UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

| | BIRNER DENTAL MANAGEMENT SERVICES, INC. | |

| | (Name of Registrant as Specified in Its Charter) | |

| | | |

| | (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

BIRNER DENTAL MANAGEMENT SERVICES, INC.

1777 SOUTH HARRISON STREET, SUITE 1400

DENVER, COLORADO 80210

April 30, 2013

TO THE SHAREHOLDERS OF BIRNER

DENTAL MANAGEMENT SERVICES, INC.:

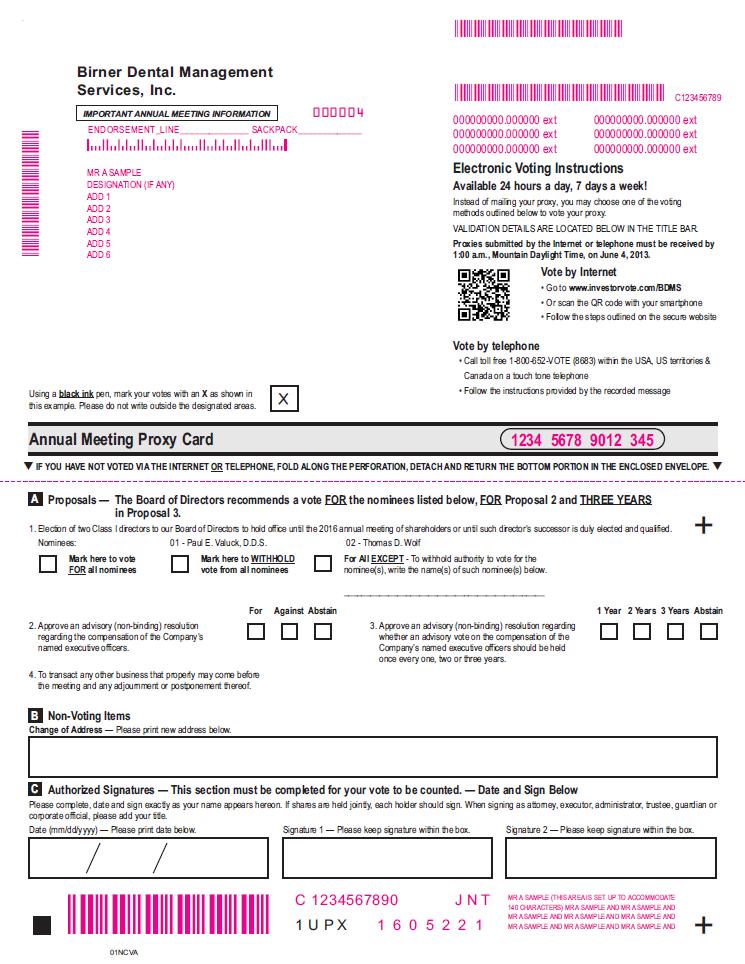

You are cordially invited to attend the 2013 Annual Meeting of Shareholders of Birner Dental Management Services, Inc., to be held on Tuesday, June 4, 2013, at 10:00a.m., Mountain Time, at the Company’s offices, 1777 South Harrison Street, Suite 1400, Denver, Colorado 80210, for the following purposes:

| (1) | To elect two Class I directors to our Board of Directors to hold office until the 2016 annual meeting of shareholders or until such director’s successor is duly elected and qualified. |

| (2) | To consider and vote upon a proposal to approve an advisory (non-binding) resolution regarding the compensation of the Company’s named executive officers. |

| (3) | To consider and vote upon a proposal to approve an advisory (non-binding) resolution regarding whether an advisory vote on the compensation of the Company’s named executive officers should be held once every one, two or three years. |

| (4) | To transact any other business that properly may come before the meeting and any adjournment or postponement thereof. |

Please read the enclosed Proxy Statement for the meeting. Whether or not you plan to attend the meeting, please sign, date and return the proxy card in the enclosed postage prepaid, addressed envelope, as soon as possible so that your vote will be recorded. If you attend the meeting, you may withdraw your proxy and vote your shares in person.

Very truly yours,

BIRNER DENTAL MANAGEMENT SERVICES, INC.

| By: | /s/ Frederic W. J. Birner | |

| | Name: | Frederic W.J. Birner | |

| | Title: | Chairman of the Board and Chief Executive Officer | |

BIRNER DENTAL MANAGEMENT SERVICES, INC.

1777 SOUTH HARRISON STREET, SUITE 1400

DENVER, COLORADO 80210

NOTICE OF

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 4, 2013

TO OUR SHAREHOLDERS:

The 2013 Annual Meeting of Shareholders of Birner Dental Management Services, Inc., a Colorado corporation (“we”, “us” or “our”), will be held on Tuesday, June 4, 2013, at 10:00 a.m., Mountain Time, at our offices, 1777 South Harrison Street, Suite 1400, Denver, Colorado 80210, for the following purposes:

| (1) | To elect two Class I directors to our Board of Directors to hold office until the 2016 annual meeting of shareholders or until such director’s successor is duly elected and qualified. |

| (2) | To consider and vote upon a proposal to approve an advisory (non-binding) resolution regarding the compensation of the Company’s named executive officers. |

| (3) | To consider and vote upon a proposal to approve an advisory (non-binding) resolution regarding whether an advisory vote on the compensation of the Company’s named executive officers should be held once every one, two or three years. |

| (4) | To transact any other business that properly may come before the meeting and any adjournment or postponement thereof. |

As fixed by our Board of Directors, only shareholders of record at the close of business on April 15, 2013 are entitled to notice of and to vote at the meeting. You may view and/or download the 2013 proxy statement and our annual report on Form 10-K atwww.edocumentview.com/BDMS.

THE BOARD OF DIRECTORS RECOMMENDS SHAREHOLDERS VOTE FOR EACH OF THE TWO CLASS I DIRECTOR NOMINEES, FOR THE APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT, AND FOR THE OPTION OF ONCE EVERY THREE YEARS AS THE PREFERRED FREQUENCY FOR ADVISORY VOTES ON EXECUTIVE COMPENSATION.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | |

| | /s/ Dennis N. Genty |

| | Name: | Dennis N. Genty |

| | Title: | Chief Financial Officer, Secretary and Treasurer |

Denver, Colorado

April 30, 2013

A PROXY CARD IS ENCLOSED. YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN. TO ASSURE THAT YOUR SHARES WILL BE VOTED AT THE MEETING, PLEASE COMPLETE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED, POSTAGE PREPAID, ADDRESSED ENVELOPE. NO ADDITIONAL POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. THE GIVING OF A PROXY WILL NOT AFFECT YOUR RIGHT TO VOTE IN PERSON IF YOU ATTEND THE MEETING.

