QuickLinks -- Click here to rapidly navigate through this document

U.S. Securities and Exchange Commission

Washington, D.C. 20549

Form 40-F

o Registration statement pursuant to section 12 of the

Securities Exchange Act of 1934

or

ý Annual report pursuant to section 13(a) or 15(d) of the

Securities Exchange Act of 1934

| | | |

|---|---|---|

| For the fiscal year ended | Commission File Number | |

| October 31, 2004 | 1-14446 |

The Toronto-Dominion Bank

(Exact name of Registrant as specified in its charter)

Canada

(Province or other jurisdiction of incorporation or organization)

6029

(Primary Standard Industrial Classification Code Number (if applicable))

13-5640479

(I.R.S. Employer Identification Number (if applicable))

c/o General Counsel's Office

P.O Box 1

Toronto Dominion Centre

Toronto, Ontario M5K 1A2

(416) 308-6963

(Address and telephone number of Registrant's principal executive offices)

Brendan O'Halloran, The Toronto-Dominion Bank

31 West 52nd Street

New York, NY

10019-6101

(212) 827-7000

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | | |

|---|---|---|

| Title of each class | Name of each exchange on which registered | |

| Common Shares | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Not Applicable

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Not Applicable

(Title of Class)

For annual reports, indicate by check mark the information filed with this Form:

| ý Annual information form | ý Audited annual financial statements |

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

| Common Shares | 656,954,072 | ||

| Class A First Preferred Shares, Series I | 16,065 | ||

| Class A First Preferred Shares, Series J | 16,383,935 | ||

| Class A First Preferred Shares, Series M | 14,000,000 | ||

| Class A First Preferred Shares, Series N | 8,000,000 |

Indicate by check mark whether the Registrant by filing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934 (the "Exchange Act"). If "Yes" is marked, indicate the filing number assigned to the Registrant in connection with such Rule.

| Yeso | 82- | Noý |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

| Yesý | Noo |

Disclosure Controls and Procedures and

Changes in Internal Control Over Financial Reporting.

The disclosure provided on page 21 of Exhibit 2: Management's Discussion and Analysis is incorporated by reference herein.

Audit Committee Financial Expert.

The disclosure provided under the headingCorporate Governance — The Audit Committee and the Shareholders' Auditors in Exhibit 4: Corporate Governance Disclosure is incorporated by reference herein.

Code of Ethics.

The Registrant has adopted theTD Bank Financial Group Guidelines of Conduct as its code of ethics applicable to the Registrant's President and Chief Executive Officer, Executive Vice President and Chief Financial Officer and Senior Vice President and Chief Accountant. The Registrant undertakes to provide a copy of its code of ethics to any person without charge upon request. Such request may be made by mail, fax or email to:

The Toronto-Dominion Bank

Shareholder Relations

P.O. Box 1, TD Centre

12th Floor, TD Tower

Toronto, Ontario, Canada

M5K 1A2

fax: 416-982-6166

email:tdshinfo@td.com

Principal Accountant Fees and Services.

The disclosure provided in Table 10 on page 54 of Exhibit 2: Management's Discussion and Analysis is incorporated by reference herein.

Pre-Approval Policy for Audit and Non-Audit Services

The disclosure provided in Table 10 on page 54 of Exhibit 2: Management's Discussion and Analysis is incorporated by reference herein.

Hours Expended on Audit Attributed to Persons Other than the Principal Accountant's Employees

N/A

Off-balance Sheet Arrangements.

The disclosure provided on page 17 of Exhibit 2: Management's Discussion and Analysis is incorporated by reference herein.

Tabular Disclosure of Contractual Obligations.

The disclosure provided in Table 17 on page 59 of Exhibit 2: Management's Discussion and Analysis is incorporated by reference herein.

Undertaking

The Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to the securities in relation to which the obligation to file an annual report on Form 40-F arises or transactions in said securities.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

| THE TORONTO-DOMINION BANK | |||

DATE: December 13, 2004 | By: | /s/ CHRISTOPHER A. MONTAGUE Name: Christopher A. Montague Title: Executive Vice President and General Counsel | |

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 40-F

ANNUAL REPORT PURSUANT TO

SECTION 13(a) or 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

THE TORONTO-DOMINION BANK

EXHIBITS

INDEX TO EXHIBITS

| No. | Exhibits | |

|---|---|---|

| 1. | Annual Information Form | |

| 2. | Management's Discussion and Analysis | |

| 3. | 2004 Annual Statement | |

| 4. | Corporate Governance Disclosure | |

| 5. | Senior Officers | |

| 6. | Independent auditors' report to the directors of Ernst & Young LLP and PricewaterhouseCoopers LLP dated November 24, 2004 and Comments by auditors for U.S. readers on Canada-U.S. reporting difference | |

| 7. | Consent of the Independent Auditors dated December 13, 2004 | |

| 8. | Certification Pursuant to Section 302 of the U.S. Sarbanes-Oxley Act of 2002 | |

| 9. | Certification Pursuant to 18 U.S.C. Section 1350 as Adopted Pursuant to Section 906 of the U.S. Sarbanes-Oxley Act of 2002 |

Exhibit 1

| ANNUAL INFORMATION FORM |

|

| The Toronto-Dominion Bank |

| Toronto-Dominion Centre |

Toronto, Ontario, Canada |

M5K 1A2 |

| December 9, 2004 |

Documents Incorporated by Reference

Portions of the Annual Information Form ("AIF") are disclosed in the Annual Report to Shareholders for the year ended October 31, 2004 ("Annual Report") and are incorporated by reference into the AIF.

| | Page Reference | ||||

|---|---|---|---|---|---|

| | Annual Information Form | Incorporated by Reference from the Annual Report | |||

| CORPORATE STRUCTURE | |||||

| Name, Address and Incorporation | 1 | ||||

| Intercorporate Relationships | 101-102 | ||||

GENERAL DEVELOPMENT OF THE BUSINESS | |||||

| Three Year History | 1 | 23-35 | |||

| DESCRIPTION OF THE BUSINESS | |||||

| Review of Business | 13-35 | ||||

| Competition | 2 | ||||

| Economic Dependence | 47 | ||||

| Average Number of Employees | 2 | ||||

| Lending | 39-41, 43-45 | ||||

| Reorganizations | 2 | ||||

| Risk Factors | 2 | 38-47 | |||

| DIVIDENDS | |||||

| Dividends per Share | 3 | ||||

| Dividend Policy and Restrictions | 49, 77-78 | ||||

| CAPITAL STRUCTURE | |||||

| Common Shares | 3 | 77-78 | |||

| Preferred Shares | 3 | 77-78 | |||

| Constraints | 4 | ||||

| Ratings | 4 | ||||

| MARKET FOR SECURITIES OF THE BANK | |||||

| Market Listings | 5 | ||||

| Trading Price and Volume | 5 | ||||

| Prior Sales | 7 | ||||

| DIRECTORS AND OFFICERS | |||||

| Directors and Board Committees of the Bank | 7 | 7-10 | |||

| Audit Committee | 9 | 9-10 | |||

| Executive Officers of the Bank | 10 | 110-111 | |||

| Shareholdings of Directors and Executive Officers | 10 | ||||

| Additional Disclosure for Directors and Executive Officers | 10 | ||||

| LEGAL PROCEEDINGS | 11 | ||||

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 11 | ||||

| TRANSFER AGENTS AND REGISTRARS | |||||

| Transfer Agent | 11 | ||||

| Co-transfer Agent and Registrar | 11 | ||||

| Shareholder Service Agent in Japan | 12 | ||||

| MATERIAL CONTRACTS | 12 | ||||

| INTERESTS OF EXPERTS | |||||

| Names of Experts | 12 | ||||

| Interests of Experts | 12 | ||||

| ADDITIONAL INFORMATION | 13 | ||||

Unless otherwise specified, this AIF presents information as at October 31, 2004.

