Exhibit 99.2

NOTICE OF

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON

August 31, 2011

AND

MANAGEMENT INFORMATION CIRCULAR

PETAQUILLA MINERALS LTD.

1780 - 400 Burrard Street,

Vancouver, British Columbia,

Canada V6C 3A6

Notice of Special Meeting of Shareholders

August 31, 2011

Notice is hereby given that the special meeting (the “Meeting”) of the holders of common shares of Petaquilla Minerals Ltd. (“Petaquilla” or the“Company”) will be held at The Fairmont Waterfront, Nootka Room, 900 Canada Place Way, Vancouver, BC, Canada, on August 31, 2011, at 10:00 a.m. (Vancouver time) for the following purposes:

1. to consider and, if thought fit, to approve with or without variation, an ordinary resolution (the “Authorizing Resolution”) authorizing the issuance by the Company of such number of common shares in the capital of the Company (the “Shares”) as is necessary to complete the proposed acquisition by the Company of all of the outstanding securities of Iberian Resources Corp. (“Iberian”) (the “Acquisition”); and

2. to transact such other business as may properly come before the Meeting or any adjournment thereof.

The full text of the Authorizing Resolution is set out in Appendix “A” to the Management Information Circular (the “Circular”) accompanying this Notice of Meeting.

The board of directors of the Company has fixed the close of business on July 27, 2011, as the record date for determining the holders of record of the Shares who are entitled to receive notice of the Meeting and to attend and vote at the Meeting and any adjournment(s) or postponement(s) thereof.

Registered shareholders who are unable to attend the Meeting in person and who wish to ensure that their Shares will be voted at the Meeting are requested to complete, date and sign the enclosed form of proxy, or another suitable form of proxy, and deliver it in accordance with the instructions set out in the form of proxy and in the Circular.

Non-registered shareholders who plan to attend the Meeting must follow the instructions set out in the voting instruction form to ensure that their Shares will be voted at the Meeting. If you hold your Shares in a brokerage account you are not a registered shareholder.

DATED at Vancouver, British Columbia on this 2ndof August, 2011.

By Order of the Board of Directors

Petaquilla Minerals Ltd.

/s/ “Richard Fifer”

Richard Fifer

Director and Executive Chairman of the Board

TABLE OF CONTENTS

| | | | |

| | | | | Page |

| | | | |

STATEMENT REGARDINGFORWARD-LOOKINGINFORMATION | I | | Reasons for the Recommendation of the Board of Directors | 6 |

CURRENCY | I | | Amalgamation Mechanics | 7 |

INFORMATION CONCERNINGIBERIAN RESOURCESCORP | I | | Approvals Required for the Acquisition | 9 |

SUMMARY OF MANAGEMENTINFORMATION CIRCULAR | II | | THE CORPORATION UPON THECOMPLETION OF THEACQUISITION | 10 |

The Meeting | II | | THE AMALGAMATIONAGREEMENT | 10 |

Parties to the Acquisition | II | |

Overview of the Acquisition | III | | Conditions to the Amalgamation | 10 |

Recommendations of the Board of Directors | III | | Exclusivity Arrangements | 11 |

| Representations and Warranties | 11 |

Approvals Necessary for the Acquisition | III | | Termination | 12 |

| Governing Law | 13 |

SELECTED UNAUDITED PROFORMA FINANCIALINFORMATION | V | | RISK FACTORS | 13 |

GLOSSARY OF TERMS | VI | | Risks Relating to the Acquisition | 13 |

GENERAL PROXY MATTERS | 1 | | Risks Relating to the Business of the Company | 15 |

Solicitation of Proxies | 1 | | Risks Relating to the Business of Iberian | 15 |

Date, Time and Place | 1 | |

Purpose of the Meeting | 1 | | DETAILED INFORMATIONABOUT IBERIAN | 18 |

Voting Shares | 1 | |

Record Date | 1 | | Corporate Structure | 18 |

Principal Shareholders | 2 | | Description of the Business | 19 |

Appointment of Proxyholder | 2 | | Dividends or Distributions | 19 |

Revocation of Proxy | 3 | | Selected Financial Information of Iberian | 20 |

Voting of Proxies | 4 | | Management’s Discussion and Analysis | 20 |

PETAQUILLA MINERALS LTD | 4 | |

THE ACQUISITION OF IBERIAN | 4 | | Consolidated Capitalization | 20 |

Background | 4 | | Prior Sales | 20 |

Recommendation of the Board of Directors | 6 | | Directors and Executive Officers | 21 |

TABLE OF CONTENTS

(continued)

| | | |

| | | | Page |

| | | |

Compensation Discussion and Analysis | 23 | | APPENDIX “A”– Authorizing Resolution |

| APPENDIX “B”– Amalgamation Agreement |

Option-Based Awards | 23 | | APPENDIX “C”– Historical Consolidated Financial Statements of Iberian |

Summary Compensation Table | 24 | |

Termination and Change of Control Benefits | 25 | | APPENDIX “D”– Iberian Management’s Discussion and Analysis |

Director Compensation | 25 | | APPENDIX “E”– Unaudited Pro Forma Consolidated Financial Statements |

Director Compensation Table | 25 | |

Indebtedness of Directors and Executive Officers | 26 | | APPENDIX “F”– Summary of the Lomero-Poyatos Property |

Audit Committees and Corporate Governance | 26 | | |

Risk Factors | 27 | | |

Auditors | 27 | | |

Material Contracts | 27 | | |

Significant Acquisitions | 27 | | |

INTEREST OF CERTAINPERSONS OR COMPANIESIN MATTERS TO BEACTED UPON | 27 | | |

INDEBTEDNESS OF DIRECTORSAND EXECUTIVEOFFICERS | 28 | | |

INTERESTS OF INFORMEDPERSONS IN MATERIALTRANSACTIONS | 28 | | |

AUDITOR | 28 | | |

INTERESTS OF EXPERTS | 28 | | |

AVAILABLE INFORMATION | 29 | | |

DIRECTORS’ APPROVAL | 29 | | |

AUDITORS’ CONSENT | 30 | | |

AUDITORS’ CONSENT | 31 | | |

CONSENT OF BEHRE DOLBEARINTERNATIONALLIMITED | 32 | | |

STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This Circular contains forward-looking information within the meaning of applicable securities laws (“forward-looking statements”) that relate to, among other things, Petaquilla’s intentions with respect to the Acquisition. All statements, other than statements of historical fact, are forward-looking statements.

Such forward-looking statements involve known and unknown risks, uncertainties and other factors and assumptions that may cause the actual results, performance or achievements of the Company to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to, the Company’s ability to effect the Acquisition and other factors discussed in this Circular. Readers are cautioned not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. Forward-looking statements are provided for the purpose of providing information about management’s current expectations and plans relating to the future. Readers are cautioned that such information may not be appropriate for other purposes. We do not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in our expectations or any change in events, conditions or circumstances on which any such statement is based, except as required by law.

CURRENCY

All currency amounts referred to in this Circular are expressed in United States dollars, unless otherwise indicated. All references to CDN$ in this Circular refer to Canadian dollars.

INFORMATION CONCERNING IBERIAN RESOURCES CORP.

Information pertaining to Iberian included or described in this Circular has been provided by or on behalf of Iberian. Iberian has reviewed this Circular and confirmed the accuracy and completeness of the information in respect of Iberian herein. Although the Company does not have any knowledge that would indicate that any such information is inaccurate or incomplete, the Company assumes no responsibility for the accuracy or completeness of such information, nor for the failure by Iberian to disclose events which may have occurred or which may affect the completeness or accuracy of such information but which is unknown to the Company. Where the information included in this Circular in relation to Iberian comprises forecasts, actual results may different from such forecasts due to the existence of risks and uncertainties, many of which are or may be outside of the control of Iberian and its management.

- I -

SUMMARY OF MANAGEMENT INFORMATION CIRCULAR

The following is a summary of the contents of this Circular. This summary is provided for convenience only and the information contained in this summary should be read in conjunction with, and is qualified in its entirety by, the more detailed information appearing in or referred to elsewhere in this Circular, including the Appendices and the documents incorporated by reference herein. Certain capitalized words and terms used in this summary and elsewhere in this Circular are defined in the “Glossary of Terms”.

