Exhibit 99.2

MANAGEMENT’S DISCUSSION AND ANALYSIS

This Management’s Discussion and Analysis (MD&A) is presented to enable readers to assess material changes in the financial condition and operational results of TD Bank Financial Group (the Bank) for the year ended October 31, 2008, compared with the corresponding periods. This MD&A should be read in conjunction with our Consolidated Financial Statements and related Notes for the year ended October 31, 2008. This MD&A is dated December 3, 2008. Unless otherwise indicated, all amounts are expressed in Canadian dollars and have been primarily derived from the Bank’s annual Consolidated Financial Statements prepared in accordance with Canadian generally accepted accounting principles (GAAP).

18 | FINANCIAL RESULTS OVERVIEW |

21 | Net Income |

22 | Revenue |

24 | Expenses |

25 | Taxes |

26 | Quarterly Financial Information |

BUSINESS SEGMENT ANALYSIS | |

28 | Business Focus |

31 | Canadian Personal and Commercial Banking |

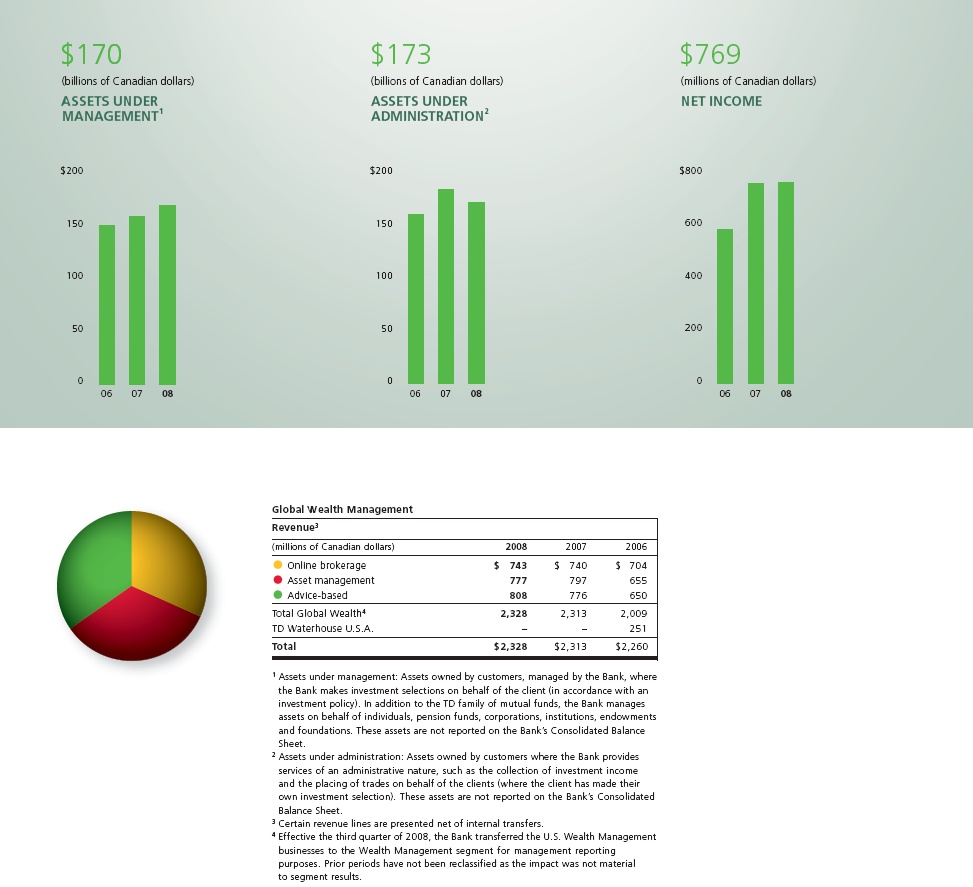

34 | Wealth Management |

38 | U.S. Personal and Commercial Banking |

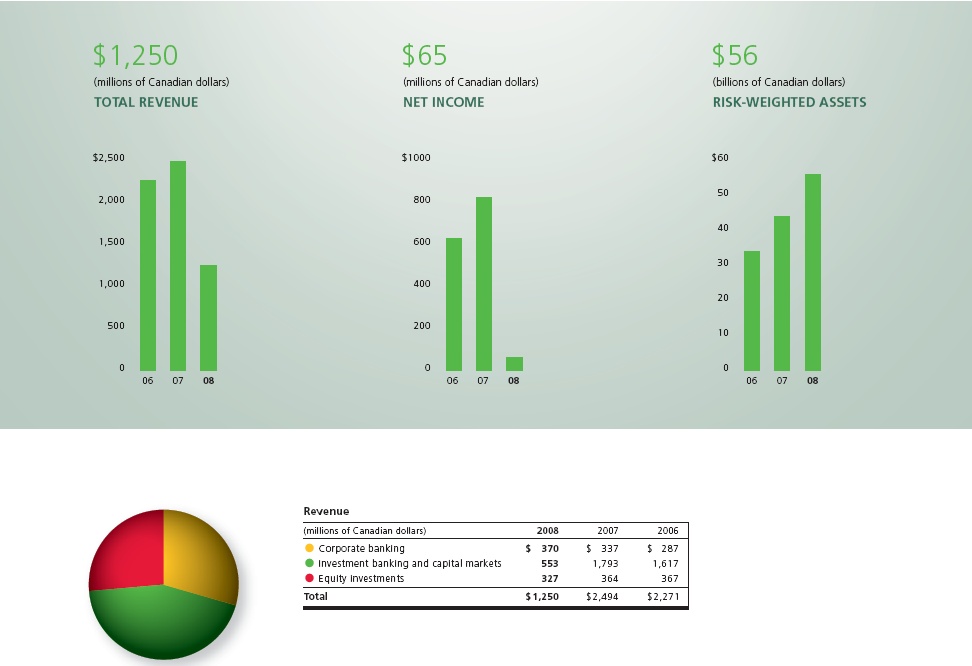

41 | Wholesale Banking |

44 | Corporate |

2007 FINANCIAL RESULTS OVERVIEW | |

45 | Summary of 2007 Performance |

46 | 2007 Financial Performance by Business Line |

GROUP FINANCIAL CONDITION | |

47 | Balance Sheet Review |

49 | Credit Portfolio Quality |

57 | Capital Position |

60 | Off-balance Sheet Arrangements |

63 | Related-party Transactions |

63 | Financial Instruments |

RISK FACTORS AND MANAGEMENT | |

64 | Risk Factors that May Affect Future Results |

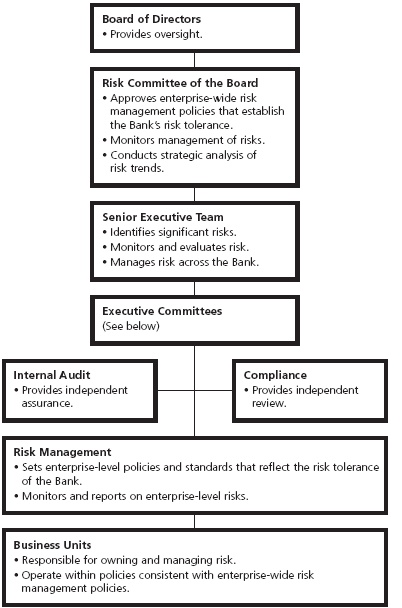

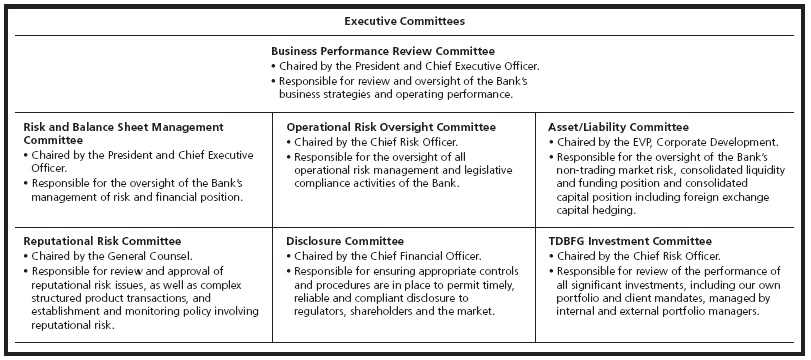

66 | Managing Risk |

ACCOUNTING STANDARDS AND POLICIES | |

80 | Critical Accounting Estimates |

84 | Changes in Accounting Policies during the Current Year |

84 | Future Accounting and Reporting Changes |

85 | Controls and Procedures |

Certain comparative amounts have been restated to conform with the presentation adopted in the current year.

Additional information relating to the Bank, including the Bank’s Annual Information Form, is available on the Bank’s website at http://www.td.com, on SEDAR at http://www.sedar.com, and on the U.S. Securities and Exchange Commission’s website at http://www.sec.gov (EDGAR filers section).

