The Toronto-Dominion Bank (TD) FWPFree writing prospectus

Filed: 4 Mar 25, 1:19pm

ACCELERATED RETURN NOTES® (ARNs®) |

ARNs® Linked to the Invesco S&P 500® Equal Weight ETF |

| Issuer | The Toronto-Dominion Bank (“TD”) | |||

| Principal Amount | $10.00 per unit | |||

| Term | Approximately fourteen months | |||

| Market Measure | The Invesco S&P 500® Equal Weight ETF (Bloomberg symbol: “RSP”) | |||

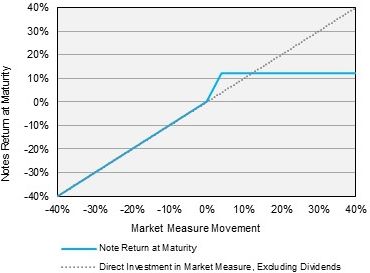

| Payout Profile at Maturity | • 3-to-1 upside exposure to increases in the Market Measure, subject to the Capped Value • 1-to-1 downside exposure to decreases in the Market Measure, with up to 100.00% of your principal at risk | |||

| Participation Rate | 300.00% | |||

| Capped Value | [$11.00 to $11.40] per unit, a [10.00% to 14.00%] return over the principal amount, to be determined on the pricing date | |||

| Interest Payments | None | |||

Preliminary Offering Documents | ||||

| Exchange Listing | No |

| • | Depending on the performance of the Market Measure as measured shortly before the maturity date, your investment may result in a loss; there is no guaranteed return of principal. |

| • | Payments on the notes are subject to the credit risk of TD, and actual or perceived changes in the creditworthiness of TD are expected to affect the value of the notes. If TD becomes unable to meet its financial obligations as they become due, you may lose some or all of your investment. |

| • | Your investment return is limited to the return represented by the Capped Value and may be less than a comparable investment directly in the Market Measure or the securities held by the Market Measure. |

| • | The initial estimated value of the notes on the pricing date will be less than their public offering price. |

| • | The initial estimated value of your notes is not a prediction of the prices at which you may sell your notes in the secondary market, if any exists, and such secondary market prices, if any, will likely be less than the public offering price of your notes, may be less than the initial estimated value of your notes and could result in a substantial loss to you. |

| • | You will have no rights of a holder of the Market Measure or the securities held by the Market Measure, and you will not be entitled to receive any shares of the Market Measure or the securities held by the Market Measure, or any dividends or other distributions in respect of the Market Measure or the securities held by the Market Measure. |

| • | There are liquidity and management risks associated with the Market Measure. |

| • | The performance of the Market Measure may not correlate with the performance of its underlying index as well as the net asset value per share of the Market Measure, especially during periods of market volatility when the liquidity and the market price of the shares of the Market Measure and/or the securities held by the Market Measure may be adversely affected, sometimes materially. |

| • | Payments on the notes will not be adjusted for all corporate events that could affect the Market Measure. |

Hypothetical Percentage Change from the Starting Value to the Ending Value | Hypothetical Redemption Amount per Unit | Hypothetical Total Rate of Return on the Notes |

| -100.00% | $0.00 | -100.00% |

| -75.00% | $2.50 | -75.00% |

| -50.00% | $5.00 | -50.00% |

| -40.00% | $6.00 | -40.00% |

| -30.00% | $7.00 | -30.00% |

| -20.00% | $8.00 | -20.00% |

| -10.00% | $9.00 | -10.00% |

| -5.00% | $9.50 | -5.00% |

| 0.00% | $10.00 | 0.00% |

| 1.00% | $10.30 | 3.00% |

| 2.00% | $10.60 | 6.00% |

| 3.00% | $10.90 | 9.00% |

| 4.00% | $11.20(1) | 12.00% |

| 10.00% | $11.20 | 12.00% |

| 20.00% | $11.20 | 12.00% |

| 30.00% | $11.20 | 12.00% |

| 40.00% | $11.20 | 12.00% |

| 50.00% | $11.20 | 12.00% |

| (1) | The Redemption Amount per unit cannot exceed the hypothetical Capped Value. |