The Meeting

Date, Time and Place

The Meeting is scheduled to be held at The Fairmont Waterfront, Nootka Room, 900 Canada Place Way, Vancouver, BC, Canada, on August 31, 2011, at 10:00 a.m. (Vancouver time).

Purpose of the Meeting

The purpose of the Meeting is to

1. consider and, if thought fit, to approve with or without variation the Authorizing Resolution authorizing the issuance by the Company of such number of Shares in the capital of the Company as is necessary to complete the Acquisition; and

2. transact such other business as may properly come before the Meeting or any adjournment thereof.

The full text of the Authorizing Resolution is set out in Appendix “A” to this Circular.

Voting Shares

As at July 27, 2011, the Company had 176,429,501 Shares outstanding, each carrying the right to one vote per share. Except as otherwise noted in this Circular, a simple majority of the votes cast at the Meeting, whether in person, by proxy or otherwise, will constitute approval of any matter submitted to a vote.

Record Date

The Board of Directors has fixed July 27, 2011, as the Record Date for the purpose of determining holders of Shares entitled to receive notice of and to vote at the Meeting. Any holder of Shares of record at the close of business on the Record Date is entitled to vote the Shares registered in such shareholder’s name at that date on each matter to be acted upon at the Meeting.

Parties to the Acquisition

Petaquilla Minerals Ltd.

Petaquilla is a corporation organized pursuant to the laws of the Province of British Columbia, Canada, the outstanding shares of which are listed on the TSX under the trading symbol PTQ.

Petaquilla is engaged in the acquisition, exploration, management and sale of mineral properties, with the primary aim of developing them to a stage where they can be exploited at a profit. Petaquilla is currently active in the production of gold from the open pit mine at the Molejon gold project in the Republic of Panama, which achieved commercial production status on January 8, 2010, as well as the exploration of a number of adjacent mineral concessions in the Republic of Panama.

- II -

Petaquilla’s registered office is located at 1780 - 400 Burrard Street, Vancouver, British Columbia, Canada, V6C 3A6.

Iberian Resources Corp.

Iberian is a private British Columbia company that owns 100% of the Lomero-Poyatos project through its wholly-owned Spanish affiliate, Corporacion de Recursos Iberia S.L. Lomero-Poyatos is located about 85 kilometres west of Seville, in the north-east part of the Spanish/Portuguese (Iberian) Pyrite Belt. Iberian also owns several other exploration licenses in Iberia through its wholly-owned Spanish and Portuguese affiliates.

Overview of the Acquisition

The Acquisition will be completed by way of a three-cornered amalgamation which will be effected pursuant to the Amalgamation Agreement.

Under the Amalgamation Agreement, Iberian and PTQ Newco will amalgamate pursuant to the provisions of the BCA to form an amalgamated corporation named Iberian Resources Corp. As soon as practicable after all conditions to the Amalgamation have been satisfied or waived, Iberian and PTQ Newco shall jointly file, with the Registrar of Companies for British Columbia, the Amalgamation Application (a copy of which is attached as Schedule “A” to the Amalgamation Agreement attached hereto as Appendix “B”), including the notice of articles and any required affidavits pursuant to sections 275 and 277 of the BCA, and such other documents as may be required to give effect to the Amalgamation.

Initially up to 49,632,988 Shares are to be issued pursuant to the terms of the Amalgamation Agreement (including Shares required for Petaquilla to assume all of Iberian’s obligations under the Iberian Warrants and Iberian Options), but as explained under the heading “The Acquisition of Iberian – Amalgamation Mechanics – Shares to be held by Azuero”, the net effect of the Acquisition may ultimately result in up to 44,208,912 total additional Shares to be issued after completion of the Acquisition (including Shares required for Petaquilla to assume all of Iberian’s obligations under the Iberian Warrants and Iberian Options) as the Company understands that Vintage BVI will distribute the Shares it receives upon completion of the Acquisition to its shareholders, which at this time includes Azuero, and thereafter Azuero has advised the Company that it will consider distributing such Shares to its shareholders resulting in Petaquilla receiving 5,424,076 Shares. Petaquilla will cancel any Shares that it receives.

See “The Acquisition of Iberian – Amalgamation Mechanics”.

Recommendations of the Board of Directors

The Board of Directors has approved the terms of the Amalgamation Agreement and the Acquisition. The Board of Directors recommends that Shareholders votein favourof the Authorizing Resolution. See “The Acquisition of Iberian – Recommendation of the Board of Directors”.

Approvals Necessary for the Acquisition

Regulatory Approval

On April 8, 2011, the Company provided notice to the TSX of the proposed share issuance of up to an aggregate of 49,632,988 Shares (which includes 5,424,076 Shares which may ultimately be cancelled), and requested conditional listing approval of such Shares. Conditional listing approval was granted on April 19, 2011, subject to the Company fulfilling certain customary conditions.

- III -

Approvals of Petaquilla, Iberian and PTQ Newco Shareholders

The TSX requires that a listed issuer obtain the majority approval of its shareholders prior to completing an acquisition that will result in the issuance of more than 25% of its outstanding non-diluted securities.

As the maximum number of Shares to be issued as consideration for the Acquisition, including to assume all of Iberian’s obligations under the Iberian Warrants and Iberian Options, is approximately 49,632,988 or 28.1% of the number of Shares outstanding as at July 27, 2011, therefore the issuance of such Shares must be approved by not less than the majority of the votes cast by Shareholders present in person or by proxy at the Meeting.

The Amalgamation was approved by shareholders of Iberian by way of a unanimous written resolution and by Petaquilla as the sole shareholder of PTQ Newco.

- IV -

SELECTED UNAUDITED PRO FORMA FINANCIAL INFORMATION

Appendix “E” to this Circular contains the unaudited pro forma consolidated financial statements of Petaquilla as at February 28, 2011. The unaudited pro forma consolidated financial statements were prepared as if the Arrangement had occurred on February 28, 2011. Below is a summary of pro forma financial information for Petaquilla as at February 28, 2011, derived from such pro forma consolidated financial statements:

| |

| | Pro forma Consolidated

(US$) |

| Total Current Assets | 15,881,827 |

| Total Assets | 140,288,566 |

| Total Current Liabilities | 37,572,623 |

| Total Liabilities | 96,523,844 |

| Total Shareholders’ Equity | 40,035,091 |

- V -

GLOSSARY OF TERMS

In this Circular, the following terms shall have the meanings set forth below, unless otherwise indicated.

“Acquisition” means the proposed acquisition of all of the outstanding securities of Iberian by Petaquilla;

“Almada”means Almada Mining S.A., a corporation organized under the laws of Portugal;

“Amalco” means the amalgamated corporation created by the amalgamation of Iberian with PTQ Newco pursuant to the provisions of the BCA;

“Amalgamation” has the meaning ascribed thereto under “The Acquisition of Iberian – Amalgamation Mechanics”;

“Amalgamation Agreement” means the agreement dated May 18, 2011, among Petaquilla, Iberian and PTQ Newco;

“Amalgamation Application” has the meaning ascribed thereto under “The Acquisition of Iberian –Amalgamation Mechanics”;

“Authorizing Resolution” has the meaning ascribed thereto under “General Proxy Matters – Purpose of the Meeting”;

“Azuero” means Azuero Mining S.A., a corporation incorporated pursuant to the laws of the Republic of Panama;

“BCA” means the British ColumbiaBusiness Corporations ActS.B.C. 2002, c. 57;

“Behre Dolbear” means Behre Dolbear International Limited;

“Board of Directors” means the board of directors of the Company;

“Circular” means this management information circular dated August 2, 2011 and furnished in connection with the solicitation, by or on behalf of the management of Petaquilla of proxies to be used at the Meeting;

“Computershare” means Computershare Investor Services Inc.;

“CRI”means Corporacion de Recursos Iberia S.L., a corporation incorporated pursuant to the laws of Spain;

“Iberian” means Iberian Resources Corp., a corporation incorporated pursuant to the laws of the Province of British Columbia, Canada;

“Iberian Option” means an outstanding option to purchase an Iberian Share, as it may be amended from time to time;

“Iberian Shares” means common shares in the capital of Iberian;

“Iberian Warrant” means an outstanding warrant entitling a person to acquire an Iberian Share upon the exercise thereof, as it may be amended from time to time;

“Meeting” means the Company’s special meeting of Shareholders to be held on August 31, 2011 or any adjournment thereof;

- VI -

“Petaquilla” or the“Company”means Petaquilla Minerals Ltd., a corporation organized pursuant to the laws of the Province of British Columbia, Canada;

“PTQ Newco” means Petaquilla Holdings Ltd., a corporation incorporated pursuant to the laws of the Province of British Columbia, Canada, and a wholly-owned subsidiary of Petaquilla;

“Record Date” means July 27, 2011;

“Registrar” means the Registrar of Companies for British Columbia;

“SCA”means Sulfuros Complejos Andalucia Mining S.L., a corporation organized under the laws of Spain;

“Share Exchange Agreement” has the meaning ascribed thereto under “Detailed Information about Iberian – Description of the Business”;

“Shareholder” means a holder of Shares;

“Shares” means common shares in the capital of Petaquilla;

“Technical Report” means the technical report prepared by Behre Dolbear titled “NI 43-101 Technical Report on the Lomero-Poyatos Au-Cu-Pb-Zn Mine in Andalusia, Spain” dated July 29, 2011, a summary of which has been reproduced in Appendix “F” attached hereto.