BIRNER DENTAL MANAGEMENT SERVICES, INC.

1777 SOUTH HARRISON STREET, SUITE, 1400

DENVER, COLORADO 80210

proxy statement

annual meeting of shareholders

to be held June 4, 2013

GENERAL INFORMATION

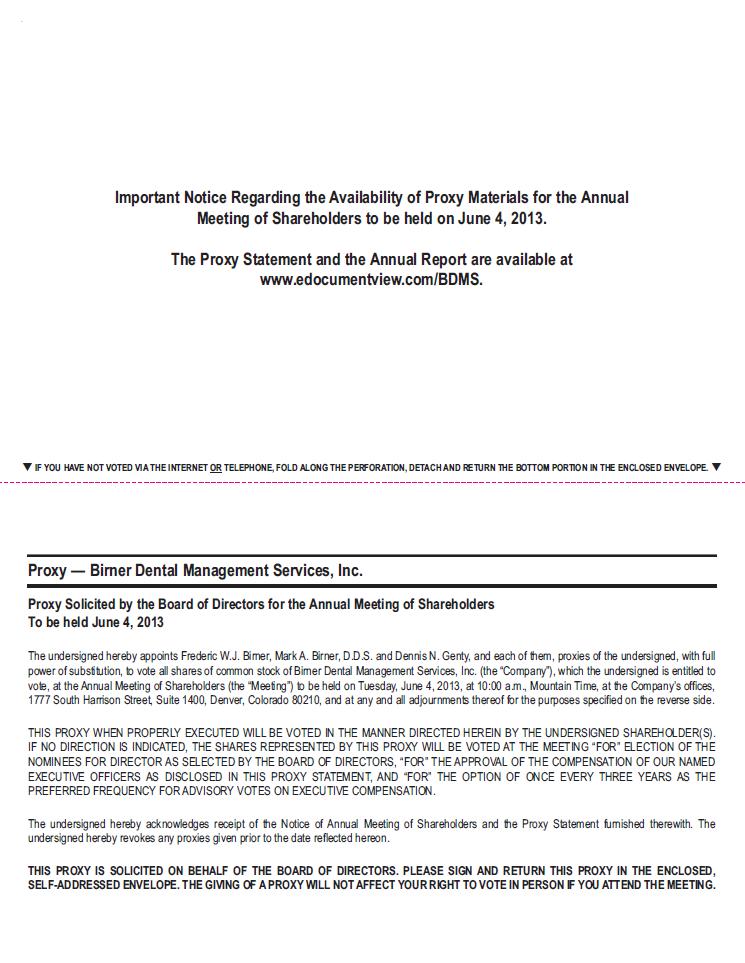

The enclosed proxy is solicited by and on behalf of the Board of Directors of Birner Dental Management Services, Inc., a Colorado corporation (“we”, “us” or “our”), for use at our 2013 Annual Meeting of Shareholders to be held at 10:00 a.m., Mountain Time, on Tuesday, June 4, 2013, at our offices, 1777 South Harrison Street, Suite 1400, Denver, Colorado 80210, and at any and all adjournments thereof. This Proxy Statement and the accompanying form of proxy are first being mailed or given to our shareholders on or about April 30, 2013.

Our Annual Report on Form 10-K for the year ended December 31, 2012 (the “Annual Report”), which includes audited financial statements, is being mailed to our shareholders simultaneously with this Proxy Statement. The Annual Report is not part of our proxy soliciting materials.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on June 4, 2013.

This Proxy Statement and the Annual Report are available at www.edocumentview.com/BDMS.

INFORMATION CONCERNING SOLICITATION AND VOTING

Shareholders are being asked to elect two Class I Directors, vote on advisory (non-binding) resolutions regarding the compensation of our named executive officers and whether an advisory vote on the compensation of our named executive officers should be held once every one, two or three years, and act on any other matters that may properly come before the meeting or any adjournments thereof. All voting rights are vested exclusively in the holders of our common stock. Each share of common stock is entitled to one vote. Cumulative voting in the election of directors is not permitted. Holders of a majority of shares entitled to vote at the meeting, present in person or by proxy, constitute a quorum. On April 15, 2013, the record date for shareholders entitled to vote at the meeting, 1,851,598 shares of common stock were issued and outstanding.

Proxies in the enclosed form will be effective if properly executed and returned to us prior to the meeting in the enclosed, postage prepaid, addressed envelope. The common stock represented by each effective proxy will be voted at the meeting in accordance with the instructions on the proxy. If no instructions are indicated on a proxy, all common stock represented by such proxy will be voted for election of the nominees named on the proxy as Class I directors, for the approval of the advisory (non-binding) resolution regarding the compensation of our named executive officers, for “Once Every Three Years” on the advisory (non-binding) resolution regarding whether an advisory vote on compensation should be held once every one, two or three years, and as to any other matters of business that may properly come before the meeting, in the discretion of the named proxies.

Any shareholder signing and mailing the enclosed proxy may revoke it at any time before it is voted by giving written notice of the revocation to us by June 3, 2013, by voting in person at the meeting or by submitting at the meeting a later executed proxy.

When a quorum is present, in the election of directors, the nominees having the highest number of votes cast in favor of their election will be elected to the Board of Directors. A vote of the holders of a majority of the common stock present, either in person or by proxy, and entitled to vote, is required to approve the advisory (non-binding) resolution regarding the compensation of our named executive officers. Approval of the advisory (non-binding) resolution regarding whether an advisory vote on compensation should be held once every one, two or three years requires the affirmative vote of the holders of a plurality of the votes cast affirmatively or negatively. With respect to any other matter that may properly come before the meeting, unless a greater number of votes are required by law or by our Amended and Restated Articles of Incorporation, a matter will be approved by the shareholders if the number of votes cast favoring the action exceeds the number of votes cast opposing the action. Abstentions, broker non-votes (i.e., shares held by brokers or nominees as to which the broker or nominee indicates on a proxy that it does not have discretionary authority to vote) and any other shares not voted will be treated as shares that are present for purposes of determining the presence of a quorum. However, for purposes of determining the outcome of the election of the Class I directors, the proposals on advisory (non-binding) resolutions regarding the compensation of our named executive officers and whether an advisory vote on the compensation of our named executive officers should be held once every one, two or three years, abstentions, broker non-votes and any other shares not voted will not be considered as votes cast. Thus, abstentions, broker non-votes and any other shares not voted will have no impact on any matter that may properly come before the meeting so long as a quorum is present.

