QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registranto |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

First Investors Financial Services Group, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

First Investors Financial Services Group, Inc.

675 Bering Drive, Suite 710

Houston, Texas 77057

| | | |

| |

| |

| | | |

| | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD

SEPTEMBER 10, 2003 | |

|

|

|

Dear Shareholder:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of First Investors Financial Services Group, Inc., a Texas corporation, will be held at the offices of the Company located at 675 Bering Drive, Suite 710, Houston, Texas 77057, on Wednesday, September 10, 2003 at 10 a.m., local time, for the following purposes:

- 1.

- To elect eight directors to serve for the ensuing year or until their respective successors have been elected and qualified.

- 2.

- To consider and vote upon a proposal to ratify the appointment of Grant Thornton LLP as our independent accountants for the fiscal year ended April 30, 2004.

- 3.

- To transact any other business as may properly come before the annual meeting or any postponement or adjournment of the meeting.

The close of business on July 31, 2003, has been fixed as the record date for the determination of shareholders entitled to notice of, and to vote at, the annual meeting.

The Company's Annual Report on Form 10-K for the fiscal year ended April 30, 2003, accompanies the enclosed proxy statement. The Annual Report does not form any part of the material for solicitation of proxies.

| | | |

| | | By Order of the Board of Directors |

Houston, Texas

August 4, 2003 |

|

Bennie H. Duck, Secretary |

| | | |

IMPORTANT: PLEASE FILL IN, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED SELF-ADDRESSED RETURN ENVELOPE AS PROMPTLY AS POSSIBLE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING. IF YOU LATER DESIRE TO REVOKE YOUR PROXY FOR ANY REASON, YOU MAY DO SO IN THE MANNER DESCRIBED IN THE ATTACHED PROXY STATEMENT.

| |

FIRST INVESTORS FINANCIAL SERVICES, INC.

675 Bering Drive, Suite 710

Houston, Texas 77057 |

|

PROXY STATEMENT

Annual Meeting of Shareholders

To Be Held September 10, 2003 |

|

|

We are soliciting the accompanying proxy in connection with our annual meeting of shareholders to be held at our offices located at 675 Bering Drive, Suite 710, Houston, Texas 77057, on September 10, 2003 at 10 a.m., local time. When the proxy is properly executed and returned, the shares of common stock it represents will be voted at the annual meeting as directed. Unless otherwise specified, the shares will be voted "FOR" the election of the nominees for director named in the proxy and each proposal in the proxy. As of the date of this proxy statement, management does not know of any matters to be brought before the annual meeting other than the proposals set forth in the notice accompanying this proxy statement; however, should any other matters be properly raised at the annual meeting, it is the intention of each of the persons named in the proxy to vote the shares represented by the proxy in accordance with his judgment.

A proxy may be revoked at any time prior to its exercise by giving written notice of revocation to our corporate Secretary at or before the annual meeting, by duly executing a subsequent proxy relating to the same number of shares or by attending the annual meeting and voting in person.

We are sending this proxy statement and accompanying notice, proxy card and our Annual Report on Form 10-K for the fiscal year ended April 30, 2003, to shareholders on or about August 4, 2003.

VOTING SECURITIES

Only holders of record of our common stock at the close of business on July 31, 2003, are entitled to receive notice of and to vote at the annual meeting or at any postponement or adjournment of the meeting. On the record date there were 5,005,269 shares of our common stock outstanding. Each share of common stock entitles its holder to one vote. Shareholders may not cumulate their votes.

The presence at the annual meeting, in person or by proxy, of holders of a majority of the outstanding shares of common stock on the record date is necessary to constitute a quorum for the transaction of business. A plurality vote of the outstanding shares of common stock represented at the annual meeting is required for the election of directors. The affirmative vote of a majority of the outstanding shares of common stock represented at the annual meeting is required to approve each other proposal. If a share of common stock is represented for any purpose at the annual meeting, it is deemed to be present for all other matters. Abstentions and shares held of record by a broker or nominee that are voted on any matter are included in determining the number of votes present for all matters at the meeting. Shares with respect to which authority is witheld, abstentions and shares held by brokers or nominees that are not voted are treated as shares as to which voting authority has been withheld by the holder of those shares and, therefore, have the effect of a vote against the proposal.

1

PROPOSAL 1:

ELECTION OF DIRECTORS

At the annual meeting, eight directors will be elected to hold office until the 2004 annual meeting of shareholders or until their respective successors are duly elected and qualified. Each of the nominees is presently a member of the Board of Directors, has consented to being named in this proxy statement and has notified us that he intends to serve, if elected.

The eight nominees receiving the highest number of affirmative votes will be elected to the Board. Shareholders may withhold authority to vote for any or all nominees for director. If any nominee becomes unavailable for election for any reason, then the shares represented by the proxy will be voted for the remainder of the listed nominees and for such other nominees as may be designated by the Board as replacements for those who become unavailable. Discretionary authority to do so is included in the proxy.

The following table sets forth certain information concerning the persons who have been nominated for election as directors.

Name

| | Age

| | Position

|

|---|

| Tommy A. Moore, Jr. | | 45 | | Chairman of the Board, President and Chief Executive Officer |

| Roberto Marchesini | | 58 | | Director and Vice President—Portfolio Risk Management |

| Walter A. Stockard | | 90 | | Director |

| Robert L. Clarke(2) | | 60 | | Director |

| Walter A. Stockard, Jr.(1) | | 50 | | Director |

| Seymour M. Jacobs(1)(2) | | 41 | | Director |

| John H. Buck(1) | | 59 | | Director |

| Daniel M. Theriault(2) | | 44 | | Director |

- (1)

- Member of the Compensation Committee

- (2)

- Member of the Audit Committee

Tommy A. Moore, Jr., a co-founder of the Company in 1989, has served as its President and Chief Executive Officer and a director since that time. Mr. Moore was elected to the additional position of Chairman of the Board in July 2000. Prior to organizing the Company, Mr. Moore was employed in commercial banking in Houston, Texas where his responsibilities included retail and commercial lending and also served for a time as manager of finance and leasing for a Houston auto dealership.

Dr. Roberto Marchesini became a director in June 1995, and served as the Treasurer, Secretary and Chief Financial Officer of the Company from its inception in 1989 until May 1, 1996, when his duties were reduced to enable him to resume his teaching pursuits. He remains a director and also continues to serve the Company as its Vice President—Portfolio Risk Management. Prior to June 1995 and subsequent to May 1, 1996 to present, he has also been employed as a Professor of Finance at the University of Houston, Clear Lake, where he has taught in the areas of finance, economics and accounting since 1974 and has served as the Associate Director of the University's Center for Economic Development and Research. Dr. Marchesini holds a Ph.D. degree in economics conferred by the University of Texas in 1974 and a degree in accounting received from the Technical Institute of Rome in 1963.