Caution Regarding Forward-Looking Statements From time to time, the Bank makes written and oral forward-looking statements, including in this 2008 Management’s Discussion & Analysis (“MD&A”), in other filings with Canadian regulators or the U.S. Securities and Exchange Commission (SEC), and in other communications. In addition, the Bank’s senior management may make forward-looking statements orally to analysts, investors, representatives of the media and others. All such statements are made pursuant to the “safe harbour” provisions of the U.S. Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation. Forward-looking statements include, among others, statements regarding the Bank’s objectives and targets for 2009 and beyond, and strategies to achieve them, the outlook for the Bank’s business lines, and the Bank’s anticipated financial performance. The forward-looking information contained in this document is presented for the purpose of assisting our shareholders and analysts in understanding our financial position as at and for the periods ended on the dates presented and our strategic priorities and objectives, and may not be appropriate for other purposes. The economic assumptions for 2009 for the Bank are set out in the 2008 MD&A under the heading “Economic Summary and Outlook” and for each of our business segments, under the heading “Business Outlook and Focus for 2009”. Forward-looking statements are typically identified by words such as “will”, “should”, “believe”, “expect”, “anticipate”, “intend”, “estimate”, “plan”, “may” and “could”. By their very nature, these statements require us to make assumptions and are subject to inherent risks and uncertainties, general and specific, which may cause actual results to differ materially from the expectations expressed in the forward-looking statements. Some of the factors - many of which are beyond our control - that could cause such differences include: credit, market (including equity and commodity), liquidity, interest rate, operational, reputational, insurance, strategic, foreign exchange, regulatory, legal and other risks discussed in the Bank’s 2008 MD&A and in other regulatory filings made in Canada and with the SEC; general business and economic conditions in Canada, the U.S. and other countries in which the Bank conducts business, as well as the effect of changes in existing and the introduction of new monetary and economic policies in those jurisdictions and changes in the foreign exchange rates for the currencies of those jurisdictions; the degree of competition in the markets in which the Bank operates, both from established competitors and new entrants; defaults by other financial institutions in Canada, the U.S. and other countries; the accuracy and completeness of information the Bank receives on customers and counterparties; the development and introduction of new products and services in markets; developing new distribution channels and realizing increased revenue from these channels; the Bank’s ability to execute its strategies, including its integration, growth and acquisition strategies and those of its subsidiaries, particularly in the U.S.; changes in accounting policies (including future accounting changes) and methods the Bank uses to report its financial condition, including uncertainties associated with critical accounting assumptions and estimates; changes to our credit ratings; global capital market activity; increased funding costs for credit due to market illiquidity and increased competition for funding; the Bank’s ability to attract and retain key executives; reliance on third parties to provide components of the Bank’s business infrastructure; the failure of third parties to comply with their obligations to the Bank or its affiliates as such obligations relate to the handling of personal information; technological changes; the use of new technologies in unprecedented ways to defraud the Bank or its customers; legislative and regulatory developments; change in tax laws; unexpected judicial or regulatory proceedings; continued negative impact of the U.S. securities litigation environment; unexpected changes in consumer spending and saving habits; the adequacy of the Bank’s risk management framework, including the risk that the Bank’s risk management models do not take into account all relevant factors; the possible impact on the Bank’s businesses of international conflicts and terrorism; acts of God, such as earthquakes; the effects of disease or illness on local, national or international economies; and the effects of disruptions to public infrastructure, such as transportation, communication, power or water supply. A substantial amount of the Bank’s business involves making loans or otherwise committing resources to specific companies, industries or countries. Unforeseen events affecting such borrowers, industries or countries could have a material adverse effect on the Bank’s financial results, businesses, financial condition or liquidity. The preceding list is not exhaustive of all possible factors. Other factors could also adversely affect the Bank’s results. For more information, see the discussion starting on page 64 of the Bank’s 2008 MD&A. All such factors should be considered carefully when making decisions with respect to the Bank, and undue reliance should not be placed on the Bank’s forward-looking statements. The Bank does not undertake to update any forward-looking statements, whether written or oral, that may be made from time to time by or on its behalf, except as required under applicable securities legislation. |

TD BANK FINANCIAL GROUP ANNUAL REPORT 2008 Management's Discussion and Analysis | 17 |

FINANCIAL RESULTS OVERVIEW

CORPORATE OVERVIEW

TD Bank Financial Group (the Bank) is one of the largest financial services providers in North America, offering comprehensive retail and commercial banking, wealth management and wholesale banking products and services. The Bank’s operations and activities are organized around operating groups: Canadian Personal and Commercial Banking; Wealth Management; U.S. Personal and Commercial Banking; and Wholesale Banking.

HOW THE BANK REPORTS

The Bank prepares its consolidated financial statements in accordance with Canadian generally accepted accounting principles (GAAP) and refers to results prepared in accordance with GAAP as the ”reported” results.

The Bank also utilizes non-GAAP financial measures referred to as “adjusted” results to assess each of its businesses and to measure overall Bank performance. To arrive at adjusted results, the Bank removes items of note, net of income taxes, from reported results. The items of note relate to items which management does not believe are indicative of underlying business performance. The items of note are listed in Table 2. The Bank believes that adjusted results provide the reader with a better understanding of how management views the Bank’s performance. As explained, adjusted results are different from reported results determined in accordance with GAAP. Adjusted results, items of note and related terms used in this MD&A are non-GAAP financial measures as these are not defined terms under GAAP and, therefore, may not be comparable to similar terms used by other issuers. Table 2 provides a reconciliation between the Bank’s reported and adjusted results.

TABLE | 1 | OPERATING RESULTS - REPORTED |

(millions of Canadian dollars) | 2008 | 2007 | 2006 | |||||||||

Net interest income | $ | 8,532 | $ | 6,924 | $ | 6,371 | ||||||

Other income | 6,137 | 7,357 | 6,821 | |||||||||

Total revenue | 14,669 | 14,281 | 13,192 | |||||||||

Provision for credit losses | (1,063 | ) | (645 | ) | (409 | ) | ||||||

Non-interest expenses | (9,502 | ) | (8,975 | ) | (8,815 | ) | ||||||

Dilution gain, net | - | - | 1,559 | |||||||||

Income before provision for income taxes, non-controlling interests in subsidiaries and equity in net income of associated company | 4,104 | 4,661 | 5,527 | |||||||||

Provision for income taxes | (537 | ) | (853 | ) | (874 | ) | ||||||

Non-controlling interests, net of income taxes | (43 | ) | (95 | ) | (184 | ) | ||||||

Equity in net income of an associated company, net of income taxes | 309 | 284 | 134 | |||||||||

Net income - reported | 3,833 | 3,997 | 4,603 | |||||||||

Preferred dividends | (59 | ) | (20 | ) | (22 | ) | ||||||

Net income available to common shareholders - reported | $ | 3,774 | $ | 3,977 | $ | 4,581 | ||||||

18 | TD BANK FINANCIAL GROUP ANNUAL REPORT 2008 Management's Discussion and Analysis |

TABLE | 2 | RECONCILIATION OF NON-GAAP FINANCIAL MEASURES1 |

Adjusted net income to reported results | ||||||||||||

Operating results - adjusted | ||||||||||||

(millions of Canadian dollars) | 2008 | 2007 | 2006 | |||||||||

Net interest income | $ | 8,532 | $ | 6,924 | $ | 6,371 | ||||||

Other income2 | 5,840 | 7,148 | 6,862 | |||||||||

Total revenue | 14,372 | 14,072 | 13,233 | |||||||||

Provision for credit losses3 | (1,046 | ) | (705 | ) | (441 | ) | ||||||

Non-interest expenses4 | (9,291 | ) | (8,390 | ) | (8,260 | ) | ||||||

Income before provision for income taxes, non-controlling interests in subsidiaries and equity in net income of associated company | 4,035 | 4,977 | 4,532 | |||||||||

Provision for income taxes5 | (554 | ) | (1,000 | ) | (1,107 | ) | ||||||

Non-controlling interests, net of income taxes6 | (43 | ) | (119 | ) | (211 | ) | ||||||

Equity in net income of associated company, net of income taxes7 | 375 | 331 | 162 | |||||||||

Net income - adjusted | 3,813 | 4,189 | 3,376 | |||||||||

Preferred dividends | (59 | ) | (20 | ) | (22 | ) | ||||||

Net income available to common shareholders - adjusted | 3,754 | 4,169 | 3,354 | |||||||||

Items of note affecting net income, net of income taxes | ||||||||||||

Amortization of intangibles8 | (404 | ) | (353 | ) | (316 | ) | ||||||

Reversal of Enron litigation reserve9 | 323 | - | - | |||||||||

Change in fair value of derivatives hedging the reclassified available-for-sale debt securities portfolio10 | 118 | - | - | |||||||||

Gain relating to restructuring of Visa11 | - | 135 | - | |||||||||

TD Banknorth restructuring, privatization and merger-related charges12 | - | (43 | ) | - | ||||||||

Restructuring and integration charges relating to the Commerce acquisition13 | (70 | ) | - | - | ||||||||

Dilution gain on Ameritrade transaction, net of costs | - | - | 1,665 | |||||||||

Dilution loss on the acquisition of Hudson by TD Banknorth | - | - | (72 | ) | ||||||||

Balance sheet restructuring charge in TD Banknorth | - | - | (19 | ) | ||||||||

Wholesale Banking restructuring charge | - | - | (35 | ) | ||||||||

Change in fair value of credit default swaps hedging the corporate loan book, net of provision for credit losses14 | 107 | 30 | 7 | |||||||||

General allowance release | - | 39 | 39 | |||||||||

Other tax items | (34 | ) | - | (24 | ) | |||||||

Provision for insurance claims15 | (20 | ) | - | - | ||||||||

Initial set up of specific allowance for credit card and overdraft loans | - | - | (18 | ) | ||||||||

Total items of note | 20 | (192 | ) | 1,227 | ||||||||

Net income available to common shareholders - reported | $ | 3,774 | $ | 3,977 | $ | 4,581 | ||||||

Reconciliation of reported earnings per share (EPS) to adjusted EPS16 | ||||||||||||

(Canadian dollars) | 2008 | 2007 | 2006 | |||||||||

Diluted - reported | $ | 4.87 | $ | 5.48 | $ | 6.34 | ||||||

Items of note affecting income (as above) | (0.03 | ) | 0.27 | (1.70 | ) | |||||||

Items of note affecting EPS only17 | 0.04 | - | 0.02 | |||||||||

Diluted - adjusted | $ | 4.88 | $ | 5.75 | $ | 4.66 | ||||||

Basic - reported | $ | 4.90 | $ | 5.53 | $ | 6.39 | ||||||

1 Certain comparative amounts have been reclassified to conform to the presentation adopted in the current year.

2 Adjusted other income excludes the following items of note: 2008 - $186 million pre-tax gain due to change in fair value of credit default swaps (CDS) hedging the corporate loan book, as explained in footnote 14; $141 million pre-tax gain due to change in fair value of derivatives hedging the reclassified available-for-sale debt securities portfolio, as explained in footnote 10; $30 million pre-tax loss due to provision for insurance claims, as explained in footnote 15; 2007 - $163 million pre-tax gain relating to restructuring of Visa, as explained in footnote 11; $46 million pre-tax gain due to change in fair value of CDS hedging the corporate loan book; 2006 - $11 million pre-tax gain due to change in fair value of CDS hedging the cor porate loan book; $52 million loss on balance sheet restructuring charge in TD Banknorth.

3 Adjusted provisions for credit losses exclude the following items of note: 2008 - $17 million due to change in fair value of CDS hedging the corporate loan book, as explained in footnote 14; 2007 - $60 million general allowance release based on revised loss rate factors, utilizing internal experience in alignment with Basel II methodology; 2006 - $60 million general allowance release; $28 million initial set up of special allowance for credit card and overdraft loans.

4 Adjusted non-interest expenses exclude the following items of note: 2008 - $577 million amortization of intangibles; $111 million restructuring and integration charges relating to the Commerce acquisition, as explained in footnote 13; and $477 million positive adjustment related to the reversal of Enron litigation reserve, as explained in footnote 9; 2007 -$499 million amortization of intangibles; $86 million TD Banknorth restructuring, privatization and merger-related charges, as explained in footnote 12; 2006 - $505 million amortization of intangibles; $50 million Wholesale Banking restructuring charges.

5 For reconciliation between reported and adjusted provisions for income taxes, see Table 11.

6 Adjusted non-controlling interests exclude the following items of note: 2007 - $9 million amortization of intangibles; $15 million from TD Banknorth restructuring, privatization and merger-related charges; 2006 - $12 million amortization of intangibles; $15 million balance sheet restructuring charge in TD Banknorth.