“TSX” means the Toronto Stock Exchange;

“Valuation Report” means the valuation report prepared by Behre Dolbear on the Lomero-Poyatos project as further described in “The Acquisition of Iberian – Background”.

“Vintage Amalgamation” has the meaning ascribed thereto under “Detailed Information about Iberian –Description of the Business”;

“Vintage BVI” means Vintage Mining (BVI) Corp., a corporation incorporated pursuant to the laws of the British Virgin Islands; and

“Vintage Canada” means Vintage Mining Corp., a corporation incorporated pursuant to the laws of the Province of British Columbia, Canada.

- VII -

PETAQUILLA MINERALS LTD.

MANAGEMENT INFORMATION CIRCULAR FOR THE SPECIAL MEETING OF SHAREHOLDERS

August 31, 2011

GENERAL PROXY MATTERS

As a Shareholder of Petaquilla, it is very important that you read this information carefully and then vote your Shares either by proxy or voting instruction form or by attending the Meeting.

Solicitation of Proxies

This Circular is furnished in connection with the solicitation, by or on behalf of the management of Petaquilla of proxies to be used at the Meeting or at any adjournment thereof.It is expected that the solicitation will be primarily by mail, but proxies may also be solicited personally, by advertisement or by telephone, by directors, officers or employees of the Company without special compensation, or by the Company’s proxy solicitation agent, Kingsdale Shareholder Services Inc. Shareholders may contact Kingsdale toll free at 1-866-581-0510 or by email at contactus@kingsdaleshareholder.com. Shareholders outside of North America, banks and brokers should call collect at (416) 867-2272.

The cost of solicitation will be borne by the Company.

Date, Time and Place

The Meeting is scheduled to be held at The Fairmont Waterfront, Nootka Room, 900 Canada Place Way, Vancouver, BC, Canada, on August 31, 2011, at 10:00 a.m. (Vancouver time).

Purpose of the Meeting

The purpose of the Meeting is to:

1. consider and, if thought fit, to approve with or without variation, an ordinary resolution (the “Authorizing Resolution”) authorizing the issuance by the Company of such number of Shares in the capital of the Company as is necessary to complete the Acquisition; and

2. transact such other business as may properly come before the Meeting or any adjournment thereof.

The full text of the Authorizing Resolution is set out in Appendix “A” to this Circular.

Voting Shares

As at July 27, 2011, the Company had 176,429,501 Shares outstanding, each carrying the right to one vote per Share. A simple majority of the votes cast at the Meeting, whether in person, by proxy or otherwise, will constitute approval of the Authorizing Resolution.

Record Date

The Board of Directors has fixed July 27, 2011, as the Record Date for the purpose of determining holders of Shares entitled to receive notice of and to vote at the Meeting. Any holder of Shares of record

- 1 -

at the close of business on the Record Date is entitled to vote the Shares registered in such shareholder’s name at that date on each matter to be acted upon at the Meeting.

Principal Shareholders

To the knowledge of the directors and executive officers of the Company, as at July 25, 2011, no person beneficially owned, directly or indirectly, or exercised control or direction over 10% or more of the voting rights attached to the outstanding Shares.

Appointment of Proxyholder

The person(s) designated by management of the Company in the enclosed form of proxy are directors or officers of the Company.Each Shareholder has the right to appoint as proxyholder a person or company (who need not be a Shareholder) other than the person(s) or company(ies) designated by management of the Company in the enclosed form of proxy to attend and act on the Shareholder’s behalf at the Meeting or at any adjournment thereof.Such right may be exercised by inserting the name of the person or company in the blank space provided in the enclosed form of proxy or by completing another form of proxy.

In the case ofregistered shareholders, the completed, dated and signed form of proxy should be sent in the enclosed envelope or otherwise to the Secretary of the Company c/o Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1, fax number 1-866-249-7775. To be effective, a proxy must be received by Computershare Investor Services Inc. by not later than 10:00 a.m. (Vancouver time) on August 29, 2011, or, in the event the Meeting is adjourned or postponed, not less than 48 hours, Saturdays, Sundays and holidays excepted, prior to the time of any reconvened or postponed Meeting.

Non-Registered Holders of Shares

The information set forth in this section is of significant importance to many holders of Shares, as a substantial number of holders of Shares do not hold Shares in their own name. Holders of Shares who do not hold Shares in their own name, referred to in this Circular as “non-registered holders”, should note that only proxies deposited by Shareholders whose names appear on the records of the Company as of the Record Date can be recognized and acted upon at the Meeting. However, in many cases, Shares beneficially owned by a non-registered holders are either:

| (a) | in the name of an intermediary that the non-registered holder deals with in respect of the Shares, such as, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans; or |

| | | |

| (b) | in the name of a depositary, such as CDS Clearing and Depositary Services Inc. (“CDS”), of which the intermediary is a participant. |

In accordance with Canadian securities laws, the Company has distributed copies of the Notice of Meeting, this Circular, and the proxy (collectively, the “meeting materials”) to CDS and intermediaries for onward distribution to those non-registered holders to whom the Company has not sent the meeting materials directly.

In such cases, intermediaries are required to forward meeting materials to non-registered holders, unless a non-registered holder has waived the right to receive them. Very often, intermediaries will use a service

- 2 -

company (such as Broadridge Financial Solutions, Inc.) to forward the meeting materials to non-registered holders.

Non-registered holders who have not waived the right to receive meeting materials will receive either a voting instruction form or, less frequently, a proxy. The purpose of these forms is to permit non-registered holders to direct the voting of the Shares that they beneficially own. Non-registered holders should follow the procedures set out below, depending on which type of form they receive.

1.Voting Instruction Form. In most cases, a non-registered holder will receive, as part of the meeting materials, a voting instruction form. If the non-registered holder does not wish to attend and vote at the Meeting in person (or have another person attend and vote on the non-registered holder’s behalf), the voting instruction form must be completed, signed and returned in accordance with the directions on the form. If a non-registered holder wishes to attend and vote at the Meeting in person (or have another person attend and vote on the non-registered holder’s behalf), the non-registered holder must complete, sign and return the voting instruction form in accordance with the directions provided, and a proxy giving the right to attend and vote will be forwarded to the non-registered holder.

Or

2.Form of Proxy. Less frequently, a non-registered holder will receive, as part of the meeting materials, a proxy that has already been signed by the intermediary (typically by facsimile, stamped signature) which is restricted as to the number of Shares beneficially owned by the non-registered holder, but which is otherwise uncompleted. If the non-registered holder does not wish to attend and vote at the Meeting in person (or to have another person attend and vote on the non-registered holder’s behalf), the non-registered holder must complete the proxy and deposit it with Computershare as described above. If a non-registered holder wishes to attend and vote at the Meeting in person (or have another person attend and vote on the non-registered holder’s behalf), the non-registered holder must strike out the names of the persons named in the proxy and insert the non-registered holder’s (or such other person’s) name in the blank space provided.

Non-registered holders should follow the instruction on the forms that they receive and contact their intermediaries promptly if they need assistance. If you require further assistance, please contact Kingsdale Shareholder Services Inc. toll free at 1-866-581-0510 or by email at contactus@kingsdaleshareholder.com. Shareholders outside of North America, banks and brokers should call collect at (416) 867-2272.