i

Caution regarding Forwarding-Looking Statements

From time to time, The Toronto-Dominion Bank (the "Bank") makes written and oral forward-looking statements, including in this Annual Information Form, in other filings with Canadian regulators or the U.S. Securities and Exchange Commission (SEC), and in other communications. All such statements are made pursuant to the "safe harbour" provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements include, among others, statements regarding the Bank's objectives and targets and strategies to achieve them, the outlook for the Bank's business lines, and the Bank's anticipated financial performance. Forward-looking statements are typically identified by words such as "believe", "expect", "may" and "could". By their very nature, these statements are subject to inherent risks and uncertainties, general and specific, which may cause actual results to differ materially from the expectations expressed in the forward-looking statements. Some of the factors that could cause such differences include: the credit, market, liquidity, interest rate, operational and other risks discussed in the management discussion and analysis section in other regulatory filings made in Canada and with the SEC, including the Bank's 2004 Annual Report; general business and economic conditions in Canada, the United States and other countries in which the Bank conducts business, as well as the effect of changes in monetary policy in those jurisdictions and changes in the foreign exchange rates for the currencies of those jurisdictions; the degree of competition in the markets in which the Bank operates, both from established competitors and new entrants; legislative and regulatory developments; the accuracy and completeness of information the Bank receives on customers and counterparties; the timely development and introduction of new products and services in receptive markets; the Bank's ability to complete and integrate acquisitions, including the acquisition of a 51% interest in Banknorth Group, Inc. ("Banknorth"); the Bank's ability to attract and retain key executives; reliance on third parties to provide components of the Bank's business infrastructure; technological changes; change in tax laws; unexpected judicial or regulatory proceedings; continued negative impact of the United States litigation environment; unexpected changes in consumer spending and saving habits; the possible impact on the Bank's businesses of international conflicts and terrorism; acts of God, such as earthquakes; and management's ability to anticipate and manage the risks associated with these factors and execute the Bank's strategies. The preceding list is not exhaustive of all possible factors. Other factors could also adversely affect the Bank's results. All such factors should be considered carefully when making decisions with respect to the Bank, and undue reliance should not be placed on the Bank's forward-looking statements. The Bank does not undertake to update any forward-looking statements, written or oral, that may be made from time to time by or on its behalf.

ii

Name, Address and Incorporation

The Toronto-Dominion Bank (the "Bank") and its subsidiaries are collectively known as "TD Bank Financial Group". The Bank, a Schedule 1 chartered bank subject to the provisions of the Bank Act of Canada (the "Bank Act"), was formed on February 1, 1955 through the amalgamation of The Bank of Toronto (chartered in 1855) and The Dominion Bank (chartered in 1869). The Bank's head office is located at Toronto-Dominion Centre, King Street West and Bay Street, Toronto, Ontario, M5K 1A2.

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

As at October 31, 2004, the Bank was the third largest Canadian bank in terms of market capitalization. From 2001 to 2004, the Bank's assets have grown on average 2.9% annually to a total of $311.0 billion at the end of fiscal 2004. In Canada and around the world, TD Bank Financial Group serves more than 13 million customers in three key businesses: personal and commercial banking including TD Canada Trust; wealth management including the global operations of TD Waterhouse; and wholesale banking, including TD Securities, operating in a number of locations in key financial centres around the globe. TD Bank Financial Group also ranks among the world's leading on-line financial services firms, with more than 4.5 million on-line customers. For additional information on the Bank's businesses, see pages 23-35 of the Annual Report.

On November 4, 2002, the Bank announced that it would split its corporate lending business into "core" business, which the Bank intended to continue, and "non-core" business, which the Bank intended to run off in a manner that maximized shareholder value. At the end of 2004, this run off has been largely completed.

In the first half of fiscal 2003, the Bank restructured the international wealth management business of TD Waterhouse. Restructuring plans included: streamlining of TD Waterhouse International's United Kingdom operations; steps taken regarding strategic initiatives such as joint ventures in India, Singapore, Hong Kong and Luxembourg; and the sale of TD Waterhouse discount brokerage operations in Australia. The Bank also announced the restructuring of its U.S. equity options business. The Bank exited the options trading business in Philadelphia and San Francisco but continues to have a strong presence on the Chicago and American stock exchanges.

On October 31, 2003, the Bank acquired 57 Laurentian Bank branches in Ontario and Western Canada and their related regional and administrative support areas. The acquisition included a loan portfolio of approximately $2.0 billion and a deposit portfolio of approximately $1.9 billion. Laurentian Bank Visa card accounts were excluded. The Laurentian Bank customers, branches and related support areas have been largely merged into TD Canada Trust.

On January 20, 2004, Meloche Monnex Inc., an affiliate of the Bank, announced the signing of an agreement to acquire the Canadian personal lines property and casualty operations (automobile and homeowners insurance) of Boston-based Liberty Mutual Group. At October 31, 2004, Meloche Monnex was Canada's largest direct-response property and casualty insurer and one of the country's top four property and casualty insurers in personal lines, serving more than 1.5 million policyholders with a total of $1.4 billion in written premiums. The transaction closed in April 2004.

On August 26, 2004, the Bank announced a definitive agreement to acquire a 51% interest in Banknorth Group, Inc. for total consideration of approximately $5 billion. Consideration is expected to be 60% cash and 40% common shares of the Bank. Banknorth is a public company with approximately $35 billion in assets. The acquisition is subject to approval by regulators and Banknorth shareholders, and if approved, is expected to close in February 2005.

1

DESCRIPTION OF THE BUSINESS

Competition

The Bank is subject to intense competition in all aspects and areas of its business from banks and other domestic and foreign financial institutions and from non-financial institutions, including retail stores that maintain their own personal credit programs and governmental agencies that make available loans to certain borrowers. Competition has increased in recent years in many areas in which the Bank operates, in substantial part because other types of financial institutions and other entities have begun to engage in activities traditionally engaged in only by banks. Many of these competitors are not subject to regulation as extensive as that under the Bank Act and, thus, may have competitive advantages over the Bank in certain respects.

Average Number of Employees

In fiscal 2004, the Bank had an average number of employees of 42,843.

Reorganizations (within the last three years)

In November, 2001, the Bank announced the successful completion of its tender offer, through its wholly owned subsidiary, TD Waterhouse Holdings, Inc., for all of the approximately 12% of the outstanding shares of TD Waterhouse Group, Inc.'s common stock that the Bank and TD Waterhouse Holdings, Inc. did not already own.

Risk Factors

Banking and financial services involve risk. The Bank's goal is to earn stable and sustainable returns from its various businesses and operations while managing risks within acceptable limits. The Bank manages the static and changing risks involved in its businesses by establishing policies, procedures and internal checks and balances to keep the potential impacts and likelihood of each risk to an acceptable level. The Bank is exposed to six major categories of risk: credit, market, operational, liquidity, investment and regulatory risks. In addition, since all risks have the potential to impact upon the Bank's reputation, how it manages the various risks determines the extent to which the Bank's overall reputation and capital are at risk.

Industry and Bank-specific risks and uncertainties may impact materially on the Bank's future results. Industry risks include general economic and business conditions in the regions in which the Bank conducts business, monetary policies of the Bank of Canada and Federal Reserve System in the United States, competition, changes in laws and regulations, and accuracy and completeness of information on customers and counterparties. Bank-specific risks include the Bank's ability to adapt products and services to evolving industry standards, its ability to successfully complete and integrate acquisitions, its ability to attract and retain key executives and the disruption of key components of the Bank's business infrastructure.

Further explanation of the types of risks cited above and the ways in which the Bank manages them can be found in the Management Discussion and Analysis in pages 38 to 47 of the Annual Report, which are incorporated by reference. The Bank cautions that the preceding discussion of risk is not exhaustive. When considering whether to purchase securities of the Bank, investors and others should carefully consider these factors as well as other uncertainties, potential events and industry- and Bank-specific factors that may adversely impact the Bank's future results.