Walter A. Stockard, a certified public accountant, co-founded the Company with Mr. Moore in 1989 and has been a director since that time. Mr. Stockard is an independent oil operator and an investor in oil and gas properties. He founded Alamo Barge Lines, Inc. in 1947 and was a substantial shareholder of that company until its sale in 1980. Mr. Stockard was also a founder of Big Six Drilling Company in 1945 and served as its vice president until 1992.

2

Robert L. Clarke became a director in June 1995, and has been a senior partner of the law firm of Bracewell & Patterson LLP, Houston, Texas since 1992. From 1985 to 1992, he served as the Comptroller of the Currency of the United States. Mr. Clarke also serves as a director of Centex Construction Products, Inc., a publicly-held company.

Walter A. Stockard, Jr. has been a director of the Company since 1989 and has been an investor in oil and gas properties and real estate for more than the past five years.

Seymour M. Jacobs became a director in November 2000 and is the founder and General Partner of JAM Partners, L.P., a hedge fund based in New York City and the managing member of Jacobs Asset Management LLC, an investment management firm also located in New York City. Prior to founding these firms, Mr. Jacobs worked as an investment securities analyst from 1983-1995, including most recently with Alex. Brown and Sons which served as the lead underwriter of the Company's initial public offering. Mr. Jacobs also serves as a director of Provident Financial Holdings, Inc., a publicly-held holding company for Provident Savings Bank, F.S.B.

John H. Buck is a retired founding partner of the Houston law firm of Buck, Keenan and Gage and served as coporate legal counsel to the Company from 1992 until his retirement in 2001. Mr. Buck is a graduate of Yale Law School and has over 31 years experience in general corporate and securities law and commercial litigation including transactional work in corporate finance and mergers and acquisitions. Mr. Buck serves on the Board of Directors of Sterling Bancshares, Inc., a Houston-based publicly-held bank holding company.

Daniel M. Theriault joined the Board of Directors in April 2003. He currently serves as a Senior Portfolio Manager with John A. Levin & Co. based in New York. Prior to joining John A. Levin & Co. in 1997, he served as President and Chairman of the Advisory Committee for the T. Rowe Price Financial Services Fund from its inception in September 1996 through October 1997 and served as Vice President and research analyst primarily responsible for analyzing the insurance and financial services industries from 1995 to 1997. Previously Mr. Theriault spent five years as a securities analyst, four years in the insurance industry and five years in public accounting. He graduated with a B.S., cum laude from Boston College and holds designations as a Certified Public Accountant and as a Chartered Financial Analyst.

Recommendation Regarding Election of Directors

The Board of Directors recommends that you vote FOR the eight named nominees to be elected as our directors.

PROPOSAL 2:

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Board of Directors has selected the accounting firm of Grant Thornton LLP as our independent auditors to audit the books and records of us and our subsidiaries for the fiscal year ending April 30, 2004, subject to ratification by our shareholders. Grant Thornton LLP has served as our independent auditors for the past two fiscal years and has provided audit opinions for the past four fiscal years.

A representative of Grant Thornton LLP is expected to be present at the annual meeting and will have the opportunity to make a statement if he or she desires to do so and is expected to be available to respond to appropriate questions.

Recommendation Regarding the Ratification of the Appointment of Grant Thornton LLP

The Board of Directors recommends that you vote FOR ratification of this appointment.

3

OTHER INFORMATION CONCERNING THE BOARD OF DIRECTORS

During the fiscal year ended April 30, 2003, the Board of Directors met five times. All directors attended 75 percent or more of the meetings of the Board of Directors and of the committees of the Board on which they served during the past fiscal year.

The Board of Directors has two committees: the Audit Committee and the Compensation Committee. The Audit Committee, which met five times during the past fiscal year, acts as a direct liaison between the Board and our independent auditors, and its functions include recommending the engagement of auditors, reviewing the scope and results of the annual audit and reviewing, as appropriate, our accounting policies, internal controls and financial reporting practices. The Audit Committee operates under a written charter approved by the Board of Directors. The Audit Committee is composed of three directors, Robert L. Clarke, Chairman, Seymour M. Jacobs and Daniel M. Theriault. Each member of the audit committee meets the membership requirements and is independent as defined in Rule 4200(a)(14) of the National Association of Securities Dealers, Inc.

The Compensation Committee, which met one time during the past fiscal year, is responsible for formulating recommendations to the Board concerning salaries, bonuses and other compensation arrangements for executive management and for administering the 1995 Employee Stock Option Plan. The Executive Compensation Committee is composed of three non-employee directors, John H. Buck, Seymour M. Jacobs and W.A. Stockard, Jr. The Board of Directors has no nominating committee.

We pay a monthly fee in the amount of $500 to each director who is not one of our officers or employees, and reimburse their out-of-pocket expenses incurred in connection with their services as such, including travel expenses. In addition, under the 2002 Non-Employee Director Stock Option Plan, each director is awarded, on July 15th of each year, stock options representing the right to purchase 20,000 shares of common stock of the Company. In addition, directors who are not employees of the Company may be eligible for additional option grants in the event we meet certain pre-determined profitability goals for the fiscal year.

In August 1995, when Robert L. Clarke joined the Board of Directors, he was granted a non-transferable option to purchase up to 20,000 shares of common stock, in recognition of the fact that he was the only member of the Board who was neither one of our executive officers nor a substantial shareholder. The option is exercisable in whole at any time or in part from time to time at an exercise price of $11.00 per share. On August 2, 2000, in recognition of Mr. Clark's service as a board member, the Board of Directors granted Mr. Clark a non-transferable option to purchase up to 50,000 shares of common stock, which is exercisable in whole at any time or in part from time to time at an exercise price of $4.75 per share Both options will terminate one year after Mr. Clarke ceases to be a member of the Board of Directors, except that in the event of Mr. Clarke's death while serving as a director the options would be exercisable by his heirs or representatives of his estate for a period of two years after the date of his death. In connection with the adoption by shareholders of the 2002 Non-Employee Director Stock Option Plan, the 50,000 options awarded in 2000 to Mr. Clarke were cancelled and reissued, under identical terms, as an award under the plan.

Walter A. Stockard, Jr. is the son of Walter A. Stockard.

OTHER EXECUTIVE OFFICER

Our other executive officer who is not also a director, and who serves at the pleasure of the Board of Directors, is as follows:

Name

| | Age

| | Position

|

|---|

| Bennie H. Duck | | 39 | | Executive Vice President, Secretary, Treasurer and Chief Financial Officer |

Bennie H. Duck joined us in May 1996 as Executive Vice President, Secretary, Treasurer and Chief Financial Officer. Mr. Duck was previously employed for ten years by Bank of America in various capacities and most recently as a Vice President of Corporate Finance where his responsibilities included corporate lending and capital market activities for both high yield and high grade clients. His previous experience includes middle market corporate finance and real estate construction and development finance.

