Exhibit 99.2

1 March 4, 2019 Acquisition of FPB Financial Corp. “Growing in the Gulf South”

2 Safe Harbor CAUTION REGARDING FORWARD LOOKING STATEMENTS This presentation contains “forward - looking statements” as defined in the Private Securities Litigation Reform Act of 1995 , and is intended to be protected by the safe harbor provided by the same . These statements are subject to numerous risks and uncertainties . These risks and uncertainties include, but are not limited to, the following : competitive pressures among financial institutions increasing significantly ; economic conditions, either nationally or locally, in areas in which FBMS conducts operations being less favorable than expected ; legislation or regulatory changes which adversely affect the ability of the consolidated company to conduct business combinations or new operations ; and risks related to the acquisition of FPB Financial Corp . including the risk that anticipated benefits from the transaction are not realized in the time frame anticipated or at all as a result of changes in general economic and market conditions or the inaccuracy of our transaction assumptions . For additional information concerning factors that could cause actual conditions, events or results to materially differ from those described in the forward - looking statements, please refer to the factors set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in FBMS’ Annual Report on Form 10 - K for the year ended December 31 , 2017 , which is available online at www . sec . gov . No assurances can be given that any of the events anticipated by the forward - looking statements will occur, or if any of them do so, what impact they will have on the results of operations or financial condition of FBMS or FPBF . FBMS disclaims any obligation to update any factors or to announce publicly the result of revisions to any forward - looking statements included herein to reflect future events or developments, except to the extent required by law . ABOUT THE FIRST BANCSHARES, INC . The First Bancshares, Inc . (“FBMS” or the “Company”), headquartered in Hattiesburg, Mississippi, is the parent company of The First, A National Banking Association . Founded in 1996 , The First has operations in Mississippi, Louisiana, Alabama, Florida and Georgia . The Company’s stock is traded on NASDAQ Global Market under the symbol FBMS . Contact : Chandra Kidd, Corporate Secretary . NON - GAAP FINANCIAL MEASURES FBMS reports its results in accordance with United States generally accepted accounting principles (“GAAP”) . However, management believes that certain non - GAAP performance measures used in managing the business may provide meaningful information about underlying trends in its business . Non - GAAP financial measures should be viewed in addition to, and not as an alternative for, FBMS’ reported results prepared in accordance with GAAP .

