QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

AXS-One Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

AXS-ONE INC.

301 Route 17 North

Rutherford, New Jersey 07070

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

JUNE 9, 2004

TO OUR STOCKHOLDERS:

The annual meeting of stockholders (the "Annual Meeting") of AXS-One Inc. (the "Company") will be held at the Renaissance Meadowlands Hotel, 801 Rutherford Avenue, Rutherford, NJ 07070, telephone number (201) 231-3100 on June 9, 2004, at 10:00 a.m. for the following purposes:

- (1)

- To elect eight directors to serve until the next Annual Meeting or until their respective successors shall have been duly elected and qualified;

- (2)

- To approve an amendment and restatement to the 1998 Stock Option Plan to: (i) increase the number of shares subject to awards granted under the 1998 Stock Option Plan by 2,000,000 shares, for a total of 5,000,000 shares; (ii) increase the annual individual participant award limits; (iii) permit the discretionary grant of awards of restricted stock and (iv) permit prospective employees and consultants to participate in the 1998 Stock Option Plan, subject to such individual actually becoming an employee or consultant.

- (3)

- To ratify the appointment of KPMG LLP as the Company's independent public accountants for 2004; and

- (4)

- To transact such other business as may properly come before the Annual Meeting.

Only stockholders of record at the close of business on April 30, 2004 are entitled to notice of and to vote at the Annual Meeting. A list of stockholders eligible to vote at the meeting will be available for inspection at the meeting and for a period of ten days prior to the meeting during regular business hours at the corporate headquarters at the address above.

Whether or not you expect to attend the Annual Meeting, your proxy vote is important. To assure your representation at the Annual Meeting, please sign and date the enclosed proxy card and return it promptly in the enclosed envelope, which requires no additional postage if mailed in the United States. A copy of the Company's Annual Report for the year 2003 is enclosed.

| | By Order of the Board of Directors, |

|

/s/ WILLIAM P. LYONS

William P. Lyons

President & Chief Executive Officer |

|

|

| | | | |

Rutherford, New Jersey

May 1, 2004

IT IS IMPORTANT THAT THE ENCLOSED PROXY CARD

BE COMPLETED AND RETURNED PROMPTLY

AXS-ONE INC.

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

JUNE 9, 2004

This Proxy Statement is furnished to stockholders of record of AXS-One Inc. (the "Company") as of the close of business on April 30, 2004 in connection with the solicitation of proxies by the Board of Directors of the Company (the "Board of Directors" or "Board") for use at the Annual Meeting of Stockholders to be held on June 9, 2004 (the "Annual Meeting").

Shares cannot be voted at the meeting unless the owner is present in person or by proxy. All properly executed and unrevoked proxies in the accompanying form that are received in time for the meeting will be voted at the meeting or any adjournment thereof in accordance with instructions thereon, or if no instructions are given, will be voted "FOR" the election of the named nominees as Directors of the Company, "FOR" the approval of the amendments to the 1998 Stock Option Plan, "FOR" the ratification of the Company's independent public accountants, and will be voted in accordance with the best judgment of the persons appointed as proxies with respect to other matters which properly come before the Annual Meeting. Any person giving a proxy may revoke it by written notice to the Company at any time prior to exercise of the proxy. In addition, although mere attendance at the Annual Meeting will not revoke the proxy, a stockholder who attends the meeting may withdraw his or her proxy and vote in person. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting. Abstentions will be counted as a vote "WITHHELD" with respect to election of directors and as a vote "AGAINST" with respect to the amendments to the 1998 Stock Option Plan and "AGAINST" the ratification of the Company's independent public accountants and will not be counted in tabulations of the votes cast on any other proposal that may be properly presented at the Annual Meeting, whereas broker non-votes will not be counted and therefore will not affect the vote with respect to any such proposal.

The Annual Report of the Company (which does not form a part of the proxy solicitation materials), including the Annual Report on Form 10-K with the financial statements of the Company for the fiscal year ended December 31, 2003, is being distributed concurrently herewith to stockholders. The expense of this proxy solicitation will be borne by the Company. In addition to solicitation by mail, proxies may be solicited in person or by telephone, telegraph or other means by directors or employees of the Company or its subsidiaries without additional compensation. The Company will reimburse brokerage firms and other nominees, custodians and fiduciaries for costs incurred by them in mailing proxy materials to the beneficial owners of shares held of record by such persons.

The mailing address of the principal executive offices of the Company is 301 Route 17 North, Rutherford, New Jersey 07070. This Proxy Statement and the accompanying form of proxy are being mailed to the stockholders of the Company on or about May 7, 2004.

2

VOTING SECURITIES

The Company has only one class of voting securities, its common stock, par value $0.01 per share (the "Common Stock"). At the Annual Meeting, each stockholder of record at the close of business on April 30, 2004 will be entitled to one vote for each share of Common Stock owned on that date as to each matter presented at the Annual Meeting. On April 6, 2004 there were 27,981,627 shares of Common Stock outstanding. A list of stockholders eligible to vote at the Annual Meeting will be available for inspection at the Annual Meeting and for a period of ten days prior to the Annual Meeting during regular business hours at the principal executive offices of the Company at the address specified above.

PROPOSAL 1

ELECTION OF DIRECTORS

Unless otherwise directed, the persons appointed in the accompanying form of proxy intend to vote at the Annual Meeting for the election of the eight nominees named below as Directors of the Company to serve until the next Annual Meeting or until their successors are duly elected and qualified. If any nominee is unable to be a candidate when the election takes place, the shares represented by valid proxies will be voted in favor of the remaining nominees. The Board of Directors does not currently anticipate that any nominee will be unable to be a candidate for election.

The Board of Directors currently has eight members, seven of whom were elected to the Board of Directors by the stockholders at the 2003 annual stockholders meeting and William P. Lyons who replaced John A. Rade on the board effective April 29, 2004, all of whom are nominees for election. Each director shall serve until the next Annual Meeting or until their respective successors shall have been duly elected and qualified. The affirmative vote of a plurality of the shares of the Company's outstanding Common Stock represented and voting at the Annual Meeting is required to elect the Directors.

Nominees for Election as Directors

The following information as of April 30, 2004 with respect to the principal occupation or employment, other affiliations and business experience of each nominee during the last five years has been furnished to the Company by such nominee. Except as indicated, each of the nominees has had the same principal occupation for the last five years.

Elias Typaldos, 53, a founder of the Company, has been Senior Vice President, Research and Development and a director since the Company's formation in 1978, and Chairman of the Board since March 1997. In April 2002, Mr. Typaldos was named Executive Vice President, Technology and Business Operations.

William P. Lyons, 59, joined the Company as President and Chief Executive Officer in April 2004. Prior to joining the Company, Mr. Lyons was President and Chief Executive Officer of Caminus Corporation, a publicly traded provider of integrated enterprise software applications to the global energy industry from July 2002 until April 2003 when it was sold to SunGard Data Systems, Inc.. From April 2003 until April 2004, Mr. Lyons served as a consultant for various pre-public software companies on strategic issues. From January 2001 until July 2002 when it sold to Rational Software, Mr. Lyons was President & Chief Executive Officer of NeuVis, a technology provider of N-tier application development software. From 1998 to 2001, Mr. Lyons was President and Chief Executive Officer of Finjan Software, a privately held vendor of security software solutions. Prior to this, Lyons was Chief Executive Officer of ParcPlace Systems and Ashton-Tate Corporation and held numerous executive management positions with the IBM Corporation. Lyons is also a director of FileNet Corporation, a software provider for Enterprise Content Management (ECM).

3

Gennaro Vendome, 57, a founder of the Company, has been a Vice President and director since the Company's formation in 1978. In April 2002, Mr. Vendome was named Executive Vice President of Sales, Marketing and Consulting for North America. Mr. Vendome was Treasurer of the Company from 1981 until 1991 and Secretary of the Company from 1982 until 1991.

