are paid on such awards if and when declared and paid by the Company on the Common Stock. The restricted MRDP shares awarded to Messrs. Houser and Alexander vest ratably over a two-year period and those awarded to Mr. Hernandez, Ms. Castellanos and Mr. Moore vest ratably over a five-year period. At September 30, 2002, the number and value of the aggregate restricted stock holdings were: Mr. Houser, 10,000 shares worth $152,000; Mr. Alexander, 5,645 shares worth $85,804; Mr. Hernandez, 8,000 shares worth $121,600; Ms. Castellanos 8,000 shares worth $1 21,600; and Mr. Moore, 4,000 shares worth $60,800. |

| (3) | Represents the total number of shares granted under the Klamath First Bancorp, Inc. 1996 Stock Option Plan ("Option Plan"). |

| (4) | Represents the cost to the Company of awards under the ESOP. |

| (5) | Mr. Houser was appointed to his position effective November 15, 2000. |

| (6) | Ms. Castellanos was appointed to her position effective February 26, 2001. |

| | |

7

<PAGE>

Option Exercise/Value Table. The following information is provided for Messrs. Houser, Alexander, Hernandez and Moore and Ms. Castellanos.

| | | | | | |

|

Shares

Acquired on |

Value |

Unexercised Options

at Fiscal Year End

| Value of

In-the-Money Options

at Fiscal Year End (1)

|

Name

| Exercise

| Realized

| Exercisable

| Unexercisable

| Exercisable

| Unexercisable

|

| Kermit K. Houser | 0 | $0 | 50,000 | 50,000 | $178,750 | $178,750 |

| Marshall J. Alexander | 0 | $0 | 117,651 | 10,000 | $244,746 | $ 21,370 |

| Frank X. Hernandez | 0 | $0 | 13,786 | 16,000 | $ 28,854 | $ 34,192 |

| M. Isabel Castellanos | 0 | $0 | 4,000 | 16,000 | $ 6,800 | $ 27,200 |

| Craig M Moore | 0 | $0 | 3,000 | 12,000 | $ 6,411 | $ 25,644 |

| ____________________ | | | | | | |

| (1) | Value of unexercised in-the-money options equals market value of shares covered by in-the-money options on September 30, 2002 less the option exercise price. Options are in-the-money if the market value of the shares covered by the options is greater than the option exercise price. |

Employment Agreements. The Company and the Association (collectively, "Employers") have entered into two-year employment agreements ("Employment Agreements") with Messrs. Houser, Alexander, Hernandez and Moore and Ms. Castellanos (individually, "Executive" and collectively, "Executives").

Under the Employment Agreements, the current annual salary levels for Messrs. Houser, Alexander, Hernandez and Moore and Ms. Castellanos are $200,000, $138,000, $108,000, $117,000 and $119,000, respectively, which amounts will be paid by the Association and which may be increased at the discretion of the Board of Directors or an authorized committee of the Board. On each anniversary of the commencement date of the Employment Agreements, the term of each agreement may be extended for an additional year at the discretion of the Board of Directors. The current term for Mr. Houser's Employment Agreement expires on November 14, 2004, and the current terms of the Employment Agreements for Messrs. Alexander, Hernandez and Moore and Ms. Castellanos expire on September 30, 2004. The Employment Agreements are terminable by the Employers for just cause at any time or upon the occurrence of certain events specified by federal regulations. Under the Employment Agreement s, the Executives may receive bonuses at the discretion of the Board.

The Employment Agreements provide for severance payments and other benefits in the event of involuntary termination of employment in connection with any change in control of the Employers. Severance payments also will be provided on a similar basis in connection with a voluntary termination of employment where, subsequent to a change in control, the Executives are assigned duties inconsistent with their respective position, responsibilities and status immediately prior to such change in control. The term "change in control" is defined in the Employment Agreements as any time during the period of employment when (a) a person other than the Company purchases shares of Common Stock pursuant to a tender or exchange offer for such shares, (b) any person (as such term is used in Sections 13(d) and 14(d)(2) of the Exchange Act) is or becomes the beneficial owner, directly or indirectly, of securities of the Company representing 25% or more of the combined voting power of the Company's then outstanding securities, (c) the membership of the Board of Directors changes as the result of a contested election, or (d) stockholders of the Company approve a merger, consolidation, sale or disposition of all or substantially all of the Company's assets, or a plan of partial or complete liquidation.