2

DIVIDENDS

Dividends per Share

| | 2004 | 2003 | 2002 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Common shares | $ | 1.36 | $ | 1.16 | $ | 1.12 | ||||

Preferred Shares | ||||||||||

| Series G | — | U.S.$ | 0.68 | U.S.$ | 1.35 | |||||

| Series H | $ | 0.90 | $ | 1.78 | $ | 1.78 | ||||

| Series I | $ | 0.04 | $ | 0.04 | $ | 0.04 | ||||

| Series J | $ | 1.28 | $ | 1.28 | $ | 1.28 | ||||

| Series K | — | $ | 0.47 | $ | 1.84 | |||||

| Series L | — | U.S.$ | 0.41 | U.S.$ | 1.60 | |||||

| Series M | $ | 1.18 | $ | 0.86 | — | |||||

| Series N | $ | 1.15 | $ | 0.58 | — | |||||

On February 3, 2003, the Bank redeemed all its 6,000,000 outstanding Class A First Preferred Shares, Series K and L.

On February 3, 2003, the Bank issued 14,000,000 Class A First Preferred Shares, Series M.

On April 30, 2003, the Bank issued 8,000,000 Class A First Preferred Shares, Series N.

On May 1, 2003, the Bank redeemed all its 7,000,000 outstanding Class A First Preferred Shares, Series G.

On May 3, 2004, the Bank redeemed all its 9,000,000 outstanding Class A First Preferred Shares, Series H.

CAPITAL STRUCTURE

Common Shares

The authorized common share capital of the Bank consists of an unlimited number of common shares without nominal or par value. The holders of common shares are entitled to vote at all meetings of the shareholders of the Bank except meetings at which only holders of a specified class or series of shares are entitled to vote. The holders of common shares are entitled to receive dividends as and when declared by the Board of Directors of the Bank, subject to the preference of the holders of the preferred shares of the Bank. After payment to the holders of the preferred shares of the Bank of the amount or amounts to which they may be entitled, and after payment of all outstanding debts, the holders of common shares shall be entitled to receive the remaining property of the Bank upon the liquidation, dissolution or winding-up thereof.

Preferred Shares

The Class A First Preferred Shares (the "Preferred Shares") of the Bank may be issued from time to time, in one or more series, with such rights, privileges, restrictions and conditions as the Board of Directors of the Bank may determine.

The Preferred Shares rank prior to the common shares and to any other shares of the Bank ranking junior to the Preferred Shares with respect to the payment of dividends and the distribution of assets in the event of the liquidation, dissolution or winding-up of the Bank. Each series of Preferred Shares ranks on a parity with every other series of Preferred Shares.

3

In the event of the liquidation, dissolution or winding-up of the Bank, before any amounts shall be paid to or any assets distributed among the holders of the common shares or shares of any other class of the Bank ranking junior to the Preferred Shares, the holder of a Preferred Share of a series shall be entitled to receive to the extent provided for with respect to such Preferred Shares by the conditions attaching to such series: (i) an amount equal to the amount paid up thereon; (ii) such premium, if any, as has been provided for with respect to the Preferred Shares of such series; and (iii) all unpaid cumulative dividends, if any, on such Preferred Shares and, in the case of non-cumulative Preferred Shares, all declared and unpaid non-cumulative dividends. After payment to the holders of the Preferred Shares of the amounts so payable to them, they shall not be entitled to share in any further distribution of the property or assets of the Bank. Each series of Preferred Shares ranks equally with every other series of Preferred Shares.

There are no voting rights attaching to the Preferred Shares except to the extent provided for by any series or by the Bank Act.

Constraints

There are no constraints imposed on the ownership of securities of the Bank to ensure that the Bank has a required level of Canadian ownership. However, under the Bank Act, the ownership by one person or entity of more than 10% of the common shares of the Bank is prohibited without approval in accordance with the provisions of the Bank Act.

Ratings

| | | Dominion Bond Rating Service | Moody's Investor Services | Standard & Poor's | Fitch | | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt (deposits) | AA (low) | Aa3 | A+ | AA - | ||||||||

| Subordinated Debt | A (high) | A1 | A | A + | ||||||||

| Short Term Debt (deposits) | R-1 (mid) | P-1 | A-1 | F-1+ | ||||||||

| Preferred Shares | Pfd-1 (low) | P-1 (low) |

The AA (low) rating assigned by Dominion Bond Rating Service Limited ("DBRS") to the Bank's long term debt and the A (high) rating assigned to the Bank's subordinated debt are the second and third highest ratings, respectively, of DBRS's ten rating categories for long term debt obligations, which range from AAA to D. DBRS uses "high" and "low" designations on ratings from AA to C to indicate the relative standing of the securities being rated within a particular rating category. The R-1 (mid) rating assigned to short tem debt is the highest rating of DBRS's four rating categories for short term debt obligations, which range from R-1 to D. A Pfd-1 (low) rating by DBRS is the highest of five categories granted by DBRS for preferred shares.

The A+ rating assigned by Standard & Poor's, a division of McGraw-Hill Companies ("S&P") to the Bank's long term debt and the A rating assigned to the Bank's subordinated debt are both the third highest ratings, of S&P's ten rating categories for long term debt obligations, which range from AAA to D. Ratings from AA to CCC may be modified by the addition of a plus or minus sign to show relative standing within the major rating categories. The A-1 rating assigned to short tem debt is the highest rating of S&P's six rating categories for short term debt obligations, which range from A-1 to D. A P-1 (low) rating by S&P is the highest of five categories used by S&P in its Canadian preferred share rating scale. "Plus" and "minus" signs may be used to indicate the relative standing of a credit within a particular rating category.

4

The Aa3 rating assigned by Moody's Investor Services Inc. ("Moody's") to the Bank's long term debt and the A1 rating assigned to the Bank's subordinated debt are the second and third highest, respectively, of its nine rating categories for long term debt obligations, which range from Aaa to C. Moody's appends numerical modifiers 1, 2 and 3 to each generic rating classification from Aa through Caa. The modifier 1 indicates that the obligation ranks in the higher end of its generic rating category, the modifier 2 indicates a mid-range ranking and the modifier 3 indicates a ranking in the lower end of that generic rating category. The P-1 rating assigned to short tem debt is the highest rating of Moody's four rating categories for short term debt obligations, which range from P-1 to NP.

The AA- rating assigned by Fitch Ratings ("Fitch") to the Bank's long term debt and the A+ rating assigned to the Bank's subordinated debt are the second and third highest ratings, respectively, of Fitch's twelve rating categories for long term debt obligations, which range from AAA to D. A plus or minus sign may be appended to ratings from AA to CCC to denote relative status within major rating categories. The F-1+ rating assigned to short term debt is the highest rating of Fitch's six rating categories for short term debt obligations, which range from F1 to D. A plus sign may be appended to an F1 rating class to denote relative status within the category.

Credit ratings are intended to provide investors with an independent assessment of the credit quality of an issue or issuer of securities and do not speak to the suitability of particular securities for any particular investor. The credit ratings assigned to securities may not reflect the potential impact of all risks on the value of the securities. A rating is therefore not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time by the rating agency.

MARKET FOR SECURITIES OF THE BANK

Market Listings

The Bank's common shares are listed on:

the Toronto Stock Exchange

the New York Stock Exchange

the Tokyo Stock Exchange

The Bank's preferred shares, except the Class A First Preferred Shares, Series I, are listed on the Toronto Stock Exchange.