Robert Migliorino, 54, has been a director since 1991. As of January 1, 2002, Mr. Migliorino is a Managing Director and founding partner of W Capital Management LLC, a private equity investment firm. Prior to W Capital he was a founding partner of the venture capital partnership Canaan Partners, which through its affiliates was until early 2000 a principal stockholder of the Company. Prior to establishing Canaan Partners in 1987, he spent 15 years with General Electric Co. in their Drive Systems, Industrial Control, Power Delivery, Information Services and Venture Capital businesses.

William E. Vogel, 66, has been a director since August 1996. Mr. Vogel is currently retired. From 1971 to October 2002, Mr. Vogel was Chief Executive Officer of Centennial Financial Group, Inc., which is in the health insurance business. He was also the Chief Executive Officer of W.S. Vogel Agency, Inc., a life insurance brokerage general agency, from 1961. From November 2000 to October 2002, Mr. Vogel was an employee and Executive Sales Manager for Benefitmall.com, which is in the employee benefits business.

Edwin T. Brondo, 56, has been a director since May 1997. Mr. Brondo is currently retired. From August 1998 to March 2000 he was Executive Vice President and Chief Financial Officer of e-Vantage Solutions, Inc., (formerly called Elligent Consulting Group, Inc.), a technology consulting company. e-Vantage Solutions may be deemed to be an affiliate of the Company by virtue of the relationship of e-Vantage Solutions with a major stockholder of the Company. Mr. Brondo was Chief Administrative Officer and Senior Vice President of First Albany Companies, Inc., an investment banking firm, from June 1993 until December 1997.

Daniel H. Burch, 52, has been a director since October 1999. Mr. Burch is the Chairman of the Board, Chief Executive Officer and founder of MacKenzie Partners, Inc., a proxy solicitation and mergers and acquisitions firm. From January 1990 to the founding of MacKenzie Partners in February 1992, Mr. Burch was Executive Vice President at Dewe Rogerson & Company, an investor and public relations firm.

Allan Weingarten, 66, has been a director since October 2000. On December 31, 2003, Mr. Weingarten retired from Jacuzzi Brands, Inc. (formerly U.S. Industries, Inc.), a manufacturer of home and building products, where, since January 2001, he was the Senior Vice President and Chief Financial Officer. He continues his work as a private investor and independent business consultant that he began in 1995. He is also a director of Programmers Paradise, Inc.

Committees of the Board of Directors

The Audit Committee of the Board of Directors reviews, acts on and reports to the Board of Directors with respect to various auditing and accounting matters, including the selection of the Company's auditors, the scope of the annual audits, fees to be paid to the auditors, the performance of the Company's auditors and the accounting practices of the Company. The Audit Committee met eight times during 2003.

In January 2004, the Company's Board of Directors revised its written charter for the Audit Committee to comply with new rules promulgated by the American Stock Exchange, on which the Company's Common Stock is listed. A copy of the revised charter is attached as an appendix to this Proxy Statement. Messrs. Burch, Vogel and Weingarten, the current members of the Audit Committee, are each independent for purposes of Section 121(A) of the listing standards of the American Stock Exchange. In addition, the Company's Board of Directors has determined that the Audit Committee has at least one "audit committee financial expert," Mr. Weingarten, as defined by the Securities and Exchange Commission, serving on the Committee.

4

The Compensation Committee of the Board of Directors determines the salaries and incentive compensation of the CEO and other officers of the Company and administers the Company's stock option plans. The Compensation Committee held no formal meetings during 2003, but did meet informally on a frequent basis and, as permitted by Delaware law, did act by unanimous written consent on several occasions. Messrs. Migliorino and Brondo are the members of the Compensation Committee and are each independent for purposes of Section 121(A) of the listing standards of the American Stock Exchange.

In January 2004, the Board of Directors established a Nominating Committee for purposes of nominating directors and for all other purposes outlined in the Nominating Committee Charter, which is attached as an appendix to this Proxy Statement (said charter is not currently posted on the Company's website). The Nominating Committee has established policies concerning the identification of candidates, including candidates recommended by stockholders; the evaluation of candidates; and the recommendation to the Board of candidates for the Board's selection as director nominees. Messers. Brondo, Vogel and Weingarten are the members of the Nominating Committee and are each independent for purposes of Section 121(A) of the listing standards of the American Stock Exchange.

The Nominating Committee's process for identifying and evaluating nominees for director is to first consider whether the then current size of the Board, and the qualifications of the incumbent directors, best serve the interests of the Company. If the foregoing evaluation were to result in expected vacancies on the Board, the Committee would then, using the extensive business contacts of the members of the Committee and of the other Board members, seek out nominees with excellent decision-making ability, business experience, personal integrity and reputation. Stockholders may also provide candidates for directors. There are no specific minimum qualifications, nor specific qualities or skills, that the Nominating Committee believes that nominees must possess. This process does not differ depending on whether the candidate has been proposed by a Committee member or by a stockholder. In order to be considered by the Nominating Committee, a candidate for director proposed by a stockholder, including his or her qualifications, should be submitted in writing to the chair of the Committee (currently Mr. Vogel), at least 180 days prior to the date of the previous year's proxy statement relating to the annual meeting of stockholders.

Attendance at Board and Committee Meetings

During fiscal year 2003, the Board of Directors held seven meetings. During fiscal year 2003, each incumbent Director attended at least 75% of the number of meetings held of the Board of Directors and Committees on which he served. In addition to formal meetings, the Board of Directors and the Audit and Compensation Committees meet frequently on an informal basis.

Compensation of Directors

Cash Compensation. Beginning in 2003, the five non-employee Directors receive a fee for attending Board of Directors or committee meetings (subject to an annual maximum of $10,000), and are reimbursed for travel expenses incurred in connection with performing their respective duties as Directors of the Company. Each non-employee Director earned a fee of $10,000 for 2003.

Stock Option Grant. Under the Company's 1998 Stock Option Plan, each non-employee Director first elected or appointed to the Board of Directors after June 1998 will automatically be granted an option for 20,000 shares of Common Stock on the date of his or her election or appointment to the Board of Directors. In addition, at each Annual Meeting of Stockholders commencing with the 1998 meeting, each non-employee director with at least twelve months of service on the Board of Directors who will continue to serve as a non-employee Director following the meeting will automatically be granted an option for 10,000 shares of Common Stock. Each option granted under the automatic grant program will have an exercise price equal to 100% of the fair market value of the Common Stock on

5

the automatic grant date, a maximum term of ten years, subject to earlier termination upon the optionee's cessation of Board of Director service, and will vest in successive equal annual installments on the first four anniversaries of the date of grant. However, each outstanding option will immediately vest upon (i) certain changes in the ownership or control of the Company or (ii) the death or disability of the optionee while serving on the Board of Directors. Pursuant to the automatic option grant program, Messrs. Migliorino, Burch, Vogel, Weingarten and Brondo will each receive a 10,000-share option grant on the date of the Annual Meeting, if such individuals are reelected.

Procedure For Stockholders to Contact Board of Directors

Attached as an Appendix to this Proxy Statement is the procedure adopted by the Board of Directors whereby stockholders can communicate directly with the Board or individual directors. All legitimate correspondence will be relayed to the Board or director, as appropriate.

Director Attendance at Annual Stockholder Meetings

The Company does not have a policy regarding director attendance at annual meetings of stockholders. Commencing with the 2004 Annual Meeting, the Company will record director attendance at Annual Meetings in order to be able to comply with recently adopted reporting requirements.