7 Equity in net income of associated company excludes the following items of note: 2008 - $66 million amortization of intangibles; 2007 - $47 million amortization of intangibles; 2006 - $28 million amortization of intangibles.

8 Amortization of intangibles primarily relates to the Canada Trust acquisition in 2000, the TD Banknorth Inc. (TD Banknorth) acquisition in 2005 and its privatization in 2007, the Commerce Bancorp, Inc. (Commerce) acquisition in 2008, the acquisitions by TD Banknorth of Hudson United Bancorp (Hudson) in 2006 and Interchange Financial Services Corporation (Interchange) in 2007, and the amortization of intangibles included in equity in net income of TD Ameritrade.

9 The Enron contingent liability for which the Bank established a reserve was re-evaluated in light of the favourable evolution of case law in similar securities class actions following the U.S. Supreme Court’s ruling in Stoneridge Partners, LLC v. Scientific-Atlanta, Inc. During the fourth quarter of 2008, the Bank recorded an after-tax positive adjustment of $323 million ($477 million before tax), reflecting the substantial reversal of the reserve. For details, see Note 28 to the 2008 Consolidated Financial Statements.

10 Effective August 1, 2008, as a result of recent deterioration in markets and severe dislocation in the credit market, the Bank changed its trading strategy with respect to certain trading debt securities. The Bank no longer intends to actively trade in these debt securities. Accordingly, the Bank reclassified certain debt securities from trading to available-for-sale category in accordance with the Amendments to Canadian Institute of Chartered Accountants (CICA) Handbook Section 3855, Financial Instruments - Recognition and Measurement. As part of the Bank’s trading strategy, these debt securities are economically hedged, primarily with CDS and interest rate swap contracts. These derivatives are not eligible for reclassification and are recorded on a fair value basis with changes in fair value recorded in the period’s earnings. Management believes that this asymmetry in the accounting treatment between derivatives and the reclassified debt securities results in volatility in earnings from period to period that is not indicative of the economics of the underlying business performance in the Wholesale Banking segment. As a result, the derivatives are accounted for on an accrual basis in Wholesale Banking and the gains and losses related to the derivatives in excess of the accrued amounts are reported in the Corporate segment and disclosed as an item of note. Adjusted results of the Bank exclude the gains and losses of the derivatives in excess of the accrued amount.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2008 Management's Discussion and Analysis | 19 |

11 As part of the global restructuring of Visa USA Inc., Visa Canada Association and Visa International Service Association, which closed on October 3, 2007 (restructuring date), the Bank received shares of the new global entity (Visa Inc.) in exchange for the Bank’s membership interest in Visa Canada Association. As required by the applicable accounting standards, the shares the Bank received in Visa Inc. were measured at fair value and an estimated gain of $135 million after tax was recognized in the Corporate segment, based on results of an independent valuation of the shares.

12 The TD Banknorth restructuring, privatization and merger-related charges include the following: $31 million restructuring charge, primarily consisted of employee severance costs, the costs of amending certain executive employment and award agreements and write-down of long-lived assets due to impairment, included in U.S. Personal and Commercial Banking; $4 million restructuring charge related to the transfer of functions from TD Bank USA, N.A. (TD Bank USA) to TD Banknorth, included in the Corporate segment; $5 million privatization charges, which primarily consisted of legal and investment banking fees, included in U.S. Personal and Commercial Banking; and $3 million merger-related charges related to conversion and customer notices in connection with the integration of Hudson and Interchange with TD Banknorth, included in U.S. Personal and Commercial Banking. In the Consolidated Statement of Income for October 31, 2007, the restructuring charges are included in the restructuring costs while the privatization and merger-related charges are included in other non-interest expenses.

13 As a result of the acquisition of Commerce and related restructuring and integration initiatives undertaken, the Bank incurred restructuring and integration charges. Restructuring charges consisted of employee severance costs, the costs of amending certain executive employment and award agreements and the write-down of long-lived assets due to impairment. Integration charges consisted of costs related to employee retention, external professional consulting charges and marketing (including customer communication and rebranding). In the Consolidated Statement of Income, the restructuring and integration charges are included in non-interest expenses.

14 The Bank purchases CDS to hedge the credit risk in Wholesale Banking’s corporate lending portfolio. These CDS do not qualify for hedge accounting treatment and are measured at fair value with changes in fair value recognized in current period’s earnings. The related loans are accounted for at amortized cost. Management believes that this asymmetry in the accounting treatment between CDS and loans would result in periodic profit and loss volatility which is not indicative of the economics of the corporate loan portfolio or the underlying business performance in Wholesale Banking. As a result, the CDS are accounted for on an accrual basis in Wholesale Banking and the gains and losses on the CDS, in excess of the accrued cost, are reported in the Corporate segment. Adjusted results exclude the gains and losses on the CDS in excess of the accrued cost. Prior to November 1, 2006, this item was described as “Hedging impact due to AcG-13”. As part of the adoption of the new financial instruments standards effective for the Bank from November 1, 2006, the guidance under Accounting Guideline 13: Hedging Relationships (AcG-13) was replaced by CICA Handbook Section 3865, Hedges.

15 The provision for insurance claims relates to a court decision in Alberta in the first quarter of 2008. The Alberta government’s legislation effectively capping minor injury insurance claims was challenged and held to be

unconstitutional. While the government of Alberta has appealed the decision, the ultimate outcome remains uncertain. As a result, the Bank accrued an additional actuarial liability for potential claims in the first quarter of 2008.

16 EPS is computed by dividing net income available to common shareholders by the weighted-average number of shares outstanding during the period. As a result, the sum of the quarterly EPS may not be equal to year-to-date EPS.

17 2008 - The diluted EPS figures do not include Commerce earnings for the month of April 2008 due to a one month lag between fiscal quarter ends, while share issuance on close resulted in a one-time negative earnings impact of 4 cents per share; 2006 - one-time adjustment for the impact of TD Ameritrade earnings, due to the one month lag between fiscal quarter ends. The results of the Bank include its equity share in TD Ameritrade from January 25, 2006 to September 30, 2006.

TABLE | 3 | AMORTIZATION OF INTANGIBLES, NET OF INCOME TAXES |

(millions of Canadian dollars) | 2008 | 2007 | 2006 | |||||||||

Canada Trust | $ | 143 | $ | 175 | $ | 207 | ||||||

TD Bank, N.A. reported amortization of intangibles | 170 | 112 | 72 | |||||||||

Less: non-controlling interests | - | 9 | 12 | |||||||||

Net amortization of intangibles | 170 | 103 | 60 | |||||||||

TD Ameritrade (included in equity in net income of associated company) | 66 | 47 | 28 | |||||||||

Other | 25 | 28 | 21 | |||||||||

Amortization of intangibles, net of income taxes1 | $ | 404 | $ | 353 | $ | 316 | ||||||

1 Amortization of intangibles is included in the Corporate segment.

ECONOMIC PROFIT AND RETURN ON INVESTED CAPITAL

The Bank utilizes economic profit as a tool to measure shareholder value creation. The rate used in the charge for capital is the equity cost of capital calculated using the capital asset pricing model. The charge represents an assumed minimum return required by common shareholders on the Bank’s invested capital. The Bank’s goal is to achieve positive and growing economic profit.

Return on invested capital (ROIC) is a variation on the economic profit measure that is useful in comparison to the equity cost of capital. Both ROIC and the cost of capital are percentage rates, while economic profit is a dollar measure. When ROIC exceeds the equity cost of capital, economic profit is positive. The Bank’s goal is to maximize economic profit by achieving ROIC that exceeds the equity cost of capital.

Economic profit and ROIC are non-GAAP financial measures as these are not defined terms under GAAP. Earnings and other measures adjusted to a basis other than GAAP do not have standardized meanings under GAAP and, therefore, may not be comparable to similar terms used by other issuers. Table 4 reconciles between the Bank’s economic profit, ROIC and adjusted net income. Adjusted results and related terms are discussed in the “How the Bank Reports” section.

TABLE | 4 | RECONCILIATION OF ECONOMIC PROFIT, RETURN ON INVESTED CAPITAL AND ADJUSTED NET INCOME |

(millions of Canadian dollars) | 2008 | 2007 | 2006 | |||||||||

Average common equity | $ | 26,213 | $ | 20,572 | $ | 17,983 | ||||||

Average cumulative goodwill/intangible assets amortized, net of income taxes | 4,136 | 3,825 | 3,540 | |||||||||

Average invested capital | 30,349 | 24,397 | 21,523 | |||||||||

Rate charged for invested capital | 9.3 | % | 9.4 | % | 9.5 | % | ||||||

Charge for invested capital | $ | (2,822 | ) | $ | (2,293 | ) | $ | (2,045 | ) | |||

Net income available to common shareholders - reported | $ | 3,774 | $ | 3,977 | $ | 4,581 | ||||||

Items of note impacting income, net of income taxes | (20 | ) | 192 | (1,227 | ) | |||||||

Net income available to common shareholders - adjusted | $ | 3,754 | $ | 4,169 | $ | 3,354 | ||||||

Economic profit | $ | 932 | $ | 1,876 | $ | 1,309 | ||||||

Return on invested capital | 12.4 | % | 17.1 | % | 15.6 | % | ||||||

20 | TD BANK FINANCIAL GROUP ANNUAL REPORT 2008 Management's Discussion and Analysis |

2008 SIGNIFICANT EVENTS

Acquisition of Commerce Bancorp, Inc.

Acquisition of Commerce Bancorp, Inc.

On March 31, 2008, the Bank acquired 100% of the outstanding shares of Commerce Bancorp, Inc. (Commerce) for purchase consideration of $8.5 billion, paid in cash and common shares. As a result, $57.1 billion of assets (including additional goodwill of approximately $6.3 billion and intangible assets of $1.5 billion) and $48.6 billion of liabilities were included in the Bank’s Consolidated Balance Sheet on the date of acquisition.

The fiscal periods of Commerce and the Bank are not co-terminus. Commerce’s results are consolidated with the Bank’s results on a one month lag basis.

For details, see Note 31 to the 2008 Consolidated Financial Statements.