Trading Price and Volume

Trading price and volume of the Bank's securities:

TORONTO STOCK EXCHANGE

| | | Preferred Shares | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| | Common Shares | ||||||||||

| | Series H | Series J | Series M | Series N | |||||||

| November 2003 | |||||||||||

| High Price ($) | 44.78 | 26.75 | 27.15 | 26.64 | 26.59 | ||||||

| Low Price ($) | 40.68 | 25.91 | 26.63 | 26.30 | 26.27 | ||||||

| Volume ('00) | 326,310 | 490 | 348 | 1,736 | 2,087 | ||||||

December | |||||||||||

| High Price ($) | 43.65 | 26.39 | 27.23 | 27.12 | 27.03 | ||||||

| Low Price ($) | 40.60 | 25.50 | 26.66 | 26.43 | 26.40 | ||||||

| Volume ('00) | 400,093 | 584 | 477 | 1,481 | 1,886 | ||||||

5

| | | Preferred Shares | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| | Common Shares | ||||||||||

| | Series H | Series J | Series M | Series N | |||||||

| January 2004 | |||||||||||

| High Price ($) | 46.05 | 26.12 | 27.38 | 27.20 | 27.17 | ||||||

| Low Price ($) | 42.88 | 25.50 | 26.75 | 26.63 | 26.67 | ||||||

| Volume ('00) | 436,732 | 21,071 | 6,063 | 6,471 | 9,384 | ||||||

February | |||||||||||

| High Price ($) | 45.33 | 25.75 | 27.85 | 27.50 | 27.40 | ||||||

| Low Price ($) | 43.40 | 25.27 | 27.25 | 26.94 | 26.94 | ||||||

| Volume ('00) | 288,812 | 513 | 4,310 | 1,285 | 1,295 | ||||||

March | |||||||||||

| High Price ($) | 47.49 | 25.89 | 27.80 | 27.88 | 27.84 | ||||||

| Low Price ($) | 44.60 | 25.25 | 27.61 | 27.30 | 27.23 | ||||||

| Volume ('00) | 506,263 | 18,627 | 28,478 | 1,446 | 2,555 | ||||||

April | |||||||||||

| High Price ($) | 48.25 | 25.45 | 27.69 | 27.84 | 27.75 | ||||||

| Low Price ($) | 43.50 | 24.95 | 26.02 | 25.75 | 24.50 | ||||||

| Volume ('00) | 285,422 | 26,244 | 12,956 | 3,524 | 6,436 | ||||||

May | |||||||||||

| High Price ($) | 45.75 | 25.03 | 26.51 | 26.47 | 26.15 | ||||||

| Low Price ($) | 43.30 | 24.94 | 26.15 | 25.90 | 25.60 | ||||||

| Volume ('00) | 267,105 | 22* | 846 | 1,208 | 2,078 | ||||||

June | |||||||||||

| High Price ($) | 46.59 | 26.85 | 26.98 | 26.39 | |||||||

| Low Price ($) | 42.67 | 26.45 | 26.20 | 25.90 | |||||||

| Volume ('00) | 305,521 | 943 | 3,518 | 1,683 | |||||||

July | |||||||||||

| High Price ($) | 44.40 | 27.10 | 26.79 | 26.58 | |||||||

| Low Price ($) | 42.54 | 26.15 | 26.00 | 25.71 | |||||||

| Volume ('00) | 206,066 | 12,994 | 2,624 | 5,354 | |||||||

August | |||||||||||

| High Price ($) | 46.07 | 26.80 | 27.00 | 27.00 | |||||||

| Low Price ($) | 42.71 | 26.48 | 26.50 | 26.40 | |||||||

| Volume ('00) | 369,755 | 562 | 1,325 | 3,708 | |||||||

September | |||||||||||

| High Price ($) | 47.07 | 26.79 | 27.16 | 27.00 | |||||||

| Low Price ($) | 45.00 | 25.60 | 26.76 | 26.75 | |||||||

| Volume ('00) | 301,567 | 939 | 973 | 1,199 | |||||||

October | |||||||||||

| High Price ($) | 50.00 | 26.75 | 27.09 | 27.04 | |||||||

| Low Price ($) | 46.04 | 25.81 | 26.25 | 26.31 | |||||||

| Volume ('00) | 378,611 | 12,669 | 4,306 | 8,841 | |||||||

- *

- On May 3, 2004, the Bank redeemed all of its Class A First Preferred Shares, Series H.

6

Prior Sales

In the most recently completed financial year, the Bank did not issue (a) any shares that are not listed or quoted on a marketplace, or (b) any subordinated debt securities. In the ordinary course of business, the Bank issues deposit notes under its Euro Medium Term and Deposit Note Programme, as well as on a stand-alone basis in various jurisdictions, including Canada. In 2004, the Bank issued approximately $690 million of such deposit notes at par.

DIRECTORS AND OFFICERS

Directors and Board Committees of the Bank

The following table sets forth the directors of the Bank as at December 9, 2004, their present principal occupation and business and the date each became a director of the Bank.

| Director Name Principal Occupation | Director Since | |

|---|---|---|

| William E. Bennett Corporate Director and retired President and Chief Executive Officer, Draper & Kramer, Inc. | May 2004 | |

Hugh J. Bolton Chair of the Board, EPCOR Utilities Inc. (integrated energy company) | April 2003 | |

John L. Bragg President and Co-Chief Executive Officer, Oxford Frozen Foods Limited (distributor of frozen food products) | October 2004 | |

W. Edmund Clark President and Chief Executive Officer of the Bank | August 2000 | |

Marshall A. Cohen Counsel, Cassels Brock & Blackwell LLP (law firm) | February 1992 | |

Wendy K. Dobson Professor and Director, Institute for International Business, Joseph L. Rotman School of Management, University of Toronto | October 1990 | |

Darren Entwistle President and Chief Executive Officer, TELUS Corporation (telecommunications company) | November 2001 | |

Donna M. Hayes Publisher and Chief Executive Officer, Harlequin Enterprises Limited (global publishing company) | January 2004 |

7

| Director Name Principal Occupation | Director Since | |

|---|---|---|

| Henry H. Ketcham Chairman of the Board, President and Chief Executive Officer, West Fraser Timber Co. Ltd. (integrated forest products company) | January 1999 | |

Pierre H. Lessard President and Chief Executive Officer, METRO INC. (food retailer and distributor) | October 1997 | |

Harold H. MacKay Senior Partner, MacPherson Leslie & Tyerman LLP (law firm) | November 2004 | |

Brian F. MacNeill Chairman of the Board, Petro-Canada (integrated oil and gas company) | August 1994 | |

Roger Phillips Corporate Director and retired President and Chief Executive Officer, IPSCO Inc. | February 1994 | |

Wilbur J. Prezzano Corporate Director and retired Vice Chairman, Eastman Kodak Company | April 2003 | |

Helen K. Sinclair Chief Executive Officer, BankWorks Trading Inc. (software and educational products company) | June 1996 | |

Donald R. Sobey Chairman Emeritus, Empire Company Limited (investment holding company) | October 1992 | |

Michael D. Sopko Corporate Director and retired Chairman and Chief Executive Officer, Inco Limited | August 1992 | |

John M. Thompson Chairman of the Board of the Bank | August 1988 |

Except as hereinafter disclosed, all directors have held their positions or other executive positions with the same, predecessor or associated firms or organizations for the past five years. Prior to his appointment as Chair of EPCOR Utilities Inc. on January 1, 2000, Mr. Hugh J. Bolton was a financial consultant and corporate director. Prior to joining the Bank on February 1, 2000, Mr. W. Edmund Clark was President and Chief Executive Officer of CT Financial Services Inc., Canada Trustco Mortgage Company and The Canada Trust Company. Until December 20, 2002 when Mr. Clark became the President and Chief Executive Officer of the Bank, he was the President and Chief Operating Officer of the Bank. Prior to joining TELUS Corporation in July 2000, Mr. Darren Entwistle held various senior executive positions in the telecommunications industry, including Cable & Wireless Communications plc in the United Kingdom. Mr. Brian F. MacNeill was President and Chief Executive Officer of Enbridge Inc. (formerly IPL Energy Inc.) from April 1991 and stepped down as President in September 2000 and as Chief Executive Officer in January 2001. Mr. Roger Phillips retired as President and Chief Executive Officer of IPSCO Inc. in January 2002. Dr. Michael D. Sopko retired as Chief Executive Officer of Inco Limited on April 25, 2001 and as its Chairman on April 17, 2002. Mr. John M. Thompson was the Vice Chairman of the Board of IBM Corporation from August 2000 until his retirement in September 2002, and prior to that held various senior executive positions with IBM. Mr. Donald R. Sobey was also a director of the Bank from May 1978 to January 1992. As announced on August 26, 2004, William J. Ryan, Chairman, President and Chief Executive Officer of Banknorth Group, Inc. will join the Board of Directors of the Bank upon the conclusion of the Bank's acquisition of 51% of the outstanding shares of Banknorth. Subject to shareholder and regulatory approval, the acquisition is expected to close in February 2005. Each director will hold office until the next annual meeting of shareholders of the Bank, which is scheduled for March 23, 2005. Information concerning the nominees proposed by management for election as directors at the meeting will be contained in the proxy circular of the Bank in respect of the meeting.