EXECUTIVE OFFICERS AND INFORMATION

REGARDING EXECUTIVE OFFICER COMPENSATION

Executive Officers

The executive officers of the Company as of April 6, 2004 were as follows:

Name

| | Age

| | Position

|

|---|

| John A. Rade | | 69 | | President, Chief Executive Officer, and Director |

| Elias Typaldos | | 53 | | Executive Vice President, Technology and Business Operations and Chairman of the Board |

| Gennaro Vendome | | 57 | | Executive Vice President of Sales, Marketing and Consulting for North America and Director |

| Paul Abel | | 50 | | Vice President, Secretary and General Counsel |

| William G. Levering III | | 44 | | Vice President, Chief Financial Officer and Treasurer |

| Alexander J. Karakozoff | | 48 | | Senior Vice President Sales and Marketing, North America |

| Nancy J. Turner | | 45 | | Vice President, Global Services |

| Thomas V. Manobianco | | 47 | | Vice President, Professional Services, North America |

In April 2004, Mr. Rade resigned his position as President, Chief Executive Officer and director of the Company and was replaced in these positions by William P. Lyons. Mr. Rade will remain an employee of the Company through December 2004.

Information Concerning Executive Officers Who Are Not Directors

John A. Rade, 69, joined the Company as a director, President and Chief Executive Officer in February 1997 and effective April 30, 2004 will transfer roles and responsibilities to William P. Lyons. Prior to joining the Company, Mr. Rade, was from April 1995, a Vice President of American Management Systems, Inc., and was also still active at S-Cubed International (now named Mergence Technology Corporation), a company in the client server system development and consulting market, which he founded in February 1990. Prior to this he held senior executive positions with Information Science, Inc., Cap Gemini and Computer Sciences Corporation.

6

Paul Abel joined the Company in April 1997 as Secretary and Corporate Counsel and was promoted to Vice President, Secretary and General Counsel in June 1998. From October 1996 to March 1997, Mr. Abel served as Project Manager for Charles River Computers, an IT systems integrator. From 1983 to September 1996, Mr. Abel was an attorney with Matsushita Electric Corporation of America, an electronic products manufacturer/distributor.

William G. Levering III joined the Company as Revenue Controller in June 1996, was promoted to Corporate Controller in February 1997, Vice President, Corporate Controller in July 1998, and became Vice President, Chief Financial Officer and Treasurer on March 2, 2001. Prior to joining the Company, Mr. Levering was a Senior Manager with the international accounting firm of KPMG LLP. Mr. Levering was employed by KPMG LLP from August 1982 to June 1996 and is a Certified Public Accountant.

Nancy J. Turner joined the Company in September 1997. In December 2000, Ms. Turner assumed leadership of the AXS-One Global Services Team, which provides the services and infrastructure to support the efforts of local operations around the world. Prior to that, Ms. Turner served as Vice President of Knowledge Systems, Director of Documentation and Training, Assistant to the President for International Operations, and Director of the Year 2000 office. Before joining the Company Ms. Turner's assignments included Unit Delivery manager for the New Jersey unit of Cap Gemini, a technology consulting company and in various client services roles at ADP, a payroll services company.

Thomas V. Manobianco rejoined the Company in February 2002 as the Vice President of Professional Services for North America. Prior to rejoining the Company he was Vice President of Global Services for StorageApps, a technology start-up enterprise in the data storage industry. Mr. Manobianco held positions as Vice President and Director of Professional Services for AXS-One from January 1995 to July 2000.

Alexander L. Karakozoff joined the Company in April 2003 as the Senior Vice President of Sales and Marketing. Prior to joining the company, he was Senior Vice President Sales and Marketing of iLumin Corporation, a secure software applications start up company. Previous to iLumin, Mr. Karakozoff held positions in two financial applications software companies: Vice President at PeopleSoft Inc. in 2000 and 2001 and Area Vice President at Oracle Corporation in 1999. In 1998 he was a Management Consultant to E. Jeffrey Bradford Group, a private capital company.

7

SUMMARY COMPENSATION TABLE

The following table sets forth the annual and long-term compensation received for the three fiscal years ended December 31, 2003, by the Company's Chief Executive Officer who served in such capacity in the fiscal year 2003, and the four most highly compensated executive officers of the Company, other than the CEO, whose total compensation during fiscal year 2003 exceeded $100,000 and who were serving as executive officers as of fiscal year ended December 31, 2003 or served during fiscal year 2003 (collectively, the "Named Executive Officers"):

| |

| | Annual Compensation

| | Long Term

Compensation Awards

| |

| |

|---|

Name and Principal Position

| | Fiscal

Year

| | Salary

| | Bonus

| | Other Annual

Compensation

| | Restricted

Stock Awards

| | Securities

Underlying

Options

| | All

Other

Compensation

| |

|---|

John A. Rade

Chief Executive Officer and President | | 2003

2002

2001 | | $

| 375,000

300,000

380,000 | | $

| —

—

50,000 | | $

| —

—

— | | —

—

— | | —

—

120,000 | | $

| 20,462

17,820

22,920 | (1)

(1)

(1) |

Elias Typaldos

Executive Vice President, Technology and Business Operations | | 2003

2002

2001 | | | 300,000

270,000

285,037 | | | 50,000

—

— | | | —

—

— | | —

—

— | | —

—

90,000 | | | 13,277

11,988

17,069 | (2)

(2)

(2) |

Gennaro Vendome

Executive Vice President Sales, Marketing, Consulting for North America | | 2003

2002

2001 | | | 225,000

189,000

171,000 | | | —

—

— | | | 62,630

1,704

31,489 | (3)

(3)

(3) | —

—

— | | —

—

54,000 | | | 6,103

6,013

8,500 | (4)

(4)

(4) |

William G. Levering III

Vice President, Chief Financial Officer | | 2003

2002

2001 | | | 180,000

157,500

175,000 | | | 84,167

69,857

28,750 | | | —

—

— | | —

—

— | | —

—

122,500 | | | 3,514

541

5,612 | (5)

(5)

(5) |

Paul Abel

Vice President, Secretary and General Counsel | | 2003

2002

2001 | | | 165,000

142,800

158,000 | | | 48,375

36,011

10,000 | | | —

—

— | | —

—

— | | —

—

55,400 | | | 9,428

9,764

6,778 | (6)

(6)

(6) |

- (1)

- Includes premiums on life and disability insurance and matching contributions to the Company's 401(k) plan of $5,100 and $2,642 for 2001 and 2003, respectively. In addition all three years include $9,000 of an auto allowance.

- (2)

- Includes for 2001 and 2003, respectively, matching contributions to the Company's 401(k) plan in the amount of $5,100 and $3,064, and premiums on life and disability insurance for all three years. In addition, the Company provided an automobile to the officer, which resulted in additional compensation of $6,114, $6,144 and $4,360 for 2001, 2002 and 2003, respectively.

- (3)

- Includes for, 2001 and 2003, respectively, commissions of $30,000 and $62,630, and amounts for auto allowance of $1,704 for 2001 and 2002 respectively.

- (4)

- Includes for 2001, 2002 and 2003, respectively, premiums on life and disability insurance, and matching contributions to the Company's 401(k) plan of $1,665 in 2001 and $2,953 in 2003.

- (5)

- Includes premiums on life and disability insurance and matching contributions to the Company's 401(K) plan in the amount $5,100 for 2001 and $2,897 in 2003.

- (6)

- Includes premiums on life and disability insurance and matching contributions to the Company's 401(K) plan in the amount $2,880 for 2001 and $1,815 in 2003. In addition all three years include $6,000 of an auto allowance.

8

1995 Stock Option Plan

The 1995 Stock Option Plan was adopted by the Board of Directors and approved by the Stockholders in June 1995. The Board of Directors and Stockholders approved certain amendments to the 1995 Stock Option Plan in 1997.

