SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. ___)

| Filed by the registrant | x |

| Filed by a party other than the registrant | o |

Check the appropriate box:

| o | Preliminary proxy statement. |

| o | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement. |

| o | Definitive Additional Materials. |

| o | Soliciting Material Pursuant to §240.14a-12 |

M Fund, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of filing fee (check the appropriate box):

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

M FUND, INC.

July 9, 2021

Dear Policy Owner:

You are the owner of a variable life insurance or annuity policy and some (or all) of your policy’s cash value is invested in M Fund, Inc. (consisting of M International Equity Fund, M Large Cap Growth Fund, M Capital Appreciation Fund, and M Large Cap Value Fund, each a series of M Fund, Inc. and each a “Fund” and collectively, the “Funds”). Although your insurance company is the legal owner of those shares of M Fund, Inc., you have certain voting rights with respect to the shares attributable to your policy’s cash value. Accordingly, we are writing to ask for your vote approving certain items described in the enclosed proxy statement and as outlined, for your convenience, in this letter. Your vote is extremely important, so we urge you to read all material carefully and vote your shares promptly.

Shareholders of each of the Funds are asked to vote on the following Proposal.

Election of the Directors of the M Fund, Inc. (“Directors”)

Shareholders are being asked to re-elect the current Directors that were previously elected by shareholders and to elect the Directors that were previously appointed or nominated by the Board (together, the “Nominees”). Federal law requires that two-thirds of directors be elected by the shareholders. Having all Nominees elected or re-elected by the shareholders facilitates the appointment of future Directors by the Board.

You will find information about each Nominee’s experience and tenure in the proxy statement.

Remember--your vote counts!

We cannot overemphasize the importance of your vote, regardless of how many shares you own. Voting promptly is also important. If we do not receive enough votes, we will have to resolicit shareholders, which can be time consuming, expensive, and may delay the meeting scheduled for September 21, 2021. A proxy solicitation firm, Broadridge Financial Solutions, Inc., may call to remind you to return your proxy.

Vote by mail, via the internet, or by toll-free telephone.

You may vote by returning the enclosed proxy card (or voting instruction card). A self-addressed, postage-paid envelope is enclosed for your convenience. You may also vote via the internet or by calling a toll-free number from a touch-tone phone. Please see your proxy card for more information and voting instructions. If you vote via the internet or by phone, you do not need to mail your proxy card. If you want to change your vote, you may do so using the proxy card, telephone or the internet.

Thank you for your cooperation in voting on these important proposals. If you have questions, please call your financial adviser. Or, if your questions relate specifically to the proxy matters, please call our service center representatives toll-free at 888-736-2878.

Sincerely,

| |

| Bridget McNamara-Fenesy | |

| President, M Fund, Inc. | |

M Fund, Inc.

M International Equity Fund

M Large Cap Growth Fund

M Capital Appreciation Fund

M Large Cap Value Fund

M Financial Plaza

1125 NW Couch Street, Suite 900

Portland, Oregon 97209

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

September 21, 2021

A special meeting (the “Meeting”) of the shareholders of M International Equity Fund, M Large Cap Growth Fund, M Capital Appreciation Fund, and M Large Cap Value Fund, each a series of M Fund, Inc. (each a “Fund” and collectively, the “Funds”) will be held at 9:30 a.m. Pacific Time on September 21, 2021 at the offices of M Financial Investment Advisers, Inc. located at 1125 NW Couch Street, Suite 900, Portland, Oregon 97209 for the following purposes:

| 1. | To elect seven Directors of M Fund, Inc. (“Proposal 1”) |

| 2. | To transact such other business as may properly come before the Meeting or any adjournments thereof. |

Shareholders of record at the close of business on July 2, 2021 are entitled to notice of and to vote at the Meeting and any adjourned session. Shareholders of each of the Funds are asked to vote on Proposal 1.

| | By order of the Board of Directors, |

| | |

| | DAVID LEES, Secretary and Treasurer |

PLEASE RESPOND. YOUR VOTE IS IMPORTANT, NO MATTER HOW MANY SHARES YOU OWN. PLEASE READ THE ENCLOSED PROXY STATEMENT. SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE SPECIAL MEETING ARE REQUESTED TO COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH NEEDS NO POSTAGE IF MAILED IN THE UNITED STATES, OR FOLLOW THE INSTRUCTIONS IN THE MATERIALS RELATING TO TELEPHONE AND INTERNET VOTING. INSTRUCTIONS FOR THE PROPER EXECUTION OF THE PROXY CARD ARE SET FORTH IMMEDIATELY FOLLOWING THIS NOTICE. IT IS IMPORTANT THAT YOU RETURN THE PROXY CARD PROMPTLY.

July 9, 2021

Instructions for Signing Proxy Cards

The following general rules for signing proxy cards may be of assistance to you and will help avoid the time and expense to the Funds involved in validating your vote if you fail to sign your proxy card properly.

1. Individual Accounts. Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Accounts. Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration.

3. All Other Accounts. Indicate the capacity of the individual signing the proxy card unless it is reflected in the form of registration. For example:

| Registration | Valid Signature |

| | |

| Corporate Accounts | |

| | |

| (1) | ABC Corp. | ABC Corp. |

| (2) | ABC Corp. | John Doe, Treasurer |

| (3) | ABC Corp. c/o John Doe, Treasurer | John Doe |

| (4) | ABC Corp. Profit Sharing Plan | John Doe, Trustee |

| | |

| Trust Accounts | |

| | |

| (1) | ABC Trust | John B. Doe, Trustee |

| (2) | Jane B. Doe, Trustee u/t/d 12/28/78 | Jane B. Doe |

| | |

| Custodial or Estate Accounts | |

| | |

| (1) | John B. Smith, Cust. f/b/o John B. Smith, Jr. UGMA | John B. Smith |

| (2) | Estate of John B. Smith | John B. Smith, Jr., Executor |

Instructions for Voting by Telephone

Read the accompanying proxy information and proxy card. Call 1-800-690-6903 and follow the simple instructions. Have your proxy card ready.

You do not need to return your proxy card if you vote by telephone.

Instructions for Voting over the Internet

To provide voting instructions via the internet follow these steps:

| 1. | Read the accompanying proxy information and proxy card. |

| 2. | Go to www.proxyvote.com. |

| 3. | Follow the instructions provided on the website. |

You do not need to return your proxy card if you vote via the internet.

PROXY STATEMENT

M Fund, Inc.