8

Audit Committee

The Audit Committee of the Board of Directors of the Bank operates under a written charter that sets out its responsibilities and composition requirements. A copy of the charter is attached to this AIF. As at December 9, 2004, the members of the Committee were: Hugh J. Bolton (chair), John L. Bragg, Darren Entwistle, Donna M. Hayes, Henry H. Ketcham and Helen K. Sinclair. The following sets out the education and experience of each director relevant to the performance of his or her duties as a member of the Committee:

Hugh J. Bolton is Chair of the Bank's Audit Committee. Mr. Bolton holds an undergraduate degree in economics from the University of Alberta. Mr. Bolton has over 40 years of experience in the accounting industry, including as a former partner, Chairman and Chief Executive Officer of Coopers & Lybrand Canada, Chartered Accountants. He remains a Chartered Accountant and Fellow of the Alberta Institute of Chartered Accountants and has significant experience with accounting and auditing issues relating to financial service corporations such as the Bank. Mr. Bolton is the Bank's Audit Committee Financial Expert for the purposes of U.S. securities legislation.

John L. Bragg is President and Founder of Oxford Frozen Foods Limited and the owner and founder of Bragg Communications Inc. Mr. Bragg holds a Bachelor of Commerce degree and a Bachelor of Education degree from Mount Allison University.

Darren Entwistle is the President and Chief Executive Officer of TELUS Corporation and is a member of its Board of Directors. Mr. Entwistle holds an undergraduate degree in economics from Concordia University and a master's degree in business administration from McGill University.

Donna M. Hayes is the Publisher and Chief Executive Officer of Harlequin Enterprises Limited and is a member of its Board of Directors and the boards of a number of associated companies. Ms. Hayes holds an undergraduate degree from McGill University and has completed the professional publishing course at Stanford University and the executive management program at the Richard Ivey School at The University of Western Ontario.

Henry H. Ketcham is the Chairman of the Board, President and Chief Executive Officer of West Fraser Timber Co. Ltd. Mr. Ketcham holds an undergraduate degree from Brown University.

Helen K. Sinclair is the founder and Chief Executive Officer of BankWorks Trading Inc. and is a member of its Board of Directors. Ms. Sinclair holds an undergraduate degree from York University and a master's degree from the University of Toronto, both in economics. She is a graduate of the Advanced Management Program of the Harvard Business School.

The Committee charter requires all members to be financially literate or be willing and able to acquire the necessary knowledge quickly. Financially literate means the ability to read and understand financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by the Bank's financial statements. The Bank believes all of the current members of the Committee are financially literate.

9

In addition, the Committee charter contains independence requirements applicable to each member and, as at December 9, 2004, each member meets those requirements. Specifically, the charter provides that no member of the Committee may be an officer or retired officer of the Bank and every member shall be independent of the Bank within the meaning of all applicable laws, rules and regulations and any other relevant consideration, including laws, rules and regulations particularly applicable to audit committee members.

The Committee has in place a policy to restrict the provision of non-audit services by the shareholders' auditors. Any such services must be permitted services and must be pre-approved by the Committee pursuant to the policy. The Committee also pre-approves the audit services and the fees to be paid. Additional information regarding audit and non-audit services, together with the fees paid to the shareholders' auditors in the last three fiscal years, can be found in Table 10 on page 54 of the Annual Report.

Executive Officers of the Bank

As at December 9, 2004, executive officers of the Bank are Mr. W. Edmund Clark, Ms. Andrea S. Rosen, and Messrs. Robert E. Dorrance, Fredric J. Tomczyk, Bernard T. Dorval, William H. Hatanaka, Robert F. MacLellan and Daniel A. Marinangeli.

Shareholdings of Directors and Executive Officers

As at December 9, 2004, the directors and executive officers of the Bank as a group beneficially owned, directly or indirectly, or exercised control or direction over, less than one percent of the outstanding common shares of the Bank.

Additional Disclosure for Directors and Executive Officers

To the best of our knowledge, having made due inquiry, the Bank confirms that, as at December 9, 2004:

- (i)

- in the last ten years, no director or executive officer of the Bank is or has been a director or officer of a company (including the Bank) that, while that person was acting in that capacity:

- (a)

- was the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation for a period of more than 30 consecutive days, except Mr. Pierre Lessard who was a director of CINAR Corporation at the time its shares were suspended from trading on the Toronto Stock Exchange for more than 30 consecutive days and were delisted from the Toronto Stock Exchange and the NASDAQ due to the inability of CINAR Corporation to meet continued listing requirements;

- (b)

- was subject to an event that resulted, after the director or executive officer ceased to be a director or executive officer, in the company being the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days; or

- (c)

- within a year of the person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets, except Mr. Marshall Cohen who ceased to be a director of Haynes International Inc. within twelve months prior to Haynes International Inc. filing for relief under Chapter 11 of the United States Bankruptcy Code in March 2004;

- (ii)

- in the last ten years, no director or executive officer of the Bank has become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the director or executive officer; and

10

- (iii)

- no director or executive officer of the Bank has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority or has been subject to any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable investor in making an investment decision.

LEGAL PROCEEDINGS

The Bank and its subsidiaries are engaged in legal actions arising in the ordinary course of business, many of which are loan-related. None of this litigation individually or in the aggregate, however, is expected to have a material adverse effect on the consolidated financial position or results of operations of the Bank.

During fiscal 2004, the Bank added $354 million to its contingent litigation reserves. This includes reserves with respect to certain Enron-related actions to which the Bank is a party. Several of these matters are in the early stages of litigation and given the size of the claims there is exposure to additional loss. The Bank will regularly assess its position as events progress.

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

To the best of our knowledge, the Bank confirms that, as at December 9, 2004 there were no directors or executive officers of the Bank or any associate or affiliate of a director or executive officer of the Bank with a material interest in any transaction within the three most recently completed financial years or during the current financial year that has materially affected or will materially affect the Bank.

TRANSFER AGENTS AND REGISTRARS

Transfer Agent

CIBC Mellon Trust Company

P.O. Box 7010

Adelaide Street Postal Station

Toronto, Ontario

M5C 2W9

(800) 387-0825

(416) 643-5500

www.cibcmellon.com or inquiries@cibcmellon.com

Co-transfer Agent and Registrar

Mellon Investor Services LLC

P.O. Box 3315

South Hackensack, New Jersey

07606

or

11

85 Challenger Road

Ridgefield Park, New Jersey

07660

(800) 370-1163

(201) 329-8660

www.melloninvestor.com

Shareholder Service Agent in Japan

Mizuho Trust & Banking Co., Ltd.

1-17-7, Saga, Koto-ku

Tokyo, Japan

135-8722

MATERIAL CONTRACTS

On August 25, 2004, the Bank and Banknorth signed a definitive agreement for the Bank to acquire 51% of the outstanding shares of Banknorth for consideration valued at the time of approximately $5 billion. The agreement between the Bank and Banknorth provides for the merger of Banknorth with a Bank subsidiary in which each Banknorth shareholder will receive a package of US$12.24 in cash, 0.2351 of a common share of the Bank and 0.49 shares of the new Banknorth stock, which will continue to be listed on the New York Stock Exchange. Subject to shareholder and regulatory approval, the acquisition is expected to close in February, 2005.

INTERESTS OF EXPERTS

Names of Experts

The consolidated financial statements of the Bank for the year ended October 31, 2004 included in the Bank's 2004 Annual Report filed under National Instrument 51-102 Continuous Disclosure (NI 51-102), portions of which are incorporated by reference in this AIF, have been audited by Ernst & Young LLP and PricewaterhouseCoopers LLP.