1998 Stock Option Plan

The 1998 Stock Option Plan was adopted by the Board of Directors, and approved by the Stockholders in June 1998. The Board of Directors and Stockholders approved certain amendments to the 1998 Stock Option Plan in 2001.

Option/SAR Grants in Last Fiscal Year

Option Grants In Fiscal 2003

There were no options granted to the Named Executive Officers during 2003.

9

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

The following table sets forth certain information with respect to the Named Executive Officers regarding stock option holdings as of December 31, 2003, and stock options exercised during fiscal 2003. No stock appreciation rights were exercised by any Named Executive Officer during fiscal year 2003 and no stock appreciation rights were outstanding as of December 31, 2003.

| |

| |

| | Number of Securities

Underlying Unexercised Options

at Fiscal Year-End

| | Value of Unexercised

in-the-Money Options

at Fiscal Year-End(1)

|

|---|

| | Shares

Acquired

Options

Exercised(#)

| |

|

|---|

Name

| | Value

Realized($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| John A. Rade | | — | | $ | — | | 808,000 | | — | | $ | 799,120 | | $ | — |

| Elias Typaldos | | — | | | — | | 90,000 | | — | | | 140,100 | | | — |

| Gennaro Vendome | | — | | | — | | 54,000 | | — | | | 84,060 | | | — |

| William G. Levering III | | — | | | — | | 141,250 | | 41,250 | | | 175,712 | | | 39,812 |

| Paul Abel | | — | | | — | | 82,900 | | 12,500 | | | 91,416 | | | 25 |

- (1)

- Based on the fair market value of the Company's Common Stock using the closing selling price on the American Stock Exchange of $1.89 per share of Common Stock at December 31, 2003, less the exercise price payable for such shares.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth certain information with respect to securities authorized for issuance under equity compensation plans that were either previously approved by security holders or not previously approved by security holders as of December 31, 2003.

Plan category

| | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

(a)

| | Weighted-average

exercise price of

outstanding options,

warrants and rights.

(b)

| | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a))

(c)

|

|---|

| Equity compensation plans approved by security holders | | 5,651,000 | | $ | 1.54 | | 893,350 |

Equity compensation plans not approved by security holders |

|

220,000 |

|

|

1.13 |

|

— |

| | |

| |

| |

|

| Total | | 5,871,000 | | | 1.52 | | 893,350 |

| | |

| |

| |

|

The equity compensation plans not approved by the security holders relate to warrants issued to non-employee advisors in exchange for consideration in the form of services received.

Employment and Severance Agreements

The Company typically has employment agreements with all its employees including the Named Executive Officers, which detail initial annual salary, stock options, benefits and severance agreements, if applicable. The Name Executive Officers' severance agreements range from six months to one year.

10

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

The Compensation Committee of the Board of Directors advises the Chief Executive Officer and the Board of Directors on matters of the Company's compensation philosophy and the compensation of executive officers. The Compensation Committee also is responsible for the administration of the Company's Option Plans under which option grants may be made to executive officers and other employees. The Compensation Committee has reviewed and is in accord with the compensation paid to executive officers in fiscal year 2003.

General Compensation Policy. The fundamental policy of the Compensation Committee is to provide the Company's executive officers with competitive compensation opportunities based upon their contribution to the development and financial success of the Company and their personal performance. It is the Compensation Committee's objective to have a portion of each executive officer's compensation contingent upon the Company's performance as well as upon such executive officer's own level of performance. Accordingly, the compensation package for each executive officer is typically comprised of two elements: (i) base salary which reflects individual performance and is designed primarily to be competitive with salary levels in the industry and (ii) long-term stock-based incentive awards which strengthen the mutuality of interests between the executive officers and the Company's stockholders.

Factors. The principal factors which the Compensation Committee considered with respect to each executive officer's compensation package for fiscal year 2003 are summarized below. The Compensation Committee may, however, in its discretion apply entirely different factors in advising the Chief Executive Officer and the Board of Directors with respect to executive compensation for future years.

Base Salary. The suggested base salary for each executive officer is determined on the basis of the following factors: experience, personal performance, the salary levels in effect for comparable positions within and without the industry and internal base salary comparability considerations. The weight given to each of these factors differs from individual to individual, as the Compensation Committee deems appropriate.

From time to time, the Compensation Committee may advocate cash bonuses when such bonuses are deemed to be in the best interest of the Company.

Long-Term Incentive Compensation. Long-term incentives are provided through grants of stock options. The grants are designed to align the interests of each executive officer with those of the stockholders and to provide each individual with a significant incentive to manage the Company from the perspective of an owner with an equity stake in the Company. Each option grant allows the individual to acquire shares of the Company's Common Stock at a fixed price per share (generally, the market price on the grant date) over a specified period of time (up to ten years). Each option generally becomes exercisable in installments over a four-year period, contingent upon the executive officer's continued employment with the Company. Accordingly, the option grant will provide a return to the executive officer only if the executive officer remains employed by the Company during the vesting period, and then only if the market price of the underlying shares appreciates.

The number of shares subject to each option grant is set at a level intended to create a meaningful opportunity for stock ownership based on the executive officer's current position with the Company, the base salary associated with that position, the size of comparable awards made to individuals in similar positions within the industry, the individual's potential for increased responsibility and promotion over the option term and the individual's personal performance in recent periods. The Compensation Committee also considers the number of unvested options held by the executive officer in order to maintain an appropriate level of equity incentive for that individual. However, the Compensation

11

Committee does not adhere to any specific guidelines as to the relative option holdings of the Company's executive officers.

CEO Compensation. In advising the Board of Directors with respect to the compensation payable to the Company's Chief Executive Officer, the Compensation Committee seeks to achieve two objectives: (i) establish a level of base salary competitive with that paid by companies within the industry which are of comparable size to the Company and by companies outside of the industry with which the Company competes for executive talent and (ii) to make a significant percentage of the total compensation package contingent upon the Company's performance and stock price appreciation.

The base salary established for Mr. Rade on the basis of the foregoing criteria was intended to provide a level of stability and certainty each year. Accordingly, this element of compensation was not affected to any significant degree by Company performance factors. Mr. Rade's base salary was $400,000 for 2001, which combined his 2000 base salary with his guaranteed bonus. Effective July 1, 2001, Mr. Rade, together with other senior officers of the Company, received a 10% reduction in base salary which continued into 2002. Effective July 1, 2002, Mr. Rade's Annual Salary was reduced to 280,000, less the 10% continued reduction to December 31, 2002. Mr. Rade's salary was $375,000 in 2003. Mr. Rade received a $50,000 performance bonus in 2001, which represented 25% of his total eligible performance bonus. Upon his employment by the Company, Mr. Rade was granted 25,000 shares of restricted stock and two stock options. The first stock option for 300,000 shares vested in three equal annual installments, and the other stock option for 300,000 shares shall vest either upon the earlier to occur of the completion of seven years of service with the Company or the achievement of certain performance-measured milestones. The Company has met one of the milestones and as such, 100,000 of these options vested. The remaining 200,000 shares were to vest in 2003 but were accelerated to 2002. The Company granted Mr. Rade 88,000 additional options due to anti-dilution provisions contained in the original stock option agreement related to certain stock issuances. Of these additional options, 50% vest in the manner of the first stock option and 50% vest in the manner of the other stock option. Mr. Rade received two stock option grants during 2001 totaling 120,000 shares, of which 40,000 shares vested on December 31, 2001, and the remaining 80,000 shares vested in equal quarterly installments during 2002. As of December 31, 2003 all of Mr. Rade's options are fully vested.