M International Equity Fund

M Large Cap Growth Fund

M Capital Appreciation Fund

M Large Cap Value Fund

M Financial Plaza

1125 NW Couch Street, Suite 900

Portland, Oregon 97209

The Board of Directors of M Fund, Inc. (the “Directors”) are soliciting proxies from the shareholders of M International Equity Fund, M Large Cap Growth Fund, M Capital Appreciation Fund and M Large Cap Value Fund, each a series of M Fund, Inc. (each a “Fund” and collectively, the “Funds”) in connection with a special meeting (the “Meeting”) of shareholders of the Funds. The Meeting has been called for 9:30 a.m. Pacific Time on September 21, 2021 at the offices of M Financial Investment Advisers, Inc. located at 1125 NW Couch Street, Suite 900, Portland, Oregon 97209. The Meeting notice, this Proxy Statement and proxy card are being sent to shareholders of record as of July 2, 2021 (the “Record Date”) beginning on or about July 9, 2021. Please read this Proxy Statement and keep it for future reference.

Each Fund has previously sent its annual report dated December 31, 2020 and its semi-annual report dated June 30, 2020 to its shareholders. You may obtain a copy of each Fund’s most recent annual report and semi-annual report without charge by writing to M Fund, Inc., Attention: M Fund Administration, at the address set forth above or by calling (888) 736-2878. In addition, each Fund’s most recent annual report and semi-annual report are available on its website at www.mfin.com/m-funds. (Click on “Annual Report” or “Semi-Annual Report”.)

The only item of business that the Directors expect will come before the Meeting is (Proposal 1) the election of Directors. The shareholders of each of the Funds are asked to vote on Proposal 1.

PROPOSAL 1: ELECTION OF DIRECTORS

Background

The purpose of this proposal is to elect a Board of Directors for M Fund, Inc. (the “Corporation”). Pursuant to the provisions of the Corporation’s current Articles of Incorporation, the Directors have previously fixed the number of Directors at five. Pursuant to the provisions of Section 2 of the Corporation’s By-laws, by vote of a majority of the entire Board of Directors, the number of directors fixed by the Articles of Incorporation or by these By-laws may be increased or decreased from time to time, but such number shall not be less than three (3) nor more than twenty (20), and the tenure of office of a director shall not be affected by any decrease in the number of directors so made by the Board of Directors. At its June 17, 2021 meeting, the Board of Directors for the Corporation fixed the number of Directors at seven. The persons named as proxies intend to vote in favor of the election of all of the seven nominees listed below, unless such authority has been withheld. Each of the nominees for Director has consented to be named in this Proxy Statement and to serve as a director of the Corporation if elected. Should the nominees be elected, each nominee’s term of office lasts until his or her successor is elected and qualified. If a nominee is unavailable for election at the time of the Meeting (which is not presently anticipated), the persons named as proxies may vote for other persons in their discretion, or the Directors may vote to fix the number of Directors at fewer than seven or to leave a vacancy in the Board. The required vote is discussed below in “Other Information-Required Vote.” Wayne Pierson, Bruce W. Madding, Peter W. Mullin, Nancy Crouse, and Mary Moran Zeven are currently Directors of the Corporation. All except Mses. Crouse and Zeven have previously been elected by shareholders. Each has served continuously since originally elected or appointed. The Board has nominated Malcolm L. “Skip” Cowen II and James “Jim” Kaplan to join the Board. Messrs. Pierson, Madding, Mullin, Cowen, and Kaplan and Mses. Crouse and Zeven are together referred to in this Proxy Statement as the “Nominees.” None of the Nominees is related to each other. The Nominees listed under “Nominees for Independent Director” are not “interested persons,” as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), of the Corporation. The Nominees listed under “Nominees for Interested Director” are “interested persons,” as defined in the 1940 Act, of the Corporation by virtue of their ownership of M Financial Holdings Incorporated, which controls M Financial Investment Advisers, Inc. (“MFIA” or the “Adviser”), the investment adviser to the Corporation. In addition, Mr. Kaplan is a director of M Financial Holdings Incorporated and Mr. Cowen is a director of MFIA.

Since July 2019, two directors have resigned from the Board for personal reasons. Shareholders are asked to re-elect the current Directors that were previously elected by shareholders in 2018 and to elect the Directors that were previously appointed or nominated by the Board because federal law requires that two-thirds of Directors be elected by the shareholders. Having all Directors elected or re-elected by the shareholders at this time facilitates the appointment of future Directors by the Board, as long as two-thirds of the resulting Board of Directors are elected by shareholders. If the shareholders do not elect the nominees, the current members of the Board of Directors will continue to serve until the earlier of their death, resignation or election and qualification of their successors.

Information about the Nominees

Set forth below is the name of the Nominee together with certain information about him or her. The address of each Nominee is 1125 NW Couch St., Suite 900, Portland, OR 97209.

Nominees for Independent Director

| Name and Age | Position(s)

Held with

Corporation | Term of Office *

and

Length of

Time Served | Principal Occupation(s) During

Past 5 Years | Number of

Portfolios in

Corporation

Complex

Overseen by

Director | Other

Directorships

Held by

Director for the

Past 5 Years |

Wayne G. Pierson

70 | Director, Chair of the Board and Nominating and Corporate | Indefinite

Eight Years | President, Acorn Investors LLC (investment holding company), 2005 to present; Principal, Clifford Capital Partners LLC, (investment manager), 2010 to present. | 4 | Director, Oaktree Capital Group, (investment manager), 2007 to 2019. |

| Name and Age | Position(s)

Held with

Corporation | Term of

Office *

and

Length of

Time Served | Principal Occupation(s) During

Past 5 Years | Number of

Portfolios in

Corporation

Complex

Overseen by

Director | Other

Directorships

Held by

Director for the

Past 5 Years |

| | Governance Committee Chair | | | | |

Bruce W. Madding

69 | Director and Audit Committee Chair | Indefinite

12 Years | Retired. Chief Executive Officer, C.M. Capital Corp., 2011 to March 2021; Chief Investment Officer, C.M. Capital Corp., 2011 to 2018. | 4 | Vice-Chair and Director, C.M. Capital Corp., March 2021 to present. |

Nancy Crouse

62 | Director | Indefinite

One Year | Retired. Senior Vice President and Portfolio Manager, Nuveen Investments (investment manager), 2005 to 2016. | 4 | Director, Women’s Economic Ventures (non-profit), 2016 to present and Treasurer, Women’s Economic Ventures (non-profit), 2018 to present. |

Mary Moran Zeven

60 | Director | Indefinite

One Year | Director, Graduate Program in Banking & Financial Law at Boston University School of Law, 2019 to present; Senior Vice President and Senior Managing Counsel, State Street Bank and Trust Company (custodial bank), 2000 to 2019. | 4 | N/A |

* In accordance with the Corporation’s current by-laws, each Director serves for an indefinite term until the date such Director resigns, retires or is removed by the Board of Directors or shareholders in accordance with the Corporation’s Articles of Incorporation.

