UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under Section 240.14a-12 |

| BIRNER DENTAL MANAGEMENT SERVICES, INC. |

| (Name of Registrant as Specified in Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

BIRNER DENTAL MANAGEMENT SERVICES, INC.

1777 SOUTH HARRISON STREET, SUITE 1400

DENVER, COLORADO 80210

May 17, 2017

TO THE SHAREHOLDERS OF BIRNER

DENTAL MANAGEMENT SERVICES, INC.:

You are cordially invited to attend the 2017 Annual Meeting of Shareholders of Birner Dental Management Services, Inc., to be held on Tuesday, June 20, 2017, at 10:00 a.m., Mountain Time, at the Company’s offices, 1777 South Harrison Street, Suite 1400, Denver, Colorado 80210, for the following purposes:

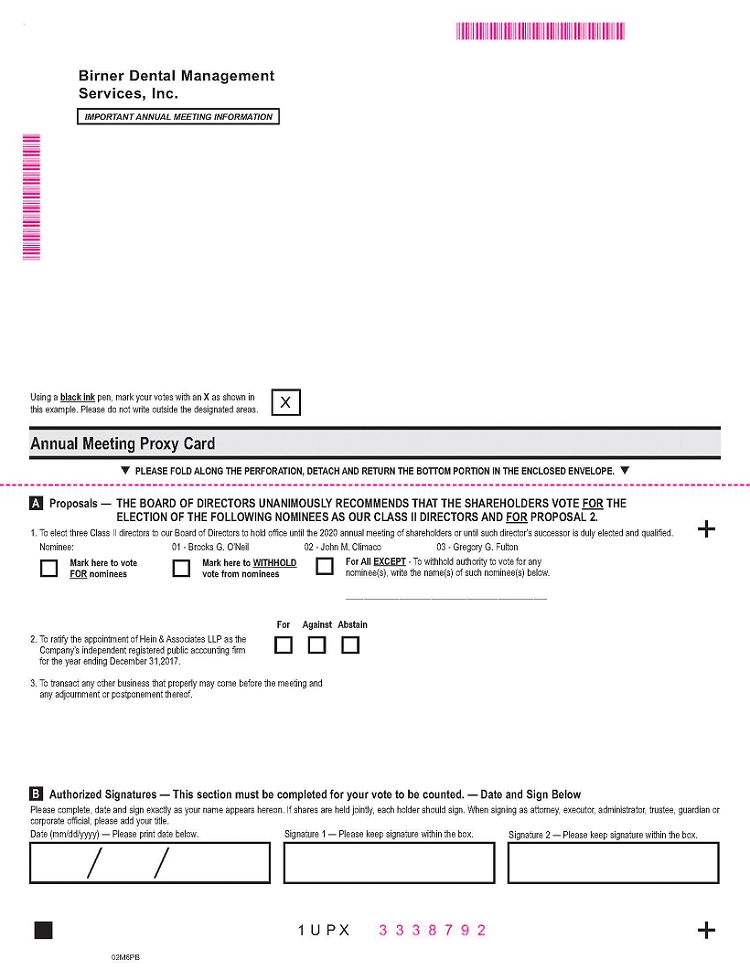

| (1) | To elect three Class II directors to our Board of Directors to hold office until the 2020 annual meeting of shareholders or until such director’s successor is duly elected and qualified. |

| (2) | To ratify the appointment of Hein & Associates LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2017. |

| (3) | To transact any other business that properly may come before the meeting and at any adjournments or postponements of the meeting. |

Please read the enclosed Proxy Statement for the meeting. Whether or not you plan to attend the meeting, please sign, date and return the proxy card in the enclosed postage prepaid, addressed envelope as soon as possible so that your vote will be recorded. You may also vote electronically through the Internet or by telephone, as further described on the proxy card. If you attend the meeting, you may withdraw your proxy and vote your shares in person.

Very truly yours,

BIRNER DENTAL MANAGEMENT SERVICES, INC.

| By: | /s/ Frederic W. J. Birner | |

| | Name: | Frederic W.J. Birner | |

| | Title: | Chairman of the Board and Chief Executive Officer | |

BIRNER DENTAL MANAGEMENT SERVICES, INC.

1777 SOUTH HARRISON STREET, SUITE 1400

DENVER, COLORADO 80210

______________ ___ __________

NOTICE OF

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 20, 2017

______________ _____________

TO OUR SHAREHOLDERS:

The 2017 Annual Meeting of Shareholders of Birner Dental Management Services, Inc., a Colorado corporation (the “Company”, “we”, “us” or “our”), will be held on Tuesday, June 20, 2017, at 10:00 a.m., Mountain Time, at our offices, 1777 South Harrison Street, Suite 1400, Denver, Colorado 80210, for the following purposes:

| (1) | To elect three Class II directors to our Board of Directors to hold office until the 2020 annual meeting of shareholders or until such director’s successor is duly elected and qualified. |

| (2) | To ratify the appointment of Hein & Associates LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2017. |

| (3) | To transact any other business that properly may come before the meeting and any adjournment or postponement thereof. |

As fixed by our Board of Directors, only shareholders of record at the close of business on May 5, 2017 are entitled to notice of and to vote at the meeting. You may view and/or download the 2017 proxy statement and our annual report on Form 10-K at www.edocumentview.com/BDMS.

THE BOARD OF DIRECTORS RECOMMENDS SHAREHOLDERS VOTE FOR THE ELECTION OF THE THREE CLASS II DIRECTOR NOMINEES AND FOR PROPOSAL NO. 2.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | | |

| | /s/ Dennis N. Genty |

| | Name: | Dennis N. Genty |

| | Title: | Chief Financial Officer, Secretary and Treasurer |

Denver, Colorado

May 17, 2017

A PROXY CARD IS ENCLOSED. YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN. TO ASSURE THAT YOUR SHARES WILL BE VOTED AT THE MEETING, PLEASE COMPLETE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED, POSTAGE PREPAID, ADDRESSED ENVELOPE. NO ADDITIONAL POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. YOU MAY ALSO VOTE ELECTRONICALLY THROUGH THE INTERNET OR BY TELEPHONE, AS FURTHER DESCRIBED ON THE PROXY CARD. THE GIVING OF A PROXY WILL NOT AFFECT YOUR RIGHT TO VOTE IN PERSON IF YOU ATTEND THE MEETING.

BIRNER DENTAL MANAGEMENT SERVICES, INC.

1777 SOUTH HARRISON STREET, SUITE 1400

DENVER, COLORADO 80210

proxy statement

annual meeting of shareholders

to be held June 20, 2017

____________________________________

GENERAL INFORMATION

The enclosed proxy is solicited by and on behalf of the Board of Directors of Birner Dental Management Services, Inc., a Colorado corporation (the “Company”, “we”, “us” or “our”), for use at our 2017 Annual Meeting of Shareholders (the “2017 Annual Meeting”) to be held at 10:00 a.m., Mountain Time, on Tuesday, June 20, 2017, at our offices, 1777 South Harrison Street, Suite 1400, Denver, Colorado 80210, and at any and all adjournments thereof. This Proxy Statement and the accompanying form of proxy are first being mailed or given to our shareholders on or about May 17, 2017.