Compliance with Internal Revenue Code Section 162(m). As a result of Section 162(m) of the Internal Revenue Code of 1986, as amended, which was enacted into law in 1993, the Company will not be allowed a federal income tax deduction for compensation paid to certain executive officers, to the extent that compensation exceeds $1 million per officer in any one year. This limitation will apply to all compensation paid to the covered executive officers, which is not considered to be performance based. Compensation that does qualify as performance-based compensation will not have to be taken into account for purposes of this limitation. The Option Plans contain certain provisions which are intended to assure that any compensation deemed paid in connection with the exercise of stock options granted under that plan with an exercise price equal to the market price of the option shares on the grant date will qualify as performance-based compensation.

The Compensation Committee does not expect that the compensation to be paid to the Company's executive officers for the 2003 fiscal year will exceed the $1 million limit per officer. Because it is very unlikely that the cash compensation payable to any of the Company's executive officers in the foreseeable future will approach the $1 million limit, the Compensation Committee has decided at this time not to take any other action to limit or restructure the elements of cash compensation payable to the Company's executive officers. The Compensation Committee will reconsider this decision should the individual compensation of any executive officer ever approach the $1 million level.

| | | THE COMPENSATION COMMITTEE |

|

|

|

|

|

|

|

|

Robert Migliorino

Edwin T. Brondo |

| April 30, 2004 | | |

12

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee reviews AXS-One's financial reporting process. In fulfilling its responsibilities, the Audit Committee has reviewed and discussed the audited consolidated financial statements contained in the 2003 Annual Report on SEC Form 10-K with AXS-One's management and the independent auditors. Management is responsible for the consolidated financial statements and the reporting process, including the system of internal controls. The independent auditors are responsible for expressing an opinion on the conformity of those audited consolidated financial statements with accounting principles generally accepted in the United States of America.

The Audit Committee discussed with the independent auditors those matters required to be discussed by Statement on Auditing Standards No. 61, "Communications with Audit Committees", as amended. In addition, the Audit Committee has discussed with the independent auditors the auditors' independence from AXS-One and its management, including the matters in the written disclosures and letter received from the independent auditors, as required by Independence Standards Board No. 1, "Independence Discussions with Audit Committees".

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited consolidated financial statements be included in AXS-One's Annual Report on SEC Form 10-K for the year ended December 31, 2003, for filing with the Securities and Exchange Commission.

| | | THE AUDIT COMMITTEE |

|

|

|

|

|

|

|

|

William E. Vogel

Daniel H. Burch

Allan Weingarten |

| April 30, 2004 | | |

13

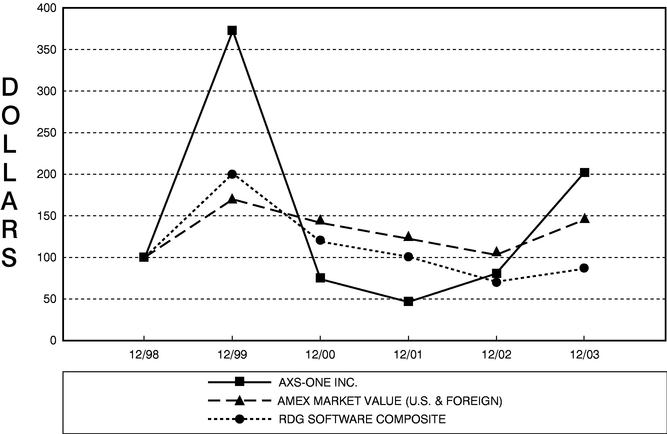

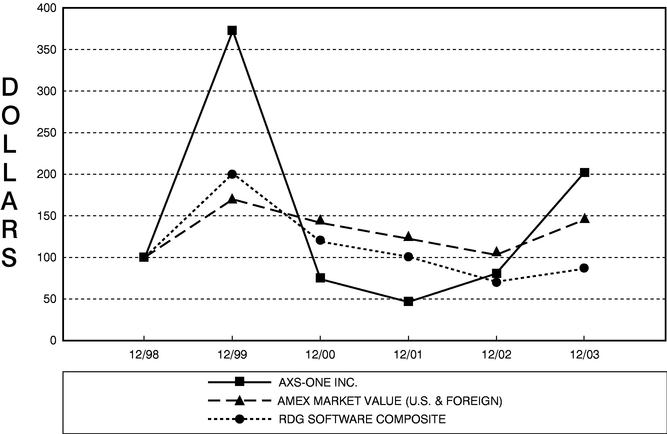

PERFORMANCE GRAPH

Set forth below is a table comparing the annual percentage change in the Company's cumulative total stockholder return on its Common Stock from December 31, 1998 to the last day of the Company's last completed fiscal year (as measured by dividing (i) the sum of (A) the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and (B) the excess of the Company's share price at the end over the price at the beginning of the measurement period, by (ii) the share price at the beginning of the measurement period) with the cumulative total return so calculated of the Amex Market Value Index and the RDG Software Composite Index during the same period.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG AXS-ONE INC., THE AMEX MARKET VALUE (U.S. & FOREIGN) INDEX

AND THE RDG SOFTWARE COMPOSITE INDEX

- *

- $100 invested on 12/31/98 in stock or index—including reinvestment of dividends. Fiscal year ending December 31.

Notwithstanding anything to the contrary set forth in any of the Company's previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, which might incorporate future filings made by the Company under those statutes, the preceding Compensation Committee Report on Executive Compensation, Audit Committee Report and the Company Stock Performance Graph will not be incorporated by reference into any of those prior filings, nor will either such report or graph be incorporated by reference into any future filings made by the Company under those statutes.

14

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of the Company's Common Stock as of April 6, 2004 by (i) each Director and nominee for Director, (ii) each of the Named Executive Officers, (iii) each person known by the Company to be the beneficial owner of more than 5% of the Company's Common Stock and (iv) all executive officers and Directors as a group. The information concerning beneficial owners of more than 5% of the Company's Common Stock is based on filings with the Securities and Exchange Commission on Schedules 13(D), 13(G) and on Forms 3, 4, and 5; and certain other information obtained by the Company.

Name of Beneficial Owner

| | Number of Shares

of Common Stock

Beneficially Owned(1)

| | Percentage of Shares

Outstanding(1)

| |

|---|

| Elias Typaldos | | 2,552,624 | (2) | 9.12 | % |

John A. Rade |

|

933,000 |

(3) |

3.33 |

% |

Gennaro Vendome |

|

1,385,060 |

(4) |

4.95 |

% |

Robert Migliorino |

|

124,480 |

(5) |

* |

|

William Vogel |

|

118,500 |

(6) |

* |

|

Edwin T. Brondo |

|

117,000 |

(7) |

* |

|

Daniel H. Burch |

|

52,500 |

(8) |

* |

|

Allan Weingarten |

|

40,000 |

(9) |

* |

|

William G. Levering, III |

|

146,250 |

(10) |

* |

|

Paul Abel |

|

83,900 |

(11) |

* |

|

Andreas Typaldos |

|

2,026,900 |

(12) |

7.24 |

% |

All Current Directors and Executive Officers As a Group (13 persons) |

|

5,769,689 |

(13) |

20.62 |

% |

- *

- Represents beneficial ownership of less than one percent of the Common Stock outstanding.

- (1)

- Applicable percentage of ownership as of April 6, 2004 is based upon 27,981,627 shares of Common Stock outstanding. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, and includes voting and investment power with respect to shares. Gives effect to the shares of Common Stock issuable within 60 days of April 6, 2004 upon exercise of all options and other rights beneficially owned by the indicated stockholders on that date.

- (2)

- Includes (i) 327,521 shares owned by the Elias Typaldos Grantor Retained Annuity Trust dated October 13, 1994, (ii) 1,147,750 shares held by the Elias Typaldos Family Limited Partnership, (iii) 129,938 shares owned by the Judith Typaldos Grantor Retained Annuity Trust dated October 13, 1994, (iv) 11,313 shares held by Judith Typaldos, Mr. Typaldos' wife, 87,000 shares held by Judith Typaldos as custodian for Typaldos' children and (v) 90,000 shares of Common Stock which may be purchased within 60 days of April 6, 2004 upon exercise of stock options. Mr. Typaldos' business address is the Company's principal executive offices.