Further, the proxy statement/prospectus relating to the Bank's acquisition of 51% of the outstanding shares of Banknorth, filed under NI 51-102, describes or includes: fairness opinions of Keefe, Bruyette & Woods, Inc. and Lehman Brothers Inc.; the audit report of Ernst & Young LLP and PricewaterhouseCoopers LLP covering the consolidated financial statements of the Bank for the year ended October 31, 2003; and legal opinions of Elias, Matz, Tiernan & Herrick L.L.P., Simpson Thacher & Bartlett LLP and Osler, Hoskin & Harcourt LLP.

Interests of Experts

Keefe, Bruyette & Woods, Inc., Lehman Brothers Inc., and the respective partners, counsel and associates of each of Elias, Matz, Tiernan & Herrick L.L.P., Simpson Thacher & Bartlett LLP and Osler, Hoskin & Harcourt LLP beneficially own, directly or indirectly, less than 1% of any class of security issued by the Bank or any of its affiliates.

As of December 9, 2004, no executive officer or director of the Bank is an officer, director or employee of Keefe, Bruyette & Woods, Inc. or Lehman Brothers Inc., or is a partner, counsel or associate of Elias, Matz, Tiernan & Herrick L.L.P., Simpson Thacher & Bartlett LLP or Osler, Hoskin & Harcourt LLP. Nor, as of December 9, 2004, to the best of our knowledge, does the Bank expect to elect, appoint or employ as a director or executive officer of the Bank any director, officer or employee of Keefe, Bruyette & Woods, Inc. or Lehman Brothers Inc., or partner, counsel or associate of Elias, Matz, Tiernan & Herrick L.L.P., Simpson Thacher & Bartlett LLP or Osler, Hoskin & Harcourt LLP.

12

The Bank has implemented a policy governing the hiring of current or former partners, employees or consultants of the shareholders' auditors. The objectives of this policy are to ensure that the Bank's hiring practices comply with all applicable securities laws, rules and regulations and to establish procedures to be followed by the Bank's Human Resources department when considering a candidate for a position at the Bank who is currently or has previously been employed by one or more of the shareholders' auditors. From time to time, at the Bank's request, law firms provide lawyers and law students for secondment to groups in the Bank's head office and business units.

ADDITIONAL INFORMATION

Additional information concerning the Bank may be found on SEDAR at www.sedar.com. The Bank will provide to any person or company upon request to the Secretary of the Bank at the head office of the Bank: (a) when the securities of the Bank are in the course of distribution pursuant to a short form prospectus or a preliminary short form prospectus which has been filed in respect of a proposed distribution of its securities, (i) one copy of this Annual Information Form, together with one copy of any document, or the pertinent pages of any document, incorporated by reference in this Annual Information Form, (ii) one copy of the comparative financial statements of the Bank for its most recently completed financial year for which financial statements have been filed, together with the accompanying report of the auditors, and one copy of the most recent interim financial statements of the Bank, if any, filed for any period after the end of its most recently completed financial year, (iii) one copy of the proxy circular of the Bank in respect of its most recent annual meeting of shareholders that involved the election of directors, and (iv) one copy of any other documents that are incorporated by reference into the preliminary short form prospectus or the short form prospectus and are not required to be provided under (i) to (iii) above; or (b) at any other time, one copy of any documents referred to in (a)(i), (ii) and (iii) above, provided the Bank may require the payment of a reasonable charge if the request is made by a person or company who is not a security holder of the Bank.

Additional information, including directors' and officers' remuneration and indebtedness, principal holders of the Bank's securities, options to purchase securities and interests of insiders in material transactions, if applicable, is contained in the Bank's proxy circular for its most recent annual meeting of shareholders that involved the election of directors. Additional financial information is provided in the Bank's comparative financial statements and management's discussion and analysis for its most recently completed financial year, which at the date hereof, was the year ended October 31, 2004. The Bank's comparative financial statements and management's discussion and analysis for the year ended October 31, 2004 are contained in the Annual Report.

13

ATTACHMENT

AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS

OF THE TORONTO-DOMINION BANK

CHARTER

~ ~ Supervising the Quality and Integrity of the Bank's Financial Reporting ~ ~

Our Main Responsibilities:

- •

- overseeing of reliable, accurate and clear financial reporting to shareholders

- •

- monitoring internal controls – the necessary checks and balances must be in place

- •

- directly responsible for the selection, compensation, retention and oversight of the work of the external auditors – the external auditors report directly to the Committee

- •

- listening to the shareholders' auditors and internal auditor and evaluating the effectiveness and independence of each

- •

- overseeing the establishment and maintenance of processes that ensure the Bank is in compliance with the laws and regulations that apply to it as well as its own policies

- •

- acting as the audit committee and conduct review committee for certain subsidiaries of the Bank that are federally-regulated financial institutions

- •

- receiving reports on and approve, if appropriate, transactions with related parties

Independence is Key:

- •

- our Committee is composed entirely of non-management directors

- •

- we meet regularly without management present

- •

- we have the power to hire – and fire – independent advisors, paid for by the Bank, to help us make the best possible decisions on the financial reporting, accounting policies and practices, disclosure practices, and internal controls of the Bank

Composition and Independence, Financial Literacy and Authority

The Committee shall be composed of members of the Board of Directors in such number as is determined by the Board with regard to the by-laws of the Bank, applicable laws, rules and regulations and any other relevant consideration, subject to a minimum requirement of three directors. In this charter, "Bank" means The Toronto-Dominion Bank on a consolidated basis.

To facilitate open communication between the Audit Committee and the Risk Committee, the Chair of the Audit Committee shall either be a member of the Risk Committee or be entitled to receive notice of and attend as an observer each meeting of the Risk Committee and to receive the materials for each meeting of the Risk Committee. The Chair of the Risk Committee shall either be a member of the Audit Committee or be entitled to receive notice of and attend as an observer each meeting of the Audit Committee and to receive the materials for each meeting of the Audit Committee.

No member of the Committee may be an officer or retired officer of the Bank. Every member of the Committee shall be independent of the Bank within the meaning of all applicable laws, rules and regulations and any other relevant consideration, including laws, rules and regulations particularly applicable to audit committee members.

The members of the Committee shall be appointed by the Board and shall serve until their successors are duly appointed. A Chair will be appointed by the Board, failing which the members of the Committee may designate a Chair by majority vote. The Committee may from time to time delegate to its Chair certain powers or responsibilities that the Committee itself may have hereunder.

In addition to the qualities set out in the Position Description for Directors, all members of the Committee should be financially literate or be willing and able to acquire the necessary knowledge quickly. "Financial Literacy" means the ability to read and understand financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by the Bank's financial statements. At least one member of the Committee shall have a background in accounting or related financial management experience which would include any experience or background which results in the individual's financial sophistication, including being or having been an auditor, a Chief Executive Officer or other senior officer with financial oversight responsibilities.

In fulfilling the responsibilities set out in this Charter, the Committee has the authority to conduct any investigation and access any officer, employee or agent of the Bank appropriate to fulfilling its responsibilities, including the shareholders' auditors of the Bank. The Audit Committee may obtain advice and assistance from outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties and may retain and determine the compensation to be paid by the Bank for such independent counsel or outside advisor in its sole discretion without seeking Board approval.

Committee members will enhance their familiarity with financial, accounting and other areas relevant to their responsibilities by participating in educational sessions or other opportunities for development.

2

Meetings

The Committee shall meet at least four times annually, or more frequently as circumstances dictate. The Committee should meet with the shareholders' auditors and management quarterly to review the Bank's financial statements consistent with the section entitled "Financial Reporting" below. The Committee should dedicate a portion of each of its regularly scheduled quarterly meetings to meeting separately with each of the Chief Financial Officer, the Chief Auditor and the shareholders' auditors and to meeting on its own without members of management or the shareholders' auditors. Annually, the Committee shall meet jointly with the Risk Committee and The Office of the Superintendent of Financial Institutions.

Specific Duties and Responsibilities

Financial Reporting

The Committee shall be responsible for the oversight of reliable, accurate and clear financial reporting to shareholders, including reviewing the Bank's annual and interim financial statements and management's discussion and analysis, prior to approval by the Board and release to the public, and reviewing, as appropriate, releases to the public of significant material non-public financial information of the Bank. Such review of the financial reports of the Bank shall include, where appropriate but at least annually discussion with management and the shareholders' auditors of significant issues regarding accounting principles, practices, and significant management estimates and judgments.