Revocation of Proxy

A Shareholder who has given a proxy may revoke it by depositing an instrument in writing signed by the Shareholder or by the Shareholder’s attorney, who is authorized in writing, or by transmitting, by telephonic or electronic means, a revocation signed by electronic signature by the Shareholder or by the Shareholder’s attorney, who is authorized in writing, to or at the registered office of the Company at 1780 - 400 Burrard Street, Vancouver, British Columbia, Canada, V6C 3A6, at any time up to and including 10:00 a.m. (Vancouver time) on the last business day preceding the day of the Meeting, or in the case of any adjournment of the Meeting, the last business day preceding the day of the adjournment, or with the Chair of the Meeting on the day of, and prior to the start of, the Meeting or any adjournment thereof. A Shareholder may also revoke a proxy in any other manner permitted by law.

Non-registered holders who wish to change their vote must, at least seven days before the Meeting, arrange for their respective intermediaries to revoke the proxy on their behalf.

- 3 -

Voting of Proxies

On any ballot that may be called for, the Shares represented by a properly executed proxy given in favour of the person(s) designated by management of the Company in the enclosed form of proxy will be voted in accordance with the instructions given on the form of proxy, and if the Shareholder specifies a choice with respect to any matter to be acted upon, the Shares will be voted accordingly.In the absence of such instructions, Shares will be voted FOR the matters identified in the accompanying Notice of Meeting.

The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the accompanying Notice of Meeting and with respect to other matters which may properly come before the Meeting or any adjournment thereof. As of the date of this Circular, management of the Company is not aware of any such amendment, variation or other matter to come before the Meeting. However, if any amendments or variations to matters identified in the accompanying Notice of Meeting or any other matters which are not now known to management should properly come before the Meeting or any adjournment thereof, the Shares represented by properly executed proxies given in favour of the person(s) designated by management of the Company in the enclosed form of proxy will be voted on such matters pursuant to such discretionary authority.

PETAQUILLA MINERALS LTD.

Petaquilla is a corporation organized under the laws of the Province of British Columbia, Canada, and its Shares are listed on the TSX under the trading symbol PTQ. The Company’s name was changed from Adrian Resources Ltd. to Petaquilla Minerals Ltd. on October 12, 2004.

Petaquilla’s registered office is located at 1780 - 400 Burrard Street, Vancouver, British Columbia, Canada, V6C 3A6.

Petaquilla is engaged in the acquisition, exploration, management and sale of mineral properties, with the primary aim of developing properties to a stage where they can be exploited at a profit. Petaquilla is currently active in the production of gold from the open pit mine at the Molejon gold project in the Republic of Panama, which achieved commercial production status on January 8, 2010, as well as the exploration of a number of adjacent mineral concessions in the Republic of Panama.

THE ACQUISITION OF IBERIAN

Background

Given that Petaquilla’s mineral properties are mainly located in the Republic of Panama, management of the Company has been recently exploring and examining acquisition opportunities outside of the Republic of Panama in an effort to diversify its geopolitical risks. Due to relationships between the managements of Petaquilla and Iberian, Petaquilla became aware of the Iberian opportunity. Iberian is attractive to Petaquilla and fits with Petaquilla’s strategic plan given the location of Iberian’s assets and its resource prospects, and given the skills and Spanish speaking capabilities of Petaquilla management.

Behre Dolbear was retained by the directors of Petaquilla to recommend an appropriate value of the Lomero-Poyatos property, being Iberian’s principal asset, for the purpose of arriving at a fair basis for a transaction between Petaquilla and Iberian. In its indicative valuation of Lomero-Poyatos (the “Valuation Report”), Behre Dolbear concluded, subject to the assumptions and limitations contained therein, that the value assigned to the Lomero-Poyatos project should be US$53.5 million. The Valuation Report is

- 4 -

included in the Technical Report, which is available for review under Petaquilla’s profile on SEDAR at www.sedar.com.

Iberian has advised Petaquilla of the following:

Prior to Iberian successfully acquiring the Lomero-Poyatos concession from San Telmo Iberica Minera S.A. (“STIM”), Sigirya Capital PTY Limited (“Sigirya”) entered into a term sheet agreement (the “TS Agreement”) with Cambridge Mineral Resources pls (“CMR”) dated October 20, 2009, for the acquisition of mining rights in Lomero-Poyatos (leased by CMR’s subsidiary, Recursos Metalicos SL (“RMSL”)) and mining rights in Masa Valverde (owned by RMSL). When CMR was unable to deliver evidence of its concession title, this triggered a break- fee claim for US$750,000.

Iberian then entered into an agreement with Sigirya to acquire the Lomero-Poyatos and Masa Valverde concessions, along with Sigirya’s rights under the TS Agreement, which included the break-fee claim. Iberian chose to pursue enforcement of the break-fee against CMR by filing a statutory claim in the United Kingdom on February 17, 2010.

A court action was also initiated in Spain as a cautionary measure intended to secure assets of CMR to cover the break-fee should Iberian be successful in its claim in the United Kingdom. At the time, CMR’s only assets of value were its shares in RMSL, and the corresponding mining rights of RMSL. Iberian filed a claim for the cautionary measure on March 29, 2010.

After commencing the claim for the cautionary measure, Iberian learned that RMSL’s mining rights were of little value. Namely, Iberian’s Spanish subsidiary, Corporacion de Recursos Iberia S.L. (“CRI”), had already acquired the mining rights in Lomero-Poyatos from STIM for US$616,444 in April 2010, the Spanish government had cancelled RMSL’s mining rights in Masa Valverde, and the remaining mining rights of RMSL were in areas of little interest to Iberian. Accordingly, Iberian decided that there was no value in continuing its statutory claim in the United Kingdom and instead adjourned proceedings in April 2010.

The court case in Spain was delayed significantly because of difficulties encountered by the Spanish court in delivering the required notice to CMR. Given that the matter in the United Kingdom had already been adjourned, Iberian had no real interest in continuing the court case in Spain. The Spanish court case was finally heard on January 17, 2011. When the Spanish court learned of Iberian’s adjournment in the United Kingdom, it decided to similarly reject the request for a cautionary measure and issued its decision on January 24, 2011.

Petaquilla entered into negotiations with Iberian in November 2010. High level discussions subsequently took place along with technical, legal and financial due diligence by both parties, and on April 5, 2011, Petaquilla and Iberian executed a letter of intent with respect to a proposed transaction between the two companies. After further negotiations and due diligence by the parties, on May 18, 2011, the parties executed the Amalgamation Agreement.

Iberian is an exploration stage company that has various projects in the Iberian Pyrite Belt in the southwest of the Iberian Peninsula in both Spain and Portugal, the main property being the Lomero-Poyatos project. The Iberian Pyrite Belt contains one of the largest massive sulphide provinces in the

- 5 -

world, and is the site of several currently working mines operated by other large mining players such as Lundin Mining Corporation and Inmet Mining Corporation. Spain has historically been a mining-friendly jurisdiction, and presents low sovereign risk as a member of the European Union. Iberian has also enjoyed support for its new projects from a cooperative regional government.

Iberian’s assets in the region range from significant metal resources capable of production in the near-term to properties with significant exploration potential. As such, Iberian presents a good balance of production and exploration potential. Iberian’s key asset, the Lomero-Poyatos property, is located about 85 kilometres west of Seville, Spain. Lomero-Poyatos is a poly-metallic, massive-sulphide deposit that is located in the northern limb of the San Telmo anticline, which is an east-west trending fold structure adjacent to a major thrust fault.

The location of the Lomero-Poyatos property provides access to excellent infrastructure and logistics. There are existing electric power lines within 1 km of the mine site and it is well serviced by paved highways to Seville, Huelva, Aracena and to several surrounding villages which represent potential sources of labour, accommodation and general services. Lomero-Poyatos is 3 km north-west of an existing railway line with an old spur line passing 750 metres to the south of Lomero-Poyatos and 60 km north-east of the port of Huelva. The proximity to highways, railway lines and the port gives Iberian a freight advantage to Europe.