4

SUMMARY COMPENSATION TABLE

The following table sets forth, for the past three fiscal years, the compensation of our President, Chief Financial Officer, and Chief Operating Officer.

| | Annual Compensation

| | Long Term

Securities

Underlying

Options/SARS

| |

|

|---|

Name and Principal Position

| | All Other

Compensation(1)

|

|---|

| | Year

| | Salary

| | Bonus

|

|---|

Tommy A. Moore, Jr.

President and Chief Executive Officer | | 2001

2002

2003 | | $

$

$ | 150,000

150,000

150,000 | | $

| 233,349

- -0-

- -0- | | -0-

- -0-

15,000 |

(3) | $

$

$ | -0-

1,163

1,125 |

Joseph A. Pisano(4)

Chief Operating Officer |

|

2001

2002

2003 |

|

$

$

$ |

150,000

150,000

150,000 |

|

$

|

- -0-

5,000

- -0- |

|

30,000

- -0-

5,000 |

(2)

|

$

$

$ |

- -0-

1,125

1,125 |

Bennie H. Duck

Chief Financial Officer |

|

2001

2002

2003 |

|

$

$

$ |

140,000

150,000

150,000 |

|

$

|

15,000

- -0-

- -0- |

|

30,000

- -0-

10,000 |

(2)

(3) |

$

$

$ |

- -0-

1,092

1,125 |

- (1)

- Reflects amounts contributed by us as regular matching contributions under our 401(K) Plan.

- (2)

- Consists of options under our 1995 Employee Stock Option Plan granted effective August 2, 2000 and April 5, 2001 covering 20,000 shares of common stock and 10,000 shares of common stock, respectively.

- (3)

- Consists of options granted under our 1995 Employee Stock Option Plan effective September 11, 2002.

- (4)

- Mr. Pisano's employment with the Company ceased on June 30, 2003.

The following table sets forth information concerning the grant of stock options under the 1995 Employee Stock Option Plan to officers named in the Summary Compensation Table above.

OPTION GRANTS IN FISCAL YEAR 2003

| | Individual Grants

|

|---|

| | Number of

Securities

Underlying

Options

Granted

(Shares)

| | Percentage

of Total

Options

Granted to

Employees

in fiscal year

| |

| |

| | Potential Realizable Value at Assumed Annual Rate of Stock Price Appreciation for Option Terms ($)(2)

|

|---|

Name

| | Exercise

Price

($/Share)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Tommy A. Moore, Jr. | | 15,000 | (1) | 23.1 | % | $ | 2.95 | | 9/11/2012 | | $ | 27,829 | | $ | 70,523 |

Bennie H. Duck |

|

10,000 |

|

15.4 |

% |

$ |

2.95 |

|

9/11/2012 |

|

$ |

18,552 |

|

$ |

47,015 |

Joseph A. Pisano |

|

5,000 |

|

7.7 |

% |

$ |

2.95 |

|

9/11/2012 |

|

$ |

9,276 |

|

$ |

23,508 |

- (1)

- The options vest in cumulative annual increments of 20% beginning September 11, 2004.

- (2)

- These amounts represent certain assumed rates of appreciation based on actual option term and annual compounding from the date of the grant. Actual gains, if any, on stock option exercises are dependent on the future performance of the common stock of the Company and overall market conditions. There can be no assurance that the stock appreciation amounts reflected in the table will be achieved.

5

The following table sets forth certain information with respect to the exercise of options to purchase common stock during the year ended April 30, 2003, and the unexercised options held at April 30, 2003 and the value thereof, by each of the named executive officers.

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND

FISCAL YEAR END OPTION/SAR VALUES

| |

| |

| | Number of Securities

Underlying Unexercised

Options/SARS at Fiscal Year End

| | Value of Unexercised

In-the-Money Options/SARS

at Fiscal Year-End

|

|---|

| | Shares

Acquired

on Exercise

(#)

| |

|

|---|

| | Value

Realized

($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Tommy A.Moore, Jr. | | — | | — | | 0 | | 15,000 | | $ | 0 | | $ | 17,250 |

| Bennie H. Duck | | — | | — | | 42,000 | | 28,000 | | $ | 400 | | $ | 12,100 |

| Joseph A. Pisano | | — | | — | | 22,000 | | 23,000 | | $ | 400 | | $ | 6,350 |

The following table sets forth certain information with respect to the aggregate amount of stock options issued by the Company under both plans approved by shareholders and plans not approved by shareholders as of April 30, 2003.

EQUITY COMPENSATION PLAN

Plan category

| | Number of securities to be issued upon exercise of outstanding options at Fiscal Year End

(a)

| | Weighted-average exercise price of outstanding options, warrants and rights

(b)

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column(a)

(c)

|

|---|

| Equity compensation plans approved by security holders | | 439,500 | | $ | 4.73 | | 560,500 |

| Equity compensation plans not approved by security holders | | 20,000 | | $ | 11.00 | | -0- |

| Total | | 459,500 | | | | | 560,500 |

EMPLOYMENT AGREEMENTS

As of April 30, 2003, there were no employment agreements in place between the Company and any executive officer or key employee.

STOCK OPTION PLANS

In June 1995, the Board of Directors adopted the Company's 1995 Employee Stock Option Plan (the "Plan"), which was thereafter approved by the shareholders of the Company. In September 2002, the shareholders approved an amendment to the Plan to increase the shares available under the Plan to an aggregate of 500,000. The Plan is administered by the Compensation Committee of the Board of Directors and provides that options may be granted to officers and other key employees for the purchase of up to 500,000 shares of common stock, subject to adjustment in the event of certain changes in capitalization. Options may be granted either as incentive stock options (which are intended to qualify for certain favorable tax treatment) or as non-qualified stock options.

6

The Compensation Committee selects the persons to receive options and determines the exercise price, the duration, any conditions on exercise and other terms of the options. In the case of options intended to be incentive stock options, the exercise price may not be less than 100% of the fair market value per share of Common Stock on the date of grant. With respect to non-qualified stock options, the exercise price may be fixed as low at 50% of the fair market value per share at the time of grant. In no event may the duration of an option exceed 10 years and no option may be granted after the expiration of 10 years from the adoption of the Plan.