We will pay the cost of soliciting proxies in the accompanying form. We have retained the services of Broadridge and Georgeson to assist in distributing proxy materials to brokerage houses, banks, custodians and other nominee holders. The estimated cost of such services is approximately $2,700 plus out-of-pocket expenses. Although there are no formal agreements to do so, our officers and other regular employees may solicit proxies by telephone or by personal interview for which the officers or employees will not receive additional compensation. Arrangements also may be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to beneficial owners of the shares held of record by such persons, and we may reimburse such persons for reasonable out-of-pocket expenses incurred by them in so doing.

Proposal ONE: ELECTION OF TWO class I DIRECTORS

General

Our Amended and Restated Articles of Incorporation provide for the classification of our Board of Directors. The Board of Directors has set the size of the Board at five members divided into three classes, with one of the three classes standing for re-election at each annual meeting ofshareholders.

Class I is made up of two directors (Paul E. Valuck, D.D.S. and Thomas D. Wolf) who are standing for re-election at this 2013 annual meeting of shareholders. Class II is made up of one director (Brooks G. O’Neil) whose term will expire upon the election and qualification of a director at the 2014 annual meeting of shareholders. Class III is made up of two directors (Frederic W.J. Birner and Mark A. Birner, D.D.S.) whose terms will expire upon the election and qualification of directors at the 2015 annual meeting of shareholders.

At each annual meeting of shareholders, directors will be elected by our shareholders for a full term of three years to succeed the directors whose terms are expiring. The powers and responsibilities of each class of directors are identical. All directors will serve until their successors are duly elected and qualified, subject, however, to prior death, resignation, retirement, disqualification or removal from office.

Class I Director Nominees

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR ELECTION OF THE FOLLOWING NOMINEES AS OUR CLASS I DIRECTORS.

| Class of | | | | | | Director |

| Director | | Name | | Age | | Since |

| | | | | | | |

| Class I | | Paul E. Valuck, D.D.S. | | 56 | | 2001 |

| | | | | | | |

| Class I | | Thomas D. Wolf | | 58 | | 2004 |

Each nominee’s biography is set forth in “Directors and Executive Officers” below.

Continuing Directors

The persons named below will continue to serve on our Board of Directors until the annual meeting of shareholders in the year indicated below and/or until their successors are elected and take office. Shareholders are not voting on the election of any Class II or Class III directors this year. The following table shows the names, ages and positions of each continuing director. Each director’s biography is set forth in “Directors and Executive Officers” below.

Class of

Director | | Term

Expires

in Year | | Name | | Age | | Director

Since |

| | | | | | | | | |

| Class II | | 2014 | | Brooks G. O’Neil | | 56 | | 2003 |

| | | | | | | | | |

| Class III | | 2015 | | Frederic W.J. Birner | | 55 | | 1995 |

| | | | | | | | | |

| Class III | | 2015 | | Mark A. Birner, D.D.S. | | 53 | | 1995 |

| | | | | | | | | |

Required Vote

Assuming a quorum is present, the two nominees having the highest number of votes cast in favor of their election will be elected to the Board of Directors as Class I Directors. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

Proxies cannot be voted for a greater number of persons than the number of nominees named therein. Unless authority to vote is withheld, the persons named in the enclosed form of proxy will vote the shares represented by such proxy FOR the election of the nominees for director named above. If, at the time of the meeting, a nominee becomes unavailable for any reason for election as a director, the persons entitled to vote the proxy will vote for such substitute nominees, if any, in their discretion. If elected, the nominees will hold office until the 2016 annual meeting of shareholders or until their successors are elected and qualified.

The BOARD OF DIRECTORS RECOMMENDS that YOU VOTE ‘FOR’ EACH OF THE TWO CLASS I DIRECTOR NOMINEES.

Proposal two:ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) requires that we provide our shareholders with the opportunity to vote to approve, on a nonbinding, advisory basis, the compensation of our named executive officers as disclosed in this proxy statement.

In order to better align the long-term interests of our executives with our shareholders and to attract and retain highly qualified executives, our compensation programs have been designed to provide competitive levels of compensation that integrate pay with our performance, with an emphasis on recognizing individual initiative and achievements. We have based our compensation primarily on experience, expertise and performance, with a portion of potential compensation dependent upon our successful long-term performance.

This vote is advisory, which means that the vote on executive compensation is not binding on the Company, our Board of Directors or the Compensation Committee of the Board of Directors. The vote on this resolution is not intended to address any specific element of compensation, but rather relates to the overall compensation of our named executive officers, as described in this proxy statement in accordance with the compensation disclosure rules of the SEC. To the extent there is a vote against our named executive officer compensation as disclosed in this proxy statement, the Compensation Committee will evaluate whether any actions are necessary to address our shareholders’ concerns.

Accordingly, we ask our shareholders to vote on the following resolution at the Annual Meeting:

“RESOLVED, that the Company’s shareholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the 2013 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Summary Compensation Table and the other related tables and disclosure.”

Required Vote

The affirmative vote of a majority of the shares present or represented and entitled to vote either in person or by proxy is required to approve this proposal. Unless authority to vote is withheld, the persons named in the enclosed form of proxy will vote the shares represented by such proxy FOR the approval of the advisory vote on executive compensation. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS, AS DISCLOSED IN THIS PROXY STATEMENT.

| Proposal Three: | ADVISORY VOTE ON THE FREQUENCY OF AN ADVISORY VOTE ON EXECUTIVE COMPENSATION |

The Dodd-Frank Act added Section 14A to the Securities Exchange Act of 1934, which requires that we provide shareholders with the opportunity to vote, on a non-binding, advisory basis, for their preference as to how frequently to vote on future advisory votes on the compensation of our named executive officers as disclosed in accordance with the rules of the Securities and Exchange Commission. Shareholders may indicate whether they would prefer that we conduct future advisory votes on executive compensation once every one, two or three years. Shareholders also may abstain from casting a vote on this proposal.