Our Annual Report on Form 10-K for the year ended December 31, 2016 (the “Annual Report”), which includes audited financial statements, is being mailed to our shareholders simultaneously with this Proxy Statement. The Annual Report is not part of our proxy soliciting materials.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on June 20, 2017.

This Proxy Statement and the Annual Report are available at www.edocumentview.com/BDMS.

INFORMATION CONCERNING VOTING AND SOLICITATION

Voting

Shareholders are being asked to vote on (1) the election of three Class II directors; and (2) a proposal to ratify the appointment of Hein & Associates LLP as our independent registered public accounting firm for the year ending December 31, 2017; and (3) any other matters that may properly come before the meeting or any adjournments thereof. All voting rights are vested exclusively in the holders of our common stock. Each share of common stock is entitled to one vote. Cumulative voting in the election of directors is not permitted. Holders of a majority of shares entitled to vote at the meeting, present in person or by proxy, constitute a quorum. On May 5, 2017, the record date for shareholders entitled to vote at the meeting, 1,860,261 shares of common stock were issued and outstanding.

Shares that are not voted in person cannot be voted on your behalf unless a proxy is given. Subject to the limitations described below, you may vote by proxy:

(i) by completing, signing and dating the enclosed proxy card and mailing it promptly in the enclosed, postage prepaid, addressed envelope;

(ii) by telephone; or

(iii) electronically through the Internet.

Voting By Proxy Card. Each shareholder may vote by proxy by using the enclosed proxy card. When you return a proxy card properly signed and completed, the shares of common stock represented by your proxy will be voted as you specify on the proxy card. If no instructions are indicated on a proxy, all common stock represented by such proxy will be voted for election of the nominees named on the proxy as Class II directors, for Proposal No. 2 and, as to any other matters of business that may properly come before the meeting, in the discretion of the named proxies. If you own common stock through a broker, bank or other nominee that holds common stock for your account in a “street name” capacity, follow the instructions provided by your nominee regarding how to instruct your nominee to vote your shares.

Voting Through the Internet Or By Telephone. If you are a registered shareholder (that is, if you own common stock in your own name and not through a broker, bank or other nominee that holds common stock for your account in a “street name” capacity), you may vote by proxy by using either the Internet or telephone methods of voting. Proxies submitted through the Internet or by telephone must be received by 5:00 p.m., Mountain Daylight Time, on June 19, 2017. Please see below and in the proxy card provided to you for instructions on how to access the Internet and telephone voting systems. If your shares of common stock are held in “street name” for your account, contact your broker, bank or other nominee to determine if you may vote through the Internet or by telephone.

Proxies submitted through the Internet or by telephone must be received by 5:00 p.m., Mountain Daylight Time, on June 19, 2017.

Vote by Internet

| • | Go towww.investorvote.com/BDMS |

| • | Or scan the QR code with your smartphone |

| • | Follow the steps outlined on the secure website |

Vote by telephone

| • | Call toll free 1-800-652-VOTE (8683) within the USA, US territories & Canada on a touch tone telephone |

| • | Follow the instructions provided by the recorded message |

Any shareholder signing and mailing the enclosed proxy may revoke it at any time before it is voted by giving written notice of the revocation that is received by us by 5:00 p.m., Mountain Daylight Time, on June 19, 2017, by voting in person at the meeting or by submitting at the meeting a later executed proxy.

When a quorum is present, (i) for the election of directors, the nominees having the highest number of votes cast in favor of election will be elected to the Board of Directors, and (ii) for Proposal No. 2, the proposal will be approved by the shareholders if the number of votes cast favoring the action exceeds the number of votes cast against the action. With respect to any other matter that may properly come before the meeting, unless a greater number of votes are required by law or by our Amended and Restated Articles of Incorporation, a matter will be approved by the shareholders if the number of votes cast favoring the action exceeds the number of votes cast against the action. Abstentions, broker non-votes (i.e., shares held by brokers or nominees as to which the broker or nominee indicates on a proxy that it does not have discretionary authority to vote) and any other shares not voted on a completed proxy will be treated as shares that are present for purposes of determining the presence of a quorum. However, for purposes of determining the outcome of the election of the Class II directors and Proposal No. 2, abstentions and broker non-votes will not be considered as votes cast. Thus, abstentions and broker non-votes will have no impact on any matter that may properly come before the meeting so long as a quorum is present.

Solicitation

We will pay the cost of soliciting proxies in the accompanying form. We have retained the services of Broadridge to assist in distributing proxy materials to brokerage houses, banks, custodians and other nominee holders. The estimated cost of such services is approximately $10,000. Although there are no formal agreements to do so, our officers and other regular employees may solicit proxies by telephone or by personal interview for which the officers or employees will not receive additional compensation. Arrangements also may be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to beneficial owners of the shares held of record by such persons, and we may reimburse such persons for reasonable out-of-pocket expenses incurred by them in so doing.

Proposal No. 1: ELECTION OF three class II DIRECTORs

General

Our Amended and Restated Articles of Incorporation provide for the classification of our Board of Directors into three classes, with one of the three classes standing for election at each annual meeting of shareholders. Under our Amended and Restated Articles of Incorporation and our Second Amended and Restated Bylaws, the number of directors shall be fixed from time to time by resolution of the Board of Directors. Under the terms of the Settlement Agreement, as defined below, the Board of Directors increased the size of the Board of Directors from five members to seven members, effective as of the date of the 2017 Annual Meeting. As agreed in the Settlement Agreement, the Board of Directors is nominating John M. Climaco and Gregory G. Fulton to serve as additional Class II directors on our Board of Directors.

Class I is made up of two directors (Paul E. Valuck, D.D.S. and Thomas D. Wolf) whose terms will expire upon the election and qualification of directors at the 2019 annual meeting of shareholders.

Class II is currently made up of one director (Brooks G. O’Neil) who is standing for re-election at this 2017 Annual Meeting. As of the date of the 2017 Annual Meeting, the Board of Directors will include three Class II directors. John M. Climaco and Gregory G. Fulton are being nominated for election as two additional Class II directors at this 2017 Annual Meeting.

Class III is made up of two directors (Frederic W.J. Birner and Dennis N. Genty) whose terms will expire upon the election and qualification of directors at the 2018 annual meeting of shareholders.

At each annual meeting of shareholders, directors will be elected by our shareholders for a full term of three years to succeed the directors whose terms are expiring or to fill any vacancies created by an increase in the size of the Board of Directors. The powers and responsibilities of each class of directors are identical. All directors will serve until their successors are duly elected and qualified, subject, however, to prior death, resignation, retirement, disqualification or removal from office.