Nominees for Interested Director

| Name and Age | Position(s) Held with Corporation | Term of

Office *

and

Length of

Time Served | Principal Occupation(s) During

Past 5 Years | Number of

Portfolios in

Fund Complex

Overseen by

Director | Other

Directorships

Held by

Director for the

Past 5 years |

Peter W. Mullin1

80 | Director | Indefinite

25 Years | Chairman Emeritus, MullinTBG, Inc. (insurance agency), 2008 to present; Founding Chairman, Mullin, Barens, Sanford (life insurance & executive benefits), 2012 to present. | 4 | N/A |

Malcolm L. “Skip” Cowen II1

62 | Nominee for Director | Indefinite

N/A | President, Cornerstone Advisors Asset Management, LLC and Cornerstone Institutional Investors, LLC, 2002 to present. | N/A | MFIA, 1999 to present; and Gettysburg |

| | | | | | College, 2012 to present. |

James “Jim” Kaplan1

60 | Nominee for Director | Indefinite

N/A | Chief Executive Officer of KB Financial, 2016 to present. | N/A | M Financial Holdings Inc., 2019 to present, M Life Insurance Company, 2019 to present; and the Mariano Rivera Foundation, April 2021 to present. |

* In accordance with the Corporation’s current by-laws, each Director serves for an indefinite term until the date such Director resigns, retires or is removed by the Board of Directors or shareholders in accordance with the Corporation’s Articles of Incorporation.

1 Messrs. Mullin, Cowen, and Kaplan are deemed to be Interested Persons as defined by the 1940 Act, for the following reasons:

| · | Mr. Mullin has the power to vote 16.4% of the stock of M Financial Group, which controls the Adviser. |

| · | Mr. Cowen is a Director of the Adviser. |

| · | Mr. Kaplan is a Director of M Financial Holdings. |

Consistent with M Financial Group’s focus on client advocacy and leadership, the Corporation’s Board of Directors continues to provide valuable direction and insight that fuel differentiation. While there are no formal qualification requirements, Directors have certain perspectives, credentials, skills, and levels of experience that enhance their ability to serve on the Board, including:

| (i) | knowledge of mutual funds, insurance, and/or financial services; |

| (ii) | a reputation for high professional integrity; and |

| (iii) | an ability to contribute to the ongoing functions of the Board, including the ability and commitment to attend meetings regularly and work collaboratively with other members of the Board and the Adviser. |

The following is a summary of the specific qualifications and experience of each Nominee:

Wayne G. Pierson: Mr. Pierson is a business executive with over 38 years’ experience in the financial services industry. His experience includes chief executive and chief financial officer positions and service as a director or trustee for various trusts and companies. He has a Bachelor’s degree in Business Administration. He is a Certified Public Accountant and a Chartered Financial Analyst. He has served on the Corporation’s Board of Directors and related committees for eight years and possesses significant experience regarding the Corporation’s operations and history.

Bruce W. Madding: Mr. Madding is a business executive with over 30 years’ experience in the financial services industry. His experience includes chief executive and chief financial officer positions and service as a director or trustee for various foundations. He has a Master’s degree in Business Administration and is a Certified Public Accountant. He has served on the Corporation’s Board of Directors and related committees for 12 years and possesses significant experience regarding the Corporation’s operations and history.

Nancy Crouse: Ms. Crouse is a business executive with over 35 years’ experience in the financial services industry. Her experience includes senior vice president and portfolio manager at Nuveen Investments. She has a Master’s

degree in Business Administration. She is a Chartered Financial Analyst. She joined the Board of Directors in July 2019.

Mary Zeven: Ms. Zeven is an attorney with over 37 years’ experience in the financial services and legal industries. Her experience includes senior vice president and senior managing counsel at State Street Bank and Trust Company. She has a Juris Doctor from St. John’s University School of Law. She joined the Board of Directors in September 2019.

Peter W. Mullin: Mr. Mullin is a business executive with over 40 years’ experience with executive compensation and benefit issues. His experience includes various chief executive positions and service as a director or trustee of various public companies and foundations. He has a Bachelor’s degree in Economics. He served on the Corporation’s Board of Directors and related committees for 25 years and possesses significant experience regarding the Corporation’s operations and history.

Malcolm L. “Skip” Cowen II: Mr. Cowen is a business executive with over 35 years’ experience in the financial services industry. His experience includes working with institutional clients and wealthy families to help design, implement and monitor portfolios on their behalf. He is a co-founder of Cornerstone Advisors Asset Management, LLC and Cornerstone Institutional Investors, LLC. Mr. Cowen is the Chair of Cornerstone’s Investment Policy Committee, which oversees all client assets. He became President in 2002 and before that served as Chief Compliance Officer. Mr. Cowen is also chair of the Board of Directors of MFIA, has been nationally ranked by Barron’s, spoken at a number of industry conferences and is an active member of various advisory groups. He received a B.A. in Business Administration from Gettysburg College, an MBA in Business Administration from Lehigh University and a Masters in Taxation from Villanova Law School.

James “Jim” Kaplan: Mr. Kaplan is a business executive with over 30 years’ experience in the financial services industry. He is co-founder and the CEO of KB Financial Partners, LLC in Princeton, New Jersey, which has been a Member Firm since 2008. Mr. Kaplan spent 28 years as an agent of Equitable and AXA where he served on various boards within the company including the EARC, the reinsurance company. Mr. Kaplan works with the KB Financial team to develop the overall strategy of the firm and leads the effort to continually refine and improve client offerings. He has a 36-year history of advising high net worth clients in the areas of sophisticated estate, wealth transfer and investment planning strategies. Mr. Kaplan received a BA in Political Science and Government from Lehigh University. He holds the CLU designation and is a member of Finseca (formerly AALU). Mr. Kaplan serves on the Board of Directors of The Mariano Rivera Foundation and is involved with a number of local charities. He is registered with M Securities. Mr. Kaplan currently serves on the Company’s Product Development Group.

If a vacancy exists on the Board of Directors for any reason, the remaining Directors will fill such vacancy by appointing another Director so long as, immediately after such appointment, at least two-thirds of the Directors have been elected by shareholders. If, at any time, less than a majority of the Directors holding office has been elected by the shareholders, the Directors then in office will promptly call a shareholders’ meeting to elect Directors. Otherwise, there will normally be no shareholders meeting to elect Directors. Therefore, electing the nominees will allow the Board to appoint new directors to fill any vacancies that occur, and may reduce the need for, and avoid the expense of, future shareholder meetings and proxy solicitations.

The Board of Directors of the Corporation is currently composed of one Interested Director and four Independent Directors. The Board of Directors held four meetings during the fiscal year ended December 31, 2020. All current Directors attended at least 75% of the Board and relevant committee meetings held during the Corporation’s last fiscal year.