The Board of Directors has determined that an advisory vote on executive compensation every three years will permit the shareholders of our small, micro-cap company to provide direct input on the Company’s executive

compensation philosophy, policies and practices as disclosed in the proxy statement, which is consistent with our efforts to engage in a dialogue with our shareholders on executive compensation and corporate governance matters and at the same time not over-burden our corporate administration. We believe that a three-year cycle provides the Board of Directors and the Compensation Committee with sufficient time to thoughtfully evaluate and respond to shareholder input and effectively implement changes, as needed, to our executive compensation program.

This vote is advisory, which means that the vote on the frequency is not binding on the Company, our Board of Directors or the Compensation Committee of the Board of Directors. The Board of Directors and the Compensation Committee will take into account the outcome of the vote; however, when considering the frequency of future advisory votes on executive compensation, the Board of Directors may decide that it is in the best interests of our shareholders and the Company to hold an advisory vote on executive compensation more or less frequently than the frequency receiving the most votes cast by our shareholders.

Required Vote

Approval of the advisory proposal requires the affirmative vote of a plurality of the votes cast affirmatively or negatively. Unless authority to vote is withheld, the persons named in the enclosed form of proxy will vote the shares represented by such proxy FOR “once every three years”, as the frequency of an advisory vote on executive compensation. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE OPTION OF “ONCE EVERY THREE YEARS” AS THE PREFERRED FREQUENCY OF AN ADVISORY VOTE ON EXECUTIVE COMPENSATION.

Corporate Governance matters

Director Independence

Our Board of Directors has determined that Thomas D. Wolf, Paul E. Valuck, D.D.S. and Brooks G. O’Neil qualify as independent directors (as defined in Nasdaq Rule 5605(a)(2)).

Nominations Process

We do not have a standing nominating committee or a nominating committee charter. Nominations for director are made by our independent directors. The Board of Directors believes that, considering the size of the Company and our Board of Directors, nominating decisions can be made effectively by our independent directors and there is no need for the added formality of a nominating committee.

The Board of Directors does not have an express policy with regard to the consideration of any director candidates recommended by our shareholders because the Board believes that it can adequately evaluate any such nominees on a case-by-case basis. The Board of Directors will consider director candidates proposed on a timely basis as described under “Shareholder Proposals,” and will evaluate shareholder-recommended candidates under the same criteria as internally generated candidates. Shareholders must include sufficient information about candidates nominated for director to enable our independent directors to consider the candidate’s qualifications and suitability for service on the Board of Directors. Although the Board of Directors does not currently have formal minimum criteria for nominees, substantial relevant business and industry experience would generally be considered important qualifying criteria, as would the ability to attend and prepare for Board, committee and shareholder meetings. Any candidate must state in advance his or her willingness and interest in serving on the Board of Directors and its committees.

Communications with Our Board

Because we are a small public company, our Board of Directors does not presently provide a website or a formal process for shareholders to send communications to the Board. However, shareholders wishing to contact any member (or all members) of the Board or any committee of the Board may do so by mail, addressed, either by name or title, to the Board of Directors or to any such individual director or group or committee of the directors, c/o Dennis N. Genty, Chief Financial Officer, Secretary and Treasurer, Birner Dental Management Services, Inc., 1777 South Harrison Street, Suite 1400, Denver, Colorado 80210. The Board believes that this approach serves the Board's and its shareholders' needs. There is no screening process, and all shareholder communications directed to a Board member, the Board or a committee of the Board are forwarded to the appropriate person or persons for review. Our Board of Directors intends to periodically evaluate its shareholder communication process, and may adopt additional procedures to facilitate shareholder communications with the Board of Directors as it deems necessary or appropriate.

Directors’ Meetings and Committees

The entire Board of Directors met fourtimes during the year ended December 31, 2012. Each director attended 100% of the Board of Directors’ meetings except for Mark A. Birner D.D.S., who attended three meetings. Our policy regarding attendance by members of the Board of Directors at our annual meeting of shareholders is to encourage our directors to attend, subject to their availability for travel at that time. Frederic W.J. Birner attended our 2012 annual meeting of shareholders.

Audit Committee

The Audit Committee is comprised solely of independent directors, as defined by applicable Nasdaq and Securities and Exchange Commission rules and regulations. The current members of the Audit Committee are Brooks G. O’Neil, Paul E. Valuck, D.D.S. and Thomas D. Wolf (Chairman). The Board of Directors has reviewed Nasdaq Rule 5605(a)(2) and has determined that Messrs. O’Neil, Valuck and Wolf are independent directors as defined in that rule. The Board of Directors has determined that Messrs. O’Neil and Wolf have accounting and related financial management expertise based on their years of relevant professional work experience and are qualified as audit committee financial experts within the meaning of Securities and Exchange Commission regulations. The Audit Committee met four times during the year ended December 31, 2012, and all members were present at each meeting.

The primary responsibilities of the Audit Committee are to select, engage, approve fees for and oversee our independent registered public accounting firm and pre-approve all services to be performed by them. Also the committee reviews and oversees our financial reporting process generally, the integrity of our financial statements, the independent registered public accounting firm’s qualifications and independence, the performance of our independent registered public accounting firm, and our compliance with legal and regulatory requirements.

The Board of Directors has adopted a written charter for the Audit Committee. We will provide a copy of the charter for the Audit Committee to any person, without charge, upon request by writing to: the Corporate Secretary, Birner Dental Management Services, Inc., 1777 South Harrison Street, Suite 1400, Denver, Colorado 80210. A copy of the charter was included as Appendix A to the Proxy Statement for the 2012 Annual Meeting of Shareholders.

Compensation Committee

The members of the Compensation Committee in 2012 were Brooks G. O’Neil, Paul E. Valuck, D.D.S. and Thomas D. Wolf, each of whom is an independent director as defined by applicable Nasdaq and Securities and Exchange Commission rules and regulations. The Compensation Committee met one time in 2012, and all members were present at the meeting.

The Compensation Committee is responsible for establishing and administering our general compensation policy and program, and for setting compensation for our executive officers. The Compensation Committee also possesses all of the powers of administration under our employee benefit plans, including the 2005 Equity Incentive Plan (“2005 Plan”). Subject to the provisions of those plans, the Compensation Committee determines the individuals eligible to participate in the plans, the extent of such participation and the terms and conditions under which benefits may be vested, received or exercised. The Compensation Committee determines grants to our executive officers and directors. The Compensation Committee has delegated to our Chief Executive Officer the authority to make grants to non-executive employees. The Compensation Committee does not currently have a charter, but is in the process of adopting a charter to comply with new Nasdaq requirements.