The exercise price of the option is payable in full upon exercise and payment may be in cash, by delivery of shares of common stock (valued at their fair market value at the time of exercise), or by a combination of cash and shares. At the discretion of the Compensation Committee, options may be issued in tandem with stock appreciation rights entitling the option holder to receive an amount in cash or in shares of common stock, or a combination thereof, equal in value to any increase since the date of grant in the fair market value of the common stock covered by the option.

As of July 23, 2003, the Compensation Committee had granted options representing the right to purchase a total of 292,000 shares of common stock to officers and key employees of the Company under the 1995 Employee Stock Option Plan leaving 208,000 shares available under the plan.

In September 2002, the shareholders approved the 2002 Non-Employee Director Stock Option Plan under which non-employee directors are issued, on July 15th of each year, an option to purchase 20,000 shares of common stock at a strike price equal to the average market price on the date of grant. In addition, non-employee directors may be issued additional options annually to the extent that we achieve certain operating results that are predetermined prior to the beginning of the fiscal year. Each option is issued for a term of 10 years and each grant vests in equal annual installment over the three years following the grant date. As of July 23, 2003, a total of 270,000 options had been issued to non-employee directors leaving a remaining 230,000 available under the plan. The Company had also granted, in 1995, stock options covering a total of 20,000 shares of common stock, to a Director who is neither an officer nor an employee. The terms of this option, which was not issued under the Plan, are described above under "Other Information Concerning the Board of Directors."

7

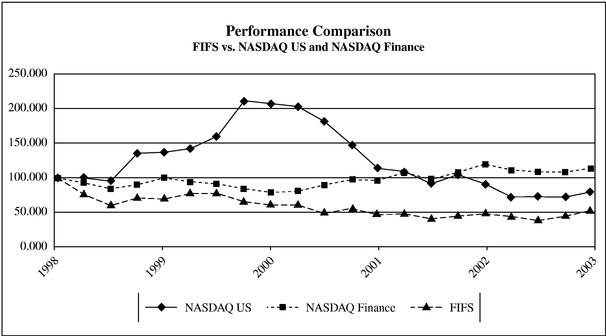

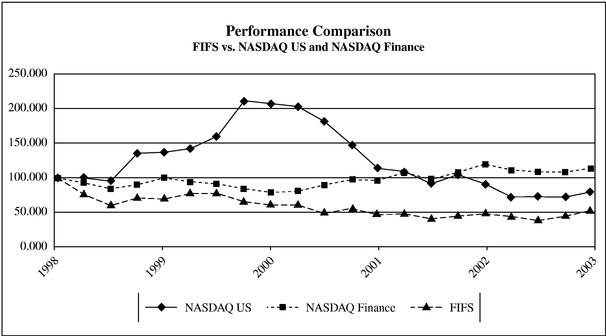

PERFORMANCE GRAPH

Set forth below is a line graph comparing the annual percentage change in the cumulative total shareholder return on the Company's (FIFS) common stock from May 1, 1998 through April 30, 2003 against the cumulative total return indices of the Nasdaq Stock (U.S.) Index and the Nasdaq Financial Index for the comparable period. The historical stock price performance for the Company's stock shown on the graph below is not necessarily indicative of future stock performance. The Company will not make nor endorse any predictions of future stock performance.

COMPENSATION COMMITTEE REPORT

The Compensation Committee establishes and administers the Company's executive compensation programs. Executive officers of the Company whose compensation is established by the Compensation Committee are Tommy A. Moore, Jr., Bennie H. Duck and Joe Pisano, prior to his departure from the Company on June 30, 2003.

The Compensation Committee strives to establish and maintain a competitive, fair and equitable compensation and benefits policy designed to retain personnel and to stimulate their useful and profitable efforts on behalf of the Company. Under the supervision of the Compensation Committee, the Company develops and implements compensation policies, plans and programs designed to enhance the profitability of the Company, and therefore shareholder value, by aligning closely the financial interests of the Company's senior executives with those of its shareholders. The Compensation Committee has adopted the following guidelines for making its compensation decisions:

- •

- Provide a competitive total compensation package that enables the Company to attract and retain key executives.

- •

- Integrate all compensation programs with the Company's annual and long-term business objectives and strategy and focus executive behavior on the fulfillment of those objectives.

- •

- Provide variable compensation opportunities that are directly linked to the performance of the Company and that align executive remuneration with the interests of shareholders.

8

The Compensation Committee establishes all components of executive pay and reports and recommends its decisions to the Board for approval. During 2003, the primary components of the Company's executive compensation program were (1) base salary, (2) bonuses, and (3) stock option grants under the Company's 1995 Employee Stock Option Program.

The Compensation Committee reviews the salary of each of these executive officers annually. In determining each executive officer's base salary the Compensation Committee considers the individual's performance, the performance of the Company and the individual's contribution to that performance, as well as the compensation practices of other companies. No changes were made to the base salaries of Mr. Moore and Mr. Duck during the 2003 fiscal year, pending a review of the Company's financial performance during the year and the Company's achievement of certain strategic and operating objectives. In May 2003, the Compensation Committee recommended an increase in Mr. Moore's annual salary from $150,000 to $210,000 and an increase in Mr. Duck's annual salary from $150,000 to $190,000. The decision to increase the base salary of Mr. Moore and Mr. Duck was based on (i) increased duties and responsibilities as a result of management changes within the Company; (ii) operating accomplishments during the year, particularly with respect to the acquisition of servicing rights and the investment in an additional $500 million in managed assets; and (iii) consideration of the compensation levels of chief executive officers and chief financial officers of comparable consumer finance companies. The Compensation Committee also noted that Mr. Moore had not received an adjustment in base salary since 1995.

Bonus compensation is discretionary and is formulated and paid on an annual basis following the Company's fiscal year end. A determination of whether to pay a bonus and the amount of any bonus is based primarily upon the overall performance of the Company and secondarily on the individual performance of each executive officer. During the 2003 fiscal year, no bonuses were paid to executive officers as a consequence of the Company's financial performance for the 2002 fiscal year falling below internally generated goals. In July 2003, the Compensation Committee awarded Mr. Moore a bonus equal to 5% of consolidated pre-tax income for the 2003 fiscal year of the Company or $26,190. In May 2003, the Compensation Committee awarded Mr. Duck a performance bonus of $15,000. These bonuses were recommended in recognition of Mr. Moore's and Mr. Duck's contributions to the performance of the Company during the 2003 fiscal year including their role in growing the total managed assets of the Company through portfolio acquisitions.

Awards under the 1995 Employee Stock Option Plan to executive officers, management and all other employees of the Company are established by the Compensation Committee. The Compensation Committee believes that grants of stock options to executive officers, management and other key employees of the Company align the interests of these individuals with the interests of stockholders. Stock options provide an ongoing, long-term, incentive to executive officers, management and key employees as the value of the stock options depends on the continued success of the Company. During the 2003 fiscal year, the Compensation Committee recommended an award of options to purchase 15,000 shares of common stock to Mr. Moore, options to purchase 10,000 shares of common stock to Mr. Duck and options to purchase 5,000 shares of common stock to Mr. Pisano in lieu of any cash bonus for the fiscal year. These option grants were made during 2003.

