Exhibit 99.1

CORPORACION RECURSOS IBERIA SL

AND

PETAQUILLA MINERALS LTD.

NI43-101 TECHNICAL REPORT ON THE

LOMERO-POYATOS Au-Cu-Pb-Zn MINE

IN ANDALUSIA, SPAIN

Prepared by

QUALIFIED PERSON

Richard Fletcher MSc, BSc,

FAusIMM, MIMMM, C.Geol. C.Eng. (Geologist)

29th July 2011

BEHRE DOLBEAR INTERNATIONAL LIMITED

3rdFLOOR, INTERNATIONAL HOUSE

DOVER PLACE, ASHFORD, KENT, UK

TN23 1HU

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

TABLE OF CONTENTS

| | |

| 1.0 | SUMMARY | 1 |

| 1.1 | THE PROPERTY | 1 |

| 1.2 | LOCATION | 1 |

| 1.3 | OWNERSHIP | 1 |

| 1.4 | GEOLOGY AND MINERALIZATION | 1 |

| 1.5 | EXPLORATION CONCEPT | 2 |

| 1.6 | STATUS OF EXPLORATION | 2 |

| 1.7 | DEVELOPMENT AND OPERATIONS | 2 |

| 1.8 | THE QUALIFIED PERSON’S CONCLUSIONS AND RECOMMENDATIONS | 3 |

| 2.0 | INTRODUCTION | 4 |

| 2.1 | THE PURPOSE OF THE ITR | 4 |

| 2.2 | THE SOURCES OF INFORMATION AND DATA | 4 |

| 2.3 | THE SCOPE OF THE PERSONAL INSPECTION ON THE PROPERTY | 4 |

| 3.0 | RELIANCE ON OTHER EXPERTS | 5 |

| 3.1 | LEGAL ISSUES | 5 |

| 3.2 | PREVIOUS STUDIES AND REPORTS | 6 |

| 4.0 | PROPERTY DESCRIPTION AND LOCATION | 6 |

| 4.1 | THE PROPERTY AREA | 6 |

| 4.2 | THE LOCATION, | 6 |

| 4.3 | THE TYPE OF MINERAL TENURE | 7 |

| 4.4 | MINERAL TITLE DETAILS | 8 |

| 4.5 | ENVIRONMENTAL ASPECTS | 10 |

| 4.6 | PERMITS REQUIRED | 11 |

| 5.0 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE | 12 |

| 5.1 | TOPOGRAPHY, ELEVATION AND VEGETATION | 12 |

| 5.2 | ACCESS TO THE PROPERTY | 12 |

| 5.3 | PROXIMITY TO POPULATION CENTRES | 13 |

| 5.4 | CLIMATE | 13 |

| 5.5 | SITE CONVENIENCE | 13 |

| 6.0 | HISTORY | 15 |

| 6.1 | PRIOR OWNERSHIP | 15 |

| 6.2 | EXPLORATION HISTORY | 18 |

| 6.3 | HISTORICAL ESTIMATES | 24 |

| 7.0 | GEOLOGICAL SETTING | 35 |

| 7.1 | REGIONAL GEOLOGY | 35 |

| 7.2 | LOCAL GEOLOGY | 36 |

| 7.3 | PROPERTY GEOLOGY | 36 |

| 8.0 | DEPOSIT TYPES | 38 |

| 9.0 | MINERALIZATION | 38 |

| 10.0 | EXPLORATION | 39 |

| 11.0 | DRILLING | 39 |

| 12.0 | SAMPLING METHOD AND APPROACH | 39 |

| 13.0 | SAMPLE PREPARATION, ANALYSES AND SECURITY | 39 |

| 14.0 | DATA VERIFICATION | 39 |

| 15.0 | ADJACENT PROPERTIES | 40 |

| 16.0 | MINERAL PROCESSING AND METALLURGICAL TESTING | 40 |

| 17.0 | MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES | 47 |

| 17.1 | MINERAL RESOURCE ESTIMATES | 47 |

| 17.2 | GEMCOM RESOURCE MODEL | 50 |

| 17.3 | DATABASE PREPARATION AND VALIDATION | 51 |

| 17.4 | MINERAL RESOURCE ESTIMATION (GEMCOM, 2011) | 56 |

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

| | |

| 18.0 | OTHER RELEVANT DATA AND INFORMATION | 59 |

| 18.1 | INDICATIVE VALUATION | 59 |

| 18.2 | OTHER | 61 |

| 18.3 | LOMERO-POYATOS BLOCK MODELS | 63 |

| 19.0 | INTERPRETATION AND CONCLUSIONS | 70 |

| 19.1 | SUMMARY OF RESULTS | 70 |

| 19.2 | DATA ADEQUACY AND RELIABILITY | 70 |

| 19.3 | THE PROJECT OBJECTIVES | 71 |

| 20.0 | RECOMMENDATIONS | 71 |

| 20.1 | COST OF PROGRAMMES | 72 |

| 21.0 | REFERENCES | 73 |

| 22.0 | ADDITIONAL REQUIREMENTS FOR TECHNICAL REPORTS ON | 75 |

| 23.0 | CERTIFICATE AND CONSENT | 76 |

| 24.0 | CERTIFICATE AND CONSENT | 77 |

| | |

| LIST OF TABLES |

| |

| Table 1 | Lomero-Poyatos Mining Concessions | 8 |

| Table 2 | Significant Newmont/CMR Drillhole Intersections (Source: WAI, 2007 ) | 21 |

| Table 3 | Significant (>2m at 1g/t Au) gold value drill intercepts (CMR, 2002 – 2004) | 23 |

| Table 4 | Mineral Resource Statement (Source: SRK, 2002) | 25 |

| Table 5 | Concentrate Grades and Recoveries from AMCO-Robertson Test work | 27 |

| Table 6 | Lomero-Poyatos Indicated Mineral Resource Estimate (Source:- CMR, 2007) | 34 |

| Table 7 | Lomero-Poyatos Underground Resource Estimate at 1.5 g/t Au cut-off | 35 |

| Table 8 | Processing test results (Source: Amco-Robertson, 2002) | 41 |

| Table 9 | Assumptions used in deriving NSR for Lomero-Poyatos (in US$) | 41 |

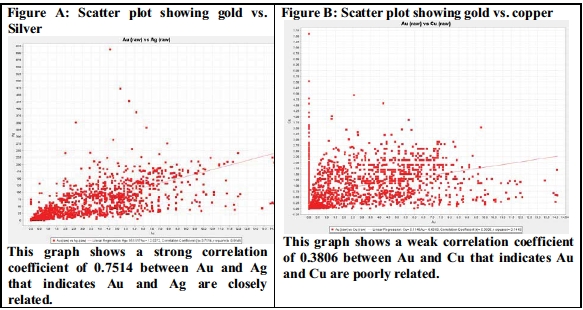

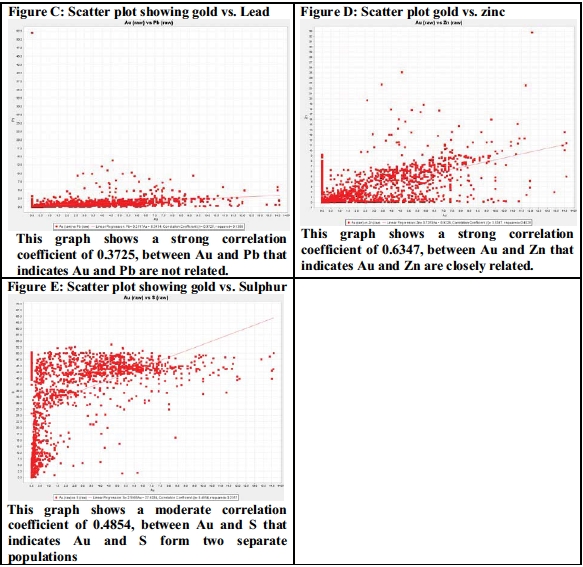

| Table 10 | Correlation Coefficients of the Raw Assay Data (Source: Gemcom, 2011) | 53 |

| Table 11 | Inferred Mineral Resource Estimate assuming Open-pit mining at SG = 3.3 | 58 |

| Table 12 | Inferred Mineral Resource Estimate assuming underground mining at 1g/t Au | 58 |

| Table 13 | Assumptions used in deriving deposit sales value in US$ | 59 |

| Table 14 | Average Stock Market Value per oz of in-situ Gold Resource | 60 |

| | |

| LIST OF FIGURES | |

| | | |

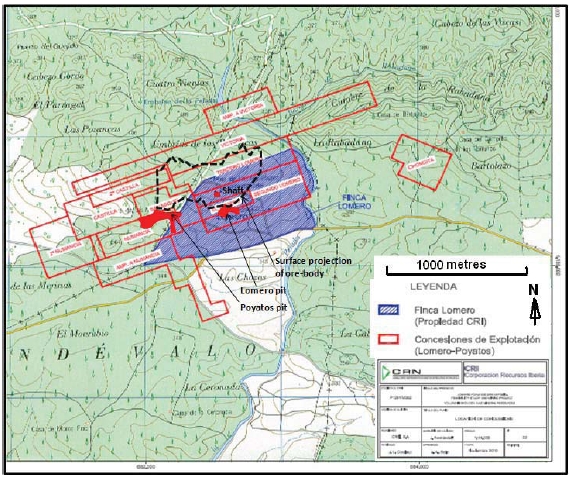

| Figure 1 | Location map of the Lomero-Poyatos mine | 7 |

| Figure 2 | Location map showing mineral concessions (Red) and surface rights (blue) | 9 |

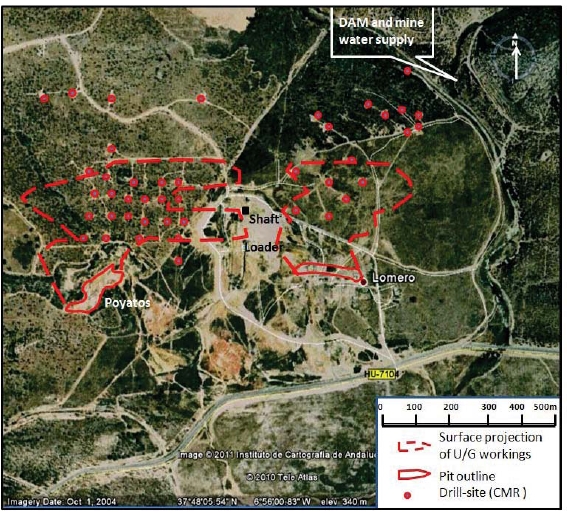

| Figure 3 | Satellite image showing location of mineral assets at Lomero-Poyatos | 10 |

| Figure 4 | Lomero-Poyatos mine shaft | 13 |

| Figure 5 | Poyatos pit (looking west) note exposed pyrite (grey) in bottom of pit | 14 |

| Figure 6 | Lomero pit (looking east) | 14 |

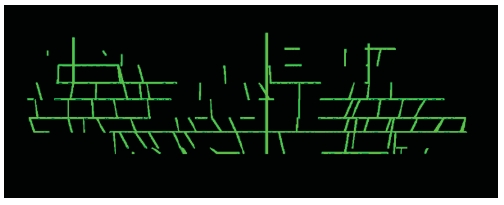

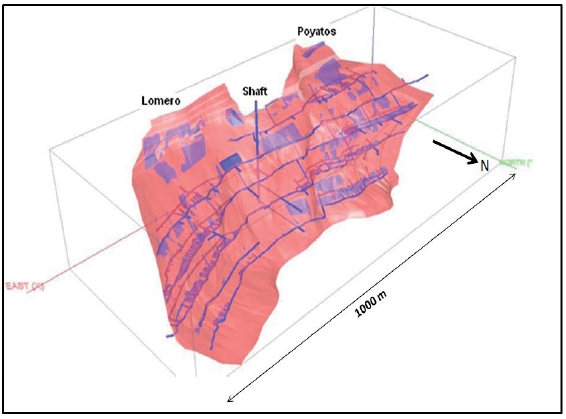

| Figure 7 | Isometric view showing extent of underground workings (Source- Sigiriya, 2009) | 16 |

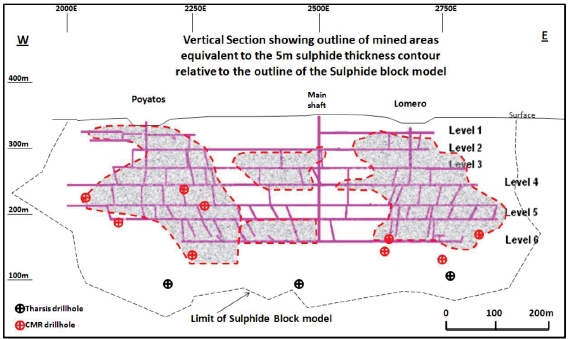

| Figure 8 | Long section showing drill hole intersections and resource boundary | 17 |

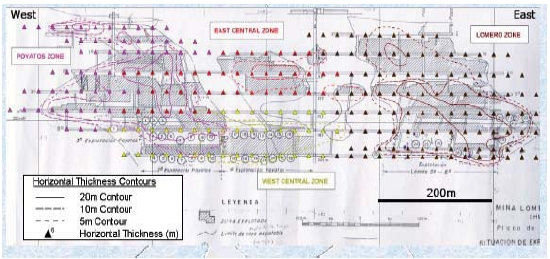

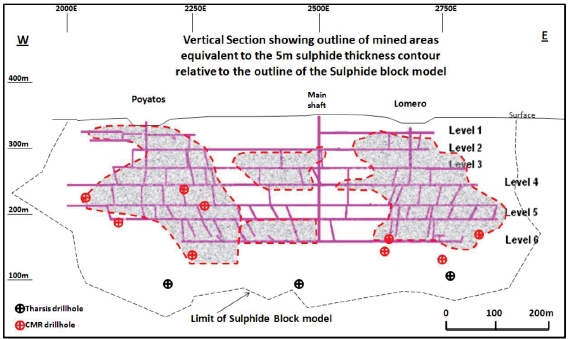

| Figure 9 | Deposit structure and isopachs in vertical section (Source: CMR, 2006) | 17 |

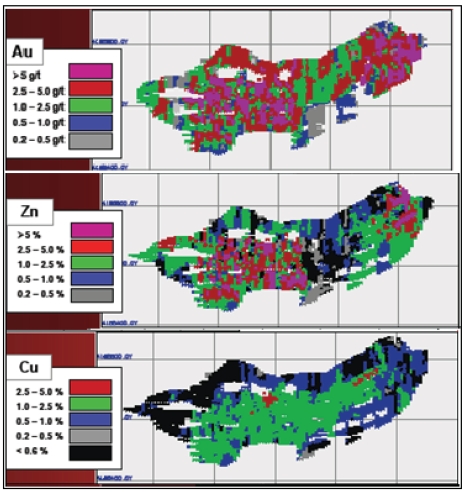

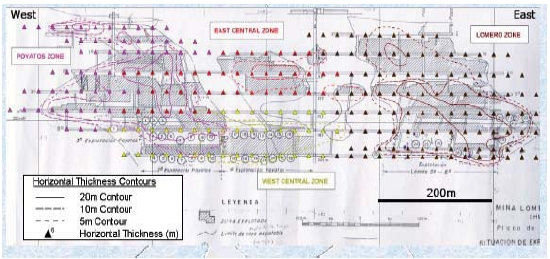

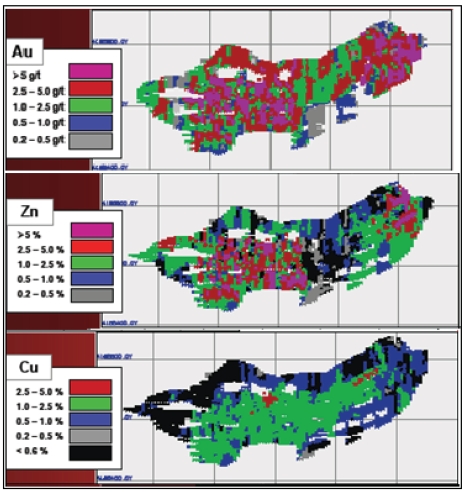

| Figure 10 | Mineral distribution block model for Au-Zn-Cu (Source: CMR, 2006) | 18 |

| Figure 11 | Lomero-Poyatos Stratigraphy and Lithology (Source: CMR, 2006) | 19 |