Audit Committee Report

The Audit Committee has reviewed and discussed the audited financial statements of the Company with management and has discussed with Hein & Associates LLP (“Hein”), the Company’s independent registered public accounting firm, the matters required to be discussed under Statement on Auditing Standards No. 61. In addition, the Audit Committee has received from Hein the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding Hein’s communications with the Audit Committee concerning its independence. The Audit Committee has reviewed the materials received from Hein and has met with representatives of Hein to discuss its independence.

Based on the review and discussions referred to above, the Audit Committee has recommended to the Board of Directors that the audited financial statements of the Company be included in its Annual Report on Form 10-K for the year ended December 31, 2012, for filing with the Securities and Exchange Commission.

| | THE AUDIT COMMITTEE |

| | |

| | Thomas D. Wolf (Chairman) |

| | Brooks G. O’Neil |

| | Paul E. Valuck, D.D.S. |

Code of Conduct

All of our employees, including our Chief Executive Officer, Chief Financial Officer, President and the persons performing similar functions, are required to abide by our code of conduct and business conduct policies to ensure that our business is conducted in a consistently legal and ethical manner. We intend to disclose any changes in or waivers from our code of conduct by filing a current report on Form 8-K with the Securities and Exchange Commission. A copy of the Company’s code of conduct is available on our website atwww.perfectteeth.com/legal.

Related Party Transactions

We do not have a formal written policy regarding the review, approval or ratification of related party transactions. However, all of our employees, officers and directors are required to comply with our code of conduct. The code of conduct addresses, among other things, actions that are required when potential conflicts of interest arise, including those from related party transactions. Specifically, if an employee, officer or director believes a conflict of interest exists or may arise, he or she is required to disclose immediately the nature and extent of the conflict, or potential conflict, to his or her supervisor, who, along with appropriate officials of the Company, will evaluate the conflict and take the appropriate action, if any, to ensure that our interests are protected. Any transaction between us and another party on terms that are reasonably believed to be at least as favorable as the terms that we otherwise could have obtained from an unrelated third party shall not create a conflict of interest or cause a violation of the code of conduct, provided that with respect to the directors and any member of senior management, the Audit Committee of the Board of Directors was given prior notice of such transaction. The rules in the code of conduct regarding conflicts of interest not only apply to all employees, officers and directors, but also to immediate family members and certain business associates of our employees, officers and directors.

Mark A. Birner, D.D.S., our President and a director, owns 55 of our 66 professional corporations through which we conduct our business. Dr. Birner does not receive any fees, payments or other compensation or remuneration from us or the professional corporations for services rendered to the professional corporations.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Beneficial Owners

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of April 15, 2013 by (i) all persons known by us to be the beneficial owners of 5% or more of our common stock, (ii) each director, (iii) each of our named executive officers, and (iv) all executive officers and directors as a group. Unless otherwise indicated, the address of each of the persons named below is our address, 1777 South Harrison Street, Suite 1400, Denver, Colorado 80210.

| Name of Beneficial Owner | | Number of Shares

Beneficially Owned

(1) | | | Percent of Class

(2) | |

| | | | | | | |

| Officers & Directors | | | | | | | | |

| Frederic W.J. Birner (3) | | | 329,708 | | | | 17.1 | % |

| Mark A. Birner, D.D.S. (4) | | | 408,956 | | | | 21.9 | % |

| Dennis N. Genty (5) | | | 146,320 | | | | 7.9 | % |

| Brooks G. O’Neil (6) | | | 36,191 | | | | 1.9 | % |

| Paul E. Valuck, D.D.S. (7) | | | 51,552 | | | | 2.8 | % |

| Thomas D. Wolf (8) | | | 59,817 | | | | 3.2 | % |

| | | | | | | | | |

| 5% Owners | | | | | | | | |

| Lee Schlessman (9) | | | 169,629 | | | | 9.2 | % |

| | | | | | | | | |

| All executive officers and directors (six persons) (10) | | | 1,032,544 | | | | 51.6 | % |

| (1) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock subject to options currently exercisable or exercisable within 60 days of April 15, 2013 are deemed outstanding for computing the percentage of the person or entity holding such securities but are not outstanding for computing the percentage of any other person or entity. Except as indicated by footnote, and subject to community property laws where applicable, the persons named in the table above have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. |

| (2) | Percentage of ownership for each beneficial owner is based on 1,851,598 shares of common stock outstanding at April 15, 2013 plus any options currently exercisable or exercisable within 60 days of April 15, 2013, computed separately for each beneficial owner using information provided in the following footnotes. |

| (3) | Includes 80,000 shares of common stock that are issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of April 15, 2013. |

| (4) | Includes 20,000 shares of common stock that are issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of April 15, 2013. |

| (5) | Gives effect to transfer of shares to Mr. Genty’s ex-wife in a divorce settlement completed in March 2013. Includes 10,000 shares of common stock that are issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of April 15, 2013. |

| (6) | Includes 13,000 shares of common stock that are issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of April 15, 2013. |

| (7) | Includes 9,000 shares of common stock that are issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of April 15, 2013. |

| (8) | Includes 16,000 shares of common stock that are issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of April 15, 2013. |

| (9) | The address for Mr. Schlessman is 1555 Blake Street, Suite 400, Denver, Colorado 80202. |

| (10) | Includes 148,000 shares of common stock issuable upon the exercise of options held by all executive officers and directors as a group that are currently exercisable or exercisable within 60 days of April 15, 2013. |

There has been no change in our control since the beginning of our last fiscal year, and there are no arrangements known to us, including any pledge of our securities, the operation of which may at a subsequent date result in a change in our control.

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth information concerning each of our directors and executive officers. All directors will serve until their successors are duly elected and qualified, subject, however, to prior death, resignation, retirement, disqualification or removal from office. Officers are appointed by and serve at the discretion of the Board of Directors.

| Name | | Age | | Position |

| Frederic W.J. Birner | | 55 | | Chairman of the Board, Chief Executive Officer and Director |

| Mark A. Birner, D.D.S. | | 53 | | President and Director |

| Dennis N. Genty | | 55 | | Chief Financial Officer, Secretary and Treasurer |

| Brooks G. O’Neil | | 56 | | Director |

| Paul E. Valuck, D.D.S. | | 56 | | Director |

| Thomas D. Wolf | | 58 | | Director |

Biographies

Frederic W.J. Birneris one of our founders and has served as Chairman of the Board and Chief Executive Officer since our inception in May 1995. Mr. Birner is the brother of Mark A. Birner, D.D.S.