9

As of July 23, 2003, stock options covering a total of 292,00 shares of common stock had been awarded under the 1995 Employee Stock Option Plan, with 208,000 shares remaining available for future grants. As of July 23, 2003, 270,000 options have been granted under the 2002 Non -Employee Director Stock Option Plan with 230,000 shares remaining available for future grants.

Date: July 28, 2003

2003 Compensation Committee

of the Board of Directors

John H. Buck

Walter A. Stockard, Jr.

Seymour M. Jacobs

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During the 2003 fiscal year, no executive officer of the Company served as (i) a member of the compensation committee (or other board committee performing equivalent functions) of another entity, one of whose executive officers served on the Compensation Committee, (ii) a director of another entity, one of whose executive officers served on the Compensation Committee, or (iii) a member of the Compensation Committee (or other board committee performing equivalent functions) of another entity, one of whose executive officers served as a director of the Company.

AUDIT COMMITTEE REPORT

To the Shareholders of First Investors Financial Services Group, Inc.

We have reviewed and discussed with management the Company's audited financial statements as of and for the fiscal year ended April 30, 2003. We have discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61,Communications with the Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants. We have also received and reviewed the written disclosures and the letter from the independenet auditors required by Independent Standard No. 1, Independent Discussions with Audit Committees, as amended, by the Independent Standards Board, and have discussed the auditors' independence with the auditors.

Based on the reviews and discussions referred to above, we recommend to the Board of Directors that the financial statements referred to above be included in the Company's Annual Report on Form 10-K for the year ended April 30, 2003.

10

AUDIT FEES

The following is a description of fees paid to Grant Thornton LLP or scheduled to be paid under an engagement agreement to Grant Thornton LLP for services in fiscal years 2002 and 2003. The final amounts actually paid for the fiscal year 2003 audit may differ by an immaterial amount based on the final hourly billing by Grant Thornton LLP.

| | Fiscal Year 2002

| | Fiscal Year 2003

|

|---|

| Audit Fees | | | | | | |

| | Applicable Fiscal Year | | $ | 121,526 | | $ | 147,803 |

| | Prior Periods(1) | | | 0 | | | 213,388 |

| | | Total Audit Fees | | $ | 121,526 | | $ | 361,191 |

Audit Related Fees(2) |

|

$ |

15,000 |

|

$ |

24,139 |

| Other Fees(3) | | $ | 7,500 | | | |

| | |

| |

|

| Total Fees | | $ | 136,526 | | $ | 392,830 |

- (1)

- Reflects fees paid in fiscal year 2003 for the re-audit of fiscal years 2000 and 2001 previously performed by Arthur Andersen LLP in connection with a restatement of prior period results.

- (2)

- Relates to certain attestation work performed in connection with the Company's activities as loan servicer for affiliated entities and audit research associated with the formation of an acquisition subsidiary.

- (3)

- Reflects fees paid in connection with certain consultation work on board compensation and non-employee director stock options.

The Audit Committee has considered whether the provision of the non-audit services by the Company's independent auditor is compatible with maintaining auditor independence and has concluded that any non-audit services performed by the independent auditor did not create a conflict of interest with respect to the issuance of the 2003 audit opinion. Effective July 10, 2003, the Audit Committee has also adopted a revised Audit Committee Charter which is included as Exhibit A to this proxy statement.

Date: July 10, 2003

2003 Audit Committee

of the Board of Directors

Robert L. Clarke

Seymour M. Jacobs

Daniel M. Theriault

11

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information regarding beneficial ownership of our common stock, as of July 23, 2003, by: (i) each person who is known by us to own beneficially more than 5% of the issued and outstanding shares of common stock, (ii) each director, and (iii) each executive officer named in the Summary Compensation Table elsewhere herein. Unless otherwise indicated, each of the persons has sole voting and dispositive power over the shares of common stock shown as beneficially owned by such person.

Name and Address

| | Position

with Company

| | Amount and

Nature of

Beneficial

Ownership

| | Percent of

Class

| |

|---|

Tommy A. Moore, Jr.

675 Bering, Suite 710

Houston, Texas 77057 | | Chairman of the Board, President and Chief Executive Officer | | 400,000 | | 8.0 | % |

Bennie H. Duck

675 Bering, Suite 710

Houston, Texas 77057 |

|

Chief Financial Officer |

|

42,000 |

(1) |

* |

|

Walter A. Stockard, Jr.

2001 Kirby, Suite 901

Houston, Texas 77019 |

|

Director |

|

366,667 |

(2) |

7.3 |

% |

Walter A. Stockard

2001 Kirby, Suite 901

Houston, Texas 77019 |

|

Director |

|

81,667 |

(3) |

1.6 |

% |

Roberto Marchesini

675 Bering, Suite 710

Houston, Texas 77057 |

|

Director and Vice President—Portfolio Risk Management |

|

36,000 |

(4) |

* |

|

Robert L. Clarke

711 Louisiana, Suite 2900

Houston, Texas 77002 |

|

Director |

|

76,667 |

(5) |

1.5 |

% |

Seymour M. Jacobs

One Fifth Avenue

New York, New York 10003 |

|

Director |

|

496,567 |

(6) |

9.9 |

% |

John H. Buck

5100 Bank of America Center

700 Louisiana

Houston, Texas 77002 |

|

Director |

|

11,667 |

(7) |

* |

|

Daniel M. Theriault

One Rockefeller Plaza, 19th Floor

New York, New York 10020 |

|

Director |

|

280,900 |

(9) |

5.6 |

% |

J. Randal Roberts

15 Sundown Parkway

Austin, Texas 78746 |

|

|

|

366,669 |

(8) |

7.3 |

% |

JAM Partners, Ltd.

One Fifth Avenue

New York, New York 10003 |

|

|

|

429,100 |

(6) |

8.6 |

% |

| | | | | | | | |

12

Dimensional Fund Advisors

1299 Ocean Avenue, 11th Floor

Santa Monica, California 90401 |

|

|

|

402,600 |

|

8.0 |

% |

Kristene S. Moore

P.O. Box 460445

Houston, Texas 77056 |

|

|

|

400,000 |

|

8.0 |

% |

Hot Creek Ventures I, LP

P.O. Box 3178

Gardnerville, Nevada |

|

|

|

403,431 |

|

8.1 |

% |

Cypress Asset Management

2929 Allen Parkway

Houston, Texas 77019 |

|

|

|

251,100 |

|

5.1 |

% |

All executive officers and directors as a group (9 persons) |

|

|

|

1,792,135 |

(10) |

34.6 |

% |

- *

- Less than 1% of the Common Stock outstanding.

