August 19, 2011

VIA EDGAR

Kevin W. Vaughn

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

Dear Mr. Vaughn:

Re: The Toronto-Dominion Bank

Form 40-F for the Fiscal Year Ended October 31, 2010

Filed December 2, 2010

Forms 6-K

Filed May 26, 2011 and July 5, 2011

File No. 1-14446

Set forth below are responses to the comments contained in the letter from the Staff of the Securities and Exchange Commission (the “Staff”) to The Toronto-Dominion Bank (“TD” or the “Bank”), dated July 13, 2011. For convenience of reference, the text of the comments in the aforementioned Staff’s letter has been reproduced in bold herein and all references to currency are in Canadian dollars, unless otherwise noted. Where proposed enhanced disclosures have been provided in our response to the Staff’s comment, the enhancements have been underlined for the Staff’s convenience.

Form 40-F filed December 2, 2010

Exhibit 2 - Management’s Discussion and Analysis

Financial Results Overview, page two

Table 2 Reconciliation of Non-GAAP Financial Measures, page three

| 1. | We note from footnote 13 to table two on page four that effective November 1, 2009 TD Financing Services (formerly VFC, Inc.) revised their loan loss methodology to align it with the methodology for all other Canadian Personal and Commercial Banking retail loans. Please tell us and revise future filings to include a detailed discussion of the specific changes you made to your loan loss methodology, including how those changes impacted the timing and amount of your charge-offs and recording of the provision for credit losses. Specifically address why the methodology change effective November 1, 2009 resulted in adjustments to both 2010 and 2009 in the table. |

TD Financing Services (formerly VFC, Inc.) is a Canadian indirect auto lending business, the results of which are included in the Canadian Personal and Commercial Banking segment.

As noted in the Staff’s comments, effective November 1, 2009, TD Financing Services adopted the loan loss methodology used by all other retail portfolios within the Canadian Personal and Commercial Banking segment. The loan loss methodology for the Canadian Personal and Commercial retail banking portfolios relies on data collected and maintained for the purpose of the Basel II Advanced Internal Ratings Based (“AIRB”) approach to measure credit risk for capital purposes (with adjustments made to ensure that only incurred losses are recorded). TD received approval from the Office of the Superintendent of Financial Institutions (“OSFI”) to use the AIRB approach in the later part of fiscal 2009 for the TD Financing Services portfolio, and as a result was able to align the methodology for this portfolio with the rest of the segment. The new methodology required an increased allowance relative to the old methodology, resulting in the recognition of additional provision for credit losses of $4 million pre-tax in the quarter ended January 31, 2010.

TD’s loan loss allowance policies are described in the Credit Portfolio Quality and Credit Risk Management sections of Management’s Discussion and Analysis (“MD&A”) on pages 42 and 63, respectively, of the Form 40-F filing for the year ended October 31, 2010 (“Fiscal 2010”), as well as in Note 3 of the Fiscal 2010 Consolidated Annual Financial Statements. As the impact of the allowance methodology change was immaterial and TD Financing Services was aligning with an existing methodology that is already disclosed, we respectfully advise that it is not our current intention to revise our future filings to disclose a detailed discussion of the specific changes made to TD Financial Services’ loan loss methodology on November 1, 2009.

Separately, the Fiscal 2010 and 2009 adjustments to the general allowance noted by the Staff were not related to the methodology change for TD Financing Services as discussed above. In order to further clarify this, we intend to revise the footnote in future filings, beginning with the year ending October 31, 2011 (“Fiscal 2011”), to reflect the following proposed wording: “Effective November 1, 2009, the ‘General allowance release (increase) in Canadian Personal and Commercial Banking and Wholesale Banking’ includes the TD Financing Services (formerly VFC Inc.) portfolio. Prior to this, the impact of the TD Financing Services portfolio was excluded from this Item of Note.”

Exposure to Non-Agency Collateralized Mortgage Obligations (“CMO”), page 46

| 2. | You state here that during the second quarter of 2009 you re-securitized a portion of the non-agency CMO portfolio. Please revise your future reconciliation footnotes to more clearly describe how you accounted for these transactions under U.S. GAAP. Please provide us with your accounting analysis under U.S. GAAP which more fully describes the re-securitizations that took place during 2009 and how you determined whether you were required to consolidate the trusts. As part of your response, also address the following: |

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding our consolidation analysis of the trusts.

| | • | In situations where you are doing re-securitizations for your own liquidity or capital purposes, tell us the other parties involved that have discretion over the design of the trust. |

| | • | Tell us the types of parties that request your assistance in performing the re-securitization and discuss their role in the design of the trust and in the structure of the securities to be issued. |

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding the parties involved in the re-securitization.

| | • | Tell us whether you performed any re-securitizations where you did not retain a variable interest that could potentially be significant to the trust. |

There was only one securitization involving the aforementioned non-agency CMO securities and all resultant variable interests are held by TD. There have been no non-agency CMO securitizations where we did not retain a variable interest that could potentially be significant to the SPE.

| | • | Explain how conclusions whether to consolidate these trusts were impacted by your adoption of ASC 810. |

The adoption of ASC 810 on November 1, 2010 had no impact on the aforementioned accounting conclusion as the transaction also did not qualify for sale accounting treatment under ASC 860, as revised by Accounting Standards Update (“ASU”) No. 2009-16 (formerly, SFAS No. 166).

Financial Instruments, page 54

| 3. | We note your disclosure on page 54 that on a less frequent basis you will take proprietary trading positions with the objective of earning a profit. In addition, we note from your disclosure on page nine that your net interest income on trading positions was $827 million for fiscal year ended October 31, 2010. It is not clear from these disclosures however, how much of this revenue was generated from your proprietary trading business. Further we note your disclosures on page five of your MD&A regarding U.S. Legislative Developments. We believe that a separate discussion of your proprietary trading, hedge fund and private equity fund sponsorship and investing activities, including quantification of revenues from such activities, will provide readers with useful information regarding the significance of these activities on your historical financial statements and the impact that the Volcker rule and its limitations on certain activities is expected to have on your business going forward. Accordingly, please tell us and revise your future filings to address the following: |

TD’s trading activities are conducted in the Wholesale Banking segment. Wholesale Banking operates a franchise, client-focused strategy and over the last several years has significantly exited businesses that may be defined as proprietary trading businesses. Accordingly, our proprietary trading business has decreased substantially, especially over the past three years. Our flow-based strategy has been in place for a number of years and efforts to realign our business lines accordingly are well under way:

| | • | In Fiscal 2006 we announced our decision to exit our structured product business, and these positions have been substantially exited. |

| | • | In Fiscal 2008 we announced our decision to exit our structured credit trading business, and these positions have been substantially exited. |

| | • | In Fiscal 2008 and 2009, we announced our intention to exit our public equity investment portfolio, and these positions have been exited. At the same time we placed our private equity investment portfolio into run-off and have been exiting positions as opportunities allow. Other than previous funding commitments, at this time there are no new investments being made in either of these portfolios and we expect our positions to be substantially liquidated by calendar 2019. |

As a result of these changes, as stated on page 33 of the Fiscal 2010 Annual Report filed on Form 40-F the focus of our Wholesale Banking strategy is “…on providing superior execution of client driven transactions.” Accordingly, our Wholesale Banking segment engages in trading primarily to provide liquidity and market-making-related activities, as well as hedging and underwriting for client-driven strategies.