Information about the Officers

The table below provides certain information about the officers of the Corporation including their age, positions, terms of office and length of time served, and principal occupations during the past five years. The business address of each Officer is 1125 NW Couch St., Suite 900, Portland, OR 97209.

| Name and Age | Position(s) Held with the Corporation | Term of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years |

Bridget McNamara-Fenesy 62 | President | One Year Four Years | President and CEO, M Holdings Securities, Inc. 2017 to present; President, M Financial Investment Advisers, Inc., 2016 to present; Vice President, M Holdings Securities, Inc. 2016 to 2017; Interim Chief Compliance Officer, M Holdings Securities, Inc. March 2016 to September 2016; President, Two Gaits Consulting 2001 to 2016. |

David Lees 55 | Secretary and Treasurer | One Year 14 Years | Accounting Director, M Financial Group, 2007 to present; Secretary and Treasurer, M Financial Investment Advisers, Inc., 2007 to present; Secretary and Treasurer, M Financial Wealth Partners, Inc., and M Financial Asset Management, Inc., 2016 to present. |

Valerie Pimenta 43 | Vice President | One Year Three Years | Vice President and Chief Operation Officer, M Holdings Securities, Inc., 2017 to present; Vice President, M Financial Investment Advisers, Inc., 2018 to present; and Vice President of Legal and Compliance, Fisher Investments, 2002 to 2017. |

Dean Beckley 49 | Chief Information Security Officer | One Year Four Years | Director, Cyber Security & IT Operations, M Financial Group, 2016 to present; Chief Information Security Officer, M Financial Investment Advisers, Inc., 2017 to present; Director, Technology of M Benefit Solutions, 2013 to 2016; and Senior Project Manager of M Financial Group, 2009 to 2013. |

There is no family relationship between any of the Directors or Officers listed above.

No Independent Director or member of his immediate family has an ownership interest in any of the Adviser, principal underwriter, or any company directly or indirectly controlling or under common control with, the Adviser or underwriter.

Standing Board Committees

The Corporation is governed by a Board of Directors, which is responsible for generally overseeing the conduct of Corporation business and for protecting the interests of shareholders. The directors meet periodically throughout the year to oversee the Corporation’s activities, review contractual arrangements with companies that provide services to the Corporation, and review each Fund’s performance.

The Board is led by the Chair of the Board who is elected annually and is not an “interested person” of the Corporation for purposes of the 1940 Act. The position of Chair is separate from the position of President. Mr. Pierson, an Independent Director, currently serves as the Chair of the Board and Ms. McNamara-Fenesy, President of the Adviser, currently serves as President of the Corporation. The Corporation believes this leadership structure is appropriate because having an Independent Director serve as Chair provides the Board with a measure of independence, while having an executive officer of the Adviser serve as President brings extensive knowledge of the Corporation’s day-to-day operations to the executive function.

The Board of Directors oversees risk management for the Corporation in several ways. The Board receives regular reports, which detail the results of testing of each Fund’s compliance with its Board-adopted policies and procedures, its investment policies and limitations, and applicable provisions of the federal securities laws and Internal Revenue Code. As needed, the Adviser discusses management related issues regarding the Corporation with the Board and solicits the Board’s input on many aspects of management, including potential risks to the Corporation. The Board’s Audit Committee also receives reports on various aspects of risk that might affect the Corporation and offers advice to management, as appropriate. The Directors also meet in executive session with

Independent counsel, the Chief Compliance Officer, the independent auditor and representatives from management, as needed.

The Corporation has two standing Committees, the Audit Committee and the Nominating and Corporate Governance Committee. The Audit and Nominating and Corporate Governance Committees were established by the Board at a meeting held on February 10, 2004. Messrs. Madding and Pierson and Mses. Crouse and Zeven are members of the Audit and Nominating and Corporate Governance Committees of the Board. Mr. Madding is Chair of the Audit Committee and Mr. Pierson is Chair of the Nominating and Corporate Governance Committee. The Audit Committee operates under a written charter approved by the Board. The purposes of the Audit Committee are: (a) to oversee generally the Funds accounting and financial reporting policies and processes, including the Funds compliance with legal and regulatory requirements applicable thereto; (b) to oversee generally the quality, objectivity, and integrity of the Funds financial statements and the independent audit thereof, including the Funds controls over financial reporting; (c) to oversee the qualifications, independence, and performance of the Funds independent accountants; (d) to act as a liaison between the Funds’ independent accountants and the full Board; and (e) to act upon reports of or other information regarding deficiencies, weaknesses in internal controls and procedures for financial reporting, fraud or other similar matters. The Nominating and Corporate Governance Committee, among other things, nominates persons to fill vacancies on the Board. The Nominating and Corporate Governance Committee does not have a procedure to consider nominees for the position of Director recommended by shareholders. During the past calendar year, the Audit Committee met twice and the Nominating and Corporate Governance Committee met twice.

Ownership of Fund Shares

As of June 30, 2021, the table below reflects the Nominees’ share ownership in the Corporation.

INDEPENDENT DIRECTORS |

| | Dollar Range of Equity Securities in the

Corporation | Aggregate Dollar Range of Equity

Securities in the Corporation |

Wayne Pierson Director, Chair of the Board and Chair of the Nominating and Corporate Governance Committee | None | None |

Bruce Madding Director and Chair of the Audit Committee | None | None |

| Nancy Crouse | None | None |

| Mary Zeven | None | None |

INTERESTED DIRECTORS |

| | Dollar Range of Equity Securities in the

Corporation | Aggregate Dollar Range of Equity

Securities in the Corporation |

Peter W. Mullin Director | M International Equity Fund over $100,000 M Large Cap Growth Fund over $100,000 M Capital Appreciation Fund over $100,000 | Over $100,000* |

| | M Large Cap Value Fund

over $100,000 | |

Malcolm L. “Skip” Cowen II** Director Nominee | None | None |

James “Jim” Kaplan Director Nominee** | M International Equity Fund $10,001-$50,000 M Large Cap Growth Fund $10,001-$50,000 M Capital Appreciation Fund $1-$10,000 M Large Cap Value Fund

$10,001-$50,000 | $50,001-$100,000* |

* Messrs. Mullin and Kaplan own shares of the Funds as a result of investment allocations made within their variable life insurance or annuity policies.

** Messrs. Cowen and Kaplan did not serve as Directors during the fiscal year ended December 31, 2020.

Director Compensation

The Corporation pays no compensation to its Officers. Each Independent Director receives $1,500 per meeting of the Board that he or she attends, as well as an annual retainer of $20,000. Each member of the Audit Committee receives $1,500 per meeting of the Audit Committee that he or she attends. The Chair of the Board and the Chair of the Audit Committee each receive additional annual compensation of $10,000. Beginning July 1, 2021, the annual retainer of each Independent Director increased to $25,000 annually. There were no changes to the per meeting fees or separate compensation to the Chair of the Board and the Chair of the Audit Committee.

Interested Directors do not receive an annual retainer, nor compensation from the Funds’ for any meeting of the Board attended. The Corporation does not provide retirement or pension benefits to the Directors.