The Committee shall review earnings press releases and satisfy itself that adequate procedures are in place for the review of the Bank's public disclosure of financial information extracted or derived from the Bank's financial statements, other than the public disclosure in the Bank's annual and interim financial statements and MD&A, and must periodically assess the adequacy of those procedures.

Financial Reporting Process

The Committee shall support the Board in its oversight of the financial reporting process of the Bank including:

- •

- working with management, the shareholders' auditors and the internal audit department to review the integrity of the Bank's financial reporting processes;

- •

- reviewing the process relating to and the certifications of the Chief Executive Officer and the Chief Financial Officers on the integrity of the Bank's quarterly and annual consolidated financial statements;

3

- •

- considering the key accounting policies of the Bank and key estimates and judgments of management and discussing such matters with management and/or the shareholders' auditors;

- •

- keeping abreast of trends and best practices in financial reporting including considering, as they arise, topical issues such as the use of variable interest entities and off-balance sheet reporting, and their application to the Bank;

- •

- reviewing with the shareholders' auditors and management significant accounting principles and policies and all critical accounting policies and practices used and any significant audit adjustments made;

- •

- considering and approving, if appropriate, major changes to the Bank's accounting and financial reporting and policies as suggested by the shareholders' auditors, management, or the internal audit department; and

- •

- establishing regular systems of reporting to the Committee by each of management, the shareholders' auditors and the internal audit department regarding any significant judgments made in management's preparation of the financial statements and any significant difficulties encountered during the course of the review or audit, including any restrictions on the scope of work or access to required information.

The Audit Committee's Role in the Financial Reporting Process

The shareholders' auditors are responsible for planning and carrying out, in accordance with professional standards, an audit of the Bank's annual financial statements and reviews of the Bank's quarterly financial information. Management of the Bank is responsible for the preparation, presentation and integrity of the Bank's financial statements and for maintaining appropriate accounting and financial reporting principles and policies and internal controls and procedures designed to ensure compliance with accounting standards and applicable laws and regulators. The Audit Committee oversees the financial reporting process at the Bank and receives quarterly reporting regarding the process undertaken by management and the results of the shareholders' auditors' review. It is not the duty of the Audit Committee to plan or conduct audits, or to determine that the Bank's financial statements are complete, accurate and in accordance with GAAP.

Internal Controls

The Committee shall monitor the internal controls of the Bank to ensure the necessary checks and balances are in place, including:

- •

- requiring management to implement and maintain appropriate systems of internal controls in accordance with applicable laws, regulations and guidance, including section 404 of the U.S. Sarbanes-Oxley Act;

4

- •

- meeting with management and the Chief Auditor to assess the adequacy and effectiveness of the Bank's internal control systems;

- •

- receiving reports from the Risk Committee as considered necessary or desirable with respect to any issues relating to internal control procedures considered by that Committee in the course of undertaking its responsibilities; and

- •

- reviewing reporting by the Bank to its shareholders regarding internal controls.

Internal Audit Division

The Committee shall monitor the internal audit division of the Bank, including reviewing and approving its annual plan and satisfying itself that the internal audit division has adequate resources and independence to perform its responsibilities. In addition, the Committee shall:

- •

- confirm the appointment and dismissal of the Chief Auditor of the Bank;

- •

- periodically assess the effectiveness of the internal audit division;

- •

- regularly review significant reports prepared by the Chief Auditor or the internal audit department together with management's response and follow-up on these reports as appropriate;

- •

- provide a forum for the Chief Auditor to raise any issues regarding the relationship and interaction among the internal audit division, management and the shareholders' auditors; and

- •

- review reports from the Chief Auditor or the internal audit department regarding the relationships between the Bank and OSFI.

Oversight of Shareholders' Auditors

The Committee shall review and evaluate the performance, qualifications and independence of the shareholders' auditors including the lead partners and annually make recommendations to the Board and shareholders regarding the nomination of the shareholders' auditors for appointment by the shareholders. The Committee shall also make recommendations regarding remuneration and, if appropriate, termination of the shareholders' auditors. The shareholders' auditors shall be accountable to the Committee and the entire Board, as representatives of the shareholders, for such shareholders' auditors' review of the financial statements and controls of the Bank. In addition, the Committee shall:

- •

- review the shareholders' auditors' annual audit plans and engagement letters;

5

- •

- review the shareholders' auditors' processes for assuring the quality of their audit services including any matters that may affect the audit firms' ability to serve the Bank as shareholders' auditors;

- •

- discuss those matters that are required to be communicated by shareholders' auditors to the Committee in accordance with the standards established by the Canadian Institute of Chartered Accountants, as such matters are applicable to the Bank from time to time;

- •

- review with the shareholders' auditors any issues that may be brought forward by them, including any audit problems or difficulties, such as restrictions on their audit activities or access to requested information, and management's responses;

- •

- review with the shareholders' auditors the auditors' concerns, if any, about the quality, not just acceptability, of the Bank's accounting principles as applied in its financial reporting; and

- •

- provide a forum for management and the internal and/or shareholders' auditors to raise issues regarding their relationship and interaction. To the extent disagreements regarding financial reporting are not resolved, be responsible for the resolution of such disagreements between management and the internal and/or shareholders' auditors.

Independence of Shareholders' Auditors

The Committee shall oversee and assess the independence of the shareholders' auditors through various mechanisms, including:

- •

- reviewing and approving (or recommending to the Board for approval) the audit fees and other significant compensation to be paid to the shareholders' auditors and reviewing and monitoring the policy for the provision of non-audit services to be performed by the shareholders' auditors, including the pre-approval of such non-audit services in accordance with an approved policy;

- •

- receiving from the shareholders' auditors, on a periodic basis, a formal written statement delineating all relationships between the shareholders' auditors and the Bank consistent with the rules of professional conduct of the Canadian provincial chartered accountants institutes or other regulatory bodies, as applicable;

- •

- reviewing and discussing with the Board, annually and otherwise as necessary, and the shareholders' auditors, any relationships or services between the shareholders' auditors and the Bank or any factors that may impact the objectivity and independence of the shareholders' auditors;

- •

- reviewing and approving policies and procedures regarding the employment of partners, employees and former partners and employees of the present or former shareholders' auditors of the Bank as required by applicable laws; and

6

- •

- reviewing and monitoring other policies put in place to facilitate auditor independence, such as the rotation of members of the audit engagement team, as applicable.

Conduct Review and Related Party Transactions

The Committee shall be responsible for conduct review and oversight of related party transactions (except the approval of Bank officer related party credit facilities which are reviewed by the Management Resources Committee and the approval of Bank director related party credit facilities which are reviewed by the Risk Committee, as required), including:

- •

- ensuring procedures and practices are established by management as required by theBank Act relating to conduct review and related party transactions and monitoring compliance with those procedures and their effectiveness from time to time; and

- •

- monitoring compliance with policies in respect of ethical personal and business conduct, including the Conflicts of Interest Procedures, Disclosure of Information and Compliant Procedures and the Guidelines of Conduct of the Bank.

Compliance

The Committee shall oversee the establishment and maintenance of processes that ensure the Bank is in compliance with the laws and regulations that apply to it as well as its own policies, including:

- •

- reviewing with management the Bank's compliance with applicable regulatory requirements, the legislative compliance management system and applicable securities legislation;

- •

- establishing procedures in accordance with regulatory requirements for the receipt, retention and treatment of complaints received by the Bank on accounting, internal accounting controls or auditing matters, as well as for confidential, anonymous submissions by employees of concerns regarding questionable accounting or auditing matters;

- •

- reviewing professional pronouncements and changes to key regulatory requirements relating to accounting rules to the extent it applies to the financial reporting process of the Bank; and

- •

- reviewing with the Bank's general counsel any legal matter arising from litigation, asserted claims or regulatory noncompliance that could have a material impact on the Bank's financial condition.