Settlement Agreement

On March 8, 2017, we received notice from Digirad Corporation, Mark A. Birner, and the other members of a group of shareholders (the “Digirad Shareholder Group”), of their intention (i) to nominate a Class II director to our Board of Directors, (ii) to make proposals to amend certain provisions of our articles of incorporation and bylaws, including a proposal to increase the size of our Board of Directors to ten directors, and (iii) to nominate directors to fill the five new directorships proposed by them.

On May 11, 2017, we entered into a Nomination and Standstill Agreement (the “Settlement Agreement”) with the Digirad Shareholder Group to settle the proxy contest pertaining to the election of directors at the 2017 Annual Meeting. Pursuant to the Settlement Agreement, our Board of Directors nominated John M. Climaco and Gregory G. Fulton for election to our Board of Directors at the 2017 Annual Meeting. Pursuant to the Settlement Agreement, if he is elected as a Class II Director at the 2017 Annual Meeting, our Board of Directors will appoint John M. Climaco as a member of the Compensation Committee, provided that he meets all independence and other applicable standards under the rules of the Securities and Exchange Commission (the “SEC”) and any applicable stock exchanges that are required to serve on such committee.

Under the Settlement Agreement, the Digirad Shareholder Group withdrew its nomination of candidates for election to our Board of Directors and withdrew its other proposals for the 2017 Annual Meeting. The Digirad Shareholder Group also agreed to certain customary standstill provisions, which will be in effect until the later of (i) the earlier of (A) the conclusion of the 2018 annual shareholders meeting and (B) June 30, 2018, (ii) the date no Digirad nominee serves as a director on our Board of Directors and (iii) June 30, 2020, in the event of resignation of the Digirad nominees from our Board of Directors due to a breach of the confidentiality obligations in the Settlement Agreement. The members of the Digirad Shareholder Group have agreed to vote all shares of our common stock beneficially owned by them in a manner consistent with our Board of Directors’ recommendations for the nominees for Class II director and for Proposal No. 2 to be voted on at the 2017 Annual Meeting.

For additional details regarding the terms of the Settlement Agreement, including a copy of the Settlement Agreement, please see the Current Report on Form 8-K that we filed with the SEC on May 12, 2017.

Class II Director Nominees

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE ELECTION OF THE FOLLOWING NOMINEES AS OUR CLASS II DIRECTORS.

| Class of Director | | Name | | Age | | Director Since |

| | | | | | | |

| Class II | | Brooks G. O’Neil | | 60 | | 2003 |

| | | | | | | |

| Class II | | John M. Climaco | | 48 | | – |

| | | | | | | |

| Class II | | Gregory G. Fulton | | 70 | | – |

The nominees’ biographies are set forth in “Directors, Director Nominees and Executive Officers” below.

Continuing Directors

The persons named below will continue to serve on our Board of Directors until the annual meeting of shareholders in the year indicated below and/or until their successors are elected and take office. Shareholders are not voting on the election of any Class I or Class III directors this year. The following table shows the names, ages and classes of the continuing directors. Each director’s biography is set forth in “Directors, Director Nominees and Executive Officers” below.

| Class of Director | | Term Expires in Year | | Name | | Age | | Director Since |

| Class I | | 2019 | | Paul E. Valuck, D.D.S. | | 59 | | 2001 |

| | | | | | | | | |

| Class I | | 2019 | | Thomas D. Wolf | | 62 | | 2004 |

| | | | | | | | | |

| Class III | | 2018 | | Frederic W.J. Birner | | 59 | | 1995 |

| | | | | | | | | |

| Class III | | 2018 | | Dennis N. Genty | | 59 | | 1995 – 2004 2015 - present |

Required Vote

Assuming a quorum is present, the three nominees having the highest number of votes cast in favor of election will be elected to the Board of Directors as Class II directors. Abstentions and broker non-votes will have no effect on the outcome of the election. Pursuant to the terms of the Settlement Agreement, the members of the Board of Directors will vote for each of Messrs. Climaco and Fulton.

Proxies cannot be voted for a greater number of persons than the number of nominees named therein. Unless authority to vote is withheld, the persons named in the enclosed form of proxy will vote the shares represented by such proxy FOR the election of the nominees for director named above. If, at the time of the meeting, a nominee becomes unavailable for any reason for election as a director, the persons entitled to vote the proxy will vote for such substitute nominee, if any, in their discretion. If elected, each nominee will hold office until the 2020 annual meeting of shareholders or until a successor is elected and qualified, subject, in the case of Messrs. Climaco and Fulton, to the terms of the Settlement Agreement.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE ‘FOR’ THE ELECTION OF THE THREE CLASS II DIRECTOR NOMINEES.

PROPOSAL NO. 2: RATIFICATION OF THE APPOINTMENT OF

THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

FOR THE YEAR ENDING DECEMBER 31, 2017

The Audit Committee and the Board believe that the retention of Hein & Associates LLP (“Hein”) to serve as our independent registered public accounting firm for the year ending December 31, 2017 is in the best interests of the Company and our shareholders. The Audit Committee has approved the engagement of Hein as our independent registered public accounting firm for the year ending December 31, 2017. We expect that representatives of Hein will be present at the 2017 Annual Meeting and will have the opportunity to make a statement if they so desire. These representatives will also be available to respond to appropriate questions from shareholders at the 2017 Annual Meeting.

The appointment of Hein as our independent registered public accounting firm is not required to be submitted to a vote of our shareholders for ratification. However, the Audit Committee and the Board believe that obtaining shareholder ratification is a sound corporate governance practice. If our shareholders fail to vote on an advisory basis in favor of the appointment of Hein, the Audit Committee will take such actions as it deems necessary, if any, as a result of such shareholder vote.

Fees Paid to Our Independent Registered Public Accounting Firm

The Audit Committee reviews and pre-approves audit-related and permissible non-audit services to be performed by our independent registered public accounting firm, which currently is Hein. The fees shown below for 2016 and 2015 were approved in advance by the Audit Committee.

Audit Fees

For the year ended December 31, 2016, Hein billed us $96,300 for professional services rendered for the audit of our annual financial statements and the reviews of the financial statements included in our Quarterly Reports on Form 10-Q filed during the year ended December 31, 2016.

For the year ended December 31, 2015, Hein billed us $94,400 for professional services rendered for the audit of our annual financial statements and the reviews of the financial statements included in our Quarterly Reports on Form 10-Q filed during the year ended December 31, 2015.

Audit-Related Fees

For the year ended December 31, 2016, Hein billed us $11,838 for audit-related professional services. These fees related to the audit of our 401(k) retirement savings plan.