During the year ended December 31, 2020, the then Directors received the following compensation from the Corporation:

INDEPENDENT DIRECTORS |

| | Aggregate

Compensation from

the Corporation | Pension or

Retirement Benefits

Accrued as Part of

the Corporation’s

Expenses | Estimated Annual

Benefits upon

Retirement | Total Compensation

from the Corporation

and Fund Complex

Paid to Directors |

Wayne Pierson Director, Chair of the Board and Chair of the Nominating and Corporate Governance Committee | $39,000 | $0 | $0 | $39,000 |

Bruce Madding Director and Chair of the Audit Committee | $39,000 | $0 | $0 | $39,000 |

| Nancy Crouse | $29,000 | $0 | $0 | $29,000 |

| Mary Zeven | $29,000 | $0 | $0 | $29,000 |

INTERESTED DIRECTORS |

| | Aggregate

Compensation from

the Corporation | Pension or

Retirement Benefits

Accrued as Part of

the Corporation’s

Expenses | Estimated Annual

Benefits upon

Retirement | Total Compensation

from the Corporation

and Fund Complex

Paid to Directors |

Peter W. Mullin Director | $0 | $0 | $0 | $0 |

Lawton Nease* Former Director | $0 | $0 | $0 | $0 |

Malcolm L. “Skip” Cowen II** Director Nominee | $0 | $0 | $0 | $0 |

James “Jim”

Kaplan** Director Nominee | $0 | $0 | $0 | $0 |

* Mr. Nease resigned from the Board effective June 16, 2020.

** Messrs. Cowen and Kaplan did not serve as Directors during the fiscal year ended December 31, 2020.

The Corporation pays no compensation to its officers.

Independent Registered Public Accounting Firm

BBD, LLP (“BBD”), located at 1835 Market Street, 3rd Floor, Philadelphia, PA 19103, serves as the Corporation’s independent registered public accounting firm. BBD audits and reports on the annual financial statements of the Funds and reviews certain regulatory reports and the Corporation’s federal income tax returns. BBD also performs other professional audit and certain allowable non-audit services, including tax services, when the Corporation engages it to do so. Representatives of BBD are not expected to be available at the Meeting.

The engagement of BBD as the Corporation’s independent registered public accounting firm is approved annually by the Audit Committee of the Board of Directors and ratified by the Board of Directors.

Audit Fees. BBD billed the Corporation aggregate fees of $86,500 and $86,500 for professional services rendered for the audit of the Corporation’s annual financial statements for the fiscal years ended December 31, 2019 and December 31, 2020, respectively.

Audit-Related Fees. BBD did not bill the Funds for any audit-related fees during the fiscal years ended December 31, 2019 and December 31, 2020.

Tax Fees. BBD billed the Corporation aggregate fees of $10,500 for professional services rendered for tax compliance, tax advice, and tax planning in each of the fiscal years ended December 31, 2019 and December 31, 2020. The nature of the services comprising the Tax Fees was the review of the Corporation’s income tax and excise returns.

All Other Fees. BBD did not bill the Corporation any fees for products and services other than those disclosed above during the fiscal years ended December 31, 2019 and December 31, 2020.

The Audit Committee approved 100% of the audit and tax fees described above. The aggregate fees billed by BBD for non-audit services rendered to the Corporation, the Corporation’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entities controlling, controlled by, or under common control with the Corporation’s investment

adviser that provides ongoing services to the Corporation were $10,500 in each of the fiscal years ended December 31, 2019 and December 31, 2020. The Audit Committee concluded that there were no fees paid to the independent registered public accountants by the Corporation’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entities controlling, controlled by, or under common control with the Corporation’s investment adviser.

Nomination and Election of Directors by Shareholders

The Bylaws of the Corporation do not provide for the annual election of Directors by shareholders. However, in accordance with the 1940 Act, (i) the Corporation will hold a shareholders’ meeting for the election of Directors at such time as less than a majority of the Directors holding office have been elected by shareholders, and (ii) if, as a result of a vacancy in the Board of Directors, less than two-thirds of the Directors holding office have been elected by the shareholders, that vacancy may only be filled by a vote of the shareholders.

Shareholder Communications with the Board

Shareholders wishing to submit written communications to the Board should send their communications to the Board of Directors, M Fund, Inc., 1125 NW Couch St., Suite 900, Portland, OR 97209. The Board will review any communications received at its next regularly scheduled meeting.

THE DIRECTORS UNANIMOUSLY RECOMMEND THAT SHAREHOLDERS

VOTE “FOR” EACH NOMINEE.

OTHER INFORMATION

Information about the Corporation

The Corporation is an open-end management investment company established as a Maryland corporation on August 11, 1995. The Corporation consists of four separate investment portfolios, each of which is, in effect, a separate mutual fund. Each Fund is a diversified open-end management investment company. The Corporation issues a separate class of stock for each Fund representing fractional undivided interests in that Fund. By investing in a Fund, an investor becomes entitled to a pro rata share of all dividends and distributions arising from the net income and capital gains on the investments of that Fund. Likewise, an investor shares pro rata in any losses of that Fund.

Investment Adviser. M Financial Investment Advisers, Inc. is the investment adviser of the Corporation and its Funds. Bridget McNamara-Fenesy serves as President of the Adviser and the Corporation; David Lees, serves as Secretary and Treasurer of the Adviser and the Corporation; Valerie Pimenta, serves as Vice President of the Adviser and the Corporation, Dean Beckley serves as Chief Information Security Officer of the Adviser and the Corporation; and Kenneth Kalina serves as Chief Compliance Officer and Anti-Money Laundering Officer of the Adviser and the Corporation.

The Adviser is controlled by M Financial Holdings Incorporated, which does business under the name M Financial Group. M Financial Group is engaged in providing product development and marketing support services for participating insurance agents, who, collectively, own a majority of the outstanding stock of M Financial Group. As shareholders, they share in the profits of M Financial Group via periodic stock or cash dividends. M Financial Group derives revenue from, among other things, investment advisory fees with respect to assets invested in the Corporation and receives from insurance carriers compensation based, in part, upon the volume of insurance premiums generated by its participating agents. Clients should be aware that these direct and indirect compensation arrangements may create economic incentives, which could influence recommendations for particular financial products or services (including the Funds). These incentives include, but are not limited to, the following: (i) commissions or other compensation in respect of one particular financial service provider, product, investment, or service may exceed commissions or compensation payable in respect of a comparable provider, product or service; (ii) certain policy features or riders may involve commissions or compensation that differ from compensation payable in respect of “base” or standard contractual features; and (iii) products or services that provide revenue, including override commissions or potential reinsurance profits, to M Financial Group could indirectly provide

incentives to agents to recommend such products over similar products or services that do not provide revenue to M Financial Group.

The Adviser was organized on September 11, 1995. Although the Adviser is not primarily responsible for the daily management of the Funds, the Adviser oversees the management of the assets of the Funds by each of the Sub-Advisers. In turn, each Sub-Adviser is responsible for the day-to-day management of a specific Fund.

Principal Underwriter. M Holdings Securities, Inc. acts as the distributor (the “Distributor”) for each of the Funds. The Distributor is a wholly-owned subsidiary of M Financial Group. No fees are due the Distributor for these services. The Distributor conducts a continuous offering and is not obligated to sell a specific number of shares. The principal executive offices of the Distributor are in the same offices as the Corporation located at M Financial Plaza, Portland, OR. The Distributor is registered with the SEC as a broker-dealer under the Securities Exchange Act of 1934; as an investment advisor under the Investment Advisers Act of 1940; and is a member of the Financial Industry Regulatory Authority.

Administrator. State Street Bank and Trust Company is the Corporation’s administrator. The address of State Street Bank and Trust Company is One Lincoln Street, Boston, MA 02111.

Outstanding Shares and Significant Shareholders. Shareholders of record at the close of business on July 2, 2021 are entitled to notice of and to vote at the Meeting and any adjourned session. Appendix A lists the total number of shares outstanding as of July 2, 2021 for each class of each Fund’s shares. It also identifies holders, as of July 2, 2021, of more than 5% of any class of shares of each Fund, and contains information about the shareholdings in the Fund of the Directors and the executive officers of the Funds as of July 2, 2021.

Information About Proxies and the Conduct of the Meeting

Solicitation of Proxies. Proxies will be solicited primarily by mailing this Proxy Statement and its enclosures, but proxies may also be solicited through further mailings, telephone calls, personal interviews or e-mails by officers of the Funds or by employees or agents of MFIA and their respective affiliated companies. In addition, Broadridge Financial Solutions, Inc. has been engaged to assist in the solicitation of proxies, at an estimated cost of $25,000.

Costs of Solicitation. The costs of the Meeting, including the costs of soliciting proxies, will be paid by the Funds. The costs of the solicitation attributed to Proposal 1 will be allocated proportionately, by assets, across all Funds.

Voting Process. You can vote in any one of the following four ways:

| By Internet – Use the Internet to vote by visiting www.proxyvote.com. |

| | By telephone – Use a touch-tone telephone to call toll-free 1-800-690-6903, which is available 24 hours a day. |

| | By mail – Complete and return the enclosed proxy card. |

| | In person – Vote your shares in person at the Meeting. |

Shareholders who owned shares of the Funds on the Record Date are entitled to vote at the Meeting. Shareholders are entitled to cast one vote for each share, and a proportionate fractional vote for each fractional share, owned on the Record Date. Shares represented by duly executed and timely proxies will be voted as instructed on the proxy. If you mail the enclosed proxy card and no choice is indicated for the proposal listed in the attached Notice of Meeting, your proxy will be voted in favor of the proposal. Votes made via the Internet or by telephone must have a choice indicated to be accepted. At any time before it has been voted, your proxy may be revoked in one of the following ways: (i) by sending a signed, written letter of revocation to the Secretary of the Corporation, (ii) by

properly executing a later-dated proxy (by any of the methods of voting described above), or (iii) by attending the Meeting, requesting return of any previously delivered proxy, and voting in person.

Tabulation of Proxies. Votes cast in person or by proxy at the Meeting will be counted by persons appointed by the Corporation as tellers for the Meeting (the “Tellers”). For each of the Funds, thirty-three and 1/3 percent (33 1/3%) of the shares of the Fund outstanding on the Record Date, present in person or represented by proxy, constitutes a quorum for the transaction of business by the shareholders of the Fund at the Meeting. In determining whether a quorum is present, the Tellers will count shares represented by proxies that reflect abstentions, and “broker non-votes,” as shares that are present and entitled to vote. Since these shares will be counted as present, but not as voting in favor of any proposal, these shares will have the same effect as if they cast votes against the proposal. “Broker non-votes” are proxies for shares held by brokers or nominees as to which (i) the broker or nominee does not have discretionary voting power and (ii) the broker or nominee has not received instructions from the beneficial owner or other person who is entitled to instruct how the shares will be voted.

Required Vote. The vote required to approve Proposal 1 is the affirmative vote of a majority of the shares of each Fund voted in person or represented by proxy at the Meeting.

Shares of the Funds are legally owned by a limited number of insurance companies. However, those shares support the cash values of certain variable life insurance or variable annuity policies, and the owners of those policies can instruct the insurance companies on how to vote the shares attributable to their policies (this does not apply to shares owned by M Financial Holdings Inc. or M Life Insurance Co.). Each insurance company will follow those instructions, and vote shares for which no instructions are received, or abstain from voting, in the same proportion for which it has received instructions from other policy owners (this is called “echo voting”). There is no quorum, minimum percentage, or number of policy owner voting instructions that the insurance company must receive to use the echo voting procedure. This means that a minority of policy owners (based on their cash values attributable to the Fund(s)) can determine the outcome of a vote.

The approval of a proposal by any Fund is not contingent upon the approval of the proposal by any other Fund’s shareholders.

Adjournments; Other Business. In the event that a quorum is not present for purposes of acting on a proposal for a Fund, or if sufficient votes in favor of the proposal for a Fund are not received by the time of the Meeting, the persons named as proxies may propose that the Meeting be adjourned with respect to one or more Funds one or more times to permit further solicitation of proxies. Any adjournment requires the affirmative vote of more than 50% of the total number of shares of the relevant Fund that are present in person or by proxy when the adjournment is being voted on. The persons named as proxies will vote in favor of any such adjournment all proxies that they are entitled to vote in favor of the proposal. They will vote against any such adjournment any proxy that directs them to vote against the proposal. They will not vote any proxy that directs them to abstain from voting on the proposal.

The Meeting has been called to transact any business that properly comes before it. The only item of business that the Directors expect will come before the Meeting is (Proposal 1), the election of Directors. If any other matters properly come before the Meeting, the persons named as proxies intend to vote the proxies in accordance with their judgment, unless the Secretary of the Corporation has previously received written contrary instructions from the shareholder entitled to vote the shares.

Shareholder Proposals at Future Meetings. The Corporation does not hold annual or other regular meetings of shareholders. Shareholder proposals for any future shareholders meeting must be received by the Corporation in writing a reasonable amount of time before the Corporation solicits proxies, to be considered for inclusion in the proxy materials for that meeting.

Certain Directors of the Corporation

No Directors have any substantial interest, direct or indirect, by security holdings or otherwise, in the election of Directors.

July 9, 2021

M Fund 2021

Appendix A

Shares Outstanding

(as of July 2, 2021)

| Fund | Number of Shares Outstanding |

| M International Equity Fund | 15,786,691 |

| M Large Cap Growth Fund | 7,003,749 |

| M Capital Appreciation Fund | 6,989,065 |

| M Large Cap Value Fund | 8,415,019 |

Control Persons and Principal Shareholders

Shares of the Funds are owned by insurance companies as depositors of separate accounts, which are used primarily to fund variable annuity contracts and variable life insurance contracts. Persons or companies owning more than 25% of the outstanding shares of a Fund are presumed to “control” the Fund within the meaning of the 1940 Act. As a result, those persons or companies could take action with respect to a Fund without the consent or approval of other shareholders. As of July 2, 2021, John Hancock Variable Life Insurance Co. and Pacific Life Insurance Co. may each be deemed a control person of certain Funds in which their separate accounts hold more than 25% as reflected below:

| | M International

Equity Fund | M Large Cap

Growth Fund | M Capital

Appreciation Fund | M Large Cap Value

Fund |

| Pacific Life Insurance Co. | 36.06% | 30.23% | 33.64% | 30.70% |

| John Hancock Variable Life Insurance Co. | 37.97% | 46.46% | 45.06% | 48.88% |

As of July 2, 2021, the following shareholders may be deemed a principal shareholder of certain Funds in which their separate accounts hold more than 5% of the shares of such Funds reflected below:

| | M International

Equity Fund | M Large Cap

Growth Fund | M Capital

Appreciation Fund | M Large Cap Value

Fund |

| Pruco Life Insurance Co. of Arizona | 6.37% | 6.36% | X | X |

| Voya American Equities, Inc. | 5.64% | X | 6.59% | X |

The addresses of each control person or principal shareholder of the Funds' shares are as follows:

Pacific Life Insurance Co., Newport Beach, CA

Pruco Life Insurance Co. of Arizona, Newark, NJ

John Hancock Variable Life Insurance Company, Boston, MA

Voya American Equities, Inc. Denver, CO

The Nominees and Officers, as a group, owned less than 1% of each Fund’s shares as of July 2, 2021.

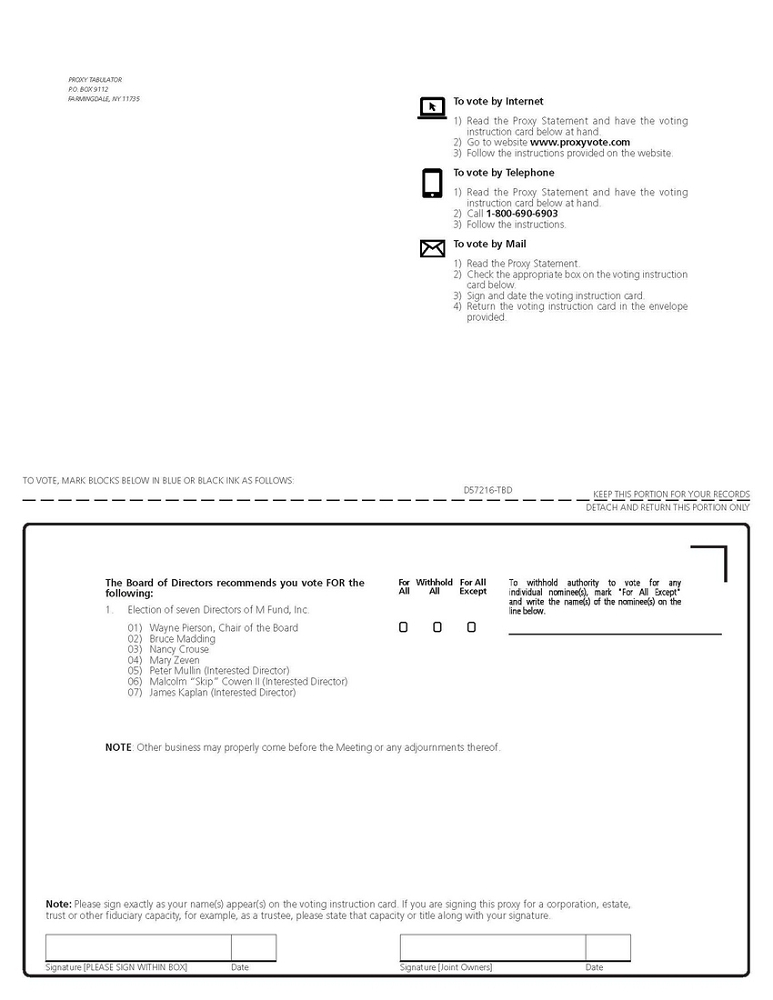

KEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLY TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: Signature [PLEASE SIGN WITHIN BOX] Date Signature [Joint Owners] Date M FUND, INC. 1125 NW COUCH STREET, STE 900 PORTLAND, OREGON 97209 D57542-S27553 ! ! ! For All Withhold All For All Except To withhold authority to vote for any individual nominee(s), mark "For All Except" and write the name(s) of the nominee(s) on the line below. NOTE: Other business may properly come before the Meeting or any adjournments thereof. The Board of Directors recommends you vote FOR the following: 01) Wayne Pierson, Chair of the Board 02) Bruce Madding 03) Nancy Crouse 04) Mary Zeven 05) Peter Mullin (Interested Director) 06) Malcolm “Skip” Cowen II (Interested Director) 07) James Kaplan (Interested Director) 1. Election of seven Directors of M Fund, Inc. Note: Please sign exactly as your name(s) appear(s) on the proxy card. If you are signing this proxy for a corporation, estate, trust or other fiduciary capacity, for example, as a trustee, please state that capacity or title along with your signature. To vote by Internet 1) Read the Proxy Statement and have the proxy card below at hand. 2) Go to website www.proxyvote.com 3) Follow the instructions provided on the website. To vote by Telephone 1) Read the Proxy Statement and have the proxy card below at hand. 2) Call 1-800-690-6903 3) Follow the instructions. To vote by Mail 1) Read the Proxy Statement. 2) Check the appropriate box on the proxy card below. 3) Sign and date the proxy card. 4) Return the proxy card in the envelope provided.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting: The Proxy Statement is available at www.proxyvote.com. SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON SEPTEMBER 21, 2021 THIS PROXY IS SOLICITED ON BEHALF OF THE COMPANY'S BOARD OF DIRECTORS. The undersigned hereby appoints Bridget McNamara-Fenesy, David Lees and Ken Kalina, and each of them, the attorneys and proxies of the undersigned, with right of submission, to vote all shares of the fund as indicated on the reverse side which the undersigned is entitled to vote, at a Special Meeting of the Shareholders (the "Meeting") of M International Equity Fund, M Large Cap Growth Fund, M Capital Appreciation Fund, and M Large Cap Value Fund, each a series of M Fund, Inc. (each a "Fund" and collectively, the "Funds") to be held at 9:30 a.m. Pacific Time on September 21, 2021 at the offices of M Financial Investment Advisers, Inc. located at 1125 NW Couch Street, Suite 900, Portland, Oregon, or any adjournment thereof. You are encouraged to specify your choice by marking the appropriate box, but you need not mark any boxes if you wish to vote in accordance with the Board of Directors' recommendations; just sign, date and return this proxy in the enclosed envelope. Shareholders of record at the close of business July 2, 2021 are entitled to notice of and to vote at the Meeting and any adjourned session. Shareholders of each of the Funds are being asked to vote on Proposal 1. PLEASE DATE AND SIGN NAME OR NAMES AS PRINTED ON THE REVERSE SIDE TO AUTHORIZE THE VOTING OF THE SHARES AS INDICATED. IF SIGNING AS A REPRESENTATIVE, PLEASE INCLUDE CAPACITY. The Board of Directors recommends you vote FOR all Directors. M International Equity Fund, M Large Cap Growth Fund, M Capital Appreciation Fund, and M Large Cap Value Fund each a series of M Fund, Inc. (the "Company") PROXY VOTING CARD

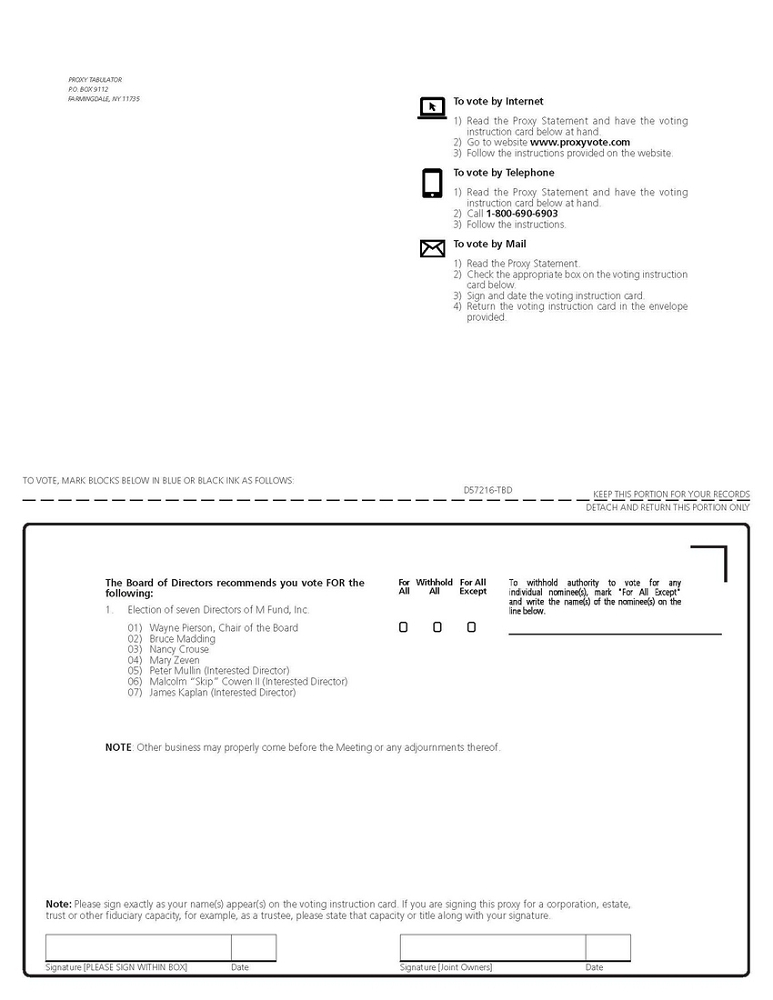

PROXY TABULATOR P.O. BOX 9112 FARMINGDALE, NY 11735To vote by Internet 1) Read the Proxy Statement and have the voting instruction card below at hand. 2) Go to website www.proxyvote.com 3) Follow the instructions provided on the website. To vote by Telephone 1) Read the Proxy Statement and have the voting instruction card below at hand. 2) Call 1-800-690-6903 3) Follow the instructions. To vote by Mail 1) Read the Proxy Statement. 2) Check the appropriate box on the voting instruction card below. 3) Sign and date the voting instruction card. 4) Return the voting instruction card in the envelope provided.TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:D57216-TBDKEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLYThe Board of Directors recommends you vote FOR the following: 1. Election of seven Directors of M Fund, Inc.For AllWithhold AllFor All ExceptTo withhold authority to vote for any individual nominee(s), mark "For All Except" and write the name(s) of the nominee(s) on the line below.01) Wayne Pierson, Chair of the Board 02) Bruce Madding 03) Nancy Crouse 04) Mary Zeven 05) Peter Mullin (Interested Director) 06) Malcolm “Skip” Cowen II (Interested Director) 07) James Kaplan (Interested Director)! ! !NOTE: Other business may properly come before the Meeting or any adjournments thereof.Note: Please sign exactly as your name(s) appear(s) on the voting instruction card. If you are signing this proxy for a corporation, estate, trust or other fiduciary capacity, for example, as a trustee, please state that capacity or title along with your signature.Signature [PLEASE SIGN WITHIN BOX] Date Signature [Joint Owners] Date

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting: The Proxy Statement is available at www.proxyvote.com.D57217-TBDVOTING INSTRUCTION CARDM International Equity Fund, M Large Cap Growth Fund, M Capital Appreciation Fund, and M Large Cap Value Fund each a series of M Fund, Inc. (the "Company") SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON SEPTEMBER 21, 2021 THIS PROXY IS SOLICITED ON BEHALF OF THE COMPANY'S BOARD OF DIRECTORS. The undersigned hereby appoints the Company mentioned on the reverse side of this Voting Instruction Card and hereby authorizes it to represent and to vote, as designated on the reverse, at the Special Meeting of Shareholders ("Meeting") of M International Equity Fund, M Large Cap Growth Fund, M Capital Appreciation Fund, and M Large Cap Value Fund, each a series of M Fund, Inc. (each a "Fund" and collectively the "Funds") to be held at 9:30 a.m. Pacific Time on September 21, 2021, at the offices of M Financial Investment Advisers, Inc. located at 1125 NW Couch St., Suite 900, Portland, Oregon, or any adjournment thereof, all shares of the Fund attributable to his or her contract or interest therein as directed on the reverse side of this Card.IF THIS VOTING INSTRUCTION CARD IS SIGNED AND RETURNED WITH NO CHOICE INDICATED, THE SHARES WILL BE VOTED "FOR" THE PROPOSAL. If you fail to return this Voting Instruction Card, depending on the separate account, the Company will either not vote all shares attributable to the account value, or will vote all shares attributable to the account value in proportion to all voting instructions for the Fund actually received from contract holders in the separate account.Shareholders of record date at the close of business July 2, 2021 are entitled to notice of and to vote at the Meeting and any adjourned session. Shareholders of each of the Funds are being asked to vote on Proposal 1.PLEASE DATE AND SIGN NAME OR NAMES AS PRINTED ON THE REVERSE SIDE TO AUTHORIZE THE VOTING OF THE SHARES AS INDICATED. IF SIGNING AS A REPRESENTATIVE, PLEASE INCLUDE CAPACITY.The Board of Directors recommends you vote FOR all Directors.