- (1)

- Reflects currently exercisable portion of stock options held by Mr. Duck covering 70,000 shares in the aggregate.

- (2)

- Consists of 360,000 shares held by Mr. Stockard as custodian for two minor children, as to which he disclaims beneficial ownership; and 6,667 shares representing the currently exercisable portion of stock options held by Mr. Stockard covering 40,000 shares in the aggregate.

- (3)

- Includes 6,667 shares representing the currently exercisable portion of stock options held by Mr. Stockard covering 40,000 shares in the aggregate.

- (4)

- Reflects the currently exercisable portion of stock options held by Dr. Marchesini covering 50,000 shares in the aggregate.

- (5)

- Reflects 76,667 shares representing the currently exercisable portion of stock options held by Mr. Clarke covering 110,000 shares in the aggregate.

- (6)

- Includes 429,100 shares held by JAM Partners, LP, 30,000 shares held by Mr. Jacobs individually, 30,000 shares held by JAM Special Opportunities Fund LP, 800 shares held by other affiliated individuals or entities as to which Mr. Jacobs may be deemed to be a beneficial holder and 6,667 shares representing the currently exercisable portion of stock options held by Mr. Jacobs covering 40,000 shares in the aggregate.

- (7)

- Consists of shares owned by J.H. Buck Descendants' Trust over which Mr. Buck has sole voting and dispository powers and 6,667 shares representing the currently exercisable portion of stock options held by Mr. Buck covering 40,000 shares in the aggregate.

- (8)

- Reflects 50,000 shares held by Mr. Theriault individually, 202,800 shares held by Palladium Partners LP, and 28,100 shares held by Palladium Offshore, Ltd.. With respect to the Palladium Partners LP shares, Mr. Theriault has a controlling interest in a general partner of Palladium Partners LP and serves as the portfolio manager of the managing general partner of Palladium Partners LP. He disclaims beneficial and pecuniary interest in a percentage of the shares not represented by his limited partnership interest which changes from time to time. With respect to the Palladium Offshore, Ltd. shares, Mr. Theriault is a non-controlling shareholder of Palladium Offshore, Ltd. and serves as a portfolio manager for the investment advisor to Palladium Offshore, Ltd. Mr. Theriault disclaims a pecuniary interest in these shares and disclaims beneficial ownership of the shares not represented by his ownership percentage in Palladium Offshore, Ltd.

- (9)

- Includes 20,000 shares held by a trust for a minor child, as to which Mr. Roberts disclaims beneficial ownership.

- (10)

- Includes 186,335 shares issuable upon the exercise of stock options that are currently exercisable.

13

RELATED PARTY TRANSACTIONS

On December 3, 2001, we entered into an agreement with W.A. Stockard, a member of our Board of Directors under which we may, from time to time, borrow up to $2.5 million. The proceeds of the borrowings will be utilized to fund certain private and open market purchases of our common stock pursuant to a Stock Repurchase Plan authorized by the Board of Directors and for general corporate purposes. Borrowings under the facility bear interest at a fixed rate of 10 percent per annum. The facility is unsecured and expressly subordinated to our senior credit facilities. The facility matures on December 3, 2008, but may be repaid at any time unless we are in default on one of our other credit facilities. As of July 23, 2003, $746,280 was outstanding under this facility. Total interest expense incurred under this facility during the fiscal year ended April 30, 2003, was $106,643.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Pursuant to Section 16(a) of the Securities Exchange Act of 1934, as amended, directors, executive officers and beneficial owners of more than ten percent of the outstanding common stock are required to file reports with the Securities and Exchange Commission reporting their beneficial ownership of common stock at the time they become subject to the reporting requirements and at the time of any changes in beneficial ownership occurring thereafter.

Based upon a review of reports submitted to us and representations of persons known by us to be subject to these reporting requirements, we believe that all such reports due in the fiscal year ended April 30, 2003, other than those discussed herein, were filed on a timely basis.

Mr. Jacobs filed one report on Form 4 reporting the purchase of 14,800 shares of common stock on October 19, 2002. The Form 4 was due to be filed on October 21, 2002 and was filed on October 22, 2002, one day past the deadline.

SHAREHOLDER PROPOSALS

Any proposals of shareholders which are intended to be presented at the 2004 Annual Meeting of shareholders must be received by the Secretary by April 5, 2004, for consideration for inclusion in the proxy statement and form of proxy for that meeting. Any such proposals should be submitted to us at 675 Bering Drive, Suite 710, Houston, Texas 77057, Attention: Corporate Secretary.

Such proposals must also have complied with Rule 14a-8 under the Securities Exchange Act of 1934, as amended, if the proposal is to be considered for inclusion in our proxy statement for such meeting. We must receive notice of any shareholder proposal to be brought before the meeting outside the process of Rule 14a-8 at the address noted above not less than 45 days prior to the meeting; provided, if we give notice or prior public disclosure of the date of the annual meeting less than 50 days before the meeting, such shareholder's notice must be received not later than the close of business on the seventh day following the date on which our notice of the date of the annual meeting was mailed or public disclosure made.

| | | By Order of the Board of Directors |

|

|

Bennie H. Duck, Secretary |

14

Exhibit A

Audit Committee Charter

This Audit Committee Charter adopted by the Board shall be effective July 10, 2003 and may be amended from time to time at the discretion of the Board.

PURPOSE

The Audit Committee ("the Committee") is established to assist the Board of Directors ("the Board") of First Investors Financial Services Group, Inc. ("the Company") in fulfilling its responsibilities for monitoring (i) the integrity of the quarterly and annual financial and accounting information to be provided to the shareholders and the Securities and Exchange Commission ("SEC"); (ii) the system of internal controls that management has established; (iii) the Company's independent auditor's qualifications and independence, (iv) the performance of the Company's internal audit functions and its independent auditor; and (v) the Company's compliance with legal and regulatory requirements governing the preparation and reporting of financial information.

COMPOSITION

The Committee will be comprised of three or more directors, as determined by the Board, each of whom will be independent and otherwise qualified in accordance with applicable law, including SEC and NASDAQ National Market ("NASDAQ") rules. The Board will elect one of the members of the Committee to be the Committee Chair. To the extent that, upon adoption of this Charter, the composition of the Committee does not satisfy the foregoing requirements, then the Board shall make the necessary appointments of members such that the Committee is in compliance upon the first annual shareholders' meeting occurring after January 1, 2004. It is understood that the Board has complete discretion in electing and removing members of the Committee.