Enron

The Bank is a party to certain legal actions regarding Enron, principally the securities class action. As at July 31, 2008, the Bank’s total contingent litigation reserve for Enron-related claims was approximately $497 million (US$413 million). The Bank re-evaluated the reserve in light of the favourable evolution of case law in similar securities class actions following the U.S. Supreme Court’s ruling in Stoneridge Partners, LLC v. Scientific-Atlanta, Inc. During the fourth quarter of 2008, the Bank recorded an after-tax positive adjustment of $323 million ($477 million before tax), reflecting the substantial reversal of the reserve. Due to the pending nature of the securities class action and other Enron-related claims to which the Bank is a party, the Bank retained $20 million (US$17 million) of the reserve. Given the uncertainties of the timing and outcome of securities litigation, the Bank will continue to assess evolving case law as it relates to the Bank’s Enron reserve to determine whether the reserve should be further reduced. The Bank will continue to defend itself vigorously in these cases and work to resolve them in the best interest of its shareholders. For details, see Note 28 to the 2008 Consolidated Financial Statements.

Deterioration in Markets and Severe Dislocation in Credit Market

During the fourth quarter of 2008, as a result of recent deterioration in markets and severe dislocation in the credit market, the Bank changed its trading strategy with respect to certain trading debt securities. These debt securities were previously recorded at fair value with changes in fair value, as well as any gains or losses realized on disposal, recognized in trading income. Since the Bank no longer intends to actively trade in these debt securities, the Bank reclassified these debt securities from trading to the available-for-sale category effective August 1, 2008 in accordance with the Amendments to CICA Section 3855, Financial Instruments - Recognition and Measurement.

The fair value of the reclassified debt securities was $7,355 million, as at October 31, 2008. In the fourth quarter of 2008, net interest income of $110 million after tax was recorded relating to the reclassified debt securities. The change in fair value of $561 million after tax for these securities was recorded in other comprehensive income. Had the Bank not reclassified these debt securities on August 1, 2008, the change in the fair value of these debt securities would have been included as part of trading income, the impact of which would have resulted in a reduction of reported net income of $561 million in the fourth quarter of 2008, and a reduction in adjusted net income of $443 million after taking into account the change in the fair value of derivatives hedging the reclassified debt securities portfolio.

For further details, see Note 2 to the 2008 Consolidated Financial Statements.

FINANCIAL RESULTS OVERVIEW

Net Income

AT A GLANCE OVERVIEW

• | Reported net income was $3,833 million, down $164 million, or 4%, from 2007. |

• | Adjusted net income was $3,813 million, down $376 million, or 9%, from 2007. |

Reported net income was $3,833 million, compared with $3,997 million in 2007. The decrease in reported net income was primarily due to weaker segment operating earnings partially offset by a positive adjustment resulting from the substantial reversal of the Enron litigation reserve. Adjusted net income was $3,813 million, compared with $4,189 million in 2007. The decrease in adjusted earnings was largely due to weaker Wholesale Banking earnings and an increased loss in Corporate segment, partially offset by increased earnings from the Canadian and U.S. Personal and Commercial Banking segments and higher earnings from the Bank’s share of earnings from TD Ameritrade. Canadian Personal and Commercial earnings increased by $171 million driven by broad based revenue and volume growth. U.S. Personal and Commercial Banking earnings increased by $447 million, largely due to the acquisition of Commerce and the privatization of TD Banknorth in 2007. Wholesale Banking earnings declined by $759 million due to a 50% reduction in revenue amid severe market conditions. The loss in Corporate segment increased by $242 million, largely due to higher unallocated corporate expenses, securitization losses, the impact of retail hedging activity and increased costs related to corporate financing activities. The Bank’s share of earnings in TD Ameritrade increased by $28 million due to higher operating earnings in TD Ameritrade.

Reported diluted earnings per share were $4.87, compared with $5.48 in 2007. Adjusted diluted earnings per share were $4.88, a decrease of 15% compared with $5.75 in 2007.

U.S. GAAP (see the Reconciliation of Canadian and U.S. Generally Accepted Accounting Principles contained in the Bank’s 2008 Annual Report on Form 40-F filed with the U.S. Securities and Exchange Commission (SEC) and available on the Bank’s website at http://www.td.com/investor/index.jsp and at the SEC’s website (http://www.sec.gov)).

Net income available to common shareholders under U.S. GAAP was $3,828 million, compared with $3,774 million under Canadian GAAP. The higher U.S. GAAP net income available to common shareholders primarily resulted from an increase in income due to the de-designation of certain fair value and cash flow hedging relationships that were designated under Canadian GAAP effective November 1, 2006 and recognition of unrealized losses related to certain debt securities that were relassified from trading to available-for-sale.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2008 Management's Discussion and Analysis | 21 |

Revenue

AT A GLANCE OVERVIEW

• | Total revenue increased by $388 million, or 3%, from the prior year. |

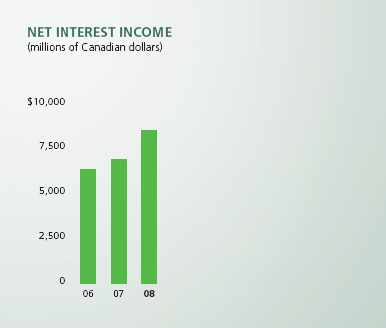

• | Net interest income was up $1,608 million, or 23%, from the prior year. |

• | Other income was down $1,220 million, or 17%, from the prior year. |

NET INTEREST INCOME

Reported net interest income was $8,532 million in 2008, an increase of $1,608 million or 23%. The increase was driven by increases in most segments. Canadian Personal and Commercial Banking net interest income increased $389 million, largely due to higher product volumes in personal loans, real-estate secured lending and deposits. U.S. Personal and Commercial Banking net interest income increased $779 million, largely due to the Commerce acquisition. Wholesale Banking net interest income increased $443 million due to higher trading-related net interest income.

NET INTEREST MARGIN

Net interest margin improved by 16 basis points (bps) in 2008 to 2.22% from 2.06% in 2007. Margin declines in both the Canadian and U.S. Personal and Commercial Banking businesses were more than offset by higher trading-related net interest income in Wholesale Banking. Net interest margin in Canadian Personal and Commercial Banking declined in 2008 compared with 2007, reflecting higher funding costs. Net interest margin in U.S. Personal and Commercial Banking declined in 2008 over 2007 due to competitive pressure on deposit pricing. The change in mix of business due to the acquisition of Commerce contributed positively to the Bank’s overall net interest margin.

TABLE | 5 | NET INTEREST INCOME ON AVERAGE EARNING BALANCES1 |

(millions of Canadian dollars) | 2008 | 2007 | 2006 | |||||||||||||||||||||||||||||||||

Average balance | Interest | Average rate | Average balance | Interest | Average rate | Average balance | Interest | Average rate | ||||||||||||||||||||||||||||

Earning assets | ||||||||||||||||||||||||||||||||||||

Deposits with banks | $ | 14,264 | $ | 629 | 4.41 | % | $ | 12,184 | $ | 357 | 2.93 | % | $ | 11,680 | $ | 302 | 2.59 | % | ||||||||||||||||||

Securities | ||||||||||||||||||||||||||||||||||||

Trading | 73,138 | 3,123 | 4.27 | 81,756 | 3,124 | 3.82 | 76,679 | 2,653 | 3.46 | |||||||||||||||||||||||||||

Non-trading | 60,726 | 2,331 | 3.84 | 43,970 | 1,642 | 3.73 | - | - | - | |||||||||||||||||||||||||||

Investment | - | - | - | - | - | - | 40,172 | 1,782 | 4.44 | |||||||||||||||||||||||||||

Total securities | 133,864 | 5,454 | 4.07 | 125,726 | 4,766 | 3.79 | 116,851 | 4,435 | 3.80 | |||||||||||||||||||||||||||

Securities purchased under reverse repurchase agreements | 38,393 | 1,705 | 4.44 | 31,960 | 1,829 | 5.72 | 30,910 | 1,413 | 4.57 | |||||||||||||||||||||||||||

Loans | ||||||||||||||||||||||||||||||||||||

Mortgages | 79,000 | 4,057 | 5.14 | 63,991 | 3,471 | 5.42 | 60,325 | 3,131 | 5.19 | |||||||||||||||||||||||||||

Consumer installment and other personal | 72,630 | 4,634 | 6.38 | 64,502 | 4,510 | 6.99 | 62,797 | 4,036 | 6.43 | |||||||||||||||||||||||||||

Credit card | 6,392 | 870 | 13.61 | 5,467 | 731 | 13.37 | 3,830 | 509 | 13.29 | |||||||||||||||||||||||||||

Business and government | 40,485 | 2,235 | 5.52 | 31,913 | 2,188 | 6.86 | 28,562 | 1,743 | 6.10 | |||||||||||||||||||||||||||

Total loans | 198,507 | 11,796 | 5.94 | 165,873 | 10,900 | 6.57 | 155,514 | 9,419 | 6.06 | |||||||||||||||||||||||||||

Total earning assets | $ | 385,028 | $ | 19,584 | 5.09 | % | $ | 335,743 | $ | 17,852 | 5.32 | % | $ | 314,955 | $ | 15,569 | 4.94 | % | ||||||||||||||||||

Interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||

Deposits | ||||||||||||||||||||||||||||||||||||

Personal | $ | 165,020 | $ | 3,679 | 2.23 | % | $ | 144,364 | $ | 3,733 | 2.59 | % | $ | 132,135 | $ | 3,027 | 2.29 | % | ||||||||||||||||||

Banks | 17,008 | 532 | 3.13 | 19,954 | 814 | 4.08 | 15,874 | 661 | 4.16 | |||||||||||||||||||||||||||

Business and government | 138,728 | 4,270 | 3.08 | 105,196 | 3,700 | 3.52 | 105,252 | 3,393 | 3.22 | |||||||||||||||||||||||||||

Total deposits | 320,756 | 8,481 | 2.64 | 269,514 | 8,247 | 3.06 | 253,261 | 7,081 | 2.80 | |||||||||||||||||||||||||||

Subordinated notes and debentures | 12,439 | 654 | 5.26 | 9,061 | 484 | 5.34 | 6,956 | 388 | 5.58 | |||||||||||||||||||||||||||

Obligations related to securities sold short and under repurchase agreements | 44,006 | 1,823 | 4.14 | 46,487 | 2,088 | 4.49 | 44,287 | 1,603 | 3.62 | |||||||||||||||||||||||||||

Preferred shares and Capital Trust Securities | 1,449 | 94 | 6.49 | 1,797 | 109 | 6.07 | 1,790 | 126 | 7.04 | |||||||||||||||||||||||||||

Total interest-bearing liabilities | $ | 378,650 | $ | 11,052 | 2.92 | % | $ | 326,859 | $ | 10,928 | 3.34 | % | $ | 306,294 | $ | 9,198 | 3.00 | % | ||||||||||||||||||

Total net interest income on average earnings assets | $ | 385,028 | $ | 8,532 | 2.22 | % | $ | 335,743 | $ | 6,924 | 2.06 | % | $ | 314,955 | $ | 6,371 | 2.02 | % | ||||||||||||||||||