The maximum value of the severance benefits under the Employment Agreements is 2.99 times the Executive's average annual compensation during the five-year period preceding the effective date of the change in control (the "base amount"). Such amounts will be paid in a lump sum within ten business days following the termination of employment. Had a change in control of the Employers occurred in 2002, Messrs. Houser, Alexander, Hernandez and Moore and Ms. Castellanos would have been entitled to severance payments of approximately $598,000, $281,034, $270,000, $210,007 and $302,211, respectively. Section 280G of the Internal Revenue Code of 1986, as amended ("Code"), provides that certain severance payments which equal or exceed three times the base amount of the individual are deemed to be

8

<PAGE>

"excess parachute payments" if they are contingent upon a change in control. Individuals receiving excess parachute payments are subject to a 20% excise tax on the amount of such excess payments, and the Employers would not be entitled to deduct the amount of such excess payments.

The Employment Agreements restrict an Executive's right to compete against the Employers for a period of one year from the date of termination of the agreement if the Executive voluntarily terminates employment, except in the event of a change in control. Mr. Houser's Employment Agreement prevents him from competing against the Employers for a period of one year from the date of termination for any reason, including a change in control.

AUDIT COMMITTEE MATTERS

Audit Committee Charter. The Audit Committee operates pursuant to a written charter approved by the Company's Board of Directors. The Audit Committee reports to the Board of Directors and is responsible for overseeing and monitoring financial accounting and reporting, the system of internal controls established by management and the audit process of the Company. The Audit Committee Charter sets out the responsibilities, authority and specific duties of the Audit Committee. The Charter specifies, among other things, the structure and membership requirements of the Audit Committee, as well as the relationship of the Audit Committee to the independent accountants, the internal audit department and management of the Company.

A copy of the Audit Committee Charter was filed as Appendix A to the Company's Annual Meeting Proxy Statement for the 2001 Annual Meeting of Stockholders.

Report of the Audit Committee. The Audit Committee reports as follows with respect to the Company's audited financial statements for the year ended September 30, 2002:

| |

| • | The Audit Committee has completed its review and discussion of the Company's 2002 audited financial statements with management; |

| | |

| • | The Audit Committee has discussed with the independent auditors, Deloitte & Touche LLP, the matters required to be discussed by Statement on Auditing Standards ("SAS") No. 61,Communication with Audit Committees, as amended by SAS No. 90,Audit Committee Communications, including, matters related to the conduct of the audit of the Company's financial statements; |

| | |

| • | The Audit Committee has received written disclosures, as required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committee, indicating all relationships, if any, between the independent auditor and its related entities and the Company and its related entities which, in the auditor's professional judgment, reasonably may be thought to bear on the auditors' independence, and the letter from the independent auditors confirming that, in its professional judgment, it is independent from the Company and its related entities, and has discussed with the auditors the auditors' independence from the Company; and |

| | |

| • | The Audit Committee has, based on its review and discussions with management of the Company's 2002 audited financial statements and discussions with the independent auditors, recommended to the Board of Directors that the Company's audited financial statements for the year ended September 30, 2002 be included in the Company's Annual Report on Form 10-K. |

| | |

| Audit Committee consisting of: | Bernard Z. Agrons, Chairman

William C. Dalton

Rodney N. Murray

Dianne E. Spires |

9

<PAGE>

Independence and Other Matters. Each member of the Audit Committee is "independent," as defined, in the case of the Company, under the Nasdaq Stock Market Rules. The Audit Committee members do not have any relationship to the Company that may interfere with the exercise of their independence from management and the Company. None of the Audit Committee members are current officers or employees of the Company or its affiliates.

COMPENSATION COMMITTEE MATTERS

Notwithstanding anything to the contrary set forth in any of the Company's previous filings under the Securities Act of 1933, as amended, or the Exchange Act that might incorporate future filings, including this Proxy Statement, in whole or in part, the following Report of the Compensation Committee and Performance Graph shall not be incorporated by reference into any such filings.