- (3)

- Includes 808,000 shares of Common Stock, which may be purchased within 60 days of April 6, 2004 upon the exercise of stock options.

15

- (4)

- Includes (i) 89,407 shares held by Carol Vendome, (ii) 149,062 shares held by the Vendome Grantor Retained Annuity Trust dated January 24, 1995, (iii) 151,297 shares held by the Carol Vendome Grantor Retained Annuity Trust dated January 24, 1995, (iv) 5,905 shares held by Carol Vendome as custodian for Laura Vendome, (v) 109,095 shares held by the Vendome Family Limited Partnership and (vi) 54,000 shares of Common Stock which may be purchased within 60 days of April 6, 2004 upon exercise of stock options. Mr. Vendome's business address is the Company's principal executive offices.

- (5)

- Includes 83,000 shares of Common Stock, which may be purchased within 60 days of April 6, 2004 upon exercise of stock options.

- (6)

- Includes (i) 20,000 shares held by the William E. Vogel IRA and (ii) 86,000 shares of Common Stock which may be purchased within 60 days of April 6, 2004 upon exercise of stock options.

- (7)

- Includes 80,000 shares of Common Stock which may be purchased within 60 days of April 6, 2004 upon exercise of stock options.

- (8)

- This number represents the number of shares of Common Stock, which may be purchased by Mr. Burch within 60 days of April 6, 2004 upon the exercise of stock options.

- (9)

- This number represents the number of shares of Common Stock, which may be purchased by Mr. Weingarten within 60 days of April 6, 2004 upon the exercise of stock options.

- (10)

- Includes 141,250 of shares of Common Stock, which may be purchased by Mr. Levering within 60 days of April 6, 2004 upon the exercise of stock options.

- (11)

- Includes 82,900 shares of Common Stock, which may be purchased by Mr. Abel within 60 days of April 6, 2004 upon the exercise of stock options.

- (12)

- Includes (i) 680,504 shares owned by the Andreas Typaldos GRAT dated September 29, 1993; (ii) 11,047 shares owned by Renee Typaldos, Mr. Typaldos' wife, (iii) 755,504 shares owned by the Renee Typaldos GRAT dated September 29, 1993,and (iv) 229,845 shares held by the Andreas Typaldos Family Limited Partnership. Mr. Typaldos' business address is e-Vantage Solutions, Inc., 41 East 11th Street, New York, NY 10003.

- (13)

- Includes 1,632,025 shares of Common Stock, which may be purchased within 60 days of April 6, 2004 upon the exercise of stock options.

Section 16(a) Beneficial Ownership Reporting Compliance

Under the securities laws of the United States, the Company's Directors, Executive Officers, and any persons holding more than ten percent of the Company's Common Stock are required to report their ownership of the Company's Common Stock and any changes in that ownership to the Securities Exchange Commission, the American Stock Exchange and the Company. Specific due dates for these reports have been established and the Company is required to report in this Proxy Statement any failure to file by these dates during fiscal year 2003. Based solely on its review of such forms received by it from such persons for their fiscal year 2003 transactions, the Company believes that all filing requirements applicable to such officers, directors, and greater than ten percent beneficial owners were complied with, except that (i) Mr. Brondo filed a Form 4 relating to the grant to him by the Company, on July 29, 2003, of an option to purchase 10,000 shares of the Company's Common Stock six days late, (ii) Mr. Vogel was an indeterminate time late in filing his Form 4 relating to the grant to him by the Company of an option to purchase 10,000 shares of the Company's Common Stock on June 11, 2003, and (iii) Mr. Vogel was nine months late in filing his Form 4 relating to the grant to him by the Company, on July 29, 2003, of an option to purchase 10,000 shares of the Company's Common Stock.

16

CERTAIN TRANSACTIONS

During the year ended December 31, 2003, the Company recorded as expense approximately $36,000 related to work performed by Mergence Technology Corporation on behalf of the Company, which sum includes royalties paid to Mergence in connection with the Company's licensing to its customers of certain software owned by Mergence. Mergence is the successor-in-interest to S-Cubed International's rights and obligations under certain contracts with the Company. Mr. Rade, who joined the Company as Chief Executive Officer and President in February 1997, founded S-Cubed International in February 1990 and currently beneficially owns 53% of the outstanding stock of Mergence. The Company believes that the amounts paid to Mergence are comparable to the amounts the Company would have otherwise paid for comparable services from an unaffiliated party.

In August 2003, the Company entered into a business relationship with an entity that is owned by the Company's former chairman and principal stockholder. This entity is providing consulting services related to the development of the Company's instant messaging archiving product. For the year ended December 31, 2003, the Company recorded $75,000 as research and development expense from this related party.

17

PROPOSAL 2

APPROVAL OF AN AMENDMENT AND RESTATEMENT OF THE 1998 STOCK OPTION PLAN

The Company's stockholders are being asked to approve an amendment and restatement of the Company's 1998 Stock Option Plan (the "1998 Plan"), which would: (i) increase the number of shares of Common Stock available for awards issued under the 1998 Plan by 2,000,000 shares to a maximum of 5,000,000 shares; (ii) increase the annual individual participant award limit by 300,000 to a maximum of 500,000 with respect to any calendar year (other than the calendar year in which a participant initially commences employment with the Company or its affiliates); (iii) increase the annual individual participant award limit by 600,000 to a maximum of 1,000,000 during a calendar year in which a participant initially commences employment (in each case subject to adjustment as provided in the 1998 Plan); (iv) permit the discretionary grant of awards of restricted stock to eligible participants other than non-employee directors and (v) permit prospective employees and consultants to participate in the 1998 Plan, subject to such individual actually becoming an employee or consultant. The Board of Directors also approved certain other miscellaneous changes to the 1998 Plan that do not require stockholder approval.

The Board of Directors adopted the amendment and restatement of the 1998 Plan in April, 2004, subject to stockholder approval at the 2004 Annual Meeting. The Board believes that it is in the best interests of the Company to increase the share reserve and the individual participant limits so that the Company can continue to attract and retain the services of those persons essential to the Company's growth and financial success.

The following is a summary of the principal features of the 1998 Plan, as amended and restated. The summary, however, does not purport to be a complete description of all the provisions of the 1998 Plan and is qualified in its entirety by reference to the 1998 Plan document. Any stockholder of the Company who wishes to obtain a copy of the actual plan document may do so upon written request to the Corporate Secretary at the Company's principal executive offices in Rutherford, New Jersey.

Administration

The 1998 Plan is administered and interpreted by a committee of the Board of Directors (currently the Compensation Committee) consisting of two or more non-employee directors, each of whom is intended to be, to the extent required by Rule 16b-3 under the Securities Exchange Act of 1934 ("Rule 16b-3"), Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code") and Amex Rule 121A, a non-employee director as defined in Rule 16b-3, an outside director as defined under Section 162(m) of the Code and an "independent director" as defined under Amex Rule 121A (the "Committee"). If no Committee exists which has the authority to administer the 1998 Plan, the functions of the Committee will be exercised by the Board of Directors. Except with regard to non-employee directors, the Committee has the full authority and discretion, subject to the terms of the 1998 Plan, to grant awards under the 1998 Plan and to determine the persons to whom awards will be granted. With regard to grants to non-employee directors, the Board administers and interprets the 1998 Plan. The Committee has authority to delete its duties under the 1998 Plan, including, without limitation, the discretion to delegate authority to officers to grant awards under the 1998 Plan.

