The Toronto-Dominion Bank (TD) 6-KCurrent report (foreign)

Filed: 2 Dec 24, 8:34am

Exhibit 99.2

| U.S. Department of Justice | |||

United States Attorney District of New Jersey | Criminal Division Money Laundering and Asset Recovery Section |

970 Broad Street, 7th floor Newark, New Jersey 07102 | Bond Building 1400 New York Ave, NW Washington, D. C. 20005 |

October 10, 2024

Loretta E. Lynch, Esq.

Paul, Weiss, Rifkind, Wharton & Garrison LLP

1285 Avenue of the Americas

New York, NY 10019

Nicolas Bourtin, Esq.

Aisling O’Shea, Esq.

Sullivan & Cromwell LLP

125 Broad Street

New York, New York 10004

| Re: | United States v. TD Bank US Holding Company |

PLEA AGREEMENT

Pursuant to Rule 11(c)(1)(C) of the Federal Rules of Criminal Procedure, the United States of America, by and through the Department of Justice, Criminal Division, Money Laundering and Asset Recovery Section (“MLARS”), and the United States Attorney’s Office for the District of New Jersey (“the USAO-DNJ”) (collectively the “Offices”), and the Defendant, TD BANK US HOLDING COMPANY (the “Defendant” or “TDBUSH”), by and through its undersigned attorneys, and through its authorized representative, pursuant to authority granted by the Defendant’s Board of Directors, hereby submit and enter into this plea agreement (the “Agreement”). The Toronto-Dominion Bank (“TD Bank Group”), the Defendant’s global parent company, and TD Group US Holdings LLC (“TDGUS”), the intermediate holding company and U.S. parent, which are not defendants in this matter, also agree,

1

pursuant to the authority granted by their Boards of Directors to certain terms and obligations of the Agreement as described below. TD Bank, N.A. (“TDBNA” or the “Bank”), a direct subsidiary of TDBUSH and a national bank, is concurrently entering a guilty plea pursuant to authority granted by its Board of Directors. The Defendant and its parents and subsidiaries, and all TD Bank Group’s subsidiaries, affiliates, and operations are collectively referred to as “TD” or the Group. The terms and conditions of this Agreement are as follows:

Term of the Defendant’s Obligations Under the Agreement

1. Except as otherwise provided in Paragraph 10 below regarding the Defendant’s cooperation obligations, the Defendant’s obligations under the Agreement shall last and be effective for a period beginning on the date on which the Information is filed and ending five years from the later of the date on which the Information is filed or the independent compliance monitor is retained by Defendant (the “Term”).

The Defendant’s Agreement

2. Pursuant to Federal Rule of Criminal Procedure 11(c)(1)(C), the Defendant agrees to waive its right to grand jury indictment and to plead guilty to a two-count criminal Information charging the Defendant with causing TDBNA to fail to maintain an adequate anti-money laundering (“AML”) program, in violation of Title 31, United States Code, Sections 5318(h) and 5322 and Title 18, United States Code, Section 2, and causing TDBNA to fail to file accurate Currency Transaction Reports (“CTRs”), in violation of Title 31, United States Code, Sections 5313 and 5324. The Defendant further agrees to persist in that plea through sentencing and, as set forth below, to cooperate fully with the Offices in their investigation into the conduct described in this Agreement and the Statement of Facts attached hereto as Attachment A (“Statement of Facts”).

2

3. The Defendant understands that to be guilty of these offenses, the following essential elements must be satisfied:

| a. | The essential elements of failure to maintain an adequate AML program are as follows: |

| i. | First, TDBNA was a financial institution; |

| ii. | Second, the Defendant caused TDBNA to fail to establish, implement, and maintain an adequate AML program; and |

| iii. | Third, the Defendant acted willfully. |

| b. | The essential elements of failure to file accurate CTRs are as follows: |

| i. | First, the Defendant had knowledge of the CTR reporting requirements; |

| ii. | Second, the Defendant caused or attempted to cause a financial institution to file a CTR that contained a material omission or misstatement of fact; and |

| iii. | Third, the Defendant acted with the purpose to evade the transaction reporting requirements. |

4. The Defendant understands and agrees that this Agreement is between the Offices and the Defendant and does not bind any other division or section of the Department of Justice or any other federal, state, local, or foreign prosecuting, administrative, or regulatory authority. Nevertheless, the Offices will bring this Agreement and the nature and quality of the conduct, cooperation, and remediation of the Defendant, its direct or indirect affiliates, subsidiaries, branches, and joint ventures, to the attention of other prosecuting, law enforcement, regulatory, and debarment authorities, if requested by the Defendant.

3

5. The Defendant agrees that this Agreement will be executed by an authorized corporate representative. The Defendant further agrees that a resolution duly adopted by the Defendant’s Board of Directors in the form attached to this Agreement as Attachment B (“Certificate of Corporate Resolutions”) authorizes the Defendant to enter into this Agreement and take all necessary steps to effectuate this Agreement on behalf of the Defendant, and that the signatures on this Agreement by the Defendant and its counsel are authorized by the Defendant’s Board of Directors.

6. The Defendant agrees that it has the full legal right, power, and authority to enter into and perform all of its obligations under this Agreement.

7. The Offices enter into this Agreement based on the individual facts and circumstances presented by this case, including:

a. The nature and seriousness of the offense conduct, as described in the Statement of Facts, including: (a) the Defendant’s pervasive and systemic failure to maintain an adequate AML compliance program at the Bank, its subsidiary, including the Defendant’s failures to substantively update the Bank’s transaction monitoring program from at least 2014 to 2022, its failure to monitor trillions of dollars of transactions from at least 2014 to 2024, its failure to implement an appropriate AML compliance training program and adequately address insider risk, which resulted in the Bank’s customers, sometimes aided by five Bank insiders, laundering approximately $671 million through accounts maintained by the Bank and created vulnerabilities that allowed the Bank’s employees to open and maintain accounts for money laundering networks that moved $39 million in proceeds through the Bank; (b) the Bank’s filing of 564 materially inaccurate CTRs involving more than $412 million in currency transactions, which omitted the identity of an individual that the Bank knew conducted the transactions and thereby impeded law enforcement; and (c) the Bank’s conspiracy to commit money laundering, which involved five Bank employees opening accounts and conducting other account-related activities in exchange for payments that facilitated the laundering of over $39 million in criminal proceeds from the United States to Colombia;

4

b. The pervasiveness of the offense, which involved the Defendant’s prioritization of growth and the customer experience over compliance; implementation of a flat-cost year-over-year spending paradigm, including in its AML program, despite changing and growing AML risks; and the involvement of employees at all levels of the Defendant and its subsidiary, ranging from store-level employees who accepted payments to open or maintain accounts involved in money laundering to the Defendant’s Audit Committee, which received regular reporting regarding the AML program and consistently endorsed the flat-cost spending paradigm for the AML program despite the Bank’s consistent growth and expansion of its business in the United States;

c. The Defendant did not receive credit for voluntary self-disclosure pursuant to the Criminal Division Corporate Enforcement and Voluntary Self-Disclosure Policy (“Criminal Division CEP”) or pursuant to the United States Sentencing Guidelines (“U.S.S.G.” or “Sentencing Guidelines”) § 8C2.5(g)(1) because it did not voluntarily and timely disclose to the Offices the conduct described in the Statement of Facts;

d. The Defendant received credit pursuant to U.S.S.G. § 8C2.5(g)(3) because it demonstrated recognition and affirmative acceptance of responsibility for its criminal conduct. The Defendant also received cooperation credit pursuant to the Criminal Division CEP because, after becoming aware of the Offices’ investigation, TD Bank cooperated with the investigation by, among other things: reviewing voluminous evidence produced in