Report of the Compensation Committee.Under rules established by the SEC, the Company is required to provide certain data and information in regard to the compensation and benefits provided to the Company's Chief Executive Officer and other executive officers of the Company and the Association. The disclosure requirements for the Chief Executive officer and other executive officers include the use of tables and a report explaining the rationale and considerations that led to the fundamental executive compensation decisions affecting those individuals. Insofar as no separate compensation is currently payable by the company, the Compensation Committee of the Association (the "Committee"), at the direction of the Board of Directors of the Company, has prepared the following report for inclusion in this proxy statement.

The Compensation Committee's duties are to recommend and administer policies that govern executive compensation for the Company and the Association. The Compensation Committee evaluates executive performance, compensation policies and salaries and makes recommendations to the Board of Directors concerning the compensation of each named executive officer and other executive officers. The Board of Directors reviews the Compensation Committee's recommendations and establishes compensation levels for the coming year.

The executive compensation policy of the Company and the Association is designed to establish an appropriate relationship between executive pay and the Company's and the Association's annual and long-term performance, long-term growth objectives, and their ability to attract and retain qualified executive officers. The principles underlying the program are:

| |

| • | To attract and retain key executives who are vital to the long-term success of the Company and the Association and who are of the highest caliber; |

| | |

| • | To provide compensation levels competitive with those offered throughout the financial industry and consistent with the Company's and the Association's level of performance; |

| | |

| • | To motivate executives to enhance long-term stockholder value by building their personal ownership in the Company; and |

| | |

| • | To integrate the compensation program with the Company's and the Association's annual and long-term strategic planning and performance measurement processes. |

| | |

The Compensation Committee also considers a variety of subjective and objective factors in determining the compensation package for individual executives, including (i) the performance of the Company and the Association as a whole with emphasis on annual and long-term performance, (ii) the responsibilities assigned to each executive, and (iii) the performance of each executive of assigned responsibilities as measured by the progress of the Company and the Association during the year.

10

<PAGE>

The Compensation Committee considers compensation surveys prepared by various sources. Most recently, the Compensation Committee used a survey prepared by RSM McGladrey, Inc., which included proxy searches and the results of surveys by Watson Wyatt & Company and Business & Legal Reports, Inc.

Although the Compensation Committee did not establish executive compensation levels only on the basis of whether specific financial goals had been achieved by the Company and the Association, the Compensation Committee (and the Board of Directors) considered the overall profitability of the Company and the Association when making their decisions. The Compensation Committee believes that management compensation levels, as a whole, appropriately reflect the application of the Company's and Association's executive compensation policy and the progress of the Company and the Association.

The compensation for the Company's President and Chief Executive Officer, Kermit K. Houser, was $200,000. The Compensation Committee believes Mr. Houser's salary is appropriate based on Company performance and competitive salary surveys.

The Committee also recommends to the Board of Directors the amount of fees paid for service on the Board. The Committee did not recommend a change in Board fees during the fiscal year ended September 30, 2002.

| Compensation Committee consisting of: | Timothy A. Bailey, Chairman

Bernard Z. Agrons

Dianne E. Spires |

Compensation Committee Interlocks and Insider Participation. No members of the Compensation Committee were officers or employees of the Company or any of its subsidiaries during the year, were formerly Company officers, or had any relationship otherwise requiring disclosure.