1 Net interest income includes dividends on securities.

22 | TD BANK FINANCIAL GROUP ANNUAL REPORT 2008 Management's Discussion and Analysis |

TABLE | 6 | ANALYSIS OF CHANGE IN NET INTEREST INCOME |

(millions of Canadian dollars) | 2008 vs 2007 | 2007 vs 2006 | ||||||||||||||||||||||

| Favourable (unfavourable) due to change in | Favourable (unfavourable) due to change in | |||||||||||||||||||||||

Average volume | Average rate | Net change | Average volume | Average rate | Net change | |||||||||||||||||||

Total earning assets | $ | 2,805 | $ | (1,073 | ) | $ | 1,732 | $ | 1,028 | $ | 1,255 | $ | 2,283 | |||||||||||

Total interest-bearing liabilities | (1,641 | ) | 1,517 | (124 | ) | (645 | ) | (1,085 | ) | (1,730 | ) | |||||||||||||

Net interest income | $ | 1,164 | $ | 444 | $ | 1,608 | $ | 383 | $ | 170 | $ | 553 | ||||||||||||

OTHER INCOME

Reported other income was $6,137 million in 2008, a decrease of $1,220 million, or 17%, from 2007. Adjusted other income was $5,840 million, a decrease of $1,308 million, or 18%, from 2007. The decrease in adjusted other income was driven by a decline in Wholesale Banking, partially offset by increases in both U.S. and Canadian Personal and Commercial Banking. Wholesale Banking other income declined $1,687 million due to weak trading income, lower syndication revenue, and merger and acquisition fees. U.S. Personal and Commercial Banking other income increased $270 million, largely due to the inclusion of Commerce. Canadian Personal and Commercial Banking other income increased $188 million, due to growth in fee income and card services revenue.

TABLE | 7 | OTHER INCOME |

| (millions of Canadian dollars) | 2008 vs 2007 | |||||||||||||||

| 2008 | 2007 | 2006 | % change | |||||||||||||

| Investment and securities services: | ||||||||||||||||

| TD Waterhouse fees and commissions | $ | 405 | $ | 438 | $ | 561 | (7.5 | )% | ||||||||

| Full-service brokerage and other securities services | 565 | 559 | 509 | 1.1 | ||||||||||||

| Underwriting and advisory | 214 | 338 | 292 | (36.7 | ) | |||||||||||

| Investment management fees | 198 | 197 | 193 | 0.5 | ||||||||||||

| Mutual funds management | 863 | 868 | 704 | (0.6 | ) | |||||||||||

| Credit fees | 459 | 420 | 371 | 9.3 | ||||||||||||

| Net securities gains | 331 | 326 | 305 | 1.5 | ||||||||||||

| Trading income (loss) | (794 | ) | 591 | 797 | (234.3 | ) | ||||||||||

| Income from financial instruments designated as trading under the fair value option | (137 | ) | (55 | ) | - | 149.1 | ||||||||||

| Service charges | 1,237 | 1,019 | 937 | 21.4 | ||||||||||||

| Loan securitizations | 231 | 397 | 346 | (41.8 | ) | |||||||||||

| Card services | 589 | 451 | 374 | 30.6 | ||||||||||||

| Insurance, net of claims | 927 | 1,005 | 896 | (7.8 | ) | |||||||||||

| Trust fees | 140 | 133 | 130 | 5.3 | ||||||||||||

| Other | 909 | 670 | 406 | 35.7 | ||||||||||||

| Total | $ | 6,137 | $ | 7,357 | $ | 6,821 | (16.6 | )% | ||||||||

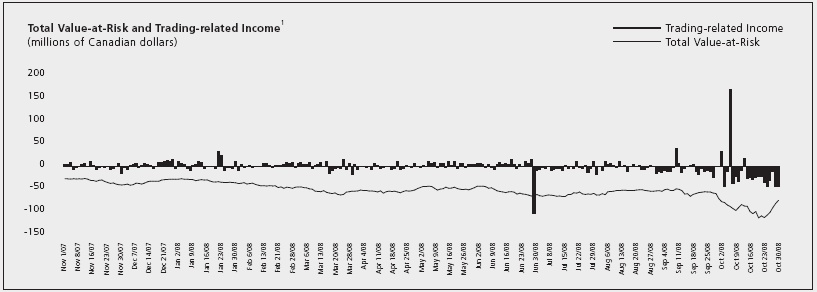

TRADING-RELATED INCOME

Trading-related income, which is the total of net interest income on trading positions and trading income, decreased by $1,069 million, or 215%, from 2007. The decrease was primarily due to weaker credit trading products associated with volatility in the credit markets and a breakdown in traditional pricing relationships between corporate bonds and credit default swaps which led to mark-to-market trading losses. Additionally, weaker results were experienced in equity trading.

The mix of trading-related income between net interest income and trading income is largely dependent upon the level of interest rates, which drives the funding costs of our trading portfolios. Generally, as interest rates rise, net interest income declines and trading income reported in other income increases. Management believes that the total trading-related income is the appropriate measure of trading performance.

TABLE | 8 | TRADING-RELATED INCOME1 |

(millions of Canadian dollars) | ||||||||||||

Trading-related income | 2008 | 2007 | 2006 | |||||||||

Net interest income | $ | 379 | $ | (55 | ) | $ | (65 | ) | ||||

Trading securities and derivatives | (794 | ) | 591 | 797 | ||||||||

Loans designated as trading under the fair value option | (156 | ) | (38 | ) | - | |||||||

Total trading-related income | $ | (571 | ) | $ | 498 | $ | 732 | |||||

By product | ||||||||||||

Interest rate and credit portfolios | $ | (663 | ) | $ | 239 | $ | 362 | |||||

Foreign exchange portfolios | 481 | 312 | 306 | |||||||||

Equity and other portfolios | (233 | ) | (15 | ) | 64 | |||||||

Loans designated as trading under the fair value option | (156 | ) | (38 | ) | - | |||||||

Total trading-related income | $ | (571 | ) | $ | 498 | $ | 732 | |||||

1 Trading-related income includes trading income arising from securities, derivatives and loans designated as trading under the fair value option, as well as net interest income derived from trading instruments.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2008 Management's Discussion and Analysis | 23 |

Expenses

AT A GLANCE OVERVIEW

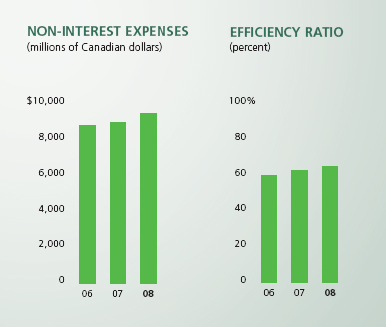

• | Reported non-interest expenses increased by $527 million, or 6%, from 2007. |

• | Adjusted non-interest expenses increased by $901 million, or 11%, from 2007. |

| • | Reported efficiency ratio was 64.8%. |

• | Adjusted efficiency ratio was 64.6%, a decline in efficiency of 500 bps from 59.6% in 2007. |

NON-INTEREST EXPENSES

Non-interest expenses for 2008 were $9,502 million, compared with $8,975 million in 2007, an increase of $527 million or 6%. The increase in expenses was driven by growth in all operating segments other than Wholesale Banking. This growth was partially offset by lower other expenses due to the impact of the $477 million positive adjustment resulting from the substantial reversal of the Enron litigation reserve. U.S. Personal and Commercial Banking expenses increased $570 million due largely to the acquisition of Commerce. Canadian Personal and Commercial Banking expenses increased $266 million due to higher employee compensation expense and investments in new business initiatives including longer hours and new branches.

EFFICIENCY RATIO

Efficiency ratio measures operating efficiency. The ratio is calculated by taking the non-interest expenses as a percentage of total revenue. A lower ratio indicates a more efficient business operation.

The Bank’s reported and adjusted efficiency ratios weakened from 2007, primarily due to the decrease in Wholesale Banking revenue.

TABLE | 9 | NON-INTEREST EXPENSES AND EFFICIENCY RATIO |

(millions of Canadian dollars) | 2008 vs 2007 | |||||||||||||||

2008 | 2007 | 2006 | % change | |||||||||||||

Salaries and employee benefits | ||||||||||||||||

Salaries | $ | 3,089 | $ | 2,737 | $ | 2,700 | 12.9 | % | ||||||||

Incentive compensation | 1,235 | 1,286 | 1,207 | (4.0 | ) | |||||||||||

Pension and other employee benefits | 660 | 583 | 578 | 13.2 | ||||||||||||

Total salaries and employee benefits | 4,984 | 4,606 | 4,485 | 8.2 | ||||||||||||

Occupancy | ||||||||||||||||

Rent | 463 | 390 | 371 | 18.7 | ||||||||||||

Depreciation | 225 | 163 | 160 | 38.0 | ||||||||||||

Property tax | 33 | 21 | 21 | 57.1 | ||||||||||||

Other | 214 | 162 | 149 | 32.1 | ||||||||||||

Total occupancy | 935 | 736 | 701 | 27.0 | ||||||||||||

Equipment | ||||||||||||||||

Rent | 216 | 192 | 200 | 12.5 | ||||||||||||

Depreciation | 213 | 199 | 183 | 7.0 | ||||||||||||

Other | 254 | 223 | 216 | 13.9 | ||||||||||||

Total equipment | 683 | 614 | 599 | 11.2 | ||||||||||||

Amortization of intangible assets | 577 | 499 | 505 | 15.6 | ||||||||||||

Restructuring costs | 48 | 67 | 50 | (28.4 | ) | |||||||||||

Marketing and business development | 491 | 445 | 470 | 10.3 | ||||||||||||

Brokerage-related fees | 252 | 233 | 222 | 8.2 | ||||||||||||

Professional and advisory services | 569 | 488 | 540 | 16.6 | ||||||||||||

Communications | 210 | 193 | 201 | 8.8 | ||||||||||||

Other | ||||||||||||||||

Capital and business taxes | 234 | 196 | 205 | 19.4 | ||||||||||||

Postage | 138 | 122 | 121 | 13.1 | ||||||||||||

Travel and relocation | 106 | 84 | 87 | 26.2 | ||||||||||||

Other | 275 | 692 | 629 | (60.3 | ) | |||||||||||

Total other | 753 | 1,094 | 1,042 | (31.2 | ) | |||||||||||

Total expenses | $ | 9,502 | $ | 8,975 | $ | 8,815 | 5.9 | % | ||||||||

Efficiency ratio - reported | 64.8 | % | 62.8 | % | 59.8 | % | 200 | bps | ||||||||

Efficiency ratio - adjusted | 64.6 | 59.6 | 62.4 | 500 | ||||||||||||

24 | TD BANK FINANCIAL GROUP ANNUAL REPORT 2008 Management's Discussion and Analysis |

FINANCIAL RESULTS OVERVIEW

Taxes

Reported total income and other taxes decreased by $236 million, or 16%, from 2007. Income tax expense, on a reported basis, was down $316 million, or 37%, from 2007. Other taxes were up $80 million, or 12%, from 2007. Adjusted total income and other taxes were down $366 million, or 22%, from 2007. Current income tax expense, on an adjusted basis, was down $446 million, or 45%, from 2007.