For the year ended December 31, 2015, Hein billed us $11,575 for audit-related professional services. These fees related to the audit of our 401(k) retirement savings plan.

Tax Fees and All Other Fees

For the years ended December 31, 2015 and 2016, Hein did not bill us for any tax fees or other professional services besides the services described above.

Required Vote

In order to approve this proposal, the number of votes cast in favor of the proposal must exceed the number of votes cast against the proposal. Unless instructed to the contrary, the persons named in the enclosed form of proxy will vote the shares represented by such proxy FOR the approval of the ratification of the appointment of Hein as our independent registered public accounting firm for the year ending December 31, 2017. Abstentions will have no effect on the outcome of this proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF HEIN & ASSOCIATES LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2017.

Corporate Governance matters

Director Independence

Our common stock is quoted on the OTCQX Market. Although our common stock is no longer listed on Nasdaq, pursuant to the regulations promulgated by the SEC under the Exchange Act, we have adopted the definition of independent director as described in Rule 5605 of the Nasdaq Listing Standards. Our Board of Directors has determined that each of the following current directors and director nominees qualify as independent directors as defined under Nasdaq Rule 5605(a)(2): Thomas D. Wolf, Paul E. Valuck, D.D.S., Brooks G. O’Neil, John M. Climaco and Gregory G. Fulton.

Nominations Process

We do not have a standing nominating committee or a nominating committee charter. Nominations for director are made by our independent directors. The Board of Directors believes that, considering the size of the Company and our Board of Directors, nominating decisions can be made effectively by our independent directors and there is no need for the added formality of a nominating committee.

On July 15, 2016, our Board of Directors adopted and approved the Second Amended and Restated Bylaws of the Company (the “Amended Bylaws”). The Amended Bylaws include advance notice requirements and procedures for the submission by shareholders of nominations for our Board of Directors and of other proposals to be presented at shareholder meetings.

Under Article II, Section 3 of the Amended Bylaws, in order for a shareholder to nominate a person for election as a director without inclusion in our proxy statement, such shareholder must give timely notice in writing delivered to our Secretary at our principal executive offices. To be timely, notice must be delivered to the Secretary not later than the close of business on the 90th day, nor earlier than the close of business on the 120th day, prior to the first anniversary of the preceding year’s annual shareholders’ meeting. If the date of the annual shareholders’ meeting is more than 30 days before or more than 60 days after such anniversary date, to be timely, notice by the shareholder must be delivered not earlier than the close of business on the 120th day prior to the date of such annual shareholders’ meeting and not later than the close of business on the later of the 90th day prior to the date of such annual shareholders’ meeting or the 10th day following the day on which we first publicly announce the date of such annual shareholders’ meeting.

The shareholder’s notice must include certain information required by the Amended Bylaws about the director nominee, the shareholder of record and the underlying beneficial owner, if any, including such information as the director nominee’s name, age, address, occupation and shares; the name, address and shares of the shareholder and any beneficial owner; information about derivatives, hedges and short positions; understandings or agreements regarding the economic and voting interests of the director nominee, the shareholder and related persons with respect to our stock, if any; and such other information as would be required to be disclosed in a proxy statement soliciting proxies for the election of the proposed director nominee. In addition, the notice must contain certain representations made by the shareholder or beneficial owner proposing to nominate such director nominee. We may require any proposed nominee to furnish such other information as may reasonably be required to determine the eligibility of such proposed nominee to serve as a director. A shareholder’s notice must be updated, if necessary, so that the information submitted is true and correct as of the record date for determining shareholders entitled to receive notice of the meeting and as of the date that is 10 business days prior to the meeting date.

The Board of Directors does not have an express policy with regard to the consideration of any director candidates recommended by our shareholders because the Board believes that it can adequately evaluate any such nominees on a case-by-case basis. The Board of Directors will consider director candidates proposed on a timely basis in accordance with the Amended Bylaws and will evaluate shareholder-recommended candidates under the same criteria as internally generated candidates. Shareholders must include sufficient information about candidates nominated for director as set forth in the Amended Bylaws to enable our independent directors to consider the candidate’s qualifications and suitability for service on the Board of Directors. Although the Board of Directors does not currently have a diversity policy regarding selection of director nominees or other formal minimum criteria for nominees, substantial relevant business and industry experience would generally be considered important qualifying criteria, as would the ability to attend and prepare for Board, committee and shareholder meetings. In considering nominees, the Board would consider diversity among other factors relevant to its decision. Any candidate must state in advance his or her willingness and interest in serving on the Board of Directors and its committees.

For the 2017 Annual Meeting, (i) Brooks G. O’Neil, who is a current director standing for re-election, was recommended and nominated by the Board of Directors and (ii) John M. Climaco and Gregory G. Fulton, who are director nominees who have not previously served as directors or officers of our Company, are being nominated pursuant to the Settlement Agreement.

Communications with Our Board

Because we are a small public company, our Board of Directors does not presently provide a website or a formal process for shareholders to send communications to the Board. However, shareholders wishing to contact any member (or all members) of the Board or any committee of the Board may do so by mail, addressed, either by name or title, to the Board of Directors or to any such individual director or group or committee of the directors, c/o Dennis N. Genty, Chief Financial Officer, Secretary and Treasurer, Birner Dental Management Services, Inc., 1777 South Harrison Street, Suite 1400, Denver, Colorado 80210. The Board believes that this approach serves the Company’s and its shareholders’ needs. There is no screening process, and all shareholder communications directed to a Board member, the Board or a committee of the Board are forwarded to the appropriate person or persons for review. Our Board of Directors intends to periodically evaluate its shareholder communication process, and may adopt additional procedures to facilitate shareholder communications with the Board of Directors as it deems necessary or appropriate.

Directors’ Meetings

The entire Board of Directors met 13 times during the year ended December 31, 2016. Each director attended 100% of all Board meetings and meetings of any Committee on which he served during 2016. Our policy regarding attendance by members of the Board of Directors at our annual meeting of shareholders is to encourage our directors to attend, subject to their availability for travel at that time. Frederic W.J. Birner, Dennis N. Genty, Thomas D. Wolf, Paul E. Valuck, D.D.S. and Brooks G. O’Neil attended our 2016 annual meeting of shareholders.

Audit Committee

The Audit Committee is comprised solely of independent directors, as defined by applicable Nasdaq and SEC rules and regulations. Though our Company is no longer listed on Nasdaq, our Board of Directors used the Nasdaq listing standards in making its independence determinations. The current members of the Audit Committee are Brooks G. O’Neil, Paul E. Valuck, D.D.S. and Thomas D. Wolf (Chairman). The Board of Directors has reviewed Nasdaq Rule 5605(c) and has determined that Messrs. O’Neil, Valuck and Wolf are independent directors as defined in that rule. The Board of Directors has determined that Messrs. O’Neil and Wolf have accounting and related financial management expertise based on their years of relevant professional work experience and are qualified as audit committee financial experts within the meaning of SEC regulations. The Audit Committee met four times during the year ended December 31, 2016, and all members were present at each meeting.