11

<PAGE>

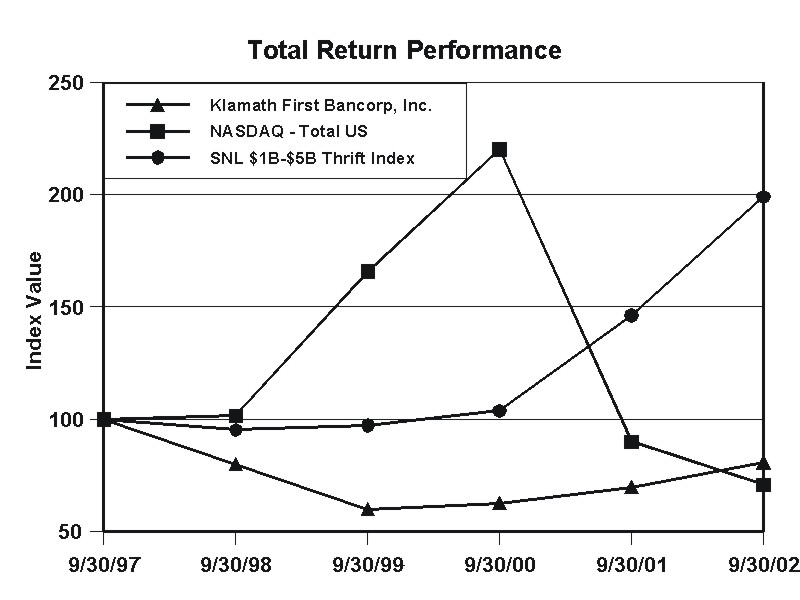

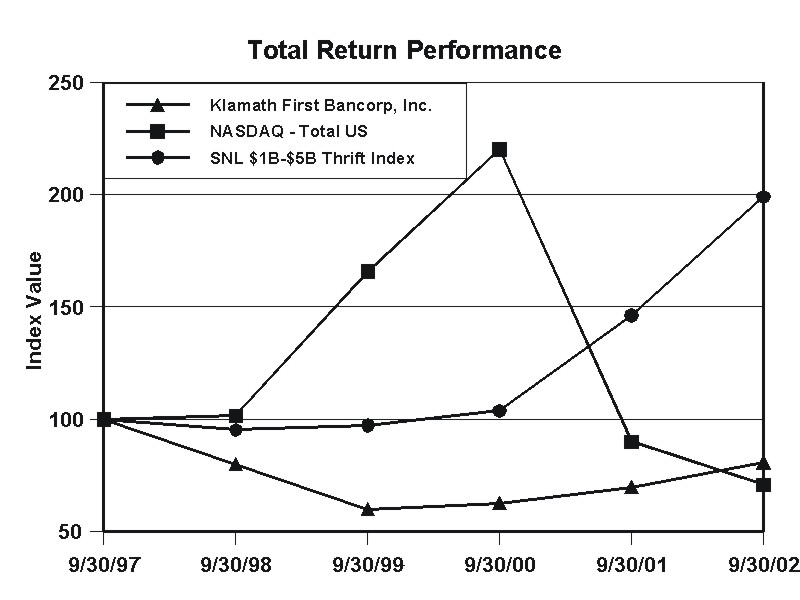

PERFORMANCE GRAPH

Performance Graph. The following graph compares the cumulative total stockholder return on the Company's Common Stock with the cumulative total return on the Nasdaq Index (U.S. Companies) and with the SNL $1 Billion to $5 Billion Thrift Index. Total return assumes the reinvestment of all dividends.

| | | | | | |

| 9/30/97

| 9/30/98

| 9/30/99

| 9/30/00

| 9/30/01

| 9/30/02

|

| | | | | | | |

| Klamath First Bancorp, Inc. | $100.00 | $ 80.16 | $ 60.05 | $ 62.79 | $ 69.90 | $ 80.85 |

| The Nasdaq Index (U.S. Companies) | 100.00 | 101.58 | 165.72 | 220.06 | 89.95 | 70.86 |

| SNL $1 Billion to $5 Billion Thrift Index | 100.00 | 95.32 | 97.27 | 103.85 | 146.25 | 199.07 |

12

<PAGE>

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company's executive officers and directors, and persons who own more than 10% of any registered class of the Company's equity securities, to file reports of ownership and changes in ownership with the SEC. Executive officers, directors and greater than 10% stockholders are required by regulation to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on its review of the copies of such forms it has received and written representations provided to the Company by the above referenced persons, the Company believes that, during the fiscal year ended September 30, 2002, all filing requirements applicable to its reporting officers, directors and greater than 10% stockholders were complied with properly and timely, except for the filing of Form 3, Initial Statement of Beneficial Ownership of Securities, to initially report securities beneficially owned by each of M. Isabel Castellanos, Senior Vice President of Retail Banking, Walter F. Dodrill, Senior Vice President of Business Banking, Nina G. Drake, Vice President of Human Resources, James E. Essany, Senior Vice President of Marketing, and Ben A. Gay, Executive Vice President and Chief Credit Officer, which were subsequently filed.

CERTAIN TRANSACTIONS WITH THE ASSOCIATION

The Association has followed the policy of granting loans to its officers, directors and employees. Loans to such persons are made in the ordinary course of business on substantially the same terms, including interest rate and collateral, as those prevailing at the time for comparable transactions with other persons (unless the loan or extension of credit is made under a benefit program generally available to all other employees and does not give preference to any insider over any other employee), and, in the opinion of management, do not involve more than the normal risk of collectability or present other unfavorable features. At September 30, 2002, loans to directors and executive officers (excluding available lines of credit) totalled approximately $4.76 million.

PROPOSAL II -- APPROVAL OF APPOINTMENT OF INDEPENDENT AUDITORS

Deloitte & Touche LLP served as the Company's independent auditors for the fiscal year ended September 30, 2002. The Board of Directors has appointed Deloitte & Touche LLP as independent auditors for the fiscal year ending September 30, 2003, subject to approval by stockholders. A representative of Deloitte & Touche LLP will be present at the Meeting to respond to stockholders' questions and will have the opportunity to make a statement if he so desires.

Audit Fees.The aggregate fees billed to the Company for professional services rendered for the audit of the Company's financial statements for fiscal year 2002 and the reviews of the financial statements included in the Company's Quarterly Reports on Form 10-Q for that year, including travel expenses, were approximately $228,000.

Financial Information Systems Design and Implementation Fees. No independent public accountant performed financial information system design or implementation work for the Company during the fiscal year ended September 30, 2002.

All Other Fees. Other than audit fees, the aggregate fees billed to the Company by Deloitte & Touche LLP for fiscal 2002, none of which were financial information systems design and implementation fees, were approximately $10,000. The Audit Committee of the Board of Directors determined that the services performed by Deloitte & Touche LLP other than audit services are not incompatible with Deloitte & Touche LLP maintaining its independence.

If the ratification of the appointment of Deloitte & Touche LLP is not approved by a majority of the votes cast by stockholders at the Meeting, other independent public accountants will be considered by the Board of Directors.

13

<PAGE>

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE APPROVAL OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS INDEPENDENT AUDITORS OF THE COMPANY FOR THE FISCAL YEAR ENDING SEPTEMBER 30, 2003.

OTHER MATTERS

The Board of Directors is not aware of any business to come before the Meeting other than those matters described above in this Proxy Statement. However, if any other matters should properly come before the Meeting, it is intended that proxies in the accompanying form will be voted in respect thereof in accordance with the judgment of the person or persons voting the proxies.

MISCELLANEOUS

The cost of solicitation of proxies will be borne by the Company. Directors, officers and employees of the Company and the Association may solicit proxies personally or by telecopier or telephone without additional compensation. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of the Common Stock.

The Company's Annual Report to Stockholders has been mailed to all stockholders of record as of the close of business on the Record Date. Any stockholder who has not received a copy of the Annual Report may obtain a copy by writing to the Company. The Annual Report is not to be treated as part of this proxy solicitation material or as having been incorporated herein by reference.

STOCKHOLDER PROPOSALS

In order to be eligible for inclusion in the proxy materials of the Company for next year's Annual Meeting of Stockholders, any stockholder proposal to take action at such meeting must be received at the Company's main office at 540 Main Street, Klamath Falls, Oregon, no later than August 29, 2003. Any such proposals shall be subject to the requirements of the proxy solicitation rules adopted under the Exchange Act.

The Company's Articles of Incorporation provide that stockholders will have the opportunity to nominate directors of the Company if such nominations are made in writing and are delivered to the Secretary of the Company not less than 30 days nor more than 60 days before the annual meeting of stockholders; provided, however, if less than 31 days notice is given, such notice shall be delivered to the Secretary of the Company no later than the close of the tenth day following the date on which notice of the meeting was mailed to stockholders. Based on the date of the 2003 Annual Meeting, the Company anticipates that, in order to be timely, stockholder nominations or proposals intended to be made at the 2004 Annual Meeting must be made by December 29, 2003. As specified in the Company's Articles of Incorporation, the notice must set forth (i) the name, age, business address and, if known, residence address of each nominee for election as a director, (ii) the principal o ccupation or employment of each nominee, (iii) the number of shares of stock of the Company which are beneficially owned by each such nominee, (iv) such other information as would be required to be included in a proxy statement soliciting proxies for the election of the proposed nominee pursuant to the Exchange Act, including, without limitation, such person's written consent to being named in the proxy statement as a nominee and to serving as a director, if elected, and (v) as to the stockholder giving such notice (a) his or her name and address as they appear on the Company's books and (b) the class and number of shares of the Company which are beneficially owned by such stockholder.

14

<PAGE>

FORM 10-K

A copy of the Annual Report on Form 10-K as filed with the SEC will be furnished without charge to stockholders as of the close of business on the Record Date upon written request to Craig M Moore, Secretary, Klamath First Bancorp, Inc., 540 Main Street, Klamath Falls, Oregon 97601.

| | |

| BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| | |

| /s/ CRAIG M MOORE |

| CRAIG M MOORE

SECRETARY |

| | |

Klamath Falls, Oregon

December 27, 2002 | |

15

<PAGE>

REVOCABLE PROXY

KLAMATH FIRST BANCORP, INC.

ANNUAL MEETING OF STOCKHOLDERS

January 29, 2003

The undersigned hereby appoints the official Proxy Committee of the Board of Directors of Klamath First Bancorp, Inc. ("Company") with full powers of substitution to act as attorneys and proxies for the undersigned, to vote all shares of Common Stock of the Company which the undersigned is entitled to vote at the Annual Meeting of Stockholders ("Meeting"), to be held at the Shilo Inn, 2500 Almond Street, Klamath Falls, Oregon, on Wednesday, January 29, 2003, at 2:00 p.m., Pacific Time, and at any and all adjournments thereof, as follows:

| | | | |

| | VOTE

FOR | | VOTE

WITHHELD |

| 1. | The election as directors of all nominees listed below

(except as marked to the contrary below). | [ ] | | [ ] |

| | | | | |

| Timothy A. Bailey (for a three year term)

James D. Bocchi (for a three year term)

William C. Dalton (for a three year term)

Donald N. Bauhofer (for a two year term)

| | | |

| | | | | |

| INSTRUCTION: To withhold your vote for any individual nominee(s), write that nominee's(s') name(s) on the line below. | | | |

|

___________________________________ | | | |

| | | | | |

| | FOR | AGAINST | ABSTAIN |

| 2. | The approval of the appointment of Deloitte & Touche LLP as independent auditors for the fiscal year ending September 30, 2003. | [ ] | [ ] | [ ] |

| | | | | |

| 3. | Such other matters that may properly come before the Meeting or any adjournments thereof. | | | |

| | | | | |

| The Board of Directors recommends a vote "FOR" the above proposals. | |

THIS PROXY, RETURNED PROPERLY SIGNED AND DATED, WILL BE VOTED AS DIRECTED, BUT IF NO INSTRUCTIONS ARE SPECIFIED, THIS PROXY WILL BE VOTED FOR THE PROPOSITIONS STATED. IF ANY OTHER BUSINESS IS PRESENTED AT SUCH MEETING, THIS PROXY WILL BE VOTED BY THOSE NAMED IN THIS PROXY IN THEIR BEST JUDGMENT. AT THE PRESENT TIME, THE BOARD OF DIRECTORS KNOWS OF NO OTHER BUSINESS TO BE PRESENTED AT THE MEETING.

<PAGE>

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS Should the undersigned be present and elect to vote at the Meeting or at any adjournment thereof and after notification to the Secretary of the Company at the Meeting of the stockholder's decision to terminate this proxy, then the power of said attorneys and proxies shall be deemed terminated and of no further force and effect.

The undersigned acknowledges receipt from the Company prior to the execution of this proxy of Notice of Annual Meeting of Stockholders, a proxy statement for the Annual Meeting of Stockholders, and an Annual Report to Stockholders.

| |

| Dated: , 200 | |

| | |

| | |

| | |

| PRINT NAME OF STOCKHOLDER | PRINT NAME OF STOCKHOLDER |

| | |

| | |

| SIGNATURE OF STOCKHOLDER | SIGNATURE OF STOCKHOLDER |

| | |

Please sign exactly as your name appears on this card. When signing as attorney, executor, administrator, trustee or guardian, please give your full title. If shares are held jointly, only one holder need sign, but each holder should sign, if possible.

PLEASE COMPLETE, DATE, SIGN AND MAIL THIS PROXY PROMPTLY

IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE.

<PAGE>