Mark A. Birner, D.D.S.is one of our founders and has served as President, and as a director, since our inception in May 1995. Dr. Birner is the brother of Frederic W.J. Birner.

Dennis N. Gentyis one of our founders and has served as Secretary since May 1995 and as Chief Financial Officer and Treasurer since September 1995.

Brooks G. O’Neilwas appointed as a director in January 2003 and was first elected by our shareholders at the 2005 annual meeting of shareholders. Since October 2006 Mr. O’Neil has been employed by Dougherty & Co. as a Senior Research Analyst covering areas of growth and change in health services.

Paul E. Valuck, D.D.S.was appointed as a director in April 2001 and was first elected by our shareholders at the 2001 annual meeting of shareholders. Dr. Valuck has been in private dental practice in Denver, Colorado since January 1998.

Thomas D. Wolfwas appointed as a director in June 2004 and was first elected by our shareholders at the 2007 annual meeting of shareholders. Mr. Wolf joined Shield Security Systems, LLC, a privately held company in the security system business, in December 1998 and is currently its Chief Financial Officer. From April 2003 until June 2012, Mr. Wolf also served as Chief Executive Officer for Shield Security Systems, LLC.

Messrs. O’Neil and Wolf bring financial and business expertise to the Board of Directors based on their years of professional work experience. Mr. Valuck brings dental industry experience to the Board of Directors based on his many years as a practicing dentist.

BOARD LEADERSHIP STRUCTURE AND THE BOARD’S ROLE IN RISK OVERSIGHT

Leadership Structure

Our Company has three directors who are not employees of the Company and two directors who are employees of the Company. Mr. Frederic W.J. Birner, the Chief Executive Officer of our Company, is Chairman of the Board of Directors. Our Company combined the positions of CEO and Chairman of the Board because of the size of the Company and the efficiency involved. A lead independent director has not been designated because the Board does not believe it is warranted for a company of our size and complexity.

Risk Oversight

The Company’s Board of Directors as a whole reviews and discusses the Company’s overall risk regarding the Company’s operations and goals and how those risks are being managed. The Board of Directors meets quarterly to discuss the Company’s operations and financial standing and to hear briefings from executive management, outside counsel and auditors. The Audit Committee meets quarterly and then the independent members of the Board of Directors conduct an executive session without senior management.

Board Diversity

We do not have a standing nominating committee or a nominating committee charter. Nominations for director are made by our independent directors. The Board of Directors believes that, considering the size of the Company and our Board of Directors, nominating decisions can be made effectively by our independent directors and there is no need for the added formality of a nominating committee.

EXECUTIVE COMPENSATION SUMMARY

Executive Compensation for Years Ended December 31, 2011 and 2012

The following table summarizes, with respect to our Chief Executive Officer and each of our other executive officers (“Named Executive Officers”), information relating to the compensation earned for services rendered in all capacities during 2011 and 2012.

| | | | | | | | | | | Option Awards | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary | | | Bonus | | | Grant Date of Stock Award | | | Approval Date of Stock Award | | Stock Options Awarded | | | Grant Price | | | Fair Value of Stock Award on Grant Date | | | Non-Equity Incentive Plan Compensation | | | All Other Compensation | | | Total | |

| | | | | | | | | | | | | | | | | | | (1) | | | (2) | | | (3) | | | (4) | | | | |

| Frederic W.J. Birner | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Chairman of the Board, Chief Executive Officer and Director | | 2011 | | $ | 450,000 | | | $ | 73,970 | | | - | | | | | | 0 | | | $ | - | | | $ | - | | | $ | 228,900 | | | $ | 8,982 | | | $ | 761,852 | |

| | | 2012 | | $ | 450,000 | | | $ | 101,682 | | | 3/15/2012 | (5) | | 3/15/2012 | | | 50,000 | | | $ | 18.39 | | | $ | 267,990 | | | $ | - | | | $ | 9,047 | | | $ | 828,719 | |

| | | | | | | | | | | | | 6/7/2012 | (5) | | 3/15/2012 | | | 50,000 | | | $ | 17.10 | | | $ | 267,990 | | | $ | - | | | $ | - | | | $ | 267,990 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mark A. Birner, D.D.S. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| President and Director | | 2011 | | $ | 315,000 | | | $ | 49,228 | | | - | | | | | | 0 | | | $ | - | | | $ | - | | | $ | 114,450 | | | $ | 19,393 | | | $ | 498,071 | |

| | | 2012 | | $ | 315,000 | | | $ | 38,341 | | | - | | | | | | 0 | | | $ | - | | | $ | - | | | $ | - | | | $ | 19,546 | | | $ | 372,887 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dennis N. Genty | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Chief Financial Officer, Treasurer and Secretary | | 2011 | | $ | 315,000 | | | $ | 49,228 | | | - | | | | | | 0 | | | $ | - | | | $ | - | | | $ | 114,450 | | | $ | 21,937 | | | $ | 500,615 | |

| | | 2012 | | $ | 315,000 | | | $ | 43,341 | | | - | | | | | | 0 | | | $ | - | | | $ | - | | | $ | - | | | $ | 22,251 | | | $ | 380,592 | |

| (1) | Based on the last reported sales price of our common stock on March 15, 2012 and on June 7, 2012, respectively. |

| (2) | The amounts reported in this column reflect the grant date fair value of the stock awards computed in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 718, “Stock Compensation” (FASB ASC Topic 718). The assumptions used in the calculation of these amounts are included in note 2 to the Company’s audited financial statements for the year ended December 31, 2012 included in the Company’s Form 10-K for the year ended December 31, 2012. |

| (3) | Cash paid under the Company’s Long-Term Incentive Program that vested on December 31, 2011. See “Long-Term Incentive Program” below. |

| (4) | All other compensation is comprised solely of our contribution to the Named Executive Officer’s 401(k) Plan account and payment for medical/vision insurance premiums. |

| (5) | Options to purchase 50,000 shares of our common stock were granted to Frederic W.J. Birner on March 15, 2012 and vested on March 15, 2012. Options to purchase 50,000 shares of our common stock were granted to Frederic W.J. Birner on March 15, 2012 effective on shareholder approval of an amendment to the 2005 Plan, which occurred on June 7, 2012. Of these options, options to purchase 25,000 shares vest on March 15, 2014 and options to purchase 25,000 shares vest on March 15, 2015. |

Base Salary and Bonus

The Compensation Committee reviews the base salaries of the Company's executive officers on an annual basis. The Compensation Committee also determines bonuses. Base salaries and bonuses are determined based upon a subjective assessment of the nature and responsibilities of the position involved, the performance of the particular executive officer and of the Company, the officer's experience and tenure with the Company and base salaries paid to persons in similar positions with companies comparable to the Company. On November 9, 2010, the Compensation Committee met and approved an increase in base salary effective January 1, 2011 for Frederic W.J. Birner, from $400,000 to $450,000, for Mark A. Birner, from $275,000 to $315,000, and for Dennis N. Genty, from $275,000 to $315,000. These base salaries remained in effect in 2012.