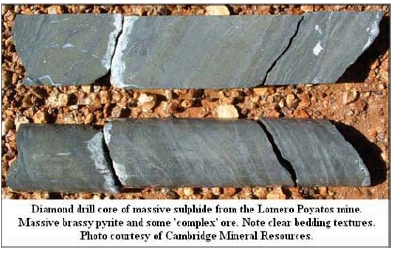

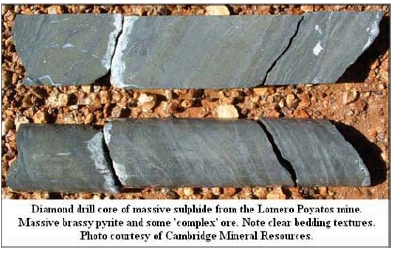

| Figure 12 | Bedded sulphides in drill core (Source: CMR, 2006) | 20 |

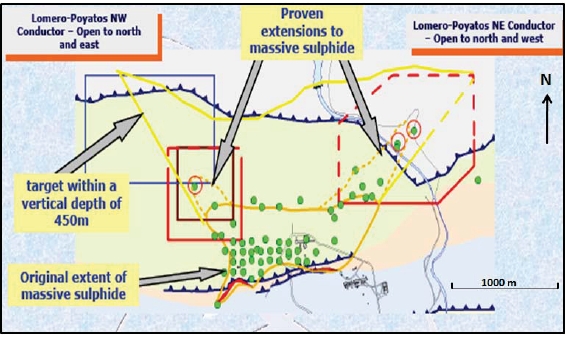

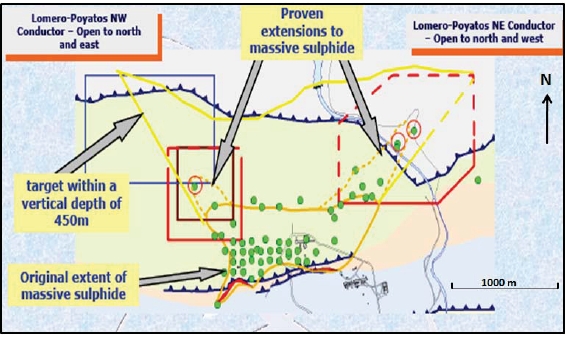

| Figure 13 | Lomero-Poyatos – exploration potential (Source: CMR, 2006) | 20 |

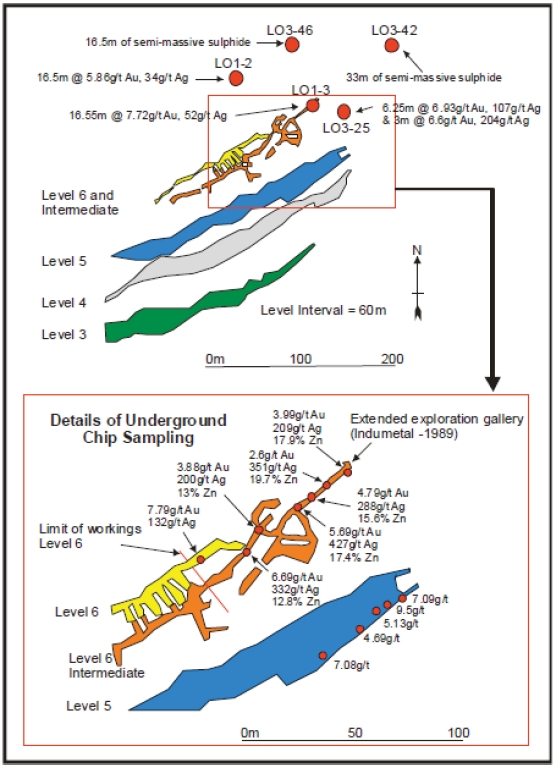

| Figure 14 | Detail of the northeast extension of the Lomero-Poyatos deposit | 22 |

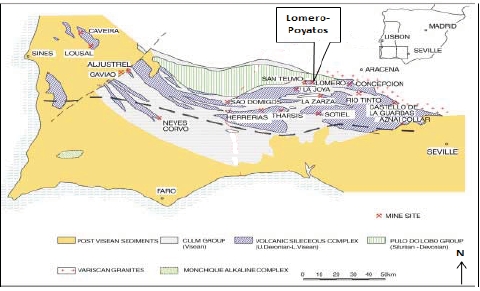

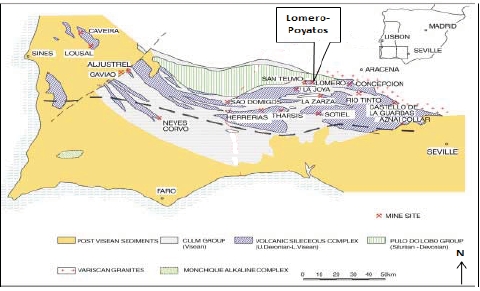

| Figure 15 | Mines in the Iberian pyrite belt | 35 |

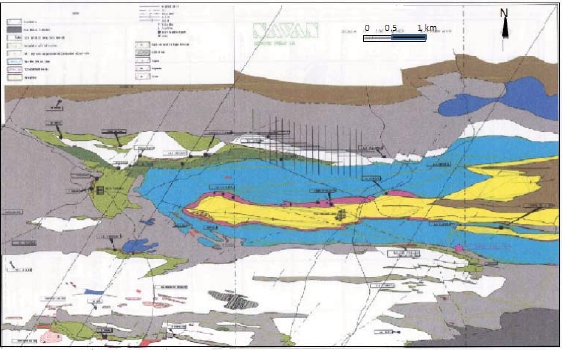

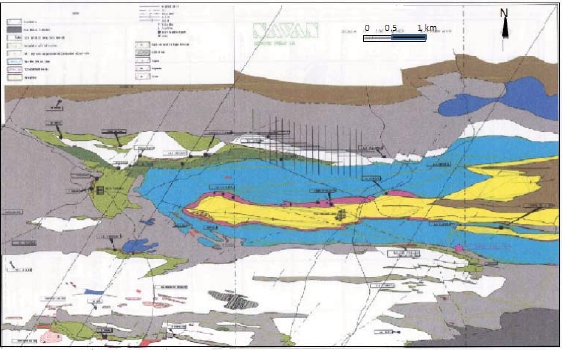

| Figure 16 | Local geology of the Lomero-Poyatos district | 36 |

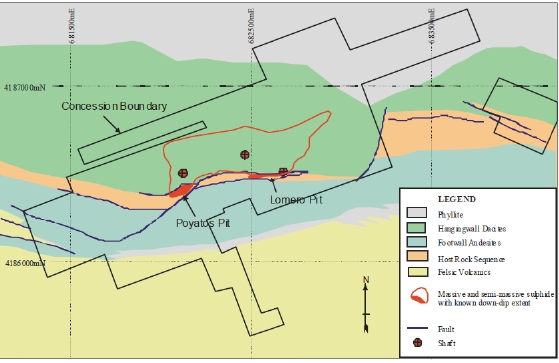

| Figure 17 | Geology of the Lomero-Poyatos mine site (Source: WAI, 2007) | 37 |

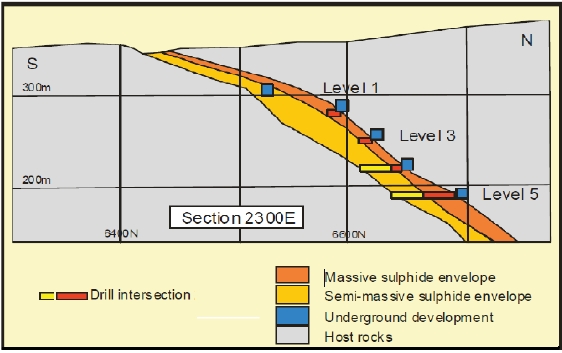

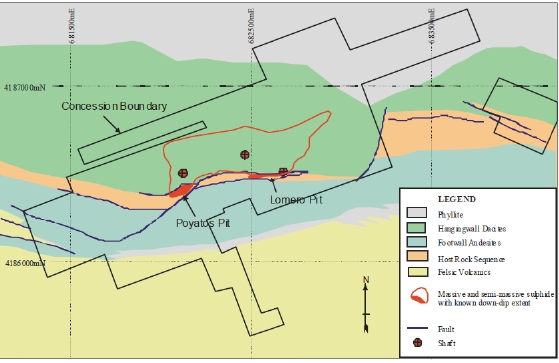

| Figure 18 | Schematic N-S cross-section through the Lomero-Poyatos deposit | 38 |

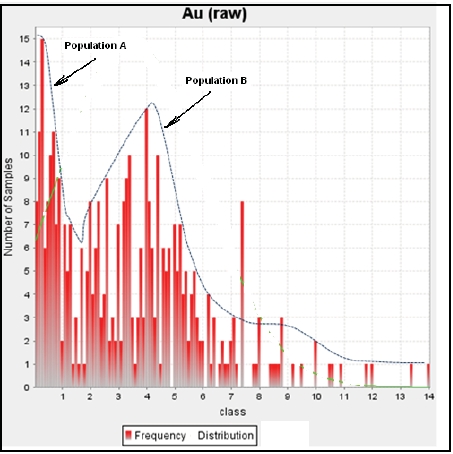

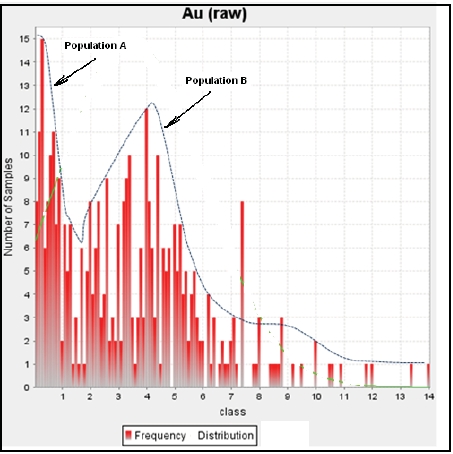

| Figure 19 | Histogram of Gold assay values showing 2 populations (blue line) | 42 |