MEETINGS

The Committee will meet at least four times annually in conjunction with the completion of the Company's quarterly and annual financial statements and as many additional times as the Committee deems necessary. Meetings may be held either in person or telephonically. Content of the agenda for each meeting should be submitted and approved by the Committee Chair prior to the meeting. The Committee may meet in separate executive sessions with the chief financial officer and independent auditor at other times when considered appropriate.

ATTENDANCE AND QUORUM REQUIREMENTS

Committee members will be expected to participate in all meetings. As necessary or desirable, the Committee Chair may request that members of management and representatives of the independent auditor be present at Committee meetings. A quorum for conducting a Committee meeting shall exist with the presence of a majority of the elected members in attendance either in person or telephonically.

VOTING

Business matters and requests presented to the Committee for consideration shall be deemed approved with the consent of a majority of members present. Matters failing to achieve a majority consent shall be considered declined by the Committee.

15

AUTHORITY

The Committee shall have the sole authority to appoint or replace the independent auditor (subject, if applicable, to shareholder ratification). The Committee shall be directly responsible for the compensation and oversight of the work of the independent auditor (including the resolution of disagreements between management and the independent auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or related work. The Committee shall determine the permitted non-audit services (including the fees and terms thereof) to be performed for the Company by its independent auditor. The independent auditor shall report directly to the Committee.

The Committee shall have the authority to investigate any matter or activity involving financial accounting and financial reporting, as well as the internal controls of the Company. All employees shall be directed to cooperate with respect thereto as requested by members of the Committee. The Committee shall have the authority, to the extent it deems necessary or appropriate to the performance of its duties, to engage and determine funding for, independent legal, accounting or other advisors. The Company shall provide for appropriate funding, as determined by the Committee, for payment of compensation to the independent auditor and to any advisors employed by the Committee. The Committee may also delegate authority to one or more designated members of the Committee, including the authority to pre-approve all auditing and permitted non-audit services, providing that such decisions are presented to the full Committee at its next scheduled meeting.

SPECIFIC DUTIES

In carrying out its oversight responsibilities, the Committee will:

Review of Documents and Reports

- 1.

- At the completion of the annual audit, review with management and the independent auditor the following:

- -

- The annual financial statements and related footnotes and financial information to be included in the Company's annual report to shareholders on Form 10-K including: (i) the selection and disclosure of all critical accounting policies and practices used; (ii) any management certifications related thereto; and (iii) any certification, report, opinion or review rendered by the independent auditor.

- -

- Results of the audit of the financial statements and the related report thereon and, if applicable, a report on changes during the year in accounting principles and their application.

- -

- Significant developments in accounting guidelines, policies and procedures including any changes in generally accepted accounting principles which may impact the Company's accounting policies or financial results.

- -

- Other communications as required to be communicated by the independent auditor by Statement of Auditing Standards (SAS) 61 as amended by SAS 90 relating to the conduct of the audit.

- 2.

- After preparation by management and review by independent auditor, approve the report required under SEC rules to be included in the Company's annual proxy statement. The Audit Committee Charter is to be published as an appendix to the proxy statement every three years.

16

- 3.

- Review with the Company's management and the independent auditor prior to filing the Company's interim financial information, earnings press release and the financial information contained in the Company's quarterly reports on Form 10-Q, including: (i) the selection, application and disclosure of the critical accounting policies and practices used; and (ii) any management certifications related thereto. The Chair may represent the Committee for purposes of review.

- 4.

- Review any reports submitted by the independent auditor, including a report, if prepared, relating to: (i) all critical accounting policies and practices used; (ii) all alternative treatments of financial information within generally accepted accounting principles that have been discussed with management, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditor; and (iii) other material written communications between the independent auditor and management, such as any management letter or schedule of unadjusted differences.

- 5.

- Review disclosures made by the Company's CEO and CFO during the Forms 10-K and 10-Q certification process about significant deficiencies in the design or operation of internal controls or any fraud that involves management or other employees who have a significant role in the Company's internal controls

- 6.

- Generally as part of the review of the annual financial statements, receive an oral report(s), at least annually, from legal counsel concerning legal and regulatory matters that may have a material impact on the financial statements.

Control Processes

- 7.

- Review with the Company's management and the independent auditor the Company's accounting and financial reporting controls. Obtain annually in writing from the independent auditor their letter as to the adequacy of such controls.

- 8.

- Require that the independent auditor advise management and the Committee, through its Chair, of any matters identified through the procedures followed for interim quarterly financial statements that may adversely affect the quality or the acceptability of the quarterly financial reports. This notification as required under standards for communication with the Audit Committees regarding the effect on the quality of significant events, transactions, and changes in accounting estimates, is to be made prior to the related press release or, if not practicable, prior to filing Form 10-Q with the SEC.

- 9.

- Meet with management and the independent auditor to discuss any relevant significant recommendations that the independent auditor may have, particularly those characterized as "material" or "serious". Typically, such recommendations will be presented by the independent auditor in the form of a Letter of Comments and Recommendations to the Committee. The Committee should review responses of management to the Letter of Comments and Recommendations from the independent auditor and receive follow-up reports on action taken concerning the aforementioned recommendations.

- 10.

- Discuss with the independent auditor the quality of the Company's financial and accounting personnel. Also elicit the comments of management regarding the responsiveness of the independent auditor to the Company's needs.

Internal Audit

- 11.

- Review with the Company's management any required annual internal audit plan; any significant findings during the year and management's responses thereto; and the effectiveness and adequacy of the internal audit function

17

External Audit

The Committee will:

- 12.

- Review with the Company's management and the independent auditor significant changes to the audit plan, if any, and any serious disputes or difficulties with management encountered during the audit. Inquire about the cooperation received by the independent auditor and whether there have been any disagreements with management which if not satisfactorily resolved, would have caused them to issue a nonstandard report on the Company's financial statements.

- 13.

- Pre-approve in accordance with applicable law (including SEC and NASDAQ rules) all audit and permissible non-audit services provided to the Company by the independent auditor. The Committee may delegate this responsibility to one or more members of the Committee.

- 14.

- Review the scope and general extent of the independent auditor's annual audit. The Committee's review should include an explanation from the independent auditor of the factors considered in determining the audit scope, including the major risk factors. The independent auditor should confirm to the Committee that no limitations have been placed on the scope or nature of their audit procedures.

- 15.

- At least annually, hold a discussion with the independent auditor as to (i) the independent auditor's internal quality control procedures; and, (ii) any material issues raised by the most recent internal quality control review, or peer review, of the registered public accounting firm, or by any inquiry or investigation by governmental or professional authorities which may have a material adverse impact on the ability of the independent auditors to perform the duties outlined in the audit engagement or indicate improper control procedures which may have bearing on the adequacy and accuracy of the independent audit performed on the Company.