The Audit Committee selects, engages, approves fees for and oversees our independent registered public accounting firm and pre-approves all services to be performed by them. The Audit Committee also reviews and oversees our financial reporting process generally, the integrity of our financial statements, the independent registered public accounting firm’s qualifications and independence, the performance of our independent registered public accounting firm, and our compliance with legal and regulatory requirements.

The Board of Directors has adopted a written charter for the Audit Committee, a copy of which was attached as Appendix B to the proxy statement for the 2015 annual meeting of shareholders. We will provide a copy of the charter for the Audit Committee to any person, without charge, upon request by writing to: the Corporate Secretary, Birner Dental Management Services, Inc., 1777 South Harrison Street, Suite 1400, Denver, Colorado 80210.

Compensation Committee

The members of the Compensation Committee in 2016 were Brooks G. O’Neil, Paul E. Valuck, D.D.S. and Thomas D. Wolf, each of whom is an independent director as defined by applicable Nasdaq and SEC rules and regulations. Though our Company is no longer listed on Nasdaq, our Board of Directors used the Nasdaq listing standards in making its independence determinations. The Compensation Committee met once in 2016.

The Compensation Committee is responsible for establishing and administering our general compensation policy and program, and for setting compensation for our executive officers. The Compensation Committee also possesses all of the powers of administration under our employee benefit plans, including our 2015 Equity Incentive Plan (“2015 Plan”). Subject to the provisions of those plans, the Compensation Committee determines the individuals eligible to participate in the plans, the extent of such participation and the terms and conditions under which benefits may be vested, received or exercised. The Compensation Committee determines awards granted to our executive officers and directors. The Compensation Committee has delegated to our Chief Executive Officer the authority to make grants to non-executive employees.

The Board of Directors has adopted a written charter for the Compensation Committee, a copy of which was attached as Appendix C to the proxy statement for the 2015 annual meeting of shareholders. We will provide a copy of the charter for the Compensation Committee to any person, without charge, upon request by writing to: the Corporate Secretary, Birner Dental Management Services, Inc., 1777 South Harrison Street, Suite 1400, Denver, Colorado 80210.

Audit Committee Report

The Audit Committee has reviewed and discussed the audited financial statements of the Company with management and has discussed with Hein, the Company’s independent registered public accounting firm, the matters required to be discussed by the Public Company Accounting Oversight Board (PCAOB) Auditing Standard No. 16, Communications with Audit Committees, as modified or supplemented. In addition, the Audit Committee has received from Hein the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding Hein’s communications with the Audit Committee concerning its independence. The Audit Committee has reviewed the materials received from Hein and has met with representatives of Hein to discuss its independence.

Based on the review and discussions referred to above, the Audit Committee has recommended to the Board of Directors that the audited financial statements of the Company be included in its Annual Report on Form 10-K for the year ended December 31, 2016 for filing with the SEC.

| | AUDIT COMMITTEE |

| | |

| | Thomas D. Wolf (Chairman) |

| | Brooks G. O’Neil |

| | Paul E. Valuck, D.D.S. |

Code of Conduct

All of our employees, including our Chief Executive Officer, Chief Financial Officer, and the persons performing similar functions, are required to abide by our code of conduct and business conduct policies to ensure that our business is conducted in a consistently legal and ethical manner. We intend to disclose any changes in or waivers from our code of conduct by filing a current report on Form 8-K with the SEC. A copy of the Company’s Code of Conduct is available on our website at www.perfectteeth.com/legal.

Related Party Transactions

On May 9, 2017, we entered into the Settlement Agreement with the Digirad Shareholder Group, pursuant to which John M. Climaco and Gregory G. Fulton are being nominated for election as Class II directors at the 2017 Annual Meeting. The Digirad Shareholder Group, including Mark A. Birner and Lee Schlessman, who each own over 5% of our common stock, as well as John M. Climaco and Gregory G. Fulton, who are current Class II director nominees, are parties to the Settlement Agreement. Pursuant to the Settlement Agreement, we agreed to reimburse the Digirad Shareholder Group’s reasonable fees and expenses related to the proxy contest by issuing Digirad Corporation 12,500 shares of our common stock, which had a value of approximately $175,000 based on the closing price of the Company’s common stock on May 11, 2017. If they are elected at the 2017 Annual Meeting, Messrs. Climaco and Fulton will participate in the standard compensation and reimbursement of expenses offered to non-employee directors of the Company. For additional information regarding the Settlement Agreement, please refer to the “Proposal No. 1: Election of Three Class II Directors” section of this proxy statement.

Except as disclosed above, since January 1, 2015, there has not been, and there is not currently proposed, any transaction or series of similar transactions to which we were or will be a party in which the amount involved exceeded or will exceed $120,000 and in which any related person had or will have a direct or indirect material interest.

We do not have a formal written policy regarding the review, approval or ratification of related party transactions. Under the Audit Committee charter, the Audit Committee is responsible for the review and approval of all related party transactions required to be disclosed to the public under the SEC rules. All of our employees, officers and directors are required to comply with our Code of Conduct. The Code of Conduct addresses, among other things, actions that are required when potential conflicts of interest arise, including those from related party transactions. Specifically, if an employee, officer or director believes a conflict of interest exists or may arise, he or she is required to disclose immediately the nature and extent of the conflict, or potential conflict, to his or her supervisor, who, along with appropriate officials of the Company, will evaluate the conflict and take the appropriate action, if any, to ensure that our interests are protected. Any transaction between us and another party on terms that are reasonably believed to be at least as favorable as the terms that we otherwise could have obtained from an unrelated third party shall not create a conflict of interest or cause a violation of the Code of Conduct, provided that with respect to the directors and any member of senior management, the Audit Committee was given prior notice of such transaction and approved it. The rules in the Code of Conduct regarding conflicts of interest not only apply to all employees, officers and directors, but also to immediate family members and certain business associates of our employees, officers and directors.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Beneficial Owners

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of April 27, 2017 by (i) all persons known by us to be the beneficial owners of 5% or more of our common stock, (ii) each director, (iii) each of our named executive officers, and (iv) all executive officers and directors as a group. The address of each of the named executive officers and directors is our office address, 1777 South Harrison Street, Suite 1400, Denver, Colorado 80210.