Grant of Plan Based Awards

In March and June 2012, the Compensation Committee granted options to purchase an aggregate of 100,000 shares of common stock to Frederic W.J. Birner. See note 5 to the Executive Compensation table above.

Outstanding Equity Awards at December 31, 2012

The following table contains information regarding options outstanding with respect to the Named Executive Officers at December 31, 2012.

| | | | | Option Awards | |

| Name and Principal Position | | Year | | Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable | | | Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable | | | Option

Exercise

Price

($/Sh) | | | Option

Expiration

Date |

| | | | | | | | | | | (2) | | | |

| Frederic W.J. Birner | | | | | | | | | | | | | | | | |

| Chairman of the Board, | | | | | | | | | | | | | | | | |

| Chief Executive Officer | | | | | | | | | | | | | | | | |

| and Director | | 2008 | (1) | | 30,000 | | | | 0 | | | $ | 21.00 | | | 1/16/2015 |

| | | 2012 | (3) | | 50,000 | (4) | | | 50,000 | | | $ | 18.39 | | | 3/15/2019 |

| | | | | | | | | | | | | | | | | |

| Mark A. Birner, D.D.S. | | | | | | | | | | | | | | | | |

| President | | | | | | | | | | | | | | | | |

| and Director | | 2008 | (1) | | 20,000 | | | | 0 | | | $ | 21.00 | | | 1/16/2015 |

| | | | | | | | | | | | | | | | | |

| Dennis N. Genty | | | | | | | | | | | | | | | | |

| Chief Financial Officer | | | | | | | | | | | | | | | | |

| Treasurer and Secretary | | 2008 | (1) | | 10,000 | | | | 0 | | | $ | 21.00 | | | 1/16/2015 |

| 1. | Options to purchase 70,000 shares of our common stock were granted on January 16, 2008. For Frederic W.J. Birner, 30,000 options became fully vested as of January 16, 2011. For Mark A. Birner, D.D.S., 20,000 options became fully vested as of January 16, 2011. For Dennis N. Genty, 10,000 options became fully vested as of January 16, 2011. |

| | | |

| 2. | The option exercise price was based on the last reported sales price of our common stock on the grant date as reported on The Nasdaq Capital Market on January 16, 2008 of $21.00 per share and on March 15, 2012 of $18.39 per share. |

| | | |

| 3. | Options to purchase 50,000 shares of our common stock were granted on March 15, 2012 to Frederic W.J. Birner and vested on March 15, 2012. |

| | | |

| 4. | Options to purchase 50,000 shares of our common stock were granted on June 7, 2012 to Frederic W.J. Birner of which 25,000 options will vest on March 15, 2014 and 25,000 options will vest on March 15, 2015. |

Equity Compensation Plan Information

Information related to securities issuable and available for issuance under the 2005 Plan as of December 31, 2012 is set forth in the table below. For information about the 2005 Plan, see note 7 to the Company’s audited financial statements for the year ended December 31, 2012 included in the Company’s Form 10-K for the year ended December 31, 2012.

| | Number of

securities to be

issued upon

exercise of

outstanding options,

warrants and rights | | | Weighted-

average exercise

price of

outstanding

options,

warrants and

rights | | | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a)) | |

| Plan category | | (a) | | | (b) | | | (c) | |

| Equity compensation plans approved by security holders | | | (1) 477,767 | | | $ | 18.63 | | | | 114,268 | |

| Equity compensation plans not approved by security holders | | | - | | | | - | | | | - | |

| Total | | | 477,767 | | | $ | 18.63 | | | | 114,268 | |

| (1) | As of December 31, 2012, there were 224,437 shares issuable under exercisable options under the 2005 Plan. |

Long-Term Incentive Program

Effective in June 2009, the Company established a Long-Term Incentive Program (the “LTIP”) that provided for long-term performance-based cash and stock opportunities for the Named Executive Officers. The Named Executive Officers could earn an aggregate of up to $1,050,000 in cash and up to 80,000 shares of common stock of the Company. Frederic Birner, Dennis Genty and Mark A. Birner could earn up to 50%, 25% and 25% of the foregoing amounts, respectively. The Company issued RSUs with respect to the shares of common stock. Based on the performance targets attained during each of the three years ended December 31, 2011, the Named Executive Officers earned a total of 17,280 RSUs in 2009, 17,600 RSUs in 2010 and no RSUs in 2011. The LTIP expired on December 31, 2011. All amounts vested only if the executive officer was employed by the Company on December 31, 2011. All three of the Named Executive Officers were employees of the Company on December 31, 2011. For 2011, based on the performance targets attained during each of the three years ended December 31, 2011, Frederic Birner, Dennis Genty and Mark Birner were awarded 17,440, 8,720 and 8,720 shares of common stock, respectively, in settlement of the RSUs and the cash payments set forth under “Non-Equity Plan Compensation” in the Executive Compensation table above.

Payments upon Change in Control

Upon a change in control of our Company, as defined in the 2005 Plan, all outstanding options, restricted stock and RSUs automatically vest.