- 16.

- Inquire as to the independence of the independent auditor and obtain from the independent auditor, at least annually, a formal written statement delineating all relationships and services between the independent auditor and the Company as contemplated by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committee.

- 17.

- Engage in a dialogue with the independent auditor with respect to any disclosed relationships or services that may impact the objectivity and independence of the auditor and take, or recommend that the full Board take, appropriate action to oversee the independence of the independent auditor.

- 18.

- Review any reports submitted to the Committee by the independent auditor.

- 19.

- Discuss with the external auditor, at least annually, the audit committee's views about fraud risks in the Company and the committee's knowledge of any fraud or suspected fraud.

- 20.

- Instruct the external auditor to inform the audit committee of any fraud involving senior management and fraud (whether caused by senior management or other employees) that causes a material misstatement of the financial statements.

- 21.

- Reach an understanding with the external auditor regarding the committee's expectations of the nature and extent of communications from the external auditor to the committee about misappropriations perpetrated by lower-level employees.

Compliance

- 22.

- As the Committee may deem appropriate, obtain, weigh and consider expert advice as to Audit Committee related rules of the NASDAQ, Statements on Auditing Standards and other accounting, legal and regulatory provisions.

18

- 23.

- Review with management and the independent auditor the methods used to establish and monitor the Company's policies with respect to unethical or illegal activities by Company employees that may have a material impact on the financial statements.

- 24.

- Establish procedures for: (i) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting control, or auditing matters; and (ii) the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters in compliance with applicable law, including SEC rules.

- 25.

- Review and investigate any matters pertaining to the integrity of management, including conflicts of interest, or adherence to standard of conduct, as required by the Code of Conduct policy adopted by the Board and any other policies of the Company governing the integrity and conduct of management which the Board determines should be overseen by the Committee. This Code of Conduct will be applicable to all directors, officers and employees and shall be made publicly available in accordance with SEC and NASDAQ rules.

Other Responsibilities

- 26.

- Make reports and recommendations to the Board on matters within the scope of the Committee's functions.

- 27.

- Review and reassess the adequacy of this charter annually and recommend any proposed changes to the Board for approval. This should be done in compliance with applicable SEC and NASDAQ Audit Committee Requirements.

- 28.

- Should the Company receive an audit opinion that contains a going concern explanatory paragraph, the Committee will assure that the Company makes a timely public announcement through the public news media disclosing the receipt of such explanatory paragraph and provides the text of the public announcement to the appropriate NASDAQ department in accordance with NASDAQ rules.

- 29.

- Review and approve, where appropriate, all related-party transaction as are required to be disclosed pursuant to SEC Regulation S-K, Item 404.

- 30.

- Engage independent counsel and other advisors, as the Committee deems necessary or appropriate to carry out its duties, with funding provided by the Company.

- 31.

- Perform other activities related to this charter as requested by the Board.

Limitation of Audit Committee's Role

While the Committee has the responsibilities and powers set forth in this charter, it is not the duty of the Committee to plan or conduct audits or to determine that the Company's financial statements and disclosures are complete and accurate and in accordance with generally accepted accounting principles and applicable rules and regulations. These are responsibilities of management and the independent auditor.

19

FIRST INVESTORS FINANCIAL

SERVICES GROUP, INC.

ANNUAL MEETING OF SHAREHOLDERS

Wednesday, September 10, 2003

.........................................................................................................................................................

First Investors Financial Services Group, Inc. |

|

proxy |

|

This Proxy is solicited by the Board of Directors

For the Annual Meeting of Shareholders September 10, 2003

Tommy A. Moore, Jr., and Roberto Marchesini, and each or any of them, with full power of substitution and revocation in each, are hereby appointed as Proxies authorized to represent the undersigned, with all powers which the undersigned would possess if personally present, to vote the Common Stock of the undersigned at the Annual Meeting of Shareholders of FIRST INVESTORS FINANCIAL SERVICES GROUP, INC. to be held at 675 Bering Drive, Suite 710, Houston, Texas 77057 on Wednesday, September 10, 2003 at 10:00 a.m., and at any postponements or adjournments of that meeting, as set forth on the reverse side, and in their discretion upon any other business that may properly come before the meeting.

This proxy will be voted as specified or, if no choice is specified, will be voted FOR the election of the nominees named and FOR each of the other proposals specified herein.

See reverse for voting instructions.

-Please detach here-

The Board of Directors Recommends a Vote FOR Items 1 and 2.

1. Election of directors:

| | 01 Tommy A. Moore, Jr.

02 Walter A. Stockard

03 Walter A. Stockard, Jr.

04 Robert L. Clarke | | 05 Roberto Marchesini

06 Seymour M. Jacobs

07 John H. Buck

08 Daniel M. Theriault | | o | | Vote FOR

all nominees

(except as marked)

| | o | | Vote WITHHELD

from all nominees

| | | | |

(Instructions: To withhold authority to vote for any indicated nominee, write the number(s) of the nominee(s) in the box provided to the right.) |

|

|

|

|

2. Ratification of the appointment of Grant Thornton LLP as independent accountants of the Company and its subsidiaries for the fiscal year ending April 30, 2004. |

|

o |

|

For |

|

o |

|

Against |

|

o |

|

Abstain |

3. In their discretion the proxies are authorized to vote upon such other matters as may come before the meeting or any adjournment thereof. |

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS GIVEN, WILL BE VOTED FOR EACH PROPOSAL. |

Address Change? Mark Box o Indicate changes below: |

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature(s) in Box

Please sign exactly as your name(s) appears on Proxy. If held in joint tenancy, all persons must sign. Trustees, administrators, etc., should include title and authority. Corporations should provide full name of corporation and title of authorized officer signing the proxy. |

QuickLinks

VOTING SECURITIESPROPOSAL 1: ELECTION OF DIRECTORSPROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORSOTHER INFORMATION CONCERNING THE BOARD OF DIRECTORSOTHER EXECUTIVE OFFICERSUMMARY COMPENSATION TABLEOPTION GRANTS IN FISCAL YEAR 2003AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR END OPTION/SAR VALUESEQUITY COMPENSATION PLANEMPLOYMENT AGREEMENTSSTOCK OPTION PLANSPERFORMANCE GRAPHCOMPENSATION COMMITTEE REPORTCOMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATIONAUDIT COMMITTEE REPORTAUDIT FEESSECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERSRELATED PARTY TRANSACTIONSSECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCESHAREHOLDER PROPOSALSPURPOSECOMPOSITIONMEETINGSATTENDANCE AND QUORUM REQUIREMENTSVOTINGAUTHORITYSPECIFIC DUTIES