| Name of Beneficial Owner | | Number of Shares Beneficially Owned | | | Percent of Class |

| | | (1) | | | (2) |

| Named Executive Officers & Directors | | | | | |

| Frederic W. J. Birner (3) | | | 368,348 | | | 18.6% |

| Dennis N. Genty (4) | | | 143,320 | | | 7.6% |

| Brooks G. O'Neil (5) | | | 34,048 | | | 1.8% |

| Paul E. Valuck, D.D.S. (6) | | | 55,885 | | | 3.0% |

| Thomas D. Wolf (7) | | | 59,650 | | | 3.2% |

| All executive officers and directors (five persons) (8) | | | 661,251 | | | 32.6% |

| | | | | | | |

| 5% Owners | | | | | | |

| Digirad Corporation Group (9) | | | 578,934 | | | 31.1% |

| Lee Schlessman (9) (10) | | | 104,026 | | | 5.6% |

| Mark A. Birner, D.D.S. (9) (11) | | | 388,956 | | | 20.9% |

| (1) | Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of common stock subject to options currently exercisable or exercisable within 60 days of April 27, 2017 are deemed outstanding for computing the percentage of the person or entity holding such securities but are not outstanding for computing the percentage of any other person or entity. Except as indicated by footnote, and subject to community property laws where applicable, the persons named in the table above have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. |

| (2) | Percentage of ownership for each beneficial owner is based on 1,860,261 shares of common stock outstanding at April 27, 2017 plus any options currently exercisable or exercisable within 60 days of April 27, 2017, computed separately for each beneficial owner using information provided in the following footnotes. |

| (3) | Includes 120,000 shares of common stock that are issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of April 27, 2017. |

| (4) | Includes 20,000 shares of common stock that are issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of April 27, 2017. |

| (5) | Includes 9,333 shares of common stock that are issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of April 27, 2017. |

| (6) | Includes 9,333 shares of common stock that are issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of April 27, 2017. |

| (7) | Includes 9,333 shares of common stock that are issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of April 27, 2017. |

| (8) | Includes 167,999 shares of common stock issuable upon the exercise of options held by all executive officers and directors as a group that are currently exercisable or exercisable within 60 days of April 27, 2017. |

| (9) | Based on a Schedule 13D filed on March 9, 2017 (the “Digirad 13D”) filed by Digirad Corporation, Mark A. Birner, Lee Schlessman, Elizabeth Genty, Gregory G. Fulton, John M. Climaco, James C. Elbaor, Charles M. Gillman, Barry A. Igdaloff, Lee D. Keddie and Benjamin E. Large. These persons, who comprise the Digirad Shareholder Group, constitute a “group” for purposes of Section 13(d)(3) of the Exchange Act that, as of March 9, 2017, collectively beneficially owned 578,934 shares of our common stock. The members of the Digirad Shareholder Group entered into a Joint Filing and Solicitation Agreement, dated as of March 8, 2017. Each member of the Digirad Shareholder Group reported having sole voting and investment power with respect to the shares of common stock, if any, individually held by such person. The address for Digirad Corporation is 1048 Industrial Court, Suwanee, Georgia 30024. |

| (10) | The Digirad 13D reported that Mr. Schlessman beneficially owned 104,026 shares, and excluded from Mr. Schlessman’s beneficial ownership 3,737 shares owned by Mr. Schlessman’s sister through a trust and 81,044 shares owned in the aggregate by Mr. Schlessman’s children both directly and indirectly through certain trusts. Based on the Digirad 13D, the address for Mr. Schlessman is 1555 Blake Street, Suite 400, Denver, Colorado 80202. |

| (11) | Based on the Digirad 13D, the address for Mark Birner, D.D.S. is 2325 E. 7th Avenue Parkway, Denver, Colorado 80206. |

There has been no change in our control since the beginning of our last fiscal year, and there are no arrangements known to us, including any pledge of our securities, the operation of which may at a subsequent date result in a change in our control.

DIRECTORS, DIRECTOR NOMINEES AND EXECUTIVE OFFICERS

The following table sets forth information concerning each of our directors, director nominees and executive officers. All directors will serve until their successors are duly elected and qualified, subject, however, to prior death, resignation, retirement, disqualification or removal from office. Officers are appointed by and serve at the discretion of the Board of Directors.

Name | | Age | | Position |

| Frederic W.J. Birner | | 59 | | Chairman of the Board, Chief Executive Officer and Director |

| Dennis N. Genty | | 59 | | Chief Financial Officer, Secretary, Treasurer and Director |

| Brooks G. O’Neil | | 60 | | Director |

| Paul E. Valuck, D.D.S. | | 59 | | Director |

| Thomas D. Wolf | | 62 | | Director |

| John M. Climaco | | 48 | | Director Nominee |

| Gregory G. Fulton | | 70 | | Director Nominee |

Biographies

Frederic W.J. Birneris one of our founders and has served as Chairman of the Board and Chief Executive Officer since our inception in May 1995.

Dennis N. Gentyis one of our founders and has served as Secretary since May 1995 and as Chief Financial Officer, Secretary and Treasurer since September 1995. Mr. Genty was a director of the Company’s Board of Directors from the Company’s inception until 2004, when he resigned enabling the Company to be in compliance with applicable stock exchange rules requiring that a majority of the Company’s directors be independent according to specified criteria. Mr. Genty was again elected to the Board of Directors in 2015.

Brooks G. O’Neil, a Class II director nominee, was appointed as a director in January 2003 and was first elected by our shareholders at the 2005 annual meeting of shareholders. In November 2016, Mr. O’Neil joined Lake Street Capital Markets, a boutique investment bank based in Minneapolis, as a Senior Research Analyst covering medical device and healthcare services companies. In November 2015, Mr. O’Neil formed White Oaks Investor Relations, a firm focused on providing investor relations services to innovative healthcare companies. From October 2006 until November 2015, Mr. O’Neil was employed by Dougherty & Co., an investment banking firm, as a Senior Research Analyst covering areas of growth and change in health care.

Paul E. Valuck, D.D.S.was appointed as a director in April 2001 and was first elected by our shareholders at the 2001 annual meeting of shareholders. Dr. Valuck has been in private dental practice in Denver, Colorado since January 1998.

Thomas D. Wolfwas appointed as a director in June 2004 and was first elected by our shareholders at the 2007 annual meeting of shareholders. Mr. Wolf joined Shield Security Systems, LLC, a privately held company in the security system business, in December 1998 and has served as its Chief Financial Officer since December 1998. From April 2003 until June 2012, Mr. Wolf also served as Chief Executive Officer for Shield Security Systems, LLC.

John M. Climaco was selected as a Class II director nominee pursuant to the Settlement Agreement. Since 2015, he has served as Executive Vice President of Perma-Fix Medical, SA, a developer of non-fission technology for the production of medical radioisotopes and a majority-owned subsidiary of Perma-Fix Environmental Services, Inc. From 2012 through 2015, Mr. Climaco served as an independent consultant to a variety of healthcare and medical technology companies. Mr. Climaco has served as a director of: Perma-Fix Environmental Services, Inc., a provider of nuclear services and radioactive waste management solutions, since 2013; Digirad Corporation, a provider of in-office nuclear cardiology imaging, since 2012; Essex Rental Corporation, a supplier of crane and related equipment rentals, from 2015 to 2017; PDI, Inc., a health care commercialization and molecular diagnostics company, from 2013 to 2014; and InfuSystem Holdings, Inc., a supplier of infusion services to oncologists and out-patient treatment settings, from 2012 to 2013. From 2003 to 2013, Mr. Climaco served as president and chief executive officer, as well as a director, of Axial Biotech, Inc., a venture-backed molecular diagnostics company specializing in spine disorders, which he cofounded in 2003.