DIRECTORcompensation

Non-Employee Director Compensation for Year Ended December 31, 2012

The following table summarizes, with respect to non-employee directors, information relating to the compensation earned for services rendered in all capacities during 2012.

| | | | | | | | Option Awards (1) | | | | | | |

Name and Principal

Position | | Year | | Fees

Earned or

paid in

Cash | | | Grant Date of

Stock Option

Award | | Stock

Options

Awarded | | | Grant

Price | | | Fair Value of

Stock on

Grant Date | | | All Other

Compensation | | | Total | |

| | | | | | | | | | (2) | | | (3) | | | | | | | | | | |

| Brooks G. O'Neil | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director | | 2012 | | $ | 21,600 | | | 6/18/2012 | | | 4,000 | | | $ | 16.88 | | | $ | 67,520 | | | $ | - | | | $ | 89,120 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Paul E. Valuck, D.D.S. | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director | | 2012 | | $ | 21,600 | | | 6/18/2012 | | | 4,000 | | | $ | 16.88 | | | $ | 67,520 | | | $ | - | | | $ | 89,120 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Thomas D. Wolf | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director, Chairman of the Audit Committee | | 2012 | | $ | 29,600 | | | 6/18/2012 | | | 4,000 | | | $ | 16.88 | | | $ | 67,520 | | | $ | - | | | $ | 97,120 | |

| (1) | At December 31, 2012, the non-employee directors had the following options outstanding: Brooks G. O’Neal: 17,000, of which 13,000 were exercisable, Paul E. Valuck, D.D.S.: 13,000, of which 9,000 were exercisable, and Thomas D. Wolf: 20,000, of which 16,000 were exercisable. |

| (2) | On June 18, 2012, the non-employee directors were granted options to purchase an aggregate 12,000 shares of common stock. |

| | | 2012 Options | |

| Name | | Granted | |

| Brooks G. O’Neil | | | 4,000 | |

| Paul E. Valuck, D.D.S. | | | 4,000 | |

| Thomas D. Wolf | | | 4,000 | |

| Total Options Granted | | | 12,000 | |

| (3) | The option exercise price was based on the last reported sales price of our common stock on the grant date as reported on The Nasdaq Capital Market on June 18, 2012 of $16.88 per share. |

Base Fees

Directors who are our full-time employees receive no compensation for serving as directors. Non-employee directors are paid: 1) a $5,000 per calendar quarter retainer, 2) $200 per calendar quarter Audit Committee meeting, 3) $1,000 per annual Audit Committee meeting and 4) $2,000 per calendar quarter retainer for the Chairman of the Audit Committee. Such amounts have been in effect since 2009.

RELATIONSHIP WITH INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Independent Registered Public Accounting Firm

Hein has acted as our independent registered public accounting firm since November 2001. We expect that representatives of Hein will be present at the 2013 Annual Meeting of Shareholders and will have the opportunity to make a statement if they so desire. These representatives will also be available to respond to appropriate questions from shareholders at the meeting.

The Audit Committee reviews and pre-approves audit-related and permissible non-audit services to be performed by our independent registered public accounting firm. The fees shown below for 2012 and 2011 were approved in advance by the Audit Committee.

Hein was selected by the Audit Committee to perform the audit function for 2012. No independent registered public accounting firm has been selected to perform the audit function for 2013. It is expected that the Audit Committee will approve the engagement of an independent registered public accounting firm later in 2013.

Audit Fees

For the year ended December 31, 2012, Hein billed us $107,630 for professional services rendered for the audit of our annual financial statements and the reviews of the financial statements included in our Quarterly Reports on Form 10-Q filed during the year ended December 31, 2012.

For the year ended December 31, 2011, Hein billed us $79,800 for professional services rendered for the audit of our annual financial statements and the reviews of the financial statements included in our Quarterly Reports on Form 10-Q filed during the year ended December 31, 2011.

Audit-Related Fees

For the year ended December 31, 2012, Hein billed us $10,750 for audit-related professional services. These fees related to the audit of our 401(k) retirement savings plan.

For the year ended December 31, 2011, Hein billed us $11,080 for audit-related professional services. These fees related to the audit of our 401(k) retirement savings plan.

Other Fees

For the years ended December 31, 2011 and 2012, Hein did not bill us for any tax fees or other professional services besides the services described above.

section 16 reports

Section 16(a) of the Securities Exchange Act of 1934 requires directors, executive officers and beneficial owners of more than 10% of our outstanding shares to file with the Securities and Exchange Commission initial reports of ownership and reports regarding changes in their beneficial ownership of our shares. To our knowledge, and based solely on a review of the Section 16(a) reports furnished to us, all Section 16(a) reports were filed on a timely basis.

shareholder proposals

The Board of Directors does not have an express policy with regard to the consideration of any director candidates recommended by our shareholders because the Board believes that it can adequately evaluate any such nominees on a case-by-case basis. The Board of Directors will consider director candidates proposed on a timely basis and will evaluate shareholder-recommended candidates under the same criteria as internally generated candidates. Shareholders must include sufficient information about candidates nominated for director to enable our independent directors to consider the candidate’s qualifications and suitability for service on the Board of Directors. Although the Board of Directors does not currently have formal minimum criteria for nominees, substantial relevant business and industry experience would generally be considered important qualifying criteria, as would the ability to attend and prepare for Board, committee and shareholder meetings. Any candidate must state in advance his or her willingness and interest in serving on the Board of Directors and its committees.

We must receive shareholder proposals for inclusion in our proxy materials relating to the 2014 annual meeting of shareholders on or before December 31, 2013. Notice of proposals received after March 16, 2014 will be deemed untimely and will not be considered at the meeting.

2012 annual reporton form 10-K

OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2012 ACCOMPANIES THIS PROXY STATEMENT AND WAS FILED ELECTRONICALLY WITH THE SECURITIES AND EXCHANGE COMMISSION. THIS REPORT IS NOT PART OF OUR PROXY SOLICITING MATERIALS. SHAREHOLDERS WHO WISH TO OBTAIN, WITHOUT CHARGE, A COPY OF OUR ANNUAL REPORT (WITHOUT EXHIBITS) ON FORM 10-K SHOULD ADDRESS A WRITTEN REQUEST TO DENNIS N. GENTY, CHIEF FINANCIAL OFFICER, SECRETARY AND TREASURER, BIRNER DENTAL MANAGEMENT SERVICES, INC., 1777 SOUTH HARRISON STREET, SUITE 1400, DENVER, COLORADO 80210 OR THEY CAN OBTAIN THE INFORMATION ON OUR WEBSITE AT WWW.PERFECTTEETH.COM. WE WILL PROVIDE COPIES OF THE EXHIBITS TO THE FORM 10-K UPON PAYMENT OF A REASONABLE FEE.

Other business

As of the date of this Proxy Statement, management was not aware of any business not described above which would be presented for consideration at the meeting. If any other business properly comes before the meeting, it is intended that the shares represented by proxies will be voted in respect thereto in accordance with the judgment of the persons voting them.

The above Notice and Proxy Statement are sent by order of the Board of Directors.

| | /s/ Dennis N. Genty |

| | Dennis N. Genty |

| | Chief Financial Officer, Secretary and Treasurer |

Denver, Colorado

April 30, 2013