5

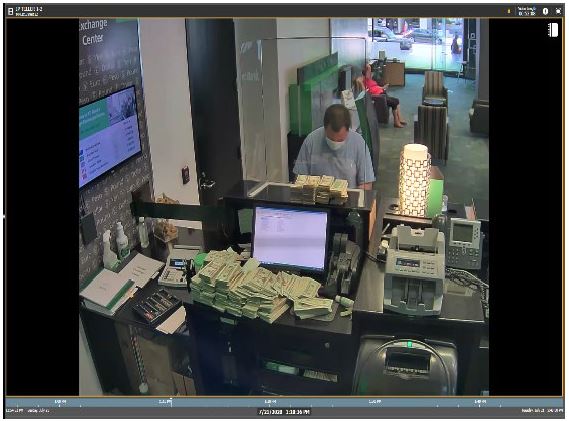

response to subpoenas, informal requests, and, in some cases, voluntarily identifying key information related to AML failures, money laundering, and insider activity, including information about the individuals involved in the conduct described in the Statement of Facts, which allowed the government to preserve and obtain relevant evidence; making regular and detailed factual presentations to the Offices; working with the Offices and the Defendant’s regulators to ensure the production of relevant documents to the Offices; making numerous witnesses available for interviews, including witnesses located outside of the United States, and deconflicting with the Offices concerning interviews; providing relevant information related to its internal investigation, including summaries of information received from internal interviews; identifying numerous incidents of potentially suspicious activity; reviewing hundreds of hours of Bank surveillance video and identifying portions of interest to the Offices; providing detailed analyses prepared by external consultants concerning money laundering through accounts at the Bank and the involvement of employees in that conduct; and taking steps to swiftly preserve and produce records and information related to employees involved in misconduct, including by securing their worksites to prevent the destruction of evidence. However, the Defendant’s cooperation was limited in some respects, including: failing to inform the Offices of concerns expressed to the Bank, during the course of its internal investigation, by a third-party financial services company concerning the Colombian money laundering activity and failing to identify a well-known and significant transaction monitoring gap that, since at least 2008, allowed the Bank to process trillions of dollars of Automated Clearing House (“ACH”) and other types of transactions per year without monitoring or reporting. Additionally, the Defendant rejected requests by the government to voluntarily keep certain accounts open related to two of the three money laundering networks identified in the Statement of Facts. Therefore, the Offices determined that a discount of 20 percent of the sentence of a fine was appropriate pursuant to the Criminal Division CEP;

6

e. The Defendant and the Bank have engaged and will continue to engage in significant remedial measures, which are not yet complete or fully tested, including: (i) implementing new transaction monitoring scenarios to address longstanding, known gaps in the Bank’s transaction monitoring system; (ii) enhancing policies and procedures related to the identification of parties involved in conducting transactions, the collection of the conductors’ identifying information, and reporting of conductors in CTRs; (iii) terminating, separating, and/or sanctioning certain employees, including AML executives, involved in the conduct; and (iv) improving the overall AML compliance function and increasing its investments in its program, including by hiring competent and experienced AML compliance employees and executives and making significant investments in technology and AML systems;

f. The Defendant and the Bank had an inadequate AML compliance program, including its policies, procedures, and controls related to transaction monitoring, identification of suspicious activity, insider risk, and employee training (collectively, the “AML Compliance Program”) during the period of the conduct described in the Statement of Facts; the Defendant and the Bank have begun to enhance and committed to continue enhancing its AML Compliance Program, including, among other things, ensuring that its AML Compliance Program satisfies the minimum elements set forth in Attachment C to this Agreement;

g. The Defendant has agreed to retain an independent compliance monitor (the “Monitor”) for a period of three years (the “Term of the Monitorship”) to oversee the Defendant’s compliance remediation and enhancement and has agreed to comply with the monitorship requirements, as further described in Attachment D to this Agreement. The Offices may extend the Term of the Monitorship through the Term of the Agreement in their sole discretion. The Offices may also extend the Term of the Monitorship in the event of a breach of the Agreement;

7

h. The Defendant and the Bank have no prior criminal history, but the Bank was subject to regulatory enforcement actions by the Department of the Treasury’s Financial Crimes Enforcement Network (“FinCEN”) and the Office of the Comptroller of the Currency (“OCC”) in September 2013 related to the Bank’s insufficient AML controls, some of which relate to the conduct described in the Statement of Facts;

i. The Defendant has agreed to cooperate with the Offices in any investigation or prosecution as described in Paragraph 10 below;

j. TDBNA, the Defendant’s wholly owned subsidiary and a retail bank in the U.S., has also agreed to plead guilty to a one-count Information and pay a criminal penalty of $500,000 and a forfeiture money judgment of $452,432,302;

k. The Defendant’s global parent company, TD Bank Group, and U.S. parent company, TDGUS, have agreed to ensure that the Group cooperates with the Offices in any investigation or prosecution as described in Paragraph 10 below and that the Defendant and TDBNA meet their disclosure and compliance obligations under the Agreements, including Attachment C, by certifying to such in Attachments E and F to this Agreement and executing Attachment G to this Agreement;

l. Various components of the Group, including the Defendant and the Bank, have agreed to enter into concurrent resolutions with the OCC, the Federal Reserve Board of Governors (the “FRB”), and FinCEN relating to certain conduct described in the Statement of Facts; and

8

m. Accordingly, based on consideration of (a) through (1) above, the Offices believe that a guilty plea to the Information and a criminal penalty of $1,434,013,478.40 are sufficient but not greater than necessary to achieve the purposes described in 18 U.S.C. § 3553.

8. The Defendant agrees to abide by all terms and obligations of this Agreement as described herein, including, but not limited to, the following:

a. to plead guilty as set forth in this Agreement;

b. to abide by all sentencing stipulations contained in this Agreement;

c. to appear, through its duly appointed representatives, as ordered for all court appearances, and obey any other ongoing court order in this matter, consistent with all applicable U.S. and foreign laws, procedures, and regulations;

d. to commit no further crimes;

e. to be truthful at all times with the Court;

f. to pay the applicable fine and special assessment;

g. to consent to and to pay the applicable forfeiture amount;

h. to cooperate fully with the Offices as described in Paragraph 10;

i. to remediate and enhance its AML Compliance Program, as described in Paragraphs 28 and 29 and Attachment C; and

j. to retain an independent compliance Monitor to oversee implementation of the Defendant’s compliance remediation and enhancement as described in Attachment D.

9

9. Except as may otherwise be agreed by the parties in connection with a particular transaction, the Defendant agrees that in the event that, during the Term, the Defendant undertakes any change in corporate form, including if it sells, merges, or transfers business operations that are material to the Defendant’s consolidated operations, or to the operations of any subsidiaries, branches, or affiliates involved in the conduct described in the Statement of Facts, as they exist as of the date of this Agreement, whether such transaction is structured as a sale, asset sale, merger, transfer, or other change in corporate form, it shall include in any contract for sale, merger, transfer, or other change in corporate form a provision binding the purchaser, or any successor in interest thereto, to the obligations described in this Agreement. Prior to such transaction, the purchaser or successor in interest must agree in writing that the terms and obligations of this Agreement are applicable in full force to the purchaser or successor in interest. The Defendant agrees that the failure to include these provisions in the transaction contract will make any such transaction null and void. The Defendant shall provide notice to the Offices at least thirty days prior to undertaking any such sale, merger, transfer, or other change in corporate form. The Offices shall notify the Defendant prior to such transaction (or series of transactions) if they determine that the transaction(s) will have the effect of circumventing or frustrating the purposes of this Agreement, as determined in the sole discretion of the Offices; the Defendant agrees that such transaction(s) will not be consummated. In addition, if at any time during the Term, the Offices determine in their sole discretion that the Defendant has engaged in a transaction(s) that has the effect of circumventing or frustrating the purposes of this Agreement, the Offices may deem it a breach of this Agreement pursuant to Paragraphs 35-38. Nothing herein shall restrict the Defendant from indemnifying (or otherwise holding harmless) the purchaser or successor in interest for penalties or other costs arising from any conduct that may have occurred prior to the date of the transaction, so long as such indemnification does not have the effect of circumventing or frustrating the purposes of this Agreement, as determined by the Offices.