Gregory G. Fultonwas selected as a Class II director nominee pursuant to the Settlement Agreement. Since 2002, Mr. Fulton has been employed at GVC Capital LLC, an investment banking firm, where he is the Director of Municipal Finance and manages Fulton Partners Investments, a division of GVC Capital LLC concentrating on municipal bond offerings. Mr. Fulton has previous experience working at E.F. Hutton & Co., Prudential Securities Incorporated and Cohig & Associates.

Messrs. Birner, Genty, O’Neil and Wolf bring financial and business expertise to the Board of Directors based on their years of professional work experience. Dr. Valuck brings dental industry experience to the Board of Directors. We believe that Mr. Climaco will bring to our Board of Directors significant executive experience relevant to our company, including advising on strategy, mergers and acquisitions, restructurings and other strategic opportunities. We believe that Mr. Fulton will draw on his financial background and substantial historical knowledge of our Company to provide financial, strategic and business advice to the Board of Directors.

BOARD LEADERSHIP STRUCTURE AND THE BOARD’S ROLE IN RISK OVERSIGHT

Leadership Structure

Our Company currently has three directors who are not employees of the Company and two directors who are employees of the Company. Frederic W.J. Birner, the Chief Executive Officer of our Company, is Chairman of the Board of Directors. Our Company combined the positions of CEO and Chairman of the Board because of the size of the Company and the efficiency involved. A lead independent director has not been designated because the Board does not believe it is warranted for a company of our size and complexity.

Risk Oversight

Our Board of Directors as a whole reviews and discusses our overall risk regarding our operations and goals and how those risks are being managed. Our Board of Directors meets quarterly to discuss our operations and financial standing and to hear briefings from executive management, outside counsel and auditors. The Audit Committee meets quarterly and then the independent members of the Board of Directors conduct an executive session without senior management.

Board Diversity

Although our Board of Directors does not currently have a diversity policy regarding selection of Board nominees or other formal criteria for nominees, substantial relevant business and industry experience would generally be considered important qualifying criteria, as would the ability to attend and prepare for Board, committee and shareholder meetings. In considering nominees, the Board would consider diversity among other factors relevant to its decision.

EXECUTIVE COMPENSATION SUMMARY

Executive Compensation for Years Ended December 31, 2015 and 2016

The following table summarizes, with respect to our Chief Executive Officer and each of the other individuals for which disclosure is required (“Named Executive Officers”), information relating to the compensation earned for services rendered in all capacities during 2015 and 2016.

Summary Compensation Table

| Name and Principal Position | | Year | | Salary | | | All Other Compensation | | | Total | |

| | | | | | | | (1) | | | | |

| Frederic W.J. Birner | | | | | | | | | | | | | | |

| Chairman of the Board, | | 2015 | | $ | 500,000 | | | $ | 10,819 | | | $ | 510,819 | |

| Chief Executive Officer, | | 2016 | | $ | 500,000 | | | $ | 12,467 | | | $ | 512,467 | |

| and Director | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Dennis N. Genty | | | | | | | | | | | | | | |

| Chief Financial Officer, | | 2015 | | $ | 340,000 | | | $ | 10,660 | | | $ | 350,660 | |

| Secretary, Treasurer, | | 2016 | | $ | 340,000 | | | $ | 12,307 | | | $ | 352,307 | |

| and Director | | | | | | | | | | | | | | |

| (1) | All other compensation is comprised solely of payments of medical/vision/life insurance premiums for Mr. Birner and Mr. Genty. |

Base Salary and Bonus

The Compensation Committee reviews the base salaries of the Company's executive officers on an annual basis. The Compensation Committee also determines bonuses. Base salaries and bonuses are determined based upon a subjective assessment of the nature and responsibilities of the position involved, the performance of the particular executive officer and of the Company, the executive officer's experience and tenure with the Company and base salaries paid to persons in similar positions with companies comparable to the Company. Messrs. Birner and Genty did not receive a base salary increase, a bonus or any equity awards during 2015 or 2016. Messrs. Birner and Genty agreed to reduce their base salaries by 20% effective February 1, 2017.

Grant of Plan-Based Awards

In November 2014, the Compensation Committee granted options to purchase 30,000 shares of common stock to each of Mr. Birner and Mr. Genty. For each of Mr. Birner and Mr. Genty, 10,000 options vested on November 12, 2015, 10,000 options vested on November 12, 2016 and 10,000 options will vest on November 12, 2017. The option awards were granted under our 2005 Equity Incentive Plan, as amended (the “2005 Plan”), which terminated on March 17, 2015.

Outstanding Equity Awards at December 31, 2016

The following table contains information regarding options outstanding with respect to the Named Executive Officers at December 31, 2016.

| | | | | | | Option Awards |

| Name | | Grant Date | | | | Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable | | | | | Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable | | | Option

Exercise

Price

($/Sh) | | | Option

Expiration

Date |

| | | | | | | | | | | | | | | (1) | | | |

| Frederic W.J. Birner | | March 15, 2012 | | (2)(3) | | | 100,000 | | | | | | | | | $ | 18.39 | | | 3/15/2019 |

| | | November 12, 2014 | | | | | 20,000 | | | (4) | | | 10,000 | | | $ | 15.50 | | | 11/12/2021 |

| | | | | | | | | | | | | | | | | | | | | |

| Dennis N. Genty | | November 12, 2014 | | | | | 20,000 | | | (4) | | | 10,000 | | | $ | 15.50 | | | 11/12/2021 |

| 1. | The option exercise price was based on the last reported sales price of our common stock on the grant date as reported on The Nasdaq Capital Market on March 15, 2012 of $18.39 per share and on November 12, 2014 of $15.50 per share. |

| 2. | Options to purchase 50,000 shares of our common stock were granted to Mr. Birner on March 15, 2012 and vested on March 15, 2012. |

| 3. | Options to purchase an additional 50,000 shares of our common stock were granted to Mr. Birner on March 15, 2012, subject to shareholder approval of an amendment to the 2005 Plan, which occurred on June 7, 2012, of which options to purchase 25,000 shares vested on March 15, 2014 and options to purchase 25,000 shares vested on March 15, 2015. |

| 4. | Options to purchase 30,000 shares of our common stock were granted to each of Mr. Birner and Mr. Genty on November 12, 2014. For each of Mr. Birner and Mr. Genty, 10,000 options vested on November 12, 2015, 10,000 options vested on November 12, 2016 and 10,000 options will vest on November 12, 2017. |