As disclosed in the U.S. Legislative Developments section of its MD&A in our Fiscal 2010 Form 40-F filing, TD acknowledges that the Dodd-Frank Act (the “Act”) will have an effect on its business, given that the Act provides for widespread reform and is expected to impact every financial institution in the United States and in some instances, many financial institutions, including TD, that also operate outside the United States. The full impact on TD is difficult to determine and is not expected to be known until such time as regulations for implementation guidance are released and finalized. In anticipation of such regulations, TD has formed a Dodd-Frank Act Implementation team. This team has been undertaking a comprehensive scoping exercise to assess the implications upon adopting the provisions of the Act.

| | • | Clearly disclose how you define “proprietary trading” and describe and quantify any effect the Volcker rule may have on your activities and results of operations. |

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding our current internal definition of “proprietary trading”.

In the current draft of the Act, “[P]roprietary trading” is defined as “…engaging as a principal for the trading account of the banking entity or nonbank financial company supervised by the Board in any transaction to purchase or sell, or otherwise acquire or dispose of, any security, any derivative, any contract of sale of a commodity for future delivery, any option on any such security, derivative, or contract, or any other security or financial instrument that the appropriate Federal banking agencies, the Securities and Exchange Commission, and the Commodity Futures Trading Commission may, by rule…determine.” The draft Act also differentiates between ”proprietary trading” and “permitted activities” which may generally include market-making, risk mitigation, underwriting, and transactions on behalf of customers, among others.

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding the effect of the Volcker rule on our business and our intentions with regards to disclosure of future filings.

| | • | Identify the trading desks and other related business units that participate in activities you believe meet the definition of proprietary trading. Identify where these activities are located in terms of your segment breakdowns. Quantify the gross revenues and operating margin from each of these units. |

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding our primary business activities that we believe meet the current internal definition of proprietary trading.

| | • | Revise your future filings to clearly identify aspects of your business that are similar to but excluded from your definition of “proprietary trading”. Clearly disclose how you differentiate such activities. Tell us the extent to which you believe it is possible that such activities will be scoped into the final regulatory definition of proprietary trading. |

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding our business activities that we believe are similar to but excluded from the definition of proprietary trading.

| | • | Clearly disclose how you define “hedge fund” and “private equity fund” as well as “sponsorship” and “investing” for the purpose of determining the limitations on your activities in these respective areas. |

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding our current internal definition of “hedge fund”, “private equity fund”, “sponsorship” and “investing”.

| | • | Identify the business units that sponsor or invest in private equity or hedge funds. Identify where these activities are located in terms of your segment breakdowns. Quantify the gross revenues, operating margins, total assets, and total liabilities associated with your sponsorship and investments in private equity and hedge funds. Clearly identify the extent to which such activities have been terminated or disposed of as well as the steps you plan to take to terminate or dispose of the rest of these components. |

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding our business units that sponsor or invest in private equity or hedge funds.

How We Manage Market Risk in Trading Activities, page 65

Calculating VaR, page 65

| 4. | We note your disclosure on page 65 that there were 30 days of trading losses but none breached your 99% one-day VaR. In addition, we note from your disclosure on page 28 of the Form 6-K filed on May 31, 2011 that during the second quarter of 2011 you never breached your 99% one-day VaR. Please address the following: |

| | • | Given that your trading losses never breached VaR for fiscal year 2010 and the first half of 2011, tell us why you believe the number of exceptions were not higher since your VaR is calculated at the 99% confidence level. |

The MD&A disclosure in our Fiscal 2010 Form 40-F and Form 6-K filed May 31, 2011 compares VaR with actual reported trading-related income.

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding the sources of our trading-related income.

Please see below for a discussion of results of back-testing TD’s VaR models for risk management purposes.

| | • | Explain to us how you determined your VaR model is still statistically appropriate given the lack of exceptions. |

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics of our internal VaR back-testing results.

On an annual basis, TD’s VaR model is subject to additional validation procedures to ensure that it remains statistically appropriate. The validation includes more extensive back-testing using a longer period of data and examining several percentile levels in the tail of the distribution. The model performance is also evaluated by business line and by risk factor for the portfolio. When deemed necessary and appropriate, additional tests are conducted to ensure that the key assumptions made within the model are appropriate and do not underestimate risk.

| | • | Address any changes you made to your VaR methodology or assumptions during the last three years, particularly highlighting any changes made because no trading losses were in excess of your one-day VaR in 2010 and first half of 2011. |

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics of our VaR methodology and assumptions.

Exhibit 3 - 2010 Annual Financial Statements

Note 3 Loans, Impaired Loans and Allowance for Credit Losses Purchased Loans, page 15

| 5. | We note your disclosure on page 15 that subsequent increases in cash flows over those expected at the acquisition date for purchased loans are recognized as interest income using the effective interest rate method. In addition, we note that decreases in expected cash flows after the acquisition date for purchased loans are recognized by recording an allowance for credit losses. Please tell us how you considered if there was a difference in the accounting for the purchased loans at the acquisition date and subsequent that would result in a reconciling item in the Canadian GAAP and U.S. GAAP reconciliation. In addition, tell us and clearly disclose in future filings how you account for the indemnification asset and adjustments to it subsequent to the acquisition date under both Canadian and U.S. GAAP. |

Accounting for Acquired Credit-Impaired Loans

The disclosure on page 15 of the Fiscal 2010 Consolidated Annual Financial Statements discusses the post-acquisition (or “Day 2”) accounting for Acquired Credit-Impaired (“ACI”) loans. In regards to acquisition (or “Day 1”) accounting for ACI loans, Canadian GAAP and U.S. GAAP are aligned in that the loans are required to be initially measured at fair value.

Day 2 accounting guidance applicable to this population for Canadian GAAP can be found in CICA Handbook Section 3855 (“Section 3855”). Section 3855 requires that when assets are acquired at a discount that is reflective of expected and incurred credit losses, those losses are included in the estimated cash flows used to determine the accretion of the discount using the Effective Interest Rate Method (“EIRM”). Currently U.S. GAAP guidance on accounting for ACI loans resides in ASC 310-30 (formerly, Statement of Position No. 03-3). The following summarizes the differences and similarities between Canadian GAAP and U.S. GAAP accounting for ACI loans:

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding our accounting analysis for ACI loans.

Accounting for Indemnification Assets

Please refer to TD’s response to the Staff’s comment #6 for a summary of the accounting for indemnification assets as well as proposed disclosures to be provided in our future filings related to FDIC covered loans.

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding our accounting analysis for indemnification assets.

Covered Loans, page 16

| 6. | We note your disclosure on page 16 that credit losses related to FDIC covered loans are determined net of the indemnification assets. In addition, we note that both the FDIC covered loans of $1.7 billion and the total indemnification asset of $168 million at October 31, 2010 were included in the line item ‘loans’ on the balance sheet. Under U.S. GAAP an allowance for credit losses for FDIC covered loans should be determined gross without consideration of the loss sharing agreement. In addition, the indemnification asset is reported separate from the assets it covers on the balance sheet, i.e. loans and foreclosed assets, either as a separate line item or within other assets. Please revise future filings to reflect the difference between Canadian GAAP and U.S. GAAP for the credit losses on FDIC covered loans and the indemnification asset. In addition, provide us with a draft of the adjustments and related footnotes as of October 31, 2010. |

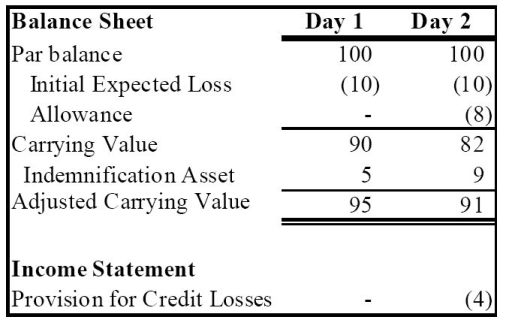

We currently calculate any additional allowance required on FDIC covered loans gross, exclusive of the indemnification asset. This allowance is recorded through the provision for credit losses. As outlined below in the proposed disclosure, the indemnification asset is also adjusted through the provision for credit losses when credit loss estimates increase from initial expectations. The end “credit loss” result, as referred to on page 16 of the Fiscal 2010 Consolidated Annual Financial Statements, is therefore reported net; however, the recorded allowance is calculated and reported gross, exclusive of the impact from the FDIC loss sharing agreement. Take the following hypothetical balance sheet and income statement as an example:

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding our accounting analysis for FDIC covered loans and the indemnification asset as well as our proposed enhanced disclosure to be provided in future filings.

Impaired Loans, page 16

| 7. | We note your disclosure on page 16 that loans where a payment is contractually past due for 90 days are generally classified as impaired. In addition, we note from your allowance for credit losses tabular disclosure on page 18 that you wrote-off loans only to the specific allowance and none to the general allowance in the past two fiscal years though you record a provision for credit losses to both. In an effort to provide clear and transparent disclosures please tell us and revise future filings to discuss in detail the relationship between the specific and general allowance and why there were no write-offs to the general allowance in the past two fiscal years. Also, in your response discuss how the impaired loan policy affects your specific allowance. |

The general allowance provides for credit losses that are considered to have occurred but which cannot yet be identified at the loan level. It recognizes losses inherent in a portfolio of loans, not losses on loans that have been indentified and classified as impaired. Once a loan has been identified as impaired (in accordance with the methodology described in the next paragraph), it is no longer included in the population of loans for the purpose of determining the general allowance. Instead, for impaired loans, a specific allowance is provided.

For non-retail borrowers (i.e., commercial, wholesale, and sovereign customers), a 21-point borrower risk rating scale is used to determine the credit quality of the borrower, where a borrower with a risk rating of 9A or 9B is classified as impaired as disclosed on page 62 of the Fiscal 2010 Form 40-F. Generally a non-retail borrower that is 90 days past due on their contractual payments will have a 9A or 9B risk rating; however, a number of borrower-specific as well as environmental factors are considered in determining a risk rating, and as a result a borrower may be classified as impaired before contractual payments are 90 days past due. For retail borrowers (i.e., individual and small business customers), given the large number of individually insignificant loans, it is impractical to complete such a borrower specific analysis. As a result, TD generally classifies retail exposures as impaired when contractual payments are 90 days past due.

Credit losses on impaired loans continue to be recognized by means of a specific allowance until a loan is written off. Loans are not written off until there is no realistic prospect of further recovery.

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics about our write-off policies.

In summary, a general allowance is established at the portfolio level for loans that have not been identified as impaired. Once a loan is identified as impaired, a specific allowance is established against the loan. A specific allowance continues to be held against the loan until it is written off. As a result of this process, a loan would not be written off against the general allowance. We currently intend to revise the accounting policy description included in future filings to clarify the relationship between the general and specific allowances (consistent with the disclosure currently provided on pages 42 and 76 of the Fiscal 2010 MD&A). Please refer to TD’s response to the Staff’s comment #8 for the proposed disclosure.

Collateral, page 19

| 8. | We note your disclosure on page 19 that as part of your determination of the net realizable value of an impaired loan you consider an assessment of the collateral. Please tell us and revise future filings to disclose the following: |

| | • | The impact the assessment of the collateral has on your specific allowance determination for impaired loans; |

Specific allowances are established to reduce the loan to its estimated realizable value. The estimated realizable value is measured by discounting the expected future cash flows at the original effective interest rate inherent in the loan. Expected future cash flows include consideration of cash flows to be received through the realization of collateral based on an assessment of the value of the collateral completed on the date the loan is identified as impaired. This assessment is updated as described in TD’s response to the Staff’s comment immediately below. We currently intend to clarify this in future filings beginning with the Fiscal 2011 Form 40-F filing, as per the proposed disclosure provided below.

| | • | How you value the underlying collateral of an impaired loan and the frequency of this assessment; and |

For non-retail borrowers, the amount of collateral that TD includes in the discounted expected cash flows approach is based on an evaluation of collateral at the date the loan is determined to be impaired. Cash flows expected to be received through the realization of collateral are estimated using management judgment that takes into consideration the nature of the collateral, seniority ranking of the debt, and loan structure. In addition, depending on the type of collateral, third party appraisals may be received. These estimated cash flows are reviewed at least annually, or more frequently when new information indicates a change in the timing or amount expected to be received.

The amount of collateral included in the discounted future cash flows used to determine specific allowances on retail borrowers is based on historical realized recovery rates for a particular type of collateral. They are reviewed annually, subject to monitoring on a quarterly basis.

We currently intend to clarify this in future filings beginning with the Fiscal 2011 Form 40-F filing, as per the proposed disclosure provided below.

| | • | The amount of impaired loans at October 31, 2010 that you considered the valuation of the collateral as part of your specific allowance determination. |

As noted in TD’s response to the Staff’s previous 2 enquiries under comment #8, where a loan is secured by collateral, the cash flows expected to be received through the realization of collateral is considered in the discounted cash flow calculation used to determine the specific allowance. Therefore, the value of collateral is considered in the determination of the specific allowance for all collateralized loans. We currently intend to clarify this in future filings beginning with the Fiscal 2011 Form 40-F filing, as per the proposed disclosure provided below.

Beginning with our Fiscal 2011 Form 40-F filing, we will revise our future filings to provide the following proposed disclosure clarifying the points discussed in TD’s response to the Staff’s comments #7 and #8:

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding proposed enhanced disclosures to be provided in future filings.

Note 5 Loan Securitizations, page 20

| 9. | We note your disclosure on page 20 that you sell loans to both third-parties and securitization structures and in most cases you retain the servicing rights. In addition, we note your disclosure on page 51 of Exhibit 99.2 that all loans securitized by you were originated in Canada and sold to Canadian securitization structures or Canadian non-SPE third parties. In an effort to provide clear and transparent disclosures on your securitization of loans and related servicing rights, please address the following: |

| | • | Tell us how you determine the prepayment rate assumption for your valuation of the retained interest in the securitization structure. Specifically, discuss the term over which the prepayment rate is calculated and how this correlates to the term and amortization period of the underlying loans of the structure. Also, tell us the percentage of the residential mortgage loans securitized in fiscal year 2010 that were “closed” mortgages. |

As at October 31, 2010, TD reported total retained interests of $1,437 million, of which $1,313 million or 91% related to securitized residential mortgage loans. In Canada, residential mortgage terms are usually 5 years or less and are renewable at maturity. Amortization periods are generally 25 years for new mortgages and effective March 18, 2011, the maximum amortization period was decreased from 35 years to 30 years on insured mortgages. The Canadian Bank Act prohibits most federally regulated lending institutions from providing mortgages without mortgage loan insurance for amounts that exceed 80% of the value of the home or purchases with less than 20% down payment. All mortgages (both residential and commercial) require insurance to be eligible for securitization within the National Housing Act Mortgage Backed Security (“NHA MBS”) program. Certain mortgages also include partial prepayment privileges, where a borrower is permitted to prepay a percentage of their original principal balance annually. Amounts prepaid in excess of this percentage are subject to prepayment penalties. Prepayment penalties are in general the greater of i) the Interest Rate Differential (“IRD”); and ii) 3 months interest. The IRD amount is typically calculated on the amount being prepaid using an interest rate equal to the difference between the existing mortgage interest rate and the interest rate that can be currently charged when the lender re-lends the funds for the remaining term of the mortgage. Liquidated mortgages in general are also subject to the same prepayment penalties. In short, the penalty makes the lender at least whole and results in low borrower refinancing activity due to interest rate incentives related to the existing mortgage. As a result, interest rate changes have a dampened impact on prepayment rates on Canadian mortgages. Rather, prepayment rates are more affected by customer behaviour statistics.

When determining the prepayment rate to apply for subsequent measurement of retained interests, consideration is made for both prepayments within prepayment privileges and prepayments/liquidations that result in a penalty to customers.

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics around determination of our prepayment rate assumptions.

On a quarterly basis, the inputs and assumptions used to fair value the retained interest, including the prepayment rate assumption, are reviewed and approved by senior level management. Historically, the prepayment rate assumption for residential mortgages have not materially changed and have consistently ranged between 18-20% (e.g., Fiscal 2010: 18.9%, Fiscal 2009: 18.8%, Fiscal 2008: 18.4%, and Fiscal 2007: 20.0%).

We define “closed” mortgages as mortgage agreements that cannot be prepaid, renegotiated or refinanced before maturity except according to its contractual terms. In Fiscal 2010, all Canadian residential mortgages securitized were closed mortgages.

| | • | Tell us how the gross impaired loans and write-offs, net presented in the loans managed table on page 21 are considered in your expected credit losses assumption for the valuation of the retained interest. In addition, explain to us the facts and circumstances that result in a write-off of a residential mortgage loan considering the fact that the residential mortgage loans securitized are government guaranteed. |

The Loans Managed table on page 21 of the Fiscal 2010 Consolidated Annual Financial Statements provides a reconciliation of total loans managed to total loans reported on the Consolidated Balance Sheet. Total loans managed include on-balance sheet loans and loans that have been securitized and sold to external third parties. Total loans securitized represent loans that have been de-recognized and removed from the Consolidated Balance Sheet. For on-balance sheet loans, regardless of whether a loan is insured or not, TD is required to disclose the amount of loans that are impaired. As noted in TD’s response to the Staff’s preceding enquiry under comment #9, in the Canadian market, loans (residential and commercial) securitized into NHA MBS are required to be insured. Due to this requirement to obtain insurance, for purposes of the valuation of retained interest, there are no credit losses as disclosed in the “Sensitivity of Key Assumptions to Adverse Changes” table on page 21.

HELOCs are not required to be insured prior to securitization, however $1.1 billion of $6.6 billion securitized HELOCs were insured as at October 31, 2010. For the portion of HELOCs that were insured, the credit loss assumption was 0%.

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics of our expected credit loss assumptions for HELOCs.

| | • | Tell us and disclose your accounting policy for servicing rights and the balance at October 31, 2010. If servicing rights are fair valued based on market expectations, tell us the valuation technique(s) used and your key assumption(s) relied upon at October 31, 2010 and October 31, 2009. |

As disclosed in Note 5 on page 51 of the Fiscal 2010 Consolidated Annual Financial Statements, the benefits of servicing are assessed against market expectations. When the benefits of servicing are more than adequate, a servicing asset is recognized. When the benefits of servicing are less than adequate, a servicing liability is recognized. Servicing assets or liabilities are reported in “Other assets” or “Other liabilities”, as appropriate. Canadian GAAP requires servicing rights to be measured at amortized cost. For U.S. GAAP, TD has elected to measure servicing assets also at amortized cost and annually assess for other-than-temporary impairment, or sooner if there is an indication that the asset may be impaired. We currently expect to include the preceding sentence in the financial statement note disclosure in future filings, beginning with our Fiscal 2011 Form 40-F filing.

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics of our mortgage servicing assets/liabilities.

| | • | Tell us if you are paid a fee to service the loans you securitize and sell. If so, tell us the average fee by loan type you receive. |

TD primarily securitizes loans through the NHA MBS program. This program is administered by the Canadian Mortgage and Housing Corporation (“CMHC”) and is sponsored by the Government of Canada. In accordance with TD’s Canadian regulator, OSFI, upon a transfer of NHA MBS, the interest spread is the difference between the stated interest rate on the mortgages and the stated rate of interest on the NHA MBS certificates. The interest spread includes a normal servicing fee.

The normal servicing fee represents a reasonable estimate of a market-based fee to service the pool of underlying mortgages over the life of the NHA MBS. The normal servicing fee rate is the amount established by CMHC which is 25 bps for homeowner pools and 15 bps for multiple family and social housing mortgage pools.

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics of our servicing fees.

| | • | Tell us and disclose if any of the loans sold to a third-party, other than to TD Mortgage Fund, or loans securitized as of October 31, 2010 could require you to repurchase the loan in the future. If so, disclose the factors that would cause a loan repurchase and the maximum exposure you have to loan repurchases. |

In connection with its securitization activities, TD typically makes customary representations and warranties to support its transfer of financial assets. The nature of these representations and warranties are for TD, as the seller, to represent that TD has executed the sale of assets in good faith, and in compliance with relevant laws and contractual requirements. In the event that they do not meet these criteria, the loans may be required to be repurchased by TD.

With respect to the pooling of residential loans for securitization into the NHA MBS program, prior to the issuance of MBS, CMHC has an opportunity to perform their own due diligence on the loans and may request the removal of certain loans. This process effectively mitigates the risk that TD will be required to repurchase loans at a future date due to incorrect representations and warranties. As at October 31, 2010, TD securitized $43.4 billion of residential mortgages, all of which could be subject to repurchase if one of the aforementioned conditions are met.

Additionally, TD securitizes variable rate HELOCs through various Canadian securitization structures. The securitization of these assets requires TD to make customary representations, warranties, and covenants regarding the sold assets, the servicing of such assets and related matters. Breaches of representations, warranties, or covenants may result in an obligation to repurchase such assets from the Canadian securitization structures.

Examples of representations, warranties, and covenants that, if breached or violated, would result in a repurchase obligation include a failure to meet asset eligibility criteria, failure to affect a valid transfer free of liens, or if an underlying HELOC fails to continue as a floating rate HELOC in its entirety. Repurchases would be limited to assets specifically related to, or affected by, the breach. As at October 31, 2010, TD securitized $6.6 billion of HELOCs, all of which could be subject to repurchase if one or more of the aforementioned conditions are met.

In the event of repurchasing the various assets discussed in this response, TD has limited exposure to credit losses as discussed in TD’s response to the second enquiry of the Staff’s comment #9.

Lastly, beginning with our Fiscal 2011 Form 40-F filing, we currently intend to revise our future filings to provide the following proposed disclosure to further clarify the contingent events that may result in a loan repurchase:

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding proposed enhanced disclosures to be provided in future filings.

Note 6 Variable Interest Entities, page 21

Significant Non-Consolidated Variable Interest Entities, page 22

| 10. | We note your disclosure on page 22 that you administer multi-seller conduits and use single-seller conduits to which you provide liquidity and credit enhancements. Please tell us and revise future filings to provide detailed disclosures regarding your obligations under these liquidity facilities. Consider providing the following in your revised disclosures: |

| | • | Whether your obligation is to purchase commercial paper, provide capital commitments or to purchase assets from the conduits; |

Our liquidity agreements are structured as loan facilities between TD, as the sole liquidity lender, and the TD sponsored trusts. If a trust experiences difficulty rolling over asset-backed commercial paper (“ABCP”), the trust may draw on the loan facility and use the proceeds to pay maturing ABCP. Typically, the loan facilities have a total commitment amount, which is disclosed in Note 6 of the Fiscal 2010 Consolidated Annual Financial Statements.

| | • | Whether there are triggers associated with your obligations to fund; and |

The trigger would be when a trust experiences difficulty rolling over maturing ABCP, and the financial services agent for the trust determines that a draw on the liquidity facility is necessary. The liquidity facility triggers are designed in the manner that TD is not providing a form of credit enhancement.

| | • | Whether there are any terms that would limit your obligation to perform. |

The liquidity lender does not have to provide any liquidity support if an event of default has occurred (defined as the bankruptcy or insolvency of the trust).

Please refer to TD’s response to the Staff’s comment #11 for the proposed disclosures that we currently intend to provide in our future filings related to clarification of these points.

| 11. | In addition, we note from your disclosure on page 22 that from time to time you may hold commercial paper issued by the conduits. Please quantify the amount of commercial paper that you purchased from the multi-seller and single-seller conduits during 2010 and 2009, and distinguish the amount of purchases that were made pursuant to liquidity agreements from those that were not. Explain whether you considered any of these purchases to be reconsideration events under U.S. GAAP, and if not, describe your rationale for making this determination. |

During the years ended October 31, 2009 and 2010, no amounts of ABCP were purchased pursuant to liquidity agreements. TD does have daily inventory positions of ABCP where TD holds ABCP for market-making activities.

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics of our inventory positions.

TD monitors these inventory positions as part of the on-going consolidation assessment process, as these purchases are considered reconsideration events. The inventory positions did not cause any change in consolidation conclusions under U.S. GAAP during the years ended October 31, 2009 and 2010.

Beginning with our Fiscal 2011 Form 40-F filing, we currently intend to revise our future filings to provide the following proposed disclosure clarifying the points discussed in TD’s response to the Staff’s comments #10 and #11:

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding proposed enhanced disclosure to be provided in future filings.

Note 7 Acquisitions and Other, page 22

a) U.S. Personal and Commercial Banking Acquisitions in Fiscal 2010

| 12. | You state that you may be required to make payments to the FDIC based on the actual losses incurred in relation to the FDIC Intrinsic Loss Estimate. Please revise to more clearly describe the extent to which you may have to make payments to the FDIC and explain how such payments would be determined under the FDIC Intrinsic Loss Estimate. |

In order to clarify the accounting for the FDIC covered loans, we currently intend to revise our future filings, beginning with our Fiscal 2011 Form 40-F filing, to include the following proposed disclosure:

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding proposed enhanced disclosure to be provided in future filings.

Note 31 Contingent Liabilities, Commitments, Pledged Assets, Collateral and Guarantees, page 58 Assets Sold with Recourse - Service Agreements, page 59

| 13. | You disclose here that you have recourse exposure for the sale of residential mortgage loans to TD Mortgage Fund, a mutual fund managed by the Bank. In addition, we note your disclosure that the repurchase obligations do not preclude sale treatment of the transferred mortgage loans. Tell us how you determined that you did not need to consolidate TD Mortgage Fund under U.S. GAAP and that the transfers of loans with recourse to this entity met sale criteria under U.S. GAAP. Please address your accounting for these transactions both before and after your adoption of ASC 810 and 860. |

Background

The recourse obligations referred to in the Staff’s comments are in fact a conditional obligation to repurchase mortgages upon default (the “Default Purchase Obligation”) and a written option to repurchase mortgages in liquidity related circumstances (the “Liquidity Option”). Under the Default Purchase Obligation, TD repurchases all mortgages upon default for an amount equal to the outstanding principal and interest balance. As all mortgages sold to the TD Mortgage Fund (the “Fund”) are insured by CMHC1, TD fully recovers all outstanding principal and interest, including interest compounded on the defaulted amounts, through realization of collateral and insurance proceeds. Under the Liquidity Option, the Fund has the option to require TD to repurchase mortgages for an amount equal to their fair value if the Fund does not have sufficient cash to honour unitholder redemptions.

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics of the contractual terms between the Fund and TD, our consolidation and sales accounting analysis, as well as proposed enhanced disclosures to be provided in future filings.

| 14. | Please tell us and revise disclosures in future filings to address the following: |

| | • | Disclose your methodology used to estimate the reserves related to the recourse exposure, if applicable. |

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics of the recourse reserve.

1 A Government of Canada Crown corporation that also sponsors TD’s primary NHA MBS securitization program as discussed in our response to the Staff’s comment #9.

| | • | Discuss the level of and type of claims you have received, any trends identified, and your “success rate” in avoiding paying claims. |

There were minimal claims by the Fund in the past related to the Liquidity Option as the requirements to trigger the claim under this repurchase obligation were generally not met. However, as noted in the enquiry immediately above as well as TD’s response to the Staff’s comment #13, TD does not incur losses on these mortgages as they are fully insured by an agent of the Canadian government. We currently intend to revise future filings as illustrated in the proposed enhanced disclosure included in TD’s response to the Staff’s comment #13.

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics of defaulted mortgages that have been repurchased.

| | • | Discuss your methods for settling claims. Specifically, disclose whether you repurchase loans outright or whether you simply make a settlement payment to them. If the former, discuss any significant effects or trends on your impaired loan statistics and any trends in terms of the average settlement amount by loan type. |

Under the Default Purchase Obligation, TD repurchases the mortgages and then recovers the outstanding balance through realization of the collateral and insurance proceeds, as noted in TD’s response to the Staff’s comment #13. The recovery process is the same for these repurchased mortgages as for the rest the Canadian Personal and Commercial Banking segment’s mortgages. There have been no claims under the Liquidity Option. As a result of the immaterial nature of these claims, we respectfully advise that it is not our current intention to revise our future filings to disclose the methods for settling claims.

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics of defaulted mortgages that have been repurchased.

| | • | Provide a roll forward of your reserves related to the recourse exposure for the periods presented. |

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics of the recourse reserve.

Exhibit 4 - Reconciliation of Canadian and U.S. Generally Accepted Accounting Principles

Condensed Consolidated Balance Sheet, page four

| 15. | We note your tabular disclosure on page four and that the retained earnings adjustment for Canadian GAAP to U.S. GAAP was $892 million. In addition, we note that the U.S. GAAP retained earnings balance increased by $2,802 million however; the U.S. GAAP net income was $5,151 million. Please provide us with a breakout of the adjustments made to retained earnings as of October 31, 2010 by footnote (i.e. a, b, c, etc). |

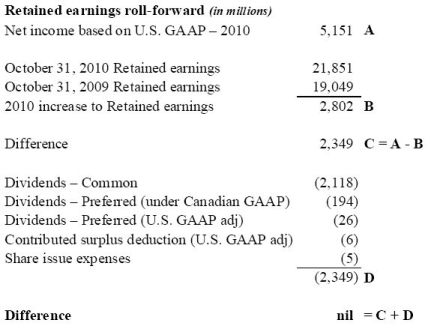

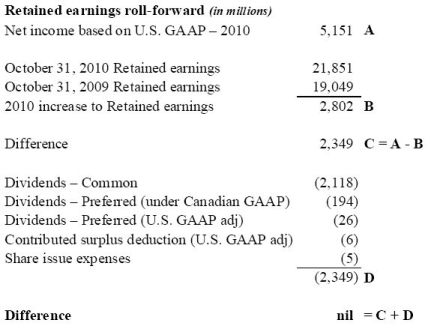

The following retained earnings roll-forward is presented below:

For our U.S. GAAP reconciliation, all items are recorded on a life-to-date basis; as a result, retained earnings is first adjusted for all prior period differences to reconcile Canadian GAAP opening retained earnings to U.S. GAAP opening retained earnings. Retained earnings is then calculated at year-end for any current period profit and loss differences. For Fiscal 2010, there were no adjustments to opening retained earnings as a result of the adoption of new accounting pronouncements. As at October 31, 2010, the $892 million retained earnings adjustment from Canadian GAAP to U.S. GAAP was attributable to two factors: higher U.S. GAAP earnings in cumulative years up to and including October 31, 2009 of $411 million, and the 2010 increase in U.S. GAAP earnings attributable to common shareholders of $481 million ($507 million net income less $26 million preferred dividend). The footnotes within the U.S. GAAP reconciliation designate items affecting profit and loss in the current period that would affect the portion of the retained earnings adjustment related to the adjustment to the closing retained earnings balance for the year.

Form 6-K Filed on May 26, 2011

Exhibit 99.1 Second Quarter 2011 Report To Shareholders

Credit Portfolio Quality, page 24

Sovereign Risk, page 24

| 16. | We note your disclosure on page 24 that you have exposure to Ireland, Italy, and Spain, both in terms of the sovereigns themselves and the largest financial institutions in those countries. Given the market concerns with the downgrades in the debt ratings in these countries and your exposure to sovereign counterparties, please tell us and enhance your disclosure in future filings to provide quantitative exposure (both direct and indirect) by country. As part of your response, please identify the financial statement line item(s) in which these exposures are included. |

TD manages its direct and indirect exposures through its continued strategy of limiting our counterparties to primarily top tier banks in AAA-rated countries. Early during the sovereign crisis, TD exited or reduced its exposure to the “PIIGS” nations (i.e., Portugal, Ireland, Italy, Greece, and Spain) and we continue to closely monitor our exposure to financial institutions of such countries. In the meantime, we also monitor the developments in Europe closely for possible impairment on investment securities and direct lending, and we will continue to make exit or exposure reduction decisions where appropriate.

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics of our exposures.

Given TD’s limited exposure as described above, management continues to believe that the level of disclosure provided is appropriate and that additional disclosure is not required. As a result, we respectfully advise that it is not our current intention to revise our future filings in this regard.

Note 15 Segmented Information, page 57

| 17. | We note your disclosure here as well as on pages 13 and 22 regarding the changes in your segment allocations. Please tell us and revise your future filings to more clearly disclose how the allowance for loan losses and provision for credit losses are allocated to the segments before and after these changes. In particular, please clearly identify the nature of the allowance that is allocated to Corporate. |

The general allowance (and related provision for credit losses) for Canadian Personal and Commercial Banking and Wholesale Banking loan portfolios is recorded in the Corporate segment. The general allowance (and related provision for credit losses) for U.S. Personal and Commercial Banking loan portfolios is recorded in the U.S. Personal and Commercial Banking segment. All specific allowances (and related provision for credit losses) are recorded in the business segment responsible for the results of the related loan portfolio.

In the first quarter of 2011, the operating results and associated loans for the U.S. credit card business were transferred from the Canadian Personal and Commercial Banking segment to the U.S. Personal and Commercial Banking segment to reflect a change in the way management manages the business. As a result, $13 million of provision for credit losses related to specific allowances on the U.S. credit card portfolio was recorded in the U.S. Personal and Commercial Banking segment rather than in the Canadian Personal and Commercial Banking segment. The quarterly variance on each segment’s provision for credit losses, both after the transfer and excluding it, was noted in the segment discussions of their results (pages 14 and 19 of the referenced filing). As the provision for credit losses related to the general allowance was nominal, there was not a significant impact on any of TD’s segments as a result of this transfer.

We currently disclose that the general allowance related to the Canadian Personal and Commercial Banking and Wholesale Banking segments is included in the Corporate segment in Note 33 of the Fiscal 2010 Consolidated Annual Financial Statements. Because there have been no changes to TD’s disclosed allocation methodology of the allowance for loan losses and provision for credit losses before and after the transfer of the U.S. credit card business to the U.S. Personal and Commercial Banking segment, we respectfully advise that it is not our current intention to revise our future filings in this regard.

Note 16 Contingencies, page 58

| 18. | We note your disclosure here regarding the four class action lawsuits in which you have been named as a defendant. You disclose that it is too early to determine the amount of or range of potential loss. We also note your disclosure in Note 31 on page 58 of your annual financial statements that you believe the ultimate disposition of legal actions, individually or in the aggregate, would not have a material adverse effect on your financial condition. Please tell us and revise the appropriate section of your future filings to disclose whether you believe the legal actions will have a material effect on your results of operations or cash flows. If you are unable to make such an assertion, provide the disclosures required by ASC 450 in the appropriate section of your document. |

We provided the disclosure referenced in Note 31 on page 58 of our Consolidated Annual Financial Statements in relation to all reasonably possible losses that were not recorded as at October 31, 2010. The interim financial statements for the three and six months ended April 30, 2011 only disclosed the 4 class action lawsuits referenced in the Staff's comment to reflect facts that arose subsequent to the issuance of our Fiscal 2010 Form 40-F filing.

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics of the effects of legal proceedings on our financial statements.

If there are no changes in facts and circumstances to the 4 class action lawsuits or any other developments related to other significant legal actions, we currently intend to revise future filings, beginning with our Fiscal 2011 Form 40-F filing, to include the following proposed note disclosure:

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding proposed enhanced disclosure to be provided in future filings.

Form 6-K Filed on July 5, 2011

Exhibit 99.1 U.S. GAAP Reconciliation

Reconciliation of Canadian and U.S. Generally accepted Accounting Principles, page one

| 19. | We note your reconciliation of net income from Canadian GAAP to U.S. GAAP on page one. In addition, we note the significant accounting policy differences between Canadian GAAP and U.S. GAAP footnotes beginning on page five. In an effort to provide clear and transparent disclosures on your reconciliations, please revise future filings to include a reference to the applicable footnote(s) for all your adjustments in the Canadian GAAP to U.S. GAAP reconciliations. |

In response to the Staff’s comments, TD as part of its 6-K filing includes only net new material disclosures as part of its footnotes beginning on page 5. This is in line with SEC Regulation S-X Form and content of and requirements for financial statements Article 10, 210.10-01 Interim financial statements (a)(5), which states:

“The interim financial information shall include disclosures either on the face of the financial statements or in accompanying footnotes sufficient so as to make the interim information presented not misleading. Registrants may presume that users of the interim financial information have read or have access to the audited financial statements for the preceding fiscal year and that the adequacy of additional disclosure needed for a fair presentation, except in regard to material contingencies, may be determined in that context. Accordingly, footnote disclosure which would substantially duplicate the disclosure contained in the most recent annual report to security holders or latest audited financial statements, such as a statement of significant accounting policies and practices, details of accounts which have not changed significantly in amount or composition since the end of the most recently completed fiscal year, and detailed disclosures prescribed by Rule 4-08 of this Regulation, may be omitted. However, disclosure shall be provided where events subsequent to the end of the most recent fiscal year have occurred which have a material impact on the registrant. Disclosures should encompass for example, significant changes since the end of the most recently completed fiscal year in such items as: accounting principles and practices; estimates inherent in the preparation of financial statements; status of long-term contracts; capitalization including significant new borrowings or modification of existing financing arrangements; and the reporting entity resulting from business combinations or dispositions. Notwithstanding the above, where material contingencies exist, disclosure of such matters shall be provided even though a significant change since year end may not have occurred.”

As a result of the above cited SEC regulation, TD, as part of its 6-K filing for the period ended April 30, 2011, has only referenced new footnotes to the adjustments noted in the reconciliation of net income from Canadian GAAP to U.S. GAAP (i.e., note h, note f, note j, note a, and note k). The remaining footnotes not referenced on page 1 relate to items with adjustments that are consistent with those in the Fiscal 2010 Consolidated Annual Financial Statements or items that are purely disclosure in nature and do not have an adjustment on the reconciliation of consolidated net income from Canadian GAAP to U.S. GAAP.

TD in its past Form 40-F filings has included a complete set of footnotes which are appropriately referenced to the adjustments noted in the reconciliation of consolidated net income from Canadian GAAP to U.S. GAAP. In future filings, we currently expect to include the remaining footnotes beginning with the Fiscal 2011 Form 40-F filing. The following is a proposed mock-up of page 1 in TD’s Form 40-F to be filed for the year ending October 31, 2011.

INTRODUCTION

The Toronto-Dominion Bank (the “Bank”) produces quarterly and annual reports, which are submitted to the U.S. Securities and Exchange Commission (SEC) under Form 6-K and Form 40-F, respectively, and which are incorporated by reference into registration statements of the Bank relating to offerings of securities. These reports are prepared in accordance with Canadian generally accepted accounting principles (Canadian GAAP). SEC regulations require certain additional disclosures to be included in such registration statements twice annually reconciling financial information in the reports from Canadian GAAP to U.S. generally accepted accounting principles (U.S. GAAP). This additional disclosure is contained within this document for the three years ended October 31, 2011, 2010 and 2009 and should be read in conjunction with the Bank’s Consolidated Financial Statements as at and for the year ended October 31, 2011 contained elsewhere in this Annual Report on Form 40-F.

Reconciliation of Canadian and United States Generally Accepted Accounting Principles

The accounting principles followed by the Bank, including the accounting requirements of the Office of the Superintendent of Financial Institutions Canada, conform with Canadian GAAP.

As required by the SEC, the significant differences between Canadian GAAP and U.S. GAAP are described below.

| (millions of Canadian dollars) | | For the years ended October 31 | |

| | | | 2011 | 1 | | | 2010 | 1 | | | 2009 | 1 |

| Net income attributable to the Bank based on Canadian GAAP | | | | | | | | | | | | |

Employee future benefits (Note a) | | | | | | | | | | | | |

Securitizations (Note q) | | | | | | | | | | | | |

Derivative instruments and hedging activities (Note e) | | | | | | | | | | | | |

Liabilities and equity (Note h) | | | | | | | | | | | | |

Net securities gains/(losses)2(Note g) | | | | | | | | | | | | |

Insurance Income (Note v) | | | | | | | | | | | | |

Other income/(expenses) (Notes f, i) | | | | | | | | | | | | |

Provision for credit losses (Note b) | | | | | | | | | | | | |

Income taxes and net change in income taxes due to the above items (Notes k, l, x) | | | | | | | | | | | | |

| Net income based on U.S. GAAP | | | | | | | | | | | | |

Less: Additional net income attributable to non-controlling interests based on U.S. GAAP (Notes h, s) | | | | | | | | | | | | |

| Net income attributable to the Bank based on U.S. GAAP | | | | | | | | | | | | |

Less: Preferred dividends (Note h) | | | | | | | | | | | | |

| Net income attributable to the Bank’s common shareholders based on U.S. GAAP | | | | | | | | | | | | |

| Average number of common shares outstanding (millions) | | | | | | | | | | | | |

| Basic - U.S. GAAP/Canadian GAAP | | | | | | | | | | | | |

| Diluted - U.S. GAAP/Canadian GAAP | | | | | | | | | | | | |

| Basic earnings per share - U.S. GAAP | | | | | | | | | | | | |

- Canadian GAAP | | | | | | | | | | | | |

| Diluted earnings per share - U.S. GAAP | | | | | | | | | | | | |

- Canadian GAAP | | | | | | | | | | | | |

| | 1 For 2011, the effect of U.S. GAAP adjustments to the Canadian GAAP Consolidated Statement of Income is as follows: $x million increase/ decrease to net interest income (2010 – $1,083 million decrease; 2009 – $561 million decrease), $x million increase/ decrease to other income (2010 – $1,609 million increase; 2009 – $1,450 million increase) and $x million increase/ decrease to non-interest expenses (2010 – $19 million increase; 2009 – $217 million increase). |

| | 2 Net securities losses for the year ended October 31, 2011 include credit losses of $x million (2010 – $117 million; 2009 – $45 million) (consisting of $x million (2010 – $178 million; 2009 – $72 million) of unrealized losses, net of $x million (2010 – $61 million; 2009 – $27 million) recognized in other comprehensive income) and realized securities gains of $x million (2010 – $101 million; 2009 – $90 million). |

Significant Accounting Policy Differences Between Canadian and U.S. GAAP, page five

(a) Business Combinations, page five

| 20. | We note your disclosure on page five that under Canadian GAAP integration and restructuring costs of $24 million are capitalized as part of the purchase consideration instead of expensed as is required under ASC 805 of U.S. GAAP. In addition, we note your ‘Other income/(expense)’ adjustment of $48 million in the reconciliation of net income on page one. Please tell us and revise future filings to discuss in greater detail the components that make up this adjustment as it was greater than the $24 million difference described. |

TD, as part of its 6-K filing includes only net new material disclosures as part of its footnotes beginning on page 5. This is in line with SEC Regulation S-X Form and content of and requirements for financial statements, Article 10, 210.10-01 Interim financial statements (a) (5), which was reproduced in TD’s response to the Staff’s comment #19.

Consequently, TD as part of its 6-K filing for the period ended April 30, 2011, has only referenced footnote (a) to “Other income (expense)”, as it is the only new difference material to the $48 million adjustment, which is broken down further as follows:

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics of the $48 million adjustment.

”Other income (expense)” in the Fiscal 2010 Form 40-F was referenced to footnotes f and i, which discuss all of the material adjustments noted above.

TD will continue to reference “Other income (expense)” in its future filings of Form 40-F (i.e., for the year ending October 31, 2011), in order to provide sufficient detail on the amounts making up the adjustment. Please refer to TD’s response to the Staff’s comment #19 for a proposed mock up of page 1 of TD’s Fiscal 2011 Form 40-F filing.

(d) Fair Value Measurements for Financial Assets and Liabilities Measured on a Non-Recurring Basis, page six

| 21. | We note your fair value measurements disclosures on page six and your changes in gross impaired loans and acceptances disclosure presented in table 19 on page 24 of your Second Quarter of 2011 Report to Shareholders. Please tell us if you had any impaired loans and/or foreclosed assets that would meet the definition of assets that are measured at fair value on a nonrecurring basis under ASC 820 during the six-months ended April 30, 2011. If so, revise future filings, beginning with your next reconciliation of Canadian GAAP to U.S. GAAP, to include all the disclosures required by ASC 820-10-50-5 for these impaired assets. |

TD has foreclosed assets that meet the definition of assets that are measured at fair value on a non-recurring basis under ASC 820 during the six months ended April 30, 2011. TD currently does not have any impaired loans that would meet the definition of an asset that is measured at fair value on a non-recurring basis. TD does not employ practical expedients such as measuring loan impairment based on the fair value of the underlying collateral, but rather uses a discounted expected cash flows approach, as indicated in TD’s response to the Staff’s comment #8.

TD believes footnote (c) Fair value measurements for non-financial assets in Form 6-K for the six months ended April 30, 2011, appropriately discloses the required items in accordance with ASC 820-10-50-5. However, in future filings beginning with the Fiscal 2011 Form 40-F filing, we will add the following proposed disclosure in footnote 2 to the table:

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding proposed enhanced disclosures to be provided in future filings.