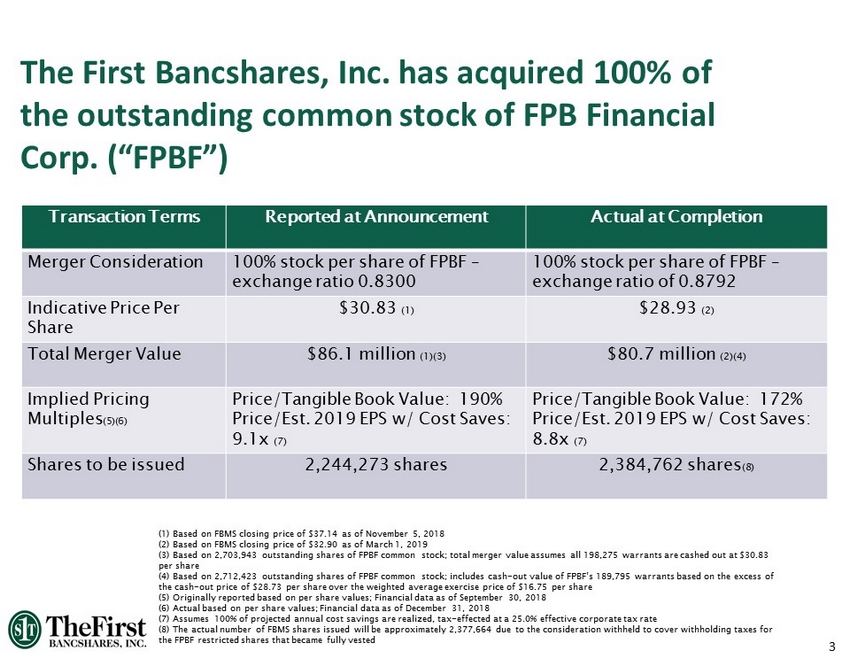

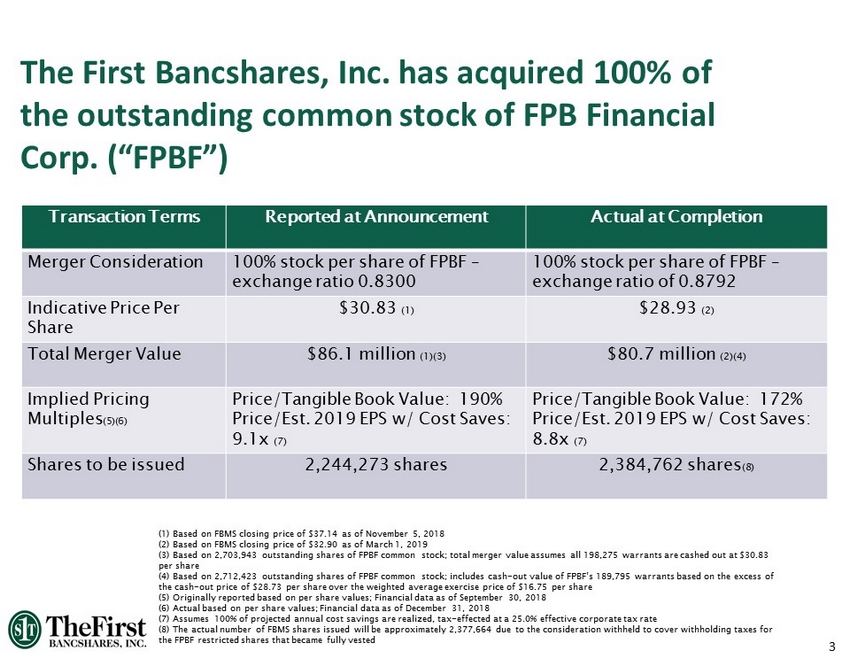

3 Transaction Terms Reported at Announcement Actual at Completion Merger Consideration 100% stock per share of FPBF – exchange ratio 0.8300 100% stock per share of FPBF – exchange ratio of 0.8792 Indicative Price Per Share $30.83 (1) $28.93 (2) Total Merger Value $86.1 million (1)(3) $80.7 million (2)(4) Implied Pricing Multiples (5)(6) Price/Tangible Book Value: 190% Price/Est. 2019 EPS w/ Cost Saves: 9.1x (7) Price/Tangible Book Value: 172% Price/Est. 2019 EPS w/ Cost Saves: 8.8x (7) Shares to be issued 2,244,273 shares 2,384,762 shares (8) (1) Based on FBMS closing price of $37.14 as of November 5, 2018 (2) Based on FBMS closing price of $32.90 as of March 1, 2019 (3) Based on 2,703,943 outstanding shares of FPBF common stock; total merger value assumes all 198,275 warrants are cashed ou t a t $30.83 per share (4) Based on 2,712,423 outstanding shares of FPBF common stock; includes cash - out value of FPBF’s 189,795 warrants based on the excess of the cash - out price of $28.73 per share over the weighted average exercise price of $16.75 per share (5) Originally reported based on per share values; Financial data as of September 30, 2018 (6) Actual based on per share values; Financial data as of December 31, 2018 (7) Assumes 100% of projected annual cost savings are realized, tax - effected at a 25.0% effective corporate tax rate (8) The actual number of FBMS shares issued will be approximately 2,377,664 due to the consideration withheld to cover withholdin g t axes for the FPBF restricted shares that became fully vested The First Bancshares, Inc. has acquired 100% of the outstanding common stock of FPB Financial Corp. (“FPBF”)