Equity Compensation Plan Information

Information related to securities issuable and available for issuance under the 2015 Plan as of December 31, 2016 is set forth in the table below. For information about the 2015 Plan, see note 8 to the Company’s audited financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016. The 2005 Plan terminated on March 17, 2015.

| Plan category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | | | Weighted-average exercise price of outstanding options, warrants and rights (b) | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |

| Equity compensation plans approved by security holders | | | 465,666 | (1) | | $ | 15.94 | | | | 129,000 | |

| Equity compensation plans not approved by security holders | | | - | | | | - | | | | - | |

| Total | | | 465,666 | | | $ | 15.94 | | | | 129,000 | |

| (1) | As of December 31, 2016, 338,415 shares were issuable under exercisable options granted under the 2005 Plan and no options granted under the 2015 Plan were exercisable. |

Payments upon Change in Control

As of April 27, 2017, there were 394,666 options issued and outstanding under our 2005 Plan, which terminated in March 2015, and there were 106,000 options issued and outstanding under our 2015 Plan.

Upon a change of control of our Company, as defined in the 2005 Plan, all outstanding options issued under our 2005 Plan will automatically vest.

Under the 2015 Plan, a “change in control” is generally defined as a merger or consolidation involving us, a sale of all or substantially all of our assets, the acquisition by a person or group of more than 30% of the voting power of our stock, or certain changes in the composition of our board of directors. Under the 2015 Plan, if a change in control of our company occurs as a result of a merger or consolidation involving us and any outstanding award is not continued, assumed or replaced by the company or the surviving or successor entity in connection with the change in control, then (i) each of the participant's outstanding options and SARs will become exercisable in full, and (ii) each of the participant's unvested full value awards will fully vest unless and to the extent the committee that administers the 2015 Plan elects to terminate such award in exchange for a payment in an amount equal to the intrinsic value of the award (or, if there is no intrinsic value, the award may be terminated without payment). Upon the occurrence of other events involving a change in control (as defined in the 2015 Plan), all exercise dates of any outstanding award will accelerate and all outstanding awards will vest. The committee may provide for different change in control consequences in an individual award agreement.

DIRECTOR compensation

Non-Employee Director Compensation for Year Ended December 31, 2016

The following table summarizes, with respect to non-employee directors, information relating to the compensation earned for services rendered in all capacities during 2016.

| | | Compensation | |

| Name of Non-Employee Director | | Fees Earned

or Paid in

Cash | | | Option

Awards

($) | | | Total | |

| | | | | | (1) | | | | |

| Brooks G. O'Neil | | $ | 25,000 | | | $ | — | | | $ | 25,000 | |

| | | | | | | | | | | | | |

| Paul E. Valuck, D.D.S. | | $ | 25,000 | | | $ | — | | | $ | 25,000 | |

| | | | | | | | | | | | | |

| Thomas D. Wolf | | $ | 37,000 | | | $ | — | | | $ | 37,000 | |

| (1) | At December 31, 2016, the non-employee directors had the following options outstanding: Brooks G. O’Neal: 16,000, of which 13,333 were exercisable, Paul E. Valuck, D.D.S.: 16,000, of which 13,333 were exercisable, and Thomas D. Wolf: 17,000, of which 14,333 were exercisable. |

Directors who are our full-time employees receive no compensation for serving as directors. For 2016, non-employee directors were paid the following fees: 1) a $5,500 per calendar quarter retainer, 2) $500 per calendar quarter Audit Committee meeting and 3) $1,500 per annual Audit Committee meeting. Mr. Wolf was paid a $3,000 per calendar quarter retainer for his services as Chairman of the Audit Committee. Such amounts were effective January 1, 2014. Effective February 1, 2017, the non-employee directors agreed to reduce their quarterly Board retainers by 20%.

section 16(a)Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires directors, executive officers and beneficial owners of more than 10% of our outstanding shares to file with the SEC initial reports of ownership and reports regarding changes in their beneficial ownership of our shares. To our knowledge, and based solely on a review of the Section 16(a) reports furnished to us, all Section 16(a) reports required to be filed for 2016 were filed on a timely basis.

DATE OF RECEIPT OF shareholder proposals

Under the applicable rules of the SEC, a shareholder who wishes to submit a shareholder proposal for inclusion in the proxy statement of the Board of Directors for the annual shareholders’ meeting to be held in 2018 must submit such proposal in writing to our Secretary at our principal executive offices no later than January 16, 2018. In addition, all shareholder proposals for inclusion in our proxy statement for the annual shareholders’ meeting to be held in 2018 must comply with the requirements of SEC Rule 14a-8 under the Exchange Act. Our Amended Bylaws also provide that shareholders desiring to nominate a director or bring any other business before the shareholders at an annual meeting (but that would not be included in our proxy statement) must notify our Secretary thereof in writing no earlier than the close of business on the 120th day, and no later than the close of business on the 90th day, prior to the first anniversary of the preceding year’s meeting date, or February 20, 2018 and March 22, 2018, respectively. Such notice must include certain information specified in our Amended Bylaws.

2016 annual report on form 10-K

OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2016 ACCOMPANIES THIS PROXY STATEMENT AND WAS FILED ELECTRONICALLY WITH THE SECURITIES AND EXCHANGE COMMISSION. THIS REPORT IS NOT PART OF OUR PROXY SOLICITING MATERIALS. SHAREHOLDERS WHO WISH TO OBTAIN, WITHOUT CHARGE, A COPY OF OUR ANNUAL REPORT (WITHOUT EXHIBITS) ON FORM 10-K SHOULD ADDRESS A WRITTEN REQUEST TO DENNIS N. GENTY, CHIEF FINANCIAL OFFICER, SECRETARY AND TREASURER, BIRNER DENTAL MANAGEMENT SERVICES, INC., 1777 SOUTH HARRISON STREET, SUITE 1400, DENVER, COLORADO 80210 OR THEY CAN OBTAIN THE INFORMATION ON OUR WEBSITE AT WWW.PERFECTTEETH.COM. WE WILL PROVIDE COPIES OF THE EXHIBITS TO THE FORM 10-K UPON PAYMENT OF A REASONABLE FEE.

Other business

As of the date of this Proxy Statement, management was not aware of any business not described above which would be presented for consideration at the meeting. If any other business properly comes before the meeting, it is intended that the shares represented by proxies will be voted in respect thereto in accordance with the judgment of the persons named in the proxies.

The above Notice and Proxy Statement are sent by order of the Board of Directors.

| | /s/ Dennis N. Genty | |

| | Dennis N. Genty |

| | Chief Financial Officer, Secretary and Treasurer |

Denver, Colorado

May 17, 2017