(h) Disclosures of Transfers of Financial Assets and Interests in Variable Interest Entities, page nine

| 22. | We note your disclosure on page 10 that due to the adoption of ASC 860 you consolidated certain bank-sponsored VIEs as a result of your continued involvement through residual interests, servicing, and your ability to collapse the VIEs based on ownership percentage. In addition, we note from your ‘Exposure Securitized by the Bank as an Originator’ table that you also have significant amounts of loan securitizations that are not consolidated. For each type of VIE, please explain to us in detail and revise future filings to describe the key differences in the nature/amount of the variable interests held, or the powers you have and how they are obtained, that resulted in the consolidation of only certain of your loan securitizations. |

TD adopted ASC 860 and ASC 810 (as revised by ASU’s 2009-16 and 2009-17 respectively) effective as of Fiscal 2011.

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding our accounting analysis under ASC 860 and ASC 810.

(m) Credit Quality of Receivables, page 13

| | 23. | We note your disclosure on page 13 that you adopted ASU 2010-20 effective November 1, 2010 and that you included updated disclosures for the standard in your notes four and seven of the Canadian GAAP Interim Financial Statements included as an exhibit to the Form 6-K filed on May 26, 2011. Please address the following related to your ASU 2010-20 disclosures either here or in your Canadian GAAP Financial Statement disclosures in future filings: |

The disclosures referenced below in our response to the Staff’s comments were previously provided in our Fiscal 2010 Form 40-F filings, and as a result we did not consider them to be new disclosures resulting from the adoption of ASU 2010-20. The details as to where TD currently discloses the required items and intends to continue to do so in future filings (i.e., Fiscal 2011 Form 40-F filing) are as follows:

| | • | Provide us and revise to disclose a breakdown of the loan portfolio by segment and class. |

TD currently provides a breakdown of the loan portfolio by class in Note 3 - Loans, Impaired Loans and Allowance for Credit Losses in the Consolidated Annual Financial Statements (e.g., page 145 of the Fiscal 2010 Form 40-F filing). The classes of loans disclosed are as follows: ‘Residential mortgages’, ‘Consumer instalment and other personal’, ‘Credit card’, ‘Business and government’, and ‘Debt securities classified as loans’.

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics of the segmentation of our loan classes.

Additionally, TD currently provides a breakdown of the loan portfolio by reporting geographic location and class in its Supplemental Financial Information package (e.g., pages 8, 10, and 22 of the Supplemental Financial Information package for the quarter ended April 30, 2011).

| | • | Revise to disclose a discussion of the risk characteristics of each portfolio segment. |

TD currently discloses its discussion of the risk characteristics of each portfolio segment in the Credit Risk section of the Risk Factors and Management section of the MD&A (pages 60-64 of the Fiscal 2010 Form 40-F filing). These disclosures are shaded and audited as they are required by Canadian GAAP, which permits their inclusion in the MD&A. As a result, they are an integral part of the audited Fiscal 2010 Consolidated Annual Financial Statements.

| | • | Tell us if your allowance for credit losses tabular disclosure was presented by portfolio segment or class of financing receivables. |

TD currently presents its Allowance for Credit Losses tabular disclosure by class of financing receivable (e.g., in Note 4 - Allowance for Credit Losses and Loans Past Due but not Impaired on page 10 of the Q2 2011 Financial Statements and Notes; in Note 3 - Loans, Impaired Loans and Allowance for Credit Losses on page 145 of the Fiscal 2010 Form 40-F filing).

| | • | Revise your allowance for credit losses tabular disclosure to segregate the allowance and the recorded investment in financing receivables at the end of each period related to each balance in the allowance for credit losses by the following impairment methodology: |

| | • | Amounts collectively evaluated for impairment (determined under Subtopic 450-20); |

TD currently presents this breakdown in the Loans, Impaired Loans and Allowance for Credit Losses tabular disclosure by class of financing receivable, under the heading General Allowance (e.g., in Note 3 - Loans, Impaired Loans and Allowance for Credit Losses on page 145 of the Fiscal 2010 Form 40-F filing).

| | • | Amounts individually evaluated for impairment (determined under Section 310-10-35); and |

TD currently presents this breakdown in the Loans, Impaired Loans and Allowance for Credit Losses tabular disclosure by class of financing receivable, under the heading Specific Allowance (e.g., in Note 3 - Loans, Impaired Loans and Allowance for Credit Losses on page 145 of the Fiscal 2010 Form 40-F filing).

| | • | Amounts related to loans acquired with deteriorated credit quality (determined under Subtopic 310-30). |

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding proposed enhanced disclosures to be provided in future filings.

| | • | Tell us and revise to disclose the recorded investment in financing receivables on nonaccrual status and past due 90 days or more and still accruing. If either of these classifications were nil please disclose that fact. |

TD currently presents this breakdown in the Allowance for Credit Losses tabular disclosure by class of financing receivable, under the heading General Allowance (e.g., in Note 4 - Allowance for Credit Losses and Loans Past Due but not Impaired on page 51 of the Q2 2011 Financial Statements and Notes; in Note 3 - Loans, Impaired Loans and Allowance for Credit Losses on page 145 of the Fiscal 2010 Form 40-F filing).

| | • | Tell us and revise to disclose within your impaired loans policy the factors you consider in determining that a loan is impaired. |

TD currently presents this disclosure (e.g., in Note 3 - Loans, Impaired Loans and Allowance for Credit Losses, under the heading Impaired Loans on page 144 of the Fiscal 2010 Form 40-F filing).

| | • | By class of financing receivable disclose the following for your impaired loans: |

| | • | The amount of the recorded investment for which there is a related allowance for credit losses determined in accordance with Section 310-10-35 and the amount of that allowance; |

TD currently presents this breakdown in the Allowance for Credit Losses tabular disclosure by class of financing receivable, under the heading General Allowance (e.g., in Note 4 - Allowance for Credit Losses and Loans Past Due but not Impaired on page 51 of the Q2 2011 Financial Statements and Notes; in Note 3 - Loans, Impaired Loans and Allowance for Credit Losses on page 145 of the Fiscal 2010 Form 40-F filing).

| | • | The amount of that recorded investment for which there is no related allowance for credit losses determined in accordance with Section 310-10-35; |

TD currently does not have a significant amount of recorded investment in impaired loans for which there is no related allowance for credit losses As such, no disclosures were made pertaining to this requirement as part of the Form 6-K filed on July 5, 2011. As per normal practice an assessment will be made for future filings to determine whether this amount is material enough to add such disclosure.

TD is providing the Staff on a confidential and supplemental basis, under the cover of a separate letter dated the date hereof, additional detail regarding specifics of our recorded investments for which there is no related allowance.

| | • | The total unpaid principal balance of the impaired loans; |

TD currently presents this in the Loans, Impaired Loans and Allowance for Credit Losses tabular disclosure in the Gross Loans - Impaired column (e.g., in Note 3 - Loans, Impaired Loans and Allowance for Credit Losses on page 145 of the Fiscal 2010 Form 40-F filing).

| | • | The average recorded investment during the period in impaired loans; and |

TD currently presents this in the Loans, Impaired Loans and Allowance for Credit Losses tabular disclosure in the Gross Loans - Impaired column (e.g., in Note 3 - Loans, Impaired Loans and Allowance for Credit Losses on page 145 of the Fiscal 2010 Form 40-F filing).

| | • | The related amount of interest income recognized; |

TD currently presents this in the Impact on Net Interest Income due to Impaired Loans tabular disclosure (e.g., in Note 3 - Loans, Impaired Loans and Allowance for Credit Losses on page 144 of the Fiscal 2010 Form 40-F filing).

| | • | Revise to disclose a description of your accounting policy and methodology for off-balance sheet credit exposures and related charges for those credit exposures. |