The Company has recently become aware of certain claims made by third parties which suggest that the rights over the Lomero-Poyatos property are in dispute. The Company has conducted thorough due diligence on the title of the Lomero-Poyatos property, including obtaining an opinion of Spanish counsel which confirms that Iberian’s wholly-owned Spanish affiliate, CRI, has sole and exclusive ownership of the Lomero-Poyatos concessions and the exclusive right to exploit the mineral rights in connection therewith. Assertions made by any third party claiming rights in connection with these same Lomero-Poyatos concessions are, in the view of the Company, unfounded and wholly without merit.

Iberian has continued to work with the Spanish government agencies with respect to the Lomero-Poyatos concessions and on July 18, 2011, the Regional Counsel of Environment notified CRI that it had dispatched the Lomero-Poyatos Environmental Impact Study, as submitted by CRI, for a 30-day public consultation period. The consultation period must be satisfied in order for the Counsel of Environment to be in a position to provide its approval related to the united environmental authorization.

Recommendation of the Board of Directors

The Board of Directors has concluded that the Acquisition is in the best interests of Petaquilla and its Shareholders, and has approved the terms of the Amalgamation Agreement and the Acquisition. The Board of Directors recommends that Shareholders votein favourof the Authorizing Resolution.

Reasons for the Recommendation of the Board of Directors

In the course of their evaluation of the Acquisition, the Board of Directors consulted with senior management of the Company and its advisors, and considered a numbered of factors including, among others, the following:

- 6 -

Valuation Report.Subject to the assumptions and limitations contained therein, the Valuation Report prepared by Behre Dolbear and included in the Technical Report, provides a value for Iberian’s Lomero-Poyatos project of US$53.5 million.

Conservative Valuation.While valuations are based on a variety of factors relating to specifics of the project and certain assumptions, the valuation of Iberian’s Lomero-Poyatos project provided by Behre Dolbear in the Valuation Report suggests a price per ounce of estimated mineral resources that, in the opinion of the Board of Directors, is below the per ounce price of estimated mineral resources used in other recent transactions in the market.

Emergence as a Mid-Tier Gold Producer.With the Acquisition, Petaquilla believes that its enhanced portfolio of production and exploration prospects could help it emerge as a mid-tier gold producer.

Geopolitical Diversification.The Acquisition will allow Petaquilla to achieve geopolitical diversification outside of the Republic of Panama and add assets in a region with a long history of mining, a cooperative regional government and established infrastructure.

Shareholder Approval.Shareholders are being provided with the opportunity to vote upon the Acquisition.

Amalgamation Mechanics

The Acquisition is to be completed by way of a three-cornered amalgamation (the “Amalgamation”) which will be effected pursuant to the Amalgamation Agreement.

Pursuant to the terms of the Amalgamation Agreement, Iberian and PTQ Newco will amalgamate pursuant to the provisions of the BCA to form Amalco to be named Iberian Resources Corp. As soon as practicable after all conditions to the Amalgamation have been satisfied or waived, Iberian and PTQ Newco shall jointly file with the Registrar the amalgamation application (the “Amalgamation Application”, a copy of which is attached as Schedule “A” to the Amalgamation Agreement attached hereto as Appendix “B”), including the notice of articles and any required affidavits pursuant to the provisions of the BCA, and such other documents as may be required to give effect to the Amalgamation.

Initially up to 49,632,988 Shares are to be issued pursuant to the terms of the Amalgamation Agreement (including Shares required for Petaquilla to assume all of Iberian’s obligations under the Iberian Warrants and Iberian Options), but as explained below under the heading “– Shares to be held by Azuero”, the net effect of the Acquisition may ultimately result in up to 44,208,912 total additional Shares to be issued after completion of the Acquisition (including Shares required for Petaquilla to assume all of Iberian’s obligations under the Iberian Warrants and Iberian Options) as the Company understands that Vintage BVI will distribute the Shares it receives upon completion of the Acquisition to its shareholders, which at this time includes Azuero, and thereafter Azuero has advised the Company that it will consider distributing such Shares to its shareholders resulting in Petaquilla receiving 5,424,076 Shares. Petaquilla will cancel any Shares that it receives.

Acquisition of Iberian Shares

Pursuant to the Amalgamation Agreement, after the filing of the Amalgamation Application and the issuance of a certificate of amalgamation by the Registrar thereafter, each Iberian Share will be exchanged for 1.3 Shares. No fractional Shares will be issued and the total number of Shares that any shareholder of Iberian will be entitled to receive will be rounded down to the nearest whole number.

- 7 -

Iberian Warrants

Pursuant to the Amalgamation Agreement, after the filing of the Amalgamation Application and the issuance of a certificate of amalgamation by the Registrar thereafter, a holder of an Iberian Warrant, other than a holder who is an insider of Iberian, shall be entitled to receive 1.3 Shares upon exercise of each Iberian Warrant.

Pursuant to the Amalgamation Agreement and with the consent of the only holder of Iberian Warrants (the “Insider’s Warrants”) who is an insider of Iberian, Iberian amended the terms of the Insider’s Warrants on May 18, 2011, to provide that the Insider’s Warrants shall entitle the holder to receive, after the filing of the Amalgamation Application and the issuance of a certificate of amalgamation by the Registrar thereafter, 1 Share for each Iberian Warrant exercised. All other terms of the Insider’s Warrants remained the same, including the exercise price. Richard Fifer, through Gold Consulting, S.A., is the Iberian insider who holds the Insider’s Warrants. Richard Fifer is a member of the board of directors and the Chief Executive Officer of Iberian, and Executive Chairman of Petaquilla.

As of the date hereof, there are 1,511,248 Iberian Warrants outstanding, each of which is exercisable for one Iberian Share at an exercise price in the range of US$0.14 to US$0.60 per Iberian Share. Each Iberian Warrant (other than the Insider’s Warrants), being 430,576 Iberian Warrants, shall entitle the holders to receive 1.3 Shares or an aggregate of 559,748 Shares and each Insider’s Warrant, being 1,080,672 Iberian Warrants, will entitle the holder to receive 1 Share for each Iberian Warrant after the filing of the Amalgamation Application and the issuance of a certificate of amalgamation by the Registrar. As a result, the maximum number of Shares issuable upon the exercise of Iberian Warrants pursuant to the Amalgamation Agreement is 1,640,420 Shares (subject to customary anti-dilution adjustments). No fractional Shares will be issued and the total number of Shares that any holder of Iberian Warrants will be entitled to receive upon the exercise thereof will be rounded down to the nearest whole number.

Iberian Options

Pursuant to the Amalgamation Agreement, Iberian, with the consent of each holder of Iberian Options, amended the terms of the Iberian Options on May 18, 2011, to provide that the options previously entitling a person to acquire an Iberian Share shall entitle the holders thereof to acquire, after the filing of the Amalgamation Application and the issuance of a certificate of amalgamation by the Registrar thereafter, one Share. All other terms of the Iberian Options remained the same, including the exercise price.

As of the date hereof, there are 3,357,313 Iberian Options outstanding, each of which is exercisable for one Iberian Share at an exercise price in the range of CDN$0.10 to US$0.60 per Iberian Share. The maximum number of Shares issuable upon the exercise of Iberian Options pursuant to the Amalgamation Agreement is 3,357,313 Shares (subject to customary anti-dilution adjustments). All of the Iberian Options are held by insiders of Iberian and, with the exception of Pascual Montañés, Pedro Pablo Permuy and Oriol Propser who hold an aggregate of 1,112,688 Iberian Options, all such insiders of Iberian are also insiders of Petaquilla.

Issuance of Amalco Shares

Pursuant to the terms of the Amalgamation Agreement, Amalco will issue to Petaquilla one common share of Amalco in exchange for the one issued and outstanding common share of PTQ Newco held by Petaquilla prior to the Amalgamation. Further, Amalco will issue to Petaquilla one common share of Amalco for each Share issued to Iberian securityholders in exchange for Iberian securities acquired under the terms of the Amalgamation Agreement.

- 8 -

Shares to be held by Azuero

Prior to the Vintage Amalgamation, Petaquilla held a 49% interest in Azuero which in turn owned all of the issued and outstanding shares of Vintage BVI, a shareholder of Vintage Canada. Pursuant to the Vintage Amalgamation, Vintage BVI received shares of Iberian. Following the Vintage Amalgamation, Petaquilla continues to hold a 49% interest in Azuero, which in turn holds a 24.8% interest in Iberian through Vintage BVI.