Eligibility

All employees and consultants of the Company and its affiliates are eligible to receive grants of stock options and stock appreciation rights under the 1998 Plan, and if approved by stockholders, restricted stock. If approved by stockholders, prospective employees and consultants will be eligible to participate in the 1998 Plan, subject to such individual actually becoming an employee or consultant. Non-employee directors of the Company automatically receive grants of stock options under the 1998 Plan and are eligible to receive discretionary grants of stock options under the 1998 Plan.

18

Available Shares

A maximum of 5,000,000 shares (increased from 3,000,000 under this proposed amendment and restatement) of Common Stock may be subject to options issued, or used for stock appreciation right reference purposes, under the 1998 Plan, of which 300,000 are available for awards of restricted stock.

The maximum number of shares of Common Stock subject to awards which may be granted to any employee during any calendar year will not exceed 500,000 shares (increased from 200,000 under this proposed amendment and restatement), except that, for the calendar year in which such individual commences his or her employment, the maximum grant will not exceed 1,000,000 shares (increased from 400,000 under this proposed amendment and restatement. If a tandem stock appreciation right or a limited stock appreciation right is granted in tandem with a stock option, it will apply against the individual limits for both stock options and stock appreciation rights, but only once against the maximum number of shares available under the 1998 Plan. To the extent that shares of Common Stock for which options or stock appreciation rights are permitted to be granted to an employee during a calendar year of the Company are not covered by a grant during such calendar year, such shares of Common Stock will be available for grant or issuance to the employee in any subsequent calendar year during the term of the 1998 Plan.

The Committee or the Board, as applicable, may make appropriate adjustments to the number of shares available for awards and the terms of outstanding awards to reflect any change in the Company's capital structure or business by reason of a stock dividend, extraordinary dividend, stock split, recapitalization, reorganization, merger, consolidation or sale of all or substantially all the assets of the Company (and certain other events).

Types of Awards

Stock Options. The 1998 Plan authorizes the Committee to grant stock options to purchase shares of the Company's Common Stock to employees and consultants of the Company and its affiliates. Options granted to employees of the Company or any "subsidiary" or "parent" (within the meaning of Section 424 of the Code) may be in the form of incentive stock options ("ISOs") or non-qualified stock options. Options granted to non-employee directors of the Company, consultants of the Company and its affiliates and employees of affiliates that do not qualify as "subsidiaries" or "parents" may only be non-qualified stock options. The Committee determines the number of shares subject to each option, the term of each option (which may not exceed ten years (or five years in the case of an ISO granted to a ten percent stockholder)), the exercise price, the vesting schedule (if any), and the other material terms of the option. No option may have an exercise price less than the fair market value of the Common Stock at the time of grant (or, in the case of an ISO granted to a ten- percent stockholder, 110 percent of fair market value).

Options granted to employees and consultants are exercisable at such time or times and subject to such terms and conditions as determined by the Committee at grant. All options granted to employees and consultants might be made exercisable in installments, and the Committee may accelerate the exercisability of such options. The exercise price of an option may be paid in cash, to the extent permitted by applicable law, by a cashless exercise procedure through a broker or by such other methods approved by the Committee (which may include payment in shares of Common Stock owned for at least six months).

Stock Appreciation Rights. The 1998 Plan authorizes the Committee to grant stock appreciation rights ("SARs") to employees and consultants, either with a stock option ("Tandem SARs") or independent of a stock option ("Non-Tandem SARs"). A SAR is a right to receive a payment either in cash or Common Stock, as the Committee may determine, equal in value to the excess of the fair market value of one share of Common Stock on the date of exercise over the reference price per share established in connection with the grant of the SAR. The reference price per share covered by a SAR

19

is the per share exercise price of the related option in the case of a Tandem SAR and is the fair market value of the Common Stock on the date of grant in the case of a Non-Tandem SAR.

A Tandem SAR may be granted at the time of the grant of the related stock option or, if the related stock option is a non-qualified stock option, at any time thereafter during the term of the related option. A Tandem SAR generally may be exercised only at such times and to the extent the related option is exercisable. A Tandem SAR is exercised by surrendering the same portion of the related option. A Tandem SAR expires upon the termination of the related option.

A Non-Tandem SAR is exercisable as provided by the Committee and has such other terms and conditions as the Committee may determine. A Non-Tandem SAR may have a term no longer than ten years from its date of grant. A Non-Tandem SAR is subject to acceleration of vesting or immediate termination upon termination of employment in certain circumstances.

The Committee is also authorized to grant "limited SARs" to employees and consultants, either as Tandem SARs or Non-Tandem SARs. Limited SARs become exercisable only upon the occurrence of a change in control of the Company or such other event as the Committee may, in its sole discretion, designate at the time of grant or thereafter.

Restricted Stock. The Committee will determine the employees and consultants to whom, and the time or times at which, grants of restricted stock will be made, the number of shares to be awarded, the purchase price (if any) to be paid, the time or times at which such awards may be subject to forfeiture (if any), the vesting schedule (if any) and rights to accelerated vesting and all other terms and conditions of the restricted stock. The Committee may condition the grant or vesting of restricted stock upon the attainment of specified performance targets or such other factors as the Committee may determine. Awards of restricted stock may or may not be intended to comply with the "performance-based" compensation exception under Section 162(m) of the Code.

Awards of restricted stock that are intended to comply with the "performance-based" compensation exception under Section 162(m) of the Code, will be granted or vest based upon the attainment of pre-established objective performance goals established by the Committee by reference to one or more of the following: (i) enterprise value or value creation targets, after-tax or pre-tax profits, operational cash flow, earnings per share or earnings per share from continuing operations, net sales, revenues, net income or earnings before income tax or other exclusions, return on capital, market share or after-tax or pre-tax return on stockholder equity of the Company; (ii) the Company's bank debt or other long-term or short-term public or private debt or other similar financial obligations of the Company, which may be calculated net of cash balances and/or other offsets and adjustments as may be established by the Committee; (iii) the fair market value of the shares of the Company's common stock; (iv) the growth in the value of an investment in the Company's common stock assuming the reinvestment of dividends; (v) controllable expenses or costs or other expenses or costs of the Company; or (vi) economic value added targets based on a cash flow return on investment formula. The performance goals may be based upon the attainment of specified levels of Company or subsidiary, division, other operational unit or administrative department of the Company.

Unless otherwise determined by the Committee at grant or thereafter, upon a participant's termination of employment or termination of consultancy (as applicable) for any reason during the relevant restriction period, all restricted stock still subject to restriction will be forfeited.

Non-Employee Director Stock Options. Under the 1998 Plan, each new non-employee director of the Company receives an automatic grant of options to purchase 20,000 shares of Common Stock on the date he or she begins service as a non-employee director. In addition, each non-employee director receives an automatic grant of options to purchase 10,000 shares of Common Stock on the date of each annual meeting of stockholders, provided such individual has been a non-employee director for the previous twelve months. The Board may also decide to make discretionary grants of options to

20

non-employee directors. The options have a ten-year term and an exercise price equal to the fair market value of the Common Stock at the time of grant. The automatic non-employee directors' stock options vest and become exercisable in four equal installments on each of the first four anniversaries of the date of grant; discretionary non-employee directors' stock options vest and become exercisable in accordance with the schedule set by the Board. Upon a change in control of the Company, all then unvested options will fully vest and become exercisable in their entirety. The exercise price may be paid in cash, to the extent permitted by applicable law, by a cashless exercise procedure through a broker or by such other methods approved by the Board of Directors (which may include payment in shares of Common Stock owned for at least six months).

Change in Control

Upon a change in control of the Company (as defined in the 1998 Plan), all unvested options and Tandem and Non-Tandem SARs and restricted stock of employees and consultants will fully vest and become exercisable (as applicable) in their entirety, provided that, no acceleration of vesting and exercisability will occur with regard to options that the Committee determines in good faith prior to a change in control of the Company will be honored or assumed or new rights substituted therefore by a participant's employer immediately following the change in control of the Company.