10

10. The Group shall continue to cooperate fully with the Offices in any and all matters relating to the conduct, individuals, and entities described in this Agreement and the Statement of Facts as well as any other conduct, individuals, and entities under investigation by MLARS or the USAO-DNJ at any time during the Term, until the later of the date upon which all investigations and prosecutions arising out of such conduct are concluded, or the end of the Term. At the request of the Offices, the Group shall also cooperate fully with any other component of the Department of Justice and other domestic or foreign law enforcement and regulatory authorities and agencies in any investigation of the Defendant, its parents, subsidiaries, or its affiliates, or any of its present or former officers, directors, employees, agents, and consultants, or any other party, in any and all matters relating to the conduct described in this Agreement and the Statement of Facts and other conduct at any time during the Term. The Defendant’s cooperation pursuant to this Agreement is subject to applicable law and regulations, including bank secrecy, data privacy and national security laws, as well as valid claims of attorney-client privilege or attorney work product doctrine; however, the Defendant must provide to the Offices a log of any information or cooperation that is not provided based on an assertion of law, regulation, or privilege, and the Defendant bears the burden of establishing the validity of any such assertion. The Defendant agrees that its cooperation pursuant to this Agreement shall include, but not be limited to, the following:

a. The Defendant represents that it has truthfully disclosed all factual information with respect to its activities, those of its parents, subsidiaries, and affiliates, and those of its present and former directors, officers, employees, agents, and consultants relating to the conduct described in this Agreement and the Statement of Facts, as well as any other conduct under investigation by the Offices at any time about which the Defendant has any knowledge. The Group further agrees that it shall timely and truthfully disclose all information with respect to its activities, those of its parents, subsidiaries, and affiliates, and those of its present and former directors, officers, employees, agents, and consultants, including any evidence, allegations, and internal or external investigations about which the Offices may inquire. This obligation of truthful disclosure includes, but is not limited to, the obligation of the Group to provide to the Offices, upon request, any document, record, or other tangible evidence about which the Offices may inquire, including evidence that is responsive to any requests made prior to the execution of this Agreement.

11

b. Upon request of the Offices, the Group shall designate knowledgeable employees, directors, officers, agents, consultants, or attorneys to provide to the Offices the information and materials described in Paragraph 10 above on behalf of the Group. It is further understood that the Group must at all times provide complete, truthful, and accurate information.

c. The Group shall use its best efforts to make available for interviews or testimony, as requested by the Offices, present and former officers, directors, employees, agents, and consultants of the Defendant. This obligation includes, but is not limited to, sworn testimony before a federal grand jury or in federal trials, as well as interviews with domestic or foreign law enforcement and regulatory authorities. Cooperation under this Paragraph shall include identification of witnesses who, to the knowledge of the Group, may have material information regarding the matters under investigation.

d. With respect to any information, testimony, documents, records, or other tangible evidence provided to the Offices pursuant to this Agreement, the Group consents to any and all disclosures, subject to applicable law and regulations, by the Offices to other governmental authorities including United States authorities and those of a foreign government of such materials as the Offices, in their sole discretion, shall deem appropriate.

12

11. In addition to the cooperation obligations provided for in Paragraph 10 of the Agreement, during the Term, should the Defendant learn of any evidence or allegation of conduct by the Defendant, its affiliates, or their employees that may constitute a violation of federal criminal law, the Defendant shall promptly report such evidence or allegation to the Offices in a manner and form consistent with local law. Thirty days prior to the expiration of the Term, the Defendant, TDBNA, TDGUS, and the Group, by the executives identified in Attachment E to this Agreement, will certify to the Offices, in the form of executing Attachment E to this Agreement, that the Defendant and its parents, subsidiaries, and affiliates have met their disclosure obligations pursuant to this Paragraph. Each certification will be deemed a material statement and representation by the Defendant to the executive branch of the United States for purposes of 18 U.S.C. §§ 1001 and 1519, and it will be deemed to have been made in the judicial district in which this Agreement is filed.

12. The Defendant agrees that any fine, forfeiture, or restitution imposed by the Court will be due and payable as specified in Paragraph 25 below, and that any forfeiture or restitution imposed by the Court will be due and payable in accordance with the Court’s order. The Defendant further agrees to pay the mandatory special assessment of $800 within ten business days from the date of sentencing.

The United States’ Agreement

13. In exchange for the guilty plea of the Defendant and the complete fulfillment of all its obligations under this Agreement, the Offices agree they will not file additional criminal charges against the Defendant or any of its direct or indirect affiliates, parent companies, subsidiaries, or joint ventures relating to the conduct described in the Statement of Facts, the Information filed pursuant to this Agreement. The Offices, however, may use any information related to the conduct described in the Statement of Facts against the Defendant: (a) in a prosecution for perjury or obstruction of justice; (b) in a prosecution for making a false statement; (c) in a prosecution or other proceeding relating to any crime of violence or terrorism-related

13

offense; or (d) in a prosecution or other proceeding relating to a violation of any provision of Title 26 of the United States Code. This Agreement does not provide any protection against prosecution for any future conduct by the Defendant or any of its direct or indirect affiliates, parent companies, subsidiaries, joint ventures, officers, directors, employees, agents, or consultants, whether or not disclosed by the Defendant pursuant to the terms of this Agreement. This Agreement does not provide any protection against prosecution of any individuals, regardless of their affiliation with the Defendant. The Defendant agrees that nothing in this Agreement is intended to release the Defendant from any and all of the Defendant’s tax liabilities and reporting obligations for any and all income not properly reported and/or legally or illegally obtained or derived.

Factual Basis

14. The Defendant is pleading guilty because it is guilty of the charges contained in the Information. Certain of the facts are based on information obtained from third parties by the United States through its investigation and described to the Defendant. The Defendant has reviewed and verified the factual allegations. The Defendant admits, agrees, and stipulates that the factual allegations set forth in the Information and the Statement of Facts are true, accurate, and correct, that it is responsible for the acts of its officers, directors, employees, and agents described in the Information and Statement of Facts, and that the Information and Statement of Facts accurately reflect the Defendant’s criminal conduct. The Defendant stipulates to the admissibility of the Statement of Facts in any proceeding by the Offices, including any trial, guilty plea, or sentencing proceeding, and will not contradict anything in the attached Statement of Facts at any such proceeding.

14

The Defendant’s Waiver of Rights, Including the Right to Appeal

15. Federal Rule of Criminal Procedure 11(f) and Federal Rule of Evidence 410 limit the admissibility of statements made in the course of plea proceedings or plea discussions in both civil and criminal proceedings, if the guilty plea is later withdrawn. The Defendant expressly warrants that it and the Group and TDGUS, as represented in Attachment G, have discussed these rules with their counsel and understand them. Solely to the extent set forth below, the Defendant voluntarily waives and gives up the rights enumerated in Federal Rule of Criminal Procedure 11 (f) and Federal Rule of Evidence 410. The Defendant agrees that, effective as of the date the Defendant signs this Agreement, it will not dispute the Statement of Facts set forth in this Agreement, and that the Statement of Facts shall be admissible against the Defendant in any criminal case involving MLARS and/or the USAO-DNJ and the Defendant, as: (a) substantive evidence offered by the government in its case-in-chief and rebuttal case; (b) impeachment evidence offered by the government on cross-examination; and (c) evidence at any sentencing hearing or other hearing. In addition, the Defendant agrees not to assert any claim under the Federal Rules of Evidence (including Rule 410 of the Federal Rules of Evidence), the Federal Rules of Criminal Procedure (including Rule 11 of the Federal Rules of Criminal Procedure), or the United States Sentencing Guidelines (including U.S.S.G. § 1Bl.1(a)) that the Statement of Facts should be suppressed or is otherwise inadmissible as evidence (in any form). Specifically, the Defendant understands and agrees that any statements the Defendant makes in the course of its guilty plea or in connection with the Agreement are admissible against the Defendant for any purpose in any U.S. federal criminal proceeding if, even though the Offices have fulfilled all of their obligations under this Agreement and the Court has imposed the agreed-upon sentence, the Defendant nevertheless withdraws its guilty plea.

15

16. The Defendant is satisfied that the Defendant’s attorneys have rendered effective assistance. The Defendant understands that by entering into this Agreement, the Defendant surrenders certain rights as provided in this Agreement. The Defendant waives its right to discovery. The Defendant further understands that the rights of criminal defendants include the following:

(a) the right to plead not guilty and to persist in that plea;

(b) the right to a jury trial;

(c) the right to be represented by counsel—and if necessary, have the court appoint counsel—at trial and at every other stage of the proceedings;

(d) the right at trial to confront and cross-examine adverse witnesses, to be protected from compelled self-incrimination, to testify and present evidence, and to compel the attendance of witnesses; and

(e) pursuant to Title 18, United States Code, Section 3742, the right to appeal the sentence imposed.