Immediately after the Amalgamation, the Company understands that Vintage BVI will distribute the Shares that it receives upon closing of the Acquisition to its shareholders, in which case Azuero will hold 11,069,543 Shares. Although it is permissible pursuant to the provisions of the BCA for Azuero to hold shares in its parent corporation Petaquilla, if Vintage BVI distributes the Shares to its shareholders, Azuero has advised that it will consider thereafter distributing such Shares to its shareholders, resulting in Petaquilla receiving 5,424,076 Shares. Petaquilla will cancel any such Shares that it receives.

Approvals Required for the Acquisition

Stock Exchange Approval

On April 8, 2011, the Company provided notice to the TSX of the proposed share issuance of up to an aggregate of 49,632,988 Shares (including Shares required for Petaquilla to assume all of Iberian’s obligations under the Iberian Warrants and Iberian Options and including the 5,424,076 Shares which may ultimately be cancelled as described above under “– Amalgamation Mechanics – Shares to be held by Azuero”), and requested conditional listing approval of such shares. Conditional listing approval was granted on April 19, 2011, subject to the Company fulfilling certain customary conditions.

Shareholder Approval

The TSX requires that a listed issuer obtain the majority approval of its shareholders prior to completing an acquisition that will result in the issuance of more than 25% of its outstanding non-diluted securities.

As the maximum number of Shares to be issued as consideration for the Acquisition, including to assume all of Iberian’s obligations under the Iberian Warrants and Iberian Options, is approximately 49,632,988 or 28.1% of the number of Shares outstanding as at July 27, 2011, the issuance of such Shares must be approved by not less than the majority of the votes cast by Shareholders present in person or by proxy at the Meeting.

The Amalgamation has been approved by shareholders of Iberian by way of a unanimous written resolution and by Petaquilla as the sole shareholder of PTQ Newco.

- 9 -

THE CORPORATION UPON THE COMPLETION OF THE ACQUISITION

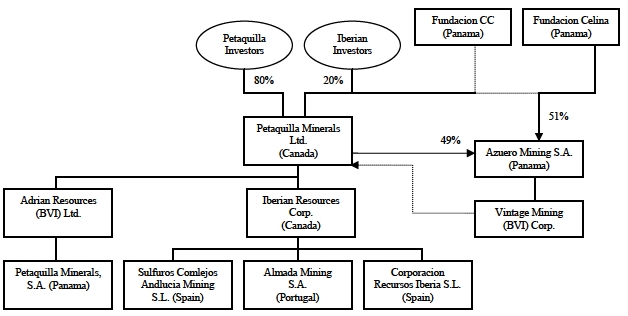

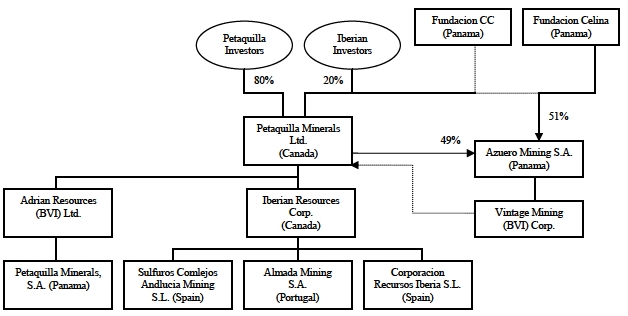

Upon the completion of the Acquisition, Petaquilla will own all of the issued and outstanding shares of Iberian. The following is the organizational chart of Petaquilla upon the completion of the Acquisition:

Note: For purposes of Iberian Investors’ 20% ownership interest in Petaquilla Minerals Ltd., Iberian Investors includes the ownership interests of Fundacion CC (Panama) and Fundacion Celina (Panama).

THE AMALGAMATION AGREEMENT

The Company, PTQ Newco and Iberian entered into the Amalgamation Agreement on May 18, 2011. The following is a summary of certain provisions of the Amalgamation Agreement. The summary does not purport to be complete and is subject to, and is qualified in its entirety by reference to, the provisions of the Amalgamation Agreement attached hereto as Appendix ‘‘B’’. Shareholders are urged to read the Amalgamation Agreement carefully and in its entirety because it, and not this description or this Circular, is the legal document that governs the Amalgamation.

Certain capitalized words and terms used in this section and not defined in this Circular shall have the meanings ascribed thereto in the Amalgamation Agreement.

Conditions to the Amalgamation

Among other things, the Amalgamation Agreement provides that closing of the Amalgamation is subject to the following:

| | |

| (a) | the conditional approval by the TSX for the listing on the TSX of Shares to be issued in connection with the Amalgamation, and if required, acceptance of notice for filing of all transactions of Petaquilla necessary to complete the Amalgamation; |

| | |

| (b) | the absence of any actions, suits, proceedings, objections or opposition under any law or before any governmental entity or regulatory authority that makes it illegal or otherwise |

- 10 -

| | |

| | directly or indirectly restrains, enjoins or prohibits the consummation of the Amalgamation in accordance with the terms of the Amalgamation Agreement or results or could reasonably be expected to result in a judgment, order, decree or assessment of damages, directly or indirectly, relating to the Amalgamation that has a Material Adverse Effect on Petaquilla or Iberian; |

| | |

| (c) | the obtaining of all consents, waivers, permits, exemptions, orders and approvals of, and any registrations and filings with, any governmental entity and all third person and other consents, waivers, permits, exemptions, orders, approvals, agreements and amendments; |

| | |

| (d) | all representations and warranties made by Petaquilla and Iberian respectively in the Amalgamation Agreement shall be true and correct in all material respects as of the applicable date; |

| | |

| (e) | none of Petaquilla or its subsidiaries, or Iberian, shall have incurred or suffered, any one or more changes, effects, events, occurrences or states of facts that, either individually or in the aggregate, have, a Material Adverse Effect on Petaquilla or Iberian respectively; |

| | |

| (f) | the adoption of all necessary resolutions and all other necessary corporate actions by the directors of Petaquilla and Iberian respectively to permit the consummation of the Amalgamation; and |

| | |

| (g) | the adoption of all necessary resolutions by the shareholders of Petaquilla and Iberian respectively to permit the consummation of the Amalgamation. |

Exclusivity Arrangements

From the date of the Amalgamation Agreement to completion of the Amalgamation or termination of the Amalgamation Agreement, Iberian has agreed to deal exclusively with Petaquilla in connection with the Amalgamation and it is not to, directly or indirectly, make, solicit, initiate or encourage enquiries from, or the submission of proposals or offers from, or continue any existing solicitations, discussions, negotiations, encouragement or activity with, any other person, corporation, partnership or other business organization whatsoever relating, directly or indirectly, to (i) any acquisition or purchase of all or a substantial part of the issued shares of Iberian or any of Iberian’s subsidiaries, (ii) any acquisition or purchase of unissued shares of Iberian or any of Iberian’s subsidiaries, (iii) any acquisition or purchase of all or a material portion of the assets of Iberian or any of Iberian’s subsidiaries, including any of the material assets relating to its mining assets, (iv) any merger, amalgamation or other business combination involving Iberian or any of Iberian’s subsidiaries with or into any other person, corporation, partnership or other business organization, (v) any liquidation, dissolution or recapitalization involving Iberian or any of Iberian’s subsidiaries, or (vi) any other similar transaction, or participate in any discussions or negotiations regarding, or furnish to any other person any information with respect to, or otherwise co-operate in any way with, or assist or participate in, facilitate or encourage, any effort or attempt by any other person, directly or indirectly, to do or seek to do any of the foregoing.