The Bank’s effective income tax rate, on a reported basis, was 13% for 2008, compared with 18% in 2007. The tax reduction was primarily due to a lower effective tax rate on international operations, which includes the tax synergies related to the Commerce acquisition. On an adjusted basis, the effective income tax rate was 14% for 2008, compared with 20% in 2007.

Prior to the sale of TD Waterhouse U.S.A. to Ameritrade to create TD Ameritrade in 2006, the financial statements reported the pre-tax and after-tax results of TD Waterhouse U.S.A. separately. TD reports its investments in TD Ameritrade using the equity method of accounting; tax expense of $178 million in the year, compared to $173 million in 2007, is not part of the tax rate reconciliation.

TABLE | 10 | TAXES |

(millions of Canadian dollars) | 2008 | 2007 | 2006 | |||||||||||||||||||||

Income taxes at Canadian statutory income tax rate | $ | 1,342 | 32.7 | % | $ | 1,627 | 34.9 | % | $ | 1,934 | 35.0 | % | ||||||||||||

Increase (decrease) resulting from: | ||||||||||||||||||||||||

Dividends received | (345 | ) | (8.4 | ) | (423 | ) | (9.1 | ) | (234 | ) | (4.2 | ) | ||||||||||||

Rate differentials on international operations | (457 | ) | (11.1 | ) | (336 | ) | (7.2 | ) | (248 | ) | (4.5 | ) | ||||||||||||

Items related to dilution gains and losses | - | - | - | - | (582 | ) | (10.5 | ) | ||||||||||||||||

Other | (3 | ) | (0.1 | ) | (15 | ) | (0.3 | ) | 4 | - | ||||||||||||||

Provision for income taxes and effective income tax rate - reported | $ | 537 | 13.1 | % | $ | 853 | 18.3 | % | $ | 874 | 15.8 | % | ||||||||||||

TABLE | 11 | RECONCILIATION OF NON-GAAP PROVISIONS FOR INCOME TAXES |

(millions of Canadian dollars) | 2008 | 2007 | 2006 | |||||||||

Provision for income taxes - reported | $ | 537 | $ | 853 | $ | 874 | ||||||

Increase (decrease) resulting from items of note: | ||||||||||||

Amortization of intangibles | 239 | 184 | 205 | |||||||||

Reversal of Enron litigation reserve | (154 | ) | - | - | ||||||||

Change in fair value of derivatives hedging the reclassified available-for-sale debt securities portfolio | (23 | ) | - | - | ||||||||

Gain relating to restructuring of Visa | - | (28 | ) | - | ||||||||

TD Banknorth restructuring, privatization and merger-related charges | - | 28 | - | |||||||||

Restructuring and integration charges relating to the Commerce acquisition | 41 | - | - | |||||||||

Dilution gain on Ameritrade transaction, net of costs | - | - | 34 | |||||||||

Balance sheet restructuring charge in TD Banknorth | - | - | 18 | |||||||||

Wholesale Banking restructuring charge | - | - | 15 | |||||||||

Change in fair value of credit default swaps hedging the corporate loan book, net of provision for credit losses | (62 | ) | (16 | ) | (4 | ) | ||||||

Other tax items | (34 | ) | - | (24 | ) | |||||||

General allowance release | - | (21 | ) | (21 | ) | |||||||

Provision for insurance claims | 10 | - | - | |||||||||

Initial set up of specific allowance for credit card and overdraft loans | - | - | 10 | |||||||||

Tax effect - items of note | 17 | 147 | 233 | |||||||||

Provision for income taxes - adjusted | 55 4 | 1,000 | 1,107 | |||||||||

Other taxes: | ||||||||||||

Payroll | 242 | 218 | 199 | |||||||||

Capital and premium taxes | 228 | 191 | 197 | |||||||||

GST and provincial | 172 | 170 | 184 | |||||||||

Municipal and business | 10 6 | 89 | 93 | |||||||||

Total other taxes | 74 8 | 668 | 673 | |||||||||

Total taxes - adjusted | $ | 1 ,302 | $ | 1,668 | $ | 1,780 | ||||||

Effective income tax rate - adjusted1 | 13.7 | % | 20.1 | % | 24.4 | % | ||||||

1 Adjusted effective income tax rate is adjusted provisions for income taxes before other taxes as a percentage of adjusted net income before tax.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2008 Management's Discussion and Analysis | 25 |

FINANCIAL RESULTS OVERVIEW

Quarterly Financial Information

FOURTH QUARTER 2008 PERFORMANCE SUMMARY

Reported net income for the quarter was $1,014 million, compared with $1,094 million in the same quarter last year. Reported diluted earnings per share were $1.22 for the quarter, compared with $1.50 in the same quarter last year. Adjusted net income for the quarter was $665 million, compared with $1,021 million in the same quarter last year. Adjusted diluted earnings per share were $0.79 for the quarter, compared with $1.40 in the fourth quarter of 2007.

Reported revenue increased by $90 million, or 3%, from the fourth quarter of 2007 due to gains in Canadian Personal and Commercial Banking from higher volumes in most products, and increases in U.S. Personal and Commercial Banking, primarily due to the acquisition of Commerce during the year. Wholesale Banking revenue decreased largely due to lower trading-related revenue due to severe market conditions.

Provision for credit losses increased by $149 million from the fourth quarter of 2007 partially due to a $60 million general allowance release in the fourth quarter of 2007. Canadian Personal and Commercial Banking increased provisions for credit losses by $33 million, largely due to higher personal banking provisions. Provision for credit losses in the U.S. Personal and Commercial Banking segment increased $43 million, largely due to the acquisition of Commerce.

Reported expenses increased $126 million from the fourth quarter of 2007. The current quarter includes the impact of the $477 million positive adjustment resulting from the substantial reversal of the Enron litigation reserve. Adjusted expenses for the quarter increased $529 million from the fourth quarter of 2007. The increase was driven by a $386 million increase in U.S. Personal and Commercial Banking expenses, primarily due to the acquisition of Commerce and an $88 million increase in Canadian Personal and Commercial Banking expenses, due to investments in new branches, higher employee compensation, and provisions related to the termination of the Truncation and Electronic Cheque Presentment (TECP) initiative by the Canadian Payments Association.

The Bank’s effective tax rate was 2% for the quarter, compared with 13% in the same quarter last year. The decline was primarily due to one-time benefits, including favourable resolutions of certain tax audits, and lower effective tax rate on international operations which includes the tax synergies related to the Commerce acquisition.

See the Bank’s fourth quarter 2008 News Release, dated December 4, 2008, for an analysis of results by quarter by business segment.

QUARTERLY TREND ANALYSIS

Over the previous eight quarters, the Bank has had steady underlying earnings growth from its retail business segments. However volatile economic conditions, most notably impacting Wholesale Banking, have contributed to weaker earnings over the last five quarters. Revenues have declined throughout 2008 in Wholesale Banking and have been relatively flat in Wealth Management, while growth in Canadian Personal and Commercial Banking has been reduced compared to that experienced in 2007. U.S. Personal and Commercial Banking experienced stronger revenue growth due to the impact of the Commerce acquisition which more than offset the weakening market conditions and a stronger Canadian dollar relative to the U.S. dollar. Additionally, provision for credit losses has increased during this period.

The Bank’s earnings have some seasonal impacts. The second quarter is affected by fewer business days. The third and fourth quarters typically experience lower levels of capital markets activity, impacting the wholesale business.

The Bank’s earnings are also impacted by market driven events, transaction and management actions. The second quarter of 2007 was negatively impacted by restructuring charges at TD Banknorth. The third quarter of 2007 peaked due to an increase in the ownership in TD Banknorth as a result of its privatization, a record quarter from Wholesale Banking and solid results from the other business segments. The fourth quarter of 2007 benefited from the positive adjustment related to Visa and a reversal of the general allowance for credit losses. The fourth quarter of 2007 marked the beginning of the liquidity crisis in the market. This had a dampening effect on earnings in that quarter as well as in subsequent quarters. The second quarter of 2008 also included restructuring charges relating to the Commerce acquisition, while the third and fourth quarters of 2008 benefited from the first time inclusion of the Commerce earnings.

For the discussion on the fourth quarter 2008 results, see the “Fourth Quarter 2008 Performance Summary” section.

26 | TD BANK FINANCIAL GROUP ANNUAL REPORT 2008 Management's Discussion and Analysis |

TABLE | 12 | QUARTERLY RESULTS |

| (millions of Canadian dollars) | 2008 | 2007 | ||||||||||||||||||||||||||||||

| Quarter ended | Quarter ended | |||||||||||||||||||||||||||||||

| Oct 31 | July 31 | April 30 | Jan 31 | Oct 31 | July 31 | April 30 | Jan 31 | |||||||||||||||||||||||||

| Net Interest Income | $ | 2,449 | $ | 2,437 | $ | 1,858 | $ | 1,788 | $ | 1,808 | $ | 1,783 | $ | 1,662 | $ | 1,671 | ||||||||||||||||

| Other income | 1,191 | 1,600 | 1,530 | 1,816 | 1,742 | 1,899 | 1,882 | 1,834 | ||||||||||||||||||||||||

| Total revenue | 3,640 | 4,037 | 3,388 | 3,604 | 3,550 | 3,682 | 3,544 | 3,505 | ||||||||||||||||||||||||

| Provision for credit losses | (288 | ) | (288 | ) | (232 | ) | (255 | ) | (139 | ) | (171 | ) | (172 | ) | (163 | ) | ||||||||||||||||

| Non-interest expenses | (2,367 | ) | (2,701 | ) | (2,206 | ) | (2,228 | ) | (2,241 | ) | (2,216 | ) | (2,297 | ) | (2,221 | ) | ||||||||||||||||

| Provision for income taxes | (20 | ) | (122 | ) | (160 | ) | (235 | ) | (153 | ) | (248 | ) | (234 | ) | (218 | ) | ||||||||||||||||

| Non-controlling interests | (18 | ) | (8 | ) | (9 | ) | (8 | ) | (8 | ) | (13 | ) | (27 | ) | (47 | ) | ||||||||||||||||

| Equity in net income of an associated company, net of income taxes | 67 | 79 | 71 | 92 | 85 | 69 | 65 | 65 | ||||||||||||||||||||||||

| Net income - reported | 1,014 | 997 | 852 | 970 | 1,094 | 1,103 | 879 | 921 | ||||||||||||||||||||||||

| Items of note affecting net income, net of income taxes: | ||||||||||||||||||||||||||||||||

| Amortization of intangibles | 126 | 111 | 92 | 75 | 99 | 91 | 80 | 83 | ||||||||||||||||||||||||

| Reversal of Enron litigation reserve | (323 | ) | - | - | - | - | - | - | - | |||||||||||||||||||||||

| Change in fair value of derivatives hedging the reclassified available-for-sale debt securities portfolio | (118 | ) | - | - | - | - | - | - | - | |||||||||||||||||||||||

| Gain relating to restructuring of Visa | - | - | - | - | (135 | ) | - | - | - | |||||||||||||||||||||||

| TD Banknorth restructuring, privatization and merger-related charges | - | - | - | - | - | - | 43 | - | ||||||||||||||||||||||||

| Restructuring and integration charges relating to the Commerce acquisition | 25 | 15 | 30 | - | - | - | - | - | ||||||||||||||||||||||||

| Change in fair value of credit default swaps hedging the corporate loan book, net of provision for credit losses | (59 | ) | (22 | ) | (1 | ) | (25 | ) | 2 | (30 | ) | (7 | ) | 5 | ||||||||||||||||||

| Other tax items | - | 14 | - | 20 | - | - | - | - | ||||||||||||||||||||||||

| Provision for insurance claims | - | - | - | 20 | - | - | - | - | ||||||||||||||||||||||||

| General allowance release | - | - | - | - | (39 | ) | - | - | - | |||||||||||||||||||||||

| Total adjustments for items of note, net of income taxes | (349 | ) | 118 | 121 | 90 | (73 | ) | 61 | 116 | 88 | ||||||||||||||||||||||

| Net income - adjusted | 665 | 1,115 | 973 | 1,060 | 1,021 | 1,164 | 995 | 1,009 | ||||||||||||||||||||||||

| Preferred dividends | (23 | ) | (17 | ) | (11 | ) | (8 | ) | (5 | ) | (2 | ) | (7 | ) | (6 | ) | ||||||||||||||||

| Net income available to common shareholders - adjusted | $ | 642 | $ | 1,098 | $ | 962 | $ | 1,052 | $ | 1,016 | $ | 1,162 | $ | 988 | $ | 1,003 | ||||||||||||||||

| (Canadian dollars) | ||||||||||||||||||||||||||||||||

| Basic earnings per share | ||||||||||||||||||||||||||||||||

| - reported | $ | 1.23 | $ | 1.22 | $ | 1.12 | $ | 1.34 | $ | 1.52 | $ | 1.53 | $ | 1.21 | $ | 1.27 | ||||||||||||||||

| - adjusted | 0.79 | 1.37 | 1.33 | 1.46 | 1.42 | 1.61 | 1.37 | 1.40 | ||||||||||||||||||||||||

| Diluted earnings per share | ||||||||||||||||||||||||||||||||

| - reported | 1.22 | 1.21 | 1.12 | 1.33 | 1.50 | 1.51 | 1.20 | 1.26 | ||||||||||||||||||||||||

| - adjusted | 0.79 | 1.35 | 1.32 | 1.45 | 1.40 | 1.60 | 1.36 | 1.38 | ||||||||||||||||||||||||

| Return on common shareholders’ equity | 13.3 | % | 13.4 | % | 13.4 | % | 18.0 | % | 20.8 | % | 21.0 | % | 17.1 | % | 18.2 | % | ||||||||||||||||

| (billions of Canadian dollars) | ||||||||||||||||||||||||||||||||

| Average earning assets | $ | 416 | $ | 410 | $ | 359 | $ | 354 | $ | 341 | $ | 329 | $ | 336 | $ | 337 | ||||||||||||||||

| Net interest margin as a percentage of average earning assets | 2.34 | % | 2.36 | % | 2.11 | % | 2.01 | % | 2.10 | % | 2.15 | % | 2.03 | % | 1.97 | % | ||||||||||||||||

TD BANK FINANCIAL GROUP ANNUAL REPORT 2008 Management's Discussion and Analysis | 27 |

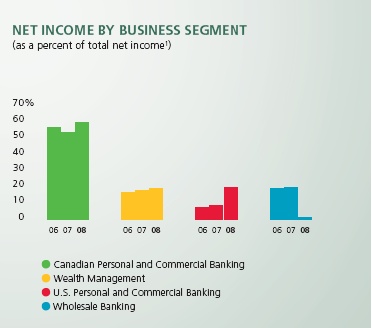

Business Focus

For management reporting purposes, the Bank’s operations and activities are organized around the following operating business segments: Canadian Personal and Commercial Banking, Wealth Management, U.S. Personal and Commercial Banking and Wholesale Banking.

Canadian Personal and Commercial Banking comprises our Canadian banking and global insurance businesses. Under the TD Canada Trust brand, the retail operations provide a full range of financial products and services to approximately 11 million personal and small business customers. As a leading customer services provider, TD Canada Trust offers anywhere, anytime banking solutions through telephone and internet banking, more than 2,600 automated banking machines and a network of 1,098 branches located across Canada. TD Commercial Banking serves the needs of medium-sized Canadian businesses, customizing a broad range of products and services to meet their financing, investment, cash management, international trade and day-to-day banking needs. Under the TD Insurance brand, the Bank offers a broad range of insurance products, including home and automobile coverage, life and health insurance in Canada and the U.S., as well as business property and casualty business in the U.S., in addition to credit protection coverage on TD Canada Trust lending products.

Wealth Management provides a wide array of investment products and services through different brands to a large and diverse retail and institutional global client base. Wealth Management is one of the largest in Canada, based on market share of assets, and comprises a number of advisory, distribution and asset management businesses, including TD Waterhouse, TD Mutual Funds and TD Asset Management Inc. (TDAM). In Canada, discount brokerage, financial planning, private investment advice and private client services cater to the needs of different retail customer segments through all stages of their investing life cycle. U.S. Wealth Management also provides a wide range of financial advisory, private banking, trust and investment management services to U.S. clients. Through Wealth Management’s discount brokerage channels, it serves customers in Canada and the United Kingdom, and TD Ameritrade serves customers in the U.S. Discount Brokerage industry and has leadership in both price and service.

U.S. Personal and Commercial Banking comprises the Bank’s retail and commercial banking operations in the U.S. The Bank’s U.S. Personal and Commercial banking operations expanded upon completion of the acquisition of Commerce in March 2008. Operating under the brand TD Bank, Amercia’s Most Convenient Bank, the retail operations provide a full range of financial products and services through multiple delivery channels, including a network of over 1,000 branches located in the U.S., primarily in the Northeast and Mid-Atlantic regions and Florida, telephone and internet banking and automated banking machines, allowing customers to have banking access virtually anywhere and anytime. U.S. Personal and Commercial Banking also serves the needs of business, customizing a broad range of products and services to meet their financing, investment, cash management, international trade and day-to-day banking needs.

Wholesale Banking serves a diverse base of corporate, government and institutional clients in key financial markets around the world. Under the TD Securities brand, Wholesale Banking provides a wide range of capital markets and investment banking products and services that include: underwriting and distribution of new debt and equity issues, providing advice on strategic acquisitions and divestitures, and executing daily trading and investment needs.

The Bank’s other business activities are not considered reportable segments and are, therefore, grouped in the Corporate segment. The Corporate segment includes effects of asset securitization programs, treasury management, general provisions for credit losses, elimination of taxable equivalent adjustments, corporate level tax benefits, and residual unallocated revenue and expenses.

Effective the third quarter of 2008, U.S. insurance and credit card businesses were transferred to the Canadian Personal and Commercial Banking segment, and the U.S. Wealth Management business to the Wealth Management segment for management reporting purposes to align how these businesses are now being managed on a North American basis. Prior periods have not been reclassified as the impact was not material.

Results of each business segment reflect revenue, expenses, assets and liabilities generated by the businesses in that segment. The Bank measures and evaluates the performance of each segment based on adjusted results where applicable, and for those segments, the Bank notes that the measure is adjusted. Amortization of intangibles expense is included in the Corporate segment. Accordingly, net income for operating business segments is presented before amortization of intangibles, as well as any other items of note not attributed to the operating segments, including those items which management does not consider within the control of the business segments. For more information, see the “How the Bank Reports” section. For information concerning the Bank’s measures of economic profit and return on invested capital, which are non-GAAP measures, see page 20. Segmented information also appears in Note 30 to the 2008 Consolidated Financial Statements.

Net interest income within the Wholesale Banking segment is calculated on a taxable equivalent basis (TEB), which means the value of non-taxable or tax-exempt income, including dividends, is adjusted to its equivalent before-tax value. Using TEB allows the Bank to measure income from all securities and loans consistently and makes for a more meaningful comparison of net interest income with similar institutions. The TEB adjustment reflected in Wholesale Banking is eliminated in the Corporate segment. The TEB adjustment for the year was $513 million, compared with $664 million last year.

As noted in Note 4 to the 2008 Consolidated Financial Statements, the Bank securitizes retail loans and receivables held by the Canadian Personal and Commercial Banking segment in transactions that are accounted for as sales. For the purpose of segmented reporting, Canadian Personal and Commercial Banking accounts for the transactions as though they are financing arrangements. Accordingly, the interest income earned on the assets sold net of the funding costs incurred by the purchaser trusts is recorded in net interest income and the provision for credit losses related to these assets is charged to provision for (reversal of) credit losses. This accounting is reversed in the Corporate segment and the gain recognized on sale together with income earned on the retained interests net of credit losses incurred are included in other income.

The “Business Outlook and Focus for 2009” section for each segment, provided on the following pages, is based on the Bank’s views and the actual “Economic Summary and Outlook” section and the outcome may be materially different. For more information, see the “Caution Regarding Forward-Looking Statements” section on page 17 and the ”Risk Factors That May Affect Future Results” section on page 64.