7

General

The Committee shall have the following additional general duties and responsibilities:

- •

- acting as the audit committee and conduct review committee for certain subsidiaries of the Bank that are federally-regulated financial institutions;

- •

- performing such other functions and tasks as may be mandated by regulatory requirements applicable to audit committees and conduct review committees or delegated by the Board;

- •

- conducting an annual evaluation of the Committee in which the Committee (and/or its individual members) reviews the performance of the Committee for the preceding year for the purpose, among other things, of assessing whether the Committee fulfilled the purposes and responsibilities stated in this charter;

- •

- reviewing reports from the Risk Committee for purposes of monitoring policies and processes with respect to risk assessment and risk management and discuss the Bank's major financial risk exposures, including operational risk issues, and the steps management has taken to monitor and control such exposures;

- •

- reviewing and assessing the adequacy of this Charter at least annually and submitting this Charter to the Corporate Governance Committee and the Board for approval upon amendment;

- •

- maintaining minutes or other records of meetings and activities of the Committee; and

- •

- reporting to the Board following each meeting of the Committee and reporting as required to the Risk Committee on issues of relevance to it.

8

Exhibit 2

MANAGEMENT'S DISCUSSION AND ANALYSIS

Management's discussion and analysis (MD&A) gives you management's perspective on performance of the Bank's businesses, the economy and how the Bank manages risk and capital. The MD&A is as of December 9, 2004.

| | | |

|---|---|---|

| page 13 | How we performed | |

| page 18 | Off-balance sheet arrangements | |

| page 19 | Critical accounting policies and estimates | |

| page 22 | Accounting and reporting changes | |

| page 23 | How our businesses performed | |

| page 25 | Personal and Commercial Banking | |

| page 29 | Wholesale Banking | |

| page 32 | Wealth Management | |

| page 35 | Corporate | |

| page 37 | Factors that may affect future results | |

| page 38 | Managing risk | |

| page 39 | Strategic Risk | |

| page 39 | Credit Risk | |

| page 41 | Market Risk | |

| page 43 | Asset Liability Management | |

| page 45 | Liquidity Risk | |

| page 46 | Operational Risk | |

| page 47 | Regulatory Risk | |

| page 47 | Reputational Risk | |

| page 48 | Managing capital | |

| page 50 | Controls and procedures | |

| page 51 | Supplementary information |

Additional information relating to the Bank, including the Bank's Annual Information Form for the year ended October 31, 2004, is on SEDAR at www.sedar.com.

Caution regarding forward-looking statements

From time to time, the Bank makes written and oral forward-looking statements, including in this report, in other filings with Canadian regulators or the U.S. Securities and Exchange Commission (SEC), and in other communications. All such statements are made pursuant to the "safe harbour" provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements include, among others, statements regarding the Bank's objectives and targets, and strategies to achieve them, the outlook for the Bank's business lines, and the Bank's anticipated financial performance. Forward-looking statements are typically identified by words such as "believe", "expect", "may" and "could". By their very nature, these statements are subject to inherent risks and uncertainties, general and specific, which may cause actual results to differ materially from the expectations expressed in the forward-looking statements. Some of the factors that could cause such differences include: the credit, market, liquidity, interest rate, operational and other risks discussed in the management discussion and analysis section of this report and in other regulatory filings made in Canada and with the SEC; general business and economic conditions in Canada, the United States and other countries in which the Bank conducts business, as well as the effect of changes in monetary policy in those jurisdictions and changes in the foreign exchange rates for the currencies of those jurisdictions; the degree of competition in the markets in which the Bank operates, both from established competitors and new entrants; legislative and regulatory developments; the accuracy and completeness of information the Bank receives on customers and counterparties; the timely development and introduction of new products and services in receptive markets; the Bank's ability to complete and integrate acquisitions, including the acquisition of a 51% interest in Banknorth Group, Inc.; the Bank's ability to attract and retain key executives; reliance on third parties to provide components of the Bank's business infrastructure; technological changes; change in tax laws; unexpected judicial or regulatory proceedings; continued negative impact of the United States securities litigation environment; unexpected changes in consumer spending and saving habits; the possible impact on the Bank's businesses of international conflicts and terrorism; acts of God, such as earthquakes; and management's ability to anticipate and manage the risks associated with these factors and execute the Bank's strategies. The preceding list is not exhaustive of all possible factors. Other factors could also adversely affect the Bank's results. For more information, please see the discussion starting on page 37 of this report concerning the effect certain key factors could have on actual results. All such factors should be considered carefully when making decisions with respect to the Bank, and undue reliance should not be placed on the Bank's forward-looking statements. The Bank does not undertake to update any forward-looking statements, written or oral, that may be made from time to time by or on its behalf.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2004 — Management's Discussion and Analysis 11

12 TD BANK FINANCIAL GROUP ANNUAL REPORT 2004 — Management's Discussion and Analysis

HOW WE PERFORMED

AT A GLANCE OVERVIEW

- •

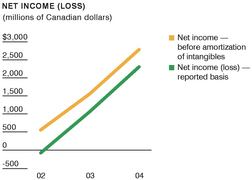

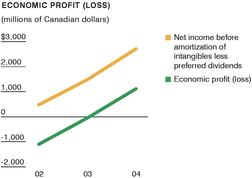

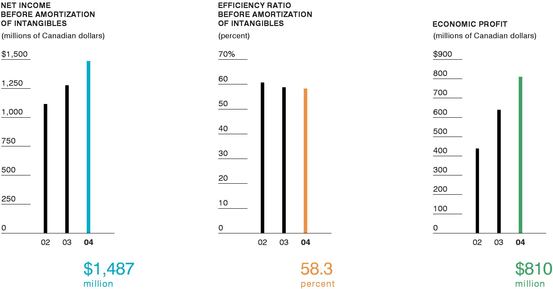

- REPORTED NET INCOME WAS $2,310 MILLION IN 2004, COMPARED WITH REPORTED NET INCOME OF $1,076 MILLION IN 2003 AND REPORTED NET LOSS OF $67 MILLION IN 2002

- •

- IN 2004, NET INCOME BEFORE AMORTIZATION OF INTANGIBLES WAS $2,787 MILLION, COMPARED WITH $1,567 MILLION IN 2003 AND $567 MILLION IN 2002

- •

- REPORTED DILUTED EARNINGS PER SHARE WERE $3.39 IN 2004 COMPARED WITH REPORTED DILUTED EARNINGS PER SHARE OF $1.51 IN 2003 AND LOSS PER SHARE OF $.25 IN 2002

- •

- DILUTED EARNINGS PER SHARE BEFORE AMORTIZATION OF INTANGIBLES WERE $4.11 IN 2004 COMPARED WITH $2.26 IN 2003 AND $.73 IN 2002

How the Bank Reports

The Bank prepares its financial statements in accordance with Canadian generally accepted accounting principles (GAAP), relevant aspects of which are presented on pages 60 to 102 of this Annual Report. The Bank refers to results prepared in accordance with GAAP as the "reported basis".

The Bank also utilizes earnings before amortization of intangibles to assess each of its businesses and to measure overall Bank performance. To arrive at this measure, the Bank removes amortization of intangibles from reported basis earnings. Previously the Bank reported operating cash basis earnings. Since the only distinction between operating cash basis and reported basis earnings beginning in 2003 was the amortization of intangibles (as there were no special items), the Bank now refers to earnings before amortization of intangibles as it is a better description of this measure. Fiscal 2002 operating cash basis earnings have been restated to reflect this new basis.

The majority of the Bank's intangible amortization relates to the Canada Trust acquisition in fiscal 2000. The Bank excludes amortization of intangibles as this approach is how the Bank manages the businesses internally. Consequently, the Bank believes that earnings before amortization of intangibles provides the reader with an understanding of the Bank's results that can be consistently tracked from period to period.

As explained, earnings before amortization of intangibles is different from reported results determined in accordance with GAAP. Earnings before amortization of intangibles and related terms used in this Annual Report are not defined terms under GAAP, and therefore may not be comparable to similar terms used by other issuers. The table below provides a reconciliation between the Bank's earnings before amortization of intangibles and its reported results.