Representations and Warranties

The Amalgamation Agreement contains a number of customary representations and warranties of the Company and Iberian relating to, among other things:

| | |

| (a) | corporate organization, status and capacity; |

- 11 -

| | |

| (b) | corporate authorization and enforceability of the Amalgamation Agreement; |

| | |

| (c) | the absence of any default that is material to the conduct of the business of each party; |

| | |

| (d) | the absence of material litigation or arbitration proceedings and an absence of facts likely to give rise to such proceedings; |

| | |

| (e) | licences, mining rights and title to assets held by each party; |

| | |

| (f) | compliance with environmental laws; |

| | |

| (g) | the accuracy of information included in previously provided disclosure materials, and that all forecasts, estimates, projections, budgets, statements of opinion or statements of intention previously disclosed were based on reasonable assumptions, prepared in good faith with due skill and care; |

| | |

| (h) | the accurate disclosure of current capitalization; |

| | |

| (i) | that all information yet to be provided or disclosed for a purpose related to the Amalgamation will be prepared and provided in good faith; and |

| | |

| (j) | the accuracy and completeness of financial statements and compliance with all continuous disclosure requirements. |

Both the Company and Iberian have acknowledged in the Amalgamation Agreement that the other party is relying on their representations and warranties in connection with entering into the Amalgamation Agreement and agreeing to complete the Amalgamation. The Amalgamation Agreement provides that each party will promptly advise the other in writing if it becomes aware of any fact, matter or circumstance which constitutes or may constitute a breach of any of the representations or warranties given by it.

Termination

The Amalgamation Agreement may be terminated at any time prior to the issuance of a Certificate of Amalgamation:

| | |

| (a) | by mutual agreement of the parties; |

| | |

| (b) | if the effective date of the Amalgamation as set forth in the Certificate of Amalgamation issued by the Registrar upon receipt of the Amalgamation Application does not occur on or before the deadline to complete the Amalgamation agreement as set out in the Amalgamation Agreement; or |

| | |

| (c) | if any of the conditions to the closing of the Amalgamation shall not be fulfilled or performed in accordance with the Amalgamation Agreement, by any party entitled to the benefit of such condition or conditions. |

In the event of any such termination each party will be released, remised and forever discharged in respect of any and all of its obligations, claims and liabilities arising in respect of the Amalgamation Agreement.

- 12 -

Governing Law

The Amalgamation Agreement is governed by, and is to be construed in accordance with, the laws of the Province of British Columbia and the federal laws of Canada applicable therein but the reference to such laws shall not, by conflict of laws rules or otherwise, require the application of the law of any jurisdiction other than the Province of British Columbia.

RISK FACTORS

In addition to the other information contained in or expressly incorporated by reference in this Circular (including the risk factors applicable to the Company contained under the heading “Risk Factors” in the Company’s annual report for the fiscal year ended May 31, 2010, such risk factors being incorporated herein by reference), the following factors should be considered carefully when considering risks related to the Acquisition. These risks and uncertainties are not the only ones that the Company and Iberian may face nor do they include all risks and uncertainties associated with the Acquisition. Additional risks and uncertainties not presently known to the Company or that the Company currently considers immaterial may also exist. If any of such risks actually occur, the Company’s business, prospects, financial condition, cash flows and operating results could be materially adversely affected.

Risks Relating to the Acquisition

Failure to complete the Acquisition could negatively impact the market price of the Shares and future business and financial results of the Company.

Pursuant to the Amalgamation Agreement, and as described herein, there are a number of important conditions that must be satisfied before the Acquisition can be completed.

If the Acquisition is not completed for any reason, the Company’s ongoing business and financial results may be adversely affected. In addition, if the Acquisition is not completed, the Company will be subject to a number of additional risks, including the risk that the price of the Shares may decline to the extent that the current market price of the Shares reflects a market assumption that the Acquisition will be completed and that the related benefits will be realized, or as a result of the market’s perceptions that the Acquisition was not consummated due to an adverse change in the Company’s business or financial condition. Whether or not the Acquisition is completed, the pending Acquisition could adversely affect the Company’s operations because:

| | |

| (a) | matters relating to the Acquisition require substantial commitments of time and resources by the Company’s management and employees, whether or not the Acquisition is completed, which could otherwise have been devoted to other opportunities that may have been beneficial to the Company; |

| | |

| (b) | the Company’s ability to attract new employees and consultants and retain its existing employees and consultants may be harmed by uncertainties associated with the Acquisition, and the Company may be required to incur substantial costs to recruit replacements for lost personnel or consultants; and |

| | |

| (c) | shareholder lawsuits could be filed against the Company challenging the Acquisition. If this occurs, even if the lawsuits are groundless and the Company ultimately prevails, it may incur substantial legal fees and expenses defending these lawsuits, and the Acquisition may be prevented or delayed. |

- 13 -

The Company cannot guarantee when, or whether, the Acquisition will be completed, that there will not be a delay in the completion of the Acquisition or that all or any of the anticipated benefits of the Acquisition will be obtained. If the Acquisition is not completed or is delayed, the Company may experience the risks discussed above which may adversely affect the Company’s business, financial results and share price.

Actual results may be less favourable than estimates.

The level of production and capital and operating cost estimates relating to the mineral projects of Iberian, which are used in establishing estimated resources for determining and obtaining financing and other purposes, are based on certain assumptions and are inherently subject to significant uncertainties. It is very likely that actual results for the mineral projects will differ from current estimates and assumptions, and these differences may be material. For example, the Lomero-Poyatos deposit is still at the exploration stage and the mineral resource estimate is based on relatively wide-spaced drilling. In addition, experience from actual mining or processing operations may identify new or unexpected conditions which could reduce production below, and/or increase capital and/or operating costs above, current estimates. If actual results are less favourable than current estimates, Iberian’s business, results of operations, financial condition and liquidity could be materially adversely impacted.

The issuance of Shares may cause the market price of Shares to decrease.

As part of the Acquisition, Shares will be issued to Iberian Shareholders, and may be issued to current holders of Iberian Warrants and Iberian Options upon the exercise thereof. The issuance of these Shares could depress the market price of the Shares.

If the Acquisition is completed, current Shareholders will experience immediate dilution as a consequence of the issuance of Shares, and may experience reduced influence on the management of the Company.

Current Shareholders will experience immediate dilution of their Shares if the Acquisition is completed, and such dilution may be significant. Further dilution may occur if Petaquilla chooses to acquire businesses in the future and to pay for such acquisitions by the issuance of Shares. Following the Acquisition, if consummated, current Shareholders would hold, in the aggregate, approximately 80% of the issued and outstanding Shares and current shareholders of Iberian as at the effective time of the Acquisition would hold, in the aggregate, approximately 20% of the issued and outstanding Shares (based on the number of Shares outstanding as of July 27, 2011).

If the Acquisition is completed, the influence of current Shareholders on management of the combined company will be reduced. Nevertheless, the Company does not expect that any changes will be made to the composition of the Board of Directors after completion of the Acquisition.

The Company will incur significant costs in connection with the Acquisition, some of which will be incurred even if the Acquisition is never completed.

The Company expects that it will be obligated to pay fees and other expenses related to the Acquisition, including financial advisors’ fees, filing fees, legal and accounting fees, soliciting fees, regulatory fees and mailing costs. A significant portion of these fees and expenses will be incurred even if the Company does not complete the Acquisition.

In addition, Iberian will require approximately an additional €13 million in order to complete the Lomero-Poyatos pre-feasibility study (including costs of drilling, metallurgy testing, process and engineering

- 14 -

design). If the Acquisition is completed, and due to the fact that Iberian does not currently generate cash flow, these costs will be funded by the Company out of the Company’s cash flows which are generated from the Molejon gold project.

Risks Relating to the Business of the Company

For a discussion of the risks associated with the Company please refer to the section in the Company’s latest annual report, incorporated by reference herein, entitled “Risk Factors”.

Risks Relating to the Business of Iberian

Iberian will require significant capital expenditures to continue exploration and development activities, and, if warranted, to develop new mining operations.

Upon the completion of the Acquisition, substantial expenditures will be required to continue with exploration at, and develop, the Iberian properties. In order to explore and develop these projects and properties, the combined company may be required to expend significant amounts for, among other things, geological, geochemical and geophysical analysis, drilling, assaying, and, if warranted, mining and infrastructure feasibility studies. Iberian will require approximately an additional €13 million in order to complete the Lomero-Poyatos pre-feasibility study (including costs of drilling, metallurgy, process and engineer design).

The Company may not benefit from any of these investments if it is unable to identify commercially exploitable mineralized material. If successful in identifying reserves, it will require significant additional capital to construct facilities necessary to extract recoverable metal from those reserves.

The ability of the Company to achieve sufficient cash flows from internal sources and obtain necessary funding depends upon a number of factors, including the state of the worldwide economy and the price of gold. The Company may not be successful in achieving sufficient cash flows from internal sources and obtaining the required financing for these or other purposes on terms that are favourable to it or at all, in which case its ability to continue operating may be adversely affected. Failure to achieve sufficient cash flows and obtain such additional financing could result in delay or indefinite postponement of further exploration or potential development.