Nonetheless, the Defendant knowingly waives the right to appeal or collaterally attack the conviction and any sentence at or below the statutory maximum described below (or the manner in which that sentence was determined) on the grounds set forth in Title 18, United States Code, Section 3742, or on any ground whatsoever except those specifically excluded in this Paragraph, in exchange for the concessions made by the Offices in this Agreement. This Agreement does not affect the rights or obligations of the United States as set forth in Title 18, United States Code, Section 3742(b). The Defendant hereby waives all rights, whether asserted directly or by a representative, to request or receive from any department or agency of the United States any records pertaining to the investigation or prosecution of this case, including without limitation any records that may

16

be sought under the Freedom of Information Act, Title 5, United States Code, Section 552, or the Privacy Act, Title 5, United States Code, Section 552a. The Defendant waives all defenses based on the statute of limitations and venue with respect to any prosecution related to the conduct described in the Statement of Facts or the Information, including any prosecution that is not time-barred on the date that this Agreement is signed in the event that: (a) the conviction is later vacated for any reason; (b) the Defendant violates this Agreement; or (c) the plea is later withdrawn, provided such prosecution is brought within one year of any such vacatur of conviction, violation of the Agreement, or withdrawal of plea, plus the remaining time period of the statute of limitations as of the date that this Agreement is signed. The Defendant further waives the right to raise on appeal or on collateral review any argument that the statutes to which the Defendant is pleading guilty are unconstitutional and/or the admitted conduct does not fall within the scope of the statutes. The Offices are free to take any position on appeal or any other post-judgment matter. The parties agree that any challenge to the Defendant’s sentence that is not foreclosed by this Paragraph will be limited to that portion of the sentencing calculation that is inconsistent with (or not addressed by) this waiver. Nothing in the foregoing waiver of appellate and collateral review rights shall preclude the Defendant from raising a claim of ineffective assistance of counsel in an appropriate forum.

Penalty

17. The statutory maximum sentence that the Court can impose for a violation of Title 31, United States Code, Sections 5318(h), 5322(b), and 5322(e), as charged in Count One, is: a fine of up to $500,000 for each day the violation continued plus the Defendant’s profit resulting from such violation or twice the gross pecuniary gain or gross pecuniary loss resulting from the offense, whichever is greatest (Title 31, United States Code,

17

Sections 5322(b), (c), and (e)(1) and Title 18, United States Code, Sections 3571(c) and (d)); five years’ probation (Title 18, United States Code, Section 3561(c)(1)); and a mandatory special assessment of $400 (Title 18, United States Code, Section 3013(a)(2)(B)). In this case, the parties agree that the violation continued from January 1, 2014 through October 30, 2023 and that the Bank profited by an amount of $723,098 from the offense; therefore, pursuant to Title 18, United States Code, Section 3571(d), the maximum fine that may be imposed as to Count One is $1,795,723,098.

18. The statutory maximum sentence that the Court can impose for a violation of Title 31, United States Code, Sections 5313 and 5324 is: a fine of $1,000,000 or twice the gross pecuniary gain or gross pecuniary loss resulting from the offense, whichever is greatest (Title 31, United States Code, Section 5324(d)(2) and Title 18, United States Code, Sections 3571(c) and (d)); five years’ probation (Title 18, United States Code, Section 3561(c)(1)); and a mandatory special assessment of $400 (Title 18, United States Code, Section 3013(a)(2)(B)). The Court must also impose forfeiture of all property, real or personal, involved in the offense and any property traceable thereto (Title 31, United States Code, Section 5317(c)(1)(A)). In this case, the parties agree that the offense involved property in an amount of $412,876,589.

Sentencing Recommendation

19. The parties agree that, pursuant to United States v. Booker, 543 U.S. 220 (2005), the Court must determine an advisory sentencing guideline range pursuant to the United States Sentencing Guidelines. The Court will then determine a reasonable sentence after considering the advisory sentencing guideline range and the factors listed in Title 18, United States Code, Section 3553(a). The parties’ agreement herein to any guideline sentencing factors constitutes proof of those factors sufficient to satisfy the applicable burden of proof. The Defendant also understands that if the Court accepts this Agreement, the parties are in agreement that the Court is bound by the sentencing provisions in Paragraphs 17 and 18.

18

20. For Count One, the Offices and the Defendant agree that a faithful application of the U.S.S.G. yields a total offense level of 12. The guideline calculation begins with a base offense level of 8, U.S.S.G. § 2S1.3(a)(1); two levels are added because the Defendant knew or believed funds were proceeds of unlawful activity or were intended to promote unlawful activity, U.S.S.G. § 2S1.3(b)(1); and two levels are added because the Defendant was convicted of an offense under subchapter II of chapter 53 of title 31, United States Code and committed the offense as part of a pattern of unlawful activity involving more than $100,000 in a 12-month period, U.S.S.G. § 2S1.3(b)(3).

21. For Count Two, the Offices and the Defendant agree that a faithful application of the U.S.S.G. yields a total offense level of 38. The guideline calculation begins with a base offense level of 6, U.S.S.G. § 2S1.3(a)(2); 28 levels are added based on the value of funds involved in the reporting offense, U.S.S.G. § 2S1.3(a)(2); two levels are added because the Defendant knew or believed funds were proceeds of unlawful activity or were intended to promote unlawful activity, U.S.S.G. § 2S1.3(b)(1); and two levels are added because the Defendant was convicted of an offense under subchapter II of chapter 53 of title 31, United States Code and committed the offense as part of a pattern of unlawful activity involving more than $100,000 in a 12-month period, U.S.S.G. § 2S1.3(b)(3) .

22. Pursuant to U.S.S.G. § 3D1.2(d), Count One and Count Two group. Pursuant to U.S.S.G. § 3D1.3, the highest offense level governs, so Count Two governs and the total offense level is 38.

19

23. With respect to the guideline fine range, pursuant to U.S.S.G. §§ 8C2.4(a)(1) and (d), the base fine is $150,000,000. Based on U.S.S.G. § 8C2.5 the culpability score is 10, calculated as follows: the base culpability score is 5, U.S.S.G. § 8C2.5(a); 5 points are added because the Defendant had 5,000 or more employees and an individual within high-level personnel of the organization participated in, condoned, or was willfully ignorant of the offense, U.S.S.G. § 8C2.5(b)(1)(A); two points are added because the Defendant or separately managed line of business committed a part of the instant offense less than 5 years after a civil or administrative adjudication based on two or more separate instances of similar misconduct, U.S.S.G. § 8C2.5(c)(2); and two points are removed because the Defendant fully cooperated in the investigation and clearly demonstrated recognition and affirmative acceptance of responsibility for its criminal conduct, U.S.S.G. § 8C2.5(g)(2). With a base fine level of $150,000,000 and a multiplier of 2.00 (minimum) to 4.00 (maximum) based on a culpability score of 10, the guideline fine range is $300,000,000 to $600,000,000, U.S.S.G. §§ 8C2.6 and 8C2.7.

24. Pursuant to Title 18, United States Code, Sections 3571(c), the statutory maximum sentence that the Court can impose for a violation of Title 31, United States Code, Sections 5318(h), 5322(b), and 5322(e), as charged in Count One, is: a fine of up to $500,000 for each day the violation continued plus the Defendant’s profit resulting from such violation or twice the gross pecuniary gain or gross pecuniary loss resulting from the offense, whichever is greatest. Pursuant to Title 18, United States Code, Section 3571(d), the maximum fine that may be imposed as to Count One is $1,795,723,098. As set forth below, the Offices and the Defendant agree to a fine of $1,434,513,478.40.