28 | TD BANK FINANCIAL GROUP ANNUAL REPORT 2008 Management's Discussion and Analysis |

TABLE | 13 | RESULTS BY SEGMENT |

| (millions of Canadian dollars) | Canadian Personal and Commercial Banking | Wealth Management | U.S. Personal and Commercial Banking1 | Wholesale Banking2 | Corporate2 | Total | ||||||||||||||||||||||||||||||||||||||||||

| 2008 | 2007 | 2008 | 2007 | 2008 | 2007 | 2008 | 2007 | 2008 | 2007 | 2008 | 2007 | |||||||||||||||||||||||||||||||||||||

Net interest income (loss)3 | $ | 5,790 | $ | 5,401 | $ | 347 | $ | 318 | $ | 2,144 | $ | 1,365 | $ | 1,318 | $ | 875 | $ | (1,067 | ) | $ | (1,035 | ) | $ | 8,532 | $ | 6,924 | ||||||||||||||||||||||

| Other income | 3,036 | 2,848 | 1,981 | 1,995 | 853 | 583 | (68 | ) | 1,619 | 335 | 312 | 6,137 | 7,357 | |||||||||||||||||||||||||||||||||||

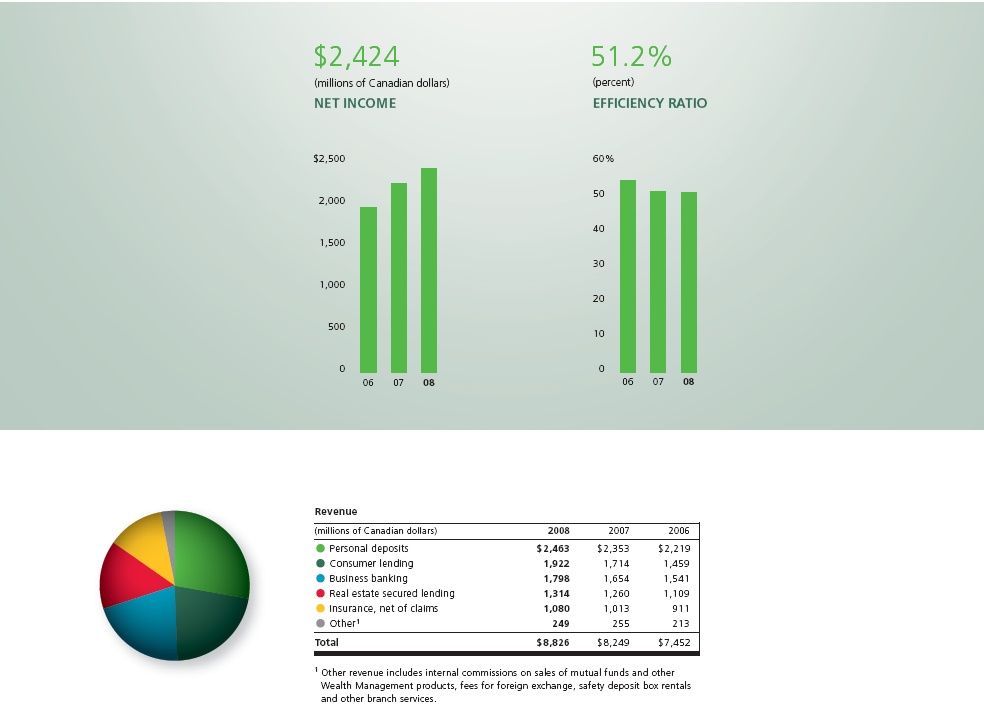

| Total revenue | 8,826 | 8,249 | 2,328 | 2,313 | 2,997 | 1,948 | 1,250 | 2,494 | (732 | ) | (723 | ) | 14,669 | 14,281 | ||||||||||||||||||||||||||||||||||

Provision for (reversal of) credit losses3 | 766 | 608 | - | - | 226 | 120 | 106 | 48 | (35 | ) | (131 | ) | 1,063 | 645 | ||||||||||||||||||||||||||||||||||

| Non-interest expenses | 4,522 | 4,256 | 1,615 | 1,551 | 1,791 | 1,221 | 1,199 | 1,261 | 375 | 686 | 9,502 | 8,975 | ||||||||||||||||||||||||||||||||||||

| Income before provision for income taxes | 3,538 | 3,385 | 713 | 762 | 980 | 607 | (55 | ) | 1,185 | (1,072 | ) | (1,278 | ) | 4,104 | 4,661 | |||||||||||||||||||||||||||||||||

Provision for (benefit of) income taxes | 1,114 | 1,132 | 233 | 261 | 258 | 196 | (120 | ) | 361 | (948 | ) | (1,097 | ) | 537 | 853 | |||||||||||||||||||||||||||||||||

| Non-controlling interests in subsidiaries, net of income taxes | - | - | - | - | - | 91 | - | - | 43 | 4 | 43 | 95 | ||||||||||||||||||||||||||||||||||||

| Equity in net income of an associated company, net of income taxes | - | - | 289 | 261 | - | - | - | - | 20 | 23 | 309 | 284 | ||||||||||||||||||||||||||||||||||||

| Net income - reported | 2,424 | 2,253 | 769 | 762 | 722 | 320 | 65 | 824 | (147 | ) | (162 | ) | 3,833 | 3,997 | ||||||||||||||||||||||||||||||||||

Items of note affecting net income, net of income taxes: | ||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of intangibles | - | - | - | - | - | - | - | - | 404 | 353 | 404 | 353 | ||||||||||||||||||||||||||||||||||||

| Reversal of Enron litigation reserve | - | - | - | - | - | - | - | - | (323 | ) | - | (323 | ) | - | ||||||||||||||||||||||||||||||||||

| Change in fair value of derivatives hedging the reclassified available-for-sale debt securities portfolio | - | - | - | - | - | - | - | - | (118 | ) | - | (118 | ) | - | ||||||||||||||||||||||||||||||||||

| Gain relating to restructuring of Visa | - | - | - | - | - | - | - | - | - | (135 | ) | - | (135 | ) | ||||||||||||||||||||||||||||||||||

| TD Banknorth restructuring, privatization and merger-related charges | - | - | - | - | - | 39 | - | - | - | 4 | - | 43 | ||||||||||||||||||||||||||||||||||||

Restructuring and integration charges relating to the Commerce acquisition | - | - | - | - | 70 | - | - | - | - | - | 70 | - | ||||||||||||||||||||||||||||||||||||

| Change in fair value of credit default swaps hedging the corporate loan book, net of provision for credit losses | - | - | - | - | - | - | - | - | (107 | ) | (30 | ) | (107 | ) | (30 | ) | ||||||||||||||||||||||||||||||||

| Other tax items | - | - | - | - | 14 | - | - | - | 20 | - | 34 | - | ||||||||||||||||||||||||||||||||||||

| Provision for insurance claims | - | - | - | - | - | - | - | - | 20 | - | 20 | - | ||||||||||||||||||||||||||||||||||||

| General allowance release | - | - | - | - | - | - | - | - | - | (39 | ) | - | (39 | ) | ||||||||||||||||||||||||||||||||||

| Items of note, net of income taxes | - | - | - | - | 84 | 39 | - | - | (104 | ) | 153 | (20 | ) | 192 | ||||||||||||||||||||||||||||||||||

| Net income - adjusted | $ | 2,424 | $ | 2,253 | $ | 769 | $ | 762 | $ | 806 | $ | 359 | $ | 65 | $ | 824 | $ | (251 | ) | $ | (9 | ) | $ | 3,813 | $ | 4,189 | ||||||||||||||||||||||

| (billions of Canadian dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Average invested capital | $ | 8.3 | $ | 8.3 | $ | 4.0 | $ | 3.8 | $ | 13.2 | $ | 7.9 | $ | 3.6 | $ | 2.8 | $ | 1.2 | $ | 1.6 | $ | 30.3 | $ | 24.4 | ||||||||||||||||||||||||

| Risk-weighted assets | $ | 58 | $ | 68 | $ | 7 | $ | 5 | $ | 83 | $ | 31 | $ | 56 | $ | 44 | $ | 8 | $ | 5 | $ | 212 | $ | 153 | ||||||||||||||||||||||||

1 Commencing May 1, 2007, the results of TD Bank USA, (previously reported in the Corporate segment for the period from the second quarter 2006 to the second quarter 2007 and in the Wealth Management segment prior to the second quarter of 2006) are included in the U.S. Personal and Commercial Banking segment prospectively. Prior periods have not been restated as the impact is not material.

2 The taxable equivalent basis (TEB) increase to net interest income and provision for income taxes reflected in the Wholesale Banking segment results is reversed in the Corporate segment.

3 The operating segment results are presented excluding the impact of asset securitization programs, which are reclassified in the Corporate segment.

1 On an adjusted basis and excluding the Corporate segment.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2008 Management's Discussion and Analysis | 29 |

ECONOMIC SUMMARY AND OUTLOOK

The dominant theme of 2008 was the credit crunch and its economic fallout on the global economy. The U.S. economy officially fell into recession, amid falling home prices, significant job losses, weak consumer spending and poor business investment. Extreme problems in the financial system severely affected the economy. Several major financial institutions failed and the weak balance sheets of others led to a contraction in the availability of credit. Strong exports and stimulus from government tax refund cheques allowed economic growth to remain positive in the first half of the year, but these effects soon declined and real GDP contracted in the second half of the year. The credit freeze necessitated a massive government intervention, including trillions of dollars of liquidity provisions and capital injections.

The U.S. economic and financial weakness proved to be a severe blow to the global economy. Speculation that the world could decouple from the U.S. was proven unfounded. There was widespread evidence of slowing economic growth around the globe in 2008, with a number of major industrialized nations posting economic contractions in at least one, if not several, quarters.

Canada was not immune and the economy experienced a significant economic slowdown in 2008. The weakness reflected Canada’s heavy reliance on exports, which accounts for close to 40% of the economy - of which 76% are destined for America. The domestic Canadian economy also showed signs of cooling, with real estate activity retreating and consumer expenditure moderating. Commodity prices corrected as investors anticipated that world demand for raw materials would advance at a softer pace. Weak business confidence and expectations of poorer profits also led to slacker business investment. The Canadian financial system weathered the credit crunch better than its counterparts in the U.S. and in Europe. Nevertheless, exposure to investments backed by U.S. assets and a significantly higher cost of funds arising from the credit crunch adversely impacted profitability of the Canadian financial sector. As a result of all of these trends, the Canadian economy is on track to grow by less than 1% in 2008.

Looking ahead, the fallout from the credit crunch will not pass quickly and a global downturn appears likely. U.S. home prices should stabilize in 2009, but high inventories of unsold homes are expected to prevent a snapback. Credit conditions will remain tight as the world financial system goes through a protracted period of restructuring and deleveraging. There is a significant risk that the U.S. economy could contract in 2009.

The U.S. economic weakness and the global stresses from the recent financial turmoil suggest that the world economy will continue to decelerate, with global growth expected to drop below 3% in 2009 - which would constitute a global recession.

The Canadian economy will continue to face challenges on the export front and domestic demand growth is likely to prove modest. The Canadian housing market will struggle, with sales expected to fall by 18% in 2008 and almost 6% in 2009, while resale prices are on track to decline by 2% this year and are expected to fall 6% next year. From a regional perspective, a convergence in provincial growth rates is anticipated, but the direction of that convergence is disappointing, as Western Canada will moderate towards the more modest growth in Atlantic Canada, but still better than the negligible growth or economic contraction in Central Canada.