Iberian is not yet in production and expects to incur further costs in the development of its business. In addition, Iberian has limited financial resources and there is no assurance that Iberian will be able to generate funds from operation or to obtain sufficient financing in the future on terms acceptable to it or at all.

Should Iberian fail to achieve profitability or, if necessary, raise sufficient capital to sustain operations, Iberian may be forced to suspend operations and possibly even liquidate assets and wind-up and dissolve the company.

The restart of mining operations at the Lomero-Poyatos project can only proceed following receipt of various regulatory approvals.

The restart of mining operations at the Lomero-Poyatos project can only proceed following receipt of various regulatory approvals. The principal regulatory approvals required are: (i) the approval by the Junta de Andalucía of the transfer of mineral rights to CRI; (ii) the approval of the exploitation project and rehabilitation plans; and (iii) the approval of the Sole Environmental Authorization.

- 15 -

In order to obtain such approvals, CRI has submitted a request to the Autonomous Community government in Spain for authorization of the transfer of mineral rights for the development of the Lomero-Poyatos mine. In order to ensure compliance with government regulations and procedures and to expedite the approval of mineral rights, CRI has commissioned a number of leading Spanish consultancies that have performed the various studies required in order to meet the requirements already filed with the Administration. The selection of these Spanish consultancies was based on their professional reputation and their experience working in the area. CRI has acquired the surface land necessary for the exploitation of the resources. The process for compulsory acquisition of additional surface land rights is formal and may take up to 2 years to complete.

The granting, renewal and continued effectiveness of such approvals and permits are, as a practical matter, subject to the discretion of the applicable government or governmental officials in the assessment of the financial and technical documentation. No assurance can be given that Iberian will be successful in obtaining any or all of the various approvals, agreements, licenses or permits. Based on our experience, the Administration has only cancelled approvals in exceptional cases when resources have not been exploited for a long period of time.

There can be no certainty that Iberian’s exploration and development activities will be commercially successful.

Substantial efforts and compliance with regulatory requirements are required to establish ore reserves through drilling and analysis, to develop metallurgical processes to extract metal from the ore and, in the case of development properties, to develop and construct the mining and processing facilities and infrastructure at any site chosen for mining. Shareholders cannot be assured that any gold reserves or mineralized material acquired or discovered will be in sufficient quantities to justify commercial operations.

The Iberian properties could be subject to regulatory risks which could expose Iberian to significant liability and delay, suspension or termination of exploration and development efforts.

In Spain, mining is subject to national, regional and local regulations (including environmental regulation) which mandate, among other things, the maintenance of air and water quality as well as land reclamation. Certain environmental regulations may also impose limitations on the generation, transportation, storage and disposal of certain types of mining-generated waste. Current environmental legislation and regulation is evolving, requiring stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees. Any future changes in environmental regulation, if any, may adversely affect the operations of the combined company, make those operations prohibitively expensive, or (unexpected at this time) prohibit them altogether.

It is also important to note that environmental hazards may exist on the properties in which the Company may hold interests in the future that are unknown to Iberian at the present and that have been caused by Iberian, previous owners or operators, or that may have occurred naturally. These potential environmental matters concerning the mining properties of Iberian may cause the Company to be liable for remediating any damage that Iberian or a previous operator may have caused. The liability could include response costs as well as the payment of certain fines and penalties.

- 16 -

Estimated resource figures pertaining to Iberian’s properties are only estimates and are subject to revision based on developing information.

Information pertaining to Iberian’s mineral reserves and mineral resources presented in this Circular, including such information as it pertains to the Lomero-Poyatos property, are compliant estimates but no assurances can be given as to their accuracy. Such estimates are, in large part, based on interpretations of geological data obtained from drill holes and mining feasibility studies. Actual mineralization may be different from that estimated. In addition, Lomero-Poyatos deposit is still at the exploration stage and the mineral resource estimate is based on relatively wide-spaced drilling. Mineral estimates are materially dependent on the prevailing price of minerals, including gold, and the cost of recovering and processing minerals at the individual mine sites. Market fluctuations in the price of minerals, including gold, or increases in recovery costs, as well as various short-term operating factors, may cause a mining operation to be unprofitable in any particular accounting period.

The estimated resources attributable to any specific property of Iberian are based on accepted geological, engineering and evaluation principles. The estimated amount of contained metals in estimated resources does not necessarily represent an estimate of a fair market value of the evaluated properties.

Mineral Resources may not be Feasible.

There is a risk that feasibility studies may not return positive results on any Iberian mineral resources, including the Lomero-Poyatos mineral resource, and even if they do, there is the risk that the development of the deposits will not be economic, completed on schedule, or that the construction cost may exceed the budget, or that significant problems in commissioning the mines may arise.

Potential litigation relating to the Lomero-Poyatos property could impact future business and financial results.

A third party has made claims in respect of certain rights over the Lomero-Poyatos property. The Company has conducted thorough due diligence on the title of the Lomero-Poyatos property, including obtaining an opinion of Spanish counsel which confirms that CRI has sole and exclusive ownership of the Lomero-Poyatos concessions and the exclusive right to exploit the mineral rights in connection therewith (see “The Acquisition of Iberian – Background”). Even though in the view of the Company’s management such claims are unfounded and wholly without merit, substantial commitments of time and resources by the Company’s management and employees may be required to defend such claims. The Company may incur substantial legal fees and expenses in connection therewith, and the Acquisition may be delayed as a result.

Dependence on Limited Mining Properties.

The Lomero-Poyatos property is Iberian’s only material mineral property. Any adverse development affecting the exploration of Lomero-Poyatos such as, but not limited to, obtaining financing on commercially suitable terms, hiring suitable personnel and mining contractors, or securing agreements on commercially suitable terms, may have a material adverse effect on Iberian’s financial performance and results of operations.

Uninsured Risks.

Iberian’s exploration of its mineral properties contains certain risks, including unexpected or unusual operating conditions including rock bursts, cave-ins, flooding, fire and earthquakes. It is not always possible to insure against these risks. Should events such as these arise, they could reduce or eliminate

- 17 -

Iberian’s assets and shareholder equity as well as result in increased costs and a decline in the value of Iberian’s securities.

Competition.

Significant and increasing competition exists for mineral acquisition opportunities throughout the world. As a result of this competition, some of which is with large, better established mining companies with substantial capabilities and greater financial and technical resources, Iberian may be unable to acquire rights to exploit additional attractive mining properties on terms it considers appropriate. Accordingly, there can be no assurance that Iberian will acquire any interest in additional operations that would yield reserves or result in commercial mining operations. If Iberian is not able to acquire such interests, this could have an adverse impact on future cash flows, earnings, results of operations and financial condition.

Need for Additional Mineral Reserves.

Given that mines have limited lives based on proven and probable mineral reserves, Iberian will be required to continually replace and expand its mineral reserves. Iberian’s ability to maintain or increase its annual production of minerals in the future will be dependent in significant part on its ability to bring new mines into production and to expand mineral reserves at existing mines.

Dependence on Key Executives and Personnel.

Iberian’s development and future potential are dependent upon the continued services and performance of its senior management and other key personnel. The loss of the services of any of the senior management or key personnel may have an adverse impact on Iberian. There is significant demand for management and employees skilled in the areas of exploration, development, production and acquisition of mineral reserves, and Iberian may not be able to attract or retain qualified individuals, or its key personnel, in the future.

DETAILED INFORMATION ABOUT IBERIAN

Corporate Structure

Iberian Resources Corp. was incorporated under the BCA on November 17, 2009. The registered office of Iberian is located at 1500 Royal Centre, 1055 West Georgia Street, P.O. Box 11117, Vancouver, British Columbia, V6E 4N7, Canada.

Following the Vintage Amalgamation, Iberian has three wholly-owned subsidiaries: Sulfuros Complejos Andalucia Mining S.L. (a corporation organized under the laws of Spain), Almada Mining S.A. (a corporation organized under the laws of Portugal) and Corporacion Recursos Iberia S.L. (a corporation organized under the laws of Spain).

The authorized share capital of SCA consists of one class of participations. Iberian holds all of the 3,006 participations that are issued and outstanding.