20

25. Pursuant to Rule 11(c)(1)(C) of the Federal Rules of Criminal Procedure, the Offices and the Defendant agree that the following represents the appropriate disposition of the case:

a. Disposition. Pursuant to Federal Rule of Criminal Procedure 11(c)(1)(C), the parties agree that the appropriate disposition of this case is as set forth herein, and agree to jointly recommend that the Court, at a hearing to be scheduled at an agreed upon time, impose a sentence requiring the Defendant to pay a criminal fine, as set forth below.

b. Criminal Fine. The parties agree that the appropriate total criminal fine is $1,434,513,478.40 (“Total Criminal Fine”). This reflects a daily fine of $500,000 from January 1, 2014 through October 30, 2023, a fine of $723,098 representing gross pecuniary gain by reason of this violation, and a twenty (20) percent discount off the agreed upon fine in recognition of the Defendant’s partial cooperation and remediation and a further reduction of $2,065,000 pursuant to the Criminal Division’s Pilot Program Regarding Compensation Incentives and clawbacks. The Offices agree that the anticipated payment made by TDBNA pursuant to its concurrent guilty plea in the amount of $500,000 (the “TDBNA Credit”) shall be credited against the Defendant’s criminal fine. The Defendant agrees that it shall pay the Total Criminal Fine less the TDBNA Credit and $5,500,000 (the “potential additional clawback credit”) to the Court no later than ten business days after entry of the judgment by the Court. The Defendant shall inform the Offices of any additional bonuses withheld or clawed back as a result of the misconduct outlined in the Statement of Facts and shall pay to the Court the potential additional clawback credit less any compensation the Defendant successfully claws back no later than January 31, 2025.

c. Criminal Forfeiture. The Defendant acknowledges that TDBNA agrees to forfeit to the United States the criminal forfeiture of $412,876,589.

21

d. Mandatory Special Assessment. The Defendant shall pay to the Clerk of the Court for the United States District Court for the District of New Jersey within ten days of the date of sentencing the mandatory special assessment of $800.

e. Term of Probation. The parties agree to recommend that the Court impose a term of probation for the period of the Term of this Agreement, pursuant to Title 18, United States Code, Sections 3551(c)(1) and 3561(c)(1). The Defendant will continue on probation until it has served the full five years, unless the Court approves early termination of probation. The parties agree, pursuant to U.S.S.G. § 8D1.4, that the term of probation shall include as conditions the obligations set forth in Paragraphs 8(a)-(h), and Paragraphs 25(b), (c), and (e). A condition of probation shall be that the Defendant retain a Monitor, as provided in Paragraph 7(g). However, the condition of probation is limited to the retention of the Monitor-not oversight of the Monitor or the Company’s compliance with the Monitor’s recommendations. The Monitor will report to and be overseen by the Offices. The Monitor’s selection process, mandate, duties, review, and certification as described in Paragraphs 30-34 and Attachment D, and the Defendant’s compliance obligations as described in Paragraphs 28 and 29 and Attachment C, are not conditions of probation. In the event the Offices find, in their sole discretion pursuant to Paragraph 7(g), that there exists a change in circumstances sufficient to eliminate the need for the Monitor or extend the term of the Monitor during the term of probation, the parties will submit a joint motion to modify the special conditions of probation.

22

26. This Agreement is presented to the Court pursuant to Federal Rule of Criminal Procedure 11(c)(1)(C). The Defendant understands that, if the Court rejects this Agreement, the Court must: (a) inform the parties that the Court rejects the Agreement; (b) advise the Defendant’s counsel that the Court is not required to follow the Agreement and afford the Defendant the opportunity to withdraw its plea; and (c) advise the Defendant that if the plea is not withdrawn, the Court may dispose of the case less favorably toward the Defendant than the Agreement contemplated. The Defendant further understands that if the Court refuses to accept any provision of this Agreement, neither party shall be bound by the provisions of the Agreement.

27. The Defendant and the Offices waive the preparation of a Pre-Sentence Investigation Report (“PSR”) and intend to seek a sentencing by the Court within thirty days of the Rule 11 hearing in the absence of a PSR. The Defendant understands that the decision whether to proceed with the sentencing proceeding without a PSR is exclusively that of the Court. In the event the Court directs the preparation of a PSR, the Offices will fully inform the preparer of the PSR and the Court of the facts and law related to the Defendant’s case.

Compliance Program, Independent Compliance Monitor, and Reporting

28. The parties have agreed to the compliance, monitoring, and reporting requirements set forth in Attachments C and D. The Defendant represents that it will continue to implement and enhance its AML Compliance Program such that it meets, at a minimum, the elements set forth in Attachment C. Such programs shall be designed to detect and prevent violations of the BSA, laws prohibiting money laundering, and other laws prohibiting illicit finance through the Defendant’s operations, as defined in Attachment C. Thirty days prior to the expiration of the Term, the Defendant, by the Defendant’s and the Bank’s Chief Executive Officer and BSA Officer, TD Bank Group’s Chief Executive Officer and Chief AML Officer, and TDGUS’s Chief Executive Officer and Chief Risk Officer, will certify to the Offices, in the form of executing the document attached as Attachment F to this Agreement, that the Defendant has met its compliance obligations pursuant to this Agreement.

23

29. In order to address any deficiencies in its AML Compliance Program, the Defendant represents that it has undertaken, and will continue to undertake in the future, in a manner consistent with all of its obligations under this Agreement, a review of its existing compliance and ethics programs, policies, procedures, systems, and internal controls regarding compliance with the BSA, laws prohibiting money laundering, and other laws prohibiting illicit finance. Where necessary and appropriate, the Defendant agrees to adopt new controls or otherwise modify its AML Compliance Program in order to ensure that it develops and maintains an effective and risk-based AML program that incorporates relevant policies, procedures, and internal systems and controls designed to effectively detect and deter violations of the BSA, laws prohibiting money laundering, and other laws prohibiting illicit finance. The AML Compliance Program will include, at a minimum, the elements set forth in Attachment C. The Offices, in their sole discretion, may consider the reports by the independent Monitor appointed pursuant to Attachment D in assessing the Defendant’s AML Compliance Program.

30. Promptly after the Offices’ selection pursuant to Paragraph 32 below, the Defendant agrees to retain the Monitor. The Monitor’s duties and authority, and the obligations of the Defendant with respect to the Monitor and the Offices, are set forth in Attachment D, which is incorporated by reference into this Agreement. No later than thirty days after the execution of this Agreement, the Defendant shall submit a written proposal to the Offices identifying three Monitor candidates, and, at a minimum, providing the following:

| a. | A description of each candidate’s qualifications and credentials in support of the evaluative considerations and factors listed below; |

| b. | A written certification by the Defendant that the Defendant and its subsidiaries will not employ or be affiliated with the Monitor for a period of not less than three years from the date of the termination of the monitorship; |

24

| c. | A written certification by each of the candidates that he/she is not a current or recent (i.e., within the prior two years) employee, agent, or representative of the Defendant and holds no interest in, and has no relationship with, the Defendant, its subsidiaries, affiliates, or related entities, or its employees, officers, or directors; |

| d. | A written certification by each of the candidates that he/she has notified any clients that the candidate represents in a matter involving the Offices (or any other Department component) handling the Monitor selection process, and that the candidate has either obtained a waiver from those clients or has withdrawn as counsel in the other matter(s); and; |

| e. | A statement identifying the Monitor candidate that is the Defendant’s first, second, and third choice to serve as the Monitor. |

31. The Monitor candidates or their team members shall have, at a minimum, the following qualifications:

| a. | Demonstrated expertise with respect to the BSA and other applicable laws requiring AML programs, including experience counseling or advising on effective AML programs at financial institutions; |

| b. | Experience designing and/or reviewing corporate compliance programs, policies, procedures, and controls, including AML compliance programs and compliance programs implemented at financial institutions; |

| c. | The ability to access and deploy resources as necessary to discharge the Monitor’s duties as described in the Agreement; and |

| d. | Sufficient independence from the Defendant and its subsidiaries to ensure effective and impartial performance of the Monitor’s duties as described in the Agreement. |

25

32. The Offices retain the right, in their sole discretion, to choose the Monitor from among the proposed candidates, though the Defendant may express its preference(s) among the candidates. Monitor selections shall be made in keeping with the Department’s commitment to diversity and inclusion. If the Offices determine, in their sole discretion, that any of the candidates are not, in fact, qualified to serve as the Monitor, or if the Offices, in their sole discretion, are not satisfied with the candidates proposed, the Offices reserve the right to request that the Defendant nominate additional candidates. In the event the Offices reject any proposed Monitors, the Defendant shall propose additional candidates within twenty business days after receiving notice of the rejection so that three qualified candidates are proposed. This process shall continue until a Monitor acceptable to both parties is chosen. The Offices and the Defendant will use their best efforts to complete the selection process within sixty days of the execution of this Agreement. The Offices retain the right to determine that the Monitor should be removed, if in the Offices’ sole discretion, the Monitor fails to conduct the monitorship effectively, fails to comply with this Agreement, or no longer meets the qualifications outlined in Paragraph 31 above. If the Monitor resigns, is removed, or is otherwise unable to fulfill his or her obligations as set out herein and in Attachment D, the Defendant shall within twenty business days recommend a pool of three qualified Monitor candidates from which the offices will choose a replacement, following the Monitor selection process outlined above.

33. The Monitor’s term shall be three years from the date on which the Monitor is retained by the Defendant, subject to extension or early termination in the Offices’ sole discretion as described in Paragraph 7(g).

26

34. The Monitor’s powers, duties, and responsibilities, as well as circumstances that may support an extension of the Monitor’s term, are set forth in Attachment D. The Defendant agrees that the Defendant and its subsidiaries, parents, branches, and affiliates will not employ or be affiliated with the Monitor or the Monitor’s firm for a period of not less than three years from the date on which the Monitor’s term expires, nor will the Defendant and its subsidiaries, parents, branches, and affiliates discuss with the Monitor or the Monitor’s firm the possibility of further employment or affiliation during the Monitor’s term. Should the Defendant be required to retain an independent compliance monitor or similar person with responsibility for overseeing or evaluating the Defendant’s AML Compliance Program in connection with any parallel civil or regulatory resolution, the Defendant agrees to consult with the Offices regarding the selection of that person and before retaining that person to ensure, among other things, coordination with the Monitor pursuant to this Agreement. The Offices agree that the Monitor appointed pursuant to this Agreement may also serve in such a role.

Breach of Agreement

35. If the Defendant (a) commits any felony under U.S. federal law; (b) provides in connection with this Agreement deliberately false, incomplete, or misleading information; (c) fails to cooperate as set forth in Paragraph 10 of this Agreement; (d) fails to implement a compliance program at the Defendant as set forth in Paragraphs 28 and 29 of this Agreement and Attachment C and complete the monitorship as set forth in Paragraphs 7(g) and 30-34 of this Agreement and Attachment D; (e) commits any acts that, had they occurred within the jurisdictional reach of the United States, would be a violation of federal money laundering laws or the Bank Secrecy Act; or (f) otherwise fails specifically to perform or to fulfill completely each of the obligations under the Agreement, regardless of whether the Offices become aware of such a breach after the Term, the Defendant entity shall thereafter

27

be subject to prosecution for any federal criminal violation of which the Offices have knowledge, including, but not limited to, the charges in the Information described in Paragraphs 2 and 3, which may be pursued by the Offices in the U.S. District Court for the District of New Jersey or any other appropriate venue. Determination of whether the Defendant has breached the Agreement and whether to pursue prosecution of the Defendant shall be in the Offices’ sole discretion. In determining a breach in the Offices’ discretion, the Offices will take into consideration, among other factors, whether the Defendant voluntarily disclosed any criminal violations, its cooperation in any investigation and remediation of the conduct, the severity and pervasiveness of the conduct, and the seniority of the employees involved. Any such prosecution may be premised on information provided by the Defendant or its personnel. Any such prosecution relating to the conduct described in the Information and the attached Statement of Facts or relating to conduct known to the Offices prior to the date on which this Agreement was signed that is not time-barred by the applicable statute of limitations on the date of the signing of this Agreement may be commenced against the Defendant or its parents pursuant to Attachment G, notwithstanding the expiration of the statute of limitations, between the signing of this Agreement and the expiration of the Term plus one year. Thus, by signing this Agreement, the Defendant agrees that the statute of limitations with respect to any such prosecution that is not time-barred on the date of the signing of this Agreement shall be tolled for the Term plus one year. The Defendant gives up all defenses based on the statute of limitations, any claim of pre-indictment delay, or any speedy trial claim with respect to any such prosecution or action, except to the extent that such defenses existed as of the date of the signing of this Agreement. In addition, the Defendant agrees that the statute of limitations as to any violation of federal law that occurs during the term of the cooperation obligations provided for in Paragraph 10 of the Agreement will be tolled from the date upon which the violation occurs until the earlier of the date upon which the Offices are made aware of the violation or the duration of the Term plus five years, and that this period shall be excluded from any calculation of time for purposes of the application of the statute of limitations.

28

36. In the event that the Offices determine there is a breach of this Agreement, the Offices agree to provide the Defendant with written notice of such breach prior to instituting any prosecution resulting from such breach. Within thirty days of receipt of such notice, the Defendant shall have the opportunity to respond to the Offices in writing to explain the nature and circumstances of such breach, as well as the actions the Defendant has taken to address and remediate the situation, which explanation the Offices shall consider in determining whether to pursue prosecution of the Defendant.

37. In the event that the Offices determine there has been a breach of this Agreement: (a) all statements made by or on behalf of the Defendant to the Offices or to the Court, including the Information and the Statement of Facts, and any testimony given by the Defendant before a grand jury, a court, or any tribunal, or at any legislative hearings, whether prior or subsequent to this Agreement, and any leads derived from such statements or testimony, shall be admissible in evidence in any and all criminal proceedings brought by the Offices against the Defendant; and (b) the Defendant shall not assert any claim under the United States Constitution, Rule 11 (f) of the Federal Rules of Criminal Procedure, Rule 410 of the Federal Rules of Evidence, or any other federal rule that any such statements or testimony made by or on behalf of the Defendant prior or subsequent to this Agreement, or any leads derived therefrom, should be suppressed or are otherwise inadmissible. The decision as to whether conduct or statements of any current director, officer, employee, or any person acting on behalf of or at the direction of the Defendant will be imputed to the Defendant for the purpose of determining whether the Defendant has violated any provision of this Agreement shall be made in the sole discretion of the Offices.

29

38. The Defendant acknowledges that the Offices have made no representations, assurances, or promises concerning what sentence may be imposed by the Court if the Defendant breaches this Agreement and this matter proceeds to judgment. The Defendant further acknowledges that any such sentence is solely within the discretion of the Court and that nothing in this Agreement binds or restricts the Court in the exercise of such discretion.

Public Statements by the Defendant

39. The Defendant expressly agrees that it shall not, through present or future parents, subsidiaries, affiliates, attorneys, officers, directors, employees, agents, or any other person authorized to speak for the Defendant, make any public statement, in litigation or otherwise, contradicting the acceptance of responsibility by the Defendant set forth above or the facts described in the Information and Statement of Facts. Any such contradictory statement shall, subject to cure rights of the Defendant described below, constitute a breach of this Agreement, and the Defendant thereafter shall be subject to prosecution as set forth in Paragraphs 35-38 of this Agreement. The decision as to whether any public statement by any such person contradicting a fact contained in the Information or Statement of Facts will be imputed to the Defendant for the purpose of determining whether it has breached this Agreement shall be made in the sole discretion of the Offices. If the Offices determine that a public statement by any such person contradicts in whole or in part a statement contained in the Information or Statement of Facts, the Offices shall so notify the Defendant, and the Defendant may avoid a breach of this Agreement by publicly repudiating such statement(s) within five business days after notification. The Defendant shall be permitted to raise defenses and to assert affirmative claims in other proceedings relating to the matters set forth in the Information and

30

Statement of Facts provided that such defenses and claims do not contradict, in whole or in part, a statement contained in the Information or Statement of Facts. This Paragraph does not apply to any statement made by any present or former officer, director, employee, or agent of the Defendant in the course of any criminal, regulatory, or civil case initiated against such individual, unless such individual is speaking on behalf of the Defendant.

40. The Defendant agrees that if it or any of its direct or indirect subsidiaries or affiliates makes any affirmative public statement in connection with this Agreement, including via press release, press conference remarks, or a scripted statement to investors, the Defendant shall first consult the Offices to determine (a) whether the text of the release or proposed statements at the press conference are true and accurate with respect to matters between the Offices and the Defendant; and (b) whether the Offices have any objection to the release or statement.

31

Complete Agreement

41. This document, including its attachments, states the full extent of the Agreement between the parties. There are no other promises or agreements, express or implied. Any modification of this Agreement shall be valid only if set forth in writing in a supplemental or revised plea agreement signed by all parties.

| AGREED: | ||||||

| FOR TD BANK US HOLDING COMPANY: | ||||||

| Date: 10/10/24 | By: | /s/ Cynthia Adams | ||||

| Cynthia Adams | ||||||

| General Counsel | ||||||

| TD BANK US HOLDING COMPANY | ||||||

| Date: 10/10/24 | By: | /s/ Loretta E. Lynch, Esq. | ||||

| Loretta E. Lynch, Esq. | ||||||

| Paul, Weiss, Rifkind, Wharton & Garrison | ||||||

| LLP | ||||||

| By: | /s/ Nicolas Bourtin, Esq. | |||||

| Nicolas Bourtin, Esq. | ||||||

| Aisling O’Shea, Esq. | ||||||

| Sullivan & Cromwell LLP | ||||||

| Counsel for TD BANK US HOLDING | ||||||

| COMPANY | ||||||

| FOR THE DEPARTMENT OF JUSTICE: | ||||||

| MARGARET A. MOESER | PHILIP R. SELLINGER | |||||

| Chief, Money Laundering and Asset Recovery | United States Attorney | |||||

| Section | District of New Jersey | |||||

| Criminal Division | U.S. Department of Justice | |||||

| U.S. Department of Justice | ||||||

| /s/ D. Zachary Adams | /s/ Mark J. Pesce | |||||

| D. Zachary Adams | Mark J. Pesce | |||||

| Chelsea R. Rooney | Angelica M. Sinopole | |||||

| Trial Attorneys | Assistant United States Attorneys | |||||

32

STATEMENT OF COUNSEL

As counsel for the Defendant, I have discussed all plea offers and the terms of this plea agreement with the Defendant, have fully explained the charges to which the Defendant is pleading guilty and the necessary elements, all possible defenses, stipulations, waivers, fine, forfeiture, sentencing, and the consequences of a guilty plea to a felony. Based on these discussions, I have no reason to doubt that the Defendant is knowingly and voluntarily entering into this agreement and entering a plea of guilty. I know of no reason to question the Defendant’s competency to make these decisions. If, prior to the imposition of sentence, I become aware of any reason to question the Defendant’s competency to enter into this plea agreement or to enter a plea of guilty, I will immediately inform the Court.

DATED: October 10, 2024

/s/ LORETTA E. LYNCH |

| LORETTA E. LYNCH |

| NICOLAS BOURTIN |

| AISLING O’SHEA |

| Counsel for Defendant |

33

ATTACHMENT A

Statement Of Facts

The following Statement of Facts is incorporated by reference as part of the Plea Agreement between the Department of Justice, Criminal Division, Money Laundering and Asset Recovery Section (“MLARS”), and the United States Attorney’s Office for the District of New Jersey (the “USAO-DNJ”) (collectively, the “Offices”), and TD BANK US HOLDING COMPANY (“TDBUSH”) and TD BANK, NATIONAL ASSOCIATION (“TDBNA” or the “Bank”) (collectively, the “Defendants”). The Defendants hereby agree and stipulate that the following facts are true and accurate. Certain of the facts herein are based on information obtained from third parties by the United States through its investigation and described to the Defendants.

The Defendants admit, accept, and acknowledge that they are responsible for the acts of their officers, directors, employees, and agents as set forth below. Had this matter proceeded to trial, the Defendants acknowledge that the United States would have proven beyond a reasonable doubt by admissible evidence the facts alleged below and set forth in the Criminal Informations.

Overview

1. TDBNA, which markets itself as “America’s Most Convenient Bank,” is the tenth largest bank in the United States. Headquartered in Cherry Hill, New Jersey, the Bank has over 1,100 branches, or what TDBNA calls “stores,” along the eastern seaboard of the United States, including a large presence in New Jersey, New York, and Florida. Throughout the relevant period, as defined below, TDBNA’s retail banking activity involved providing banking products and services (e.g., checking and savings accounts, debit cards, and loans) to over 10 million individual and commercial customers in the United States.

1

2. TDBUSH, the direct parent of TDBNA, has oversight of the Bank’s anti-money laundering (“AML”) compliance program, including through reporting to TDBUSH’s Audit Committee, and is accountable for monitoring the effectiveness of the Bank’s AML program pursuant to the Bank Secrecy Act (“BSA”). TDBUSH in turn is the wholly owned subsidiary of TD Group US Holdings LLC (“TDGUS”), which is the intermediate holding company and ultimate parent holding company in the United States. TDGUS is responsible for oversight of the risk management framework for all U.S. operations, including AML programs. TDGUS is a wholly owned subsidiary of the Toronto-Dominion Bank d/b/a TD Bank Group, an international banking and financial services corporation located in Canada. TD Bank Group is the ultimate parent bank of all TD operations. Together, TDBNA, TDBUSH, TDGUS, and TD Bank Group, and their affiliates and subsidiaries, are referred to herein as TD or the Group.

3. Between January 2014 and October 2023 (the “relevant period”), TDBNA and TDBUSH failed to maintain an AML program that complied with the BSA and prioritized a “flat cost paradigm” across operations and the “customer experience.” As a result, the Defendants willfully failed to remediate persistent, pervasive, and known deficiencies in its AML program, including (a) failing to substantively update its transaction monitoring system, which is used to detect illicit and suspicious transactions through the Bank, between 2014 and 2022 despite rapid growth in the volume and risks of the Bank’s business and repeated warnings about the outdated system, and (b) failing to adequately train its employees who served as the first line of defense against money laundering. These failures enabled, among other things, three money laundering networks to launder over $600 million in criminal proceeds through the Bank between 2019 and 2023. These failures also created vulnerabilities that allowed five Bank store employees to open and maintain accounts for one of the money laundering networks. These five Bank employees ultimately conspired with criminal organizations to open and maintain accounts at the Bank that were used to launder $39 million to Colombia.

2

4. TDBUSH’s conduct, as described herein, constituted: (i) the willful failure to maintain an adequate AML program, in violation of Title 31, United States Code, Sections 5318(h) and 5322; and (ii) the knowing failure to accurately report currency transactions as required by the Secretary of the Treasury, in violation of Title 31, United States Code, Sections 5313 and 5324.

5. TDBNA’s conduct, as described herein, constituted a conspiracy to: (1) willfully fail to maintain an appropriate AML program, contrary to Title 31, United States Code, Sections 5318(h), 5322; (2) knowingly fail to file accurate Currency Transaction Reports (“CTRs”), contrary to Title 31, United States Code, Sections 5313 and 5324; and (3) launder monetary instruments, contrary to Title 18, United States Code, Section 1956(a)(2)(B)(i), all in violation of Title 18, United States Code, Section 371.

6. During the relevant period, Defendants willfully failed to maintain an adequate AML program at the Bank. At various times, high-level executives including those in Global AML Operations, in senior executive management, and on the TDBUSH Audit Committee—specifically including an individual who became Defendants’ Chief Anti-Money Laundering Officer (“Chief AML Officer”) during the relevant period (Individual-1) and the Bank’s BSA Officer (Individual-2)—knew there were long-term, pervasive, and systemic deficiencies in the Defendants’ U.S. AML policies, procedures, and controls. The Defendants did not substantively update the Bank’s automated transaction monitoring system from at least 2014 through 2022—including to address known gaps and vulnerabilities in the TDBNA’s transaction monitoring program—despite increases in the volume and risk of its business and significant changes in the nature and risk of transactional activity. In addition, during the relevant period, TDBNA monitored only

3

approximately 8% of the volume of transactions because it omitted all domestic automated clearinghouse (“ACH”) transactions, most check activity, and numerous other transaction types from its automated transaction monitoring system. Due to this failure, the Bank did not monitor approximately $18.3 trillion in activity between January 1, 2018, through April 12, 2024. At the same time, Bank senior executives repeatedly prioritized the “customer experience” over AML compliance and enforced a budget mandate, referred to internally as a “flat cost paradigm,” that set expectations that all budgets, including the AML budget, would not increase year-over-year. The Defendants’ failures to appropriately fund the Bank’s AML program and to adapt its transaction monitoring program resulted in a willfully deficient AML program that allowed three money laundering networks to exploit the Bank and collectively transfer over $670 million through TDBNA accounts. At least one scheme had the assistance of five store insiders at TDBNA.