Amendment and Termination

The 1998 Plan may be amended or terminated in its entirety by the Board of Directors or the Committee, provided that the rights granted to an individual prior to such amendment or termination may not be impaired without the consent of such individual. In addition, no such amendment, without stockholder approval to the extent such approval is required by the laws of the State of Delaware, Rule 16b-3, the rules of the American Stock Exchange or under Section 162(m) or 422 of the Code, may increase the aggregate number of shares of Common Stock that may be issued under the 1998 Plan, increase the maximum individual award limits for any calendar year, change the classification of employees and consultants eligible to receive awards, decrease the minimum exercise price of any option or SAR or extend the maximum option term under the 1998 Plan.

Miscellaneous

Subject to limited post-service exercise periods and vesting in certain instances, awards to participants under the 1998 Plan are generally forfeited upon any termination of employment, consultancy or directorship. Awards have such terms and terminate upon such conditions as may be contained in the individual awards. Although awards are generally nontransferable (except by will or the laws of descent and distribution), the Committee may determine at the time of grant or thereafter that a non-qualified option granted to an employee or consultant that is otherwise nontransferable may be transferable in whole or in part and in such circumstances, and under such conditions, as specified by the Committee.

Because future awards granted under the 1998 Plan will be based upon prospective factors including the nature of services to be rendered by prospective key employees and officers of, advisors and independent consultants to, the Company or its affiliates, who are neither officers nor employees of the Company or its affiliates and their potential contributions to the success of the Company, actual award grants cannot be determined at this time, except that non-employee directors are eligible for automatic stock option grants as described above.

U.S. Federal Income Tax Consequences

The following discussion of the principal U.S. federal income tax consequences with respect to options under the 1998 Plan is based on statutory authority and judicial and administrative

21

interpretations as of the date of this Proxy Statement, which are subject to change at any time (possibly with retroactive effect) and may vary in individual circumstances. Therefore, the following is designed to provide a general understanding of the federal income tax consequences (state, local and other tax consequences are not addressed below). This discussion is limited to the U.S. federal income tax consequences to individuals who are citizens or residents of the U.S., other than those individuals who are taxed on a residence basis in a foreign country.

Under current federal income tax law, when an employee is granted a stock option that qualifies as an ISO, the granting of such option to the employee is not a taxable event. The employer that granted the option is not entitled to claim a trade or business expense deduction with respect to the ISO.

When the employee exercises the ISO, and holds the stock for a specified period (generally two years from the date that the ISO was granted and one year from the date that the option was exercised), the employer does not take any tax deduction with respect to the exercise of the option, nor does the employee recognize any income. The employer is however, allowed a deduction when the holding period is met and the underlying stock is sold and the employee recognizes income at the same time, generally at preferential capital gains rates.

Certain events can disqualify the stock option from being considered an ISO. These events include, but are not limited to, a failure of the optionee to satisfy the holding period discussed above, limitations on the amount of the fair market value of the underlying stock exercised in a single year by an individual and alternative minimum tax consequences. These disqualifying events can alter the timing of the tax deduction by the employer and the recognition of income by the individual (a "disqualifying disposition"). In general, in the event of a disqualifying disposition any gain equal to the difference between the exercise price and the lesser of (i) the fair market value of the Common Stock at exercise or (ii) the amount realized on disposition over the exercise price, will constitute ordinary income. Any remaining gain is treated as long-term or short-term capital gain and taxed at the applicable rate, depending on the optionee's holding period for the sold stock. The Company generally will be entitled to a deduction at that time equal to the amount of ordinary income realized by the optionee, subject to the requirements of Section 162(m) of the Code.

The treatment of nonqualified options, with no ascertainable fair market value, is similar to that of a disqualified ISO. The taxable event generally occurs when the option is exercised. The optionee recognizes compensation income at that point, and the Company receives a corresponding deduction.

In addition: (i) any officers and directors of the Company subject to Section 16(b) of the Exchange Act may be subject to special tax rules regarding the income tax consequences concerning their options; (ii) any entitlement to a tax deduction on the part of the Company is subject to the applicable federal tax rules, including, without limitation, Section 162(m) of the Code regarding the $1 million annual limitation on deductible compensation; (iii) in the event that the exercisability of an award is accelerated because of a change in control of the Company, payments relating to the awards, either alone or together with certain other payments may constitute parachute payments under Section 280G of the Code, which excess amounts may be subject to excise taxes and be nondeductible by the Company; and (iv) the exercise of an ISO may have implications in the computation of alternative minimum taxable income.

In general, Section 162(m) of the Code denies a publicly held corporation a deduction for federal income tax purposes for compensation in excess of $1 million per taxable year per person to its chief executive officer and the four other officers whose compensation is disclosed in its proxy statement, subject to certain exceptions. Options and SARs will generally qualify under one of these exceptions if they are granted under a plan that states the maximum number of shares which may be granted to any employee during a specified period, the exercise price is not less than the fair market value of the Common Stock at the time of grant, and the plan under which the options and SARs are granted is

22

approved by stockholders and is administered by a compensation committee comprised of outside directors. The 1998 Plan is intended to satisfy these requirements with respect to options and SARs granted to employees. Restricted stock granted under the 1998 Plan may or may not qualify under the performance-based compensation exception under Section 162(m) of the Code.

The 1998 Plan is not subject to any of the requirements of the Employee Retirement Income Security Act of 1974, as amended and is not, nor is it intended to be, qualified under Section 401(a) of the Code.

OPTION TRANSACTIONS UNDER 1998 PLAN

| | Number of

Option Shares

Granted(1)

| | Weighted

Average

Exercise Price

|

|---|

John A. Rade

President, Chief Executive Officer and Director | | 200,000 | | $ | 0.34 |

Elias Typaldos

Executive Vice President, Technology and Business Operations and Chairman of the Board of Directors | | 90,000 | | | 0.33 |

Gennaro Vendome

Executive Vice President of Sales, Marketing and Consulting for North America and Director | | 54,000 | | | 0.33 |

Paul Abel

Vice President, Secretary and General Counsel | | 75,400 | | | 0.77 |

William G. Levering III

Vice President, Chief Financial Officer and Treasurer | | 157,500 | | | 0.68 |

Alexander Karakozoff

Vice President Sales and Marketing for North America | | 100,000 | | | 0.75 |

Nancy J. Turner

Vice President, Global Services | | 61,000 | | | 0.33 |

Thomas V. Manobianco

Vice President, Professional Services for North America | | 50,000 | | | 1.14 |

Daniel H. Burch

Director | | 90,000 | | | 0.65 |

Robert Migliorino

Director | | 90,000 | | | 1.17 |

William E. Vogel

Director | | 90,000 | | | 1.17 |

Edwin T. Brondo

Director | | 90,000 | | | 1.17 |

Allan Weingarten

Director | | 80,000 | | | 1.08 |

| All non-employee directors as a group (5 persons) | | 440,000 | | | 1.05 |

| All current executive officers as a group (8 persons) | | 817,900 | | | 0.64 |

| All employees, including current officers who are not executive officers, as a group | | 3,617,050 | | | 1.67 |

- (1)

- Of the above options granted, 876,193 have been cancelled during the period ended April 6, 2004. Additional options may have been granted to the foregoing individuals under the Company's 1995 Stock Option Plan (which is not being amended at the Annual Meeting).

The affirmative vote of a majority of the shares of the Company's outstanding Common Stock present or represented, and entitled to vote, at the Annual Meeting is required to approve this amendment and restatement of the 1998 Plan.

The Board of Directors recommends that the stockholders vote FOR the approval of this amendment to the 1998 Plan.

23

PROPOSAL 3

PROPOSED RATIFICATION OF APPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTANTS