QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

AXS-ONE INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

AXS-ONE INC.

301 Route 17 North

Rutherford, New Jersey 07070

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

MAY 25, 2005

TO OUR STOCKHOLDERS:

The annual meeting of stockholders (the "Annual Meeting") of AXS-One Inc. (the "Company") will be held at the Renaissance Meadowlands Hotel, 801 Rutherford Avenue, Rutherford, NJ 07070, telephone number (201) 231-3100 on May 25, 2005, at 10:00 a.m. for the following purposes:

- (1)

- To elect eight directors to serve until the next Annual Meeting or until their respective successors shall have been duly elected and qualified;

- (2)

- To approve the 2005 Stock Incentive Plan

- (3)

- To ratify the appointment of KPMG LLP as the Company's independent registered public accounting firm for 2005; and

- (4)

- To transact such other business as may properly come before the Annual Meeting.

Only stockholders of record at the close of business on April 15, 2005 are entitled to notice of and to vote at the Annual Meeting. A list of stockholders eligible to vote at the meeting will be available for inspection at the meeting and for a period of ten days prior to the meeting during regular business hours at the corporate headquarters at the address above.

Whether or not you expect to attend the Annual Meeting, your proxy vote is important. To assure your representation at the Annual Meeting, please sign and date the enclosed proxy card and return it promptly in the enclosed envelope, which requires no additional postage if mailed in the United States. A copy of the Company's Annual Report for the year 2004 is enclosed.

| | By Order of the Board of Directors, |

|

WILLIAM P. LYONS

Chief Executive Officer and

Chairman of the Board |

|

|

| | | | |

Rutherford, New Jersey

April 15, 2005

IT IS IMPORTANT THAT THE ENCLOSED PROXY CARD

BE COMPLETED AND RETURNED PROMPTLY

AXS-ONE INC.

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

MAY 25, 2005

This Proxy Statement is furnished to stockholders of record of AXS-One Inc. (the "Company") as of the close of business on April 15, 2005 in connection with the solicitation of proxies by the Board of Directors of the Company (the "Board of Directors" or "Board") for use at the Annual Meeting of Stockholders to be held on May 25, 2005 (the "Annual Meeting").

Shares cannot be voted at the meeting unless the owner is present in person or by proxy. All properly executed and unrevoked proxies in the accompanying form that are received in time for the meeting will be voted at the meeting or any adjournment thereof in accordance with instructions thereon, or if no instructions are given, will be voted "FOR" the election of the named nominees as Directors of the Company, "FOR" the approval of the 2005 Stock Incentive Plan, "FOR" the ratification of the Company's independent public accountants, and will be voted in accordance with the best judgment of the persons appointed as proxies with respect to other matters which properly come before the Annual Meeting. Any person giving a proxy may revoke it by written notice to the Company at any time prior to exercise of the proxy. In addition, although mere attendance at the Annual Meeting will not revoke the proxy, a stockholder who attends the meeting may withdraw his or her proxy and vote in person. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting. Abstentions will be counted as a vote "WITHHELD" with respect to election of directors, as a vote "AGAINST" the approval of the 2005 Stock Incentive Plan and "AGAINST" the ratification of the Company's independent public accountants and will not be counted in tabulations of the votes cast on any other proposal that may be properly presented at the Annual Meeting, whereas broker non-votes will not be counted and therefore will not affect the vote with respect to any such proposal.

The Annual Report of the Company (which does not form a part of the proxy solicitation materials), including the Annual Report on Form 10-K with the financial statements of the Company for the fiscal year ended December 31, 2004, is being distributed concurrently herewith to stockholders. The expense of this proxy solicitation will be borne by the Company. In addition to solicitation by mail, proxies may be solicited in person or by telephone or other means by directors or employees of the Company or its subsidiaries without additional compensation. The Company will reimburse brokerage firms and other nominees, custodians and fiduciaries for costs incurred by them in mailing proxy materials to the beneficial owners of shares held of record by such persons.

The mailing address of the principal executive offices of the Company is 301 Route 17 North, Rutherford, New Jersey 07070. This Proxy Statement and the accompanying form of proxy are being mailed to the stockholders of the Company on or about April 22, 2005.

Unless the Company receives contrary instructions from one or more of the affected stockholders, only one copy of the Company's Annual Report and this Proxy Statement is being delivered to multiple stockholders sharing the same address. The Company hereby undertakes to promptly deliver a separate copy of this Proxy Statement and/or the Annual Report upon the written or oral request of any stockholder to whom the previous sentence applies. Said written or oral request should be made to the Company Secretary at the address set forth in the preceding paragraph or by telephone (201-935-3400). Stockholders sharing the same address and (a) currently receiving only one copy of the Annual Report and Proxy Statement but desiring multiple copies of such materials in the future, or (b) currently receiving multiple copies of the Annual Report and Proxy Statement but desiring only one copy of such materials in the future, should contact the Company Secretary as provided in the previous sentence.

1

VOTING SECURITIES

The Company has only one class of voting securities, its common stock, par value $0.01 per share (the "Common Stock"). At the Annual Meeting, each stockholder of record at the close of business on April 15, 2005 will be entitled to one vote for each share of Common Stock owned on that date as to each matter presented at the Annual Meeting. On April 15, 2005 there were 29,350,116 shares of Common Stock outstanding. A list of stockholders eligible to vote at the Annual Meeting will be available for inspection at the Annual Meeting and for a period of ten days prior to the Annual Meeting during regular business hours at the principal executive offices of the Company at the address specified above.

PROPOSAL 1

ELECTION OF DIRECTORS

Unless otherwise directed, the persons appointed in the accompanying form of proxy intend to vote at the Annual Meeting for the election of the eight nominees named below as Directors of the Company to serve until the next Annual Meeting or until their successors are duly elected and qualified. If any nominee is unable to be a candidate when the election takes place, the shares represented by valid proxies will be voted in favor of the remaining nominees. The Board of Directors does not currently anticipate that any nominee will be unable to be a candidate for election.

The Board of Directors currently has eight members, all of whom are nominees for election. Each director shall serve until the next Annual Meeting or until their respective successors shall have been duly elected and qualified. The affirmative vote of a plurality of the shares of the Company's outstanding Common Stock represented and voting at the Annual Meeting is required to elect the Directors.

Nominees for Election as Directors

The following information, as of April 15, 2005 with respect to the principal occupation or employment, other affiliations and business experience of each nominee during the last five years, has been furnished to the Company by such nominee. Except as indicated, each of the nominees has had the same principal occupation for the last five years.

William P. Lyons, 60, joined the Company as President and Chief Executive Officer in April 2004 and was appointed Chairman of the Board on June 10, 2004. Prior to joining the Company, Mr. Lyons was President and Chief Executive Officer of Caminus Corporation, a publicly traded provider of integrated enterprise software applications to the global energy industry from July 2002 until April 2003 when it was sold to SunGard Data Systems, Inc. From April 2003 until April 2004, Mr. Lyons served as a consultant for various pre-public software companies on strategic issues. From January 2001 until July 2002, when it was sold to Rational Software, Mr. Lyons was President & Chief Executive Officer of NeuVis, a technology provider of N-tier application development software. From 1998 to 2001, Mr. Lyons was President and Chief Executive Officer of Finjan Software, a privately held vendor of security software solutions. Mr. Lyons was a director of FileNet Corporation, a software provider for Enterprise Content Management (ECM) until he resigned in November 2004.

Elias Typaldos, 54, a founder of the Company, has been Senior Vice President, Research and Development (1978 – 2002) and Executive Vice President, Technology (2002 – present) of the Company. Mr. Typaldos has also been a director since the Company's formation in 1978, and served as Chairman of the Board from March 1997 until June 2004.

Gennaro Vendome, 58, a founder of the Company, has been a Vice President and director since the Company's formation in 1978, with the exception that Mr. Vendome served as Executive Vice President of Sales, Marketing and Consulting for North America from April 2002 until August 2004. He is

2

currently the Executive Vice President of Business Development. Mr. Vendome was Treasurer of the Company from 1981 until 1991 and Secretary of the Company from 1982 until 1991.

Robert Migliorino, 55, has been a director since 1991. Since January 1, 2002, Mr. Migliorino has been a Managing Director and founding partner of W Capital Management LLC, a private equity investment firm. Prior to W Capital, he was a founding partner of the venture capital partnership Canaan Partners, which, through its affiliates, was, until early 2000, a principal stockholder of the Company. Prior to establishing Canaan Partners in 1987, he spent 15 years with General Electric Co. in their Drive Systems, Industrial Control, Power Delivery, Information Services and Venture Capital businesses.

William E. Vogel, 67, has been a director since August 1996. Mr. Vogel is currently retired. From 1971 to October 2002, Mr. Vogel was Chief Executive Officer of Centennial Financial Group, Inc., which is in the health insurance business. He was also the Chief Executive Officer of W.S. Vogel Agency, Inc., a life insurance brokerage general agency, from 1961 until October 2002. From November 2000 to October 2002, Mr. Vogel was an employee and Executive Sales Manager for Benefitmall.com which is in the employee benefits business.

Edwin T. Brondo, 57, has been a director since May 1997. Mr. Brondo is currently retired. From August 1998 to August 2000 he was Executive Vice President and Chief Financial Officer of e-Vantage Solutions, Inc. (formerly called Elligent Consulting Group, Inc.), a technology consulting company. e-Vantage Solutions may be deemed to be an affiliate of the Company by virtue of the relationship of e-Vantage Solutions with a major stockholder of the Company. Mr. Brondo was Chief Administrative Officer and Senior Vice President of First Albany Companies, Inc., an investment banking firm, from June 1993 until December 1997.

Daniel H. Burch, 53, has been a director since October 1999. Mr. Burch is the Chairman of the Board, Chief Executive Officer and founder of MacKenzie Partners, Inc., a proxy solicitation and mergers and acquisitions firm. From January 1990 to the founding of MacKenzie Partners in February 1992, Mr. Burch was Executive Vice President at Dewe Rogerson & Company, an investor and public relations firm.

Allan Weingarten, 67, has been a director since October 2000. On December 31, 2003, Mr. Weingarten retired from Jacuzzi Brands, Inc. (formerly U.S. Industries, Inc.), a manufacturer of home and building products, where, since January 2001, he was the Senior Vice President and Chief Financial Officer. He continues his work as a private investor and independent business consultant that he began in 1995. He is also a director of Programmers Paradise, Inc.

Committees of the Board of Directors

The Audit Committee of the Board of Directors reviews, acts on and reports to the Board of Directors with respect to various auditing and accounting matters, including the selection of the Company's auditors, the scope of the annual audits, fees to be paid to the auditors, the performance of the Company's independent registered public accounting firm and the accounting practices of the Company. The Audit Committee met eight times during 2004.

The Audit Committee operates pursuant to a written charter, reviewed and re-adopted annually by the Company's Board of Directors. The current version of this charter (said charter is not currently posted on the Company's website) is attached as an appendix to the Company's June 9, 2004 Proxy Statement. Messrs. Burch, Vogel and Weingarten, the current members of the Audit Committee, are each independent for purposes of Section 121(A) of the listing standards of the American Stock Exchange. In addition, the Company's Board of Directors has determined that the Audit Committee has at least one "audit committee financial expert," Mr. Weingarten, as defined by the Securities and Exchange Commission, serving on the Committee.

3

The Compensation Committee operates pursuant to a written charter, reviewed and re-adopted annually by the Company's Board of Directors (said charter is not currently posted on the Company's website). The Compensation Committee of the Board of Directors determines the salaries and incentive compensation of the CEO and other officers of the Company and administers the Company's equity plans. The Compensation Committee held three formal meetings during 2004, met informally on a frequent basis and, as permitted by Delaware law, did act by unanimous written consent on several occasions. Messrs. Migliorino and Brondo are the members of the Compensation Committee and are each independent for purposes of Section 121(A) of the listing standards of the American Stock Exchange.

The Nominating Committee of the Board of Directors recruits and nominates directors. The Nominating Committee operates pursuant to a written charter, reviewed and re-adopted annually by the Company's Board of Directors. The current version of this charter is attached as an appendix to the Company's June 9, 2004 Proxy Statement (said charter is not currently posted on the Company's website). The Nominating Committee has established policies concerning the identification of candidates, including candidates recommended by stockholders; the evaluation of candidates; and the recommendation to the Board of candidates for the Board's selection as director nominees. Messers. Brondo, Vogel and Weingarten are the members of the Nominating Committee and are each independent for purposes of Section 121(A) of the listing standards of the American Stock Exchange. The Nominating Committee met two times during 2004.

The Nominating Committee's process for identifying and evaluating nominees for director is to first consider whether the then current size of the Board, and the qualifications of the incumbent directors, best serve the interests of the Company. If the foregoing evaluation were to result in expected vacancies on the Board, the Committee would then, using the extensive business contacts of the members of the Committee and of the other Board members, seek out nominees with excellent decision-making ability, business experience, personal integrity and reputation. Stockholders may also provide candidates for directors. There are no specific minimum qualifications, nor specific qualities or skills, that the Nominating Committee believes that the nominees must possess. This process does not differ depending on whether the candidate has been proposed by a Committee member or by a stockholder. In order to be considered by the Nominating Committee, a candidate for director proposed by a stockholder, including his or her qualifications, should be submitted in writing to the chair of the Committee (currently Mr. Vogel), at least 180 days prior to the date of the previous year's proxy statement relating to the annual meeting of stockholders.

Attendance at Board and Committee Meetings

During fiscal year 2004, the Board of Directors held ten meetings. During fiscal year 2004, each incumbent Director attended at least 75% of the number of meetings held of the Board of Directors and Committees on which he served. In addition to formal meetings, the Board of Directors and the Audit, Nominating and Compensation Committees meet frequently on an informal basis.

Compensation of Directors

Cash Compensation. Beginning in 2003, the five non-employee Directors receive a fee for attending Board of Directors or committee meetings (subject to an annual maximum of $10,000), and are reimbursed for travel expenses incurred in connection with performing their respective duties as Directors of the Company. Each non-employee Director earned a fee of $10,000 for 2004. Beginning in 2005, the fee structure has been revised as follows: each non-employee Director will be paid an annual cash retainer of $20,000 plus per meeting fees of $2,000 for each regularly scheduled Board meeting, $1,000 for each telephonic, special Board meeting, $750 for each Audit Committee meeting and $500 for each other committee meeting attended by that non-employee Director (no separate fees for any committee meeting will be paid when the committee meeting is on the same day as a Board meeting).

4

Stock Option Grant. Each non-employee Director first elected or appointed to the Board of Directors will be granted an option for 40,000 shares of Common Stock on the date of his or her election or appointment to the Board of Directors. In addition, at each Annual Meeting of Stockholders, each non-employee Director with at least twelve months of service on the Board of Directors who will continue to serve as a non-employee Director following the meeting will be granted an option for 10,000 shares of Common Stock. Each of these options will have an exercise price equal to 100% of the fair market value of the Common Stock on the grant date, a maximum term of ten years, subject to earlier termination upon the optionee's cessation of Board of Director service, and will vest in successive equal annual installments on the first four anniversaries of the date of grant. However, each outstanding option will immediately vest upon (i) certain changes in the ownership or control of the Company or (ii) the death or disability of the optionee while serving on the Board of Directors. Pursuant to this option grant program, Messrs. Migliorino, Burch, Vogel, Weingarten and Brondo will each receive a 10,000-share option grant on the date of the Annual Meeting, if such individuals are reelected.

Procedure For Stockholders to Contact Board of Directors

Attached as an Appendix to this Proxy Statement is the procedure adopted by the Board of Directors whereby stockholders can communicate directly with the Board or individual directors. All legitimate correspondence will be relayed to the Board or director, as appropriate.

Director Attendance at Annual Stockholder Meetings

The Company does not have a policy regarding director attendance at annual meetings of stockholders. Seven of the eight directors attended the 2004 Annual Meeting.

EXECUTIVE OFFICERS AND INFORMATION

REGARDING EXECUTIVE OFFICER COMPENSATION

Executive Officers

The executive officers of the Company as of March 31, 2005 were as follows:

Name

| | Age

| | Position

|

|---|

| William P. Lyons | | 60 | | Chairman of the Board and Chief Executive Officer |

| Elias Typaldos | | 54 | | Executive Vice President, Technology and Director |

| Gennaro Vendome | | 58 | | Executive Vice President, Business Development and Director |

| Joseph Dwyer | | 49 | | Executive Vice President, Chief Financial Officer and Treasurer |

| Matthew Suffoletto | | 57 | | Senior Vice President, Sales and Professional Services, North America |

| Richard Dym | | 57 | | Executive Vice President, Chief Marketing Officer |

| Paul Abel | | 51 | | Vice President, Secretary and General Counsel |

Information Concerning Executive Officers Who Are Not Directors

Paul Abel joined the Company in April 1997 as Secretary and Corporate Counsel and was promoted to Vice President, Secretary and General Counsel in June 1998. From October 1996 to March 1997, Mr. Abel served as Project Manager for Charles River Computers, an IT systems integrator. From 1983 to September 1996, Mr. Abel was an attorney with Matsushita Electric Corporation of America, an electronic products manufacturer/distributor.

5

Joseph Dwyer joined the Company as Executive Vice President, Chief Financial Officer and Treasurer in December 2004. In 2004, prior to joining the Company, Mr. Dwyer served as Chief Financial Officer of Synergen, Inc, a company engaged in the development and marketing of enterprise asset management and mobile workforce software to utilities, municipalities and asset intensive industries. From 2001 to 2003, Mr. Dwyer served as Executive Vice President and Chief Financial Officer of Caminus Corporation, a publicly traded provider of integrated enterprise software applications to the global energy industry, and from 2000 to 2001 he served as Executive Vice President and Chief Financial Officer of ACTV, Inc., a publicly traded digital media company. Prior to ACTV, from 1994 to 2000, Mr. Dwyer served as Senior Vice President of Finance for Winstar Communications, Inc., a publicly traded global telecommunications provider.

Richard Dym joined the Company in June 2004 as the Executive Vice President and Chief Marketing Officer. Prior to joining the Company, from September 2002 through July 2004, Mr. Dym held the position of Chief Marketing Officer at OpSource, Inc., a venture funded IT infrastructure outsourcing company. From February 2001 through May 2002, Mr. Dym served as Senior Vice President of Marketing for Metromedia Fiber Networks (now Abovenet). From January 2000 to February 2001 he served as Vice President Marketing for SiteSmith, Inc., which was sold to Metromedia Fiber Networks. Prior positions included Senior Vice President of Marketing and Vice president of International Operations at ParcPlace; General Manager of the Multimedia Division at Autodesk; and Director, Graphics and Decision Support products for Ashton-Tate, all software vendors.

Matthew Suffoletto joined the Company in October 2004 as the Senior Vice President of Sales and Professional Services, North America. Prior to joining the Company, from November 2001 through September 2004, Mr. Suffoletto was President and CEO of IXOS Software, Inc., a wholly owned subsidiary of SAP archiving software vendor, IXOS Software AG (acquired by Open Text in October 2003). From November 2000 to November 2001, Mr. Suffoletto served as CEO of TechTrader, an Internet infrastructure software company. Previously, he spent six years leading sales and marketing, as Senior Vice President and General Manager, with a project management software company, Primavera Systems Inc.

6

SUMMARY COMPENSATION TABLE

The following table sets forth the annual and long-term compensation received for the three fiscal years ended December 31, 2004, by the Company's Chief Executive Officer who served in such capacity in the fiscal year 2004, and the four most highly compensated executive officers of the Company, other than the CEO, whose total compensation during fiscal year 2004 exceeded $100,000 and who were serving as executive officers as of fiscal year ended December 31, 2004 or served during fiscal year 2004 (collectively, the "Named Executive Officers"):

| |

| | Annual Compensation

| | Long Term

Compensation Awards

| |

| |

|---|

Name and Principal Position

| | Fiscal

Year

| | Salary

| | Bonus

| | Other Annual

Compensation

| | Restricted

Stock Awards

| | Securities

Underlying

Options

| | All

Other

Compensation

| |

|---|

William P. Lyons

Chairman of the Board and Chief Executive Officer | | 2004 | | $ | 271,282 | | $ | 43,200 | | $ | — | | — | | 900,000 | | $ | 17,721 | (1) |

John A. Rade(8)

Former Chief Executive Officer and President | | 2004

2003

2002 | | | 400,000

375,000

300,000 | | | —

—

— | | | —

—

— | | —

—

— | | —

—

— | | | 24,119

20,462

17,820 | (2)

(2)

(2) |

Elias Typaldos

Executive Vice President, Technology and Director | | 2004

2003

2002 | | | 300,000

300,000

270,000 | | | 29,534

50,000

— | | | —

—

— | | —

—

— | | —

—

— | | | 12,503

13,277

11,988 | (3)

(3)

(3) |

Gennaro Vendome

Executive Vice President, Business Development | | 2004

2003

2002 | | | 225,000

225,000

189,000 | | | —

—

— | | | 52,809

62,630

1,704 | (4)

(4)

(4) | —

—

— | | —

—

— | | | 9,650

6,103

6,013 | (5)

(5)

(5) |

William G. Levering III(9)

Former Vice President, Chief Financial Officer | | 2004

2003

2002 | | | 180,000

180,000

157,500 | | | 61,000

84,167

69,857 | | | —

—

— | | —

—

— | | —

—

— | | | 7,132

3,541

541 | (6)

(6)

(6) |

Paul Abel

Vice President, Secretary and General Counsel | | 2004

2003

2002 | | | 165,000

165,000

142,800 | | | 22,200

48,375

36,011 | | | —

—

— | | —

—

— | | —

—

— | | | 11,513

9,428

9,764 | (7)

(7)

(7) |

- (1)

- Includes premiums on life and disability insurance and matching contributions to the Company's 401(k) plan of $6,500. In addition, the amount includes $7,009 of an auto allowance.

- (2)

- Includes premiums on life and disability insurance and matching contributions to the Company's 401(k) plan of $2,642 and $6,299 for 2003 and 2004, respectively. In addition all three years include $9,000 of an auto allowance

- (3)

- Includes for 2003 and 2004, respectively, matching contributions to the Company's 401(k) plan in the amount of $3,064 and $6,500, and premiums on life and disability insurance for all three years. In addition, the Company provided an automobile to the officer, which resulted in additional compensation of $6,114, $4,360 and $3,987 for 2002, 2003 and 2004, respectively.

- (4)

- Includes for 2003 and 2004, respectively, commissions of $62,630 and $48,115, and amounts for auto allowance of $1,704 and $4,694 for 2002 and 2004, respectively.

- (5)

- Includes premiums on life and disability insurance, and matching contributions to the Company's 401(k) plan of $2,953 in 2003 and $6,500 in 2004.

- (6)

- Includes premiums on life and disability insurance and matching contributions to the Company's 401(K) plan in the amount $2,897 for 2003 and $6,500 in 2004.

- (7)

- Includes premiums on life and disability insurance and matching contributions to the Company's 401(K) plan in the amount $1,815 for 2003 and $3,900 in 2004. In addition all three years include $6,000 of an auto allowance.

7

- (8)

- Mr. Rade resigned his CEO title effective April 28, 2004 and retired as an employee effective December 31, 2004.

- (9)

- Mr. Levering resigned as an employee effective December 31, 2004.

1995 Stock Option Plan

The 1995 Stock Option Plan was adopted by the Board of Directors and approved by the Stockholders in June 1995. The Board of Directors and Stockholders approved certain amendments to the 1995 Stock Option Plan in 1997.

1998 Stock Option Plan

The 1998 Stock Option Plan was adopted by the Board of Directors, and approved by the Stockholders in June 1998. The Board of Directors and Stockholders approved certain amendments to the 1998 Stock Option Plan in 2001 and again in 2004.

2005 Stock Incentive Plan

The 2005 Stock Incentive Plan was approved by the Board of Directors on April 13, 2005. The 2005 Stock Incentive Plan is discussed in detail at "Proposal 2—Approval of the 2005 Stock Incentive Plan".

Option/SAR Grants in Last Fiscal Year

Option Grants In Fiscal 2004

The following table provides information with respect to stock option grants made to the Named Executive Officers during fiscal 2004. No stock appreciation rights or awards of restricted stock were granted to any of the Named Executive Officers during fiscal 2004.

Of the 900,000 options listed below, 516,000 were issued under the 1995 Plan, 259,000 were issued under the 1998 Plan and the remaining 125,000 options were non-qualified and issued outside of either plan. Generally, stock options under these plans become exercisable with respect to 25% of the shares on each of the first four annual anniversaries of the date of grant and, in certain cases, subject to acceleration upon change in control. These 900,000 options all vest as noted above and vest upon a change in control.

The potential realizable value of the options in the table below is calculated based upon the term of the option at its time of grant, and by assuming that the aggregate exercise price appreciates at the indicated annual rate compounded annually for the entire term of the option, and that the option is exercised and sold on the last day of its term for the appreciated price. The hypothetical 5% and 10% assumed annual compound rates of stock price appreciation are mandated by the rules of the SEC and do not represent AXS-One's estimates or projections of future common stock prices. There can be no assurance that the common stock will appreciate at any particular rate or at all.

| | Individual Grants

| |

| |

| |

|

|---|

| |

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term

|

|---|

| | Number of Securities Underlying Options Granted

| | % of Total Options Granted to Employees in Fiscal 2004(1)

| |

| |

|

|---|

Name

| | Exercise Price Per Share(2)

| | Expiration Date

|

|---|

| | At 5%

| | At 10%

|

|---|

| William P. Lyons | | 900,000 | | 33.7 | % | $ | 4.21 | | 04/28/14 | | $ | 2,382,882 | | $ | 6,038,690 |

- (1)

- Based on 2,670,325 options granted to all employees during fiscal 2004.

- (2)

- Options were granted at an exercise price equal to the fair market value of AXS-One's common stock as of the date of grant.

8

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

The following table sets forth certain information with respect to the Named Executive Officers regarding stock option holdings as of December 31, 2004, and stock options exercised during fiscal 2004. No stock appreciation rights were exercised by any Named Executive Officer during fiscal year 2004 and no stock appreciation rights nor shares of restricted stock were outstanding as of December 31, 2004.

| |

| |

| | Number of Securities Underlying Unexercised Options at Fiscal Year-End

| | Value of Unexercised in-the-Money Options at Fiscal Year-End(1)

|

|---|

Name

| | Shares Acquired

Options

Exercised (#)

| | Value

Realized ($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| William P. Lyons | | — | | $ | — | | — | | 900,000 | | $ | — | | $ | — |

| John A. Rade | | — | | | — | | 808,000 | | — | | | 1,348,560 | | | — |

| Elias Typaldos | | — | | | — | | 90,000 | | — | | | 201,300 | | | — |

| Gennaro Vendome | | — | | | — | | 54,000 | | — | | | 120,780 | | | — |

| William G. Levering III | | — | | | — | | 160,000 | | — | | | 304,450 | | | — |

| Paul Abel | | — | | | — | | 85,400 | | 10,000 | | | 149,513 | | | 4,400 |

- (1)

- Based on the fair market value of the Company's Common Stock using the closing selling price on the American Stock Exchange of $2.57 per share of Common Stock at December 31, 2004, less the exercise price payable for such shares.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth certain information with respect to securities authorized for issuance under equity compensation plans that were either previously approved by security holders or not previously approved by security holders as of December 31, 2004.

Plan category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights

(a)

| | Weighted-average exercise price of outstanding options, warrants and rights.

(b)

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

(c)

|

|---|

| Equity compensation plans approved by security holders | | 7,332,428 | | $ | 2.04 | | 616,656 |

Equity compensation plans not approved by security holders |

|

641,129 |

|

$ |

4.23 |

|

— |

| | |

| |

| |

|

| Total | | 7,973,557 | | $ | 2.21 | | 616,656 |

| | |

| |

| |

|

The equity compensation plans not approved by the security holders relate to 516,129 warrants issued to private placement investors and 125,000 non-plan options issued to Mr. Lyons.

Employment and Severance Agreements

The Company typically has employment agreements with all its employees including the Named Executive Officers, which detail initial annual salary, stock options, benefits and severance agreements, if applicable. The Named Executive Officers' severance agreements range from six to thirty months.

9

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

The Compensation Committee of the Board of Directors advises the Chief Executive Officer and the Board of Directors on matters of the Company's compensation philosophy and the compensation of executive officers. The Compensation Committee also is responsible for the administration of the Company's equity plans under which option grants and restricted stock awards may be made to executive officers and other employees. The Compensation Committee has reviewed and is in accord with the compensation paid to executive officers in fiscal year 2004.

General Compensation Policy. As set forth in its charter, adopted in 2005, the fundamental policy of the Compensation Committee is to create a competitive compensation structure that will help attract and retain key management talent, assure the integrity of the Company's compensation and benefit practices, and tie compensation to performance and to safeguard the interests of all stockholders. Compensation plans should not include any incentives that would (a) conflict with any applicable laws or regulations in the jurisdictions in which the employee operates, or (b) encourage any behavior that would be in conflict with the Company' Code of Conduct. It is the Compensation Committee's objective to have a portion of each executive officer's compensation contingent upon the Company's performance as well as upon such executive officer's own level of performance. Accordingly, the compensation package for each executive officer is typically comprised of two elements: (i) base salary which reflects individual performance and is designed primarily to be competitive with salary levels in the industry and (ii) long-term stock-based incentive awards which strengthen the mutuality of interests between the executive officers and the Company's stockholders.

Factors. The principal factors that the Compensation Committee considered with respect to each executive officer's compensation package for fiscal year 2004 are summarized below. The Compensation Committee may, however, in its discretion apply entirely different factors in advising the Chief Executive Officer and the Board of Directors with respect to executive compensation for future years.

Base Salary. The suggested base salary for each executive officer is determined on the basis of the following factors: experience, personal performance, the salary levels in effect for comparable positions within and without the industry and internal base salary comparability considerations. The weight given to each of these factors differs from individual to individual, as the Compensation Committee deems appropriate.

From time to time, the Compensation Committee may advocate cash bonuses when such bonuses are deemed to be in the best interest of the Company.

Long-Term Incentive Compensation. Long-term incentives are provided through grants of stock options or awards of restricted stock. The grants and awards are designed to align the interests of each executive officer with those of the stockholders and to provide each individual with a significant incentive to manage the Company from the perspective of an owner with an equity stake in the Company. Each option grant allows the individual to acquire shares of the Company's Common Stock at a fixed price per share (generally, the market price on the grant date) over a specified period of time (up to ten years). Each option generally becomes exercisable in installments over a four-year period, contingent upon the executive officer's continued employment with the Company. Each restricted stock award grants the individual non-transferable shares of the Company's Common Stock. The restriction on transferability terminates after the expiration of a specified number of years (generally five years), subject to acceleration if certain performance targets are met by the Company. If the individual leaves the Company prior to complete termination of the restriction on transferability, then the shares still so restricted forfeit back to the Company. Accordingly, the option grant or restricted stock award will provide a return to the executive officer only if the executive officer remains employed by the Company during the vesting period, and then, with respect to options, only if the market price of the underlying shares appreciates.

10

The number of shares subject to each option grant or restricted stock award is set at a level intended to create a meaningful opportunity for stock ownership based on the executive officer's current position with the Company, the base salary associated with that position, the size of comparable awards made to individuals in similar positions within the industry, the individual's potential for increased responsibility and promotion over the option or restriction term and the individual's personal performance in recent periods. The Compensation Committee also considers the number of unvested options and restricted shares held by the executive officer in order to maintain an appropriate level of equity incentive for that individual. However, the Compensation Committee does not adhere to any specific guidelines as to the relative option or restricted share holdings of the Company's executive officers.

CEO Compensation. In advising the Board of Directors with respect to the compensation payable to the Company's Chief Executive Officer, the Compensation Committee seeks to achieve two objectives: (i) establish a level of base salary competitive with that paid by companies within the industry which are of comparable size to the Company and by companies outside of the industry with which the Company competes for executive talent and (ii) to make a significant percentage of the total compensation package contingent upon the Company's performance and stock price appreciation.

The base salary established for Mr. Rade on the basis of the foregoing criteria was intended to provide a level of stability and certainty each year. Accordingly, this element of compensation was not affected to any significant degree by Company performance factors. Effective July 1, 2001, Mr. Rade, together with other senior officers of the Company, received a 10% reduction in base salary which continued into 2002. Effective July 1, 2002, Mr. Rade's Annual Salary was reduced to 280,000, less the 10% continued reduction to December 31, 2002. Mr. Rade's salary was $375,000 in 2003 and $400,000 in 2004. Mr. Rade resigned as CEO effective in April 2004 and resigned as an employee effective December 31, 2004. Mr. Rade will continue to act as a consultant during 2005 and will be paid $317,000 as total compensation. Upon his employment by the Company, Mr. Rade was granted 25,000 shares of restricted stock and two stock options. The first stock option for 300,000 shares vested in three equal annual installments, and the other stock option for 300,000 shares vested either upon the earlier to occur of the completion of seven years of service with the Company or the achievement of certain performance-measured milestones. The Company has met one of the milestones and as such, 100,000 of these options vested. The remaining 200,000 shares were to vest in 2003 but were accelerated to 2002. The Company granted Mr. Rade 88,000 additional options due to anti-dilution provisions contained in the original stock option agreement related to certain stock issuances. Of these additional options, 50% vested in the manner of the first stock option and 50% vested in the manner of the other stock option. Mr. Rade received two stock option grants during 2001 totaling 120,000 shares, of which 40,000 shares vested on December 31, 2001, and the remaining 80,000 shares vested in equal quarterly installments during 2002. As of December 31, 2004 all of Mr. Rade's options are fully vested. On March 22, 2005, Mr. Rade exercised 688,000 of his outstanding options.

Effective with Mr. Rade's resignation in April 2004 as noted above, the Company hired Mr. Lyons as the new CEO. Mr. Lyons' annual base salary was $400,000 which was prorated for 2004. In addition, Mr. Lyons was eligible for a bonus based on achieving certain financial metrics. Mr. Lyons was paid a bonus of $43,200 during 2004 in accordance with the bonus plan. Upon his employment with the Company, Mr. Lyons was granted 900,000 stock options that vest in four equal annual installments.

Compliance with Internal Revenue Code Section 162(m). As a result of Section 162(m) of the Internal Revenue Code of 1986, as amended, which was enacted into law in 1993, the Company will not be allowed a federal income tax deduction for compensation paid to certain executive officers, to the extent that compensation exceeds $1 million per officer in any one year. This limitation will apply to all compensation paid to the covered executive officers, which is not considered to be performance based. Compensation that does qualify as performance-based compensation will not have to be taken into account for purposes of this limitation. The Company's equity plans contain certain provisions

11

which are intended to assure that any compensation deemed paid in connection with the exercise of stock options granted under that plan with an exercise price equal to the market price of the option shares on the grant date will qualify as performance-based compensation.

The Compensation Committee does not expect that the compensation to be paid to the Company's executive officers for the 2004 fiscal year will exceed the $1 million limit per officer. Because it is very unlikely that the cash compensation payable to any of the Company's executive officers in the foreseeable future will approach the $1 million limit, the Compensation Committee has decided at this time not to take any other action to limit or restructure the elements of cash compensation payable to the Company's executive officers. The Compensation Committee will reconsider this decision should the individual compensation of any executive officer ever approach the $1 million level.

| | | THE COMPENSATION COMMITTEE |

|

|

|

|

|

|

|

|

Robert Migliorino

Edwin T. Brondo |

| April 15, 2005 | | |

12

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee reviews AXS-One's financial reporting process. In fulfilling its responsibilities, the Audit Committee has reviewed and discussed the audited consolidated financial statements contained in the 2004 Annual Report on SEC Form 10-K with AXS-One's management and the independent registered public accounting firm. Management is responsible for the consolidated financial statements and the reporting process, including the system of internal controls. The independent registered public accounting firm is responsible for expressing an opinion on the conformity of those audited consolidated financial statements with U.S. generally accepted accounting principles.

The Audit Committee discussed with the independent registered public accounting firm those matters required to be discussed by Statement on Auditing Standards No. 61, "Communications with Audit Committees", as amended. In addition, the Audit Committee has discussed with the independent registered public accounting firm their independence from AXS-One and its management, including the matters in the written disclosures and letter received from the independent registered public accounting firm, as required by Independence Standards Board No. 1, "Independence Discussions with Audit Committees".

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited consolidated financial statements be included in AXS-One's Annual Report on SEC Form 10-K for the year ended December 31, 2004, for filing with the Securities and Exchange Commission.

April 15, 2005

13

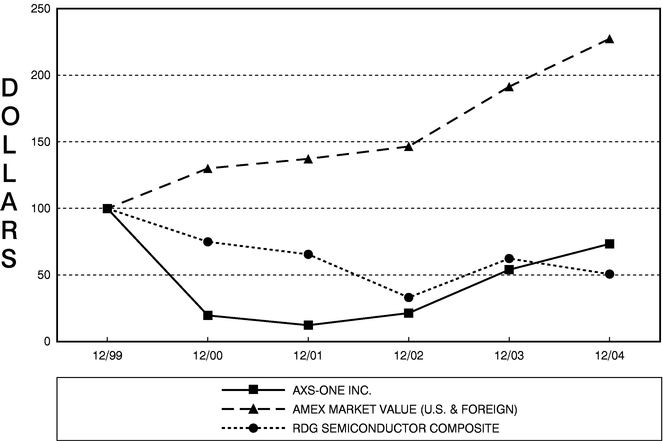

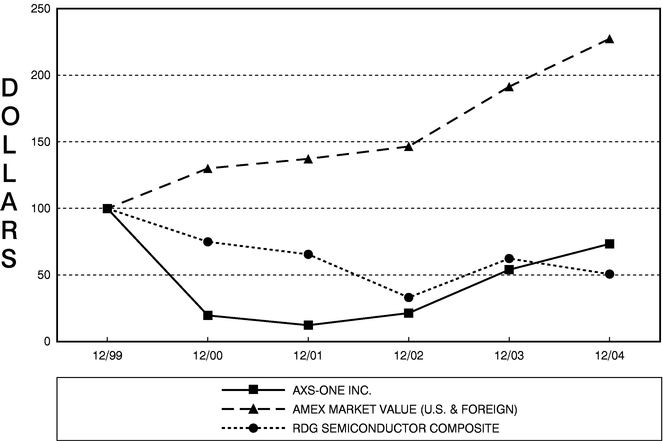

PERFORMANCE GRAPH

Set forth below is a table comparing the annual percentage change in the Company's cumulative total stockholder return on its Common Stock from December 31, 1999 to the last day of the Company's last completed fiscal year (as measured by dividing (i) the sum of (A) the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and (B) the excess of the Company's share price at the end over the price at the beginning of the measurement period, by (ii) the share price at the beginning of the measurement period) with the cumulative total return so calculated of the Amex Market Value Index and the RDG Software Composite Index during the same period.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG AXS-ONE INC., THE AMEX MARKET VALUE (U.S. & FOREIGN) INDEX

AND THE RDG SEMICONDUCTOR COMPOSITE INDEX

- *

- $100 invested on 12/31/99 in stock or index—including reinvestment of dividends. Fiscal year ending December 31.

Notwithstanding anything to the contrary set forth in any of the Company's previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, which might incorporate future filings made by the Company under those statutes, the preceding Compensation Committee Report on Executive Compensation, Audit Committee Report and the Company Stock Performance Graph will not be incorporated by reference into any of those prior filings, nor will either such report or graph be incorporated by reference into any future filings made by the Company under those statutes.

14

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of the Company's Common Stock as of March 31, 2005 by (i) each Director and nominee for Director, (ii) each of the Named Executive Officers, (iii) each person known by the Company to be the beneficial owner of more than 5% of the Company's Common Stock and (iv) all executive officers and Directors as a group. The information concerning beneficial owners of more than 5% of the Company's Common Stock is based on filings with the Securities and Exchange Commission on Schedules 13(D), 13(G) and on Forms 3, 4, and 5; and certain other information obtained by the Company.

Name of Beneficial Owner

| | Number of Shares

of Common Stock

Beneficially Owned(1)

| | Percentage of Shares

Outstanding(1)

| |

|---|

William P. Lyons |

|

324,600 |

(2) |

1.14 |

% |

Elias Typaldos |

|

2,536,624 |

(3) |

8.88 |

% |

John A Rade |

|

884,100 |

(4) |

3.10 |

% |

Gennaro Vendome |

|

1,521,060 |

(5) |

5.33 |

% |

Robert Migliorino |

|

139,480 |

(6) |

* |

|

William Vogel |

|

207,800 |

(7) |

* |

|

Edwin T. Brondo |

|

132,000 |

(8) |

* |

|

Daniel H. Burch |

|

65,000 |

(9) |

* |

|

Allan Weingarten |

|

63,000 |

(10) |

* |

|

William G. Levering, III |

|

45,000 |

(11) |

* |

|

Paul Abel |

|

86,400 |

(12) |

* |

|

Andreas Typaldos |

|

2,533,439 |

(13) |

8.87 |

% |

All Current Directors and Executive Officers As a Group (12 persons) |

|

5,160,964 |

(14) |

18.07 |

% |

- *

- Represents beneficial ownership of less than one percent of the Common Stock outstanding.

- (1)

- Applicable percentage of ownership as of March 31, 2005 is based upon 28,563,566 shares of Common Stock outstanding. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, and includes voting and investment power with respect to shares. Gives effect to the shares of Common Stock issuable within 60 days of March 31, 2005 upon exercise of all options and other rights beneficially owned by the indicated stockholders on that date.

- (2)

- Represents 99,600 shares owned by the Lyons Family Trust dated February 17, 1992.

- (3)

- Includes (i) 327,521 shares owned by the Elias Typaldos Grantor Retained Annuity Trust dated October 13, 1994, (ii) 1,147,750 shares held by the Elias Typaldos Family Limited Partnership, (iii) 129,938 shares owned by the Judith Typaldos Grantor Retained Annuity Trust dated October 13, 1994, (iv) 3,313 shares held by Judith Typaldos, Mr. Typaldos' wife, 96,000 shares held by Judith Typaldos as custodian for Mr. Typaldos' children and (v) 90,000 shares of Common Stock which may be purchased within 60 days of March 31, 2005 upon exercise of stock options. Mr. Typaldos' business address is the Company's principal executive offices.

15

- (4)

- Includes 120,000 shares of Common Stock, which may be purchased within 60 days of March 31, 2005 upon the exercise of stock options.

- (5)

- Includes (i) 89,407 shares held by Carol Vendome, (ii) 149,062 shares held by the Vendome Grantor Retained Annuity Trust dated January 24, 1995, (iii) 151,297 shares held by the Carol Vendome Grantor Retained Annuity Trust dated January 24, 1995, (iv) 71,905 shares held by Carol Vendome as custodian for Laura and Chris Vendome, (v) 179,095 shares held by the Vendome Family Limited Partnership and (vi) 54,000 shares of Common Stock which may be purchased within 60 days of March 31, 2005 upon exercise of stock options. Mr. Vendome's business address is the Company's principal executive offices.

- (6)

- Includes 98,000 shares of Common Stock, which may be purchased within 60 days of March 31, 2005 upon exercise of stock options.

- (7)

- Includes (i) 89,300 shares held by the William E. Vogel IRA and (ii) 101,000 shares of Common Stock which may be purchased within 60 days of March 31, 2005 upon exercise of stock options.

- (8)

- Includes 95,000 shares of Common Stock which may be purchased within 60 days of March 31, 2005 upon exercise of stock options.

- (9)

- This number represents the number of shares of Common Stock, which may be purchased by Mr. Burch within 60 days of March 31, 2005 upon the exercise of stock options.

- (10)

- Includes 60,000 shares of Common Stock which may be purchased within 60 days of March 31, 2005 upon exercise of stock options.

- (11)

- Represents shares owned by Mr. Levering.

- (12)

- Includes 85,400 shares of Common Stock, which may be purchased by Mr. Abel within 60 days of March 31, 2005 upon the exercise of stock options.

- (13)

- Includes (i) 680,504 shares owned by the Andreas Typaldos GRAT dated September 29, 1993; (ii) 11,047 shares owned by Renee Typaldos, Mr. Typaldos' wife, (iii) 755,504 shares owned by the Renee Typaldos GRAT dated September 29, 1993,and (iv) 736,384 shares held by the Andreas Typaldos Family Limited Partnership. Mr. Typaldos' business address is e-Vantage Solutions, Inc., 41 East 11th Street, New York, NY 10003.

- (14)

- Includes 1,681,400 shares of Common Stock, which may be purchased within 60 days of March 31, 2005 upon the exercise of stock options.

Section 16(a) Beneficial Ownership Reporting Compliance

Under the securities laws of the United States, the Company's Directors, Executive Officers, and any persons holding more than ten percent of the Company's Common Stock are required to report their ownership of the Company's Common Stock and any changes in that ownership to the Securities Exchange Commission, the American Stock Exchange and the Company. Specific due dates for these reports have been established and the Company is required to report in this Proxy Statement any failure to file by these dates during fiscal year 2004. Based solely on its review of such forms received by it from such persons for their fiscal year 2004 transactions, the Company believes that all filing requirements applicable to such officers, directors, and greater than ten percent beneficial owners were complied with, except that (i) Mr. Brondo and Mr. Burch each filed a Form 4 relating to the grant by the Company, on June 9, 2004, of an option to purchase 10,000 shares of the Company's Common Stock two weeks late as a result of an SEC delay in renewing Messrs. Brondo's and Burch's passwords to access the online filing system, and (ii) Mr. Dym was three weeks late in filing his Form 3.

16

CERTAIN TRANSACTIONS

During the year ended December 31, 2004, the Company recorded as expense approximately $1,000 related to work performed by Mergence Technology Corporation on behalf of the Company, which sum includes royalties paid to Mergence in connection with the Company's licensing to its customers of certain software owned by Mergence. Mergence is the successor-in-interest to S-Cubed International's rights and obligations under certain contracts with the Company. Mr. Rade, who joined the Company as Chief Executive Officer and President in February 1997 and resigned from such positions in April 2004, founded S-Cubed International in February 1990 and during at least part of 2004 beneficially owned 53% of the outstanding stock of Mergence. The Company believes that the amounts paid to Mergence are comparable to the amounts the Company would have otherwise paid for comparable services from an unaffiliated party.

In August 2003, the Company entered into a business relationship with an entity that is owned by the Company's initial chairman and principal stockholder. This entity is providing consulting services related to the development of the Company's instant messaging archiving product. For the year ended December 31, 2004, the Company recorded $84,000 as research and development expense from this related party. The Company discontinued use of this entity's services in June 2004.

PROPOSAL 2

APPROVAL OF THE 2005 STOCK INCENTIVE PLAN

The Board of Directors adopted the 2005 Stock Incentive Plan (the "2005 Plan") on April 13, 2005, subject to stockholder approval at the 2005 Annual Meeting. The Board believes that it is in the best interests of the Company to adopt the 2005 Plan so that the Company can continue to attract and retain the services of those persons essential to the Company's growth and financial success.

The following is a summary of the principal features of the 2005 Plan. The summary, however, does not purport to be a complete description of all the provisions of the 2005 Plan and is qualified in its entirety by reference to the 2005 Plan document, a copy of which has been filed with the Securities and Exchange Commission as an exhibit to this proxy statement. Any stockholder of the Company who wishes to obtain a copy of the actual plan document may do so upon written request to the Corporate Secretary at the Company's principal executive offices in Rutherford, New Jersey.

Administration

The 2005 Plan is administered and interpreted by a committee of the Board of Directors (currently the Compensation Committee) consisting of two or more non-employee directors, each of whom is intended to be, to the extent required by Rule 16b-3 under the Securities Exchange Act of 1934 ("Rule 16b-3"), Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code") and Amex Rule 121A, a non-employee director as defined in Rule 16b-3, an outside director as defined under Section 162(m) of the Code and an "independent director" as defined under Amex Rule 121A (the "Committee"). If no Committee exists which has the authority to administer the 2005 Plan, the functions of the Committee will be exercised by the Board of Directors. Except with regard to options automatically granted under the 2005 Plan to non-employee directors, the Committee has the full authority and discretion, subject to the terms of the 2005 Plan, to grant awards under the 2005 Plan and to determine the persons to whom awards will be granted. With regard to options automatically granted under the 2005 Plan to non-employee directors, the Board administers and interprets the 2005 Plan. The Committee has authority to delete its duties under the 2005 Plan, including, without limitation, the discretion to delegate authority to officers to grant awards under the 2005 Plan.

17

Eligibility

All employees and consultants of the Company and its affiliates are eligible to receive grants of stock options, stock appreciation rights and shares of restricted stock (collectively, "Awards") under the 2005 Plan. Prospective employees and consultants are also eligible to participate in the 2005 Plan, subject to such individual actually becoming an employee or consultant. Non-employee directors of the Company automatically receive grants of stock options under the 2005 Plan and are eligible to receive discretionary grants of stock options under the 2005 Plan.

Available Shares

A maximum of 1,500,000 shares of Common Stock are available for Awards under the 2005 Plan, of which 375,000 are available for awards of restricted stock.

The maximum number of shares of Common Stock subject to Awards intended to be "performance-based" compensation within the meaning of Section 162(m) of the Code which may be granted to any employee during any calendar year will not exceed 500,000 shares except that, for the calendar year in which such individual commences his or her employment, the maximum grant will not exceed 1,000,000 shares. If a tandem stock appreciation right or a limited stock appreciation right is granted in tandem with a stock option, it will apply against the individual limits for both stock options and stock appreciation rights, but only once against the maximum number of shares available under the 2005 Plan. To the extent that shares of Common Stock for which Awards are permitted to be granted to an employee during a calendar year of the Company are not covered by a grant during such calendar year, such shares of Common Stock will be available for grant or issuance to the employee in any subsequent calendar year during the term of the 2005 Plan.

The Committee or the Board, as applicable, may make appropriate adjustments to the number of shares available for Awards and the terms of outstanding Awards to reflect any change in the Company's capital structure or business by reason of a stock dividend, extraordinary dividend, stock split, recapitalization, reorganization, merger, consolidation or sale of all or substantially all the assets of the Company (and certain other events).

Types of Awards

Stock Options. The 2005 Plan authorizes the Committee to grant stock options to purchase shares of the Company's Common Stock to employees and consultants of the Company and its affiliates and to non-employee directors of the Company. Options granted to employees of the Company or any "subsidiary" or "parent" (within the meaning of Section 424 of the Code) may be in the form of incentive stock options ("ISOs") or non-qualified stock options. Options granted to non-employee directors of the Company, consultants of the Company and its affiliates and employees of affiliates that do not qualify as "subsidiaries" or "parents" may only be non-qualified stock options. Except with regard to automatic option grants to non-employee directors, the Committee determines the number of shares subject to each option, the term of each option (which may not exceed ten years (or five years in the case of an ISO granted to a ten percent stockholder)), the exercise price, the vesting schedule (if any), and the other material terms of the option. No option may have an exercise price less than the fair market value of the Common Stock at the time of grant (or, in the case of an ISO granted to a ten- percent stockholder, 110 percent of fair market value).

Options granted to employees and consultants are exercisable at such time or times and subject to such terms and conditions as determined by the Committee at grant. All options granted to employees and consultants might be made exercisable in installments, and the Committee may accelerate the exercisability of such options. The exercise price of an option may be paid in cash, to the extent permitted by applicable law, by a cashless exercise procedure through a broker or by such other methods approved by the Committee (which may include payment in shares of Common Stock owned for at least six months).

18

Stock Appreciation Rights. The 2005 Plan authorizes the Committee to grant stock appreciation rights ("SARs") to employees and consultants, either with a stock option ("Tandem SARs") or independent of a stock option ("Non-Tandem SARs"). A SAR is a right to receive a payment in a number of shares of Common Stock equal in value to the excess of the fair market value of one share of Common Stock on the date of exercise over the reference price per share established in connection with the grant of the SAR. The reference price per share covered by a SAR is the per share exercise price of the related option in the case of a Tandem SAR and is the fair market value of the Common Stock on the date of grant in the case of a Non-Tandem SAR.

A Tandem SAR may be granted at the time of the grant of the related stock option or, if the related stock option is a non-qualified stock option, at any time thereafter during the term of the related option. A Tandem SAR generally may be exercised only at such times and to the extent the related option is exercisable. A Tandem SAR is exercised by surrendering the same portion of the related option. A Tandem SAR expires upon the termination of the related option.

A Non-Tandem SAR is exercisable as provided by the Committee and has such other terms and conditions as the Committee may determine. A Non-Tandem SAR may have a term no longer than ten years from its date of grant. A Non-Tandem SAR is subject to acceleration of vesting or immediate termination upon termination of employment in certain circumstances.

The Committee is also authorized to grant "limited SARs" to employees and consultants, either as Tandem SARs or Non-Tandem SARs. Limited SARs become exercisable only upon the occurrence of a change in control of the Company or such other event as the Committee may, in its sole discretion, designate at the time of grant or thereafter.

Restricted Stock. The Committee will determine the employees and consultants to whom, and the time or times at which, grants of restricted stock will be made, the number of shares to be awarded, the purchase price (if any) to be paid, the time or times at which such awards may be subject to forfeiture (if any), the vesting schedule (if any) and rights to accelerated vesting and all other terms and conditions of the restricted stock. The Committee may condition the grant or vesting of restricted stock upon the attainment of specified performance targets or such other factors as the Committee may determine. Awards of restricted stock may or may not be intended to comply with the "performance-based" compensation exception under Section 162(m) of the Code.

Awards of restricted stock that are intended to comply with the "performance-based" compensation exception under Section 162(m) of the Code will be granted or vest based upon the attainment of pre-established objective performance goals established by the Committee by reference to one or more of the following: (i) enterprise value or value creation targets, after-tax or pre-tax profits, operational cash flow, earnings per share or earnings per share from continuing operations, net sales, revenues, net income or earnings before income tax or other exclusions, return on capital, market share or after-tax or pre-tax return on stockholder equity of the Company; (ii) the Company's bank debt or other long-term or short-term public or private debt or other similar financial obligations of the Company, which may be calculated net of cash balances and/or other offsets and adjustments as may be established by the Committee; (iii) the fair market value of the shares of the Company's Common Stock; (iv) the growth in the value of an investment in the Company's Common Stock assuming the reinvestment of dividends; (v) controllable expenses or costs or other expenses or costs of the Company; or (vi) economic value added targets based on a cash flow return on investment formula. The performance goals may be based upon the attainment of specified targets by the Company or any subsidiary, division, other operational unit or administrative department of the Company.

Unless otherwise determined by the Committee at grant or thereafter, upon a participant's termination of employment or termination of consultancy (as applicable) for any reason during the relevant restriction period, all restricted stock still subject to restriction will be forfeited.

19

Non-Employee Director Stock Options. Under the 2005 Plan, each new non-employee director of the Company receives an automatic grant of options to purchase 40,000 shares of Common Stock (or such other quantity of shares as the Board shall, from time to time during the term of the 2005 Plan, determine) on the date he or she begins service as a non-employee director. In addition, each non-employee director receives an automatic grant of options to purchase 10,000 shares of Common Stock (or such other quantity of shares as the Board shall, from time to time during the term of the 2005 Plan, determine) on the date of each annual meeting of stockholders, provided such individual has been a non-employee director for the previous twelve months. The Board may also award discretionary grants of options to non-employee directors. The options have a ten-year term and an exercise price equal to the fair market value of the Common Stock at the time of grant. The automatic non-employee directors' stock options vest and become exercisable in four equal installments on each of the first four anniversaries of the date of grant; discretionary non-employee directors' stock options vest and become exercisable in accordance with the schedule set by the Board. Upon a change in control of the Company or termination of directorship as a result of death or disability, all then unvested options will fully vest and become exercisable in their entirety. The exercise price may be paid in cash, to the extent permitted by applicable law, by a cashless exercise procedure through a broker or by such other methods approved by the Board of Directors (which may include payment in shares of Common Stock owned for at least six months).

Change in Control

Upon a change in control of the Company (as defined in the 2005 Plan), all unvested options granted to a non-employee director will fully vest and become exercisable. Unless otherwise determined by the Committee at grant, Awards granted to employees and consultants will fully vest and become exercisable in their entirety, provided that: (i) the Committee may elect to purchase any option at the "change in control price" (as defined in the 2005 Plan) and (ii) no acceleration of vesting and exercisability will occur with regard to options that the Committee determines in good faith prior to a change in control of the Company will be honored or assumed or new rights substituted therefore by a participant's employer immediately following the change in control of the Company.

Amendment and Termination

In general, the 2005 Plan may be amended or terminated in its entirety by the Board of Directors or the Committee, provided that the rights granted to an individual prior to such amendment or termination may not be impaired without the consent of such individual. In addition, generally no such amendment, without stockholder approval to the extent such approval is required by the laws of the State of Delaware, Rule 16b-3, the rules of the American Stock Exchange or under Section 162(m) or 422 of the Code, may increase the aggregate number of shares of Common Stock that may be issued under the 2005 Plan, increase the maximum individual Award limits for any calendar year, change the classification of employees and consultants eligible to receive Awards, decrease the minimum exercise price of any option or SAR or extend the maximum option term under the 2005 Plan.

Awards under the 2005 Plan may not be made on or after April 13, 2015, but awards granted prior to such date may extend beyond that date.

Miscellaneous

Subject to limited post-service exercise periods and vesting in certain instances, Awards to participants under the 2005 Plan are generally forfeited upon any termination of employment, consultancy or directorship. Awards have such terms and terminate upon such conditions as may be contained in the individual Awards. Although Awards are generally nontransferable (except by will or the laws of descent and distribution), the Committee may determine at the time of grant or thereafter that a non-qualified option granted to an employee or consultant that is otherwise nontransferable may be transferable in whole or in part and in such circumstances, and under such conditions, as specified by the Committee.

20

Because future Awards granted under the 2005 Plan will be based upon prospective factors including the nature of services to be rendered by employees and consultants (including prospective employees and consultants) and their potential contributions to the success of the Company, actual Award grants cannot be determined at this time, except that non-employee directors are eligible for automatic stock option grants as described above.

The last reported sales price for the Company's Common Stock as reported on the American Stock Exchange on April 15, 2005 was $2.99 per share.

U.S. Federal Income Tax Consequences

The following discussion of the principal U.S. federal income tax consequences with respect to options under the 2005 Plan is based on statutory authority and judicial and administrative interpretations as of the date of this Proxy Statement, which are subject to change at any time (possibly with retroactive effect) and may vary in individual circumstances. Therefore, the following is designed to provide a general understanding of the federal income tax consequences (state, local and other tax consequences are not addressed below). This discussion is limited to the U.S. federal income tax consequences to individuals who are citizens or residents of the U.S., other than those individuals who are taxed on a residence basis in a foreign country.

�� Under current federal income tax law, when an employee is granted a stock option that qualifies as an ISO, the granting of such option to the employee, or the exercise of the option, is not a taxable event. The employer that granted the option is not entitled to claim a trade or business expense deduction with respect to the ISO.

When the employee exercises the ISO, and holds the stock for a specified period (generally two years from the date that the ISO was granted and one year from the date that the option was exercised), the employer does not take any tax deduction with respect to the exercise of the option, nor does the employee recognize any income. The employer is however, allowed a deduction when the holding period is met and the underlying stock is sold and the employee recognizes income at the same time, generally at preferential capital gains rates.

Certain events can disqualify the stock option from being considered an ISO. These events include, but are not limited to, a failure of the optionee to satisfy the holding period discussed above, limitations on the amount of the fair market value of the underlying stock exercised in a single year by an individual and alternative minimum tax consequences. These disqualifying events can alter the timing of the tax deduction by the employer and the recognition of income by the individual (a "disqualifying disposition"). In general, in the event of a disqualifying disposition any gain equal to the difference between the exercise price and the lesser of (i) the fair market value of the Common Stock at exercise or (ii) the amount realized on disposition over the exercise price, will constitute ordinary income. Any remaining gain is treated as long-term or short-term capital gain and taxed at the applicable rate, depending on the optionee's holding period for the sold stock. The Company generally will be entitled to a deduction at that time equal to the amount of ordinary income realized by the optionee, subject to the requirements of Section 162(m) of the Code.

The treatment of nonqualified options, with no ascertainable fair market value, is similar to that of a disqualified ISO. The taxable event generally occurs when the option is exercised. The optionee recognizes compensation income at that point, and the Company receives a corresponding deduction.

In addition: (i) any officers and directors of the Company subject to Section 16(b) of the Exchange Act may be subject to special tax rules regarding the income tax consequences concerning their options; (ii) any entitlement to a tax deduction on the part of the Company is subject to the applicable federal tax rules, including, without limitation, Section 162(m) of the Code regarding the $1 million annual limitation on deductible compensation; (iii) in the event that the exercisability of an award is

21