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

| | |

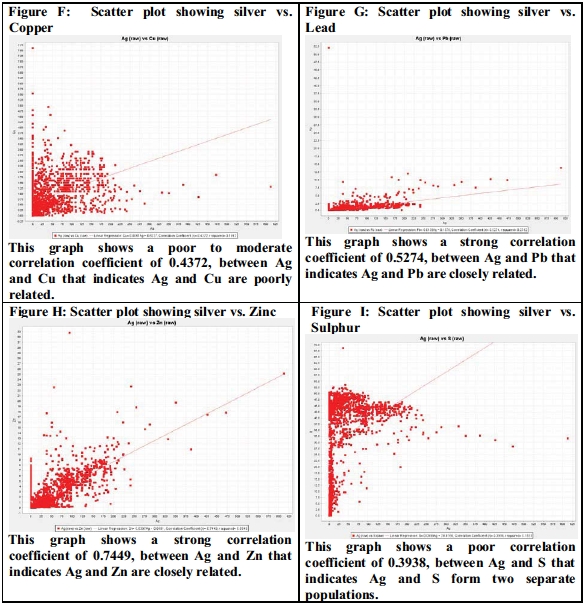

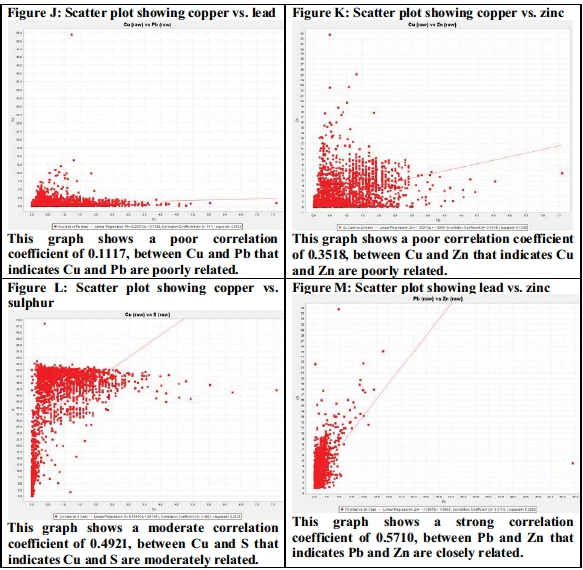

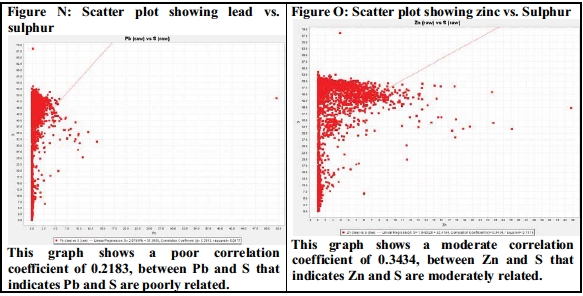

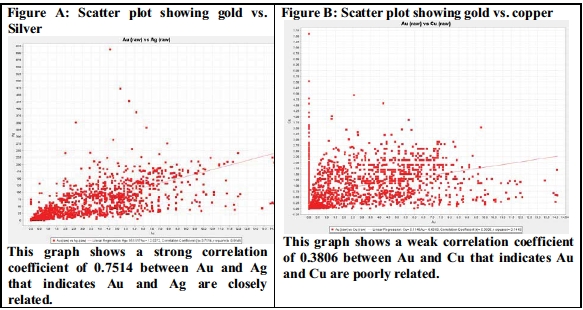

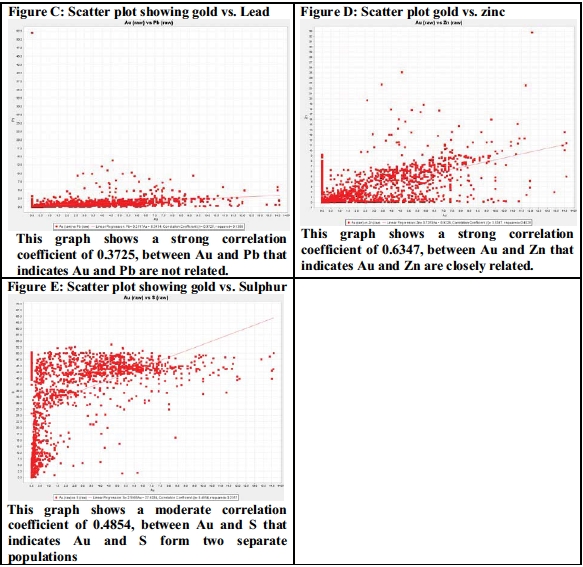

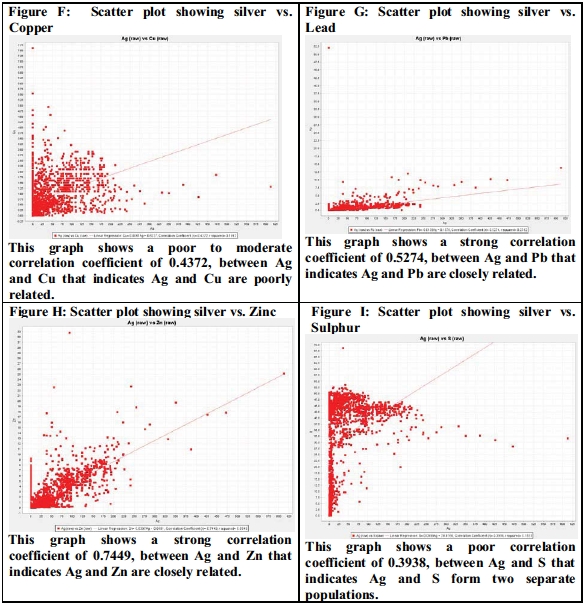

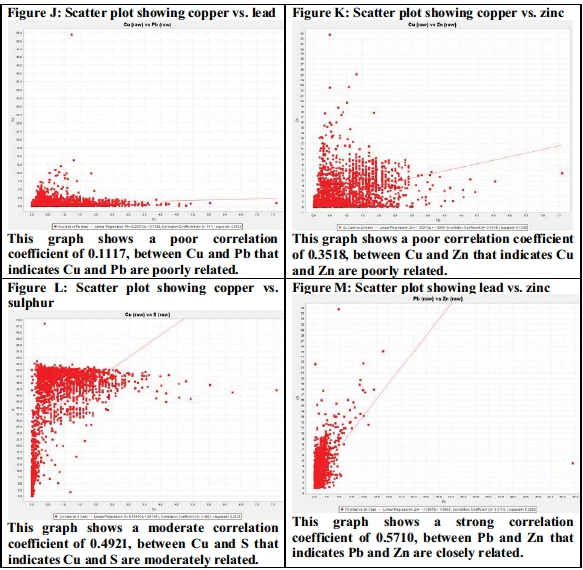

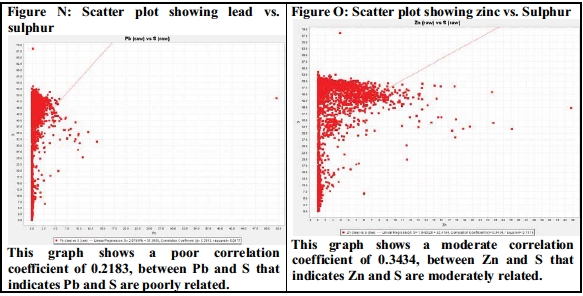

| Figure 20 | Correlation plots of each metal pair assay values | 43 |

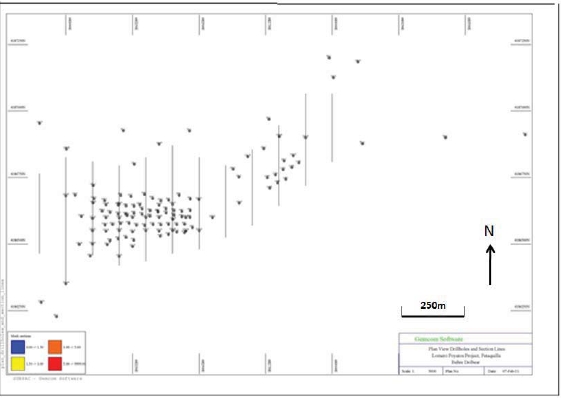

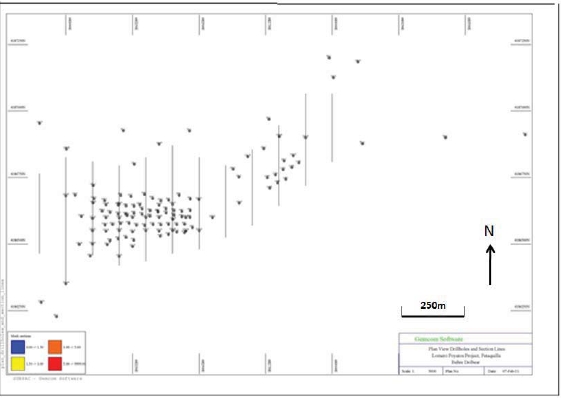

| Figure 21 | Plan view of CMR drillholes and section lines (source: Gemcom, 2011) | 48 |

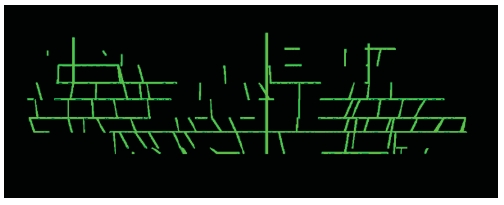

| Figure 22 | Long section showing underground workings (Source: Gemcom, 2010) | 50 |

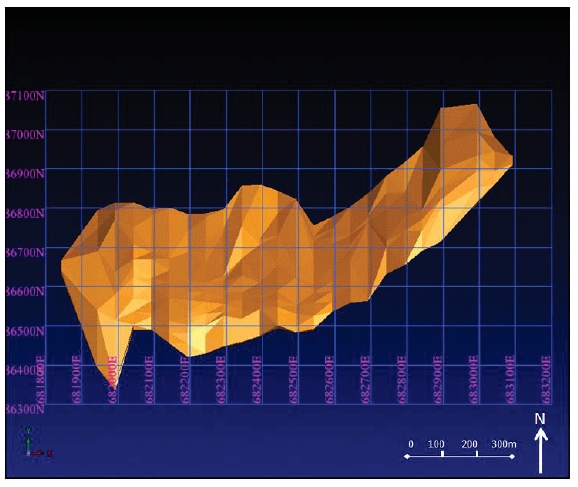

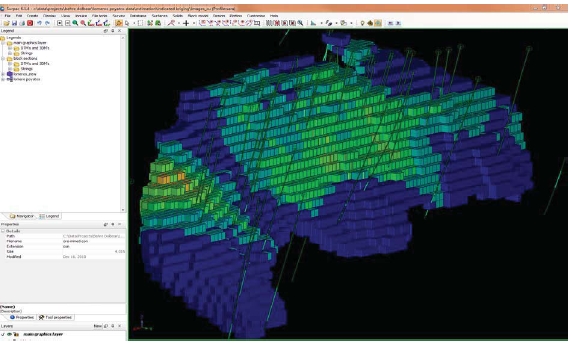

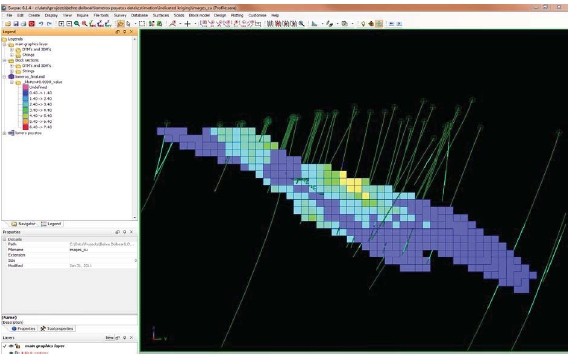

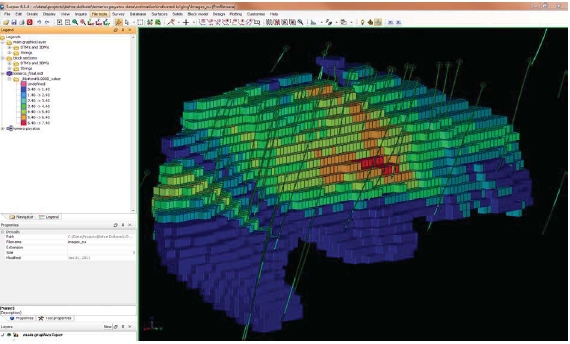

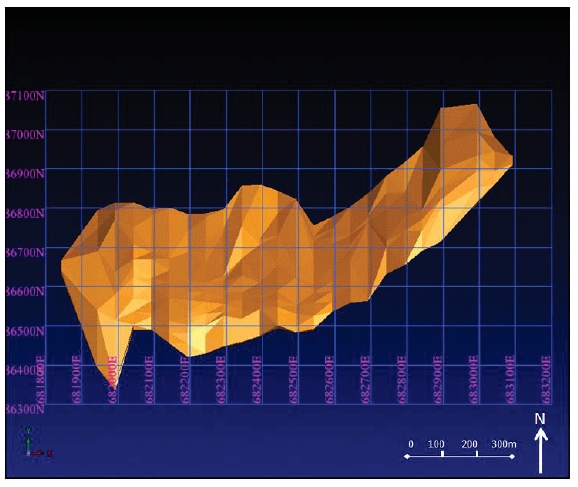

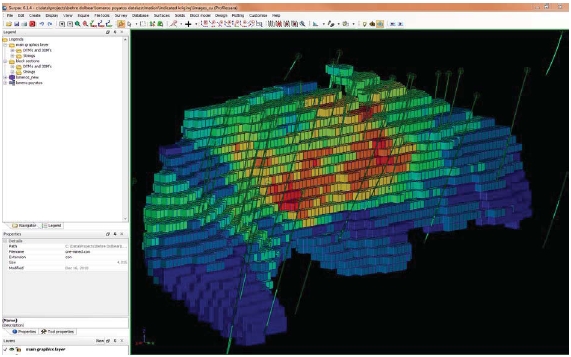

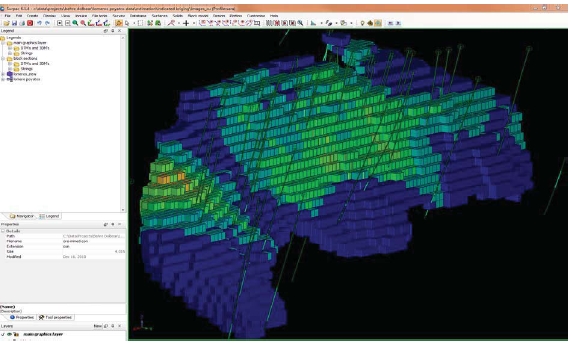

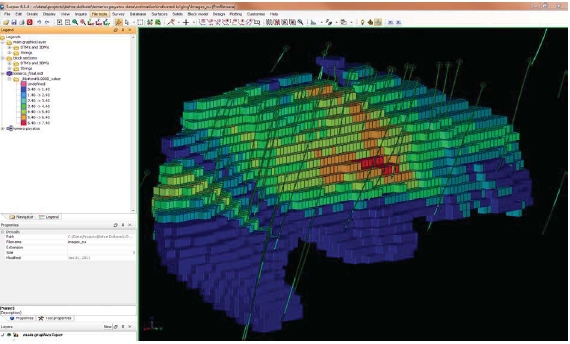

| Figure 23 | Block Model Solid of Lomero-Poyatos deposit at >25% S | 54 |

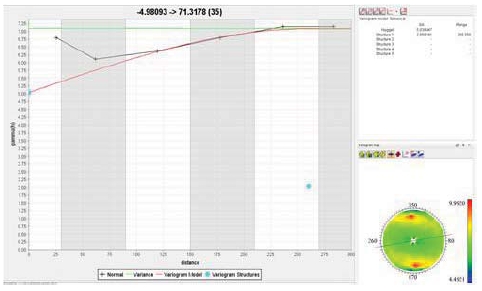

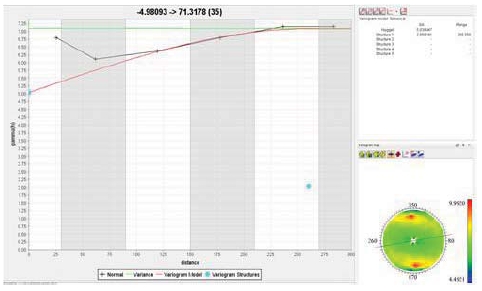

| Figure 24 | Primary Variogram – gold | 56 |

| Figure 25 | Model of Mine Workings | 57 |

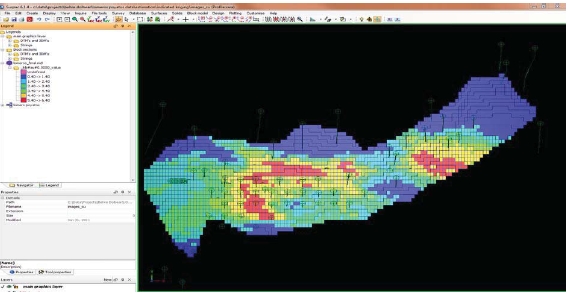

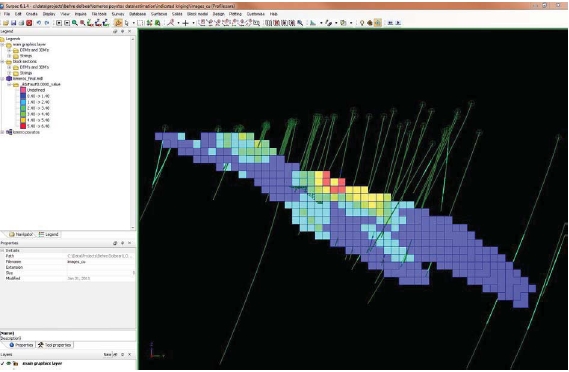

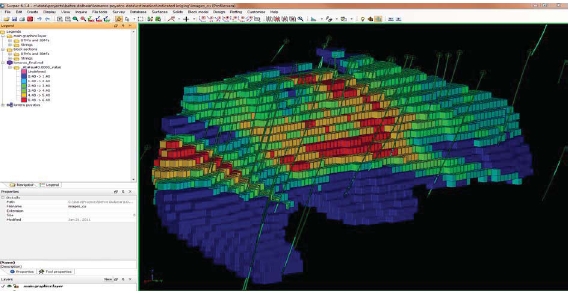

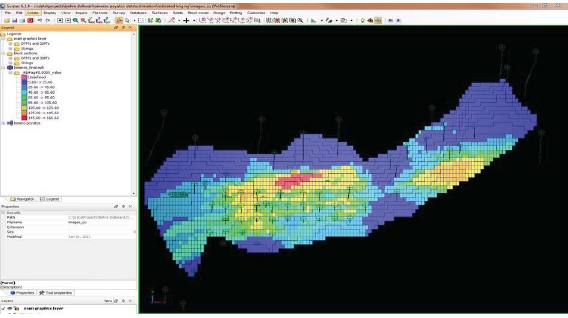

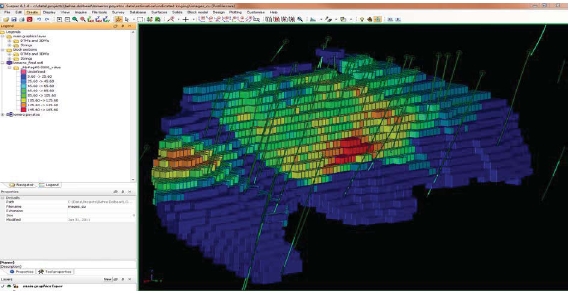

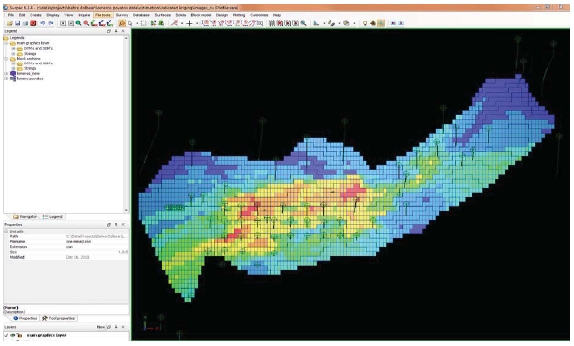

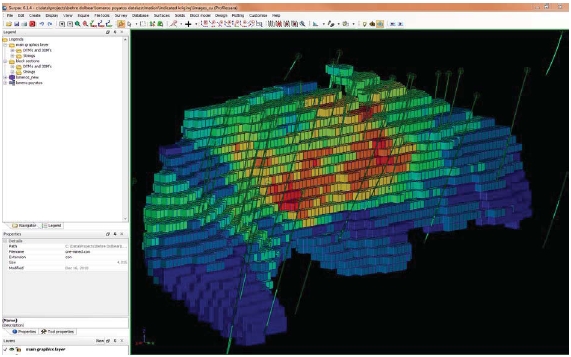

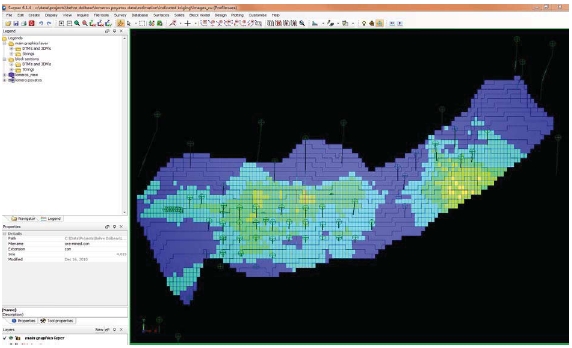

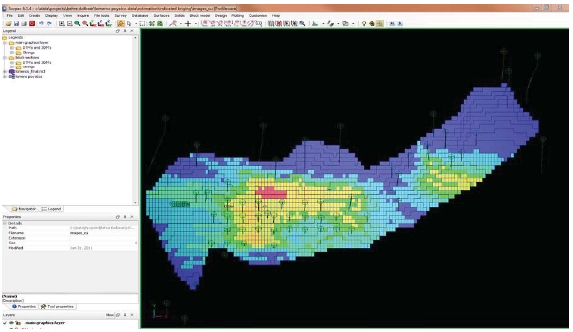

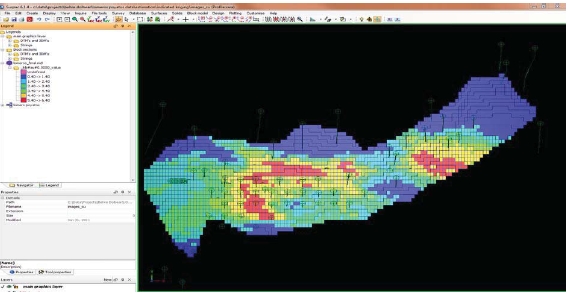

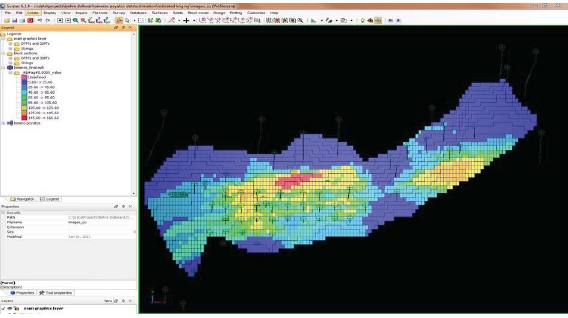

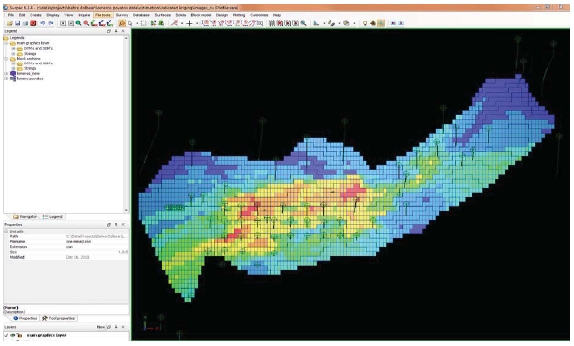

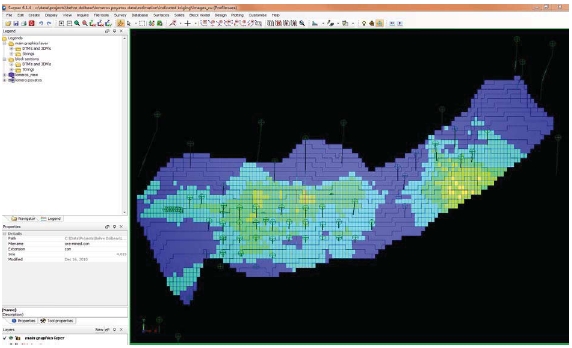

| Figure 26 | Plan view showing Au mineralisation, drill holes and IK estimated block model | 63 |

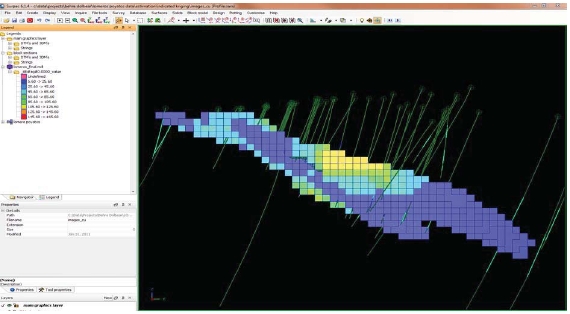

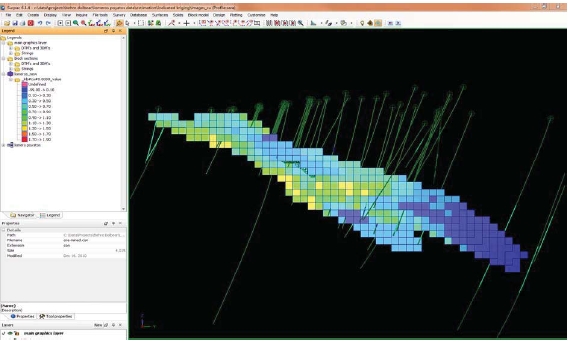

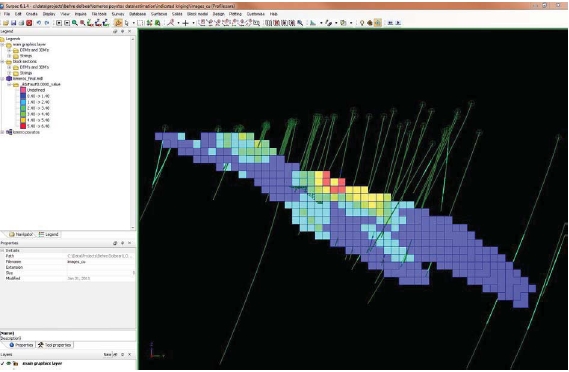

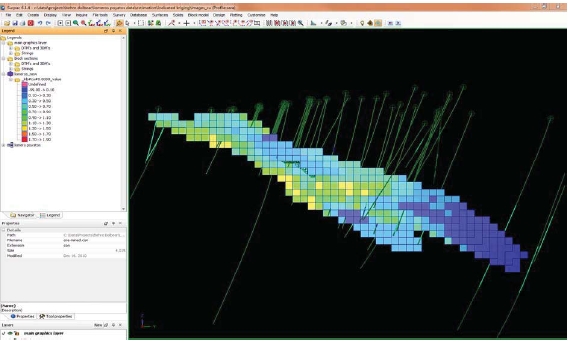

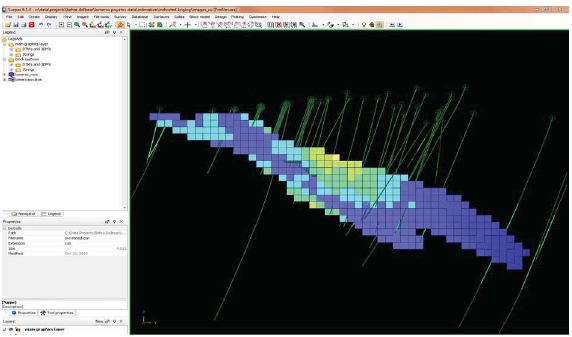

| Figure 27 | Section view showing Au mineralisation at the eastern extremity of the block | 63 |

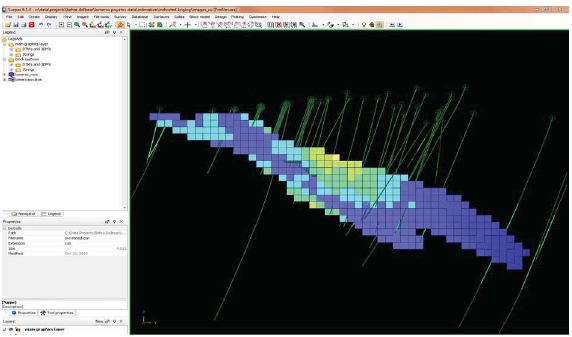

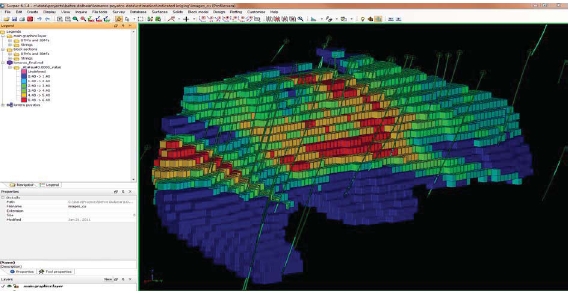

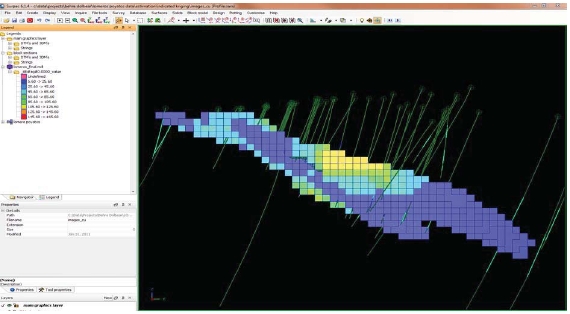

| Figure 28 | Inclined section looking towards the SW showing Au mineralisation | 64 |

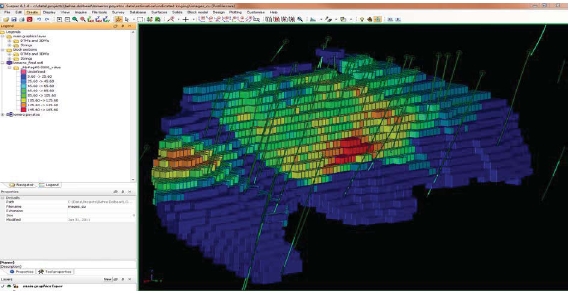

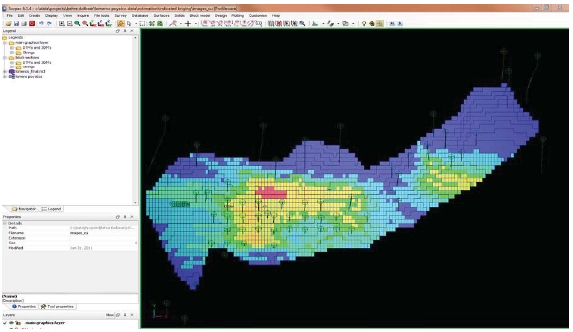

| Figure 29 | Plan view showing Ag mineralisation, drill holes and IK estimated block model | 64 |

| Figure 30 | Section view showing Ag mineralisation at the eastern extremity of the block | 65 |

| Figure 31 | Inclined section looking towards the SW showing Ag mineralisation, drill holes | 65 |

| Figure 32 | Plan view showing Cu mineralisation, drill holes and IK estimated block model | 66 |

| Figure 33 | Section view showing Cu mineralisation at the eastern extremity of the block | 66 |

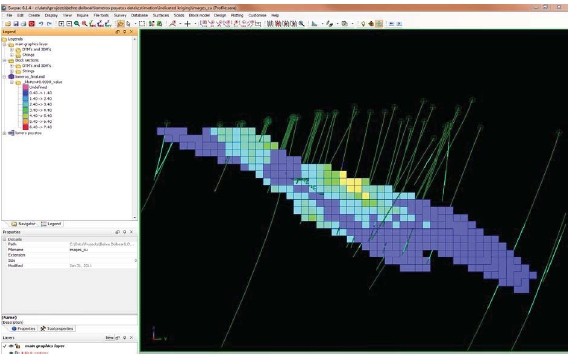

| Figure 34 | Inclined section looking towards the SW showing Cu mineralisation, drill holes | 67 |

| Figure 35 | Plan view showing Pb mineralisation, drill holes and IK estimated block model | 67 |

| Figure 36 | Section view showing Pb mineralisation at the eastern extremity of the block | 68 |

| Figure 37 | Inclined section looking towards the SW showing Pb mineralisation, drill holes | 68 |

| Figure 38 | Plan view showing Zn mineralisation, drill holes and IK estimated block model | 69 |

| Figure 39 | Section view showing Zn mineralisation at the eastern extremity of the block | 69 |

| Figure 40 | Inclined section looking towards the SW showing Zn mineralisation, drill holes | 70 |

| | |

| J11 - 132 | iii | BEHRE DOLBEAR |

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

1.0 SUMMARY

Behre Dolbear International Limited (Behre Dolbear) was commissioned by Corporacion Recursos Iberia SL (“CRI”) to review the Lomero-Poyatos Mine project in southwest Spain and prepare this report in compliance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Behre Dolbear understands that this technical report is to be used by CRI in connection with a contemplated transaction with Petaquilla Minerals Ltd.

The Behre Dolbear team visiting the project comprised Mr. Richard Fletcher, M.Sc, FAusIMM, MIMMM, C. Eng, C.Geol, a Qualified Person for geological reviews and mineral resource estimation. The Report has been reviewed by Mr. Denis Acheson, B.Sc. Eng, MMMSA, as Project Manager. Mr. Fletcher accepts responsibility for all Sections of this report.

CRI acquired an interest in the historic Lomero-Poyatos Mine from the previous owner Recursos Metalicos SL (RMSL) and commissioned Behre Dolbear to prepare a preliminary geological model and Mineral Resource Estimate of the Lomero-Poyatos deposit based on available historical data. It is this work that forms the basis for this NI43-101 Report. Much of the historical data, including most of the drill-hole data, was generated by Cambridge Mineral Resources plc (CMR), a company that previously owned the property during the period 2001- 2007.

The Lomero-Poyatos mine produced about 2.6 Mt of pyrite ore, mostly by underground mining methods, for use as sulphuric acid feedstock, but has been closed for about 20 years. The site consists of a sealed vertical shaft and headgear that would need refurbishing, the Lomero open-pit mine to the east of the shaft and the Poyatos open-pit mine to the west of the shaft. It is likely that a Unified Environmental Authorisation (Autorización Ambiental Unificada - AAU) would be required prior to any significant re-development of the mine site.

The Lomero-Poyatos mine is located at 37°48’N / 6°56’W in Huelva Province of the Autonomous Community of Andalucía in Southern Spain, about 500 km south of Madrid, 85 km north-west of Seville and 60 km north-east of the port of Huelva.

In June 2001, the Provincial Government in Spain granted a consolidation of the 13 Operating Concessions totalling about 175 ha. at Lomero-Poyatos, offering a long term (60 years) security to any future development plans. CRI acquired the Lomero-Poyatos Concessions in a public offering in April 2010. Behre Dolbear has not carried out any legal due diligence on the validity, legality, ownership or constraints of the Lomero-Poyatos mineral Concessions or any agreements with related or third parties. Behre Dolbear has assumed that the process of establishing the exploitation rights and a Mining Permit does not affect the likely viability of the mineral assets nor the estimation and classification of the Mineral Resources as reported herein.

| |

| 1.4 | GEOLOGY AND MINERALIZATION |

The Lomero-Poyatos mine is located in the north-east part of the Spanish/Portuguese (Iberian) pyrite belt which extends about 230 km between Seville in the east (in southern Spain) and the Atlantic coast near Lisbon in the west (in Portugal). Lomero-Poyatos is a poly-metallic, massive-sulphide deposit that is located on the northern limb of the San Telmo anticline, which is an E-W trending fold structure adjacent to a major thrust fault. The deposit has an ENE (075°) strike and dips about 35°N.

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

At the surface there are two separate orebodies - Lomero (east) and Poyatos (west) - that combine at depth to form a single deposit 900 m in strike length. The average thickness of massive sulphide, based on drill-hole intersections, is about 7.5m, although the maximum thickness of massive sulphide exceeds 20m. The mineralisation is known to extend at least 500m down dip.

The mineral assemblage consists of pyrite, tenantite, sphalerite, galena, chalcopyrite, minor arsenopyrite, barite, pyrrhotite and gold. There are some hematite-magnetite-rich bands.

CRI, the present owner of the Lomero-Poyatos mine, has not carried out any exploration of the property. All the available data is derived from the work carried out by the previous owners, particularly CMR. Exploration during CMR’s tenure included about 10,000m of drilling, 1,100m of trenching, detailed geological studies, metallurgical test work, resource evaluation and electromagnetic and gravity surveys. Resource modelling and assessment ranged from high-tonnage/low-grade open-pit development to high-grade/lower tonnage underground mining development options.

The Lomero-Poyatos deposit is still at the exploration stage and the mineral resource estimate is based on relatively wide-spaced drilling. Therefore, the mineral resource is categorised as an Inferred Mineral Resource. However, as stressed in this Independent Technical Report, resources that are not ore reserves do not have demonstrated economic viability and an Inferred Mineral Resources may not be upgraded to an Indicated or Measured Mineral Resource as a result of continued exploration. Until these Inferred Mineral Resources are upgraded to at least Indicated Mineral Resource category, the Inferred Mineral Resource estimate should not be included as part of any economic appraisal for NI 43-101 reporting purposes.

Recent (April, 2011) work carried out at the University of Madrid showed that the deposit contains at least three different ore types as follows:

Cupriferous Ore typically assaying 1.0% to 1.5% Cu with gold credits but with no Pb,Zn or Ag.

Arsenic/Pyrite Ore containing gold credits only.

Massive sulphide Ore containing all three base-metals, with silver associated withlead and gold associated with sulphides, and some free gold.

Consequently, these three different ore types may require at least three different processing flow-sheets.

| |

| 1.7 | DEVELOPMENT AND OPERATIONS |

The approximate size of the Lomero-Poyatos deposit, based mainly on the CMR drill-hole data, has been estimated by three independent consultants in the past nine years. The results are summarised below as two separate scenarios, namely open-pit and underground.

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

Open-pit Scenario:

SRK (2002) Inferred Mineral Resource:at a €50 value cut-off = 20.6 Mt at 3.1 g/tAu, 69.9 g/t Ag, 3.3% Zn, 1.2% Cu, 1.2% Pb. Containing 2.1 Moz Au.

Gemcom (2010) Inferred Mineral Resource:at 1 g/t Au cut-off grade = 20.9 Mt at3.08 g/t Au, 62.38 g/t Ag, 2.5% Zn, 0.7% Cu, 0.7% Pb. Containing 2.07 Moz Au.

This scenario does not look practical due to the great depth (>250 m) and the huge waste:ore ratio (>50:1) involved in open-pit mining below the existing underground workings.

Underground Scenario:

SRK (2002) Indicated Mineral Resource:at €70 value cut-off = 1.85 Mt at 3.4 g/tAu, 52 g/t Ag, 0.8% Cu, 1.4% Pb, 2.3% Zn. Containing 0.203 Moz Au.

WAl (2006) Indicated Mineral Resource:at 1.5 g/t Au cut-off = 3.71 Mt at 3.26 g/tAu, 27.9 g/t Ag, 0.87% Cu, 1.16% Pb, 1.57% Zn. Containing 0.39 Moz Au.

Gemcom (2011) Inferred Mineral Resource:at 1 g/t Au cut-off = 6.07 Mt at 4.25g/t Au, 88.74 g/t Ag. Containing 0.83 Moz Au.

| |

| 1.8 | THE QUALIFIED PERSON’S CONCLUSIONS AND RECOMMENDATIONS |

It is Behre Dolbear’s opinion that:

As a consequence of the mineral diversity, the geological and mineralogical domains need to be defined so as to provide separate tonnage and grade estimates for each of the ore types. Carefully selected and representative metallurgical samples need to be extracted from each of these ore type domains for metallurgical testing. In addition, further validation of the nature and distribution of the Au, Ag, Cu, Pb, Zn mineralisation is required, in order that the Inferred Mineral Resources can be upgraded.

The Mineral Resource estimates were based on assumptions made about the specific gravity of the main mineralised rock types and it is strongly recommended that studies of the specific gravity be undertaken to enable the Inferred Mineral Resources to be upgraded to Indicated and Measured Mineral Resource categories.

Behre Dolbear carried out a preliminary valuation of the Lomero-poyatos deposit based on; published average global stock market valuations per ounce of in-situ gold resources; and value from a comparable acquisition transaction. Taking the average of these two estimates, assuming equal weightings for each, Behre Dolbear conclude that an appropriate current value for the Lomero-Poyatos project is$53.5 million.

It is recommended that additional drilling (totalling 20,000m) be carried out, including some duplicate drill-holes, twinning selected surveyed historical holes, in order to cross-correlate the historical data with confirmatory data and some additional drill-holes to better define the physical extent of the solid at depth and along strike.

It is proposed to achieve this in two stages: as a Stage 1 drilling programme and scoping study at an estimated cost of €6 million; and a Stage 2 pre-feasibility study with further drilling and test-work at an estimated cost of €7 million.

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

2.0 INTRODUCTION

This Independent Technical Report (ITR) has been prepared for Corporacion Recursos Iberia SL (CRI), a wholly-owned affiliate of Vancouver based Iberian Resources Corp (IRC), a company recently incorporated under the laws of the Province of British Columbia, Canada; and Petaquilla Minerals Ltd. (“PML”), a company incorporated under the laws of the Province of British Columbia, Canada.

| |

| 2.1 | THE PURPOSE OF THE ITR |

CRI has acquired an interest in the historic Lomero-Poyatos mine from the previous owner Recursos Metalicos SL (RMSL), whose assets included a 100% interest in the mine that lies within a granted mining licence, with 30 years left to run. This ITR has been commissioned in relation to an interest by PML in acquiring IRC. PML is not currently part of the IRC/CRI corporate structure although 5 of its Directors and Officers are shareholders of IRC.

The Behre Dolbear team visiting the project comprised Mr. Richard Fletcher, M.Sc, FAusIMM, MIMMM, C. Eng, C.Geol, a Qualified Person for geological reviews and mineral resource estimation. This Report has been reviewed by Mr. Denis Acheson, B.Sc. Eng, MMMSA, as Project Manager.Mr. Fletcher accepts responsibility for all Sections of this report.

Behre Dolbear is acting in an independent capacity as a consultant to CRI and is receiving a pre-negotiated fee for its services. Neither Behre Dolbear nor any professional working on this assignment has any ownership interest, financial interest, or any other pecuniary interest in CRI, IRC or PML, or the Lomero-Poyatos project.

| |

| 2.2 | THE SOURCES OF INFORMATION AND DATA |

CRI commissioned Behre Dolbear International Ltd, to prepare a preliminary geological model and Mineral Resource Estimate of the Lomero-Poyatos deposit based on available historical data and it is this work that forms the basis for this NI43-101 Report. Much of the historical data, including most of the drill-hole data, was generated by Cambridge Mineral Resources plc, a company that previously owned the property during the period 2001 to 2007.

| |

| 2.3 | THE SCOPE OF THE PERSONAL INSPECTION ON THE PROPERTY |

Behre Dolbear carried out a site visit to the Lomero-Poyatos mine on the 8th-9th January 2011. The site visit team comprised Richard Fletcher (geologist), Wayne Taylor (mining engineer) and Susan Struthers (environmental) from Behre Dolbear; and Oriol Prósper Cardoso (legal) and Juan Leon Coullaut (mining CRN) representing Petaquilla. Richard Fifer (Chairman of PML) and several local dignitaries met the Behre Dolbear team on site and gave a brief summary of the project’s aims and objectives.

The Lomero-Poyatos mine has been inactive for about 20 years. The site consists of: a sealed vertical shaft and headgear that would need refurbishing; the Lomero open-pit mine to the east of the shaft; and the Poyatos open-pit mine to the west of the shaft. These are illustrated in the photographs included under Item 7 of this report.

The site visit coincided with a period of heavy rain that had flooded the open pits and made the ground conditions very slippery, so that it was not possible to examine the exposures in the lower parts of the pits.

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

Petaquilla’s consultant, Juan Leon Coullart, explained the general geology and history of the mine and showed some plans and sections of the drilling results and the historical underground workings. He also pointed out several of the drill sites and drill-hole collars from the Cambridge Mineral Resources drilling programme.

The Lomero pit is about 100m in length, about 40m wide and about 20m deep. It has been partially filled with mine waste at the western end and domestic refuse at the eastern end. The Poyatos pit is about 150m in length about 70m in width and about 20m deep. These two pits were worked by two separate companies prior to 1910 when they were merged into a single underground operation.

The massive sulphide body is visible in the deeper parts of the pits where it appears to be about 5m thick dipping at about 40 degrees to the north. The hanging wall consists of massive competent volcanic rock and the footwall consists of intensely sheared phyllite (clay, mica and talc) that merges downwards into more competent volcanic rock that contains significant amounts of disseminated sulphide minerals (mostly pyrite).

At the surface, the rocks are weathered and the sulphides are converted to hematite and limonite. The surface “gossan” extends to a depth of less than 5m and Juan Leon Coullaut advised that there was some evidence that the surface “gossan” zone had been worked for gold in Roman times but that virtually all archaeological remains had been destroyed by the open-pit mining.

The impression gained from the open pits was that the sulphide mineralisation occurred as separate lenses in the two pits with the mineralisation being thin or absent in the area between the pits. This appears to be reflected in the distribution of the stoped-out areas in the underground workings.

3.0 RELIANCE ON OTHER EXPERTS

Behre Dolbear’s review of the Lomero-Poyatos mine in Spain was conducted on a reasonableness basis and Behre Dolbear has noted herein where such provided information stemming from the review has raised questions. Except where noted, Behre Dolbear has relied upon the information provided by CRI and CRI’s Consultants as being accurate, reliable and suitable for use in this assessment. Behre Dolbear retains the right to modify its conclusions if new or undisclosed information is provided. Electronic mail copies of this report are not official unless authenticated and signed by Behre Dolbear and are not to be modified in any manner without Behre Dolbear’s written consent.

Behre Dolbear has not carried out any legal due diligence on the validity, legality, ownership or constraints of the Lomero-Poyatos mineral concessions or any agreements with related or third parties.

In consideration of all legal aspects relating to the Lomero-Poyatos project, Behre Dolbear has placed reliance on the representations by CRI’s legal advisor Oriol Prósper Cardoso in Madrid that, as of June 2011, the legal ownership of most of the land required for mining operations and the physical assets thereon, are secure. Behre Dolbear understands that exploitation rights and a Mining Permit are still in the process of review by the Junta de Andalucía and accepts the probability that these will be granted during 2011 and that access to required adjacent lands held by third parties, but required for certain operations, including tailings disposal, may then be facilitated by the regulatory process if private negotiations fail.

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

Behre Dolbear has assumed that the process of establishing the exploitation rights and the Mining Permit does not affect the likely viability of the mineral assets nor the estimation and classification of the Mineral Resources as reported herein.

| |

| 3.2 | PREVIOUS STUDIES AND REPORTS |

The Lomero-Poyatos Mine has been the subject of various technical studies by its previous owners.This work included an independent due diligence and verification by international consultants SRK, appointed by Cambridge Mineral Resources plc, covering geology, drilling, mineral resources and reserves, mining, processing and project economics. The 2002 SRK reports were prepared by “qualified persons” as defined by NI43-101 under the supervision of Mr R.A. (Dick) Watts, their Principal Mining Engineer. The 2006 CMR resource model was developed by Colin Andrew and Bill Sheppard, who would be “Qualified Persons” under the definitions of NI43-101.

Behre Dolbear has also been advised by mining experts from the University of Madrid, particularly Angel Rodrigues-Avello Sanz and Jose Antonio Botin Gonzalez, concerning the history of ownership, geology, mining and processing at Lomero-Poyatos.

Behre Dolbear commissioned Gemcom Software Europe Ltd to prepare a new computer generated block model and mineral resource estimate of the Lomerio-Poyatos deposit based on available historical drill-hole data.

This report, authored by Behre Dolbear, is largely based on these data contributions.

4.0 PROPERTY DESCRIPTION AND LOCATION

In Spain, the right to exploit a mine is granted by the Autonomous Community by means of a Concession. The Lomero-Poyatos Concession(s) were formerly owned and operated by Piritas de Huelva s.a.l, and in 1985 they were transferred to San Telmo Ibérica Minera S.A. (in receivership).

In June 2001, the Provincial Government in Spain granted a consolidation of the Lomrero-Poyatos Concessions, offering a long-term (60 years) security to any future development plans (SRK, 2002).

In May 2010, the Lomero-Poyatos Concession(s) were transferred to CRI.

The Lomero-Poyatos mine is located at 37°48’N / 6°56’W in Huelva Province of the Autonomous Community of Andalucía in Southern Spain, about 500 km south of Madrid, 85 km north-west of Seville and 60 km north-east of the port of Huelva.

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

| |

| Figure 1 | Location map of the Lomero-Poyatos mine |

The mine workings area located at UTM coordinates:

Lomero pit (east of the main shaft) 682.52/4186.25

Poyatos pit (west of the main shaft) 682.08/4186.26

Adjacent to road H-120 (Cabezas Rubias- N-435) pk.85, 4.4 km east of San Telmo.

| |

| 4.3 | THE TYPE OF MINERAL TENURE |

In Spain, there are typically three different types of mineral tenure:

Exploration Permits (Art. 40.2 Mining Law) granted for a period of 1 year, and whichmay be extended for a maximum of one more year.

Research Permits (Art. 45 Mining Law) granted for the period requested which maynot be more than 3 years, and which may be extended for a further 3 years.

Operating Concessions (Art. 62 Mining Law) also referred to as a Mining Permit,granted for a 30-year period, and which may be extended for equal periods up to amaximum of 90 years.

Lomero-Poyatos already has an Operating Concession (mining permit) and it is necessary to demonstrate actual work being performed in order to retain this. CRI proposes to accomplish this by a diamond drilling programme and further mining (effectively bulk sampling) initially at a rate of 100 tonnes per day over the next 3 years. A new decline ramp is proposed for this purpose. These proposals are presented in a document called a design feasibility study that is being prepared by Madrid University personnel. This document is also required by the Andalusian authorities to facilitate transfer of the property title to CRI.

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

In Spain, the right to exploit a mine is granted by the Autonomous Community by means of a Concession. The Lomero-Poyatos concession(s) were formerly owned and operated by Piritas de Huelva s.a.l, and in 1985 they were transferred to San Telmo Ibérica Minera S.A. (in receivership). The concessions were granted prior to the current Mining Act (1973) and were consolidated on May 2001 and are valid until August 2033.

CRI acquired the Lomero-Poyatos Concession(s) from the Spanish authorities through a public auction bid in April 2010. CRI did not obtain the surface rights at that time but acquired the surface rights to Finca Lomero at a later date. The Concessions grant the exclusive right to exploit Section C natural resources located beneath its surface. According to Article 3 of Mines Law 22/1973, July 23rd, Section C covers those (metallic) minerals and natural resources not included in Section A (low value construction minerals), section B (mineral water, thermal water, underground structures and others) or Section D ( radioactive minerals, geothermal resources, bituminous rocks and other energy minerals or geological resources).

The Concession cumulatively referred to by the name Lomero-Poyatos consists of 13 mining concessions covering a total of 175.6 ha, as follows:

| |

| Table 1 | Lomero-Poyatos Mining Concessions |

| | | | | |

| Number of | Nameof | Registration with the | Surface Date | Granted | Valid until |

| concession | concession | Real Estate Registry | area (ha) | | |

| 3,730 | El Lomero | Registry of Valverde, | 4.0 | 22/10/1877 | 13-08-2033 |

| | | plot number 1,364 | | | |

| 12,094 | Ampliación a | Registry of Valverde, | 20.0 | 10/10/1919 | 13-08-2033 |

| | Numancia | plot number 2,338 | | | |

| 6,503 | Segundo | Registry of Valverde, | 20.0 | 17/08/1891 | 13-08-2033 |

| | Lomero | plot number 1,943 | | | |

| 537 | Castilla | Registry of Aracena, | 12.0 | 22/05/1865 | 13-08-2033 |

| | | plot number 148 | | | |

| 506 | Numancia | Registry of Aracena, | 12.0 | 16/05/1865 | 13-08-2033 |

| | | plot number 149 | | | |

| 1,974 | San Miguel | Registry of Aracena, | 8.4 | 06/03/1876 | 13-08-2033 |

| (also 108) | | plot number 525 | | | |

| 12,529 | Ampliación | Registry of Aracena, | 10.0 | 05/04/1921 | 13-08-2033 |

| | Victoria | plot number 2,579 | | | |

| 12,318 | Victoria | Registry of Aracena, | 39.0 | 01/12/1919 | 13-08-2033 |

| | | plot number 2,547 | | | |

| 11,255 | Segunda A | Registry of Aracena, | 6.0 | 04/12/1913 | 13-08-2033 |

| | Castilla | plot number 2,372 | | | |

| 11,420 | Demasía San | Registry of Aracena, | 2.2 | 27/03/1915 | 13-08-2033 |

| | Miguel | plot number 2,417 | | | |

| 11,424 | Segunda | Registry of Aracena, | 14.0 | 27/03/1915 | 13-08-2033 |

| | Numancia | plot number 2,416 | | | |

| 11,232 | Tercer | Registry of Aracena, | 17.0 | 04/09/1913 | 13-08-2033 |

| | Lomero | plot number 2.373 | | | |

| 10,843 | Conchita | Registry of Aracena, | 11.0 | 29/03/1910 | 13-08-2033 |

| | | plot number 2,285 | | | |

| GRUPO LOMERO Y OTRAS | Total area (ha) | 175.6 | | |

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

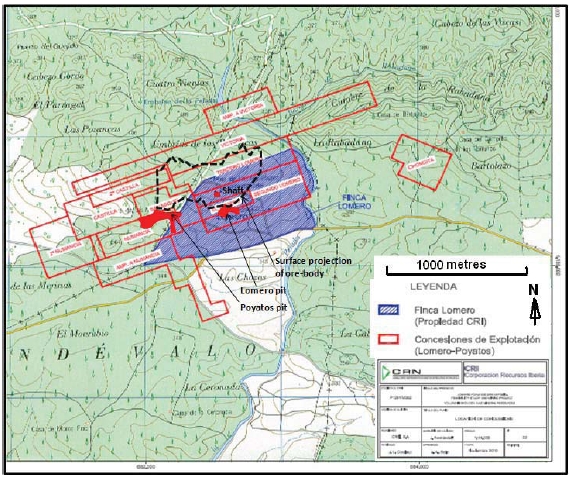

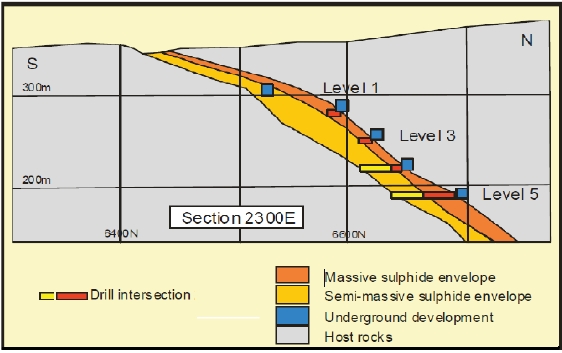

The Mining Concession boundary data was obtained from the Geographic Information System belonging to the Junta de Andalucia and have not been verified on the ground. The Concession boundaries are shown relative to the known mineral deposits, mineral resources and mining assets on figures 2 and 3 below.

Surface Rights

Corporación Recursos Iberia S.L. has acquired the rustic estate "Finca Lomero" in the Register of Valverde del Camino under number 2,697 duplicate (Area 1, Page ½), that extends over 57 hectares and 52 areas in the municipality of El Cerro de Andevalo,

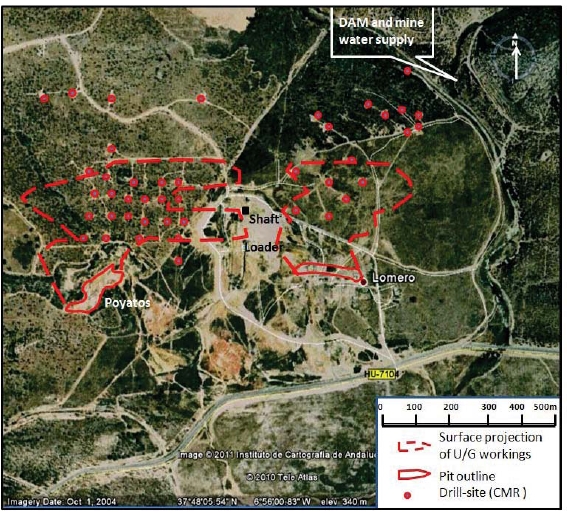

The location of all known mineralized zones and the main mining and infrastructure assets are shown in figures 2 and 3.

| |

| Figure 2 | Location map showing mineral concessions (Red) and surface rights (blue) |

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

| |

| Figure 3 | Satellite image showing location of mineral assets at Lomero-Poyatos |

While the current ‘operating concession’ allows and requires the conduct of mining at the Lomero-Poyatos site, there will almost certainly be a need to demonstrate that the environmental impacts of this work have been assessed and mitigation methods defined.

It is therefore recommended that a study is undertaken to determine the environmental impacts of both the proposed drilling and development of the underground access ramp, dewatering and small scale mining. This should include a plan of how the water from the underground workings is to be treated and either stored or released. Such a report will be a strong indication to the authorities that this project takes environmental responsibilities seriously and is prepared to be proactive in this regard.

In the longer term (18 to 24 months), a Unified Environmental Authorisation (Autorización Ambiental Unificada - AAU) will almost certainly be required prior to any significant development of the mine site. The AAU consolidates all of the required environmental and land-use permits and applications into one document, including, but not limited to:

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

Noise emissions;

Production of waste products;

Soil use;

Forestry authorisations and fire prevention;

Protection of natural species both flora and fauna; and

Final restoration plan.

The overall permitting process of the Junta de Andalucía is co-ordinated by the Ministry of Innovation, Science and Companies together with the Ministry of Environment, including all environmental permits.

The restart of mining operations at the Lomero-Poyatos Mine can only proceed following receipt of various regulatory approvals. The principal regulatory approvals required are:

Approval by the Junta de Andalucía of the transfer of mineral rights to CRI;

Approval of the restart, operating and rehabilitation plans; and

Issue of a Mining Permit.

CRI must submit a request to the Government for authorisation of the transfer of Mineral Rights, (pursuant to the provisions of Articles 95.2, 97.1 and the Second Transitional Provision of the current Mining Act) for the development of the Lomero-Poyatos Mine. This request must be accompanied by supporting documentation, including relevant technical documentation, as well as contracts and title transfer deeds showing that CRI owns the mineral rights including, the registered Lease which incorporates the area of the mine, the facilities and the exclusive rights of operation and beneficiation of minerals from the soil and subsoil.

The necessary steps the CRI needs to complete in order to gain full authorisation for the recommencement of mining activities, include:

Submission of mining project and final restoration plan;

Review by local government authorities and corrections by CRI if required;

Formal departmental reporting, public hearing and processing of the UnifiedEnvironmental Authorisation (AAU);

Review by IGME and CEDEX and modification by CRI if required;

Review by the Provincial Delegado;

AAU-authorised approval of final restoration plan by Provincial Delegado;

Application to Regional Delegado for approval of mining project;

Transfer of Mineral Rights and approval of mining project;

Processing of other authorizations, use of tailings storage facilities, authorisation ofequipment usage, verification of operator permissions, etc;

Authorisation for blasting;

Verification of lodgement of bonds, insurances, etc; and

Commencement of operations.

In order to ensure compliance with the Government regulations and procedures and to expedite the approval of mineral rights, CRI has commissioned a number of leading Spanish consultancies to complete the various studies required in order meet the above requirements. The selection of these Spanish consultancies was based on their professional reputation and historical relationships with various Government authorities.

The process for compulsory acquisition of surface land rights is formal and may, in the best case scenario, take less than 12 months, or in the worst case scenario, up to 2 years to complete. The price

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

to be paid (if there is no agreement) is based on independent valuations, taking into account the tax value and recent transactions. Once the agreed compulsory value has been established, the expropriating party can occupy the lands or rights.

5.0 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTUREAND PHYSIOGRAPHY

| |

| 5.1 | TOPOGRAPHY, ELEVATION AND VEGETATION |

The Lomero-Poyatos area is located at an altitude of 340m and consists of low rolling hills with a topographic relief of about 50m. The area has very thin, stony soils and is largely given over to native scrub-land and planted eucalyptus forests on the hills; and citrus fruits on the slightly better soils in the valleys. The area is sparsely populated with the population concentrated in small villages several kilometres apart.

Australian eucalypts, mostly introduced for paper production, have established themselves in the region as they are fast growing and well adapted to the climatic conditions and are therefore useful for re-vegetation and rehabilitation. However, they are considered a pest species in many instances, as they compete successfully with the native Spanish Oak and Cork Oak that are essential for established rural livelihoods.

| |

| 5.2 | ACCESS TO THE PROPERTY |

The Lomero-Poyatos mine is located at 37°48’N / 6°56’W, about 90 km west of Seville (1.5 hours by car) and about 10 km west of the operating Agua Tenidas mine and about 5 km east of the abandoned San Telmo mine. These are all served by good road access (HU-710 highway). Lomero-Poyatos is 3km northwest of the existing railway line at Valdelamusa (near Agua Tenidas) with an old spur line to San Telmo passing about 750m to the south of Lomero-Poyatos. There are existing electric power lines within 1km of the mine site. The original mine obtained its water supply from a small dam about 1km to the northeast on the stream that drains the eastern side of the mine site. This was not inspected at the time of the site visit due to the poor access and wet ground conditions, so its condition is not known. It is unlikely that it could provide an adequate water supply for a modern mining operation.

The Lomero-Poyatos Mine site is well serviced by paved highways to Seville, Huelva, Aracena and to several surrounding villages which represent potential sources of labour, accommodation and general services. Seville (population 700,000) is the administrative centre of the Autonomous Community of Andalucía. A high-speed train service links the regional towns of Cordoba, Seville and Huelva with the capital Madrid. There are many international flights that connect the provincial cities of Seville and Malaga with Madrid and other major cities in Europe and North America.

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

In 1970, a copper smelter and refinery were built next to the port of Huelva. In 1993 Freeport-McMoRan Copper & Gold Inc acquired Rio Tinto Minera SA and decided to dispose of the mining operation to local interests and concentrate on the metallurgy part of the business (Atlantic Copper S.A) by investing more than €200M (about $260M at current exchange rates) to double Huelva's smelting and refining capacity.

| |

| 5.3 | PROXIMITY TO POPULATION CENTRES |

As noted above, the Lomero-Poyatos mine site is reasonably close to several villages and readily accessible from major urban centres

Due to the geographical location and varied topography, the climate in the Andalucía province is diverse, with a Continental Mediterranean climate in the inland areas and a Mediterranean climate along the coast. The daily temperature ranges from 3ºC in January to 40ºC in July and August. The average annual mean temperature is 18.7ºC and the average annual precipitation is 795 mm.

The Lomero-Poyatos mine is located about 100m north of the HU0170 highway. The site consists of a sealed vertical shaft and headgear, that would need refurbishing, and the Lomero open-pit mine to the east and the Poyatos open-pit mine to the west of the shaft. These are illustrated in the photographs on the following pages.

With high, but short, rainfall periods and currently no storage capacities, there are water shortages in the area, not only for mining but also for agriculture. Two possible water storage areas have been identified for new water reservoirs.

| |

| Figure 4 | Lomero-Poyatos mine shaft |

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

| |

| Figure 5 | Poyatos pit (looking west) note exposed pyrite (grey) in bottom of pit |

| |

| Figure 6 | Lomero pit (looking east) |

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

6.0 HISTORY

Lomero-Poyatosis a former sulphide (pyrite) mine with underground development on eight levels, although they are currently flooded. The deposit was discovered in 1853 by Ernesto Deligny who noticed the distinctive gossan outcrop at Poyatos. Mining commenced in the late 1850’s and continued until 1990. Mining at Lomero-Poyatos was initially by open pit and since 1905 was by underground means.

The first three blocks of six terrace houses in the village of Lomero to the east of the mining operations were built between 1855 and 1867 when the Compagnie des Mines de Cuivre d'Huelva worked the mine. Later, after 1900, when the French “Society of Pyrites de Huelva" increased the workforce at the mine, these houses were divided into about 40 homes without any new construction in order to accommodate more workers. Currently, most are in ruins and only a few are inhabited as weekend homes.

In 1984, Billiton conducted a programme of 60 underground diamond drilling programme horizontally through the crown pillars in order to obtain full intersections of the massive sulphide (MS) and semi-massive sulphide (SMS) ores down to 25% sulphur content.

In 1986, Indumetal, the Bilbao smelting company that treated the roasted pyrite residue from Lomero-Poyatos, expressed interest in delineating the gold reserves and conducted some underground mapping and sampling to assess the base- and precious-metal grades.

In 1989, Outokumpu, in joint venture with Tharsis, drilled several (9) holes from surface to assess the potential at depth beyond the mined areas.

Following closure in 1991, the mine was held in receivership. The licences were acquired by Tethys Iberian Minerals Ltd who undertook some consolidation and valuation work before their acquisition by Cambridge Mineral Resources in 2000. The licenses were valid for 45 years, from 2001.

CMR carried out a major exploration programme, including drilling 49 holes, and commissioned several technical studies on potential mining and processing methods. In 2007, CMR surrendered the property to the government.

Previous Production

A small amount of ore came from the two pits at Lomero (east) and Poyatos (west), but most of the historical production (2.6 million tonnes) came from underground. The mined ore was massive pyrite that was used as a source of sulphur for sulphuric acid production. Mineralization with greater than about 43% sulphur was regarded as ore. Production ceased in 1984 with the final closure of the mine in 1991.

The estimated historical production was at least 2.6 million tonnes of massive sulphide ore grading 5g/t Au, 80g/t Ag, 1.20% Cu, 1.10% Pb and 2.91% Zn from orebodies containing variable, but significant amounts of copper, lead, zinc and silver.

In the 1970’s, the mine produced between 40 Kt and 60 Kt of ore per year and in 1980 produced 40,600 tons averaging 46% S and 0.7% Cu. The gold grades at Lomero-Poyatos, deduced from the sampling and exploration data, are some of the highest known in the Iberian Pyrite Belt.

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

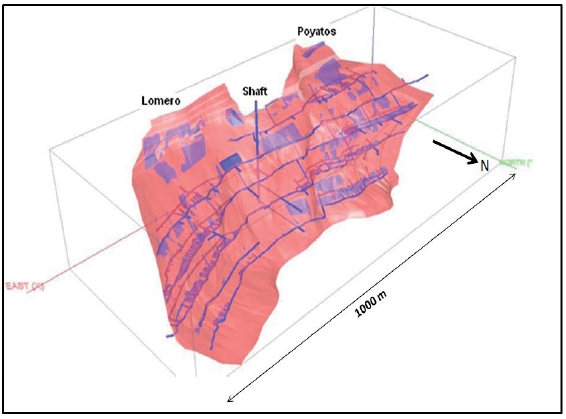

The massive sulphide deposit is tabular, continuous, and dips at moderate angles to the north. There are two zones, Lomero and Poyatos, where historical mining was concentrated, separated by a thinner central zone. In the eastern part of the deposit, the strike of the mineralization turns to the east-northeast and the massive sulphide thins out on the mine level plans.

| |

| Figure 7 | Isometric view showing extent of underground workings (Source- Sigiriya, 2009) |

The early open-pit mining proceeded to a depth of approximately 25m, whilst below the pits, three different underground mining methods were applied depending on the geometry of the deposit (flattening in the lower levels), the brittle characteristics of the ore, and the poor condition of the hanging wall contact.

Down to Level 3, an ascending cut and fill method was applied using 30m levels with 2.5m sublevel units. Extensive timber support w as required and a crown pillar w as left between levels.

Between Level 3 and Level 5, a descending cut and caving method was used, with levels mined from top to bottom by 2m sublevels. A wooden floor was laid down on every sublevel that acted as roof support for the next sublevel down. The timber was subsequently recovered and reused.

On Level 5 and Level 6, the last method used was ascending room and pillar with backfill. Stopes were typically 100m long and 10m to 15m wide. Within each stope, three 2.5m x 2.5m pillars were left for additional support. Each stope had an ore pass, footwall access, a hanging wall backfill raise and vent shafts. Back fill included low-sulphide (<43% S) underground waste and surface material quarried from the Poyatos pit.

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

| |

| Figure 8 | Long section showing drill hole intersections and resource boundary |

| | (Source: - Behre Dolbear, 2011) |

| |

| Figure 9 | Deposit structure and isopachs in vertical section (Source: CMR, 2006) |

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

| |

| Figure 10 | Mineral distribution block model for Au-Zn-Cu (Source: CMR, 2006) |

Note similar distribution of Au and Zn in Lomero and Poyatos lenses, but Cu is more central

Through Recursos, CMR spent about US $7.5 million on an extensive programme of exploration and drilling during the years 2001-2007.

Evaluation of the un-mined parts and exploration for extensions of the known massive sulphide deposit was the prime focus of CMR’s activities after the acquisition of the project in the year 2000. Activities during CMR’s tenure included about 10,000m of drilling, 1,100m of trenching, detailed geological studies, metallurgical testwork, resource evaluation and electromagnetic and gravity surveying. Resource modelling and assessment ranged from high-tonnage low-grade to high-grade options at lower tonnage.

Cambridge Mineral Resources commissioned SRK Consulting Ltd to prepare a “conceptual mining study” of the poly-metallic Lomero-Poyatos property. SRK was commissioned to undertake a JORC compliant resource estimate and an associated conceptual mining study in 2002 based on a gold price at time of study of US$ 330/oz.

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

Key outcomes of the study were as follows (as at December 2002).

SRK estimated that Lomero-Poyatos contained Indicated and Inferred Mineral Resources, comprising Indicated Mineral Resources of 1.6 Mt at 5.1 g/t Au, and Inferred Mineral Resources of 17.2 Mt at 2.9 g/t Au, totalling 20.6 Mt at an average grade of 3.1 g/t Au, containing 2.1 Moz of gold, 46 Moz of silver, 675,000 tonnes of zinc and 250,000 tonnes of copper, of which an open pit resource of 18.8Mt containing 1.9Moz and an U/G resource containing 0.2 Moz was “reasonably likely” to be mined economically.

The findings indicated that the deposit could be economically developed by open-pit and underground mining methods, over at least ten years. Ore was to be processed through locally available facilities at the Almagrera processing plant. Preliminary metallurgical testing indicated that recoveries were expected to be 75-77% for gold, 50% for copper and 78% for zinc.

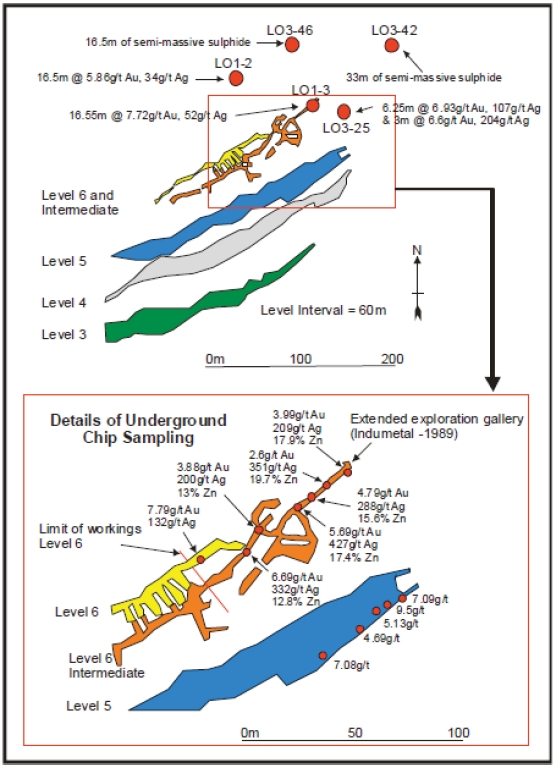

The results from drill testing within the northeast Lomeros extension included:

16.6 metres @ 7.7 g/t gold in drillhole L01-3,

21.5 metres @ 5 g/t gold in drillhole L01-2 and,

20.4 metres at a composite grade of 6.82 g/t gold, 139 g/t silver and high base metals in drill- hole L03–25. Drill hole L03-42 intersected 33 metres of semi-massive sulphide including 29.4 metres of 0.52 g/t gold containing a maximum value of 2.97 g/t gold.

The intersection of an extensive thickness of semi-massive sulphide in drill hole L03-42 indicated proximity to the core or "feeder zone" of the deposit. In support of this view, follow-up drill hole L03-46 intercepted an interpreted feeder zone with values in the range 0.3g/t gold to 0.8g/t gold, a 5.65 metre zone of massive sulphide and 16.55 metres of semi-massive sulphide including 5.8 metres of 0.93 g/t gold. These drill intersections extended the northeast extension zone beyond the limits of the known underground mine.

| |

| Figure 11 | Lomero-Poyatos Stratigraphy and Lithology (Source: CMR, 2006) |

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

| |

| Figure 12 | Bedded sulphides in drill core (Source: CMR, 2006) |

A strong EM conductor west of the known limits of the Poyatos orebody indicated a previously undefined target. Drill hole L01-4 highlighted the auriferous nature of the western area with an intercept of 3 metres of 4.9 g/t gold and associated base metals. West of L01-4, drill-hole L03-47 encountered 1.65 metres of 4.02 g/t gold in massive sulphide with a peak value of 11.12% zinc.

| |

| Figure 13 | Lomero-Poyatos – exploration potential (Source: CMR, 2006) |

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

| |

| Table 2 | Significant Newmont/CMR Drillhole Intersections (Source: WAI, 2007 ) |

| | | | | | | | | | |

| Hole | From | To | Width | Assay value | Mineral |

| No. | (m) | (m) | (m) | Au | Ag | Cu | Pb | Zn | S % | Type |

| | | | | g/t | g/t | % | % | % | | |

| L01-1 | 247,40 | 250,12 | 2,72 | 4,90 | 51,80 | 0,51 | 0,00 | 0,00 | 45,70 | Massive |

| L01-1 | 254,40 | 278,25 | 23,85 | 0,15 | 1,44 | 0,13 | 0,03 | 0,08 | 20,67 | Semi-Massive |

| L01-2 | 214,40 | 219,35 | 4,95 | 2,06 | 61,98 | 0,24 | 1,91 | 1,92 | 14,79 | Semi-Massive |

| L01-2 | 222,10 | 238,60 | 16,50 | 5,86 | 33,53 | 2,44 | 0,21 | 0,52 | 47,81 | Massive |

| L01-2 | 238,60 | 247,30 | 8,70 | 0,52 | 2,83 | 0,07 | 0,08 | 0,18 | 23,37 | Semi-Massive |

| L01-3 | 170,75 | 173,15 | 2,40 | 0,55 | 28,77 | 0,16 | 1,99 | 2,68 | 13,20 | Semi-Massive |

| L01-3 | 173,15 | 189,70 | 16,55 | 7,72 | 52,42 | 0,40 | 1,03 | 7,83 | 42,45 | Massive |

| L01-3 | 194,80 | 210,05 | 15,25 | 0,51 | 2,81 | 0,10 | 0,04 | 0,19 | 18,92 | Semi-Massive |

| L01-4 | 193,40 | 198,00 | 4,60 | 0,89 | 8,61 | 0,44 | 0,08 | 0,03 | 41,16 | Massive |

| L01-4 | 198,00 | 207,20 | 9,20 | 0,18 | 4,87 | 0,11 | 0,02 | 0,05 | 16,99 | Semi-Massive |

| L01-4 | 207,20 | 210,50 | 3,30 | 1,71 | 13,85 | 0,26 | 0,62 | 1,16 | 46,39 | Massive |

| L01-5 | 206,00 | 215,70 | 9,70 | 2,69 | 25,77 | 1,80 | 0,68 | 1,23 | 40,60 | Massive |

| L01-5 | 215,70 | 221,50 | 5,80 | 1,62 | 35,98 | 2,35 | 1,39 | 1,85 | 46,57 | Mine Opening |

| L01-6 | 148,65 | 151,9 | 3,25 | 1,11 | 47,66 | 1,06 | 1,57 | 2,79 | 46,97 | Massive |

| L01-7 | 231,20 | 235,40 | 4,20 | 4,06 | 28,56 | 0,68 | 0,26 | 0,39 | 42,32 | Massive |

| L01-7 | 235,40 | 249,90 | 14,50 | 0,35 | 2,40 | 0,05 | 0,04 | 0,07 | 24,77 | Semi-Massive |

| L01-8 | 148,30 | 151,70 | 3,40 | 7,29 | 112,41 | 0,31 | 3,75 | 5,12 | 42,04 | Massive |

| L01-8 | 151,70 | 154,10 | 2,40 | 0,18 | 12,47 | 0,20 | 0,04 | 0,08 | 10,23 | Semi-Massive |

| L01-9 | 105,60 | 116,00 | 10,40 | 1,65 | 7,50 | 1,25 | 0,12 | 0,06 | 50,00 | Massive |

| L01-9 | 116,00 | 119,20 | 3,20 | 0,44 | 2,80 | 0,33 | 0,02 | 0,03 | 31,85 | Semi-Massive |

| Northeast Extension Zone |

| | | | |

| Hole Number | Intersection (m) | Au g/t | Ag g/t | Comments |

| LO3-25 | 6.25 | 6.93 | 107 | 15.07% Zn+Pb |

| LO3-25 | 3.00 | 6.60 | 204 | 5.94% Zn+Pb |

| LO3-42 | 33m of semi-massive sulphide including 29.4m @ 0.52g/t Au |

| LO3-46 | A feeder zone with 16.55m of semi-massive sulphide including 5.8m @ 0.93g/t |

Northwest Extension Zone

|

| LO3-22 | 3.00 | 4.89 38 | | |

| LO3-47 | 1.65 | 4.02 | 115 | 11.51%Pb+Zn |

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

| |

Figure 14 | Detail of the northeast extension of the Lomero-Poyatos deposit |

| | |

| | (Source: WAI, 2007) |

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

| |

| Table 3 | Significant (>2m at 1g/t Au) gold value drill intercepts (CMR, 2002 – 2004) |

| | | |

| Drillhole | Intersection Depth (m) | Thickness (m) | Range of Assay values (g/t Au) |

| number | | | |

| TH-1 | 254 - 256 | 2 | 0.88 – 6.1 |

| TH-2 | 312 - 326 | 14 | 0.07 – 1.03 |

| Th-3 | 321 - 322 | 1 | 1.68 |

| TH-5 | 225 – 226 | 1 | 5.21 |

| | 245 – 250 | 5 | 1.12 |

| | 265 - 270 | 5 | 1.74 |

| LO1-1 | 247 - 251 | 4 | 4.2 – 4.9 |

| LO1-2 | 216 - 240 | 24 | 2 – 9 |

| LO1-3 | 173 – 190 | 17 | 4 – 14 |

| | 200 - 207 | 7 | 0.4 – 1.32 |

| LO1-4 | 193 - 210 | 17 | 0.1 – 2.34 |

| LO1-5 | 206 - 222 | 16 | 1.4 – 5.9 |

| LO1-6 | 141 - 153 | 12 | 0.37 – 3.27 |

| LO1-7 | 231 – 244 | 13 | 0.1 – 4.7 |

| LO1-8 | 148 - 152 | 4 | 6 – 8.4 |

| LO1-9 | 106 - 116 | 10 | 0.78 – 2.5 |

| LO3-10 | 105 - 110 | 5 | 2 – 11 |

| LO3-11 | 94 - 101 | 7 | 1 – 4 |

| LO3-13 | 126 - 131 | 5 | 0.01 – 1.55 |

| LO3-14 | 147 - 148 | 1 | 5.32 |

| LO3-15 | 55 - 58 | 3 | 0.94 – 3.1 |

| LO3-16 | 98 - 110 | 12 | 0.1 – 5.8 |

| LO3-17 | 44 - 45 | 1 | 4.4 |

| LO3-18 | 64 - 74 | 10 | 0.5 – 4.66 |

| LO3-19 | 74 - 81 | 7 | 2.3 – 3.8 |

| LO3-20 | 90 - 93 | 3 | 1.5 – 1.65 |

| LO3-22 | 103 - 106 | 3 | 1.2 – 9.88 |

| LO3-24 | 56 – 58 | 2 | 1.0 – 10.1 |

| LO3-25 | 155 - 181 | 24 | 1.3 – 10.1 |

| LO3-31 | 101 - 117 | 16 | 0.5 – 2.2 |

| LO3-32 | 63 - 76 | 13 | 0.1 – 2.4 |

| LO3-33 | 156 - 158 | 2 | 1.7 – 3.65 |

| LO3-35 | 96 - 104 | 8 | 0.3 – 1.8 |

| LO3-38 | 85 - 87 | 2 | 0.5 – 2.14 |

| LO3-41 | 141 - 144 | 3 | 0.3 – 1.3 |

| LO3-42 | 195 - 201 | 7 | 0.3 – 2.9 |

| LO3-44 | 19 - 21 | 2 | 3.2 – 5.32 |

| LO3-45 | 124 - 133 | 9 | 0.1 – 2.8 |

| LO3-46 | 225 - 233 | 8 | 0.6 – 1.1 |

| LO3-47 | 152 - 156 | 4 | 0.6 – 4.4 |

| LO4-48 | 277 - 284 | 7 | 0.1 – 4.6 |

| LO4-50 | 225 - 263 | 33 | 0.7 – 5.8 |

| LO4-51 | 314 - 318 | 4 | 0.7 – 8.4 |

| Range | | 1 – 33m | 0.1 - 14.0 |

| Average | | 7.85 m | |

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

Note: Most of these 40 drill-hole intersections were inclined southwards at 70° (from horizontal) but flattened by an average of 5° to 10° to intersect the deposit which dips northwards at about 30° at close to the true thickness of the deposit.

In 2002, SRK completed a Mineral Resource estimation, based on the results from the CMR exploration and drilling programme. Lomero-Poyatos was estimated, to contain an Indicated Mineral Resource of 3.71 million tonnes @ 3.26 g/t Au, 27.9 g/t Ag, 0.87% Cu, 1.57% Pb and 1.16% Zn using a 1.5 g/t gold equivalent cut-off (based on JORC compliant definitions).

In 2005, Wardell Armstrong International (“WAI”) completed an independent NI 43-101 compliant report (based on CIM definitions) and in April 2007 completed a Scoping Study based upon the above resource data.

There is no material difference between the CIM and JORC definitions of Mineral Reserves or Mineral Resources.

SRK Mining Study (2002) – Mineral Resource Estimate

Previous resource studies had concentrated their estimates in and adjacent to the existing mine workings. SRK took account of this work, but considered the un-mined Inferred Mineral Resource surrounding the existing mine workings demonstrated by the previous exploration work completed by Billiton, Indumetal and Newmont, to have additional potential for future mining, particularly as the results of the Newmont drilling programme showed a trend of gold grades improving to the northeast at increasing depth outside the existing mine workings.

There were indications that significant un-mined massive sulphide pillars and stope remnants within the mined area could be considered as open pit resources. These were quantified and incorporated into a geological model and optimised using Whittle 4D software.