7. From at least in or around January 2019 through in or around March 2021, the Defendants willfully failed to file accurate CTRs related to one of these three money laundering schemes. Da Ying Sze, a/k/a David (“David”), used TDBNA in furtherance of a money laundering and unlicensed money transmitting scheme for which he ultimately pled guilty in 2022. David conspired to launder and transmit over $653 million, of which more than $470 million was laundered through the Bank. David bribed Bank employees with more than $57,000 in gift cards in furtherance of the scheme. David laundered money through the Bank by depositing large amounts of cash—occasionally in excess of one million dollars in a single day—into accounts opened by other individuals and by requesting that Bank employees send wires and issue official checks. TDBNA failed to identify David as the conductor of transactions in over 500 of the CTRs the Bank filed for his transactions, totaling over $400 million in transaction value, despite David entering TDBNA stores with nominee account holders and conducting transactions directly by making large cash deposits into accounts he purportedly did not control.

4

8. During the relevant period, TDBNA employed five individuals who provided material assistance, often in return for a fee, to a second money laundering scheme, which involved laundering tens of millions of dollars from the United States to Colombia. Insider-1 was a former Financial Service Representative at a TDBNA store in New Jersey. Insider-2 was a former Retail Banker at a TDBNA store in southern Florida. Insider-3 was a former Retail Banker at another TDBNA store in southern Florida. Insider-4 was a former Assistant Store Manager at a TDBNA store in eastern Florida. Insider-5 (jointly, the “TDBNA Insiders”) was a former Store Supervisor at another TDBNA store in southern Florida. These insiders opened accounts and provided dozens of ATM cards to the money laundering networks, which these networks used to launder funds from the United States to Colombia through high volume ATM withdrawals. The insiders assisted with maintaining accounts by issuing new ATM cards and resolving internal controls and roadblocks, including freezes on certain account activity. Through the accounts the insiders opened, the money laundering networks laundered approximately $39 million through the Bank. Despite significant internal red flags, the Defendants did not identify the role the insiders played in the money laundering activity until law enforcement arrested Insider-1 in October 2023.

9. From March 2021 through March 2023, another money laundering organization that purported to be involved in the wholesale diamond, gold, and jewelry business (“MLO-1”) maintained accounts for at least five shell companies at TDBNA and used those accounts to move approximately $123 million in illicit funds through the Bank. Since their account openings in 2021, TDBNA knew that these shell companies were connected because they shared the same account signatories. Despite these red flags, TDBNA did not file a Suspicious Activity Report (“SAR”) on

5

MLO-1 until law enforcement alerted TDBNA to MLO-1’s conduct in April 2022. By that time, MLO-1’s accounts had been open for over 13 months and had been used to transfer nearly $120 million through TDBNA.

The Bank Secrecy Act and Other Relevant Legal Background

10. TDBNA is a national bank in the United States that is insured under the Federal Deposit Insurance Act and regulated and supervised by the Office of the Comptroller of the Currency (“OCC”). The Bank is therefore a financial institution for purposes of Title 31, United States Code, Section 5318(h).

11. The BSA, Title 31, United States Code, Section 5311, et seq., requires financial institutions—including TDBNA—to establish, implement, and maintain risk-based anti-money laundering programs to combat money laundering and the financing of terrorism through financial institutions.

12. The BSA requires that these AML programs, at a minimum, address five core pillars: (a) internal policies, procedures, and controls designed to guard against money laundering; (b) an individual or individuals responsible for overseeing day-to-day compliance with BSA and AML requirements; (c) an ongoing employee training program; (d) an independent audit function to test compliance programs; and (e) a risk-based approach for conducting ongoing customer due diligence. 31 U.S.C. § 5318(h); see also 31 C.F.R. § 1020.210.

13. To satisfy the BSA’s requirements, a bank’s AML program must be risk-based and its systems for identifying suspicious activity must be tailored to effectively monitor its customer-base and the products and services it offers, and reporting suspicious activity as required under the BSA. Moreover, a bank’s AML policies, procedures, and controls must be calibrated to address emerging and evolving risk, including risk associated with new products and services and new patterns of criminal activity.

6

14. For financial institutions of TDBNA’s size and sophistication, an effective automated transaction monitoring system is necessary to properly identify, mitigate, and report suspicious activity as required by law and to prevent the institution from being used to facilitate criminal activity. Automated transaction monitoring systems filter transactions through a series of scenarios, or rules, in order to isolate a transaction or series of transactions with heightened indicia of money laundering, terrorist financing, or other illicit activity. If a transaction or series of transactions meet the parameters of a specific scenario, the automated transaction monitoring system generates an alert. Analysts then review each alert to determine whether the transaction was in fact suspicious and, if so, whether it should be escalated for further investigation or for the filing of a SAR with the United States Department of the Treasury’s Financial Crimes Enforcement Network (“FinCEN”), as required by the BSA. See 31 U.S.C. § 5318(g); 31 C.F.R. § 1020.320.

15. Under the BSA and its implementing regulations, financial institutions are also required to submit CTRs to FinCEN for “each deposit, withdrawal, exchange of currency or other payment or transfer, by, through, or to such financial institution which involves a transaction in currency of more than $10,000.” 31 C.F.R. § 1010.311. Banks must file the CTR with FinCEN “within 15 days following the day on which the reportable transaction occurred,” and must include “[a]ll information called for” in the “forms prescribed.” 31 C.F.R. §§ 1010.306(a)(1), (a)(3), (d). The BSA describes CTRs as the types of “reports or records that are highly useful in . . . criminal . . . investigations,” 31 U.S.C. § 5311, as they help establish a paper trail for law enforcement to identify large currency transactions, recreate financial transactions, and identify conductors and beneficiaries.

7

16. As part of the obligation to report currency transactions above $10,000, a financial institution must “verify and record the name and address of the individual presenting a transaction, as well as record the identity, account number, and the social security or taxpayer identification number, if any, of any person or entity on whose behalf such transaction is to be effected.” 31 C.F.R. § 1010.312. Therefore, a bank is required to identify in its CTR filing the person who conducted the transaction (i.e., the conductor) in addition to the account holder. See 31 U.S.C. § 5313(a); FinCEN Form 104 (March 2011).

TDBNA and TDBUSH’s Failure to Maintain an Adequate AML Program

Background Regarding TDBNA’s BSA/AML Program

17. TD Bank Group is a publicly traded (NYSE: TD) international banking and financial services corporation headquartered in Toronto, Canada. TD Bank Group is one of the thirty largest banks in the world and the second-largest bank in Canada. TD Bank Group’s board is responsible for the supervision of the Group overall including major strategies, enterprise risk, executive hiring, and oversight of all subsidiaries. TD Bank Group’s board oversees and monitors the integrity and effectiveness of the Group’s internal controls and adherence to applicable compliance standards and is responsible for “setting the tone at the top as it relates to integrity and culture . . . and communicating and reinforcing the compliance culture throughout the [Group].”

18. TDGUS, incorporated in Delaware, is a wholly owned subsidiary of TD Bank Group. TDBUSH, which owns TDBNA, is a wholly owned subsidiary of TDGUS. Throughout the relevant period, TDBUSH and its Audit Committee oversaw TDBNA’s BSA/AML program, including issuing the BSA/AML Policy and Standards, approving the appointment of the BSA Officer, and receiving reporting and briefing on all AML program matters. According to TDBUSH’s BSA/AML Policy, “[t]he TDBUSH Board has ultimate responsibility for oversight of the [BSA/AML] Program and is accountable for monitoring its effectiveness regularly.”

8

TDBUSH’s responsibilities included “[s]etting the ‘tone from the top’ commitment; and [p]articipating in briefings regarding inherent risks and controls, so that Board members attain an adequate level of understanding, as well as challenging the information presented to them about the [BSA/AML] Program matters.”