The SRK estimate of resources is shown in the following table 4:

|

| NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 11 July 2011 |

| |

| Table 4 | Mineral Resource Statement (Source: SRK, 2002) |

| | | | | | | | | |

| INFERRED MINERAL | Cut-off | Tonnage | Au | Ag | Zn | Cu | Pb | S | Total |

| RESOURCES | grade | (Mt) | (g/t) | (g/t) | (%) | (%) | (%) | (%) | Value |

| | €/t | | | | | | | | €/t |

| Open Pit Component | | | | | | | | | |

| Massive Sulphide | >50 | 1.61 | 5.1 | 102 | 4.4 | 1.4 | 1.7 | 41 | 125 |

| Massive Sulphide | >50 | 7.81 | 4.4 | 89 | 4.2 | 1.4 | 1.4 | 41 | 118 |

| Semi-massive Sulphide | >50 | 8.61 | 1.6 | 53 | 2 | 1 | 0.8 | 32 | 70 |

| Remnant Pillars and Fill | | >50 | 0.78 | 2.3 | 44 | 8.2 | 2.4 | 2.4 | 29 |

| Sub-total Open Pit | >50 | 17.2 | 2.9 | 69 | 3.3 | 1.2 | 1.1 | 36 | 93 |

| Sub-total Open Pit | >50 | 18.81 | 3.1 | 72 | 3.4 | 1.3 | 1.2 | 37 | 96 |

| Underground Component | | | | | | | | | |

| Massive Sulphide | >70 | 1.8 | 3.4 | 51 | 2.3 | 0.8 | 1.5 | 38 | 92 |

| Semi-massive Sulphide | >70 | 0.05 | 1.8 | 57 | 2.2 | 1.1 | 0.9 | 35 | 78 |

| Sub-total Underground | >70 | 1.85 | 3.4 | 52 | 2.3 | 0.8 | 1.4 | 38 | 92 |

| Combined O/P and U/G Resource | | | | | | | | | |

| Total | >50 / >70 | 20.61 | 3.1 | 70 | 3.3 | 1.2 | 1.2 | 37 | 96 |

|

| Updated NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

The SRK categorisation of resources into “Open Pit” and “Underground” was based on their opinion of the maximum open-pit potential of the modelled deposit and was not based on the current capacity of the locally available mining and processing facilities. SRK considered that gravity surveys had identified promising anomalies to the north and east of the mine area confirming indications that the orebody was open along strike and at depth.

Note: In Behre Dolbear’s opinion, this is an historical Mineral Resource estimate that may not be compliant with NI43-101 / CIM guidelines and is included here for the historical record only. This material should all be categorised as Inferred Mineral Resources due to the lack of certainty regarding the mining and processing methodology. Due to the uncertainty that may be attached to Inferred Mineral Resources, it cannot be assumed that all or any part of an Inferred Mineral Resource will be upgraded to an Indicated or Measured Mineral Resource as a result of continued exploration. Confidence in the estimate is insufficient to allow the meaningful application of technical and economic parameters or to enable the evaluation of economic viability worthy of public disclosure. Inferred Mineral Resources must be excluded from estimates forming the basis of feasibility or other economic studies.

Mining

The SRK model was based on a production rate of 350,000 run-of-mine (ROM) tonnes per year of massive sulphide material. They considered there was potential to increase this to as much as 1 million ROM tonnes per year once a full evaluation of other treatment options was completed.

Open Pit

The open-pit resource model was optimised using Whittle 4D software and indications were that there was sufficient ore in the open pit for more than 8 years at a production rate of 350K ROM tonnes per year. Geological losses and dilution were each estimated at 10% and the open pit was scheduled to start mining at the beginning of the second year (year 1 of mining) following completion of the permitting process, some further exploration drilling to upgrade the resources to the Measured and Indicated categories, and some modifications to the local processing facilities.

Underground

The underground mine was scheduled to begin operations as the open pit wound down in year 9. The underground mine would be developed from the bottom of the open pit with the production rate maintained at 350K ROM tonnes per year. The start-up of the underground mine will be dependent on the development of a ramp from the bottom of the open pit.

As the deposit dips at between 30oand 40oit is unlikely that ore could be extracted using a gravity-based mining method. It was planned to use mechanised cut and fill mining, which is relatively expensive, but is flexible and can be used to selectively mine high grade areas with low levels of dilution.

Newmont Metallurgical Testwork

As part of the investigation concluded during 2002, Newmont carried out a limited metallurgical test programme on core samples from ten diamond drill holes drilled in 2001.

To plan the test programme, Newmont carried out three mineralogical investigations. The first two were XRD-XRF analyses that provided useful information on the mineralogical nature of the samples to be tested. The deportment of gold in two samples was then investigated by microbeam techniques that showed that most of the gold existed as a solid solution in the pyrite lattice and a smaller amount occurred as a gold-silver-mercury alloy with an average grain size of 15 to 23 microns. For the samples analysed, Newmont concluded;

|

| Updated NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

i) For poly-metallic samples, with low levels of copper mineralization, the majority of the gold would report to pyrite.

ii) For cupriferous ores, 14 to 38% of the gold would report to a copper flotation concentrate and the rest to the pyrite.

Newmont concluded that if the gold was to be recovered, then the pyrite lattice needed to be oxidised prior to cyanidation. Subsequent test work has verified this. Newmont were unable to produce saleable zinc concentrates from the poly-metallic samples during their flotation test work.

AMCO-Robertson / CSMA Metallurgical Test work

The issues identified by Newmont’s metallurgical work led CMR to submit three ore samples, taken from the 2001 drill-core, to AMCO-Robertson for scoping flotation tests and these were reported in March 2002. For the poly-metallic sample, a zinc rougher concentrate was cleaned twice to give a cleaner concentrate of 51.2% Zn with a final recovery of 80.8%. Subsequent tests obtained a concentrate grade of 54.4% zinc and AMCO-Robertson concluded that a recovery of 85% could be achieved.

| |

| Table 5 | Concentrate Grades and Recoveries from AMCO-Robertson Test work |

| | | | | | | |

| Product | Expected | Cu (%) | Pb (%) | Zn (%) | Ag (g/t) | Au (g/t) | Gold |

| | Recovery | | | | | | Distribution |

| Copper conc | 50% | 23.0 | 3.1 | 5.3 | 177 | 100 | 13.0% |

| Lead conc | 42.5% | 0.3 | 44.3 | 5.7 | 98 | 7.0 | 2.2% |

| Zinc conc. | 80% | 0.2 | 0.7 | 54.4 | 38 | 3.2 | 4.8% |

| Pyrite conc. | - | - | - | - | - | 4.0 | 80.0% |

In July 2002, independent metallurgical consultant Tony Jackson reviewed this data and concluded from his experience of roaster and cyanidation test-work with other Pyrite Belt ores that gold recoveries of 80% could be anticipated from Lomero-Poyatos ore following refinement of the roast and cyanidation process.

CSMA Pyrite Cyanidation Test work

Two scoping tests were carried out on the pyrite-rich zinc flotation tailings to recover gold and these were reported in June 2002.

The material was subjected to a “dead roast” in a muffle furnace at temperatures of 720°C and 900°C.The roasted products were then leached with sulphuric acid to remove soluble copper and the residue cyanide leached to recover gold. Gold recovery was moderate at 60.4% for Test 1 and 65.2% for Test 2 but it was expected that following optimisation test work this could be increased to 78 to 80%.

Kvaerner review

Both the Newmont and CSMA/Tony Jackson test-work and conclusions were subsequently reviewed by Kvaerner E&C in September 2002 who concurred with Tony Jackson’s final report, with the proviso that the zinc recovery relationship was likely to be complex and dependent upon the marmatitic nature of the zinc mineralization.

|

| Updated NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

CSMA 2003 Test-work Programme

Further scoping tests were performed during early 2003 utilising coarse reject samples from the Newmont test-work programme and reported in April 2003. The test-work programme was designed to confirm flotation recoveries and concentrate grades and re-evaluate gold recovery after roasting of the floatation pyrite tailings. Test-work results were summarised as follows:

| | |

| 1. | Flotation testsdemonstrated that oxidation of the samples had taken place and therefore the test-work was stopped as no meaningful flotation tests could take place. |

| 2. | Roast-Cyanidation testsachieved gold recoveries of 62% in tests on Composite 1samples, and over 80% in three tests of Composite 2 samples. The difference was attributed to the roasting conditions. CSMA conclusion that further test work waswarranted to improve the standard method if a muffle furnace was to be used. |

| 3. | Pre-Concentration testswere conducted to evaluate the amenability of the ore topre-concentration upgrading of the semi-massive sulphide mineralisation. These testsindicated that the siliceous gangue associated with the semi-massive ore was notliberated at a large enough grind size that would allow it to be rejected by a practical method. |

| 4. | Gravity recoverable goldtests on one sample showed that no gravity recoverablegold was liberated. If pilot plant trials were conducted then samples from around thegrinding circuit should be taken for further test work. |

| 5. | Cyclosizer testwork on one sample indicated that 46% of the gold reported to the -7micron fines and the gold grade of the -7 micron fraction was more than twice that of the larger size fractions. Further test-work was recommended. |

Processing Plant

The concept of processing the ore from Lomero-Poyatos at locally available processing facilities was investigated. The Lomero-Poyatos ore is poly-metallic and refractory and requires primary flotation of base metal concentrates and roasting of pyrite-rich tailings for satisfactory levels of gold recovery.The basic treatment recommended was as follows:

Primary and secondary crushing followed by grinding.

Flotation of copper, zinc and lead concentrates (lead to be discarded).

De-watering of flotation tailings.

Roasting of flotation tails with the conversion of waste gases to sulphuric acid.

Acid leach of roaster cinders to extract copper and SXEW copper production.

Treatment of leached roaster cinders in a CIL plant for gold recovery, with gold doréproduction from carbon stripping and electro-winning.

A modified local facility would be capable of treating 350k ROM tonnes of ore per year and would provide the roaster with a capacity feed of 250k tonnes per year. The capital cost of modifying these facilities, including a gold extraction plant and mercury scrubbing facilities, was estimated to be about €13.3 million (at 2003 prices).

Summary Discussion

The SRK economic model indicated that the project was economically robust, but theeconomics could be improved by further drilling to upgrade the resources thusreducing the applied discount factor for calculation of the project NPV.

There was potential for a significant increase in resources as the deposit was openalong strike and down dip and a gravity survey had identified anomalies at depth.

There was an established infrastructure in the area including roads, railway, powerand water supplies, etc.

There was an existing Exploitation Permit for the Lomero-Poyatos project,consolidated for 60 years that reduces the permitting requirements of the project.

There were established local mining contractors and processing facilities for bothopen-pit and underground mining that offered potential for a quick-start option.

|

| Updated NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

There was potential to increase production to as much as 1 million ROM tonnes peryear.

Metal and gold recoveries needed to be confirmed through further test work and toevaluate alternative processing routes.

The cost of treating the mine water must be established before mine dewatering cancommence.

SRK concluded that, using the technical and financial parameters adopted in the SRK study, the Lomero-Poyatos Project appeared to be economically robust, based on mine production of 350,000 tonnes of ore per year and using locally available processing facilities.

CMR Resource Evaluation and Pre-feasibility Study (2006)

The 2006 CMR resource model was developed by Colin Andrew and Bill Sheppard, who meet the JORC and NI43-101 definitions of a “Qualified Person”.

Most of the 10,000m of drilling by CMR was focused on Resource delimitation. This included nine diamond drill-holes for 2,490m in 2001 and 48 surface drill-holes for 4,781m in 2003. The holes were typically drilled at an inclination of -70° and at an azimuth of 180° in order to provide almost true width intersections of the mineralisation. They were primarily intended to:

| | |

| i) | obtain in-situ massive sulphide mineralisation for metallurgical test work, |

| ii) | improve the knowledge of the grade distribution and |

| iii) | verify the historical mine records. The drill intersections obtained confirmed that themine records were reliable. |

A 3D model and Resource estimate for the known Lomero-Poyatos deposit was completed in March 2005 as a prerequisite to a pre-feasibility study. As a result of rigorous data verification and detailed research into previous mining practice, the veracity of the modelled in-situ massive sulphide deposit and previous mine development openings was established by comprehensive checking against CMR drill intersections.

In 2005, CMR commissioned a pre-feasibility study by WAI to assess the economic viability of the Lomero-Poyatos project as an underground mining operation with a view to processing ores using the nearby facilities at Almagrera. The WAI study concluded that, considering the anticipated development and operating costs and risks related to the acquisition of the processing facilities, and the project’s dependency on the long term regional acid market, the project would not generate a sufficiently attractive rate of return to justify its immediate development. WAI, however, supported the view that there was potential to increase the mineral resources at Lomero-Poyatos and recommended a surface drilling programme to test the established targets within the mine area and along strike.

Data Availability

Following an exhaustive search of all possible data sources incorporating discussion with numerous professional persons that had experience with the mine, all the data acquired by CMR was integrated into a Lomero-Poyatos database. This necessitated the transfer of data from various sources, including plans, surveys and maps, into a readily accessible digital format for use in geological and resource modelling software packages. Data incorporated into the Lomero-Poyatos Mineral Resource Model included:

|

| Updated NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

The underground data included:

Underground geochemical sampling on Levels 2, 3, 4 and 5 by Societe Francaise dePiritas de Huelva (SFPH) from 1934 onwards, taken every 2m during leveldevelopment;

Detailed, across-strike, underground geochemical sampling on Levels 4 and 5 withinthe Lomero area by Societe Francaise de Pyrites de Huelva in 1968; and

Detailed underground geochemical sampling on Levels 5 and 6 by Jeff Smith forIndumetal in 1986 to establish the gold grade and distribution on these Levels.

An important component of the ore-zone modelling was the detailed geological level plans prepared by the Spanish geological survey (IGME) in the early 1980s. These were updated to include mining activity between 1980 and the cessation of production in 1984. There was thus a very detailed and verified knowledge of the distribution of massive sulphide on each of the 6 mine Levels and Sub-Levels at vertical intervals of not more than 30m. CMR had:

Compiled and reviewed all data pertaining to the deposit in MapInfo© andGemcom© software.

Developed a detailed understanding of the disposition of the Mineral Resource inrelation to mined-out areas.

Verified the historical mine records through drilling.

Completed a detailed geological study of the deposit and its host rocks, including afull long-section interpretation of the deposit.

Established that zoning within the massive sulphide envelope, both lateral and acrossstrike, was reflected in the modelled grade distribution.

Data Handling

1313 “records” comprising 9 surface drill-holes completed by Outokumpu (TH-1 to TH-9), and 56 surface drill holes completed by Cambridge Mineral Resources plc (L01-1 to L04-56) and 1,248 underground channel samples taken by various previous operators were entered into a standard database structure comprising five tables:

| | |

| Header | 1,313 records |

| Survey | 1,585 records |

| Assay | 2,588 records |

| Lithology | 458 records |

| Composites | 10,717 records |

All underground channel samples were taken as being over a 2.0m horizontal interval orientated perpendicular to the azimuth of the specific drive from which they were collected.

All surface drill-hole collar locations were surveyed using a laser total station, and all surface drill-hole orientations were surveyed with a single shot photographic method of giving down-hole azimuth and dip.

Underground assay locations were digitised from underground level plans registered to fixed and constant points using MapInfo© and then exported into MSExcel as ASCII.csv files for eventual import into Gemcom©.

Following detailed assessment incorporating comparative geological and geochemical study using both 2D hard copy and 3D computer presentation, 43 underground drill-holes completed by Pyritas de Huelva in the early 1980’s were discarded from the initial data set as they were not considered to be reliable overall. It was noted, however, that, in certain areas, these drill-holes did appear to match all other data inputs. Nonetheless, given that significant doubt was cast on the veracity of the dataset and that there was a lack of signed-off laboratory returns, the entire dataset was discarded.

|

| Updated NI43-101 Technical Report on the Lomero-Poyatos Mine |

| 29 July 2011 |

Of the total records the 2,588 entries in the Assays Table the following entries were not available due to absence of assay data or the value being below detection limit:

| | |

| Au 220 | no assays |

| Ag 104 | no assays |

| Cu 75 | no assays and 72 below detection limit |

| Pb 81 | no assays |

| Zn 107 | no assays and 56 below detection limit |

| As 82 | no assays |

| Ba 264 | no assays |

All records possessed assay values for Sulphur.

Before continuing into any form of data analysis the data base was verified using Gemcom’s internal verification package and any errors (such as mismatched lengths, duplicate values etc.) removed.Following verification, the Composites Table was defined using an equal length method. The length of the composites was taken as 1.5m and 10,717 values were generated by the software.

From the Composites Table individual extraction files for Au, Ag, Cu, Pb, Zn, S, As and Ba containing 3D locations (X, Y and Z) and values were generated for use in the block model variography.

Missing Values